Corporate Tax Planning Strategies

Plan a tax strategy that reduces risk with a complete picture of what’s on the horizon.

Corporate tax professionals often face significant changes in corporate taxation across federal, state, and international jurisdictions – and this year is no exception. Bloomberg Tax helps you plan ahead with expert analysis.

Prepare for tax filing season with confidence

Bloomberg Tax provides comprehensive global research, news, and technology services to give corporate tax professionals the timely, accurate, and in-depth information they need to plan and comply with confidence.

Save time with practice tools

Increase efficiency with exclusive timesaving practice tools, including chart builders, interactive forms, client letters, transactional diagrams, elections and compliance statements, and tax prep guides. Real-world examples are fully integrated with expert analysis to get you to the right answers quickly.

Reduce risk with primary sources

Go straight to every primary source you need to stay compliant. With Internal Revenue Code dating back to 1913, regulations and procedures, state laws, and international tax treaties, our collection of primary sources is fully integrated across our tools so you can work with certainty.

Plan with confidence using Tax Management Portfolios

Understand the principles and nuances of more than 500 complex tax issues. Written by a network of more than 1,000 leading outside practitioners with deep expertise, this essential resource provides a depth of real-world experience not found in any other tax research solution available today.

Stay informed with expert news and analysis

Access concise coverage of tax news and breaking developments with special reports, roadmaps, our Daily Tax Report, and other expertly prepared content. Our network of seasoned tax and accounting reporters and specialists shares the latest news, trends, and issues to keep you up to date with the news that impacts your company and clients as it happens.

See it for yourself

Find out how Bloomberg Tax can help you spend less time on research tasks, plan with confidence, explore the nuances of complex tax developments, and minimize risk.

CORPORATE TAX PLANNING TOPICS

Federal Tax Planning Strategies

State Tax Planning for Corporations

International Tax Planning for U.S. Corporations

CORPORATE TAX PLANNING RESOURCES

Business Entertainment Expenses and Deductions

What Is the Limitation on Business Interest Expense Deductions?

Can Corporate Tax Returns Be Filed Electronically?

Having the right tax strategy can help corporate tax professionals stay ahead of tax law changes that may affect their business entity’s tax liability. Changes to tax provisions and new legislation present new tax challenges but can also offer opportunities to help reduce a business’s tax burden.

This planning guide highlights several potential tax-saving opportunities and key considerations to help you leverage all available credits and deductions, ensure a smooth filing process, and avoid errors that could trigger an audit.

How does deferring income help?

Although C corporations enjoy a flat 21% statutory tax rate and pass-through entities are taxed at lower rates following the 2017 Tax Cuts and Jobs Act (TCJA), income deferral remains an important consideration in business tax planning. If a taxpayer expects taxable income to be higher in one year than the next, or if the taxpayer anticipates being taxed at a lower rate the next year, the taxpayer may benefit by deferring income into that next tax year. Of course, if a business owner is subject to the individual alternative minimum tax (AMT), an S corporation is subject to the passive investment income tax, or a C corporation may be subject to the corporate alternative minimum tax (AMT), this type of standard tax planning may not be warranted. Some ways to defer income are discussed below.

Use of cash method of accounting

By adopting the cash method of accounting instead of the accrual method, a taxpayer generally can put itself in a better position for accelerating deductions and deferring income. An automatic change to the cash method can be made by the due date of the return including extensions.

A business entity generally must obtain IRS consent to change either an overall method of accounting or the accounting treatment of any material item. To do so, the business generally must file Form 3115 , Application for Change in Accounting Method .

Certain C corporations and partnerships with a C corporation partner with average annual gross receipts of $27 million or less for the prior three tax years can make an automatic change to the cash method.

Provided inventories are not a material income-producing factor, sole proprietors, limited liability companies (LLCs), partnerships, and S corporations can change to the cash method of accounting without regard to their average annual gross receipts.

Installment sales

Generally, a sale occurs on the transfer of property. If gain will be realized on the sale, income recognition will normally be deferred under the installment method until payments are received, so long as one payment is received in the year after the sale. Therefore, if a business is expecting to sell property prior to the end of a tax year, and it makes economic sense, the taxpayer should consider selling the property and reporting the gain under the installment method to defer payments (and tax) until the next tax year or later.

Delay billing

If a taxpayer uses the cash method of accounting, the taxpayer may consider delaying year-end billing to clients so that payments are not received until the next tax year.

Defer interest and dividends

Interest income earned on Treasury securities and bank certificates of deposit with maturities of one year or less is not includible in income until received. To defer interest income, the taxpayer could consider buying short-term bonds or certificates that will not mature until the next tax year.

A taxpayer will be taxed only on dividends for which there is constructive receipt before year-end. Owners of closely held corporations may consider delaying dividends unless other provisions prevent such delay.

Should an owner of a closely held family business consider gifting interests?

Owners of closely held businesses may want to consider gifting an interest in the business (corporate stock or interests in family limited partnerships or LLCs). A taxpayer may take advantage of valuation discounts (marketability and minority discounts) and the gift tax exclusion of $17,000 per donee ($34,000 when gift-splitting) when gifting family business interests before year-end.

Should a corporate taxpayer accelerate income into the current year?

A business taxpayer may benefit from accelerating income into the current year. For example, the taxpayer may anticipate being taxed at a higher rate the next tax year, being subject to the corporate alternative minimum tax (AMT) in 2023, or perhaps the taxpayer needs additional income this year to take advantage of an offsetting deduction or credit that will not be available in a future tax year. Note, however, that accelerating income into the current tax year could be disadvantageous if the taxpayer expects to be in the same or lower tax bracket the next year.

Early collection

A business that reports business income and expenses on a cash basis could issue bills and pursue collection before the end of the current year. Also, the taxpayer could check to see if clients or customers are willing to pay for next year’s goods or services in advance. Any income received using these steps will shift income from the next tax year to the current one.

Qualified dividends

Qualified dividends are subject to rates similar to capital gains rates. Qualified dividend income is generally subject to a 15% or 20% rate, dependent upon statutory thresholds. The thresholds are not tied to specific income tax brackets, but roughly speaking, the 20% rate applies to those in the 37% rate bracket and most of those in the 35% bracket, while the 15% rate applies to those at or above the 22% bracket. Note that qualified dividends may be subject to an additional 3.8% net investment income tax. Qualified dividends are typically dividends from domestic and certain foreign corporations. The corporate board may consider the tax impact of declaring a dividend on its shareholders. If a controlling shareholder is not in the highest capital gains bracket for the current tax year, but expects to be in a higher bracket the next year, the controlling shareholder should consider authorizing any dividend payment prior to the end of the current tax year to utilize the more favorable 15% tax rate.

Are there business deductions that can be accelerated into the current year?

If a business uses the accrual method, business accounts receivable should be analyzed and those receivables that are totally or partially worthless should be written off. By identifying specific bad debts, the taxpayer should be entitled to a deduction. The taxpayer may be able to complete this process after year’s end if the write-off is reflected in year-end financial statements. For nonbusiness bad debts (such as uncollectible loans), the debts must be wholly worthless to be deductible, and will probably only be deductible as a capital loss.

Current-year bonuses

In general, a taxpayer’s liability for employee bonuses accrues and is deductible for the current year even though the bonus is paid in the following year, if all the events are satisfied that fix the liability and the taxpayer does not have a unilateral right to cancel the bonus at any time prior to payment.

Generally, the taxpayer may accelerate the bonus deduction into the current year while the employees will report the income in the following year if they are cash method taxpayers. Furthermore, any compensation arrangement that defers payment will be currently deductible only if paid within 2.5 months after the employer’s year-end.

