Samsung is a Case Study in How Manufacturers Leave China

“De-risking” is the latest buzzword describing Western governments’ strategy toward China. While it sounds less ambitious than “decoupling,” the basic idea is similar: reducing reliance on China for manufacturing, especially for key technological goods.

Driven by both geopolitics and commercial needs, the trend seems likely to pick up further steam: Even Apple, the most visible beneficiary of the “made in China” phenomenon in the tech space, is starting to push its suppliers more aggressively toward India and other alternatives. But the practicalities of even a partial move away from China-based manufacturing are daunting.

Luckily there is at least one conspicuous example of a major high-technology company that has successfully relocated large parts of its production apparatus: Samsung Electronics, the global electronics giant and Apple’s smartphone rival.

Samsung still has significant operations in China, including for its crucial memory chip business. But from a head-count perspective, it has been edging away from China for years. The company had over 60,000 employees in China in 2013 according to its 2014 Sustainability Report, but that number had fallen to less than 18,000 by 2021. Samsung closed its last smartphone factory there in 2019.

Lower labor costs in other Asian countries are a big draw. But geopolitics was probably also an important factor. In 2016 and 2017 Beijing and Seoul became embroiled in a major diplomatic spat over South Korea’s plan to host a high-tech U.S. missile defense radar system. In an early preview of the coercive economic tactics that China has employed against a widening range of countries in recent years, Beijing effectively forced the sale of Korean conglomerate Lotte Group’s China supermarket business and curtailed tourist visits to Korea.

One result is that as Apple and other big manufacturers increasingly scope out Vietnam and India, Samsung is already there in spades—which could add up to a significant competitive advantage given the difficulties of replicating China’s scale abroad. Vietnam, for example, has a population of around 100 million. But China’s Guangdong province alone has over 125 million.

Samsung is now Vietnam’s largest foreign investor. It accounted for nearly a fifth of the country’s total exports last year. The company has also invested big in India: the country accounts for around 20% to 30% of Samsung’s smartphone production, according to Morgan Stanley.

The fact that the world’s largest smartphone maker has managed to ditch China may offer some comfort for other companies looking to “de-risk.” But Samsung’s success was also related to market factors that could be hard for Apple, for example, to replicate. Samsung’s smartphone market share in China was battered in the mid-2010s: Strong competition from Chinese companies like Xiaomi that make comparable Android smartphones with affordable prices was one major reason.

On the other hand, Samsung is the top-selling brand in India and Southeast Asia—meaning it can produce and sell a big chunk of its output in the same places. Apple, with its high prices and premium focus, could struggle to achieve that, especially in price-conscious India.

Another issue for both Apple and Samsung is that even if the final assembly of gadgets is moved outside of China, manufacturers will still depend on many suppliers there. During the height of the 2020 Covid-19 outbreak in China, Samsung also found itself scrambling to secure suddenly-scarce Chinese components. Chinese suppliers have moved rapidly up the value chain in recent years and now make many high-tech electronic components too.

Samsung’s success in relocating its smartphone business is instructive—but it also had a major first mover advantage and a product mix suitable to lower income Asian nations. Others will now try to follow in its footsteps, at least in part. But for Apple and many other top manufacturers, China will loom large in the global supply chain for a long time.

Write to Jacky Wong at [email protected]

Samsung is a Case Study in How Manufacturers Leave China

- The company still has significant operations in China but its smartphone manufacturing business pulled up stakes years ago

“De-risking" is the latest buzzword describing Western governments’ strategy toward China. While it sounds less ambitious than “decoupling," the basic idea is similar: reducing reliance on China for manufacturing, especially for key technological goods.

Driven by both geopolitics and commercial needs, the trend seems likely to pick up further steam: Even Apple, the most visible beneficiary of the “made in China" phenomenon in the tech space, is starting to push its suppliers more aggressively toward India and other alternatives. But the practicalities of even a partial move away from China-based manufacturing are daunting.

Luckily there is at least one conspicuous example of a major high-technology company that has successfully relocated large parts of its production apparatus: Samsung Electronics, the global electronics giant and Apple’s smartphone rival.

Samsung still has significant operations in China, including for its crucial memory chip business. But from a head-count perspective, it has been edging away from China for years. The company had over 60,000 employees in China in 2013 according to its 2014 Sustainability Report, but that number had fallen to less than 18,000 by 2021. Samsung closed its last smartphone factory there in 2019.

Lower labor costs in other Asian countries are a big draw. But geopolitics was probably also an important factor. In 2016 and 2017 Beijing and Seoul became embroiled in a major diplomatic spat over South Korea’s plan to host a high-tech U.S. missile defense radar system. In an early preview of the coercive economic tactics that China has employed against a widening range of countries in recent years, Beijing effectively forced the sale of Korean conglomerate Lotte Group’s China supermarket business and curtailed tourist visits to Korea.

One result is that as Apple and other big manufacturers increasingly scope out Vietnam and India, Samsung is already there in spades—which could add up to a significant competitive advantage given the difficulties of replicating China’s scale abroad. Vietnam, for example, has a population of around 100 million. But China’s Guangdong province alone has over 125 million.

Samsung is now Vietnam’s largest foreign investor. It accounted for nearly a fifth of the country’s total exports last year. The company has also invested big in India: the country accounts for around 20% to 30% of Samsung’s smartphone production, according to Morgan Stanley.

The fact that the world’s largest smartphone maker has managed to ditch China may offer some comfort for other companies looking to “de-risk." But Samsung’s success was also related to market factors that could be hard for Apple, for example, to replicate. Samsung’s smartphone market share in China was battered in the mid-2010s: Strong competition from Chinese companies like Xiaomi that make comparable Android smartphones with affordable prices was one major reason.

On the other hand, Samsung is the top-selling brand in India and Southeast Asia—meaning it can produce and sell a big chunk of its output in the same places. Apple, with its high prices and premium focus, could struggle to achieve that, especially in price-conscious India.

Another issue for both Apple and Samsung is that even if the final assembly of gadgets is moved outside of China, manufacturers will still depend on many suppliers there. During the height of the 2020 Covid-19 outbreak in China, Samsung also found itself scrambling to secure suddenly-scarce Chinese components. Chinese suppliers have moved rapidly up the value chain in recent years and now make many high-tech electronic components too.

