Cost of Credit

Jul 11, 2014

880 likes | 2.26k Views

Cost of Credit. Ch. 18-2 PoB 2011. Finding Interest. Interest – is the cost of using some one else’s money It is the amount of interest paid on a loan or charge account that should be clearly understood Principal (P) – amount of the loan

Share Presentation

- installment interest

- credit history

- finance charge

- payment table

- total dollar cost

Presentation Transcript

Cost of Credit Ch. 18-2 PoB 2011

Finding Interest • Interest – is the cost of using some one else’s money • It is the amount of interest paid on a loan or charge account that should be clearly understood • Principal (P) – amount of the loan • Interest Rate (R) - percent of interest charged or earned • Time (T) - length of time for which interest will be charged

Simple Interest • Simple Interest – usually occurs on single-payment loans • Interest = Principal x Rate x Time • I = P x R x • Time can occur in days and months

Maturity Dates • Maturity Date - the date on which the loan must be paid • When the time of the loan is stated in months, the date of maturity is the same day of the month on which the loan was made • When the time of the loan is stated in days, you must count the exact number of days to find the date of maturity

Installment Interest • Installment Loan – a loan that you repay in partial payments • Where each payment is an Installment • Gives the borrower a schedule of payments • You sign a promissory note for the total amount • Amortization Schedule – the payment table of principal and interest over time

Finance Charges • Annual Percentage Rate (APR) – is a disclosure required by law • States the percentage cost of credit on a yearly basis • Includes other charges that may be made • Service Fees – involve the time and money it takes a creditor to investigate your credit history, process your loan or charge account applications, and keep records of your payments and balances • Uncollectible Accounts - the cost of collecting from those who do not pay their accounts • May be passed on to other borrowers

Finance Charges • Total Dollar Charge – to make you aware of the total cost of credit • Federal law requires that the lender must tell you the finance charge • Finance Charge – is the total dollar cost of the credit, including interest and all other charges • Compare Credit Costs • Be sure to compare the total cost of credit among alternative sources • Check with several lenders and compare APRs • Shop around when getting a loan • Remember you are using future income when using credit

Review What three things are necessary to calculate interest? What does APR represent?

- More by User

Letter of Credit

Letter of Credit. Letter of Credit. Letter of Credit. An order is sent to the exporter. It is agreed that payment will be by letter of credit (L/C) Importer sends L/C application to his bank, the issuing bank

1.48k views • 5 slides

The Cost of Credit Cards

The Cost of Credit Cards. Presented by:. What is a Credit Card?. Fast Fact. Credit Cards let you charge purchases up to a preset dollar limit, called your available credit or credit limit. Fast Fact.

519 views • 34 slides

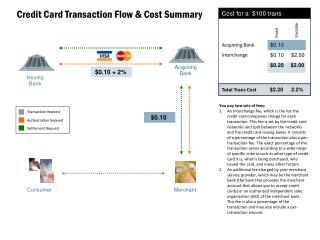

Credit Card Transaction Flow & Cost Summary

$0.10 + 2%. $0.10. Transaction Request. Authorization Request. Settlement Request. Cost for a $ 100 trans. Credit Card Transaction Flow & Cost Summary. Fixed. Variable. Acquiring Bank. $ 0.10. $ 0.10. Interchange. $ 0.10. $2.00. $ 0.20. $2.00. Acquiring Bank. Issuing Bank.

188 views • 0 slides

Cost of credit

Cost of credit. 18-2. Finding interest. Borrowing money has a cost Interest (I) is the cost of using someone else’s money. The amount of interest paid on a loan should be clearly understood. To determine the amount you need the following Principal (P) Amount of the loan

147 views • 0 slides

Secrets of Credit

Secrets of Credit . “The difference between school and life? In school, you're taught a lesson and then given a test. In life, you're given a test that teaches you a lesson.” Tom Bodett. The “Top 10” credit mistakes Credit score implications FICO scoring industry secrets

565 views • 43 slides

Cost of Delivering Rural Credit in India

Cost of Delivering Rural Credit in India. Deepti George IFMR Finance Foundation. 3 rd June 2013. Overview. Five channels covered in the Note Costs covered in the Note Cost of Debt Cost of Equity Loan Loss Provisions Transaction Cost Total Channel costs Implications for Policy.

