The 24 Best eCommerce Retail Case Studies Worth Reading

In the fast-paced world of retail and eCommerce, staying ahead of the game is not just a goal; it’s the lifeline of our industry. For seasoned retail executives, inspiration often comes from the experiences and successes of industry giants who paved the way with their innovative thinking and managed to thrive through thick and thin. That’s why we’re excited to bring you an exclusive collection of the 30 best eCommerce case studies meticulously curated to provide you with a wealth of insights and ideas to fuel your strategies. These case studies are more than just success stories; they are beacons of guidance for retail professionals navigating the ever-changing landscape of our industry.

In this article, we delve deep into the journeys of retail giants who have not only weathered the storms of disruption but have emerged as trailblazers in eCommerce. From adapting to shifting consumer behaviors to mastering the art of online engagement, this compilation offers a treasure trove of wisdom for the modern retail executive.

Table of Contents

- > Case studies for grocery/wholesale eCommerce retailers

- > Case studies for fashion eCommerce retailers

- > Case Studies for home & furniture eCommerce retailers

- > Case Studies for health & beauty eCommerce retailers

- > Case studies for electronics and tools eCommerce retailers

- > Case Studies for toys and leisure eCommerce retailers

Case studies for grocery/wholesale eCommerce retailers

Retail case study #1: tesco .

Industry : Grocery stores

Why worth reading:

- Historical evolution: Understanding Tesco’s rise from a group of market stalls to a retail giant provides valuable lessons on growth and adaptation to market changes.

- Customer service focus: Tesco’s long-term emphasis on customer service, which is consistent across their physical and online platforms, showcases the importance of customer-centric strategies.

- Innovation in eCommerce: The case study covers Tesco’s pioneering of the world’s first virtual grocery store in South Korea, a testament to its innovative approach to digital retailing.

- Crisis management: Insights into how Tesco handled the Horse Meat Scandal, including efforts to tighten its supply chain, contributing to its logistical success.

- Financial integrity: The study discusses the Accounting Scandal, offering a sobering look at financial transparency and the repercussions of financial misreporting.

Read the full Tesco case study here .

Retail case study #2: Walmart

Industry : Discount department and grocery stores

- Data-driven success: The case study provides a wealth of data, showcasing Walmart’s remarkable achievements. With an annual revenue of almost $570 billion, a global presence in 24 countries, and a customer base exceeding 230 million weekly, it’s a testament to the effectiveness of their strategies.

- Marketing strategies: The case study delves deep into Walmart’s marketing strategies. It highlights their focus on catering to low to middle-class demographics, the introduction of the Walmart Rewards loyalty program, and their commitment to environmental sustainability, all of which have contributed to their success.

- eCommerce transformation: As eCommerce continues to reshape the retail landscape, this case study details how Walmart shifted significantly towards omnichannel retail. Readers can learn about their innovative technologies and approaches, such as personalized shopping experiences and augmented reality, that have helped them adapt to changing consumer behavior.

- Supply chain innovation: Walmart’s proficiency in supply chain management is a crucial takeaway for retail executives. Their decentralized distribution center model , in-house deliveries, and data-driven optimization exemplify the importance of efficient logistics in maintaining a competitive edge.

Read the full Walmart case study here .

Retail case study #3: Sainsbury’s

Industry : Grocery stores

- Omnichannel success amidst pandemic challenges: With the fastest growth in online shopping among major retailers, the study illustrates how Sainsbury’s adapted and thrived during unprecedented times.

- Dynamic brand positioning: The analysis delves into Sainsbury’s strategic shift in brand positioning, demonstrating a keen responsiveness to changing consumer preferences. This shift showcases the brand’s agility in aligning with contemporary health-conscious consumer trends, supported by relevant data and market insights.

- Supply chain and quality assurance: The study highlights Sainsbury’s commitment to a stellar supply chain, emphasizing the correlation between high product quality, ethical sourcing, and customer loyalty. With data-backed insights into the extensive distribution network and sourcing standards, retail executives can glean valuable lessons in maintaining a competitive edge through a robust supply chain.

- Innovative technological integration: Sainsbury’s implementation of cutting-edge technologies, such as Amazon’s “Just Walk Out” and Pay@Browse, demonstrates a commitment to providing customers with a seamless and convenient shopping experience.

- Diversification beyond grocery: The case study unveils Sainsbury’s strategic partnerships with companies like Amazon, Carluccio’s, Itsu, Leon, and Wasabi, showcasing the brand’s versatility beyond traditional grocery retail.

Read the full Sainsbury’s case study here .

Retail case study #4: Ocado

- From startup to industry leader: The Ocado case study presents a remarkable journey from a three-employee startup in 2000 to becoming the UK’s largest online grocery platform.

- Omnichannel excellence: The study emphasizes Ocado’s success in implementing an omnichannel approach, particularly its early adoption of smartphone technology for customer engagement.

- Operational efficiency: From automated warehouses with machine learning-driven robots to digital twins for simulating order selection and delivery processes, the data-rich content sheds light on how technology can be leveraged for operational efficiency.

- Navigating challenges through innovation: Ocado’s strategic response to challenges, particularly its shift from primarily a grocery delivery service to a technology-driven company, showcases the power of innovative thinking. The case study details how Ocado tackled complexities associated with grocery deliveries and embraced technology partnerships to stay ahead.

- Strategic partnerships: The study sheds light on Ocado’s strategic partnerships with grocery chains and companies like CitrusAd for advertising opportunities on its platform.

Read the full Ocado case study here .

Retail case study #5: Lidl

Industry : Discount supermarkets

- Longevity and evolution: The article provides a detailed overview of Lidl’s origins and evolution, offering insights into how the brand transformed from a local fruit wholesaler to a global retail powerhouse. Understanding this journey can inspire retail executives to explore innovative strategies in their own companies.

- Global success: Retail executives can draw lessons from Lidl’s international expansion strategy, identifying key factors that contributed to its success and applying similar principles to their global ventures.

- Awards and recognitions: The numerous awards and accomplishments earned by Lidl underscore the effectiveness of its marketing strategy. Marketers and eCommerce professionals can learn from Lidl’s approach to quality, innovation, and customer satisfaction.

- Comprehensive marketing components: The article breaks down Lidl’s marketing strategy into key components, such as pricing strategy, product diversification, and target audience focus. Readers can analyze these components and consider incorporating similar holistic approaches in their businesses to achieve well-rounded success.

- Omnichannel transformation: The discussion on Lidl’s transformation to an omnichannel strategy is particularly relevant in the current digital age. This information can guide executives in adopting and optimizing similar omnichannel strategies to enhance customer experiences and drive sales.

Read the full Lidl case study here .

Retail case study #6: ALDI

Industry : FMCG

- Omnichannel approach: Aldi’s growth is attributed to a robust omnichannel strategy that seamlessly integrates online and offline channels. The case study delves into how Aldi effectively implemented services that can overcome the intricacies of a successful omnichannel approach in today’s dynamic retail landscape.

- Target market positioning: Aldi’s strategic positioning as the most cost-effective retail store for the middle-income group is explored in detail. The case study elucidates how Aldi’s pricing strategy, emphasizing the lowest possible prices and no-frills discounts, resonates with a wide audience.

- Transparency: Aldi’s commitment to transparency in its supply chain is a distinctive feature discussed in the case study. For retail executives, understanding the importance of transparent supply chain practices and their impact on brand perception is crucial in building consumer trust.

- Differentiation: Aldi’s successful “Good Different” brand positioning, which communicates that low prices result from conscientious business practices, is a key focus of the case study. Effective differentiation through brand messaging contributes to customer trust and loyalty, especially when combined with ethical business practices.

- CSR Initiatives: The case study highlights Aldi’s emphasis on social responsibility to meet the expectations of millennial and Gen-Z shoppers. By consistently communicating its CSR efforts, such as sustainable sourcing of products, Aldi creates a positive brand image that resonates with socially conscious consumers and builds brand reputation.

Read the full Aldi case study here .

Retail case study #7: ASDA

Industry : Supermarket chain

- Omnichannel implementation: The case study details how ASDA seamlessly integrates physical and virtual channels, offering customers a diverse shopping experience through in-store, digital checkouts, Click & Collect services, and a dedicated mobile app.

- Market segmentation strategies: The incorporation of partnerships with young British designers and influencer collaborations, coupled with socially progressive messaging, reflects a strategic shift that can inspire marketers looking to revitalize product lines.

- Crisis management and ethical branding: The study highlights ASDA’s strong response to the COVID-19 crisis, with ASDA’s actions showcasing a combination of crisis management and ethical business practices. This section provides valuable insights for executives seeking to align their brand with social responsibility during challenging times.

