The Millionaires’ Factory lays bare the good and bad about Australia’s millionaire manufacturer – Macquarie bank

Emeritus Professor of Finance, The University of Melbourne

Disclosure statement

Kevin Davis does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

University of Melbourne provides funding as a founding partner of The Conversation AU.

View all partners

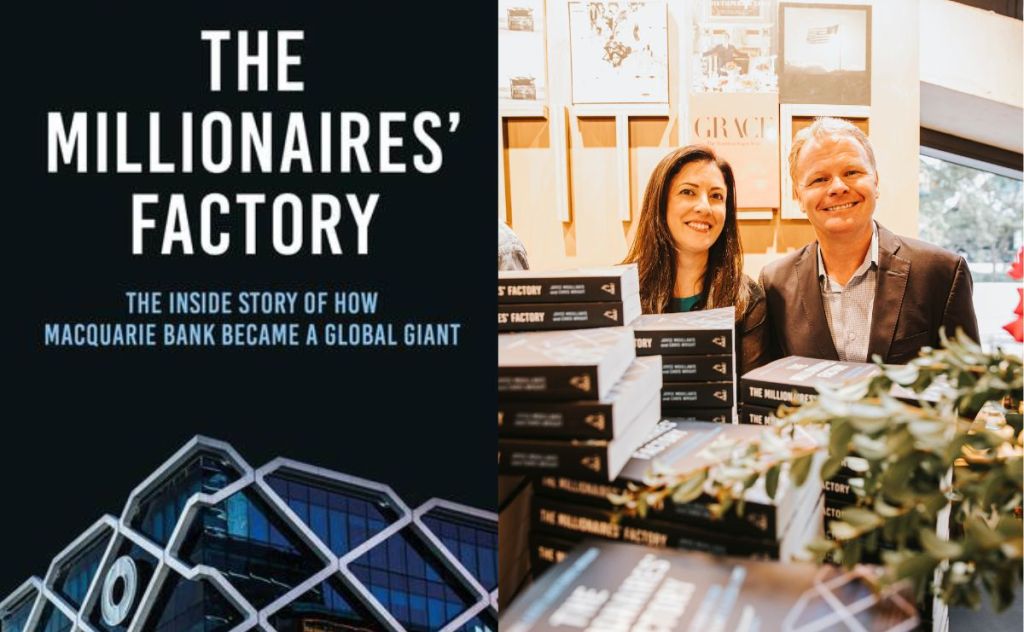

The Millionaires’ Factory , subtitled “the inside story of how Macquarie Bank became a global giant” by financial journalists Joyce Moullakis and Chris Wright is an impressive, informative book that I enjoyed reading.

As well as providing insights into the Australian financial giant’s evolution, organisation, scope and success, it says a lot about Australia’s financial history.

The large number of Macquarie alumni (the book suggests around 100,000) and current staff (more than 18,000 globally in 2022) will provide a ready market.

But for others, despite the many interesting character sketches and well-written “travelogue” through Macquarie’s exploits, the book may be somewhat heavy going – for one main reason.

Macquarie is a mammoth organisation that has been involved in a huge number of complex financial activities across the international stage.

Macquarie’s 2022 annual report says it operates across 33 markets in

asset management

retail and business banking

wealth management

leasing and asset financing

market access

commodity trading

renewables development

specialist advice

access to capital, and

principal investment.

Outlines of key transactions alone, necessarily, form a large part of the book.

Unfortunately, most need virtually an entire book each to explain and, in any event, require a high level of financial expertise to properly understand.

Those who are not finance experts can skip over the specific deals and will still find much value in (at least) two parts of the book.

One is the information on the management and governance of the organisation, including the adaptability of its divisional structure to opportunities and challenges.

Macquarie has consistently shown a willingness to expand into new (generally “adjacent”) activities suggested by staff (rather than from the top) under a strict risk-control framework.

A second (related) element is its emphasis on the quality of its staff and its dependence on its staff to investigate, generate and develop new activities.

