Ultimate Letter

Letter For Everyone

7 Samples Of Application For Opening Bank Account

Need to open a new savings bank account? We are giving you test application letters to the bank office chief for opening a financial balance for yourself, your children, your mom, your dad, kin, your better half, or some other relatives of your loved ones. The financial balance can be opened for a solitary individual or a joint ledger like you, your girl, and your child.

So, in this article, I am going to give 7 samples of application for opening bank account . So, see below the samples…

Documents Required To Open A Bank Account:

If you do not have a bank account yet and you also want to open a new saving bank account, then you may also need to write a letter to the bank manager to open a new bank account.

To open a new bank account, you can write a letter to bank manager requesting him to open a new saving account in your name in his branch. With this, you can use the facilities of that bank

Before writing the application letter for opening a savings account with the bank, you have to collect all the vital and important documents for opening a new personal bank account. For those who want to open their bank account for the first time, the below-mentioned documents are required.

- After filling out the bank account opening form, it has to be signed.

- Opening an account with a bank also requires someone who signs your account opening form as the introduction.

- Copy of your Aadhar Card and Address Proof document.

- Copy of your PAN card.

- Your 2 passport size photographs.

After collecting all these documents you will have to write a letter to open a savings account in the bank.

Mr. Branch Manager

[Name Of The Bank]

[Branch Address]

Subject: Application For Opening A Bank Account

It is a humble request that I [Your Name] need to open a saving account in your bank and I can take advantage of the facility of your bank, so it is requested to open my new account. For which I will be forever grateful to you.

Yours Faithfully.

[Your Name]

[Your Address]

[Mobile Number]

[Signature]

Download Application For Opening A Bank Account In MS Word File

The Branch Manager

[Address Of The Bank]

Subject: Application For A Opening Bank Account

Humble request that I [Your Name] need to open a new account in your bank. So that I can take advantage of the facilities of the bank. I have attached all the required documents with the application form for opening the account. It is requested that you will kindly pay attention to my application and help me to open my account at the earliest.

So I kindly request you to open the account. For which I will always be grateful to you.

[Bank Name]

I kindly request that I [Your Name] want to open an account at your bank.

Therefore, you are requested to open a bank account at your bank in my name. For this, I will be forever grateful to you.

Download Application For Opening A Savings Account In MS Word File

Branch Manager

Subject: Application For Bank Account Opening

With this letter, I would like to request you to open a new savings account with your bank so that I can avail the facilities of the bank. My name is [Your Name] am a resident of [Your City] and [State] . I am enclosing the vital and important documents and address proof along with the account opening form.

I formally request you to provide a saving account in your branch in the name of [Candidate Name] . Please let me know at the provided number if anything is required.

I am waiting for your favorable reply.

Download Application For Opening Savings Account In MS Word File

The Bank Manager,

Subject: Application For Opening Young Kid Saving Account

I formally request you to open a young kid saving account for my 11 years old daughter, [Name] , at [Name Of The Bank and Branch] . I declare myself as her sole source of income. Attached with this application are the details of my account and a copy of my required documents, along with a copy of my pension book. If any documents are missing for this procedure, please let me know at the provided number.

Download Application For Opening Bank Account In MS Word File

I have read a lot about your bank’s success and customer service from my friends and on social media. It creates interest, so I also want to open a saving account in your bank, and I also want to enjoy your customer service.

I hope you will process my application for account opening as soon as possible.

Yours truly,

Subject: Application For Opening New Savings Bank Account

I hope you are doing well. I want to open an account in this bank. The type of account should be saved because the primary purpose of opening this account is that I am trying to save some money. I have another account but could not manage to save the money. I have also been through your saving account benefits and like them the most. I have attached all required documents with this letter to open the account.

I hope you will proceed with my application as soon as possible. Again, I would be very thankful to you.

Q. How do I write a letter to open a bank account?

A. To open a bank account an application letter from your bank you might demand face to face at a bank office from one of the investors, by a call to the bank, and contingent upon the monetary foundation, through their web-based stage.

Q. Can I access my account information online?

A. You might have the option to really look at balances, move cash, get proclamations and take care of bills on the web. In the event that you don’t have simple admittance to a branch, online banking can be entirely important. Ensure you know your internet banking liabilities and ensure the occasion somebody falsely eliminates your assets through web-based administrations.

Q. What Is The Application For Opening A Bank Account?

A. Savings Account Opening Form means the standardized application form prescribed by the Management Company to be duly filled by the investors at the time of opening an account with the Fund.

Q. Can I apply for a bank account online?

A. You can start the cycle with only your portable number, and records, and by finishing up a structure. It should be in every way possible helpfully by means of our online entryway, permitting you to try not to need to genuinely go to the bank.

Related Articles:-

- 5 Samples Of Accident Leave Letter

- 9 Easy Samples Of Leave Application For Surgery

- Leave Application For Cousin Marriage

- Leave Application For Surgery Samples

- Format And Samples Of Writing Absent Application Letter

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Bank Account Opening Letter For Individuals & Companies

A “Request Letter to Bank for Opening a Current Account” is a formal letter written to a bank when an individual or organization wants to open a new current account with the bank. The letter serves as a formal request for the bank to open an account and should be written professionally and politely. The letter should include the name and contact information of the person or organization making the request and any relevant identification or documentation that the bank requires. This may include personal identification such as a government-issued ID, proof of address, and other relevant documentation such as a business registration certificate for a company. The letter should also clearly state the purpose of the account, whether it is for personal use or business operation. It should also specify any specific requirements or preferences the account holder has, such as a desired account number or the need for online banking access. It is also important to mention any initial deposit the account holder plans to make. The letter should be addressed to the appropriate person or department at the bank, such as the account opening department. It should be signed by the person or authorized organisation representative who is making the request. Including a self-addressed stamped envelope for the bank’s reply is also advisable. In conclusion, a Request Letter to Bank for Opening a Current Account is an important document that should be written professionally. It should provide all the necessary information to the bank, including the purpose of the account, identification, and any specific requirements or preferences. By following these guidelines, the account holder can successfully open a current account with the bank.

TEMPLATE (Letter by Individual / Sole Proprietor)

Date : _________

From: (Name of the Applicant) (Full Address) (Contact No.)

To: The Branch Manager (Name of the Bank) (Name of the Branch) (Address)

Sub .: Application for opening of a current account.

Dear Sir/Madam,

I am writing to express my interest in opening a current account with your bank at (Name of the Branch). I am a resident of (Locality) and currently operate a (type of business) business under the name of (Name of the business). Our business has an annual turnover of around INR ___________to __________lakhs.

I have filled out and signed the necessary application forms, which I have enclosed with this letter. I have also requested for a cheque book and online banking facilities for the account. I am committed to maintaining a sufficient balance in the account to honor any cheques issued, in order to avoid any inconvenience to the bank or the parties involved. I am willing to comply with all the rules and regulations set by the bank for customers with a current account.

As proof of identification and address, I have enclosed copies of the relevant documents. I have also included an introductory letter from an existing customer of your bank.

I would appreciate it if you could approve my application for opening a current account with your bank. Thank you for your time and consideration.

Sincerely, (Signature) (Name of the Applicant) Encl.: As above

TEMPLATE (Letter by a Company)

Date: __ ______ To: The Branch Manager (Bank’s Name) (Branch’s Name) (Address) Sub .: Application for opening of a current account for the company. Dear Sir/Madam, I am writing on behalf of our company, (Company Name) Limited, to apply for the opening of a current account with your bank at (Branch’s Name) branch. Our Board of Directors has passed a resolution in their meeting held on (Date) to open the account for our company. Enclosed with this letter, you will find the necessary documents for opening the current account, including (1) A completed application form as prescribed by your bank, (2) A certified copy of the board resolution for account opening, (3) Specimen signatures of the authorized signatories, (4) ID proofs of the authorized signatories, and (5) Introductory letters from 2 existing customers of your bank. We anticipate transactions amounting to INR per month and expect this amount to increase as our sales grow. We will make an initial deposit of INR when the account is opened. We would greatly appreciate it if you could open the account as soon as possible and inform us of the confirmation. We are committed to abiding by all the rules governing the current account. Thank you for your time and consideration. Sincerely, (Signature) (Name of the Authorized Officer) (Designation, Department) Encl.: A/a

Read More: Application For New Passbook To The Bank Manager

Similar Posts

Late Rent Payment Letter To Landlord

Most rental agreements contain an agreement on the timetable of rent payment, namely. The due dates for quarterly or monthly payments. If the tenant is unable to pay rent in time, it is a violation of the conditions of the rental contract. In such an event, the landlord can issue a notice and force the…

Application For New Meter Connection Sample

An application for a new meter connection is a request made to the utility company by a customer who wishes to have a new meter installed at their property. This may be necessary for new construction, a change of occupancy, or an upgrade to the existing service. The application typically includes personal and property information…

Indefinite Leave Letter for Work Due to Sickness

An indefinite leave letter for work because of sickness is a serious request from an employee. They need time off from their job because they’re not well. This kind of letter is used when a person’s sickness needs long-term care. It means they can’t know exactly when they’ll be back at work. In this letter,…

