Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

- Write my thesis

- Thesis writers

- Buy thesis papers

- Bachelor thesis

- Master's thesis

- Thesis editing services

- Thesis proofreading services

- Buy a thesis online

- Write my dissertation

- Dissertation proposal help

- Pay for dissertation

- Custom dissertation

- Dissertation help online

- Buy dissertation online

- Cheap dissertation

- Dissertation editing services

- Write my research paper

- Buy research paper online

- Pay for research paper

- Research paper help

- Order research paper

- Custom research paper

- Cheap research paper

- Research papers for sale

- Thesis subjects

- How It Works

Top 140 Finance Research Paper Topics

Why finance topics? The search for interesting finance topics is a constant one. Of course, this is understandable because knowledge of hot topics in finance puts you ahead of the game. Students or researchers who major in business will, at one point or the other in their careers, make presentations, and submit research papers, essays,or help with dissertation or projects. With the headache of writing these papers aside, the challenge of picking finance topics always looms around. We have, therefore, carried out extensive research to present you with these 30 finance topics that will make your paper worth reading! When in doubt, this list of finance topics will surely come in handy to shed some light on that darkness!

Finding Excellent Topics in Finance

We offer you 30 researchable topics in finance. But why should we only catch fish for you if we can teach you how to fish too? The need to find unique topics in finance is on the increase. Here are some excellent tips that will help you choose appropriate finance topics:

- Find out unanswered questions from previous research works or develop on areas that require additional study.

- Read several theses to form ideas.

- Check economics topics . They may be more general but you can narrow down some of them.

- Search online for related topics that are unique, or make them unique to suit your purpose.

- Discuss your chosen topic with other students or people who have experience writing dissertations asking for their input.

Research Topics In Finance

In financial research, unique topics are pivotal to the overall success of the study. The reason for this is simple. Now put yourself in the shoes of professors who have read hundreds of theses and essays. They already know common topics that students like to write or work on. A hot research topic in finance will surely catch the attention of your professor and will likely earn you better grades. Writing finance research papers becomes much easier when you have superb finance research topics.

Here is a finance research topics list that will spark people’s interest in your research work and make your finance research paper worth reading! Ready for these research topics in finance? Read on!

- Merger and Acquisition: An Analytical Study of the Benefits and Set-backs.

- Capital Asset Pricing Model: Possible Solutions to its Inadequacies.

- Global Financial Crisis: A Critical Study of the Role of Auditors and Stakeholders.

- The Impact of Manipulating the Commodity Market on Future Commerce.

- Continuous-time Models: An exhaustive Comparative Analysis of its Application in Divers financial Environments.

- How Speculations Undermine the Stability of Banking in Asian Markets.

- Branding: Its Effect on Consumer Behavior.

- An effective strategy for managing inventory and controlling your budget.

- An analytical report on the various investments in tax-saving products.

- Using a systematic investment strategy to build stability for retail investments.

- How income tax is planned and implemented in India’s economy.

- A detailed analysis of how the Indian banking system operates.

- How does multi-level marketing work in different economies around the world?

- A detailed report on electronic payment and how it can be improved.

- A case study regarding senior citizen investment portfolios.

- Are there potential risks and rewards when comparing savings to investments?

- Is ratio analysis an effective component of financial statement analysis?

- How the Indian economy functions with its current banking operations.

Finance Research Topics For MBA

Here are some great finance research topics you can use toward your MBA. It’s sure to intrigue your professor and get you to look at finance from a different perspective.

- Investment analysis of a company of your choice.

- A detailed report on working capital management.

- Financial plans and considerations for saving taxes and salaried employees.

- A detailed analysis of the cost and costing models of the company of your choice.

- The awareness of investments in financial assets and equity trading preference with financial intermediaries.

- The perspective of investors and their involvement with life insurance investments.

- A detailed analysis of the perception of mutual fund investors.

- The comparative study between UIL and the traditional products.

- A detailed report on how the ABC company manages cash.

Corporate Risk Management Topics

These are some key topics you can use relating to corporate risk management.

- A detailed report on the fundamentals of corporate risk management.

- The analytical concepts relating to effective corporate and financial management within a company.

- How does corporate risk management affect the financial market and its products?

- What are risk models and how are they evaluated?

- How is market risk effectively measured and managed in today’s economy?

- How can a company be vigilant of potential credit risks they can face?

- What are the differences between operational and integrated risks in the corporate world?

- Is liquidity an effective strategy to lower financial risk to a company?

- How risk management can connect with and benefit investment management.

- The current issues that are affecting the modern marketplace and the financial risks they bring.

Healthcare Finance Research Topics

These are some key topics you can use relating to healthcare finance research.

- Is it better for the government to pay for an individual’s healthcare?

- The origins of healthcare finance.

- An analysis of Canada and their healthcare finance system.

- Is healthcare financing a right or a privilege?

- The changing policies of healthcare in the U.S.

- Can healthcare be improved in first-world countries?

- Can the healthcare system be improved or remade?

- How much influence does the government have on healthcare in a country?

- The impact of growing global health spending.

- Is free healthcare achievable worldwide?

Corporate Finance Topics

Corporate finance deals with processes such as financing, structuring of capital, and making investment decisions. It seeks to maximize shareholder value by implementing diverse strategies in long and short-term financial planning.

Corporate finance research topics broadly cover areas like tools for risk management, trend research in advanced finance, physical and electronic techniques in securities markets, research trends in advance finance, investment analysis, and management of government debt. The following corporate finance topics will surely minimize any risk of mistakes!

- Using the Bootstrapped Interest Rates to Price Corporate Debt Capital Market Instruments.

- Corporate Organizations: The Impact of Audit Independence on Accountability and Transparency.

- Buybacks: A Critical Analysis of how Firms can Buy Back at Optimal Prices.

