- Research note

- Open access

- Published: 10 September 2022

A case study of adapting a health insurance decision intervention from trial into routine cancer care

- Miles E. Charles ORCID: orcid.org/0000-0001-8381-6803 1 ,

- Lindsay M. Kuroki 2 ,

- Ana A. Baumann 1 ,

- Rachel G. Tabak 3 , 4 ,

- Aimee James 1 ,

- Krista Cooksey 1 &

- Mary C. Politi 1

BMC Research Notes volume 15 , Article number: 298 ( 2022 ) Cite this article

3033 Accesses

3 Altmetric

Metrics details

This study adapted Improving Cancer Patients’ Insurance Choices ( I Can PIC), an intervention to help cancer patients navigate health insurance decisions and care costs. The original intervention improved knowledge and confidence making insurance decisions , however, users felt limited by choices provided in insurance markets. Using decision trees and frameworks to guide adaptations, we modified I Can PIC to focus on using rather than choosing health insurance. The COVID-19 pandemic introduced unforeseen obstacles, prompting changes to study protocols. As a result, we allowed users outside of the study to use I Can PIC (> 1050 guest users) to optimize public benefit. This paper describes the steps took to conduct the study, evaluating both the effectiveness of I Can PIC and the implementation process to improve its impact.

Although I Can PIC users had higher knowledge and health insurance literacy compared to the control group, results were not statistically significant. This outcome may be associated with systems-level challenges as well as the number and demographic characteristics of participants. The publicly available tool can be a resource for those navigating insurance and care costs, and researchers can use this flexible approach to intervention delivery and testing as future health emergencies arise.

Introduction

JL is a 66-year-old patient with progressive, recurrent ovarian cancer whose clinician recommended that she start on a targeted, oral cancer therapy based on genomic testing of her cancer. A month after receiving this recommendation, JL received a “summary of benefits” from her insurance company reflecting she owed a $3000 USD co-pay for a 30-day supply of this targeted therapy (the goal was to continue this therapy until her disease no longer responded to it, or she had intolerable side effects; her clinicians estimated this might take 1–2 years). As a full-time employed nurse, JL had health insurance. However, she did not qualify for the industry-sponsored financial assistance drug program because her annual income was slightly ($3500) over the allowed threshold. She would have to spend down 3% of her income on prescriptions that year in order to receive 100% coverage for the medication. Furthermore, because she had both government-sponsored and private insurance, her government-sponsored insurance made her ineligible for a “co-pay card” sponsored by the pharmaceutical company. JL was extremely distressed about this financial strain and considered whether and how she could take this therapy recommended by her doctor.

JL, like many under-insured patients, was inadvertently overlooked by her oncology team to be at risk for what scholars refer to as “financial toxicity,” or the material and psychosocial hardship from high costs of care. Yet, as many as 64% of patients report financial hardship following a cancer diagnosis [ 1 ], and many face barriers, like those described above, that prohibit affordable access to needed cancer therapies [ 2 , 3 ]. We use this case study to describe the critical steps we took to adapt and implement a health insurance decision intervention for cancer patients and survivors like JL, while balancing intervention testing and adaptation with real-world needs during a global pandemic.

Evidence supporting the intervention and the need for adaptation

Improving Cancer Patients’ Insurance Choices ( I Can PIC) is an interactive online decision tool originally designed to help cancer patients, like JL, think through their health insurance choices and identify ways to offset high costs of cancer and survivorship [ 4 ]. It provides tailored cost estimates across insurance plan types based on demographic and health characteristics and provides financial support resources.

In a randomized controlled trial of I Can PIC compared to an attention control group where participants were given an alternative intervention: a handout that lists financial resources along with brief definitions of health insurance terms, I Can PIC users knew more about health insurance and were more confident understanding insurance terms [ 4 ]. However, many I Can PIC users reported that their employer-based and marketplace insurance gave them limited choices [ 4 ]. This implied the potential to better align the tool within the current insurance landscape, even if it required adaptation before meeting all of its goals [ 5 ]. Therefore, the team elicited feedback from clinicians, patients, and policy experts on ways to emphasize using health insurance rather than focusing mostly on choosing health insurance (Additional file 2 : Table S1). This paper describes the adaptation process of I Can PIC to achieve these goals.

Intervention adaptation process

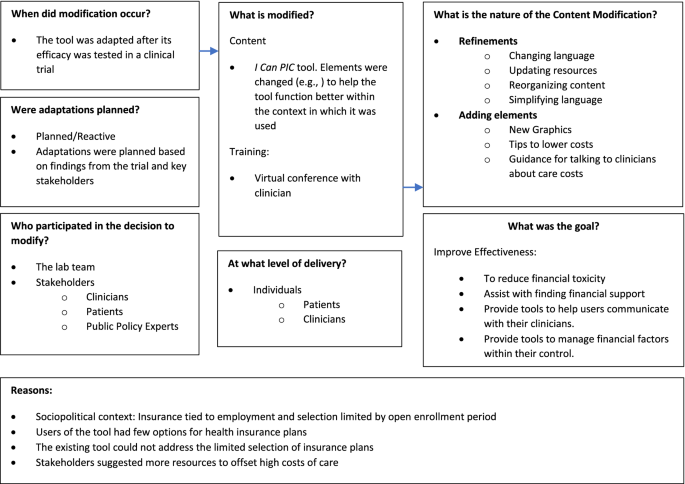

We used two guides to structure the adaptation process. The Iterative Decision-making for Evaluation of Adaptations (IDEA) decision tree informed the process of adaptation [ 6 ], and the Framework for Reporting Adaptation and Modifications-Expanded (FRAME) guided the tracking of adaptations (Fig. 1 ) [ 7 ]. To start the adaptation process, we first identified the core elements of the intervention that improved outcomes: health insurance educational resources, cost-of-care conversation guidance, and resources to offset costs which are critical to patients like JL (Additional file 1 : Fig S1). During this iterative process, we then added new elements to I Can PIC and made content, format, and functional improvements based on stakeholder feedback and the original trial results (Additional file 2 : Table S1).

