Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Case Study: Consolidated Balance Sheet At Date Of Purchase

2016, Journal of Business Case Studies (JBCS)

Consolidated financial statements have gained great popularity over the last decade with the resurrection of acquisitions and the increased global expansion of business. This case study provides an actual case study of the preparation and presentation of a Consolidated Balance Sheet on the date of acquisition. An in-depth analysis is provided as to how to value the acquired entity, how to calculate Goodwill and how to measure the Non-Controlling interest portion. Work paper and adjusting entries are also highlighted to help facilitate the consolidation process.

Related Papers

Advances in Accounting

Agnes Cheng

Journal of International Financial Management & Accounting

Juan Jose Piñero

In this paper we investigate the value‐relevance of consolidated versus parent company accounting information. In particular we investigate the value relevance of the minority interest components of net total assets and earnings as currently reported and under the full entity approach to consolidated reporting. An Edwards‐Bell‐Ohlson valuation framework is used to generate results. By this means we cast light on the suitability of accounting regulation being developed based upon the entity or parent company theories of consolidation. We carry out the analysis in the Spanish context and the sample contains 474 observations of non‐financial firms quoted in the Madrid Stock Exchange for the period 1991–97. The results from this analysis not only have domestic relevance but provide guidance of a more international nature relating to the impact of group definition, concepts of control and the most value relevant method of consolidated disclosure. The results show that, from a valuation p...

The international journal of accounting and business society

Bambang Pramuka

The intent of consolidated financial statements is to provide meaningful, relevant, useful, and reliable information about the operations of a group of companies. In compliance with AASB 1024 ’Consolidated Accounts’, and AAS 24 Consolidated Financial Reports’, a parent entity now has to include in its consolidated financial statements all controlled entities, regardless of their legal form or the ownership interest held. The new Standard also provides a new style of consolidated financial statements format, which requires an increased disclosure of outside equity interest (OEI, formerly minority interest), especially in the Balance Sheet. The purpose of this study is to determine the impact of AASB 1024 on the consolidated financial statements of effected companies. Examination of the financial statements of 52 companies reveals that: (1) the adoption of AASB 1024 (and AAS 24) did significantly alter the structu...

AJHSSR Journal

This study aims to analyze the differences in the company's financial performance between before and after being acquired based on financial ratios. This research was conducted at acquired companies listed on the Indonesia Stock Exchange for the period 2013-2017. The population of this study was 559 companies. The sampling method used was non-probability sampling method with a purposive sampling approach. The sample obtained was 5 companies. The method of collecting data used was the non-participant observation method. The data analysis technique used paired sample t test (paired sample T-test) and Wilcoxon signed ranks test. Based on the analysis, it is found that financial performance is measured by current ratio (CR), total debt to total assets (DAR), long term debt to equity (DER), return on total assets (ROA), return on equity (ROE), net profit margin (NPM), total assets turnover (TATO), and earnings per share (EPS) found no significant differences before and after the acquisition. The economic motive of the company cannot be achieved, but the motives that are thought to underlie the acquisition are non-economic motives and diversification. This research is expected to contribute to investors and company management in taking action to expand the company.

Mahdi Salehi

Mohammad Labu

Financial Analysis of Mergers and Acquisitions

Choice Reviews Online

Richard Westin

Fauziah Fitri

Acquisition is believed as a strategy to improve performance of a company. However, several previous researches shows that acquisition can not improve the performance. The purpose of this study is to examine the impact of acquisition on acquirer companies’ financial performance. The population of this study is 21 Indonesian companies that involved in acquisition during 2011-2013. The data is financial ratios, collected from Indonesian Capital Market Directory provided by Indonesian Stock Exchange website. To analyse the performance, five ratios are used in this research. Paired sample t-test is applied on the ratios with the help of statistical software called PASW (Predictice Analytics Software). The findings confirm that liquidity, leverage, efficiency, profitability, and market value decrease insignificantly a year after acquisition. Therefore, it is concluded that there is no different in financial performance before and after acquisition. Keywords: Acquisition, acquirer compani...

Halvard Arntzen

RELATED PAPERS

British Journal of Plastic Surgery

Lucas Chester

Gayana. Botánica

mélica muñoz schick

Proceedings of the ACM on Human-Computer Interaction

TURKISH JOURNAL OF BIOLOGY

HIZLAN HINCAL AGUS

E3S Web of Conferences

Marcin Wdowikowski

ambar susanti

Western Indian Ocean journal of marine science

Hugo Mabilana

Journal of Advanced Research in Dynamic and Control Systems

windy mooduto

Logica Universalis

C. Sernadas

Animal science journal = Nihon chikusan Gakkaiho

Revista Eletrônica de Comunicação, Informação e Inovação em Saúde

Luciane Salaroli

Acta Obstetricia et Gynecologica Scandinavica

syahrul fitra

Thiago Oliveira Moreira

Qualidade e políticas públicas na educação 2

Eduardo Freire

Geografares

Christian Laval

Archives of General Psychiatry

Evelyn Stewart

Nur Hafsah Yunus MS

Carlo Tasso

Revista Ibero-Americana de Humanidades, Ciências e Educação

Paulo Sabino

International Journal of Insect Morphology and Embryology

Terrance Adams

Mustapha Ibrahim

Epidemiology

Alisa Jenny

Physics Letters B

Barry Holstein

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Search Search Please fill out this field.

- Understand Consolidated Financials

Reporting Requirements

- Cost and Equity Methods

Company Examples

The bottom line.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Consolidated Financial Statements: Requirements and Examples

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Consolidated financial statements are financial statements of an entity with multiple divisions or subsidiaries. Companies often use the word consolidated loosely in financial statement reporting to refer to the aggregated reporting of their entire business collectively. However, the Financial Accounting Standards Board defines consolidated financial statement reporting as reporting of an entity structured with a parent company and subsidiaries.

Private companies have very few requirements for financial statement reporting, but public companies must report financials in line with the Financial Accounting Standards Board’s Generally Accepted Accounting Principles (GAAP) . If a company reports internationally, it must also work within the guidelines laid out by the International Accounting Standards Board’s International Financial Reporting Standards (IFRS) . Both GAAP and IFRS have some specific guidelines for companies that choose to report consolidated financial statements with subsidiaries.

Key Takeaways

- Consolidated financial statements are strictly defined as statements collectively aggregating a parent company and subsidiaries.

- GAAP and IFRS include provisions that help to create the framework for consolidated subsidiary financial statement reporting.

- If a company doesn’t use consolidated subsidiary financial statement reporting, it may account for its subsidiary ownership using the cost or equity methods.

Investopedia / Michela Buttignol

Understanding Consolidated Financial Statements

The consolidation of financial statements integrates and combines all of a company's financial accounting functions to create statements that show results in standard balance sheet , income statement , and cash flow statement reporting. The decision to file consolidated financial statements with subsidiaries is usually made on a year-to-year basis and is often chosen because of tax or other advantages that arise. The criteria for filing a consolidated financial statement with subsidiaries is primarily based on the amount of ownership the parent company has in the subsidiary.

Generally, 50% or more ownership in another company defines it as a subsidiary and gives the parent company the opportunity to include the subsidiary in a consolidated financial statement. In some cases, less than 50% ownership may be allowed if the parent company shows that the subsidiary’s management is heavily aligned with the decision-making processes of the parent company.

If a company has ownership in subsidiaries but does not choose to include a subsidiary in complex consolidated financial statement reporting, then it will usually account for the subsidiary ownership using the cost method or the equity method .

Private companies will usually make the decision to create consolidated financial statements that include subsidiaries on an annual basis. This annual decision is usually influenced by the tax advantages a company may obtain from filing a consolidated vs. unconsolidated income statement for a tax year.

Public companies usually choose to create consolidated or unconsolidated financial statements for a longer period of time. If a public company wants to change from consolidated to unconsolidated, it may need to file a change request. Changing from consolidated to unconsolidated may also raise concerns with investors or complications with auditors, so filing consolidated subsidiary financial statements is usually a long-term financial accounting decision. There are, however, some situations where a corporate structure change may call for a changing of consolidated financials, such as a spinoff or acquisition.

