Rigorous primary research

A framework for allocating to cash: risk, horizon, and funding level

A Rational Multi-Asset Portfolio Rebalancing Decision-Making Framework

Resilient Liquidity: The Robust Reaction of Equity Volume and Spreads to Market Volatility

Filter by topic

Sort by date

Financial wellness & planning

May 26, 2022

For many families, planning for college costs is a top financial priority. A Byzantine landscape of consumer choices, loans, tuition discounting, and public and private aid, however, makes it difficult to answer key questions like "How much will this cost us?” This is especially so for young families, for whom future spending needs are necessarily vague. Vanguard researchers explore how understanding the dynamics of financial aid and net pricing can help parents set a realistic savings target early on and shape a savings plan that evolves with them.

Portfolio considerations

May 20, 2022

A number of factors have fueled the growth of index investing around the world. “The case for low-cost index-fund investing,” a newly revised research paper from Vanguard’s Investment Strategy Group, explores these factors. The paper discusses why the authors expect that index investing will continue to be effective over the long term.

April 14, 2022

The past few decades were a good time for spending from a retirement portfolio. What about the next 30 years? The apparent shifts in capital market conditions seen since the start of 2022 led us to examine sustainable withdrawal rates. Looking at historical return environments our authors developed three scenarios, with rates from 2.8% to 3.3%.

April 13, 2022

Vanguard believes private corporate pension plans should consider a liability-driven investing (LDI) program in the fixed income portion of their portfolio. Based on our analysis, a customized mix of U.S. investment-grade credit bonds and Treasuries aligns well with that liability. Such a mix has historically helped plan sponsors mitigate risk.

March 29, 2022

Personalized indexing (PI) is a flexible portfolio management solution that can track a personalized index and harvest capital losses for tax-saving purposes. This paper presents a portfolio construction plan using PI, touching on how to optimally implement tax-loss harvesting and allocate to PI in the presence of other assets.

August 10, 2022

Investors typically decide whether to convert to a Roth IRA from a traditional IRA by comparing their current and expected future marginal tax rates. The traditional wisdom has been that higher future tax rates make conversion more desirable and lower ones make it less so. Vanguard researchers describe a break-even tax rate (BETR) that yields a more accurate view of what future tax rate would make an investor indifferent to a conversion.

March 15, 2022

New Vanguard research indicates that investors are frequently using non-total market index funds to build portfolios with active exposures, according to “How investors use passive for active,” a paper authored by Vanguard’s Jan-Carl Plagge, Haifeng Wang, and Jim Rowley. The paper was published in The Journal of Beta Investment Strategies .

Behavioral research

February 23, 2022

Investors prefer some aspects of human advice over digital but perceive value in all advice services. Technology can help human advisors scale their businesses while strengthening their uniquely human value proposition.

February 02, 2022

Vanguard shares our current views on best practices for U.S. private-sector pension plan asset allocation. We highlight the value of identifying three targets—the return-seeking asset allocation, interest rate hedge ratio, and credit spread hedge ratio—that can be the foundation for a robust, customized portfolio construction process.

December 15, 2021

Retirees often eschew investing for total returns, relying instead on dividends and interest from high-income-producing assets to support spending from ad hoc portfolios. We introduce a method for building high-income portfolios that maximize the investor’s utility of wealth based on total returns while accounting for yield preferences.

Economics & markets

December 13, 2021

Our annual forecast explains why we expect the global economy to slow, leaving full-year 2022 growth, in our base case, of 4.8%. It also explains why our 10-year market outlook is guarded, as reflected in the low-single-digit range of expected returns for a globally diversified, 60% stock/40% bond portfolio.

November 19, 2021

Tax-loss harvesting (TLH) has been promoted as a “free lunch” for increasing investment returns. Vanguard researchers explore the potential for TLH and demonstrate how to customize a TLH strategy for optimal benefits. A case study is also featured that illustrates how the benefits of TLH can vary considerably from investor to investor.

November 15, 2021

Historically low yields on most global fixed income investments are likely to result in low returns over the next decade, leading some investors to question the allocation to bonds in multi-asset portfolios. In this paper, Vanguard researchers demonstrate the value of bonds as “shock absorbers” for portfolios when equity markets are under stress.

October 29, 2021

This paper examines the effect of automatic escalation on defined contribution plan contribution rates and provides insights into plan designs that maximize participants’ chance of savings at rates necessary for a secure retirement. The motivations of participants to override automatic deferral rates and annual increases are also explored.

October 11, 2021

This study explores how factoring in health care cost uncertainty can benefit retirement planning by enabling the development of more customized plans. Vanguard researchers employ a stochastic health care model to offer more realistic insights into how longevity and health care-related risks affect the viability of spending plans in retirement.

September 08, 2021

Growth in pension liabilities, along with new disclosure requirements and market-based accounting standards, have led defined benefit pension plan sponsors to consider corporate finances as they manage their plans. This paper discusses how pension plan risk can affect corporate finances and the strategies sponsors can use to mitigate that risk.

October 08, 2021

Parents and students face distinct challenges when financing higher education expenses. This research paper discusses financial aid options, tax credits, and 529 savings plans and other savings vehicles, as well as the need to plan strategically and understand how college spending decisions affect one's broader financial situation.

September 28, 2021

With interest rates and inflation expected to rise, the negative stock/bond correlation that supports the diversification properties of a balanced portfolio could also be at risk. In this paper, researchers find that negative correlation will continue and the diversification benefits of a 60% stock/40% bond portfolio will persist.

Vanguard’s Megatrends series examines fundamental shifts in the global economic landscape that are likely to affect the financial services industry and broader society. In this edition, Vanguard researchers explore China’s future as an economic powerhouse and its broad implications for global growth, geopolitics, and financial markets.

September 23, 2021

Vanguard’s Megatrends series examines fundamental shifts in the global economic landscape that are likely to affect the financial services industry and broader society. In this paper, Vanguard economists examine global trade growth and conclude that growth will likely slow, as it has since the global financial crisis, but not decline.

September 13, 2021

Vanguard researchers classify the economic and market environment into five states: recession, recovery, expansion, slowdown, and high inflation. This paper discusses the characteristics, valuations, and return expectations of each and concludes that investors willing to take on active risk should adopt a dynamic, state-dependent approach.

Amid a backdrop of highly accommodative monetary and fiscal policies, how likely are persistently higher rates of inflation in the United States for 2022 and beyond? In this paper, Vanguard researchers present the findings of Vanguard’s state-of-the-art forecasting model to project core inflation over the next two years.

August 30, 2021

Employing machine-learning, Vanguard researchers found that government bonds have historically acted as a counterbalance in an equity/bond portfolio during low-rate periods. Although in some months both equities and bonds fall, the analysis suggests that this can be thought of as market noise and distinctly different from typical outcomes.

Most target-date fund series offer a single post-retirement asset allocation designed to help retirees replace a reasonable portion of pre-retirement income. In this paper, Vanguard researchers offer a framework demonstrating that adding a second asset allocation could support additional goals for those with the resources and desire to pursue them.

A Vanguard survey shows that most investors underestimate the risk of mild cognitive impairment. In addition, while most respondents had some plans to mitigate the effects of cognitive decline, they were less likely to focus on the transfer of control of their finances, the timing of which can have significant implications for financial well-being.

August 05, 2021

This paper examines developments in the fixed income markets before and during the liquidity event precipitated by the coronavirus pandemic and the accompanying economic shock to the global financial markets. Vanguard calls for fixed income market participants and policymakers to make recommendations to improve market resiliency in the future.

July 23, 2021

This research looks at the withdrawal patterns, rates, and frequencies of more than two million Vanguard retail households at or near retirement age. It finds that only 52% took at least one withdrawal during the three-year study period.

Asset classes

Vanguard researchers examine the range of frequencies, durations, and magnitudes of underperformance experienced by active fixed income funds. The findings: Nearly all outperforming active fixed income funds experience periods of underperformance, although significant drawdowns over long periods are less likely than they are for active equity funds.

July 14, 2021

This paper explores the relationship of the number of fixed income holdings in a fund to systemic risk and alpha.

July 06, 2021

Vanguard researchers analyze the results of a survey of Vanguard investors' expectations for U.S. stock returns throughout the COVID market crisis. The results indicate that expectations follow market activity in close lockstep, shifting in tandem with recent performance rather than rising and falling in a more rational or contrary manner.

June 25, 2021

The Financial Independence, Retire Early (F.I.R.E.) movement relies on the 4% rule to determine withdrawals over 40 to 50 years in retirement. But that rule was designed for a 30-year horizon. This paper illustrates how F.I.R.E. investors can improve their chances of financing an early retirement by employing Vanguard’s investing principles.

June 11, 2021

This paper presents a framework, developed by Vanguard and Mercer, to forecast health care costs for U.S. retirees. Vanguard researchers outline key health care cost factors and personal considerations and frame expenses as an annual cost rather than a lifetime lump sum, enabling retirees to plan accordingly during their retirement years.

June 07, 2021

This supplement to How America Saves delves deeper into defined contribution plan landscape, combining comprehensive data on plan design and participant behavior with practical advice and insights from Vanguard's leading retirement plan experts to offer recommendations to improve plan efficacy and employee participation.