Turning staff into millionaires

The remuneration arrangements bring the promise of rich personal rewards if successful, while failure in a new activity that has received the go-ahead under strict risk controls is not a career-limiting outcome.

Some readers may find strange the continued recitation of names and characteristics of key Macquarie personnel – but it is the people involved who have made Macquarie what it is today. As the saying goes, in financial institutions the main assets walk out the door every night (or early morning in many cases).

One thing the book does not do is provide any tables or graphs showing the enormous growth of Macquarie since its creation out of Hill Samuel in 1985, its integral role in Australia’s financial system and its successful overseas expansion.

Of course, given the scope of Macquarie’s activities, relevant metrics for comparison purposes are not easy to identify. For example, Macquarie Bank (the “commercial banking” part of the group) is small compared to the four major banks, with resident deposits about one-third of the smallest of the big four, ANZ.

The Macquarie Group overall has about half the number of employees of ANZ, but its overall personnel expenses in 2022 were around 15% higher than the ANZ (reflecting the words “millionaires’ factory” used in the book’s title).

Pushing boundaries

The authors hint at, but do not address, several questions posed by Macquarie Group’s critics.

First, to what extent have Macquarie’s profits come from pushing the boundaries of tax arbitrage (such as moving profits from high-tax locations to low-tax locations and moving losses in the other direction), such that its resulting profit isn’t a reward for adding social value but is instead generated at the expense of taxpayers?

There are always loopholes in tax law due to imperfect drafting, or grey areas that fall between what is clearly within or outside of the law. The opportunity to exploit such loopholes is greater when several jurisdictions are involved, and the book refers to several, such as the “cum-ex” dividend arbitrage . There are others.

Read more: The robbery of the century: the cum-ex trading scandal

The profit motive underpinning Macquarie and its remuneration structure naturally lead towards attempts to exploit such opportunities even if the private gains are purely at the expense of government tax revenue and not involving any (or much) creation of social value.

The authors quote former Treasurer Peter Costello saying “they engineered tax breaks to within an inch of their lives”, which often led to changes to tax laws to prevent such activities. How much this is ethical behaviour is a matter of opinion!

Heavily charging customers

The second question is: in constructing value-adding deals with clients and customers, how much of the net benefit has accrued to Macquarie, and how much to its customers?

As well as the nickname of “Millionaires’ Factory”, Macquarie has also been referred to as the “fee factory”.

For example, in its now-abandoned infrastructure trust structures, various parts of Macquarie would obtain fees: when purchasing assets for the trust (and “clipping the ticket” via a profit on the sale price into the trust), fees from managing the trust, commissions from selling units in the trust to investors, etc.

Macquarie’s position as an innovative creator of financial products and structures has often given it a first-mover advantage, such that with no competing supplier, Macquarie has been able to extract a major part of the value created.

Obviously, some value for the client needs to be provided, and concerns that a perceived unfair distribution of benefits would make it hard to repeat the exercise limit the amount of value extraction possible. But what is “fair” is a matter of opinion!

Exploiting the poorly informed

The third question is: to what extent did Macquarie benefit from exploiting poorly informed (wholesale and retail) consumers and users of its financial products – as the Hayne Royal Commission found to be the case for the four major banks and others?

Macquarie escaped from the Royal Commission with its image barely tarnished compared to the big four. One reason was that its then-chief executive, Nicholas Moore, was able to point to the remediation activities it had put in place prior to the commission once it had recognised the problems.

But Macquarie was also lucky in that the Royal Commission’s terms of reference only required it to look back as far as the global financial crisis. Had it been required to look back further, its findings might have been different.

Prior to the financial crisis, Macquarie (and other banks) created highly financially engineered, structured products and marketed them to retail (and other) investors. Even financially literate investors could not have possibly understood the risks or value of the products they were sold.

A vast majority of these products would not have met current design and distribution obligation requirements aimed at protecting consumers.

This was typical of the time and Macquarie was not particularly different to other purveyors of such products. But whether, in the absence of effective regulation, Macquarie would revert to pushing these boundaries is a matter of opinion!