I Can PIC as Tracked and Adapted Using the FRAME Approach

Assessment of the adapted I Can PIC tool

After we adapted I Can PIC , we assessed its effectiveness among newly-diagnosed patients with gynecological, colorectal, or lung cancer, examining their health insurance knowledge, financial toxicity, health insurance literacy, and delayed or forgone care due to cost. We conducted a historic control survey assessing these constructs as well as whether and how treatment costs were discussed with patients at their most recent visit with their physicians. Next, we conducted a brief virtual/video conference training with fifteen medical or surgical oncologists to talk about screening for financial distress and discussing costs with patients. After the training, we conducted a pilot intervention study where patients were sent I Can PIC , completed a survey after their upcoming oncology appointment, and a follow-up survey 3–6 months after recruitment. Once during the study, we gave the oncologists feedback and reminded them to screen for financial distress and refer patients to I Can PIC. This study was approved by the Human Research Protection Office at Washington University in St. Louis (protocol number 202003033).

The COVID-19 pandemic introduced unforeseen obstacles to patient enrollment that shifted in-person recruitment to virtual methods (e.g., phone calls and emails) from secured, Health Insurance Portability and Accountability Act (HIPAA) compliant university-affiliated phone numbers and emails. We also partnered with the institutional review board and streamlined the consent script to be more succinct and engaging [ 8 ]. Prior to these changes and even after, many newly diagnosed cancer patients did not want to add a research commitment to their already busy or overextended lives. With recognition of these challenges and others, the revised version of I Can PIC was made available to the public while undergoing testing so that patients outside of eligibility criteria, like JL with recurrent cancer, or patients not interested in research, could still benefit from its health insurance and care costs information and support.

Eligible patients for both the historic control and intervention groups were English speaking, at least 18 years old, eligible for insurance through their employer or the federal marketplace, and diagnosed with a new lung, gynecological, or colorectal cancer within five months. Participants were recruited from a single site, NCI-designated cancer center where fifteen oncologists (five gynecologic oncologists, three colorectal surgeons, two medical oncologists treating colorectal cancer patients, and five thoracic surgeons treating lung cancer patients) gave the study team permission to review medical records and approach eligible patients for study participation. Recruitment into the historic control group began in May 2020. Starting in October 2020, we conducted our first provider training, since health insurance open enrollment was beginning, and we wanted at least some patients to use I Can PIC while they had options of changing insurance. Between October 2020 and February 2021, we trained the fifteen oncologists to screen for financial toxicity and discuss care costs with patients.

After clinicians were trained, we recruited patients into the intervention arm. Patients were asked to review I Can PIC before their upcoming appointment. After they met with their oncologist, the research team sent them a survey that could either be completed online or by phone. A three-month follow-up survey was also sent to patients in the intervention arm.

Patient socio-demographics were self-reported. As in the original trial, participant numeracy and health literacy were assessed using validated scales [ 9 , 10 , 11 , 12 ]. Primary outcomes included health insurance knowledge, health insurance literacy, frequency, and type of care cost conversations (including topics and strategies discussed), financial toxicity, and patient referrals to resources to further discuss costs [ 13 ].

Statistical analysis

Descriptive statistics were calculated for all sociodemographic variables and compared between groups using chi‐square analyses or Fisher's exact test for categorical variables, as appropriate, and the Kruskal–Wallis test for continuous variables. Baseline surveys for both the control and intervention groups were compared for one-way analysis of variance, Fisher's exact test to determine if there were nonrandom associations between two categorial variables, and Chi-Square tests to determine if two categorical variables were independent. To compare the intervention at the baseline survey and 3–6 month follow-up survey, paired t-tests for continuous variables and kappa statistics for categorical variables (discussed costs or not, discussed cost strategies or not, referral made or not, etc.)

During our study period, there were 1512 total logins on the I Can PIC website, of which 1058 (70%) were guest users. Guest users were treated in other facilities, ineligible due to cancer type, or not interested in participating in the research study, but wanted to access the information. Among the 136 consented and surveyed participants (68 historic controls; 68 intervention group), socio-demographics were similar except that the intervention group was slightly higher educated (Table 1 ). The intervention group had slightly higher health insurance knowledge (mean score 77.02 vs 72.45) and slightly higher health insurance literacy (mean score 34.71 vs 33.03) compared to controls; these differences were not statistically significant. Knowledge and health insurance literacy was sustained at the 3–6 month follow-up.

The frequency of cost discussions related to cancer care was similar between the intervention and control groups (57.4 vs 67.7%, p = 0.22), with the most common topics involving insurance, time off work, and costs of medications. Specific cost strategies that were discussed are detailed in Table 1 . Overall, a small proportion of patients received referrals (eg., I Can PIC website or any outside agency/office such as government assistance, community agency or charity, or hospital billing) from their oncologist to learn more about cancer costs and did not vary by group (controls, 16.2% vs intervention group, 20.6%).

Financial toxicity was reportedly low in both groups (17.7% in the control vs 16.1% in the intervention group), though decreased slightly within the intervention group during the study period (first survey average score was 16.06 vs. 14.17 at the 3–6 month follow-up). Unfortunately, 18% of individuals in the control group and 13% in the intervention group reported delaying care due to cost (p = 0.41).