- Merge and Acquisitions: Reasons why Firms still Overpay for bad Acquisitions.

- Corporate Finance: Ethical Concerns and Possible Solutions.

- Understanding the investment patterns relative to smaller and medium-capitalization businesses.

- A detailed analysis of the different streams of investment relating to mutual funds.

- Equity investors and how they manage their portfolios and perception of potential risks.

- How does investor preference operate in the commodity market in Karvy Stock Broking Limited?

- An analysis of the performance of mutual funds in the public and private sectors.

- Understanding how Videcon manages its working capital.

- The Visa Port trust and how it conducts ratio analysis.

- How the gold monetization scheme has affected the Indian economy and banking operations.

- How does SWIFT work and what are the potential risks and rewards?

- A detailed analysis of the FMC and SEBI merger.

Business Finance Topics

Every decision made in a business has financial implications. It is, therefore, essential that business people have a fundamental understanding of finance. To show your knowledge, you must be able to write articles on finance topics in areas such as financial analysis, valuation, management, etc. Here are some juicy business finance topics!

- Application of Business Finance: Its importance to the Business Sector.

- The Importance of Business Finance in the Establishment of Business Enterprises.

- Modernization of Business: Roles of Business Finance in Business Modernization.

- A detailed study on providing financial aid to self-help groups and projects.

- Is tax an effective incentive for selling life insurance to the public?

- Understanding how the performance of mutual funds can change within the private and public sectors.

- Is there a preference for different investment options from financial classes?

- A detailed analysis of retail investors and their preferences and choices.

- A study on investors and their perspective on investing in private insurance companies.

- How analyzing financial statements can assess a business’s performance.

- Increasing the accountability of corporate entities.

- Ethical concerns connected to business finance and how they can be managed.

- The level of tax paid by small to medium businesses.

International Finance Topics

As the world is now a global village, business transactions occur all around the world. No more are we limited to local trade, and this is why the study of international is essential and relevant. Here are some international finance topics that will suit your research purpose!

- Stock Exchange: How Important are the Functions of a Bank Office?

- Global Economic Crises: Possible Precautions to prevent Global Financial crisis.

- Bond Rating: the Effect of Changes on the Price of Stocks.

- How the Banking Industry can Decrease the Impact of Financial Crisis.

- Is it possible for a country to budget funds for healthcare for the homeless?

- The negative impact of private healthcare payments on impoverished communities.

- What sectors in healthcare require more funding at the moment?

- The dilemma of unequal access to adequate healthcare in third world countries.

- Can cancer treatment be more inexpensive to the public?

- The problem with the high pricing of medication in the U.S.

- Is there a better way to establish healthcare financing in the U.S?

- What are the benefits of healthcare finance systems in Canada and the UK?

- How can third-world countries improve their healthcare systems without hurting their economy?

- Is financing research a priority in healthcare and medicine?

- Does free healthcare hurt the tax system of a country?

- Why is free and privatized healthcare present in different economies?

- How does government funding affect healthcare finance systems?

- How do patient management systems work?

- Where does affordable healthcare financing fit in growing economies?

- The economic impact of COVID-19 in various countries.

- The healthcare policies of the Serbian government.

Finance Research Paper Ideas

Writing a research paper requires an independent investigation of a chosen subject and the analysis of the remarkable outcomes of that research. A finance researcher will, therefore, need to have enough finance research paper topics from which to choose at his fingertip. Carefully selecting a finance thesis topic out of the many finance research papers topics will require some skill. Here are some exciting finance paper topics!

- Behavioral Finance versus Traditional Finance: Differences and Similarities.

- Budgetary Controls: The Impact of this Control on Organizational performance.

- Electronic Banking: The Effect of e-Banking on Consumer Satisfaction.

- Credit and Bad Debts: Novel Techniques of management in commercial Banks.

- Loan Default: A Critical Assessment of the Impact of Loan Defaults on the Profitability of Banks.

- A detailed analysis of the best risk management methods used in the manufacturing industry.

- Identifying and measuring financial risks in a derivative marketplace.

- Exploring the potential risks that can occur in the banking sector and how they can be avoided.

- The risks that online transactions bring.

- What are the methods used to ensure quantitive risk management is achieved?

- A better understanding of policy evaluation and asset management.

- What makes traditional finance so different from behavioral?

- The significance of budgetary control in a corporate organization.

- How do loans benefit the profitability of banks?

- How do commercial banks assist their clients that are in bad debt?

- The various considerations we need to be aware of before making investment decisions.

Personal Finance Topics

Personal finance covers the aspects of managing your money, including saving and investing. It comprises aspects such as investments, retirement planning, budgeting, estate planning, mortgages, banking, tax, and insurance. Researching in this area will surely be of direct impact on the quality of living. Here are some great personal finance topics that are eager to have you work on them!

- Evaluation of Possible Methods of Saving while on a Budget.

- The Effect of Increase in Interest Rate and Inflation on Personal Finance.

- Benefits of Working from Home to both Employers and Employees.

- Will dental services be considered an essential medical service soon?

- Is affordable or free healthcare a right that everyone should be entitled to?

- The best ways to save money while on a tight budget.

- What happens to personal finance when inflation and interest rates rise?

- The financial benefits of working from home.

- Does innovations in personal finance act as an incentive for households to take risks?

- A detailed analysis of credit scores.

- The importance of credit and vehicle loans.

- A detailed analysis of employee benefits and what should be considered.

- The effect of tax on making certain financial decisions.

- The best ways to manage your credit.

- The difficulties that come with mobile banking.

Finance Topics For Presentation

Sometimes, you may need to present a topic in a seminar. The idea is that you can whet the appetite of your audience with the highlights of your subject matter. Choosing these finance seminar topics requires a slightly different approach in that you must be thoroughly familiar with that topic before giving the presentation. Interesting and easy-to-grasp finance topics are, therefore, necessary for presentations. Here are some topic examples that fit perfectly into this category.

