Reply Letter Format to GST Department in Word

If you have received a letter from GST Department in relation with your taxation then you must frame a formal reply letter to GST notice to explain yourself in a formal way. You can follow the letter to GST officer format to respond to the notice from the department to avoid any complications. Letter to GST Department has to be precise and must have the clarification in context of the notice. It must include answers to all the questions that have been posed by the department.

In this post, you will find the format for reply of GST notice . Use this GST reply letter format in Word based on your requirement.

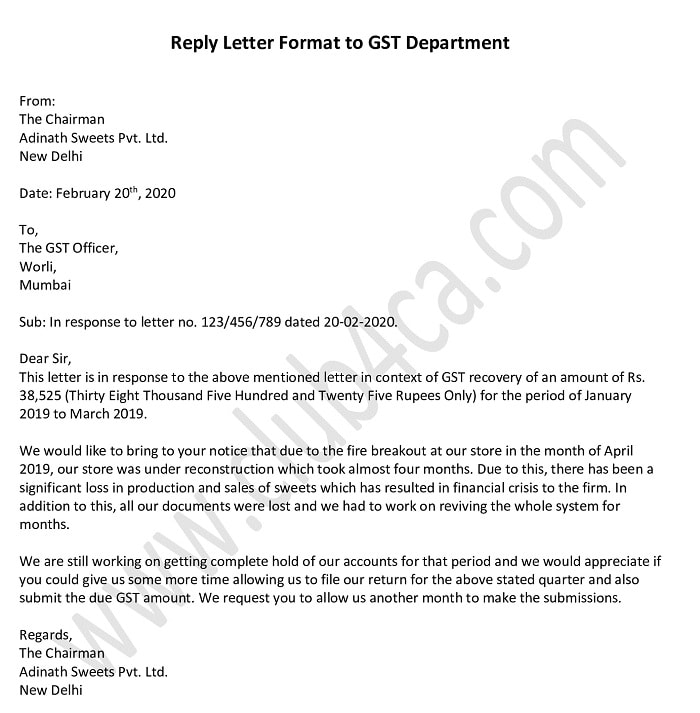

Letter Format for Reply of GST Notice

The Chairman

Adinath Sweets Pvt. Ltd.

Date: February 20 th , 2020

The GST Officer,

Sub: In response to letter no. 123/456/789 dated 20-02-2020.

This letter is in response to the above mentioned letter in context of GST recovery of an amount of Rs. 38,525 (Thirty Eight Thousand Five Hundred and Twenty Five Rupees Only) for the period of January 2019 to March 2019.

We would like to bring to your notice that due to the fire breakout at our store in the month of April 2019, our store was under reconstruction which took almost four months. Due to this, there has been a significant loss in production and sales of sweets which has resulted in financial crisis to the firm. In addition to this, all our documents were lost and we had to work on reviving the whole system for months.

We are still working on getting complete hold of our accounts for that period and we would appreciate if you could give us some more time allowing us to file our return for the above stated quarter and also submit the due GST amount. We request you to allow us another month to make the submissions.

Click Here to Download Reply Letter Format to GST Department in Word

Other GST Related Formats

NOC Letter for GST Registration for Address Proof GST Revocation Request Letter Format GST Email id and Mobile Number Change Letter Letter of Authorization for GST Sole Proprietorship NOC Format for obtain GST Registration Letter to Vendor for GST Mismatch GST Tax Invoice Rules Format in PDF GST Format for Sales & Purchase Summary for Small Businesses GST Invoice for Service Provider in Excel Format GST Delivery Challan Format in PDF GST Delivery Challan Format in Excel For Transportation of Goods Without Tax Invoice GST Retail Invoice Format in Excel Sheet GST Receipt Voucher for Advance Payments under GST Format GST Penalty Calculator in Excel Format Everything You Must Know About GST on Rent FAQ on E commerce under GST Reply Letter Format to GST Department

Top File Download:

- letter to gst department format

- gst notice reply letter

- gst notice reply format

- 270 A REPLY FORMAT WORD

- VAT NOTICE REPLY LETTER

- notice reply format

- reply of notice of owner for rent

- reply letter in word formate

- notice reply letter

- reply to gst notice format

Related Files:

- GST Email id and Mobile Number Change Letter Format

- Letter for GST not Applicable

- Letter Requesting Adjournment of Hearing to Assessing Officer

- Effective Study Tips for Success in Chartered Accountancy

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

Letter Templates

authorized letter format for gst representative

As a business owner, you may need to authorize someone to represent you for GST-related matters. To do so, you need to provide an authorized letter. In this article, we’ll discuss the format for an authorized letter for GST representative, and we’ll provide some examples to help you get started.

Tips for Writing an Authorized Letter for GST Representative

Before we dive into the examples, let’s go over some tips to keep in mind when writing an authorized letter for GST representative:

- Keep it simple and straightforward.

- Use a formal, polite tone of voice.

- Include all the necessary details, such as the name and contact information of the representative.

- Specify the purpose of the authorization, such as filing GST returns or responding to GST notices.

- Make sure the letter is signed and dated.

- Provide examples for the reader to edit as needed.

Examples of Authorized Letter Format for GST Representative

Authorization for gst filing.

Dear Sir/Madam,

I, [Your Name], hereby authorize [Representative’s Name] to act as my representative for all matters related to GST filing. [Representative’s Name] is authorized to sign and file GST returns on my behalf, and to correspond with the GST department as necessary.