Private companies have very few requirements for financial statement reporting, but public companies must report financials in line with the Financial Accounting Standards Board’s Generally Accepted Accounting Principles (GAAP). If a company reports internationally, it must also work within the guidelines laid out by the International Accounting Standards Board’s International Financial Reporting Standards (IFRS). Both GAAP and IFRS have some specific guidelines for entities that choose to report consolidated financial statements with subsidiaries.

Generally, a parent company and its subsidiaries will use the same financial accounting framework for preparing both separate and consolidated financial statements. Companies that choose to create consolidated financial statements with subsidiaries require a significant investment in financial accounting infrastructure due to the accounting integrations needed to prepare final consolidated financial reports.

There are some key provisional standards that companies using consolidated subsidiary financial statements must abide by. The primary one mandates that the parent company or any of its subsidiaries cannot transfer cash, revenue, assets, or liabilities among companies to unfairly improve results or decrease taxes owed. Depending on the accounting guidelines used, standards may differ for the amount of ownership that is required to include a company in consolidated subsidiary financial statements.

Consolidated financial statements report the aggregate reporting results of separate legal entities. The final financial reporting statements remain the same in the balance sheet, income statement, and cash flow statement. Each separate legal entity has its own financial accounting processes and creates its own financial statements. These statements are then comprehensively combined by the parent company to final consolidated reports of the balance sheet, income statement, and cash flow statement. Because the parent company and its subsidiaries form one economic entity, investors, regulators, and customers find consolidated financial statements helpful in gauging the overall position of the entire entity.

Ownership Accounting: Cost and Equity Methods

There are primarily three ways to report ownership interest between companies. The first way is to create consolidated subsidiary financial statements. The cost and equity methods are two additional ways companies may account for ownership interests in their financial reporting. Overall, ownership is usually based on the total amount of equity owned. If a company owns less than 20% of another company's stock, it will usually use the cost method of financial reporting. If a company owns more than 20% but less than 50%, it will usually use the equity method .

Berkshire Hathaway Inc. (BRK.A, BRK.B) and Coca-Cola (KO) are two company examples. Berkshire Hathaway is a holding company with ownership interests in many different companies. It uses a hybrid consolidated financial statements approach, as seen in its financials. For example, its consolidated financial statement breaks out its businesses by Insurance and Other, then Railroad, Utilities , and Energy. Its ownership stake in publicly traded company Kraft Heinz (KHC) is accounted for through the equity method.

Coca-Cola is a global company with many subsidiaries. It has subsidiaries around the world that help it to support its global presence in many ways. Each of its subsidiaries contributes to its food retail goals with subsidiaries in the areas of bottling, beverages, brands, and more.

What Is Consolidated vs. Separate Financial Statement?

A separate financial statement reports on the finances of a single entity. A consolidated financial statement reports on the entirety of a company with detailed information about each subsidiary.

How Do Consolidated Financial Statements Work?

Consolidated financial statements report a parent company's financial health and include financial information from its subsidiaries.

What Are the Requirements for Consolidated Financial Statements?

If a parent company has 50% or more ownership in another company, that other company is considered a subsidiary and should be included in the consolidated financial statement. This also applies if the parent company has less than 50% ownership but still has a controlling interest in that company.

Consolidated financial statements include the aggregated financial data for a parent company and its subsidiaries. Private companies have more flexibility with financial statements than public companies, which must adhere to GAAP standards.

Financial Accounting Standards Board. " S99 SEC Materials ."

Berkshire Hathaway via U.S. Securities and Exchange Commission. " Form 10-Q ."

Coca-Cola. " Form 10-K, Exhibit 21.1 ." Click on Documents, then EX-21.1.

:max_bytes(150000):strip_icc():format(webp)/whollyownedsubsidiary.asp-final-d5a14f7bbd454e3b9922d066bd95650b.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Example: How to Consolidate

Let’s be more practical today and learn some advanced accounting techniques.

After summaries of standards related to consolidation and group accounts, I’d like to show you how to prepare consolidated financial statements step by step .

I’ll do it on a case study, with explaining what I do and why. If you don’t like reading, you can skip to the end of this article and watch my video.

If you’d like to revise a theory first, then please read my summary of IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements , both of them contain video in the end.

What’s the situation?

Here’s the question:

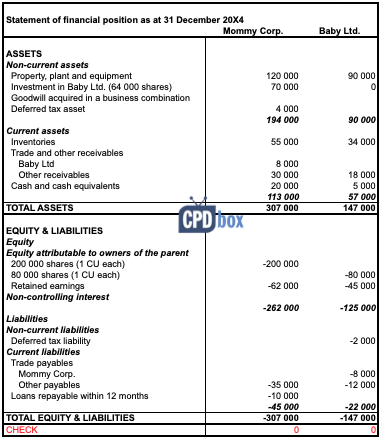

Mommy Corp has owned 80% shares of Baby Ltd since Baby’s incorporation.

Below there are statements of financial positions of both Mommy and Baby at 31 December 20X4.

Prepare consolidated statement of financial position of Mommy Group as at 31 December 20X4. Measure NCI at its proportionate share of Baby’s net assets.

Please note here that in the above statements of financial position, all assets are with “+” and all liabilities are with “-“ . I use it this way because for me it’s easier to verify and identify mistakes, but it’s up to you.

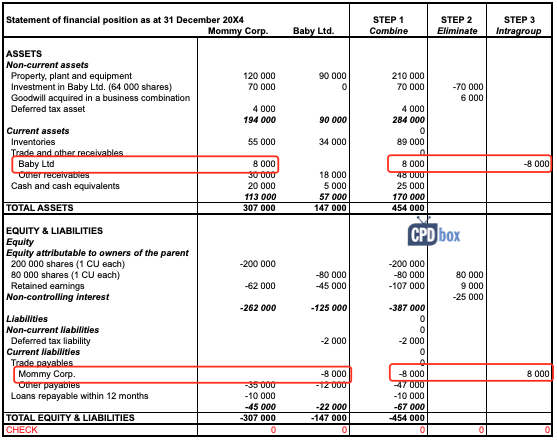

3 Steps in Consolidation Procedures

I have described the consolidation procedures and their 3-step process in my previous article with the summary of IFRS 10 Consolidated financial statements , but let me repeat it here and follow these steps:

- Combine like items of assets, liabilities, equity, income, expenses and cash flows of the parent with those of its subsidiaries;

- the carrying amount of the parent’s investment in each subsidiary; and

- the parent’s portion of equity of each subsidiary;

- Eliminate in full intragroup assets and liabilities, equity, income, expenses and cash flows relating to transactions between entities of the group.

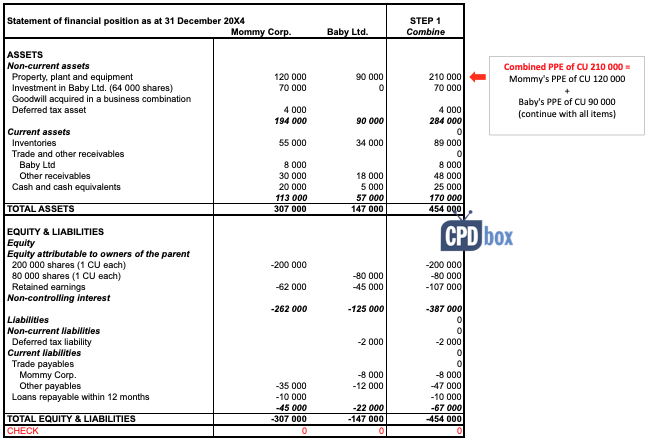

Step 1: Combine

After you make sure that all subsidiary’s assets and liabilities are stated at fair values and all the other conditions are met, you can combine, or add up like items.

It’s very easy when a parent (Mommy) and a subsidiary (Baby) use the same format of the statement of financial position – you just add Mommy’s PPE and Baby’s PPE, Mommy’s cash and Baby’s cash balance, etc.

Therefore, when a group controller calls you every five minutes to remind you the consolidation package, you’ll know why!

In our case study, combined numbers looks as follows:

Of course, there are some strange and redundant numbers, for example both Mommy’s and Baby’s share capital, but we haven’t finished yet!

