- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

Time Value of Money (TVM): A Primer

- 16 Jun 2022

Would you rather receive $1,000 today or the promise that you’ll receive it one year from now? At first glance, this may seem like a trick question; in both instances, you receive the same amount of money.

Yet, if you answered the former, you made the correct choice. Why does receiving $1,000 now provide more value than in the future?

This concept is called the time value of money (TVM), and it’s central to financial accounting and business decision-making. Here’s a primer on what TVM is, how to calculate it, and why it matters.

Access your free e-book today.

What Is the Time Value of Money?

The time value of money (TVM) is a core financial principle that states a sum of money is worth more now than in the future.

In the online course Financial Accounting , Harvard Business School Professor V.G. Narayanan presents three reasons why this is true:

- Opportunity cost: Money you have today can be invested and accrue interest, increasing its value.

- Inflation: Your money may buy less in the future than it does today.

- Uncertainty: Something could happen to the money before you’re scheduled to receive it. Until you have it, it’s not a given.

Essentially, a sum of money’s value depends on how long you must wait to use it; the sooner you can use it, the more valuable it is.

When time is the only differentiating factor, the money you receive sooner will always be more valuable. Yet, sometimes, there are other factors at play. For instance, what’s more valuable: $1,000 today or $2,000 one year from now?

TVM calculations “translate” all future cash to its present value. This way, you can directly compare its values and make financially informed decisions.

“Cash flows expressed in different time periods are analogous to cash flows expressed in different currencies,” Narayanan says in Financial Accounting. “To add or subtract cash flows of different currencies, we first have to convert them to the same currency. Likewise, cash flows of different time periods can be added and subtracted only if we convert them first into the same period.”

Related: 8 Financial Accounting Skills for Business Success

How to Calculate TVM

How you calculate TVM depends on which value you have and which you want to solve for. If you know the money’s present value (for instance, the amount you deposited into your savings account today), you can use the following formula to find its future value after accruing interest:

FV = PV x [ 1 + (i / n) ] (n x t)

Alternatively, if you know the money’s future value (for instance, a sum that’s expected three years from now), you can use the following version of the formula to solve for its present value:

PV = FV / [ 1 + (i / n) ] (n x t)

In the TVM formula:

- FV = cash’s future value

- PV = cash’s present value

- i = interest rate (when calculating future value) or discount rate (when calculating present value)

- n = number of compounding periods per year

- t = number of years

Calculating TVM Manually: An Example

Imagine you’re a key decision-maker in your organization and two projects are proposed:

- Project A is predicted to bring in $2 million in one year.

- Project B is predicted to bring in $2 million in two years.

Before running the calculation, you know that the time value of money states the $2 million brought in by Project A is worth more than the $2 million brought in by Project B, simply because Project A’s earnings are predicted to happen sooner.

To prove it, here’s the calculation to compare the present value of both projects’ predicted earnings, using an assumed four percent discount rate:

PV = 2,000,000 / [ 1 + (.04 / 1) ] (1 x 1)

PV = 2,000,000 / [ 1 + .04 ] 1

PV = 2,000,000 / 1.04

PV = $1,923,076.92

PV = 2,000,000 / [ 1 + (.04 / 1) ] (1 x 2)

PV = 2,000,000 / [ 1 + .04 ] 2

PV = 2,000,000 / 1.04 2

PV = 2,000,000 / 1.0816

PV = $1,849,112.43

In this example, the present value of Project A’s returns is greater than Project B’s because Project A’s will be received one year sooner. In that year, you could invest the $2 million in other revenue-generating activities, put it into a savings account to accrue interest, or pay expenses without risk.

Now, imagine there’s a third project to consider: Project C, which is predicted to bring in $3 million in two years. This adds another variable into the mix: When sums of money aren’t the same, how much weight does timeliness carry?

PV = 3,000,000 / [ 1 + (.04 / 1) ] (1 x 2)

PV = 3,000,000 / [ 1 + .04 ] 2

PV = 3,000,000 / 1.04 2

PV = 3,000,000 / 1.0816

PV = $2,773,668.64

In this case, Project C’s present value is greater than Project A’s, despite Project C having a longer timeline. In this case, you’d be wise to choose Project C.

Calculating TVM in Excel

While the aforementioned example was calculated manually, you can use a formula in Microsoft Excel, Google Sheets, or other data processing software to calculate TVM. Use the following formula to calculate a future sum’s present value:

=PV(rate,nper,pmt,FV,type)

In this formula:

- Rate refers to the interest rate or discount rate for the period. This is “i” in the manual formula.

- Nper refers to the number of payment periods for a given cash flow. This is “t” in the manual formula.

- Pmt or FV refers to the payment or cash flow to be discounted. This is “FV” in the manual formula. You don’t need to include values for both pmt and FV.

- Type refers to when the payment is received. If it’s received at the beginning of the period, use 0. If it’s received at the end of the period, use 1.

It’s important to note that this formula assumes payments are equal over the total number of periods (nper).

Here’s the calculation for Project A’s present value using Excel:

Why Is TVM Important?

Even if you don’t need to use the TVM formula in your daily work, understanding it can help guide decisions about which projects or initiatives to pursue.

“Applying the concept of time value of money to projections of free cash flows provides us with a way of determining what the value of a specific project or business really is,” Narayanan says in Financial Accounting.

As in the previous examples, you can use the TVM formula to calculate predicted returns’ present values for multiple projects. Those present values can then be compared to determine which will provide the most value to your organization.

Additionally, investors use TVM to assess businesses’ present values based on projected future returns, which helps them decide which investment opportunities to prioritize and pursue. If you’re an entrepreneur seeking venture capital funding, keep this in mind. The quicker you provide returns to investors, the higher cash’s present value, and the higher the likelihood they’ll choose to invest in your company over others.

You now know the basics of TVM and can use it to make financially informed decisions. If this piqued your interest, consider taking an online course like Financial Accounting to build your skills and learn more about TVM and other financial levers that impact an organization’s financial health .

Do you want to take your career to the next level? Explore Financial Accounting —one of three online courses comprising our Credential of Readiness (CORe) program —which can teach you the key financial topics you need to understand business performance and potential. Not sure which course is right for you? Download our free flowchart .

About the Author

- Search Search Please fill out this field.

- What Is Time Value of Money?

- Understanding TVM

The Bottom Line

- Corporate Finance

- Financial Ratios

Time Value of Money Explained with Formula and Examples

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

What Is the Time Value of Money (TVM)?

The time value of money (TVM) is the concept that a sum of money is worth more now than the same sum will be at a future date due to its earnings potential in the interim. The time value of money is a core principle of finance. A sum of money in the hand has greater value than the same sum to be paid in the future. The time value of money is also referred to as the present discounted value.

Key Takeaways

- The time value of money means that a sum of money is worth more now than the same sum of money in the future.

- The principle of the time value of money means that it can grow only through investing so a delayed investment is a lost opportunity.

- The formula for computing the time value of money considers the amount of money, its future value, the amount it can earn, and the time frame.

- For savings accounts, the number of compounding periods is an important determinant as well.

- Inflation has a negative impact on the time value of money because your purchasing power decreases as prices rise.

Investopedia / Mira Norian

Understanding the Time Value of Money (TVM)

Investors prefer to receive money today rather than the same amount of money in the future because a sum of money, once invested, grows over time. For example, money deposited into a savings account earns interest. Over time, the interest is added to the principal, earning more interest. That's the power of compounding interest.

If it is not invested, the value of the money erodes over time. If you hide $1,000 in a mattress for three years, you will lose the additional money it could have earned over that time if invested. It will have even less buying power when you retrieve it because inflation reduces its value .

As another example, say you have the option of receiving $10,000 now or $10,000 two years from now. Despite the equal face value, $10,000 today has more value and utility than it will two years from now due to the opportunity costs associated with the delay. In other words, a delayed payment is a missed opportunity.

The time value of money has a negative relationship with inflation . Remember that inflation is an increase in the prices of goods and services. As such, the value of a single dollar goes down when prices rise, which means you can't purchase as much as you were able to in the past.

Time Value of Money Formula

The most fundamental formula for the time value of money takes into account the following: the future value of money, the present value of money, the interest rate, the number of compounding periods per year, and the number of years.