Samsung’s success in relocating its smartphone business is instructive—but it also had a major first mover advantage and a product mix suitable to lower income Asian nations. Others will now try to follow in its footsteps, at least in part. But for Apple and many other top manufacturers, China will loom large in the global supply chain for a long time.

MINT SPECIALS

Wait for it….

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

Congratulations!

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

Subscribe to continue

This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, digital standard + weekend, digital premium + weekend.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend newspaper delivered Saturday plus standard digital access

- FT Weekend Print edition

- FT Weekend Digital edition

- FT Weekend newspaper delivered Saturday plus complete digital access

- Everything in Preimum Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

How Samsung Lost China

While being the uncontested leader in 2014, by 2020, Samsung had lost China entirely. From an 18% market share of the Chinese mobile phone market in 2014 to a measly 2% in 2018, by 2020, Samsung had virtually disappeared from the Chinese mainland market. What went wrong, and why should you care?

China maps our future mobile market.

You should care about Samsung's adventures in China because it's a fantastic story about tech global marketing and corporate strategy (or lack thereof).

More than 1.2 billion Chinese consumers are subscribed to a mobile service (about 83% of the population). It's a market where massive governmental investments push 5G, IoT devices are rising faster than any other market, and mobile platforms are often the default mode for shopping. But it's not only a massive tech-oriented market; it's, more importantly, a very mature market. Most projections indicate that China will "only" add up to 60 million new mobile subscribers by 2025.

In that regard, China is a fantastic template for business strategists. Like it did for many years, it maps out the future of our US and European markets (even regarding tech regulation and quenching monopolies' footprints–but this is another story).

What happens there matters for the rest of us.

What went wrong with Samsung

Samsung lost China within just a few years. From 2013 to 2019, Samsung went down in a rapid spiral of miscalculations, cultural lack of strategic awareness, and, above all, plain tone-deafness to the local market.

Here's the short version:

- Samsung is using Android and heavily relies on the Google app store worldwide. But Google exited China at the turn of 2010, and Chinese consumers no longer have access to this app store. Granted that you can consider WeChat as a de facto mobile OS in China, Samsung never cared enough to build a decent alternative store. Why bother? It's only the most significant market on the planet.

- Most Samsung execs in China were Korean. Not a big surprise in a culture that, like in Japan, only trusts in its own. This largely explains why they struggled to connect with the needs of the Chinese markets. But worse, as expats, they were all living in Tier I cities, with only a vague understanding (if at all) of the reality of Tier III or IV cities in rural China.

- An example of the tone-deaf culture of Samsung is the lack of beauty filters to enhance selfies taken with Samsung's otherwise impressive mobile phone cameras. It might seem detailed, but it's anything but in a highly online social market like China.

- In 2017, following the worldwide quality issues with the Galaxy Note 7 batteries catching fire, Samsung recalled the units sold to fix them. All of them? Yes. Except, of course, in China! Given the Chinese consumers' natural defiance, lack of trust, and their own extreme national pride, this was eventually the most significant nail in Samsung's market share coffin.

- And lastly, instead of doubling down in its commitment to fighting in the Chinese market (5G? Anyone?), Samsung lost China by cutting its losses and disinvesting its local consumer electronic devices factories in 2018. This, again didn't fly well in the Chinese public opinion at all. If you're in China, you demonstrate your willingness to invest for the long haul or get rapidly busted.

I often repeat that culture's a bitch, don't I? Whether it's your corporate culture or your local consumers' culture, you ignore it at your own risk. When you miss both, you enter a particular kind of business hell.

Samsung's lack of focus

Furthermore, Chinese very own mobile manufacturers didn't stay put while Samsung was trying to sort its mess. A dozen national companies ended up slicing the market with three different strategic approaches.

Xiaomi, the process-driven company

After some back and forth with flagship retail stores, Xiaomi shifted its focus to a no-store / pure online sales platform across China. With good enough quality and affordable prices, the goal was to be the default phone for consumers ranging from rural to young urban. There are no frills, just reliable technology to get on WeChat and get things done.

Samsung? They never developed a horizontal online presence strong enough to address the Chinese market that way — try in your own country to get advice online through their website and despair.

Oppo and Vivo, the customer-driven companies

Oppo and Vivo, on the other hand, understanding they wouldn't be as powerful as Xiaomi at addressing China in a very horizontal way, went vertical on the countryside and Tier III to IV cities. Call it low-cost if you want, but it's not that simple, and both companies didn't make the mistake of just fighting on price . They really cared about this part of the market and carved a precise identity in the western part of China, where they became difficult to displace. Contrary to Xiaomi, they didn't balk, for example, at investing in a widespread retail presence (even if sometimes just meant small corner shops and an army of small distributors).

Samsung? While selling a wide range of devices ranging from entry-level devices to flagship phones on par with premium brands, they never really committed to one part or another. And Chinese consumers are susceptible to brand values. Who are you? What are you selling to us? Pure functionality? Aspirational lifestyle? Being 'A Galaxy For Everyone' is not a clear value proposition for anyone.

Apple and Huawei, the future-driven companies

Lastly, Apple and Huawei seized the premium spot in Tier I and II cities . Big names, big stores, big prices, big ecosystem, big value, big brands. You don't just buy a phone; you spend the afternoon in a luxury mall in a Huawei store .

Samsung? Well, given the lack of consideration for the Chinese market in 2017, a range of products spreading in all directions, and a lack of decisiveness playing a specific role in China, they couldn't really fight on the premium segment. Sure they have some amazing technologies (and generally try to beat Apple at introducing new things in the market — which Chinese consumers absolutely love in principle), but where's the ecosystem? Where are the apps? Where is the Chinese-only exclusive content?

The default Samsung strategy

In the end, Samsung lost China for many different reasons. The core one is a corporate culture that is incapable of focus. Flagship phones? Yes, but with a thin commitment to this part of the market while you chase low-end sales. Accessible technology? Yes, but not enough commitment to developing a warm and extensive online services platform. Chasing the last millions of new mobile phone owners in China? Yes, when do they visit Shanghai once a year… If they visit Shanghai.

