What Is the Stamp Duty for Trademark Assignment?

The application process of obtaining a trademark and assignment of a trademark as an individual entrepreneur can be seen as daunting due to the number of documents one needs to take care of, and it's often tricky to find information about the proper procedure. However, with this blog article, you'll know everything about the stamp duty for trademark assignment.

Stamp Duty for Trademark Assignment: Trademark assignment is the process of handing over trademark rights to someone else in order to use the same trademark. Sometimes, this switch can help your firm increase or improve its perspective and market share.

Table of Contents

Types of Trademark Assignment:

Partial assignment:.

Partial trademark assignment is when the trademark owner assigns part of the trademark to another business. It allows the business to receive legal protection until it becomes a complete trademark and ownership transfer happens. The retailer may use both pieces of information in advertisements to promote their company and verify that they are not breaking any laws.

Complete Assignment:

In a complete assignment, the assignee owns every right to sell, and earn royalties on the trademarks assigned to them.

With goodwill trademark assignment, the power of a registered trademark is assigned to someone else. The party that receives the assignment is named as the assignee on the trademark registration. Once a trademark is assigned with goodwill, it may be transferred or used by anyone.

Without Goodwill:

Under these trademark assignments, only the trademark is transferred and not the brand value. And the assignor must use the trademark for any of their other businesses.

Applying Trademark Application

To apply for a trademark online in India, you need to create an account with the Trademark Registrar. After creating your account, you will need to identify your goods and services and provide relevant information such as the name of your company and the type of mark you are filing for. The Trademark Registrar offers a variety of documents to support your application, such as a drawing of your proposed mark, an affidavit of use or intent to use the mark in commerce, and proof of ownership of the mark. You will also be required to pay a filing fee and submit a verified original signature. Once your application is filed, it will be sent to an examiner who will decide whether to allow your mark into circulation. If your application is approved, you will receive a registration certificate that includes the symbol ® and identifying information.

Fees and Payments

To apply for a registered trademark online, you’ll need to pay the applicable filing fee and send in your application. Here’s a breakdown of what you’ll need to pay:

- If you are not a start-up, small enterprise, or individual you will have to pay ₹ 9,000 for lodging an application electronically and ₹10,000 if you file in person with the Trademark Registrar.

- Individuals, small enterprises, or startups must file with the TM application by paying a fee of ₹ 4,500 for e-filing or ₹5,000 for filing by hand

- Based on the type of TM applied as per the stamp duty act, one needs to pay 5% stamp duty per TM application or assignment submitted

Forms of Identification

When applying for a registered trademark, it is important to have the appropriate forms of identification ready. There are a few different options available, and each has its own set of requirements:

- The first option is to submit a filing affidavit with your application. This document must be signed by the owner or owner’s representative and verified by an independent expert. The affidavit must include information such as the trademark’s logo, description, and date of first use. In addition, you must list the names and addresses of all owners or holders of rights to the mark.

- Another option is to submit an application containing only documents that establish trademark ownership. This document must include a copy of the registration of trademark certificate or a declaration from the entity claiming ownership that it is the true owner of the mark. The application must also include a statement from the applicant confirming that he or she is authorized to use the mark. Finally, you must provide contact information for any authorized representatives.

If neither of these options meets your needs, you can submit an application containing only extracts from previously filed documents. This document must include a statement confirming that you are copying copyrighted material without permission.

Benefits of Trademark Registration:

The benefits of trademark ownership can vary greatly depending on individual needs. Registering your mark, however, will help protect your financial and intellectual property rights. For beginning business owners that are not already familiar with trademark law, the process may seem a bit complicated and confusing to begin with.

If you are looking to apply for a registered trademark online and understand the fees involved, this article explains it all in detail. The process is relatively easy. Just go to the Trademark Registrar, fill out an application form, and pay the applicable fees. You will then need to send in citations of where your mark is currently being used, as well as additional documents if requested by the Trademark Registrar. Once the application is complete, you will be given details on when to send in your trademark registration certificate.

Also, Read:

- How Are Trademarks Selected and Ownership ?

- Document Required for Assignment of Trademark

- How Do I Assign a Registered Trademark ?

Non-Traditional Trademarks: Future and Complete Details

Traditionally, trademarks have consisted of words, logos, and symbols that serve as identifiers of goods and services in the marketplace.…

Trademarks and Privacy Law: Meaning and Easy Explanation

In the digital age, the intersection of trademarks and privacy law has become increasingly complex and nuanced. Trademarks protect brand…

Trademarking in the Food and Beverage Industry: A Guide

In the highly competitive food and beverage industry, building a distinctive brand identity is essential for success. Trademarks play a…

The Role of Trademarks in Franchising: Protecting Your Brand

Trademarks in Franchising offers businesses a powerful model for expansion and growth by allowing entrepreneurs to replicate successful business concepts…

Understanding G-Secs and How to Invest in Them for Business?

G-secs refer to government securities or, in other words, loans or capital issued by the government. The biggest advantage associated…

Startups to Continue Receiving a Tax Holiday

Businesses of all sizes and types have been having a tough year courtesy of the coronavirus pandemic. The Indian government…

How the Rupee Depreciation is Enticing NRIs in Real Estate?

The Indian currency has depreciated as much as 5.2% against the US dollar in 2022 so far. The rupee’s depreciation…

