- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is Conjoint Analysis & How Can You Use It?

- 18 Dec 2020

For a business to run effectively, its leadership needs a firm understanding of the value its products or services bring to consumers. This understanding allows for a more informed strategy across the board—from long-term planning to pricing and sales.

In today’s business environment, most products and services include multiple features and functions by default. So, how do businesses go about learning which ones their customers value most? Is it possible to assign a specific value to each feature a product offers?

This is where conjoint analysis becomes an essential tool.

Here’s an overview of conjoint analysis, why it’s important, and steps you can take to analyze your products or services.

Access your free e-book today.

What Is Conjoint Analysis?

Conjoint analysis is a form of statistical analysis that firms use in market research to understand how customers value different components or features of their products or services. It’s based on the principle that any product can be broken down into a set of attributes that ultimately impact users’ perceived value of an item or service.

Conjoint analysis is typically conducted via a specialized survey that asks consumers to rank the importance of the specific features in question. Analyzing the results allows the firm to then assign a value to each one.

Learn about conjoint analysis in the video below, and subscribe to our YouTube channel for more explainer content!

Types of Conjoint Analysis

Conjoint analysis can take various forms. Some of the most common include:

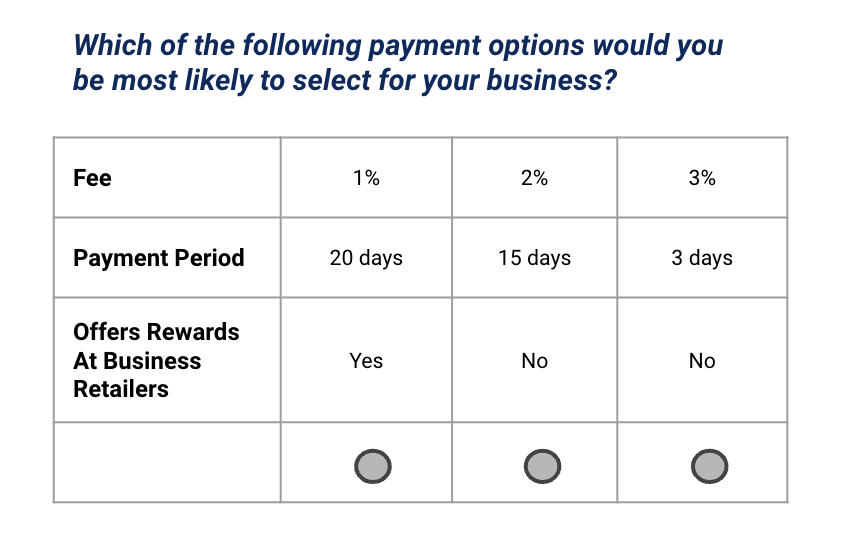

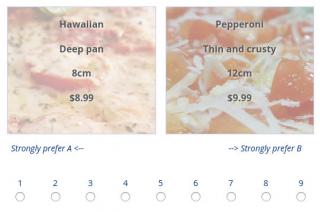

- Choice-Based Conjoint (CBC) Analysis: This is one of the most common forms of conjoint analysis and is used to identify how a respondent values combinations of features.

- Adaptive Conjoint Analysis (ACA): This form of analysis customizes each respondent's survey experience based on their answers to early questions. It’s often leveraged in studies where several features or attributes are being evaluated to streamline the process and extract the most valuable insights from each respondent.

- Full-Profile Conjoint Analysis: This form of analysis presents the respondent with a series of full product descriptions and asks them to select the one they’d be most inclined to buy.

- MaxDiff Conjoint Analysis: This form of analysis presents multiple options to the respondent, which they’re asked to organize on a scale of “best” to “worst” (or “most likely to buy” to “least likely to buy”).

The type of conjoint analysis a company uses is determined by the goals driving its analysis (i.e., what does it hope to learn?) and, potentially, the type of product or service being evaluated. It’s possible to combine multiple conjoint analysis types into “hybrid models” to take advantage of the benefits of each.

What Is Conjoint Analysis Used For?

The insights a company gleans from conjoint analysis of its product features can be leveraged in several ways. Most often, conjoint analysis impacts pricing strategy, sales and marketing efforts, and research and development plans.

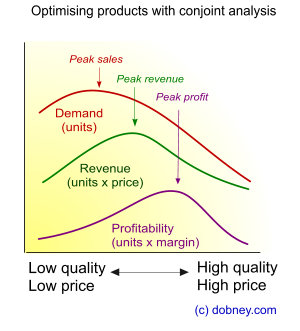

Conjoint Analysis in Pricing

Conjoint analysis works by asking users to directly compare different features to determine how they value each one. When a company understands how its customers value its products or services’ features, it can use the information to develop its pricing strategy.

For example, a software company hoping to take advantage of network effects to scale its business might pursue a “freemium” model wherein its users access its product at no charge. If the company determines through conjoint analysis that its users highly value one feature above the others, it might choose to place that feature behind a paywall.

As such, conjoint analysis is an excellent means of understanding what product attributes determine a customer’s willingness to pay . It’s a method of learning what features a customer is willing to pay for and whether they’d be willing to pay more.

Conjoint Analysis in Sales & Marketing

Conjoint analysis can inform more than just a company’s pricing strategy; it can also inform how it markets and sells its offerings. When a company knows which features its customers value most, it can lean into them in its advertisements, marketing copy, and promotions.

On the other hand, a company may find that its customers aren’t uniform in assigning value to different features. In such a case, conjoint analysis can be a powerful means of segmenting customers based on their interests and how they value features—allowing for more targeted communication.

For example, an online store selling chocolate may find through conjoint analysis that its customers primarily value two features: Quality and the fact that a portion of each sale goes toward funding environmental sustainability efforts. The company can then use that information to send different messaging and appeal to each segment's specific value.

Conjoint Analysis in Research & Development

Conjoint analysis can also inform a company’s research and development pipeline. The insights gleaned can help determine which new features are added to its products or services, along with whether there’s enough market demand for an entirely new product.

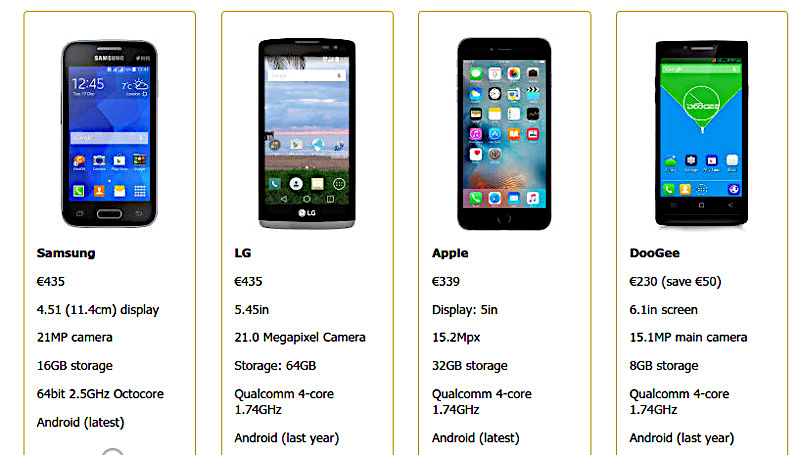

For example, consider a smartphone manufacturer that conducts a conjoint analysis and discovers its customers value larger screens over all other features. With this information, the company might logically conclude that the best use of its product development budget and resources would be to develop larger screens. If, however, future analyses reveal that customer value has shifted to a different feature—for example, audio quality—the company may use that information to pivot its product development plans.

Additionally, a company may use conjoint analysis to narrow down its product or service’s features. Returning to the smartphone example: There’s only so much space within a smartphone for components. How a phone manufacturer’s customers value different features can inform which components make it into the end product—and which are cut.

One example is Apple’s 2016 decision to remove the headphone jack from the iPhone to free up space for other components. It’s reasonable to assume this decision was reached after analysis revealed that customers valued other features above a headphone jack.

Leveraging Conjoint Analysis for Your Business

Conjoint analysis is an incredibly useful tool you can leverage at your company. By using it to understand which product or service features your customers value over others, you can make more informed decisions about pricing, product development, and sales and marketing activities.

Are you interested in learning more about how customers perceive and realize value from the products they buy, and how you can use that information to better inform your business? Explore Economics for Managers — one of our online strategy courses —and download our free e-book on how to formulate a successful business strategy.

About the Author

Popular searches

- How to Get Participants For Your Study

- How to Do Segmentation?

- Conjoint Preference Share Simulator

- MaxDiff Analysis

- Likert Scales

- Reliability & Validity

Request consultation

Do you need support in running a pricing or product study? We can help you with agile consumer research and conjoint analysis.

Looking for an online survey platform?

Conjointly offers a great survey tool with multiple question types, randomisation blocks, and multilingual support. The Basic tier is always free.

- Getting respondents

- Bring your own respondents

- Predefined panel

- Self-serve sample

- Managed general sample

- Send an email campaign

- Managing your audiences on Conjointly

- Quality assurance process at Conjointly

- Quick Feedback

- Introduction to question types available

- Intro text: No respondent input

- Multiple choice

- Dropdown menu

- Email address

- Regular expression

- Paragraph input

- Positive/negative open-ended feedback

- Likert scale

- Dual negative-positive scale

- Net Promoter Score

- Star rating grid

- Constant sum

- Single swipe card

- Set of swipe cards

- Image heatmap

- Text highlighter

- Video response

- Matrix grid

- Simple block

- Randomisation block

- Setup survey flow controls

- What is conjoint analysis?

- Classification of conjoint

- Alternatives to conjoint

- Technical notes on conjoint

- Overview of conjoint study set up

- Setting up a Brand-Price Trade-Off study

- Tips for setting up conjoint studies

- Multiple languages in one study

- AI-based survey and question creation

- Response quality management and warnings

- GET variables

- External variables

- Display logic for survey questions

- Survey flow of a monadic block

- Setting up quotas

- Piping in previous answers or other data

- Managing your team on Conjointly

- Integrating with a third-party tool

- Review survey participants

- Checking response quality

- Suggestions for survey improvements

- Formula basics

- Respondent properties

- Formulas in the simulator

- Formulas in respondent weighting

- Text formulas

- Access to respondents' answers

- Date and time formulas

- Partworth utilities

- Marginal willingness to pay

- Manual calculation of partworth utilities

- Price Elasticity of Demand

- Analysing time series

- Setting up segmentation for subgroup analysis

- Comparing across segments

- Adding covariates to your analysis

- Setup respondent weightings

- AI summary of open-ended text responses

- Calculation of Van Westendorp results

- Introduction to preference share simulations

- Top simulator usability tips

- Calculating volume, revenue, and profit

- Scale factor adjustments

- Models for calculating preference shares

- Margin of error in simulations

- Availability adjustments in the simulator

- The segregate function

- The source of business function

- Correlation matrix for simulations

- Scenario optimisation

- Product concept ladder

- Sensitivity to adding or removing concepts

- Adding groups of concepts

- Including adcepts in simulations

- Interactive Excel simulator

- Comparison against the TURF simulator

- Exporting experiment data

- Exporting as an Excel Workbook

- Exporting in JMP format

- Exporting as a PowerPoint Presentation

- Exporting simulator scenarios

- Exporting in SPSS format

- Exporting your survey script

- Making beautiful charts in Excel

- Interpreting Market Test results

- Validating your Figma work

- Research Methods Knowledge Base

- Frequently asked questions

What is Conjoint Analysis?

