Blog about all things SAP

ERProof » SAP CO » SAP CO Training » SAP CO Account Assignment

SAP CO Account Assignment

Normally, when a financial document is entered in SAP FI module , user has the option of entering the cost center in the financial document. However, when documents are entered from different modules or a cross-module financial transaction occurs, such as from MM or SD , there is no option of entering the cost center in the document. In this situation, the SAP system will derive the cost center through automatic SAP CO account assignment, substitutions, or through default settings made in the primary cost element.

Automatic SAP CO Account Assignment

The automatic account assignment has to be configured in the transaction code OKB9 . For posting made in external accounting, such as for price differences, exchange rate differences, etc., the SAP system automatically checks entries in the OKB9 settings and derives the cost center.

If you do not enter a CO object (order, cost center, or project) in external accounting postings made in FI, MM or SD modules and the posting is cost relevant, then the automatic account assignment checks the relevant cost center and makes the posting.

Here are examples of automatic account assignments:

- Banking fees, exchange rate differences and discounts in FI

- Minor differences and price differences in MM

The account assignment objects that can be maintained in the transaction OKB9 are:

- Cost center

- Profit center (profitability segment)

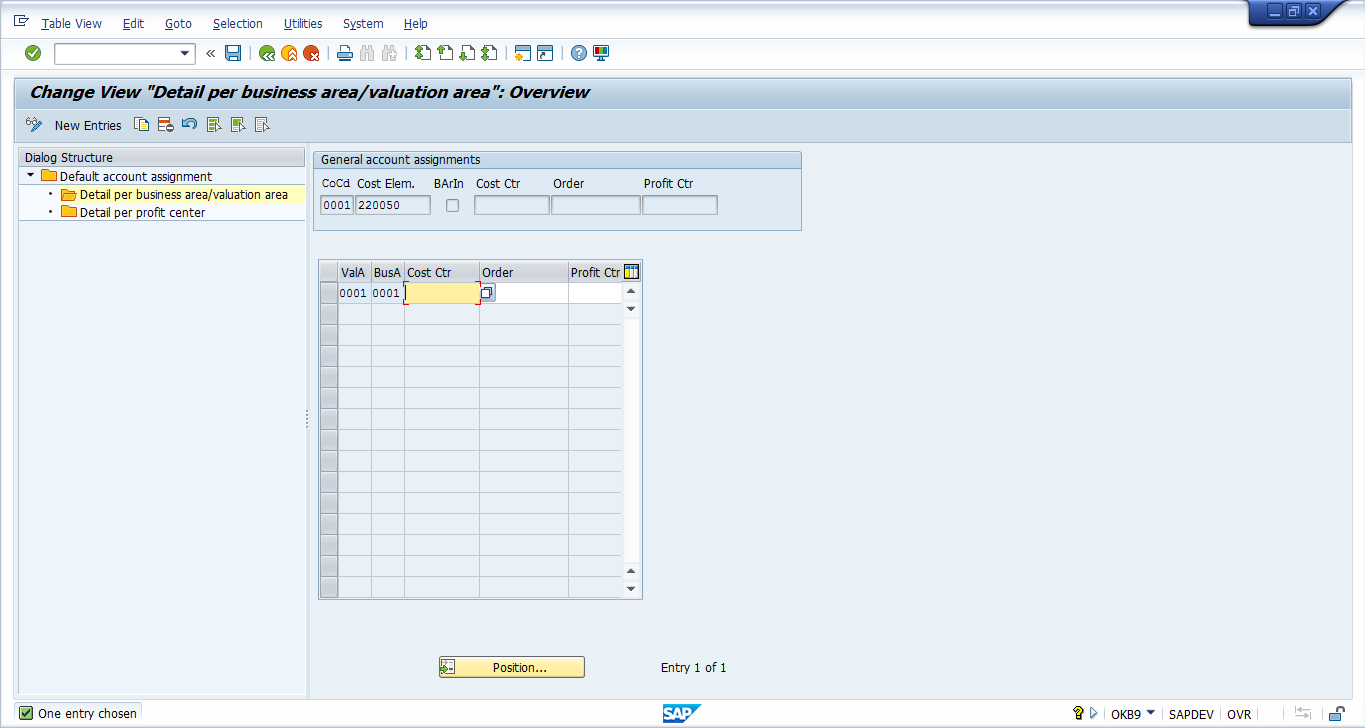

Normally, the automatic account assignment runs on the company code level along with the CO object. However, if the user wants to make the posting on the business area level, valuation area level or profit center level, it is also available in OKB9 settings. So basically it includes the following levels:

- Company code level

- Business area level

- Valuation area level

- Profit center level

The above 3 excluding the company code level are used in cases when the account assignment is needed below the company code level.