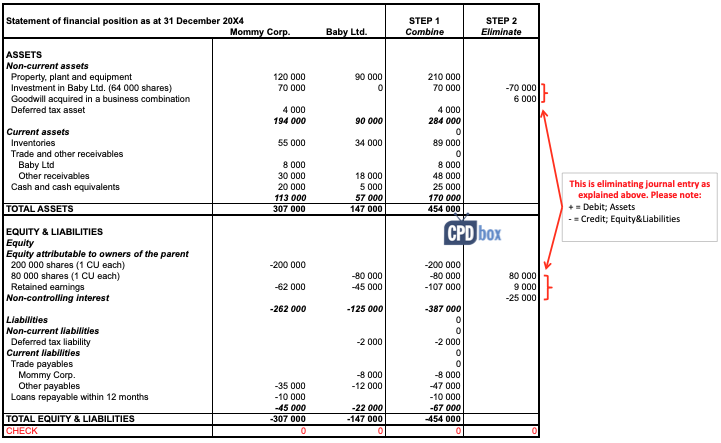

Step 2: Eliminate

After combining like items, we need to offset (eliminate) :

and of course, recognize any non-controlling interest and goodwill.

So let’s proceed. The first two items are easy – just remove Mommy’s investment into Baby (CU – 70 000), and remove Baby’s share capital in full (CU + 80 000).

As there is some non-controlling interest of 20% (please see below), you need to remove its share in Baby’s post-acquisition retained earnings of CU 9 000 (20%*CU 45 000).

Wait a second – how do we know that all Baby’s reserves (retained earnings) of CU 45 000 are post-acquisition?

Well, the question says that Mommy has owned Baby’s shares since its incorporation , therefore full Baby’s retained earnings are post-acquisition.

Be careful here, because you absolutely need to differentiate pre-acquisition retained earnings from post-acquisition retained earnings , but here, we’re not going to complicate the things.

Then we need to recognize any non-controlling interest and goodwill.

Non-controlling interest at 31 December 20X4

Mommy has owned 80% of Baby’s share and therefore, non-controlling interest owns remaining 20% of Baby’s net assets.

The question asks to measure non-controlling interest at proportionate share on Baby’s net assets, so here’s how it looks like at the end of the reporting period:

Baby’s net assets are CU 125 000 as at 31 December 20X4 , including Baby’s share capital of CU 80 000 and Baby’s post-acquisition reserves of CU 45 000.

Non-controlling interest at 31 December 20X4 is 20% of Baby’s net assets of CU 125 000, which is CU 25 000 . Recognize it with minus, as we are crediting equity with non-controlling interest.

Initial recognition of goodwill

There might be some goodwill arisen on initial recognition. If you’d like to learn more about goodwill, please refer to the article about IFRS 3 Business Combinations .

Let’s calculate it. Please don’t forget that we calculate goodwill based on numbers on acquisition , not on 31 December 20X4.

The goodwill is calculated as:

- Fair value of consideration transferred : in this case, we simply take Mommy’s investment in Baby of CU 70 000;

- Add any non-controlling interest at acquisition : here, we’re not adding the non-controlling interest calculated above, as it’s the measurement on 31 December 20X4. At acquisition, the value of non-controlling interest is 20% of Baby’s net assets on its incorporation of CU 80 000 (share capital only). It equals CU 16 000.

- When a business combination was achieved in stages, you would need to add the acquisition-date fair value of the acquirer’s previously-held equity interest in the acquiree, but in this example, it’s not applicable,

- Deduct Baby’s net assets at acquisition: CU – 80 000.

Goodwill acquired in a business combination comes to CU 6 000 (70 000 + 16 000 – 80 000).

The elimination entry looks as follows (sign “+” indicates a debit entry; sign “-“ indicates a credit entry):

I have transferred this journal entry into our consolidation worksheet and it looks as follows:

Eliminate Intragroup Transactions

Parents and subsidiaries trade with each other very often.

However, when you look at both parent and subsidiary as at 1 company, which is the purpose of consolidation, then you find out that there’s no transaction at all.

In other words, group has not performed any transaction from the view of some external user.

Therefore you need to eliminate all transactions happening within the group , between a parent and its subsidiaries.

Looking to above individual statements of financial position of Mommy and Baby you see that Mommy has a receivable to Baby of CU 8 000 and Baby has a payable to Mommy of CU 8 000 . Perhaps these 2 items relate to the same transaction between them and we need to eliminate them, by debiting payables and crediting receivables :

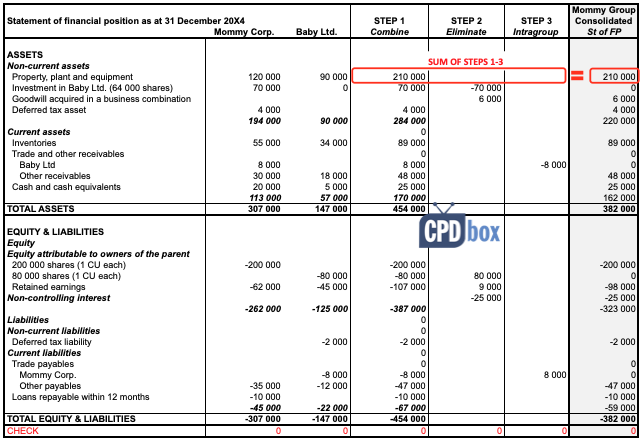

Final steps

After we have completed all steps or consolidation procedures, we can add up all the combined numbers with our adjustments and thus we arrive at consolidated statement of financial position.

You can revise all the steps and formulas in Excel file that you can download at the end of this article.

Here’s how it looks like:

Please note the following facts:

- Consolidated numbers are simply sum of Mommy’s balance, Baby’s balance and all adjustments or entries (Steps 1-3).

- Mommy’s investment in Baby’s shares is 0 as we eliminated it in the step 2. The same applies for Baby’s share capital and consolidated statement of financial position shows only a share capital of Mommy (parent).

- There’s a goodwill of CU 6 000 and non-controlling interest of CU 25 000, as we have calculated above.

- Mommy’s retained earnings of CU 62 000 in full, and

- Mommy’s share (80%) on Baby’s post-acquisition retained earnings of CU 45 000, that is CU 36 000

Exam-style consolidation

I know that many of you prepare for your exams and this is NOT the way how you learned consolidation during exam preparation courses.

OK, I understand.

I prefer this way of making consolidation by far, because here, you go systematically, step by step. You can deal with each adjustment in a separate column and as a result, your numbers will always balance. You will never forget anything.

The “exam-style” of making consolidated financial statements is good and easy when there are just a few issues or complications.

However, to make you happy, you can find the same case study solved “by the exam-style” in the attached excel file that you can download in the end of this article.

Is consolidation really easy?

But in most cases, there is lots of issues or circumstances that you need to take into account and exactly their significance and amount makes it all difficult.

What issues? For example:

- Consideration transferred for acquiring the shares may involve not only cash, but also some other forms, such as share issue, contingent consideration, transfers of assets, etc.

- Non-controlling interest can be measured at fair value instead of at proportionate share.

- There might be some unrealized profit on transactions within the group and it needs to be eliminated.

- There might be some transfer of property, plant and equipment at profit within the group and as a result, you need to adjust both unrealized profit and depreciation charge, too.

- Goodwill might be either positive or negative (=gain on a bargain purchase). Moreover, it can be impaired.

- Subsidiary’s net assets might be stated in the amounts different from their fair value , or even not recognized at all.

- Subsidiary may show both pre-acquisition retained earnings and post-acquisition retained earnings . You need to be extremely careful in differentiating them and dealing with them separately.

I can go on and on, but I don’t want to discourage you. However, if you need to know more about all these issues, I have covered them fully in my premium learning package the IFRS Kit , so please check out if interested.

DOWNLOAD EXCEL FILE HERE

Please watch the video here:

Further reading: Here’s the example of consolidation where a subsidiary has different functional currency than its parent. You’ll learn how to translate the subsidiary’s financial statements.

Here, you can learn the opposite process – disposal of subsidiary (deconsolidation) .

If you like this example and explanations, please help me spread a word about it and share it with your friends. Thank you! 1518169940415 -->

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

227 Comments

Hi Silvia, thanks for the insightful article. I have question on how to attribute post-acquisition profit to NCI where a shareholders’ agreement exists that modifies the profit entitlement of the subsidiary’s shareholders. Lets consider an example of a 60% owned subsidiary and the agreement between its shareholders’ provides the following:

1. The 40% share capital to be contributed by the other shareholders (hereafter referred to as “NCI”) shall be paid up by the parent company (who is the 60% shareholder) in form of advancement to NCI.