Suspended passive losses

Generally, a taxpayer may have passive losses that have been suspended and not yet allowed as a deduction. Determine what might be done to identify and absorb or release the suspended losses as part of the taxpayer’s overall tax planning.

Prepayment of taxes

For taxpayers that pay payroll taxes on a quarterly basis, consider accelerating 4th quarter payroll taxes at Dec. 31 year-end and don’t wait until January.

Consider accelerating state income estimated taxes and property taxes if possible if the taxpayer would benefit from a current year state income tax deduction. AMT should be considered for pass-through entities taxed at individual rates if accelerating state income and property taxes.

What tax credits are available to corporate taxpayers?

Generally, tax credits reduce a taxpayer’s liability on a dollar-for-dollar basis. There are many tax credits available to corporate taxpayers. Specifically, consider the taxpayer’s eligibility for the following credits.

Research and development (R&D) tax credit

Some business projects, such as those involving development of new or more reliable products, processes, or techniques, may be eligible for the R&D tax credit. Eligible small businesses ($50 million or less in gross receipts) may claim the R&D tax credit against alternative minimum tax liability of individuals, and the credit can be used by certain qualified small businesses against the employer’s payroll tax (i.e., FICA) liability.

Employer wage credit for employees in the uniformed services

Some employers continue to pay all or a portion of the wages of employees who are called to active service. The amount of the credit is equal to 20% of the first $20,000 of differential wage payments to each employee for the taxable year. Employers of any size with a written plan for providing such differential wage payments are eligible for the credit.

Work opportunity credit

The work opportunity credit is an incentive provided to employers that hire individuals in groups whose members historically have had difficulty obtaining employment. The credit gives a business an expanded opportunity to employ new workers and to be eligible for a tax credit based on the wages paid. The credit is available for first-year wages paid or incurred in the tax year for employees hired and who began work before Dec. 31 of that tax year. Employers that hire members of targeted groups, including qualified long-term unemployed individuals (i.e., those who have been unemployed for 27 weeks or more), will be entitled to a credit equal to 40% of the first $6,000 of wages. Employers that hire qualified veterans will be entitled to a credit equal to 40% of a higher wage limit, with the wage limit dependent on the reason for qualification.

Small employer pension plan startup cost credit

Certain small business employers that didn’t have a pension plan for the preceding three years may claim a nonrefundable income tax credit for expenses of establishing and administering a new retirement plan for employees. The credit applies to 50% of qualified administrative and retirement-education expenses for each of the first three plan years. The credit is limited to the greater of (a) $500; or (b) the lesser of (i) $250 for each eligible employee, or (ii) $5,000. Thus, the maximum available credit is limited to $5,000 per year.

Small employer retirement savings auto-enrollment credit

Starting in 2020, certain small business employers that include an eligible automatic contribution arrangement in a qualified employer plan may claim a nonrefundable income tax credit of $500 for each of the first three plan years.

Employer-provided child care credit

Employers may claim a credit of up to $150,000 for supporting employee child care or child care resource and referral services. The credit is allowed for a percentage of “qualified child care expenditures,” including for property to be used as part of a qualified child care facility, for operating costs of a qualified child care facility, and for resource and referral expenditures.

Low-income housing credit

The low-income housing credit is a tax credit which may be claimed over a 10-year period by owners of residential rental property used for low-income housing. The amount of credit available depends on whether expenditures were federally subsidized. Among other requirements, low-income housing units may not be used on a “transient” basis. The IRS and Treasury have provided limited exceptions to the transiency rule, including one for disaster relief.

After a major disaster, a state housing credit agency may permit owners within its jurisdiction to provide temporary emergency housing (not to exceed 12 months) to displaced individuals who were living within the agency’s jurisdiction at the time of the disaster. Before housing any displaced individuals, the owner must obtain written approval from the agency to participate in “temporary emergency housing” relief. An individual is a displaced individual if the individual was displaced from their principal place of residence as a result of a major disaster and the principal place of residence is in a city, county, or other local jurisdiction designated for “individual assistance” by FEMA. The temporary housing of displaced individuals in low-income units without meeting the documentation requirements will not cause the building to suffer a reduction in qualified basis that would cause the recapture of low-income housing credits.

Employer credit for Family and Medical Leave Act wages

An eligible employer may take a paid family and medical leave credit of between 12.5% and 25% of the wages paid to the employee, depending on what portion of the employee’s normal wages is paid during the leave (minimum 50% of wages).

New Markets Tax Credit

Taxpayers may claim a New Markets Tax Credit equal to 39% of any capital invested in a qualified community development entity. The credit is claimed in seven annual installments beginning in the year of the original investment.

Energy investment credit

The energy investment credit is available for investments in certain alternative and renewable energy property and renewable electricity production facilities. The credit is either 10% or 30% of the basis of energy property placed in service during the tax year.

Rehabilitation tax credit

Qualified expenses incurred in the rehabilitation of certified historic structures are eligible for a credit of 20% of such expenses. The credit is claimed in five equal annual installments beginning with the year in which the rehabilitated property is placed in service.

What income exclusions are available?

Stock acquisitions that qualify as “small business stock” under §1202 are subject to special exclusion rules upon their sale as long as a five-year holding period is satisfied. S corporation stock does not qualify for the exclusion. A 100% gain exclusion applies for qualified small business stock acquired after Sept. 27, 2010, and held for more than five years. A 75% exclusion applies for qualified small business stock acquired after Feb. 17, 2009, and before Sept. 28, 2010 (and held for at least five years). A 50% exclusion applies for qualified small business stock acquired before Feb. 18, 2009 (and held for at least five years).

What business deductions are available?

Qualified business income.

Individual taxpayers with qualified business income (QBI) from a pass-through entity (partnership or S corporation) or a sole proprietorship may be entitled to a deduction equal to the lesser of the deductible amount of the QBI or 20% of taxable income. The deduction applies to reduce taxable income and is available whether or not the taxpayer itemizes. The deduction does not impact the calculation of self-employment tax.

The trade or business of being an employee is not a qualified trade or business and, therefore, no deduction is allowed for income from the trade or business of being an employee.

The deductible amount of QBI is generally 20%. However, if the taxpayer’s taxable income (not factoring in the deduction) exceeds $340,100 (for married taxpayers filing jointly) or $170,050 (for all other taxpayers), the deduction is subject to a limitation based on W-2 wages paid by the business.

Limitation on business interest expense

The deduction for net interest expenses incurred by a corporation is limited to the sum of business interest income, 30% of the business’s adjusted taxable income (ATI), and floor plan financing interest, though taxpayers with average annual gross receipts of $27 million or less are exempt from the limit. Further, the limitation does not apply to the trade or business of being an employee, electing real property trades or businesses, electing farming businesses, or certain regulated utilities.

Excess business loss

Taxpayers other than C corporations are not allowed to deduct excess business loss. An excess business loss for the tax year is the amount by which aggregate deductions of the taxpayer attributable to trades or businesses of the taxpayer, less the sum of aggregate gross income, exceeds $540,000 (for married taxpayers filing jointly) or $270,000 (for all other taxpayers). Any excess business loss is carried forward and treated as part of the taxpayer’s net operating loss carryforward in succeeding taxable years. Pass-through entities are limited in deducting active business losses against nonbusiness income.

Equipment purchases

Corporations purchasing equipment may make a “§179 election,” which allows them to expense (i.e., currently deduct) otherwise depreciable business property, including computer software and qualified real property. Air conditioning and heating units placed in service since 2016 are eligible and continue to be eligible for this deduction. Certain improvements to nonresidential real property (roofs, heating, ventilation, and air-conditioning property, fire protection and alarm systems, and security systems), that may not be eligible for bonus depreciation, are eligible under §179 . Taxpayers may elect to expense up to $1,080,000 of equipment costs (with a phase-out for purchases exceeding $2,700,000). The deduction is subject to a business income limit.

