Financial development, human capital and its impact on economic growth of emerging countries

Asian Journal of Economics and Banking

ISSN : 2615-9821

Article publication date: 14 December 2020

Issue publication date: 27 April 2021

This paper aims to investigate the critical aspect of financial development, human capital and their interactive term on economic growth from the perspective of emerging economies.

Design/methodology/approach

Data set ranged from 2002 to 2017 of 83 emerging countries used in this research and collected from world development indicators of the World Bank. The two-step system generalized method of moments is used to conduct this research within the endogenous growth model while controlling time and country-specific effects.

The findings of the study indicate that financial development has a positive and significant effect on economic growth. In emerging countries, human capital also has a positive impact on economic growth. Financial development and human capital interactively affect economic growth for emerging economies positively and significantly.

Research limitations/implications

The data set is limited to 83 emerging countries of the world. The time period for the study is 2002 to 2017.

Originality/value

This research contributes to the existing literature on human capital, financial development and economic growth. Limited research has been conducted on the impact of financial development and human capital on economic growth.

- Financial development

- Economic growth

- Emerging countries

- Human capital

Sarwar, A. , Khan, M.A. , Sarwar, Z. and Khan, W. (2021), "Financial development, human capital and its impact on economic growth of emerging countries", Asian Journal of Economics and Banking , Vol. 5 No. 1, pp. 86-100. https://doi.org/10.1108/AJEB-06-2020-0015

Emerald Publishing Limited

Copyright © 2020, Aaqib Sarwar, Muhammad Asif Khan, Zahid Sarwar and Wajid Khan.

Published in Asian Journal of Economics and Banking . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence maybe seen at http://creativecommons.org/licences/by/4.0/legalcode

Introduction

World Bank Report (2012) , the financial sector is a legal system, regulatory institutes, instruments and markets that enable transactions to be carried out by credit extension. The financial sector’s development aims to overcome the costs involved in the financial system. This process of reducing the information costs acquisition, contract enforcement and transactions led to intermediaries’ appearance, financial contracts and markets. Moreover, the report suggested that these financial institution systems perform and play a more important role in developing economic growth. Well-developed financial institutions in a country can perform better over a long time as they tend to grow faster due to the causal effect of financial development’s contribution to growth.

According to Levine (1997) , a well-developed financial institution is a key to the economic growth of the country as it acts to reduce the risk/uncertainty through well-organized risk management processes, effective sharing and utilization of saving by lowering the cost of transaction and access to financial institutions, monitoring transactions through proper regulatory bodies to promoting efficient market and comfort in trade by exchanging of goods, services, knowledge, technology and innovation. According to Ibrahim (2018) , the recent constant growth rates of world development indicators (WDIs) practiced in different regions partially stimulate financial deepening, with the financial sector’s development playing an important role in growth. In general, the role of finance in facilitating investment productivity and growth models of economics has been expanded to provide a theoretical basis for examining the relationship between financial sector development and economic growth. The growth in the economy can be facilitated via the financial system by increasing human and physical capital by assigning money to the utmost fruitful activities and sinking the cost of the resources used in saving and investment ( Montiel, 2011 ).

Besides financial development, the role of human capital is also essential in the growth process. Some countries have less stock of human capital, while some have a high supply of human capital. So due to this, the impact of financial development may not be the same for all countries. Barro and Sala-i-Martin (1999) stated that if capital is generally defined as human capital, it relaxes the limitations of declining returns and contributing to per capita long-term growth even in the lack of exogenous technological advancements. Barro and Lee (1996) investigated the human capital by using education and life expectancy proxy on economic growth and found that it affects economic growth. Blundell et al. (1999) revealed that the growth rate highly depends on human capital accumulation and innovation as the stock of human capital and education level influences labor productivity.

Countries with high-quality human capital stocks can benefit more from the financial sector, as many scientists, researchers, doctors, accountants and financial analysts in these countries can make efficient and effective choices among different alternates. They are more efficient and effective in using opportunities and resources and can also innovate better to support the financial sector growth. These are all essential to promote growth in the economy. Many studies have been researched the impact of financial development on economic growth ( Acaravci et al. , 2009 ; Eita and Jordaan, 2010 ; Levine, 2005 ; Rousseau, 2003 ). Many previous studies claimed that financial development significantly impacts economic growth in developing economies ( Acaravci et al. , 2009 ; Khan and Senhadji, 2003 ; Khan et al. , 2020 ; Rousseau and Sylla, 2005 ).

But in contrast, some studies also claim that government intervention and restriction in financial sectors negatively affect as restriction causes the problem to the economic development and adverse this relationship to real growth ( Boyreau-Debray, 2003 ; Fry, 1980 ; Lucas, 1988 ). On the other hand, many studies have also researched the effect of human capital on economic growth ( Barro and Lee, 1996 ; Blundell et al. , 1999 ; Lucas, 1988 ). They ignore the human capital and financial development interactive term on economic growth. There is less study on the human capital and financial development interactive term on economic growth. Kendall (2012) researched both human capital and financial development on economic growth in India’s sub-national economy. Hakeem (2010) and Ibrahim (2018) conducted the same research in Sub-Saharan Africa. Munir and Arshad (2018) mentioned two foremost difficulties that most developing economies face: achieving high growth in the economy and keeping economic development at the highest rate.

The primary aim of this study is to evaluate the interaction role of financial development and human capital on economic growth in the context of emerging countries. This study extends the existing literature in the following ways: first, there are limited studies on the simultaneous impact of financial development and human capital on economic growth. This study evaluates the interactive effect of financial development and human capital on economic growth in developing economies. Second, this study investigates the marginal impact of human capital and financial development on economic growth in developing countries. Finally, this study investigates the econometric relationship between financial development, human capital and economic growth. This study is important for policymakers and researchers in modeling the stability of the human capital and financial sector development in emerging economies in the future.

Literature review

This portion outlines the theoretical implications and related research in developed and developing economies. It evaluates a specific research section on the relationship between financial development, human capital and economic growth. Such understanding is critical and essential for the developing economies to carry out an empirical study on the relationship between financial development, human capital and economic growth.

Theoretical background

The basic principle of the endogenous growth theory is that capital stock increases (all these physical and human resources) create beneficial externalities that raise productivity. If the spillover effects are high, these will deter declining returns on investment. The consequences for growth are similar to those observed when separately examining technical development and human capital, but assuming that there are diminishing returns to human capital in the production of final output and education. Fischer (1991) stated that the interaction effect of financial development and human capital on economic growth fabricates certain appealing repercussions for the transitional dynamics. However, Young (1995) observed that although long-term growth is induced by independent-scale changes in the product quality, and therefore does not show nonlinearities, human capital is the long-term impact of growth rate on the economy. Recognizing that the economy’s growth rate is largely dictated by the potential to deliver human capital, human capital accumulation determines investment opportunities.

A deep-rooted financial system is an essential part of human resource development ( Diamond and Dybvig, 1983 ). Although recognized in the established theoretical literature, the relationship between financial growth and human capital remains less discussed at the empirical level. The literature shows that people with better education are less risk-averse, have high knowledge and are high savers. Improving education rates like adult education, thus, offer new opportunities for empowerment for people. Training also enables individuals to switch from informal to formal sector opportunities allowing them to access formal financial services. Development of the financial sector through credit channels often provides for the accumulation of human capital and influences economic growth. The consequence, then, is both ways.

Financial growth and good human capital endowment will promote greater use of the borrowed funds than individual savers. This may also increase management performance by fostering competition by successfully taking over or attempting to take over. Demirgüç-Kunt and Maksimovic (2005) argue that financial development and human capital allow specific entrepreneurs to engage in creative activity that impacted growth through productivity enhancement and viewed the financial and human capital environment as an important role in mitigating the effect of external shocks on domestic economies. They conclude that financial structures without the requisite institutional growth, human growth, educational achievement have led rather than mitigation to poor handling or even amplification of the danger. Such relationships provide the theoretical basis for the present study.