2. The advancement shall be repaid to the holding company by way of setting off against future dividend to be distributed to NCI.

In the absence of the above factors, the consolidated income statements of the parent company should report the profit attributable to the parent company and NCI based on their respective ownership interest. This would result in attributing CU 40 to NCI if the current year profit of the subsidiary is CU 100.

However, having the additional factors in mind, if the advancement owed by NCI is CU 40, and should there be any dividend distribution in the future, NCI will never get paid for the CU40 profit attributed to them because the payment will instead be diverted to the holding company to settle the advancement they owe. In that sense, should the CU 40 profit be attributed to NCI at the first place?

When we need to adjust the Subsidiary net assets to fair value – do we do revaluation entries in the consolidate statements ?

For example, if we need to recognise client lists or provisions that wouldn’t be in the individual statements – do we debit assets client lists and credit p&l

Or debit PPE – credit revaluation reserve ?

What about the provisions for probable liabilities ?

Hi Daniel, you do all adjustments when consolidating, but in the separate statements. If you are subscribed to our courses, there’s a full solved example about it.

How to account for the pre – acquisition deficit in an asset acquisition? In a business combination, this would be accounted when calculating goodwill.

You can read and watch the video about it here .

What is the difference between GAAP and IFRS when considering consolidation to GAAP financials in the US.

Basically they are completely different sets of accounting and reporting rules. Please see more here.

If I have company A which has associate B and B has subsidairy C 100% Now Company A wants to acquire full C What the impact in books of Company A and Company B

I just wanted to thank you for this amazing, wonderful and extraordinary work you do for us students. You really make IFRS more digest. you are a STAR!

Thanks Silvia. Helpful. Few requests, pl.. 1)Step 2: Eliminate – removing Baby’s share capital in full ,ie.CU 80 000. Could we remove only 64000, ie. the parent’s portion of Baby’s equity instead? 2)Removal of 20% NCI of Baby’s post-acquisition retained earnings: Why is this required, pl.?

Hi Selva- What is the possible case, that a dividends from subsidiaries are shown on the consolidated statement of cash flow only ?!

Hi Silvia, I have a question on consolidation and I hope that you can share your opinion on this problem. The background of the case was as follows:

Company A asked its directors to set up a company (Company B) in Country X in the 1980s. The shares in Company B are registered under the individual directors name. Company B operates independently from Company A and there was no information whether Company A has control over Company B.

In 2020, the new management of Company A sued the former directors and claimed that the shares held by them in Company B are in trust for Company A. In 2021, Company A won the suit and the Court passed a judgment saying that Company A is the rightful owner of the shares in Company B. The Court also ordered the former directors to pay Company A legal costs and all the dividends (plus interest) they received from Company B in those years. In 2022, the shares in Company B are successfully transferred to Company A and Company B become a wholly owned subsidiary of Company A.

My questions are:

(a) Is this a prior year adjustment? Can Company A recognise Company B as subsidiary in 2022 on the basis that Company A does not have control over B until the shares have been transferred?

(b) If Company A recognised Company B as subsidiary in 2022, what is the “cost of investments” amount to be recorded in A books? Is it legal fees incurred by Company A or the share capital of Company B?

(c) How does Company A record the compensation received (past dividends, interest and legal costs) from the former directors?

(d) How does the above transactions recorded in the Group level?

Thank you for your help. Kelvin

Thank you Silvia for your illustration , If you don’t mind I have two questions regarding the consolidation, the first one why we eliminate the retained earnings that exits at the acquisition date (or before the acquisition date) ? is it like the amount that it’s hidden for the future that the investor will take it from the investee ? the second question when we eliminate intragroup transactions regarding purchasing of PPE or Inventory : if the sale is made from the parent to its subsidiary why we do not reduce the subsidiary share for unrealized profit since the subsidiary will take part of the net Assets (equity) that are attributable to (non-controlling interest)? in other words if the net assets affected for the group the net assets for the non-controlling interest will be affected also. Thank you in advance. Regards, Mohammad Obeid

1. Because they enter in the goodwill calculation and do not belong to the group as they were achieved prior acquisition date. 2. Because the parent made unrealized profit, not the subsidiary, in your outlined transaction. Mohammed, I strongly recommend you to look inside the IFRS Kit, because these questions are all solved there.

Thank you for your response and advice, In reference to answer No. 2 , in your videos when the Subsidiary made sale to its parent you allocate the amount of unrealized profit also to Controlling interest(parent share in Retained Earnings , 80% of the total amount) although the amount of unrealized profit should reflect the non-controlling interest. Thanks in advance.

And that is correct. However in your question, you asked about the opposite situation.

yes but your answer is ” Because the parent made unrealized profit, not the subsidiary” regarding the reason of not allocating part of unrealized profit to non-controlling interest despite we calculate the percentage of unrealized profit to controlling interest in the case when the subsidiary made a sale to its parent.

Thank you for your Answer, Regarding answer No.1 if this is the case then all Assets and Liabilities that are acquired by the parent at the acquisition date are not belong to that investor because the Investee who assume these Assets and Liabilities, it’s like the retained earnings that achieved prior to the acquisition date right ?

No. Please see more in the IFRS Kit.

Thank you Silvia for your illustration, I have a question about the elimination for “related party” transactions, can we say that the reason of not including these transactions in the consolidated Financial Statements is these transactions are not between Arm’s length transactions and therefore it does not reflect the Commercial substance of the transaction since one party has control over another? For example the transfer pricing between the parent and subsidiary in different countries its just transfer the retained earnings or “Capital” from one country to another to avoid the taxation. Thank you in advance. Regards Mohammad Obeid

No. The reason for not including them in consolidated financial statements has nothing to do with commercial substance. They are included because if we treat the group as one entity, then these transactions are between “individual departments” within the same entity, so from the outside view, there are no transactions.

How do we consolidate if the acquisition date happened in the middle of the year?

Hi jan, basically you consolidate balance sheet in full and profit or loss only since the acquisition date until the end of the reporting period. Profit or loss items incurred from the beginning of the period til the acquisition date are considered pre-acquisition and enter into calculation of goodwill and NCI. I cover it quite well with practical examples in the IFRS Kit, so please check that out if interested.

Hi Silvia, An individual is a shareholder in both parent and subsidiary companies. Will his interest be added to the interest held by the parent company in determining the minority interest in a subsidiary company? Thanks

Hi Silvia, Thank you very much for the good work, We can leisurely learn and love to read the content. You can reshape people by sharing your knowledge.

I want to pay for IFRS kit, how do I do it? In Uganda

Please write me via Contact form. Thank you!

if there are intercompany sales. is the minority interest calculated based on the eliminated net income.for eg if the standlone net income of the subsidiary is 20,000 after elimination it is 15,000. then minority interest share of earnings will be 15000 multiplied by ownership % of minority interest?

Ok Silva i know that the Consolidation one of the several difficult techniques independently makes a difference ….. what is the other techniques from your Opinion would you talk to us about it thank you too much for all you Do for us here

Hi Sylvia and everyone else,

Hope you all are doing well,

Can you please shed some light on my below questions regarding the presentation of Accounts ?

My question is that if we have audited the Interim accounts for the period ended 31-Dec-2020 and we have purchased a subsidiary in this particular period only (before this period, Parent had no subsidiary ), so, do we have to show unconsolidated accounts or not, for the 30-June-2020 period end (for Balance sheet) to show it as comparative Accounts ?

And for PnL, to show comparative accounts for 31-Dec-2019, do we have to consolidate it or not in order to present it as comparative accounts for 31-Dec-2020 period end audit.

Thanks. Simplify a quite involving process.

Hi Sylvia, Thanks for this article. Just a follow up question, will there be any change if baby( the subsidiary) should have share premium in her book.