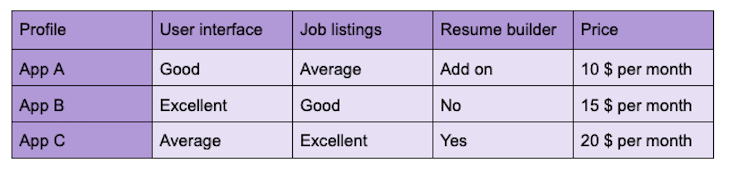

Conjoint analysis is a popular method of product and pricing research that uncovers consumers’ preferences, which is useful when a company wants to:

- Select product features.

- Assess consumers’ sensitivity to price changes.

- Forecast its volumes and market share.

- Predict adoption of new products or services.

Conjoint analysis is frequently used across different industries for all types of products, such as consumer goods, electrical goods, life insurance plans, retirement housing, luxury goods, and air travel. It is applicable in various instances that centre around discovering what type of product consumers are likely to buy and what consumers value the most (and least) about a product. As such, it is a familiar tool for marketers, product managers, and pricing specialists.

Businesses of all sizes can benefit from conjoint analysis, including even local grocery stores and restaurants — and its scope is not just limited to consumer contexts, for example, charities can use conjoint analysis’ techniques to find out donor preferences, while HR departments can use it to build optimal compensation packages .

How does conjoint analysis work?

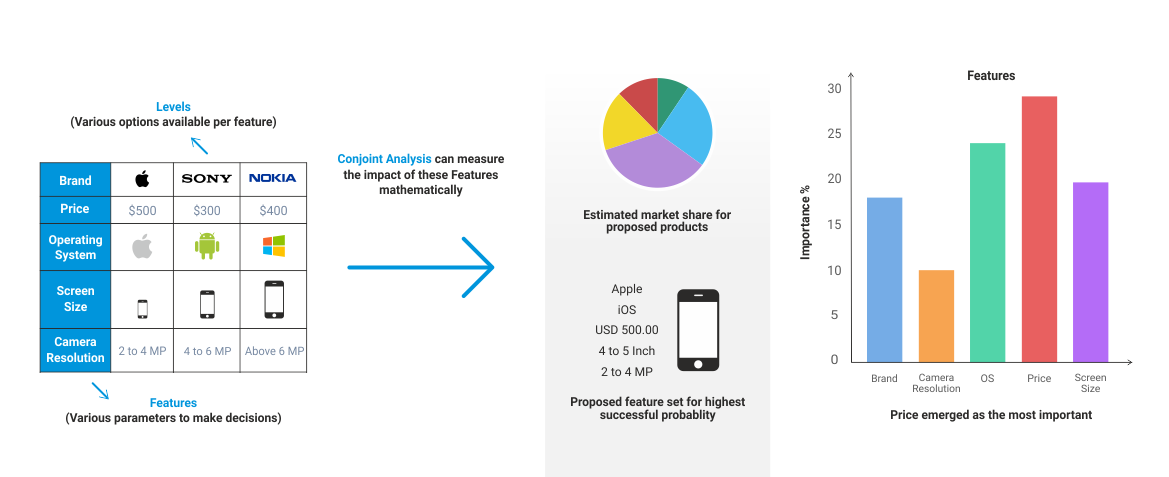

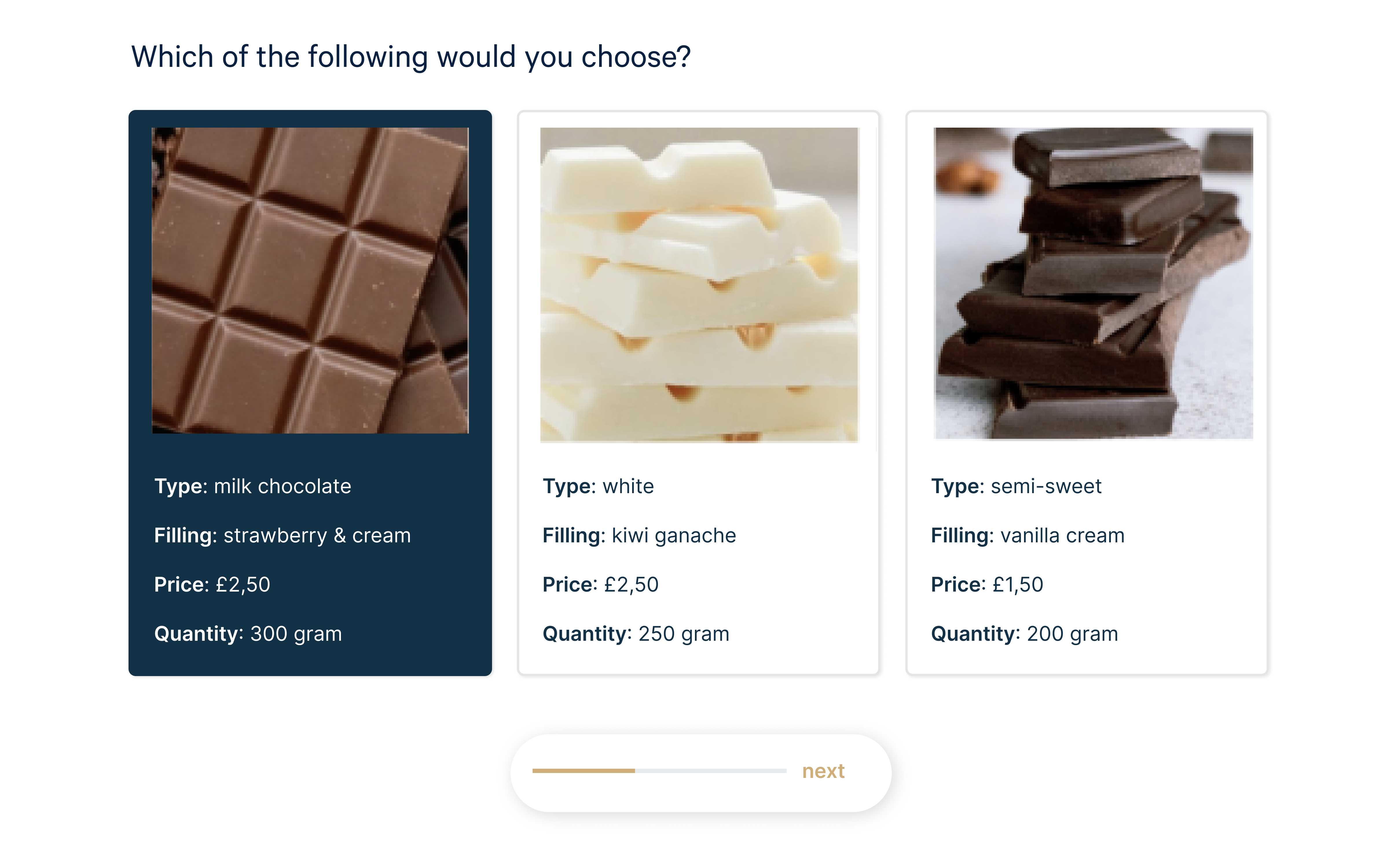

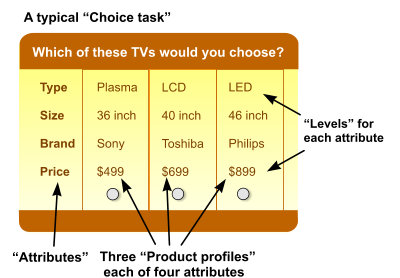

Conjoint analysis works by breaking a product or service down into its components ( attributes and levels ) and testing different combinations of these components to identify consumer preferences .

For example, consider a conjoint study on smartphones. The smartphone is broken down into four attributes which are each assigned different possible variations to create levels:

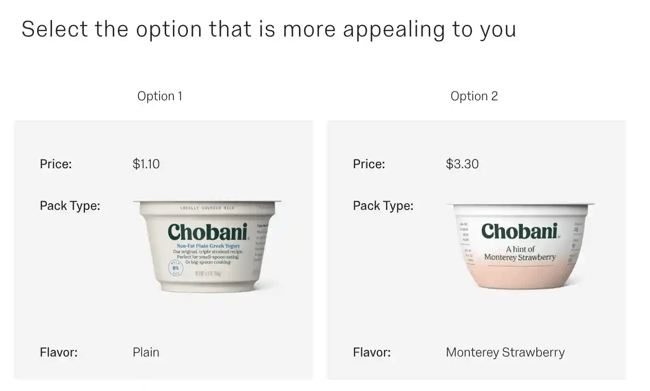

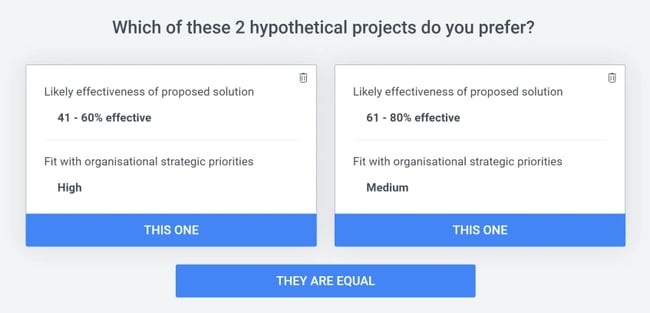

Each choice tasks then presents a respondent with different possible smartphones, each created by combining different levels for each attribute:

Going further than simply asking respondents what they like in a product, or what features they find most important, conjoint analysis employs a more realistic approach: asking each respondent to choose between potential product concepts (or alternatives) formed through the combination of attributes and levels. These combinations are carefully assembled into choice sets (or questions). Each respondent is typically presented with 8 to 12 questions . The process of assembling attributes and levels into product concepts and then into choice sets is called experimental design and requires extensive statistical and mathematical analysis (done automatically by Conjointly or manually by researchers).