Empirical literature

Human capital has been articulated differently in different studies. They include human capital as health, education, Knowledge, migration, training and other factors investment in labor that can enhance labor productivity to contribute to the gross domestic product (GDP) of the country, as discussed in the previous literature. In the past two decades of twenty centuries, human capital has been dominated in growth literature with the great appearance of endogenous growth theory presented by Lucas (1988) and Romer (1986) as they contend in oppose to previous neo-classical growth theory. They said that if capital is efficiently allocated to the human capital, the return can be getting back in the shape of a stable return to scale despite diminishing and the low return to scale. Romer (1986) specified a long-term economic growth model in which human education capital includes an input to the production, which increases marginal production and growth over the long run. He further reasons that a country with a large size of human capital may grow much quicker than a country with a small human capital size.

Munir and Arshad (2018) practice the endogenous growth model to find the impact of stock of human capital and real physical capital to investigate the long-term and short-term effects on Pakistan’s economic growth. The research findings follow the endogenous growth model, suggesting that GDP per labor increases with accumulation factors of human capital and real physical capital as accumulation factors increase employment rate level, per capita income, labor productivity and economic growth sources. Rosendo Silva et al. (2018) investigated human capital on economic growth. Results show that better health also has a strong significant and positive impact on economic growth because the healthy worker can improve labor productivity more. Li and Liang (2010) practice human capital in East Asia, and results show that both stocks of health and education have a positive correlation to growth. Still, the stock of health capital is highly significant to growth than the stock of education capital. Neeliah and Seetanah (2016) study the positive relationship between human capital and economic growth in both the short run and long run. The study stated that there is a bi-directional association between human capital and growth. The main conclusion suggested that any shock to the development of human capital can destroy growth, so policy-making must pay attention to human capital.

Knowles et al. (2002) practice a neo-classical growth model approach, which included female and male human capital education separately. The research results show that female human capital is more important than male human capital in boosting labor productivity. Similarly, Sehrawat and Giri (2017) also examine female human capital and male human capital separately on India’s economic growth. The statistical results disclose that in both the short and long run, female human capital is statistically significant and positive to the development and increases labor productivity. However, male human capital is positive but unexpectedly insignificant to the growth. The study noted in long-run causal relationship of growth variable with physical capital, male and female human capital.

The early study of King and Levine (1993) presented a cross-country analysis based on Schumpeter’s view that the financial institution system can encourage growth in the economy. The level of financial development with various measures predicts strong relation with real GDP per capita. Levine (2005) evaluated and encountered the linkage between the system of financial operation and the economy’s growth. Evidence suggested that both the financial market and intermediary institutions are important for growth in a financial system. Moreover, the study proposed that well developed financial system comfort and illuminate constraint of external financing that firms may face in a way to economic growth.

Nyasha and Odhiambo (2015) conducted a review paper to highlight the empirical and theoretical relationship of bank-based and market-based financial development on growth in the economy of both developed and developing countries. They concluded that casualty relationship direction highly depends on the countries’ various specific characteristics, methodology, data sets and different factors used by the study. According to Jalles (2016) , there is a growing interest in the financial institution’s importance and are quality in the development process. Corruption is the main obstacle in economic development and lower corruption or better high-quality establishment enhancing financial development, and thus enhancing growth. Phiri (2015) claimed that there is an asymmetric relationship between financial development and growth. Banking activity proved a key factor for growth, while growth in the economy was confirmed as a lashing force behind the stock market development. Shahid et al. (2015) also specified that financial development has a significant and positive connection to economic growth.

The effects of financial development and growth in the SAARC nations have been studied by Sehrawat and Giri (2016) and the long-term connection of economic and economic growth has been explored. Sehrawat and Giri (2015) , long-term relationships in India’s economic and economic development, are also found. The impact of financial development in emerging economies and using the endogenous growth model is further studied by Masoud and Hardaker (2012) . It is investigated that the development of financial development is essential to growth and that the connection between stock market development and financial growth is stable in the long term.

There is growing concern about the relationship with economic growth in the human capital and financial development interactive term. The human capital and financial development growth in Sub-Saharan Africa has been examined by Ibrahim (2018) in the latest research. He said human capital and financial development boost economic growth in the short and long-term. The combined effect of human capital and financial development has suggested that financial development primarily stimulates growth with strong human capital quality. Better accumulation of human capital leads to innovation and adaptation of new technologies to promote global economic growth. Hakeem (2010) , the stock of physical capital and human capital is compulsory for growth. Due to financial under-development, the study did not find any strong effect of economic development on growth. However, the combined impact of human capital and financial development is key to accelerate the growth and nonappearance of anyone who can affect and reduce development speed in the Sub-Saharan Africa region. Evans et al. (2002) also claim positive and significant interaction of human capital and financial development toward the economy’s growth and ignorance can mislead as both are of the same importance to growth.

Is there any combined impact of human capital and financial development on economic growth in emerging countries?

Methodology

Data and preliminary findings.

This study constructed a set of panel data of 83 emerging economies from 2002–2017. The selected time interval and the number of countries were only based on the availability of data. Data related to all the variables used in this research was collected from WDIs, listed on the World Bank website. The study used two financial development indicators; domestic credit provided by the financial sector (DCfs) and domestic credit to private sectors (DCps), and two human capital indicators; secondary school enrollment (SSE) and primary pupil-teacher ratio (PPTR). DCps refers to financial resources provided by financial corporations to the private sector as a percentage of GDP such as via loans, non-equity securities purchases, commercial credits and other receivable accounts. While, DCfs includes all gross credit to different sectors as a percentage of GDP, except for net central government credit. SSE ratio is the ratio of total enrollment, irrespective of age, to the age group population in a percentage that corresponds officially to the educational level shown. SSE concludes the basic education that started at the primary level and is intended to lay the basis for permanent learning and human development. At the same time, the PPTR is the average number of pupils per primary school teacher in a percentage. In this research, we use real GDP per capita as an indicator of economic growth taken as the constant prices of the year 2010 in the US dollar amount in line with standard literature.

This research uses five control variables, namely, general government expenditure, inflation, labor force, trade openness and fixed capital formation. These variables are developed based on the growth theory of neo-classical. Government general expenditure measures the size of government and is projected to influence economic growth negatively. Inflation relates to the consumer price index, representing an annual shift in the cost for the average user of services and products. Inflation is used as the macroeconomic proxy of (in)stability and is expected to influence the economy’s growth negatively. Trade openness relates to the number of products and services as a percentage share of GDP exports and imports and is anticipated to impact economic growth positively. The labor force’s participation rate is the proportion (percentage) of the population 15 to 64 years of age who are economically active and is expected to positively influence the economy’s growth. While the gross capital formation relates to the cost of additions to the economy’s fixed assets plus net inventory changes as a proportion of GDP and is anticipated to have a positive effect on the economy’s development.

Specification of the model

In this study, to assess the impact of human capital and financial development on economic growth in emerging nations, we use Ibrahim (2018) ’s the endogenous model. This study uses SSE and PPTR variables as the stock of human capital and uses DCps and DCfs variables as financial development indicators: Δ l n y i t = δ + ρ l n y i t - 1 + α 2 l i t + α 3 p k i t + α 4 h k i t + α 5 f d i t + α 6 ( h k i t × f d i t ) + α 7 q i t + τ i + ϑ t + ε i t

y it = Real GDP per capita in the country i at time t

l it = Labor force in the country i at time t

pk it = Stock of physical capital in the country i at time t

hk it = Stock of human capital in the country i at time t

fd it = Financial development indicators in the country i at time t

q it = Government expenditure, inflation, trade openness in the country i at time t

τ i = Time effect in the country i

ϑ t = Country fixed effect at time t

ε it = Error term in the country i at time t .

The direct impact of human capital and financial development is examined based on α 4 and α 5, while the indirect effect of an interactive term is evaluated based on α 6 . As we rely on prior studies, we expect the direct impact of human capital and financial development α 4 , α 5 > 0. However, the PPTR is expected to negatively influence growth as learning and teaching must be efficient and effective if the ratio is low. On the other hand, the impact of an interactive term of both human capital and financial development is expected α 6 > 0.