Hi Silvia just looked at your youtube video and have subscribed, im currently confused as to what method i should use and how to calculate NCI at % of net assets and at Full Fair value, would you be able to assist me and tell me which method would be better and why? Again it will be different depending on the depending GAAP but lets just say UK Expander plc wishes to acquire a 70% stake in Target plc by purchasing 280 million of Target’s 400 million £1 ordinary shares. Target currently has retained earnings of £1,360 million and is not expecting to issue any shares or pay any dividends in the immediate future. The purchase of Target will be paid for through a combination of immediate and deferred cash payments. Expander will pay £5,000 million of cash at the date of acquisition, plus a further £2,000 million in two years’ time. Target has some valuable brands, trade names and internet domain names. These are not currently recognised in Target’s financial statements. The estimated fair value of these assets is £3,500 million and these brands and domain names are estimated to have a useful life of approximately 8 years. Expander has not yet determined whether it should measure non-controlling interest in its subsidiaries on the basis of a proportionate interest in the identifiable net assets of the subsidiary or whether it should use the “full goodwill” method. The fair value of a 30% holding in Target is estimated to be £2,500 million. Where appropriate you may assume a discount rate of 5% per annum.

What does mean by “subsuming intangible assets in goodwill”?

Hello, Why does the subsidiary share capital remain the same at acquisition and at balance sheet date ? and why do we show parent’s share capital only, in consolidated financials?

waiting for your reply thank you

Dear Silvia, Thank you for the great article. May I ask a question on revaluation please? If a parent company revalue its investment in subsidiary and recognize a surplus, then how I can eliminate or offset the carrying amount of the parent’s investment in subsidiary(which is revalued); and the parent’s portion of equity of each subsidiary(which is unchanged). Would you please guide me? Thank you.

HI. SILVIA, X company purchased 960000 million shares from other one a few years ago. At the time subsidiary had $190 million in reserves. The fair value of non – controlling interest at the date of acquisition was $330 million. How can i work out group structure, % of parent share

Hi Silvia, baby company sold the goods to mommy company at DAP price; therefore the freight cost should be bear by baby company.

In consolidation level, baby company sales = mommy company cost of good sold; should baby company need to report the freight cost for consolidation? the freight cost is paid by baby company to outside forwarder.

how do you calculate legal/statutory reserve at the consolidated level.

hie SILVIA I AM FINDING IT DIFFICULT TO WORK CONSOLIDATION QUESTION OF A GROUP WITH TWO SUBSIDIARIES HOW CAN I DO IT

How would I calculate Goodwill if NCI is measured at Fair Value

Good day i would like to know what happens when the group sells an asset outside,how do we recognize the transaction? second uestion,when the inventory must be eliminated and there is the net realizable value used, what should i do?

Hello, great tutorial. However, how would you adjust these figures if there were some pre-acquisition earnings to apportion out?

Hi Silvia, Thanks greatly for your very helpful explanation, I do have a situation where one of our companies had completed the acquisition of 70% of CS equity of another company on December 31, 2019, so do I still need to do the consolidated financials for the year 2019 based on this scenario ?

Thanks very much.

hi Sivlia! what has to haapen if the parent and subsidiary have different reporting dates?

Hi Silvia! One question: Why don’t you incorporate fair values in the consolidated?

Simplicity is the key. This is a basic example to teach the basic technique. For more advanced examples, there’s IFRS Kit .

Please need explanation on this. If a company previously become an associate of the parent entity, parent entity owned less than 50%, later become a subsidiary, the ownership shares increased, how would I put the entries to recognize as a subsidiary from an associate in consolidation?

Hi Douglas, please read this article .

Hi Silvia, If a subsidiary is at loss position, will the NCI be written down to negative value? Or zero is the bottom for the loss absorption by NCI? Many thanks Alice

Yes, negative value.

Thank you very much Silvia!

Hi silva i just need you help to ward the direct business combination acquisition cost. When cash is paid for different direct acquisition related types the assets of the combiner business specially cash account is affected. But, my question which capital accounts of combiner business parallel affected. Because, IFRS 3 stated that the acquirer shall account for acquisition-related costs as expenses in the periods in which the costs are incurred and the services are received, Debit-expense & Credit cash…..

Hi Silvia, I have this below question that really hope to get your help with: the Mother Co sold some shares of its Son Co to NCI. The shares were issued at a higher price so the capital $$ received is higher than the percentage of holdings given. Illustrated like below: Share Capital $800 total, Son Co 600 and NCI 200, but holding percentage Son Co 80% and NCI 20% So on console elimination the above all eliminated by $$. The current year (assume all post acquisition) retained earnings $100. If portion between Mother group and NCI by holding percentage it would be $80/$20, but if portion by $amount injected then it would be $75/25. For verification the total assets are $900 (800 + 100), portion by percentage of holding it would be $720/180. It doesn’t support either above elimination computation results for NCI: i.e. 1/ $200 + $20 = $220, or 2/ $200 + 25 = $225 So what I did wrong? Desperately waiting for your reply. Many thanks! Alice

Dear Alice, I would like to recommend you our online advisory service – our consultants can answer exactly to these highly specific questions within 2 business days. S.

and by the way it’s the Son Co sold 18% of holdings to NCI for 180, so no goodwill for Son Co or Grandpa Co, I think. Many thanks Alice

Hi Silvia, if the intermediate holding company (Son Co) doesn’t provide consolidation because the utmost holding entity (Grandpa Co) provide the consolidation, would 1) the Grandson Co be consoled first with Son Co and then Son Co console with Grandpa Co, or 2) Grandpa Co console directly with both Son Co and Grandson Co, i.e. Son and Grandson be treated like two individual and parallel entities in the Grandpa Co’s consolidation? And if it’s the 2) situation how the intragroup elimination should be provided? Many thanks

Hi Alice, I would say the option 2 is more probable 🙂 Of course, if Grandpa fully controls both companies, then all intragroup balances need to be eliminated in full. Well, I will write an article about complex consolidation soon!

Thank you Silvia! Yet a further question: if the Son Co and Grandson Co are both foreign currency entity, say, Singapore Dollar. Son invest SGD1000 into Grandson Co. Grandpa Co is USD (the group’s console report currency), for consolidation what exchange rate should be used for the Son’s investment of SGD1000 in Grandson Co? for 1st, 2nd, 3rd… years? Many thanks Alice

Alice, for all currency questions, I recommend reading this article . S.

Thanks Silvia. I did read that articles multiple times… maybe I should post the question under that article? My question is the different currency is NOT between the ultimate holding Co (the console entity), but between the two subsidiaries of it that are both the same foreign currency. Anyways, I posted another question that I desperately needed answer on, but it disappeared? I’ll post again. Many thanks Alice

Hi there, I am not sure if I am asking this question on the correct platform, but this is bothering me a bit in terms of consolidation. What do you do if a Trust has the majority Shareholding? Let’s say they have control and it is not an Investment entity. How does it work exactly? Will the trust present Financial Statements? And what will your consolidation look like?

Hi Charne, the first question is: is the trust following IFRS? Is the trust presenting its financial statements under IFRS? This is the question and the answer depends on the legislation of the trust’s jurisdiction and trust’s intentions (if voluntary application is selected) – not on IFRS. If the answer is yes, then in most cases the trust is not exempted from consolidation – but it also depends on the specific structure of the trust.

Hi Silvia, Your explanation is so good!

Could you please explain why Mommy has invested 70k only but the Share capital of Baby becomes 80k?

Well, it seems that Mommy did not buy 100% share in Baby 🙂

Hi Silvia, Thanks for the nice presentation. During the consolidation of my subsidiaries and parent company A/C, i face below problem and want your kind support.. Let The the parent company is “X” and there are two subsidiaries “Y” & “Z” and X holding 99.5% share of Y & Z, and also Y holding 1 % share of Z. Now I am confused how can i eliminate the investment of Y in Z share during the consolidation.

Hi, good presentation.

Interested to receive updates regarding this.

Hi Silvia, This is a good article. i would like to more and more. Regards Mohamed Fouad

Query on alignment of Accounting Policies under IFRS Consolidated Financial Statements: Let say both parent and subsidiary had invested in unlisted / unquoted security of Co. A If parent determined the fair value of such security using income approach at CU 100 and for the same security in Co. A subsidiary determines fair value using market approach at CU 130. Is alignment required in consolidated financial statement? Or can this be allowed on the basis that fair value is an accounting estimate?

Requesting some clarity in such scenario.