Throughout the adaptation process, it is important to ensure that end users like JL can benefit from effective interventions, even if interventions require refinement and continued testing. Using systematic decision trees and guides such as IDEA and FRAME, we described one way to systematically track intervention adaptations while ensuring real-world access throughout the process to benefit patients. Strengths of our study include our diverse stakeholders which included patients, clinicians and policy experts who provided advice on I Can PIC , including patients across several cancer types, and modification of consent processes and tool access to optimize patient engagement and minimize burden.

This case example provides a guide for deploying low-risk interventions in routine care while continuing to generate evidence and improve on their public health impact. Of 1512 total logins on the I Can PIC website, 70% were guest users outside of the research study, and we hope many of them, like JL, benefited from I Can PIC access even if they were reluctant to join a study. JL ultimately made an informed decision with her oncology team and the support of her family to only work part-time to optimize her benefits in order to receive the targeted, oral cancer therapy through the pharmaceutical company’s financial assistance program.

Despite growing awareness of financial toxicity on underinsured patients, more interventions are needed to better integrate cost conversations into routine cancer care. Systems-level changes are needed to address this burden of care on patients. Future work will continue to build on the frameworks discussed to adapt content and delivery of I Can PIC so that patient-centered outcomes, such as financial toxicity, distress, quality-of-life, and adherence to treatment, are improved. This case study can provide guidance for other implementation studies, including those that might be conducted during future health emergencies.

Limitations

Due to rapid changes as a result of the COVID-19 pandemic, it is important to note limitations of our study design and execution of our protocol. Given this unprecedented time when unmet social and health needs were and still remain under constant threat and turmoil, we acknowledge our non-randomized study design and recruitment of historic controls are critical limitations to interpretation and generalizability of results. The timing of their recruitment could have exacerbated health or financial strain, although the pandemic was still ongoing even at the end of the study with new waves of health risks emerging. Future health emergencies could introduce similar issues without addressing the larger social and societal needs. Furthermore, COVID-19 and rapid transitions to virtual recruitment presented other challenges to this project, which was initially planned to be in person. Despite modifications to the protocol, consent documents, and workflow to reduce burden on participants, systemic issues remained that reduced the diversity of our sample in the research component of intervention implementation. These challenges are likely to remain without addressing systemic barriers to research and care more broadly. Consequently, these results may not be representative of the experiences of lower income and/or racially diverse patients experiencing financial toxicity due to their cancer diagnosis. Ongoing feedback from stakeholders will continue to ensure that the needs of various populations, including oncology providers are considered.

Availability of data and materials

The datasets used during the current study are available from the corresponding author on reasonable request.

Abbreviations

Improving Cancer Patients’ Insurance Choices

Iterative Decision-making for Evaluation of Adaptations

Framework for Reporting Adaptation and Modifications-Expanded

Health Insurance Portability and Accountability Act

PDQ ® Adult treatment editorial board. PDQ Financial toxicity and cancer treatment. Bethesda, MD United States: National Cancer Institute

Gunn AH, Sorenson C, Greenup RA. Navigating the high costs of cancer care: opportunities for patient engagement. Future Oncology (London, England). 2021;17(28):3729–42.

Article CAS Google Scholar

Zafar SY, et al. The financial toxicity of cancer treatment: a pilot study assessing out-of-pocket expenses and the insured cancer patient’s experience. Oncologist (Durham, NC United States). 2013;18(4):381–90.

Article Google Scholar

Politi MC, et al. Improving cancer patients’ insurance choices (I Can PIC): a randomized trial of a personalized health insurance decision aid. Oncologist. (St. Louis, MO United States) 2020;25(7):609–19.

Lundmark R, et al. Alignment in implementation of evidence—based interventions: a scoping review. Implement Sci. 2021;16(1):93.

Miller CJ, Wiltsey-Stirman S, Baumann AA. Iterative decision-making for evaluation of adaptations (IDEA): a decision tree for balancing adaptation, fidelity, and intervention impact. J Community Psychol. 2020;48(4):1163–77.

Wiltsey Stirman S, Baumann AA, Miller CJ. The FRAME: an expanded framework for reporting adaptations and modifications to evidence-based interventions. Implement Sci. 2019;14(1):58.

Cooksey K, Mozersky J, DuBois J, Kuroki L, Marx C, Politi MC. Challenges and possible solutions to adapting to virtual recruitment: lessons learned from a survey study during the COVID-19 pandemic. Ethics Hum Res. (2022). epub ahead of print.

Fagerlin A, et al. Measuring numeracy without a math test: development of the Subjective Numeracy Scale. Med Decis Mak. 2007;27(5):672–80.

Lipkus IM, Samsa G, Rimer BK. General performance on a numeracy scale among highly educated samples. Med Decis Mak. 2001;21(1):37–44.

Morris NS, et al. The Single Item Literacy Screener: evaluation of a brief instrument to identify limited reading ability. BMC Fam Pract. 2006;7:21.

Zikmund-Fisher BJ, et al. Validation of the Subjective Numeracy Scale: effects of low numeracy on comprehension of risk communications and utility elicitations. Med Decis Mak. 2007;27(5):663–71.

De Souza JA, Yap BJ, Wroblewski K, Blinder V, Araújo FS, Hlubocky FJ, Nicholas LH, O’Connor JM, Brockstein B, Ratain MJ, Daugherty CK, Cella D. Measuring financial toxicity as a clinically relevant patient-reported outcome: the validation of the Comprehensive Score for financial Toxicity (COST). Cancer. 2017. https://doi.org/10.1002/cncr.30369 ( Epub 2016 Oct 7. ).

Article PubMed PubMed Central Google Scholar

Download references

Acknowledgements

Not Applicable.