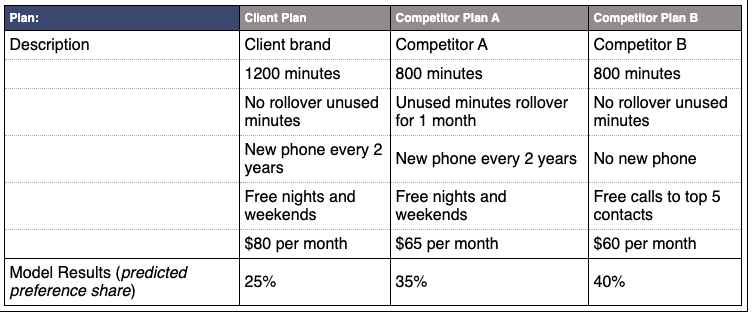

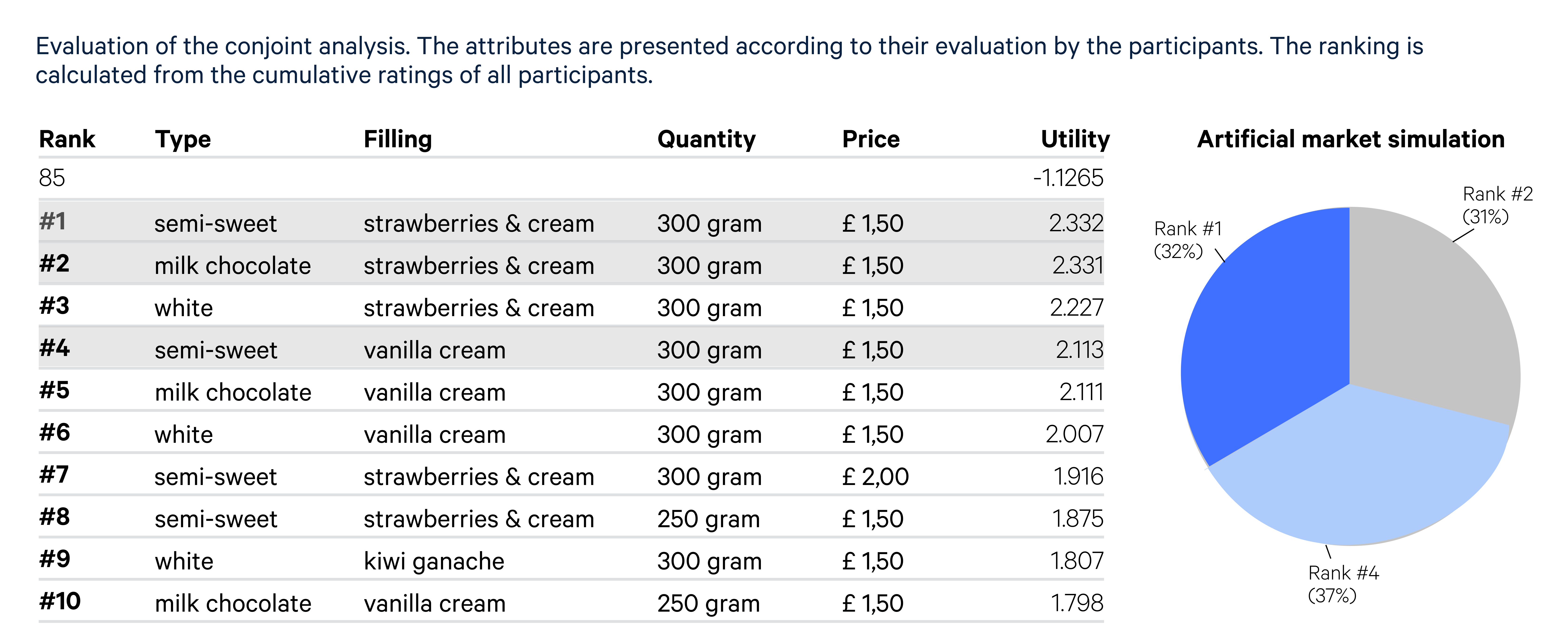

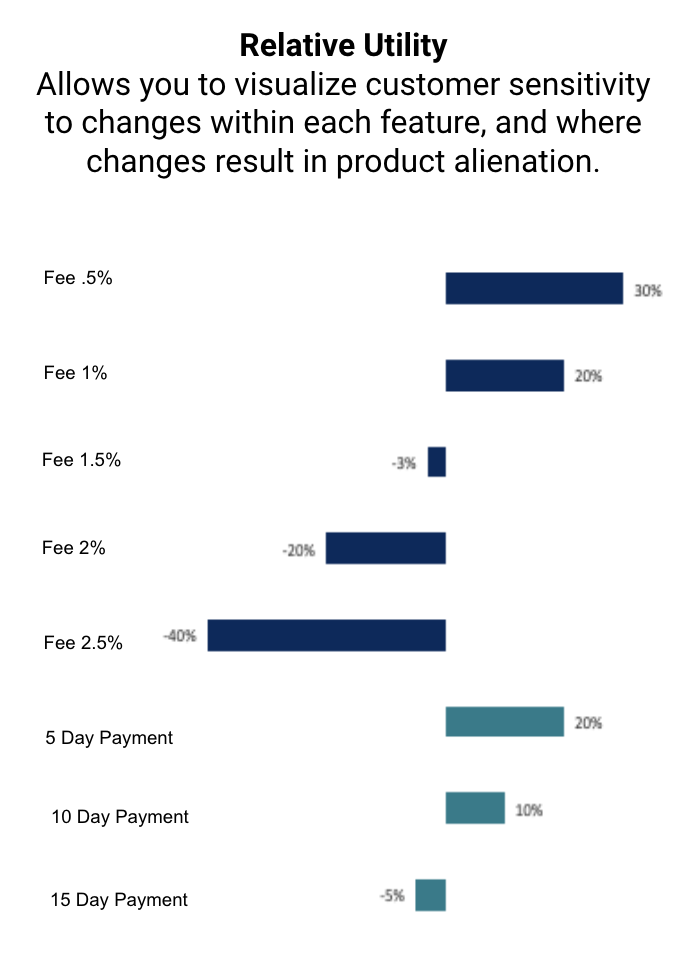

Using survey results, it is possible to calculate a numerical value that measures how much each attribute and level influenced the respondent’s choices. Each of these values is called a “ preference score ” (AKA “partworth utility” or “utility score”). The below example shows preference scores for attributes and levels of a mobile phone plan.

Preference scores are used to build simulators that forecast market shares for a set of different products offered to the market. By using the simulator to model (i.e. simulate ) respondents’ decisions, we can identify the specific features and pricing that balance value to the customer with cost to the company and forecast potential demand in a competitive market situation. The below example shows how different data amounts in a mobile plan will affect a company’s market share.

Consider you are launching a new product and wish to address several research questions. Through the below example, we demonstrate how various outputs from your Conjointly survey report can be used to gain insights.

- It is also possible to perform clustering based on raw conjoint utilities .

Why do conjoint analysis with Conjointly?

Conjointly automates the often complicated experimental design process using state-of-the-art methodology. This gives you control over specific settings , such as the number of concepts per choice set and the number of choice sets per respondent when you set up a conjoint analysis experiment. Respondents then complete the choice tasks within the conjoint survey – this typically requires a few hundred responses but may vary depending on the complexity of the study.

Once we’ve gathered the recommended sample size of respondents, Conjointly produces a survey report which contains several in-depth outputs. The outputs of Brand Specific Conjoint , Generic Conjoint , and Brand-Price Trade-Off include estimates of respondents’ preferences, overall sample profile, segmentation and interactive simulations. Conjointly estimates and charts preference shares, revenue projections, and price elasticity using simulators.

There are many types/flavours of conjoint analysis , classified by response type, questioning approach, design type, and adaptivity of the design. All flavours of conjoint analysis have the same basics but not all are as effective as others. That’s why Conjointly offers two key conjoint designs, called generic and brand-specific, and uses the most tested, developed, and theoretically sound response type – choice-based conjoint analysis (CBC). CBC’s predictive power far surpasses its alternatives , such as SIMALTO and self-explicated conjoint, making it the ideal choice for your next experiment.

Don’t have a large marketing budget or the scope to conduct conjoint analysis? That’s OK: Conjointly does full conjoint analysis for you, affordably . Unlike desktop software tools, Conjointly does not require you to deep dive into the advanced methodology of conjoint analysis. Your business can rely on the full functionality of the software to deliver high-quality analysis and powerfully accurate results. Conjointly embodies an agile approach that puts you in control of the research process without the need.

Conjointly is made unique by the following characteristics:

We are the home of conjoint analysis. Conjointly offers complete set of outputs and features through an accessible interface.

Quick to set up. Setting up your experiment is fast and hassle-free with a simple wizard, which helps you choose appropriate settings and suggests your minimum sample size. You won’t need to customise or test any survey – the system does that for you. Conjointly can send participants invites on your behalf or generate a shareable link for you.

Easy on respondents. Experiment participants only need a few minutes to complete a survey and can answer questions with ease on their mobile phone, tablet, or computer.

Smart analytics done for you. Behind the scenes, Conjointly uses state-of-the-art analytics to crunch the numbers, and check validity of reporting. Outputs are ready for any application of conjoint analysis (pricing, feature selection, product testing, new market entry, cannibalisation analysis, etc.) in any industry (telecommunications, SaaS, FMCG, automotive, financial services, HR, etc.).

Our market research experts are always ready to support your studies. Schedule a consultation if you need any assistance.

What is the difference between conjoint and discrete choice experiments?

Conjoint analysis is a survey-based quantitative research technique of presenting respondents with several options (each described in terms of feature and price levels) and measuring their response to these options.

When the measured response is their choice between these options (rather than ranking or rating each of these options), it is called choice-based conjoint (which is the most commonly-used type of discrete choice experiments).

Discrete choice analysis is examination of datasets that contain choices made by people from among several alternatives. Commonly, we want to understand what drove people to make these choices. For example, how does weather affect people’s choice of eating out, ordering food delivery, or cooking at home. Discrete choice analysis can be done on historical data (e.g. sales data) or from experiments (including survey-based experiments).

Choice-based conjoint is an example of discrete choice experimentation.

History of conjoint analysis

Conjoint analysis has its roots in academic research from the 1960s and has been used commercially since the 1970s. In 1964, two mathematicians, Duncan Luce and John Tukey published a rather indigestible (by modern standards) article called ‘Simultaneous conjoint measurement: A new type of fundamental measurement’ . In abstract terms, they sketched the idea of “measuring the intrinsic goodness of certain characteristics of objects by measuring the goodness of an object as a whole”.

The article did not mention data collection, products, features, prices, or other elements that we associate with conjoint analysis today, but it spurred academic interest in the topic and perhaps gave rise to the name “conjoint”. It not only kick-started the topic but also set the tone for future developments in the area. Over time, it has become technical to the point of inaccessibility to most people, led by American academics with a strong emphasis on the statistical workings of survey research.

Green and Srinivasin (1978) agree that the theory of conjoint measurement was developed in Luce and Tukey’s paper but that “the first detailed, consumer-orientated" approach was Green and Rao’s (1971) ‘Conjoint Measurement for Quantifying Judgmental Data’ . In 1974, Professor Paul E. Green penned ‘On the Design of Choice Experiments Involving Multifactor Alternatives’ , cementing the impact of conjoint analysis in market research.

Over the next few decades, conjoint analysis became an increasingly popular method across the globe with notable studies in the 1980s and 90s highlighting its growing adoption and development during this time (Wittink & Cattin 1989; Wittink, Vriens, and Burhenne 1994 cited in Green, Kreiger & Wind 2001) .

Conjoint surveys are continuously developing on a range of software platforms, through which many different flavours of conjoint analysis can be enjoyed. Today, conjoint analysis thrives as a widespread tool built on a robust methodology and is used by market researchers daily as an indispensable tool for understanding consumer trade-offs.