An Australian success nevertheless

There is no question that Macquarie is an Australian success story.

Its 2022 annual report indicates that A$100 invested in its shares at the time of its stock exchange listing in 1996 would have grown to $10,000 in 2022.

More importantly, it has provided or enabled funding for many investment projects of its customers, which might not otherwise have gone ahead.

By taking an active role in the management and governance of large projects (such as toll roads and utilities), it has enabled more efficient operation of such projects than might have otherwise occurred.

It currently is near the forefront of financiers focusing on “green finance”, where activities generating social and environmental benefits can be consistent with profiting from a first-mover position.

There will, no doubt, remain many critics of Macquarie’s profit orientation and a resulting possible conflict with broader social goals. They would gain much from reading this book, both to find specific instances of that conflict, but also to see that profit-seeking is not always inconsistent with social goals.

- Macquarie Bank

- Royal Commission

- Hayne Royal Commission

Events and Communications Coordinator

Assistant Editor - 1 year cadetship

Executive Dean, Faculty of Health

Lecturer/Senior Lecturer, Earth System Science (School of Science)

Sydney Horizon Educators (Identified)

Book review: The Millionaires’ Factory, Joyce Moullakis and Chris Wright

Writing and Publishing

‘It is the insights into the personalities and the corporate culture that will be the most absorbing for general readers.’ Photo: Olga Nebot.

Australia’s own Macquarie Bank has been referred to colloquially as ‘the millionaires’ factory’ almost since its inception. It shouldn’t be real – it should be a Netflix series, the product of a vivid imagination. Think Mad Men with bigger deals, bigger egos and much, much more money. Or Wall Street with all the excesses of the 80s but enough talent, and money, to survive the GFC and come out even stronger than before. But it is all too real and an impressive Australian success story with a formidable global reach. Indeed, only around 25% of Macquarie’s business is now based in Australia.

The ‘millionaires’ factory’ nickname came about not because it made millions for its clients, who were usually high net worth individuals to begin with, but because of the extraordinary salaries and bonuses it paid to its staff. These are people who can make more money in a day than most of us make in a year and whose actions can influence financial markets across the world.

Anyone who worked in banking and finance dreamed of a job at Macquarie, a place where ‘a few bankers … used to, on a whim, fly out to places like Thailand on Friday after work, because they felt like eating Thai food from a particular restaurant’.

Some 50 years on, the Macquarie Group is now much more than a bank; it’s a major investor in businesses and commodities the world over and an international leader in infrastructure funds management. It would be hard to measure the level of access and influence it holds, fiscally and politically. Many critical industries in the UK, the US, Canada, Europe and South Korea rely heavily on Macquarie Group’s involvement and expertise.

One of the difficulties in writing about an institution like Macquarie is the complexity of the business. The authors here, Joyce Moullakis and Chris Wright, are both senior financial journalists whose own global careers mean they are well-placed to understand both the company and the markets in which it operates. Together, they have compiled an extraordinarily detailed account of the place and its people, the deals it makes and its all-important corporate culture.

This depth of research is both the strength and the weakness of the book. At over 400 pages, there is just too much for the general reader to absorb. And that’s without the 25,000 words of supplementary material that can be read online. Rather frustratingly, this includes everything that would traditionally be included in a footnote or endnote, so you can’t just turn to the back of the book to check a quote or find a source.

Inevitably, it is the insights into the personalities and the corporate culture that will be the most absorbing for general readers. It’s intriguing to know what it’s really like to work in a place where multimillion-dollar deals are being made every day. How do those at the top create and maintain an environment where creativity and risk-taking are at the heart of its success, but still maintain some control and discipline? And how are those risks managed and mitigated?

Is there a lesson here for us all in their “fail to succeed” ethos? There have, of course, been some mistakes along the way, and the authors discuss Macquarie’s failures as well as its successes. And those successes have benefited the small shareholder, as well as the organisation and its wealthy clients. If you’d bought $100 of Macquarie shares back in the beginning, that would now be worth around $10,000. And even just 10 years ago you could buy MQG shares for around $25 – they’re now trading at near to $180.