If anything, Samsung is the poster child of these companies where no one can renounce market options, and everyone is trying to push in all directions while not achieving much in the end. Why? Because all these opposite directional pulls cancel each other.

There's a precise description of such companies that want to be premium yet economically accessible, customer-driven, and super-efficient at processing everything. They are the stuck-in-the-middle corporations. Without strategic focus, they end up being run in default mode by their CFO.

Is Samsung dead?

Since I was introducing this article by reminding you how much China maps our future tech markets, it would be fair to ask if Samsunwg's demise in China indicates its future worldwide demise as well?

I don't think so.

I'm anything but optimistic for Samsung, mind you. But I also how they reacted in India after losing China (which is still the world's largest mobile market!). In India, where many Chinese companies are aggressively pushing in, Samsung now managed to focus on being the Nokia of old. Their strategy seems to show off their flagship phones (because they can) and essentially sell low-end mobiles with fair localization and some modicum of cultural awareness.

As for Q1, 2021, they've held their 20% market share quite well in India. Lessons learned? Maybe. But even in India, Samsung is under an ongoing squeeze between Xiaomi (26%), Vivo (16%), and Oppo (11%). And worse, I would bet they don't see them coming in the US or Europe yet.

So we'll see where all this goes (remember Nokia mobile market was wiped off in 2013 while being the #1 mobile phone seller on the planet — in units sold and with zero margins) .

But if anything, Samsung should be a lesson for the rest of us in the energy sector, the car industry, or aerospace. China doesn't just map the future of the mobile market. Pay attention. Now.

Tesla , as we speak, might be falling into the same trappings as Samsung did…

By signing up, I agree to receive emails from Innovation Copilots.

Restricted Access

Please login to view this data.

BE SMARTER Important daily news briefs and media intelligence straight to your inbox

© 2024 mediaintel.asia. all rights reserved..

- Regular Savings Plan

- Mutual Funds

- Paper Trading

- Margin Trading

- Short Selling

Please log in to view news

- Currencies / FX

- Cryptocurrency

- Open Live Account

- Stock Market

- Economic Calendar

- Earnings Calendar

- Price Alert

- Latest News Alert

- Economic Calendar Alert

- Stock Details

Subscribe To

Live trading account, open live account in few minutes with just 10$, ssnlf / samsung is a case study in how manufacturers leave china.

Content Topics

Manufacturers

Ssnlf news .

By TechXplore October 31, 2023

Samsung Electronics says Q3 operating profits down 77.57%

South Korea's Samsung Electronics said Tuesday that its operating profits for the July to September period were down 77.57 percent from the year befor more_horizontal

By Seeking Alpha October 31, 2023

Samsung Electronics Co Ltd (SSNLF) Q3 2023 Earnings Conference Call Transcript

Samsung Electronics Co Ltd (OTCPK:SSNLF) Q2 2023 Earnings Conference Call October 30, 2023 9:00 PM ET Company Participants Ben Suh - SVP, IR Jaejune K more_horizontal

By CNBC October 31, 2023

Samsung expects memory chip demand to improve, as operating profit beats expectations

Samsung reported its third-quarter earnings on Tuesday, beating estimates and signaling that a memory chip glut may be bottoming out. more_horizontal

By Market Watch October 30, 2023

Samsung Electronics beats expectations on Q3 net profit, as chip business narrows losses

South Korean tech giant Samsung Electronics 005930, +0.15% said its third-quarter net profit fell 38% on the year but more than tripled on the quarter more_horizontal

By Bloomberg Markets and Finance October 30, 2023

Samsung Electronics Profit Beats Estimates; Sees Memory Recovery

Samsung Electronics Co., the world's largest maker of memory chips and smartphones, reported third-quarter profit that beat expectations. And the comp more_horizontal

By PYMNTS October 19, 2023

Samsung Invests in Skipify's Digital Wallet Expansion

Frictionless commerce company Skipify says it has landed new funding from Samsung's investment group. The company says the investment by Samsung more_horizontal

By Reuters October 13, 2023

US to allow Samsung, SK Hynix to ship certain products to China

The United States on Friday gave permission for SK Hynix and Samsung to supply their China plants with certain U.S. chipmaking tools, the Commerce Dep more_horizontal

By Investopedia October 11, 2023

Stellantis, Samsung SDI Agree To Build Second Battery Plant in Indiana

Automaker Stellantis (STLA) and battery manufacturer Samsung SDI said they would build a second U.S. battery manufacturing facility in Kokomo, Indiana more_horizontal

- Terms And Conditions

- Privacy Policy

- Manage Cookies

- Risk Warning

Risk Disclosure:

©2014-2024 All Rights Reserved. I.C

Hand-crafted & made with Love

Pages Search Results:

Samsung is a Case Study in How Manufacturers Leave China

Samsung prepares for a Chinese exit - to relocate TV production

Smartphones are already out

China's consumer electronics related supply-chains appears to be losing its sheen in the post-Covid-19 world. Samsung and arch-rival Apple initiated the shift of shifting their smartphone manufacturing to other locations. The South Korean tech giant is now following it up by moving its only TV making facility out of of Tianjin.

Reports in the South Korean media suggests that Samsung could soon shut down its only manufacturing factory in Tianjin before end-2020. Nikkei Asian Review , said production could shift to Samsung's facilities located in Vietnam, Mexico, Egypt, Hungary and possibly to newer destinations as well.

- Samsung Galaxy Z Fold 2: price in India and pre-booking offers

- Check out our Hands-on review of the Samsung Galaxy M51

- Apple, Samsung lead India's smartphones export plan for $100 billion

However, the electronics giant has clarified that there would be no slowing down of the current production from the Tianjin unit. Nikkei quoted company officials to state that the move was part of a greater trend of businesses shifting supply chains out of China.

Samsung's arch-rival Apple has already stated that it intends to shift smartphone manufacture completely out of China, having already announced that its upcoming flagship iPhone 12 could be made out of India. Apple's manufacturers have visibly enhanced their Indian operations over the past couple of months.

What's driving Samsung's move?

In recent times, Samsung, which has been the world's top seller of flat-screen TVs, lost market share in China due to rising local competition as well as local reactions to South Korea's decision to deploy anti-missile shields despite Beijing's objections. The growing anti-China sentiment further exacerbated Samsung's decision to shift out.