Prerequisites

Here are the prerequisites of activating automatic SAP CO account assignment:

- Activation of the cost center accounting

- Creation of cost centers

- Maintenance of cost elements

Additionally, you can also create orders and profit centers as per the business requirements.

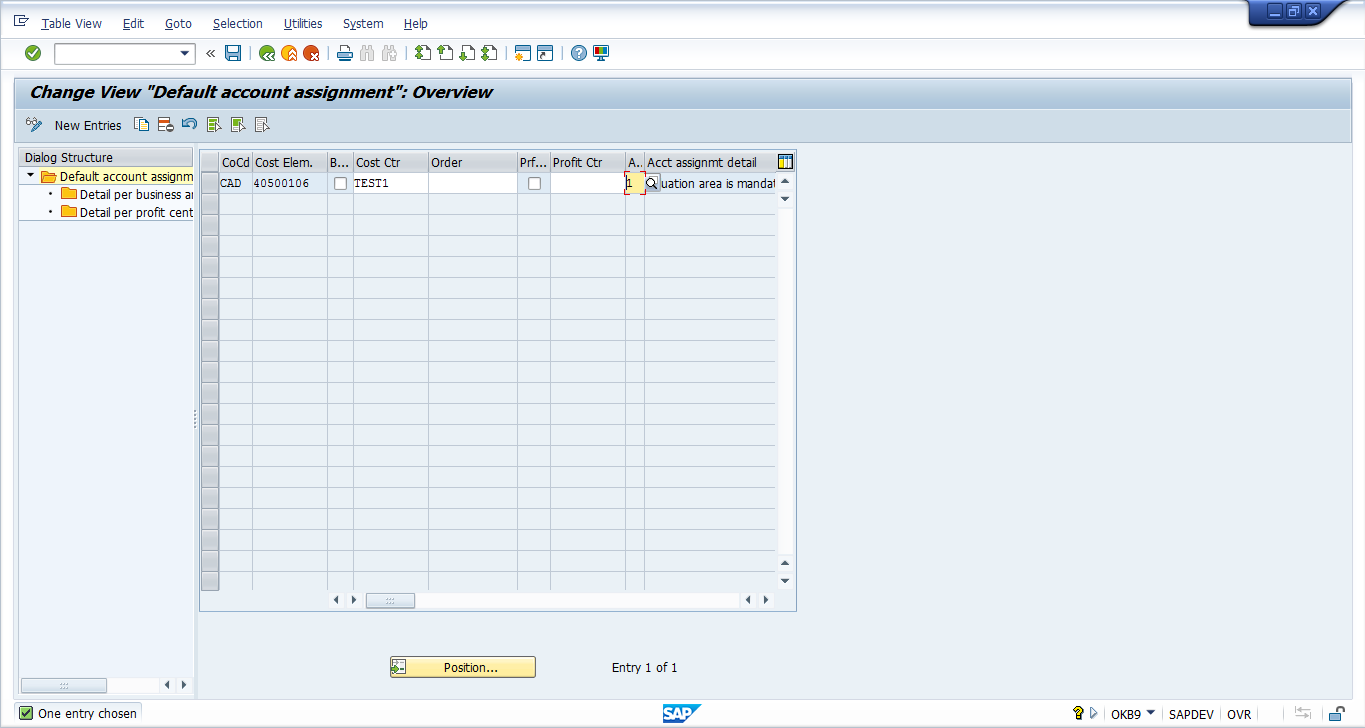

Settings in Transaction OKB9

Let’s discuss settings that are possible for automatic SAP CO account assignment in OKB9 transaction.

Start SPRO transaction and navigate to the following path:

Controlling – Cost Center Accounting – Actual Postings – Manual Actual Postings – Edit Automatic Account Assignment (OKB9)

Alternatively, you can start OKB9 transaction directly from the command bar.

- If you want to have the setting on the company code level only, then enter the company code and the cost element along with the corresponding CO object, i.e. a cost center, an order or a profit center.

- If you want to have the settings on the valuation area level, then enter the company code and the cost element and chose the ‘valuation area’ option in the account assignment detail as ‘1’.