- Analysis of the Year-over-Year Trend.

- Maximizing Pension Using Life Insurance.

- The Architecture of the Global Financial System.

- Non-communicable diseases and the burden they have on economies.

- Is there a connection between a country’s population and its healthcare budget?

- The spending capability of medical innovations in a third-world economy.

- The long-term effects of healthcare finance systems in the U.S.

- A detailed analysis of pharmaceutical marketing in eastern Europe.

- Understanding the reduction in medical expenses in Greece.

- Private payment for healthcare in Bulgaria.

- A complete change in healthcare policy worldwide. Is it necessary?

- The significance of electronic banking on the public.

- The evolution of banking and its operations.

So here we are! Surely, with this essay on finance topics that you have read, you’ll need only a few minutes to decide your topic and plunge into proper research! If you need professional help, don’t hesitate to contact our economics thesis writers .

Leave a Reply Cancel reply

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

Finance articles from across Nature Portfolio

Latest research and reviews.

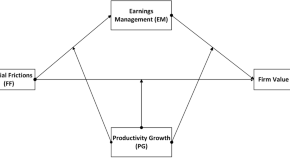

Firm value adjustment speed through financial friction in the presence of earnings management and productivity growth: evidence from emerging economies

- Saifullah Khan

- Adnan Shoaib

ESG performance on the value of family firms: international evidence during Covid-19

- Christian Espinosa-Méndez

- Carlos Maquieira

- José Tomás Arias

Nexus between boardroom independence and firm financial performance: evidence from South Asian emerging market

- Majid Jamal Khan

- Faiza Saleem

- Muhammad Yar Khan

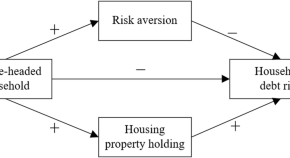

The influence and mechanism of female-headed households on household debt risk: empirical evidence from China

- Yingzhu Guo

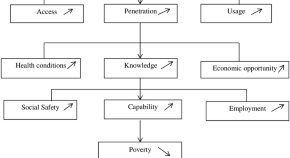

Can financial inclusion enhance human development? Evidence from low- and middle-income countries

- Kais Tissaoui

- Abdelaziz Hakimi

- Taha Zaghdoudi

Ecological money and finance—upscaling local complementary currencies

- Thomas Lagoarde-Ségot

- Alban Mathieu

News and Comment

Hunger, debt and interest rates

Financial imperatives to food system transformation

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial resources while making better use of existing ones. These imperatives are yet to garner greater traction to instigate meaningful change.

- Eugenio Diaz-Bonilla

- Brian McNamara

Central bank digital currencies risk becoming a digital Leviathan

Central bank digital currencies (CBDCs) already exist in several countries, with many more on the way. But although CBDCs can promote financial inclusivity by offering convenience and low transaction costs, their adoption must not lead to the loss of privacy and erosion of civil liberties.

- Andrea Baronchelli

- Hanna Halaburda

- Alexander Teytelboym

ESG performance of ports

An article in Case Studies on Transport Policy quantifies the environmental, social, and governance performances of three ports.

- Laura Zinke

Venture capital accelerates food technology innovation

Start-ups are now the predominant source of innovation in all categories of food technology. Venture capital can accelerate innovation by enabling start-ups to pursue niche areas, iterate more rapidly and take more risks than larger companies, writes Samir Kaul.

Challenges for a climate risk disclosure mandate

The United States and other G7 countries are considering a framework for mandatory climate risk disclosure by companies. However, unless a globally acceptable hybrid corporate governance model can be forged to address the disparities among different countries’ governance systems, the proposed framework may not succeed.

- Paul Griffin

- Amy Myers Jaffe

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

200 Unique Finance Research Topics to Impress Your Professor

In the ever-evolving landscape of finance, the quest for an exceptional research topic becomes the cornerstone of academic distinction. Are you looking for an interesting research topic that will help your finance paper stand out? You’re in luck, as we have curated a comprehensive list of 200 unparalleled topics for you to develop an impressive idea for your research paper. As a professional Custom writing service , we will present the research topics on finance that will get you started on your own. Let’s dive in!

Table of Contents

Unique Finance Research Topics for You to Score Big

As we have tried our best to serve you with unique topics, choosing a research topic from these lists will help you unleash your financial prowess. Let’s get to reading the first one:

Top Finance Research Topics or Finance Report Topics

- Merger and acquisition: an analytical study of the benefits and obstacles.

- Capital asset valuation model: possible solutions to some deficiencies.

- The impact of commodity market manipulation on future trading.

- Continuous time models: a comparative analysis of their application in various financial environments.

- How speculation undermines the stability of banking in national markets.

- Branding: its effect on consumer behavior

- Regulation of Investments of Pension Funds and Insurance Companies

- Strategic Asset Allocation for the International Reserves of the Central Bank

- Budget Independence of the Central Bank

- Financial in the Department

- Financing of the Livestock Sector in the USA and the Trust as an Alternative

- Implications of the Retirement and Pension

- Financing of Agroindustry

- Oligopolistic practices in the marking of the interest rate in the Banking System

- Non-Traditional Financing Mechanisms applicable to SMEs

- Design a cost accounting proposal for Telecommunications Companies

- Impact of the implementation of the electronic payment system

- Contribution of Microcredit to economic development through Public Banking

- Electronic Money in the process of Financial Inclusion in some countries

- Mitigation of Risks assumed by the Central Banks

- Strategic planning in the field of financial crime

The finance research paper topics we mentioned above will help you sort things out for your assignments.

