This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

Foreign direct investment (FDI) in Bangladesh

Fdi in figures.

According to the UNCTAD’s World Investment Report 2023 , FDI inflows to Bangladesh increased by 20.2% to USD 3.48 billion in 2022 (compared to USD 2.89 billion in 2021). In the same year, the total stock of FDI was estimated at USD 21.1 billion, representing only 4.6% of the country’s GDP. Figures from the National Bank show that, during the fiscal year 2022-23, net FDI inflows totaled USD 3.25 billion, marking a decrease of USD 189.95 million or 5.5% compared to the fiscal year 2021-22 and an increase of 29.6% compared to the fiscal year 2020-21. In FY 2022-23, net FDI inflows by country blocs showed that Other European Countries (OEC) led with USD 0.828 billion, down from USD 0.845 billion in the previous fiscal year. The European Union (EU) followed with USD 0.729 billion, up from USD 0.624 billion. Other Asian Countries (OAC) contributed USD 0.659 billion, down from USD 0.836 billion, while the Association of South-East Asian Nations (ASEAN) invested USD 0.351 billion, down from USD 0.423 billion in the preceding fiscal year. In FY 2022-23, the manufacturing sector attracted the highest net FDI inflows, totaling USD 1.316 billion or 40.5%. This comprised mainly textiles & wearing (USD 0.662 billion or 20.4%), food products (USD 0.256 billion or 7.9%), and leather & leather products (USD 0.121 billion or 3.7%). The second-highest attracting sectors were power, gas, and petroleum, which drew USD 0.691 billion or 21.3%, including power (USD 0.365 billion or 11.2%) and gas and petroleum (USD 0.326 billion or 10.0%). Transport, storage & communication ranked third, attracting USD 0.463 billion or 14.3%, mainly from the telecommunications sector (USD 0.434 billion or 13.4%). Trade and commerce followed, drawing USD 0.404 billion or 12.4%, with banking (USD 0.364 billion or 11.2%) and trading (USD 0.055 billion or 1.7%) being the major contributors. Finally, services attracted USD 0.243 billion or 7.5%, mainly from the other service sector (USD 0.186 billion or 5.7%). Despite steady economic growth in the country over the past decade, foreign direct investment has been comparatively low in Bangladesh compared to regional peers. Bangladesh suffers from a negative image: the country is seen as being extremely poor, under-developed, subject to devastating natural disasters and socio-political instability. Bangladesh's capital markets are in the early stages of development, and the financial sector relies heavily on banks. In 2022, the sector experienced a significant scandal where 11 banks collectively faced a shortfall of USD 3.1 billion. However, the country has the advantage of being in a strategic geographical position between South and Southeast Asia. In addition, its domestic consumption potential and the wealth of its natural resources make the country a good candidate for investment. The government promotes private sector-led growth, foreign currency is abundant due to remittances, and the central bank respects the transferability of foreign currency. A number of more developed Asian countries have outsourced their factory production, mainly textile, to the country. Moreover, the government simplified a set of laws as part of its efforts to reduce barriers to foreign investment. Foreign and domestic private entities have the freedom to establish, operate, and divest interests in most business enterprises. However, the government imposes restrictions on foreign ownership and control in certain industries. Four sectors are exclusively reserved for government investment: arms, ammunition, and defense equipment; forest plantations and mechanized extraction in reserved forests; nuclear energy production; and security printing (e.g., currency). While private investments are allowed in power generation and natural gas exploration, full foreign ownership in petroleum marketing and gas distribution is not permitted. Foreign ownership in telecommunications is capped at 60% (70% for tower sharing). Seventeen sectors, including aviation, banking, coal, natural gas, and mineral exploration, require operational permission from ministries. Bangladesh ranks 105th among the 132 economies on the Global Innovation Index 2023 and 116th out of 184 countries on the latest Index of Economic Freedom .

Source: UNCTAD, Latest available data

Note: * Greenfield Investments are a form of Foreign Direct Investment where a parent company starts a new venture in a foreign country by constructing new operational facilities from the ground up.

Source: Doing Business, Latest available data

Note: *The Greater the Index, the More Transparent the Conditions of Transactions. **The Greater the Index, the More the Manager is Personally Responsible. *** The Greater the Index, the Easier it Will Be For Shareholders to Take Legal Action.

What to consider if you invest in Bangladesh

The main assets of Bangladesh's economy are:

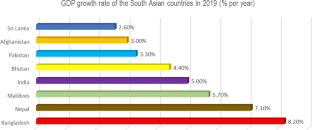

- Good macroeconomic stability characterised by a high growth rate of 8.2% in 2019 and 3.8% in 2020 ( IMF ) as well as a satisfactory level of the public debt of 39.6% in 2020 ( IMF )

- An open and diverse economy

- A very low-cost workforce

- A strategic geographic position as a gateway to countries in the Asia-Pacific region

- A strategic and competitive position in the value chain of the global economy

- An economic and legislative environment globally favourable to business

- Favourable biodiversity and weather conditions

The main obstacles to attracting investment include:

- A business environment complicated by the country's weak infrastructure, burdensome bureaucracy, high risk of corruption, lack of transparency and the slow pace of the judicial system

- Exports that are not sufficiently diversified and highly dependent on the textile sector

- Fragile political stability threatened by recurrent social movements;

- Weakness of the financial sector

- Vulnerability to natural disasters (cyclones, severe floods) that result in substantial income losses

- An economy dependent on the garment industry and characterised by a weak per capita income

Any Comment About This Content? Report It to Us.