In addition, careful timing of equipment purchases can result in favorable depreciation deductions. In general, under the “half-year convention,” taxpayers may deduct six months’ worth of depreciation for equipment that is placed in service on or before the last day of the tax year. If more than 40% of the cost of all personal property placed in service occurs during the last quarter of the year, however, a “mid-quarter convention” applies, which lowers the depreciation deduction.

Bonus depreciation

For property acquired after Sept. 27, 2017, and placed in service during the current tax year, a taxpayer may deduct 100% of the cost of qualified property. Bonus depreciation applies to new as well as used property, so taxpayers planning to acquire a business should consider whether structuring the acquisition as an asset acquisition rather than a stock acquisition would be advantageous.

Vehicles weighing more than 6,000 pounds

A popular strategy is to purchase a vehicle for business purposes that exceeds the depreciation limits set by statute (i.e., a vehicle rated more than 6,000 pounds). Doing so wouldn’t subject the purchase to the dollar limit for depreciation of passenger vehicles of $11,200 in 2022 (if bonus depreciation is taken, the amounts increase to $19,200). For SUVs (rated between 6,000 and 14,000 pounds gross vehicle weight) the expensing amount is limited to $27,000.

NOL carryforward and carryback

If a corporation expects to suffer a net operating loss (NOL) for the tax year, it may generally carry the loss forward indefinitely. A farming loss may be carried back two years or forward indefinitely. Non-life insurance companies with a net operating loss may carry the loss back two years but may only carry the loss forward 20 years. Corporations may elect to waive the carryback period and instead choose to only carry forward losses. If the taxpayer has any net operating loss carryforwards from prior tax years, deductions for losses arising before 2018 are deductible up to 100% of taxable income, while deductions for losses arising after 2017 are limited to 80% of taxable income.

A corporation that expects a tax loss for the current year and that has paid estimated taxes should consider seeking a quick refund of overpayments. A corporation may file Form 4466 , Corporation Application for Quick Refund of Overpayment of Estimated Tax , to recover any overpayment of estimated tax for the tax year over the final income tax liability expected for the tax year. Be aware that if a corporation has a loss one year and income the next, it will have to make estimated tax payments for that next year.

Inventories of subnormal goods

A business should check for subnormal goods in inventory. Subnormal goods are goods that are unsalable at normal prices or unusable in the normal way due to damage, imperfections, shop wear, changes of style, odd or broken lots, or other similar causes, including second-hand goods taken in exchange. If a business has subnormal inventory as of the end of the tax year, the taxpayer can take a deduction for any write-downs associated with that inventory provided they offer it for sale within 30 days of the inventory date. The inventory does not have to be sold within the 30-day timeframe.

Business travel, meals, and entertainment expenses

Although significantly limited, business deductions for meal and entertainment expenses are still available in certain circumstances.

Charitable contributions

A charitable contribution deduction is available to businesses. A corporation is generally allowed to deduct charitable contributions up to 10% of its taxable income for cash contributions. Under the CARES Act, the corporate limitation was temporarily increased to 25% of taxable income for cash contributions made in calendar year 2021. Contributions from pass-through entities are allocated to individual equity interest holders and are subject to the individual’s limitations. An individual is generally allowed to deduct charitable contributions up to 60% of adjusted gross income. Certain contributions of property are subject to additional limits as well as additional recordkeeping and substantiation requirements.

Should a corporation make an S corporation election?

For an otherwise eligible C corporation, consider whether an S corporation election would make sense. A detailed tax analysis needs to be prepared, which should include a comparative discounted after-tax, cash-flow analysis of C status versus S status. The analysis would focus on the marginal and effective tax rates on corporate income under various scenarios as a C corporation and S corporation.

Passive income and S corporations

S corporations that were formerly C corporations, and that have subchapter C earnings and profits at year-end, need to monitor the amount of their passive income, or subject themselves to the passive income tax for termination of their S corporation status. S corporations can avoid both consequences by electing to distribute the subchapter C earnings and profits first, or by making a consent dividend election. Either the distribution or consent dividend can purge the S corporation of all its earnings and profits at year-end. For the closely held C corporation, an S corporation election needs to be considered from time to time.

In considering a conversion to S status, the C corporation must first confirm its eligibility. A key component of this analysis will include assumptions on potential sources of passive investment income the converting C corporation may have as an S corporation, e.g., gross receipts from royalties, rents, dividends, interest, or annuities. If the converting C corporation will have accumulated earnings and profits at the end of any of its Subchapter S tax years, and it has the requisite gross receipts from passive investment income, a passive investment income tax may apply.

S corporations with recognized built-in gains subject to the built-in gains tax can offset these gains with recognized built-in losses before the corporation’s tax year ends and eliminate the tax.

What health care and other benefit planning is available?

Pay or play excise tax.

A corporate taxpayer that has 50 or more full-time equivalent employees could be subject to an excise tax, which could be as much as $2,750 per full-time employee, for failure to offer a health care plan that is minimum essential coverage to at least 95% of the full-time employees if at least one employee obtains subsidized coverage through a public health insurance exchange. The first 30 workers are excluded from this calculation. If the taxpayer does offer coverage but it is not adequate or is unaffordable, the excise tax could be $4,120 for each full-time employee who obtains subsidized coverage through an exchange.

Smaller employers should review whether they have undergone, or will soon undergo, any changes to their business structure that would require them to be aggregated with other entities and subject them to potential liability. Larger employers should consider their health care plan options in light of this potential excise tax liability.

Health reimbursement arrangements

Certain small employers that want to assist their employees in obtaining health insurance may choose to set up a qualified small employer health reimbursement arrangement (QSEHRA). The QSEHRA, unlike other health reimbursement arrangements, is a tax-favored arrangement that is not considered a group health plan and does not expose the employer to excise taxes for not satisfying Affordable Care Act insurance market requirements. It’s available to employers that have fewer than 50 full-time equivalent employees, do not offer any health plan, and meet other requirements.

Credit for employee health insurance expenses of small employers

Some small employers that provide health coverage to their employees through a Small Business Health Options Program (SHOP) Exchange may be eligible to claim a credit if they pay for at least half of the premiums for health insurance coverage for their employees. Generally, employers with 10 or fewer full-time equivalent employees (FTEs) and an average annual per-employee wage of $28,700 or less are eligible for the full credit. In 2022, the credit amount begins to phase out for employers with either 11 FTEs or an average annual per-employee wage of more than $28,700. The credit is phased out completely for employers with 25 or more FTEs or an average annual per-employee wage of $57,400 or more. The credit is available on a sliding scale for up to 50% of the employer’s contribution toward employee health insurance premiums. The credit is available only for two consecutive taxable years after 2013, so it is not available to a taxpayer if, for example, the taxpayer or a predecessor claimed it for 2019–2020, or 2020–2021.

Preparing and filing corporate tax returns

A corporation must file a tax return every taxable year, regardless of the relevant amount of gross income. C corporations file Form 1120 , which is due by the 15th day of the fourth month following the close of the corporation’s taxable year. A calendar year corporation, for example, files its return by April 15. Exception: for June 30 fiscal year C corporation filers, the filing deadline is Sept. 15.

There is generally an automatic six-month extension for calendar year C corporations, and an automatic seven-month extension for fiscal-year C corporations with a taxable year ending on June 30.

Corporate taxpayers should be made aware of any penalties that may apply. The tax code imposes a host of penalties for late-filed returns, failing to file returns, failing to furnish information returns, and failing to pay tax. Many penalties are subject to inflation adjustments.