- Similarly, if you want to have the settings on the business area or profit center level, then choose the option ‘2’ or ‘3’ respectively.

If you have chosen account assignment detail ‘1’ or ‘2’, then click on ‘Detail per business area/valuation area’ on the left sidebar.

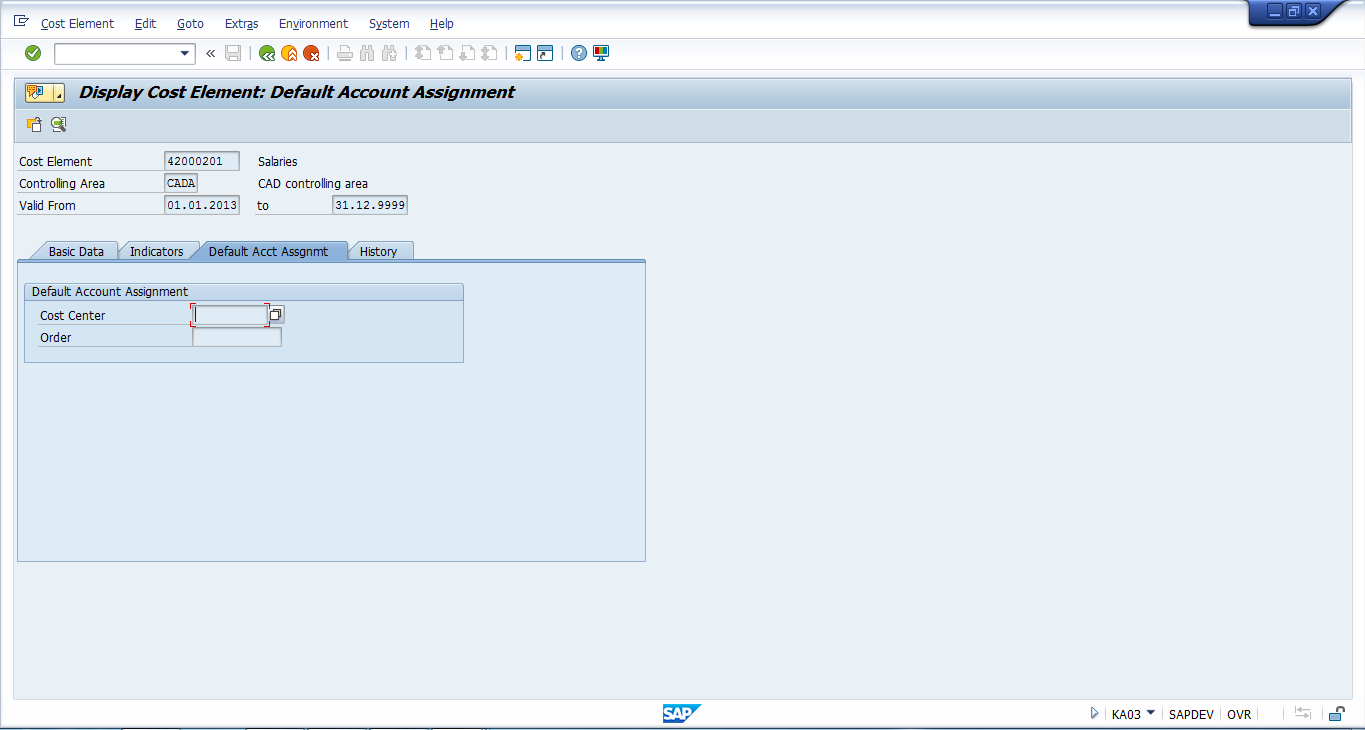

Default SAP CO Account Assignment

In order to determine the correct CO account assignment, the SAP system performs several checks in the following sequence. First it checks the document which a user is posting. If the cost center is empty in the document, then the system checks if any substitutions are maintained for the particular G/L account . Next, if the substitution is also missing, then the system moves on to the OKB9 settings for automatic SAP CO account assignments. Finally, if these settings are also missing, the SAP system checks master data of the primary cost element (G/L Account) under the tab of Default Account Assignment . You can display this master data using the transaction KA03 .

You can maintain the cost center and the order in the master data of the primary cost element.

So, basically the order of checks the system makes is:

- Financial document – Cost center

- Substitutions – transaction OKC9

- Automatic account assignments – transaction OKB9

- Default account assignments – transaction KA03 / KA02

Lastly, if any of the above is not maintained, then the SAP system throws an error ‘Account X requires an assignment to a CO Object’ and doesn’t allow posting of a document.