The company started manufacturing television from Tianjin close to 27 years ago. In recent times, the company downsized its operations considerably with just about 300 people working there now. Samsung would be reassigning these workers to other facilities or help them find alternate employment, says the report.

Whatever your entertainment fix is, our 2020 #QLED line-up is ready.Check the thread to discover whether the Q60, Q70, Q80, or Q90 suits your needs best.#SamsungQLED #SmartTV pic.twitter.com/5Jyg95EoBR August 27, 2020

The Indian option is open

The production from this factory could shift to other geographies with India already on the radar for the electronics giant. In June, the company had indicated that it will be making more than 85% of its TVs sold in India locally. Both Samsung and OnePlus had partnered with Chinese firm Skyworth to make TVs at their Hyderabad facility, operated under a joint venture with an Indian partner.

Get daily insight, inspiration and deals in your inbox

Get the hottest deals available in your inbox plus news, reviews, opinion, analysis and more from the TechRadar team.

A report in the Economic Times had also claimed that Samsung had deepened its association with its Indian contract manufacturer Dixon Technologies to expand its range of TVs in India to include 43-to-58 inch models. Till now, Dixon was making only televisions in the 32-43 inches range.

Readers would recall that Samsung had exited TV production in India in 2018 after the federal government imposed additional duties on open cell TV panels that led to Samsung importing finished televisions from Vietnam at zero duties through the free trade agreement route.

In 2019, these additional duties on open cell panels were brought back to zero. Given that open cell panels account for close to 70% of a TV's manufacturing cost, Samsung's shift back to India is understandable in the present context where it's need to exit from China is supplemented by India's open door policy.

India has witnessed large scale action on the TV manufacturing front with some of Samsung's top rivals including LG , Sony , Panasonic , Xiaomi and OnePlus, joining the bandwagon of making in India.

- In case you missed: The top-tech stories of the week-ending September 12

A media veteran who turned a gadget lover fairly recently. An early adopter of Apple products, Raj has an insatiable curiosity for facts and figures which he puts to use in research. He engages in active sport and retreats to his farm during his spare time.

New report says an Apple TV with camera would support gestures, but do we really need this?

I tested LG's new webOS on its latest TVs – and I loved these 3 big upgrades

I shot the eclipse with an iPhone 15 Pro Max, Google Pixel 8 Pro and a Samsung Galaxy S23 Ultra – here's which one did best

Most Popular

By James Capell April 08, 2024

By Craig Hale April 08, 2024

By Mackenzie Frazier April 08, 2024

By Benedict Collins April 08, 2024

By Mike Moore April 08, 2024

By Muskaan Saxena April 08, 2024

By Sead Fadilpašić April 08, 2024

By Darren Allan April 08, 2024

By Lewis Maddison April 08, 2024

- 2 7 new movies and TV shows to stream on Netflix, Prime Video, Max, and more this weekend (April 5)

- 3 Sony's best noise-cancelling wireless headphones plummet to a record-low price

- 4 I tested LG's new webOS on its latest TVs – and I loved these 3 big upgrades

- 5 Ninja Woodfire Pro Connect XL BBQ Grill and Smoker review

- 2 New iPad Air and iPad Pros look set to launch very soon – here’s why

- 3 Epic Mint Mobile deal: get an unlimited plan for $15/mo plus a second line free

- 5 Are iPhones a rip-off?

Samsung Electronics—A Detailed Case Study

Devashish Shrivastava

Samsung is a South Korean electronic gadget manufacturer in Samsung Town, Seoul. Samsung Electronics was established by Lee Byung-Chul in 1938 as an exchanging organization.

We all know this information about Samsung. Don't we? But what we don't know? Do you know how much Samsung has grown in these years? What are the Future Plans of Samsung? How much Samsung invested in its R&D? What difficulties did the company face coming all this way? What is the history behind this multinational conglomerate?

Don't worry we got you covered. We have penned down a detailed Case Study on Samsung Electronics. Let's find out in this thoroughly studied Samsung case study.

Let's start the detailed case study from here.

Samsung entered the electronics industry in the late 1960s and the development and shipbuilding ventures in the mid-1970. Following Lee's demise in 1987, Samsung was divided into five business groups - Samsung Group, Shinsegae Group, CJ Group, Hansol Group and Joongang Group.

Some of the notable Samsung industrial subsidiaries include Samsung Electronics, Samsung Heavy Industries Samsung Engineering, and Samsung C&T (separately the world's 13th and 36th biggest development companies). Other notable subsidiaries include Samsung Life Insurance, Samsung Everland, and Cheil Worldwide.

Samsung has a powerful influence on South Korea's monetary advancement, legislative issues, media, and culture. Samsung has played a significant role behind the "Miracle on the Han River". Its subsidiary organizations produce around a fifth of South Korea's complete exports. Samsung's revenue was equivalent to 17% of South Korea's $1,082 billion GDP.

History of Samsung Electronics Samsung's Business Strategy Samsung Rides High In India Business Growth in India Future Plans of Samsung FAQ's

History of Samsung Electronics

1938 (Inception of Samsung)-

- In 1938, Lee Byung-Chul (1910–1987) of a huge landowning family in the Uiryeong region moved to nearby city Daegu and established Samsung Sanghoe.

- Samsung began as a little exchanging organization with forty representatives situated in Su-dong. It managed dried fish, privately developed staple goods and noodles. The organization succeeded and Lee moved its head office to Seoul in 1947.

- When the Korean War broke out, Lee had to leave Seoul. He began a sugar processing plant in Busan named Cheil Jedang. In 1954, Lee founded Cheil Mojik. It was the biggest woollen factory in the country.

- Samsung broadened into a wide range of territories. Lee wanted to build Samsung as a pioneer in a wide scope of enterprises.

- In 1947, Cho Hong-Jai, the Hyosung gathering's organizer, put resources into another organization called Samsung Mulsan Gongsa or the Samsung Trading Corporation with Samsung's founder Lee Byung-Chul. The exchanging firm developed into the present-day Samsung C&T Corporation .

- After few years in business, Cho and Lee got separated due to the differences in the management style. In 1980, Samsung acquired the Gumi-based Hanguk Jeonja Tongsin and entered the telecommunications market . During the initial days, it sold switchboards.