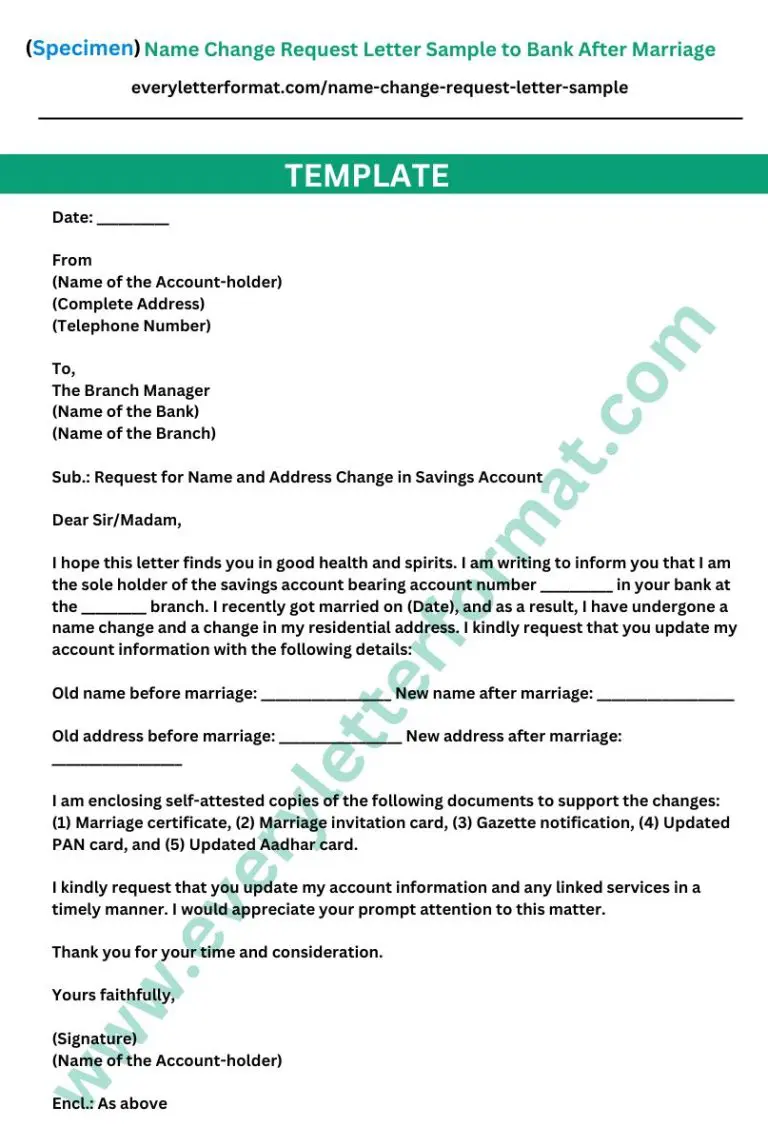

Name Change Request Letter Sample to Bank After Marriage

A name change request letter is a written document used to officially inform a bank of a change in a customer’s name due to marriage. This letter serves as proof of the name change and is used to update the customer’s account information with the bank. The sample letter provides a format and content guide…

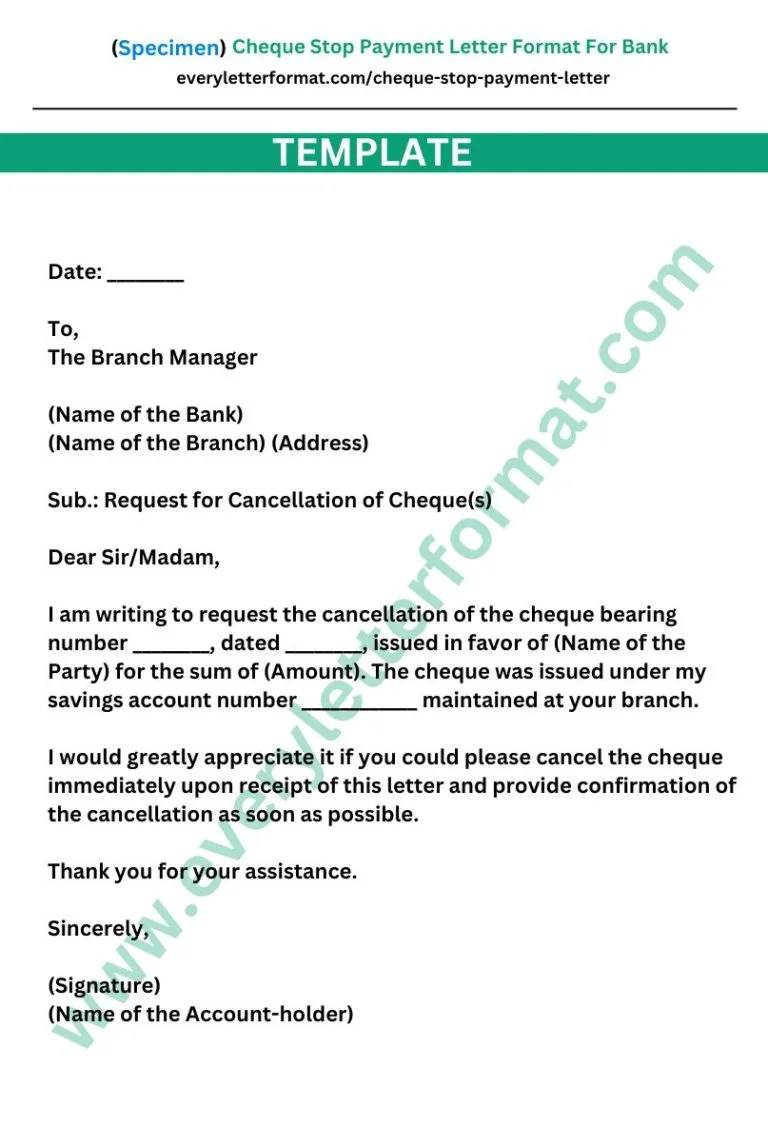

Cheque Stop Payment Letter Format For Bank

A Cheque Stop Payment Letter is a formal request to a bank to cancel and prevent payment on a specific cheque. The letter typically includes the account holder’s name and account number, the cheque number, the date of the cheque, and the name of the payee. The letter also includes a request for confirmation of…

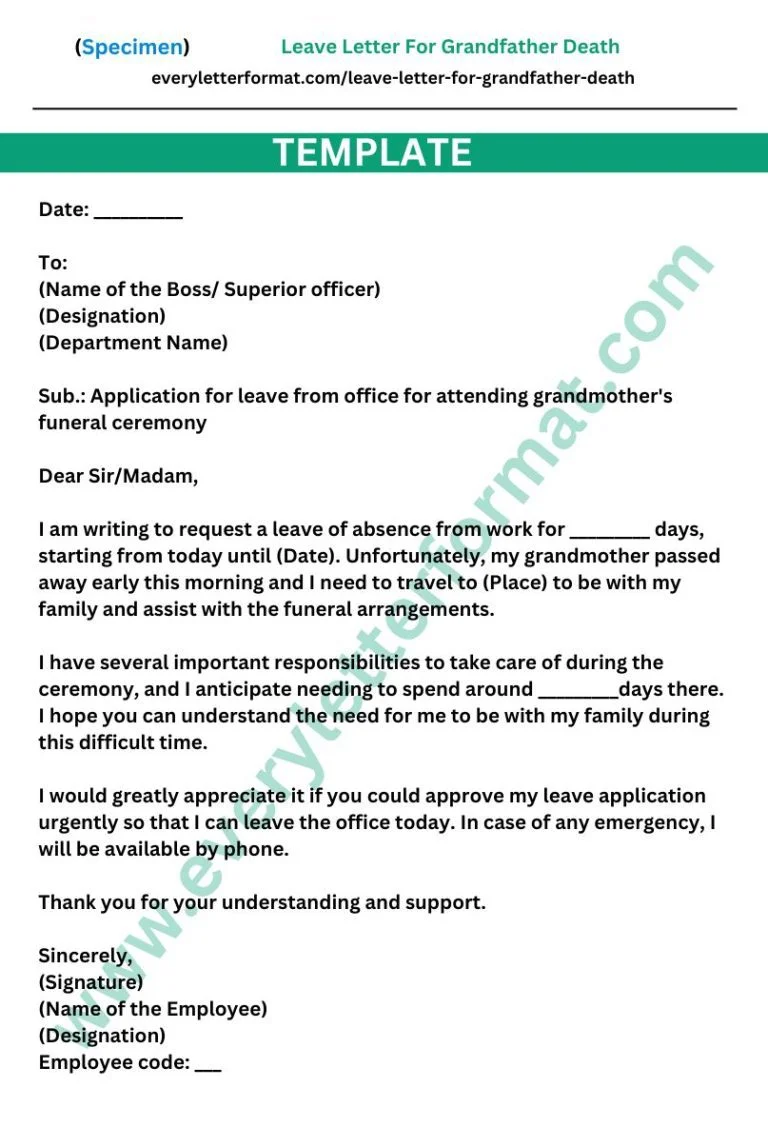

Leave Letter For Grandfather Death

A “Leave Letter for Grandfather Death” is a formal letter written to an employer to request time off work due to the death of an employee’s grandfather. The letter should be written in a sincere and respectful tone, and should provide details about the death and the employee’s plans for the funeral or memorial service….

12+ Bank Account Opening Letter Format – Writing Tips, Examples

- Letter Format

- February 1, 2024

- Application Letters , Bank Letters , Legal Letters

Bank Account Opening Letter Format : Bank account opening letters are formal letters that an individual or a company writes to a bank to request the opening of a new bank account . A well-written bank account opening letter can ensure that the account opening process is smooth and hassle-free . In this article, we will discuss the Bank Account Opening Letter Format and essential components of a Bank Account Opening Letter.

