- Website Inauguration Function.

- Vocational Placement Cell Inauguration

- Media Coverage.

- Certificate & Recommendations

- Privacy Policy

- Science Project Metric

- Social Studies 8 Class

- Computer Fundamentals

- Introduction to C++

- Programming Methodology

- Programming in C++

- Data structures

- Boolean Algebra

- Object Oriented Concepts

- Database Management Systems

- Open Source Software

- Operating System

- PHP Tutorials

- Earth Science

- Physical Science

- Sets & Functions

- Coordinate Geometry

- Mathematical Reasoning

- Statics and Probability

- Accountancy

- Business Studies

- Political Science

- English (Sr. Secondary)

Hindi (Sr. Secondary)

- Punjab (Sr. Secondary)

- Accountancy and Auditing

- Air Conditioning and Refrigeration Technology

- Automobile Technology

- Electrical Technology

- Electronics Technology

- Hotel Management and Catering Technology

- IT Application

- Marketing and Salesmanship

- Office Secretaryship

- Stenography

- Hindi Essays

- English Essays

Letter Writing

- Shorthand Dictation

10 Lines on “Pocket Money” Complete Essay, Speech for Class 8, 9, 10 and 12 Students.

10 lines on “pocket money”.

1. There is nothing as thrilling as the jingle of coins in one’s pocket or the feel of crisp notes -money that belongs entirely to oneself to do as we please with it.

2. I strongly feel that our parents should give us pocket money.

3. If children don’t get a monthly or weekly allowance how will they learn to handle their finances?

4. Moreover, when they see others spending lavishly they may be tempted to steal some money!

5. Oh how I long for pocket money! If you ever see me staring out of the window absently during the Maths period, you will know that I am thinking of all the wonderful things I would do with my pocket money if my parents ever gave it.

6. First of all I would buy that lovely Teddy Bear I saw in the shop the other day.

7. Then I would make sure that my friends received birthday cards from me regularly.

8. At present, my mother gives me money for this “useless” luxury only after she has asked me at least a dozen questions!

9. The rest of my money, if there was any remaining, would be spent on sweets and ice cream.

10. You see how simple my desires are. I wish somebody would convince my parents that if I had some money of my own, I would not, as they seem to think, fall into all kinds of evil ways.

About evirtualguru_ajaygour

commentscomments

i will do the level best

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Quick Links

Popular Tags

Visitors question & answer.

- Gangadhar Singh on Essay on “A Journey in a Crowded Train” Complete Essay for Class 10, Class 12 and Graduation and other classes.

- Hemashree on Hindi Essay on “Charitra Bal”, “चरित्र बल” Complete Hindi Essay, Paragraph, Speech for Class 7, 8, 9, 10, 12 Students.

- S.J Roy on Letter to the editor of a daily newspaper, about the misuse and poor maintenance of a public park in your area.

- ashutosh jaju on Essay on “If there were No Sun” Complete Essay for Class 10, Class 12 and Graduation and other classes.

- Unknown on Essay on “A Visit to A Hill Station” Complete Essay for Class 10, Class 12 and Graduation and other classes.

Download Our Educational Android Apps

Latest Desk

- Role of the Indian Youth | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Students and Politics | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Menace of Drug Addiction | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- How to Contain Terrorism | Social Issue Essay, Article, Paragraph for Class 12, Graduation and Competitive Examination.

- Sanskrit Diwas “संस्कृत दिवस” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- Nagrik Suraksha Diwas – 6 December “नागरिक सुरक्षा दिवस – 6 दिसम्बर” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- Jhanda Diwas – 25 November “झण्डा दिवस – 25 नवम्बर” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- NCC Diwas – 28 November “एन.सी.सी. दिवस – 28 नवम्बर” Hindi Nibandh, Essay for Class 9, 10 and 12 Students.

- Example Letter regarding election victory.

- Example Letter regarding the award of a Ph.D.

- Example Letter regarding the birth of a child.

- Example Letter regarding going abroad.

- Letter regarding the publishing of a Novel.

Vocational Edu.

- English Shorthand Dictation “East and Dwellings” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines.

- English Shorthand Dictation “Haryana General Sales Tax Act” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

- English Shorthand Dictation “Deal with Export of Goods” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

- English Shorthand Dictation “Interpreting a State Law” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

Essay on Pocket Money

Students are often asked to write an essay on Pocket Money in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Pocket Money

Introduction.

Pocket money is a small amount of money given to children by their parents. It is a practical way to teach kids about financial responsibility.

Importance of Pocket Money

Pocket money helps children learn about budgeting and saving. It teaches them the value of money and encourages them to make wise spending decisions.

Managing Pocket Money

Children should be guided on how to manage their pocket money. They can save part of it, spend some on their needs, and maybe donate a portion to charity.

In conclusion, pocket money is a tool to prepare children for the financial realities of adulthood.

250 Words Essay on Pocket Money

The concept of pocket money.

Pocket money, a concept as old as money itself, is an important tool in a young person’s journey towards financial literacy. It is essentially a small amount of money given to children by their parents or guardians on a regular basis.

The Importance of Pocket Money

Pocket money plays a vital role in shaping a person’s understanding of money management. It teaches the value of money and the importance of budgeting, saving, and making informed financial decisions. It also fosters a sense of responsibility, as one has to manage their own funds and prioritize their spending based on needs and wants.

Pocket Money and Financial Independence

Financial independence is an essential life skill that begins with managing pocket money. It’s a stepping stone towards understanding the complexities of the financial world. It empowers youngsters to make their own spending decisions, consequently teaching them about the repercussions of poor financial choices.

Potential Downsides

Despite its benefits, pocket money can also have potential downsides. If not properly guided, children may develop poor spending habits or a sense of entitlement. It’s therefore crucial for parents to provide guidance and set boundaries around the use of pocket money.

In conclusion, pocket money serves as a practical tool for teaching financial literacy from a young age. It’s a concept that, when used properly, can cultivate financial independence and responsible financial habits. However, it requires careful guidance to ensure it fosters positive attitudes towards money management.

500 Words Essay on Pocket Money

Pocket money, often considered a simple financial tool, is a profound concept that holds the potential to shape an individual’s financial understanding and habits. It is a small amount of money given to children by their parents or guardians on a regular basis. The concept of pocket money is not just about providing financial support for minor expenses, but it is a practical way to teach young people about the value of money and financial responsibility.

The Significance of Pocket Money

Pocket money serves as an essential learning tool for young adults, especially college students, who are at a critical juncture of their life. It helps them understand the concept of budgeting, saving, and spending wisely. By managing their own pocket money, they gain insights into the financial world, which is crucial for their future independence.

Moreover, pocket money can also help in fostering a sense of responsibility. When students manage their own money, they understand the importance of making wise choices and the consequences of their financial decisions. They learn to prioritize their needs and wants, which is a critical life skill.

The Challenges of Pocket Money

Despite its numerous benefits, pocket money comes with its own set of challenges. The primary issue is determining the right amount. Too little pocket money could leave students struggling to cover their basic needs, while too much could lead to reckless spending and a lack of appreciation for the value of money.

Furthermore, the misuse of pocket money is another concern. Without proper guidance, students might spend their money on unnecessary items or develop unhealthy habits, such as gambling. Therefore, it is crucial for parents and guardians to provide guidance and monitor the usage of pocket money.

Strategies for Effective Use of Pocket Money

To ensure the effective use of pocket money, it’s essential to implement strategies that promote responsible financial behavior. One effective method is to encourage students to save a certain percentage of their pocket money. This not only helps them accumulate savings but also instills a habit of saving.

Another important strategy is to involve students in budgeting. They should be encouraged to plan their expenditures, which will help them understand their spending patterns and control impulsive buying.