Subscribe to our newsletter blogs

Private Limited Company Registration Private Limited Company with Indian and Foreign Shareholders One Person Company Registration Limited Liability Partnership (LLP) Registration Partnership Firm Registration Subisdary Company Registration Subsidiary of an Indian Company in India Public Limited Company Registration Section 8 (Not-for-Profit) Company Registration Trust Registration Society Registration USA Company Incorporation Register a NBFC Company in India NIDHI Company Registration Producer Company Registration Digital Signature Certificate (DSC) Tax Deduction Account Number (TAN) Trademark Registration - India Trademark Renewal International Trademark Application Trademark Ownership Transfer Respond to a Trademark Objection File a Trademark Opposition Judgments Vakil GPT Libra Winding Up of Company roDTEP Private Company into OPC Patent Search Apply for a Provisional Patent Apply for a Patent Changes in IEC Changes in GST LUT Application ITR for LLP Business Ideas Business Loans NGO Registration Change the Objectives of Your Company Sole Proprietorship Scope of Work and Deliverables Agreement Service Level Agreement Business Compliance PIL Web Ecommerce Development Hallmark Registration Caveat Petition OSP License GDPR APEDA Registration Money Recovery Vendor Termination RBI Compounding Application Patent Infringement Labour Law Non Compete Agreement Relinquishment Deed Spice Board Registration Convert Private to Public Limited Company Posh Compliance Trademark Assignment Restitution Of Conjugal Rights Company Name Search Corporate tax e-FIR Property Documents Verification Trademark Infringement Well Known Trademarks Copyright Infringement Intellectual Property Employment Agreement Income tax Notice Financial Agreement Trademark Search NRI Legal Services Professional Tax for Employees Professional Tax for Directors ESI Registration PF Registration ESI Filing PF Filing Cancellation of GST Professional Tax Registration DIPP Certification Basic Food License State Food License Central Food License Fundraising PF and ESI Filings PF and ESI Registration Professional Tax Filing Shops and Establishment Act Registration Importer Exporter Code Registration SSI / MSME Registration Trade License Registration Copyright Registration Change in trademark application Trademark Withdrawal Payroll Services Goods & Service Tax (GST) Registration Trademark Watch ISO Registration Hearing Labour Welfare Fund Registration USA Company Compliances NGO Compliance Non-Disclosure Agreement Memorandum of Understanding (MoU) Get Advice from a Lawyer Get a Detailed Legal Opinion from an Expert Commercial Rental / Lease Agreement Leave and License Agreement Prepare a Power of Attorney Agreement Review Shareholders' Agreement Term Sheet Review a Term Sheet given by an Investor Share Purchase Agreement Terms of Service and Privacy Policy Terms of Service Privacy Policy Get Basic Legal Advice Get Basic Legal Opinion Get an Advanced Legal Opinion Get Expert Legal Opinion Legal Agreement Legal Notice Disclaimer Draft a Consumer Complaint Founders Agreement Franchise Agreement Vendor Agreement Master Service Agreement Joint Venture Agreement Freelancer Agreement Consultancy Agreement Profit Sharing Agreement Cheque Bounce Notice Freelancer / Contractor's Agreement Loan Agreement Terms of Service and Privacy Policy Website Terms of Service and Privacy Policy App Terms of Service and Privacy Policy - Web & App Probate of Will Divorce Consultation Property Registration Property Consultancy - opinion Management of a Trust Management of a Society Dissolution of Partnership Firm Accounting and Book Keeping GST Filings TDS Filings File Annual Returns for your Private Limited Company Get help from a Company Secretary for your Private Limited Company Get help from a Company Secretary for your Limited Liability Partnership Change your Company Name Change the Objectives of Your Company Appointment of a Director Removal/Resignation of a Director Change the Official Address of Private Company Close your Private Limited Company Convert your Partnership into a Private Limited company Convert your Sole Proprietorship into a Private Limited Company Convert your Private Limited Company into an LLP Convert your Private Limited Company into a Public Limited Company Income tax returns - Propreitorship Firm Financial Projections for Bank Loan Investor Pitch Deck CA/CS certification Increase in Authorized Capital of your Company Change the Objectives of Your LLP Change your LLP Name Adding a Designated Partner Change the Official Address of Your LLP Increase in Contribution to your LLP Change LLP Agreement Close your Limited Liability Partnership Convert your Sole Proprietorship into an LLP Compliance - Section 8 Close down your Not-for-Profit (Section 8) Company Get Share Certificates for your Company Replacement of a Director Change in the Designation of Director Adding a Partner in LLP Replacement of Designated Partner Resignation of Designated Partner Resignation of Partner Change Name of your LLP Close your Partnership firm Close your Proprietorship firm Close your Public Limited Company Convert your LLP into a Private Limited Company Convert your Partnership into an LLP Convert your Sole Proprietorship into a Partnership Audit your Company Valuation of Business Convert your Private Limited Company into an One Person Company Transfer of Shares Change in Authorized Capital of your Company Employee Stock Options (ESOP) Issue of New Shares (To existing promoters) RBI & SECRETARIAL COMPLIANCES FOR FOREIGN INVESTMENT ISSUE OF NEW SHARES IN YOUR COMPANY (TO OTHER THAN EXISTING PROMOTERS) Employment Agreement with ESOP Due Diligence of Company Convert your One Person Company into a Private Limited Company DIR-3 KYC Filing Issue of Convertible Debentures (CCD) Permanent Account Number (PAN) Religion change Gender Change Apply for Name Change - Minor Name Change Application FSSAI Marriage Certificate Mutual Divorce Court Marriage Public Notice - Gazette Notification Make a Will Residential Rental Agreement Gift Deed File your Income Tax Returns - Salaried Individual Logo design Free GST Registration Internal Start a Branch Office in India Get a Section 80 G Tax Exemption Trademark Search ISI Registration Apply for Birth Certificate Employment Contract without ESOP Sale Deed CA Advisory Service Apply for Succession Certificate Legal notice for recovery of dues Apply for legal heir certificate Apply for Psara License RERA complaints Main Service Startup India Registration Integrated Accounting + GST Talk to a CA Talk to a Lawyer Talk to a CS FCRA Registration FCRA Renewal Change in Member or Nominee of OPC Change in Particulars of Director Creation or Modification of Charge Satisfaction of Charge Conversion of Dormant Company to Active Company Conversion of Loan into Equity Shares Change the Official Address of Your Business (from one state to another state ) Get Support on Opening Current Bank Account Design registration Legal Metrology NGO Deed Drafting File an Opposition for Brand Infringement Darpan Registration Cessation of Partner or Designated Partner SEBI IA Registration Surrender of DIN/DPIN Foreign Liabilities and Assets (FLA) Return Change the Official Address of Your LLP (From One State to Another State) Change the Official Address of Your Company (Outside the City) CSR-1 Registration Service

Bengaluru - Bangalore Chennai Cochin Coimbatore Delhi Gurugram - Gurgaon Hyderabad Kolkata Mumbai Noida Thiruvananthapuram Vijayawada Visakhapatnam Addanki Adilabad Agartala Agra Ahmedabad Aizawl Ajmer Akola Alappuzha Aligarh Allahabad Alwar Amaravati Ambala Amritsar Anand Anantapur Andaman Aurangabad Aurangabad-Bihar Azamgarh Badaun Badlapur Bagaha Bagalkot Bahadurgarh Baltora Baraut Bardhaman Bareilly Bathinda Begusarai Belgaum Bellary Berhampur Bhadrak Bhadreswar Bhagalpur Bharuch Bhavnagar Bhayandar Bhilai Bhilwara Bhiwandi Bhiwani Bhopal Bhubaneswar Bidar Bijapur Bikaner Bilaspur Bina Etawa Birati Birbhum Bishalgarh Botlagudur Budaun Budgam Buldhana Bundi Cachar Calicut Chandauli Chandigarh Chandigarh-Punjab Chhapur Chhatarpur Chhindwara chidambaram Chitradurga Chittoor Chittorgarh Churu Cooch Behar Cuddalore Cuttack Dahod Daman Darbhanga Dehradun Deoghar Dera Bassi Dewas Dhaka Dhanbad Darbhanga Dharmapuri Dharmanagar Dharwad Dhule Dimapur Dindigul Dispur Dombivli Dumarkunda Dungri Durgapur Dwarka Eluru Erode Faridabad Firozabad Firozpur Gandhidham Gandhinagar Gangtok Ganjam Gannavaram Ghaziabad Gonda Gorakhpur Greater Noida Gulbarga Guntur Gunupur Guwahati Gwalior Haldwani Hansi Hanumangarh Haridwar Hisar Hoshiarpur Hosur Howrah Hubli Idukki Imphal Indore Itanagar Jabalpur Jagdalpur Jaipur Jalandhar Jalgaon Jalgaon Jamod Jamalpur Jammu Jamnagar Jamshedpur Jamui Jaunpur Jhansi Jind Jodhpur Jorhat Kadapa Kakinada Kalahandi Kalimpong Kalyan Kangra Kankroli Kannur Kanpur Kanyakumari Kapurthala Karad Karaikal Karaikudi Karimnagar Karjat Karnal Karur kasganj Kashipur Katihar Katni Kavaratti Khamgaon Khammam Kharagpur Khordha Kochi Kohima Kolhapur Kollam Koppal Kota Kottayam Kozhikode Krishnagiri Kullu Kumbakonam Kurnool Kurukshetra Lalitpur Latur Loharu Lucknow Ludhiana Madhubani Madikeri Madurai Mainpuri Malappuram Malda Mandi Mandsaur Mangalore Mapusa Margao Marthandam Mathura Meerut Midnapore Mirzapur Mohali Mone Moradabad Morbi Morena Muktsar Mundra Muzaffarnagar Muzaffarpur Mysore Nabarangpur Nadiad Nagapattinam Nagaur Nagercoil Nagpur Nainital Nalanda Namakkal Nanded Nandigama Nashik Navi Mumbai Navsari Nellore Nilgiris Nizamabad Ongole Ooty Other Cities Palakkad Palampur Palgadh Pali Panaji Panchkula Panipat Paradip Pathanamthitta Pathankot Patiala Patna Pilani Port Blair Pratapgarh Puducherry Pune Raichur Raigarh Raipur Rajahmundry Rajapalayam Rajkot Ramanathapuram Ramgarh Ranchi Raniganj Ratlam Rewa Rohtak Roorkee Rourkela Rupnagar Saharanpur Salem Sangli Sangrur Satara Secunderabad Shillong Shimla Shimoga shirdi Sikar Siliguri Silvassa Singrauli Sirmaur Sirmur Sitamarhi Sitapur Sivaganga Sivakasi Siwan Solan Solapur Sonipat sonla Sri Ganganagar Srinagar Surat Talbehat Tezpur Thalassery Thane Thanjavur Theni Thoothukudi Thrissur Tiruchirappalli Tirunelveli Tirupati Tirupur Tiruvannamalai Tumkur Udaipur Udupi Ujjain Una Uppala Uttarpara Vadodara Vapi Varanasi Vasai Vellore Vidisha Vill Damla Viluppuram Vinukonda Virar Virudhunagar Warangal Washim Yamuna Nagar Yelahanka Zirakpur Select City*

Email Enter valid email addres

You'll be redirected to payment page to reserve a callback from our expert

An official website of the United States government Here’s how you know keyboard_arrow_down

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Jump to main content

Trademark assignments: Transferring ownership or changing your name

Assignment Center

Trademark owners may need to transfer ownership or change the name on their application or registration. This could happen while your trademark application is pending or after your trademark has registered. Use Assignment Center to transfer ownership or to request a change in name. See our how-to guide for trademarks on using Assignment Center.