I really appreciate what you are doing to us I personally benefited a lot from this article thank you

Leave a Reply Cancel reply

Recent Comments

- ASHAGRE TILAHUN TAYE on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Silvia on Example: IFRS 10 Disposal of Subsidiary

- Silvia on IFRS 17 Insurance Contracts: Summary

- Shiksha on Example: IFRS 10 Disposal of Subsidiary

- Chrisant on IFRS S2 Climate-related Disclosures: What, How, When

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (65)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

JOIN OUR FREE NEWSLETTER

report “Top 7 IFRS Mistakes” + free IFRS mini-course

1514305265169 -->

We use cookies to offer useful features and measure performance to improve your experience. By clicking "Accept" you agree to the categories of cookies you have selected. You can find further information here .

Advertisement

Consolidated financial statements and global tax policy (OECD BEPS) insights from a multijurisdictional case study

- Original Article

- Published: 06 August 2022

- Volume 2 , article number 118 , ( 2022 )

Cite this article

- Thomas Walter Kollruss 1

211 Accesses

2 Citations

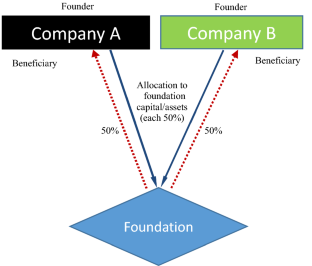

Explore all metrics

This article addresses the relationship between consolidated financial statements and achievement of global tax policy objectives (OECD BEPS) against the background of a case study. Major instruments for preventing tax avoidance are strongly linked with consolidated financial statements. Irrespective of the accounting standard applied (IFRS, US GAAP, and German GAAP), a systematic gap in the group accounting regulations regarding the effective inclusion of entities without members and shareholdings in the consolidated financial statements can be shown. This applies to foundations that are set up as structured entities. The non-inclusion of such legal entities in the consolidated financial statements considerably jeopardises the information function and the core objectives of group accounting. Furthermore, the tax policy goals of the European Union (EU) or Organisation for Economic Co-operation and Development (OECD) to combat cross-border profit shifting and tax avoidance (BEPS) are negatively affected, as relevant instruments such as the interest limitation rule according to Art. 4 of the Anti-Tax Avoidance Directive (ATAD) are linked to the consolidated financial statements. In addition, the hybrid mismatch rule under Art. 9 ATAD is affected, as their scope of application relates to entities that are fully included in consolidated financial statements drawn up in accordance with the IFRS or the national financial reporting system. The same applies to CFC taxation under Art. 7 ATAD, which is based on the concept of control of the foreign entity (majority of the voting rights, capital interest or more than 50% of the profits). The effectiveness of the inclusion rules of the group accounting regulations has a significant international tax policy dimension and superior economic relevance. Thus, the study develops solutions to include structured foundations and entities without members in the consolidated financial statements. Furthermore, solutions for the further development of the OECD base erosion and profit shifting instruments connected to group accounting are presented to achieve global tax policy goals.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Negative Spillovers in International Corporate Taxation and the European Union

The Base Erosion and Profit Shifting: A View of Portugal and Brazil

The Role of Taxation in the Mediterranean Financial Integration

Amoruso AJ et al (2014) Special purpose entities and the shadow banking system: the backbone of the 2008 financial crisis. Acad Account Financ Stud J 18:107–118

Google Scholar

Ašenbrenerová P (2016) Disclosure of joint ventures and associates in financial statement under IFRS. Eur Financ Account J 11:85–94

Article Google Scholar

Bedford A et al (2021) The impact of IFRS 10 on consolidated financial reporting. Account Finance. https://doi.org/10.1111/acfi.12782

Biondi Y (2019) Ownership (lost) and corporate control: an enterprise entity perspective. Account Econ Law Convivium. https://doi.org/10.1515/ael-2019-0025

Bradbury ME (2018) Commentary on the adjustments required for intercompany transactions when equity accounting under IAS 28. Aust Account Rev. https://doi.org/10.1111/auar.12180

BFH (2011) German Supreme Tax Court Judgement I R 98/09 Federal Tax Gazette, p 417

D’Alvia D (2019) The international financial regulation of SPACs between legal standardised regulation and standardisation of market practices. J Bank Regul 21:107–124

Edgley CR, Holland KM (2020) “Unknown unknowns” and the tax knowledge gap: Power and the materiality of discretionary tax disclosures. Crit Perspect Account. https://doi.org/10.1016/j.cpa.2020.102227

EFRAG (2012) European Financial Reporting Advisory Group. Supplementary study—Consolidation of Special Purpose Entities (SPEs) under IFRS 10. https://www.efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing%2FProject%20Documents%2F244%2FSPE_Supplementary_study_-_EFRAG_secretariat_report.pdf&AspxAutoDetectCookieSupport=1 . Accessed 28 May 2021

Glander S et al (2011) The adequate presentation of Special Purpose Entities in Consolidated Financial Statements. KoR IFRS , pp 467–475

Hale LM (2007) SPAC: a financing tool with something for everyone. J Corp Account Finance 18:67–74

Hertz GT et al (2009) Selecting a legal structure: revisiting the strategic issues and views of small and micro business owners. J Small Bus Strategy 20:81–102

IASB, International Accounting Standards Board (2012) Consolidated financial statements, joint arrangements and disclosure of interests in other entities: transition guidance; amendments to IFRS 10, IFRS 11 and IFRS 12

Kovermann P, Velte P (2019) The impact of corporate governance on corporate tax avoidance—a literature review. J Int Account Audit Tax 36:1–29

Joshi P (2020) Does private country-by-country reporting deter tax avoidance and income shifting? Evidence from BEPS action item 13. J Account Res 58:333–381

Matsuoka A (2021) The new international tax regime: analysis from a power-basis perspective. SN Bus Econ 1:1–23

Newman NF (2007) Enron and the special purpose entities—use or abuse—the real problem—the real focus. Law Bus Rev Am 97–137

Nistorenco T (2019) Compliance with disclosure requirements under IFRS 3 of companies trading at prague stock exchange. Eur Financ Account J 14:5–26

Oats L, Tuck P (2019) Corporate tax avoidance: is tax transparency the solution? Account Bus Res 49:565–583

Otaka S (2020) Rethinking the concept of equity in accounting: origin and attribution of business profit. Account Econ Law Convivium. https://doi.org/10.1515/ael-2019-0018

So S et al (2018) Value relevance of proportionate consolidation versus the equity method: evidence from Hong Kong. China J Account Res 11:255–278

Schroeder RG et al (2019) Financial accounting theory and analysis: text and cases, 13th edn. Wiley, Hoboken, pp 1–672

Tănase AE et al (2019) Investments in associates and joint ventures. Acad J Econ Stud 47–50

Tell M (2017) Interest limitation rules in the post-BEPS era. Intertax 45:750–763

Thiemann M (2012) "Out of the shadow?”: accounting for special purpose entities in European banking system. Compet Change 16:37–55

Zicke J et al (2017) The effects of accounting standards on the financial reporting properties of private firms: evidence from the German Accounting Law Modernization Act. Bus Res 10:215–248

Download references

Author information

Authors and affiliations.

Berlin, Germany

Thomas Walter Kollruss

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Thomas Walter Kollruss .

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Kollruss, T.W. Consolidated financial statements and global tax policy (OECD BEPS) insights from a multijurisdictional case study. SN Bus Econ 2 , 118 (2022). https://doi.org/10.1007/s43546-022-00294-3

Download citation

Received : 28 May 2021

Accepted : 18 July 2022

Published : 06 August 2022

DOI : https://doi.org/10.1007/s43546-022-00294-3

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Consolidated financial statements

- Tax avoidance

- Profit shifting

JEL Classification

- Find a journal

- Publish with us

- Track your research

- Contract Management

Supplier Management

Savings Management

- Data & Security

FAQ’s

oboloo Articles

Consolidated and consolidating financial statements: accounting insights in procurement, introduction to consolidated and consolidating financial statements.

Unlocking the mysteries of financial statements is like digging into a treasure trove of insights for businesses. And when it comes to procurement, mastering the art of consolidated and consolidating financial statements can be a game-changer. But what exactly do these terms mean? How do they differ from each other? And how can they revolutionize your procurement strategies ?