Based on these variables, the formula for TVM is:

F V = P V ( 1 + i n ) n × t where: F V = Future value of money P V = Present value of money i = Interest rate n = Number of compounding periods per year t = Number of years \begin{aligned}&FV = PV \Big ( 1 + \frac {i}{n} \Big ) ^ {n \times t} \\&\textbf{where:} \\&FV = \text{Future value of money} \\&PV = \text{Present value of money} \\&i = \text{Interest rate} \\&n = \text{Number of compounding periods per year} \\&t = \text{Number of years}\end{aligned} F V = P V ( 1 + n i ) n × t where: F V = Future value of money P V = Present value of money i = Interest rate n = Number of compounding periods per year t = Number of years

Keep in mind, though that the TVM formula may change slightly depending on the situation. For example, in the case of annuity or perpetuity payments, the generalized formula has additional or fewer factors.

The time value of money doesn't take into account any capital losses that you may incur or any negative interest rates that may apply. In these cases, you may be able to use negative growth rates to calculate the time value of money

Examples of Time Value of Money

Here's a hypothetical example to show how the time value of money works. Let's assume a sum of $10,000 is invested for one year at 10% interest compounded annually. The future value of that money is:

F V = $ 10 , 000 × ( 1 + 10 % 1 ) 1 × 1 = $ 11 , 000 \begin{aligned}FV &= \$10,000 \times \Big ( 1 + \frac{10\%}{1} \Big ) ^ {1 \times 1} \\ &= \$11,000 \\\end{aligned} F V = $10 , 000 × ( 1 + 1 10% ) 1 × 1 = $11 , 000

The formula can also be rearranged to find the value of the future sum in present-day dollars. For example, the present-day dollar amount compounded annually at 7% interest that would be worth $5,000 one year from today is:

P V = [ $ 5 , 000 ( 1 + 7 % 1 ) ] 1 × 1 = $ 4 , 673 \begin{aligned}PV &= \Big [ \frac{ \$5,000 }{ \big (1 + \frac {7\%}{1} \big ) } \Big ] ^ {1 \times 1} \\&= \$4,673 \\\end{aligned} P V = [ ( 1 + 1 7% ) $5 , 000 ] 1 × 1 = $4 , 673

Effect of Compounding Periods on Future Value

The number of compounding periods has a dramatic effect on the TVM calculations. Taking the $10,000 example above, if the number of compounding periods is increased to quarterly, monthly, or daily, the ending future value calculations are:

- Quarterly Compounding: F V = $ 10 , 000 × ( 1 + 10 % 4 ) 4 × 1 = $ 11 , 038 FV = \$10,000 \times \Big ( 1 + \frac { 10\% }{ 4 } \Big ) ^ {4 \times 1} = \$11,038 F V = $10 , 000 × ( 1 + 4 10% ) 4 × 1 = $11 , 038

- Monthly Compounding: F V = $ 10 , 000 × ( 1 + 10 % 12 ) 12 × 1 = $ 11 , 047 FV = \$10,000 \times \Big ( 1 + \frac { 10\% }{ 12 } \Big ) ^ {12 \times 1} = \$11,047 F V = $10 , 000 × ( 1 + 12 10% ) 12 × 1 = $11 , 047

- Daily Compounding: F V = $ 10 , 000 × ( 1 + 10 % 365 ) 365 × 1 = $ 11 , 052 FV = \$10,000 \times \Big ( 1 + \frac { 10\% }{ 365 } \Big ) ^ {365 \times 1} = \$11,052 F V = $10 , 000 × ( 1 + 365 10% ) 365 × 1 = $11 , 052

This shows that the TVM depends not only on the interest rate and time horizon but also on how many times the compounding calculations are computed each year.

How Does the Time Value of Money Relate to Opportunity Cost?

Opportunity cost is key to the concept of the time value of money. Money can grow only if it is invested over time and earns a positive return. Money that is not invested loses value over time. Therefore, a sum of money that is expected to be paid in the future, no matter how confidently it is expected, is losing value in the meantime.

Why Is the Time Value of Money Important?

The concept of the time value of money can help guide investment decisions. For instance, suppose an investor can choose between two projects: Project A and Project B. They are identical except that Project A promises a $1 million cash payout in year one, whereas Project B offers a $1 million cash payout in year five. The payouts are not equal. The $1 million payout received after one year has a higher present value than the $1 million payout after five years.

How Is the Time Value of Money Used in Finance?

It would be hard to find a single area of finance where the time value of money does not influence the decision-making process. The time value of money is the central concept in discounted cash flow (DCF) analysis, which is one of the most popular and influential methods for valuing investment opportunities. It is also an integral part of financial planning and risk management activities. Pension fund managers, for instance, consider the time value of money to ensure that their account holders will receive adequate funds in retirement.

What Impact Does Inflation Have on the Time Value of Money?

The value of money changes over time and there are several factors that can affect it. Inflation, which is the general rise in prices of goods and services, has a negative impact on the future value of money. That's because when prices rise, your money only goes so far. Even a slight increase in prices means that your purchasing power drops. So that dollar you earned in 2015 and kept in your piggy bank buys less today than it would have back then.

How Do You Calculate the Time Value of Money?

The time value of money takes several things into account when calculating the future value of money, including the present value of money (PV), the number of compounding periods per year (n), the total number of years (t), and the interest rate (i). You can use the following formula to calculate the time value of money: FV = PV x [1 + (i / n)] (n x t) .

The future value of money isn't the same as present-day dollars. And the same is true about money from the past. This phenomenon is known as the time value of money. Businesses can use it to gauge the potential for future projects. And as an investor, you can use it to pinpoint investment opportunities. Put simply, knowing what TVM is and how to calculate it can help you make sound decisions about how you spend, save, and invest.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1297136298-e20bf707974f45fd9bfb5f0371b35571.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Dr. Kevin Bracker; Dr. Fang Lin; and jpursley

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it. – Albert Einstein

Chapter Learning Objectives

After completing this chapter, students should be able to

- Explain the concepts of future value, present value, annuities, and discount rates

- Solve for the future value, present value, payment, interest rate or number of periods using the 5-key approach on a financial calculator

- Work with annual, semi-annual, quarterly, monthly, biweekly, weekly, or daily periods

- Solve for the present value of a perpetuity

- Solve for the present value or future value of an uneven cash flow stream

- Solve for the interest rate implied by an uneven cash flow stream

- Explain, calculate, and compare investments based on the effective annual rate

- Perform complex time value of money calculations (problems where multiple steps are required in order to reach the final solution)

The Power of Compound Interest

The quote at the start of the chapter is often attributed to Albert Einstein (despite some controversy as to the accuracy of that attribution). However, the validity of the statement itself has merit. Positive returns on investments over long periods of time are central to making money work for you as the power of compounding allows for geometric growth. Consider the following table (before long, you’ll be able to verify these calculations) of someone saving $250 per month for various times at various rates of return. Note that an individual who is 25 would have about 40 years until a standard retirement at age 65 and, assuming their employer offers a 50% match on retirement savings plans such as a 401(k), a total contribution of $250 each month would only be $2000 per year out of pocket before taxes.

Table: Future Value of $250 per month investment

Take a moment to review the table above. Note that at 5 years out, the rate of return makes some difference, but not a dramatic difference. By 15 years out, an individual would have 2.5 times as much at the 15% rate of return as the 5% rate of return. By 30 years out, the 10% rate of return is 2.7 times as much as the 5% rate of return and the 15% rate of return has accumulated 8.3 times the wealth. By 40 years out, an individual has invested $120,000 into her retirement savings (40 years at $3000 per year – with the potential for some of that $120,000 coming from the employer). The power of compounding has generated about $261,500 at 5%, nearly $1.5 million at 10%, and over $7.5 million at 15%. This example illustrates how powerful time and return are as tools for building wealth. Now it is time to show you how to do these and other time value of money calculations.

Future Value

When you put your money in a savings account (or invest it in some fashion), you earn a certain return (sometimes called interest) in order to compensate you. Because of this, a dollar today is not worth the same amount as a dollar sometime in the future. Since you earn money on the dollar invested (or saved) today, you will have more than a dollar at some later future point (making a dollar today worth more than the same dollar received later). The specific amount that you will have at the future date is referred to as a Future Value.