Lastly, it’s important to have open conversations about money. Discussing financial matters, such as the importance of saving, the consequences of debt, and the significance of investing, can help students develop a healthy relationship with money.

In conclusion, pocket money is a powerful tool that can shape a student’s financial behavior and understanding. Despite the challenges it presents, with the right strategies and guidance, it can be used effectively to instill financial responsibility and independence in students. The lessons learned from managing pocket money are invaluable, and they lay the groundwork for sound financial habits in adulthood.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Money Is the Root of All Evil

- Essay on Money is Not Everything

- Essay on Money Is Important for Happiness

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

Pocket money: When to start, how much to give, and how to use it to teach your kids financial skills

A useful starting point is working out what the pocket money will be used for. .

Robyn McCormack

Giving kids pocket money can be a really challenging decision for families. It raises questions about when to start it, how much to give, and whether it should be tied to chores.

As a finance researcher and parent, it’s also important to view pocket money as an educational opportunity. You can use it to teach children how to make informed financial decisions, set meaningful goals and develop responsible spending habits.

Here’s how you can approach it.

When should you start?

There is no one “right age”, but you could reasonably consider pocket money when children start school and begin learning to add and subtract.

This means your child will be old enough to start grasping concepts like saving and spending.

As your child grows, you can move on from basic arithmetic and tailor your discussions to what your child is learning in maths.

How much should it be?

How much you give will depend on your family situation and finances.

A useful starting point is working out what the pocket money will be used for. Is it simply to give your child a bit of autonomy over spending (for example, buying an ice block from the canteen)? Is it to try to save for something special? Or is it to be used for all entertainment, clothes and on-trend desires like fancy water bottles?

A long-held rule of thumb is giving $1 per week relating to your child’s age (so $5 for a five-year-old). But of course, amounts tying pocket money to a child’s raw age may not work with today’s economic conditions. Three years ago, $10 bought a lot more than it does today.

Of course, you will also need to consider pocket money within the context of your wider household budget. Down the track, there’s nothing wrong with talking to your child about adjusting their pocket money if your household budget needs changing.

Cash or direct debit?

When your child is little, giving them pocket money in cash is a good way to help them start to understand money. It’s something they can see and hold in their hands.

As they get older and the amounts get larger, direct debits will become more convenient and can teach them about handling their money online.

Since getting your hands on cash is difficult these days, when they’re young you can also give your kids pocket money electronically but give them monopoly money or a similar representative of what they have earned. You can then progress to a spreadsheet as they get older.

What about tying it to chores?

Many parents like to provide pocket money in exchange for chores, as they feel it might instil a work ethic in their kids and the idea you don’t get money for nothing.

If you are tying pocket money to chores, be very clear about what will be done for what money and when chores need to be reviewed. Follow-through is important for this structure to be effective, so if they don’t do the work, they don’t get paid. You can also give them bonuses for jobs that are particularly well done.

Personally, I find this process to be more work for parents than it’s worth. I prefer the children to simply help around the house because it’s a core family value, rather than tying it to finances.

The bigger picture

However you structure pocket money in your family, it’s important to consider it an opportunity to learn about finances.

You might start with simple discussions around “do I have enough money to buy this packet of textas and that toy car?” or “how many weeks until I can afford that book?” Then, as your child develops, you can introduce concepts such as cash flow, interest rates and banking products.

For example, cash flow lessons can start with talking about the importance of spending less than you earn.

Teaching kids about goals

Pocket money is also a fantastic way to help kids learn how to save. Help them set a realistic goal to save up for something that matters to them. A pair of sneakers they want, or a particular video game, is likely to be more achievable than a new bike. This will help motivate and challenge your child, without overwhelming them.

As your child gets older, you can introduce more sophisticated notions of saving and funds.

For example, when my child started high school, we talked about setting up an emergency fund. As she was going to catch buses, we worked out the fund should be $50 (based on missing the bus and needing a taxi home). This became her new “baseline” before spending on non-essential items such as food from the school canteen.

Barefoot Investor author Scott Pape recommends starting with physical buckets with “splurge” for everyday little things, “save” for big goals, “give” for acts of kindness and “grow” for investing.

Shopping skills

Once your child has their own money to spend, a trip to the shops takes on a whole new significance.

Smart shopping is not just about comparing prices or where to find the best bargains. It is also learning what is worth spending your money on and when.

You can talk to your child about what they value and their emotional responses around buying decisions. For example, “how long was it before the excitement of your new T-shirt wore off?” Or, “did you feel differently when you spent your money on going to that movie (an experience) versus that box of Lego (a tangible product)?”

There are lots of things to consider (and no perfect formula) when it comes to pocket money. But if it means you can integrate financial skills into everyday life, it’s a fantastic investment in your kids’ education.

- Robyn McCormack is a marketing and finance academic at Bond University in Australia. This article was first published in The Conversation

Join ST's Telegram channel and get the latest breaking news delivered to you.

- Children and youth

- Social conditions and trends

- Financial literacy

Read 3 articles and stand to win rewards

Spin the wheel now

The Great Debate – Pros and Cons of Pocket Money

by Lacey | Sep 9, 2014 | Parenting , Pocket money , Relationships , Teaching kids about money | 1 comment

In this extreme social experiment we call parenting, choices abound. From contentious issues like vaccination, to comparatively trivial ones like when to cut your child’s hair for the first time, we are bombarded opinions on what and what not to do, often in no uncertain terms. Ah, the glorious interweb, font of information (but not necessarily wisdom). So, if you’ve been getting lost trying to navigate the debate around the pros and cons of pocket money, let me assure this one’s completely subjective. Without further ado.

POCKET MONEY!

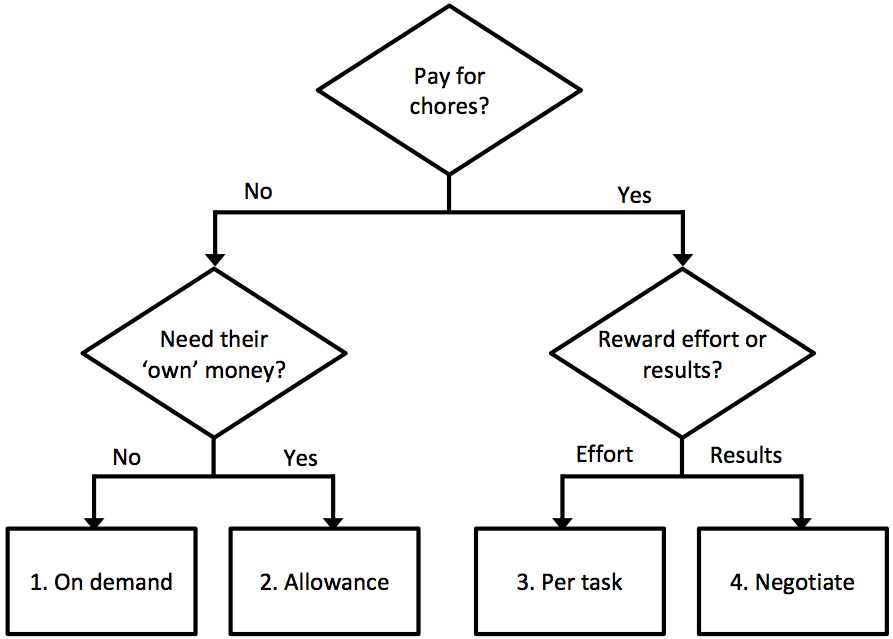

In this post, I try spare you the overload of the ‘pocket money should be earned’ debate. I will cover the pros and cons of pocket money, four ways you can go about setting it up, and some simple tools to help you work out which method is right for you and your child.

The four ways parents manage pocket money

I’ve spoken with a lot of parents about how they manage their child’s pocket money and I have observed four basic methods. They are:

- By allowance

- Per task and

- By negotiation.