Here are examples of common reasons:

- I’ve sold my business and need to transfer ownership of the trademark. This is a transfer of ownership called an assignment.

- I got married just after I filed my application and my last name changed. This is a name change of the owner.

There are fees associated with recording assignments, name changes, and other ownership-type changes with the USPTO. See the Trademark Services Fee Code “8521” on the current fee schedule to find the specific fee amount.

See the correcting the owner name page to learn if you can correct an error in the owner's name that does not require an assignment.

Limitations based on filing basis

Intent-to-use section 1(b) applications.

If you’re transferring ownership to a business successor for the goods or services listed in your identification, you can file your assignment at any time. In all other cases, you must wait until after you file an Amendment to Allege Use or a Statement of Use before you file your assignment. For more information, see the Trademark Manual of Examining Procedure (TMEP) section 501.01(a) .

Madrid Protocol section 66(a) U.S. applications and registrations

All ownership changes involving international registrations must be filed with the International Bureau of the World Intellectual Property Organization (WIPO). Follow the guidance on the WIPO website about changing ownership or changing an owner’s or holder’s name. See the TMEP section 502.02(b) for more information.

How to update ownership information

Submit a request to transfer ownership or change the name.

Use Assignment Center to submit your request to transfer ownership or change the owner name for your U.S. application or registration. You will need to fill out a cover sheet with certain information and may also need to upload supporting documents, depending on the type of change. Also, be prepared to pay the Trademark Services Fee Code “8521” on the current fee schedule .

You'll receive a notice of recordation or non-recordation

In about seven days, look for your notice. If you don’t receive one, contact the Assignment Recordation Branch . The Notice of Non-Recordation will explain the reason your request to record was denied. Here are four common reasons:

- A critical piece of information was omitted from the cover sheet.

- The document is illegible or not scannable.

- The information on the cover sheet and the supporting document do not match.

- The assignment was not transferred with the good will of the business.

USPTO trademark database will be automatically updated after recordation

Once recorded, the trademark database should reflect the new owner information or name change. Check the Trademark Status and Document Retrieval (TSDR) system to see if the owner information has been updated. See below for information about what to do if the database isn’t updated.

What to do if the USPTO trademark database isn’t updated

In some cases, the USPTO will not automatically update the trademark database to show the change in ownership or name. This could happen when the execution date conflicts with a previously recorded document or multiple assignments have the same execution date on the same date. For more information, see TMEP section 504.01 .

If the trademark database wasn’t updated and your trademark has not published in the Trademark Official Gazette yet, and you need to respond to an outstanding USPTO letter or office action, use the appropriate Response form to request the update of the owner information. If you don’t have a response due, use the Voluntary Amendment form . To do this,

- Answer “yes” to the question at the beginning of the form that asks if you need to change the owner’s name or entity information.

- Enter the new name in the “Owner” field in the “Owner Information” section of the form.

Your request to update the owner information will be reviewed by a USPTO employee and entered, if appropriate. To request the owner information be updated manually when your trademark has already published or registered, use the appropriate form listed in the “Checking the USPTO trademark database for assignment/name change” section below.

If you made an error in your Assignment Center cover sheet

Immediately call the Assignment Recordation Branch to request possible suspension of the recordation. The recordation may be suspended for two days. You’ll be instructed to email the specialist you speak with requesting the cancellation and that a refund be issued. However, if the assignment has already been recorded, your request will be denied. You must then follow the procedures outlined in the TMEP section 503.06 to make any corrections to the assignment.

We strongly recommend filing these changes online using Assignment Center , which will record your changes in less than a week. It is possible to request these changes by paper using the Recordation Form Cover Sheet and mailing the cover sheet, any supporting documentation, and fee to:

Mail Stop Assignment Recordation Branch Director of the U.S. Patent and Trademark Office PO Box 1450 Alexandria, VA 22313-1450

If you file by paper, we will record your changes within 20 days of filing.

Checking the USPTO trademark database for assignment /name change

After you receive a Notice of Recordation, wait one week before checking to see if the owner information has been updated in your application or registration in the trademark database. Follow these instructions:

- Go to TSDR .

- Enter the application serial number or registration number.

- Select the “Status” button.

- Scroll down to the “Current Owner(s) Information” section.

- Check to see that your owner information was updated correctly.

If the owner information hasn’t yet been updated, go to the “Prosecution History” section in TSDR to see the status of the assignment or name change. It can take up to seven days to see an entry in the Prosecution History regarding the assignment. If an entry shows "Ownership records not automatically updated," you will need to submit a TEAS form making the owner or name change manually.

The form you need depends on where your application is in the process.

- If your trademark has not published in the Trademark Official Gazette yet, use the TEAS Response to Examining Attorney Office Action form or the TEAS Voluntary Amendment form . If you are responding to an outstanding USPTO Office action regarding your application or registration, use the TEAS response form.

- If your trademark has published but hasn't registered, use the TEAS Post-Publication Amendment form .

- If your trademark is registered , use the TEAS Section 7 Request form . A fee is required.

Updating your correspondence information

If your ownership information is automatically updated in TSDR , you must ensure your correspondence information, including any attorney information, is also updated. To update your correspondence or attorney information, use the TEAS Change of Address or Representation (CAR) form . This form cannot be used to change the owner name.

For further information, see TMEP Chapter 500 and look at the frequently asked questions .

Additional information about this page

- Submit Post

- Union Budget 2024

- Corporate Law

Assignment of Trademark

GENERAL UNDERSTANDING:

As physical properties are transferred, the same way trademarks are also transferred. This transfer of trademark is called Assignment of trademark. In general terms, Assignment means transfer of title, rights, interest and benefits from one person to another person.

Thus, Assignment of trademark means transfer of Owner’s title, rights, interest and benefits to other person. The transferring party is called as “Assignor” and the receiving party is called as “Assignee”.

STATUTORY DEFINITION:

Section 2(1)(b) of the Trade Marks Act, 1999 “Assignment” means an assignment in writing by the act of the parties concerned;

WHO CAN ASSIGN A TRADEMARK:

As per section 37 of the Trade Marks Act, 1999, the person entered in the register of trademarks, as the proprietor of a trademark, shall have power to assign a trade mark and to give effectual receipt of for any consideration for such assignment.

ASSIGNABILITY OF REGISTERED OR UNREGISTERED TRADEMARK:-

As per section 38 of the Act, a registered trademark can be transferred with or without the Goodwill of the business concerned either in respect of all the goods or services in respect of which the said trademark is registered or of some of the goods or service.

Moreover, as per section 39 of the Act, an unregistered trademark may be assigned with or without the Goodwill of the business concerned.

TYPES OF ASSIGNMENT:-

1. Assignment with Goodwill of Business: Where an assignor assigns to the assignee, the value, rights and entitlements also, as associated with a trademark with respect to the goods or services already in use by the assignor. After taking over the goodwill associated with the trademark, the assignee is free to use the trademark assigned to him for all goods or services including for the goods or services which were already in use by the Assignor. Such assignment is called assignment with Goodwill of Business.

For Example: Mr. X is the owner of a trademark “TM” who is already using the said trademark “TM” in relation to clothing and footwear. Mr. X assign to Mr. Y the said trademark “TM” through an agreement (in writing) in relation to clothing and footwear alongwith the Goodwill associated with trademark “TM”.

In this case, Mr. X has also assigned to Mr. Y, the Goodwill associated with trademark “TM” for the business of clothing and footwear as well as for other goods or services. Therefore, Mr. Y is eligible to use the said trademark “TM”, for clothing and footwear including other goods or service dealt by Mr. Y.