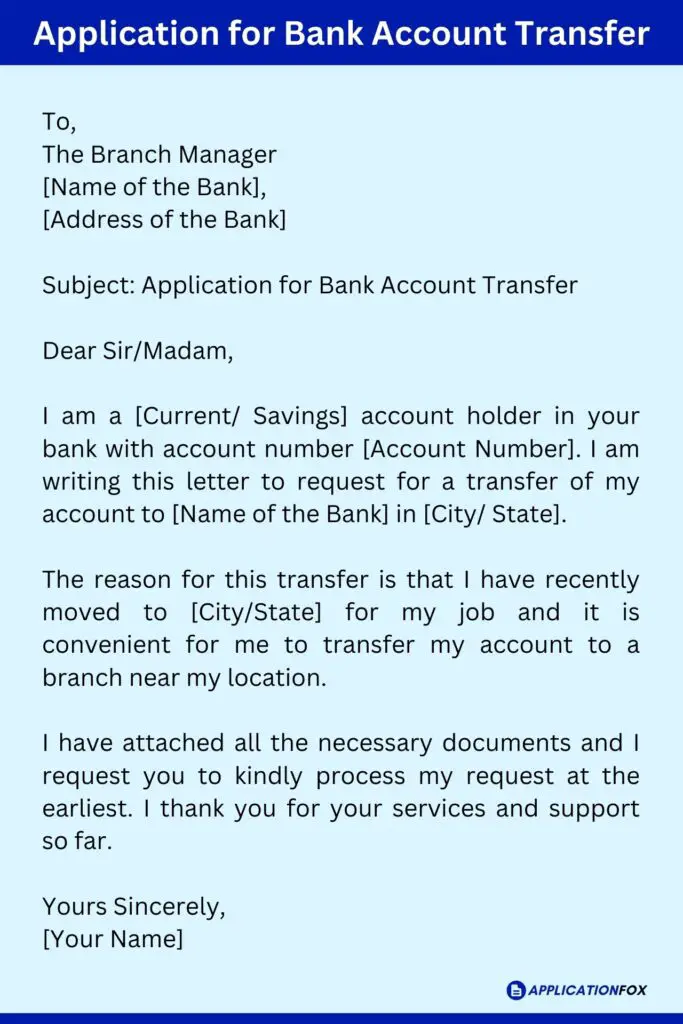

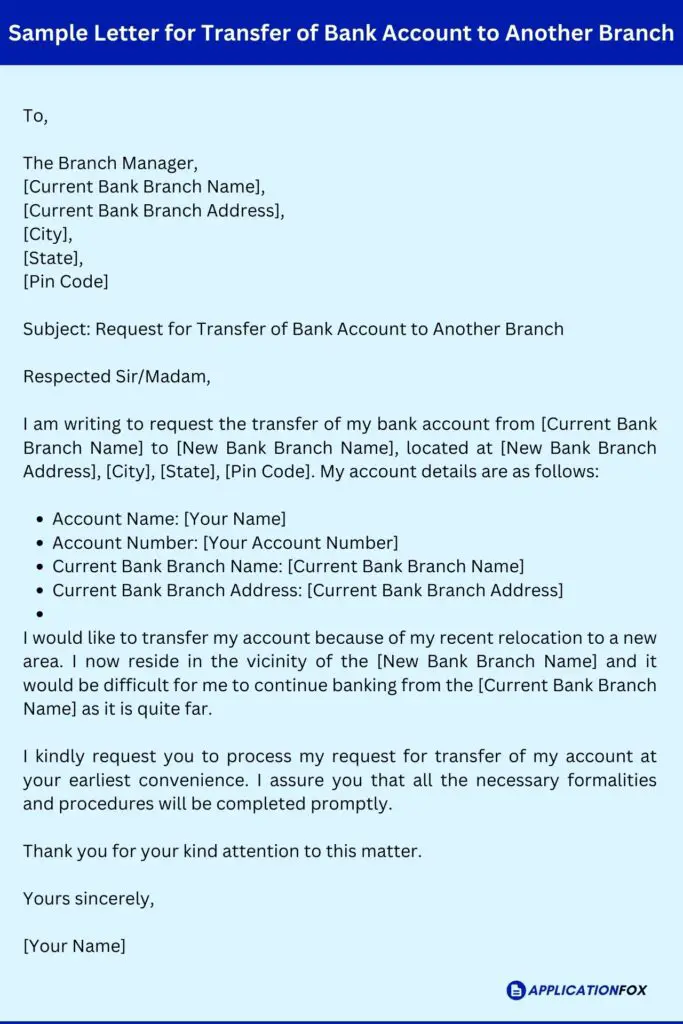

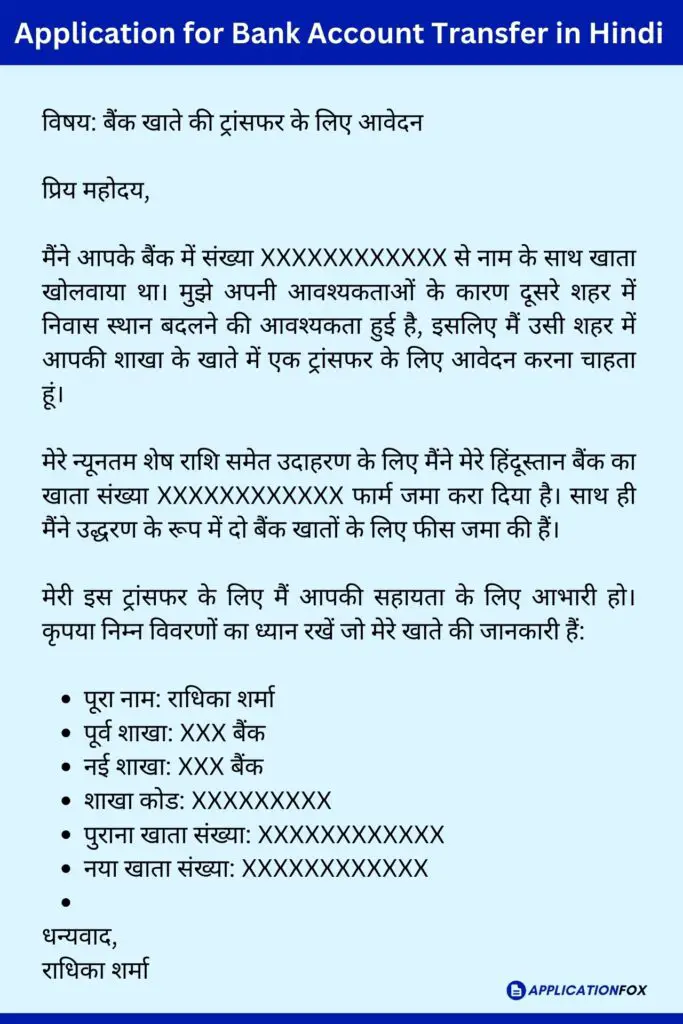

- Bank Account Transfer to Another Branch Letter Format

- NOC Letter Format for Bank

- Bank Account Closing Letter Format

- Request Letter to Bank for Open Current Account Format

Bank Account Opening Letter Format Writing Tips

Content in this article

- Sender’s Information : The Bank letter should start with the sender’s information, including their name, address, phone number, and email address. This information is important as it enables the bank to contact the sender for any queries or clarifications.

- Date : The date should be mentioned below the sender’s information. It is crucial to include the date as it helps in record-keeping and tracking the timeline of the account opening process.

- Bank’s Information : Next, the letter should include the bank’s information, such as the bank’s name, address, and contact details. This information will help the bank to identify the recipient of the letter and ensure that it reaches the right person.

- Salutation : The letter should start with a formal salutation, such as “Dear Sir/Madam,” or “To Whom It May Concern.” This helps establish a respectful tone for the letter.

- Introduction : The introduction should state the reason for writing the letter, which is to request the opening of a new bank account. The introduction should be concise and clear.

- Type of Account : The letter should mention the type of account that the sender wishes to open, such as a savings account, current account, or fixed deposit account.

- Required Documents : The letter should mention the necessary documents required to open the account, such as identity proof, address proof, and income proof. The sender should attach these documents along with the letter.

- Signatures : The letter should end with the sender’s signature and date. This indicates that the sender has provided accurate and complete information and agrees to the bank’s terms and conditions.

Template 1: Email Format about Bank Account Opening Letter

Here is the Email Template about Bank Account Opening Letter Format

Subject: Request for Opening a Bank Account

Dear Sir/Madam,

I am writing to request the opening of a new bank account with your esteemed bank. Please find attached all the necessary documents, including my identity proof, address proof, and income proof, as required by your bank.

I would like to open a [type of account] account with your bank, and I have enclosed a check for the initial deposit amount of $[Amount].

I request you to kindly provide me with the necessary information and guidelines to complete the account opening process. Please let me know if any further information or documentation is required from my end.

I would appreciate your prompt assistance in this matter.

Thank you for your time and consideration.

[Your Name] [Your Address] [City, State, Zip Code] [Phone Number] [Email Address]

Template 2: Personal Bank Account Opening Letter Format

Here is the Template about Bank Account Opening Letter Format

[Your Name] [Your Address] [City, State, Zip Code] [Phone Number] [Email Address] [Date]

[Bank Name] [Bank Address] [City, State, Zip Code]

I am writing to request the opening of a personal account with your bank. I have attached all the required documents, including my identity proof, address proof, and income proof.

I would like to open a savings account with your bank, and I have enclosed a check for the initial deposit of $[Amount].

If you need any further information or clarification, please do not hesitate to contact me.

[Your Name and Signature] [Date]

Template 3: Business Bank Account Opening Letter Format

[Your Company Name] [Your Address] [City, State, Zip Code] [Phone Number] [Email Address] [Date]

I am writing to request the opening of a business account with your bank. I have attached all the required documents, including my identity proof, address proof, and income proof.

Our company is a [type of business], and we require a current account to manage our financial transactions.

Template 4: Fixed Deposit Bank Account Opening Letter Format

I am writing to request the opening of a fixed deposit account with your bank. I have attached all the required documents, including my identity proof, address proof, and income proof.

I would like to deposit $[Amount] for a period of [Number] months. Please let me know the interest rate and any other details required to complete the account opening process.

A well-written Bank Account Opening Letter Format should include the sender’s information , date, bank’s information, salutation, introduction, type of account, required documents, and signatures . By following Bank Account Opening Letter Format, individuals and companies can ensure that their account opening request is processed efficiently and effectively .

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

20+ Comp Off Leave Letter – Check Meaning, How to Apply, Email Ideas

11+ Authorized Signatory Letter Format – Templates, Writing Tips

20+ Authorization Letter Format for ICEGATE Registration – Examples

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Application Letter for Opening Bank Account (With Samples)

Opening a bank account is an important step in managing your finances. A bank account allows you to safely deposit your money, make payments, avail of loans and credit cards, and reap the benefits of interest.

Banks usually require you to submit an application form to open an account. Along with the form, you need to provide identity proof, address proof, photographs, and other KYC documents.