Financial support for this study was provided in part by a grant from the American Cancer Society (RSGI-17–018-01-CPHPS), the National Cancer Institute (P50CA244431), Washington University’s Institute for Clinical and Translational Sciences Dissemination and Implementation Research Core (UL1 TR002345) and The Foundation for Barnes Jewish Hospital. The content is solely the responsibility of the authors and does not necessarily represent the official views of the American Cancer Society, the National Institutes of Health, or Washington University. Ana Baumann and Rachel Tabak are funded by CTSA Grant UL1 TR002345 and P50 CA-19–006. Ana Baumann is also funded by 3U01HL13399403S1 and 5U24HL136790-02. LK was supported by the KL2 TR000450 and Doris Duke to Retain Clinical Scientists (2015215).

Author information

Authors and affiliations.

Division of Public Health Sciences, Department of Surgery, Washington University School of Medicine, 660 S. Euclid Ave, Campus, Box 8100, St. Louis, MO, 63110, USA

Miles E. Charles, Ana A. Baumann, Aimee James, Krista Cooksey & Mary C. Politi

Division of Gynecologic Oncology, Department of Obstetrics and Gynecology, Washington University School of Medicine, St. Louis, USA

Lindsay M. Kuroki

Brown School, Washington University, St. Louis, USA

Rachel G. Tabak

Prevention Research Center, Washington University, St. Louis, USA

You can also search for this author in PubMed Google Scholar

Contributions

All authors contributed to writing, revising, and approving the manuscript. MP led the decision intervention development and adaptation process and critically evaluated and revised the manuscript. MC and LK led the writing of the manuscript, its revisions, and final submission. AB and RT led the evaluation of the adaptation process and critically revised the manuscript for important implementation content. AJ contributed to the design and adaptation of the intervention and critically revised the manuscript. KC led the discussion of the changes to the study as a result of the COVID-19 pandemic, assisted with data analysis, and contributed to revisions of the manuscript. All the authors read and approved the final manuscript.

Corresponding author

Correspondence to Mary C. Politi .

Ethics declarations

Ethics approval and consent to participate.

This study was approved by the Human Research Protection Office at Washington University in St. Louis (protocol number 202003033). All individuals that participated in this study provided informed consent.

Consent for publication

Not applicable.

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Additional file 1: figure s1..

I Can PIC as Adapted and Tracked Using the Iterative Decision-Making for Evaluation of Adaptations (IDEA) Framework Steps.

Additional file 2: Table S1.

Stakeholder- and Participant-Suggested Adaptations to I Can PIC.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ . The Creative Commons Public Domain Dedication waiver ( http://creativecommons.org/publicdomain/zero/1.0/ ) applies to the data made available in this article, unless otherwise stated in a credit line to the data.

Reprints and permissions

About this article

Cite this article.

Charles, M.E., Kuroki, L.M., Baumann, A.A. et al. A case study of adapting a health insurance decision intervention from trial into routine cancer care. BMC Res Notes 15 , 298 (2022). https://doi.org/10.1186/s13104-022-06189-8

Download citation

Received : 23 May 2022

Accepted : 27 August 2022

Published : 10 September 2022

DOI : https://doi.org/10.1186/s13104-022-06189-8

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Implementation

- Decision science

- Health insurance

- Health policy

BMC Research Notes

ISSN: 1756-0500

- Submission enquiries: [email protected]

- General enquiries: [email protected]

Insurance Case Studies: The Ultimate Guide

How do you show your prospects exactly what your company can do for them? With a case study. Insurance case studies provide buyers with the solid facts, figures and performance examples they need to make a purchasing decision.

What Is a Case Study?

A case study is a powerful marketing tool that is often used in the middle or bottom of the sales funnel, to help buyers develop a preference for your offering. Case studies increase buying confidence and validate the buying decision. They prove that your product or service performs as promised.

Case studies change the conversation from telling to showing. Instead of just telling prospects how great your brand is, you can show prospects exactly what your brand is capable of achieving. This gives prospects a more concrete understanding of what to expect and enables them to step into the shoes of a satisfied customer.

The Elements of a Case Study

An effective case study contains key elements that align with the buyer’s journey:

- Who is the customer? If you don’t have permission to name the customer, describe the customer by industry, size and other relevant details.

- What problem were they trying to solve? When B2B buyers are shopping for a product, they’re trying to solve a specific problem. Identify this problem so other prospects with similar problems can relate. Sometimes, there’s more than one problem.

- What other solutions did they consider? B2B buyers usually consider multiple options before deciding. This is a key part of the process, and including the details can help emphasize why your company stood out.

- Why did they choose your solution? State exactly what your company offered that other competitors couldn’t.

- What was the implementation process like? Switching B2B vendors can be a major undertaking. Describe the process so your prospects will know what to expect. Of course, you want to put your company in a positive light and focus on the positives, but you can include hiccups that occurred in the process and how you handled them. Prospects know that things don’t always go perfectly according to plan, and this shows that you’re competent and able to overcome any barriers that arise.

- How has the company benefited? In the beginning of the case study, you described the client’s problem. Now touch back on this and show how the problem has been solved. Include specific information about how the company has benefited from your product or service. For example, how much time or money has the client saved? How are they better prepared? How have you helped increase their revenues?

- What are the key takeaways for others in a similar situation? Convince prospects that they should follow the client’s example and partner with your company. Summarize your argument with key takeaways from the case study.

Case Study Dos and Don’ts

To squeeze the most value from your case study, you need to follow some best practices.

- Don’t just list bulleted facts. You might be able to pull a list of bulleted facts from your case study to use in other types of content, such as social media posts, but your actual case study should be at least two pages long to tell the story in a meaningful way.

- Do use names. Your case study will carry a lot more weight if the featured customer is named. You can also use anonymous case studies, but they are not quite as credible.