2. Assignment without the Goodwill of Business: Where an assignor assigns to the assignee, the right and entitlements in a trademark with respect to the goods or services which are not in use by the assignor. In other words, where the assignor restricts the assignee with a condition that the assignee is not entitled to use the trademark assigned in relation to the goods or services already in use by the assignor. Such assignment is called assignment without the Goodwill of Business.

For Example: Mr. X is the owner of a trademark “TM” who is already using the said trademark “TM” in relation to clothing and footwear. Mr. X assign to Mr. Y the said trademark “TM” through an agreement (in writing) in relation to goods or services other than clothing and footwear without assigning the Goodwill associated with trademark “TM”.

In this case, Mr. X has not assigned to Mr. Y, the Goodwill associated with trademark “TM” for the business of clothing and footwear. Therefore, Mr. Y is not eligible to use the said trademark “TM”, for clothing and footwear. Thus, in case, Mr. Y wishes to use the said trademark “TM” in relation to other goods or services then he will be required to create separate Goodwill for trademark “TM” for such other goods or services dealt by him.

RESTRICTION ON ASSIGNMENT OF TRADEMARK:-

1. Parallel use Restriction: Where assignment results in creation of exclusive right in different persons, in relation to same or similar goods or services and the use of the trademark will be likely to deceive or cause confusion. Thus, multiple exclusive right in relation to same or similar goods or services, in different person is not allowed. This prevents the parallel use of a trademark by more than one person concerned in relation to same or similar goods or services. (Section-40)

2. Multiple Territorial use Restriction: Where the assignment results in creation of exclusive right, in different person in different parts of India, in relation to same or similar goods or services. Thus, assigning of scattered right in different parts of India is not allowed. (Section-41)

PROCEDURE FOR ASSIGNMENT OF TRADEMARK:

REGISTRATION OF ASSIGNMENT OF TRADEMARK:

1. A person (subsequent proprietor) who becomes entitled by way of assignment, shall apply for registration of assignment before the Registrar of trademarks. (section 45)

2. After due satisfaction of the Registrar of trademarks, the Registrar shall enter the details of the assignee (subsequent proprietor) as the proprietor of the trademark assigned to him in respect of goods or services for which the assignment has been made. (section 45)

3. Where the validity of assignment is in dispute between the parties, the Registrar may refuse to register the assignment until the rights of the parties are determined by the competent court. (section 45)

4. Registrar of trademark shall dispose of the application for registration of assignment of trademark within a period of 3 (three) months from the date of receipt of application. (rule 76 of Trade Marks Rules, 2017 )

5. Registrar may, where there is reasonable doubt about the veracity of any statement or any document furnished, may call upon any person who has applied to be registered as proprietor of a registered trademark to furnish such proof or additional proof of title as the Registrar may think fit. (rule 77 of Trade Marks Rules, 2017)

6. Where in the opinion of the Registrar any document produced in proof of title of a person is not properly or sufficiently stamped, the Registrar shall impound and deal with it as per Chapter IV of the Indian Stamp Act, 1899 . (rule 78 of Trade Marks Rules, 2017)

7. Where the Registrar has allowed the registration of assignment, then there shall be entered in the register the particulars as follows(rule 84 of Trade Marks Rules, 2017):-

a) the name and address of the assignee;

b) the date of assignment;

c) where the assignment is in respect of any right in the trademark, a description of the right assigned;

d) the basis under which the assignment is made; and

e) the date on which the entry is made in the register.

RIGHT OF THE ASSIGNOR ON ASSIGNMENT OF TRADEMARK:

The assignor terminates to have his rights, title or any interest in the trademark, the moment assignment deed is executed in favour of the assignee, irrespective of the fact that the name of the assignee has not been updated in the record of the Registrar of trademarks.

In the matter of Classic Equipments Pvt. Ltd. Vs. Johnson Enterprises, 2009 (41) PTC 385 (Del), it was observed as follows:

“Once an Assignment Deed has executed, the Assignor ceases to have any right, title or interest in the property assigned. It is not open to the Assignor to cancel the assignment by means of communication”.

RIGHTS OF THE ASSIGNEE: WHEN ASSIGNMENT IS COMPLETE BUT REGISTRATION IS PENDING:

Though as per section 45 of the Act, it is mandated that the assignee shall apply before the Registrar of the trademarks to register his title. But this does not mean that recording of assignment of registered trademark asserts all rights or titles or interest in the assignee.

The reason behind this understanding are the opening words of section 45 of the Act, which says “where a person becomes entitled by assignment or transmission of a registered trademark, ……..”. Therefore, the first condition is entitlement of rights, title or interest by way of assignment or transmission of a registered trademark followed by registration of assignment of a registered trademark. Thus right in assignee does exist even before the registration of assignment.

In the matter of M/S. Modi Threads Limited vs M/S. Som Soot Gola Factory And…. on 4 th December, 1990: AIR 1992 Delhi 4, 1992 (22) DRJ 24 was observed as follows:

“It is true that the plaintiffs application for getting transferred the registered trade mark in its name in the office of the Registrar is still pending but that does not debar the plaintiff to protect the violation of the aforesaid trade mark at the hands of unscrupulous persons by filing an action in court of law for injunction. It is, prima facie, clear to me that during the interregnum period when the application of the plaintiff is kept pending for consideration by the Registrar of Trade Marks the dishonest persons cannot be allowed to make use of the said trade mark in order to get themselves illegally enriched earning upon the reputation built up qua that trade mark by the predecessor-in-interest of the plaintiff.”

The assignee of a trademark is also entitled to file a civil suit, even though the recording of assignment of registered trademark is pending before the registrar of trademarks. Moreover, section 45 does not confer any title over the trademark assigned. Instead the registration granted under section 45 is only proof of title of the trademark of assignee or the person who acquired it by way of assignment.

IMPORTANT KEY POINTS

√ Assignment is to be in writing;

√ Registered or unregistered both type of marks can be assigned;

√ Assignment can be with or without the goodwill of the business;

√ Event of assignment asserts the rights and title in an assignee not the registration thereof;

√ Registration of assignment is only prima facie proof of title of trademark;

√ Rights in an assignee exists even before registration of assignment of trademark.

Conclusion: –

Assignment of trademarks allows the Proprietor thereof to en-cash their intellect, efforts, time and money. It is equally important to register the assignment of trademark, since on registration the details of the assignee are updated in the register of trademark, this serves as a notice to public at large. Moreover, preparation of assignment agreements are also important as it involves rights, entitlements, interests and obligation including the commercial terms between the assignor and the assignee.

Disclaimer: The entire content of this document has been prepared as per the relevant provisions of the Act and rules made thereunder, applicable at the time of preparation. Though proper care has been taken to ensure accuracy, completeness and reliability of the information provided therein. The users and readers agree that the information provided in this document is not professional advice. Therefore, we assume no responsibility therefrom. Further, this write up shall not be considered as solicitation in any manner.

- « Previous Article

- Next Article »

Name: Mohit Gulati

Qualification: cs, company: gm & associates, location: new delhi, new delhi, in, member since: 02 jul 2020 | total posts: 3, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Group

- Join Our Telegram Group

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Subscribe to Our Daily Newsletter

Latest posts.

Ex-Parte Orders Without Considering Taxpayer’s Reply Liable for Set-Aside: Delhi HC

GST on Sale of Second-hand Goods

Simplifying Residential Status Concept in India

IBBI Suspends IP for Mishandling Unclaimed CD Units in Resolution Plan

IBBI Suspends IP for Negligence in Asset Custody, Legal Pursuits & CD Interests Protection

IBBI Penalizes IP for Non-Cooperation & Failure to Conduct CIRP Proceedings

IBBI Suspends IP Registration for Lack of Due Diligence in Verifying Claims

RTI Act Does Not Obligate Public Authorities to Answer Queries

IBBI Suspends IP Registration for Failing to Conduct Asset Due Diligence

Merely being students of university do not trigger larger public interest under RTI

Featured posts.