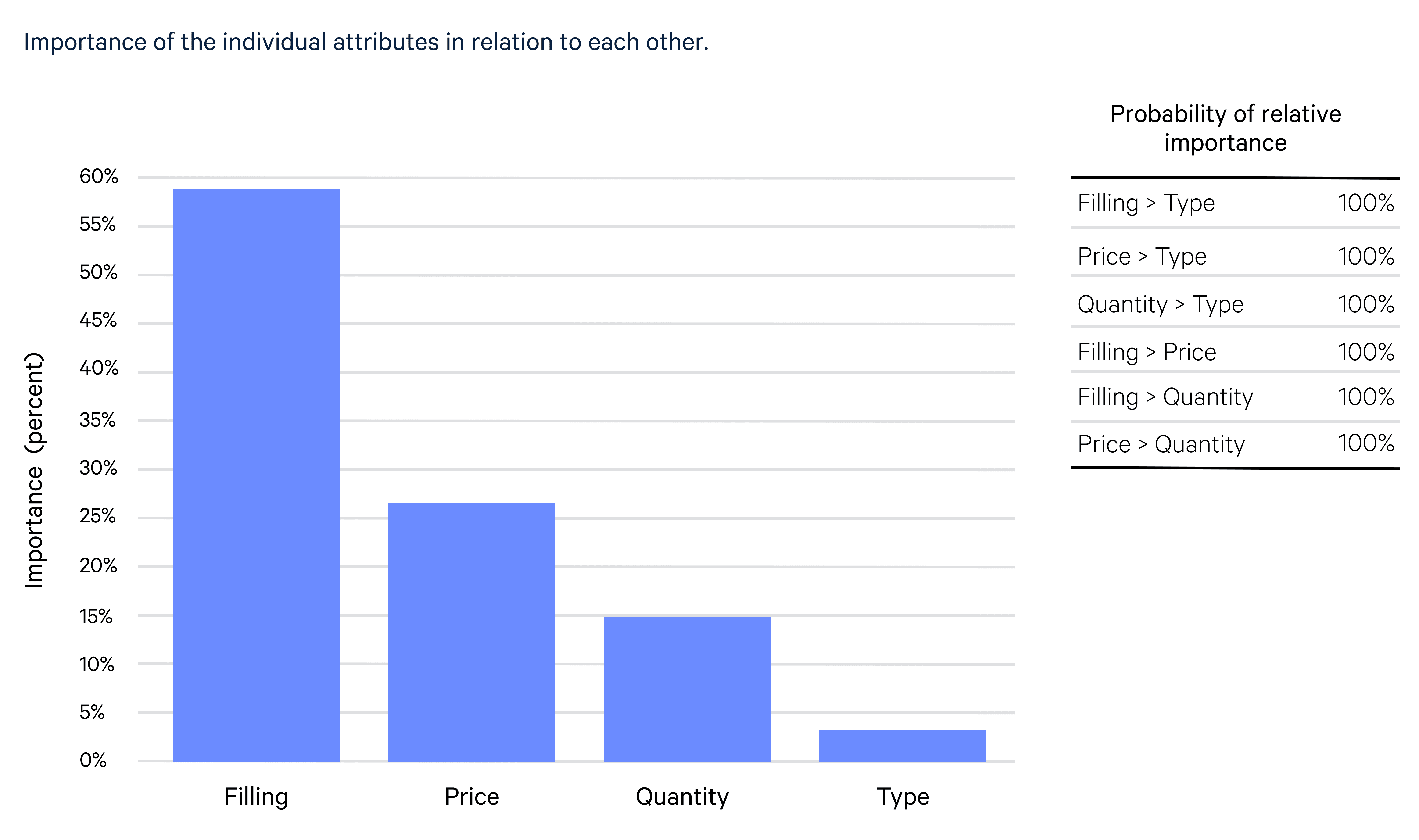

Example outputs of Generic Conjoint on ice-cream

This is a simple conjoint analysis report for a Generic Conjoint test on ice-cream. You can also take this survey yourself . We tested three features:

- Flavour (Fudge, Vanilla, Strawberry, and Mango)

- Size (from 120g to 200g)

- Price (from $1.95 to $3.50)

We collected over 1,500 good quality responses in this test (even though this report would be robust enough with a hundred complete answers). It turns out that variation of price was a more important driver of people’s decision-making than differences in both flavour and size of the cone combined:

Unsurprisingly, people preferred larger and cheaper cones. Fudge and vanilla were the two top flavours:

But when we look at confidence intervals, we notice that we are much less certain about average preferences for flavours than for size or price:

It is probably because if we simulate preference shares for four concepts with varied flavours but fixed price and size, we observe that the distribution of people who pick different options is not extremely skewed towards one flavour:

But when we do simulation analysis with different price points, we clearly see that more people prefer to pay a lower price. Even though some still stick with a higher price, probably due to price-quality inference.

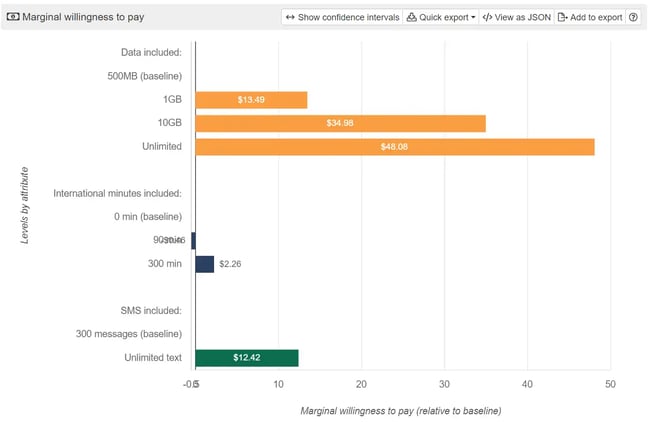

Another useful output of the study is marginal willingness to pay , which shows the equivalent amount of money for upgrade from the less preferred to the more preferred features:

If you want to pick the topmost preferred combination of product features, you can take a look at the following ranking as well:

It looks like a large dollop of modestly-priced Frosty Vanilla is the winner today.

A simple conjoint analysis example in Excel

To further your understanding, you can download a conjoint analysis example in Excel , also available on Google Sheets (which you can copy to edit). This example covers:

- Inputs for a conjoint study

- Questions presented to respondents

- Calculations of preference scores (relative preferences and importance scores of attributes)

This example is limited to:

- Ten choice-based responses (in real conjoint tests, we collect ~12 choices from 100 to 2,000 respondents);

- Four attributes with two levels each (in real conjoint tests, we can have up to a dozen attributes and up to several dozen levels);

- A multiple linear regression (in real conjoint tests, we use hierarchical Bayesian multinomial logit );

- A fractional factorial design .

The best way to learn more about conjoint analysis is to set up your own study, which you can do when you sign up . You can also read about:

- Alternatives to conjoint (such as MaxDiff and Claims Test )

- Common mistakes and practical tips for setting up conjoint studies

- Check out our webinar on Conjoint Analysis 101

Which one are you?

I am new to conjointly, i am already using conjointly, cookie consent.

Conjointly uses essential cookies to make our site work. We also use additional cookies in order to understand the usage of the site, gather audience analytics, and for remarketing purposes.

For more information on Conjointly's use of cookies, please read our Cookie Policy .

Do you want to be updated on new features from Conjointly?

We send an occasional email to keep our users informed about new developments on Conjointly : new types of analysis and features for quality insight.

Subscribe to updates from Conjointly

You can always unsubscribe later. Your email will not be shared with other companies.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Conjoint Analysis: Definition, Example, Types, and Model

Have you ever bought a house? As one of the most complex purchase decisions you can make, you must consider many preferences. Everything from the location and price to interest rate and quality of local schools can play a factor in your home-buying decision. You can use conjoint analysis to make data-driven decisions that will help you meet customer needs and develop your organization.

LEARN ABOUT: Level of Analysis

Less complicated purchases feature a similar process of choosing a good or service that meets your needs. You just may not be aware you’re making those decisions.

LEARN ABOUT: Behavioral Research

Subconsciously, one person might be more price-sensitive while another is more feature-focused. Understanding which elements consumers consider essential and trivial is the core purpose of conjoint analysis.

Content Index

What is conjoint analysis?

Why is it important for researchers, why use conjoint analysis in surveys, when to use it, how to use conjoint analysis, types of conjoint analysis, conjoint analysis: key terms, when is a good time to run a discrete choice-based conjoint study, advantages of conjoint analysis, conjoint analysis example, conjoint algorithm: how it is works, level-up conjoint analysis insights, conjoint analysis marketing example, how to conduct conjoint analysis using questionpro.

Conjoint analysis is defined as a survey-based advanced market research analysis method that attempts to understand how people make complex choices. We make choices that require trade-offs every day — so often that we may not even realize it. Even simple decisions like choosing a laundry detergent or deciding to book a flight are mental conjoint studies that contain multiple elements that lead us to our choice.

Conjoint analysis is one of the most effective models for extracting consumer preferences during the purchasing process . This data is then turned into a quantitative measurement using statistical analysis. It evaluates products or services in a way no other method can.

LEARN ABOUT: Data Analytics Projects

Researchers consider conjoint analysis as the best survey method for determining customer values. It consists of creating, distributing, and analyzing surveys among customers to model their purchasing decision based on response analysis.

QuestionPro can automatically compute and analyze numerical values to explain consumer behavior . Our software analyzes responses to see how much value is placed on price, features, geographic location, and other factors. The software then correlates this data to consumer profiles. A software-driven regression analysis of data obtained from real customers makes an accurate report instead of a hypothesis. Practical business intelligence relies on the synergy between analytics and reporting , where analytics uncovers valuable insights, and reporting communicates these findings to stakeholders.

LEARN ABOUT: Consumer Surveys

Reliable, accurate data gives your business the best chance to produce a product or service that meets all your customer’s needs and wants.

Currently, choice-based conjoint analysis is the most popular form of conjoint. Participants are shown a series of options and asked to select the one they would most likely buy. Other types of conjoint include asking participants to rate or rank products. Choosing a product to buy usually yields more accurate results than ranking systems.

We recommend you take a look at this free resource: Conjoint analysis survey template

The survey question shows each participant several choices of products or features. The answers they give allow our software to work out the underlying values. For example, the program can work out its preferred size and how much it would pay for its favorite brand. Once we have the choice data, there is a range of analytic options. The critical tools for analysis include What-if modeling, forecasting, segmentation, and applying cost-benefit analysis.

LEARN ABOUT: Statistical Analysis Methods

Traditional rating surveys can’t place a value on the different attributes that make up a product. On the other hand, conjoint analysis can sift through respondents’ choices to determine the reasoning for those choices. Analyzing the data gives you the ability to peek into your target audience’s minds and see what they value most in goods or services and acts as a market simulator.

Many businesses shy away from the conjoint analysis because of its seemingly sophisticated design and methodology. But the truth is, you can use this method efficiently, thanks to user-friendly survey software like QuestionPro. Here is a breakdown of conjoint in simple terms, along with a conjoint analysis marketing example.

Over the past 50 years, Conjoint analysis has evolved into a method that market researchers and statisticians implement to predict the kinds of decisions consumers will make about products by using questions in a survey.

The central idea is that consumers evaluate different characteristics of a product and decide which are more relevant to them for any purchase decision. An online conjoint survey’s primary aim is to set distinct values to the alternatives that the buyers may consider when making a purchase decision. Equipped with this knowledge, marketers can target the features of products or services that are highly important and design messages more likely to strike a chord with target buyers.

You can also find best alternatives of Conjoint.ly for your business.

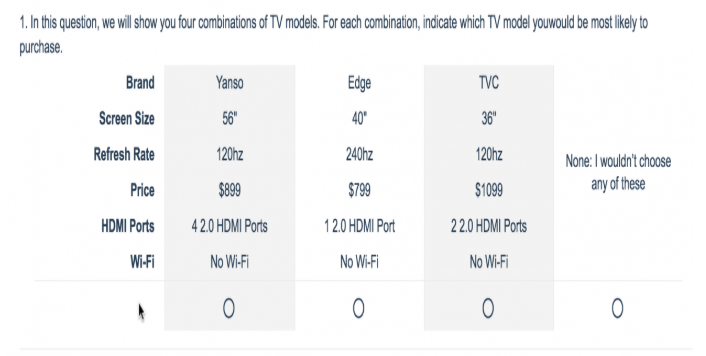

The discrete choice conjoint analysis presents a set of possible decisions to consumers via a survey and asks them to decide which one they would pick. Each concept is composed of a set of attributes (e.g., color, size, price) detailed by a set of levels.

GATHER RESEARCH INSIGHTS

Conjoint models predict respondent preference. For instance, we could have a conjoint study on laptops. The laptop can come in three colors (white, silver, and gold), three screen sizes (11”, 13”, and 15”), and three prices ($200, $400, and $600). This would give 3 x 3 x 3 possible product combinations. In this example, there are three attributes (color, size, and price) with three levels per attribute.