Read: Exhibition review: Troy-Anthony Baylis , QUT Art Museum

The authors do address some of the scandals and rumours that have afflicted Macquarie over the years, but so far the bank has avoided the “rogue trader” affairs that have devastated other financial companies. And as CEO Shemara Wikramanayake says diplomatically in the book, any organisation employing close to 20,000 staff is bound to have “idiosyncratic events” occur occasionally.

The Millionaires’ Factory really is a fascinating read – even if you skim through some of the more complex financial sections – and the closest most of us will ever come to people who earn a million dollars a week!

The Millionaires’ Factory: The inside story of how Macquarie Bank became a global giant. Publisher: Allen and Unwin ISBN: 9781761067150 Format: Paperback Pages: 416pp Publication date: 28 February 2023 RRP: $36.99

Share this:

Dr Diana Carroll

Dr Diana Carroll is a writer, speaker, and reviewer based in Adelaide. Her work has been published in newspapers and magazines including the Sydney Morning Herald, The Australian, Woman's Day, and B&T. Writing about the arts is one of her great passions.

Related News

Look, look, a cat in a book! (part 2)

Still don't have enough cat books in your life? Here are 10 more books, especially for the young.

Are art books an anomaly in the publishing industry?

As Melbourne Art Book Fair gears for its 10th anniversary, ArtsHub asks how art and design books have survived the…

Book review: Thunderhead, Miranda Darling

Inspired by Virginia Woolf’s Mrs Dalloway, this novella explores coercive control.

Catherine C Turner

Is Substack changing the lives of Australian writers?

Australian writers are flocking to the popular platform, which promises to centre the experience of the writer and reader.

David Burton

Opportunities and awards

Textile Awards call for entries, funding for live music in NSW, plus winners of new JUNCTURE Art Prize and 2024…

Want more content?

Get free newsletters full of the best in Australian arts news, jobs and more delivered to your inbox!

- Work & Careers

- Life & Arts

Inside the ‘millionaires’ factory’: rolling Macquarie bank gathers no Moss…

- Inside the ‘millionaires’ factory’: rolling Macquarie bank gathers no Moss… on x (opens in a new window)

- Inside the ‘millionaires’ factory’: rolling Macquarie bank gathers no Moss… on facebook (opens in a new window)

- Inside the ‘millionaires’ factory’: rolling Macquarie bank gathers no Moss… on linkedin (opens in a new window)

- Inside the ‘millionaires’ factory’: rolling Macquarie bank gathers no Moss… on whatsapp (opens in a new window)

Gwen Robinson

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Here’s a novel twist — an investment banking chief bowing out of his own volition and, moreover, quitting while he is ahead, notes Lex on Wednesday. As the FT reported earlier in the day, Allan Moss is to hand over the reins after nearly 15 years as CEO of Australia’s leading investment bank Macquarie Group.

His departure, according to company forecasts, will coincide with another year of record profits. The trouble is the market does not quite believe it. Macquarie shares plunged 9 per cent on the news, outpacing a 3 per cent fall on the S&P/ASX broader index (although, to be fair, tracking the closest peer, Babcock & Brown).

The fall destroyed A$1.66bn of market cap, noted Stephen Mayne, commentator, founder of Australian news-and-views website Crickey.com and now publisher of his new The Mayne Report , and is the “biggest wipe-out of value that we’ve even seen at a major Australian company after an appointment”.

Still, says Mayne, “Moss deserves to go out as an absolute Australian business legend”. To help that become a reality, he has packaged up a few of his favourite exchanges between the media and the lad over the years.

“Let’s just hope he chooses to write the tell-all book one day because the rise and rise of Macquarie Bank is one of the most remarkable business stories in Australia”, he adds.

Lex, meanwhile, notes that while Moss’ departure is a surprise, with his 60th birthday approaching, it is hardly untimely.

The bank’s performance, however, “is the bigger concern”.