If you are applying in person at a bank branch, the process is straightforward. However, sometimes banks may ask you to submit a written application letter for opening a new account. This is especially true if you are mailing your account opening documents or applying through an intermediary.

Writing an application letter to the bank manager will make the process faster and increase your chances of approval. Read on to learn how to write an application for opening a bank account along with sample letters for different scenarios.

How to Write an Application to Open a Bank Account?

Follow these steps to draft an effective application letter to open a bank account:

1. Add the Date and Your Contact Details

Begin the letter by mentioning the date at the top. Below this, provide your complete name, address, phone number, and email id.

Adding your contact information at the beginning establishes your identity. It also allows the bank to get in touch in case they need any clarifications.

2. Use the Correct Salutation

The next step is to address the letter to the relevant person using an appropriate salutation. For account opening applications, this would be:

- To, The Branch Manager

- Dear Sir/Madam

Make sure to mention the bank’s name and branch address below the salutation. Getting these small details right increases the letter’s formality.

3. State Your Purpose Clearly

In the first paragraph itself, state the purpose of your letter – that you want to open an account. Mention the type of account you want to open – savings, current, salary, etc.

Your purpose needs to be clear so the reader immediately knows that it is an account opening application letter.

4. Provide Necessary Personal Details

The next section should cover your personal details like full name, date of birth, contact number, marital status, spouse’s name (if married), nationality, etc.

Provide your permanent and current residential address. Also, attach proof of identity and address like an Aadhaar card photocopy, lease agreement, etc.

These details will help the bank verify your identity and eligibility for opening the account.

5. Share Your Occupation Details

This section should cover details related to your work. Mention your educational qualifications, employment status, organization name and address, monthly income, etc.

If you are self-employed, provide details of your business. Retired individuals must state their former occupation and pension amount.

Occupation details are necessary for the bank to gauge your financial standing. It also helps them offer suitable products and services.

6. Explain Why You Need the Account

Briefly explain the purpose and benefits of opening this bank account. For example – you may need it to receive your salary, make transactions for your business, pay college fees, apply for loans, save tax by investing, etc.

Giving a genuine reason tailored to your profile and needs increases the chances of approval.

7. Request for Swift Action

Politely request the bank manager to process your application and open the account at the earliest. You can mention that you have provided all the necessary documents. Also, express gratitude for their assistance.

A humble and sincere request creates a positive impression in the reader’s mind.

8. Say Thanks

Conclude the letter by thanking the bank manager for considering your request.

Leave a space below your signature to write your full name.

This shows etiquette and professionalism even in formal communication.

7+ Sample Application Letters for Opening Bank Account

Here are sample application letters for different situations when you may need to open a new bank account:

1. Letter for Opening Bank Account

To, The Branch Manager, Bank of Baroda, C Block, XYZ Road, Mumbai

Date: dd/mm/yy

Subject: Account opening letter

Respected Sir/Madam,

I wish to open a savings account in your branch. My name is John Doe and I am a businessman based out of Mumbai. I own a fleet of 5 goods carriers that transport cargo across the state.

I am 35 years old and unmarried. My permanent address is Flat 201, Hill View Apartments, XYZ Road, Mumbai which is also my place of birth. However, presently I am residing at Happy Homes, XYX Lane, Mumbai.

I have recently started my transport business and require a bank account to manage the company’s finances efficiently. Kindly open a savings account so I may start depositing the capital and operating revenue. Having an account with your reputed bank will be very beneficial for my new venture.

I have attached all the necessary KYC documents like identity proof, address proof, photographs, etc. I hope you will process the account opening application at the earliest so I can start using it for business transactions. Looking forward to a long association with your bank.

Thank you for your assistance.

Yours faithfully, [Signature] John Doe

2. Application for Account Opening in Bank

To, The Branch Manager, Bank of India, D Block, XYZ Road, Bengaluru

Subject: Application for opening a current account

Dear Sir/Madam,

I am writing this letter to request you to open a current account in your branch. I am Viral Desai working at Zillion Technologies Pvt Ltd as a Software Developer for the past 5 years. I am planning to start my own IT consulting and services business soon.

For smooth operations of the business, I need a dedicated current account to manage cash flows efficiently. My office will be located near your bank branch, hence it will be very convenient to maintain an account with you.

Here are some of my key details:

Full Name: Viral Mahesh Desai Address: Flat 502, ABC Apartments, PQR Road, Bengaluru Date of Birth: 25/08/1991 Mobile No: 9876543210 Email: [email protected] Aadhaar No: xxxxxxxxxxxx

Kindly process my request at the earliest so I can start using the account. I have provided all the required documents and hope to hear from you soon. Looking forward to a fruitful association with your bank.

Yours sincerely, [Signature] Viral Desai

3. Bank Account Open Application

To, The Branch Manager, Bank of Maharashtra, E Block, XYZ Road, Kolkata

Subject: Application for opening a savings bank account

I wish to open a savings account with your bank branch. I am Varun Gupta, 25 years old, working as a Computer Science Engineer at Zomato. I have been employed here for 4 years now and earn Rs. 50,000 per month.

Recently, I have started some side freelancing work in web development. This brings me an additional income of around Rs. 15,000 – Rs. 20,000 per month. I wish to open this savings account to deposit this income separately.

Having this account with your reputed bank will help me efficiently manage and grow my hard-earned money. I reside at ABC sector 8, near Hanuman Mandir, Kolkata. You will find attached the photocopies of my KYC documents.

Kindly open the savings account at the earliest so I can start using it for banking transactions. I look forward to a long, fruitful relationship with your bank. Thank you for your time and assistance.

Yours sincerely, [Signature] Varun Gupta

4. Bank Account Opening Request Letter

To, The Branch Manager, Canara Bank, F Block, XYZ Road, Agra

Subject: Request for opening a minor’s savings account

I wish to open a minor savings account in your branch for my daughter, Siya Gupta. She is 10 years old and currently studying in Class 5 at DPS School, Agra.

I want to open this account so I can start saving for her future education needs. I am aware that your bank offers excellent interest rates and facilities for children’s savings accounts.

We reside at ABC Colony, Near Post Office, Agra. You will find attached Siya’s birth certificate, address proof, photographs, and other documents for KYC verification.

Kindly open her account as soon as possible so I can start depositing funds monthly towards her future. I assure you all account operations will be handled responsibly. Looking forward to associating with your esteemed bank.

Thank you for your consideration.

Yours faithfully, [Signature] Rahul Gupta

5. Letter for Account Opening in Bank

To, The Branch Manager, Central Bank of India, G Block, XYZ Road, Jaipur

Subject: Request for opening a salary account

I wish to open a salary account with your bank. I, Raj Malhotra, have recently joined Infosys Ltd as a Software Engineer Trainee. As per company policy, I need to open a salary account with the Central Bank of India to start receiving my monthly salary.

Please find attached the account opening forms duly filled along with self-attested copies of my PAN card, Aadhaar card, passport, and Infosys offer letter. I shall be obliged if you could expedite the process and open my salary account at the earliest.

Opening an account with your bank will allow smooth disbursal of my salary and provide me access to other benefits like internet banking, mobile banking, locker facility, etc. I look forward to a long fruitful association with your bank.

Thank you for your assistance in this matter.

Sincerely, [Signature] Raj Malhotra

6. Application to Open Bank Account

To, The Branch Manager, Indian Bank, H Block, XYZ Road, Chennai

Subject: Application for opening a PPF Account

I wish to open a Public Provident Fund (PPF) account with your bank. I am Veena Goswami, 35 years old, working as an Accountant at RST Enterprises since 2010. I earn a gross monthly income of Rs. 50,000.

I want to start investing for my retirement by opening a PPF account. Being a reputed nationalized bank, Indian Bank is ideal for my long-term investment needs.

Please find enclosed documents like KYC, PAN card, address proof, passport-size photographs, etc. for account opening formalities. It will be highly appreciated if you could expedite the process and open my PPF account so I can begin investing.

I assure you all contributions will be made regularly as per PPF rules. Thank you for your assistance. I look forward to a fruitful association with your bank.

Regards, [Signature] Veena Goswami

7. Bank Account Opening Letter Format

To, The Branch Manager, State Bank of India, J Block, XYZ Road, Varanasi

Subject: Fixed deposit account opening request

I am writing this letter to request you to open a fixed deposit (FD) account in your branch. I am Ramesh Kumar, aged 45 years, working as a Marketing Manager at TeleTech Solutions Pvt Ltd since 2015.

I wish to open an FD account to invest my savings for better returns. Being one of India’s largest PSU banks, SBI offers very attractive interest rates on fixed deposits. I wish to deposit Rs. 5 lakhs for a 3-year tenure in the FD account.

Please find attached the duly filled FD account opening forms along with KYC documents and photographs for processing. It will be highly appreciated if you could expedite the process so I can deposit the funds soon. I assure you of maintaining the required account balance as per guidelines.

Thank you for your assistance in this matter. I look forward to a smooth account opening process and great returns on my FD investment.

Regards, [Signature] Ramesh Kumar

So these were some sample application letters for opening different types of bank accounts. Simply tweak them as per your profile and requirements while applying. Do remember to provide the necessary supporting documents for fast approval. A well-drafted application letter is key to a hassle-free account opening process.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Bank Application Letter

If you want to open an account with your local bank, you can use this Bank Application Letter to submit your application for processing.

[Sender’s Name]

Bank Manager

[Bank’s Name]

[City, State and Zip Code]

[Fax Number

Dear [Bank Manager’s Name]

I am writing to request a bank account from [Bank’s Name]. I am a new client and would like to use my account for [Personal or Business use]. You have a good reputation for security and friendly loan terms, and I believe you are the best option for me.

I have included all signed documents to process my request. I also want a Visa card for transactions. Please find proof of identification and all necessary account opening forms signed. Thank you for your assistance in this matter.

Contact me through my mobile number [Number] or email address for any clarification.