A set of concepts or tasks, based on the defined attributes, are presented to respondents. Respondents make choices as to which product they would purchase in real life. It is important to note that there are a lot of variations of conjoint techniques. QuestionPro’s conjoint analysis software uses choice-based analysis, which most accurately simulates the purchase process of consumers.

LEARN ABOUT: Marketing Insight

There are two main types of conjoint analysis: Choice-based Conjoint (CBC) Analysis and Adaptive Conjoint Analysis (ACA).

Discrete choice-based conjoint (CBC) analysis:

This type of conjoint study is the most popular because it asks consumers to imitate the real market’s purchasing behavior: which products they would choose, given specific criteria on price and features.

For example, each product or service has a specific set of fictional characters. Some of these characters might be similar to each other or will differ. For instance, you can present your respondents with the following choice:

The devices are almost identical, but device 2 has triple cameras with better configuration, and Device 1 has a higher battery power than Device 2. You would know how vital the trade-off between the number of cameras and battery capacity is by analyzing the responses.

Using the discrete choice model, QuestionPro offers three design types to conduct conjoint analysis:

- Random: This design displays random samples of the possible attributes. For each respondent, the survey software uniquely combines the characteristics. You can run a conjoint concept simulator to know what the choices that the tool will present when you deploy your survey.

- D-Optimal: A flawlessly designed experiment helps researchers estimate parameters without minimum variance and bias. A D-optimal design runs a few tests to investigate or optimize the subject under study. The algorithm helps to create a design that is optimal for the sample size and tasks per respondent.

- Import design: You can also import designs in SPSS format. For example, QuestionPro lets you import fractional factorial orthogonal designs to make use of in surveys.

Adaptive conjoint analysis (ACA):

Researchers use this type of conjoint analysis often in scenarios where the number of attributes/features exceeds what can be done in a choice-based scenario. ACA is great for product design and product segmentation research but not for determining the ideal price.

For example, the adaptive conjoint analysis is a graded-pair comparison task wherein the survey respondents are asked to assess their relative preferences between a set of attributes, and each pair is then evaluated on a predefined point scale.

QuestionPro uses CBC, or Discrete Choice Conjoint Analysis, a great option if the price is one of the most critical factors for you or your customers. The method’s key benefit is that it provides a picture of the market’s willingness to make tradeoffs between various features. The result is an answer to what constitutes an “ideal” product or service.

It is a statistical analysis plan used in market research to gain a better understanding of how people make complex decisions. The following are some key terms of it:

- Attributes (Features): The product features are evaluated by the analysis. Examples of characteristics of Laptops: Brand, Size, Color, and Battery Life.

- Levels: The specifications of each attribute. Examples of standards for Laptops include Brands: Samsung, Dell, Apple, and Asus.

- Task: The number of times the respondent must make a choice. The example shows the first of the five functions as indicated by “Step 1 of 5.” 5.”

- Concept or Profile : The hypothetical product or offering. This is a set of attributes with different levels that are displayed at each task count. There are usually at least two to choose from.

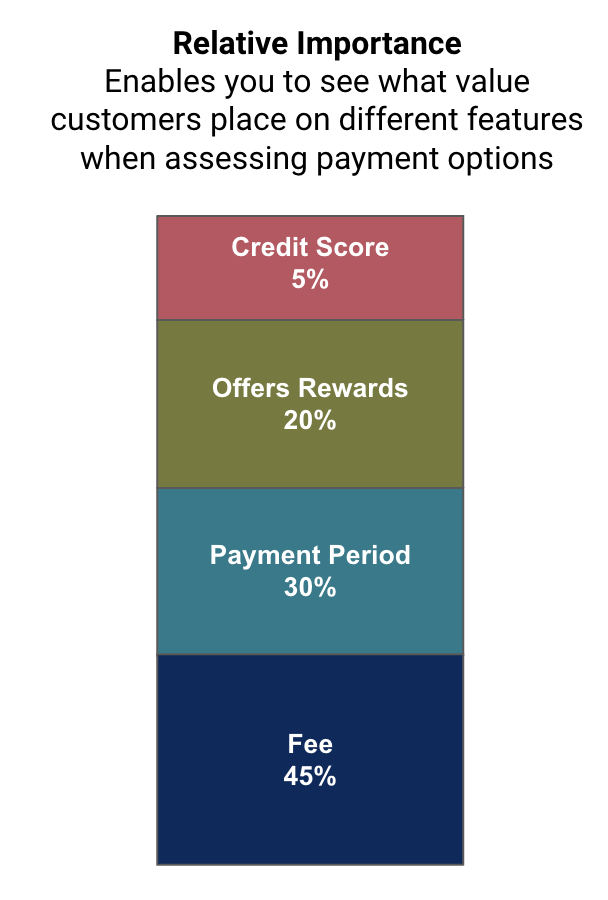

- Relative importance : “attribute importance,” which depicts which of the various attributes of a product/service is more or less important when making a purchasing decision. Example of Laptop Relative Importance: Brand 35%, Price 30%, Size 15%, Battery Life 15%, and Color 5%.

- Part-Worths/Utility values : Part-Worths, or utility values, is how much weight an attribute level carries with a respondent. The individual factors that lead to a product’s overall value to consumers are part-worths. Example part-worths for Laptops Brands: Samsung – 0.11, Dell 0.10, Apple 0.17, and Asus -0.16.

- Profiles : Discover the ultimate product with the highest utility value. At a glance, QuestionPro lets you compare all the possible combinations of product profiles ranked by utility value to build the product or service that the market wants.

- Market share simulation : One of the most unique and fascinating aspects of conjoint analysis is the conjoint simulator. This gives you the ability to “predict” the consumer’s choice for new products and concepts that may not exist. Measure the gain or loss in market share based on changes to existing products in the given market.

- Brand Premium : How much more will help a customer pay for a Samsung versus an LG television? Assigning price as an attribute and tying that to a brand attribute returns a model for a $ per utility distribution. This is leveraged to compute the actual dollar amount relative to any characteristic. When the analysis is done relative to the brand, so you get to put a price on your brand.

- Price elasticity and demand curve : Price elasticity relates to the aggregate demand for a product and the demand curve’s shape. We calculate it by plotting the demand (frequency count/total response) at different price levels. ADD_THIS_TEXT

LEARN ABOUT: Test Market Demand

We’re asked this question a lot. So much so that we’ve coined the term Conjoint O’ Clock. If you find yourself needing to get into your customers’ minds to understand why they buy, ask yourself what you hope to get from your insights. It’s time for Conjoint O’Clock if you are trying to:

- Launch a new product or service in the market.

- Repackage existing products or services to the market.

- Understand your customers and what they value in your products.

- Gain actionable insight to increase your brand’s competitive edge .

- Place a price on your brand versus competing brands.

- Revamp your pricing structure.

LEARN ABOUT: Pricing Research

There are multiple advantages to using conjoint analysis in your surveys:

- It helps researchers estimate the tradeoffs that consumers make on a psychological level when they evaluate numerous attributes simultaneously.

- Researchers can measure consumer preferences at an individual level.

- It gives researchers insights into real or hidden drivers that may not be too apparent.

- Conjoint analysis can study the consumers and attributes deeper and create a needs-based segmentation.

For example, assume a scenario where a product marketer needs to measure individual product features’ impact on the estimated market share or sales revenue.

In this conjoint study example, we’ll assume the product is a mobile phone. The competitors are Apple, Samsung, and Google. The organization needs to understand how different customers value attributes, such as brand, price, screen size, and screen resolution. Armed with this information, they can create their product range to match consumer preferences.

Conjoint analysis assigns values to these product attributes and levels by creating realistic choices and asking people to evaluate them.

LEARN ABOUT: Average Order Value

It enables businesses to mathematically analyze consumer or client behavior and make decisions based on real insights from customer data. This allows them to develop better business strategies that provide a competitive edge. To fulfill customer wishes profitably requires companies to fully understand which aspects of their product and service are most valued.

We use a logic model coupled with a Nelder-Mead Simplex algorithm. It helps to calculate the utility values or part-worths. This algorithm’s benefit allows QuestionPro to offer a cohesive and comprehensive survey experience all within one platform.

We understand that most businesses don’t need the intricate details of our mathematical analysis. However, we want to provide you with the transparency you need to use conjoint survey results. Have confidence in your results by reviewing the algorithm below.

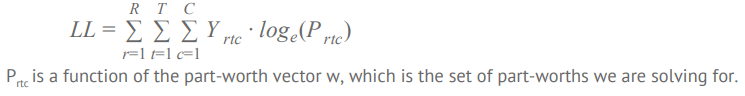

- Let there be R respondents, with individuals r = 1 … R

- Let each respondent see T tasks, with t = 1 … T

- Let each task t have C concepts, with c = 1 … C

- If we have A attributes, a = 1 to A, with each attribute having La levels, l = 1 to La, then the part-worth for a particular attribute/level is w’(a,l). In this exercise, we will be solving this (jagged array) of part worths.

- We can simplify this to a one-dimensional array w(s), where the elements are {w′(1, 1), w′(1, 2)…w′(1, L1), w′(2, 1)…w′(A, LA)} with w having S elements.

- A specific concept x can be shown as a one-dimensional array x(s), where x(s)=1 if the specific attribute is available, and 0 otherwise.

- Let X rtc represent the specific concept of the c th concept in the t th task for the r th respondent. Thus, the experiment design is represented by the four-dimensional matrix X with size RxTxCxS.

- If respondent r chooses concept c in task t then let Y rtc =1; otherwise 0.

- The value Ux of a definite idea is the total of the part-worths for those elements available in the conception, i.e. the scalar product of x and w.

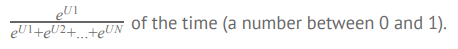

Multinomial logit model

For a simple choice between two concepts, with utilities U1 and U2, the multinomial logit (MNL) model predicts that concept 1 will be chosen.

Modeled Choice Probability

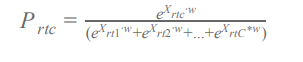

Let the choice probability (using MNL model) of choosing the cth concept in the tth task for the r th respondent be:

Log-Likelihood Measure

Solving for Part-Worths using Maximum Likelihood

We solve for the part-worth vector by finding the vector w that gives the maximum value for LL. Note that we are solving for S variables.

- This is a multi-dimensional, nonlinear continuous maximization research problem , and it is essential to have a standard solver library. We use the Nelder-Mead Simplex Algorithm.

- The Log-Likelihood function should be implemented as a function LL(w, Y, X) and then optimized to find the vector w that gives us a maximum. The responses Y, and the design.

X is specified and constant for a specific development. The starting values for w can be set to the origin 0. The final part-worth values, w, are re-scaled so that the part-worths for any attribute have a mean of zero. This is done by subtracting the mean of the part-worths for all levels of each quality.

Although conjoint analysis requires more involvement in survey design and analysis, the additional planning effort is often worth it. With a few extra steps, you get an authentic look into your most significant customer preferences when choosing a product.

Price, for example, is vital to most folks shopping for a laptop. But how much more is the majority willing to pay for longer battery life for their laptop if it means a heavier and bulkier design? How much less in value is a smaller screen size compared to a slightly larger one? Using conjoint surveys, you’ll discover these details before making a considerable investment in product development.

Conjoint is just a piece of the insights pie. Capture the full story with a cohesive pricing, consumer preference, branding, or go-to-market strategy using other question types and delivery methodologies to stretch the project to its full potential. With QuestionPro, you can build and deliver comprehensive surveys that combine conjoint analysis results with insights from additional questions or custom profiling information included in the survey.