- Product and format diversification: ASDA’s product categories extend beyond groceries, including clothing, home goods, mobile products, and even insurance. The case study explores how ASDA continues to explore opportunities for cross-promotion and integration.

- Website analysis and improvement recommendations: The detailed analysis of ASDA’s eCommerce website provides actionable insights for professionals in the online retail space. This section is particularly beneficial for eCommerce professionals aiming to enhance user experience and design.

Read the full ASDA case study here .

Case studies for fashion eCommerce retailers

Retail case study #8: Farfetch

Industry : Fashion retail

- Effective SEO strategies: The Farfetch case study offers a detailed analysis of the company’s search engine optimization (SEO) strategies, revealing how it attracted over 4 million monthly visitors. The data presented underscores the importance of patient and dedicated SEO efforts, emphasizing the significance of detailed page structuring, optimized content, and strategic backlinking.

- Paid search advertising wisdom and cost considerations: The study delves into Farfetch’s paid search advertising approach, shedding light on its intelligent optimization tools and the nuances of running localized advertisements. Moreover, it discusses the higher cost of visitor acquisition through paid search compared to organic methods, providing valuable insights for marketers navigating the paid advertising landscape.

- Innovative LinkedIn advertising for talent acquisition: Farfetch’s unique use of LinkedIn advertising to attract talent is a standout feature of the case study and highlights the significance of proactive recruitment efforts and employer branding through social media channels.

- Strategic use of social media platforms: Exploring the brand’s highly consistent organic marketing across various social media channels, with a focus on visual content, highlights Farfetch’s innovative use of Instagram’s IGTV to promote luxury brands. The emphasis on social media engagement numbers serves as a testament to the effectiveness of visual content in the eCommerce and fashion sectors.

- Website design and conversion optimization insights: A significant portion of the case study is dedicated to analyzing Farfetch’s eCommerce website, providing valuable insights for professionals aiming to enhance their online platforms. By identifying strengths and areas for improvement in the website’s design, marketers, and eCommerce professionals can draw actionable insights for their platforms.

Read the full Farfetch case study here .

Retail case study #9: ASOS

Industry : Fashion eCommerce retail

- Mobile shopping success: eCommerce executives can draw inspiration from ASOS’s commitment to enhancing the mobile shopping experience, including features such as notifications for sale items and easy payment methods using smartphone cameras.

- Customer-centric mentality: ASOS emphasizes the importance of engaging customers on a personal level, gathering feedback through surveys, and using data for continuous improvement. This approach has contributed to the brand’s strong base of loyal customers.

- Inclusive marketing: ASOS’s adoption of an ‘all-inclusive approach’ by embracing genderless fashion and featuring ‘real’ people as models reflects an understanding of evolving consumer preferences. Marketers can learn from ASOS’s bold approach to inclusivity, adapting their strategies to align with the latest trends and values embraced by their target audience.

- Investment in technology and innovation: The case study provides data on ASOS’s substantial investment in technology, including visual search, voice search, and artificial intelligence (AI). eCommerce professionals can gain insights into staying at the forefront of innovation by partnering with technology startups.

- Efficient global presence: ASOS’s success in offering a wide range of brands with same and next-day shipping globally is attributed to its strategic investment in technology for warehouse automation. This highlights the importance of operational efficiency through technology, ensuring a seamless customer experience and reduced warehouse costs.

Read the full ASOS case study here .

Retail case study #10: Tommy Hilfiger

Industry : High-end fashion retail

- Worldwide brand awareness: The data presented highlights Tommy Hilfiger’s remarkable journey from a men’s clothing line in 1985 to a global lifestyle brand with 2,000 stores in 100 countries, generating $4.7 billion in revenue in 2021. This strategic evolution, exemplified by awards and recognitions, showcases the brand’s adaptability and enduring relevance in the ever-changing fashion landscape.

- Adaptation and flexibility to changing market trends: The discussion on how the brand navigates changing trends and overcame market saturation, particularly in the US, provides practical insights for professionals seeking to navigate the challenges of evolving consumer preferences.

- Successful omnichannel marketing: Tommy Hilfiger’s success is attributed to a brand-focused, digitally-led approach. The analysis of the brand’s omnichannel marketing strategy serves as a map for effective promotion and engagement across various channels.

- Decision-making and customer engagement: The case study emphasizes the brand’s commitment to data-driven decision-making with insights into customer behavior, leveraging data for effective customer engagement.

Read the full Tommy Hilfiger case study here .

Retail case study #11: Gap

- Overcoming challenges: The case study provides a comprehensive look at Gap Inc.’s financial performance, and growth despite the challenges. These insights can offer valuable takeaways into effective financial management and strategies for sustained success.

- Strong branding: Gap’s journey from a single store to a global fashion retailer reveals the importance of strategic brand positioning. Understanding how Gap targeted different market segments with unique brand identities, can inspire retail executives looking to diversify and expand their brand portfolios.

- Omnichannel adaptation: The case study delves into Gap’s omnichannel strategy, illustrating how the company seamlessly integrates online and offline experiences.

- Unique use of technology: By exploring the technologies Gap employs, such as Optimizely and New Relic, retail executives can learn about cutting-edge tools for A/B testing, personalization, and real-time user experience monitoring. This insight is crucial for staying competitive in the digital retail landscape.

- Inspiring solutions: The case study highlights challenges faced by Gap, including logistical, technological, financial, and human resource challenges.

Read the full Gap case study here .

Retail case study #12: Superdry

- Success story: The case study emphasizes SUPERDRY’s successful transition to an omnichannel retail strategy, with in-depth insights into their adaptation to online platforms and the integration of technologies like the Fynd app.

- Mobile-first and social-first strategies: As mobile internet usage continues to rise, understanding how SUPERDRY leverages videos and social media to engage customers can offer valuable takeaways for optimizing digital strategies.

- Sustainable fashion focus: Executives looking to appeal to environmentally conscious consumers can gain insights into how SUPERDRY navigated the shift towards sustainable practices and became a leader in eco-friendly fashion.

- Data-driven marketing strategies: The case study delves into SUPERDRY’s social media marketing strategies, showcasing how the company uses targeted campaigns, influencers, and seasonal keywords.

- Global market understanding: By exploring SUPERDRY’s experience in the Chinese market and its decision to exit when faced with challenges, the case study offers valuable insights into global market dynamics.

Read the full SUPERDRY case study here .

Retail case study #13: New Look

Industry : Fast-fashion retail

- Strategic pivots for profitability: A decade of revenue contraction led New Look to adopt transformative measures, from restructuring credits to withdrawing from non-profitable markets.

- Omnichannel strategy: Marketers and eCommerce professionals can study New Look’s journey, understanding how the integration of physical stores and online platforms enhances customer experience, reduces costs, and improves profitability.

- Social media mastery: The case study underscores the pivotal role of social media in engaging audiences, showcasing how New Look leverages user-generated content to build brand loyalty and maintain a positive brand perception.

- Effective partnerships for growth: New Look strategically partners with major eCommerce platforms like eBay & Next to expand its brand presence, and tap into new audiences and markets.

Read the full New Look case study here .

Retail case study #14: Zara

- Rapid international expansion through innovative strategies: Zara’s unique approach to continuous innovation and quick adaptation to fashion trends fueled its global success. Marketers can learn how to build brand narratives that resonate across diverse markets, and eCommerce professionals can glean strategies for seamless international expansion.

- Revolutionary eCommerce tactics: The case study provides a deep dive into Zara’s eCommerce strategy, emphasizing the importance of agility and responsiveness. The brand can be a bright example of implementing supply chain strategies for a swift market adapting to rapid fashion cycles.

- Visionary leadership: Amancio Ortega’s low-profile persona and visionary leadership style are explored in the case study, aiding retail executives to learn about leadership strategies that prioritize customer-centric business models.

- Omnichannel marketing and integrated stock management: Zara’s successful integration of automated marketing and stock management systems is a focal point in the case study. With insights into implementing integrated stock management systems to meet the demands of both online and offline channels, Zara can inspire professionals to improve their operations.

- Co-creation with the masses: Zara’s innovative use of customer feedback as a driving force for fashion trends is a key takeaway. Marketers can learn about the power of customer co-creation in shaping brand identity, and eCommerce professionals can implement similar models for product launches and updates.

Read the full Zara case study here .

Case Studies for home & furniture eCommerce retailers

Retail case study #15: john lewis.

Industry : Homeware and clothing retail

- Omnichannel perspective: The data-driven approach, especially in tracking orders and customer behavior, serves as a blueprint for any retail business aiming to enhance its omnichannel experience.