Estimated tax payments

A corporation (other than a large corporation) generally may be able to avoid any underpayment penalties by paying estimated taxes based on 100% of the tax shown on the prior year return. A large corporation is a corporation that had taxable income of $1 million or more for any of the three tax years immediately preceding the current year.

Documentation

Before the end of the year the corporation should hold any required board meetings, properly document any minutes, and collect any documentation that may be needed to substantiate tax returns upon audit.

Tax planning resources and expert insights from Bloomberg Tax

Year-round, proactive tax planning is an important way for corporate tax professionals to add strategic value to their organization and optimize their tax position. But preparing a corporate tax return involves navigating a multitude of potential pitfalls and errors that could trigger an audit, like updated or expired tax provisions, changes to tax credits, and new reporting obligations. Download the 2022 Corporate Tax Survey to better understand the greatest risks, challenges, and expected changes that corporate tax teams are facing across the U.S.

Stay on top of the dynamic field of corporate tax planning with expert analysis, comprehensive coverage, news, and practice tools from Bloomberg Tax . See how technology company Match Group uses Bloomberg Tax Research to save time and money understanding complex tax issues. Request a demo to learn more.

By clicking submit, I agree to the privacy policy .

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Make Tax Planning a Part of Your Company’s Risk Management Strategy

- Mark Beasley,

- Nathan Goldman,

- Christina Lewellen,

- Michelle McAllister

Three strategies for boards.

Companies face a taxpaying dilemma: Paying less means higher earnings and a higher value for shareholders, but overly aggressive tax minimization strategies can lead to fines, public scrutiny, and/or reputational damage. Research finds that companies that incorporate their tax-planning decisions into their overall enterprise risk management are better able to find that balance of risk and reward. To do this, boards should 1) Take responsibility for risk oversight; 2) Engage in risk-monitoring activities on a regular basis; and 3) Foster an appropriate risk mindset.

The five largest U.S. companies (Apple, Microsoft, Alphabet, Amazon, and Facebook) reported an average income tax liability of $7.3 billion in their 2019 annual reports. Yet those same companies have repeatedly faced criticism from politicians and activists for aggressively avoiding paying billions more.

- Mark Beasley is KPMG professor of accounting and the director of the Enterprise Risk Management Initiative in the Poole College of Management at North Carolina State University. Having published over 100 articles and thought papers, his research particularly focuses on the intersection of enterprise risk management (ERM) practices and corporate governance. He frequently works with boards and senior executive teams on ERM implementation issues.

- Nathan Goldman is an assistant professor in the Poole College of Management at North Carolina State University. His research examines capital market consequences of corporate taxation and has been published in journals including The Accounting Review, The Journal of the American Taxation Association, Journal of Accounting, Auditing, and Finance, and Journal of Management Accounting Research .

- Christina Lewellen is an assistant professor in the Poole College of Management at North Carolina State University. Her research primarily focuses on the determinants and capital market consequences of corporate taxation and the intersection of corporate governance and taxation, and her work has been published in journals including Contemporary Accounting Research and Journal of Management Accounting Research .

- Michelle McAllister is an assistant professor in the W. A. Franke College of Business at Northern Arizona University. Her research considers judgment and decision-making issues in auditing and accounting, and her work has been published journals including The Accounting Review and Journal of Management Accounting Research .

Partner Center

Corporate Tax Planning: Meaning, Objective, Types, Advantages and Limitations

Meaning of corporate tax.

Income earned by a person (who comes under the threshold limit) is taxable under the Income Tax Act 1961. A person liable to pay tax has to find out the best way to make use of the deductions available to him. The planning done by the person to reduce his tax liability by making use of the allowances, deductions and other privileges available to him is known as tax planning.

Every business registered under The Companies Act, 2013 is mandatorily liable to pay the tax accrued to them. The companies have different deductions and provisions which are available to them. The process of analysing all the provisions to reduce tax liability is called Corporate Tax Planning.

Understanding Corporate tax

In simple words, corporate tax planning is the plan laid out by the companies to reduce the tax liability accrued to them by making the optimum use of the different provisions and deductions available to them. This process of tax planning is inevitable in a corporate entity. It minimises the obligation to pay tax to the government with the help of different advantages given to the corporate by the government. For those who have confusions let us make it clear. The business set up in SEZ is free from majority of the tax payable to the government. Even though they are liable to pay taxes to the government they make use of the advantage of working in the SEZ to avoid the burden of paying taxes. Did you understand the concept?

It might be a little difficult to understand the corporate measures taken by the company to reduce the tax because it is a result of continuous efforts and study that take part in the organisation.

We said corporate tax planning is an inevitable process in an organisation. Can’t a company survive without tax planning? The answer to the question is no. Tax planning is very essential to ensure the smooth working of the organisation.

Let us now look into the objectives that are behind the setting up of tax planning.

Objectives of Corporate Tax Planning

Let us now look into each objective in detail

Reduction of Tax Liability

The most important and main objective of corporate tax planning is to reduce the burden of the tax. Every corporate has some fixed amount of tax which is imposed upon them. They are inevitable. So in this case the additional taxes incurred by them need to be managed properly so that the burden can be reduced to an extent.

Economic Stability

A firm that plans its tax accordingly will have a stable economic position over other firms. We all know that corporate tax is subject to double taxation ie, the profits earned by the company are subject to tax, and this profit distributed among the stakeholders is also subject to the tax as that becomes a part of their income. So once the firm plans the tax accordingly this can be avoided to an extent by understanding the different deductions available to them and enjoying an economic privilege.

Increased Production

The firm is reducing its tax liability. The money saved by the firm can be put to other profitable and productive uses. This will in turn give rise to the optimum utilisation of the resources available to the firm.

Awareness regarding Deductions

The corporate will dig deep into the different provisions, rebates and deductions stated in favour of them in the light of tax reduction. The company will have a clear idea of the versatile options available to them and make use of them in the most efficient manner. They will be aware of these deductions only if they are keen to do tax planning in a corporation.

Minimize Litigation

The corporate even though finds ways to reduce tax corporate planning act as a standard by which this financial planning should take place. They lay out a just plan which does not break any rules of the government system that should be followed. Thus, there is a smooth link between the government and the corporate.

Planning of sales and capital

Corporate tax planning includes the proper planning of the capital that should be introduced to the business and the sales that are to achieve. There should always be a balance of both to avoid the imposition of high taxes due to high fluctuations in the business.

From the above, we can understand that corporate tax planning helps in the smooth running of the organisation. We now need to know the different types of corporate tax planning

Types of Corporate Tax Planning

Short-range and long-range tax planning.

Plans laid out by the corporate can differ in their nature. They may serve a single purpose or maybe they will act as a standard for the entire tenure of the organisation. If the plan is stated for a particular purpose and is usually of limited scope is called short-range tax planning. They are usually put forward at the end of the year. On the other hand, when the plan is outstretched for the whole fiscal year it is called long-range tax planning. The incidence and impact will be there for a foreseen future.

Purposive tax planning

In this the corporate tax take into consideration all the tax provisions available to them. They avail all the tax benefits and get the maximum benefit out of that. Making use of the provisions will increase the savings of the corporation.

Permissive tax planning

The organisations take into consideration the deductions and permissions given by the tax authorities to the corporation regarding limiting tax liability. They make use of all the concessions provided to them as per certain sections of the law

Advantages of Corporate Tax planning

We have discussed the different advantages of corporate tax planning in the previous headings. Let us summarise them into the following:

- Minimise the tax liability

- Increase in the use of the resources

- Increased economic stability

- Minimise litigation

- Awareness regarding provisions

- Proper maintenance of the business cycle (production process)

These are the advantage of tax planning. Doesn’t it have any limitations?