Macquarie reiterated its full year forecast of at least A$1.8bn in net profit, a more-than-respectable year-on-year increase of 23 per cent though a shade below consensus forecasts of A$1.9bn. Although second-half earnings are expected to at least match those of the same period in 2007, all bar one of the seven operating groups expects income to be lower or flat, notes Lex.

Macquarie reckons it can bridge the gap thanks to a A$9bn infusion of capital raised as part of its restructuring. This cash will earn interest and — under the complex formula used for calculating bonuses — result in a reduced payout relative to earnings. That, however, is a one-off fillip, it adds.

Well, FT Alphaville ploughed through Macquarie’s Wednesday operating update ( posted on its website ) and can see why some investors might harbour concerns – despite the forecast 23 per cent profit increase when Macquarie annoucnes full-year results May 20.

As one hedge fund manager (who, incidentally, is short on Macquarie stock) said Wednesday:

I don’t quite see how they are getting to approximately A$730m for 2H08 results and A$1.8bn for fiscal 2008 based on the weakness seen across its sectors. Four of its seven business units expect profits below 2H07, two expect business in line and only one (financial services group) expects results above year-earlier period. Net profit after tax in 2H07 was A$777m. I wonder if they are anticipating several non intra-Macquarie deals getting done in the current quarter.

In Lex’s view: “Global woes are encroaching on the fabled Macquarie model, despite its focus on the relatively more resilient Asian and Australian markets”.

Credit costs are up to 100 basis points higher compared with August 2007. Real estate holdings are mostly below book value. Performance fees are fast evaporating: nearly all the listed infrastructure funds under-performed their relevant benchmarks in the final quarter of 2007.

In contrast to its global peers, however, Macquarie has enjoyed a series of earnings upgrades by analysts in the past year. Alas, concludes Lex, the so-called “millionaires’ factory” is starting to look a little less unique.

Also making it a “little less unique” is upshot of the recent hoo-hah over the stratospheric bonuses paid to top Macquarie staff. In a separate item, The Mayne Report notes that the big news on Australia’s corporate governance front is that from April 1 this year, the leadership team at Macquarie will be on a “far more appropriate profit-sharing scheme”.

Macquarie has “listened to the protest vote at last year’s AGM and acted,” says Mayne. Excessive cash bonuses based on short-term performance are out and longer term equity incentive schemes are in. See this Crikey report after the AGM for the context.

Rather than only 20 per cent of the profit share being withheld in Macquarie instruments for up to 10 years, an additional 35 per cent will be used to buy Macquarie Group shares that must be held for at least three years. See page five of Macquarie’s Wednesday announcement for the specifics. The change happens immediately for Moore and will be phased in progressively for the rest of the management committee, notes Mayne, adding: “And isn’t it interesting how the change came after co-founder David Clarke stepped down as executive chairman and become a non-executive chairman on a fixed $680,000 a year from April 1 last year.”

The Macquarie protest vote in 2007 was one of 20 largest Mayne has seen in Australia against an ASX 200 remuneration report, and it has delivered an immediate change of policy that will see more than 90 per cent of shares being voted in favour of this year’s remuneration report. We’d say Allan Moss’s timing – after a very solid innings – is probably impeccable.

Promoted Content

Follow the topics in this article.

- Gwen Robinson Add to myFT

- FT Alphaville Add to myFT

- Financial Times Add to myFT

- Bank bonuses Add to myFT

- Hedge funds Add to myFT

Comments have not been enabled for this article.

International Edition

Book review: Inside “The Millionaires’ Factory”

The inside story of how Macquarie Bank became a global giant lays bare the good and bad about Australia’s millionaire manufacturer, according to Kevin Davis from The University of Melbourne.

“The Millionaires’ Factory” by financial journalists Joyce Moullakis and Chris Wright is an impressive, informative book that I enjoyed reading.

As well as providing insights into the Australian financial giant’s evolution, organisation, scope and success, it says a lot about Australia’s financial history.

The large number of Macquarie alumni (the book suggests around 100,000) and current staff (more than 18,000 globally in 2022) will provide a ready market.