Consider if you had $100 today and were able to earn 12% per year by putting that money in a savings account at XYZ bank. How much would you have in one year? Two years? Three years? At first, you might think that you would have $112 in one year, $124 in two years and $136 in three years as you would earn $12 per year in interest. However, this is WRONG! It ignores the concept of compounding. After one year, you would indeed have $112. However, during the second year you earn 12% interest on the full $112 instead of only the $100 you started with. Therefore, you will earn $13.44 (=112×0.12) in interest in the second year and have $125.44 in two years. During the third year, you will earn $15.05 (=125.44×0.12) in interest and have $140.49 in three years. Therefore, the Future Value of $100 for three years at 12% is $140.49. In other words, $100 today is equivalent to $140.49 received three years from now assuming that you can earn 12% interest annually.

Solving for Future Value

We have three ways to solve for the FV: formula, financial table, and financial calculator.

Method 1: Using a Formula to Find the FV

The first is directly with a formula. Under this method, we use the following formula:

[latex]FV=PV(1+k)^n[/latex]

FV is the future value (in year n) for which we are trying to solve PV is the present value (how much we have today) k is the rate of return we are earning (also referred to as the interest rate, required return, growth rate, or discount rate) n is the number of years which we will be saving (or investing) the money.

Method 2: Using a Table to Find the FV

The second method is to use Financial Tables, in Appendix A. Financial tables are cumbersome and don’t allow us as much flexibility as other methods, so they will not be covered in this text.

Method 3: Using a Financial Calculator to Find the FV

The third method (and the method focused on here) is to use the financial calculator or spreadsheet. Each financial calculator follows the same basic ideas, but the specifics are different for each brand of calculator. The steps below are for the HP10BII, TI-BAII+ and TI-83/84. If this is the first time using your financial calculator, see the detailed instructions Setting up Your Financial Calculator , in Appendix B. Please pause here to read that and set up your financial calculator before proceeding.

Calculator Steps to Compute FV:

Note: The order of steps 1-4 is not important. The FV answer will appear as a negative number, ignore the negative sign for now. For the TI-83/84 calculators your P/Y and C/Y on the onscreen display should both be 1 for now.

Example: Finding FV using the Financial Calculator

Find the Future Value of $350 invested for 25 years at 9.5% per year.

Step 1: 25 N Step 2: 9.5 I/YR Step 3: 350 PV Step 4: 0 PMT Step 5: FV⇒

You should get a solution of $3383.93.

In other words, if we invest $350 today and let it compound at 9.5% per year for 25 years, we will have $3383.93 at the end of the 25th year.

Technically, you will get a value of -3383.93. The negative sign is an important aspect of financial calculators. The calculator is looking for the solution that balances both parties of a transaction. Here, since the $350 starting value was positive, the calculator assumes that this amount is being received today. If an individual receives $350, that individual needs to pay back $3383.93. Positive values represent cash inflows and negative values represent cash outflows. In a problem like this, it is not essential. However, later in the chapter, we will introduce problems where the cash flow direction is essential. Specifically, whenever there are nonzero values for two or three of the cash flows (PV, PMT, and/or FV), cash flow direction matters. In those cases, figure out if the cash flow is coming to you (available at that moment to spend) or the cash flow is going away from you (set aside into a savings plan). If the cash flow is coming to you, it is positive. If it is going away from you, it is negative. If we applied that logic in this example, the $350 PV would actually be -350. However, this would not change the value of the FV other than to make it positive.

Present Value

The flip side of Future Value is Present Value. Future value tells us how much a certain amount of money will be worth at some future date assuming a certain rate of return. However, what if we know how much we are supposed to get at some point in the future and want to know what it is worth to us today? Now we must find the Present Value. Assume we are offered an opportunity to receive $200 at the end of two years (call it investment A). How much is this opportunity worth to us today assuming we could earn 8% by placing our money in a savings account (that has risk similar to investment A)? To answer this, we must ask how much we would need to place in a savings account today in order to have $200 at the end of the two years.

[latex]FV=PV(1+k)^n[/latex] [latex]200=PV(1.08)^2[/latex] [latex]\frac{200}{(1.08)^2}=PV[/latex] [latex]\$171.47=PV[/latex]

If we had $171.47 today and placed it in a savings account earning 8%, we would have $200 in two years (the same as through investment A). Assuming that investment A had the same degree of risk as our savings account, then we would buy investment A if it was available for less than $171.47 and put our money in the savings account if investment A cost more than $171.47. We could say that the present value of investment A is $171.47.

Solving for Present Value

We have three ways to solve for the PV: formula, financial table, and financial calculator.

Method 1: Using a Formula to Find the PV

[latex]PV=\frac{FV}{(1+k)^n}[/latex]

FV is the future value (in year n) that we plan to receive PV is the present value (how much it is worth to us today) k is the rate of return we can earn elsewhere (also referred to as the compound rate, required return, or discount rate) n is the number of years which we will have to wait before receiving the money.

Method 2: Using a Table to Find the PV

The second method is to use financial tables and will not be covered in this text.

Method 3: Using a Financial Calculator to Find the PV

The third method is to use the financial calculator (or spreadsheet). Each financial calculator follows the same basic ideas, but the specifics are different for each brand of calculator. The steps below are for the HP10BII, TI-BAII+ and TI-83/84.

Calculator Steps to Compute PV

Note: The order of steps 1-4 is not important. The PV answer will appear as a negative number, ignore the negative sign for now.

Example: Finding PV using the Financial Calculator

Find the Present Value of $5000 received 15 years from today with a 9.5% discount rate.

Step 1: 15 N Step 2: 9.5 I/YR Step 3: 0 PMT Step 4: 5000 FV Step 5: PV⇒

You should get a solution of $1281.62

In other words, if we are offered the opportunity to receive $5000 at the end of 15 years that is equivalent to receiving $1281.62 today.

The examples previously discussed are for situations where we have a specific amount today and want to know what it is worth at some point in the future (FV) or when we plan to receive a certain amount at some point in the future and want to know what it is worth today (PV). These are referred to as lump sum situations because there is only one cash flow that we are discounting or compounding.

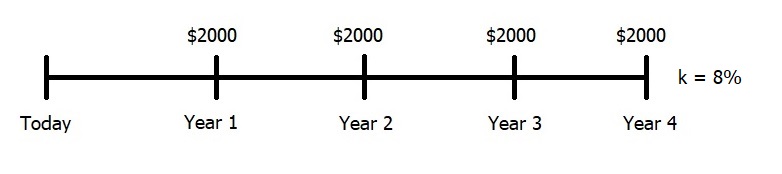

Timelines: Let us pause here for a moment to introduce an important tool used in time value of money – timelines. Timelines provide an aid that helps us better visualize what the cash flow stream looks like. Consider an annuity that pays $2000 per year for 4 years with an 8% discount rate. We can illustrate this on a timeline as follows:

Note that the hashmarks represent the end of the time increment and the space between the hashmarks represent the time increment itself. In other words, the year 1 hashmark represents the end of year 1 where the annuity makes its first $2000 payment. Some students find timelines very helpful and use them for most time value of money problems while others use them less frequently. However, when we get to the section on complex time value of money problems later in this chapter, most students will find timelines quite beneficial.

Solving for Present Value of an Annuity

We have three ways to solve for the PV of an annuity: formula, financial table, and financial calculator.

Method 1: Using a Formula to Find the PV of an Annuity

[latex]PVA=PMT\Big(\frac{1-\frac{1}{(1+k)^n}}{k}\Big)[/latex]

PVA is the present value of the anticipated cash flow stream (annuity) PMT is the annuity payment (how much we receive or save each period) k is the rate of return we can earn elsewhere (also referred to as the compound rate, required return, or discount rate) n is the number of periods which we will have to wait before receiving the money.

Method 2: Using a Table to Find the PV of an Annuity

Method 3: using a financial calculator to find the pv of an annuity.

The third method is to use the financial calculator (or spreadsheet) which is what we will focus on. Let’s walk through an example with the financial calculator. An investment that pays $100 at the end of each year for 4 years is an annuity (note that a clue for annuities is to look for the word “each’ or “every” to indicate that the same cash flow is being repeated multiple times). If we wanted to know what that investment is worth to us today and we had a 10% discount rate, we would be finding the present value of that annuity.

Calculator Steps to Compute PV of an Annuity

You should get a solution of $316.99

Solving for Future Value of an Annuity

As with the other TVM calculations we have encountered, there are 3 basic methods to solve for the FV of an annuity: formula, financial table, and financial calculator.