The research used the two-step system generalized method of moments (GMM), the dynamic panel estimate, to determine the impact of human capital and financial development on economic growth in emerging nations. Meanwhile, Hansen (1982) presented the two-step system GMM; the system GMM has become a valuable estimation procedure in many fields of finance and applied economics. It can be viewed as a generalization of various other estimates, i.e. maximum likelihood and ordinary least square. System GMM is much more versatile. It uses assumptions about the extra moment conditions by using the lagged value of an independent and dependent variable as valid instruments in the model and levels of lagged for endogenous variables in the model. It is, therefore, less probable to be incorrectly specified. The system GMM is a suitable method to make unbiased and consistent estimates based on the system regression in variations with the regression level. Blundell and Bond (1998) , system GMM which considering the valid tools on even back of extremely persistent variables, is preferable to the GMM of first difference. However, the effectiveness and consistency of the system GMM technique depend on the validity of test tools as examined by the serial AR1 or AR2 correlation test and by the Hansen exogeneity test for overstated limitations.

Descriptive analysis

The total observations for real GDP are 1,328, with the mean value of the 3,443.437and having the standard deviation value of 2,952.97. The total observations for the government’s general expenditures are 1,278, with a mean value of 15.224 and having a standard deviation of 6.532. The inflation rate has a mean value of 6.28 with a total observation of 1,292 and has a standard deviation value of 6.47. The total number of observations for trade openness is 1,306, with a mean value of 79.11 and a standard deviation of 32.111. The total number of observations of the labor force is 1,328, with its mean value is 66.144 and its standard deviation value is 10.502. The number of observations for the variable of physical capital is 1,276, with a mean value of 24.075, while the standard deviation of 8.778.

The SSE and PPTR are the representative variables of the human capital. The SSE’s mean value is 67.57, with a total observation of 1,007 and has a standard deviation of 26.191. While on the other hand, the PPTR has a mean value of 30.292, with several observations of 1,024 and having a standard deviation of 12.69.DCps and DCfs are the representative variables of financial development. The mean value of the DCfs is 45.87, which indicates that financial sectors provide 45.87% of the GDP as a domestic credit. While on the other hand, the mean value of the DCps is 35.799, which indicates that almost 35.80% of credit provided by financial sectors in the form of domestic credit is allocated to private sectors. The standard deviation values of the DCps and DCfs are 27.582 and 38.301 correspondingly ( Table 1 ).

The correlation analysis of the variables allows the researchers to identify the correlation between the different variables that potentially affect the investigation’s independent variable contribution. However, the correlation analysis results shown in Table 2 , no variable presents a larger correlation that may affect the analysis results of this study.

Table 2 shows a significant and positive correlation between real GDP and SSE, the relationship between the real GDP and the PPTR as expected, which is negative and significant according to the suggested hypothesis. The correlation between real GDP and the two variables, i.e. DCps and DCfs, is positive and statistically significant, consistent with the hypothesis proposed.

The relationship between a dependent variable and control variables in this research is also according to the study expectations. It is positive and significant that real GDP is linked to per capita and capital formation, trade openness and government expenditure. There are adverse and significant inter-relation of labor and real GDP per capita while also negative, statistically significant interrelationship of inflation and real GDP. The correlation matrix generally shows a stable and not so preeminent correlation between all of these variables that may impact the analysis of this research.

We examine human capital and financial development and their interactive term through a two-step system GMM in panel data estimation in 83 emerging countries. In the model, we use a lag value of real GDP, financial development indicators, human capital indicators, inflation, physical capital, labor force, general government expenditure and trade openness variables consistent with standard literature. We include country and time effect in our estimation to deal with time associated shocks and heterogeneity of the country in growth. We estimate four different model combinations by introducing the different indicators of human capital and financial development in the model, and the results are presented in Table 3 .

First, begin with discussing estimated models’ fitness, we get p -values (0.0000) of Wald chi 2 for all models, indicating that models are well specified and jointly significant. The Hansen test for over-identifying restrictions shows that the used instruments are valid, and no hypotheses can be rejected. The AR 2 examination of autocorrelation reveals that there is no serial correlation among the variables.

The coefficient of the lag.1real GDP growth per capita is negative and in line with standard growth literature, implying a conditional convergence ( Barro, 1991 ; Ibrahim, 2018 ; Mankiw et al. , 1992 ). The results indicate that emerging countries are converging to their stable per capita growth, and over time, they will ultimately converge to a common growth rate in the economy. The convergence rate provided by the lagged coefficients improves in all models as we track other independent variables indicating that the region’s growth perspective effectively supports the hypothesis.

In model 1, the coefficient value of the human capital variable SSE is 0.0205 (positive) and significant to growth, indicating that human capital increases economic growth. This inline with previous studies like ( Barro, 2001 ; Bosworth and Collins, 2003 ; Hakeem, 2010 ; Mankiw et al. , 1992 ). The coefficient value of financial development variable DCfs is 0.0395 (positive) and significant to growth, indicating that financial capital increases economic growth. This is in line with previous studies( Ibrahim, 2018 ; Levine, 2005 ; Schumpeter, 1911 ). The interaction term results indicate that the combined effect of SSE and DCfs increases the growth by 0.0140%, which shows that the interaction term of human capital and financial development has a positive and significant influence on the economic growth at a 1% significance level. These are similar to previous studies ( Ibrahim, 2018 ; Evans et al. , 2002 ; Hakeem, 2010 ).

The Model 1 control variables’ findings indicate that the workforce is positive but insignificant for economic growth. Fixed capital formation influences financial development significantly and positively. While trade openness, inflation and overall government expenditure impact development are negatively and statistically significant.

In model 2, the coefficient value of the human capital variable SSE is 0.0127, positive and significant to growth, indicating that human capital increases economic growth. The coefficient value of financial development variable DCps is 0.0227, positive and significant to growth, indicating that financial development increases economic growth. The interaction term results also suggest that the combined effect of SSE and DCps increases the growth by 0.0793%, which shows that the interaction term of human capital and financial development has a positive and significant influence on the economic growth at a 1% significance level.

The Model 2 control variables’ findings also indicate that fixed capital formation has a positive and significant impact on financial development. The labor force has a negative but insignificant influence on growth. While trade openness, inflation and general government expenditure have a negative and significant influence on growth.

In model 3, the analysis was done to illuster the interaction effect of human capital (primary pupil-teacher ratio) and financial development (domestic credit) on the economic development in emerging countries. In model 3, the coefficient value of the human capital variable (primary pupil-teacher ratio) is −0.1114 (negative) and significant to growth, indicating that economic growth increases with decreasing primary pupil-teacher ratio as expected. Here human capital also has a positive and considerable influence on growth. The coefficient value of the financial development variable domestic credit is 0.1153 (positive) and significant to growth, indicating that financial development increases economic growth. The interaction term value suggests that the combined effect of the primary pupil-teacher ratio and domestic credit increases the growth by 0.0330%, which implies that the combined impact of human capital and financial development has a positive and significant influence on economic growth. The above analysis interprets that solely human capital and financial development enhance economic growth, but their combined effect boosts the economic growth of developing economies. The findings for Model 3 control variables show that the labor force, fixed capital formation and trade openness positively and significantly impact the growth. However, inflation and government general expenditure have a negative and significant impact on economic growth.

In model 4, the human capital variable PPTR coefficient is −0.0245 (negative) as expected, which indicates an increase of economic growth with the decrease of PPTR. In this respect, human capital influences growth positively and significantly. The financial development’s variable DCps coefficient value is 0.0470 and positive for growth, which indicates that financial development is increasing economic growth. The interaction term’s findings show that the combined impact of PPTR and DCps improves growth to 0.0101%, demonstrating that human capital and financial development have a positive and significant effect on the growth.

The findings of the control variables of Model 4 also indicate that the labor force, fixed capital formation and trade openness have a positive and significant impact on growth while inflation and government general expenditure have a negative and significant impact on economic growth.