In this blog post, we’ll unravel the secrets behind consolidated and consolidating financial statements. We’ll explore their benefits in procurement , shed light on potential challenges, and provide you with best practices for accurate financial reporting. So grab a cup of coffee and get ready to delve into the fascinating world of accounting insights in procurement!

Understanding the Difference between the Two

When it comes to financial statements in procurement, it’s important to have a clear understanding of the difference between consolidated and consolidating financial statements. While these terms may sound similar, they actually refer to two distinct accounting practices.

Consolidated financial statements are a summary of the financial activities of a parent company and its subsidiaries. This means that all the assets, liabilities, revenues, and expenses of these entities are combined into one comprehensive statement. Consolidated financial statements provide an overall picture of the entire business group’s performance and are often used by investors and stakeholders to assess its financial health.

On the other hand, consolidating financial statements focus on individual companies within a group. These statements present separate information for each subsidiary or entity within a larger corporate structure. Consolidating financial statements help analyze each subsidiary’s contribution to the overall group’s performance.

The key distinction lies in their level of detail: consolidated financial statements offer an aggregated view while consolidating ones delve into specific entities’ finances. Both types serve different purposes but work together in providing valuable insights for decision-making.

By understanding this difference, businesses can make more informed decisions based on accurate data analysis tailored to their specific needs. Whether you’re assessing your organization as a whole or evaluating individual subsidiaries’ performances, having access to both consolidated and consolidating financial statements ensures comprehensive insight into your procurement process .

Benefits of Using Consolidated and Consolidating Financial Statements in Procurement

When it comes to procurement, having accurate financial information is crucial for making informed decisions and ensuring transparency. This is where consolidated and consolidating financial statements come into play, offering a range of benefits.

These statements provide a comprehensive view of the financial health of an organization. By consolidating the financial data from different subsidiaries or business units, companies can get a holistic picture of their overall performance. This allows procurement teams to assess the financial stability and viability of potential suppliers before entering into any agreements.

Consolidated and consolidating financial statements help in identifying cost-saving opportunities within procurement operations . By analyzing the expenses across various entities or departments, organizations can identify areas where efficiency improvements can be made. This enables them to negotiate better terms with suppliers or streamline processes to reduce costs .

Furthermore, these statements facilitate compliance with regulatory requirements. Many industries have specific accounting standards that need to be followed when reporting financial information. Consolidated and consolidating statements ensure that companies meet these standards by providing a unified view of their finances.

In addition, using consolidated and consolidating financial statements enhances risk management capabilities in procurement. Organizations can identify potential risks by analyzing key metrics such as debt levels, liquidity ratios, or profitability across multiple entities. This helps in evaluating supplier risk profiles and mitigating any potential threats to the supply chain.

These statements improve decision-making by providing accurate and reliable data for analysis. Procurement professionals can use this information to evaluate supplier performance based on key metrics like revenue growth or profitability trends over time.

Utilizing consolidated and consolidating financial statements in procurement brings numerous advantages such as gaining insight into overall company performance, identifying cost-saving opportunities, ensuring compliance with regulations, enhancing risk management capabilities, and facilitating informed decision-making.

Challenges in Implementing Consolidated and Consolidating Financial Statements

Implementing consolidated and consolidating financial statements in procurement can present various challenges that organizations need to navigate. One major challenge is the complexity involved in gathering and integrating financial data from multiple subsidiaries or entities within a corporate group. Each entity may have its own accounting systems, policies, and practices, making it difficult to consolidate the information accurately.

Another challenge lies in ensuring consistency and standardization across different reporting periods. Timely communication and collaboration between finance teams are crucial for aligning accounting principles, reconciling intercompany transactions, eliminating duplications or omissions, and addressing any discrepancies that arise during the consolidation process.

Furthermore, language barriers, cultural differences, and varying regulatory requirements across jurisdictions can complicate the consolidation of financial statements for multinational corporations with operations in different countries. Understanding local regulations regarding currency translation methods, tax treatments, or disclosure requirements becomes essential to ensure compliance while preparing consolidated reports.

In addition to these technical challenges, there may also be resistance to change within an organization when implementing new processes for consolidated financial reporting. Stakeholders might be accustomed to traditional reporting methods or reluctant to adopt new technologies or accounting standards.

Overcoming these challenges requires a dedicated effort towards streamlining processes through automation tools such as enterprise resource planning (ERP) systems or specialized software designed specifically for consolidation purposes. It also necessitates ongoing training and education for staff members involved in financial reporting to stay updated on relevant accounting standards and best practices.

Despite these challenges, organizations who successfully implement consolidated and consolidating financial statements gain valuable benefits such as enhanced visibility into overall performance metrics across their entire corporate structure. This enables better decision-making by identifying areas of improvement or potential cost savings within procurement strategies at both individual entity levels as well as on a group-wide basis.

Best Practices for Accurate Financial Reporting in Procurement

When it comes to accurate financial reporting in procurement, there are several best practices that organizations should follow. These practices not only ensure transparency and compliance but also provide valuable insights into the financial health of the company. Let’s explore some key strategies for maintaining accuracy in financial reporting.

First and foremost, it is essential to establish clear guidelines and processes for recording procurement transactions. This includes documenting all purchases, sales, and expenses accurately and consistently. By maintaining comprehensive records, companies can easily track their financial activities and identify any discrepancies or errors.

Another important practice is to regularly reconcile procurement data with other financial documents such as invoices, receipts, and bank statements. This helps verify the accuracy of recorded transactions and ensures that all information aligns correctly.

Implementing robust internal controls is crucial for preventing fraud or misrepresentation of financial data. Companies should have checks in place to review approvals, monitor spending limits, and validate vendor information. Regular audits can help identify any weaknesses or potential risks within the procurement process.

Utilizing technology solutions such as enterprise resource planning (ERP) systems can greatly enhance accuracy in financial reporting. These systems automate various tasks like invoice processing, purchase order management purchase order management ing – reducing manual errors while improving efficiency.

Regular training sessions for employees involved in procurement processes can significantly contribute to accurate financial reporting. Educating staff on proper record-keeping techniques, compliance requirements, and ethical business practices fosters a culture of accountability within the organization.

By implementing these best practices consistently across their procurement operations, companies can ensure accurate financial reporting that provides valuable insights into their overall fiscal health. Ultimately this helps make informed decisions regarding budgeting, cost control measures, and strategic planning. In conclusion accurate financial reporting plays a critical role in driving success within an organization’s procurement function

Case Studies: Companies Successfully Utilizing Consolidated and Consolidating Financial Statements

When it comes to the world of procurement, having accurate financial reporting is essential for making informed decisions. Many companies have realized the benefits of using consolidated and consolidating financial statements in their procurement processes . Let’s take a look at some case studies that highlight how these statements have helped businesses streamline their operations and achieve success.

One such company is ABC Manufacturing, a global supplier of industrial equipment. By implementing consolidated financial statements, they were able to gain a comprehensive view of their subsidiaries’ financial health. This allowed them to identify areas of inefficiency and implement cost-saving measures across the board.

Another success story comes from XYZ Pharmaceuticals, a leading player in the healthcare industry. Through consolidating financial statements, they were able to accurately assess the performance of their various business units. This enabled them to reallocate resources effectively and focus on areas with high growth potential.

Furthermore, DEF Retail Corporation utilized consolidating financial statements to track expenses across its multiple retail chains. By analyzing data from each store individually, they were able to identify trends and make informed decisions about inventory management and pricing strategies.

These case studies clearly demonstrate how consolidated and consolidating financial statements can provide valuable insights into procurement processes. With accurate data at hand, companies are better equipped to optimize resource allocation, improve operational efficiency, and ultimately drive profitability.

By leveraging these best practices in financial reporting within procurement processes, companies can ensure greater transparency throughout their supply chain operations. It’s evident that incorporating consolidated and consolidating financial statements is not only beneficial but also crucial for long-term success in today’s competitive business landscape.

Consolidated and consolidating financial statements play a crucial role in procurement, providing valuable insights into the financial health of an organization. By combining the financial data from multiple entities within a company, these statements offer a holistic view of the overall performance and position.