526 views • 30 slides

PICPA The Cost of Credit Cards

PICPA The Cost of Credit Cards. Presented by: . What is a Credit Card?. Fast Fact. Credit Cards let you charge purchases up to a preset dollar limit, called your available credit or credit limit. Fast Fact.

466 views • 33 slides

LETTER OF CREDIT

LETTER OF CREDIT. LETTER OF CREDIT /DOCUMENTARY CREDIT.

3.26k views • 37 slides

The rising cost of credit hire……. Who is responsible?

The rising cost of credit hire……. Who is responsible?. Ralph Ferguson Chairman - NACHO. Overview. History – how we got to where we are? Now – why are there still issues? Now – what does distribution look like? Future – taking responsibility for a service that’s here to stay. History.

191 views • 6 slides

CONCEPTS OF CREDIT

CONCEPTS OF CREDIT. PERSONAL FINANCIAL PLANNING DR. AA NEIDERMEYER. WHY BORROW $$?. TO AVOID LARGE CASH OUTLAYS TO MEET AN EMERGENCY FOR CONVENIENCE FOR INVESTMENT. CREDIT DANGER SIGNS. USE CARDS TO BUY ON IMPULSE POSTDATE CHECKS BORROW TO THE LIMIT

253 views • 16 slides

Knowledge of the Cost and Duration of Credit: Effects on Repayment Decisions

Knowledge of the Cost and Duration of Credit: Effects on Repayment Decisions. Rob Ranyard , Sandie McHugh (University of Bolton, UK) Alan Lewis (University of Bath, UK). Issues and Research Questions 1.

378 views • 26 slides

Letter of Credit. Contents. 5.1 An Overview of L/C. 5.2 Procedures of L/C. 5.3 Types of credit. 5.1 An Overview of L/C. 5.1.1 Definition of L/C 5.1.2 Contents of a L/C 5.1.3 Issuance Forms of L/C 5.1.4 Characteristics of a L/C 5.1.5 Parties involved in a L/C.

1.31k views • 69 slides

Credit – cost, arrangements, denial, default, collection

Credit – cost, arrangements, denial, default, collection. Objectives. Discuss: Rates Payments Collections Legal statutes. IN PENNSYLVANIA, the legal rate of interest on secured loans is 6%, and this is the general usury limit for loans below $ 50,000,

183 views • 10 slides

Credit letters cloud: The best low cost solution

Credit letters cloud formerly (Dispute Letter Generator) is a powerful low-cost solution. This is excellent for credit repair startup companies, but we have added some new features that may be a winner for startups too. Find one solution of all business related problems. To know more please visit http://how-to-start-a-credit-repair-business.com/