Method 1: Using a Formula to Find the FV of an Annuity

[latex]FVA=PMT\Big(\frac{(1+k)^n-1}{k}\Big)[/latex]

FVA is the future value that our cash flow stream will grow to at the end of n periods PMT is the annuity payment (how much we receive or save each period) k is the rate of return we can earn elsewhere (also referred to as the compound rate, required return, or discount rate) n is the number of periods which we will have to wait before receiving the money.

Method 2: Using a Table to Find the FV of an Annuity

The second method is to use financial tables . These tables are included in Appendix A and will not be covered in this text.

Method 3: Using a Financial Calculator to Find the FV of an Annuity

The third method is the financial calculator (or spreadsheet) approach. Let’s walk through an example using the financial calculator to solve for the future value of an annuity. We want to save $1000 per year (at the end of each year) for 10 years at 12%. How much will this be worth at the end of the 10th year?

Calculator Steps to Compute FV of an Annuity

Note: The order of steps 1-4 is not important. The FV answer will appear as a negative number, ignore the negative sign for now.

You should get a solution of $17,548.74

Note: Ordinary annuities (both present value and future value) assume that cash flows will arrive at the end of each period. Occasionally, you might encounter an annuity due (which means that cash flows arrive at the BEGINNING of each period). It is easy to adjust for this when using a financial calculator by changing the calculator from END of period cash flows to BEGINNING of period cash flows. This process is described in Setting up Your Financial Calculator in Appendix B (for the TI-83/84, it is just part of the onscreen display in the TVM_Solver).

Solving for PMT, I/YR, or N

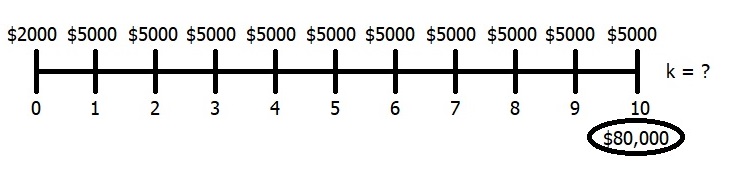

Sometimes you may need to find something other than the present value or future value. For instance, you may want to know how much you have to save per year to reach a certain future value (or how much you must earn as a rate of return or how many years it will take). If you are using a financial calculator, these are relatively easy. For example, assume you have $2000 saved already and want to save another $5000 per year to accumulate $80,000 after 10 years. What rate of return must you earn?

Calculator Steps for the Solution

Solution = 8.83%

Reminder: Either the PMT must be negative and the FV positive or the PMT positive and the FV negative. It doesn’t matter which way you do it, but one must be negative and the other positive.

Solving for N and PMT is done along similar lines.

Perpetuities

A Perpetuity is an annuity that lasts forever. While it is difficult to imagine a situation where an individual could buy a cash flow stream that will pay a fixed amount per year through infinity, perpetuities can be useful tools when dealing with long, constant cash flow streams. Consider someone wanting to fund a scholarship or plan for retirement where she is not sure how long she’ll live. A perpetuity can provide a reasonable approximation in either of those situations.

How much would a perpetuity of $100 be worth assuming a discount rate of 10%? Remember this is $100 per year forever. It would seem that this would be worth an infinite amount. However, consider what would happen if you had $1000 today and could put it in the bank to earn 10% interest. You would receive $100 per year and never touch the principal. You would essentially be buying a $100 perpetuity (assuming the bank didn’t change the interest rate). Therefore, a perpetuity has a finite value. The formula for finding the present value of a perpetuity is as follows:

[latex]PV=\frac{PMT}{k}[/latex]

Note: When using this formula, always plug in k as a decimal so that 10% is 0.10

Uneven Cash Flow Streams

Sometimes you will encounter a situation where you have more than one payment, but it is not the same each year. Remember that an annuity requires the payment to be the same each year. If you have multiple cash flows, but they are not the same, you have an uneven cash flow stream. In order to solve a problem like this, treat it as a series of single cash flows (or possibly a series of smaller annuities).

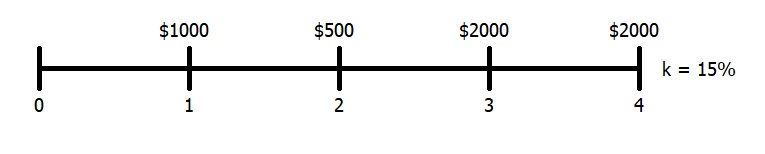

Net Present Value of an Uneven Cash Flow Stream

Consider the following example: you have an investment project that will pay the following cash flows:

Year 1 $1000 Year 2 $500 Year 3 $2000 Year 4 $2000

The discount rate is 15%. Find the Present Value.

Calculator Steps to Compute PV of an Uneven Cash Flow Stream

Solution $3706.18

Note for HP10BII+: The Nj key is used to tell the calculator the number of times that the same cash flow will be received consecutively. If the cash flow only occurs once (in a row) then we do not need to use the Nj key. However, when we have the same cash flow multiple times in a row (such as the $2000 for two years), we can use the Nj key to tell the calculator that this $2000 will occur in two consecutive years.

Note for TI-BAII+: The F screen that appears after you enter a cash flow and down arrow is used to tell the calculator the number of times we have that same cash flow consecutively. If the cash flow only occurs once (in a row) then we do not F screen and just down arrow past it. However, when we have the same cash flow multiple times in a row (such as the 2000 for two years), we use the F screen to tell this to the calculator. The calculator does not have a F screen after the initial cash flow, so we do not need the double down arrow after entering the initial CF.

The above calculator methods are referred to as your Cash Flow Register or Cash Flow Worksheet. It is essential that you always clear all/clear work before entering any cash flows. If you do not do this you will be adding cash flows to a previous problem instead of starting a new problem. The TI-83/84 does not utilize this type of register and does not need to be cleared.

Future Value of an Uneven Cash Flow Stream

The NPV function gives you the present value. You may alternatively want to know how much you will have at the END of the time period (solve for the future value). If this is the case, you start by solving for the NPV. Once you have that, use the 5-key approach to bring that present value forward to the end of the time horizon. For example, if we wanted to know what the above cash flow stream was worth at the END of the fourth year, we would start by solving for the NPV and get the same $3706.18 we calculated earlier. Then, we would go to our 5-key and solve for the future value as follows:

Step 1: 4 N Step 2: 15 I/YR Step 3: 3706.18 PV Step 4: 0 PMT Step 5: Solve for FV⇒ $6482.13

When calculating the PV of an uneven cash flow stream, it should always be less than the sum of the cash flows. When calculating the FV of an uneven cash flow stream, it should always be more than the sum of the cash flows. Also, many financial calculators allow you to solve directly for the future value of an uneven cash flow stream. To see if yours does this, consult your user manual or ask your instructor.

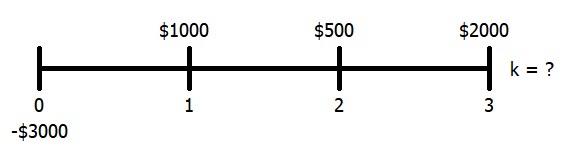

Finding the discount rate of an Uneven Cash Flow Stream

We can also find the discount rate (I/Y) if we have uneven cash flows. Consider the following example: We have an investment project that will pay the following cash flows:

Year 1 $1000 Year 2 $500 Year 3 $2000

If the present value of this investment is $3000, what is the discount rate?

Calculator Steps to Compute I/Y of an Uneven Cash Flow Stream

Solution 7.06%

Note for HP10BII+: The IRR/YR is not the same key as you used for the I/YR, but it serves a similar role — finding the discount rate (or rate of return) for a cash flow stream. The difference is that they I/YR key only works with single cash flows or annuities while the IRR/YR key works with uneven cash flows.

Note for TI-BAII+: The IRR is not the same key as you used for the I/Y, but it serves a similar role — finding the discount rate (or rate of return) for a cash flow stream. The difference is that the I/Y key only works with single cash flows or annuities while the IRR key works with uneven cash flows.

CF0 will always be negative when calculating IRR. If you end up with an error message when calculating the IRR, one of the first things you should do is make sure that your CF0 was a negative value.

Non-Annual Compounding

The more frequently interest is compounded, the greater the effective yield on our savings. Many banks use non-annual compounding periods (monthly, daily, etc). In order to make comparisons, we must find the effective annual yield. This tells us how much we are earning on an annual basis.