Corporate Finance Research Titles

Embark on a captivating journey into corporate finance with our meticulously curated research topics . We know interesting finance topics are hard to find but today is your lucky day. Our professional essay writers will assist you to choose finance topics to write about. So, here you go:

- Using interest rate bootstrapping to price corporate debt analysis.

- Corporate Organizations: The Impact of Independent Audits on Accountability and Transparency.

- Stock Buybacks: A Critical Look at How Companies Can Buy Back at Optimum Prices.

- Mergers and Acquisitions: Reasons Companies Overpay for Bad Acquisitions.

- Corporate Finance: Ethical Concerns and Possible Solutions

- Constraints for potential participation in tourism

- Economics and business management

- Systematic Review, Analysis, and Evaluation of Research in Corporate Finance

- Corporate governance: improving their performance.

- Valuation of the Wall Street Stock Exchange Companies

- Valuation of Companies In San Andreas

- Valuation of Companies In San Francisco

- Valuation of Companies In Las Angeles

- Valuation of Companies In New York

- Valuation of Companies In Mexico

- Bioeconomy and sustainable development goals

- Social networks and financial restrictions

- Balanced scorecard of an IT consulting company

- Proposal to improve the process of preparing and managing investment projects

- Design a strategic growth plan for the company

- Bank concentration, institutional investors and financial restrictions

- Realities and challenges: internal communications at an American Company

- How does the development of institutional investors affect the volatility of growth?

- Early entrepreneurship and financial development: a global approach

- Analysis and resolution of methodologies to estimate the share price

- Design of a management control system

- New organizational culture in the States

- Using the discounted cash flow method

- Design of an innovation management system

- Business plan for an information technology company

- Management of high-net-worth clients

- Investor behavior in multinational companies

- Redesign the formulation process and management control

These Financial and History research paper topics allow students to create unique and captivating content for their assignments. Students can start a good research in finance topics after reading our expert’s list.

Healthcare Finance Topics

Navigate the intersection of healthcare and finance with our compelling array of research topics. Here you go with the list of amazing financial research topics:

- The impact of healthcare reimbursement models on patient outcomes.

- Cost-effectiveness analysis of pharmaceutical interventions.

- Financial implications of value-based healthcare delivery.

- The role of health insurance in reducing healthcare disparities.

- Financial challenges and opportunities in telemedicine adoption.

- Financing strategies for healthcare infrastructure development.

- The economics of healthcare technology innovation.

- Analyzing the financial sustainability of public healthcare systems.

- The impact of healthcare mergers and acquisitions on costs and quality.

- Financing long-term care services for an aging population.

- Financial implications of healthcare fraud and abuse.

- Evaluating the financial viability of healthcare startups.

- The economics of healthcare workforce planning and staffing.

- Financial incentives for healthcare providers to adopt evidence-based practices.

- The role of health savings accounts (HSAs) in healthcare financing.

- Financing strategies for addressing mental health and addiction treatment.

- The economics of healthcare quality improvement initiatives.

- Analyzing the financial impact of healthcare policy reforms.

- The role of healthcare finance in supporting global health initiatives.

- Financial challenges and solutions in managing healthcare costs for chronic diseases.

Our experts have presented the best research topics in finance and healthcare for you. Students may choose the one that suits their abilities.

Business Finance Research Topics

Explore the full potential of business finance by choosing a topic for research from our carefully picked list. Here you go:

- Application of trade finance: its importance for the business sector.

- Business Modernization: Roles of Trade Finance in Business Modernization.

- Feasibility of the Implementation of a quinoa processing plant for export in the company

- Validation of the theory of return on investment in the commercial management of logistics companies

- Financial consulting unit for the implementation of information systems

- Internal control financial system

- Proposal to improve the works trust supervision process in a technical-financial consulting company

- Short-term financial planning and profitability case: Pacific Savings and Credit Cooperative

- Business plan for the launch of a financial products

- Strengthening the strategy toward value creation

- Impact of operational risk management on regulatory capital and the global capital ratio of microfinance entities

- The discounted cash flow and the real options method in the valuation of a company in the mass consumption sector

- Estimation of financial solvency to assess the risk of bankruptcy

- Participation associations are an effective tool for seeking financing

- Analysis and design of a process architecture for a small mining

- Analysis of the ROI in the commercial management of department stores

- Analysis of the evolution of the value of the industrial sector through the model of the net present value of growth options

- The impact of capital budgeting techniques on investment decisions.

- Financial risk management strategies in multinational corporations.

- The role of financial derivatives in hedging against market volatility.

- Analyzing the effectiveness of corporate governance mechanisms in mitigating agency problems.

- Financial implications of mergers and acquisitions on shareholder value.

- The relationship between corporate social responsibility and financial performance.

- The impact of corporate taxation on firm profitability and investment decisions.

Our finance topics for research business and marketing are handpicked by our experts and it allows you to bypass the lengthy processes.

International Financial Research Paper Topics

Uncover the complexities of global finance with these great research topics.

- Interaction of the USA financial system with international financial markets

- Repercussions on economic theory and policy

- The financial crisis of 2008-2011. Causes, spread, and consequences

- Effects of external shocks on the United States economy

- The economic problems in the nineties

- The debt crisis and emerging markets

- The Big Short Crises: Causes and Impact

- Crypto-currency crashes

- Exchange collapses and balance of payments crises

- First, second, and third-generation economic crisis models

- Financial crises in emerging countries

- Financial deregulation and capital flows.

- Long-term evolution, Relationship with the exchange rate regime.

- Relationship between financial flows and FDI, short and long-term.

- Push and pull factors and determinants of capital flows

- External financial markets. Eurocurrencies and Euromarkets

- The North American market

- Oil market and independency with international financial affairs

- The forward exchange markets

- Taxonomy and operation of international financial markets

- Models of external restriction and growth

- Real exchange rate and growth.