© eexpand, All Rights Reserved. Latest Update: April 2024

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Foreign Direct Investment (FDI) in Bangladesh: Trends, Challenges, and Recommendations

During the liberation war in 1971 a nationalist weave emerged which gives Bangladeshis a spirit of freedom and dignity of independence but it also results on more reserved position in case of economic policy. Policy makers at that period used to see foreign companies access with a negative eyes. Foreign investments were discouraged as a result foreign direct investment (FDI) inflow in Bangladesh till 1980 is very insignificant. The growth of Bangladesh’s FDI inflow was around US$ 308 – 356 million for long fifteen years (1980 – 1995) which started with an amount of US $ 0.090 million in 1972. Afterwards this concept has been changed into a reverse position and government start encouraging foreign direct investment from 1990s. A series of policy incentives, investment sovereignty has been offered to the FDI investors including tax holiday for several years, duty free facility for importing capital machinery, 100% foreign ownership, 100% profit repatriation facility, reinvestment of profit or dividend as FDI, multiple visa, work permit to foreign executives, permanent resident or even citizenship for investing a specific amount, Export Processing Zone (EPZ) facility, and easy hassle free exit facility. Potential sectors of can attract more FDI are power generation, infrastructure devel-opment, private port establishment, joint venture with deep sea port establishment under PPP, ship building, ICT sector, call center, education, healthcare, mining, gas extraction, agro processed product, electrical & electronics, light engineering, and fashion designing etc. After so many incentives offered by the government till now FDI Inflow into Bangladesh is not at a satisfactory level. During last few years fresh FDI investment in not taking place. From the statistics of last few years it is quite clear that, reinvestment of locally earned profit is the major amount of FDI into Bangladesh. Fresh FDI inflow is decreasing day by day. Government has to investigate the issue and undertake necessary measures to increase fresh FDI into Bangladesh.

Related Papers

International Journal of Sustainable Economies Management

Md. Joynal Abdin

During the liberation war in 1971 a nationalist weave emerged which gives Bangladeshis a spirit of freedom and dignity of independence but it also results on more reserved position in case of economic policy. Policy makers at that period used to see foreign companies access with a negative eyes. Foreign investments were discouraged as a result foreign direct investment (FDI) inflow in Bangladesh till 1980 is very insignificant. The growth of Bangladesh's FDI inflow was around US$ 308 – 356 million for long fifteen years (1980 – 1995) which started with an amount of US $ 0.090 million in 1972. Afterwards this concept has been changed into a reverse position and government start encouraging foreign direct investment from 1990s. A series of policy incentives, investment sovereignty has been offered to the FDI investors including tax holiday for several years, duty free facility for importing capital machinery, 100% foreign ownership, 100% profit repatriation facility, reinvestment ...

World Vision

Mohammad Kamrul Hasan

The most prominent and important element in modern economics to develop a country is considered FDI. FDI can accelerate the economy of a developing country like Bangladesh through the influence on its GDP, export & import, and bringing some welfare to her. Being a less developing country, Bangladesh faces lot of obstacles in attracting more inflow of inward FDI. So, it is very important for Bangladesh to have some effective strategies in order to protect the foreign direct investors and ensure a congenial atmosphere to bring their capital. Bangladesh now is going through an economic & industrial transition where it needs more domestic and international investment. But it is a duty on the govt. part to make investors feel assure that their role in the business arena of Bangladesh is valued and hazardless. In this connection, friendly regulations, simplifying regulatory practices, investment incentives and bureaucratic procedures should be ensured. Problems on the way of inward FDI in Bangladesh should meet a well solution and new strategies should be taken to attract inward FDI to accelerate the economic growth of Bangladesh.

Asian Business Review

This research will try to examine the FDI plays a dominant role in the economy of Bangladesh through accelerating Gross Domestic Product (GDP), export and domestic investment followed by overall economic growth. So it is vital for a developing country like Bangladesh to carry out effective measures in protecting the prospective foreign investors so that they can get a congenial atmosphere to invest their capital. They should feel that their role in the business arena of Bangladesh is respectfully valued. In this connection, friendly regulations, simplifying regulatory practices, investment incentives and removal of inefficient bureaucratic procedures should be ensured.

Mammo Muchie

rubiya shova

Mashiur Rahman

Foreign Direct lwestment (FDI) grasps lots of benefit on a macroeconomic level. The FDI inflow facilitotes capital formation and the growth of economy, including industry, manufacturing, infrastructure, and energ/. The expansion of the GDP creates jobs and reduces unemployment rate. On the basis of intricate link between FDI and growth, the trade regime of Bangladesh has been intensely liberalized to maintain the streams of itvestments and finance from abroad. Although severql attempts (Foreign Irwestment Protection Lavt, Tm incentives, Special Investment Zones) have been made to create an irwestment friendly climate, Bangladesh has yet to be successful in creating domestic poliq settings factors, hospitable to the facilitation of business and inducement of inflow of Foreign Direct Investment.

Bangladesh is a developing country so rapid industrialization is essential to keep pace with its development needs. But the low rate of Gross Domestic Savings and Investment as well as low level of technology base hamper the expected industrialization process. Foreign aids and grants had been serving to overpass the gap. As the developing countries are in the process of graduating from being aid dependent economy into a trading economy, therefore, Foreign Direct Investment (FDI) is viewed as a major motivation to economic growth in these countries. Despite some policies reforms, Bangladesh could not attract handsome flow of FDI as yet. Furthermore, the major share of FDI is being repatriated. The main focus of this paper is to make known some general features of FDI, to observe the problems associated with attracting FDI and to recommend remedial measures to overcome those problems. The paper analyses the trends of FDI inflow and repatriation as well as what Bangladesh is doing presently to attract handsome flow of FDI.