PMLA with particular reference to Arvind Kejriwal and Aam Aadmi Party (AAP)

June, 2024 Tax Compliance Tracker: Income Tax & GST Deadlines

TDS Returns: Solution to FVU Errors T_FV_6351 and T_FV_6354

Non-filing of e-Form BEN-2: MCA Imposes ₹14 Lakh Penalty for Section 90(4) Violation

MCA Imposes ₹15 Lakh Penalty: Section 42(5) Private Placement Violation

GSTN Advisory: Portal Enhancements, Pan Masala/Tobacco Manufacturer Info & E-way Bill 2 Portal Launch

Seeking Cancellation of GST Registration is Not Easy

Advisory on launch of E-Way Bill 2 Portal

Importance of Annual Information Statement while filing Income Tax Return!!

CBDT exempts RBI from Section 206CCA provisions (TCS Collection at higher rate)

Popular posts.

Cost Inflation Index – Meaning & Index from 1981-82 to 2024-25

Due Date Compliance Calendar May 2024

Corporate Compliance Calendar for May, 2024

Empanelment of Concurrent Auditors With Canara Bank

Empanelment with Punjab & Sind Bank for Concurrent Audit: Last Date 08/06/2024

ICAI penalises CA in Practice for involvement in other business without prior permission

GST compliance calendar for May 2024

Sovereign Gold Bonds (SGBs) – Tax and It’s Reporting In ITR

CBDT notifies Cost Inflation Index for Financial Year 2024-25

Javascript Is Disabled !!!

This will break some site Features. Please enable javascript or use some other browser.

- Phone : to connect with us call at: +91-11-40123000

- Email : [email protected]

- Our facebook

- Our Twitter

- Our linkedin

- Our whatsapp

- Map Location

- Domain Names

- Geographical Indication

- Trademark Search India

- Trademark Application

- Trademark Filing

- Trademark objection reply India

- Online Trademark Filing

- Trademark Process

- Trademark Flowchart

- Trademark Opposition

- Trademark Opposition Flowchart

- IRDI Provisional Refusal of Trademark in India

Trademark Assignment Agreement India – Assignment of Trademark in India

- Trademark Brand Registration India – Apply Online Trademark Registration

- TRADEMARK WATCH AND MONITOR

- Trademark Renewal

- Trademark Classes and Classification

- Trademark infringement – Trademark Misuse in India

- Trademarks INN Search

- Trademark Restoration

- Trademark Removal

- Trademark Rectification

- Trademark Filing Cost, Fees & Forms

- Trademark Status

- Indian Trademarks Act

- Marks not Registerable

- Well Known Trademarks

- Trademark Protection

- MADRID PROTOCOL INDIA

- TRADEMARK LICENSING

- Trademark FAQ

STREAMLINING THE PROCESS OF NEWSPAPERS and PERIODICALS REGISTRATIONS IN INDIA

May 31, 2024

IP JURIS LEGEM

Intellectual property services, book your call with our trademark team.

Assignment Licencing of Trademarks

Assignment of trademarks:.

Assignment of a trademark occurs when the ownership of Registered/Unregistered Trademark is transferred from one party to another party whether along with or without the goodwill of the business. In case of a registered Trademark, such assignment is required to be recorded in the Register of trademarks.

Can a Trademark be sold in India?

Yes, it can be sold in India.

Assignment of Trademark Procedure

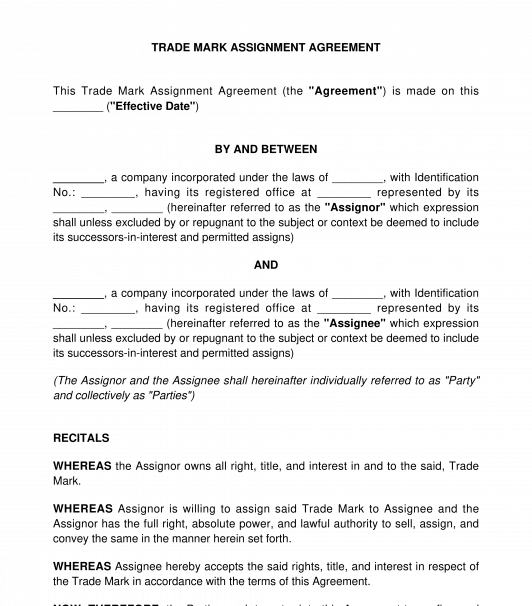

Drafting of a Trademark Assignment Agreement is the most important step in the procedure of assigning the trademark in order to avoid future litigation. The given below are some of the major elements which be obliged while drafting the trademark assignment agreement:

- The effective date of transfer

- Stamp duty is charged under state laws

- Consideration of the trademark assignment

- Public notary

- Signature of both the parties.

- An assignment deed must be filed with the ipindiagov.in

Documents Required to Transfer Trademark

- Trademark Assignment agreement

- Affidavits from both the parties

- Power of attorney

- Other relevant documents like Invoices etc

- Board Resolution in case of Incorporated Company

How much does it Assignment Cost of a brand or Trademark?

Stamp duty on assignment of intellectual property or trademark in india, is registration of assignment deed compulsory in trademark registry, why do you need an attorney/advocate to draft an assignment trademark deed, how do i get a trademark assignment done, how are we different from others.

We are not any call centre agents who are offering pathetic services at markets by outsourcing the work to others with whom one may not get a Chance to interact with!.

We are Intellectual Property Law Firm, with specialization in Trademark Registration. who take pride in the services delivered by us and guarantee your satisfaction with our services and support.

How do you sell/ Buy a trademark?

Is a trademark worth money, how to sell a registered trademark or brand, how to transfer the ownership of trademark who can transfer.

A Trademark is an intellectual property, the same as a any other property like Plot, Land or Flat. Just like an owner of land has the right to sell or transfer his/her property, in the same way, the owner of a trademark also has the right to do the same to his/her trademark.

Assignment means transferring rights, interests, titles and benefits from one person to another. Assignment of a trademark means to transfer the owner's right in a trademark to another person. The transferring party is called the assignor, and the receiving party is called the assignee. An assignment deed must be filed with the relevant IP office in India

Benefits of Trademark Assignment transmission

- Monetary value

- Transfer to third party

- Transfer to own kith and kins

- Assignment and transmission of trademark help the assignee to use the already established trademark in the market to create their base. It also helps the assignee to save money and resources by not spending on marketing to create a brand.

- Legal Proof

- Expansion of Business

- Right to sue for Infringements

- Right of Priority

- Trademark assignment can also be done for some or all of the goods or services for which the trademark has been assigned. For example, a cement company having multiple other businesses like construction, quarrying and interior designing, may assign the trademark of its construction business only.

What is the difference between assignment of trademark and licensing of trademark?

Unregistered trademark be assigned.

Yes, an unregistered trademark can be transferred with or without the goodwill. Assignment deals with the transferring of the rights vested with the trademark of the proprietor, who was using the unregistered trademark over the period of a few years, to a third party.

The major difference between a registered and unregistered trademark is that the latter is not registered under the Trademarks Act, 1999.

Can a trademark be transferred from one person to another?

Advantages of trademark.

- TM allow customers to identify a business as the source of a product or service.

- Trademarks are the basis to create a company's brand and reputation

- Trademarks allow consumers to base their purchasing decisions

- Trademarks help prevent consumer confusion: they indicate the source of the products and a consistent level of quality.

Need Help - Enquiry With us

Quick Links

- Why is Trademark Trademark Application Process Trademark Search Trademark Classes Examination Report Objections Trademark Application Status Trademark Monitoring Trademark Assignment Trademark Renewal FAQ Trademark

1246 Happy Reviews

Ip Juris Legem Delhi NCR : Intellectual Property Law Firm Sector 44, Noida -201301 (U.P) Delhi NCR Bangalore : No 35, Good Earth PalmGrove Dodda aladamara Road Gerupalya, Bangalore 560074 Chennai : 235, KH Road, Ayanavaram, Chennai Call us : +91-8029620143, +91-9560067306, +91-9108840766 Email : [email protected]

- Law of torts – Complete Reading Material

- Weekly Competition – Week 4 – September 2019

- Weekly Competition – Week 1 October 2019

- Weekly Competition – Week 2 – October 2019

- Weekly Competition – Week 3 – October 2019

- Weekly Competition – Week 4 – October 2019

- Weekly Competition – Week 5 October 2019

- Weekly Competition – Week 1 – November 2019

- Weekly Competition – Week 2 – November 2019

- Weekly Competition – Week 3 – November 2019

- Weekly Competition – Week 4 – November 2019

- Weekly Competition – Week 1 – December 2019

- Sign in / Join

- Data Protection

Assignment of Intellectual Property Rights in India

Assignment of copyright

Assignment of copyright has to be in writing and signed by the assignor or by his duly authorised agent. Copyright consists of a bundle of different rights in the same work, which can be assigned either as a whole to one party or separately to different parties.