- Exchange policy in developing countries.

- Real effects of exchange rate policy.

- Currency substitution and dollarization

- Relationship between the euro and the dollar

- SME: credibility and external commitment policies as a form of stabilization

- Consequences of global monetary conditions on international prices

- Economic integration and financial integration in Europe

- The role of international reserves in the different stages of the international monetary system

- Evolution from the European Monetary System (EMS) to the single currency

- Analysis of costs and benefits

- International macroeconomic cycles and their transmission.

- Economic interdependence and coordination of monetary and exchange policies

- The strategic approach and the theory of games in the global economy

- International liquidity generation mechanisms

- The international monetary system

- The flotation bands. Theory and evidence.

- Crawling peg. Theory and evidence.

- Exchange rate administered. Theory and evidence.

- Inflation Targeting. Theory and evidence.

- Volatility and exchange rate regime

- Stabilization plans based on the exchange rate

- Costs and benefits of macroeconomic efficiency and macroeconomic flexibility

- Effects of fiscal and monetary policy.

- Nominal volatility and absolute volatility.

- The efficiency of the asset market and the premium for risk: Different ways to cover risks

Personal Financial Topics for Research

Check out our list of hand-picked personal finance topics:

- Paying debts, as well as savings and investment

- The balance between the present and the future

- How to improve personal finances

- Create a spending plan

- Salary, unemployment benefit, pension.

- Personal finance applications for mobile

- Net profit on your investments

- Plan a reduction of expenses

- Personal finance books

- Investing in Stock Exchange

- Investment in Cryptocurrencies

- Research interest rates on loans, credit cards, and similar investment instruments.

- SMEs and businesses

- Discussing the Importance of Financial protection

- Creation of capital and assets

- Financial instruments – What Do We Need to Know About Them?

- Inflation and loss of purchasing power

- Evaluation of possible saving methods with a limited budget.

- The effect of rising interest rates and inflation on personal finance.

- Define your financial goals and create a budget

- The US banks that no longer want more money from their customers

- GameStop: Amateur Investors Taking on Wall Street

Hopefully, this blog post has allowed you to explore the different aspects of finance. So get creative and choose a topic that speaks to you. When delving into how to write an 8-page paper , these carefully curated lists covering topics from corporate finance to personal finance provide all the necessary guidance and resources.

What are the main topics of finance?

The main topics for finance research include:

- Financial Markets and Instruments

- Corporate Finance

- Financial Institutions and Banking

- Investments

- Personal Finance

- Financial Planning and Risk Management

- International Finance

How can I choose a unique finance research topic?

Are there any finance research topics that have real-world applications, how can i make my finance research topic stand out.

Order Original Papers & Essays

Your First Custom Paper Sample is on Us!

Timely Deliveries

No Plagiarism & AI

100% Refund

Try Our Free Paper Writing Service

Related blogs.

Connections with Writers and support

Privacy and Confidentiality Guarantee

Average Quality Score

50 Best Finance Dissertation Topics For Research Students

Link Copied

Share on Facebook

Share on Twitter

Share on LinkedIn

Finance Dissertation Made Easier!

Embarking on your dissertation adventure? Look no further! Choosing the right finance dissertation topics is like laying the foundation for your research journey in Finance, and we're here to light up your path. In this blog, we're diving deep into why dissertation topics in finance matter so much. We've got some golden writing tips to share with you! We're also unveiling the secret recipe for structuring a stellar finance dissertation and exploring intriguing topics across various finance sub-fields. Whether you're captivated by cryptocurrency, risk management strategies, or exploring the wonders of Internet banking, microfinance, retail and commercial banking - our buffet of Finance dissertation topics will surely set your research spirit on fire!

What is a Finance Dissertation?

Finance dissertations are academic papers that delve into specific finance topics chosen by students, covering areas such as stock markets, banking, risk management, and healthcare finance. These dissertations require extensive research to create a compelling report and contribute to the student's confidence and satisfaction in the field of Finance. Now, let's understand why these dissertations are so important and why choosing the right Finance dissertation topics is crucial!

Why Are Finance Dissertation Topics Important?

Choosing the dissertation topics for Finance students is essential as it will influence the course of your research. It determines the direction and scope of your study. You must make sure that the Finance dissertation topics you choose are relevant to your field of interest, or you may end up finding it more challenging to write. Here are a few reasons why finance thesis topics are important:

1. Relevance

Opting for relevant finance thesis topics ensures that your research contributes to the existing body of knowledge and addresses contemporary issues in the field of Finance. Choosing a dissertation topic in Finance that is relevant to the industry can make a meaningful impact and advance understanding in your chosen area.

2. Personal Interest

Selecting Finance dissertation topics that align with your interests and career goals is vital. When genuinely passionate about your research area, you are more likely to stay motivated during the dissertation process. Your interest will drive you to explore the subject thoroughly and produce high-quality work.

3. Future Opportunities

Well-chosen Finance dissertation topics can open doors to various future opportunities. It can enhance your employability by showcasing your expertise in a specific finance area. It may lead to potential research collaborations and invitations to conferences in your field of interest.

4. Academic Supervision

Your choice of topics for dissertation in Finance also influences the availability of academic supervisors with expertise in your chosen area. Selecting a well-defined research area increases the likelihood of finding a supervisor to guide you effectively throughout the dissertation. Their knowledge and guidance will greatly contribute to the success of your research.

Writing Tips for Finance Dissertation

A lot of planning, formatting, and structuring goes into writing a dissertation. It starts with deciding on topics for a dissertation in Finance and conducting tons of research, deciding on methods, and so on. However, you can navigate the process more effectively with proper planning and organisation. Below are some tips to assist you along the way, and here is a blog on the 10 tips on writing a dissertation that can give you more information, should you need it!