Conclusion and recommendations

This study investigates the key aspects of human capital, financial development and interactive term in emerging countries. This research focuses on all emerging countries from which 83 economies have been selected based on data availability. This study uses panel data analysis for 2002 and 2017 and collected secondary data from WDIs. In this research, we use SSE and PPTR as human capital proxy and DCfs, as well as DCps variables as financial development indicators. The study uses growth rates of real GDP per capita of US dollars 2010’s constant prices to measure economic growth. It uses descriptive analysis, correlation analysis and a two-step system GMM method.

The main findings of this study are that human capital positively affects economic growth. This inline with previous studies like ( Barro, 2001 ; Bosworth and Collins, 2003 ; Hakeem, 2010 ; Mankiw et al. , 1992 ). SSE is positive to economic growth in model combinations 1 and 2. While PPTR is negative as expected to economic growth in model combinations 3 and 4. These results indicate that human capital increases economic growth in emerging countries. Besides, financial development has a statistically significant and positive impact on growth. This corresponds to earlier studies ( Ibrahim, 2018 ; Levine, 2005 ; Schumpeter, 1911 ). As DCfs is positive to economic growth in model combination 1 and 3. DCps is also positive to economic growth in model combination 2 and 4. These results indicate that financial development increases economic growth in emerging countries.

This study also explored the interactive term of human capital and financial development. The results indicate a positive and significant impact of the interaction term on economic growth in all model combinations. This is in line with previous studies ( Ibrahim, 2018 ; Evans et al. , 2002 ; Hakeem, 2010 ). In a nutshell, human capital and financial development are twins needed to accelerate growth in emerging countries. Hence, neglect of either could affect the pace of development in the states.

So, emerging countries should invest in human capital and focus on financial development. The results of this research show that human capital and financial development increase economic growth in emerging economies. They should increase access to education by increasing the number of schools across different regions and ensure the supply of highly qualified teachers. They should focus on the financial system and their functions to get the benefits from it. Policymakers in emerging countries should concentrate on this while making and implementing the country’s economic policies.

Limitation and future study of research

The data set is limited to 83 emerging countries of the world. The time period for the study is 2002 to 2017. Future studies can be done by increasing the time period of the study or to a specific region of the world. More variables can be added for more deep studies, and comparative analysis can be done among different countries.

Descriptive statistics of variables

Correlation matrix

Shows significance level at 1%,

Acaravci , S.K. , Ozturk , I. and Acaravci , A. ( 2009 ), “ Financial development and economic growth: literature survey and empirical evidence from sub-Saharan African countries ”, South African Journal of Economic and Management Sciences , Vol. 12 No. 1 , pp. 11 - 27 .

Barro , R.J. ( 1991 ), “ Economic growth in a cross-section of countries ”, The Quarterly Journal of Economics , Vol. 106 No. 2 , pp. 407 - 443 .

Barro , R.J. ( 2001 ), “ Human capital and growth ”, American Economic Review , Vol. 91 No. 2 , pp. 12 - 17 .

Barro , R.J. and Lee , J.W. ( 1996 ), “ International measures of schooling years and schooling quality ”, The American Economic Review , Vol. 86 No. 2 , pp. 218 - 223 .

Barro , R.J. and Sala-I-Martin , X. ( 1999 ), Economic Growth , The MIT Press , Cambridge .

Blundell , R. and Bond , S. ( 1998 ), “ Initial conditions and moment restrictions in dynamic panel data models ”, Journal of Econometrics , Vol. 87 No. 1 , pp. 115 - 143 .

Blundell , R. , Dearden , L. , Meghir , C. and Sianesi , B. ( 1999 ), “ Human capital investment: the returns from education and training to the individual, the firm and the economy ”, Fiscal Studies , Vol. 20 No. 1 , pp. 1 - 23 .

Bosworth , B. and Collins , S.M. ( 2003 ), “ The empirics of growth: an update ”, Brookings Papers on Economic Activity , Vol. 2003 No. 2 , pp. 113 - 206 .

Boyreau-Debray , G. ( 2003 ), Financial Intermediation and Growth: Chinese Style , The World Bank .

Demirgüç-Kunt , A. and Maksimovic , V. ( 2005 ), Financial Constraints, Uses of Funds, and Firm Growth: An International Comparison , The World Bank .

Diamond , D.W. and Dybvig , P.H. ( 1983 ), “ Bank runs, deposit insurance, and liquidity ”, Journal of Political Economy , Vol. 91 No. 3 , pp. 401 - 419 .

Eita , J.H. and Jordaan , A.C. ( 2010 ), “ A causality analysis between financial development and economic growth for Botswana ”, African Finance Journal , Vol. 12 No. 1 , pp. 72 - 89 .

Evans , D.A. , Green , C.J. and Murinde , V. ( 2002 ), “ Human capital and financial development in economic growth: new evidence using the translog production function ”, International Journal of Finance and Economics , Vol. 7 No. 2 , pp. 123 - 140 .

Fischer , S. ( 1991 ), “ Growth, macroeconomics, and development ”, NBER Macroeconomics Annual , Vol. 6 , pp. 329 - 364 .

Fry , M.J. ( 1980 ), “ Saving, investment, growth and the cost of financial repression ”, World Development , Vol. 8 No. 4 , pp. 317 - 327 .

Hakeem , M. ( 2010 ), “ Banking development, human capital and economic growth in sub-Saharan africa (SSA) ”, Journal of Economic Studies , Vol. 37 No. 5 , pp. 557 - 577 .

Hansen , L.P. ( 1982 ), “ Large sample properties of generalized method of moments estimators ”, Econometrica , Vol. 50 No. 4 , pp. 1029 - 1054 .

Ibrahim , M. ( 2018 ), “ Interactive effects of human capital in finance–economic growth nexus in sub-Saharan africa ”, Journal of Economic Studies , Vol. 45 No. 6 , pp. 1192 - 1210 .

Jalles , J.T. ( 2016 ), “ A new theory of innovation and growth: the role of banking intermediation and corruption ”, Studies in Economics and Finance , Vol. 33 No. 4 , pp. 488 - 500 .

Kendall , J. ( 2012 ), “ Local financial development and growth ”, Journal of Banking and Finance , Vol. 36 No. 5 , pp. 1548 - 1562 .

Khan , M.S. and Senhadji , A.S. ( 2003 ), “ Financial development and economic growth: a review and new evidence ”, Journal of African Economies , Vol. 12 No. 2 , pp. 89 - 110 .

Khan , M.A. , Siddique , A. and Sarwar , Z. ( 2020 ), “ Determinants of non-performing loans in the banking sector in developing state ”, Asian Journal of Accounting Research , Vol. 5 No. 1 .

King , R.G. and Levine , R. ( 1993 ), “ Finance and growth: Schumpeter might be right ”, The Quarterly Journal of Economics , Vol. 108 No. 3 , pp. 717 - 737 .

Knowles , S. , Lorgelly , P.K. and Owen , P.D. ( 2002 ), “ Are educational gender gaps a brake on economic development? Some cross-country empirical evidence ”, Oxford Economic Papers , Vol. 54 No. 1 , pp. 118 - 149 .

Levine , R. ( 1997 ), “ Financial development and economic growth: views and agenda ”, Journal of Economic Literature , Vol. 35 No. 2 , pp. 688 - 726 .

Levine , R. ( 2005 ), “ Finance and growth: theory and evidence ”, Handbook of Economic Growth , Vol. 1 , pp. 865 - 934 .

Li , H. and Liang , H. ( 2010 ), “ Health, education, and economic growth in east asia ”, Journal of Chinese Economic and Foreign Trade Studies , Vol. 3 No. 2 , pp. 110 - 131 .

Lucas , R.E. Jr ( 1988 ), “ On the mechanics of economic development ”, Journal of Monetary Economics , Vol. 22 No. 1 , pp. 3 - 42 .

Mankiw , N.G. , Romer , D. and Weil , D.N. ( 1992 ), “ A contribution to the empirics of economic growth ”, The Quarterly Journal of Economics , Vol. 107 No. 2 , pp. 407 - 437 .