1987 (Demise of Lee Byung-Chul)-

- After Lee's demise in 1987, the Samsung Group was divided into four business gatherings—Samsung Group, Shinsegae Group, CJ Group, and the Hansol Group.

- One Hansol Group agent stated, "Just individuals uninformed of the laws overseeing the business world could think something so ridiculous," while also adding, "When Hansol got separated from the Samsung Group in 1991, it cut off all installment assurances and offer holding ties with Samsung subsidiaries."

- One Hansol Group source attested, "Hansol, Shinsegae, and CJ have been under autonomous administration since their particular divisions from the Samsung Group."

- One Shinsegae retail chain official executive stated, "Shinsegae has no installment certifications related to the Samsung Group." In 1982, it constructed a TV get-together plant in Portugal, a plant in New York in 1984, a plant in Tokyo in 1985 and an office in England in 1996.

2000 (Samsung in 20th Century)

- In 2000, Samsung opened a development center in Warsaw, Poland. It started with set-top-box technology before moving to TV and cell phones. The cell phone stage was created with accomplices and formally propelled with the first Samsung Solstice line of gadgets and different subordinates in 2008. It later emerged into the Samsung Galaxy line of gadgets that is Notes, Edge, and other models.

- In 2010, Samsung declared a ten-year development system based on five businesses. One of these organizations was to be centered around bio-pharmaceuticals in which ₩2,100 billion was invested.

- In the first quarter of 2012, Samsung Electronics turned into the world's biggest cell phone creator by unit deals, surpassing Nokia which had been the market chief since 1998.

- In 2015, Samsung was granted U.S. patents as compared to other organizations like IBM , Google , Sony, Microsoft , and Apple. Samsung got 7,679 utility licenses before 11 December 2015.

- On 2 August 2016, Samsung Electronics revealed the Galaxy Note7 smartphone, which went on sale on 19 August 2016. At the beginning of September 2016, it halted its selling of smartphones due to some problems with the smartphones. Samsung suspended the selling of the smartphones and recalled its units for inspection.

- This happened after certain units of the telephones had batteries with a deformity that made them produce extreme warmth, prompting flames and blasts. Samsung replaced the reviewed units of the telephones with a new version. It was later found that the new version of the Galaxy Note 7 also had the same battery deformity.

- Samsung recalled all Galaxy Note7 cell phones worldwide on 10 October 2016 and permanently ended its production on the same day.

Samsung's Business Strategy

Great business strategies have been applied by Samsung over the years. Not very far back, Samsung wasn't as famous as now. Samsung has now advanced so much that it is the principal contender of Apple Inc. Samsung is the biggest tech business by income and the seventh most significant brand today. The showcasing procedure it applied encouraged Samsung electronics to turn into an industry driving innovation organization.

The Samsung marketing strategy was one of the best systems at any point because it helped a cost-driven organization to change its structure and become a power producer. Due to the consistently changing tastes of purchasers in the innovation business, organizations needed to pursue the pace and offer dynamic and advancing devices to their clients. In this way, Samsung additionally needed to change to pick up the high ground available, and the new Samsung showcasing methodology was the way to advancement.

Some of the business strategies of Samsung Electronics are listed below:

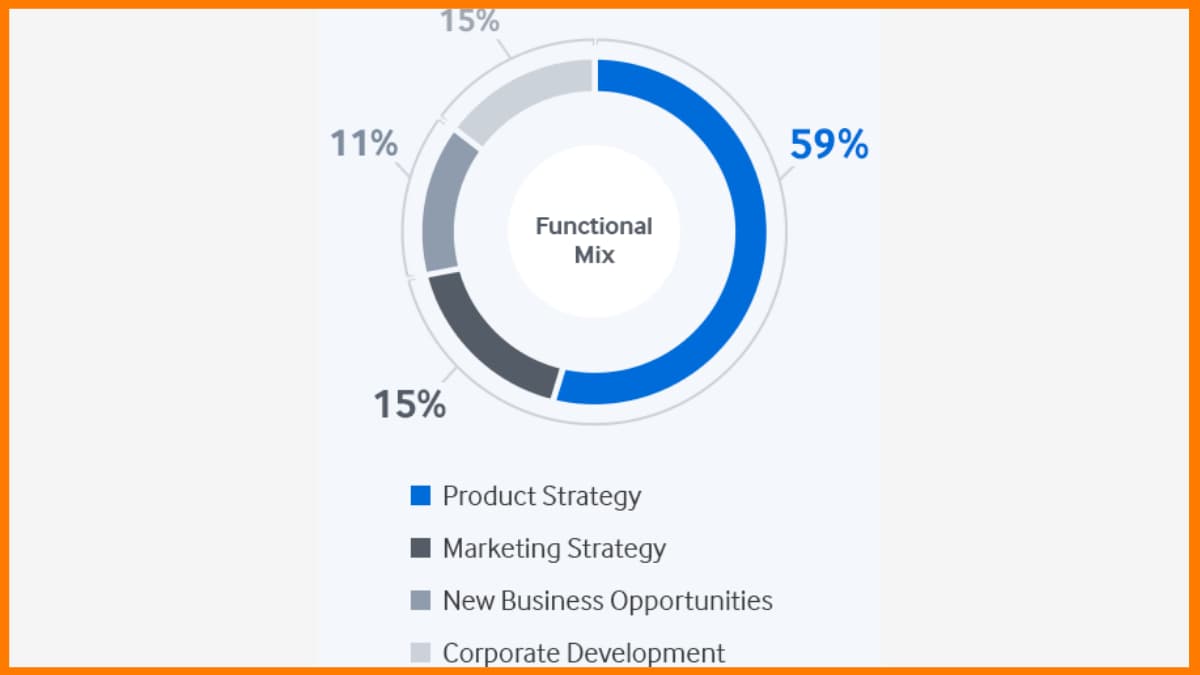

Promotional Mix Of Samsung

Samsung has arrived at fantastic statures with its cell phones which helped the brand to turn into an image of value and unwavering quality for its purchasers.