80 views • 7 slides

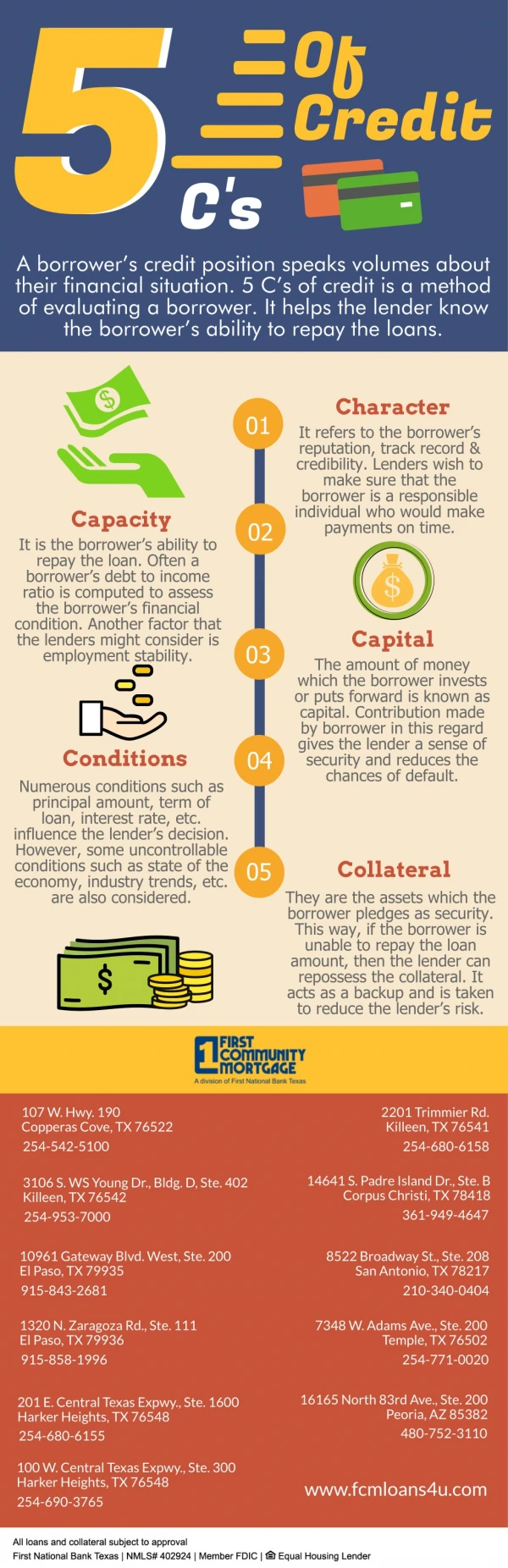

5C's Of Credit

14 views • 1 slides

Does Zero Credit Card Processing Actually Cost Nothing

Credit Card Processing fees are applied as a cost of managing the exchange of money from customers account to the merchantu2019s account in a secured manner.

60 views • 6 slides

Credit Card Processing Fees- A major Cost Component

Accepting credit cards is vital to ensure the success of the business. Credit card processing fees are not only paid by the merchant, but also by the cardholder for specific transactions, especially for international transactions.

24 views • 1 slides

IMAGES

VIDEO

COMMENTS

For 4 years, I changed the down payment and now the monthly cost would be $242 which is more affordable. Lastly, for 5 years, the cost is $198.99. Total cost of car- $10995. Sales tax- 5%.

View The Cost of Credit.pptx from ANTH 101 010 at Crescent Heights High School. Creating a Multimedia Presentation on Financing Your First Car •Daycia Boyer •Wilkerson, Debra •Oct 16th My First ... View Multimedia Presentation.pptx from ECON 101 at Massaponax High. Best Loan For Your... Real Estate 7.ppt. Missouri State University ...

o In Unit 4 - Multimedia Presentation: Students will create a multimedia presentation on the cost of credit in a real-world situation about financing a car. o In Unit 5 - Case Study: Starting a Business: Students will apply mathematics to analyze production possibilities for a hypothetical business.

cost of credit. Analyze how interest Calculate the total cost of repaying a loan. Words to Know Fill in this table as you work through the lesson. You may also use the glossary to help you. annual percentage rate (APR) the annual interest rate that is charged for borrowing money from an institution closed-end credit credit that is to be repaid ...

source someone or something that gives credible and of trust multimedia the use or combination of different of , such as photographs, music, and video. Creating a Multimedia Presentation. 2Thinking about Unity. In a multimedia presentation, you use visuals to present ideas.

Add 1 to the interest rate per period. Raise the number calculated in step 2 to the negative power of the number of loan payments to be made, and then subtract this number from 1. Divide the interest rate per period by the number calculated in step 3. The monthly payment will be ________ .

Your presentation should include the following slides. The slides should be a title slide, a slide containing your used car information, a slide containing information on loan options with a bank and with a credit union, a slide including calculations, a slide comparing the loan options, a slide with the best choice for a car loan, and a works ...

The Cost of Credit Multimedia Presentation.pdf - My Bank ... Doc Preview. Pages 3. Total views 100+ College of Charleston. HEAL. HEAL 216. Myharo. 1/25/2021. 100% (4) View full document. Students also studied. Financing My First Car Assignment.pdf. South Doyle High School. CTE 101. The Cost of Credit.pptx.