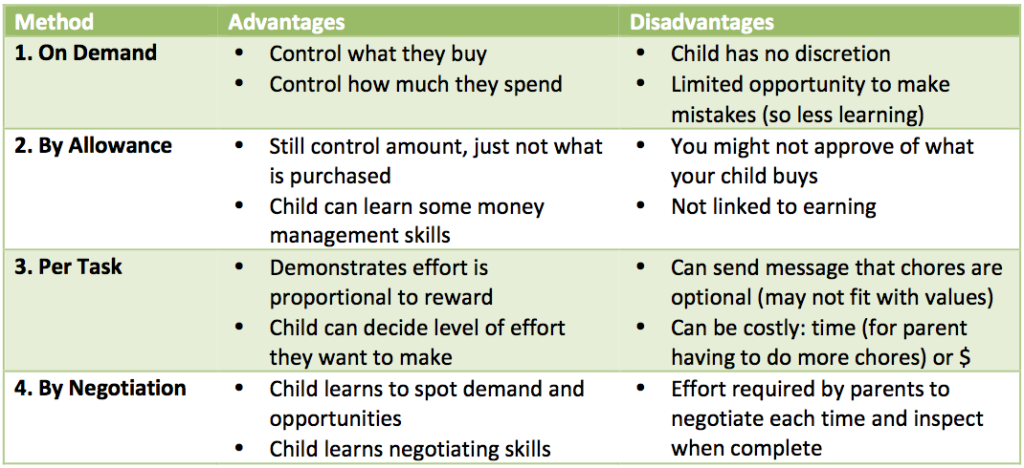

1. On Demand

This is where the child asks the parent whenever they need money for a specific item or event. The most common sentiment I hear from this group of parents is:

“I provide everything my child needs, so they don’t need pocket money.”

While technically correct, the reality is that they probably still get the same material outcomes as other kids who do receive pocket money, i.e. they get to go to the movies, or to buy a treat, or whatever else their little heart desires. It’s just that they have to ask permission for how that money is spent every time they want it. Really, it’s pocket money on demand and subject to the discretion of the parent. This is the only method that allows the parent to control how, when and on what money is spent.

2. By Allowance

This is the fixed amount approach: Mum and Dad give child X dollars a week/month/year, and it’s up to the child how that money is spent. The money is not a reward or payment for any particular behaviour or task, it’s a given. The exception to this is deprivation as a form of punishment – much like grounding, or banning from watching TV, you can hold back the allowance when your child behaves badly.

3. Per Task

This method most closely mirrors a wage or salary: do this task, and you will be paid accordingly. Different levels of pay can be associated with different tasks, and often the value varies with the amount of time or effort required for a given task. For example, you might offer $5 for stacking and unstacking the dishwasher for a week, or $10 for doing the washing up for the same period. It reiterates the concept of earning money through effort: a child who doesn’t want to earn much doesn’t have to do much, but if they want more pocket money they need to put in more effort.

4. By Negotiation

Perhaps the most entrepreneurial approach, this method not only varies the pay with the task, it requires the child to negotiate what that pay will be and what the deliverables are. Parents using this method set the expectation with their child that s/he will come to the parent with a proposal to complete a task and negotiate with the parent as to what it’s worth to them. This method can help children learn to spot demand: if a child knows both parents detest washing the car, they can charge a premium for that task. Be warned – kids are smart. They will work out how far they can push you with this. Of course, that’s exactly what we want them to do, but be prepared not to curse when it happens.

Which method is right for you and your child, right now?

Good news: there is no right or wrong answer! (Despite what Facebook parenting experts tell you!)

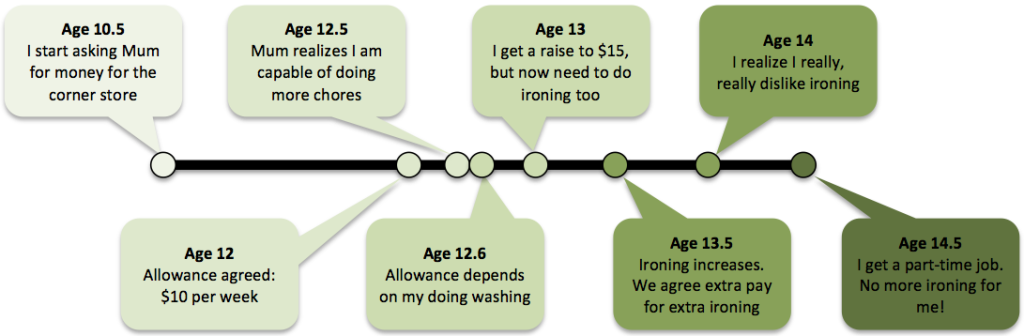

It’s a matter of personal choice, and you may find you use all four types at various points over the years. That was certainly the case for me – see below for the phases I went through with my Mum. It’s a cautionary tale in one way: I stopped doing the ironing at 14 ½ years, leaving Mum to iron everything except my school uniforms. I’ve ironed about twice a year on average ever since. (I REALLY detest ironing!)

A cautionary tale: my experience receiving pocket money

Ask yourself two questions

You can use the flow chart below to decide how you think pocket money will best work for you and your child, right now.

Start at the top and work your way down to one of the four pocket money methods

Still not sure? Let’s explore these questions in a bit more depth:

Question 1: Do you believe children should be paid for chores?

I was raised being paid for chores, so it never occurred to me to ask this question until a friend of mine recently offered an alternative point of view.

Her take on it was that chores are part of life – a responsibility we all share. No one pays Dad to cook dinner, or Mum to do the washing – it’s just what Dad and Mum do for the family. My friend believed that paying her child for chores would mean he missed a big lesson about contributing to family life and shared responsibility.

On the flip side, there are parents out there who think getting your child to do chores is robbing them of their all-too-fleeting childhood. Why shouldn’t they be rewarded financially for something that takes them away from the fun of being a kid?

Ah, moral questions. Enjoy wading through the quagmire on that one, or simply go with the majority of parents I’ve surveyed and pick ‘Yes’.

Question 2a: If you do believe children should be paid for chores, do you prefer to reward them for effort or results?

Assuming you went with the majority and said ‘Yes’ to paying your child for chores, the next question is whether you’re going to pay them for effort – their time or the type of task they undertake – or for the result they produce?

Not a question I’d considered much, until my mum reduced my pocket money for doing a crappy job of the ironing one week. Her explanation was simple: ‘I’m not paying you do something I’ll need to do again myself because you didn’t do it properly.’ Obviously, I was disgusted and went on strike to protest… until I wanted to go to the movies three days later.

In case you hadn’t guessed, my Mum is of the ‘results’ persuasion, which I theoretically agree with.

However, most jobs I’ve had do not reward results in the short term. They reward effort. If I stuffed up something while I was working, I had to do it again, but I got paid for the failed attempt anyway. I might not get another shift for a while, or I might eventually get fired for my poor productivity, but that week I got my paycheck. So, you could really argue either way for this one – your call!

Question 2b: If you don’t believe children should be paid for chores, do you believe children need some cash of their own?

At some point in their lives, our children are able to make their own decisions. When you think your child is ready to make such decisions relating to money, you are probably ready to let them have cash of their own by paying an allowance. If you think your child is not ready to make these kinds of decisions, you may prefer the ‘on demand’ method: simply providing the cash they need, when they want it, when you have discussed it.

Personally, I’d prefer NOT to have my hypothetical teenage son ask me for $10 so he can buy condoms. I’d rather he had the $10 to be responsible for himself.

Pros and Cons of each method

If you’re still debating which way to go, you can consider the advantages and disadvantages in this table:

What’s next?