Gather research insights

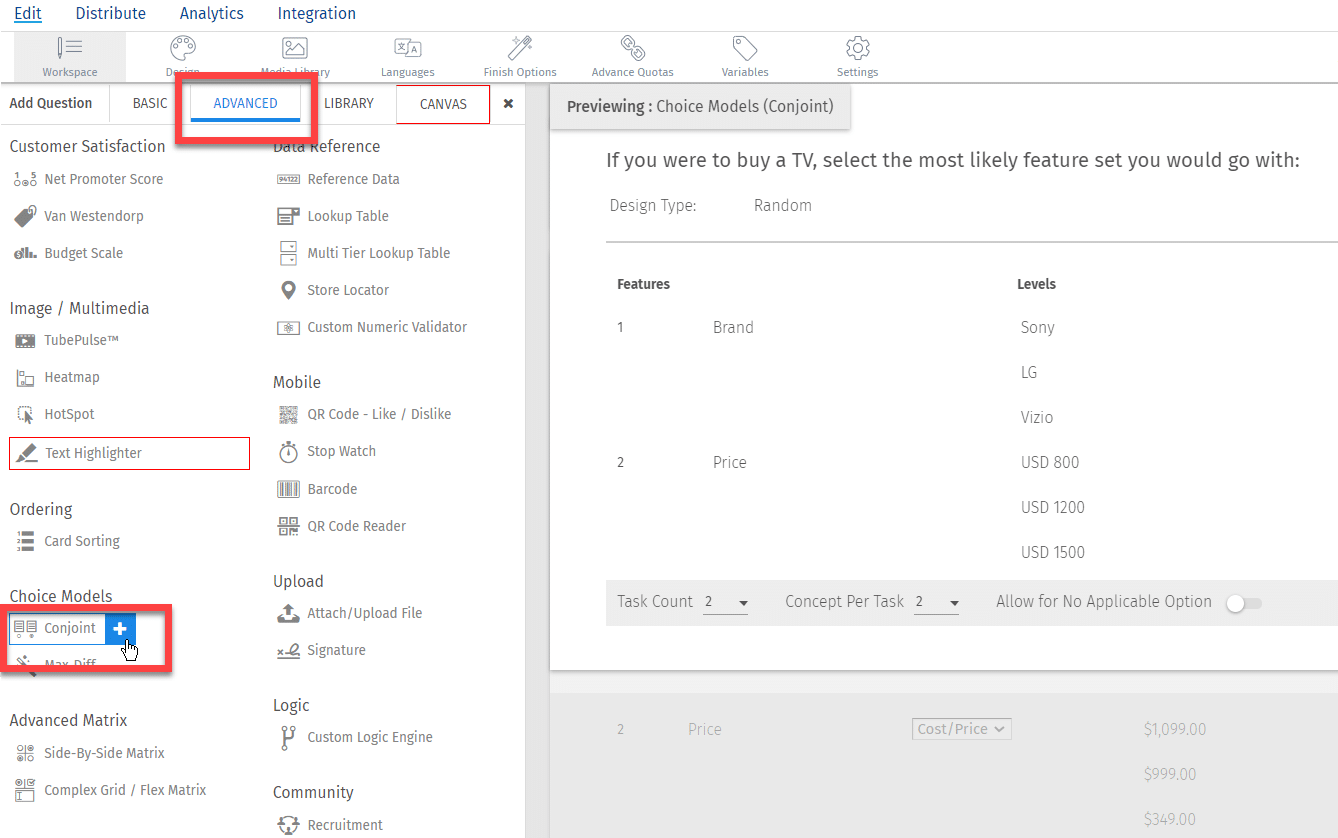

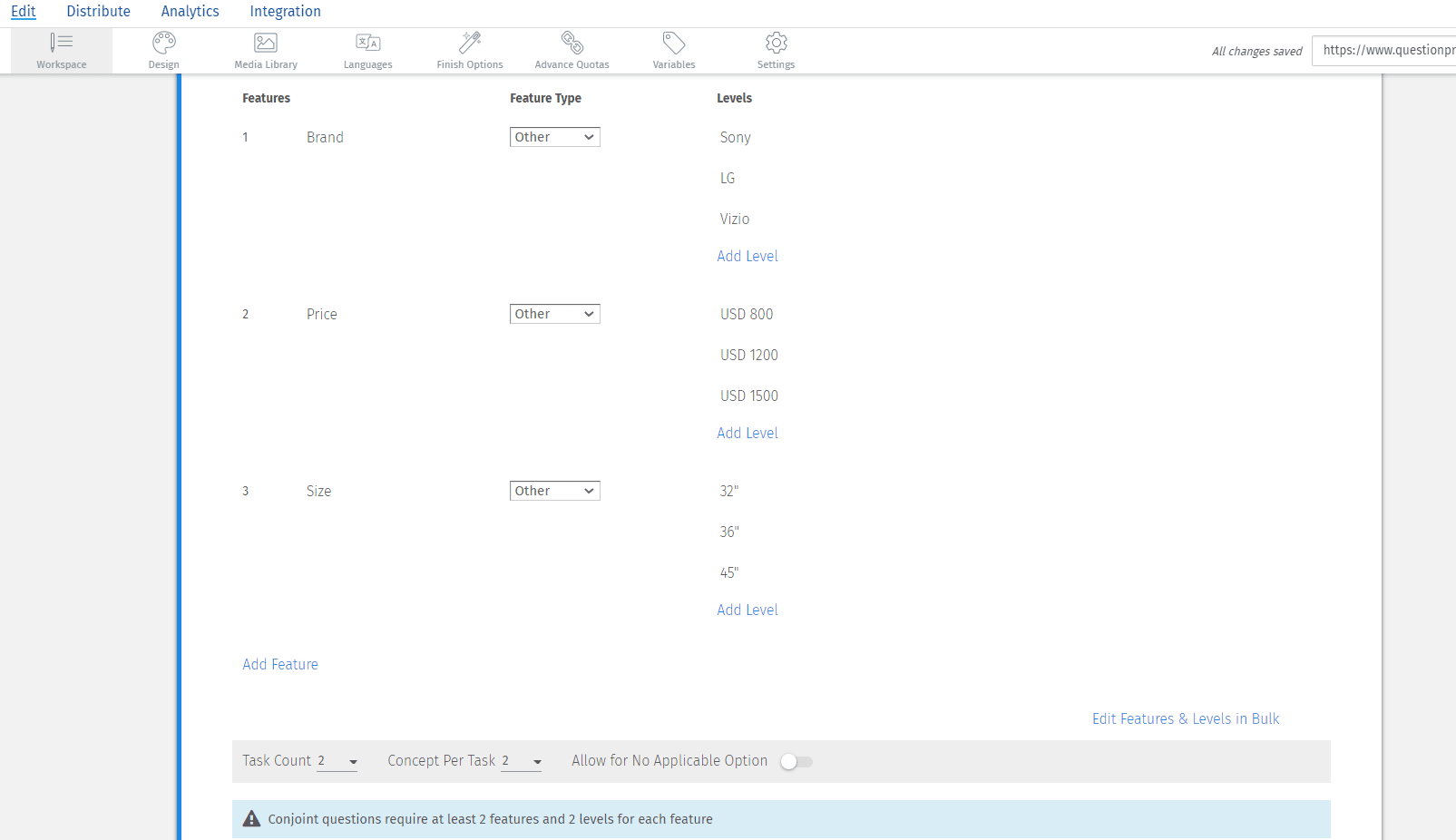

Click on the Add New Question link and select the Conjoint (Discrete Choice) Option from under Advanced Question Types. This will open the wizard-based conjoint question template to create tasks by entering attributes (features) and levels for each of the features.

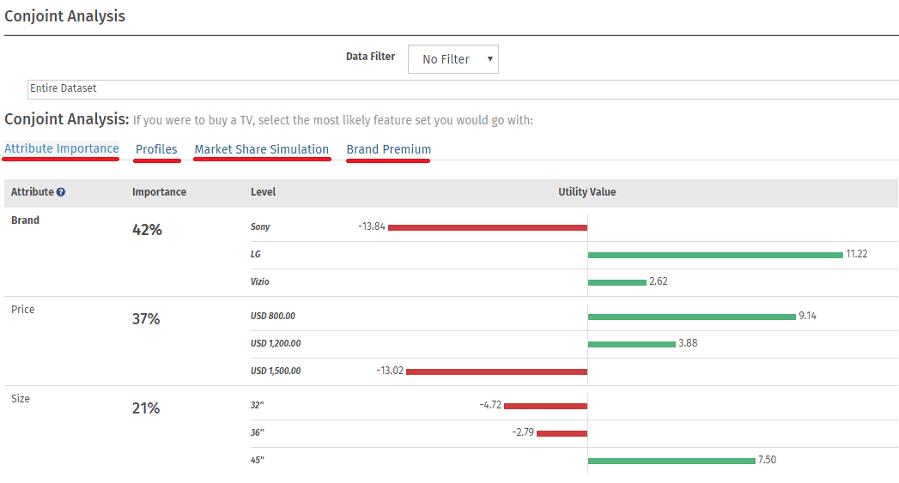

For example, an organization produces televisions and they are a competitor of Samsung, LG, or Vizio. The organization needs to understand how different customers value specific attributes such as the size, brand, and price of a television. Armed with this information, they can create their very own product range and offering that meets a market need and generates revenue.

Step 2: Enter the features and levels.

Enter the features and levels. Set up the task counts and concepts per task and assign feature types: Price, Brand, or Other. Using television brands as an example, consider the following:

- Features for televisions: Price, Size, Brand.

- Price:$800, $1,200, $1,500

- Size: 36”, 45”, 52”

- Brand: Sony, LG, Vizio

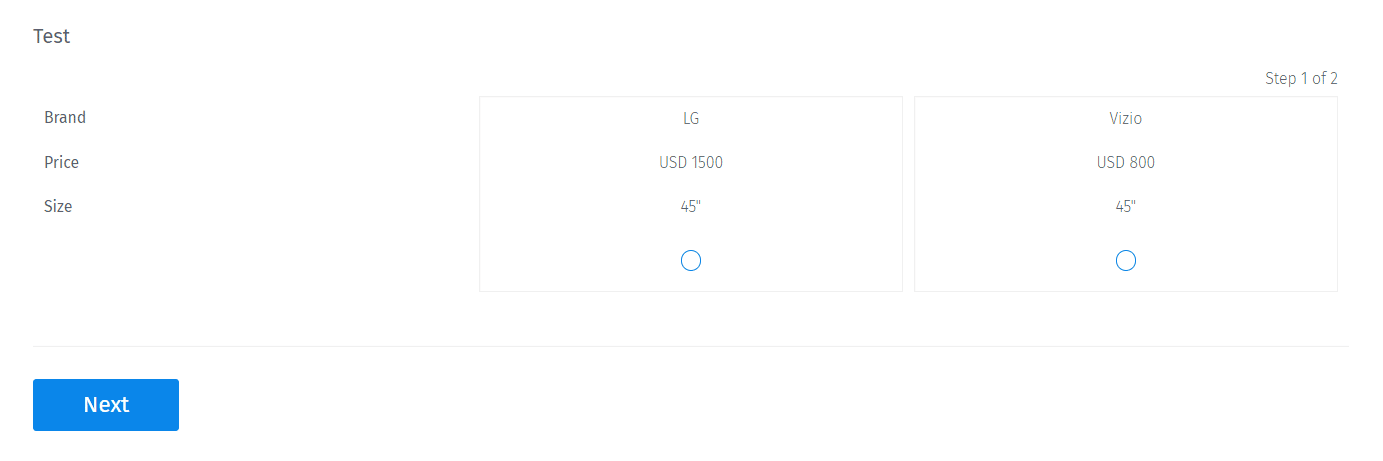

Step 3: Select Design Type to either of the three design types: Random, D-Optimal, and Import.