Limitations of Corporate Tax planning

The main limitations of corporate tax planning are that:

- Opting to the wrong methods for tax saving like insurance. From an individual point of view, insurance is a good option for tax savings but from a corporate point of view, it is not advisory to insure in numerous insurances for tax savings as it will not give the desired result.

- The corporate will be more focused on the optimisation of resources and maybe this will cause overproduction.

- If the deductions are not clearly understood it may result in tax evasion and result in the attraction of unwanted litigation.

For a corporate firm to achieve the desired success it is necessary to understand all the legal and financial aspects of the working of the business. Tax planning helps the firm to optimize its economic stability and reduce the tax burden of the corporation. All companies registered under the act would follow corporate tax planning to reduce the tax liability imposed on them. Thus we can conclude that a firm following a good systematic corporate tax planning tends to have a successful run for a foreseeable future.

Related posts:

- What is Business? Definition, Nature, Types, and Objective

- Business Objective: Meaning, Types, and Importance

- Objective & Features of Business Environment

- Business Forecasting: Types, Techniques, Need, Advantages, Limitations

- Business Income: Meaning, Computation and Example

- Characteristics and Features of Business Ethics

Add CommerceMates to your Homescreen!

- Search Search Please fill out this field.

What Is Tax Planning?

Understanding tax planning, retirement saving strategies.

- Tax Gain-Loss Harvesting

The Bottom Line

- Investing Basics

Tax Planning: What It Is, How It Works, Examples

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Investopedia / Joules Garcia

Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. A plan that minimizes how much you pay in taxes is referred to as tax efficient . Tax planning should be an essential part of an individual investor's financial plan. Reduction of tax liability and maximizing the ability to contribute to retirement plans are crucial for success.

Key Takeaways

- Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible.

- Considerations of tax planning include the timing of income, size, the timing of purchases, and planning for expenditures.

- Tax planning strategies can include saving for retirement in an IRA or engaging in tax gain-loss harvesting.

Tax planning covers several considerations. Considerations include timing of income, size, and timing of purchases, and planning for other expenditures. Also, the selection of investments and types of retirement plans must complement the tax filing status and deductions to create the best possible outcome.

Saving via a retirement plan is a popular way to efficiently reduce taxes. Contributing money to a traditional IRA can minimize gross income by the amount contributed. For 2023, if meeting all qualifications, a filer under age 50 can contribute a maximum of $6,500 to their IRA with an additional catch-up contribution of $1,000 if age 50 or older. That number rises to $7,000 in 2024, with the catch-up contribution holding steady at $1,000.

If an individual who made $75,000 a year contributed a total of $7,000 to a traditional IRA in 2024, they would have an adjusted gross income of $68,000 ($75,000-$7,000) on which they would be taxed. The $7,000 would then grow tax-deferred until withdrawn.

There are several other retirement plans that an individual may use to help reduce tax liability. 401(k) plans are popular with larger companies that have many employees. Participants in the plan can defer income from their paycheck directly into the company’s 401(k) plan. The greatest difference is that the contribution limit dollar amount is much higher than that of an IRA .

In 2023, the contribution limit for a 401(k) is $22,500, increasing to $23,000 in 2024. For both years, if you are 50 and over, you can contribute an additional $7,500.

If we take the example above, if an individual contributed $23,000 in 2024, their adjusted gross income would be $52,000 ($75,000-$23,000) on which they would be taxed. The $23,000 would grow tax-deferred until withdrawn.

Tax Planning vs. Tax Gain-Loss Harvesting

Tax gain-loss harvesting is another form of tax planning or management relating to investments. It is helpful because it can use a portfolio's losses to offset overall capital gains. According to the IRS, short and long-term capital losses must first be used to offset capital gains of the same type.

In other words, long-term losses offset long-term gains before offsetting short-term gains. Short-term capital gains, or earnings from assets owned for less than one year, are taxed at ordinary income rates.

In 2023, long-term capital gain limits are the following:

- 0% for single filers whose income is no more than $44,625 ($89,250 in the case of a joint return or widow(er), $59,750 in the case of an individual who is head of household, $44,625 in the case of a married individual filing a separate return)

- 15% tax for single filers whose income is between $44,626 and $492,300 ($553,850 in the case of a joint return or widow(er), $523,050 in the case of an individual who is the head of a household, or $276,900 in the case of a married individual filing a separate return)

- 20% tax for those whose income is higher than that listed for the 15% tax

In 2024, long-term capital gain limits will be increasing to the following:

- 0% for single filers whose income is no more than $47,025 ($94,050 in the case of a joint return or widow(er), $63,000 in the case of an individual who is head of household, $47,025 in the case of a married individual filing a separate return)

- 15% tax for single filers whose income is between $47,026 and $518,900 ($583,750 in the case of a joint return or widow(er), $551,350 in the case of an individual who is the head of a household, or $291,850 in the case of a married individual filing a separate return)

For example, if a single investor whose income was $100,000 had $10,000 in long-term capital gains, there would be a tax liability of $1,500. If the same investor sold underperforming investments carrying $10,000 in long-term capital losses, the losses would offset the gains, resulting in a tax liability of 0. If the same losing investment were brought back, then a minimum of 30 days would have to pass to avoid incurring a wash sale .

According to the Internal Revenue Service, "If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total net loss shown on line 16 of Schedule D (Form 1040) ."

For example, if an individual earned $75,000 a year and had $5,000 in net capital losses for the year, the $75,000 income will be adjusted to $72,000 ($72,000-$3,000). The remaining $2,000 in capital losses can be carried over with no expiration to offset future capital gains.

What Are Basic Tax Planning Strategies?

Some of the most basic tax planning strategies include reducing your overall income, such as by contributing to retirement plans, making tax deductions, and taking advantage of tax credits.

How Do High-Income Earners Reduce Taxes?

There are many ways to reduce taxes that are not only available to high-income earners but to all earners. These include contributing to retirement accounts, contributing to health savings accounts (HSAs), investing in stocks with qualified dividends, buying muni bonds, and planning where you live based on favorable tax treatments of a specific state.

Can I Contribute to a 401(k), a Traditional IRA, and a Roth IRA?

Yes, you can contribute to a 401(k), a traditional IRA, and a Roth IRA. You must ensure that you only contribute the legally allowed amount per year. If you invest in both a traditional IRA and a Roth IRA, you cannot contribute more than the overall maximum allowed for an IRA.

Tax planning involves utilizing strategies that lower the taxes that you need to pay. There are many legal ways in which to do this, such as utilizing retirement plans, holding on to investments for more than a year, and offsetting capital gains with capital losses.

Internal Revenue Service. “ 401(k) Limit Increases to $23,000 for 2024, IRA Limit Rises to $7,000 .”

Internal Revenue Service. " Rev. Proc. 2022-38 ." Pages 8-9.

Internal Revenue Service. “ Rev. Proc. 2023-34 .” Pages 7-8.

Internal Revenue Service. " Publication 550: Investment Income and Expenses ." Page 56.

Internal Revenue Service. " Topic No. 409, Capital Gains and Losses ."

:max_bytes(150000):strip_icc():format(webp)/womandoingtaxesonline-5c082ff1c9e77c0001aee8e2.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Download Corporate Tax Planning Notes, PDF I MCOM (2024)

- Post last modified: 11 January 2023

- Reading time: 12 mins read

- Post category: Uncategorized

Download Corporate Tax Planning Tax Planning Notes, PDF, Books, Syllabus for MCOM (2024). We provide complete corporate tax planning pdf. Corporate Tax Planning study material includes corporate tax planning notes, book, courses, case study, syllabus, question paper, MCQ, questions and answers and available in corporate tax planning pdf form.