Application For Credit Letter Application Letter For Loan Application Medical Application Letter Application Follow Up Letter Doctor Application Letter Application Acceptance Letter Advice Letter For Job Application Essay Application Letter Customer Service Job Application Letter First Job Application Letter

Application Samples

BANK Application Letter Formats

Opening a new bank account is a pivotal step in managing your finances efficiently. In this blog, we’ll guide you through the essential components of an effective letter for Opening New Bank Account , ensuring a smooth and hassle-free process.

Closing A Bank Account is a significant financial decision that may arise due to various reasons, such as changing financial institutions, relocating, or streamlining your banking accounts. we’ll provide you with a structured guide on how to compose an effective letter for closing a bank account.

We need essential funds for various purposes, from purchasing a home or starting a business to managing unexpected expenses. A well-structured Bank Loan Application Letter can significantly increase your chances of securing the loan you need.

When faced with a lost, damaged, or expired ATM card, writing an effective Issue Of New ATM Card letter or an Application To Unblock ATM Card is essential. Such a letter not only expedites the process but also helps the bank understand the urgency.

When you suspect an unauthorized transaction on your bank account, promptly drafting application for Complaint About An Unauthorized Transaction letter to your bank is crucial. Such a letter serves as an official record of your concern, allowing the bank to investigate and resolve the issue swiftly.

A well-crafted Application For Bank Statement specifies the period for which you need the statement, ensuring accuracy and providing a documented history of your financial activities, which can be invaluable for budgeting, tax purposes, or verifying transactions.

Submitting a well-composed letter to Request For New Cheque Book from your bank ensures a seamless process. An efficacious letter conveys your need clearly.

When you’re relocating or your address has changed, a friendly and clear Application Request For Address Change letter to your bank can save you from any hassle. It helps update your information promptly and also ensures your bank statements and correspondence reach the right doorstep, making your banking experience convenient.

Keeping your KYC (Know Your Customer) information up-to-date is important. An informal yet informative KYC Update Letter to Bank, Request For Change Of Mobile Number, Application For Linking Aadhar Number To Bank Account etc helps you quickly verify your identity and keeps your account safe and trustworthy.

We have tried to cover Application For Reopen Dormant Bank Account , Application For Changing Account From Minor To Major Account, Bank Account Transfer Application , Requesting Letter For Bank Statement and many more bank application formats for your convenience.

Samples for Bank Applications:

- Opening New Bank Account

- Closing A Bank Account

- Bank Loan Application Letter

- Issue Of New ATM Card

- Application To Unblock ATM Card

- Complaint About An Unauthorized Transaction

- Application For Bank Statement

- Request For New Cheque Book

- Application Request For Address Change

- KYC Update Letter to Bank

- Request For Change Of Mobile Number

- Application For Linking Aadhar Number To Bank Account

- Application For Reopen Dormant Bank Account

- Application For Changing Account From Minor To Major Account

- Bank Account Transfer Application

- Requesting Letter For Bank Statement

- Sign in

Applying for Bank Accounts FAQs

Select your state.

Please tell us where you bank so we can give you accurate rate and fee information for your location.

You can apply online for a checking account , savings account, CD or IRA. Simply select an account, enter your personal information, verify your information and choose features & funding options. You will receive an email once your application is received and a follow-up email telling you whether it has been approved, plus any next steps.

For a faster application process, please have the following information on hand when you begin your application:

- Your Social Security number

- Your current residential address

- Your email address

- Your account number or debit card number to make your opening deposit into your new Bank of America account

- Co-applicant's personal information (if applicable)

If you're missing one of these pieces of information, you can also schedule an appointment with an associate at your local financial center for a day and time that works best for you.

You'll need the same information that's needed when opening an individual account, but you'll need it for both applicants. For details, please see the preceding question and answer. Please note that each co-applicant has to sign the signature form.

To make your initial deposit, you can transfer money from your account at another bank. If you are already a Bank of America customer, you can transfer money from your existing account. You can also use a debit card, check or money order for your initial deposit.

The transfer will not take place until your account is approved. Please ensure that you have sufficient funds available to be transferred.

When applying for a new checking or savings account , you can deposit any amount ranging from the minimum opening deposit amount to a higher amount.

We use Secure Socket Layer (SSL) technology to ensure your online information is passed to us securely. This technology allows users to establish sessions with internet sites that are secure, meaning they have minimal risk of external violation. Once inside the Online Banking site, you are secure through our use of SSL technology.

Your application will be processed in 1 to 2 business days. We'll send you either an email or letter letting you know if you are approved for your account. You will receive your account documents via U.S. Mail within 7-10 business days.

Processing times may be slower due to high volume of applications

An offer code is a series of numbers and letters that you may have received from Bank of America in conjunction with a promotion or offer. Your offer code is indicated on the communication material you may have received from us. Examples of communications are a brochure that you received in the mail or from a web page ad. You can provide this offer code with your application.

"Online access to my account" means that you can view your account through Online or Mobile Banking . Check account balances and transactions, transfer funds between accounts, and set up Alerts to remind yourself about important activity in your accounts. You can also use Bill Pay to pay all your bills in minutes from one simple site. Want us to walk you through enrolling? Show me how to enroll in Online Banking Show me how to enroll in Mobile Banking

As part of your online application, you will be asked to give consent to receive certain account opening documents and notices from us electronically. Other account opening documents will be sent through U.S. Mail within 7-10 days of account opening. If you do not wish to consent to receiving documents electronically, you may visit any Bank of America banking center to apply in person.

A signature form allows Bank of America to service your account. It is important to sign and mail your signature form to us as soon as possible (and have any co-applicants sign the signature form too) so that we can service your account, which includes verifying your identity and reporting tax information.

Yes, if you need more time, you can save what you've already entered for up to 30 days and complete the application later.

To save your application, you'll need to provide some personal information such as your date of birth and Social Security number so we can identify you when you return.

When you're ready to complete your application, either follow the link in the confirmation email or access your saved application now.

Yes. U.S. visa holders currently living in the U.S. may open an account in person at one of our financial centers. You must be able to provide both your permanent (foreign) and local address, as well as your ITIN (Individual Tax Identification Number).

What to bring to your appointment: 1. Proof of U.S. residency For example: U.S. government-issued photo ID, student/employer photo ID, current utility bill or rental agreement (documents must show your name and U.S. physical address).

2. One primary photo ID For example: Foreign passport (with or without passport visa), U.S. Non-Immigrant visa and Border Crossing Card-DSP-150, Canadian Citizenship card (with photo), Mexican, Guatemalan, Dominican or Colombian Consular ID (with photo).

3. One secondary ID For example: Foreign or U.S. driver's license (with photo), student/employer ID (with photo), major debit or credit card with Visa® or Mastercard® logo, major retail credit card from a nationally well-known company, U.S. Department of State Diplomat ID.

Discover the smart banking solution for you

Whatever your needs, we have the account and features to help you bank your way

Please select your county

- Schedule an appointment

- Phone number: 844.375.7028

Enter your zip code

Please enter the zip code for your home address so we can give you accurate rate and fee information for your location.

Bank Account Application Letter Format

Save, fill-In The Blanks, Print, Done!

Download Bank Account Application Letter Format

Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (21.72 kB)

- Language: English

- We recommend downloading this file onto your computer.