Perhaps your choice is obvious, perhaps it’s not. Maybe you want to set aside some time to speak to your child about it, depending on their age. Remember that all four methods can work – it’s up to you when and how you apply your choice, and you can always change your mind. Hooray for a parenting choice that’s not fraught with danger!

Do you have a story to share regarding pocket money? We’d love to hear it – please leave a comment below.

What comes next?

Download our Free Financial Resources

Find the right Money School Course for you

Get the Book: Money School, Become Financially Independent and Reclaim Your Life, Lacey Filipich

Got a question: Contact Us

Lacey Filipich is the co-founder and director of Money School. She helps parents raise financially savvy kids and helps adults get on top of their finances. Connect with her on LinkedIn and follow Money School Facebook to learn more.

Exceptional Info

Trackbacks/Pingbacks

- Future-Proof Kids Part 2 of 4: Raising entrepreneurs - LBD Group - […] problem in life, so every problem is an opportunity to demonstrate entrepreneurial thinking. Even pocket money can be used…

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

- Interviews & Personal Stories

- Negotiation

- Relationships

Money School

Pocket money: when and how much?

Does it make sense to give pocket money to children? Is it good for them, and what are their benefits of learning through spending and saving?

Well, first things first.

Let’s be honest — we can’t imagine today’s human society without cash, so all in all, every child will have to learn about money sooner or later, and it’s up to every parent to decide what age they think fit as a starting point.

Opinions as to whether one gives pocket money to kids vary. Those, who are against this idea, substantiate their belief with these arguments:

- kids already have everything they need for everyday life;

- a kid will spend cash on trifles;

- he or she won’t appreciate the value of money;

- and will become greedy.

Such risks do exist if parents:

- don’t follow any reasonable system in the way they provide cash to their kids;

- don’t offer any pieces of advice about rational spending of funds;

- scold their children in case of any mistakes and unwise spending instead of discussing and helping to learn lessons for future.

However, most psychologists and advocates of financial literacy rely on the importance of establishing some line of financial interaction between children and parents. The arguments in support of this position are that kids will:

- learn to set and achieve financial goals;

- appreciate the advantages of financial independence;

- evolve into an adult, who will spend smartly;

- will ultimately learn to handle a variety of financial instruments;

- not have hang-ups as compared to teenagers that have the cash to cover everyday expenses.

On the contrary, if you prefer not to give cash to kids, you can sooner or later face the issues arising out of such unwillingness:

- The kids will face difficulties when shopping since their previous experience won’t offer any prompts.

- They won’t master budget planning and cost management.

- When kids have no own cash, they are under pressure to the temptation to take what doesn’t belong to them, even if it is just a pack of chips.

- A kid will see himself as a white crow among coevals.

An interesting point to mention here is that psychologists have already classified parenting style as related to “cash management”.

The controlling type requires strict accountability about every spending item. If a kid fails to submit the balance sheet, the provided amount will be reduced to the minimum. Here, a parent may prevent any unwanted spending or consult their kids on rational spending. However, at the same time, this approach doesn’t develop independent financial thinking since a parent still remains the only decision-maker.

The behaviorist type allocates remuneration after a kid cleans the room or gets an excellent mark. Here cash serves as an incentive of academic excellence and industrious help about the house. The side-effect of such an approach is that a kid can totally refuse to study or do the chores for free.

The planning type — these are the parents that give the agreed amount once a month or week. This develops independent financial thinking, the ability to control and prioritize spending.

How will a child benefit from having their own cash?

Pocket money will help kids learn important financial literacy lessons, from the basic guides of how not to lose money on trash up to family budget planning or investments.

This way, kids will grasp the idea that:

- cash is an occult substance that can just vanish in the air for no reason,

- big purchases require small but regular steps of savings,

- that, once borrowed, the cash must not only be paid back but also observe the deadline when repayment is due,

- that the most straightforward way to possessing your own money is a job you do (especially for adults),

- planing your spending beforehand and prioritizing items is required not to overspend and reserve some cash for emergencies.

When and How Much?

There are no one-size-fits-all recommendations about the age to acquaint your son or daughter with cash. Still, the general criteria, if your kids are ready to handle the issue, is that:

- Kids understand everyone needs money to purchase goods from stores.

- They clearly see the importance of savings instead of spending it all right away.

- They accept that if the entire sum is gone today, they have to wait until the next date when they usually receive it.

At the pre-school age, kids can grasp the primary principles of cash management:

- cash is used to buy staff and food for a person’s everyday needs,

- it’s essential to learn how to save money , or it disappears before the date of next payment you are supposed to get it,

- cash can be physically lost or stolen,

- funds are gone after you’ve exchanged them for any necessary goods.

Parents could use cash instead of paying with debit/credit cards in a supermarket to clearly visualize the message they want to deliver.

Parents are supposed to bring home to their youngest ones what they are permitted and forbidden to buy. It’s worth recording the rules, making a list of the allowed goods or select a set of matching pictures and putting these instructions in the place where they are clearly visible. This way, they will be easier to remember.

Tell teenagers about lending. It’s important to bring home to them that borrowed money must be repaid and that you borrow someone’s other funds only for a while but need to repay them for good. Tell them about the interest rates accrued on any credit nowadays. You can even practice it if your kids ask you for additional cash in case he/she has run out of money or wants to make a larger purchase. That will teach them the basics of lending, with all disadvantages that accompany quick cash accessible through credit cards.

The exact sum to allocate to your kid is entirely your choice as a parent. Take into account your family’s spending needs, financial position, and what you believe will be reasonable. It is logical to consistently raise the sum as your kid gets older because both their spending demands and the ability to deal with money will grow. Of course, younger children lose cash more often, and the lesson is less expensive if the amount lost is not great. Besides, get ready for mistakes younger kids can make while learning: chances are they will occasionally overspend or buy the things they don’t need. So this is another reason, while smaller amounts match the situation better.

Consider what your kid needs cash for every day: a bus to school, having lunch during the daytime, small pleasures. Another portion of cash can be saved for a bigger purchase or charity if your kid shares a certain cause and wants to contribute. As an option, consider the amount your child’s friends get as a guiding light. Still, if you feel this amount is too large, stand pat and follow your sense of proportion.

It’s a reasonable approach to give cash in denominations that make it easier for a kid to save a part of the provided amount. If it’s five dollars, then give 5 one dollar banknotes: this way, it is much easier for a kid to save at least one banknote. Seemingly little as it is, it would be twenty percent savings! Another recommendation here is to store cash in different jars or transparent plastic containers: the first jar for everyday needs, the second — for long-term saving goals, and the third one (optional) for charity.

However, this is a parent’s right to control your child’s spending and prevent purchases you don’t approve, such as junk food, computer games or action films you wouldn’t allow to watch.

Cash for Chores: Pros and Cons

Pocket money for chores is a debatable issue, but here, again, every parent should do what they think appropriate.

One point of view is that chores are what both adults and kids do because they are family members and not because it is a kind of employment.

The opposite viewpoint is that paying for chores motivates doing it better, more regularly and teaches kids, especially teenagers, that employment is actually the only honest and decent way to get your own cash.

Besides, there is a rarely met approach when you pay kids for excellent school grades, with the underlying idea that this creates a strong connection between academic excellence, professional success, and prosperity.

If a kid gets cash for chores, it’s reasonable to pay it for regular activities, like daily laundering or cleaning their room once a week. This also helps to form a habit of having a regular paid job.

Tips and Tricks: Common Pocket Money Rules

Determine the sum you provide, judging by what you can afford in your financial circumstances. Opinions of other people are only advice you are free to follow or not.

Pay cash on the set date. This is how you teach your son or daughter to spread the expenses throughout the period and drill the basics of budgeting. This implies the skill to plan certain expenses, like mobile phone services.

Ask your kid what frequency is best for him or her — this will let your child feel his or her opinion matters and you are responsive to your kid’s ideas. Besides, if the provided case covers entertainment, discuss with the kid what kinds of pleasures are allowed.