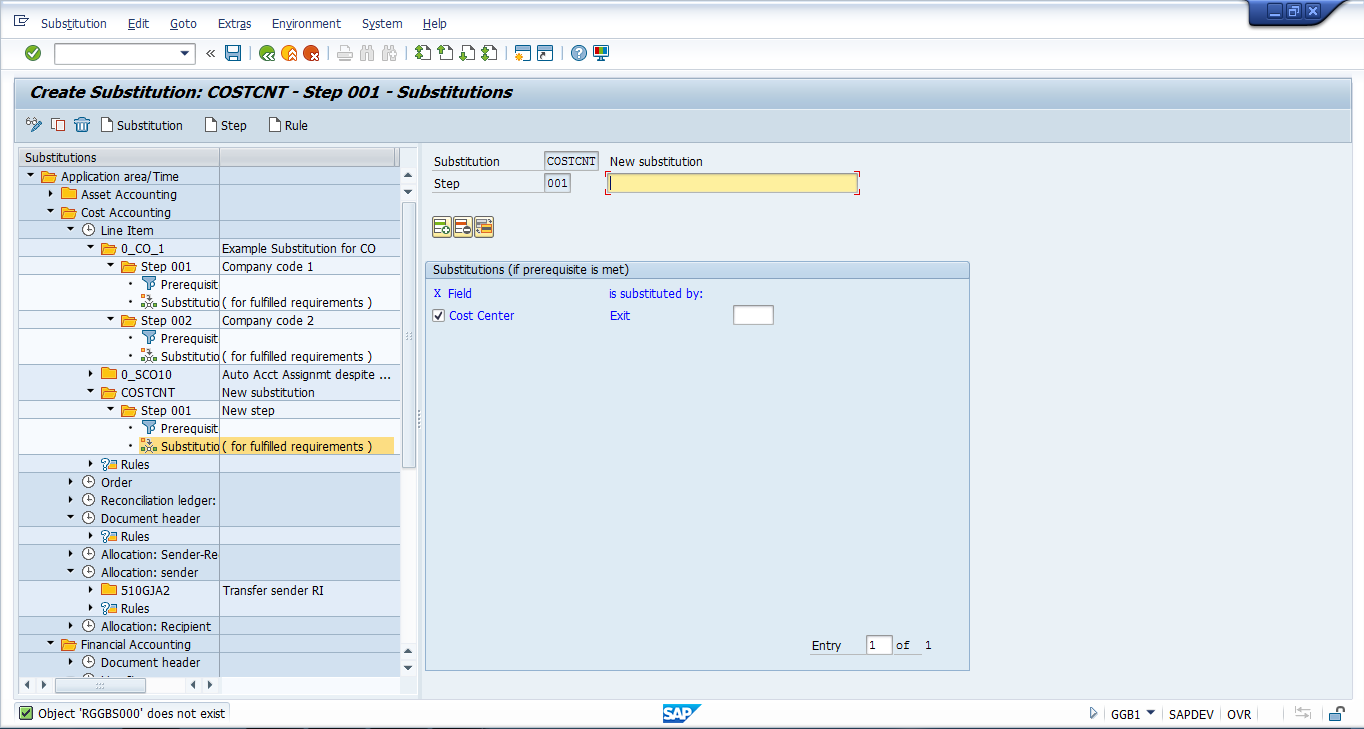

SAP CO Account Assignment using Substitution

In cases where you don’t need OKB9 or default account assignment, the user can go for user exits where a specific G/L account is mentioned under the company and the value in the cost center is substituted by the cost center given in the substitution.

The transaction for maintaining the substitution is GGB1 .

Usage of substitutions for SAP CO account assignment is justified by the business requirement and usually SAP CO account assignment requirements are fulfilled by OKB9 or default account assignments.

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP CO tutorials.

Navigation Links

Go to next lesson: SAP Adjustment Postings

Go to previous lesson: SAP Profit Center

Go to overview of the course: Free SAP CO Training

4 thoughts on “SAP CO Account Assignment”

it is helpful material i ask for more clear details for using substitution method for Account Assignment. thanks in advance

Sir, I am not receiving the training mails from yesterday 7/1/2019. I have completed my training till here(SAP CO Account Assignment) please do send the rest of the training emails for SAP CO. Hope you will do the needful.