Using a Formula to Find the Effective Annual Yield

The formula for effective annual yield is as follows:

[latex]k_{eff}=\Big(1+\frac{k_{nom}}{m}\Big)^m-1[/latex]

k eff is the effective annual yield k nom is the nominal or stated yield m is the number of compounding periods per year

For example, what is the effective interest rate of 8% compounded daily?

[latex]k_{eff}=\Big(1+\frac{0.08}{365}\Big)^{365}-1[/latex]

Note: Be careful not to round when you take .08/365 or you will end up with significant error after compounding it 365 times.

Using a Calculator to Find the Effective Annual Yield

As an alternative, you could use your financial calculator to find the effective interest rate. Again, using 8% compounded daily.

Calculator Steps to Find the Effective Annual Yield

Solution 8.33%.

Note for HP-10BII+: You have changed your payments per year when doing this calculation. If you go back to another TVM problem, be sure to reset your payments per year to one.

Example: Solve a Problem Involving Non-Annual Compounding

We could also look at non-annual compounding with loans or investments. For example, consider a mortgage loan. You are borrowing $80,000 at an 8% rate with monthly payments for 30 years (note that non-annual annuities and lump sums work best with calculators), what is your monthly payment?

Step 1: Convert your calculator to monthly payments by entering 12 P/YR Step 2: -80000 PV Step 3: 8 I/YR Step 4: 360 N (30 years at 12 months per year) Step 5: 0 FV Step 6: PMT

Solution = $587.01 per month

Be VERY careful if you change your payments per year to change it back to 1 P/YR when you are done. Also, each calculator is slightly different in how it sets the periods per year. Be sure to review the Setting up Your Financial Calculator in Appendix B for calculator specific instructions.

Return to Future Value Tables

Remember the table of future values that we used to start the chapter? We said that the value of $250 set aside every month for 40 years at 10% would be $1,581,019.90. We also suggested that by the end of this chapter, you would be able to do that calculation on your own. Well, now you can.

Step 1: Convert your calculator to monthly payments by entering 12 P/YR Step 2: 0 PV Step 3: 10 I/YR Step 4: 480 N (40 years at 12 months per year) Step 5: 250 PMT Step 6: FV

Solution = $1,581,019.90

Complex Time Value of Money Problems

Everything above this point completes your “Time Value of Money Toolbox.” All the examples to this point have been straight-forward situations. However, sometimes we have what we refer to as complex time value of money problems where there are multiple issues that need addressed within one problem. One of the most common examples of this would be a retirement problem where you have X dollars available today, want to be able to withdraw a certain cash flow stream at retirement throughout your retirement years and want to find out how much you need to save each month until retirement between now and the day you retire to achieve your goal. In order to solve a problem like this, you need to visualize (a time line is very helpful) what information you have and what you are missing (that you need to solve for). You will often need to break this down into multiple steps.

Example: Solve a Complex Time Value of Money Problem

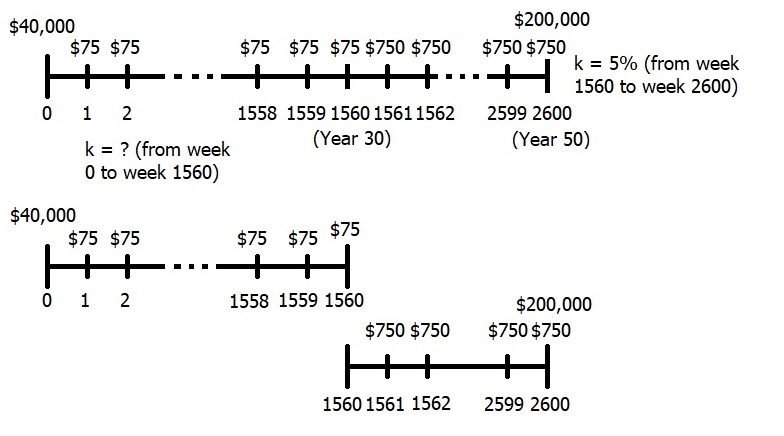

Consider a situation where you are saving for retirement. You currently have $40,000 saved and would like to save an additional $75 per week for the next 30 years. You estimate that when you retire (30 years from today), you want to be able to withdraw $750 each week for the next 20 years and have $200,000 left over at the end of the 20-year retirement period. Assuming you earn 5% during retirement, what rate of return must you earn during the next 30 years to meet your goal?

One way to approach this is to start with a timeline. Note that each period is one week and there are 52 weeks per year. This means that we will have 1560 periods until retirement (1560 = 30×52) and another 1040 periods until the end of retirement (1040 = 20×52). This provides a total of 2600 periods for the entire 50 year time (2600 = 1560 + 1040). Once we’ve created the timeline, we can split it into two timelines. Timeline one will begin today and go to retirement (period 1560) and timeline 2 will begin at retirement (also period 1560) and go to the end of the retirement time frame (period 2600). Here, the timelines help us visualize the information that we know and what we need to find out (specifically our rate of return we must earn over the first 30 years).

Now we can start the calculations. To start, you need to figure out how much you will require at the end of the 30 years. This is the amount you want to have when you retire.

Step 1: Solve for how much you need at retirement.

Set your calculator to 52 periods per year to reflect weekly withdraws during retirement

Set your N to 1040 (52 periods per year for 20 years = 1040 weekly periods)

Set your PMT to 750 (to reflect the weekly withdraw)

Set your FV to 200,000 (to reflect the amount left over)

Set your I/YR to 5 (for your rate of return during retirement)

Solve for PV ⇒$566,527.38

Note – your PMT and FV need to be the same sign. You can make them both positive or both negative, but they are both flowing in the same direction so must be the same sign.

Step 2: Now that you know how much you need when you retire ($566,527.38), you can calculate what rate of return you need to earn over the next 30 years to get there.

Keep your calculator set to 52 periods per year as you are making weekly contributions

Set your N to 1560 (52 periods per year for 30 years = 1560 weekly periods)

Set your PV to -40,000 (to reflect the initial $40,000 contribution)

Set your PMT to -75 (to reflect your weekly $75 contribution)

Set your FV to 566,527.38 (to reflect how much you need at retirement)

Solve for I/YR ⇒5.98%

Note – your PV and PMT both need to be the same sign. Again, you can make them positive or negative, but they are both flowing in the same direction. The FV needs to be the opposite sign. The easiest way to think of this is that you are giving up the $40,000 today and the $75 per week in order to get back the $566,527.38 30 years from today.

Key Takeaways

Time value of money is one of the most powerful and most important concepts in finance. It essentially is as simple as recognizing that because we can earn a return on our money, the value of money changes depending on when it is received or spent. One dollar today is worth more than one dollar received next year. The value of the dollar initially is referred to as a present value while the value of the dollar at a later point in time is referred to as the future value. Compound interest implies that money will grow exponentially over time instead of linearly. This means that relatively small increases in rates of return or time horizons have more power to increase wealth. After completing this chapter, you should be comfortable performing many calculations to see exactly how time value of money can work for you.

Explain why $1 received today is worth more than $1 received one year from today.

What do we mean when we refer to an annuity? How is an annuity different from an annuity due?

What is the relationship between present value and future value?

How do we determine the appropriate discount rate to use when finding present value?

Why is compounding on a monthly basis better for us than compounding on an annual basis?

Determine the answer to each of the following questions.

1a. Find the Future Value of $2500 invested today at 11% for 10 years. 1b. Find the Future Value of $2500 invested today at 11% for 30 years. 1c. Find the Present Value of $6000 received 10 years from today if the discount rate is 5%. 1d. Find the Present Value of $6000 received 10 years from today if the discount rate is 10%. 1e. Find the Future Value of $3000 per year (at the end of each year) invested at 6% for 30 years. 1f. Find the Future Value of $3000 per year (at the end of each year) invested at 12% for 30 years. 1g. Find the Present Value of $4000 per year (at the end of each year) if the discount rate is 15% for 20 years. 1h. Find the Present Value of $4000 per year (at the end of each year) if the discount rate is 15% for 40 years.

Find the interest rates implied by each of the following:

2a. You borrow $1500 today and promise to repay the loan by making a single payment of $2114.00 in 5 years. 2b. You invest $500 today and receive a promise of receiving back $193.50 for each of the next 4 years.

If $2000 is invested today at a 12% nominal interest rate, how much will it be worth in 15 years if interest is compounded

3a. Annually 3b. Quarterly 3c. Monthly 3d. Daily (365-days per year)

How long will it take your money to triple given the following interest rates?