Masoud , N. and Hardaker , G. ( 2012 ), “ The impact of financial development on economic growth: empirical analysis of emerging market countries ”, Studies in Economics and Finance , Vol. 29 No. 3 , pp. 148 - 173 .

Montiel , P.J. ( 2011 ), Macroeconomics in Emerging Markets , Cambridge University Press .

Munir , K. and Arshad , S. ( 2018 ), “ Factor accumulation and economic growth in Pakistan: incorporating human capital ”, International Journal of Social Economics , Vol. 45 No. 3 , pp. 480 - 491 .

Neeliah , H. and Seetanah , B. ( 2016 ), “ Does human capital contribute to economic growth in Mauritius? ”, European Journal of Training and Development , Vol. 40 No. 4 , pp. 248 - 261 .

Nyasha , S. and Odhiambo , N.M. ( 2015 ), “ Economic growth and market-based financial systems: a review ”, Studies in Economics and Finance , Vol. 32 No. 2 , pp. 235 - 255 .

Phiri , A. ( 2015 ), “ Asymmetric cointegration and causality effects between financial development and economic growth in South Africa ”, Studies in Economics and Finance , Vol. 32 No. 4 , pp. 464 - 484 .

Romer , P.M. ( 1986 ), “ Increasing returns and long-run growth ”, Journal of Political Economy , Vol. 94 No. 5 , pp. 1002 - 1037 .

Rosendo Silva , F. , Simões , M. and Sousa Andrade , J. ( 2018 ), “ Health investments and economic growth: a quantile regression approach ”, International Journal of Development Issues , Vol. 17 No. 2 , pp. 220 - 245 .

Rousseau , P.L. ( 2003 ), “ Historical perspectives on financial development and economic growth ”, Review , Vol. 85 No. 4 , pp. 81 - 106 .

Rousseau , P.L. and Sylla , R. ( 2005 ), “ Emerging financial markets and early US growth ”, Explorations in Economic History , Vol. 42 No. 1 , pp. 1 - 26 .

Schumpeter , J. ( 1911 ), Theory of Economic Development , Harvard University Press , Cambridge, MA .

Sehrawat , M. and Giri , A.K. ( 2015 ), “ Financial development and economic growth: empirical evidence from India ”, Studies in Economics and Finance , Vol. 32 No. 3 , pp. 340 - 356 .

Sehrawat , M. and Giri , A.K. ( 2016 ), “ The impact of financial development on economic growth: evidence from SAARC countries ”, International Journal of Emerging Markets , Vol. 11 No. 4 , pp. 569 - 583 .

Sehrawat , M. and Giri , A.K. ( 2017 ), “ Does female human capital contribute to economic growth in India? An empirical investigation ”, International Journal of Social Economics , Vol. 44 No. 11 , pp. 1506 - 1521 .

Shahid , A. , Saeed , H. and Tirmizi , S.M.A. ( 2015 ), “ Economic development and banking sector growth in Pakistan ”, Journal of Sustainable Finance and Investment , Vol. 5 No. 3 , pp. 121 - 135 .

World Bank ( 2012 ), The World Bank Annual Report 2012 , The World Bank .

Young , A. ( 1995 ), “ The tyranny of numbers: confronting the statistical realities of the East Asian growth experience ”, The Quarterly Journal of Economics , Vol. 110 No. 3 , pp. 641 - 680 .

Further reading

Goldsmith , R.W. ( 1969 ), Financial Structure and Development , Yale Uni. Press , New Haven, CT .

McKinnon , R.I. ( 1973 ), Money and Capital in Economic Development , Brookings Institute Press , Washington, DC .

Shaw , E. ( 1969 ), Financial Deepening in Economic Development , Oxford University Press , New York, NY .

Valickova , P. , Havranek , T. and Horvath , R. ( 2015 ), “ Financial development and economic growth: a meta-analysis ”, Journal of Economic Surveys , Vol. 29 No. 3 , pp. 506 - 526 .

World Bank ( 2012 ), Global Financial Development Report 2013: Rethinking the Role of theStateinFinance , WorldBankPublications . https://openknowledge.worldbank.org/handle/10986/11848 .

Corresponding author

Related articles, we’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- PMC10602251

The impact of financial development on income inequality and poverty

Ayşe aylin bayar.

Department of Management Engineering, Economics Division, Faculty of Management, Istanbul Technical University, Istanbul, Türkiye

Associated Data

The data underlying the results presented in the study are available from Global Financial Development database ( https://www.worldbank.org/en/publication/gfdr/data/global-financial-development-database ), World Development Indicator Database, and Turkish Statistical Institute ( https://data.tuik.gov.tr/Kategori/GetKategori?p=gelir-yasam-tuketim-ve-yoksulluk-107&dil=1 )

The Turkish economy has undergone a structural transformation with impressive economic performance during 2002–2018 and then a slowdown. The implementation of policies on the financial markets results in a significant capital inflow, which leads to an increase in the volume of domestic credit. Despite improvements in Türkiye, income inequality and poverty are still relatively high. While much of the literature shows that financial development accelerates growth, there is no consensus on its clear impact on poverty and inequality. While some studies stress that financial development improves inequality and combats poverty by increasing the ability of advantage of new investment opportunities, and by improving the allocation of capital, others point out that the beneficial impact of financial development depends on whether the overall population or the upper-income groups benefit or not. Therefore, this paper aims to empirically investigate the impact of financial development on inequalities and poverty during the 2002–2017 period when Türkiye relatively has been prosperous. According to simultaneous equation regression findings, the widening of the financial sector leads to more equal income distribution and poverty alleviation.

Introduction

Several studies have investigated the causal relationship between financial development, (which is the extension of the banking and financial services sector), income inequality, and poverty for a long time and attempted to provide clear evidence on the effects of financial development on poverty and income inequality [ 1 – 10 ]. While there has been a great deal of literature on this issue, there is no consensus on the proposition that financial development is a remedy for damaged income distribution. It has been proven by some studies that a well-organized financial sector is the only way to make a positive contribution to macroeconomic indicators. Financial development can be used as a tool to reduce inequality and combat poverty in developing countries that are experiencing high inequality and poverty rates. That is why the impact of financial development is widely examined for developing countries in the literature.

There has been a stunning economic performance in the Turkish economy during 2002 and 2018 and there is a slowdown afterwards. Improvements have been observed in the main macroeconomic indicators of Türkiye. Despite witnessing these improvements, she is still experiencing some distributional problems. She has previously documented the worst income distribution and poverty among OECD countries [ 11 – 13 ], which makes the distributional problems especially critical. The main factors behind this poor distributional outcome are a persistently high inflation record, ongoing high-interest rate policies, and political and economic instability. After the 1990s, the Turkish economy has undergone structural and social transformation due to trade and financial liberalization. In that regard, macroeconomic policies have some distributional effects on income inequality and poverty. The complexity and persistence of dealing with inequality and poverty have led to ongoing debates among researchers about how to overcome these problems.

For Türkiye, unfortunately, there is a lack of data about inequality and poverty, and therefore, limited studies can examine this issue empirically before 2001. One of the well-known Gürsel et al. (2000) [ 12 ] studies argued that income inequality slightly increased from 1987 to 1994 in Türkiye. Some other studies focus on inequality and poverty in Türkiye before the year 2000 [ 14 – 16 ]. Although income distribution has improved after 2001, income inequality and poverty are still high. Therefore, researchers who focus on the period after 2001 analyze inequality and poverty by examining the distributional problems using different approaches. According to the researchers, financial development and the improvement of access to financial institutions play a crucial role in reducing inequality and fighting poverty. The objective of this paper is to examine the impact of financial development on inequality and poverty in the Turkish economy between 2002 and 2017. This linkage is extensively revealed through the use of a variety of econometric analyses.

The paper is organized as follows. Following section provides a summary of the studies on financial development, inequality, and poverty. The economic and financial indicators of the Turkish economy are given in Third Section. The data, empirical analysis, and findings are presented in Section 4, and Section 5. The conclusion is given in Section 6.