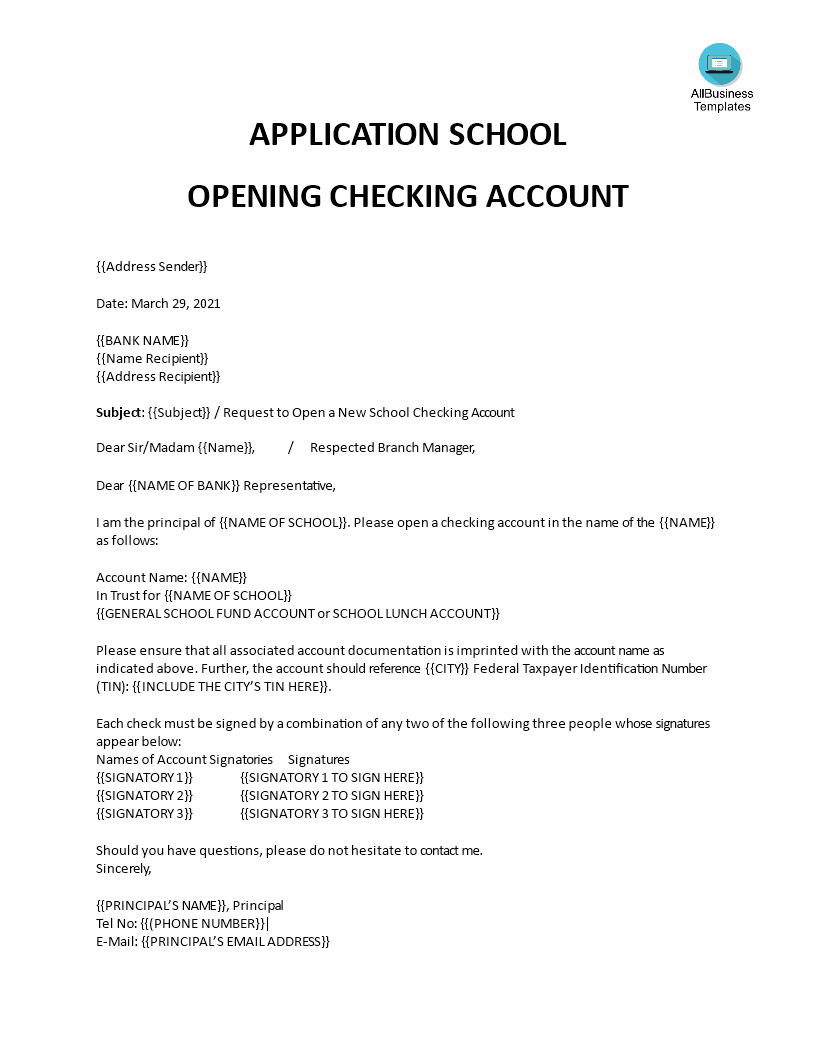

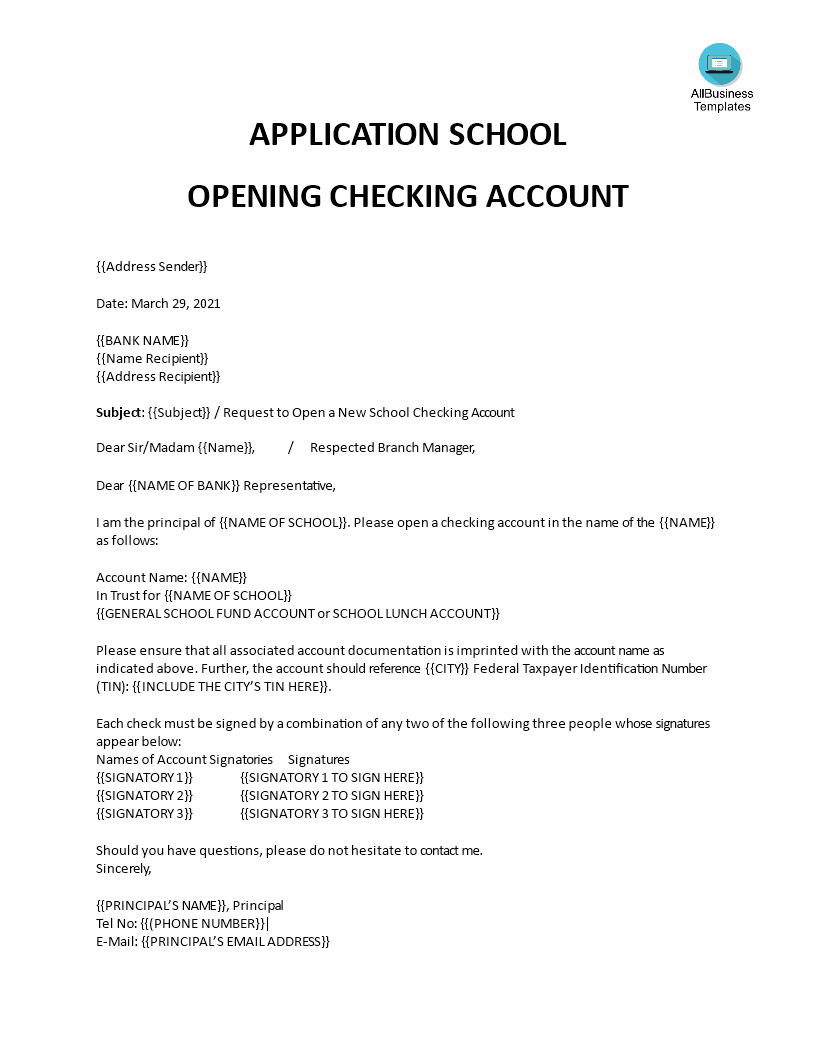

- Copy the sample letter (below) onto school letterhead.

- Enter information specific to your school in the fields beginning/ending with brackets (for example SCHOOL).

- Be sure to indicate, in the designated field, the type of account you wish to open: Either a General School Fund Account or a School Lunch Account.

- If you do not know the City’s Taxpayer Identification Number (TIN), call the Banking Unit to obtain it in order to add it to the letter.

- Provide the names and signatures of three people at your school who will act as account signatories. One of the signatories must be the principal. All signatories must be full-time employees.

- If your school letterhead does not include the school’s mailing address, include it after the principal’s signature (along with the other contact information).

- Mail the completed letter, plus the completed Bank Account Request Form and bank signatory cards (obtained from the Banking Unit)

- Structured and written to highlight your strengths;

- Brief, preferably one page in length;

- Clean, error-free, and easy to read;

- Immediately clear about your name and the position you are seeking.

DISCLAIMER Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Easter Templates

Related templates.

- Bank Authorization Letter

- Power Of Attorney for Opening Bank Account

Thank you for Opening an Bank account

- Simple Authorization Letter To Bank

Latest templates

- Personal Balance Sheet For Bank

- Capital Budgeting Sheet

- Home Improvement Budget Worksheet

- Mileage Log Kilometer Tracker

Latest topics

- Easter Templates What is the true meaning of Easter? Check out some fun facts about the Easter Bunny and download nice Easter templates here.

- GDPR Compliance Templates What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly...

- Google Docs How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs...

- Excel Templates Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly!

- Letter of interest How to write a letter of interest? What is a letter of interest? Check out and download here several professional and formal letters of interest:

There’s no shortage of remarkable ideas, what’s missing is the will to execute them. | Seth Godin

ONLY TODAY!

Receive the template in another format, for free!

- Search Search Please fill out this field.

- Banking Basics

Letter To Close Bank Accounts

Other ways to close your account, tips for a successful account closure, the bottom line, frequently asked questions (faqs).

Sometimes an old-fashioned letter is the best way to get the job done. To close a bank account, you might be required to mail your request in a traditional letter or submit it in person at a bank branch. There's no need to wait on hold or in a line, explain yourself to customer service, and hope that the account is closed expeditiously—you can just send the letter and be done with it. Even if a letter isn’t required, using one creates a paper trail that may give you peace of mind, should any errors or complications arise.

Use the text below as a template and fill in the information between brackets (“[“ and “]”) as necessary. See the tips below the letter for more details and other easy ways to close an account.

Sample Account Closing Letter

[Today's Date]

To whom it may concern,

Please close the account(s) listed below. Please send any remaining funds in those accounts by check to the address below, and reject any further requests for transactions in these accounts.

Checking Account: [Account Number]

Savings Account: [Account Number]

Money Market Account: [Account Number]

Other Account: [Account Number]

Please provide written confirmation that the accounts are closed.

If you have any questions, please contact me at the phone number below.

[Account Owner's Original Signature]

[Account Owner’s Printed Name]

[Mailing Address]

[Phone Number]

There might be easier ways to close your account. If you don’t want to print, sign, and mail a letter, try a higher-tech or more personal approach. In some cases, banks may prefer one of these methods over a letter. Check your bank's website to see what steps they recommend taking.

Submit an Online Request

Online banks allow you to transfer all of your funds out and request a closure online. It can be as easy as clicking “Close Account.” Other banks require you to write a request to customer service while you’re logged in to your account.

Call Customer Service

A quick phone call might also do the trick. If you’ve got a few minutes, just call customer service and ask to close your account. Be prepared for a few attempts at keeping your business, which you can firmly (but politely) decline.

In many cases, submitting a written, online, or over-the-phone request is all you need to do to close an account. However, you can take extra steps to ensure the process goes as smoothly as possible. Before you finalize your account closure, review these optional steps and special scenarios.

Make Sure You're Done

Before closing your account, double-check to make sure there are no outstanding checks or automatic payments scheduled to hit your account. Change your direct deposit instructions to your new account, and wait to see that the update has taken place before you close an account.

Empty It Yourself

It is usually best to empty your bank account before you send the letter to close it. In most cases, transferring the funds yourself will get the money in your hands more quickly than if you wait for the bank to process your request.

There are several free and easy ways to send funds to yourself electronically, including basic bank-to-bank transfers . Apps and non-bank services for sending money can also do the job.

If you do it yourself, you’ll know exactly when and where to expect the money. The alternative is to wait for a check in the mail (which you’ll have to deposit before you can withdraw and spend the money). Be careful not to empty your old account too soon if there are pending fees or charges. A fee or charge that you can't cover could complicate and delay the process.

Be Direct, But Polite

To close your bank account , you just need to make the request (whether it’s in writing or by clicking a button). The wording isn't the most important thing. It’s not necessary to instruct them to do it “promptly” or “immediately” because they will do it as soon as possible anyway.

Banks do not drag their feet on these things until somebody notices and applies pressure. Just make it easy for the person who opens your letter (tell them exactly what to do and where to send the money), and it’s more likely to get done quickly and accurately. If you have complaints about the bank or its services, send that feedback separately and wait until after your account is closed.

Download Statements or Transactions

Once you close your account, you may lose access to your account history. Someday, you may wish you had a record of an important transaction. Download several years’ worth of statements before you close your account—just in case. Alternatively, download your transactions into a software program that stores the information for you.

You May Need To Provide an Original Signature

You may be required to sign your letter with ink, rather than with an e-signature or stamp, depending on bank policy. If a bank asks for a written letter, a component of that requirement may include a real signature in order to authorize the account closure.

Use Wire Transfers or Cashier's Checks in Time-Sensitive Situations

If you really need the money to move immediately and be available for spending, send the money to your new account by wire transfer . Alternatively, get a cashier's check , which will cost a bit less and still provide "cleared" funds.

Changes of Address Can Delay the Process

If you’re closing the account because you’ve moved, be aware that bank policies typically only allow them to send funds to your address of record (the address they currently have on file at the bank). Address changes followed by check requests could potentially raise a red flag—they could worry an identity thief is attempting to steal your money. If the bank questions the legitimacy of the transfer, you may have to wait longer for your money, or you may have to do additional paperwork and get your request notarized .

Ask your bank what is required to mail a check to a new address (better yet, get the money out yourself, as described above).

If you use a credit union, you might not need to close your account just because you've moved. Many credit unions participate in shared branching, which allows you to use a different credit union's branches (with thousands of locations available to you nationwide). You might eventually need an account at a local institution for more complex needs—or you might be just fine using your old account.

Use an App To Deposit the Check

If the bank sends a check for the leftover money in the closed account, you'll need to deposit that check somewhere—and many people these days hardly ever deal with paper checks. The easiest way to make that deposit is with your new bank's mobile app (if available).

Verify the Closure

Don’t just assume your instructions will be followed. Double-check by logging in to your account or calling the bank to ensure that your account is closed. Sometimes instructions get lost, or something needs to be done before you can close the account. If you’re not aware of problems that arise, you risk having inactivity charges or low balance fees charged to your account. They might not be your fault, but it’s easier to clean everything up while it’s fresh in your mind.