Understanding the difference between consolidated and consolidating financial statements is essential for accurate reporting and decision-making in procurement . Consolidated financial statements consolidate the accounts of subsidiaries or other entities under common control, while consolidating financial statements provide detailed information about individual entities within a group.

The benefits of utilizing consolidated and consolidating financial statements are abundant. They allow procurement professionals to assess risks more effectively, identify cost-saving opportunities, negotiate better contracts with suppliers, and make informed decisions based on comprehensive financial analysis.

However, implementing consolidated and consolidating financial statements can present some challenges. It requires consolidation accounting expertise, meticulous record-keeping across multiple entities, ensuring consistency in accounting policies, dealing with intercompany transactions accurately, and complying with complex regulatory requirements.

To ensure accurate reporting in procurement using these types of financial statements, it is important to follow best practices such as maintaining proper documentation for intercompany transactions, reconciling discrepancies between different entity records promptly, conducting regular audits to verify accuracy and completeness of data entries.

Real-life case studies provide inspiration for companies looking to leverage consolidated and consolidating financial statements effectively. Organizations like XYZ Inc., ABC Corp., have successfully utilized these reports to streamline their procurement processes resulting in significant cost savings while improving supplier relationships .

In conclusion,

Consolidated and consolidatingfinancialstatements are powerful tools that enable organizations to gain deeper insights into their finances when it comes to procurement operations. By understanding their differencesand implementing best practicesinaccuratefinancialreporting,theypoise businessesfor success.

The abilitytoanalyzethecomprehensive data frommultipleentitieswithinacompanyprovidesprocurementprofessionalswiththeinformationthey needtomakeeducateddecisionsandreduceriskswhileforgingstrongersupplierpartnerships.

In the ever-evolving world of procurement , consolidated

Want to find out more about procurement?

Access more blogs, articles and FAQ's relating to procurement

The smarter way to have full visibility & control of your suppliers

Contract Management

Partnerships

Charities/Non-Profits

Service Status

Release Notes

Feel free to contact us here. Our support team will get back to you as soon as possible

Sustainability

- Basic Finance

- Financial Planning

- Fundamental Analysis

- Technical Analysis

- Mutual Funds

- Marketshala

- Miscellaneous

Major loops between Standalone vs Consolidated Financial Statements

An investor is often confused in terms of which financial statements should be used to make investment decisions i.e. to analyze standalone vs consolidated financial statements or both.

Let us understand what is the difference between both and which should an investor analyze or are both equally relevant.

What are Standalone Financials?

Standalone financial represents the financial statement of the entity as a single entity i.e. the financial represents only the position of the single entity.

By analysing the standalone financials the investor will not be aware of the position of its subsidiaries which might affect its investment decisions.

For Instance, the parent company might be a debt-free company but the subsidiaries of that company may be heavily debt-laden and hence this vital information could be missed out on the standalone financials.

What are Consolidated Financials?

Consolidated financial represents the financial position of the group as a whole i.e. the parent along with its subsidiaries.

By analyzing the consolidated financial statement the investor gets an overall view of the position of the entity i.e. the shortcoming of the standalone is overcome by analyzing the consolidated financials.

Also Read : Consolidated Financial Statements

The consolidated gives an overall view of the entity and makes the investor better informed about making the investment decisions.

For instance, the heavy debt in the books of the subsidiary which was being missed while analyzing the standalone finances of the parent could be identified in analysing the consolidated financial.

However, because the subsidiaries form one economic entity thus investors, regulators, and customers find consolidated financial statements more beneficial to gauge the overall position of the entity.

For Instance ,

The parent and the subsidiary perform transaction among them as if they are unrelated. An automaker, for example, might own the company that makes its transmissions, but still pays that company for the transmissions it provides.

The parent company supports the subsidiary during struggling time in a hope to recover the amount paid to subsidiary from its operation.

Transactions of this nature will appear on standalone financial statements because they affect the profitability of the standalone units. But such transactions do not appear on consolidated statements because they don’t affect the overall nature of the larger company.

When a parent owns stock in a subsidiary, the stock have different treatment in the books of parent and subsidiary, the stock appears as an asset on the parents standalone balance sheet but as equity on the subsidiary’s sheet.

When the parent buys something from the subsidiary, or vice versa, each accounts for the transaction to be shown separately on its cash flow or income statements. If one party lends money to the other, the treatment is different from both perspectives; the loan is an asset on the lenders balance sheet and a liability on the borrowers.

During consolidation, intra company transactions will be eliminated to avoid double recording of the transactions..

The listed companies do not disclose detailed financial position of their unlisted subsidiaries in the annual report. Therefore, to find out the utilization of cash or investment made by the subsidiary companies, an investor needs to compare the standalone and consolidated financials.

Financial Statements – Case Study

To compare standalone and consolidated financial statements, let’s assume that a company XYZ Ltd only makes investments in subsidiaries and it does not have any other business operation of its own.

The only income XYZ Ltd shows in its profit and loss statement (P&L) is the dividend income received by it from its subsidiaries.

Further let us assume that all the subsidiaries of ABC Ltd are making huge losses.

But sometimes the subsidiaries survive by taking loans from banks and use these loans to declare dividends for its shareholders like XYZ Ltd.

If in such a situation, while analysing XYZ Ltd, an investor considers only the standalone financials of XYZ Ltd,

Then it will be found that XYZ Ltd has very little debt and is showing profits due to the dividend received from its investments in its subsidiaries

However, if the investor analyses the consolidated financials of XYZ Ltd, then they would immediately come to know that XYZ Ltd (as a group including its subsidiaries) is making huge losses and have loans outstanding.

The investor would immediately become aware of the problems being faced by XYZ Ltd.

Therefore, after analysing consolidated financials of XYZ Ltd, the investor may take a better informed investment decision.

Which Financial statements should be used for analysis?

From the above understanding of the consolidated and standalone financial statements, we could conclude that analyzing the consolidated financial statement is better than analyzing the standalone financial statement.

In analyzing the consolidated financials the investor is well informed about all the transactions and information which might be missing in analyzing the respective standalone financials.

For instance, the debt structure which looks good in the parent book and heavily indebted in the subsidiary book might be correctly captured and understood in the consolidated financials.

Moreover, for a better-detailed analysis, the investor should lay more emphasis on the consolidated financials but at the same time analyze the standalone along with it because it will give a detailed analysis and better understanding of the financials on an individual basis also.

Also Read : How to better analyse Financial statement of a company

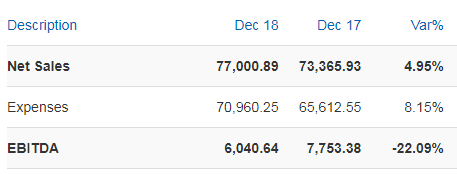

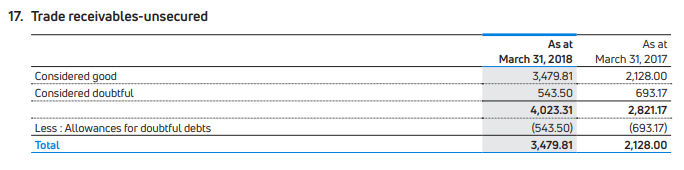

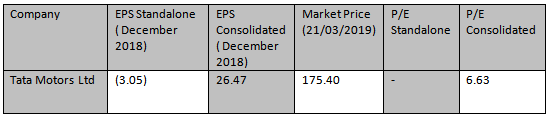

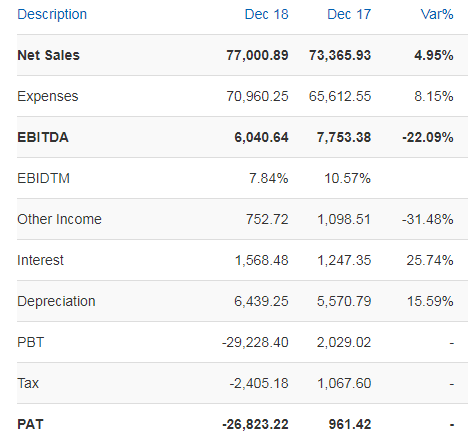

Comparative analysis of EBITDA

Company: Tata Motors Ltd

Below is the quarterly financials of Tata Motors Ltd both consolidated and standalone.

Analyse the EBITDA in both the financials below:-