"How America Saves" is the industry's definitive report on American's retirement savings habits. The 2021 edition details how automatic plan features and target-date funds helped millions of defined contribution plans participants adhere to their financial goals, even amid severe market volatility resulting from the coronavirus pandemic.

June 02, 2021

While the global economy recovers from the pandemic, central bank policy rates are expected to lift off starting in 2023 as quantitative easing unwinds. But how will that affect bond yields? Vanguard's model suggests that long-term government bond yields will increase only modestly as ultra-accommodative monetary policy normalizes.

June 01, 2021

Critical to constructing a portfolio for a specific goal is selecting a combination of assets that offers the best chance of meeting that objective. This paper reviews the decisions investors face when constructing a globally diversified portfolio and discusses the importance of broad asset allocation and diversification within sub-asset classes.

May 28, 2021

Although one-third of participants in Vanguard defined contribution plans had access to a self-directed brokerage option in 2020, only 1 percent of those participants chose to use it. On average, brokerage participants invest half of their account balance in the brokerage option.

April 19, 2021

The past ten years have been tremendous for growth stocks, but we do not expect that trend to continue. This research presents the results of our fair value model for the ratio of value to growth stocks. These results suggest that value will outperform growth over the next ten years by as much as the equity risk premium.

April 12, 2021

Researchers and policymakers have suggested that annuities can help retirees manage the risk of outliving their assets. Vanguard research finds, however, that most retirees are reluctant to annuitize and decide against exchanging liquid wealth for guaranteed income in order to retain future financial flexibility.

May 24, 2019

In this paper, Vanguard researchers examine investing behavior in 1.8 million 529 plan accounts holding $53 billion in assets. The findings: Accounts using automatic investment methods exhibit the most consistent savings behavior, and those using age-based allocations have substantially less portfolio risk than self-directed ones.

October 11, 2018

Technology advances have spawned fear that they eliminate jobs. New Vanguard research finds more room for optimism.

February 19, 2019

ETFs can be useful tools for investors building their portfolios. A Vanguard commentary explores their role in portfolio construction and in providing market liquidity and market information.

June 23, 2022

A new Megatrends paper explores equilibrium interest rates, the forces that shape them, and where they may be headed.

June 16, 2022

Our experts provide insights into who has retired during the pandemic and whether these retirees might need to return to the workforce.

June 28, 2022

Recent Vanguard research indicates that gender diversity on a fund’s investment team may offer performance benefits. The findings underscore the benefit of evaluating the diversity of an investment management team with the same rigor we do portfolio diversification, recognizing the meaningful impact that both can have on fund performance.

July 06, 2022

Even the most groundbreaking technological innovations can experience a lag between discovery and the implementation of a commercial application. That lag—along with current social, economic, and technological conditions—can have vast implications on the broader economy.

July 13, 2022

We summarize in two pages the conditions of five major economic blocs and provide 10-year return forecasts for major asset classes.

July 27, 2022

A Vanguard white paper looks at ways to tailor portfolios to address specific investor goals and preferences.

March 29, 2019

This paper presents a methodology for estimating the trading volume on U.S. exchanges attributable to index funds, index ETFs, and other indexing strategies. Vanguard researchers estimate that index funds and index ETFs currently account for approximately 1% of overall trading volume on U.S. exchanges, well below the more widely quoted 5% to 7%.

August 04, 2022

Using four hypothetical case studies, a new Vanguard research paper, The Value of Personalized Advice , provides insights into how to think about and measure the value of financial advice for individual clients.

September 14, 2022

Regulation, fee, and technology trends in the advice industry may get all the attention, but it’s still soft skills and relationships that will distinguish advisors from others. Learn more from the latest in the Vanguard Advisor’s Alpha series.

September 15, 2022

A new Vanguard research paper sheds light on how investors’ health state can affect their asset allocation and consumption in retirement.

November 09, 2022

Vanguard Financial Advice Model (VFAM) is a new approach to financial planning, assessing combinations of strategies and their relative value for an investor.

November 08, 2022

A new Vanguard research paper outlines an approach to determining life insurance needs that could save thousands of dollars while minimizing the chances that coverage falls short of those needs.

October 31, 2022

A recently updated research paper makes the investment case for Vanguard target-date funds and offers insights into the role these strategies can play in the portfolios of different types of investors.

October 27, 2022

As direct indexing accelerates in popularity among investors, one of its measurable benefits is the ability to implement a systematic tax-loss harvesting (TLH) strategy. Vanguard researchers examine the value of different modes of TLH for direct indexing investors to determine which is the most effective. The paper was published in The Journal of Beta Investment Strategies .

October 24, 2022

Our research shows that an annual rebalancing is optimal for investors who don’t participate in tax-loss harvesting or where maintaining tight tracking to the multiasset benchmark portfolio is not a concern.

October 06, 2022

Understanding your health care priorities and available coverage types can help you choose a Medicare coverage option, according to Vanguard researchers.

September 22, 2022

Americans donated $471 billion to charitable organizations in 2020. Vanguard research explores the three key elements of a successful giving plan: When to give, what to give, and how to give.

June 06, 2019

Our Megatrends series examines fundamental shifts in the global economy likely to affect the financial services industry and society. In this edition, Vanguard explores the economic implications of an unprecedented shift in the age of global populations toward a smaller young-age cohort and a larger old-age cohort.

January 31, 2018

In this article published in The Journal of Portfolio Management in 2018, Vanguard researchers describe an enhancement to a standard approach of forecasting U.S. stock market returns. Starting with the cyclically adjusted price-to-earnings (CAPE) ratio, they incorporate bond yields, inflation, and volatility into the calculations. The authors find that results from this “fair-value” CAPE forecasting model, while not perfect, are about 40%–50% more accurate than conventional methods for 10-year-ahead stock market forecasts since 1960.

August 14, 2023

Key components for efficient tax savings: threshold planning, capital gains, income exclusions, and deductions.

July 27, 2023

Our updated research examines saving and investing behavior in 1.9 million 529 plan education savings accounts.

July 05, 2023

Updates are provided on our 2023 outlook for growth, inflation, and central bank policies, plus 10-year asset class return forecasts.

June 15, 2023

In its 22nd edition, How America Saves provides an in-depth examination of the retirement plan data of nearly 5 million defined contribution plan participants.

May 16, 2023

Learn how our target enrollment glidepath can help maximize risk-adjusted value for investors saving for college.

May 12, 2023

Our research explores practical ways to build savings for an emergency while balancing long-term financial goals.

April 28, 2023

Selectively adding a credit tilt to the bond portion of a portfolio can enhance long-term expected returns.

April 04, 2023

This paper highlights some of the generational differences we have observed in our recordkeeping data over a 15-year period as a result of automatic solutions. We answer the question: How have generational patterns of saving and investing changed in DC plans?

March 28, 2023

Our research offers a framework to help maximize wealth by taking advantage of your investment options alongside repaying debt.

March 01, 2023

This paper compares the performance of cost averaging with lump-sum investing as strategies for investing cash.

February 27, 2023

Relocating to a cheaper housing market can help retirees bolster retirement readiness, Vanguard research finds.

February 15, 2023

Our research considers ways to measure inflation based on the specific circumstances of an individual and how to build portfolios that seek to minimize the risks of rising costs.

February 01, 2023

A small commodities position may improve an investor’s outcome while adding resilience to a portfolio.

January 31, 2023

Best way to hedge a portfolio against inflation? Research suggests a method but not without its own risks.

January 23, 2023

Pension plan sponsors considering a risk transfer should look beyond immediate benefits and consider the impact on the management of the remainder of the plan, according to Vanguard experts.

January 09, 2023

The prospect of saving for long-term financial planning goals can be overwhelming at times given its enormity and uncertainty. Vanguard’s guide to financial wellness offers a blueprint for achieving financial flexibility to meet both short- and long-term goals.

December 13, 2022

Studies of ESG investment strategies have tried to identify an ESG-related factor to explain performance, but Vanguard research reveals that the performance of many ESG investment strategies is largely driven by well-known traditional sources of risk. We found quite a bit of variability in the exposure to and influence of the factors explored.

December 12, 2022

Our base case for 2023 includes a global recession brought about by policymakers’ efforts to control inflation. Unemployment is likely to rise and consumer demand weaken, but central banks may still miss their targets of 2% inflation in 2023.

November 30, 2022

Sustainable withdrawal rates can vary considerably, depending on the levels of desired bequests, portfolio depletion risk, and asset allocation, highlighting the need for customization rather than relying on a single rule of thumb. Learn more about the feasible ranges.

November 21, 2022

There’s no place like home, even when it comes to stock investing. Recent Vanguard research discusses investor local bias, what that disposition means for a portfolio, and how a few small tweaks can alleviate a portfolio’s concentration risk.

November 16, 2022

Time-varying asset allocation can help build diversified, tax-efficient portfolios, Vanguard researchers say.

October 23, 2020

What is the value of tax-loss harvesting? Examining more than 80,000 investors, Vanguard analysts demonstrate that outcomes of equity-based tax-loss harvesting vary significantly across investor characteristics and market environments. The expected results range from no benefit or even negative returns to gains of more than 1% annually.

August 08, 2022

A new Vanguard research paper, Revisiting the conventional wisdom regarding asset location , takes a second look at best practices for asset location and whether they are appropriate for investors.