I am getting the same error “Account 500911 requires an assignment to a CO object”. In OKB9, we have given company code, Cost element and ticked the check box ‘Indicator: Find profitability segment using substitution’ (V_TKA3A-BSSUBST) and not filled anything like cost center, order and profit center. in OKC9 we have created substitution. All the process happening through Idoc Message Type SINGLESETTRQS_CREATE and inside BAPI BAPI_SINGLESETTREQS_CREATEMULT triggering and raising this error. Cost center is not maintained in 1. Financial document – Cost center 2. Automatic account assignments – transaction OKB9 and 3. Default account assignments – transaction KA03/KA02 But we have substitution in transaction OKC9 to determine cost centre.

Where woulbe be the issue?

good explanation

Leave a Reply Cancel reply

Do you have a question and want it to be answered ASAP? Post it on our FORUM here --> SAP FORUM !

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Explaining Management Accounting (CO)

After completing this lesson, you will be able to:

- Explain Management Accounting (CO)

Management Accounting Components

CO contains all of the functions necessary for controlling cost and revenue effectively. It covers all aspects of management controlling and includes many tools for compiling information for company management.

CO consists of several components, as shown in the figure, Components of Management Accounting .

Data that the system creates in other SAP S/4HANA applications can have a direct influence on CO. For example, if you purchase a non-stock item, the system posts an expense to the general ledger (G/L). The system also posts this expense as costs to the cost center for which the item was purchased. This cost center can then pass these costs as overhead to a production cost center.

FI, in the SAP S/4HANA application, is a primary source of data for CO. In fact, most expense postings in the G/L result in a cost posting in CO. These expense postings to the G/L can be journal postings, vendor invoices, or depreciation postings from Asset Management.

Management Accounting provides information that management can use to make decisions. It facilitates the coordination, supervision and optimization of all processes within a company. This involves recording both the consumption of production factors and the services provided by an organization.

In SAP S/4HANA, all relevant cost information from Financial Accounting and Management Accounting is available in real-time on line item level in the central table ACDOCA. Costs and revenues are assigned to different CO account assignment objects such as cost centers, projects, or orders. These Financial Accounting accounts are managed in Management Accounting as cost or revenue elements.

Product Cost Controlling calculates the costs incurred when a service is provided or a product is manufactured. It enables you to calculate the minimum price at which a product can be profitably marketed. The manufacturing area of Logistics also works closely with CO. Bills of material (BOMs) and routings can be used in CO-PC.

Profitability Analysis analyzes the profit or loss of an organization according to individual market segments. In Profitability Analysis, costs are assigned to the revenues of each market segment. This gives you a basis for calculating prices, targeting customers, determining conditions, and choosing sales channels, for example. Sales order management is a primary source for revenue postings from billing documents to revenue postings in CO-PA and PCA. In addition to direct postings from FI, Profitability Analysis (CO-PA) can receive cost assessments from cost centers and ABC processes, settlements of costs from internal orders, and settlements of production variances from cost objects.

Within the Overhead Cost Controlling (CO-OM) area, you can post costs to cost centers, internal orders, and processes from other SAP S/4HANA applications (external costs). Cost centers can then allocate these costs to other cost centers, internal orders, and processes in Activity-Based Costing (ABC). ABC, in turn, can pass costs to cost centers and internal orders. Internal orders can settle costs to cost centers, processes in ABC, and other internal orders.

You use Cost Center Accounting for controlling purposes in your organization. Cost center accounting takes the costs incurred in a company and allocates them to the actual subareas that caused them.

Cost centers are separate areas within a controlling area at which costs are incurred. You can create cost centers according to various criteria including functional considerations, allocation criteria, activities provided, or according to their physical location and/or management area.

An activity type defines the type of activity that can be provided by a cost center. Activity outputs supplied by one cost center (the sending cost center) to other cost centers, orders, or processes, represent the utilization of resources for this sending cost center. You valuate activities using a price calculated on the basis of certain business or management information.

Internal orders are used to plan, collect, and analyze the costs arising from internal activities.

SAP Human Capital Management (HCM) can generate cost postings in CO. SAP HCM allows you to allocate labor costs to various controlling objects. In addition, you can transfer and use planned personnel costs for planning in CO.