- Strategic growth factors: This case study offers concrete data on the strategies that contributed to the company’s sustained success, inspiring similar endeavors.

- Innovative customer engagement: John Lewis’s take on customer engagement showcases the brand’s agility and responsiveness to evolving consumer needs, supported by data on the effectiveness of these initiatives.

- eCommerce best practices and pitfalls: The analysis of John Lewis’s eCommerce website provides a data-backed evaluation of what works and what could be improved. The critique is grounded in data, making it a valuable resource for those looking to optimize their online platforms.

Read the full John Lewis case study here .

Retail case study #16: Argos

Industry : Homeware catalog retail

- Adaptation to the changing retail landscape: Argos’s journey from a catalog retailer to a retail giant demonstrates its ability to successfully adapt to the evolving retail landscape.

- Omnichannel success story: The case study provides a detailed analysis of Argos’s omnichannel strategy, showcasing how the company effectively integrated online and offline channels to achieve a seamless shopping experience across multiple touchpoints.

- Market share and financial performance: The inclusion of data on Argos’s market share and financial performance offers retail executives concrete metrics to evaluate the success of the marketing strategy. Understanding how Argos maintained a robust market share despite challenges provides actionable insights.

- Technological advancements: The case study delves into the technologies employed by Argos, such as Adobe Marketing Cloud, New Relic, and ForeSee.

- Overcoming obstacles: By examining the challenges faced by Argos, including logistical, technological, financial, and human resources challenges, retail executives can gain a realistic understanding of potential obstacles in implementing omnichannel strategies.

Read the full Argos case study here .

Retail case study #17: IKEA

Industry : Home & furniture retail

- Data-driven evolution: This detailed case study offers a data-rich narrative, illuminating the brand’s evolution into a leader in omnichannel retail.

- Pandemic response: This exploration delves into the integration of eCommerce strategies, online expansions, and the balance between physical and digital customer experiences.

- Advanced mobile apps and AR integration: A deep dive into IKEA’s innovative applications, notably the AR app “IKEA Place,” showcases how the brand leverages technology for a seamless customer experience.

- Democratic design approach: The study meticulously breaks down IKEA’s success factors, emphasizing the brand’s holistic approach through the lens of “Democratic Design.”

- DIY mentality and demographic targeting: A detailed analysis of how IKEA’s affordability is intertwined with a Do-It-Yourself (DIY) mentality. The case study explores how IKEA strategically tapped into a shift in consumer behavior, particularly among younger demographics, influencing not only purchasing patterns but also reshaping industry norms.

Read the full IKEA case study here .

Retail case study #18: Marks & Spencer

Industry : Clothing and home products retail

- Valuable lessons in eCommerce: The Marks & Spencer eCommerce case study offers a profound exploration of the brand’s journey from a latecomer to the online scene to a digital-first retailer.

- Real-world application of effective solutions: By diving into the history of Marks & Spencer, the case study provides tangible examples of how a retail giant faced setbacks and strategically pivoted to revitalize its eCommerce platform.

- Data-driven analysis of eCommerce failures: The case study meticulously analyzes the pitfalls Marks & Spencer encountered during its eCommerce journey, offering a data-driven examination of the repercussions of a poorly executed website relaunch.

- Multichannel customer experience: Marks & Spencer’s shift towards a multichannel customer experience is dissected in the case study, emphasizing the significance of a seamless user journey for increased customer satisfaction and loyalty.

- Embracing technology: Exploring Marks & Spencer’s technological innovations, such as the introduction of an intelligent virtual assistant can enhance the customer shopping journey, foster engagement, and contribute to revenue growth.

Read the full Marks & Spencer case study here .

Retail case study #19: Macy’s

Industry : Clothing and homeware retail

- Resilience and adaptability: The case study showcases Macy’s ability to navigate and triumph over obstacles, especially evident during the COVID-19 pandemic. Despite hardships, Macy’s not only survived but thrived, achieving $24.4 billion in net sales for 2022.

- Omnichannel innovation: Macy’s successful transition to omnichannel retailing is a standout feature. The case study delves into Macy’s implementation of a seamless omnichannel strategy, emphasizing the integration of physical and digital retail channels.

- Private label strategy: The introduction of new private brands and the emphasis on increasing the contribution of private brands to sales by 2025 provides a strategic lesson. Retailers can learn from Macy’s approach to enhancing control over production and distribution by investing in private brands, ultimately aiming for a more significant share of profits.

- Groundbreaking retail media strategy: Macy’s innovative approach to retail media and digital marketing is another compelling aspect. For marketers, this presents a case study on how to leverage proprietary shopper data for effective advertising, including entry into connected TV (CTV).

- Community engagement and social responsibility: The case study explores Macy’s “Mission Every One” initiative, highlighting its commitment to corporate citizenship and societal impact, integrating values into business strategies.

Read the full Macy’s case study here .

Case Studies for health & beauty eCommerce retailers

Retail case study #20: the body shop .

Industry : Beauty, health, and cosmetics

- Activism and ethical values: The Body Shop has pioneered promoting eco-friendly, sustainable, and cruelty-free products. The brand’s mission is to empower women and girls worldwide to be their best, natural selves. This strong ethical foundation has been integral to its identity.

- Recycling, community fair trade, and sustainability: The Body Shop initiated a recycling program early on, which turned into a pioneering strategy. It collaborates with organizations to create sustainable solutions for recycling, such as the Community Trade recycled plastic initiative in partnership with Plastics for Change.

- Product diversity: The Body Shop’s target demographic primarily focuses on women, but it has expanded some product lines to include men. Its products include skincare, hair and body treatments, makeup, and fragrances for both men and women.

- Omnichannel strategy, technology, and eCommerce best practices: The Body Shop has embraced an omnichannel approach that incorporates personalization, customer data and analytics, and loyalty programs. The Body Shop utilizes technology, including ContactPigeon, for omnichannel customer engagement, personalization, and data-driven decision-making.

Read the full The Body Shop case study here .

Retail case study #21: Boots

Industry : Pharmacy retail

- Long-term success: Boots’ rich history serves as a testament to the effectiveness of the brand’s strategies over time, offering valuable insights into building a brand that withstands the test of time.

- Strategic omnichannel approach: The Boots case study provides a deep dive into the marketing strategy that propelled the brand to success, with valuable insights into crafting effective omnichannel growth.

- Impactful loyalty program: Marketers can glean insights into designing loyalty programs that resonate with customers, fostering brand allegiance.

- Corporate Social Responsibility (CSR) as a pillar: The case study sheds light on how Boots addresses critical issues like youth unemployment and climate change, showcasing how a socially responsible approach can positively impact brand perception.

- Adaptive strategies during crises: Boots’ proactive role during the COVID-19 pandemic, offering vaccination services and supporting the National Health Service (NHS), demonstrates the brand’s agility during crises.

Read the full Boots case study here .

Retail case study #22: Sephora

Industry : Cosmetics

- Authentic customer experience-focused mentality: Backed by an impressive array of data, the case study meticulously outlines how Sephora transforms its in-store spaces into digital playgrounds, leveraging mobile technologies, screens, and augmented reality to enhance the customer shopping experience.

- Exceptional omnichannel business plan: The early adoption of an omnichannel strategy has been pivotal to Sephora’s ascendancy. The case study delves into the mobile app’s central role, acting as a comprehensive beauty hub with data-driven insights that drive the success of groundbreaking technologies.

- Omnichannel company culture: The case study illuminates this by detailing how this amalgamation allows a holistic view of the customer journey, blurring the lines between online and in-store interactions. This unique approach positions Sephora as a global leader in turning omnichannel thinking into a robust business strategy.

- Turning data into growth: Sephora’s adept utilization of mobile technologies to harness customer insights is a beacon for retailers in an era where data reigns supreme. The case study dissects how a surge in digital ad-driven sales, showcases the power of data-driven decision-making.

Read the full Sephora case study here .

Case studies for electronics and tools eCommerce retailers

Retail case study #23: screwfix.

Industry : Tools and hardware retail

- Innovative omnichannel approach: The case study highlights how the company strategically implemented online ordering with in-store pickup, creating a seamless shopping experience that contributed to a significant sales growth of 27.9% in just one year.

- Customer-centric strategies: Marketers can gain insights from Screwfix’s emphasis on customer experience. By studying customer feedback and incorporating personalized shopping experiences, Screwfix achieved success in the competitive home improvement sector.

- Supply chain management for rapid growth: The company strategically opened distribution centers to keep up with demand, ensuring efficient inventory management for both online and in-store orders.