Khulna University studies

Monimul Haque

Foreign Direct Investment (FDI) has great impact on the development of a developing country like Bangladesh. The foreign investor seeks for new sources of investment where the developing country seeks for new sources of fund to develop the country. The FDI does not only bring sources of fund in a developing country but also new technology in a developing country. The FDI has the important role to develop the garments & weaving, telecommunication, banking and pharmaceuticals industry of Bangladesh. In this paper the role of FDI in economic growth (GDP) is analyzed to find out relationship between FDI and GDP in Bangladesh. To analyze the impact, The GDP has been taken as a dependent and FDI as an independent variable to run the regression analysis where the result shows that the FDI can explain about 83% data of GDP, p value much less than 0.05 to reject null hypothesis and GDP changes 64.0709 units for changes of each unit of FDI. The correlation matrix shows the GDP and FDI is highly correlated (0.912024962) in perspective of Bangladesh economy, so the FDI has grater impact on GDP or Economic Growth of Bangladesh. Some of the problems and prospects of FDI in Bangladesh is also discussed in the paper.

RELATED PAPERS

Indian Journal of Otolaryngology and Head & Neck Surgery

Mahesha Vankalakunti

Études Épistémè

Christian Grosse

Shalini Rai

Krzysztof Podemski

Cancer Research

Mohammed Mustapha abba

Dr. Christoph Krauß

Yurii Lozovik

Leslie Youd

Lecture notes on information theory

Marek Ogiela

PLOS Currents

Annick Antierens

Analytical Sciences: X-ray Structure Analysis Online

Shaukath Khanum

Chemical Engineering Transactions

Bruno Fabiano

Arterialʹnaâ gipertenziâ

Yurii Sviryaev

Percy Nohama

Semina: Ciências Agrárias

Sarita LEONEL

Putri Rafa Salihah

Zandile Kubeka

Medical physics

Esther Vicente

1比1仿制英国萨里大学 surrey毕业证学历证书GRE成绩单原版一模一样

Revista Gestão Inovação e Tecnologias

Mariela Medeiros

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Advertisement

Inward foreign direct investment in Bangladesh: Do we need to rethink about some of the macro-level quantitative determinants?

- Original Article

- Published: 24 February 2021

- Volume 1 , article number 48 , ( 2021 )

Cite this article

- Mohammad Razib Hossain ORCID: orcid.org/0000-0001-8448-1291 1 nAff2

2192 Accesses

23 Citations

1 Altmetric

Explore all metrics

FDI has become a desired form of incoming investment for capital-poor nations like Bangladesh. Therefore, a critical analysis of macroeconomic constituent’s influences that determine the inflow of this “Investment-Blood” is undoubtedly rational. The study is conducted to shed empirical light on the relationship between FDI and other macroeconomic variables in Bangladesh, which is believed to assist modifications at the policy level. Resorting on annual time-series data and harnessing ARDL bounds testing and Error Correction Model, this study detects a long-run relationship between inward FDI and a set of regressors. The study finds no impact of interest rate and foreign reserve on FDI. Export is inversely related to FDI. This study reveals a substitutionary effect of export on FDI, which suggests applying the Heckscher-Ohlin model to reduce redundant exports by producing goods only in which the nation has a comparative advantage to create more room for FDI. In other words, to attract more FDI, Bangladesh has to make a trade-off in export. This paper recommends adopting FDI-led development as an intermediary solution until export can surpass the total import. The effects of import, current account balance (CAB), and per capita GDP are all positive. The findings further disclose that the CAB gap due to reduced export can be mitigated with more FDI. Electricity production has an inverse effect on FDI for high energy production costs. Thus, to attract more FDI in Bangladesh, this paper's robust findings suggest increasing the interest rate, decreasing unnecessary export, and relying more on renewable energy sources.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Author’s compilation by exploiting data from Asian Development Bank,

The output of CUSUM was retrieved from STATA statistical software

Similar content being viewed by others

Modeling the nexus between coal consumption, FDI inflow and economic expansion: does industrialization matter in South Africa?

A multilateral network perspective on inward FDI

Institutions and FDI: evidence from developed and developing countries

Data availability.

The data that support the findings of this study are available on the World Development Indicators (WDI) website of the [World Bank] at the following URL: https://datacatalog.worldbank.org/dataset/world-development-indicators .

Code availability

Not applicable for the present study.

1 USD = BDT 85.

Ahmad F, Draz MU, Yang SC (2018) Causality nexus of exports, FDI and economic growth of the ASEAN5 economies: evidence from panel data analysis. J Int Trade Econ Dev 27(6):685–700. https://doi.org/10.1080/09638199.2018.1426035

Article Google Scholar

Akaike H (1974) A new look at the statistical model identification. IEEE Trans Autom Control 19(6):716–723. https://doi.org/10.1109/TAC.1974.1100705

Ali U, Wang JJ (2018) Does outbound foreign direct investment crowd out domestic investment in China? Evidence from time series analysis. Global Econ Rev 47(4):419–433. https://doi.org/10.1080/1226508X.2018.1492431

Ali W, Abdullah A, Azam M (2017) Re-visiting the environmental Kuznets curve hypothesis for Malaysia: fresh evidence from ARDL bounds testing approach. Renew Sust Energ Rev 77:990–1000. https://doi.org/10.1016/j.rser.2016.11.236

Ali M, Ahmad TI, Sadiq R (2019) Empirical investigation of foreign direct investment and current account balance in East Asian economies. Pak J Commer Soc Sci (PJCSS) 13(3):779–795

Google Scholar

Amighini A, Sanfilippo M (2014) Impact of South-South FDI and trade on the export upgrading of African economies. World Dev 64:1–17. https://doi.org/10.1016/j.worlddev.2014.05.021