Corporate Tax Planning subject is included in MCOM so students are able to download corporate tax planning notes for MCOM 3rd year and corporate tax planning notes for MCOM 5th semester.

Table of Content

- 1 Corporate Tax Planning Syllabus

- 2 Corporate Tax Planning PDF

- 3 Corporate Tax Planning Notes

- 4 Corporate Tax Planning Questions and Answers

- 5 Corporate Tax Planning Question Paper

- 6 Corporate Tax Planning Books

Corporate Tax Planning Notes can be downloaded in corporate tax planning pdf from the below article.

Corporate Tax Planning Syllabus

A detailed corporate tax planning syllabus as prescribed by various Universities and colleges in India are as under. You can download the syllabus in corporate tax planning pdf form.

- Basic framework of tax laws in India, Residential status of a Company and incidence of tax, Corporate Tax Planning: meaning, Tax Evasion and Tax Avoidance. Tax Planning & Tax Management.

2. Planning regarding Set off & Carry Forward of Losses and Computation of taxable income of companies, Minimum Alternate Tax, Tax on distributed profits of domestic companies, Tax on dividends and income received from venture capital companies.

3. Special provisions in respect of newly established undertakings in Free Trade Zones: General and specific conditions, consequence of amalgamation, demerger and sec 10A. Special provisions in respect of newly established undertakings in SEZ’s.: conditions, consequence of amalgamation, demerger and sec 10AA. Special provisions in respect of newly established undertakings in 100% EOU’s: specific conditions, consequence of amalgamation, demerger, sec 10 B.

4. Deductions available to undertakings developing infrastructure facility, SEZ, Industrial Park, power generation, Telecommunication, reconstruction of power unit. Deductions in respect of profits and gains of undertakings engaged in development of SEZ. Deductions in respect of certain undertakings in certain special category of states, North-Eastern States. Application of these special conditions.

5. Decision regarding form of organization. Tax Planning regarding form of organization with reference to sole proprietorship, Partnership & Company.

6. Financial Management Decisions: Capital Structure Decisions, regarding Dividend Policy: meaning of dividend and its distribution, DDT and regarding issue of Bonus Shares.

7. Managerial Decision: Buy or Lease, Make or Buy and Export or Local Sales, Tax Planning regarding employees remuneration, FBT Planning and Remuneration Planning.

8. Tax Planning in case of liquidation, Advance payment of Tax and Double Taxation Relief.

9. Restructuring business, Amalgamation: conditions, transfer of capital asset, Setoff and carry forward of losses and consequences, Demerger: Conditions, transfer of capital asset, capital gains, Set off and carry forward of losses, expenditure on demerger and consequences.

10. Conversion of sole proprietorship into company and firm into company, Slump Sale and Transfer of assets between holding and subsidiary company.

Corporate Tax Planning PDF

Corporate tax planning notes.

Corporate Tax Planning Questions and Answers

If you have already studied the corporate tax planning and services notes, then it’s time to move ahead and go through previous year corporate tax planning question papers.

- Discuss the historical background of Income tax. What is its importance?

- What is net tax?

- What are the components of Income Tax Law?

- What do you understand by residential status of an individual? How is it related to incidence of an assessee?

- Describe the division of taxable entities for the purpose of determining residential status.

- Discuss, in detail, the provisions for determining the residential status of an assessee.

- Describe how you would determine the residential status of an assessee.

- Write a note on residential status of a company.

- Defi ne incidence of tax as per section 5 of the Income Tax Act, 1961.

- Differentiate between Indian and Foreign Income.

- Explain the meaning of income received or deemed to be received in India.

Corporate Tax Planning Question Paper

If you have already studied the corporate tax planning and services notes, then it’s time to move ahead and go through previous year corporate tax planning question paper.

It will help you to understand the question paper pattern and type of corporate tax planning question and answer asked in MCOM 3rd year corporate tax planning exam. You can download the syllabus in corporate tax planning pdf form.

Corporate Tax Planning Books

Below is the list of corporate tax planning books recommended by the top university in India.

- Ahuja, G. K. & Gupta, Ravi, Systematic Approach to Income Tax, Bharat Law House.

- Aggarwal, K., Direct Tax Planning and Management, Atlantic Publications.

- Lakhotia, R.N., Income Tax Planning Handbook, Vision Books.

- Singhania, V. K. & Singhania, Kapil, Direct Taxes law & Practice. Taxmann Publications.

- Srinivas E. A., Handbook of Corporate Tax Planning, Tata McGraw Hill.

In the above article, a student can download corporate tax planning notes for MCOM 3rd year and corporate tax planning notes for MCOM 6th semester. Corporate Tax Planning study material includes corporate tax planning notes, corporate tax planning books, corporate tax planning syllabus, corporate tax planning question paper, corporate tax planning case study, corporate tax planning questions and answers, corporate tax planning courses in corporate tax planning pdf form.

Go On, Share & Help your Friend

Did we miss something in M.COM Study Material or You want something More? Come on! Tell us what you think about our post on Corporate Financial Accounting Notes | PDF, Book, Syllabus | M COM in the comments section and Share this post with your friends.

You Might Also Like

What is organisational buying process, factors influencing, models, what is social entrepreneurship ecological, sustainable, plant layout, best microsoft sql courses & certification, best sas courses online & certification (march 2024), legal aspects of business notes, pdf i mba 2024, what is consumer protection malpractices, system, right, methods, what is retailing definition, functions, importance, indian political system notes, pdf i mba 2024, business policy and strategic management notes, pdf, paper i mba (2024), industrial relations and labour welfare notes, pdf i mba 2024, economics of business and finance notes, pdf | ba, ma (2024), leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal growth.

Development

Ask the experts to write an essay for me!

Our writers will be by your side throughout the entire process of essay writing. After you have made the payment, the essay writer for me will take over ‘my assignment’ and start working on it, with commitment. We assure you to deliver the order before the deadline, without compromising on any facet of your draft. You can easily ask us for free revisions, in case you want to add up some information. The assurance that we provide you is genuine and thus get your original draft done competently.

Customer Reviews

Remember, the longer the due date, the lower the price. Place your order in advance for a discussion post with our paper writing services to save money!

offers a great selection of professional essay writing services. Take advantage of original, plagiarism-free essay writing. Also, separate editing and proofreading services are available, designed for those students who did an essay and seek professional help with polishing it to perfection. In addition, a number of additional essay writing services are available to boost your customer experience to the maximum!

Advanced writer

Add more quality to your essay or be able to obtain a new paper within a day by requesting a top or premium writer to work on your order. The option will increase the price of your order but the final result will be totally worth it.

Top order status

Every day, we receive dozens of orders. To process every order, we need time. If you’re in a great hurry or seek premium service, then choose this additional service. As a result, we’ll process your order and assign a great writer as soon as it’s placed. Maximize your time by giving your order a top status!

SMS updates

Have you already started to write my essay? When it will be finished? If you have occasional questions like that, then opt-in for SMS order status updates to be informed regarding every stage of the writing process. If you’re pressed for time, then we recommend adding this extra to your order.

Plagiarism report

Is my essay original? How do I know it’s Turnitin-ready? Very simple – order us to attach a detailed plagiarism report when work is done so you could rest assured the paper is authentic and can be uploaded to Turnitin without hesitating.

1-page summary

World’s peace isn’t riding on essay writing. If you don’t have any intent on reading the entire 2000-word essay that we did for you, add a 1-page summary to your order, which will be a short overview of your essay one paragraph long, just to be in the loop.

President Biden Outlines Vision for Higher, More Complicated Taxes in State of the Union Address and FY 2025 Budget

Latest updates.

- Updated to reflect the latest details in President Biden's FY 2025 budget.

- Originally published following President Biden's 2024 State of the Union Address.