March 11, 2021

The Vanguard Life-Cycle Investing Model is a proprietary model for glide-path construction that can assist in the creation of custom investment portfolios for retirement and nonretirement goals. This paper describes the model, the benefits of a customizable, goals-based approach, and practical applications in product design and advice methodology.

April 10, 2024

While holding cash can provide a sense of security, it can come at a cost.

January 05, 2024

Our research into years of daily stock-level data suggests that U.S. equities are resilient to periods of volatility and that liquidity remains available under all market conditions.

December 12, 2023

A return to sound money, with interest rates above inflation, is the best financial market development in 20 years.

November 17, 2023

In this paper, Vanguard espouses four simple and enduring principles to help investors achieve long-term success. Goals: Create clear, appropriate investment goals. Balance: Keep a balanced and diversified mix of investments. Costs: Minimize costs. Discipline: Maintain perspective and long-term discipline.

November 15, 2023

Our research looks at the role factors can play in shaping a portfolio’s performance and risk profile.

November 01, 2023

Vanguard research considers investors who may benefit from target portfolios using valuation-aware, time-varying return forecasts.

October 20, 2023

We consider the “loss harvest profile” of direct indexing over time, focusing on volatility and cash contributions.

October 13, 2023

Vanguard research shows how to optimize after-tax returns through placement of equity subclasses across accounts.

October 03, 2023

A Vanguard analysis assesses retirement readiness for a nationally representative sample of American workers.

September 15, 2023

The benefits of HSAs aren’t limited to just covering medical expenses, according to updated Vanguard research.

September 06, 2023

Negative convexity has rejoined duration and credit as central considerations in active muni investing.

Vanguard is the trusted name in investing. Since our founding in 1975, we’ve put investors first.

- Open access

- Published: 28 August 2020

Short-term stock market price trend prediction using a comprehensive deep learning system

- Jingyi Shen 1 &

- M. Omair Shafiq ORCID: orcid.org/0000-0002-1859-8296 1

Journal of Big Data volume 7 , Article number: 66 ( 2020 ) Cite this article

266k Accesses

161 Citations

91 Altmetric

Metrics details

In the era of big data, deep learning for predicting stock market prices and trends has become even more popular than before. We collected 2 years of data from Chinese stock market and proposed a comprehensive customization of feature engineering and deep learning-based model for predicting price trend of stock markets. The proposed solution is comprehensive as it includes pre-processing of the stock market dataset, utilization of multiple feature engineering techniques, combined with a customized deep learning based system for stock market price trend prediction. We conducted comprehensive evaluations on frequently used machine learning models and conclude that our proposed solution outperforms due to the comprehensive feature engineering that we built. The system achieves overall high accuracy for stock market trend prediction. With the detailed design and evaluation of prediction term lengths, feature engineering, and data pre-processing methods, this work contributes to the stock analysis research community both in the financial and technical domains.

Introduction

Stock market is one of the major fields that investors are dedicated to, thus stock market price trend prediction is always a hot topic for researchers from both financial and technical domains. In this research, our objective is to build a state-of-art prediction model for price trend prediction, which focuses on short-term price trend prediction.

As concluded by Fama in [ 26 ], financial time series prediction is known to be a notoriously difficult task due to the generally accepted, semi-strong form of market efficiency and the high level of noise. Back in 2003, Wang et al. in [ 44 ] already applied artificial neural networks on stock market price prediction and focused on volume, as a specific feature of stock market. One of the key findings by them was that the volume was not found to be effective in improving the forecasting performance on the datasets they used, which was S&P 500 and DJI. Ince and Trafalis in [ 15 ] targeted short-term forecasting and applied support vector machine (SVM) model on the stock price prediction. Their main contribution is performing a comparison between multi-layer perceptron (MLP) and SVM then found that most of the scenarios SVM outperformed MLP, while the result was also affected by different trading strategies. In the meantime, researchers from financial domains were applying conventional statistical methods and signal processing techniques on analyzing stock market data.

The optimization techniques, such as principal component analysis (PCA) were also applied in short-term stock price prediction [ 22 ]. During the years, researchers are not only focused on stock price-related analysis but also tried to analyze stock market transactions such as volume burst risks, which expands the stock market analysis research domain broader and indicates this research domain still has high potential [ 39 ]. As the artificial intelligence techniques evolved in recent years, many proposed solutions attempted to combine machine learning and deep learning techniques based on previous approaches, and then proposed new metrics that serve as training features such as Liu and Wang [ 23 ]. This type of previous works belongs to the feature engineering domain and can be considered as the inspiration of feature extension ideas in our research. Liu et al. in [ 24 ] proposed a convolutional neural network (CNN) as well as a long short-term memory (LSTM) neural network based model to analyze different quantitative strategies in stock markets. The CNN serves for the stock selection strategy, automatically extracts features based on quantitative data, then follows an LSTM to preserve the time-series features for improving profits.

The latest work also proposes a similar hybrid neural network architecture, integrating a convolutional neural network with a bidirectional long short-term memory to predict the stock market index [ 4 ]. While the researchers frequently proposed different neural network solution architectures, it brought further discussions about the topic if the high cost of training such models is worth the result or not.

There are three key contributions of our work (1) a new dataset extracted and cleansed (2) a comprehensive feature engineering, and (3) a customized long short-term memory (LSTM) based deep learning model.

We have built the dataset by ourselves from the data source as an open-sourced data API called Tushare [ 43 ]. The novelty of our proposed solution is that we proposed a feature engineering along with a fine-tuned system instead of just an LSTM model only. We observe from the previous works and find the gaps and proposed a solution architecture with a comprehensive feature engineering procedure before training the prediction model. With the success of feature extension method collaborating with recursive feature elimination algorithms, it opens doors for many other machine learning algorithms to achieve high accuracy scores for short-term price trend prediction. It proved the effectiveness of our proposed feature extension as feature engineering. We further introduced our customized LSTM model and further improved the prediction scores in all the evaluation metrics. The proposed solution outperformed the machine learning and deep learning-based models in similar previous works.

The remainder of this paper is organized as follows. “ Survey of related works ” section describes the survey of related works. “ The dataset ” section provides details on the data that we extracted from the public data sources and the dataset prepared. “ Methods ” section presents the research problems, methods, and design of the proposed solution. Detailed technical design with algorithms and how the model implemented are also included in this section. “ Results ” section presents comprehensive results and evaluation of our proposed model, and by comparing it with the models used in most of the related works. “ Discussion ” section provides a discussion and comparison of the results. “ Conclusion ” section presents the conclusion. This research paper has been built based on Shen [ 36 ].

Survey of related works

In this section, we discuss related works. We reviewed the related work in two different domains: technical and financial, respectively.

Kim and Han in [ 19 ] built a model as a combination of artificial neural networks (ANN) and genetic algorithms (GAs) with discretization of features for predicting stock price index. The data used in their study include the technical indicators as well as the direction of change in the daily Korea stock price index (KOSPI). They used the data containing samples of 2928 trading days, ranging from January 1989 to December 1998, and give their selected features and formulas. They also applied optimization of feature discretization, as a technique that is similar to dimensionality reduction. The strengths of their work are that they introduced GA to optimize the ANN. First, the amount of input features and processing elements in the hidden layer are 12 and not adjustable. Another limitation is in the learning process of ANN, and the authors only focused on two factors in optimization. While they still believed that GA has great potential for feature discretization optimization. Our initialized feature pool refers to the selected features. Qiu and Song in [ 34 ] also presented a solution to predict the direction of the Japanese stock market based on an optimized artificial neural network model. In this work, authors utilize genetic algorithms together with artificial neural network based models, and name it as a hybrid GA-ANN model.

Piramuthu in [ 33 ] conducted a thorough evaluation of different feature selection methods for data mining applications. He used for datasets, which were credit approval data, loan defaults data, web traffic data, tam, and kiang data, and compared how different feature selection methods optimized decision tree performance. The feature selection methods he compared included probabilistic distance measure: the Bhattacharyya measure, the Matusita measure, the divergence measure, the Mahalanobis distance measure, and the Patrick-Fisher measure. For inter-class distance measures: the Minkowski distance measure, city block distance measure, Euclidean distance measure, the Chebychev distance measure, and the nonlinear (Parzen and hyper-spherical kernel) distance measure. The strength of this paper is that the author evaluated both probabilistic distance-based and several inter-class feature selection methods. Besides, the author performed the evaluation based on different datasets, which reinforced the strength of this paper. However, the evaluation algorithm was a decision tree only. We cannot conclude if the feature selection methods will still perform the same on a larger dataset or a more complex model.

Hassan and Nath in [ 9 ] applied the Hidden Markov Model (HMM) on the stock market forecasting on stock prices of four different Airlines. They reduce states of the model into four states: the opening price, closing price, the highest price, and the lowest price. The strong point of this paper is that the approach does not need expert knowledge to build a prediction model. While this work is limited within the industry of Airlines and evaluated on a very small dataset, it may not lead to a prediction model with generality. One of the approaches in stock market prediction related works could be exploited to do the comparison work. The authors selected a maximum 2 years as the date range of training and testing dataset, which provided us a date range reference for our evaluation part.