While not always required, using a hand-signed letter to request an account closure is an easy way to add an extra layer of financial protection. If any complications or errors occur during the process, you have handwritten and dated proof of key details like what exactly you requested, when you requested it, and where any remaining funds were supposed to go—just remember to keep a copy for yourself.

If the process does go awry at some point, make sure to reach out as soon as you notice the discrepancies. Be direct in your conversations with customer service, but don't burn bridges. Rude comments won't speed up the process, only clear communication will.

If you still have questions about the process, you can read more about what to do before you change banks or closing a joint checking account .

Which bank has the highest interest rate on savings accounts?

Some of the banks with the highest interest rates on savings accounts include Sallie Mae Bank, Affirm, and ConnectOne.

How do you remove a bank account from Google Pay?

To delete a bank account from your Google Pay app , tap your photo, then tap "bank account," and select the account you want to delete. Tap the three dots to bring up the option to remove the bank account.

How do you transfer money to another bank account?

There are many ways to transfer money to another bank account. You can directly transfer the money to another account via ACH transfer . You can use a payment app like Venmo. You can use a money order or personal check. You can also withdraw the cash and physically bring it to your new bank, but that may be unnecessarily burdensome when so many digital options exist.

BBVA. " Closing a Checking Account ."

Consumer Financial Protection Bureau (CFPB). " Can I Close My Account Whenever I Want? "

Capital One. " How to Close a Bank Account ."

First National Bank of Moose Lake. " Account Closing Letter ."

Bank of America. " International Wire Transfers ."

Capital One. " What Is a Cashier's Check and How Do You Use It? "

CO-OP Financial Services. " CO-OP Shared Branch ."

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-06-24at12.24.57PM-da686b9735da4f35b4635703253e7ed0.png)

- Letter To Inform Change Of Bank Account

Changing bank account details is a crucial matter that requires effective communication to ensure a smooth transition. To assist you in conveying this important information, we have prepared four templates for letters to inform about a change of bank account. These templates cover various scenarios, such as personal bank account updates, business account changes, and bank account information updates for non-profit organizations and vendors/suppliers.Each template is thoughtfully crafted to provide a clear and concise explanation of the change, including the reason behind the switch and the new bank account details. Whether you are updating your own account or informing others about your organization's new banking arrangements, these templates offer a professional and courteous approach.Remember to personalize the templates by adding specific details such as the effective date of the change, the name of the new bank, and the new account number. Additionally, include any supporting documentation if required.

Template Letter to Inform Change of Bank Account - Personal

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date]

[Recipient's Name] [Recipient's Address] [City, State, ZIP]

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to inform you of a recent change in my bank account details. Due to [reason for the change, such as switching banks, account upgrade, etc.], I have opened a new bank account with [New Bank Name] under the account number [New Account Number].

Starting from [Effective Date], I kindly request you to update your records with this new bank account information. All future transactions, including salary deposits, payments, or any other financial matters, should be processed using the new account details.

I have also enclosed a copy of the necessary documentation, including the new account details and any relevant identification documents, for your reference and verification purposes.

Please do not hesitate to contact me if you require any additional information or assistance during this transition. I understand the importance of a smooth changeover and am committed to resolving any potential issues promptly.

Thank you for your attention to this matter. Your cooperation in updating my account information is greatly appreciated.

[Your Name]

Template Letter to Inform Change of Bank Account - Business/Company

[Your Name] [Your Position] [Company Name] [Company Address] [City, State, ZIP] [Email Address] [Phone Number] [Date]

[Recipient's Name] [Recipient's Position] [Company Name] [Company Address] [City, State, ZIP]

I trust this letter finds you in good health. I am writing on behalf of [Company Name] to notify you of a significant change in our banking arrangements.

We have recently undertaken a strategic decision to switch our banking services to [New Bank Name]. As a result, we have opened a new corporate bank account under the account number [New Account Number].

Effective from [Effective Date], we kindly request you to update your records with our new bank account details. All future payments, including invoices and transactions, should be processed using the new account information provided.

Attached to this letter is a formal notification containing the new account details and any other pertinent documentation required for verification purposes.

We understand the importance of a seamless transition and assure you that our team is available to address any queries or concerns you may have during this period.

Thank you for your prompt attention to this matter. We look forward to your cooperation in updating our bank account details in your records.

[Your Name] [Your Position] [Company Name]

Template Letter to Inform Change of Bank Account - Non-Profit Organization

[Your Name] [Your Position] [Organization Name] [Organization Address] [City, State, ZIP] [Email Address] [Phone Number] [Date]

[Recipient's Name] [Recipient's Position] [Organization Name] [Organization Address] [City, State, ZIP]

I hope this letter finds you well. We are writing to inform you of a recent update to our banking information at [Organization Name].

In order to streamline our financial operations, we have decided to change our banking service provider to [New Bank Name]. Subsequently, we have successfully opened a new bank account with the account number [New Account Number].

We kindly request you to update your records with our new bank account details, effective from [Effective Date]. All future donations, contributions, and transactions should be processed using the new account information provided.

Enclosed with this letter is a formal notice containing our new account details and any supporting documentation required for verification purposes.

Should you have any questions or require further information during this transition, please do not hesitate to contact us. We greatly value your cooperation and support in updating our bank account details in your records.

Thank you for your understanding and prompt attention to this matter.

[Your Name] [Your Position] [Organization Name]

Template Letter to Inform Change of Bank Account - Vendor/Supplier

[Recipient's Name] [Recipient's Position] [Vendor/Supplier Name] [Vendor/Supplier Address] [City, State, ZIP]

I trust this letter finds you in good health. I am writing on behalf of [Company Name] to inform you of a significant change in our banking arrangements.

In order to optimize our financial operations, we have decided to switch our banking services to [New Bank Name]. Consequently, we have opened a new corporate bank account under the account number [New Account Number].

We kindly request you to update your records with our new bank account details, effective from [Effective Date]. All future payments and transactions to [Company Name] should be processed using the new account information provided.

Enclosed with this letter is a formal notification containing the new account details and any other relevant documentation required for verification purposes.

Should you have any queries or require further assistance during this transition, please do not hesitate to contact us. Your cooperation in updating our bank account details in your records is greatly appreciated.

Thank you for your prompt attention to this matter.

We are delighted to extend our professional proofreading and writing services to cater to all your business and professional requirements, absolutely free of charge at Englishtemplates.com . Should you need any email, letter, or application templates, please do not hesitate to reach out to us at englishtemplates.com. Kindly leave a comment stating your request, and we will ensure to provide the necessary template at the earliest.

Posts in this Series

- Causes Of Corruption, And Their Solutions Letter To Editor

- Chair Request Letter For Office, Teacher, Employee

- Change Of Address Letter For Customers

- Change Of Engineer Of Record Letter, Change Engineer Of Record Florida

- Change Of Residential Address Letter Sample

- Character Reference Letter From Mother To Judge

- Character Reference Letter Sample For Jobs

- Cheque Date Correction Letter Request Format

- Clarification Letter From Shipper On Mistake To Customs

- Closure Letter To Someone You Love

- Clothing Store Manager Cover Letter

- Company Address Change Letter To Bank

- Compensation Letter For Damages

- Complaint Letter About A Rude Staff

- Complaint Letter Against Father In Law

- Disability Insurance Recovery Letter

- Disappointment Letter To Boss On Appraisal

- Disappointment Letter To Client

- Disappointment Letter To My Wife

- Dishonoured Cheque Letter Before Action

- Diwali Holiday Announcement Email To Employees, Customers

- Donation Letter For Football Team

- Donation Request Letter For Laptop

- Donation Request Letter For Orphanage

- Donor Meeting Request Letter

- Down Payment Request Letter Sample

- Draft A Letter Of Interest To Contract, Or Lent Cars To Government Departments, And Agencies