1. Select a Manageable Topic

Choosing Finance research topics within the given timeframe and resources is important. Select a research area that interests you and aligns with your career goals. It will help you stay inspired throughout the dissertation process.

2. Conduct a Thorough Literature Review

A comprehensive literature review forms the backbone of your research. After choosing the Finance dissertation topics, dive deep into academic papers, books, and industry reports, gaining a solid understanding of your chosen area to identify research gaps and establish the significance of your study.

3. Define Clear Research Objectives

Clearly define your dissertation's research questions and objectives. It will provide a clear direction for your research and guide your data collection, analysis, and overall structure. Ensure your objectives are specific, measurable, achievable, relevant, and time-bound (SMART).

4. Collect and Analyse Data

Depending on your research methodology and your Finance dissertation topics, collect and analyze relevant data to support your findings. It may involve conducting surveys, interviews, experiments, and analyzing existing datasets. Choose appropriate statistical techniques and qualitative methods to derive meaningful insights from your data.

5. Structure and Organization

Pay attention to the structure and organization of your dissertation. Follow a logical progression of chapters and sections, ensuring that each chapter contributes to the overall coherence of your study. Use headings, subheadings, and clear signposts to guide the reader through your work.

6. Proofread and Edit

Once you have completed the writing process, take the time to proofread and edit your dissertation carefully. Check for clarity, coherence, and proper grammar. Ensure that your arguments are well-supported, and eliminate any inconsistencies or repetitions. Pay attention to formatting, citation styles, and consistency in referencing throughout your dissertation.

Don't let student accommodation hassles derail your finance research.

Book through amber today!

Finance Dissertation Topics

Now that you know what a finance dissertation is and why they are important, it's time to have a look at some of the best Finance dissertation topics. For your convenience, we have segregated these topics into categories, including cryptocurrency, risk management, internet banking, and so many more. So, let's dive right in and explore the best Finance dissertation topics:

Dissertation topics in Finance related to Cryptocurrency

1. The Impact of Regulatory Frameworks on the Volatility and Liquidity of Cryptocurrencies.

2. Exploring the Factors Influencing Cryptocurrency Adoption: A Comparative Study.

3. Assessing the Efficiency and Market Integration of Cryptocurrency Exchanges.

4. An Analysis of the Relationship between Cryptocurrency Prices and Macroeconomic Factors.

5. The Role of Initial Coin Offerings (ICOs) in Financing Startups: Opportunities and Challenges.

Dissertation topics in Finance related to Risk Management

1. The Effectiveness of Different Risk Management Strategies in Mitigating Financial Risks in Banking Institutions.

2. The Role of Derivatives in Hedging Financial Risks: A Comparative Study.

3. Analyzing the Impact of Risk Management Practices on Firm Performance: A Case Study of a Specific Industry.

4. The Use of Stress Testing in Evaluating Systemic Risk: Lessons from the Global Financial Crisis.

5. Assessing the Relationship between Corporate Governance and Risk Management in Financial Institutions.

Dissertation topics in Finance related to Internet Banking

1. Customer Adoption of Internet Banking: An Empirical Study on Factors Influencing Usage.

Enhancing Security in Internet Banking: Exploring Biometric Authentication Technologies.

2. The Impact of Mobile Banking Applications on Customer Engagement and Satisfaction.

3. Evaluating the Efficiency and Effectiveness of Internet Banking Services in Emerging Markets.

4. The Role of Social Media in Shaping Customer Perception and Adoption of Internet Banking.

Dissertation topics in Finance related to Microfinance

1. The Impact of Microfinance on Poverty Alleviation: A Comparative Study of Different Models.

2. Exploring the Role of Microfinance in Empowering Women Entrepreneurs.

3. Assessing the Financial Sustainability of Microfinance Institutions in Developing Countries.

4. The Effectiveness of Microfinance in Promoting Rural Development: Evidence from a Specific Region.

5. Analyzing the Relationship between Microfinance and Entrepreneurial Success: A Longitudinal Study.

Dissertation topics in Finance related to Retail and Commercial Banking

1. The Impact of Digital Transformation on Retail and Commercial Banking: A Case Study of a Specific Bank.

2. Customer Satisfaction and Loyalty in Retail Banking: An Analysis of Service Quality Dimensions.

3. Analyzing the Relationship between Bank Branch Expansion and Financial Performance.

4. The Role of Fintech Startups in Disrupting Retail and Commercial Banking: Opportunities and Challenges.

5. Assessing the Impact of Mergers and Acquisitions on the Performance of Retail and Commercial Banks.

Dissertation topics in Finance related to Alternative Investment

1. The Performance and Risk Characteristics of Hedge Funds: A Comparative Analysis.

2. Exploring the Role of Private Equity in Financing and Growing Small and Medium-Sized Enterprises.

3. Analyzing the Relationship between Real Estate Investments and Portfolio Diversification.

4. The Potential of Impact Investing: Evaluating the Social and Financial Returns.

5. Assessing the Risk-Return Tradeoff in Cryptocurrency Investments: A Comparative Study.

Dissertation topics in Finance related to International Affairs

1. The Impact of Exchange Rate Volatility on International Trade: A Case Study of a Specific Industry.

2. Analyzing the Effectiveness of Capital Controls in Managing Financial Crises: Comparative Study of Different Countries.