Literature on financial development, inequality, and poverty

In particular, for developing countries, reducing poverty and improving income inequality have attracted a lot of attention from researchers. Macroeconomic policies to overcome such obstacles are one of the most debated questions in the literature. Thus, the impact of financial development is studied to tackle the problems of poverty and inequality.

The connection between financial development, inequality, and poverty holds special interest. The studies indicate that financial development, directly and indirectly, impacts income distribution and poverty [ 2 , 7 – 10 ]. The findings of these studies demonstrate that financial development accelerates economic growth indirectly by mobilizing savings, diversifying risks, and improving entrepreneurs’ positions. It contributes to economic growth by fostering physical capital accumulation [ 1 , 3 – 6 , 9 ]. Furthermore, it is believed that economic growth, inequality, and poverty are strongly connected [ 17 – 20 ]. By increasing the average incomes of the poorest 20% of society proportionately, growth causes a change in poverty. It is revealed that policies that promote growth bring about benefits that are mostly in favor of the poor, which is known as pro-poor growth. If policies are pro-poor, their impact on reducing poverty will be much more significant. For instance, Appiah-Otoo and Song (2021) [ 21 ] question whether fintech and its sub-measures reduce poverty in China or not and their findings show that fintech complements economic growth and financial development in the country and therefore, helps to reduce poverty.

One of the most recent papers by de Hann et al. (2022) [ 22 ], studies the both indirect and direct link between financial development and poverty by utilizing a large panel of 84 countries over the period 1975 to 2014. The findings suggest that financial development does not directly reduce the poverty gap (or headcount poverty), but there are indirect effects, in which lower income inequality reduces poverty, but there is no effect on economic growth and financial instability. According to the results, financial development indirectly impacts poverty adversely as it leads to an increase in income inequality. These findings exhibit that the overall effect of financial development on poverty results positively or negatively, depending on which indirect effect, i.e. that of income inequality or growth, is stronger. Moreover, Demir et al. (2020) [ 23 ] develop a model for the interrelationship between Fintech, financial inclusion, and income inequality for a panel of 140 countries and suggest Fintech has an impact on inequality directly and indirectly through financial inclusion and the effects of financial inclusion on inequality are primarily associated with higher-income countries.

Additionally, Chisadza and Biyase (2023) [ 24 ] demonstrate the impact of financial development on income inequality for a global sample of countries (advanced, emerging, and developing) between 1980 and 2019. The findings reveal a positive impact of financial development on inequality for emerging and least-developed countries, but they can not find a significant conclusion for advanced countries. They further disaggregate the financial development into financial institutions and financial markets and they demonstrate that while the development of the banking sector leads to an improvement in income inequality in emerging and least developed countries, the development of the stock market adversely affects inequality in the least developed countries.

Other studies question whether financial development is beneficial to everyone in society or not. Some have concluded that developing countries’ financial development improves inequality and reduces poverty [ 7 , 25 – 27 ]. This is due to the development of financial markets that have a more positive impact on developing countries than on developed countries, as freer markets strengthen lending capacity. Therefore, it facilitates the poor in investing in both physical capital and human capital. By widening financial opportunities, the poor can invest and equalize income distribution [ 28 , 29 ]. A similar conclusion is obtained for Australia in the work of Shi et al. (2020) [ 30 ] where the impact of financial deepening on income inequality is revealed. According to the obtained findings, financial development indicators have a significant positive impact on income inequality.

Despite studies emphasizing a positive connection between financial development, inequality, and poverty, several other studies point out the opposite. These studies indicate that the poor lack sufficient access to credit during the development of the financial sector due to their position. According to empirical studies from developing countries and cross-country cases, those who are better off in society are more likely to benefit from new financial opportunities in proportion. This widens the gap in the income distribution of society and worsens the poverty rate [ 31 , 32 ]. For instance, a recent paper, that examines emerging countries, suggests that even though financial development improves economic growth, this improvement does not necessarily benefit the ones on low-income groups, and also financial development has no significant role in poverty alleviation in these countries [ 33 ]. Besides, Sethi et al. (2021) [ 34 ], assert financial development and globalization deteriorates income inequality in India. Moreover, some studies also indicate that high-income groups and people with political connections primarily benefit from financial development which can lead to a volatile macroeconomic environment. As a result, it worsens inequality and raises the poverty rate [ 35 – 37 ].

A recent study proves that as a developing country, China is not passing the turning point of the inverted U-shaped curve yet, and therefore, the empirical findings show that financial deepening worsens inequality [ 38 ]. In addition, a similar approach is applied in some studies which predict an inverted U-shaped relationship between financial development and inequality [ 39 , 40 ]. The idea of such a relationship is based on Kuznet’s (1955) [ 41 ] work on economic development and inequality. According to him, at the early stage of development, while the importance of the agricultural sector in the economy declines, income inequality worsens and later slows down with the development of the industry and improves with the increased percentage of the service sector. Therefore, the linkage between development and inequality is inverted U-shaped. As a result, studies that hypothesize a reverse U-shaped association between financial development and inequality are an extension of Kuznet’s idea. It is mentioned that financial development results in economic development and this has a significant impact on the distribution of income.

Extensive research suggests different empirical findings for countries. Cross-country cases, panel data, and country-specific studies have been employed to observe the linkage between financial development, inequality, and poverty [ 7 , 25 , 33 – 46 ]. For the Turkish economy, there exist limited empirical studies, which mainly suggest a positive effect of financial development on inequality and poverty [ 47 – 55 ]. For instance, while Kar et al. (2011) [ 50 ] empirically examine the relationship between financial development and poverty alleviation in Türkiye and conclude that financial development has a limited effect on poverty reduction through economic growth, Koçak and Uzay (2019) [ 51 ] emphasize the impact of financial development on inequality and suggest that it has a significant impact in the long term. Furthermore, Destek et al. (2020) [ 52 ] discuss the impact of financial development on inequality, whether it has a U-shaped shape or not. Their findings suggest that in the early stages of economic development, inequality is negatively impacted by financial development. The availability of credit for lower-income groups later on improves income inequality. Another recent study examines the impact of financial inclusion on poverty in Türkiye and points out that an increase in financial inclusion leads to a decrease in poverty [ 53 ].

Besides, similar to the other studies, Cetin et al. ( 2021 ) [ 54 ] conclude that financial development has a positive impact on income inequality for Türkiye, as well. A close idea and methodology with this paper is employed by Calis and Gökçeli (2022) [ 55 ], and they develop a VAR and Granger causality model to analyze the impact of financial inclusion on income inequality in Türkiye and like the other studies in the literature, they find that financial inclusion cause an improvement in the inequality and there is a unidirectional causality is found from financial inclusion to income inequality.

Economic and financial indicators for Türkiye

During the 1990s, the Turkish economy experienced underwhelming macroeconomic and financial indicators. During that time, she faced unexpected fluctuations, political instability, a large budget burden, a trade deficit, high interest rates, inflation, and unemployment rates. At the end of this period, she was hit by a severe economic crisis in 2001. With the agreement of the International Monetary Fund, she began to implement solid macroeconomic policies, which included fiscal and monetary policies. Her economic performance after 2001 was spectacular, and the reform package had a positive impact on the overall economy. Most macroeconomic indicators improved and rates declined. After 2001, there was a period of high economic growth until the global economic crisis that resulted from the American subprime mortgage crisis in 2008. Even though there has been improvement in macroeconomic indicators, as a small economy, she was still vulnerable to international fluctuations, which is why the global crisis has hit negatively. To examine more closely, a summary of Turkish macroeconomic and financial conditions is discussed in this section.