- Mobile-first approach for trade professionals: With a customer base primarily consisting of trade professionals, the company’s mobile app allows for easy inventory search, order placement, and quick pickups, catering to the needs of time-sensitive projects.

- Commitment to employee well-being and community: Retail executives and marketers can draw inspiration from Screwfix’s commitment to building a positive workplace culture.

Read the full Screwfix case study here .

Case Studies for toys and leisure eCommerce retailers

Retail case study #24: lego.

Industry : Toys and leisure retail

- Global reach strategies: LEGO’s case study meticulously outlines LEGO’s focused approach, investing in flagship stores and understanding the local market nuances.

- Diversification and licensing brilliance: LEGO’s commitment to diversification through licensing and merchandising emerges as a beacon for marketers. The collaboration with well-established brands, the creation of movie franchises, and themed playsets not only elevate brand visibility but also contribute significantly to sales.

- Social media takeover: The case study unveils LEGO’s unparalleled success on social media platforms, boasting over 13 million Facebook followers and 10.04 billion views on YouTube. LEGO’s adept utilization of Facebook, Instagram, and YouTube showcases the power of social media in engaging customers.

- User-generated content (UGC) as a cornerstone: LEGO’s innovative use of digital platforms to foster a community around user-generated content is a masterclass in customer engagement. This abundance of UGC not only strengthens brand loyalty but also serves as an authentic testament to LEGO’s positive impact on users’ lives.

- Education as a marketing pillar: LEGO’s unwavering commitment to education, exemplified by its partnerships and $24 million commitment to educational aid, positions the brand as more than just a toy. Aligning brand values with social causes and leveraging educational initiatives, builds trust and credibility.

- Cutting-edge mobile strategy: Sephora’s foresight into the mobile revolution is dissected in the case study, presenting a playbook for retailers aiming to capitalize on the mobile landscape.

Read the full LEGO case study here .

Tons of eCommerce retail inspiration, in one place

In the realm of business, success stories are not just tales of triumph but blueprints for aspiring executives to carve their paths to growth. The case studies explored here underscore a common theme: a mindset poised for evolution, a commitment to experimentation, and an embrace of emerging trends and technologies are the catalysts for unparalleled growth.

For any executive eager to script their growth story, these narratives serve as beacons illuminating the way forward. The dynamic world of retail beckons those ready to challenge the status quo, adopting the strategies and technologies that promise scalability. The key lies in constant optimization, mirroring the agility demonstrated by industry leaders.

As you embark on your growth journey, consider the invaluable lessons embedded in these success stories. Now is the time to experiment boldly, adopting new trends and technologies that align with your brand’s ethos. If you seek personalized guidance on navigating the intricate landscape of growth, our omnichannel retail experts at ContactPigeon are here to assist. Book a free consultation call to explore how our customer engagement platform can be the linchpin of your growth strategy. Remember, the path to scaling growth begins with a willingness to innovate, and your unwritten success story awaits its chapter of transformation.

Let’s Help You Scale Up

Loved this article? We also suggest:

Sofia Spanou

Sign up for a demo, this site uses cookies..

We use cookies to optimize our communication and to enhance your customer experience. By clicking on the Accept All button, you agree to the collection of cookies. You can also adjust your preferences by clicking on Customize.

Essential (Always Active)

Performance.

9 Case Studies That Prove Experiential Retail Is The Future

Table of Contents

What is a pop-up shop? Everything you need to know to try short-term retail > 23 Smart Pop-Up Shop Ideas to Steal From These Successful Brands > 9 Case Studies That Prove Experiential Retail Is The Future

What is experiential retail, and how can experiential retail benefit your business?

Experiential retail is a term used to define a type of retailing that aims to provide customers with a unique and memorable experience. Experiential retail is typically characterized by one or more of the following features: the use of unique and interesting spaces, objects, or experiences; high levels of customer engagement; and the use of technology to enhance customer interactions.

One key aspect of experiential retail is the ability to create an attractive and welcoming environment for staff and customers alike. This can be achieved through a combination of factors, including good design, cleanliness, and lighting . Another important factor is how well the store reflects its brand identity.

Although there are many different types of experiential retail outlets, they all share certain common elements: they are designed to provide a memorable experience for their customers; they are focused on creating an enjoyable atmosphere for staff members as well as the public; they offer an appealing mix of products and services, and they use technology to enhance customer interactions.

Finally, experiential retail is not just about selling products or services. It is also about building strong relationships with customers that go beyond transactions.

Experiential retail is the future. For years we’ve heard about the decline of physical retail and the rise of the internet. However, the desire for retail experiences is on the rise with 52% millennials saying of their spending goes on experience-related purchases. This introduces the concept of ‘retailtainment’.

Enter: retailtainment

Because of this, retailers have evolved their offerings. By focusing on so-called ‘ retailtainment’ and immersive retail experiences, brands are able to provide customers with fun, unique and in-person experiences that elevate shopping to new heights.

With retailtainment, the retail industry is shifting attention from a features-and-benefits approach to a focus on immersive shopping and customer experience . To be successful, retailers must offer consumers a desirable retail experience that in turn drives sales.

What is meant by Retailtainment?

The term “retailtainment” is used to describe the trend of retailers using entertainment to attract customers and encourage them to spend more time – and money – in their stores. This can take the form of in-store events, interactive displays, and even simply providing a comfortable and enjoyable environment for customers to shop in. The goal of retailtainment is to create a unique and memorable shopping experience that will keep customers coming back.

With the rise of online shopping and brick-and-mortar retailers have to work harder than ever to compete. By offering an enjoyable and entertaining shopping experience, retailers can attract customers who are looking for more than just a transaction. Retailtainment can be a powerful tool to build customer loyalty and drive sales.

How does retailtainment fit in today’s retail experiential strategy?

As shoppers’ expectations become more demanding, retailers are turning to retailtainment to create a more engaging and memorable shopping experience. By incorporating elements of entertainment into the retail environment, retailers can create a unique and differentiated customer experience that will help them stand out from the competition.

There are a number of ways that retailtainment can be used to improve the customer experience. For example, retailers can use interactive technology to create an immersive shopping experience that engages shoppers on a personal level. Additionally, retailers can use entertainment to add excitement and energy to their store environment, making it more inviting and enjoyable for shoppers.

Ultimately, retailtainment can play a key role in helping retailers create a customer experience that is unique, differentiated, and memorable.

What is the difference between retailtainment and experiential retail?

Both retailtainment and experiential retail are designed to make the shopping experience more enjoyable and engaging. However, experiential retail goes a step further by creating an emotional connection with customers. This emotional connection can lead to brand loyalty and repeat business.

Thus, while both retailtainment and experiential retail are important trends in the retail industry, experiential retail is more focused on creating a lasting impression and emotional connection with customers.

Here are our 8 favorite examples of Experiential Retail and retailtainment in action:

Marvel: Avengers S.T.A.T.I.O.N provides fans with interactive brand building experience

The Avengers S.T.A.T.I.O.N. is an immersive exhibit that has toured the world since the first Avengers film. It has appeared in key retail areas such as New York Seoul Paris , Beijing, London and Las Vegas, and always pulls in huge crowds. Based on the global box-office film franchise, Marvel’s The Avengers, the store features real life movie props and interactive displays.

There are Marvel-branded items for sale but the goal of the project is not to shift T-shirts and mugs. It is about delivering an in-person experience to fans and bringing the brand to life.

The Avengers S.T.A.T.I.O.N. is a great example of retailtainment and experiential retail in action. Visitors are fully immersed in the fictional world they adore, further cementing their affiliation and love for the Marvel brand.

For a brand as strong and iconic as Marvel, it would be easy to sit back and take popularity for granted. However, through the use of retailtainment they are continuing to delight their customers beyond the screen.

Farfetch: Creating a retail experience of the future

Image via Bloomberg

Farfetch is as an e-commerce portal for luxury boutiques. It’s successfully positioned itself as a technology provider for brands; combining technology and fashion to provide unique in-store experiences.

José Neves, CEO of Farfetch, has spoken about his concern that physical retail is diminishing; it accounts for 93 per cent of sales today, but by 2025 is predicted to account for just 80 per cent.

Enter: Farfetch’s Augmented Retail Solution

Neves’ vision for retailtainment includes advancements in technology to make the consumer experience more human. He produced Farfetch’s Store of the Future, an augmented retail solution that “links the online and offline worlds, using data to enhance the retail experience.” In its retail store in London, Farfetch provided connected clothing racks, touch-screen-enhanced mirrors and sign-in stations that pulled data collected online to use in-store.