Anuchitworawong C, Thampanishvong K (2015) Determinants of foreign direct investment in Thailand: Does natural disaster matter? Int J Disast Risk Re 14:312–321. https://doi.org/10.1016/j.ijdrr.2014.09.001

Asiamah M, Ofori D, Afful J (2019) Analysis of the determinants of foreign direct investment in Ghana. J Asian Bus Econ Stud 26(1):56–75. https://doi.org/10.1108/JABES-08-2018-0057

Asian Development Bank (2020) Economic indicators for Bangladesh. Available via https://www.adb.org/countries/bangladesh/economy/ Accessed 29 March 2020

Bangladesh Bank (2017) Foreign Direct Investment (FDI) in Bangladesh: Survey Report January-June, 2017. Available via https://www.bb.org.bd/pub/halfyearly/fdisurvey/fdisurveyjanjun2017.pdf/ Accessed 29 March 2020

Bangladesh Bank (2018) Foreign Direct Investment in Bangladesh. Available via https://www.bb.org.bd/pub/halfyearly/fdisurvey/fdisurveyjuldec2018.pdf/ Accessed 5 April 2020.

Bangladesh Bank (2020) Annual reports on economic indicators. Available via https://www.bb.org.bd/openpdf.php/ Accessed 5 April 2020

Behera H, Yadav I (2019) Explaining India’s current account deficit: a time series perspective. J Asian Bus Econ Stud 26(1):117–138. https://doi.org/10.1108/JABES-11-2018-0089

Bera AK, Jarque CM (1981) Efficient tests for normality, homoscedasticity and serial independence of regression residuals: Monte Carlo evidence. Econ Lett 7(4):313–318. https://doi.org/10.1016/0165-1765(81)90035-5

Bermejo Carbonell J, Werner RA (2018) Does foreign direct investment generate economic growth? A new empirical approach applied to Spain. Econ Geogr 94(4):425–456. https://doi.org/10.1080/00130095.2017.1393312

Bevan AA, Estrin S (2000) The Determinants of Foreign Direct Investment in Transition Economies (December 2000). CEPR Discussion Paper No. 2638. Available at SSRN: https://ssrn.com/abstract=258070

Bhasin N, Gupta A (2017) Macroeconomic impact of FDI inflows: an ARDL approach for the case of India. Trans Corp Rev 9(3):150–168. https://doi.org/10.1080/19186444.2017.1362860

Bhujabal P, Sethi N (2020) Foreign direct investment, information and communication technology, trade, and economic growth in the South Asian Association for Regional Cooperation countries: an empirical insight. J Public Aff 20(1):e2010. https://doi.org/10.1002/pa.2010

Blanton RG, Blanton SL (2015) Is foreign direct investment “Gender Blind”? Women’s rights as a determinant of US FDI. Fem Econ 21(4):61–88. https://doi.org/10.1080/13545701.2015.1006651

Boateng A, Hua X, Nisar S, Wu J (2015) Examining the determinants of inward FDI: evidence from Norway. Econ Model 47:118–127. https://doi.org/10.1016/j.econmod.2015.02.018

Breusch TS (1978) Testing for autocorrelation in dynamic linear models. Austr Econo Papers 17:334–355. https://doi.org/10.1111/j.1467-8454.1978.tb00635.x

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc B 37(2):149–163. https://doi.org/10.1111/j.2517-6161.1975.tb01532.x

Cavallari L, d’Addona S (2013) Nominal and real volatility as determinants of FDI. Appl Econ 45(18):2603–2610. https://doi.org/10.1080/00036846.2012.674206

Chanegrih M, Stewart C, Tsoukis C (2017) Identifying the robust economic, geographical and political determinants of FDI: an extreme bounds analysis. Empir Econ 52(2):759–776. https://doi.org/10.1007/s00181-016-1097-1

Dhaka Tribune (2019) Bangladesh's export earnings decline further. Available via https://www.dhakatribune.com/business/commerce/2019/12/05/bangladesh-s-export-earnings-decline-further/ Accessed 7 April 2020

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431. https://doi.org/10.1080/01621459.1979.10482531

Doraisami AG (2007) Financial crisis in Malaysia: did FDI flows contribute to vulnerability? J Int Dev J Dev Stud Assoc 19(7):949–962. https://doi.org/10.1002/jid.1358

Dreger C, Schüler-Zhou Y, Schüller M (2017) Determinants of Chinese direct investments in the European Union. Appl Econ 49(42):4231–4240. https://doi.org/10.1080/00036846.2017.1279269

Durbin J, Watson GS (1950) Testing for serial correlation in least squares regression: I. Biometrika 37(3/4):409–428. https://doi.org/10.2307/2332391

Eita JH, Manuel V, Naimhwaka E (2018) Macroeconomic variables and current account balance in Namibia. https://mpra.ub.uni-muenchen.de/id/eprint/88818

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica J Econ Soc 64(4):813–836. https://doi.org/10.2307/2171846

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica J Econ Soc. https://doi.org/10.2307/1913236

Financial Express (2018) Bangladesh attracts nearly $3.0b FDI in 2017–18 fiscal year. Available via Bangladesh attracts nearly $3.0b FDI in 2017–18 fiscal year (thefinancialexpress.com.bd) Accessed 26 November 2020

Financial Express (2019a) BD’s economic growth hits record 8.15pc in FY19. Available via https://thefinancialexpress.com.bd/economy/bds-economic-growth-hits-record-815pc-in-fy191575976234/ Accessed 5 April 2020.

Financial Express (2019b) Bangladesh's FDI rises over 5pc from July to October. Available via https://thefinancialexpress.com.bd/economy/bangladeshs-fdi-rises-over-5pc-from-july-to-october-1577257337/ Accessed 7 April 2020.