Table 1 includes the data that is derived from the Ministry of Development, Economic and Social Indicators, The Central Bank of the Turkish Republic, and the Turkish Statistical Institute. The table indicates that there has been economic growth (7 percent) in the Turkish economy between 2001 and 2008 which was a steady recovery from negative GDP growth in 2001. This growth was followed by a contraction in 2008 when a global financial crisis negatively affected the economy. Following this period, there has been another improvement, and the growth rate has been around 6% and 4% from 2010 to 2013, and from 2013 to 2017, respectively. Indeed, these figures reveal that, as a small country, the Turkish economy is affected by the global era and fluctuations. Until 2000, inflation and interest rates were high, and they reached their peak in 2002. Until the period of 2013–2017, these rates declined to 7.6% and 11.1%, respectively, but then went up to 8.8% and 10.2% in the 2013–2017 period. Easy access to international financing and easy utilization of financial resources have resulted in relatively low rates during this period.

* Until 2008, the Nominal wage index was taken from Economic and Social Indicators, and then in recent years, the nominal wage index for the manufacturing sector became available from TurkStat.

The implementation of a sound fiscal policy by policymakers resulted in a decline in the public sector borrowing requirement (PSBR) as a percentage of total income until 2008. Similarly, to other macroeconomic indicators, it increased after the global financial crisis in 2008 reached 4%, and decreased to an average of 0.5% between 2013 and 2017. Structural reforms and privatizations have caused a decline in the PSBR. As a result, the public’s role in the economy changed while the private sector began to gain importance. Economic growth was sustained with the increase in productivity in the private sector.

The nominal exchange rate and real effective rate have the same trends: there was a decline during the 2001–2008 period, but a rise in the year 2008. In 2008, the nominal exchange rate reached its lowest level of 1.299 TL, and then it attempted to increase to control the current account deficit. Table 1 shows that the nominal exchange rate and the real effective rate increased between 2013 and 2017. There is no doubt that all macroeconomic indicators have improved after 2001, except for 2008, until 2013. However, the positive atmosphere seems to have deteriorated from 2013 to 2017.

Private bank credits, total deposits, and money supply as a share of total income can be used to measure financial development or depth. These figures take into account the growth of the financial services industry. The financial sector’s development allows savings to be channeled into efficient investment opportunities, resulting in increased capital accumulation and economic growth. Table 1 data shows that all financial indicators are experiencing a parallel trend of increasing over the entire period. To create strong macroeconomic indicators in the economy, money supply, bank deposits, and domestic credits are employed to mitigate the deterioration effects of the crisis in 2001. Between 2002 and 2017, financial depth was achieved by increasing the average share of money supply, domestic credit, and bank deposits.

Table 1 summarizes that the Turkish economy experienced distinct conditions in several sub-periods after 2001. During the first period, from 2002 to 2007, when the reforms were implemented, overall macroeconomic and financial indicators improved. With the boom of the international era, the inflow of foreign capital to Türkiye has accelerated, and sound macroeconomic policies have created opportunities for foreigners to invest. Depending on the positive developments in the international financial markets, foreign funds were used to finance economic growth in that sense. This situation has resulted in a growth process that is driven by domestic demand, with the domestic private sector obtaining long-term funds from abroad at a low cost. With the restructuring of the banking system and the independence of the Central Bank, the burden and constraints on foreign investment have been reduced and foreign capital investment was boosted by new legal regulations.

However, these optimistic conditions were reversed by the subprime mortgage crisis of 2008. Therefore, the period of 2008–2009 is given separately in the table. Even though this crisis appears to be a financial one, at first, the financial institution issues deteriorated economic activities and investments, leading to a global recession. The impact of this financial crisis on the economic indicators could be captured by the period between 2010 and 2013. As a result of financial crisis there occurred a decline in capital inflows from foreign investors, and the Turkish government has tried to sustain economic growth with a domestic credit boom and an increase in public expenditure during this period. At the same time, the shares of financial indicators in GDP reveal that financial development and financial depth can be achieved over the same period. And then after 2013, Türkiye implemented several recovery policies to overcome the problems in the economy and therefore, the period of 2010 and 2013 is given separately in Table 1 . As observed from the table, even though there is a slowdown in economic growth, financial indicators such as private bank credits and total TL deposits are improved.

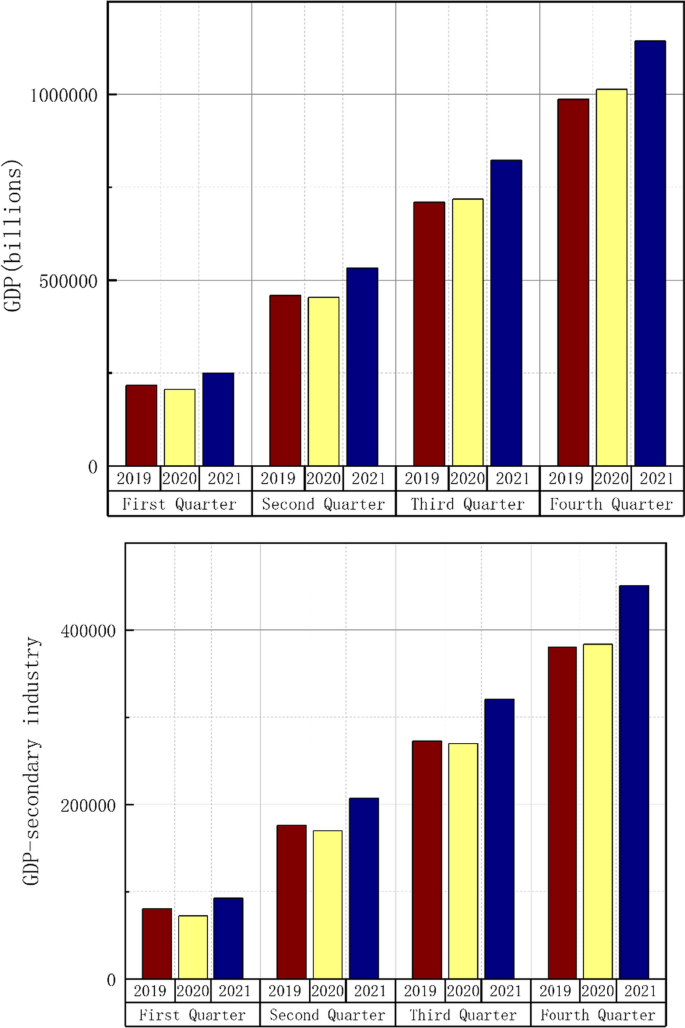

Although macroeconomic and financial indicators indicate these improvements, the Turkish economy exhibits interesting distributional results that are represented by the Gini coefficient, a measure of inequality; and the headcount ratio, a measure of poverty in Fig 1 . In this figure is for 2002–2006 the data is derived from Household Budget Surveys, and for 2006–2017, it is derived from the Survey of Income and Living Conditions. It should be noted that section 4 provides detailed information about the Gini coefficient and Headcount index, which are the most well-known measures for income inequality and poverty.

It should be noted that section 4 provides detailed information about the Gini coefficient and Headcount index, which are the most well-known measures for income inequality and poverty.

Fig 1 indicates that both measures followed two different trends after 2002. First, the rapid decline between 2002 and 2007 indicates an improvement in income inequality. In 2002, it was 0.45 and then decreased to 0.41 in 2007. After 2007, it fluctuated and eventually formed a smooth line between 2009 and 2013. However, when analyzed more closely, despite the improvement in income distribution, there is not a significant difference between statistics. This indicates that the distributional policies were not enough to overcome unequal distribution. When poverty rates are examined, it seems that the Turkish economy is slightly better in terms of poverty rates than income inequality. The number of people who remain below the predetermined poverty line has a declining trend and continues to fall below 13%. In 2002, it was 17.7%, but it dropped almost 5 points throughout the investigated years.

The Gini coefficients and poverty rates in OECD countries are depicted in Figs Figs2 2 and and3 3 [ 56 ]. As seen in Fig 2 , Türkiye, which is highlighted in the red column, remains one of the worst countries for inequality and poverty in OECD countries over this period. Chile, Costa Rica, and South Africa were the only countries where her income distribution was better than in 2015.