Older kids can learn more about cash management. The aspects and topics covered may include:

- They will gradually understand the relative price of things, accepting that some goods are more expensive than others.

- Kids will see that the only decent way to have cash is to earn it. Another side of this knowledge is that work can be exciting and exhausting simultaneously.

- Set short- and long-term objectives to provide some details about the investment basics.

- When wishing to save money for larger purchases, they will have to learn budget planning, decide how much cash they are willing and can afford to save every month, what expenses can be reduced to improve the savings pace. This is also a valid reason to look for special offers and discounts.

- If, at some age, you begin paying for doing chores, that will teach them to regularly work for money, to be accountable for the quality of work, to agree upon the scope of work or remuneration due to it. The said of paid tasks will be changed over time: easier ones will have to be done for free, but your kids will have an opportunity to earn through engaging in a wider set of chores.

- At the teenage age, the experiment of charging interest on minor credits you grant to your kids will quickly teach them that borrowing it’s really expensive.

- On some occasions, you can withdraw cash as a punishment for a variety of violations, but this must be agreed upon from the very beginning.

- Avoid giving pocket money in advance or that will ruin the idea of teaching budget planning.

Key Takeaways

Any financial relations between parents and children are entirely a family matter where a parent decides what is right and what is wrong.

But the most important thing to remember here is that all of us live in the society where money is an everyday attribute of both work and beyond and, to some extent, is a benchmark of success or a source of problems. The reasonable attitude to money and proper financial culture is based on the well-developed skills of budget planning, spending / saving ratio, and the understanding that work is the most straightforward way of earning for a living. All of this will help your children avoid multiple financial issues they could face as adults. Like any other skills, these will also be maximized when developed since the early years.

So follow your common sense to choose a starting point and do your children a favor that is bound to improve their life in the long run.

Essay on “Pocket Money” for Kids and Students, English, Paragraph, Speech for Class 8, 9, 10, 12, College and Competitive Exams.

Pocket Money

There is nothing so thrilling as the jingle of coins in one’s pocket or the feel of crisp notes –money which belongs entirely to oneself to do as we please with it. I strongly feel that our parents should give us pocket money; If children don’t get a monthly or weekly allowance how will they learn to handle their finances? Moreover, when they see others spending lavishly they may be tempted to steal some money!

Oh how I long for pocket money! If you ever see me staring out of the window absently during the Maths period, you will know that I am thinking of all the wonderful things I would do with my pocket money if my parents ever gave it. First of all, I would buy that lovely teddy bear I saw in the shop the other day. Then I would make sure that my friends received birthday cards from me regularly. At present, my mother gives me money for this ‘useless’ luxury only after she has asked me at least a dozen questions! The rest of my money, if there was any remaining, would be spent on sweets and ice-cream.

You see how simple my desires are. I wish somebody would convince my parents that if I had some money of my own, I would not, as they seem to think, fall into all kinds of evil ways.

Related Posts

Absolute-Study

Hindi Essay, English Essay, Punjabi Essay, Biography, General Knowledge, Ielts Essay, Social Issues Essay, Letter Writing in Hindi, English and Punjabi, Moral Stories in Hindi, English and Punjabi.

Save my name, email, and website in this browser for the next time I comment.

Pocket Money should be given to children. To what extent do you agree or disagree.

Unauthorized use and/or duplication of this material without express and written permission from this site’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to Writing9 with appropriate and specific direction to the original content.

- Check your IELTS writing »

- Find writings with the same topic

- View collections of IELTS Writing Samples

- Show IELTS Writing Task 2 Topics

105.Some people believe that it is best to accept a bad situation, such as an unsatisfactory job or shortageof money. Others argue that it is better to try and improve such situations. Discuss both these views and give your own opinion.

You are going to write a for-and-against essay about whether spending time indoors or outdoors is better for our well-being., task 2: in many countries, people decide to have a child at a later age. why is this do the advantages of this development outweigh the disadvantages, some people think certain prisoner should be made to do unpaid community work instead of being put behind the bars. to what extent do you agree or disagree., the birth rate in most developed countries is predicted to begin to fall over the next 50 years. by 2030 it is estimated that over one-third of the population in most developed countries will be aged 65 and over. what effects will these predictions have on developed countries if they prove true what can be done now to deal with this situation.

Talk to our experts

1800-120-456-456

- Speech on Money in English for Students

Speech on Money

One of the most important aspects of everyone's life is money. We require money to purchase a variety of items for ourselves, ranging from the simplest to the largest. Money is also the source of any country's economic balance or imbalance. At various moments, you may be asked to give a speech on money. We'll show you some money speech examples that will help you give an excellent speech to your audience. If you need to give a one-minute speech anywhere, you can utilize the short speech on money. The language is simple yet powerful for any occasion.

Long and Short Speech on Money

For this money is speech, let's understand what money is. It is an essential commodity that is exchanged when one consumes products or services for themselves. Possessing money by people can be very useful to provide them with all the resources necessary to fulfill their dreams. It can help in so many ways, but it is also important to understand it is not everything. Having enough is good enough for leading a comfortable life. In this article, we will look into various ways of presenting money as speech, or money is not speech. It can be a Long Speech on Money or a Short Speech on Money.

Long Speech on Money

Many people believe that money equals free speech, in this form of speech we will dive into these details and this can be helpful for students in grades 8-12 who are trying to understand the workings of the world.

Good Morning everyone, honorable Principal, respected teachers and my dear friends, I Abc (mention your name) am here to enlighten you with the learnings I had when I was trying to understand the importance of money. It is certainly an asset to have access to this commodity, especially at a time when the prices are only rising. Money also definitely gives you the power to fulfill your dreams, be it attaining a quality education, traveling, starting a business, owning a luxurious car or helping your immediate family also fulfill their dreams.

It however has a way to bring out the worst in people as they become greedy, and try to earn more than necessary and not always by legal means. Those who have an abundance of it are the rich and they are in a position of power to dictate the lives of others, especially ones who lack and are at a disadvantage here.

It is assumed that money is free speech, which suggests when an individual or a community with money has the freedom to be upfront about their opinions and notions about anyone or anything without having to deal with any consequence. But this idea for the large part does not hold because the supreme court money is speech and is not just limited to money. Rather it emphasizes that everyone has the freedom to speak without interference and not be limited by fear.

It is very evident in our daily lives that not everybody has access to everything one needs or desires. People with money have also worked hard to reach a stage where they can not worry about anything and can afford luxuries without feeling guilty. People who follow the righteous path for earning money by putting in a lot of hard work and perseverance value this commodity. And are also aware of other people's hardships and help them in their ways. These people also uplift the credibility of the society they live in.

Whereas people who are only driven by greed engage in illegal means of earning money and even after that they are dissatisfied and wish to earn even more and not even consider the struggles of other people.

Money is truly a double-edged sword, while on one hand, it can give you a certain level of respect and status in society. But it can also rob you of the time where you can enjoy life with the money you earned, spending time by yourself or your loved ones. One is always on the go when driven by such a powerful commodity. So it is important to understand where to draw the line, not overwork and drain yourself in the process and use it for good purposes.

Short Speech on Money

For students in grades 4-7, this format of a short and brief speech is helpful, as this money speech is easy to convey using simple words .

Good morning everyone, I am here to speak on the topic of money. Money is one of the most important reasons which divides society into different classes. It is just a commodity to be exchanged for purchases, but it seeps into so much more deep-rooted ideas and ways of living.

When one possesses lots of it, they are the rich and upper class who can live an extravagant life and can fulfill their desires and dreams due to the easy access and availability of resources. And they lead a very privileged life.