3. The Role of International Financial Institutions in Promoting Economic Development in Developing Countries.

4. Evaluating the Implications of Trade Wars on Global Financial Markets.

5. Assessing the Role of Central Banks in Managing Financial Stability in a Globalized Economy.

Dissertation topics in Finance related to Sustainable Finance

1. The impact of sustainable investing on financial performance.

2. The role of green bonds in financing climate change mitigation and adaptation.

3. The development of carbon markets.

4. The use of environmental, social, and governance (ESG) factors in investment decision-making.

5. The challenges and opportunities of sustainable Finance in emerging markets.

Dissertation topics in Finance related to Investment Banking

1. The valuation of distressed assets.

2. The pricing of derivatives.

3. The risk management of financial institutions.

4. The regulation of investment banks.

5. The impact of technology on the investment banking industry.

Dissertation topics in Finance related to Actuarial Science

1. The development of new actuarial models for pricing insurance products.

2. The use of big data in actuarial analysis.

3. The impact of climate change on insurance risk.

4. The design of pension plans that are sustainable in the long term.

5. The use of actuarial science to manage risk in other industries, such as healthcare and Finance.

Tips To Find Good Finance Dissertation Topics

Embarking on a financial dissertation journey requires careful consideration of various factors. Your choice of topic in finance research topics is pivotal, as it sets the stage for the entire research process. Finding a good financial dissertation topic is essential to blend your interests with the current trends in the financial landscape. We suggest the following tips that can help you pick the perfect dissertation topic:

1. Identify your interests and strengths

2. Check for current relevance

3. Feedback from your superiors

4. Finalise the research methods

5. Gather the data

6. Work on the outline of your dissertation

7. Make a draft and proofread it

In this blog, we have discussed the importance of finance thesis topics and provided valuable writing tips and tips for finding the right topic, too. We have also presented a list of topics within various subfields of Finance. With this, we hope you have great ideas for finance dissertations. Good luck with your finance research journey!

Frequently Asked Questions

How do i research for my dissertation project topics in finance, what is the best topic for dissertation topics for mba finance, what is the hardest finance topic, how do i choose the right topic for my dissertation in finance, where can i find a dissertation topic in finance.

Your ideal student home & a flight ticket awaits

Follow us on :

Related Posts

The Best Time to Study: Morning, Afternoon, or Night!

21 Best Note Taking Apps For Students In 2024 (Free & Paid)

.jpg)

15 Top Aerospace Engineering Universities in the World in 2024

Planning to Study Abroad ?

Your ideal student accommodation is a few steps away! Please fill in your details below so we can find you a new home!

We have got your response

amber © 2024. All rights reserved.

4.8/5 on Trustpilot

Rated as "Excellent" • 4800+ Reviews by students

Rated as "Excellent" • 4800+ Reviews by Students

- Research Paper Guides

- Research Paper Topics

- 250+ Finance Research Paper Topics & Ideas for Your Project

- Speech Topics

- Basics of Essay Writing

- Essay Topics

- Other Essays

- Main Academic Essays

- Basics of Research Paper Writing

- Miscellaneous

- Chicago/ Turabian

- Data & Statistics

- Methodology

- Admission Writing Tips

- Admission Advice

- Other Guides

- Student Life

- Studying Tips

- Understanding Plagiarism

- Academic Writing Tips

- Basics of Dissertation & Thesis Writing

- Essay Guides

- Formatting Guides

- Basics of Research Process

- Admission Guides

- Dissertation & Thesis Guides

250+ Finance Research Paper Topics & Ideas for Your Project

Table of contents

Use our free Readability checker

Have you ever found yourself angling for the perfect finance topic, only to be caught in the net of confusion? Well, reel in your worries, because this blog is your golden fish! We've curated 250 distinct finance research topics tailored to any taste.

Need a nudge in the right direction? Or maybe you're after a whole new financial perspective? Whatever it is, our research paper writing service has got you covered. Dive into this assortment of finance research paper topics and choose an idea that speaks to you.

What Are Finance Research Topics?

finance is all about how money works – how it's made, how it's managed, and how it's spent. It essentially oversees the process of allocating resources and assets over time. This domain is fundamental for the smooth functioning of economies, businesses, and personal lives.

With this in mind, financial research topics are the subjects that explore how finances are managed. These subjects can range from anything from figuring out how Bitcoin affects the stock market to examining how a country's economy recovers after a recession.

Features of Good Finance Research Paper Topics

Now that you understand what a finance domain is all about, let’s discuss what makes finance research paper topics worthwhile. Before you pick any topic, make sure it fills the boxes of these requirements:

- Contemporary relevance Your topic should be connected to current issues or trends in finance.

- Focused scope Your topic should be specific enough to allow a deep analysis. For example, rather than exploring "Global finance," you might examine "The impact of cryptocurrency on global finance."

- Data accessibility Ensure you can find enough information about your topic to base your research on.

- Fresh perspective There are many aspects that have already been covered by other scholars. Make sure your topic offers fresh insights or explores a matter from a new angle.

- Personal engagement If you're excited about your study, that's a good sign you've picked a winning topic.

How to Choose a Finance Research Paper Topic?

Choosing a finance research topic idea is like going on a treasure hunt. But don’t be afraid. Our online essay writer team has shared guidelines to help you find that 'X' marks the spot!

- Explore possible directions Read articles, watch videos, listen to podcasts. As you search for topics, jot down interesting ideas that capture your attention.

- Prioritize your interests Reflect on what really interests you. You might be fascinated by investment strategies or passionate about sustainable finance.

- Uncover the gaps Look for questions that are yet unanswered or try to recognize unique angles.

- Check for information Now, you need to ensure you have enough equipment and credible sources to work with.

- Take a leap Once you've done all your groundwork, go ahead and pick a theme that resonates with your goals.

Now that you have a clue how to spot decent finance research topic ideas, let’s move one to the actual list of suggestions.

Finance Research Topics List

Get ready to navigate through our collection of finance research paper topic ideas! We've mapped out these suggestions to explore. Each of these topics can be further divided into subtopics for a more in-depth analysis.

- Cryptocurrency's impact on traditional banking.

- Sustainable investment practices and implications.

- Unveiling the role of artificial intelligence in market predictions.