Last week, President Biden’s 2024 State of the Union Address presented a vision of higher taxes for American businesses and high earners combined with carveouts, credits, and more complex rules for taxpayers at all income levels. On Monday, the president released his proposed budget for fiscal year 2025 outlining how the White House would implement the president’s tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. vision, amounting to a gross tax hike exceeding $5.1 trillion over 10 years.

Rather than aiming for a simpler tax code that broadly encourages investment, saving, and work in the United States , the president has promised higher taxes that would decrease economic output and incomes, reduce U.S. competitiveness, and further complicate the tax code.

While the Biden budget claims to reduce deficits as a share of the economy over the next decade, that claim is based on several unrealistic assumptions, including:

- No extension of the individual and estate tax An estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits , at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. cuts from the 2017 Tax Cuts and Jobs Act ( TCJA ) that are set to expire at the end of 2025, despite signaling interest in extending the tax cuts for people earning under $400,000, which would cost at least $1.4 trillion over the 10-year budget window

- No extension of the administration’s proposed expansion of the child tax credit beyond 2025, which would cost more than $1 trillion over the budget window

- Economic growth well in excess of what is forecast by the Congressional Budget Office ( CBO )

The FY 2025 Biden budget includes the following major changes, beginning in 2024 unless otherwise noted:

Major Business Tax Provisions in Biden Budget

- Increase the corporate tax rate from 21 percent to 28 percent

- Increase the corporate alternative minimum tax (CAMT) on book income Book income is the amount of income corporations publicly report on their financial statements to shareholders. This measure is useful for assessing the financial health of a business but often does not reflect economic reality and can result in a firm appearing profitable while paying little or no income tax. tax rate from 15 percent to 21 percent

- Disallow deductions for employee compensation above $1 million

- Quadruple the stock buyback tax from 1 percent to 4 percent

- Make permanent the excess business loss limitation for pass-through businesses

- Eliminate the foreign-derived intangible deduction ( FDII ) and replace it with unspecified research & development (R&D) incentives

- Repeal the base erosion and anti-abuse tax ( BEAT ) and replace it with an undertaxed profits rule ( UTPR ) consistent with the OECD/G20 global minimum tax model rules

- Raise taxes on fossil fuel companies and oil extraction

Major Individual, Capital Gains, and Estate Tax Provisions in Biden Budget

- Expand the base of the net investment income tax (NIIT) to include nonpassive business income and increase the rates for the NIIT and the additional Medicare tax to reach 5 percent on income above $400,000

- Increase top individual income tax An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment . Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rate to 39.6 percent on income above $400,000 for single filers and $450,000 for joint filers

- Tax long-term capital gains and qualified dividends at ordinary income tax rates for taxable income Taxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. above $1 million and tax unrealized capital gains at death above a $5 million exemption ($10 million for joint filers)

- Create a 25 percent “ billionaire minimum tax ” to tax unrealized capital gains of high-net-worth taxpayers

- Limit retirement account contributions for high-income taxpayers with large individual retirement account (IRA) balances

- Tax carried interest as ordinary income for those earning over $400,000

- Limit 1031 like-kind exchanges to $500,000 in gains

- Tighten estate and generation-skipping tax (GST) rules

- Tighten tax rules for digital assets, including cryptocurrency, and impose a new 30 percent excise tax An excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda , gasoline , insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on electricity costs associated with digital asset mining

Major Tax Credit A tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. Provisions in Biden Budget

- Extend the American Rescue Plan Act (ARPA) child tax credit (CTC) through 2025 and make the CTC fully refundable on a permanent basis (effective 2023)

- Permanently extend the ARPA earned income tax credit (EITC) expansion for workers without qualifying children (effective 2023)

- Permanently extend the ARPA premium tax credits expansion

- Make permanent the new markets housing tax credit and provide new tax credits for home buying and selling

Additional Major Provisions in Biden Budget

- Expand federal rules on drug pricing provisions

- Make permanent the exclusion of student loan forgiveness from income tax

Note : In a forthcoming update, we will estimate the economic, revenue, and distributional effects of the major tax proposals in the FY 2025 budget.

The tax changes Biden proposes fall under three main categories: additional taxes on high earners, higher taxes on U.S. businesses—including increasing taxes that Biden enacted with the Inflation Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “ hidden tax ,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. Reduction Act ( IRA )—and more tax credits for a variety of taxpayers and activities. The combination of policies would move the tax code further away from simplicity, transparency, and neutrality.

President Biden reintroduced his proposal to raise the effective tax rates paid by households with net worth over $100 million. The proposal requires these households to pay a 25 percent minimum tax rate on an expanded definition of income that includes unrealized capital gains. This means these households would pay tax on capital gains even if the underlying asset has not yet been sold, operating as a prepayment for future capital gains tax A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. liability.

The billionaire minimum tax, as it is commonly known, would increase the complexity of the tax code by using a non-traditional and difficult-to-measure definition of income. It would require formulaic rules for valuing different types of assets, payment periods that vary by asset type, and a separate tax system to deal with illiquid assets. This tax design goes well beyond international norms , where capital gains are taxed when realized and at lower rates than the U.S. in many cases.

Aiming to address Medicare’s growing budgetary shortfalls , the president would raise the hospital insurance (HI) payroll tax A payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. for those earning over $400,000 from 0.9 percent to 2.1 percent. The net investment income tax (NIIT), a 3.8 percent tax on passive investment income for those earning over $200,000 (single) or $250,000 (joint), would be expanded to include active business income. This change would raise top tax rates on labor and business income while not doing enough to put entitlements on a path toward solvency.

President Biden also committed to preserving the additional funding appropriated to the Internal Revenue Service (IRS) as part of the Inflation Reduction Act. Biden argues this would help raise revenue from higher earners who evade taxes and would also improve taxpayer services. Much of this new revenue may take time to appear as the IRS trains new staff and spends time identifying evasion and enforcing the tax law. However, the other components of Biden’s tax plan will push the code in a more complex direction, making the job of the IRS to enforce the law more difficult.