Step 4: Add additional setting options, including fixed tasks and prohibited concepts.

Step 5: Preview, review text data, and distribute the survey.

In this example, the survey would look like this:

Where can I view Reports for the conjoint questions?

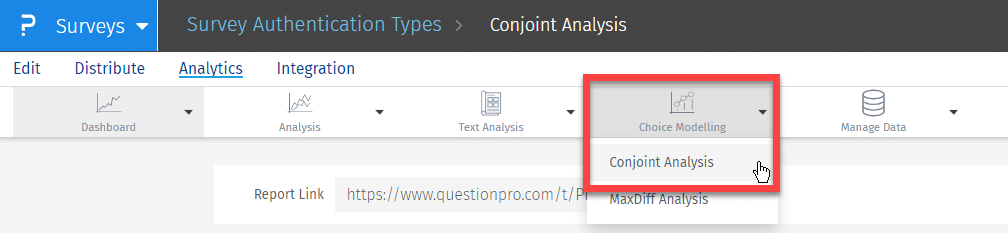

Step 1: Go To Login » Surveys » Analytics » Choice Modelling » Conjoint Analysis

Step 2: Here, you can view the online reports.

Step 3: You can download the data in Excel/CSV or HTML format.

The QuestionPro conjoint analysis offering includes the following tools:

- Conjoint Task Creation Wizard: Wizard-based interface to create Conjoint Tasks based on merely entering features(attributes), like price and levels, like $100 or $200, for each feature.

- Conjoint Design Parameters: Tweak your design by choosing the number of tasks, the number of profiles per task, and the “Not-Applicable” option.

- Utility Calculation: Automatically calculates utilities.

- Relative Importance: Automatically calculates the relative importance of attributes (based on utilities).

- Cross/Segmentation and Filtering: Filter the data based on criteria and then run Relative Importance calculations.

LEARN ABOUT: 12 Best Tools for Researchers

Conjoint analysis is an effective market research technique that helps businesses better understand their customer’s preferences and make educated decisions about product creation, pricing, and marketing strategies.

LEARN ABOUT: Market research vs marketing research

The conjoint analysis provides significant insights into how customers assess different aspects when making purchase decisions by breaking down complex purchasing decisions into smaller components and examining them systematically.

There are several types of conjoint analysis models accessible, each with its own set of advantages and disadvantages. Choosing the best model is determined by the study objectives and the specific characteristics of the market under consideration.

Conjoint analysis is a valuable tool for any company wanting to obtain a better knowledge of its customers and keep ahead of the competition in today’s ever-changing market. If you are thinking about conducting conjoint analysis, QuestionPro is there for you.

QuestionPro provides a comprehensive set of features and tools to assist businesses in conducting conjoint analysis efficiently and effectively, making it a valuable tool for market research professionals. Contact QuestionPro right away!

FREE TRIAL LEARN MORE

MORE LIKE THIS

21 Best Customer Advocacy Software for Customers in 2024

Apr 19, 2024

10 Quantitative Data Analysis Software for Every Data Scientist

Apr 18, 2024

11 Best Enterprise Feedback Management Software in 2024

17 Best Online Reputation Management Software in 2024

Apr 17, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Survey Data Analysis & Reporting

- Conjoint Analysis

Try Qualtrics for free

What is a conjoint analysis conjoint types & when to use them.

11 min read Conjoint analysis is a popular market research approach for measuring the value that consumers place on individual and packages of features of a product.

Conjoint analysis explained

Conjoint analysis can be defined as a popular survey-based statistical technique used in market research. It is the optimal approach for measuring the value that consumers place on features of a product or service. This commonly used approach combines real-life scenarios and statistical techniques with the modeling of actual market decisions.

Product testing and employee benefits packages are examples of where conjoint analysis is commonly used. Conjoint surveys will show respondents a series of packages where feature variables are different to better understand which features drive purchase decisions.

Note: For an in-depth guide to conjoint analysis, download our free eBook: 12 Business Decisions you can Optimize with Conjoint Analysis

Menu-based conjoint analysis

Menu-based conjoint analysis is an analysis technique that is fast gaining momentum in the marketing world. One reason is that menu-based conjoint analysis allows each respondent to package their own product or service.

Conjoint studies can help you determine pricing, product features, product configurations, bundling packages, or all of the above. Conjoint is helpful because it simulates real-world buying situations that ask respondents to trade one option for another.

For example, in a survey, the respondent is shown a list of features with associated prices. The respondent then chooses what they want in their ideal product while keeping price as a factor in their decision. For the person conducting the market research , key information can be gained by analyzing what was selected and what was left out. If feature A for $100 was included in the menu question but feature B for $100 was not, it can be assumed that this respondent prefers feature A over feature B.

The outcome of menu-based conjoint analysis is that we can identify the trade-offs consumers are willing to make. We can discover trends indicating must-have features versus luxury features.

Add in the fact that menu-based conjoint analysis is a more engaging and interactive process for the survey taker, and one can see why menu-based conjoint analysis is becoming an increasingly popular way to evaluate the utility of features.

The advanced functionality of Qualtrics allows for the perfect conjoint survey – built with the exact look and feel needed to provide a reliable, easy to understand experience for the respondent. This means better quality data for you.

There are numerous conjoint methodologies available from Qualtrics.

- Full-Profile Conjoint Analysis

- Choice-Based/Discrete-Choice Conjoint Analysis

- Adaptive Conjoint Analysis

- Max-Diff Conjoint Analysis

To provide a sense of these options, the following discussion provides an overview of conjoint analysis methods.

Two-attribute tradeoff analysis

Perhaps the earliest conjoint data collection method involved presented a series of attribute-by-attribute (two attributes at a time) tradeoff tables where respondents ranked their preferences for the different combinations of the attribute levels. For example, if two attributes each had three levels, the table would have nine cells and the respondents would rank their tradeoff preferences from 1 to 9.

The two-factor-at-a-time approach makes few cognitive demands of the respondent and is simple to follow but it is both time-consuming and tedious. Moreover, respondents often lose their place in the table or develop some stylized pattern just to get the job done. Most importantly, however, the task is unrealistic in that real alternatives do not present themselves for evaluation two attributes at a time.

Full-profile conjoint analysis

Full-profile conjoint analysis takes the approach of displaying a large number of full product descriptions to the respondent. The evaluation of these packages yields large amounts of information for each customer/respondent. Full-profile conjoint analysis has been a popular approach to measure attribute utilities. In the full-profile conjoint task, different product descriptions (or even different actual products) are developed and presented to the respondent for acceptability or preference evaluations.

Each product profile represents a part of a fractional factorial experimental design that evenly matches the occurrence of each attribute with all other attributes. By controlling the attribute pairings, the researcher can correlate attributes with profile preferences and estimate the respondent’s utility for each level of each attribute tested. In the rating task, the respondent gives their preference or likelihood of purchase. While many features and levels may be studied, this type of conjoint is best used where a moderate number of profiles are presented, thereby minimizing respondent fatigue. The advanced functionality of Qualtrics employs experimental designs to reduce the number of evaluation requests within the survey. The output and analysis accumulated from full-profile conjoint surveys is similar to that of other conjoint models.

Adaptive conjoint analysis

Adaptive conjoint analysis varies the choice sets presented to respondents based on their preference. This adaption targets the respondent’s most preferred feature and levels, thereby making the conjoint exercise more efficient, wasting no questions on levels with little or no appeal. Every package shown is more competitive and will yield ‘smarter’ data.

Adaptive conjoint analysis is often more engaging to the survey-taker and thus can produce more relevant data. It reduces the survey length without diminishing the power of the conjoint analysis metrics or simulations. There are multiple ways to adapt the conjoint scenarios to the respondent. Most commonly the design is based on the most important feature levels. As each package is presented for evaluation, the survey accounts for the choice and then makes the next question more efficient. A combination of full profile and feature evaluation methods can be utilized and is referred to as Hybrid Conjoint Analysis.

Choice-based conjoint

The Choice-based conjoint analysis (CBC) (also known as discrete-choice conjoint analysis) is the most common form of conjoint analysis. Choice-based conjoint requires the respondent to choose their most preferred full-profile concept. This choice is made repeatedly from sets of 3–5 full profile concepts.

This choice activity is thought to simulate an actual buying situation, thereby mimicking actual shopping behavior. The importance and preference for the attribute features and levels can be mathematically deduced from the trade-offs made when selecting one (or none) of the available choices. Choice-based conjoint designs are contingent on the number of features and levels. Often, that number is large and an experimental design is implemented to avoid respondent fatigue. Qualtrics provides extreme flexibility in utilizing experimental designs within the conjoint survey.

The output of a Choice-based conjoint analysis provides excellent estimates of the importance of the features, especially in regards to pricing. Results can estimate the value of each level and the combinations that make up optimal products. Simulators report the preference and value of a selected package and the expected choice share (surrogate for market share).

Self-explicated conjoint analysis

Self-explicated conjoint analysis offers a simple but surprisingly robust approach that is easy to implement and does not require the development of full-profile concepts. Self-explicated conjoint analysis is a hybrid approach that focuses on the evaluation of various attributes of a product. This conjoint analysis model asks explicitly about the preference for each feature level rather than the preference for a bundle of features.

Although the approach is different, the outcome is still the same in that it produces high-quality estimates of preference utilities.

- First, like ACA, factors and levels are presented to respondents for elimination if they are not acceptable in products under any condition

- For each feature, the respondent selects the levels they most and least prefer

- Next, the remaining levels of each feature are rated in relation to the most preferred and least preferred levels

- Finally, we measure how important the overall feature is in their preference. The relative importance of the most preferred level of each attribute is measured using a constant sum scale (allocate 100 points between the most desirable levels of each attribute).

- The attribute level desirability scores are then weighted by the attribute importance to provide utility values for each attribute level.

Self-explicated conjoint analysis does not require the statistical analysis or the heuristic logic required in many other conjoint approaches. This approach has been shown to provide results equal or superior to full-profile approaches, and places fewer demands on the respondent. There are some limitations to self-explicated conjoint analysis, including an inability to trade off price with other attribute bundles. In this situation, the respondent always prefers the lowest price, and other conjoint analysis models are more appropriate.

Max-diff conjoint analysis

Max-Diff conjoint analysis presents an assortment of packages to be selected under best/most preferred and worst/least preferred scenarios. Respondents can quickly indicate the best and worst items in a list, but often struggle to decipher their feelings for the ‘middle ground’. Max-Diff is often an easier task to undertake because consumers are well trained at making comparative judgments.

Max-Diff conjoint analysis is an ideal methodology when the decision task is to evaluate product choice. An experimental design is employed to balance and properly represent the sets of items. There are several approaches that can be taken with analyzing Max-Diff studies including: Hierarchical Bayes conjoint modeling to derive utility score estimations, best/worst counting analysis and TURF analysis.

Hierarchical Bayes analysis (HB)

Hierarchical Bayes Analysis (HB) is similarly used to estimate attribute level utilities from choice data. HB is particularly useful in situations where the data collection task is so large that the respondent cannot reasonably provide preference evaluations for all attribute levels. As part of the procedure to estimate attribute level utilities for each individual, hierarchical Bayes focuses individual respondent measurement on highly variable attributes and uses the sample’s attribute level averages when attribute-level variability is smaller. This approach again allows more attributes and levels to be estimated with smaller amounts of data collected from each individual respondent.