Samsung Marketing Mix Pricing Strategy and Samsung Advertising Methodology are the two estimating techniques used by the organization. Other than its items, Samsung is celebrated for its customer support . However, item variety is the most dominant part of the promoting blend of Samsung.

- Skimming Price

Like Apple , Samsung uses skimming costs to pick up the high ground over its rivals. For example, Galaxy S6 and S6 Edge are the brand's new results of Samsung conveying the trademark "Next is Now" and guaranteeing that they are the best smartphone maker at any point made.

What will happen when different contenders will dispatch a cell phone with indistinguishable highlights? Straightforward. Samsung will bring down the cost and effectively steal the customers from its competitors.

- Focused Pricing

Samsung experiences issues in increasing an edge over its rivals with different items. Doubtlessly, Samsung is a credible brand. However, regarding home appliances, it can't be in any way, shape, or form outperform LG In the cameras segment and other home appliance units. Also, Samsung cannot compete with Canon and Nikon.

For Samsung to withstand this savage challenge, it's crucial to utilize aggressive valuing of its products. Moreover, Samsung is neither a newbie underway nor non-inventive. For the most part, it is often the first company to be innovative with its products and present a change among its competitors.

- Putting in Samsung Marketing Strategy

Samsung uses divert advertising strategies. Retailers who present the innovation chain will undoubtedly incorporate Samsung in their rundown on account of the firm being a world-celebrated brand. Samsung can likewise fill in as an option for the purchasers. The circulation is a convincing piece of the Samsung promoting methodology.

In specific urban communities, Samsung has an agreement with a solitary dissemination organization that circulates the items all through the city. For example, Mumbai is an incredible case where Samsung conveys its products through a solitary organization.

Samsung Rides High In India

The greatest leader by far in the smartphone business is Samsung Electronics, the world's greatest cell phone and TV producer.

Samsung is India's greatest, versatile brand. It is the developer of Reliance Jio's 4G LTE system — the greatest and busiest information system on the planet.

Discernments, advertise wars, openings, rivalry — now and then from conventional remote adversaries, from nearby upstarts, and emerging Chinese brands trouble Samsung.

Be that as it may, every time Samsung has had the option to fight off the dangers and hold its ground. It has been leading the market in the TV fragment for more than 12 years and in the versatile business for a long time after it toppled Nokia in 2012.

Riding The Smartphone Wave

As indicated by some statistical surveying firms following cell phone shipments, Chinese firm Xiaomi is creeping nearer — or has even surpassed Samsung after December 2017 quarter.

While for the entire year 2017, Samsung was No. 1 in the cell phone space, IDC information indicated Xiaomi drove the last quarter with 26.8% piece of the overall industry. Samsung was at 24.2%. Different players, for example, Vivo, Lenovo, and Oppo stayed at 6.5, 5.6, and 4.9%, separately.

Warsi, who has been working with Samsung for as far back as 12 years and has as of late been advanced as Global Vice President, is unflinching, "These difficulties offer us the chance to work more earnestly for our customers and with our accomplices.

Furthermore, shoppers love marks that emphasis on them," he says. "Samsung is India's No. 1 cell phone organization crosswise over sections — premium, mid and reasonable. That is what makes a difference."

Statistical surveying firm GfK tracks disconnected offers of handsets — which make up around 70% of the market — in which Xiaomi is attempting to make advances.

Samsung had a 42% worth piece of the overall industry in the general cell phone showcase in the nation in 2019 and 55% in the superior fragment as indicated by GfK. An industry official who would not like to be named says that India must be Samsung's greatest market by large volumes.

The thought currently is to become the cell phone business which gets more worth. As indicated by reports, Samsung India's incomes from cell phone deals in 2018-19 remained at an astounding INR 34,300 crore. That is over $5.5 billion and development of 27%. Samsung's nearest adversaries are talking about incomes of $1 billion in India, going up to $2 billion.

Samsung is the world's largest manufacturer of consumer electronics by revenue. As of 2019, Samsung Electronics is the world's second-largest technology company by revenue, and its market capitalization stood at US$301.65 billion, the 18th largest in the world.

Shopper Is At The Center

Samsung is a worldwide advancement powerhouse that leads the patterns. It profoundly put resources in India — 22 years of connections in the exchange, and tremendous interests in neighborhood R&D . It has around 10,000 architects working in research offices in India and is perhaps the greatest scout from the IITs.

"Samsung has a solid brand picture in India, as it has been available in various customer electronic portions with quality items for quite a while now. The brand is trusted because of its long history in the nation, dish India nearness, and a vigorous after deals support for buyers," says Shobhit Srivastava, explore expert at Counterpoint Research.

Indeed, even an item fizzle of the size of the Galaxy Note7 in September 2016 couldn't affect Samsung. While the organization was fast enough to get back to every one of the units that had been sold and cease the gadget totally, Samsung's activities and ensuing effective dispatches of leads like Galaxy S8, Note8, the Galaxy S9 and S9+, which were propelled in February, rescued the harm and raised the profile of the brand as a dependable organization. "They rushed to concede their error and that helped them interface with the perceiving clients of today far superior," says Koshy.

Make For India

Samsung's system 'Make for India', which resounds with the administration's ' Make in India ' activity, was conceived in the late spring of 2015. Samsung India's new President and CEO, H.C. Hong, had recently moved in from Latin America and was looked with the prompt tough assignment of fighting a firm challenge from two nearby versatile organizations that is Micromax and Intex.

Samsung's customer hardware business containing TVs, fridges, and other advanced machines were additionally confronting challenges from Sony and LG.

Around a similar time, the legislature of India propelled its 'Make in India' activity. "In this way, Mr. Hong revealed to us we have been doing Make in India effectively for two decades. What we should concentrate on widely to remain on top of things is Make for India (MFI)," says Dipesh Shah, Managing Director of Samsung R&D Institute in Bengaluru, the greatest R&D community for Samsung outside Korea.

Truth be told, the R&D focuses in India contribute intensely to the improvement of worldwide items, for example, Samsung's lead cell phones (Galaxy S9 and S9+). While different organizations focused on propelling their worldwide items in India, Samsung went about rethinking items for the nation at its R&D focuses.