Financial Express (2019c) Power generation cut to one-third of capacity. Available vai https://thefinancialexpress.com.bd/trade/power-generation-cut-to-one-third-of-capacity-1576988993/ Accessed 6 April 2020.

Financial Express (2020a) Time to switch over to brand apparel exports. Available via https://thefinancialexpress.com.bd/views/views/time-to-switch-over-to-brand-apparel-exports1582903085/ Accessed 6 April 2020.

Financial Express (2020b) Interest rates of 6%-9%: At whose interest? Available via https://thefinancialexpress.com.bd/views/reviews/interest-rates-of-6-9-at-whose-interest-1583598314/ Accessed 5 April 2020.

Godfrey LG (1978) Testing against general autoregressive and moving average error models when the regressors include lagged dependent variables. Econometrica 46:1293–1301. https://doi.org/10.2307/1913829

Goh SK, Tham SY (2013) Trade linkages of inward and outward FDI: evidence from Malaysia. Econ Model 35:224–230. https://doi.org/10.1016/j.econmod.2013.06.035

Goswami C, Saikia KK (2012) FDI and its relation with exports in India, status and prospect in north east region. Procedia-Soc Behav Sci 37:123–132. https://doi.org/10.1016/j.sbspro.2012.03.280

Gupta P, Aggarwal V, Champaneri K, Narayan K (2020) Impact of foreign direct investment on GDP growth rate in india: analysis of the new millennium. In: Rajagopal BR (ed) Innovation, technology, and market ecosystems. Palgrave Macmillan, Cham

Heckscher E (1919) The effect of foreign trade on the distribution of income. Ekonomisk Tidskrift 11:497–512

Hossain MR (2020) Can small-scale biogas projects mitigate the energy crisis of rural Bangladesh? A study with economic analysis. Int J Sustain Energy. https://doi.org/10.1080/14786451.2020.1749056

Jaffri AA, Asghar N, Ali MM, Asjed R (2012) Foreign direct investment and current account balance of Pakistan. Pak Econ Soc Rev 50:207–222

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12(2–3):231–254. https://doi.org/10.1016/0165-1889(88)90041-3

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxford B Econ Stat 52(2):169–210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Jude C (2016) Technology spillovers from FDI. Evidence on the intensity of different spillover channels. World Econ 39(12):1947–1973. https://doi.org/10.1111/twec.12335

Jude C (2019) Does FDI crowd out domestic investment in transition countries? Econ Trans Instit Change 27(1):163–200. https://doi.org/10.1111/ecot.1218

Khalid AM, Marasco A (2019) Do channels of financial integration matter for FDI’s impact on growth? Empirical evidence using a panel. Appl Econ 51(37):4025–4045. https://doi.org/10.1080/00036846.2019.1588945

Kueh JSH, Puah CH, Lau E, Abu Mansor S (2007) FDI-trade nexus: empirical analysis on ASEAN-5. https://mpra.ub.uni-muenchen.de/id/eprint/5220

Kumari R, Sharma A (2017) Determinants of foreign direct investment in developing countries: a panel data study. Int J Emerg Mark 12(4):658–682. https://doi.org/10.1108/IJoEM-10-2014-0169

Kurtović S, Maxhuni N, Halili B, Talović S (2020) The determinants of FDI location choice in the Western Balkan countries. Post-Communist Econ. https://doi.org/10.1080/14631377.2020.1722584

Liang FH (2017) Does foreign direct investment improve the productivity of domestic firms? Technology spillovers, industry linkages, and firm capabilities. Res Policy 46(1):138–159. https://doi.org/10.1016/j.respol.2016.08.007

Mahmoodi M, Mahmoodi E (2016) Foreign direct investment, exports and economic growth: evidence from two panels of developing countries. Econ Res-Ekon Istraz 29(1):938–949. https://doi.org/10.1080/1331677X.2016.1164922

Mamuti A, Ganic M (2019) Impact of FDI on GDP and unemployment in macedonia compared to albania and bosnia and herzegovina. In: Mateev M, Poutziouris P (eds) Creative business and social innovations for a sustainable future advances in science, technology & innovation (IEREK interdisciplinary series for sustainable development). Springer, Cham

Mengistu AA, Adhikary BK (2011) Does good governance matter for FDI inflows? Evidence from Asian economies. Asia Pac Bus Rev 17(3):281–299. https://doi.org/10.1080/13602381003755765

Milner HV (2014) Introduction: the global economy, FDI, and the regime for investment. World Polit 66(1):1–11. https://doi.org/10.1017/S0043887113000300

Mina W (2020) Do GCC market-oriented labor policies encourage inward FDI flows? Res Int Bus Finance 51:101092. https://doi.org/10.1016/j.ribaf.2019.101092

Mishra B, Jena P (2019) Bilateral FDI flows in four major Asian economies: a gravity model analysis. J Econ Stud 46(1):71–89. https://doi.org/10.1108/JES-07-2017-0169

Mukherjee J, Chakraborty D, Sinha T (2014) The Causal Linkage Between FDI and Current Account Balance in India: An Econometric Study in the Presence of Endogenous Structural Breaks. In: Ghosh A, Karmakar A (eds) Analytical Issues in Trade, Development and Finance. India Studies in Business and Economics. Springer, New Delhi

Nelson CR, Plosser CR (1982) Trends and random walks in macroeconmic time series: some evidence and implications. J Monetary Econ 10(2):139–162. https://doi.org/10.1016/0304-3932(82)90012-5

Newey WK, West KD (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica The Econom Soc 55(3):703–708. https://doi.org/10.2307/1913610

Odhiambo NM (2009) Energy consumption and economic growth nexus in Tanzania: An ARDL bounds testing approach. Energ Policy 37(2):617–622. https://doi.org/10.1016/j.enpol.2008.09.077