But for others, despite the many interesting character sketches and well-written “travelogue” through Macquarie’s exploits, the book may be somewhat heavy going – for one main reason.

Macquarie is a mammoth organisation that has been involved in a huge number of complex financial activities across the international stage.

Macquarie’s 2022 annual report says it operates across 33 markets in

- asset management

- retail and business banking

- wealth management

- leasing and asset financing

- market access

- commodity trading

- renewables development

- specialist advice

- access to capital, and

- principal investment.

Outlines of key transactions alone, necessarily, form a large part of the book.

Unfortunately, most need virtually an entire book each to explain and, in any event, require a high level of financial expertise to properly understand.

Those who are not finance experts can skip over the specific deals and will still find much value in (at least) two parts of the book.

One is the information on the management and governance of the organisation, including the adaptability of its divisional structure to opportunities and challenges.

Macquarie has consistently shown a willingness to expand into new (generally “adjacent”) activities suggested by staff (rather than from the top) under a strict risk-control framework.

A second (related) element is its emphasis on the quality of its staff and its dependence on its staff to investigate, generate and develop new activities.

Turning staff into millionaires

The remuneration arrangements bring the promise of rich personal rewards if successful, while failure in a new activity that has received the go-ahead under strict risk controls is not a career-limiting outcome.

Some readers may find strange the continued recitation of names and characteristics of key Macquarie personnel – but it is the people involved who have made Macquarie what it is today. As the saying goes, in financial institutions the main assets walk out the door every night (or early morning in many cases).

One thing the book does not do is provide any tables or graphs showing the enormous growth of Macquarie since its creation out of Hill Samuel in 1985, its integral role in Australia’s financial system and its successful overseas expansion.

Of course, given the scope of Macquarie’s activities, relevant metrics for comparison purposes are not easy to identify. For example, Macquarie Bank (the “commercial banking” part of the group) is small compared to the four major banks, with resident deposits about one-third of the smallest of the big four, ANZ.

The Macquarie Group overall has about half the number of employees of ANZ, but its overall personnel expenses in 2022 were around 15% higher than the ANZ (reflecting the words “millionaires’ factory” used in the book’s title).

Pushing boundaries

The authors hint at, but do not address, several questions posed by Macquarie Group’s critics.

First, to what extent have Macquarie’s profits come from pushing the boundaries of tax arbitrage (such as moving profits from high-tax locations to low-tax locations and moving losses in the other direction), such that its resulting profit isn’t a reward for adding social value but is instead generated at the expense of taxpayers?

There are always loopholes in tax law due to imperfect drafting, or grey areas that fall between what is clearly within or outside of the law. The opportunity to exploit such loopholes is greater when several jurisdictions are involved, and the book refers to several, such as the “cum-ex” dividend arbitrage . There are others.

The profit motive underpinning Macquarie and its remuneration structure naturally leads towards attempts to exploit such opportunities even if the private gains are purely at the expense of government tax revenue and not involving any (or much) creation of social value.

The authors quote former Treasurer Peter Costello saying “they engineered tax breaks to within an inch of their lives”, which often led to changes to tax laws to prevent such activities. How much this is ethical behaviour is a matter of opinion!

Heavily charging customers

The second question is: in constructing value-adding deals with clients and customers, how much of the net benefit has accrued to Macquarie, and how much to its customers?

As well as the nickname of “Millionaires’ Factory”, Macquarie has also been referred to as the “fee factory”.

For example, in its now-abandoned infrastructure trust structures, various parts of Macquarie would obtain fees: when purchasing assets for the trust (and “clipping the ticket” via a profit on the sale price into the trust), fees from managing the trust, commissions from selling units in the trust to investors, etc.

Macquarie’s position as an innovative creator of financial products and structures has often given it a first-mover advantage, such that with no competing supplier, Macquarie has been able to extract a major part of the value created.

Obviously, some value for the client needs to be provided, and concerns that a perceived unfair distribution of benefits would make it hard to repeat the exercise limit the amount of value extraction possible. But what is “fair” is a matter of opinion!