Whereas the middle-class man and a middle-class family must be very diligent in saving up for the future, like for the education of their children, and invest their hard-earned money very cautiously. It is a hard life to tread when you lie in the middle of problems, and you cannot afford to even get out of it.

The lower-class who have only a bare minimum to get by the day and have no access to quality education or good food, live in very unhygienic places like slums toil extremely hard to earn a basic minimum wage.

This class difference in different communities creates a division in many things that is necessary for a good life. The rich have access to fine food, and the poor are only able to afford 1-2 meals a day. Everything divides these communities, in aspects of the school, food, home, vehicle, health because many poor children are facing the issue of malnutrition and the most crucial are better healthcare facilities. To support their families, children start working and the illegal practice of child labour increases.

There are a few organizations that try to help these underprivileged societies. This is a never-ending fight, but the gap only seems to be increasing.

Speech on Money in 150 words

Good morning, a warm welcome to everyone present here. Today, I am going to speak about the topic “Money”

Money is defined in a variety of ways. In terms of economics, it is defined as an economic unit that serves as a means of exchange in an economy. Money can be regarded as an item that is commonly accepted as payment for goods and services consumed. The three primary functions of money are the center of its interest. They are 1. The means of exchange: this is the medium through which goods and services are exchanged for money. 2. Unit of account: in economics, this refers to the monetary value of a product or service. 3. The term "store of value" refers to an asset that can be kept for future use and sold at a better price to profit financially.

Speech on Money

Good morning everyone.

I am here to give a speech on Money. None of us can exist in such a competitive society and world without money. We require money to meet our basic needs, such as purchasing food and other basics of life that are impossible to achieve without it. People who are wealthy and own property are regarded as respectable and respected members of society. A poor person, on the other hand, is seen with hatred and no good feelings. Money improves a person's social position and helps him create a positive image. We all want to get rich by making more money through business, a good job, a good business, and so on so that we can meet all the modern world's expanding needs. However, only a small percentage of people can fulfill their dream of becoming a billionaire. As a result, money is a significant factor in one's life.

Money cannot purchase or stop time, nor can it buy true love and caring. However, it is still required by all to keep life on the proper track. Even though money cannot buy us time or love, it can buy us happiness, confidence, fulfillment, and physical and mental well-being. As a result, we can go about our daily lives with ease and overcome even the most challenging problems.

10 Line Speech on Money

This is helpful for explaining to the students in grades 1-3 to understand in short and simple sentences.

Money is very important for getting the resources useful for living a good life.

It is the commodity used as a means or mode of exchange when in consumption of a product or service.

Everyone needs it, but one has to strive hard to earn, save and grow forward with it.

It can be cash, which is usually a note or coin that is now used as an exchange commodity.

Earlier, the barter system was used and slowly gold and silver coins were introduced leading up to today.

One must have enough to survive with the access and availability of basic resources like food, clean water and shelter.

To have a better life with good healthcare, schooling, and luxuries, one must possess a lot of it.

One who has more holds a lot of power and commands respect from others in society.

Money need not necessarily be directly proportional to happiness, but it sure does give you the means to fulfill your dreams and desires.

It has to be smartly invested for it to be of help in this ever-increasing expense of the world.

FAQs on Speech on Money in English for Students

1. What is the need to save money?

After basic essentials such as food, shelter, and clothing, money is by far the most important thing required. The fact that you need to save money for future crises, business troubles, travel, any type of emergency, achieving a long-cherished dream, or anything else should not be forgotten. Money is a cherished treasure, though its value is subjective. Regardless, it is required in every next step, and to do so, you must prioritize your needs and understand how important savings are in securing the future. So, it is important to save money.

2. What are the things to keep in mind while giving a speech?

There are certain things that you need to keep in mind while giving a speech:

Make direct eye contact with your audience to connect with them and give them the impression that you're speaking directly to them.

Stick to the time limit and be concise and tight without diverting from the topic.

To draw your audience into your world, use your words to create a picture of your subject.

Try to overcome the fear of lack of confidence.

Always speak slowly and steadily, as this gives the audience more time to absorb and remember information.

- EssayBasics.com

- Pay For Essay

- Write My Essay

- Homework Writing Help

- Essay Editing Service

- Thesis Writing Help

- Write My College Essay

- Do My Essay

- Term Paper Writing Service

- Coursework Writing Service

- Write My Research Paper

- Assignment Writing Help

- Essay Writing Help

- Call Now! (USA) Login Order now

- EssayBasics.com Call Now! (USA) Order now

- Writing Guides

How I Spent My Pocket Money (Essay Sample)

Table of Contents

Introduction

If you had your own pocket money, how would you spend it?

This essay focuses on how to spend money, and how to do so wisely. In this piece, we share a person’s experience of being taught to spend money wisely and what he would buy when he was given a regular allowance.

Writing an essay on what you would spend your money on? We can help. Go to EssayBasics.com to learn more about our essay writing services . We can help you express yourself by pairing you with a writer who has some experience in your chosen topic.

How I Spend My Money essay

One of the most exciting events in a young one’s life is when their parents give them an allowance. No matter the amount, an allowance gives us the opportunity to spend on small things that make us happy as a child.

The joy that an allowance brings is more than just the amount itself. It’s really rooted in the experience one gets in choosing how to spend it. First, there’s the anticipation of receiving an allowance. Next, there’s the excitement of thinking about all the things you’ve been wanting to get for yourself. Third, there’s the delight of actually receiving the allowance. Finally, there’s the sheer thrill of choosing what to buy and taking it home.

How and when an allowance is given, and how much is gifted to the child, depends on the guardians’ principles. There are those who provide an allowance for children to buy basic needs. But there are some who might give a little extra to give the child an opportunity to learn how to handle money well.

It must be said that not all children are privileged to have an allowance to spend on themselves. If they come from a poor family, the guardians may not have any extra finances to give. They may save up for this just once in a while.

I am very blessed that my parents gave me an allowance on a regular basis. My allowance has really taught me financial stewardship at a very young age. They also allowed me to make decisions regarding my finances, even if I made mistakes.

Saving Money at a Young Age

While my allowance isn’t a fixed amount, I have since learned that the first thing I should do is set aside a portion of it for savings. I get a third of whatever amount I get and earmark it for saving.

To make sure that I won’t be tempted to use it, my mom helped me open a bank account where I deposit the money. They opened a time deposit account, which means I cannot just withdraw from it anytime. Whenever I hesitated to go to the bank, my dad would remind me that my small deposits would turn into one big bulk of cash that could someday be used for a rainy day, or for strategic investments.

How I Spend Money with Whatever is Left

With what’s left of my allowance, I usually buy books. These are mainly documentary magazines, which I read during my leisure time. It is actually one of my hobbies. I have made it a personal tradition to always purchase a documentary magazine each time I get my regular allowance. I particularly enjoy news magazines and feature magazines. I am a lover of general knowledge. I love knowing about everything, how and why things are the way they are – whether about nature, politics, science, or geography. It is always a first on my list of hobbies.

The other bit of my regular allowance goes towards the purchase of snacks. I love yogurt and ice cream. The refrigerator at home always has a shelf specifically reserved for my yogurts.

The remainder of my allowance goes towards others. These include my family and friends. I try to buy them something nice as a way of thanking them for taking good care of me.

I also go out of the way to purchase some gifts for my siblings as well as my parents. I want to gift them with simple things, even if they were the ones who gave me my allowance. Doing this for them gives me so much satisfaction since I love making them happy. After all, what is life without happy family and friends?

Regular allowances taught me how to make wise spending decisions. I know how to handle and spend my cash, whatever amount it might be. Therefore, I am confident that when I start handling larger amounts of money in the future, I won’t be as overwhelmed. I will make it a point to remember the financial lessons I’ve learned as a child. I hope to also be able to teach others who to use their money wisely.