Farfetch provided customers with a sign-in screen to search their purchase history and wish list, which provided valuable customer insight for the sales assistants. There was also a smart mirror to request different sizes, alternative products or pay without leaving the dressing room.

This innovation led them to be labeled as “ The Retailer of the Future ”, allowing customers to enjoy an effortless in-person experience that harmonizes the best parts of boutique shopping with the speed and convenience of online shopping.

Read More: Excess Inventory Post-Holiday? Open a Pop-Up Shop

Huda Beauty: Cosmic experience in Covent Garden

Huda Beauty , one of the world’s fastest-growing beauty brands, ran an immersive retail experience pop-up store right in the centre of Covent Garden, London, to launch a new product range and reach new customers.

Huda used the location ( sourced by Storefront pop up space rental ) to deliver a sci-fi themed experience in support of their new eye-shadow palette Mercury Retrograde.

The entire exterior of the pop-up resembled a multi-faceted, metallic mass of geometrical shapes. This was echoed inside with various ‘galactic’ elements, all manner of mirrored surfaces and shimmering fixtures and elements.

As part of the event, visitors could sit on the throne Huda used in her launch material, all set up to encourage as much social media activity and engagement as possible.

Huda Beauty caught the eye and wowed its visitors. Introducing a whole swathe of new customers to the Huda Beauty brand.

Read More: 4 Beauty Brands Who Successfully Launched A Pop-Up Store

Vans: A shopping experience to remember

Image via Skateparks

The House of Vans in London lives up to the company motto of being “off the wall”. A location where art, music, BMX, street culture and fashion converge, you can find almost everything you can imagine across the 30,000 square feet building. Amongst a cinema, café, live music venue and art gallery, the bottom floor holds the most unique feature of the building: the concrete ramp, mini ramp and street course.

Nothing better epitomizes the Vans brand than a space where young people can not only shop but spontaneously socialize. The House of Vans is the perfect example of how experiential retail can be used to empower a shopping experience.

Read More: How The Music Industry Is Making The Most of Pop-Up Stores

Ikea: Using social media to power a unique retail experience

Ikea brought 100 Facebook competition winners to one of its warehouses and let them stay the night. They were able to select the mattress, sheets and pillows to fully give them a fully tailored experience. A sleep expert was on hand with tips for getting a good night’s rest, including how to find the perfect mattress for any sleeping style.

This was a clever and unique way to obtain visibility and get fans to focus on what Ikea has to offer and try it out for themselves.

This idea came from understanding their consumer insights on social media. Lois Blenkinsop, Ikea’s U.K. PR and internal communications manager, said: “Social media has opened up a unique platform for us to interact directly with our customers. Listening to what they want is what we do best, and the Big Sleepover is just one example of how we’re using such instant and open feedback to better inform our marketing activity.”

From using social media they were able to apply experiential marketing to their retail strategy and provide their customers with a memorable event that brought the brand a ton of visibility and engagement.

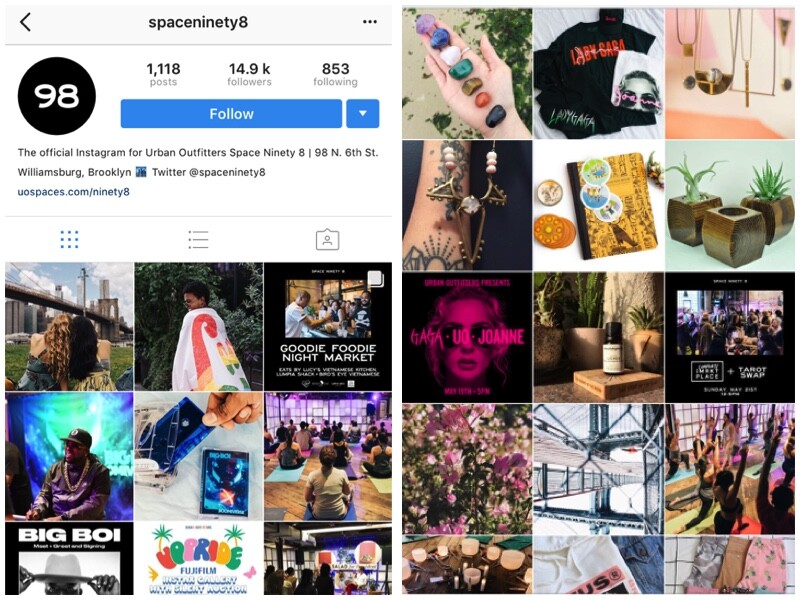

Space Ninety 8: showcasing the art of retailtainment

Image via @Space90

As a spin-off from Urban Outfitters, Space Ninety 8 is a shared retail space that spans 5 floors, hosting retailers, galleries and even a rooftop restaurant and bar.

Scanning their Instagram, you can see the variety of what Space Ninety 8 offers beyond solely retail. Advertised next to yoga classes is an album signing by Big Boi, alongside pictures of art classes and Lady GaGa merchandise. By reflecting the flexible nature of modern life, the brand created a versatile store that emphasizes experience, perfecting the art of retailtainment.

TOMS: creating an immersive experience through VR

Experiences don’t have to be a permanent feature of a store in order to make an impact on customers. In 2015 TOMS’ placed VR headsets into 100 stores, enabling them to virtually transport players to Peru to see the impact of their One for One giving campaign on local people.

As you walk through the village stores with locals smiling and waving at you, it is impossible not to feel warmed by the friendly atmosphere. Not only did this retail experience improve awareness of their social corporate responsibility and promote their giving campaign, it also gave customers an unforgettable and immersive experience they were unlikely to forget.

[Check out Toms’ continued focus on immersive retail experiences here]

How to Provide Retailtainment that Drives Traffic and Sales

These case studies all stress the importance of providing an in-store experience. By exceeding expectations you drive emotional reactions. There are five consistent elements each use in their stores to ensure a remarkable customer shopping experience:

- Interactiveness: All of these retailers ensure that the senses are connected – memories of what we feel, hear, see, smell, and touch, may last a lifetime.

- Originality: These ideas were all authentic and natural, making the customer feel as if they entered a different world.

- Connectedness: Customers must feel that the experience has been created for them.

- Unexpectedness: These unique experiences are critical to ensure your brand is remembered.

- Reliability: The experience is executed through tested methods to achieve consistency and excellence.

The future of experiential retail

As the world of retail continues to evolve, so too must the way brands create memorable experiences for their customers. With the rise of digital and mobile technologies, consumers now have more choices than ever before when it comes to how they shop and what they buy. To stay ahead of the curve, brands must find new and innovative ways to engage with their customers and create unforgettable shopping experiences.

One way to do this is through experiential retail – using physical spaces to create immersive, one-of-a-kind experiences that cannot be replicated online. This could involve anything from in-store events and workshops to augmented reality and virtual reality experiences.

Experiential marketing isn’t about spending millions on fancy gadgets for your retail store. Sure it can help, but it’s mostly about a personalized shopping experience and providing an unparalleled retail experience for your guests and customers. The brands that delight their customers are the brands that drive loyalty and advocacy. Couple this with excellent customer service and you’re on to a winner. These case studies all demonstrate how it is possible to follow similar steps to overcome the challenges eCommerce has brought.

The brands that use their physical stores to focus on the customer experience are the brands that will do the best. The dynamic between physical and online retail has shifted and the impact of the Covid 19 pandemic has only accentuated this.

Planning your own experiential retail project and need some help? Drop us a note and we’ll help you out.

For more on launching temporary retail stores and one-off events, download our Ultimate Pop-Up Guide and make your ideas happen.