Lei in [ 21 ] exploited Wavelet Neural Network (WNN) to predict stock price trends. The author also applied Rough Set (RS) for attribute reduction as an optimization. Rough Set was utilized to reduce the stock price trend feature dimensions. It was also used to determine the structure of the Wavelet Neural Network. The dataset of this work consists of five well-known stock market indices, i.e., (1) SSE Composite Index (China), (2) CSI 300 Index (China), (3) All Ordinaries Index (Australian), (4) Nikkei 225 Index (Japan), and (5) Dow Jones Index (USA). Evaluation of the model was based on different stock market indices, and the result was convincing with generality. By using Rough Set for optimizing the feature dimension before processing reduces the computational complexity. However, the author only stressed the parameter adjustment in the discussion part but did not specify the weakness of the model itself. Meanwhile, we also found that the evaluations were performed on indices, the same model may not have the same performance if applied on a specific stock.

Lee in [ 20 ] used the support vector machine (SVM) along with a hybrid feature selection method to carry out prediction of stock trends. The dataset in this research is a sub dataset of NASDAQ Index in Taiwan Economic Journal Database (TEJD) in 2008. The feature selection part was using a hybrid method, supported sequential forward search (SSFS) played the role of the wrapper. Another advantage of this work is that they designed a detailed procedure of parameter adjustment with performance under different parameter values. The clear structure of the feature selection model is also heuristic to the primary stage of model structuring. One of the limitations was that the performance of SVM was compared to back-propagation neural network (BPNN) only and did not compare to the other machine learning algorithms.

Sirignano and Cont leveraged a deep learning solution trained on a universal feature set of financial markets in [ 40 ]. The dataset used included buy and sell records of all transactions, and cancellations of orders for approximately 1000 NASDAQ stocks through the order book of the stock exchange. The NN consists of three layers with LSTM units and a feed-forward layer with rectified linear units (ReLUs) at last, with stochastic gradient descent (SGD) algorithm as an optimization. Their universal model was able to generalize and cover the stocks other than the ones in the training data. Though they mentioned the advantages of a universal model, the training cost was still expensive. Meanwhile, due to the inexplicit programming of the deep learning algorithm, it is unclear that if there are useless features contaminated when feeding the data into the model. Authors found out that it would have been better if they performed feature selection part before training the model and found it as an effective way to reduce the computational complexity.

Ni et al. in [ 30 ] predicted stock price trends by exploiting SVM and performed fractal feature selection for optimization. The dataset they used is the Shanghai Stock Exchange Composite Index (SSECI), with 19 technical indicators as features. Before processing the data, they optimized the input data by performing feature selection. When finding the best parameter combination, they also used a grid search method, which is k cross-validation. Besides, the evaluation of different feature selection methods is also comprehensive. As the authors mentioned in their conclusion part, they only considered the technical indicators but not macro and micro factors in the financial domain. The source of datasets that the authors used was similar to our dataset, which makes their evaluation results useful to our research. They also mentioned a method called k cross-validation when testing hyper-parameter combinations.

McNally et al. in [ 27 ] leveraged RNN and LSTM on predicting the price of Bitcoin, optimized by using the Boruta algorithm for feature engineering part, and it works similarly to the random forest classifier. Besides feature selection, they also used Bayesian optimization to select LSTM parameters. The Bitcoin dataset ranged from the 19th of August 2013 to 19th of July 2016. Used multiple optimization methods to improve the performance of deep learning methods. The primary problem of their work is overfitting. The research problem of predicting Bitcoin price trend has some similarities with stock market price prediction. Hidden features and noises embedded in the price data are threats of this work. The authors treated the research question as a time sequence problem. The best part of this paper is the feature engineering and optimization part; we could replicate the methods they exploited in our data pre-processing.

Weng et al. in [ 45 ] focused on short-term stock price prediction by using ensemble methods of four well-known machine learning models. The dataset for this research is five sets of data. They obtained these datasets from three open-sourced APIs and an R package named TTR. The machine learning models they used are (1) neural network regression ensemble (NNRE), (2) a Random Forest with unpruned regression trees as base learners (RFR), (3) AdaBoost with unpruned regression trees as base learners (BRT) and (4) a support vector regression ensemble (SVRE). A thorough study of ensemble methods specified for short-term stock price prediction. With background knowledge, the authors selected eight technical indicators in this study then performed a thoughtful evaluation of five datasets. The primary contribution of this paper is that they developed a platform for investors using R, which does not need users to input their own data but call API to fetch the data from online source straightforward. From the research perspective, they only evaluated the prediction of the price for 1 up to 10 days ahead but did not evaluate longer terms than two trading weeks or a shorter term than 1 day. The primary limitation of their research was that they only analyzed 20 U.S.-based stocks, the model might not be generalized to other stock market or need further revalidation to see if it suffered from overfitting problems.

Kara et al. in [ 17 ] also exploited ANN and SVM in predicting the movement of stock price index. The data set they used covers a time period from January 2, 1997, to December 31, 2007, of the Istanbul Stock Exchange. The primary strength of this work is its detailed record of parameter adjustment procedures. While the weaknesses of this work are that neither the technical indicator nor the model structure has novelty, and the authors did not explain how their model performed better than other models in previous works. Thus, more validation works on other datasets would help. They explained how ANN and SVM work with stock market features, also recorded the parameter adjustment. The implementation part of our research could benefit from this previous work.

Jeon et al. in [ 16 ] performed research on millisecond interval-based big dataset by using pattern graph tracking to complete stock price prediction tasks. The dataset they used is a millisecond interval-based big dataset of historical stock data from KOSCOM, from August 2014 to October 2014, 10G–15G capacity. The author applied Euclidean distance, Dynamic Time Warping (DTW) for pattern recognition. For feature selection, they used stepwise regression. The authors completed the prediction task by ANN and Hadoop and RHive for big data processing. The “ Results ” section is based on the result processed by a combination of SAX and Jaro–Winkler distance. Before processing the data, they generated aggregated data at 5-min intervals from discrete data. The primary strength of this work is the explicit structure of the whole implementation procedure. While they exploited a relatively old model, another weakness is the overall time span of the training dataset is extremely short. It is difficult to access the millisecond interval-based data in real life, so the model is not as practical as a daily based data model.

Huang et al. in [ 12 ] applied a fuzzy-GA model to complete the stock selection task. They used the key stocks of the 200 largest market capitalization listed as the investment universe in the Taiwan Stock Exchange. Besides, the yearly financial statement data and the stock returns were taken from the Taiwan Economic Journal (TEJ) database at www.tej.com.tw/ for the time period from year 1995 to year 2009. They conducted the fuzzy membership function with model parameters optimized with GA and extracted features for optimizing stock scoring. The authors proposed an optimized model for selection and scoring of stocks. Different from the prediction model, the authors more focused on stock rankings, selection, and performance evaluation. Their structure is more practical among investors. But in the model validation part, they did not compare the model with existed algorithms but the statistics of the benchmark, which made it challenging to identify if GA would outperform other algorithms.

Fischer and Krauss in [ 5 ] applied long short-term memory (LSTM) on financial market prediction. The dataset they used is S&P 500 index constituents from Thomson Reuters. They obtained all month-end constituent lists for the S&P 500 from Dec 1989 to Sep 2015, then consolidated the lists into a binary matrix to eliminate survivor bias. The authors also used RMSprop as an optimizer, which is a mini-batch version of rprop. The primary strength of this work is that the authors used the latest deep learning technique to perform predictions. They relied on the LSTM technique, lack of background knowledge in the financial domain. Although the LSTM outperformed the standard DNN and logistic regression algorithms, while the author did not mention the effort to train an LSTM with long-time dependencies.

Tsai and Hsiao in [ 42 ] proposed a solution as a combination of different feature selection methods for prediction of stocks. They used Taiwan Economic Journal (TEJ) database as data source. The data used in their analysis was from year 2000 to 2007. In their work, they used a sliding window method and combined it with multi layer perceptron (MLP) based artificial neural networks with back propagation, as their prediction model. In their work, they also applied principal component analysis (PCA) for dimensionality reduction, genetic algorithms (GA) and the classification and regression trees (CART) to select important features. They did not just rely on technical indices only. Instead, they also included both fundamental and macroeconomic indices in their analysis. The authors also reported a comparison on feature selection methods. The validation part was done by combining the model performance stats with statistical analysis.

Pimenta et al. in [ 32 ] leveraged an automated investing method by using multi-objective genetic programming and applied it in the stock market. The dataset was obtained from Brazilian stock exchange market (BOVESPA), and the primary techniques they exploited were a combination of multi-objective optimization, genetic programming, and technical trading rules. For optimization, they leveraged genetic programming (GP) to optimize decision rules. The novelty of this paper was in the evaluation part. They included a historical period, which was a critical moment of Brazilian politics and economics when performing validation. This approach reinforced the generalization strength of their proposed model. When selecting the sub-dataset for evaluation, they also set criteria to ensure more asset liquidity. While the baseline of the comparison was too basic and fundamental, and the authors did not perform any comparison with other existing models.

Huang and Tsai in [ 13 ] conducted a filter-based feature selection assembled with a hybrid self-organizing feature map (SOFM) support vector regression (SVR) model to forecast Taiwan index futures (FITX) trend. They divided the training samples into clusters to marginally improve the training efficiency. The authors proposed a comprehensive model, which was a combination of two novel machine learning techniques in stock market analysis. Besides, the optimizer of feature selection was also applied before the data processing to improve the prediction accuracy and reduce the computational complexity of processing daily stock index data. Though they optimized the feature selection part and split the sample data into small clusters, it was already strenuous to train daily stock index data of this model. It would be difficult for this model to predict trading activities in shorter time intervals since the data volume would be increased drastically. Moreover, the evaluation is not strong enough since they set a single SVR model as a baseline, but did not compare the performance with other previous works, which caused difficulty for future researchers to identify the advantages of SOFM-SVR model why it outperforms other algorithms.