· The deed of assignment must specify the `rights assigned’, the duration and territorial extent of assignment, and the royalty payable, if any. When duration of assignment is not specified, it is presumed to be for five years and when territorial extent is not specified, it is presumed to extend within India. (Section 19, Copyright Act, 1957)

· An assignment of a Copyright is exempted from Stamp Duty. (Article 25 of Schedule I of the Bombay Stamp Act, 1958).

The above provisions apply both to registered and unregistered copyright. Apart from the above requirements, in case of registered copyright, the following additional steps also have to be taken.

Registered Copyright

Assignee has to make an application for registration of changes in the particulars of copyright entered in the Register of Copyrights in Form V under Rule 16 of Copyright Rules, 1958 to be delivered by hand or registered post. Attested copies of the deeds of assignments should be enclosed with the application.

Assignment of Design

One can obtain copyright protection on a design either under the Copyright Act, 1957 or Designs Act, 2000. A design which is registrable under the Designs Act but not registered, ceases to have copyright protection after 50 copies have been made of the same using an industrial process. (Section 15 Copyright Act)

Once registered, on subsequent assignment of the design it will be necessary to apply for entry of subsequent ownership under Rule 33 of Designs Rules, 2001. Such application shall be made to the Controller in Form 11. The instrument of assignment has to be presented in original or notarised copy. (Rule 37, Design Rules, 2001)

· The document assigning the right on design has to be in writing and the agreement between the parties concerned should be reduced to the form of an instrument embodying all the terms and conditions governing their rights and obligations. Any contravention of this requirement will render the instrument invalid. (Design Manual) (Possibly based on Copyright Act)

· Upon entry of its particulars in the register of designs, the instrument shall be effective from the date of its execution.

· An application for registration of title shall be filed within six months from the date of execution of the instrument. This period is extendable by a maximum of six months.

Assignment of Trademark

Registered Trademark

Assignment of trademark can be made by making a request on Form TM-23 or 24 depending on whether it is made by assignee alone or conjointly with the registered proprietor, along with the deed of assignment. (Rule 68 of Trademark Rules, 2002)

An application under Rule 68 has to contain full particulars of the instrument, if any, under which the applicant claims to be entitled to the trade mark and such instrument or a duly certified copy thereof has to be produced at the Trade Marks Registry for inspection at the time of application. The Registrar may require and retain an attested copy of any instrument produced for inspection in proof of title.

Unregistered Trademark

An unregistered trade mark may be assigned or transmitted with or without the goodwill of the business concerned. (Section 39 Trademark Act, 1999)

Assignment of Patents

An assignment of a patent has to be made in writing and the agreement between the parties concerned is required to be reduced to the form of a document embodying all the terms and conditions governing their rights and obligations, which must be duly executed. (Section 68, Patents Act, 1970).

Two copies of the assignment instrument certified to be true copies by the applicant or his agent along with an application in Form 16 and the Controller of Patents may call for such other proof of title or written consent as he may require. (Rule 91, Patent Rules, 2003).

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

https://t.me/joinchat/J_ 0YrBa4IBSHdpuTfQO_sA

RELATED ARTICLES MORE FROM AUTHOR

Arbitration procedure under the arbitration and conciliation act , career opportunities in data protection and privacy laws, article 20 of the indian constitution .

This is commendable piece of work Ramanuj. In paragraph 3 of the article, it is stated that assignment of copyright is exempted from any stamp duty under Article 25 Schedule I of the Bombay Stamp Act. This is on a matter of record true.

However, on a bare reading of Article 5 [A] (V) (a), it is stated that “if the amount agreed does not exceed rupees ten lakhs; stamp duty to be paid is Two rupees and fifty paise for every rupees 1,000 or part thereof on the amount agreed in the contract subject to minimum of rupees 100”. My question is which among the two provisions of the same Act would prevail. Article 5 or Article 25?

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

International Opportunities in Contract Drafting

Register now

Thank you for registering with us, you made the right choice.

Congratulations! You have successfully registered for the webinar. See you there.

Registration Of A Trademark Assignment: Mere Formality Or A Mandate?

Contributor.

Introduction

With the advent of technology and newer trends of merchandising and marketing, the protection of an intellectual property of a person has become a dire need of the day. Consequently, the title related to a trademark is also a quintessential of it. This title can be transferred to another person or legal person through assignment, merger, transmission etc.

As per the provisions of the Trademarks Act, any person who is getting a title on any trademark by way of assignment or transmission shall bring himself on records of the Trademarks Registry as the proprietor of the trademark by making an application in the appropriate form with the appropriate fee. Now, the question which arises here is that what will be the status and position of an Assignee who has not made an application for registering himself as the proprietor of the trademark or whose application for such a registration is pending before the Trademarks Registry? While taking actions against third parties for infringement or passing off of its trademark, Should he be allowed to enter into the shoes of the Assignor by virtue of the assignment deed? Or should he be restrained form taking any such actions as he is not the proprietor of the Trademark as per the records of the Registry? The question has been discussed in detail below under various heads-

Procedure Relating To The Registration Of Assignments And Transmissions:-

Assignment of a trademark occurs when the ownership of a mark as such, is transferred from one party to another whether along with or without the goodwill of the business. Assignment agreements pertain to the transfer of intellectual property rights from, the owner of the rights to another person or organization. Assignment is an important aspect of this act, as per the section 2(1) (b) of the Trademarks Act, 1999; assignment has been described as "an assignment in writing by act of parties concerned". Thus this clarifies that for the assignment of trademark, it is necessary for the agreement to be in writing and to be act of an assignor and assignee of their own volition and not a third party.

Further, in case of registered Trademarks, the Trade Mark Act 1999 under section 40 also puts certain restrictions on the assignment of a registered trade mark wherein there exist possibilities of creating confusion in the mind of public/users. Such restrictions are:

- Restriction on assignment that results in the creation of exclusive rights in more than one person with respect to the same goods or services, or for same description of goods or services or such goods or services as associated with each other.

- Restriction on assignment that results in different people using the trademark in different parts of the country simultaneously.

Discretion Provided To The Registrar Under Section 45 (2) Of The Trademarks Act, 1999-

As per section 45 of the Act, an assignment deed needs to be registered in the appropriate form with the Trademarks Registry in order to bring the Assignee as an owner of the trademark on records. The Section runs as follows-

(1) Where a person becomes entitled by assignment or transmission to a registered trade mark he shall apply in the prescribed manner to the Registrar to register his title. And the Registrar shall on receipt of the application and on proof of title to his satisfaction register him as the proprietor of the trade mark in respect of the goods or services in respect of which the assignment or transmission has effect, and shall cause particulars of the assignment or tranmission to be entered on the register. Provided that where the validity of an assignment or transmission is in dispute between the parties, the Registrar may refuse to register the assignment or transmission until the rights of the parties have been determined by a competent court.

(2) Except for the purpose of an application before the Registrar under sub-section (1) or an appeal from an order thereon, or an application under section 57 or an appeal from an order thereon, a document or instrument in respect of which no entry has been made in the register in accordance with sub-section (1), shall not be admitted in evidence by the Registrar or the Appellate Board or any court in proof of title to the trade mark by assignment or transmission unless the Registrar or the Appellate Board or the court, as the case may be, otherwise directs .