Study with Quizlet and memorize flashcards containing terms like Caitlyn has a credit card with a spending limit of $1500 and an APR (annual percentage rate) of 18%. During the first month, Caitlyn charged $375 and paid $250 of that in her billing cycle. Which expression will find the amount of interest Caitlyn will be charged after the first month?, Maura had to get a $350 emergency loan at a ...

This breaks down to about $10 per month, making your monthly payments roughly $27. Paying an additional $10 per month may not seem significant, but by the time you repay your loan, your credit cost will reach $1,589. This amount is over 50% more than you originally borrowed. 2. Total debt.

When you log into Edgenuity, you can view the entire course map—an interactive scope and sequence of all topics you will study. The units of study are summarized below: Unit 1: Financial Responsibility and Budgeting Unit 2: Relating Income and Careers Unit 3: Managing Money Unit 4: Credit and Debt Unit 5: Microeconomics & Entrepreneurship

The Cost of Credit Honda Civic 2010 Kim Trinh Mr.Porter Due Date: 10/6/17 My first car: HOnda Civic 2010 -Year: 2010 -Price: $7,995 -Make: Honda -Mileage: 102,878 -Model: Civic -Location: Saint Charles, MO -Why I choose the car: I like Honda Civic and this car has a good deal, including its price and mileage.

The Cost of Credit Analyze the impact of interest rate and loan length on the cost of credit. Calculate the total cost of repaying a loan. ... ©Edgenuity Inc. Confidential Page 2 of 3. Personal Finance - EL3403 Scope and Sequence Unit Lesson Lesson Objectives

Cost of Credit. Ch. 18-2 PoB 2011. Finding Interest. Interest - is the cost of using some one else's money It is the amount of interest paid on a loan or charge account that should be clearly understood Principal (P) - amount of the loan Slideshow 1641533 by nan.

Credit is the ability to borrow money when you need it. A credit card is issued by a ˚nancial institution and allows you to borrow money for purchases. • Credit limit Limit is set • Fees Interest rate 0%−29% Late fees up to $ 25 Annual fee $18 to $ 500 Payment Options The newest cell phone costs $299.

The benefits of using credit in this way are spread out over a period of time and may be large. The large costs of acquiring the education or housing are spread out over time as well. The benefits of using credit to make daily pur-chases of food or clothing are short-lived and do not accumulate over time. 3.

Creating a Multimedia Presentation: 2: Developing Central Ideas in Wheels of Change, Part 5: 2: Evaluating an Argument and Questioning: The Code Book Part 2: 2: Heroic Characteristics in "Perseus" 7: Historical Context and Conflict in Lizzie Bright and the Buckminster Boy, Part 1: 9: Imagery and Symbolism in The Scarlet Ibis: 2

15K subscribers in the edgenuity community. Unofficial Student-led Edgenuity Subreddit **Not affiliated with Edgenuity.** ... Anyone know if the multimedia presentation is graded in us history Bc after the slide show I got a 100% without doing anything . ... you will get FULL CREDIT (100%). If you don't have any of the keywords its looking for ...

multimedia. repetition. rhetorical question. more than one form of communication used to connect with an audience. to judge something in a careful and thoughtful way. a question asked to create an effect rather than provoke a specific answer. a statement of a particular viewpoint that is supported by reasons and evidence.

Payment options. The averange APR for tesla S has a lease that last 24 or 36 months and APR starts at 5.92% for those with excellent credit. Payment Estimates. Monthly Payment $519. Order Payment $250. Due at signing* $5,714.

Prompt: Identify a situation in which there is a division that could benefit from increased unity. You may choose an example of division in the country, your community, your school, a group, or a team. Create a multimedia presentation that presents the problem and demonstrates how increased unity can be achieved to solve it.

to connect with the audience. audience. B. the reason something is done or created. C. the people giving or likely to give attention. claim. to something; the readership or viewership. D. a statement of opinion supported by.