Thakur and Kumar in [ 41 ] also developed a hybrid financial trading support system by exploiting multi-category classifiers and random forest (RAF). They conducted their research on stock indices from NASDAQ, DOW JONES, S&P 500, NIFTY 50, and NIFTY BANK. The authors proposed a hybrid model combined random forest (RF) algorithms with a weighted multicategory generalized eigenvalue support vector machine (WMGEPSVM) to generate “Buy/Hold/Sell” signals. Before processing the data, they used Random Forest (RF) for feature pruning. The authors proposed a practical model designed for real-life investment activities, which could generate three basic signals for investors to refer to. They also performed a thorough comparison of related algorithms. While they did not mention the time and computational complexity of their works. Meanwhile, the unignorable issue of their work was the lack of financial domain knowledge background. The investors regard the indices data as one of the attributes but could not take the signal from indices to operate a specific stock straightforward.

Hsu in [ 11 ] assembled feature selection with a back propagation neural network (BNN) combined with genetic programming to predict the stock/futures price. The dataset in this research was obtained from Taiwan Stock Exchange Corporation (TWSE). The authors have introduced the description of the background knowledge in detail. While the weakness of their work is that it is a lack of data set description. This is a combination of the model proposed by other previous works. Though we did not see the novelty of this work, we can still conclude that the genetic programming (GP) algorithm is admitted in stock market research domain. To reinforce the validation strengths, it would be good to consider adding GP models into evaluation if the model is predicting a specific price.

Hafezi et al. in [ 7 ] built a bat-neural network multi-agent system (BN-NMAS) to predict stock price. The dataset was obtained from the Deutsche bundes-bank. They also applied the Bat algorithm (BA) for optimizing neural network weights. The authors illustrated their overall structure and logic of system design in clear flowcharts. While there were very few previous works that had performed on DAX data, it would be difficult to recognize if the model they proposed still has the generality if migrated on other datasets. The system design and feature selection logic are fascinating, which worth referring to. Their findings in optimization algorithms are also valuable for the research in the stock market price prediction research domain. It is worth trying the Bat algorithm (BA) when constructing neural network models.

Long et al. in [ 25 ] conducted a deep learning approach to predict the stock price movement. The dataset they used is the Chinese stock market index CSI 300. For predicting the stock price movement, they constructed a multi-filter neural network (MFNN) with stochastic gradient descent (SGD) and back propagation optimizer for learning NN parameters. The strength of this paper is that the authors exploited a novel model with a hybrid model constructed by different kinds of neural networks, it provides an inspiration for constructing hybrid neural network structures.

Atsalakis and Valavanis in [ 1 ] proposed a solution of a neuro-fuzzy system, which is composed of controller named as Adaptive Neuro Fuzzy Inference System (ANFIS), to achieve short-term stock price trend prediction. The noticeable strength of this work is the evaluation part. Not only did they compare their proposed system with the popular data models, but also compared with investment strategies. While the weakness that we found from their proposed solution is that their solution architecture is lack of optimization part, which might limit their model performance. Since our proposed solution is also focusing on short-term stock price trend prediction, this work is heuristic for our system design. Meanwhile, by comparing with the popular trading strategies from investors, their work inspired us to compare the strategies used by investors with techniques used by researchers.

Nekoeiqachkanloo et al. in [ 29 ] proposed a system with two different approaches for stock investment. The strengths of their proposed solution are obvious. First, it is a comprehensive system that consists of data pre-processing and two different algorithms to suggest the best investment portions. Second, the system also embedded with a forecasting component, which also retains the features of the time series. Last but not least, their input features are a mix of fundamental features and technical indices that aim to fill in the gap between the financial domain and technical domain. However, their work has a weakness in the evaluation part. Instead of evaluating the proposed system on a large dataset, they chose 25 well-known stocks. There is a high possibility that the well-known stocks might potentially share some common hidden features.

As another related latest work, Idrees et al. [ 14 ] published a time series-based prediction approach for the volatility of the stock market. ARIMA is not a new approach in the time series prediction research domain. Their work is more focusing on the feature engineering side. Before feeding the features into ARIMA models, they designed three steps for feature engineering: Analyze the time series, identify if the time series is stationary or not, perform estimation by plot ACF and PACF charts and look for parameters. The only weakness of their proposed solution is that the authors did not perform any customization on the existing ARIMA model, which might limit the system performance to be improved.

One of the main weaknesses found in the related works is limited data-preprocessing mechanisms built and used. Technical works mostly tend to focus on building prediction models. When they select the features, they list all the features mentioned in previous works and go through the feature selection algorithm then select the best-voted features. Related works in the investment domain have shown more interest in behavior analysis, such as how herding behaviors affect the stock performance, or how the percentage of inside directors hold the firm’s common stock affects the performance of a certain stock. These behaviors often need a pre-processing procedure of standard technical indices and investment experience to recognize.

In the related works, often a thorough statistical analysis is performed based on a special dataset and conclude new features rather than performing feature selections. Some data, such as the percentage of a certain index fluctuation has been proven to be effective on stock performance. We believe that by extracting new features from data, then combining such features with existed common technical indices will significantly benefit the existing and well-tested prediction models.

The dataset

This section details the data that was extracted from the public data sources, and the final dataset that was prepared. Stock market-related data are diverse, so we first compared the related works from the survey of financial research works in stock market data analysis to specify the data collection directions. After collecting the data, we defined a data structure of the dataset. Given below, we describe the dataset in detail, including the data structure, and data tables in each category of data with the segment definitions.

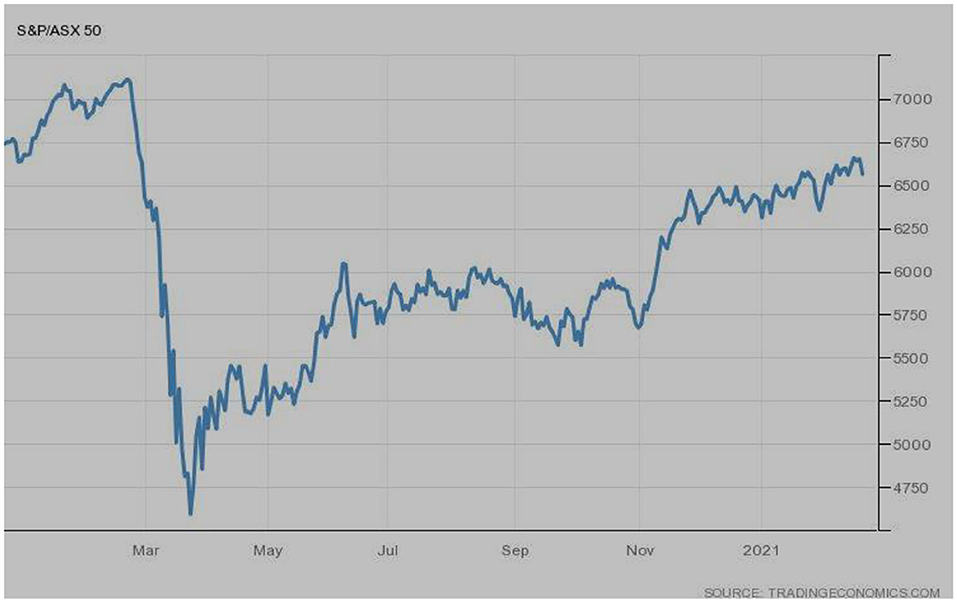

Description of our dataset

In this section, we will describe the dataset in detail. This dataset consists of 3558 stocks from the Chinese stock market. Besides the daily price data, daily fundamental data of each stock ID, we also collected the suspending and resuming history, top 10 shareholders, etc. We list two reasons that we choose 2 years as the time span of this dataset: (1) most of the investors perform stock market price trend analysis using the data within the latest 2 years, (2) using more recent data would benefit the analysis result. We collected data through the open-sourced API, namely Tushare [ 43 ], mean-while we also leveraged a web-scraping technique to collect data from Sina Finance web pages, SWS Research website.

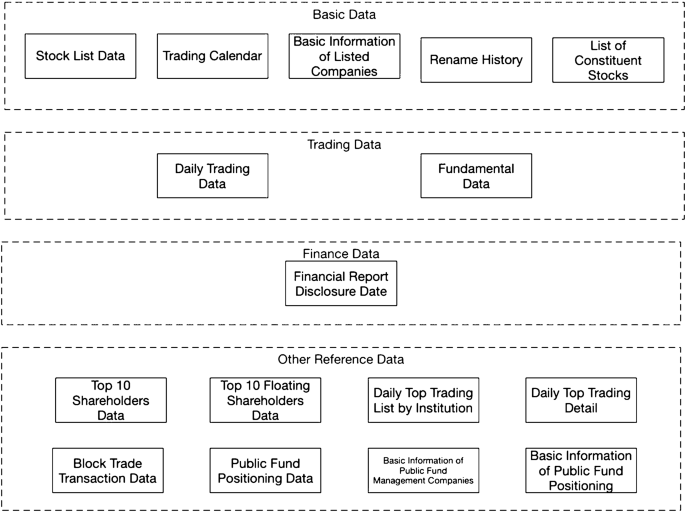

Data structure

Figure 1 illustrates all the data tables in the dataset. We collected four categories of data in this dataset: (1) basic data, (2) trading data, (3) finance data, and (4) other reference data. All the data tables can be linked to each other by a common field called “Stock ID” It is a unique stock identifier registered in the Chinese Stock market. Table 1 shows an overview of the dataset.