- Do appeal to emotions. Think of your case study as a story. You’re showing your prospects what it’s like to work with your company, so you need to build a narrative. This is also a good place to build an emotional argument by showing how your company can help clients deal with pain points and reduce problems.

- Don’t make your case study longer than it needs to be. Your prospects are busy, and they probably won’t have time to read an overly verbose document. Provide enough information to create a compelling story, but don’t get bogged down with unnecessary details. An effective case study will often be around two pages.

- Do include quotes. You can say that your company is great, but it sounds more convincing if one of your customers says it. The featured customer may be willing to provide you with quotes and their logo to include in your case study. As a bonus, this is also free publicity for them.

- Do get permission. If you’re naming a customer, you will need to secure their permission and allow them the opportunity to review and approve the final piece before it is used. Be sure to save their written approval in case questions arise in the future.

Case Studies Should Be Part of Your Content Library

Creating a case study can take some time and effort, but they are worth it.

According to the 2022 Edelman Trust Barometer , 63% of people worry business leaders are trying to mislead people with false or exaggerated statements. If you just say that your company can help people solve their problems, your prospects might not believe you. You need to build credibility, and a case study that provides concrete examples can help.

A case study is also a fantastic way to differentiate yourself from your competition. As mentioned earlier, case studies are often used in more advanced stages of the customer journey, when prospects are already familiar with your company and need information that’s going to guide their purchasing decision. You want to create preference for your company so you can close the sale, and a case study can help you do that.

Your Case Study Can Convert Leads for Years

Some content has a short life, but not case studies. Although creating a case study will require some effort, once you have it, you can use it for as long as you continue to offer the featured products and services, and the featured company is still a customer.

- Feature your case study on your website. You can create a landing page for your case study or case studies so prospects can find them easily. They can be offered as instant downloads or you can generate leads by gating them with a form.

- Promote your case study in social media posts. Spread the word about your case study on social media. You can always just write a post and link to the case study, but also consider designing graphics for the case study. A LinkedIn carousel post is another great way to highlight your case study on social media.

- Encourage prospects to download the study as a call to action in your blog posts . This is a practical way to encourage your audience to learn more about your company.

- Link to case studies in email nurturing campaigns . If you’re nurturing a prospect that has downloaded other content, a case study link can entice additional engagement.

- Build case studies into your sales processes . Sales professionals love using case studies as handouts as they provide a great springboard for meaningful conversations.

- Use content to develop webinars or videos . You can even use case study content as the foundation for very powerful webinars or videos.

Need Case Studies but Don’t Know Where to Start?

Inbound Insurance Marketing can help your company develop powerful, effective case studies. Learn more. Or, if you’re ready to get started, schedule 30 minutes to discuss your project.

Share this Article:

47 case interview examples (from McKinsey, BCG, Bain, etc.)

One of the best ways to prepare for case interviews at firms like McKinsey, BCG, or Bain, is by studying case interview examples.

There are a lot of free sample cases out there, but it's really hard to know where to start. So in this article, we have listed all the best free case examples available, in one place.

The below list of resources includes interactive case interview samples provided by consulting firms, video case interview demonstrations, case books, and materials developed by the team here at IGotAnOffer. Let's continue to the list.

- McKinsey examples

- BCG examples

- Bain examples

- Deloitte examples

- Other firms' examples

- Case books from consulting clubs

- Case interview preparation

Click here to practise 1-on-1 with MBB ex-interviewers

1. mckinsey case interview examples.

- Beautify case interview (McKinsey website)

- Diconsa case interview (McKinsey website)

- Electro-light case interview (McKinsey website)

- GlobaPharm case interview (McKinsey website)

- National Education case interview (McKinsey website)

- Talbot Trucks case interview (McKinsey website)

- Shops Corporation case interview (McKinsey website)

- Conservation Forever case interview (McKinsey website)

- McKinsey case interview guide (by IGotAnOffer)

- McKinsey live case interview extract (by IGotAnOffer) - See below

2. BCG case interview examples

- Foods Inc and GenCo case samples (BCG website)

- Chateau Boomerang written case interview (BCG website)

- BCG case interview guide (by IGotAnOffer)

- Written cases guide (by IGotAnOffer)

- BCG live case interview with notes (by IGotAnOffer)

- BCG mock case interview with ex-BCG associate director - Public sector case (by IGotAnOffer)

- BCG mock case interview: Revenue problem case (by IGotAnOffer) - See below

3. Bain case interview examples

- CoffeeCo practice case (Bain website)

- FashionCo practice case (Bain website)

- Associate Consultant mock interview video (Bain website)

- Consultant mock interview video (Bain website)

- Written case interview tips (Bain website)

- Bain case interview guide (by IGotAnOffer)

- Bain case mock interview with ex-Bain manager (below)

4. Deloitte case interview examples

- Engagement Strategy practice case (Deloitte website)

- Recreation Unlimited practice case (Deloitte website)

- Strategic Vision practice case (Deloitte website)

- Retail Strategy practice case (Deloitte website)

- Finance Strategy practice case (Deloitte website)

- Talent Management practice case (Deloitte website)

- Enterprise Resource Management practice case (Deloitte website)

- Footloose written case (by Deloitte)

- Deloitte case interview guide (by IGotAnOffer)

5. Accenture case interview examples

- Case interview workbook (by Accenture)

- Accenture case interview guide (by IGotAnOffer)

6. OC&C case interview examples

- Leisure Club case example (by OC&C)

- Imported Spirits case example (by OC&C)

7. Oliver Wyman case interview examples

- Wumbleworld case sample (Oliver Wyman website)

- Aqualine case sample (Oliver Wyman website)

- Oliver Wyman case interview guide (by IGotAnOffer)