4a. 5% 4b. 10% 4c. 15%

After graduating from college you make it big — all because of your success in business finance. You decide to endow a scholarship for needy finance students that will provide $5000 per year indefinitely, beginning 1 year from now. How much must be deposited today to fund the scholarship under the following conditions.

5a. The interest rate is 10% 5b. The interest rate is 10% and the first payment is made 6 years from today instead of 1 year from today.

Find the present value of the following cash flow stream if the discount rate is 12%:

Years 1-10 $4000 per year Years 11-15 $6000 per year Years 16-20 $8000 per year

Find the value of the following cash flow stream at the end of year 30 if the rate of return is 8.75%:

Years 1-5 $3000 per year Year 6 $7500 Years 7-15 $9000 per year Years 16-30 $12,000 per year

Find the effective annual rate of interest for a nominal rate of 9% compounded

8a. Annually 8b. Quarterly 8c. Monthly 8d. Daily (365 days per year)

Your firm has a retirement plan that matches all contributions on a one-to-two basis. That is, if you contribute $3000 per year, the company will add $1500 to make it $4500. The firm guarantees a 9% return on your investment. Alternatively, you can “do-it-yourself” and you think you can earn 12% on your money by doing it this way. The first contribution will be made 1 year from today. At that time, and every year thereafter, you will put $3000 into the retirement account. If you want to retire in 25 years, which way are you better off?

Jen is planning for retirement. She plans to work for 32 more years. She currently has $15,000 saved and, for the next 15 years, she can save $6,000 at the end of each year. Fifteen years from now, she wants to buy a weekend vacation home that she estimates will require her to withdraw $100,000. How much will she have to save in years 16 through 32 so that she has exactly $750,000 saved when she retires? Assume she can earn 9% throughout the 32-year period.

You are a recent college graduate and want to start saving for retirement. You plan to save $2000 per year for the next 15 years. After that you will stop contributing and just allow your savings to accumulate for another 20 years. Your twin brother would rather wait awhile before he starts saving. He is not going to put away anything for the next ten years, then he will start making contributions at the end of each year for the final 25 years. You both anticipate earning a 9.5% rate of return on your investments. How much must your brother put away at the end of each year to have the same amount of money for retirement as you?

You are considering purchasing a new home. The house you are looking at costs $120,000 and you plan to make a 10% down payment. You checked with a bank and they have two mortgage loan options for you. The first is a 15-year mortgage at 6.25%. The second is a 30-year mortgage at 6.50%.

12a. What are your monthly payments for each loan? 12b. What is the total you will pay over the life of the loan for each loan? 12c. After one year you get a job transfer and have to sell the house. What is the payoff value of your remaining loan balance (hint: find PV of remaining payments)? 12d. Over the first year, how much did you pay in principal and how much did you pay in interest?

Solutions to CH 3 Exercises

Student resources.

Table: Future Value of $250 per month investment, in Appendix B

Financial Tables, in Appendix A

Setting up Your Financial Calculator, in Appendix B

TVM 5-Key Approach Guided Tutorial with HP10BII+, in Appendix B

TVM 5-Key Approach Guided Tutorial with TI-BAII+, in Appendix B

TVM 5-Key Approach Guided Tutorial with TI-83 or TI-84, in Appendix B

Attributions

Image: Mixed from Godkänd Grön Handskrivning by Anthony Poynton is licensed under CC0 1.0

Business Finance Essentials Copyright © 2018 by Dr. Kevin Bracker; Dr. Fang Lin; and jpursley is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License , except where otherwise noted.

Share This Book

Brought to you by:

Time Value of Money: A Home Investment Decision Dilemma

By: Arit Chaudhury, Varun Dawar, Rakesh Arrawatia

In early 2016, Naresh Jain was busy looking at various rental properties on popular real estate listing websites. Because of a sudden downturn in business conditions and an immediate need for money,…

- Length: 4 page(s)

- Publication Date: Jul 26, 2017

- Discipline: Finance

- Product #: W17453-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

- Supplements

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

In early 2016, Naresh Jain was busy looking at various rental properties on popular real estate listing websites. Because of a sudden downturn in business conditions and an immediate need for money, Jain's landlord wanted to sell the property and therefore had asked Jain to vacate the premises within 30 days. Jain had been living in the spacious, two-bedroom apartment in North West Delhi for the past five years as it was within a reasonable commuting distance to his workplace. After looking at various rental properties, Jain had come across a furnished apartment identical to his, next door, and met with a broker to discuss it. During the discussion, it came up that an identical apartment in an adjoining locality was for sale at ₹12.5 million. Jain was thus faced with a quantitative finance decision of buy versus rent to arrive at the right option for him given his current financial conditions and the potential future benefits.

The authors Arit Chaudhury and Varun Dawar are affiliated with Institute of Management Technology, Ghaziabad.

Learning Objectives

This case can be used in a corporate finance or financial management course in an undergraduate or MBA program. The case illustrates practical usage of the time value of money concept and techniques to quantitatively evaluate the classic decision of buying versus renting a home. After working through the case and assignment questions, students will be able to do the following: Understand the practical concepts and techniques of the time value of money. Understand the present and future value estimation framework. Estimate relevant cash flows, including equated monthly installments, after taking into account taxation and opportunity cost considerations. Perform quantitative evaluation, using the time value of money framework, for the proposed alternatives of buying versus renting.

Jul 26, 2017

Discipline:

Geographies:

Industries:

Real estate industry

Ivey Publishing

W17453-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Public Discovery of the Concept of Time Value of Money with Economic Value of Time

Proceedings of MICoMS 2017

eISBN : 978-1-78756-793-1

ISSN : 2516-2853

Publication date: 4 May 2018

Purpose – The purpose of this research is to know the public discovery of the concept of time value of money with economic value of time.

Design/Methodology/Approach – The method of research involved a causal research design in North Sumatera Province, Indonesia. The data used are primary data sourced from questionnaires distributed to 112 random respondents. Data were analyzed using the SEM method with Smart PLS software.

Findings – The results show that the public do not know exactly the application and the concept of “time value of money” and the economic value of time.

Research Limitations/Implications – The limitation of this study is that it was conducted on heterogeneous Medan city samples and did not extend to other cities in North Sumatra with large samples. The study has implications on the socialization of the community’s understanding of the concept of time value of money with the economic value of time.

Originality/Value – This study has value in that it compares the understanding of the society over the concept model of time value of money and the economic value of time.

- Time value of money

- Economic value of time

- Public discovery

Muda, I. and Hasibuan, A.N. (2018), "Public Discovery of the Concept of Time Value of Money with Economic Value of Time", Proceedings of MICoMS 2017 ( Emerald Reach Proceedings Series, Vol. 1 ), Emerald Publishing Limited, Leeds, pp. 251-257. https://doi.org/10.1108/978-1-78756-793-1-00050

Emerald Publishing Limited

Copyright © 2018, Emerald Publishing Limited

Published in the Emerald Reach Proceedings Series. Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at The full terms of this licence may be seen at http://creativecommons.org/licences/by/4.0/legalcode