Short Essay About What You Would Spend Your Money On

Did you grow up being taught about the value of saving money? If you were like me, your mom and dad probably gave you a regular allowance. They also probably gave you free rein to use your money in whatever way.

Growing up, I deposited regular amounts into my savings account the moment my allowance was handed to me. I did not want to be tempted to splurge on all the food I was craving for while holding all of my money. Personally, apart from fast food, I enjoyed treating myself to books. In fact, I made it a regular tradition to purchase a book every time I got my allowance.

I remember being taught how to make a personal budget out of my allowance. Exactly how much money was given to me didn’t matter as much as the main principle they passed on: save money. They didn’t care if I used the rest of my allowance on junk food or other types of impulse buying. All that mattered to them was whether or not I set aside a portion to put in a savings account. And so I did.

How To Write An Essay About Money

There are so many ways to write a piece about finances. It depends on the lens you are viewing the topic from. Are you an adult looking back at your childhood and remembering important lessons learned? Are you a financial expert looking to give some advice on how to maximize your cash? Are you a student wanting to teach people how to set aside an amount in case of an emergency? Are you a parent who discovered creative hacks in your finances to make ends meet? Find your angle and work it.

How To Spend Money Wisely As A Teenager

When you are young and still living under your guardians’ roof, thinking about contingencies or other things you may be needing to buy before your next allowance comes may not come naturally to you. It is so important to learn how to handle your personal finances even at that age because that sets the direction of your spending in the future. When you start getting a monthly income, the weight of the responsibility is even greater as you start to live independently. Even as a teenager, learn to set financial goals and think of the long game. Even if you have to put money inside a piggy bank to avoid temptation, do so. Track your expenses and make adjustments according to your level of contentment. Learn the art of investing from an expert. Finally, don’t shop ’till you drop. It’s a trap.

- Money Moments

The pocket money debate: What the experts say

By Kimberly Gillan | Presented by Bendigo Bank | 3 years ago

Whether you give your kids a set amount each week or pay per chore, providing pocket money to children can be a great way to instil some financial lessons from a young age.

In fact, financial experts say one of the best things about pocket money is that it gives kids a chance to experience buyer's remorse and other important spending lessons when the stakes aren't too high.

"I'm wanting my kids to feel the responsibility and the pain and the joy of what money can bring," says Brenton Tong, Sydney financial advisor, father of three and author of The Secret to Raising Money-Wise Kids.

"If they've saved up $20 from weeks of hard work and chores and then they go and buy something only to realise it was a complete waste, that's a great money experience. I'd much prefer they do that with $20 than with their first pay packet of $1,000 and go, 'Oh I've now got nothing to show for it'."

Of course, the sky is the limit when it comes to how much, how often and how to earn, so we asked the pros for some pointers on the most common pocket money questions parents have.

How much should you give?

There is no set amount of recommended pocket money – every family is different in terms of how much the household budget can afford and how each family member contributes.

"Parents need to determine what's best for them and their children in their particular financial situation," says Gavin Holden, State Manager, Queensland, Bendigo Bank, and father of three.

"The goal for my family was always about teaching our children and assisting them to respect earning."

Even paying in silver coins can have considerable value for children. "Twenty cents a day will hit a dollar after a week and they'll hit $5 at the end of the month and that can be a big deal," Tong points out.

Regardless of how much you pay, Holden says it's important for parents to be clear on the reasons for paying pocket money. "Ask yourself, 'What is the overall objective here?' Is it to give the child some money to play with, or is it to teach them some lifelong habits?"

What's the right age to introduce pocket money?

Holden says that around 12 years old – or when your kids start high school – can be a perfect time to start giving them a bit of financial responsibility.

"We started giving our kids $5 a week when they started high school, which was a real eye opener for them," Holden recalls. "They had a canteen that was bigger than anything they'd had in primary school and they could make somewhat independent choices."

Tong believes every kid is different and that parents should start pocket money when their child starts to show an interest in money. "Pay attention to when they catch on to the idea that money has a value and you transact upon it," he says.

"Some kids might be three or four, others might not start asking questions until they are seven or eight."

How should kids earn it?

Some families will have a list of chores to complete for a set weekly "wage" while others will pay on completion of tasks, such as $1 for folding the washing or $2 for washing the car, so consider how to best motivate your child and get the most household value out of their contribution.

"My wife and I put together a list of jobs, which included keeping their rooms tidy and making sure they were doing homework in a timely manner," Holden recalls.

"Then we built up on the requirements, extending it to things like caring for pets, doing the weeds, helping put the bins out, doing some ironing and things like that."

In Tong's household, on top of earning money upon completion of set tasks, the kids are encouraged to think strategically about making their own money.

"I give my kids 'start up capital' – I loaned my nine-year-old money to start her business making soaps to sell and she's had to pay me back with her profits," he says.

Should you dictate what they can spend their money on?

Again, each family will be different when it comes to whether they have to cover clothes and other essentials or can simply use their money for "fun".

"If we, as a family, decided to go to the movies, then we parents would pay for that, but if the kids want to do something, then we let them pay," Tong says.

Holden suggests setting up a separate savings account for them as well, especially in the age of "tap and go" convenience. "I think it's important for kids to have the ability to see their account balance at any time of the day," he says.

"My kids had a savings account that we jointly managed, as well as a spending account, and we kept encouraging them to put money aside in their savings account, which gives some helpful discipline."

Bendigo Bank wants to help you plan and save to build a better future for you and your family. Get more information at bendigobank.com.au/familyhub .

Note: This article contains general advice only. Readers should seek a trusted professional's advice on financial matters. Please read the applicable product disclosure statement(s) on the Bendigo Bank website before acquiring any product.

'Final goodbye': Harry could 'cut ties' with royal family

Rosso clears the air on 'fractured' bond with Merrick

Vet reveals the six signs you have a velcro cat

Speech on Money for Students and Children

Speech on money.

Hello everyone, I am here to present a speech on Money. Money is anything that people use to buy goods and services. Money is also that people receive for selling their own things or services. Most countries have their own kind of money such as the United States has a dollar, Britain has pound and Indian has rupees. Money is also called by many other names such as currency or cash.

Source: pixabay.com

Types of Money

There are different types of money as commodity money, convertible money, inconvertible money, bank deposit, and electronic money. Commodity money can be used for other purposes besides serving as a medium of exchange. Cattle, silk, gold, and silver are some examples of commodity money.

Convertible paper is money that can be converted into gold and silver. Inconvertible money is the money that we cannot convert into gold and silver. Notes and coins are inconvertible money. Such type of money is a country’s legal tender.

Money is an essential commodity that helps run our lives. Exchanging goods for goods is an older practice and without any money, we can buy anything we wish. Money has become important because people are trying to save wealth for their future needs. Rich people are rich as they know or realize the true value of money. It is a general saying that money stays in the hands of people who know its value.

Get the Huge list of 100+ Speech Topics here

Money also affects Relationships

There are many people who grow hatred between each other only because of money. There are also people who treat rich people with respect and poor people with disrespect. Women also prefer men who are rich and powerful for marriage. Thus money also has the power to make and break relationships.

It’s important to earn money but it’s also important to save money. Someone has rightly said that if you save money today, the money will save you in the future. If you work hard and spend all the money then it’s of no sense. Saved money can also help you in older age and in times of medical emergencies.

There are many schemes of government that encourages and help people who want to save a portion of their income as savings. Investment is also an option of saving. One can adopt any kind of investment after proper consultation.

There are several ways to earn money but one should always concentrate on earning money through legal means. As said in our purans, that one should work to earn Gaja Laxmi, which will come slowly. It will come through legal means and stay for long. One should never work to earn money which comes from illegal means. This type of money will come quickly and will go more quickly.