As per the provisions of Section 45 and Rule 68 of the Trademarks Act, 1999, an application to register the title of a person who becomes entitled by assignment or transmission shall be made in Form TM-24 or TM-23 as it is made by such person alone or conjointly with the registered proprietor. Further, as per the practices of the Indian Trademarks Office, an affidavit for no legal proceedings pending related with the trademarks which are subject of the merger is also to be filed on behalf of the transferee company. Now, in case of a merger, since a proprietor registered on record is no more in existence and hence an application for change in title shall be filed in the name of the transferee. The Registrar may require statement of case to be verified by an affidavit on form TM 18 and may call upon the person concerned to furnish such proof or additional proof of title as he may require for his satisfaction. On proof of title to his satisfaction, the registrar will register him as a subsequent proprietor of the trade mark in respect of the goods or services and shall cause the particulars of the assignment or the transmission to be entered on the register. Once the trademark is assigned with goodwill, the assignor cannot in the eyes of law have any interest in the trademark assigned and the assignee alone, as a person interested in the trademark assigned, can represent in opposition proceedings as a party to protect its interest.

Position Of A Non-Registered Assignee In India

The law empowers the registrar to refuse to register the assignment or transmission when the validity of an assignment or transmission is in dispute between the parties, until the rights of the parties have been determined by a competent court [section 47 (2)]. The Registrar's refusal to register the assignment or transmission will naturally arise only before the actual change is effected in the register. The assignor or any other person may complain that the assignment is invalid or that it has been procured from him under circumstances entitling him to repudiate that transaction. In such circumstances the registrar cannot be expected to decide upon the validity of the assignment where it is challenged before him.

In Radhakashan Khandelwal vs. Asst. Registrar of Trade Marks 1 - The Delhi high court held that "it is true that the rules do not expressly require a notice to be issued or a hearing to be given to the party adversely affected by the order when an application on form TM 24 is made before the registrar, but there is in eye of law a necessary implication that the party adversely affected should be heard before an order for the removal of his name can be made against him.

Moreover if no entry has been made in the register, the document or instrument will not be admitted in evidence by the registrar or the appellate board or any court except for certain purposes as stipulated. The Registrar, or the concerned Authority as the case may be, has been given a discretion under this section to admit or not admit an assignment deed for which no application under Form TM-24 has not been made as an evidence of title of the assignee. Such a situation usually arises in cases where actions against third parties are involved. Very often the question as to the maintainability of a suit initiated by an unregistered assignee against the third parties has been dealt with by the Courts-

In Cott Beverage Inc., A Georgia ... vs. Silvassa Bottling Company on 7 October, 2003 2 - In this case, section 44 does not create a bar for filing a suit by the assignee whose application is pending disposal for registration. Discretion, however, is vested in the Court under Subclause (2) of Section 44 of the Act, whether to permit the said unregistered document in evidence or not. At the same time, it cannot be said that the procedure of registration of assignment is a mere formality. Section 44 has been incorporated merely as a safeguard by the Legislature in order to avoid the multiplicity of the proceedings and also in order to ensure that the various other laws prevailing in the country are safeguarded while registering the assignment. Thus, the grant of registration of assignment or transmission cannot be said to be a mere formality and on a conjoint reading of the provisions it will be apparent that the Registrar has to be satisfied after going through the application, which has to be filed in the prescribed form giving various particulars. In the present case, non-registration of the assignment will have to be considered as an important factor.

In Shaw Wallace & Co. (supra) 3 case- an application for impleadment of the assignee was under consideration. This court held that till the time the Registrar of Trade Mark, does not record the title in favour of the assignee, the deed of assignment cannot be admitted in evidence. However, the assignee was still impleaded as a party with direction to file the registration as and when accorded by the Registrar.

The above view of the Courts has also been contravened by other Courts. Emphasizing the fact that even if the assignment deed is not registerd with the records of the Trademarks Registry, it, itself is a valid instrument and hence permissible to be taken as an evidence of the assignee's title on the trademark.

IN Mohammad Zumoon Sahib vs. Fathimunnisa 4 , it was held that the " registration of assignment is not a condition precedent to an action for infringement by the assignee and an assignor of registered trademark will not be disentitled to an action on infringement on ground that assignment was not registered." The Madras court held that the law prescribes a procedure for the assignee or the representative to have registration of this title. The fallacy in the argument is that it is this registration by the Registrar under section 35(1) of the act that confers title .The title already exists in the legal representative and on proof of such title to his satisfaction; the registrar registers him as the proprietor of the trade mark. The plaintiff to the suit for infringement, whose name was not entered as subsequent proprietor, was allowed to maintain the suit on proof of prima Facie title to the mark.

Further, in Hindustan Lever Ltd. v. Bombay Soda Factory 5 , it was held that " the plaintiff could not be non suited merely because the change in the name of the registered proprietor had not been effected by the time suit was instituted. Registration of the name of the proprietor does not confer title on him. it is merely an evidence of his title. The plaintiff –company was the owner of the trademark in question at all times ."

In the case of Modi Threads Ltd. v. Som soot Gola Factory and another, 6 it was held that despite non registration of the application the civil suit was maintainable. The court held that it is true that the plaintiff's application for getting transferred and registered trade mark in its name in the office of the registrar is still pending but that does not debar the plantiff to protect the violation of the aforesaid trademark at the hands of unscrupulous persons by filing an action in court of law for injuction.so this is clear prima facie for the court.

Under sub section 2 of section 45 of Trademarks Act, the Registrar or the Competent Authority as the case may be, has been given discretion to admit or refuse to admit an unregistered deed of assignment as a proof of title of the assignee. However, another important thing the courts show that even without registration of assignment, a suit by the assignee is maintainable. If necessary, the suit may be stayed to enable the assignee to register the same. Therefore, it is an obvious fact that after an assignment or merger or transmission as the case may be the assignee has to step into the shoes of the assignor for purposes of any legal proceedings which are pending or indisposed.

Assignment agreements are of considerable importance in IPR since they allow the intellectual property owners to transfer their intellectual property for commercial returns, ensuring intellectual property can be used for monetary gains as well. So issues relating to ownership of IPR must be carefully considered .Though the law provides safeguards, but the slight ambiguity present in the Indian Trademarks Law on this point shall be dealt with by the legislature.

Ayush Vats Intern(Amity law school, Noida) 5 th year(2010-2015)

1 AIR 1969 Delhi 324, ILR 1969 Delhi 1227

2 2004 (29) PTC 679 Bom

3 105 (2003) DLT 586, 2003 (27) PTC 63 Del, 2003 (3) RAJ 224

4 (1960) 1 MLJ 270

5 AIR 1964 Kant 173, AIR 1964 Mys 173, (1964) 1 MysLJ

6 AIR 1992 Delhi 4, 1992 (22) DRJ 24

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Intellectual Property

Mondaq uses cookies on this website. By using our website you agree to our use of cookies as set out in our Privacy Policy.

Search bar.

- Legal Queries

- Files

- Online Law Courses

- Lawyers Search

- Legal Dictionary

- The Indian Penal Code

- Juvenile Justice

- Negotiable Instruments

- Commercial Courts Act

- The 3 New Criminal Laws

- Matrimonial Laws

- Data Privacy

- Court Fees Act

- Commercial Law

- Criminal Law

- Procedural Law

- The Constitutional Expert

- Matrimonial

- Writs and PILs

- CrPC Certification Course

- Criminal Manual

- Execution U/O 21

- Transfer of Property

- Domestic Violence

- Muslim Laws

- Indian Constitution

- Arbitration

- Matrimonial-Criminal Law

- Indian Evidence Act

- Live Classes

- Writs and PIL

Share on Facebook

Share on Twitter

Share on LinkedIn

Share on Email

Kedar Naniwadekar --> 29 October 2015

Calculation of stamp duty for trademark assignment deed

What is the stamp duty for Trademark Assignment Deed and how is the stamp duty calculated for the same? Also what is the procedure for registration of Trademark Assignment Deed? I have been given 2 different advices 1) the stamp duty shall be 0.1% of the total value if the value is below Rs. 10 Lakhs and 0.2% if the total value is above Rs. 10 Lakhs; and 2) the stamp duty shall be 3% of the total value.

1 Replies

Priyanka Kulkarni (Advocate and Intellectual Property Attorney Solicitor (England and Wales) (NP)) --> 30 October 2015

Being lawyer, first you need to check the relevant jurisdiction and decide which stamp Act applies e.g. Maharashtra Stamp Act (previously Bombay Stamp Act) and then read the relevant provision.