8. A.T. Kearney case interview examples

- Promotion planning case question (A.T. Kearney website)

- Consulting case book and examples (by A.T. Kearney)

- AT Kearney case interview guide (by IGotAnOffer)

9. Strategy& / PWC case interview examples

- Presentation overview with sample questions (by Strategy& / PWC)

- Strategy& / PWC case interview guide (by IGotAnOffer)

10. L.E.K. Consulting case interview examples

- Case interview example video walkthrough (L.E.K. website)

- Market sizing case example video walkthrough (L.E.K. website)

11. Roland Berger case interview examples

- Transit oriented development case webinar part 1 (Roland Berger website)

- Transit oriented development case webinar part 2 (Roland Berger website)

- 3D printed hip implants case webinar part 1 (Roland Berger website)

- 3D printed hip implants case webinar part 2 (Roland Berger website)

- Roland Berger case interview guide (by IGotAnOffer)

12. Capital One case interview examples

- Case interview example video walkthrough (Capital One website)

- Capital One case interview guide (by IGotAnOffer)

13. Consulting clubs case interview examples

- Berkeley case book (2006)

- Columbia case book (2006)

- Darden case book (2012)

- Darden case book (2018)

- Duke case book (2010)

- Duke case book (2014)

- ESADE case book (2011)

- Goizueta case book (2006)

- Illinois case book (2015)

- LBS case book (2006)

- MIT case book (2001)

- Notre Dame case book (2017)

- Ross case book (2010)

- Wharton case book (2010)

Practice with experts

Using case interview examples is a key part of your interview preparation, but it isn’t enough.

At some point you’ll want to practise with friends or family who can give some useful feedback. However, if you really want the best possible preparation for your case interview, you'll also want to work with ex-consultants who have experience running interviews at McKinsey, Bain, BCG, etc.

If you know anyone who fits that description, fantastic! But for most of us, it's tough to find the right connections to make this happen. And it might also be difficult to practice multiple hours with that person unless you know them really well.

Here's the good news. We've already made the connections for you. We’ve created a coaching service where you can do mock case interviews 1-on-1 with ex-interviewers from MBB firms . Start scheduling sessions today!

The IGotAnOffer team

Industry Case Studies, Banking, Insurance and Financial Services Case Study

Ibs ® case development centre, asia-pacific's largest repository of management case studies, mba course case maps.

- Business Models

- Blue Ocean Strategy

- Competition & Strategy ⁄ Competitive Strategies

- Core Competency & Competitive Advantage

- Corporate Strategy

- Corporate Transformation

- Diversification Strategies

- Going Global & Managing Global Businesses

- Growth Strategies

- Industry Analysis

- Managing In Troubled Times⁄Managing a Crisis

- Managing a Downturn⁄ Managing through Receissionary Times

- Market Entry Strategies

- Mergers, Acquisitions & Takeovers

- Restructuring / Turnaround Strategies

- Strategic Alliances, Collaboration & Joint Ventures

- Supply Chain Management

- Value Chain Analysis

- Vision, Mission & Goals

- Brands & Branding and Private Labels

- Brand ⁄ Marketing Communication Strategies and Advertising & Promotional Strategies

- Consumer Behaviour

- Customer Relationship Management (CRM)

- Marketing Strategies ⁄ Strategic Marketing

- Positioning, Repositioning, Reverse Positioning Strategies

- Sales & Distribution

- Services Marketing

- Economic Crisis

- Fiscal Policy

- Government & Business Environment

- Macroeconomics

- Micro ⁄ Business ⁄ Managerial Economics

- Monetary Policy

- Public-Private Partnership

- Financial Management & Corporate Finance

- Investment & Banking

- Leadership,Organizational Change & CEOs

- Succession Planning

- Corporate Governance & Business Ethics

- Corporate Social Responsibility

- International Trade & Finance

- Entrepreneurship

- Family Businesses

- Social Entrepreneurship

- HRM ⁄ Organizational Behaviour

- Innovation & New Product Development

- Business Research Methods

- Operations & Project Management

- Quantitative Methods

- Social Networking

- China-related Cases

- India-related Cases

- Women Executives ⁄ CEO's

- Course Case Maps

- Effective Executive Interviews

- Video Interviews

Executive Brief

- Case Catalogues

- Case studies in Other Languages

- Multimedia Case Studies

- Textbook Adoptions

- Customized Categories

- Free Case Studies

- Faculty Zone

- Student Zone

- By CaseCode

- By CaseTitle

- By Industry

- By Keywords

- Aircraft & Ship Building

- Automobiles

- Home Appliances & Personal Care Products

- Minerals, Metals & Mining

- Engineering, Electrical & Electronics

- Building Materials & Construction Equipment

- Food, Diary & Agriculture Products

- Oil & Natural Gas

- Office Equipment

- Banking, Insurance & Financial Services

- Telecommunications

- e-commerce & Internet

- Freight &l Courier

- Movies,Music, Theatre & Circus

- Video Games

- Broadcasting

- Accessories & Luxury Goods

- Accounting & Audit

- IT Consulting

- Corporate Consulting

- Advertising

- IT and ITES

- Hotels & Resorts

- Theme Parks

- Health Care

- Sports & Sports Related

- General Business

- Business Law, Corporate Governence & Ethics

- Conglomerates

Case Categories

- Corporate Governance & Business Ethics

- Investment and Banking

- Human Resource Management (HRM)⁄Organizational Behaviour

- Leadership, Organizational Change and CEOs

- Brand⁄Marketing Communication Strategies and Advertising & Promotional Strategies

- Consumer Behaviour & Marketing Research

- Operations & Project Management

- Operations Management

- China-related cases

- India-related cases

- Women Executives/CEO's

Companies & Organizations

- Deutsche Bank

- Bank of America

Useful Links

- How to buy case studies?