Exploiting the poorly informed

The third question is: to what extent did Macquarie benefit from exploiting poorly informed (wholesale and retail) consumers and users of its financial products – as the Hayne Royal Commission found to be the case for the four major banks and others?

Macquarie escaped from the Royal Commission with its image barely tarnished compared to the big four. One reason was that its then-chief executive, Nicholas Moore, was able to point to the remediation activities it had put in place prior to the commission once it had recognised the problems.

Macquarie Group chief Nicholas Moore leaving the Hayne Royal Commission in 2018. Joel Carrett/AAP

But Macquarie was also lucky in that the Royal Commission’s terms of reference only required it to look back as far as the global financial crisis. Had it been required to look back further, its findings might have been different.

Prior to the financial crisis, Macquarie (and other banks) created highly financially engineered, structured products and marketed them to retail (and other) investors. Even financially literate investors could not have possibly understood the risks or value of the products they were sold.

A vast majority of these products would not have met current design and distribution obligation requirements aimed at protecting consumers.

This was typical of the time and Macquarie was not particularly different to other purveyors of such products. But whether, in the absence of effective regulation, Macquarie would revert to pushing these boundaries is a matter of opinion!

An Australian success nevertheless

There is no question that Macquarie is an Australian success story.

Its 2022 annual report indicates that A$100 invested in its shares at the time of its stock exchange listing in 1996 would have grown to $10,000 in 2022.

More importantly, it has provided or enabled funding for many investment projects of its customers, which might not otherwise have gone ahead.

By taking an active role in the management and governance of large projects (such as toll roads and utilities), it has enabled more efficient operation of such projects than might have otherwise occurred.

It currently is near the forefront of financiers focusing on “green finance”, where activities generating social and environmental benefits can be consistent with profiting from a first-mover position.

Kevin Davis , Emeritus Professor of Finance, The University of Melbourne

This article is republished from The Conversation under a Creative Commons license. Read the original article .

Green hydrogen 101: A two-minute guide

This mother’s day, give a gift that gives back: buy sa. for sa, why screen time’s no substitute for talking to your baby, check out the future of women’s and children’s health.

We strive to deliver the best local independent coverage of the issues that matter to South Australians.

- Food & Wine

- Arts & Culture

- About InDaily

- Support Independent Journalism

- Advertising & Sponsorship

- Terms & Conditions

- Back Issues

IMAGES

COMMENTS

The Millionaires' Factory: The Inside Story of How Macquarie Bank Became a Global Giant by Joyce Moullakis and Chris Wright, Allen & Unwin £29.99, 432 pages. Robin Harding is the FT's Asia ...

The Millionaires' Factory lifts the lid on this unique banking success story, from its origins in Australia in 1969 to its presence in 33 markets today. It identifies the big decisions that have allowed the bank to thrive where others have floundered, and the unique Macquarie ability to spot a niche few others can see.

The Millionaires' Factory, subtitled "the inside story of how Macquarie Bank became a global giant" by financial journalists Joyce Moullakis and Chris Wright is an impressive, informative ...

The Millionaires' Factory really is a fascinating read - even if you skim through some of the more complex financial sections - and the closest most of us will ever come to people who earn a million dollars a week! The Millionaires' Factory: The inside story of how Macquarie Bank became a global giant. Publisher: Allen and Unwin.

The Millionaires' Factory: The inside story of how Macquarie became a global giant. by Joyce Moullakis and Chris Wright. Allen & Unwin, $36.99 pb, 431 pp. ... Australian Book Review acknowledges the Kulin Nation as the Traditional Owners of the land on which it is situated in Southbank, Victoria, ...

Feb 28, 2023 - 5.00am. Readers of the first unauthorised history of Macquarie Group - The Millionaires' Factory - should not expect a racy thriller despite the best efforts of headline ...

The Millionaires' Factory lifts the lid on this unique banking success story, from its origins in Australia in 1969 to its presence in 33 markets today. It identifies the big decisions that have allowed the bank to thrive where others have floundered, and the unique Macquarie ability to spot a niche few others can see.