- Recent Posts

- Easter: 25 spaces to rent around the world to treat your customers! - May 31, 2022

- 11 retail trends to expect in 2022 - January 26, 2022

- Online children’s fashion resale platform uses pop-up stores to increase visibility and spread its message of sustainability - July 21, 2021

Related posts:

Start typing and press enter to search

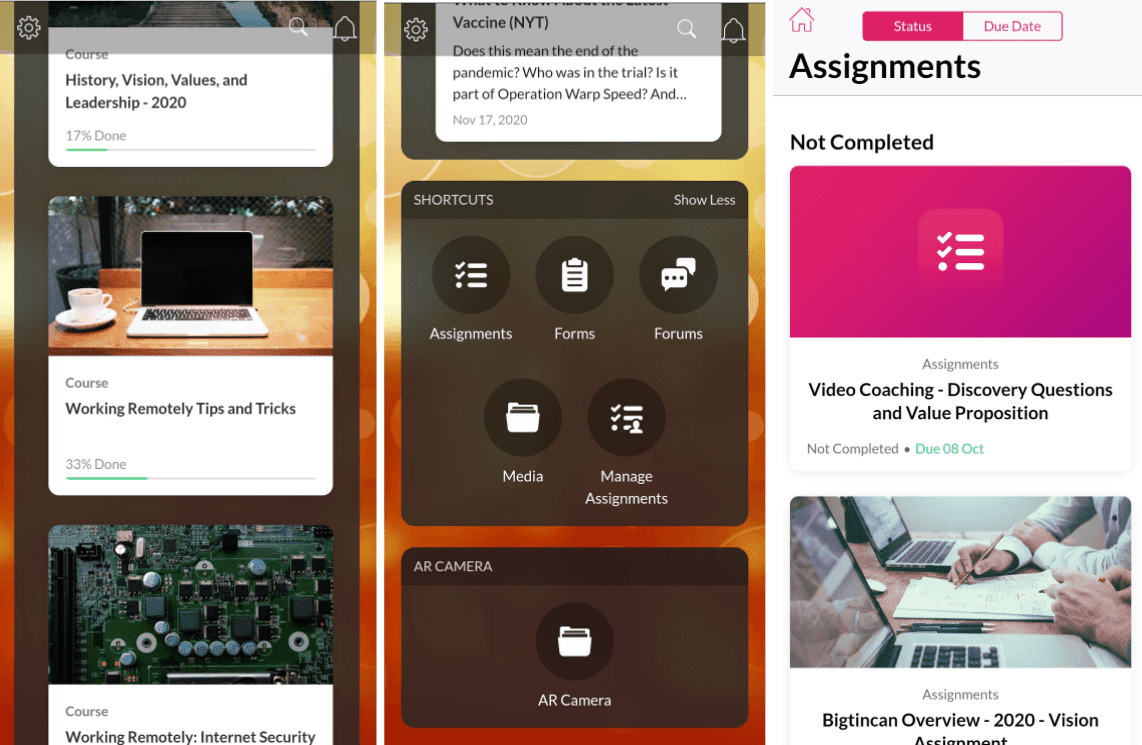

Two Global Brand Digital Retail Transformation Case Studies: Lessons & Challenges

Digital retail transformation case studies almost always focus on customer experiences (for example, providing iPads for in-store eCommerce, using augmented reality for product demos, etc.) but in this article we’re going to dive into the other — and equally important — side of digital retail transformation: the employee experience.

In our experience, when employees have access to updated digital tools and training techniques, retail organizations and customers both benefit. Specifically:

- Quicker Onboarding: Employees are onboarded more quickly and retain more information, so training costs decrease.

- Better Training: Employees can look up answers to detailed questions or help customers find products in real time which improves the customer experience.

- Better Customer Experience: Customers are more satisfied and buy more because their questions are answered quickly and accurately.

- More Insights: Retail leaders get more insight into what training or policies are working the best across an entire organization.

Below, we’ll show you exactly what this transformation was like for two multinational retail brands — each with tens of thousands of store employees.

(Details have been anonymized for confidentiality reasons.)

You’ll learn the real-world details of how we did it and the key insights and lessons that any retail brand should heed:

- The legacy retail training and communication problems these two brands were dealing with (and many others still are).

- A case study of a global sportswear brand’s digital transformation odyssey, including details on why generic digital solutions simply wouldn’t work for their business model.

- How Bigtincan’s custom-tailored digital training solution helped a multinational beauty retailer overcome a bottleneck for growth and sales productivity.

- The themes that emerge from our experience solving training and communication problems for big players on the retail stage.

First, let’s start with a closer look at the why , by examining some challenges and pain points that have plagued corporate-retail relations for decades.

An Overview of Legacy Retail Training and Communication Problems

Retail employee training procedures and headquarters-to-store communications have always had more than their share of inefficiencies.

Associate training at many retail stores, including (until recently) those of the major brands we cover in this article, commonly involves posting updates on a corkboard at the back of the store and reliance on weekly “team meetings.”

But this standard system doesn’t typically work well.

Just think about it: how many employees ignore the corkboard, skip the meetings, or just zone out?

Scale those scenarios up to hundreds or thousands of individual retail locations and consider the impact of subpar training methodologies on liability, product messaging, customer experience, and sales productivity, and you have a significant set of inefficiencies that are hurting profitability.

Or, for another example, think about retail training in a store with extremely high employee turnover.

One of the brands we’ll discuss shortly has an average annual attrition or turnover rate around 40% at the store level (largely due to their employee demographics). This is common in the retail industry, and some stores are even higher.

The quality of employee training tends to decrease in proportion to the number of new employees being onboarded, the other obligations of managers on duty, and during the times of year when customer demand is highest.

In other words, the times when employees should be performing at their peak are when they’re least likely to get the quality training they need to succeed.

Most of these problems with retail communication and training have existed for decades (or longer) because no one knew how to fix them.

Companies may have accepted these inefficiencies as unavoidable for a long time, but that's no longer the case.

However, what’s not necessarily obvious is that basic digital solutions like computer-based training software, cloud-based file-sharing, and email, are inadequate to address these decades-old problems. We’ll explain why that is in a moment, in the first case study.

These case studies are anonymized for nondisclosure reasons, but still contain plenty of details to teach you how we approach and solve training and communication problems at scale.

Case Study #1: Global Sportswear Apparel and Lifestyle Brand

This sportswear apparel company has over a thousand brick and mortar physical stores worldwide and tens of thousands of retail workers.

The vast majority of their store employees are young, high school age to early 20s, which helps account for the average annual employee turnover rate of 40% we alluded to in the previous section.

On the front lines, the customer-facing employees are in what's known as persona-driven positions, which essentially means roles that reflect the "lifestyle brand" nature of the company. As such, the company heavily incentivizes employees to consume and wear the brand — a calculated psychological strategy that fuels brand enthusiasm during associate-customer interactions.

Aside from basic, legally mandated compliance training, most of their retail training relates to running brand campaigns and product launches. They're constantly introducing campaigns or promoting products, typically several at once, and it’s vital for employees to stay current.

The company was facing legacy issues with communication as well as in-store training and they knew it. That’s why Bigtincan eventually won a bid against 50 other service providers. But before we take a look at how we custom-tailored our solution, let’s take a look at the problems.

Global Sportswear Brand Retail Challenges

First off, associates at this company don't have company email addresses.

With the sheer volume of employees and their attrition rate, direct email is unworkable as a mass communication tool. (Side note, cloud-based file sharing platforms like Dropbox, OneDrive, and Google Drive also don’t work at that scale for various reasons, including the fact that young retail employees are unfamiliar with the user interface.)