Conjoint is a highly effective analysis technique

Conjoint analysis methodology has withstood intense scrutiny from both academics and professional researchers for more than 30 years. It is widely used in consumer products, durable goods, pharmaceutical, transportation, and service industries, and ought to be a staple in your research toolkit.

eBook: 12 Business Decisions You Can Optimize with Conjoint

Related resources

Analysis & Reporting

Margin of error 11 min read

Data saturation in qualitative research 8 min read, thematic analysis 11 min read, behavioral analytics 12 min read, statistical significance calculator: tool & complete guide 18 min read, regression analysis 19 min read, data analysis 31 min read, request demo.

Ready to learn more about Qualtrics?

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

Conjoint Analysis: A Research Method to Study Patients’ Preferences and Personalize Care

Basem al-omari.

1 Department of Epidemiology and Population Health, College of Medicine and Health Sciences, Khalifa University, Abu Dhabi P.O. Box 127788, United Arab Emirates; [email protected] (J.F.); [email protected] (M.E.)

2 KU Research and Data Intelligence Support Center (RDISC) AW 8474000331, Khalifa University of Science and Technology, Abu Dhabi P.O. Box 127788, United Arab Emirates

Joviana Farhat

Mai ershaid, associated data.

Not applicable.

This article aims to describe the conjoint analysis (CA) method and its application in healthcare settings, and to provide researchers with a brief guide to conduct a conjoint study. CA is a method for eliciting patients’ preferences that offers choices similar to those in the real world and allows researchers to quantify these preferences. To identify literature related to conjoint analysis, a comprehensive search of PubMed (MEDLINE), EMBASE, Web of Science, and Google Scholar was conducted without language or date restrictions. To identify the trend of publications and citations in conjoint analysis, an online search of all databases indexed in the Web of Science Core Collection was conducted on the 8th of December 2021 without time restriction. Searching key terms covered a wide range of synonyms related to conjoint analysis. The search field was limited to the title, and no language or date limitations were applied. The number of published documents related to CA was nearly 900 during the year 2021 and the total number of citations for CA documents was approximately 20,000 citations, which certainly shows that the popularity of CA is increasing, especially in the healthcare sciences services discipline, which is in the top five fields publishing CA documents. However, there are some limitations regarding the appropriate sample size, quality assessment tool, and external validity of CA.

1. Introduction

The popularity of conjoint analysis (CA) in health outcomes research has been increasing in recent years [ 1 , 2 ]. Yet, the untraditional concept of this research method is still unclear for many healthcare researchers and clinicians in terms of the design complexity and the absence of confirmed sample size [ 1 , 3 , 4 ]. Throughout clinical practice, healthcare professionals have been driving their efforts towards a patient-oriented profession to improve patient adherence to medications, prognosis, and quality of life [ 5 ]. Over the years, approaches that are referred to as stated and revealed preference methods have been executed to assess patients’ preferences in relation to drug pharmacodynamics, pharmacokinetics, and financial characteristics [ 5 , 6 ]. The stated preferences method relies on what people state while evaluating alternative hypothetical situations (hypothetical decision) [ 7 , 8 ]. Contrarily, the revealed preferences method relies on the observations of the actual choices made by people to measure preferences (actual decision) [ 7 , 8 , 9 ]. Since stated choice does not always reveal the actual preference [ 8 ], behavioral scientists developed alternative techniques that involve studying choice behavior rather than just stated choices [ 10 ]. Therefore, the application of alternative methods in clinical practice is linked to the patients’ own perspective of selecting the best cost-effective treatment, while considering their social and psychological situation instead of relying mostly on disease symptoms [ 6 , 11 , 12 ].

One of the main methods of examining patients’ preferences is the CA, which was developed to scrutinize preferences within the decision-making process [ 4 , 13 ]. CA is a stated preference method that measures how respondents state that they will react in a certain situation [ 14 , 15 ]. Conjoint measurement was first developed in the 1960s by the American mathematical psychologist Duncan Luce and the statistician John Tukey [ 16 ]. In the early 1970s, Green and Rao introduced conjoint measurement to marketing research in order to understand and predict buyer behavior [ 17 ] and thereafter it was most widely used in marketing research [ 18 ]. Although the CA technique was developed in the 1960s, it was not until the 1990s that it was used to elicit patients’ views in the healthcare field [ 19 ]. Since then, its popularity and social impact have been growing gradually through its frequent usage in health services rating based research studies [ 1 , 3 ].

The term CA generally belongs to the description of the variety of quantitative methods used to analyze preferences [ 19 , 20 ]. The denomination “conjoint” refers to the idea that several factors can be “considered jointly” [ 21 ]. Therefore, CA permits people to choose between different hypothetical products or treatments scenarios rather than evaluating their characteristics separately. CA presents people with ideas that closely resemble the decisions made in real life when choosing between alternatives [ 22 ]. For example, if a patient is requested to select the preferred surgical procedure from several alternatives for the treatment of kidney stones, they may consider a specific procedure superior to others. CA elicits patients’ preferences for the selected surgical procedure by evaluating multiple factors associated with each offered procedure. These factors may include adverse events, associated benefits, recovery time, and cost.

When people are making treatment decisions, they base their choice on several characteristics of this treatment. CA assumes that each one of these characteristics has a specific importance to people and they are making trade-offs between these characteristics [ 4 , 23 ]. It is also suggested that people give well-ordered preferences when evaluating options together rather than in isolation [ 17 ]. Therefore, unlike traditional questionnaires, CA poses several hypothetical scenarios and asks patients to rate, rank, or choose their preferred scenario [ 24 ]. Accordingly, the importance of CA is highlighted by being a multivariate technique used specifically to understand how respondents develop preferences for products or services [ 25 ]. In most cases, individuals could make up their minds about a particular treatment characteristic, but they might change their preference when this characteristic is combined to form a treatment scenario. For example, a patient’s decision to choose between different pain-relieving medications could be based on several characteristics of these medications, which may include a pain-relieving effect, frequency of administration, and side effects. This patient may state that she/he would like the medication that provides maximum pain relief, is taken once a day, and has no side effects. Yet, she/he may change their decision when the reality states that the medications with maximum benefits hold risks of side effects and may have to be taken more than once a day. In this situation, the patient must trade off benefits, frequency, and side effects and make some compromises. Hence, CA suggests that presenting patients with several scenarios in a conjoint task could resemble the decision made when selecting medication in real life.

CA methods use three main approaches and tools to elicit well-ordered preferences: ranking, rating, or discrete choices [ 19 ]. When conducting a CA questionnaire, researchers can either utilize a pre-developed questionnaire design or develop their own customized one. For example, Ratcliffe and colleagues developed their conjoint questionnaire using a computer software package to produce a fractional factorial design [ 26 ]. Others built narratives describing different options and asked participants to rate these options [ 27 ] or created hypothetical scenarios and asked participants to choose between them [ 22 ]. In recent years, pre-developed designs such as adaptive conjoint analysis (ACA) or adaptive choice-based conjoint (ACBC) by “Sawtooth software” (a provider of CA software packages) are becoming popular [ 4 , 28 , 29 ]. These designs provide researchers with questionnaire templates and an analysis platform. Consequently, researchers can customize the template to suit their requirements and can build up the questionnaire using the attributes and levels specific to their study. Then, a built-in statistical software such as hierarchical basin (HB) can be used to analyze the data.

This article aims to provide an overview of the CA method and analyze the growth of its application over the past 70 years. It also narratively discusses the literature of the CA method’s process and validity, its use in healthcare settings, and its strengths and limitations.

A comprehensive literature search was conducted. Following Gasparyan and colleagues’ recommendations [ 30 ], PubMed (MEDLINE), EMBASE, Web of Science, and Google Scholar were electronically searched without language or date restrictions. Keywords related to “conjoint analysis”, “discrete choice”, “choice experiment”, “rating conjoint”, and “ranking conjoint” were used to search the literature. Additionally, the lead author has significant experience in the field, and the opinions expressed in this article are also based on personal experience of writing, editing, and commenting on reviewed articles.

The Web of Science Core Collection (WoSCC) was utilized to identify the trend of publications and citations over the past 70 years. WoSCC is a database providing access to billions of cited references dating back to 1900 in the areas of life sciences, social sciences, arts, and humanities [ 31 ], and is an emerging source of citation index [ 32 , 33 , 34 , 35 ]. Bibliometric studies, which are used to systematize and summarize the growing body of publications [ 36 ] and focus on a topic’s popularity at a given point in time [ 37 ], mainly use WoSCC. Therefore, an online search was conducted utilizing all databases indexed in the WoSCC to identify the publications and citations trend in CA. The retrieved database was searched on the 8th of December 2021. The database was accessed through the electronic library portal of Khalifa University, United Arab Emirates. The Boolean search query method was applied. The searching key terms covered a wide range of synonyms which included “conjoint analysis” OR “conjoint measurement” OR “conjoint studies” OR “conjoint choice experiment” OR “discrete choice conjoint experiment” OR “discrete choice experiment” OR “pairwise choices” OR “Best-Worst Scaling” OR “Best Worst Scaling” OR “MaxDiff Scaling” OR “Maximum Difference Scaling” OR “ranking conjoint” OR “rating conjoint” OR “adaptive conjoint analysis” OR “adaptive choice based conjoint” OR “choice based analysis” OR “full profile conjoint” OR “choice based conjoint” OR “choice set” OR “relative preference weight” OR “hypothetical scenario” OR “stated preference”. The search field was limited to the title, and no language or date limitations were applied.

3. Conjoint Analysis Trend over the Past 70 Years

The WoSCC search identified a total of 9614 documents related to CA, which were published between 1950 and the 8th of December 2021. The result of the search demonstrated a significant increase in the production and citation of published papers related to CA over the years to reach nearly 900 documents and 20,000 citations in 2020 and 2021 (see Figure 1 ). The gradual increase in citations and research production indicates the expanded popularity of CA methods. Furthermore, it is an indication of the improvement of the reporting of conjoint experiments that are conducted for commercial purposes. Between 1981 and 1985, it was estimated that approximately 400 commercial conjoint analysis applications were carried out each year [ 38 ]. Yet, only a few documents were published each year during the 1980s. This indicates that the primary purpose of using CA during that period was commercial and academic application and reporting have only become popular during the last 20 years. Furthermore, many advances in CA methods were documented during the 1980s and 1990s [ 39 ] along with observations of greater interest in CA usage throughout the healthcare field during the 1990s [ 19 ].

The trend of CA documents published between 1950 and 2021.

The results of the citations analysis indicated that the business and economics field has the highest number of publications of CA. This is expected, as CA originated from this area of research, more specifically for marketing research. It is not surprising that the healthcare field of research was one of the top five areas publishing papers on CA topics. This indicates the growing interest in the CA method by healthcare researchers (see Table 1 ). In terms of the type of documents, the highest number of published documents were research articles (n = 7047; 73.3%), then meeting abstracts (n = 1624; 16.9%). Furthermore, the highest contributing countries to CA research were the USA (n = 2321; 24.1%), People’s Republic of China (n = 1549; 16.1%), and England (n = 899; 9.4%).

Top 10 research areas publishing CA documents.

Note: The number of published papers in Table 1 adds up to more than the total analyzed documents (n = 9614). The reason for this is that several documents are classified by the databases under several research areas; for example, some documents would be classified under psychology and healthcare sciences services at the same time.

4. The Conjoint Analysis Study Process