You may contact me at [email protected]

Priyanka Kulkarni

IP Attorney and Solicitor of England and Wales( NP)

Leave a reply

Your are not logged in . Please login to post replies Click here to Login / Register

Recent Topics

- How to complain against judge/ court working

- Whether it is kidnapping

- Fraud agreement

- moot court problem

- Night shift allowance in bank

- Share certificate holder is dead

- Broadband isp not closing connection

- Legal guidance required for ensuring 100% property

- Profit round tripping

Related Threads

Popular Discussion

- Land portion dispute

- Land purchase related

- Car iw damaged in coop housing society

- Problems from spouse

- Rights of flat buyers if builder deny ac

- Best option to document small portion of

- How to make wife a sole beneficiary in t

- Can i make my up obc certificate if i al

- Guidelines issued by the govt to prevent

- Divorce for men

view more »

Browse by Category

- Business Law

- Constitutional Law

- Labour & Service Law

- Legal Documents

- Intellectual Property Rights

- Property Law

- Forum Portal

- Today's Topic

- Popular Threads

- Post New Topic

- Unreplied Threads

- Top Members

- Share Files

- LCI Online Learning

Member Strength 9,54,238 and growing..

Download LCI APP

Our Network Sites

- We are Hiring

- Terms of Service

- Privacy Policy

© 2024 LAWyersclubindia.com. Let us grow stronger by mutual exchange of knowledge.

Lawyersclubindia Search

Whatsapp groups, login at lawyersclubindia.

Alternatively, you can log in using:

AI Summary to Minimize your effort

Assignment of Trademark

Updated on : Feb 22nd, 2022

Trademark proprietors can transfer trademarks similarly to how they can transfer physical properties. One of the ways to transfer a trademark is through an assignment. Assignment means transferring rights, interests, titles and benefits from one person to another. Assignment of a trademark means to transfer the owner’s right in a trademark to another person.

The transferring party is called the assignor, and the receiving party is called the assignee. Section 2(1)(b) of the Trade Marks Act, 1999 states that assignment means an assignment of a trademark in writing by the act of the concerned parties. Both unregistered and registered trademarks can be assigned with or without the goodwill of the business.

Who can Assign a Trademark?

Section 37 of the Trade Marks Act, 1999 states that the person registered as proprietor of trademark in the register of trademarks has the power to assign a trademark and receive consideration for such assignment. Thus, a trademark proprietor can assign a trademark to another person.

Kinds of Trademark Assignment

The different kinds of trademark assignments are as follows:

Complete Assignment

The trademark proprietor transfers all rights in the trademark to another person, including the right to earn royalties, to further transfer, etc.

For example: X is the proprietor of brand ‘ABC’. X assigns his trademark ‘ABC’ completely through an agreement to Y. After this, X will not have any rights with respect to the brand ‘ABC’.

Partial Assignment

The trademark proprietor assigns the trademark to another person with respect to only specific services or goods. The transfer of ownership in the trademark is restricted to specific services or products.

For example: X is the proprietor of a brand ‘ABC’ used for sauces and dairy products. X assigns the rights in the brand ‘ABC’ with respect to only dairy products to Y and retains the rights in the brand ‘ABC’ with respect to sauces.

Assignment with Goodwill of Business

The trademark proprietor assigns the rights, entitlements and values associated with a trademark to another person. When the trademark is assigned with goodwill, the assignee can use the trademark for any class of goods or services, including the goods or services which were already in use by the assignor.

For example: X is the proprietor of ‘Sherry’ brand relating to hair products. X assigns the brand ‘Sherry’ to Y with goodwill. Y will be able to use the brand ‘Sherry’ with respect to food products and any other products they manufacture.

Assignment without the Goodwill of Business

The trademark proprietor assigns to the assignee rights and entitlements in a trademark with respect to the products or services that are not in use. The assignor restricts the transfer of the rights in the trademark in the case of assignment without goodwill. The assignor assigns with the condition that the assignee is not entitled to use the trademark relating to the goods or services already in use by the assignor.

For example: X is the proprietor of a brand ‘Sherry’ that he uses for manufacturing and selling bags. X assigns the brand ‘Sherry’ without goodwill to Y. Y will be able to use the brand ‘Sherry’ for any other product other than bags.

Pre-Requisites for Assignment of Trademark

- The trademark assignment should be in writing.

- The assignment should be between two identifying parties, i.e. assignor (owner of the trademark) and the assignee (buyer of the trademark).

- The assignor should have the intent and must consent for the trademark assignment.

- The trademark assignment should be for a proper and adequate consideration (amount).

Trademark Assignment Agreement

The proprietor of a trademark generally assigns it to the assignee through a properly executed trademark assignment agreement. The trademark assignment agreement should be drafted keeping the following points in mind:

- The rights of the trademark should not be detrimentally affected due to the obligations contained in the agreement.

- The decision and requirement regarding whether the assignment is with or without the goodwill of the business must be explicitly mentioned.

- The agreement should show a clear purpose of the transaction/assignment.

- The geographical scope of the location where the assignee possesses the values and rights in the trademark must be mentioned.

- The transfer of the right to collect and sue damages for future and past infringements must be mentioned.

- The agreement should be duly executed, i.e. it must be stamped and notarised as per the applicable Stamp Act.

- The signatures and witnesses must be mentioned.

- The place and date of agreement execution must be mentioned.

- The date and day of the assignment along with the parties to the assignment must be mentioned.

- The agreement should mention whether or not it would be binding on the legal heirs of the assignor and assignee.

Process of Assignment of Trademark

The process of assignment of the trademark in India are as follows:

- The proprietor of the trademark (assignor) assigns his/her rights in the trademark through a trademark assignment agreement to the assignee.

- The assignor or assignee, or both, can make a joint request to register the assignment by filing an application of a trademark assignment in Form TM-P to the register of trademarks.

- Form TM-P must be filed with the registrar of the trademark within six months from the date of the assignment. The application can be filed after six months of assignment, but the fee may vary accordingly.

- The assignment must be advertised in such a manner and within the period directed by the registrar of trademarks.

- The copy of the advertisement and the registrar’s direction should be submitted to the office of the registrar of trademarks.

- Upon the receipt of the trademark assignment application (form TM-P) and required documents, the registrar of trademarks will register the assignee as the proprietor of the trademark and record the specifications of the assignment in the register.

Documents Required for Assignment of Trademark

The following documents must be submitted to the registrar of trademark along with form TM-P:

- Trademark assignment agreement.

- Trademark certificate.

- NOC from the assignor.

- Identification documents of the assignor and assignee.

Restrictions on Assignment of Trademark

The Trademarks Act, 1999 provides the following restrictions on trademark assignment:

Parallel Use Restriction

The assignor cannot assign a trademark when the assignment results in the creation of exclusive rights in different persons with relation to the same or similar products or services and will likely deceive or cause confusion. Thus, multiple exclusive rights relating to the same/similar products or services in different persons are not allowed. It prevents the parallel use of a trademark by more than one person in relation to the same/similar products or services.

Multiple Territorial Use Restriction

The assignor cannot assign a trademark when the assignment results in the creation of an exclusive right in different persons in various parts of India relating to the same/similar products or services. The assignor cannot assign a trademark when the assignment results in the creation of an exclusive right in different persons in various parts of India relating to the same/similar products or services sold or delivered outside India. Thus, assigning rights in different parts of India relating to the same/similar products or services is not allowed.

Benefits of Trademark Assignment

- The trademark assignment enables the trademark proprietor to encash the value of his/her brand.

- The assignee obtains the rights of an already established brand due to trademark assignment.

- The trademark assignment supports the assignor and the assignee to expand their respective businesses.

- The trademark assignment agreement enables the assignor and the assignee to establish their legal rights in case of any dispute.

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

About the Author

Mayashree Acharya

I am an advocate by profession and have a keen interest in writing. I write articles in various categories, from legal, business, personal finance, and investments to government schemes. I put words in a simplified manner and write easy-to-understand articles. Read more

Public Discussion

Get involved!

Share your thoughts!