India is significant for Samsung, thinking of the nation as the second biggest cell phone showcase on the planet today, and it is possibly the greatest undiscovered market for some advanced apparatuses. The entrance of iceboxes, clothes washers, microwaves, and forced air systems are appallingly low because of components like the accessibility of continuous power, social conduct, way of life, and earnings.

Business Growth in India

Samsung India crossed the INR 50,000 crore deals achievement in 2017 according to the simply distributed organization filings with the Registrar of Companies (RoC), uniting its situation as the nation's biggest unadulterated play purchaser products MNC. The Korean mammoth's all-out salary, including turnover and other pay, developed by 15.5% to INR 55,511.9 crore in FY 2017 from INR 48,053 crore in the earlier year regardless of Chinese organizations making genuine advances into the Indian cell phone advertise.

Samsung's cell phone business developed deals at 26.7% to INR 34,261 crore, while the home apparatus business developed by 12% to INR 6,395.6 crore. The organization's TV business stayed dormant at INR 4,481.2 crore even though Samsung held the market initiative.

The organization's net benefit developed at a quicker pace of 38% to INR 4,156.2 crore which industry examiners credited to more concentrate on premium models crosswise over cell phones and customer hardware having higher edges.

Samsung, in its filings, said the 'Make for India' activity, through which a large portion of the items was planned and created given the Indian customer's needs, has been an enormous achievement and a major factor behind the development.

All the units at Samsung India improved their gross productivity with the TV business dramatically increasing it and the home machine business nearly trebling it. The cell phone business was the biggest supporter of gross benefit having developed by 44% in FY17 at INR 5,005.9 crore.

Future Plans of Samsung

Samsung has arranged a new venture of around INR 2,500 crore to transform its India tasks into a center for parts business, two senior industry administrators said. The ventures could be increased further, they included. The Korean organization has set up two new parts fabricating substances in India—Samsung Display Co and Samsung SDI India—for the generation of cell phones and batteries.

Independently, Samsung's funding arm—Samsung Venture Investment Corp—has set up activities in India to support new companies in gadgets equipment and programming organizations. The segment organizations will supply items to both Samsung India and other cell phone merchants who as of now source parts from Samsung's abroad tasks.

Samsung sees a big opportunity for segment business considering the administration's push on 'Make in India' where expense on imported cell phone segments and purchaser hardware is going up, the administrators said.

Samsung is likewise pitching to the administration for fare impetuses so it can even fare segments from India. Samsung Display has just marked an update of comprehension with the Uttar Pradesh government for an INR 1,500 crore plant for assembling telephone show to be operational by one year from now April. The plant will come up in Noida, the administrators said.

Samsung SDI India has plans to set up an assembling unit in India for lithium-particle batteries after the organization was drifted a month ago, according to its administrative filings with the Registrar of Companies (RoC).

As per the administrators, Samsung SDI has plans to contribute another INR 900-1,000 crore and will settle the plans after counseling with the Center post general races. These speculations come after it introduced the world's biggest cell phone fabricating unit in India a year ago at an all-out cost of INR 4,915 crore. It is expected to be completed in 2020.

That's all for now. Share your learnings and findings. What did you learn from this article? Which information surprised or amused you the most? Feel free to reach us and share your feedback. We would love to hear from you. Do comment us in the comments section below. Happy Reading.

Who is the owner of Samsung Electronics?

Samsung Group is the owner of Samsung Electronics.

Who is the Founder of Samsung?

Samsung Electronics was established by Lee Byung-Chul (1910–1987) in 1938 as an exchanging organization.

Who is the current CEO of Samsung?

Kim, Ki Nam, Kim, Hyun Suk and Koh, Dong Jin are the current CEO of multinational conglomerate Samsung.

What does Samsung Electronics make?

Samsung Electronics produces smartphones, TV sets, laptops, solid-state drives, digital cinemas screens, etc.

Is Samsung a Chinese company?

Samsung is a South Korean electronic gadget manufacturer in Samsung Town, Seoul.

What is Samsung's strategy?

- Promotional Mix of Samsung

How large is Samsung Electronics?

Samsung is the world's largest manufacturer of consumer electronics by revenue. Samsung Electronics is the world's second-largest technology company by revenue, and its market capitalization stood at US$ 301.65 billion, the 18th largest in the world.

What are the future plans of Samsung Company?

Samsung has arranged a new venture of around INR 2,500 crore to transform its India tasks into a center for parts business, two senior industry administrators said.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace

Fees of IPL Title Sponsors Over the Years

The cash-rich Indian Premier League— as a product and brand— has emerged as one of the most profitable arms of cricket. Since its inception in 2008, the Board of Control for Cricket in India’s brainchild has risen by leaps and bounds to be adequately represented by the title sponsors

A Look at Berkshire Hathaway's Marketing Strategy

Berkshire Hathaway Inc. is a highly diversified American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States. The company has a rich history, dating back to 1839 when it was established as a textile manufacturer. However, under the visionary leadership of Chairman and CEO Warren Buffett and Vice Chairman

Swiggy - How is it Delivering Happiness at the Doorstep?

Do you wish to have a delicious bite of blueberry cheesecake in the middle of the day at work or a hearty biryani meal for lunch? Moving out of your house, facing the relentless traffic, unending queues at the restaurants and cafes, waiting for your order, etc., sounds demotivating as

Biigbull Financial Services Private Limited Makes Financial Security a Reality for Everyday People

Jamshedpur (Jharkhand) [India], April 10: Imagine a world where financial literacy and investment opportunities are no longer reserved for the privileged few. This is the vision that drives Biigbull Financial Services Private Limited, a company built on the remarkable story of its founder, Mr. Raj Kumar Paswan, and his unwavering

Get in touch

+86 21 6083 1177

Colors of Samsung

Samsung/amoled.

Promoting cutting-edge screen technology to mobile phone manufacturers

Samsung’s AMOLED screen technology is considered to be the best in the world - from the color gamut, to contrast, to backlit screen usage. The company headquarters in Korea wanted to promote their screen technology to Chinese mobile phone manufacturers through an integrated campaign.

Actions

Brandigo worked directly with Samsung’s Korea headquarters to create an interactive B2B website that showcased their screen technology, AMOLED. The accompanying online campaign utilized experts across many fields: an optometrist, fashion designer, color expert, photographer, and other influencers, who wrote articles and gave testimonials about the importance of color, contrast and vision in their respective line of work. By choosing key channels in the mobile market space, the target audience was reached with compelling, interesting messages and insights.