- Early Payment Discount Letter Sample

- Early Retirement Letter Due To Illness

- Early Retirement Letter Of Resignation

- Early Retirement Request Letter For Teachers

- Eid Greetings Letter From Company To Staff Members, Employees And Students

- Electrical Engineer Experience Letter Sample

- Employee Encouragement Letter Sample

- Employee Not Returning Uniforms

- Employee Recognition Letters Sample

- Employee Warning Letter Sample For Employers

- Best Thank You Letter After Interview 2023

- Beautiful Apology Letter To Girlfriend

- Babysitter Cover Letter No Experience

- Babysitter Letter Of Payment

- Babysitting Letter To Parents

- Back To School Letter From Principal In Florida

- Balance Confirmation Letter Format For Banks And Companies

- Bank Account Maintenance Certificate Request Letter

- Bank Balance Confirmation Letter Sample

- Bank Internship Letter Format, And Sample

- Bank Loan Repayment Letter Format

- Authorization Letter To Collect Money On My Behalf

- Authorized Signatory Letter Format For Bank

- Aviation Management Cover Letter Example

- Attestation Letter For Employee

- Attestation Letter Of A Good Character

- Audit Document Request Letter

- Authority Letter For Degree Attestation Sample

- Authority Letter For Issuing Degree

- Authority Letter For Receiving Degree

- Authority Letter To Collect Documents

- Authority Letter To Collect Passport

- Authorization Letter For Air Ticket Refund

- Authorization Letter For Car Insurance Claim

- Authorization Letter For Driver License Renewal

- Authorization Letter For Getting Driver License

- Authorization Letter For Student Driver License

- Authorization Letter For Tree Cutting Permit

- Ask Permission From My Boss For Straight Afternoon

- Asking For Compensation In A Complaint Letter Example

- Appointment Letter With Probation Period

- Appreciation Letter For Good Performance On Duty

- Appreciation Letter For Hosting An Event

- Appreciation Letter For Manager

- Appreciation Letter From Hotel To Guest

- Appreciation Letter To Employee For Good Performance

- Apprenticeship Result Letter By Principal

- Approval Letter For Job Transfer

- Approval Letter For Laptop

- Approval Request To Govt Authorities For Sports Shop Approval

- Ask For A Letter Of Recommendation Taxas

- Apply For Government Contracts Letter

- Appointment Letter Daily Wages

- Appointment Letter For A Medical Representative Job

- Appointment Letter For Job In Word Free Download

- Appointment Letter For Patient

- Credit Card Address Change Request Letter To Hdfc Bank

- Customer Request Letter For Insurance Policy Pending

- Data Collection Application Letter Request From University

- Dealership Cancellation Request Letter

- Death Intimation Letter Format To Bank

- Debit Card Cancellation Letter Format

- Demand For Assurance Letter

- Demand Letter For Attorney Fees

- Demand Letter For Mortgage Payment

- Demand Letter For Property Return

- Demand Letter For Return Of Items

- Demanding Letter For The Competition Exams Books For Your College Library

- Denial Letter For Insurance Claim

- Compliment Letter To Hotel Staff

- Compromise Agreement Sample Letter

- Compromise Letter For The Reason Of Disturbance

- Compromise Letter To Police Station

- Computer Repair, And Replacement Complaining Letter

- Condolence Letter For Death Of Friend

- Condolence Letter For Death Of Mother

- Condolence Letter For Loss Of Child

- Condolence Letter For The Death Of Father, Mother, Or Someone Else

- Condolence Letter On Death Of Father In English

- Condolence Letter To A Friend Who Lost His Brother

- Condolence To My Player Lost A Parent

- Condolences Letter On Loss Of Wife

- Confessional Letter To Church

- Confirm Meeting Appointment Letter Sample

- Confirmation Letter For Airport Pick Up

- Confirmation Letter For Appointment In Email

- Confirmation Letter For Bank Account

- Confirmation Letter For Completion Of Training

- Confirmation Letter For Teacher After Completion Of 1 Year Of Probation With Necessary Terms, And Conditions

- Conflict Resolution Letter For Employees

- Congratulation Letter After Job Interview

- Congratulation Letter Business Success

- Congratulation Letter For Passing Board Exam

- Congratulation Letter For Promotion

- Congratulations Letter Receiving Award

- Consent Letter For Children Travelling Abroad

- Consent Letter For Guarantor

- Construction Contract Approval Letter

- Construction Delay Claim Letter Sample

- Contract Approval Letter Example

- Contract Extension Approval Letter

- Contract Renewal Letter To Manager

- Contract Termination Letter Due To Poor Performance

- Contract Termination Letter To Vendor

- Contractor Recommendation Letter Format

- Convert Residential To Commercial Property

- Courtesy Call Letter Sample

- Work From Home After Accident Letter Format

- Uniform Exemption Letter For Workers, Students, Employees

- Thanks Letter For Visitors Free Download

- Thanks Letter To Chief Guest And Guest Of Honor

- Apology For Resignation Letter

- Apply For Funds For Ngo Dealing With Disabled People, We Have A Land, And Want To Build The Proper Shelter

- Allow Vehicles For Lifting Auction Material Letter Format

- Address Change Request Letter For Credit Card

- Address Proof Letter Format

- Admission Confirmation Letter Format

- Admission Rejection Letter Samples

- Accreditation Letter For School

- Accreditation Letter For Travel Agency

- Accountant Letter For Visa

- Accreditation Letter For Organization

- Absence Excuse Letter For Professor-Lecturer

- Acceptance Letter By Auditor

- A Letter Of Support For A Graduation

- School Timing Change Notice

- Thank You Letter For Sponsoring An Event

- Sample Letter Of Data Collection, And Research Work

- Sample Letter Of Request For Borrowing Materials

- Sample Letter Of Thank You For Participation

- Sample Letter To Bank Manager For Unblock Atm Card

- Sample Letter To Claim Car Insurance

- Sample Letter To Close Bank Account Of Company

- Sample Letter To Parents About Fee Increase

- Sample Letter To Parents For School Fees Submission

- Sample Letter To Return Products, Or Ordered Items Or Replacement

- Sample Nomination Letter To Attend Training

- Sample Notice For Parent Teacher Meeting (Ptm)

- Sample Authority Letter For Cheque Collection

- Sample Experience Letter For Hotel Chef Or Cook

- Sample Experience Letter For Nurses

- Sample Holiday Notification Letter Format For Office

- Sample Invitation Letter To Chief Guest

- Sample Letter Asking Permission To Conduct Seminar

- Sample Letter For Acknowledging Delivery Of Goods, Or Services

- Sample Letter For Leave Without Permission

- Sample Letter For Requesting Quotations

- Sample Letter For Urgent Visa Request

- Salary Deduction Letter To Employee

- Request Letter For Any Suitable Job - Covering Letter Format

- Request Letter For Change Of Name In School Records

- Reply To Employment Verification Letter

- Request Application Letter To The College Principal -Vice-Chancellor -Admission Office For Taking Admission

- Request Final Payment Settlement After The Resignation

- Request For Fuel Allowance To Company-Employer

- Request For Meeting Appointment With Seniors - Other Employees-Clients Sample Letter

- Request For Office Supplies Templates

- Request Letter For Accommodation In University

- Request Letter For An Online Interview

- New Email Address Change Notification Letter

- Notice On Cleanliness In Your Office Compound

- Office Closing Reason For Business Loss Letter Format

- One Hour Leave Application Request Letter

- Permission Letter For Blood Donation Camp

- Promotion Request Letter And Application Format

- Proposal Letter For School Events And Activities

- Quotation Approval Request Letter With Advance Payment

- Recommendation Letter For Visa Application From Employer

- Remaining Payment Request Letter Sample For Clients, Customers

- Letter To Principal For Change Of School Bus Route

- Letter To Principal From Teacher About Misbehavior of a Student

- Letter To Remove Name From Joint Bank Account

- Letter To Renew Employment Contract Sample

- Letter To Subcontractor For Work Delay By The Contractor

- Letter To Your Friend About An Exhibition You Have Seen Recently

- Loan Cancellation Letter Sample

- Marriage Leave Extension Letter To Office-Manager Or Company

- Letter Of Introduction From A Company To An Employee For Visa

- Letter Of Recommendation For Further Studies By Employer

- Letter Regarding Visa Delay To Embassy

- Letter Requesting School Principal To Issue A New Student Identity Card

- Letter Requesting Sponsorship For Education From Ngo-Spouse-Court

- Letter To Airline For Refund Due To Illness, Death, Or Medical Grounds

- Letter To Cancel The Approved Leave Of Employee Due To Work In Office

- Letter To Customs Officer To Release Goods-Cargo

- Letter To Friend Telling About Your New School

- Letter To Friend Thanking Him For The Books He Lent To You

- Letter To Increase PF(Provident Fund) Contribution

- Letter To Insurance Company For Change Of Address

- Letter To Municipal Commissioner For Street Lights

- Letter To Municipal Corporation For Road Repair

- Letter To Parents Asking For Money

- Email Letter to Request Travelling Allowance

- 10 Examples of Letters of Recommendations

How Do I Write a Request Letter to Unblock / Reactivate My Bank Account

Your bank account can be blocked by your bank due to several reasons like not making any transactions for a long time (or) multiple failed attempts of internet banking logins (or) failed cheque transactions (or) not linking KYC with your bank account or due to any illegal activities associated with your bank.

If your bank account was blocked then you can unblock or reactivate your bank account by writing a request letter to the bank.

Sample Request Letter to Unblock Your Bank Account (Format 1)

The Branch Manager,

Bank Address.

Sub: Request to unblock my bank account.

Dear Sir/Madam,

My name is ___________(your name), account holder of your bank for the last 2 years with a/c no ____________(bank a/c no).

Unfortunately, my bank account was blocked for not making any transactions and not maintaining the minimum balance for a while.

I hereby request you to kindly reactivate my bank account and I promise that from now onwards I will maintain the minimum balance and keep making transactions through my bank account regularly.

I would also like to request you to kindly waive off my minimum balance charges if possible.

I shall be obliged to you in this matter.

Thanking you.

Yours faithfully,

Request Letter to Unblock Your Bank Account (Format 2)

The Bank Manager,

Sub: Request for reactivation of bank account.

I, __________(your name), account holder of your bank with a/c no __________. I have not used my bank account for the last 1 year and today when I wanted to make some transaction I got to know that my account was blocked.

Here I would like to request you to please unblock my bank account and please let me know if you need any further information or documents.

To Unblock Internet Banking Facility

Sub: Request to unblock the internet banking facility.

I am _____________(your name), account holder of your bank with savings bank a/c no ___________(bank a/c no).

My internet banking was blocked due to multiple failed login attempts, this was due to erroneous typings of passwords. I mistakenly typed the password more than 3 times and my net banking facility was blocked.

So here I am requesting you to kindly unblock my internet banking facility and I shall be very grateful to you in this regard.

Request Letter to Reactivate Bank Account for Non Submission of KYC

Sub: Reactivation of bank account, Ref a/c no __________.

I am _____________ (your name) account holder of your bank, writing this letter to bring your kind notice that my bank account was blocked due to not linking my Aadhar and PAN with my bank account.

Now I am submitting all the required KYC copies like my Aadhar card and PAN card, so kindly reactivate my bank account and please inform me if you need any other information.

Yours sincerely,

- Sample letter to bank manager for reversal of minimum balance charges .

- SBI internet banking password reset letter.

- Letter to convert savings bank account to salary account in SBI.

19 thoughts on “How Do I Write a Request Letter to Unblock / Reactivate My Bank Account”

Money un expectedly debited block the bank

Hi am Gurveer Singh from DIALGAHR JEJIAN my HDFC Bank account Blocked please unblock My account

Hi am akshay makwana my account unbolok my account bank Nena Surat peoples cooperative bank

Dear sir unblock my account

your bank has blocked or frozen your account please contact your bank for more information phone pe

Mam mera bhi account blocked kar diya gya hai please help me

Mera khata unblock kare kotak mahindra bank account number 3948107497 CRN NO 739182048

Apgp net banking account blocked unbok please

My account blocked is frozen ke liye request Neme jitamal tabiyar Mobile number 820XXXX84 Email I’d niramaltabiyad076@ gmail.com

My account bolok please unblock bolok please help me