At last, money makes the world revolve and function. Money satisfies our needs and gives us pleasure and satisfaction. Money can bring us everything but money is not everything. One should value relationships more than money. People and our relationship with each other are more important than money.

Money should be utilized for the betterment of society. Rich people should help and respect poor people. We should also inculcate in our children, habit of saving from an early age. Money, if used wisely and properly, will contribute to the building of a strong, developed and powerful nation.

Read Essays for Students and Children here !

Customize your course in 30 seconds

Which class are you in.

Speech for Students

- Speech on India for Students and Children

- Speech on Mother for Students and Children

- Speech on Air Pollution for Students and Children

- Speech about Life for Students and Children

- Speech on Disaster Management for Students and Children

- Speech on Internet for Students and Children

- Speech on Generation Gap for Students and Children

- Speech on Indian Culture for Students and Children

- Speech on Sports for Students and Children

- Speech on Water for Students and Children

16 responses to “Speech on Water for Students and Children”

this was very helpful it saved my life i got this at the correct time very nice and helpful

This Helped Me With My Speech!!!

I can give it 100 stars for the speech it is amazing i love it.

Its amazing!!

Great !!!! It is an advanced definition and detail about Pollution. The word limit is also sufficient. It helped me a lot.

This is very good

Very helpful in my speech

Oh my god, this saved my life. You can just copy and paste it and change a few words. I would give this 4 out of 5 stars, because I had to research a few words. But my teacher didn’t know about this website, so amazing.

Tomorrow is my exam . This is Very helpfull

It’s really very helpful

yah it’s is very cool and helpful for me… a lot of 👍👍👍

Very much helpful and its well crafted and expressed. Thumb’s up!!!

wow so amazing it helped me that one of environment infact i was given a certificate

check it out travel and tourism voucher

thank you very much

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

The Hope-Filled Family

DOES POCKET MONEY ‘SPOIL THE CHILD’ – OR TEACH INDEPENDENCE?

September 22, 2020 7 Comments

I use affiliate links in some blog posts. If you click through and make a purchase, I earn a small commission at no extra cost to yourself. Thank you for your support.

I’ve been wanting to write about pocket money for SO LONG!

Not because it’s an area I have all the answers to, but because there are so many interesting questions around it (like “Does pocket money spoil the child?” – a big one on Google!), and ideas for how to make it work beautifully.

I’ve been longing to dive in, share our experience and hear about yours, so I hope this post resonates with you.

Our family and pocket money

If you’re new around here, to give you some background, my own kids are nearly 11, 9, and the twins are nearly 6. My nearly-11-year-old has been getting pocket money since his 10th birthday, and the others don’t get any yet.

It’s pretty late to start giving pocket money at age 10 – I think, on average, families start giving it much younger. And we only give him £1/week which, again, is much lower than the average.

But I always said we’d only start giving money to our kids when what they wanted was of significantly higher value than what they received from extended family for birthdays and holidays.

We have very generous family around us, so this point didn’t come until Mister was 10. And even then, it was more a case of “If we don’t start now, we’ll never do it” rather than because he desperately needed it.

Why such a low figure of £1? A few reasons:

- we wanted to be able to increase his pocket money each birthday

- we have four kids, and needed to make it sustainable

- we wanted to test our son’s ability to steward a small amount of money

- we wanted our son to learn patience in saving up for what he wanted

Now we are nearly a year in, and it’s been a successful experiment. He’s been very diligent in saving up for things, but has also been grateful for the £10 here and £20 there that his relatives have given him when we’ve met up.

He’s often chosen to spend a few pounds on sweets for when friends come for sleepovers – but has also learnt that this significantly sets back his saving for larger items, such as a new controller or game for his XBox. He’s learnt that you can’t have everything all at once, and has been pretty sensible in weighing up different options to decide what to buy first.

We’ll be increasing his money when he turns 11, perhaps just to £1.50 for now, which will slightly widen his options without starting a trend of too high an increase which we would struggle to maintain when all four of our kids are receiving pocket money.

Why do kids need pocket money?

Pocket money is a great way to start giving our children some financial independence. It enables us to teach them about budgeting – spending, saving and giving – and allows them to learn through their own mistakes too. It shows that we trust them enough to give them some of their own money, without an agenda of what to spend it on.

It’s also helpful for us as parents. Giving a small amount each week or month means that we know where we are with our own budgets. The alternative is that we don’t give anything regularly, but end up just buying things for our children when they want them, which can work out pricey and unpredictable. Not cool.

Giving pocket money at a young age and gradually increasing it provides helpful scaffolding to children and teens as they learn how to deal with bigger and bigger amounts of money. The alternative is that they get to 18, suddenly start receiving a student loan or income from a job, and end up going crazy with it!

As long as it is carefully managed, there is absolutely no reason why pocket money should spoil a child. Rather, there are some awesome skills that kids can pick up through dealing with their own money.

<<IS IT OK TO WANT FINANCIAL SECURITY FOR OUR KIDS?<<

Why pocket money should not be given

We all see things differently around the subject of money, and this is a particularly controversial topic when it comes to pocket money. Are there situations in which pocket money should not be given? Yep, I think there are.

One situation would be if the child in question doesn’t have the cognitive ability to be able to steward their money well. This might be due to additional needs, a lower emotional age, or some kind of trauma which is being dealt with first.

Another reason is if you can’t afford it. If money is so tight that just putting food on the table is a stretch, please don’t think you need to be giving your child pocket money in order to teach them good budgeting skills. As they get older, you can involve them in your budget, showing them what you spend money on and why. And when your child is a teenager they will be extra motivated to get a part-time job to increase their income and opportunities.

Many entrepreneurs started life with very little – it often gives us the self-motivation that we need to work hard – so it’s no long-term hardship if you can’t afford to give your child pocket money right now.

There is also a school of thought that says children shouldn’t be given pocket money but ‘share’ the family money. If they want something, that something is discussed with parents, and decisions are made based on if it can be afforded, if it’s a good buy, etc. (You can read more about this approach over at Happiness is Here .)

Finally, some parents would withdraw pocket money as a consequence for rudeness, poor behaviour or laziness around the home. They don’t want pocket money to spoil their child, and so they remove the privilege if it’s not developing the skills and traits they wish to nurture in their child.

Personally, I haven’t done this, as I like to see pocket money as a set income that children can work with and budget for. I would rather withdraw other treats if needed, like a later weekend bedtime or after-dinner sweets .

However, if your philosophy connects pocket money with chores and responsibilities around the home, and your child hasn’t fulfilled their side of the bargain, then yes, it makes sense to withdraw pocket money in this situation.

When should you start giving pocket money?

Again, there are such different schools of thought on this! Every child develops differently, so I think it’s helpful to think in terms of skills rather than actual age.

I would say your child is ready for pocket money when they:

- recognise money and know which coin is which (in the UK, this is taught in schools around Year 1/2 – age 5-7 – but you can teach it earlier if your child is ready)

- count to 100 (makes it much easier for them to relate pence to pounds, cents to dollars, or whatever your currency is)

- can store money safely and sensibly (my nearly-6-year-old twins play with any money they get – it doesn’t stay in the piggy bank, and it gets thrown around, separated into myriad different bags and containers, and no one knows where it’s gone! So now I keep a note on my phone of any money which has been gifted to them, and we avoid them having physical money in their bedroom. And we DEFINITELY won’t be giving them pocket money for a while yet!)

- has started asking for things which you can’t or won’t buy them (between birthdays and Christmases)

- understands the concept that saving small amounts of money adds up to a larger amount

Should every child be given pocket money?

If you give money to one child in your family, you need to give it to every child (unless, of course, they don’t have the cognitive ability to handle money – see above). Fairness is very important in family life!

I don’t believe you necessarily have to start it at the same age with each child, though. As I said above, each child is different, and one of your children may develop money-handling skills much earlier or later than the others.