1. Introduction

The concept of time value of money is needed by financial managers for making decisions on when to invest in an asset and when to determine the source of loan funds to be allocated. If a certain amount of money will be received at a future time, in the present value, then the amount of money should be discounted with a certain interest rate ( Zaman and Movassaghi, 2002 ; Thomi, 2014 ). If a certain amount of money is currently in value for the future, then the amount of money must be multiplied by a certain interest rate. Limitations that will lead to the public only save money if (for) apbila high bank interest rates, because they assume that if the bank’s interest is high, then the money they will receive in the future is also high ( Syahyunan et al ., 2017 ). The time value of money does not take into account the inflation rate. The question of whether there is any time value of money in Islam has always been asked by many parties – from experts to practitioners. Although the answer to this question will illustrate how the attitude of Islamic economics determine the parameters of investment decisions ( Qureshi, 2013 ), the answer would be one of the benchmarks in differentiating Islamic economics with today’s modern economy, especially in the financial sector. Time value of money basically represents a person’s time preference in holding money. Based on this theory, an economic actor is assumed to be more inclined to hold current money than the future. According to conventional assumptions that human preference is only driven by human nature, there is nothing wrong in the theory of time value of money. The only question is whether Islamic economics follows the same concept on this issue. In Islamic economic theory, it must be admitted that man has an inherent need according to the traits existing in him. However, to meet that need, he is not free to do anything he wants because he is limited by the law ( sharia ) and the values ( aqeedah ) and morals he believes. In this paper, we discuss this theory on the basis of this philosophy and on the assumptions underlying why the time value of money exists ( Akacem and and Gillian, 2002 ; El-Ansary, 2005 ; Babikir, 2006 ; Campante and Drott, 2015 ; Khoir, 2016 ). Therefore, we will discuss it through the theory of economic behavior because it may be that the time value of money differs from the Islamic perspective not solely on the field of application but on the basic assumption of economic behavior. With regard to wealth, in Islamic economics, the crucial question is essentially not “how” or “when” ( Khan and Mirakhor, 1989 ; Haron and Ahmad, 2000 ; Huda et al ., 2008 ; Karim, 2014 ), but more important is the question “for what.” The economic value of time is a concept whereby time has an economic value, but money does not have a time value. The economic value of time can be interpreted to maximize the economic value of a fund at a periodic time. The basic calculation on the principle of time-based value of money is interest, while the basic calculation of the principle based on the economic value of time is ratio. The first question is how and when, assuming that all human beings have the same preference, is man consistent with the principle or the economic rationality ( Mukhtar et al ., 2014 ). In Islamic economics, there is no assumption that some money will provide fixed income because it does not have a fixed pre-determined return concept possessed by conventional finance through an interest-based economy. With the concept of assuring the profit of a certain amount of money, one would be more inclined to hold the present money than later, for there is a definite advantage that he can get from holding that money now. Or if he holds the money, then there must be a compensation for the profit he should get.

This type of research is a comparative study, which is conducted to compare the similarities and differences between two or more facts and the properties of the object in detail based on a particular frame of mind. In this study, the variables are self-sufficient but further study is needed for more than one sample or at different times ( Achmad and Muda, 2017 ; Badaruddin et al ., 2017 ; Nurlina and Muda, 2017 ; Sirojuzilam and Muda, 2017 ; Hasan et al., 2017 ; Honggowati et al., 2017 ; Muda et al., 2018 ). A total of 112 respondents were randomly selected for this research for understanding the concept of the time value of money with the economic value of time (Khoir, 2016). The indicators of the questions include rationality, falah in the world and the hereafter, the concept of need, and orientation of the balance between consumers and producers.

3. Result and discussion

3.1. results, 3.1.1. evaluation of the structural model (inner model)..

Inner model evaluation through the bootstrapping menu also generates T - statistics values that will be used to test the hypothesis. The criteria are T - statistic > 1.66 ( Dalimunthe and Muda, 2017 ; Ferine et al ., 2017 ; Sirojuzilam and Muda, 2017). If the value of t count < t table , then H 0 is accepted and when the value of t count > t table then H 0 is rejected, which means that for the variable in question there is a significant influence ( Lutfi et al ., 2016 ; Ferine et al ., 2017; Lubis et al ., 2017 ; Marhayanie et al ., 2017 ; Muda, 2017 ; Sihombing et al ., 2017 ). This means that the independent variables tested have a significant effect on the dependent variable. The result of the T -statistics value in the path coefficients of the table is presented in Figure 1 .

Overall Model with Coefficient

The test effect can be seen in Table 1 .

The Result of Bootstrapping

If Table 1 provides a coefficient of 0.005, smaller than 1 α = 5%, then the decision of the hypothesis testing is to reject H 0 and accept the hypothesis H a ( Asmeri et al ., 2017 ; Hanggowati et al. , 2017; Jones et al. , 2017 ; Khoiruman and Haryanto, 2017 ; Muda et al ., 2017 ; Rahmawati et al ., 2017 ; Suprianto et al ., 2017 ). The results show that the economic value of time is a significant variable on the application and the concept model ( Y ). In addition to testing the hypothesis through the bootstrapping menu, which produces T -statistics, inner model evaluation is also done by reviewing the R 2 value ( Muda, 2017 ). The R 2 value generated from the inner model evaluation is presented in Table 2 and Figure 2 .

The variation of the R 2 value is 75.6%. The economic value of time is a significant variable on the application and the concept model ( Y ).

3.2. Discussion

Islamic economic perspectives are not familiar with the method of time value of money because this method adds value to money solely with increasing time and not the effort that it actually leads to Ribawi transactions as the opinion of Imam Nawawi provides definitions related to the addition of value of money which is based only on time value is the category of usury. Islam actually knows the money value of time, that is, time has an economic value. In accordance with Islamic teachings, efficient and fair monetary management is not based on the application of the method of interest. Redeeming the decline in the value of money due to eroded inflation and consumption of time is to make money productive and/or recover the yield that exceeds the rate of inflation. The most effective way is to invest the funds in order to generate returns above the inflation rate so that the value of the existing money is relatively fixed or can even increase.

4. Limitation and implications

The limitation of this study is that it was conducted on heterogeneous Medan city samples and did not extend to other cities in North Sumatra with larger sample sizes. The study has implications on the socialization of the community’s understanding of the concept of time value of money with the economic value of time.

5. Conclusions

The results show that the public do not know exactly the application and the concept model of the time value of money and the economic value of time.

Achmad , N. and Muda , I. ( 2017 ). “ Economic Activities of Karo Older Adults in Lingga Village, Tanah Karo Regency, North Sumatera, Indonesia ”. International Journal of Economic Research , Vol. 14 , No. 16 , pp. 365 – 379 .

Akacem , M. and Gillian , L. ( 2002 ). “ Principles of Islamic Banking: Debt Versus Equity Financing ”, Middle East Policy , Vol. 9 , No. 1 , pp. 127 – 131 .

Asmeri , R. , Alvionita , T. and Gunardi , A. ( 2017 ). “ CSR Disclosures in the Mining Industry: Empirical Evidence from Listed Mining Firms in Indonesia ”. Indonesian Journal of Sustainability Accounting and Management , Vol. 1 , No. 1 , pp. 16 – 22 . Doi: 10.28992/ijsam.v1i1.23.

Babikir , A.O. ( 2006 ). “Islamic Banking in Practice” . In Paper presented in International Course on Principles and Practices of Islamic Economics and Banking , Baku , Azerbaijan .

Badaruddin , R. , Ermansyah , E. and Muda , I. ( 2017 ). “ Village Governance with Implementation of Law Number 6 of 2014 on the Village and Village Administration ”. International Journal of Economic Research , Vol. 14 , No. 16 , pp. 350 – 363 .

Campante , F. and Drott , D.Y. ( 2015 ). “ Does Religion Affect Economic Growth and Happiness? Evidence from Ramadan ”. The Quarterly Journal of Economics , Vol. 130 , No. 2 , pp. 615 – 658 .

Dalimunthe , D.M.J. and Muda , I. ( 2017 ). “ The Empirical Effect of Education and Training to the Performance of Employees ”. International Journal of Applied Business and Economic Research , Vol. 15 , No. 24 , pp. 5423 – 5437 .

El-Ansary , W. ( 2005 ). “The Quantum Enigma and Islamic Sciences of Nature: Implications for Islamic Economic Theory” . In Paper presented at the 6th International Conference on Islamic Economics , Jeddah .

Ferine , F.K. , Ermiaty , C. and Muda , I. ( 2017 ). “ The Impact of Entrepreneurship and Competence on Small Medium Enterprises Tangan Di Atas (TDA) Medan Entrepreneurs’ Work Performance ”. International Journal of Economic Research , Vol. 14 , No. 16 , pp. 380 – 393 .

Haron , S. and Ahmad , N. ( 2000 ). “ The Effects of Conventional Interest Rates and Rate of Profit on Funds Deposited with Islamic Banking System in Malaysia ”. International Journal of Islamic Financial Services , Vol. 1 , No. 4 , pp. 89 – 107 .

Hasan , A. , Gusnardi and Muda , I. ( 2017 ). “ Analysis of Taxpayers and Understanding Awareness Increase in Compliance With Taxpayers Individual Taxpayers ”. International Journal of Economic Research , Vol. 14 , No. 12 , pp. 75 – 90 .

Honggowati , S. , Rahmawati , R. , Aryani , Y.A. and Probohudono , A.N. ( 2017 ). “ Corporate Governance and Strategic Management Accounting Disclosure ”. Indonesian Journal of Sustainability Accounting and Management , Vol. 1 , No. 1 , pp. 23 – 30 . Doi: 10.28992/ijsam.v1i1.24.