Buy The Millionaires' Factory: The inside story of how Macquarie Bank became a global giant by Moullakis, Joyce, Wright, Chris (ISBN: 9781761067150) from Amazon's Book Store. Everyday low prices and free delivery on eligible orders. ... She has written for the Australian Financial Review and Bloomberg, and is currently a senior banking reporter ...

The Millionaires' Factory lifts the lid on this unique banking success story, from its origins in Australia in 1969 to its presence in 33 markets today. It identifies the big decisions that have allowed the bank to thrive where others have floundered, and the unique Macquarie ability to spot a niche few others can see.

The Millionaires' Factory lifts the lid on this unique banking success story, from its origins in Australia in 1969 to its presence in 33 markets today. It identifies the big decisions that have allowed the bank to thrive where others have floundered, and the unique Macquarie ability to spot a niche few others can see.

Jump to ratings and reviews. Want to read. Kindle $10.99. Rate this book. ... Macquarie has inserted itself into your life somehow, no matter where in the world you're reading this book.The Millionaires' Factory lifts the lid on this unique banking success story, from its origins in Australia in 1969 to its presence in 33 markets today. ...

Here's a novel twist — an investment banking chief bowing out of his own volition and, moreover, quitting while he is ahead, notes Lex on Wednesday. As the FT reported earlier in the day ...

Find helpful customer reviews and review ratings for The Millionaires' Factory: The inside story of how Macquarie Bank became a global giant at Amazon.com. Read honest and unbiased product reviews from our users.

The Millionaires' Factory: The inside story of how Macquarie Bank became a global giant - Ebook written by Joyce Moullakis, Chris Wright. Read this book using Google Play Books app on your PC, android, iOS devices. Download for offline reading, highlight, bookmark or take notes while you read The Millionaires' Factory: The inside story of how Macquarie Bank became a global giant.

Print article. "The Millionaires' Factory" by financial journalists Joyce Moullakis and Chris Wright is an impressive, informative book that I enjoyed reading. As well as providing insights into the Australian financial giant's evolution, organisation, scope and success, it says a lot about Australia's financial history.

The Millionaires' Factory: The inside story of how Macquarie Bank became a global giant - Kindle edition by Moullakis, Joyce, Wright, Chris. Download it once and read it on your Kindle device, PC, phones or tablets. Use features like bookmarks, note taking and highlighting while reading The Millionaires' Factory: The inside story of how Macquarie Bank became a global giant.

The Millionaires' Factory lifts the lid on this unique banking success story, from its origins in Australia in 1969 to its presence in 33 markets today. It identifies the big decisions that have allowed the bank to thrive where others have floundered, and the unique Macquarie ability to spot a niche few others can see.

The Millionaire's Factory lifts the lid on this unique banking success story, from its origins in Australia in 1969 to its presence in 33 markets today. It identifies the big decisions that have allowed the bank to thrive where others have floundered, and the unique Macquarie ability to spot a niche few others can see.

Amazon.in - Buy The Millionaires Factory: The Inside Story of How Macquarie Bank Became a Global Giant book online at best prices in India on Amazon.in. Read The Millionaires Factory: The Inside Story of How Macquarie Bank Became a Global Giant book reviews & author details and more at Amazon.in. Free delivery on qualified orders.

Find helpful customer reviews and review ratings for The Millionaire Factory: A Complete System for Becoming Insanely Rich at Amazon.com. Read honest and unbiased product reviews from our users.

PwC has audited the bank - dubbed the Millionaires' Factory - since 1993, and it is one of its most lucrative ASX contracts. From 2017 to 2023, Macquarie paid the big four firm $309 million ...

"The Millionaire Factory" written by Andrii Sedniev is a must read for anybody who is looking for some practical advice on being successful. In all honesty, most books being written on subjects like running a business or becoming a millionaire are extremely hard to read, as they are long, boring and filled with plenty of useless or farfetched information.