Data structure for the extracted dataset

The Table 1 lists the field information of each data table as well as which category the data table belongs to.

In this section, we present the proposed methods and the design of the proposed solution. Moreover, we also introduce the architecture design as well as algorithmic and implementation details.

Problem statement

We analyzed the best possible approach for predicting short-term price trends from different aspects: feature engineering, financial domain knowledge, and prediction algorithm. Then we addressed three research questions in each aspect, respectively: How can feature engineering benefit model prediction accuracy? How do findings from the financial domain benefit prediction model design? And what is the best algorithm for predicting short-term price trends?

The first research question is about feature engineering. We would like to know how the feature selection method benefits the performance of prediction models. From the abundance of the previous works, we can conclude that stock price data embedded with a high level of noise, and there are also correlations between features, which makes the price prediction notoriously difficult. That is also the primary reason for most of the previous works introduced the feature engineering part as an optimization module.

The second research question is evaluating the effectiveness of findings we extracted from the financial domain. Different from the previous works, besides the common evaluation of data models such as the training costs and scores, our evaluation will emphasize the effectiveness of newly added features that we extracted from the financial domain. We introduce some features from the financial domain. While we only obtained some specific findings from previous works, and the related raw data needs to be processed into usable features. After extracting related features from the financial domain, we combine the features with other common technical indices for voting out the features with a higher impact. There are numerous features said to be effective from the financial domain, and it would be impossible for us to cover all of them. Thus, how to appropriately convert the findings from the financial domain to a data processing module of our system design is a hidden research question that we attempt to answer.

The third research question is that which algorithms are we going to model our data? From the previous works, researchers have been putting efforts into the exact price prediction. We decompose the problem into predicting the trend and then the exact number. This paper focuses on the first step. Hence, the objective has been converted to resolve a binary classification problem, meanwhile, finding an effective way to eliminate the negative effect brought by the high level of noise. Our approach is to decompose the complex problem into sub-problems which have fewer dependencies and resolve them one by one, and then compile the resolutions into an ensemble model as an aiding system for investing behavior reference.

In the previous works, researchers have been using a variety of models for predicting stock price trends. While most of the best-performed models are based on machine learning techniques, in this work, we will compare our approach with the outperformed machine learning models in the evaluation part and find the solution for this research question.

Proposed solution

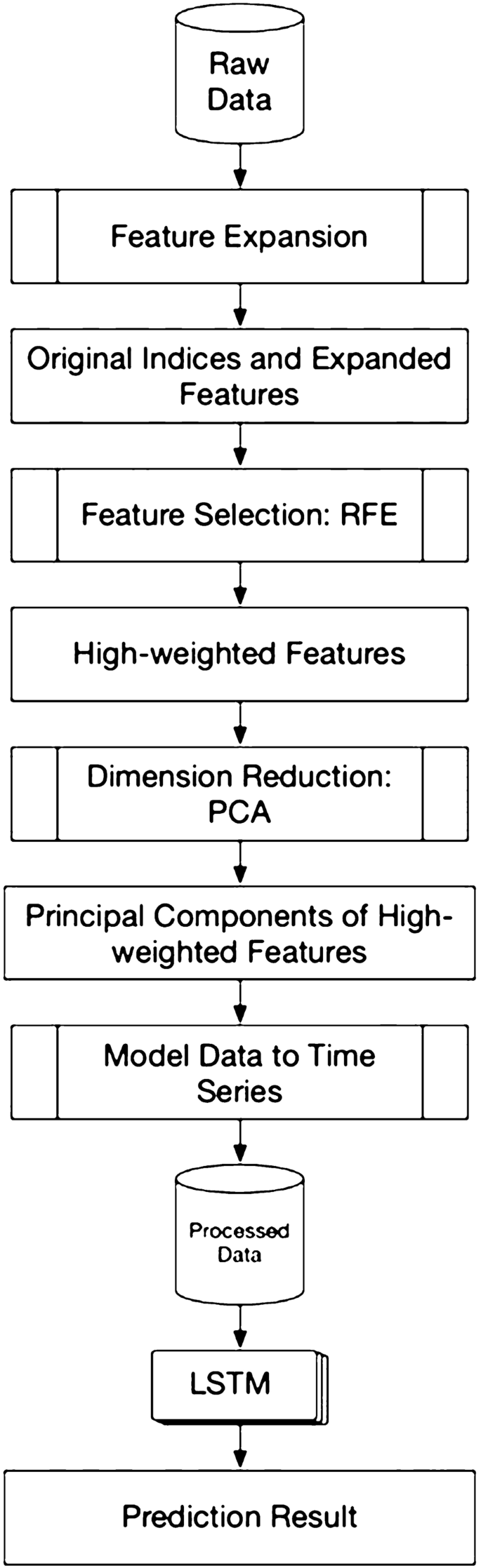

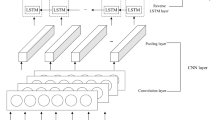

The high-level architecture of our proposed solution could be separated into three parts. First is the feature selection part, to guarantee the selected features are highly effective. Second, we look into the data and perform the dimensionality reduction. And the last part, which is the main contribution of our work is to build a prediction model of target stocks. Figure 2 depicts a high-level architecture of the proposed solution.

High-level architecture of the proposed solution

There are ways to classify different categories of stocks. Some investors prefer long-term investments, while others show more interest in short-term investments. It is common to see the stock-related reports showing an average performance, while the stock price is increasing drastically; this is one of the phenomena that indicate the stock price prediction has no fixed rules, thus finding effective features before training a model on data is necessary.

In this research, we focus on the short-term price trend prediction. Currently, we only have the raw data with no labels. So, the very first step is to label the data. We mark the price trend by comparing the current closing price with the closing price of n trading days ago, the range of n is from 1 to 10 since our research is focusing on the short-term. If the price trend goes up, we mark it as 1 or mark as 0 in the opposite case. To be more specified, we use the indices from the indices of n − 1 th day to predict the price trend of the n th day.

According to the previous works, some researchers who applied both financial domain knowledge and technical methods on stock data were using rules to filter the high-quality stocks. We referred to their works and exploited their rules to contribute to our feature extension design.

However, to ensure the best performance of the prediction model, we will look into the data first. There are a large number of features in the raw data; if we involve all the features into our consideration, it will not only drastically increase the computational complexity but will also cause side effects if we would like to perform unsupervised learning in further research. So, we leverage the recursive feature elimination (RFE) to ensure all the selected features are effective.

We found most of the previous works in the technical domain were analyzing all the stocks, while in the financial domain, researchers prefer to analyze the specific scenario of investment, to fill the gap between the two domains, we decide to apply a feature extension based on the findings we gathered from the financial domain before we start the RFE procedure.

Since we plan to model the data into time series, the number of the features, the more complex the training procedure will be. So, we will leverage the dimensionality reduction by using randomized PCA at the beginning of our proposed solution architecture.

Detailed technical design elaboration

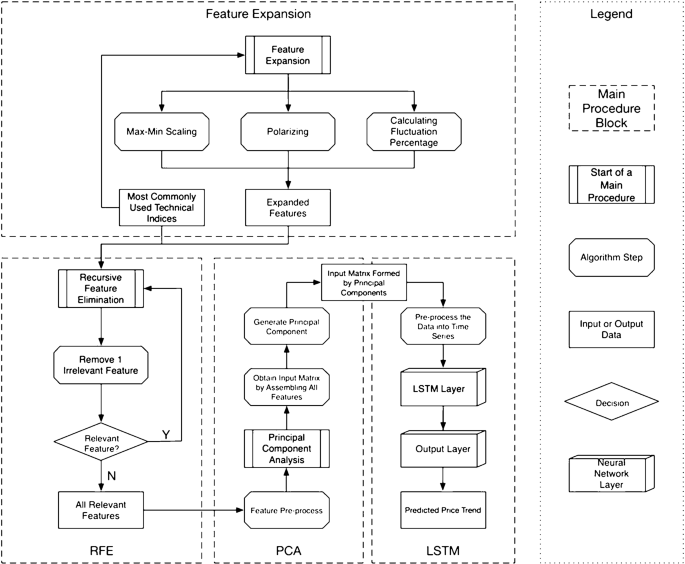

This section provides an elaboration of the detailed technical design as being a comprehensive solution based on utilizing, combining, and customizing several existing data preprocessing, feature engineering, and deep learning techniques. Figure 3 provides the detailed technical design from data processing to prediction, including the data exploration. We split the content by main procedures, and each procedure contains algorithmic steps. Algorithmic details are elaborated in the next section. The contents of this section will focus on illustrating the data workflow.