- Microloans and their role in alleviating poverty.

- Behavioral finance: Understanding investor psychology.

- Making a case for teaching money management in schools.

- The rise of fintech startups: Disruption or evolution?

- Entering the era of digital wallets: What's next?

- Exploring the balance between profit and social responsibility in impact investing.

- Success of crowdfunding campaigns.

- Securing our online vaults: The importance of cybersecurity in banking.

- Strategies for recovery after an economic downturn.

- Central banks and their contribution to economic stability.

- Blockchain technology: A new era of transaction processing.

- Robo-advisors in investment management.

Interesting Finance Research Topics

Fasten your seatbelts, scholars! We're about to take off on another round of academic adventure with interesting finance topics. With these ideas at hand, you are sure to find a captivating topic for your financial project.

- How does pandemic affect the global economy?

- Cryptocurrency: A bubble or new standard?

- Influence of artificial intelligence on credit scoring systems.

- Evolution and significance of green bonds.

- Correlation between investor psychology and stock market volatility.

- Impact of educational initiatives on personal money management.

- Fintech startups and traditional banking: Rivals or collaborators?

- Mobile wallets: Balancing convenience and security.

- Is social responsibility becoming a decisive factor in investment choices?

- Success factors in crowdfunding campaigns.

- Prioritizing cybersecurity in the age of digital transactions.

- Strategic approaches to post-recession recovery.

- What role do central banks play in navigating economic turbulence?

- Applications of blockchain beyond cryptocurrency.

- Automated advisors and their impact on investment management.

Easy Finance Research Topics

Finance can be a tough nut to crack. But worry not, we've sifted through the complexities to bring you easy finance research papers topics. They'll help you find the right direction without overwhelming you. Are you ready to take the plunge?

- Understanding credit scores: What makes them rise and fall?

- Basics of personal budgeting.

- An overview of stock market investing.

- The rise and implications of mobile banking.

- Microloans and their impact on small businesses.

- Cryptocurrency: Hype or a game-changer?

- Retirement planning: A critical component of personal finance.

- What are financial regulations?

- A closer look at online payment systems.

- How does crowdfunding work?

- Ethics in finance.

- Emergency fund creation: Its significance in financial planning.

- Tax planning: Exploring strategies and impacts on personal wealth.

- Exploring e-commerce business models.

- Insurance policies and their role in financial risk management.

Great Finance Research Paper Topics

The finance world is a goldmine of great research avenues waiting to be explored. Below we've collected fantastic research topics in finance to inspire your work. Now, all you need to do is take your pick and start investigating.

- Exploring mergers and acquisitions in global corporations.

- Is venture capital a catalyst for startup success?

- Public fiscal policy across nations.

- Insider trading: Unethical advantage or strategic insight?

- Unpacking the intricacies of derivatives and risk management.

- How digital transformation is reshaping banking services.

- Harnessing mathematics for modeling in quantitative disciplines.

- Investigating corporate social responsibility in multinational institutions.

- Unraveling the role of AI in fraud prevention.

- Are microcredit initiatives a key to broader financial inclusion?

- Psychology that drives economic decisions.

- How do credit rating agencies influence market dynamics?

- Ripple effects of inflation on investment portfolios.

- What role does forensic accounting play in unveiling fraud?

- Balance between debt and equity in capital structuring.

Popular Finance Research Topics

Are you wondering what's trending in the world of finance? Consider these popular financial topics to write about and choose one for your project. Don't forget to check if your professor has additional guidelines before you get started! If you have unique requirements and want to obtain a top-quality work tailored to your needs, consider buying research papers from our experts.

- Machine learning in credit risk modeling: A new frontier?

- Can businesses strike a balance between sustainability and profit?

- Peer-to-peer lending: Revolutionizing or destabilizing finance?

- Microfinancing in developing nations: An analysis of success factors.

- The growth of ESG (Environmental, Social, and Governance) investing.

- Global economic impact of sovereign debt crises.

- How are trends in corporate governance shaping businesses?

- Impact of globalization on investment strategies.

- Examining the rise and implications of neobanks.

- Fiscal policy responses to climate change: A global overview.

- Role of behavioral biases in investment decision-making.

- Economic fallout of pandemics: A case study of COVID-19

- Evaluating the ethics of high-frequency trading.

- Internet of Things (IoT) and its implications for financial services.

- Impact of FinTech innovations on traditional banking.

Current Research Topics in Finance

Keeping pace with the latest trends is crucial in research, and finance is no exception. We've therefore rounded up current finance topics for a research paper, designed to resonate with the here and now.

- Central Bank Digital Currencies (CBDCs): A new era in finance?

- Sustainable finance: Navigating the path to greener economies.

- Tech giants entering financial services: Disruption or evolution?

- Exploring the implications of Brexit on global trade and finance.

- Regulation of fintech in the era of digital currencies.

- Influence of geopolitical conflicts on global fiscal markets.

- Influence of political stability on stock market performance.

- Data privacy in financial market.

- Implications of quantum computing for financial cryptography.

- Ethical implications of AI in finance.

- Effects of trade wars on currency markets.

- COVID-19 and the shift towards a cashless society.

- Evaluating the stability of cryptocurrency markets.

- Impact of remote work trends on global economies.

- Leveraging big data for predictive analysis in finance.

>> Read more: Economics Research Paper Topics

Best Finance Research Topics

When it comes to research, not all topics are created equal. To bring out your best, we've curated a selection of the finest finance research topic list. These topics offer a blend of depth, relevance, and originality.

- Financial implications of demographic shifts in developed economies.

- Challenges of regulating emerging financial technologies.

- Big data and its transformative role in credit risk management.

- Comparative analysis of traditional banks and digital-only banks.

- The rise of ethical investing: Fad or future of finance?

- Financial resilience in the face of global crises.