- Pricing Information

Advertisement

Popular searches, recently bought cases.

- SSS�s Experiment: Choosing an Appropriate Research Design

- Differentiating Services: Yatra.com�s �Click and Mortar�Model

- Wedding Services Business in India: Led by Entrepreneurs

- Shinsei Bank - A Turnaround

- Accenture�s Grand Vision: �Corporate America�s Superstar Maker�

- Tata Group�s Strategy: Ratan Tata�s Vision

- MindTree Consulting: Designing and Delivering its Mission and Vision

- Coca-Cola in India: Innovative Distribution Strategies with 'RED' Approach

- IndiGo�s Low-Cost Carrier Operating Model: Flying High in Turbulent Skies

- Evaluation of GMR Hyderabad International Airport Limited (GHIAL)

- Ambuja Cements: Weighted Average Cost of Capital

- Walmart-Bharti Retail Alliance in India: The Best Way Forward?

- Exploring Primary and Secondary Data: Lessons to Learn

- Global Inflationary Trends: Raising Pressure on Central Banks

- Performance Management System@TCS

- Violet Home Theater System: A Sound Innovation

- Consumer�s Perception on Inverters in India: A Factor Analysis Case

- Demand Forecasting of Magic Foods using Multiple Regression Analysis Technique

- Saturn Clothing Company: Measuring Customer Satisfaction using Likert Scaling

Best Selling Cases

- Xerox�s Turnaround: Anne Mulcahy�s �Organizational Change�

- IKEA in Japan: The Market Re-entry Strategies

- Leadership Conundrum: Nike After Knight

- Nintendo�s Innovation Strategies: A Sustainable Competitive Advantage?

- Perfect Competition under eBay: A Fact or a Factoid?

- Googles HR Practices: A Strategic Edge?

- H&M vs Zara: Competitive Growth Strategies

Keep up with IBSCDC

- Email Newsletters

- IBSCDC on Twitter

- IBSCDC on Facebook

- IBSCDC on YouTube

Video Inerviews

Executive inerviews, case studies on.

- View all Casebooks »

Course Case Mapping For

- View All Course Casemaps »

- View all Video Interviews »

- View all Executive Briefs »

- View All Executive Interviews »

Advetisement

Contact us: IBS Case Development Centre (IBSCDC), IFHE Campus, Donthanapally, Sankarapally Road, Hyderabad-501203, Telangana, INDIA. Mob: +91- 9640901313 E-mail: [email protected]

Consultingcase101

Tag: Insurance life & health

Allianz to keep independent sales force model post-merger.

Case Type: Mergers and Acquisitions ; Marketing . Business Concepts Tested: Mergers & acquisitions (M&A) ; Sales model ; Synergies ; Data from exhibits ; Cost-benefit analysis . Consulting Firm: Bain & Company first round full time job interview. Industry Coverage: health & life insurance . Quantitative Difficulty: Easy; Qualitative Difficulty: Easy; Overall Difficulty: Easy

Case Interview Question #01387: Our client Allianz is a European multinational insurance company headquartered in … Read the rest

Case Industry Overview: Healthcare Payors

Industry Coverage: insurance: life & health .

(1) Overview of Healthcare Payors Industry

WHAT HEALTHCARE PAYORS DO:

* Underwrite (assume risk of, assign premiums for) health insurance policies. * Provide admin services for self-funded plans (e.g. employers providing benefits with own funds). * Help manage individuals’ care.

KEY INDUSTRY STATISTICS:

* Revenues/Profits: $707.4 Billion / 28.3 Billion (4%) * CAGR: — 2007-2012: 2.8% — 2012-2017: 5.1% * Number of businesses: … Read the rest

Blue Shield of California to Expand into Florida

Case Type: new market, market entry ; marketing . Consulting Firm: AlixPartners first round full time job interview. Industry Coverage: insurance: life & health .

Zenith Insurance to Expand into State of Virginia

Case Type: market entry ; math problem . Consulting Firm: American Express final round full time job interview. Industry Coverage: life & health insurance .

American Insurance Group to Divest P&C Business Unit

Case Type: pricing & valuation ; industry analysis . Consulting Firm: Deloitte Consulting final round full time job interview. Industry Coverage: life & health insurance ; property & casualty insurance .

Case Interview Question #01189: Our client, American Insurance Group, Inc. (NYSE: AIG), is a large, multi-national insurance provider, with revenues of over $25B in 2009. The company operates through three businesses: AIG Property Casualty, AIG Life and Retirement, and … Read the rest

Aetna to Acquire Humana for $37 Billion in Cash and Stock

Case Type: organizational behavior, human capital ; mergers & acquisitions (M&A) . Consulting Firm: Mercer first round full time job interview. Industry Coverage: health & life insurance .

Case Interview Question #01180: Aetna Inc. (NYSE: AET) is an American health plan company that operates primarily in the United States. Aetna recently announced that it is merging with another big player in the market, Humana Inc. (NYSE: HUM). Humana is also … Read the rest

Monday 12 September 2016

Business studies case studies class 11; chapters 3,4 and 5, 14 comments:.

Sir inke solutions kha milenge

Sir where are the answers of all these questions

Yes sir we want answers

anssererdsd

sir answers pls

answer de na

Ans. Dasso yrr

Give answer of these case studies

answers bhej do yrr

Sir answer kaha h

Amul is a big brand now. Read how supply chain of amul work.