Ohlin B (1924) The theory of trade. In: Flam H, Flanders J (eds) Heckscher-Ohlin trade theory. The MIT Press, Cambridge, pp 73–214

Okafor G, Piesse J, Webster A (2017) FDI determinants in least recipient regions: the case of sub-Saharan Africa and MENA. Afr Dev Rev 29(4):589–600. https://doi.org/10.1111/1467-8268.12298

Opoku EEO, Ibrahim M, Sare YA (2019) Foreign direct investment, sectoral effects and economic growth in africa. Int Econ J 33(3):473–492. https://doi.org/10.1080/10168737.2019.1613440

Owusu-Manu D, Edwards D, Mohammed A, Thwala W, Birch T (2019) Short run causal relationship between foreign direct investment (FDI) and infrastructure development. J Eng Design Technol 17(6):1202–1221. https://doi.org/10.1108/JEDT-04-2019-0100

Pacheco-López P (2005) Foreign direct investment, exports and imports in Mexico. World Econ 28(8):1157–1172. https://doi.org/10.1111/j.1467-9701.2005.00724.x

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica J Econ Soc. https://doi.org/10.2307/1913712

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326. https://doi.org/10.1002/jae.616

Pfaffermayr M (1994) Foreign direct investment and exports: a time series approach. Appl Econ 26(4):337–351. https://doi.org/10.1080/00036849400000080

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346. https://doi.org/10.1093/biomet/75.2.335

Rodríguez-Pose A, Cols G (2017) The determinants of foreign direct investment in sub-Saharan Africa: What role for governance? Reg Sci Policy Pract 9(2):63–81. https://doi.org/10.1111/rsp3.12093

Sabir S, Rafique A, Abbas K (2019) Institutions and FDI: evidence from developed and developing countries. Financial Innov 5(1):8. https://doi.org/10.1186/s40854-019-0123-7

Saini N, Singhania M (2018) Determinants of FDI in developed and developing countries: a quantitative analysis using GMM. J Econ Stud 45(2):348–382. https://doi.org/10.1108/JES-07-2016-0138

Salem M, Baum A (2016) Determinants of foreign direct real estate investment in selected MENA countries. J Prop Invest Finance 34(2):116–142. https://doi.org/10.1108/JPIF-06-2015-0042

Salike N (2016) Role of human capital on regional distribution of FDI in China: new evidences. China Econ Rev 37:66–84. https://doi.org/10.1016/j.chieco.2015.11.013

Schwarz G (1978) Estimating the dimension of a model. Ann Stat 6(2):461–464. https://doi.org/10.1214/aos/1176344136

Seker F, Ertugrul HM, Cetin M (2015) The impact of foreign direct investment on environmental quality: a bounds testing and causality analysis for Turkey. Renew Sust Energ Rev 52:347–356. https://doi.org/10.1016/j.rser.2015.07.118

Shah MH, Khan F (2019) Telecommunication Infrastructure Development and FDI into Asian Developing Nations. Journal of Business and Tourism 5(1): 91–102. https://ssrn.com/abstract=3455150

Stock JH, Watson MW (1993) A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica J Econ Soc. https://doi.org/10.2307/2951763

Sunde T (2017) Foreign direct investment, exports and economic growth: ADRL and causality analysis for South Africa. Res Int Bus Finance 41:434–444. https://doi.org/10.1016/j.ribaf.2017.04.035

The Business Standard (2019) Bangladesh’s foreign debt rises 122pc in 10 years. Available via https://tbsnews.net/economy/bangladeshs-foreign-debt-rises-122pc-10-years/ Accessed 10 April 2020.

The Daily Star (2015) The importance of FDI: Constraints and potential. Available via https://www.thedailystar.net/supplements/24th-anniversary-the-daily-star-part-2/the-importance-fdi-constraints-and-potential/ Accessed 6 April 2020.

The Daily Star (2018) Economy to stay strong. Available via Bangladesh GDP Growth Rate in 2017–18: Economy to stay strong (thedailystar.net) Accessed 26 November 2020

Uddin M, Chowdhury A, Zafar S, Shafique S, Liu J (2019) Institutional determinants of inward FDI: evidence from Pakistan. Int Bus Rev 28(2):344–358. https://doi.org/10.1016/j.ibusrev.2018.10.006

UNCTAD (2006) World Investment Report (WIR). Available via http://unctad.org/en/pages/PublicationArchive.aspx?publicationid=709/ Accessed 7 April 2020

UNCTAD (2019) World Investment Report. Special Economic Zones. Available via https://unctad.org/en/PublicationsLibrary/wir2019_en.pdf/ Accessed 6 April 2020

Wang CC, Wu A (2016) Geographical FDI knowledge spillover and innovation of indigenous firms in China. Int Bus Rev 25(4):895–906. https://doi.org/10.1016/j.ibusrev.2015.12.004

White H (1980) A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica J Econ Soc 48:817–838. https://doi.org/10.2307/1912934

World Bank (2018) World development indicators 2018. World Bank, Washington, DC. https://datacatalog.worldbank.org/dataset/world-development-indicators .

World Bank (2020) Doing Business 2020. Available via http://documents.worldbank.org/curated/en/688761571934946384/pdf/Doing-Business-2020-Comparing-Business-Regulation-in-190-Economies.pdf/ Accessed 6 April 2020.