Huda , N. , Nasution , M.E. , Risza , I.H. and Ranti , W. ( 2008 ). Macroeconomic Economics Theoretical Approach . Kencana Publishers , Jakarta .

Jones , P. , Wynn , M. , Hillier , D. and Comfort , D. ( 2017 ). “ The Sustainable Development Goals and Information and Communication Technologies ”. Indonesian Journal of Sustainability Accounting and Management , Vol. 1 , No. 1 , pp. 1 – 15 . DOI: 10.28992/ijsam.v1i1.22.

Karim , A.A. ( 2014 ). Macroeconomic Economics ( 3rd ed.). PT RajaGrafindo Persada Publishers , Jakarta .

Khan , M.S. and Mirakhor , A. ( 1989 ). “ The Financial System and Monetary Policy in an Islamic Economy ”. Journal of King Abdul Aziz University: Islamic Economics , Vol. 1 , No. 1 , pp. 39 – 57 .

Khoir , M. ( 2016 ). “ Time Rate of Money in Islamic Economic Perspective ”. Journal of Sharia Economics , Vol. 42 , No. 2 , pp. 71 – 84 .

Khoiruman , M. and Haryanto , A.T. ( 2017 ). “ Green Purchasing Behavior Analysis of Government Policy About Paid Plastic Bags ”. Indonesian Journal of Sustainability Accounting and Management , Vol. 1 , No. 1 , pp. 31 – 39 . DOI: 10.28992/ijsam.v1i1.25.

Lubis , A. , Rustam and Muda , I. ( 2017 ). “ Factors Affecting the Cost of Agency of Village Owned Enterprise (BUMDES) in Indonesia ”. International Journal of Economic Research , Vol. 14 , No. 16 , pp. 334 – 348 .

Lutfi , M. , Nazwar , C. and Muda , I. ( 2016 ). “ Effects of Investment Opportunity Set, Company Size and Real Activity Manipulation of Issuers in Indonesia Stock Exchange on Stock Price in Indonesia ”. International Journal of Economic Research , Vol. 13 , No. 5 , pp. 2149 – 2161 .

Marhayanie , Ismail , M. and Muda , I. ( 2017 ). “ Impact of the Online Car Rental Service Order System on Sales Turnover with Financial Literacy Customer as Intervening Variables ”. International Journal of Economic Perspectives , Vol. 14 , No. 16 , pp. 317 – 332 .

Muda , I. , Dharsuky , A. , Siregar , H.S. and Sadalia , I. ( 2017 ). “ Combined Loading and Cross-Dimensional Loadings Timeliness of Presentation of Financial Statements of Local Government ”. IOP Conference Series: Materials Science and Engineering , Vol. 180 , pp. 1 – 5 . DOI: 10.1088/1757-899X/180/1/012099.

Muda , I. , Rahmanta , S.A. and Marhayanie. ( 2017 ). “ The Role of Working Capital, Productivity, Applied Technology and Selling Market Prices on Fisherman’s Revenues ”. International Journal of Economic Research , Vol. 14 , No. 16 , pp. 291 – 302 .

Muda , I. , Weldi , M. , Siregar , H.S. and Indra , N. ( 2018 ). “ The Analysis of Effects of Good Corporate Governance on Earnings Management in Indonesia with Panel Data Approach ”. Iranian Economic Review , Vol. 22 , No. 2 , pp. 657 – 669 .

Muda , I. ( 2017 ). “ The Effect of Allocation of Dividend of the Regional Government-Owned Enterprises and the Empowerment Efforts on the Revenue of Regional Government: The Case of Indonesia ”. European Research Studies Journal , Vol. XX , No. 3A , pp. 223 – 246 .

Mukhtar , M.M. , Nihal , H.M.S. , Rauf , H.A. , Wasti , W. and Qureshi , M.S. ( 2014 ). “ Socio-Economic Philosophy of Conventional and Islamic Economics: Articulating Hayat-e-Tayyaba Index (HTI) on the Basis of Maqāṣid al-Sharī’ah ”. Islamic Economic Studies , Vol. 22 , No. 2 , pp. 65 – 98 .

Nurlina and Muda , I. ( 2017 ). “ The Analysis of the Effects of Capital Expenditure and Human Development Index on Economic Growth and Poverty in East Aceh Regency ”. International Journal of Economic Research , Vol. 14 , No. 16 , pp. 395 – 409 .

Qureshi , M.S. ( 2013 ). “Entrepreneurship plus: The Impact of Spiritual Orientation on Entrepreneurial Orientation, Market Orientation and the Entrepreneurial Process” . In Paper Presented at the International Research Conference on Contemporary Management Practices , Lahore School of Economics , Lahore, Pakistan .

Rahmawati , R. , Rispantyo , R. and Djamaluddin , S. ( 2017 ). “ Mentoring Function and Quality of Supervisor Auditor Relationship: Organizational Justice as a Mediation . Indonesian Journal of Sustainability Accounting and Management , Vol. 1 , No. 1 , pp. 40 – 48 . DOI: 10.28992/ijsam.v1i1.26.

Sihombing , M. , Muda , I. , Jumilawati , E. and Dharsuky , A. ( 2017 ). “ Factors Affecting the Success of Local Innovation Systems with Government Programs as Moderators ”. International Journal of Economic Research , Vol. 14 , No. 16 , pp. 272 – 289 .

Sirojuzilam , H.S. and Muda , I. ( 2017 ). “ Effect of Private Collaborative as a Moderation of Success of Agropolitan Program . International Journal of Economic Research , Vol. 14 , No. 16 , pp. 304 – 315 .

Suprianto , E. , Suwarno , S. , Murtini , H. , Rahmawati , R. and Sawitri , D. ( 2017 ). “ Audit Committee Accounting Expert and Earnings Management with “Status ” Audit Committee as Moderating Variable”. Indonesian Journal of Sustainability Accounting and Management , Vol. 1 , No. 2 , pp. 49 – 58 . DOI: 10.28992/ijsam.v1i2.16.

Syahyunan , Muda , I. , Siregar , H.S. , Sadalia , I. and Chandra , G. ( 2017 ). “ The Effect of Learner Index and Income Diversification on the General Bank Stability in Indonesia ”. Banks and Bank Systems , Vol. 12 , No. 4 , pp. 56 – 64 . DOI: http://10.21511/bbs.12(4).2017.05.

Thomi , D.K. ( 2014 ). The Effect of Islamic Banking Products on Financial Performance of Commercial Banks in Kenya. The Degree of Master of Business Administration. The University of Nairobi .

Zaman , M.R. and Movassaghi , H. ( 2002 ). “ Interest-Free Islamic Banking: Ideals and Reality . The International Journal of Finance , Vol. 14 , No. 4 , pp. 2428 – 2443 .

All papers within this proceedings volume have been peer reviewed by the scientific committee of the Malikussaleh International Conference on Multidisciplinary Studies (MICoMS 2017).

Corresponding author

Book chapters, we’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Transnational Dispute Management

Skip navigation

The network for international arbitration, mediation and ADR, international investment law and Transnational Dispute Management

Time Value of Money: A Case Study

- Table of contents

- In this category

- Suggested citation

Article from: TDM 6 (2007), in Compensation and Damages in International Investment Arbitration

In this article, we wish to examine the possible methods of adjusting the value of damages to reflect current day monetary values. The main question is: What reasonable rate of interest accruing from the date of loss needs to be applied to account for the passage of time? Thus the principal aims of the article are: (1) to identify standards from the fields of economics and finance that may be employed to achieve this purpose; (2) to recommend the most appropriate financial basis on which the actualization may be carried out; and (3) to formulate arguments to support the ...

To read this article you need to be a subscriber

Forgot password?

Fill in the registration form and answer a few simple questions to receive a quote.

Subscribe now

Why subscribe?

Tdm journal.

Access to TDM Journal articles (well over 2500 articles in total for Premium account holders)

Legal & regulatory

Access to Legal & Regulatory data (well over 10000 documents)

OGEMID membership (lively discussion platform bringing together the world's international dispute management community)

Suggested Citation T. Senechal; "Time Value of Money: A Case Study" TDM 6 (2007), www.transnational-dispute-management.com URL: www.transnational-dispute-management.com/article.asp?key=1185

7.3 Methods for Solving Time Value of Money Problems

Learning outcomes.

By the end of this section, you will be able to:

- Explain how future dollar amounts are calculated.