Thank you for sharing amazing case studies related to business. Case Studies For Small Businesses

Andre Cardoso

Customer Reviews

Finished Papers

IMAGES

VIDEO

COMMENTS

Without insurance, the appointment cost $150 and the eye drops cost $90. Vision. Yes. $30 copay for doctor visit; $10 copay for prescription. Summarize the costs of Lucy's deductibles, copays, and premiums: Lucy paid a total of $2,930 for the incidents that year. Without any insurance, she would have paid $6,620.

of insurance products available in the case study countries are quantified and presented using survey approaches. Wherever such quantification was not possible, the benefits were presented either qualitatively or from the literature review. I believe that this report will raise awareness of the need to

This study adapted Improving Cancer Patients' Insurance Choices (I Can PIC), an intervention to help cancer patients navigate health insurance decisions and care costs. The original intervention improved knowledge and confidence making insurance decisions, however, users felt limited by choices provided in insurance markets. Using decision trees and frameworks to guide adaptations, we ...

This question has been foremost in the minds of insurance executives in recent years. The answers are gaining in urgency as the ongoing social and economic consequences of COVID-19 are leading many customers to consider the value and flexibility of insurance products in terms of changing circumstances and needs. ... Case study: flexible and ...

It offered a 4.56 percent payout rate. In this case study, we use income annuities for males and couples, and we must also account for the fact that the annuity will not be purchased for twenty ...

Students read about how insurance works, then review a case study to see how insurance choices can affect personal finances for a young adult in a city. Topic Protect (Managing risk, Using insurance) Subject CTE (Career and technical education), Math, Physical education or health, Social studies or history Grade Level High school (9-10), High school […]

Case Studies in Insurance - ICMR Case Book Collection, Management of Companies, General Corporation of , Life Corporation of , Advertising, Promotion Norms, Distribution Norms, Life Product, Pricing Norms, Film Financing Operations, Assessing Loss Due to Theft, Claims for Loss to Property, Genuine or Fraudulent, Vandalism, Trends in Commercial Vehicle Claims Adjusters, Workers Compensation ...

Case studies increase buying confidence and validate the buying decision. They prove that your product or service performs as promised. Case studies change the conversation from telling to showing. Instead of just telling prospects how great your brand is, you can show prospects exactly what your brand is capable of achieving.

insurance professional would be ready to advise Kevin and Patricia regarding the adequacy of their current life insurance program. Based on the total needs of $1,065,000 and available assets to meet those needs of $818,000, there is a shortfall of $247,000. Total Life Insurance Needs . Total needs $1,065,000 . Minus total assets $ 818,000

Case study: Insurance REJECTION OF INSURANCE CLAIM AND COVERAGE REVOKED Themes: Home Insurance, Loss adjustment-cause of damage, customer obligation to provide accurate and complete answers to questions, customer obligation to act in good faith. Mrs M contacted her insurance broker to file a claim for damage to the roof of her home. The

Health Insurance. Start your case study practice now with this Booz Allen Hamilton case study. Case Intro. A health insurance company experienced a loss of $40M this year, after recording a $40M profit last year. The company is in only one line of business, Commercial Risk Insurance, in only one region. They have several direct competitors.

These renters insurance case studies are great examples of times when renters insurance is a helpful part of your personal financial plan. Look at 8 scenarios where you need renters insurance. Renters Insurance Scenarios Break-ins. Renters insurance can help cover the costs of the stolen items.

Read the "Exploring key financial concepts" section to students. Distribute the "Analyzing auto insurance scenarios" worksheet and review the six types of auto insurance coverage listed: collision, comprehensive, medical payments, bodily injury, property damage, and uninsured/underinsured driver. Make sure students understand what each ...

BCG mock case interview with ex-BCG associate director - Public sector case (by IGotAnOffer) BCG mock case interview: Revenue problem case (by IGotAnOffer) - See below. 3. Bain case interview examples. CoffeeCo practice case (Bain website) FashionCo practice case (Bain website)

Case Study Strategic Portfolio Repositioning. Working closely with a leading multiline insurance company, we followed a comprehensive four-step process to reposition its traditional core portfolio. By incorporating more diversified exposures, including illiquid assets, we enhanced book yield while meeting the client's objectives.

Icfai Business School Case Development Centre has developed over 1100 world-class case studies. Industry Case Studies, Banking, Insurance and Financial Services Case Study Help

A case library of 600+ case study examples to get you ready for your case interview! McKinsey, BCG, Bain & 20+ other firm styles represented! Skip to primary navigation; ... Car Insurance Company : BCG: Profitability - Cost: Y: 1: Financial Services: Operations: Car Lubricant : McKinsey: Market Study - Growth: N: 1: Automotive:

Contents vi 13. Mis-selling: The Case of Parv Money Life Insurance ..... 97 14. RK Industries: A Case Study on Estimation of Working Capital .....

Industry Coverage: insurance: life & health. Case Interview Question #01375: Your client is Blue Shield of California (BSC), a health insurance company and health plan provider based in Oakland, California. The company serves over 4 million health plan members in California. Blue Shield of California's provider network currently includes ...

1. Answer. 2.7 k. Views. 3. Total Upvotes. 5 results. Here. Find all questions and answers on Insurance Case. Management Consulting Career Application Process Case Interview Tips.

Case Study Questions - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Case Study

Q:1 It is a prime responsibility of he insured to take reasonable steps to minimise loss/ damage to the insured property . Identify and explain the principle of insurance highlighted in the given statement. Q:2 Paul Ltd. insures its stock against fire for Rs 20 lakh. A fire broke down and the total stock was lost.

Insurance Case Study Questions, Ptu M Tech Thesis Report Format, Best Graduate School Admission Essays Write Way Into The Graduate, Gender And International Relations Essay, Annotated Bibliography Endnote X4, Humorous Wedding Speech By The Father Of The Groom, An Essay On Peace