Key Actions:

- Bespoke Chinese website design and development, with interactive elements showing AMOLED benefits

- Recommend & manage KOL (influencers) to participate in the campaign

- Photoshoot of influencers across China

- PR, paid advertorial and banner ad campaign for 3 months

- 500,000 site visits in 3 months

- Adoption by Chinese mobile phone manufacturing targets

- Increase in product awareness across market

Related Projects

Effective infrastructure lead generation

Boeing Campaign

Raising awareness for one of Boeing's key products

National Instruments

Encouraging engagement with semiconductor test engineers

+ 86 21 6083 1177

4F, Anken Access

285 Anyuan Road

Jing'An District

Shanghia, China

Follow us on WeChat

Brandigo is an independent marketing communications agency based in Shanghai, China. We work with multinational clients to support their marketing and business growth efforts in China.

For global brand strategy, visit brandigo.com

© 2023 Shanghai Zaoyihang Advertising Ltd. All rights reserved.

COMMENTS

Samsung Is a Case Study in How Manufacturers Leave China. Company still has significant operations in China but its smartphone manufacturing business pulled up stakes years ago. The $53 billion ...

Samsung is a Case Study in How Manufacturers Leave China. Story by Jacky Wong. • 10mo • 3 min read.

Samsung is a Case Study in How Manufacturers Leave China. The Wall Street Journal 3 min read 03 May 2023, 08:41 PM IST. Visitors walk beneath a Samsung logo at the Mobile World Congress (MWC), the ...

The departure of the world's largest smartphone maker was the latest blow to China's long dominance in high-end manufacturing, as wages rise and the threat of US tariffs weighs on other ...

How Samsung Lost China. Photo by Kote Puerto / Unsplash. While being the uncontested leader in 2014, by 2020, Samsung had lost China entirely. From an 18% market share of the Chinese mobile phone market in 2014 to a measly 2% in 2018, by 2020, Samsung had virtually disappeared from the Chinese mainland market.

The $53 billion Chips Act seeks to end the U.S.'s reliance on foreign-made semiconductors, especially those used by the Pentagon. It's the latest example of the federal government using its cash to remake an industry it sees as crucial to national security. "De-risking" is the latest buzzword describing Western governments' strategy toward China. While it sounds less ambitious than ...

Samsung is a Case Study in How Manufacturers Leave China. "De-risking" is the newest buzzword describing Western governments' technique towards China. Whilst it sounds much less bold than "decoupling," the fundamental thought is identical: decreasing reliance on China for production, particularly for key technological items. "De ...

"De-risking" is the newest buzzword describing Western governments' technique towards China. Whilst it sounds much less bold than "decoupling," the

Samsung still has significant operations in China, including for its crucial memory chip business. But from a head-count perspective, it has been edging away from China for years. The company had over 60,000 employees in China in 2013 according to its 2014 Sustainability Report, but that number had fallen to less than 18,000 by 2021.

Market data, development and operations of Webull's website/application are provided by Webull Technologies Pte. Ltd. ("Webull"). Financial products and services are offered to self-directed customers by Webull Securities (Singapore) Pte. Ltd. ("Webull Securities") (UEN: 202116981M), a Capital Markets Services Licence holder under the Securities and Futures Act 2001, licensed and ...

current affairs. industry. defence

SSNLF / Samsung is a Case Study in How Manufacturers Leave China ... Content Topics. Samsung Case Study Manufacturers Leave China Stock SSNLF . Posted: May 3 2023, 09:17. Author Name: WSJ. Views: 011389. SSNLF News . By TechXplore October 31, 2023. Samsung Electronics says Q3 operating profits down 77.57% ...

Samsung is a Case Study in How Manufacturers Leave China. Wall Street Journal - 3 May 2023 15:17. The company still has significant operations in China but its smartphone manufacturing business pulled up stakes years ago. How and why that happened is instructive. Full Article at Wall Street Journal.

This case study describes how Samsung Electronics transformed into a world-class company and the strategic challenges it faces as it looks to sustain its success in both developed and emerging markets. It has been 20 years since Lee Kun-Hee announced the New Management initiative that played a crucial role in transforming Samsung from a second-tier

Here's how it works. Samsung prepares for a Chinese exit - to relocate TV production. China's consumer electronics related supply-chains appears to be losing its sheen in the post-Covid-19 world ...

Heard on the Street: Samsung's smartphone manufacturing business pulled up stakes in China years ago. How and why that happened is instructive. Samsung Is a Case Study in How Manufacturers Leave ...

Samsung is a Case Study in How Manufacturers Leave China. Source Link. "De-risking" is the latest buzzword describing Western governments' strategy toward China. While it sounds less ambitious than "decoupling," the basic idea is similar: reducing reliance on China for manufacturing, especially for key technological goods.

Samsung Is a Case Study in How Manufacturers Leave China WSJ, was launched in India on September 2, 2016 (Official) at an introductory price of Rs 59,900 and is available in different color options like Gold. ... Samsung Is a Case Study in How Manufacturers Leave China WSJ. 4.3 (57)

Samsung is a Case Study in How Manufacturers Leave China The company still has significant operations in China but its smartphone manufacturing business pulled up stakes years ago. How and why that happened is instructive.

management will do a deep analysis of the org anization's mission, vision and the way to. use the resources to meet the objectives. Strategic planning is often done by the top management in an ...

Let's start the detailed case study from here. Samsung entered the electronics industry in the late 1960s and the development and shipbuilding ventures in the mid-1970. Following Lee's demise in 1987, Samsung was divided into five business groups - Samsung Group, Shinsegae Group, CJ Group, Hansol Group and Joongang Group.

Samsung's AMOLED screen technology is considered to be the best in the world - from the color gamut, to contrast, to backlit screen usage. The company headquarters in Korea wanted to promote their screen technology to Chinese mobile phone manufacturers through an integrated campaign.

Samsung still has significant operations in China, including for its crucial memory chip business. ... Samsung Is a Case Study in How Manufacturers Leave China wsj.com 7 Like Comment Share Copy ...