Detailed technical design of the proposed solution

Based on the literature review, we select the most commonly used technical indices and then feed them into the feature extension procedure to get the expanded feature set. We will select the most effective i features from the expanded feature set. Then we will feed the data with i selected features into the PCA algorithm to reduce the dimension into j features. After we get the best combination of i and j , we process the data into finalized the feature set and feed them into the LSTM [ 10 ] model to get the price trend prediction result.

The novelty of our proposed solution is that we will not only apply the technical method on raw data but also carry out the feature extensions that are used among stock market investors. Details on feature extension are given in the next subsection. Experiences gained from applying and optimizing deep learning based solutions in [ 37 , 38 ] were taken into account while designing and customizing feature engineering and deep learning solution in this work.

Applying feature extension

The first main procedure in Fig. 3 is the feature extension. In this block, the input data is the most commonly used technical indices concluded from related works. The three feature extension methods are max–min scaling, polarizing, and calculating fluctuation percentage. Not all the technical indices are applicable for all three of the feature extension methods; this procedure only applies the meaningful extension methods on technical indices. We choose meaningful extension methods while looking at how the indices are calculated. The technical indices and the corresponding feature extension methods are illustrated in Table 2 .

After the feature extension procedure, the expanded features will be combined with the most commonly used technical indices, i.e., input data with output data, and feed into RFE block as input data in the next step.

Applying recursive feature elimination

After the feature extension above, we explore the most effective i features by using the Recursive Feature Elimination (RFE) algorithm [ 6 ]. We estimate all the features by two attributes, coefficient, and feature importance. We also limit the features that remove from the pool by one, which means we will remove one feature at each step and retain all the relevant features. Then the output of the RFE block will be the input of the next step, which refers to PCA.

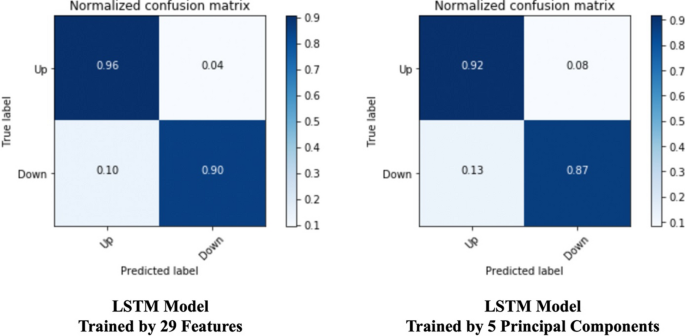

Applying principal component analysis (PCA)

The very first step before leveraging PCA is feature pre-processing. Because some of the features after RFE are percentage data, while others are very large numbers, i.e., the output from RFE are in different units. It will affect the principal component extraction result. Thus, before feeding the data into the PCA algorithm [ 8 ], a feature pre-processing is necessary. We also illustrate the effectiveness and methods comparison in “ Results ” section.

After performing feature pre-processing, the next step is to feed the processed data with selected i features into the PCA algorithm to reduce the feature matrix scale into j features. This step is to retain as many effective features as possible and meanwhile eliminate the computational complexity of training the model. This research work also evaluates the best combination of i and j, which has relatively better prediction accuracy, meanwhile, cuts the computational consumption. The result can be found in the “ Results ” section, as well. After the PCA step, the system will get a reshaped matrix with j columns.

Fitting long short-term memory (LSTM) model

PCA reduced the dimensions of the input data, while the data pre-processing is mandatory before feeding the data into the LSTM layer. The reason for adding the data pre-processing step before the LSTM model is that the input matrix formed by principal components has no time steps. While one of the most important parameters of training an LSTM is the number of time steps. Hence, we have to model the matrix into corresponding time steps for both training and testing dataset.

After performing the data pre-processing part, the last step is to feed the training data into LSTM and evaluate the performance using testing data. As a variant neural network of RNN, even with one LSTM layer, the NN structure is still a deep neural network since it can process sequential data and memorizes its hidden states through time. An LSTM layer is composed of one or more LSTM units, and an LSTM unit consists of cells and gates to perform classification and prediction based on time series data.

The LSTM structure is formed by two layers. The input dimension is determined by j after the PCA algorithm. The first layer is the input LSTM layer, and the second layer is the output layer. The final output will be 0 or 1 indicates if the stock price trend prediction result is going down or going up, as a supporting suggestion for the investors to perform the next investment decision.

Design discussion

Feature extension is one of the novelties of our proposed price trend predicting system. In the feature extension procedure, we use technical indices to collaborate with the heuristic processing methods learned from investors, which fills the gap between the financial research area and technical research area.

Since we proposed a system of price trend prediction, feature engineering is extremely important to the final prediction result. Not only the feature extension method is helpful to guarantee we do not miss the potentially correlated feature, but also feature selection method is necessary for pooling the effective features. The more irrelevant features are fed into the model, the more noise would be introduced. Each main procedure is carefully considered contributing to the whole system design.

Besides the feature engineering part, we also leverage LSTM, the state-of-the-art deep learning method for time-series prediction, which guarantees the prediction model can capture both complex hidden pattern and the time-series related pattern.

It is known that the training cost of deep learning models is expansive in both time and hardware aspects; another advantage of our system design is the optimization procedure—PCA. It can retain the principal components of the features while reducing the scale of the feature matrix, thus help the system to save the training cost of processing the large time-series feature matrix.

Algorithm elaboration

This section provides comprehensive details on the algorithms we built while utilizing and customizing different existing techniques. Details about the terminologies, parameters, as well as optimizers. From the legend on the right side of Fig. 3 , we note the algorithm steps as octagons, all of them can be found in this “ Algorithm elaboration ” section.

Before dive deep into the algorithm steps, here is the brief introduction of data pre-processing: since we will go through the supervised learning algorithms, we also need to program the ground truth. The ground truth of this research is programmed by comparing the closing price of the current trading date with the closing price of the previous trading date the users want to compare with. Label the price increase as 1, else the ground truth will be labeled as 0. Because this research work is not only focused on predicting the price trend of a specific period of time but short-term in general, the ground truth processing is according to a range of trading days. While the algorithms will not change with the prediction term length, we can regard the term length as a parameter.

The algorithmic detail is elaborated, respectively, the first algorithm is the hybrid feature engineering part for preparing high-quality training and testing data. It corresponds to the Feature extension, RFE, and PCA blocks in Fig. 3 . The second algorithm is the LSTM procedure block, including time-series data pre-processing, NN constructing, training, and testing.

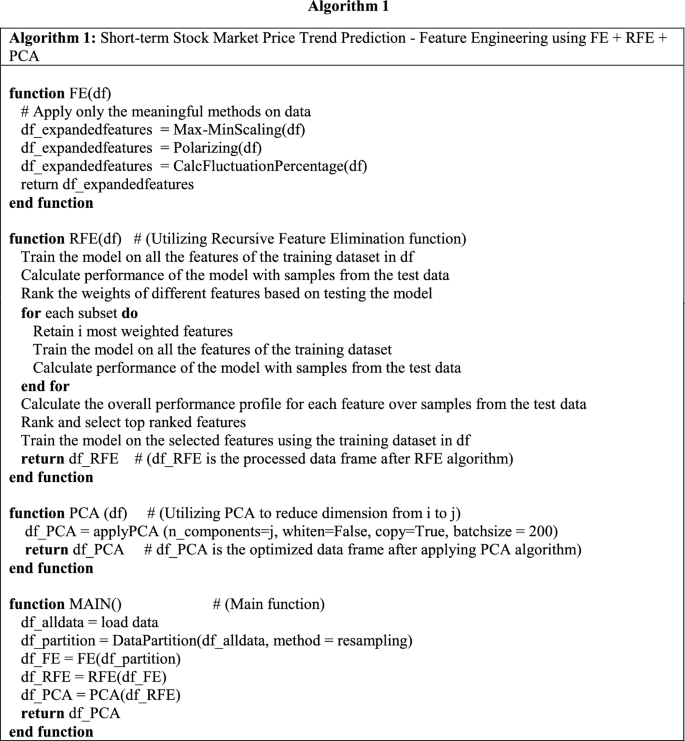

Algorithm 1: Short-term stock market price trend prediction—applying feature engineering using FE + RFE + PCA

The function FE is corresponding to the feature extension block. For the feature extension procedure, we apply three different processing methods to translate the findings from the financial domain to a technical module in our system design. While not all the indices are applicable for expanding, we only choose the proper method(s) for certain features to perform the feature extension (FE), according to Table 2 .

Normalize method preserves the relative frequencies of the terms, and transform the technical indices into the range of [0, 1]. Polarize is a well-known method often used by real-world investors, sometimes they prefer to consider if the technical index value is above or below zero, we program some of the features using polarize method and prepare for RFE. Max-min (or min-max) [ 35 ] scaling is a transformation method often used as an alternative to zero mean and unit variance scaling. Another well-known method used is fluctuation percentage, and we transform the technical indices fluctuation percentage into the range of [− 1, 1].