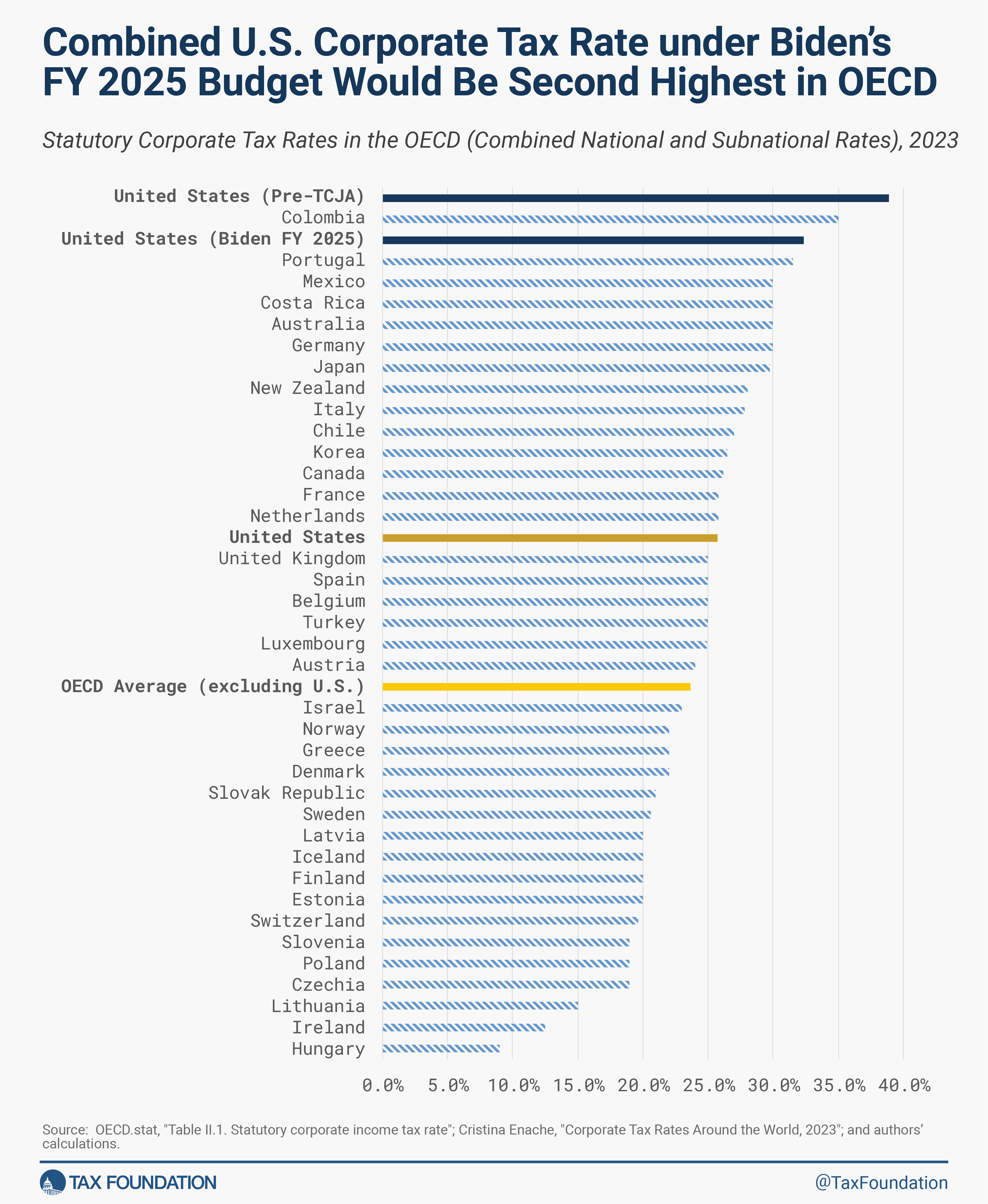

President Biden proposed to raise the corporate income tax A corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses , with income reportable under the individual income tax . rate from 21 percent to 28 percent, a policy he has pushed for since the 2020 campaign. The corporate income tax is the most harmful tax for economic growth and its many problems have led countries around the world to reduce corporate tax rates considerably over the last 40 years to an average of about 23 percent as of 2023. The U.S. had the highest corporate tax rate in the OECD prior to the TCJA, which lowered the U.S. corporate tax rate to be roughly average among OECD countries. Recent studies have determined that lowering the corporate tax rate significantly boosted investment in the United States, a long-term process that continues to yield economic benefits, including gains in workers’ wages.

Raising the corporate tax rate from the current 21 percent to 28 percent, combined with the average state-level corporate tax rate, would give the U.S. the second-highest combined corporate tax rate in the OECD, significantly worsening the competitive position of U.S. businesses and reducing prospects for business investment and workers.

On top of a higher statutory corporate tax rate, Biden has proposed increasing the rate of the new corporate alternative minimum tax on book income from 15 percent to 21 percent. The tax was enacted in August 2022 as part of the IRA and scheduled to go into effect starting in 2023, but the IRS postponed its implementation because of the complexity of enforcing it . Taxpayers are still awaiting guidance on several significant questions related to the CAMT, and it remains questionable whether the tax is even feasible. It has certainly failed thus far as an effective minimum tax.

Biden also proposed quadrupling the IRA’s 1 percent excise tax on stock buybacks. Stock buybacks are one of the ways businesses return value to their shareholders. Companies can return earnings to shareholders by issuing dividends (namely cash payments) or with stock buybacks (purchasing shares of their own company). As much as 95 percent of the money returned to shareholders from stock buybacks subsequently gets reinvested in other public companies. Quadrupling the tax rate would likely discourage firms from pursuing stock buybacks, potentially tilting toward more dividend issuances instead, and could discourage investment.

As a new proposal, Biden would expand the cap on deductions for employee compensation above $1 million (Section 162m). The cap currently applies to the CEO, CFO, and the next three highest-paid employees of a corporation, and due to ARPA is already scheduled to expand to the next five additional highest-paid employees beginning after 2026.

Biden’s proposal would expand the cap to cover all employees, raising the cost of compensating employees and making it costlier for corporations to attract and retain top talent. It would mean both the corporate and individual top tax rates would apply to wages, resulting in top tax rates of 70 percent or more including state taxes. If the $1 million threshold is not indexed to inflation, over time the tax would hit more than just the C-suite.

Biden has called for several proposals to subsidize home purchases and boost the low-income housing tax credit, including a tax credit worth $5,000 per year for two years for middle-class, first-time homebuyers. The president would also offer a one-year tax credit worth up to $10,000 for middle-class households who sell a starter home to help improve starter home availability. Finally, the president proposes to provide up to $25,000 in down payment assistance for first-generation homebuyers.

Boosting demand through subsidies is likely to cause housing prices to increase further. What is needed is a greater supply of housing, which would be best accomplished at the state and local level by reforming zoning rules and at the federal level by reforming tax depreciation Depreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income . Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing ), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. rules for residential structures .

For developers, the president would expand the low-income housing tax credit (LIHTC) and create a new neighborhood homes tax credit to build or renovate affordable houses. This approach would be an inefficient way to build new homes as the existing LIHTC is expensive for the homes produced, with much of the credit value going to developers and financing agencies .

President Biden would renew the expanded child tax credit from the 2021 American Rescue Plan Act, which would raise the CTC value from $2,000 to a maximum value of $3,600 while removing work and income requirements. This CTC expansion would have major fiscal costs totaling over $1 trillion over 10 years above the current-policy CTC. If we include the underlying CTC expansion from the Tax Cuts and Jobs Act that expires at the end of 2025 , the cost approaches $2 trillion over 10 years.

In addition to the CTC expansion, the president would expand the EITC and make permanent the expanded Affordable Care Act (ACA) premium tax credits that are scheduled to expire at the end of 2025.

Finally, the president recommitted to not raising taxes on those earning under $400,000, arguing that he would fully pay for expiring TCJA individual tax changes with “ additional reforms ” that would further raise taxes on high earners and businesses. These unspecified reforms would need to total at least $1.4 trillion to cover TCJA extension for people earning under $400,000.

The president’s tax policy proposals as outlined in the State of the Union address would make the tax code more complicated, unstable, and anti-growth, while also expanding the amount of spending in the tax code for a variety of policy goals not related to revenue collection.

The White House estimates the FY 2025 Biden budget would reduce the budget deficit by $3.2 trillion over 10 years. However, this estimate does not include the cost of their intended extension of the TCJA tax cuts for those earning less than $400,000 or for the proposed expanded CTC post-2025. These tax changes alone would wipe out most of the touted deficit reduction.

The Biden budget also assumes an unrealistically high rate of growth in the economy, especially considering the large tax increases proposed on businesses and high earners that will slow growth. The budget assumes real GDP will grow at 2.2 percent annually in the last 5 years of the budget window, while the CBO assumes real GDP will grow about 1.9 percent annually over this period.

In sum, President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the U.S. in a distinctly uncompetitive international position and threaten the health of the U.S. economy. The Biden budget ignores or makes unrealistic assumptions about the fiscal cost of major proposals as well as economic growth under this plan, concealing what is likely to be a substantial cost borne by American workers and taxpayers.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Timeline of Activity

Finished Papers

Sophia Melo Gomes

Meeting Deadlines

Well-planned online essay writing assistance by penmypaper.