Yakubu I (2020) Institutional quality and foreign direct investment in Ghana: a bounds-testing cointegration approach. Rev Int Bus Strat 30(1):109–122. https://doi.org/10.1108/RIBS-08-2019-0107

Yimer A (2017) Macroeconomic, political, and institutional determinants of FDI inflows to ethiopia: an ARDL approach. In: Heshmati A (ed) Studies on economic development and growth in selected African countries. Frontiers in African business research. Springer, Singapore. https://doi.org/10.1007/978-981-10-4451-9_7

Chapter Google Scholar

Zheng J, Ismail MN (2019) Determinants of Chinese overseas FDI in ASEAN countries. In: Idris A, Kamaruddin N (eds) ASEAN Post-50. Palgrave Macmillan, Singapore

Download references

Acknowledgement

I am genuinely grateful to my research supervisor Dr. Kausik Chaudhuri for his valuable time and suggestions during this manuscript's preparation. Besides, I would like to express my gratitude to the Commonwealth Scholarship Commission (CSC) and the University of Leeds for funding my research work.

This research was supported and funded by the Commonwealth Scholarship Commission (CSC), United Kingdom and Leeds University Business School, University of Leeds, UK.

Author information

Mohammad Razib Hossain

Present address: Department of Agricultural Finance and Cooperatives, Bangabandhu Sheikh Mujibur Rahman Agricultural University, Gazipur, 1706, Bangladesh

Authors and Affiliations

Leeds University Business School, University of Leeds, Leeds, United Kingdom

You can also search for this author in PubMed Google Scholar

Contributions

The corresponding author is liable for every aspect from designing to writing of the manuscript.

Corresponding author

Correspondence to Mohammad Razib Hossain .

Ethics declarations

Conflict of interest.

The author declares of having no competing interests.

Rights and permissions

Reprints and permissions

About this article

Hossain, M.R. Inward foreign direct investment in Bangladesh: Do we need to rethink about some of the macro-level quantitative determinants?. SN Bus Econ 1 , 48 (2021). https://doi.org/10.1007/s43546-021-00050-z

Download citation

Received : 23 September 2020

Accepted : 25 January 2021

Published : 24 February 2021

DOI : https://doi.org/10.1007/s43546-021-00050-z

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Current account balance

- Export reduction

- ARDL cointegration

- Bangladesh’s FDI-led development

JEL Classification

- Find a journal

- Publish with us

- Track your research

This website stores cookies on your computer. These cookies are used to collect information about how you interact with our website and allow us to remember you. We use this information in order to improve and customize your browsing experience and for analytics and metrics about our visitors both on this website and other media. To find out more about the cookies we use, see our Cookies Policy .

If you decline, your information won’t be tracked when you visit this website. A single cookie will be used in your browser to remember your preference not to be tracked.

Bangladesh Foreign Direct Investment

- Bangladesh Foreign Direct Investment (FDI) increased by 720.0 USD mn in Dec 2023, compared with an increase of 1.1 USD bn in the previous quarter.

- Bangladesh Foreign Direct Investment: USD mn net flows data is updated quarterly, available from Sep 2003 to Dec 2023.

- The data reached an all-time high of 1.6 USD bn in Dec 2018 and a record low of -119.0 USD mn in Dec 2005.

- In the latest reports of Bangladesh, Current Account recorded a surplus of 1.3 USD bn in Jan 2024.

- Bangladesh Direct Investment Abroad expanded by 0.1 USD mn in Dec 2023.

- Its Foreign Portfolio Investment fell by 110.3 USD mn in Dec 2023.

- The country's Nominal GDP was reported at 460.2 USD bn in Jun 2022.

View Bangladesh's Foreign Direct Investment from Sep 2003 to Dec 2023 in the chart:

What was Bangladesh's Foreign Direct Investment in Dec 2023?

Bangladesh Foreign Direct Investment (FDI) increased by 720.0 USD mn in Dec 2023, compared with an increase of 1.1 USD bn in the previous quarter. See the table below for more data.

Foreign Direct Investment by Country Comparison

Buy selected data, accurate macro & micro economic data you can trust.

Explore the most complete set of 6.6 million time series covering more than 200 economies, 20 industries and 18 macroeconomic sectors.

Bangladesh Key Series

More indicators for bangladesh, request a demo of ceic.

CEIC’s economic databases cover over 200 global markets. Our Platform offers the most reliable macroeconomic data and advanced analytical tools.

Balance of Payments

Explore our Data

IMAGES

VIDEO

COMMENTS

Foreign Direct Investment (FDI) plays an important role in the economy of Bangladesh to accelerate GDP, export and domestic investment followed by overall economic growth. Despite global declining trend, in 2016 FDI inflows has increased in Bangladesh, particularly in energy, stockmarket and telecommunication sector.

This is the presentation slide of foreign direct investment of Bangladesh and world perspective. Here you will find the detail Definition, Objectives, Motives, Types, Strategies, Theories of FDI with example. You will also find the recent fact and figure of FDI on Bangladesh perspective and world perspective. 1.

In case of foreign direct investment in Bangladesh, the survey seeks information on the profit, net income, and retained earnings of the reporting enterprise (and its subsidiaries) attributable to foreign direct investors. Operating profit includes . Survey Report (July-December, 2019) ...

This is the presentation slide of foreign direct investment of Bangladesh and world perspective. Here you will find the detail Definition, Objectives, Motives, Types, Strategies, Theories of FDI with example. You will also find the recent fact and figure of FDI on Bangladesh perspective and world perspective.

I am pleased to be informed of that Bangladesh Investment Development Authority (BIDA) is going to publish its Annual Report for FY 2021-22. BIDA is at the forefront of national efforts to attract foreign direct investment (FDI) to boost productivity, enhance overall competitiveness and support sustainable economic growth.

Kazi Mahmudur Rahman, Research Associate, Centre for Policy Dialogue (CPD). OECD Benchmark Definition of Foreign Direct Investment, OECD, 1999. Over the last 25 years, FDI in low-income countries has been highly concentrated in three countries, China, Nigeria and India because of their large market size, low labour costs and high returns in ...