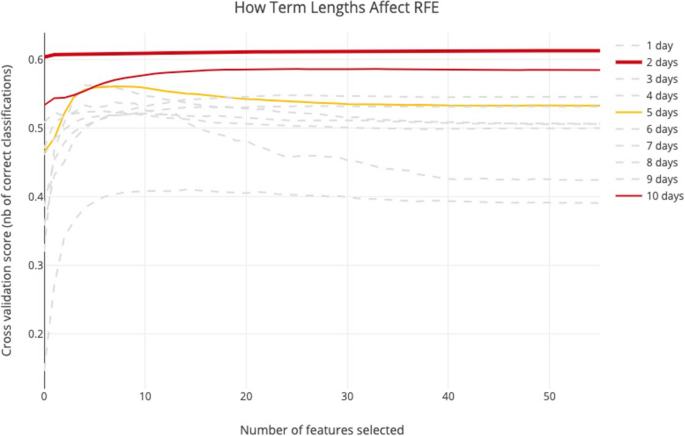

The function RFE () in the first algorithm refers to recursive feature elimination. Before we perform the training data scale reduction, we will have to make sure that the features we selected are effective. Ineffective features will not only drag down the classification precision but also add more computational complexity. For the feature selection part, we choose recursive feature elimination (RFE). As [ 45 ] explained, the process of recursive feature elimination can be split into the ranking algorithm, resampling, and external validation.

For the ranking algorithm, it fits the model to the features and ranks by the importance to the model. We set the parameter to retain i numbers of features, and at each iteration of feature selection retains Si top-ranked features, then refit the model and assess the performance again to begin another iteration. The ranking algorithm will eventually determine the top Si features.

The RFE algorithm is known to have suffered from the over-fitting problem. To eliminate the over-fitting issue, we will run the RFE algorithm multiple times on randomly selected stocks as the training set and ensure all the features we select are high-weighted. This procedure is called data resampling. Resampling can be built as an optimization step as an outer layer of the RFE algorithm.

The last part of our hybrid feature engineering algorithm is for optimization purposes. For the training data matrix scale reduction, we apply Randomized principal component analysis (PCA) [ 31 ], before we decide the features of the classification model.

Financial ratios of a listed company are used to present the growth ability, earning ability, solvency ability, etc. Each financial ratio consists of a set of technical indices, each time we add a technical index (or feature) will add another column of data into the data matrix and will result in low training efficiency and redundancy. If non-relevant or less relevant features are included in training data, it will also decrease the precision of classification.

The above equation represents the explanation power of principal components extracted by PCA method for original data. If an ACR is below 85%, the PCA method would be unsuitable due to a loss of original information. Because the covariance matrix is sensitive to the order of magnitudes of data, there should be a data standardize procedure before performing the PCA. The commonly used standardized methods are mean-standardization and normal-standardization and are noted as given below:

Mean-standardization: \(X_{ij}^{*} = X_{ij} /\overline{{X_{j} }}\) , which \(\overline{{X_{j} }}\) represents the mean value.

Normal-standardization: \(X_{ij}^{*} = (X_{ij} - \overline{{X_{j} }} )/s_{j}\) , which \(\overline{{X_{j} }}\) represents the mean value, and \(s_{j}\) is the standard deviation.

The array fe_array is defined according to Table 2 , row number maps to the features, columns 0, 1, 2, 3 note for the extension methods of normalize, polarize, max–min scale, and fluctuation percentage, respectively. Then we fill in the values for the array by the rule where 0 stands for no necessity to expand and 1 for features need to apply the corresponding extension methods. The final algorithm of data preprocessing using RFE and PCA can be illustrated as Algorithm 1.

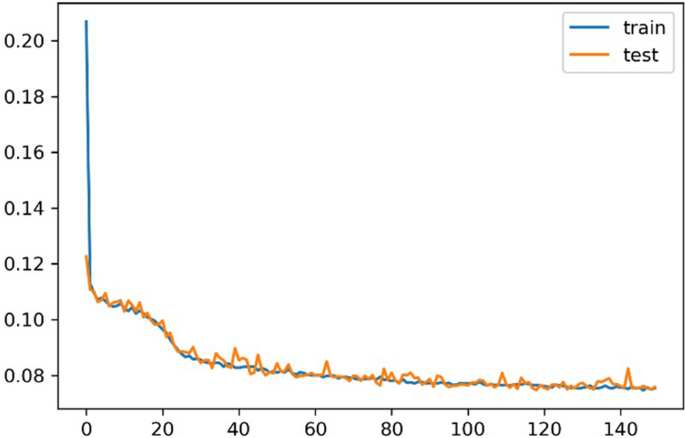

Algorithm 2: Price trend prediction model using LSTM

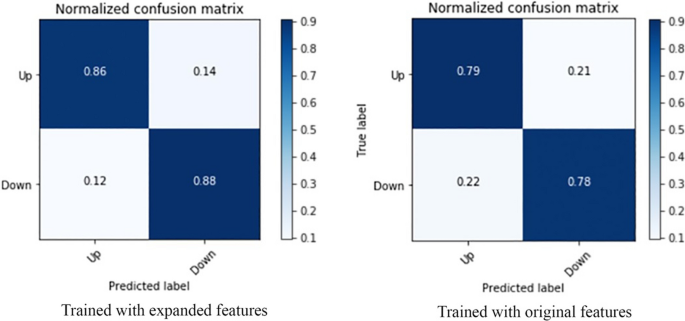

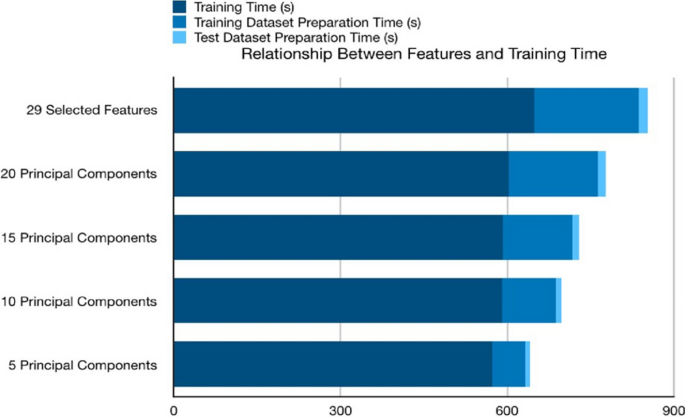

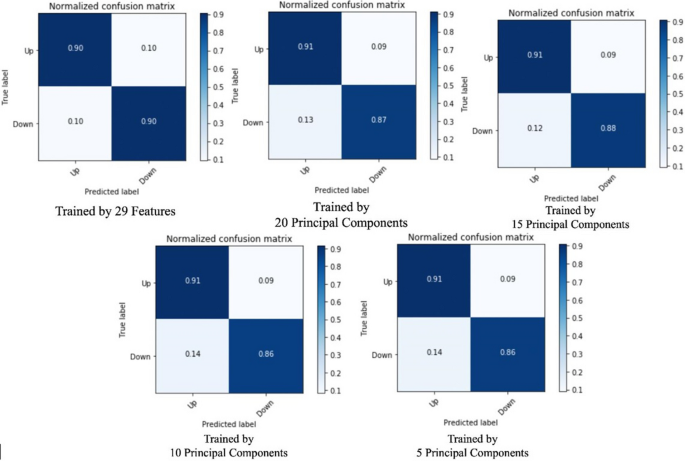

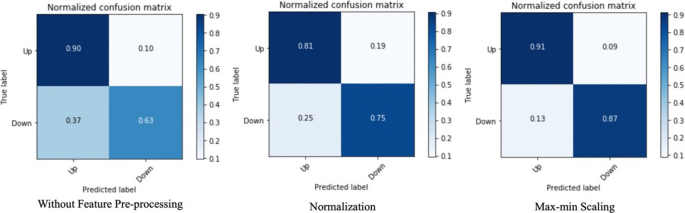

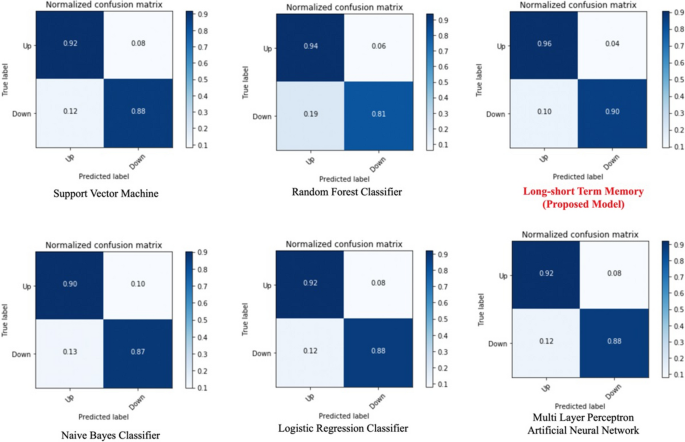

After the principal component extraction, we will get the scale-reduced matrix, which means i most effective features are converted into j principal components for training the prediction model. We utilized an LSTM model and added a conversion procedure for our stock price dataset. The detailed algorithm design is illustrated in Alg 2. The function TimeSeriesConversion () converts the principal components matrix into time series by shifting the input data frame according to the number of time steps [ 3 ], i.e., term length in this research. The processed dataset consists of the input sequence and forecast sequence. In this research, the parameter of LAG is 1, because the model is detecting the pattern of features fluctuation on a daily basis. Meanwhile, the N_TIME_STEPS is varied from 1 trading day to 10 trading days. The functions DataPartition (), FitModel (), EvaluateModel () are regular steps without customization. The NN structure design, optimizer decision, and other parameters are illustrated in function ModelCompile () .