Log in to track your progress & complete quizzes

/support/notes/service/sap_logo.png)

2335851 - SuccessFactors SAP ERP : The CO account assignment object belongs to company code A, not B [Valid Only for USA]

Your are observing the following symptom:

When running replication, an error is listed in SLG1:

The CO account assignment object belongs to company code A, not B Message No. KI100

Environment

- SuccessFactors BizX, SAP ERP

- Employee Central Payroll (ECP, EC Payroll)

KI100, KI 100 , KBA , LOD-SF-INT-PAY , please use LOD-EC-GCP-PY* , LOD-SF-INT , Integrations , LOD-EC-GCP-PY , Payroll Integration EC to Employee Central Payroll , LOD-EC-GCP-PY-EDR , Employee Data Replication , Problem

About this page

Search for additional results.

Visit SAP Support Portal's SAP Notes and KBA Search .

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

IMAGES

VIDEO

COMMENTS

This tutorial is part of our free SAP CO training. You will learn how account assignment works in SAP ERP and what are different sources of information about account assignment that the SAP system uses. Normally, when a financial document is entered in SAP FI module, user has the option of entering the cost center in the financial document.

The most important account assignment objects are listed in the following table. The identification code corresponds to the first two characters of the object number (object type). Network Activity Element will have ID code "OK". Sales orders are valid only with make-to-order production (VBAP-KZVBR = "E").

3442629-KI100 "The CO account assignment object belongs to company code &, not &" raised in supplier invoice posting. Symptom. ... 2943897 - Known issues related to incorrect account assignment settings - SAP ERP & SAP S/4HANA. Keywords. KI100, OKB9, DIF, Account Assignment, Default Account Assignment, Supplier Invoice. , KBA , CO-OM-CEL-E ...

CO Account Assignment. Home; Support Content; Financials - Controlling; ... If you do not have an SAP ID, you can create one for free from the login page. Log on ... Account Assignment Objects and object types . Account assignment example logic - posting to Cost center and order .

Resolution. Account assignment objects in Controlling are orders, cost centers, projects, cost objects, networks, special make-to-order sales orders, and profitability segments. The most important rule is that for each posting line to an account that is also created as a cost element in CO a real CO account assignment is required.

In SAP S/4HANA, all relevant cost information from Financial Accounting and Management Accounting is available in real-time on line item level in the central table ACDOCA. Costs and revenues are assigned to different CO account assignment objects such as cost centers, projects, or orders. These Financial Accounting accounts are managed in ...

You can indicate internal orders and projects in each master record as statistical. You can also specify Statistical Controlling objects as account assignment objects in addition to true Controlling objects. You cannot allocate costs on statistical Controlling objects to other objects. Account assignments are for information purposes only.

Controlling (CO) An object to which costs or quantities are posted in Controlling. Account assignment objects can be objects such as cost centers, internal orders, projects, or business processes.

That means the account assignments are being inherited if the values of the split criteria in the complete document are the same. There is no update in the general ledger view of the CO object example Cost Center, WBS Element, Internal Order etc, in case the account in question is not an account with account type Primary Costs or Revenue.

Account Assignment of Controlling Objects. Home; SAP ERP Support Package Versions; Controlling (CO) Controlling Methods; Account Assignment of Controlling Objects; Controlling (CO) 6.0 SP31. Available Versions: 6.0 EHP5 SP21 ; ... If you do not have an SAP ID, you can create one for free from the login page.

During a cross-company posting, system issued error message KI100 - "The CO account assignment object belongs to company code &3, not &4" indicating that the account ...

You are replicating employee master data from SuccessFactors Employee Central to HCM (either On-premise or ECP) In the system log, the following message is displayed: The CO account assignment object belongs to company code XXXX, not YYYY - Message No. KI100

SAP Knowledge Base Article - Preview 2335851 - SuccessFactors SAP ERP : The CO account assignment object belongs to company code A, not B [Valid Only for USA] Symptom

Account assignment objects can be objects such as cost centers, internal orders, projects, or business processes. Project System (PS) : The CO object to which postings can be made. In interest calculation, this is a CO object bearing costs and payments. Account assignment objects include WBS elements, network activities, and orders.

The CO account assignment object belongs to company code 2200, not 2900. Message no. KI 100. Diagnosis. You want to make a posting in company code 2900. At the same time, a CO account assignment object was specified that is assigned to company code 2200. This is account assignment object with object type SDI, and object key 133444/20.

Dear, While doing goods receipt for Purchage oredr, it is showing error Account 800066 requires an assignment to CO object . Kindly help me out. I sincerely thanks in ...