Equity 54%. The volume of FDI inflows to Bangladesh since FY98 is given in Table 1. Over the 1998-2007 period, the aggregate FDI inflow to Bangladesh was USD 5,510 million. Of this, equity was USD 2,986 million (54 percent), reinvested earnings amounted to USD 1,634 million (nearly 30 percent), and intra-company loans constituted USD 890 ...

Foreign Dire ct Investment in Bangladesh: A nalysis of Policy Fr amewor k, Impact and Po tential Neaz Mujeri 1 *, Shahnewaz Mustafiz 1 , Fahim Mo sabbi r 1 , Syeda Mayesha Tul Jannat S anjida 1 and

Foreign Direct Investment is the category of international investment that reflects the objective of a resident ... In case of foreign direct investment in Bangladesh, the survey seeks information on the profit, net income, and retained earnings of the reporting enterprise (and its subsidiaries) attributable to foreign direct investors. ...

Foreign Direct Investment - View presentation slides online. The document discusses foreign direct investment (FDI) in Bangladesh. It defines FDI and notes its importance for economic growth in developing countries. Bangladesh has seen increasing FDI inflows in recent decades, reaching over $1 billion annually, though various factors still affect FDI levels such as bureaucracy, weak ...

Daily Updates of the Latest Projects & Documents. Foreign direct investment (FDI) generates economic benefits to the recipient country through positive impacts on the real economy resulting from physical capital .

According to the UNCTAD's World Investment Report 2023, FDI inflows to Bangladesh increased by 20.2% to USD 3.48 billion in 2022 (compared to USD 2.89 billion in 2021). In the same year, the total stock of FDI was estimated at USD 21.1 billion, representing only 4.6% of the country's GDP. Figures from the National Bank show that, during the ...

Inward foreign direct investment in Bangladesh: Do we need to rethink about some of the macro‑level quantitative ... also included catalysts like real interest rate and total reserve of foreign currency in Bangladesh to identify their eect on the inward FDI. To cushion the impact of social and infrastructural developments, variables like ...

Foreign investments were discouraged as a result foreign direct investment (FDI) inflow in Bangladesh till 1980 is very insignificant. The growth of Bangladesh's FDI inflow was around US$ 308-356 million for long fifteen years (1980-1995) which started with an amount of US $ 0.090 million in 1972.

The total inflows of FDI have been increasing over the years. In 1972, annual FDI inflow in Bangladesh was 0.090 million USD, and after 33 years, in 2005 annual FDI rose to 845.30 million USD and to 989 million USD in 2006. played a minor role in the economy of Bangladesh until 1980, a crucial year of policy change.

Bangladesh's F oreign Direct Investment (FDI) stock was $16.9 billion in 2019, with the United. States being the top investing count ry with $3.5 billion in accumulated investments. Bangladesh ...

Foreign direct Investment (FDI): USD 2.88 billion in 2019-20 (USD ... are free to make investment in Bangladesh excepting a few restricted sectors. ... Foreign investment and 100% foreign ownership is permitted in general, with a limited number of business activities which

advancement in FDI investment in Bangladesh by the foreign investors. During 1980s, FDI to Bangladesh was very little and mostly focused in banking and a few other sectors. Bangladesh started attracting FDI since 1996 in energy and power sector because of favorable and supportive policies for foreign investment, economic reform as well

Foreign investments were discouraged as a. result foreign direct investment (FDI) in ow in Bangladesh till 1980 is very insigni cant. The growth of Bangladesh's. FDI in ow was around US$ 308-356 ...

Source: Survey Report, Statistics Department of Bangladesh Bank and Foreign Direct Investment in Bangladesh (1971-2010), Board of Investment. In the Figure 8 and 3.4.4, it is clearly shown that the percentage of investment in various sectors has changed quite a lot. The percentage of telecommunication investment was 2% in 1996-2000 was only 2% ...

Foreign direct investment, net inflows (% of GDP) - Bangladesh. International Monetary Fund, International Financial Statistics and Balance of Payments databases, World Bank, International Debt Statistics, and World Bank and OECD GDP estimates. License : CC BY-4.0. LineBarMap. Also Show Share Details. Label. 1972 - 2022.

Keywords: FDI into Bangladesh, Foreign Direct Investment, Incentive available for FDI Investors in Bangladesh, Investment Climate in Bangladesh INTRODUCTION Bangladesh is one of the N11 Countries (Lawson, Heacock, and Stupnytska, 2007). It is considered as a land of opportunities because it is growing 6% - 7% annual growth rate during last one ...

FDI has become a desired form of incoming investment for capital-poor nations like Bangladesh. Therefore, a critical analysis of macroeconomic constituent's influences that determine the inflow of this "Investment-Blood" is undoubtedly rational. The study is conducted to shed empirical light on the relationship between FDI and other macroeconomic variables in Bangladesh, which is ...

Bangladesh foreign direct investment for 2021 was $1.72B, a 13.02% increase from 2020. Bangladesh foreign direct investment for 2020 was $1.53B, a 20.06% decline from 2019. Bangladesh foreign direct investment for 2019 was $1.91B, a 21.21% decline from 2018. Foreign direct investment refers to direct investment equity flows in the reporting ...

In the latest reports of Bangladesh, Current Account recorded a surplus of 1.3 USD bn in Jan 2024. Bangladesh Direct Investment Abroad expanded by 0.1 USD mn in Dec 2023. Its Foreign Portfolio Investment fell by 110.3 USD mn in Dec 2023. The country's Nominal GDP was reported at 460.2 USD bn in Jun 2022.