The poverty rates exhibit the same pattern. The headcount index represented in the Fig 3 , is the ratio of the number of individuals whose income falls below the poverty line and is taken as half the median household income of the total population. The Turkish economy has a headcount index that is higher than most of the OECD countries. Poverty in Türkiye was around 17% in 2015. The vulnerability of the economy is represented by the poor who live under a pre-determined poverty line. Therefore, the policy’s primary objective is to alleviate poverty, or at least reduce it. As seen from the Fig 3 , although the Turkish poverty rate is not the highest in OECD countries, it is still prominent as it doesn’t decline as desired.

Data and methodology

The main purpose of this paper is to explore the effects of financial development on inequality and poverty. To achieve this aim, the data taken from the World Development Indicators and Global Financial Development databases of the year 2019 are analyzed. A simultaneous equations model is utilized to reveal the connection between financial development, poverty, and inequality. Since there is correlation and causality among these variables, ordinary least squares estimates are not employed for satisfying consistent and non-biased estimates of model parameters as in the simultaneous equations, a dependent variable in one equation is an explanatory variable in another. This model can handle a potential endogeneity problem. Below is a representation of the poverty equation, growth equation, and inequality equation. In these models, control variables are added to variables such as trade openness, government spending, inflation, and population growth.

where P t represents the headcount index, GDP t is the growth rate of total income, FD t is the proxy variable for financial development, T t is trade openness, I t is the inflation rate, G t is government spending, and GINI t is income inequality.

According to the studies, the ratio of private credit to total income (GDP), the ratio of bank liquid reserves to bank assets, and the ratio of domestic credit of the banking sector to total income are generally used as proxies for financial development. In the literature, for developing countries, the ratio of private credit to total income is commonly chosen. That is why in this paper, this variable is employed, as well. And, to find out accurate results, it is assumed that financial development is the only common explanatory variable in all equations. The literature indicates that financial development is likely to have n simultaneous effects on the three endogenous variables [ 42 ].

As previously mentioned, there are a number of common measures for poverty and inequality in the literature. The most well-known ones are utilized for empirical analysis as indicators of poverty and inequality. The common poverty measurements are the measures of the Foster-Greer-Thorbecke (FGT) class of poverty, namely the headcount ratio (P0), the poverty gap (P1), and the squared poverty gap (P2) [ 58 , 59 ]. The general formula for the FGT class of poverty measures takes different names depending on a parameter α which is zero for the headcount index, one for the poverty gap, and two for the squared poverty gap. The formula can be expressed as follows:

where z is the poverty line, (1- Yi ) is the poverty gap, N is the size of the sample, and α is a parameter. For the empirical analysis, the head-count index (P 0 ) which is the ratio of the population whose income level is lower than the pre-determined poverty line, is chosen as a proxy of poverty.

Besides, among some common different measures, which are employed to express the income distribution the most well-known measure, the Gini coefficient is preferred in this paper distribution [ 57 – 59 ], The Gini coefficient can be written as follows:

where n is the number of individuals, y i and y j are individuals’ income level, i ∈ (1, 2, 3, … , n ), and y ¯ is the arithmetic mean income. The Gini coefficient takes value from “0” to “1”. If the distribution of incomes is completely equal (unequal), the Gini index is equal to zero (one).

In addition, control variables are included in the equations. First, the growth rate of GDP per capita is used as a proxy for growth. Secondly, the degree of openness is revealed by adding the sum of exports and imports as a share of GDP. Third, the government’s role in economic activities is captured through the inclusion of government spending. It is believed that the government’s role decreases with increased economic growth and reduced inequality.

Aside from simultaneous regression models, causality tests and the correlation between variables are utilized as well for the empirical analysis. For causality control, the Granger Causality test is applied. The main purpose of this test is to check the direction of the relation between the variables. Granger’s causality is a statistical test to determine if a time series is useful for forecasting another time series. Granger defined causality as “If the prediction of Y is more successful when the past values of X are used, then X is the Granger cause of Y”, after testing the accuracy of this statement the relationship is shown as X → Y [ 60 ].

Before utilizing the simultaneous equation regression model to examine the impact of financial development on inequality and poverty, first, the correlation matrix for the variables in the regression model is utilized. The results are shown in Table 2 . As observed from the table, there is a negative correlation between the private credits of banks as a share of GDP and the Gini coefficient. The degree of correlation between them is high, close to 1. This is also true for the headcount index. The correlation pattern of their correlation is very similar to that of the Gini coefficient. The correlation results exhibit the connection between financial development, inequality, and poverty. The correlation between financial development and poverty and inequality is negative. These results indicate that the increase in financial services development indicates a decline in inequality and poverty. These findings are compatible with the expectations. In addition, there is a positive correlation between financial development and growth. The more developed the financial services industry, the greater the growth of the economy.

It is also observed that government spending as a share of GDP and Private Credit of Banks as a share of GDP correlate negatively. Another significant finding in correlations between variables is between inequality and growth. Growth can lead to improvements in inequality, as evidenced by a negative correlation. The correlation between growth and poverty reduction is weak, in contrast. And as expected, there is a negative correlation between the inflation rate and private bank credits as a share of GDP. The inflation rate will increase in the short run as financial services with lower credit rates and easy accessibility are expanded.

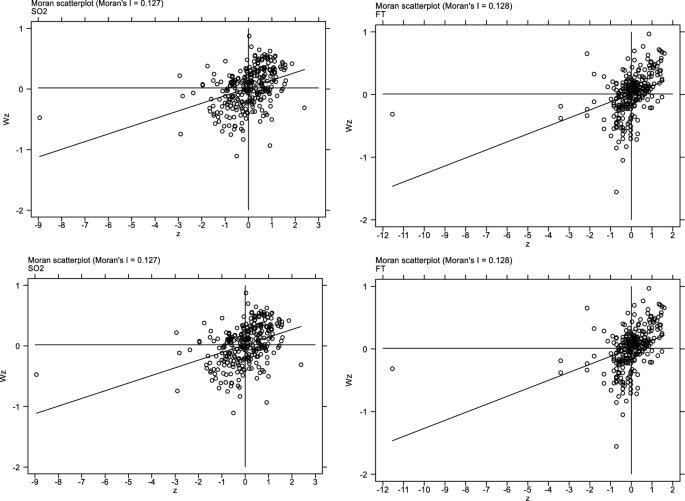

The Granger Causality test results are represented in Table 3 . The results indicate that the lag level is two (2). A standard Chi-squared test for Granger causality was performed on all of the lag-length specifications. Then, Granger’s two-way causality is performed to check whether there is a causal direction from one to another. As observed from the table, the p-value (0.011) falls below the statistically significant threshold of 0.05 hence, the null hypothesis that lags of financial development variable does not impact the inequality is rejected. This indicates financial development is a Granger cause of inequality. The same holds for inequality and financial development. The null hypothesis is rejected because the p-value (0.058) does not meet the statistically significant threshold of 0.10. Therefore, the result shows that there is a two-way direction causality between financial development and inequality. In addition, there is also a two-way direction between poverty and inequality. The null hypotheses are not rejected as well. There is a one-way direction causality between the headcount index and financial development.

(*: statistically significant at %5, ** statistically significant at %10)

The obtained findings reveal that financial development is the Granger cause of the headcount index, whereas the headcount index is not the Granger cause of financial development. These empirical results are consistent with the findings of other studies in the literature. The findings validate theoretical expectations about the impact of financial development on income inequality and poverty in the Turkish case.

Table 4 presents the empirical findings of the simultaneous equations regression model. According to the results, GDP per capita growth has a positive impact on poverty. The arguments of Dollar and Kraay (2001) [ 17 ], which suggest an increased growth rate induces a lower poverty rate, cannot be met. Therefore, the poverty rate in Türkiye has worsened due to economic growth. This could be a result of the short time of the examination, and besides, during this period, the Turkish economy is undergoing a structural transformation and shifting economic priorities. The quality of growth is a crucial factor in poverty reduction, which results in pro-poor growth. According to this result, Türkiye’s growth is not sufficient to alleviate poverty. In the empirical model, inequality has no significant impact on poverty.