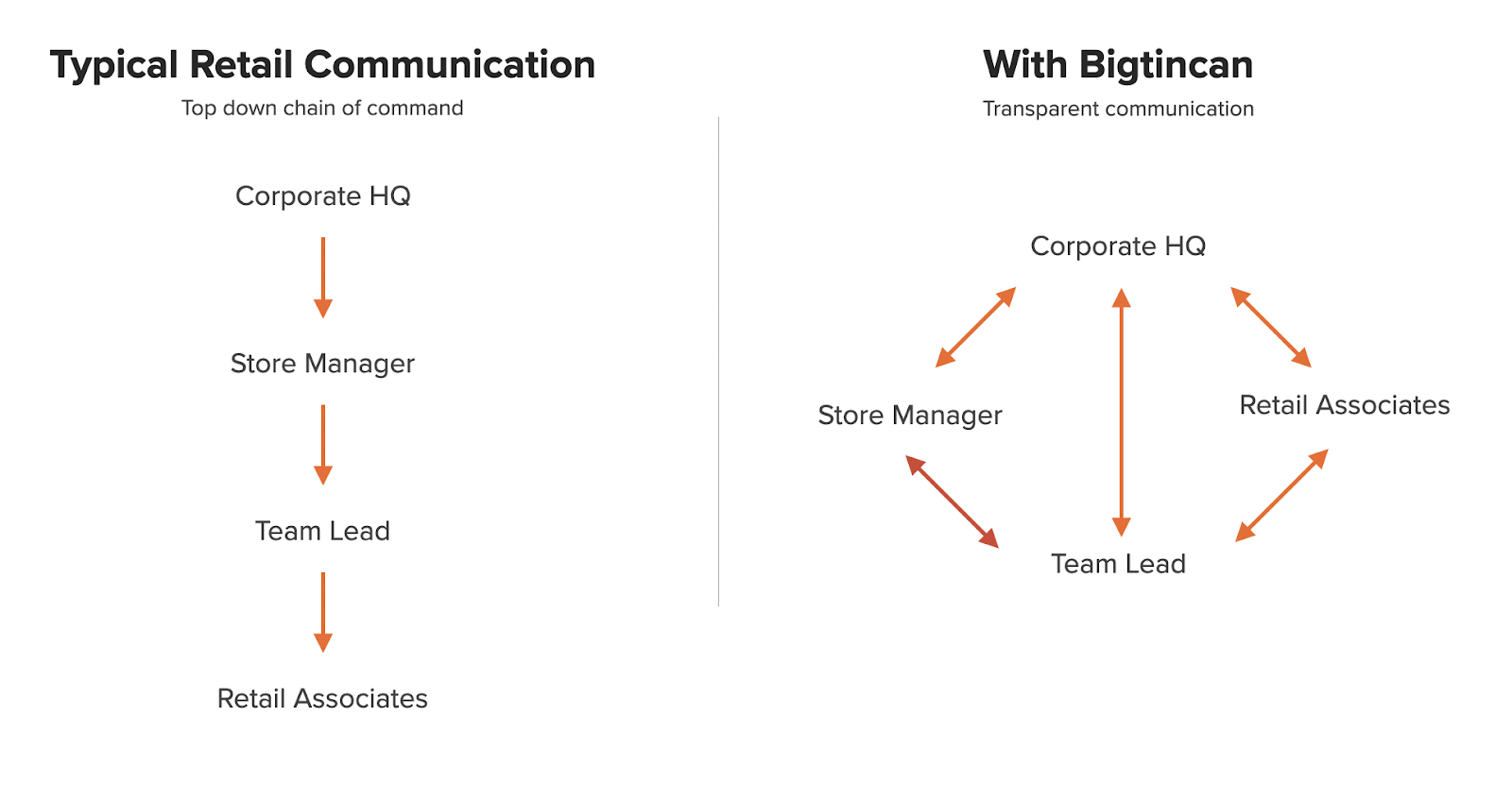

Instead, communication typically followed a “chain of command” sequence: from corporate HQ to the store manager, then from the store manager to the team leader(s) on duty, and finally from the team leader to the associates.

But since associates didn’t have email addresses, the process entailed printing sheets of paper and tacking them on a back-room corkboard or placing them into a three-ring binder (depending on the store). Team leaders would direct their associates' attention to the communique or training content during morning huddles or “pump up” sessions…at least in theory.

Here are some of the problems that came up in interviews or problems we observed firsthand:

- Communication was slow , especially when it had to travel up and down the chain of command repeatedly.

- No channels existed for any type of feedback, surveys, or polling. No measures of learning success.

- There was zero feedback available on whether training content was interesting or useful.

- No accountability for training: HQ had to take team leaders’ or managers’ word that the training had even been administered.

Memorably, compliance training took place on a lone, aged Windows computer at the back of each store. Stressed store managers and team leaders frequently encouraged new hires to “just click through” mandatory compliance slides as quickly as possible.

There was a lot of friction in the system. It was barely working .

BigTinCan’s Training and Communication Solution

When Bigtincan entered the picture, we offered our easy to custom-tailor app that could run on employees’ personal mobile devices as well as in-store devices. The idea was a one-stop shop for training and communication.

Our app is highly flexible and customizable by default, but we knew this company needed some additional features to address their pain points.

Here’s how Bigtincan solved the problems from the previous section:

- Previously, new product updates or campaign launches were delivered “manually” during morning huddles or weekly team meetings, but our app instead offers frictionless micro-lessons (based on the concept of microlearning with lessons of 15 minutes or less) so associates can learn at their own pace.

- Instead of bits and pieces of info trickling down slowly, a live feed feature on the training app updates employees in real time to ensure everyone’s on the same page about brand campaigns and product updates.

- Along with receiving constant refreshes and updates in bite-sized chunks, employees can also exceed customer expectations by looking up any answers to their questions instantaneously in the app.

- Managers and corporate have constant access to training stats and follow-through so there’s no more back-and-forth about training participation or accountability.

- The app's communication functionality removed any need for email by offering a direct line between management and employees within the app itself.

Another unique consideration related to the company’s novel approach to fostering brand enthusiasm among associates.

Earlier, we mentioned that the company encourages employees to showcase and enjoy their lifestyle products. We knew that the app had to reflect that rather than feeling “corporate” and boring.

As an executive confided to me, the internal branding is essential because the brand is the equity of the company, period . It’s what makes the difference between a $100 pair of sweatpants versus a $15 pair of sweatpants.

Our solution was to incorporate the type of imagery and style you would normally find in an advertisement directly into the app — virtually the opposite of generic apps, visually speaking. In other words, our app has production value that helps associates feel excited and proud of their role to represent the brand.

To sum up, we custom-tailored the Bigtincan Learning app to offer a heavily branded experience that focused on daily content updates; frictionless training in chunks of 15 minutes or smaller (even as short as 1 to 2 minutes in some cases), accountability metrics for training participation that are visible to managers as well as corporate headquarters; and company-wide communication optimization.

The end results are a better customer experience, increased sales productivity, and ultimately a huge competitive advantage. Employees can focus on customer engagement and helping customers through their buying journey, while decision-makers at the company receive real-time feedback on what’s working and when to pivot.

Case Study #2: Multinational Personal Care and Beauty Retailer

The company featured in this second case study has over 2,000 retail stores worldwide and tens of thousands of store employees. They carry thousands of personal care and beauty brands along with their own private label.

Aside from cashiers, the company assigns associates dedicated roles as product specialists to work on optimizing the customer experience.

When a customer walks into any section of the store, there’s an associate there who specializes in customer-centric product education and helping the customer find the perfect fit within their niche.

For example, makeup requires employees to understand how to color match (the product to the skin tone of the shopper) and conduct tutorials, while fragrances require a working understanding of hundreds of different products and how to describe their nuances to new customers.

This retail model necessitates extensive training for employees.

Multinational Beauty Retailer Problems

Clearly, this retailer already understood the advantages of placing training first and prioritizing customer experience.

But, by the same token, the legacy approach the company took to training and employee education represented a serious bottleneck for growth and sales productivity.

Store managers were in a teaching role (in addition to all their other tasks, of course) for employees in all niches. If they had other priorities to keep the store running that day or week, training would take a back seat.

The managers would take regular e-learning courses that consisted of slides and PDFs administered via the store’s lone desktop PC (in, you guessed it, the back room). The quality of these media were severely restricted by poor connectivity, discussed more in-depth below.

Sometimes intensive associate training, such as during onboarding, took place one-on-one. But because the store manager acted as a conduit to all training, the only way to scale was by doing group sessions.

Role play is an essential part of the learning process for this company, but results were all over the place. Learning outcomes largely depended on the skill and willingness of each manager, and there were no metrics for corporate to understand what was going on at any given store — let alone correlate training with real-world outcomes.

The main reason the company conducted their training that way was because of internet bandwidth issues. Mall stores have limited bandwidth, so streaming 4K, 1080p, or even 720p video was out of the question.

Record-keeping around training was another pain point. Employees were supposed to sign sheets, but sometimes forgot to, or there were suspicions that signatures were collected when training wasn’t completed.

Bigtincan’s Training Solution

Our training solution for this multinational beauty brand was a fully custom-tailored, branded, themed app that worked on employees’ personal devices as well as on in-store devices.

We began by taking into account the chief problems that came up during our audit:

- Managers as sole touchpoints for all training was an inefficiency that often created holdups in other areas of the business.

- The total lack of training accountability bred complacency and indifference, when training should actually be a top priority.

- The inability of training content creators to understand the effectiveness of their training meant that training content couldn’t evolve or improve in meaningful ways.

- Connectivity issues at the store level prevented a modern, high-quality training experience.

The company was receptive to our proposal for a distributed approach to training that would remove the bottleneck effect of relying on overworked managers as exclusive training providers.

With our solution, any employee can pick up any device at any time, open the training app, enter their ID number, and receive individualized niche training based on microlearning concepts.

We answered training record-keeping problems with a fix that not only provided accountability, but also made associates proud of their training accomplishments. Employees now have training profiles that include certifications and badges for achievements, which are also visible to managers and corporate.

Because there’s still a need for face-to-face roleplay learning (or more often webinar roleplay during the COVID pandemic), we also incorporated instructor-led training (ILT) and events that require attendance to be registered directly into the system and provide employees with badging or certification for attending.

All training analytics were then tracked for instructor-led training and digital learning courses and made readily available in Bigtincan Learning. This was especially helpful for corporate leadership because they were able to track and fully understand how all training was being leveraged and impacting outcomes.

Last but not least, our solution had to address the speed and connectivity issues faced by most mall retail stores.

Fortunately, due to deep experience in retail, we had a solution ready for stores in bandwidth-constrained environments. Instead of constantly downloading new content to the Bigtincan app during the day, we used the back office PCs as media servers or “edge servers” overnight.

In other words, as the mall internet speeds up every night from 12am-4am when stores are offline, our software gets to work downloading new videos, documents, courseware, and other assets to every mobile device.

That training content is available for associate use during the day, without the terrible user experience due to slow internet buffering, and the system maintains a minimalist daytime connection to the cloud to update employee training actions and completion rates in real-time.

Understanding the Lessons That Emerge

To recap, retail stores have always faced specific challenges around training and communication, which companies muddled through until recently.

Digital transformation in retail offers opportunities to solve these problems, but most providers offer generic solutions that don’t address the companies’ defining needs (such as heavily branded content or personalized experiences during training) or ignore their biggest challenges.

The best way to address retail sector inefficiencies at scale is by using new technologies to unify communication and training in one-stop mobile apps for retail associates.

(We also offer options to integrate customer data, pricing, inventory management, e-commerce, and online shopping into apps.)

These retail training and communication apps facilitate never-before-seen approaches to solving decades-old challenges:

- Personalized experiences using microlearning for associate training integrate into their workflow and enhance employee performance rather than serving as a distraction or afterthought.

- Digitalization of daily updates and communication from corporate headquarters to associates overcomes the inadequacies of email and other legacy solutions.

- Tracking and metrics ensure accountability of employees to managers and corporate supervisors for training adherence and meeting performance standards.

- Real-time insights offer feedback on how training affects key outcomes such as customer behavior, customer retention, and operational efficiency.

- Over time, “big data” allows us to leverage machine learning algorithms to automate the pacing and distribution of training and other variables.

And when you address training inefficiencies with digital technologies, customer experience ratings and sales productivity skyrocket.

No one is doing what Bigtincan does, as our track record of working with global brands in areas like sportswear, beauty, yoga, and high-end luxury jewelry shows. Instead of transactional, generic software, we deliver transformative, fully customizable, one-stop solutions.

Book a demo to learn more and see how Bigtincan could work at your company.

To read this content please select one of the options below:

Please note you do not have access to teaching notes, inventory management practices at a big-box retailer: a case study.

Benchmarking: An International Journal

ISSN : 1463-5771

Article publication date: 14 June 2022

Issue publication date: 24 August 2023

Managing inventory continues to be a growing area of concern for many retailers due to the multitude of issues that arise from either an excess or shortage of inventory. This study aims to understand how a large-scale retail chain can improve its handling of excess seasonal inventory using three common strategies: information sharing, visibility, and collaboration.

Design/methodology/approach

This study has been designed utilizing a case study method focusing on one retail chain at three key levels: strategic (head office), warehouses, and retail stores. The data have been collected by conducting semi-structured interviews with senior-level employees at each of the three levels and employing a thematic analysis to examine the major themes.

The results show how three common strategies are being practiced by this retailer and how utilizing these strategies aids the retailer in improving its performance in regard to seasonal inventory. Among our research findings, some challenges were discovered in implementing the strategies, most notably: human errors, advanced forecasting deficiencies, and the handling of return merchandise authorizations.

Originality/value

This research takes a case study approach and focuses on one big-box retailer. The authors chose to study three levels (head office, warehouses, and retail stores) to gain a deeper understanding of the functions and processes of each level, and to understand the working relationships between them. Through the collection of primary data in a Canadian context, this study contributes to the literature by investigating supply chain strategies for managing inventory. The Canadian context is especially interesting due to the multi-cultural demographics of the country.

- Supply chain

- Information sharing

- Collaboration

- Inventory management

- North America

Esrar, H. , Zolfaghariania, H. and Yu, H. (2023), "Inventory management practices at a big-box retailer: a case study", Benchmarking: An International Journal , Vol. 30 No. 7, pp. 2458-2485. https://doi.org/10.1108/BIJ-11-2021-0716

Emerald Publishing Limited

Copyright © 2022, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Retail and consumer goods

How E-Commerce Fits into Retail's Post-Pandemic Future

- Kathy Gramling

- Jeff Orschell

- Joshua Chernoff

- May 11, 2021

How E-Commerce Will Trump Brand Management

- Peter Sealey

- From the July–August 1999 Issue

Getting Real About Virtual Commerce

- Philip Evans

- Thomas S. Wurster

- From the November–December 1999 Issue

Retailing:Â Confronting the Challenges That Face Bricks-and-Mortar Stores

- Raymond Burke

- Sir Richard Greenbury

- John Quelch

- Robert A. Smith

- Ragnar Nilsson

How Diversity of Thought Can Fit into Your DEI Strategy

- Ella F Washington

- September 26, 2022

With Ron Johnson Out, What Should J.C. Penney Do Now?

- Rafi Mohammed

- April 09, 2013

How Open Wireless Will Change Your Business

- John Sviokla

- January 23, 2008

Personalization? No Thanks.

- Ajit Kambil

- From the April 2001 Issue

Why Amazon’s Grocery Store May Not Be the Future of Retail

- Nick Harrison

- George Faigen

- Duncan Brewer

- February 08, 2018

Pricing Lessons from New England’s Lobster Glut

- August 09, 2012

The Myth of Sustainable Fashion

- Kenneth P Pucker

- January 13, 2022

The Other Women’s Movement: Factory Workers in the Developing World

- Racheal Meiers

- May 28, 2013

Listening Begins at Home

- James R. Stengel

- Andrea L. Dixon

- Chris T. Allen

- From the November 2003 Issue

From Starbucks to Nike, Business Asks for Green Legislation

- Mindy S. Lubber

- December 05, 2008

Who’s to Blame for the Bubble?

- D. Quinn Mills

- From the May 2001 Issue

Black Friday 2011: Advantage Retailers

- November 22, 2011

Why You Should Warn Customers When You're Running Low on Stock

- Benjamin Knight

- Dmitry Mitrofanov

- September 05, 2022

Maclaren’s Stroller Recall: What Would You Do?

- Julia Kirby

- November 10, 2009

Winning with the Big-Box Retailers

- Eric Schwalm

- David Harding

- From the September–October 2000 Issue

Yelp is Leaving Chains Behind

- Michael Luca

- December 07, 2011

BNP Paribas Fortis: The "James" Banking Experience

- Steve Muylle

- Willem Standaert

- June 28, 2017

Wegmans and Listeria: Developing a Proactive Food Safety System for Produce

- Ray A. Goldberg

- Christine Snively

- January 22, 2015

Unilever International 3.0: Scaling the White Spaces Venturing Effort

- Benoit Leleux

- Pallivathukkal Cherian Abraham

- June 07, 2020

Starbucks Coffee Company: Transformation and Renewal

- Nancy F. Koehn

- Kelly McNamara

- Nora N. Khan

- Elizabeth Legris

- June 02, 2014

Showrooming at Best Buy

- Thales S. Teixeira

- Elizabeth Anne Watkins

- August 14, 2014

Kathy Fish at Procter & Gamble: Navigating Industry Disruption by Disrupting from Within

- Emily Truelove

- Linda A. Hill

- Emily Tedards

- July 10, 2020

Apple: Privacy vs. Safety (A)

- Henry W. McGee

- Nien-he Hsieh

- Sarah McAra

- Christian Godwin

- February 22, 2021

Hunley, Inc.: Casting for Growth

- John A. Quelch

- James T. Kindley

- September 20, 2018

X Fire Paintball & Airsoft: is Amazon a Friend or Foe? (A)

- Angela Acocella

- January 29, 2017

Knowledge Sharing at REMA 1000 (A)

- Tatiana Sandino

- Olivia Hull

- March 06, 2018

La Martina: Leveraging Polo's Luxury Lifestyle

- Anat Keinan

- Maria Fernanda Miguel

- Sandrine Crener

- January 28, 2015

Arcos Dorados: Decarbonizing McDonald's in Latin America

- George Serafeim

- Michael W. Toffel

- Jenyfeer Martinez Buitrago

- Mariana Cal

- May 24, 2023

County Line Markets: Real Options and Store Expansions

- Tom J. Cook

- Lou D'Antonio

- Ron Rizzuto

- May 01, 2015

Global Brand Management of Anheuser Busch InBev's Budweiser

- June 15, 2018

Flipkart (A): Transitioning to a Marketplace Model

- Das Narayandas

- Sunil Gupta

- Rachna Tahilyani

- November 04, 2015