Please find attached a copy of [Representative’s Name]’s ID proof and contact information for your reference. This authorization is effective from [Start Date] until [End Date], unless I revoke it earlier.

Thank you for your prompt attention to this matter.

[Your Name]

———————————————————-

[Your Signature]

Authorization for GST Payment

Dear [GST Officer’s Name],

I, [Your Name], hereby authorize [Representative’s Name] to act as my representative for all matters related to GST payment. [Representative’s Name] is authorized to make GST payments on my behalf, and to correspond with the GST department as necessary.

Thank you for your cooperation.

Best regards,

Authorization for GST Refund

I, [Your Name], hereby authorize [Representative’s Name] to act as my representative for all matters related to GST refund. [Representative’s Name] is authorized to file GST refund claims on my behalf, and to correspond with the GST department as necessary.

Authorization for GST Notice Response

I, [Your Name], hereby authorize [Representative’s Name] to act as my representative for all matters related to GST notices. [Representative’s Name] is authorized to receive GST notices on my behalf, to respond to them, and to correspond with the GST department as necessary.

Thank you for your attention to this matter.

Yours sincerely,

Authorization for GST Registration

To Whom It May Concern,

I, [Your Name], hereby authorize [Representative’s Name] to act as my representative for all matters related to GST registration. [Representative’s Name] is authorized to apply for GST registration on my behalf, and to correspond with the GST department as necessary.

Thank you for your assistance in this matter.

Authorization for GST Audit

I, [Your Name], hereby authorize [Representative’s Name] to act as my representative for all matters related to GST audit. [Representative’s Name] is authorized to attend meetings with the GST department, to provide information and documents on my behalf, and to correspond with the GST department as necessary.

Authorization for GST Appeal

I, [Your Name], hereby authorize [Representative’s Name] to act as my representative for all matters related to GST appeal. [Representative’s Name] is authorized to represent me in appeals before the GST Appellate Authority, to provide information and documents on my behalf, and to correspond with the GST department as necessary.

Yours faithfully,

Frequently Asked Questions

Can i authorize more than one person for gst-related matters.

Yes, you can authorize more than one person to represent you for GST-related matters. However, you need to provide a separate authorized letter for each representative, specifying their scope of authority and the period of authorization.

Do I need to provide any documents along with the authorized letter?

Yes, you need to provide a copy of the representative’s ID proof and contact information, along with the authorized letter. This is to ensure that the GST department can verify the representative’s identity and contact them if needed.

Can I revoke the authorization before the end date?

Yes, you can revoke the authorization at any time before the end date by providing a written notice to the GST department. However, any actions taken by the representative before the revocation will still be valid.

Can the representative sign and file GST returns electronically?

Yes, if the representative has been authorized to do so, they can sign and file GST returns electronically using their own digital signature.

Can the representative attend meetings with the GST department on my behalf?

Yes, if the representative has been authorized to do so, they can attend meetings with the GST department on your behalf, provide information and documents, and respond to queries.

Do I need to pay the representative for their services?

That depends on your agreement with the representative. If you have agreed to pay them a fee for their services, you need to mention it in the authorized letter. If there is no such agreement, the representative cannot charge you for their services.

An authorized letter for GST representative is an important document that can help you delegate your GST-related tasks to someone else. By following the tips and examples provided in this article, you can create an effective authorized letter that meets your needs. If you have any further questions, feel free to consult a legal or financial expert.

- sample authorization letter to lhdn

- authorization letter to represent on behalf of company sample

- authority letter format word for court

- authorization letter format for gst audit

- sample authorization letter to allow

- authority letter format for court

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Tax Assistant Cover Letter Sample

Get hired faster & learn to perfect your new cover letter with this expertly drafted Tax Assistant cover letter sample. Copy and paste this cover letter sample as it is or revise it in our proven and tested cover letter creator.

Related resume guides and samples

How to craft an appealing administration resume?

How to create a professional facilities manager resume

How to write an effective front desk receptionist resume?

How to build an effective office staff resume

How to build an effective personal assistant resume?

Tax Assistant Cover Letter Sample (Full Text Version)

Arturo Marti

Dear Hiring Managers,

Thank you for the opportunity to submit my application for the Tax Assistant job within BFR Financial, Ltd. in Miami, FL as advertised on your company careers website. I am certain that I possess everything necessary to execute the role successfully while coming to you with a pro-active approach and determination to meet and exceed all assigned goals.

To shortly introduce myself, I am a Certified Tax Manager offering a strong attention to detail and accuracy and the ability to function well both independently and in a team setting. At Vertex, Inc., where I worked as a Tax Assistant for over two years, I was given the responsibility for reviewing and examining financial records and statements, computing taxes, and building and maintaining strategic relationships with clients and business partners. In addition, I filled various forms, stayed up-to-date with current laws and regulations, and executed other clerical tasks as required. There, I had demonstrated numerous times that I am a performance-driven individual with exceptional analytical skills.

Next, I am a native Spanish speaker with a proficiency in English and a basic knowledge of Chinese. With a bachelor's degree in Economics & Finance from the Bentley University, I am also experienced with all software programs required for the position, including TurboTax, QuickBooks, and Kashoo. Finally, I would appreciate the opportunity to meet with you in person to discuss the job and my qualifications in further detail. I can be reached at 555-555-5555 or via email at [email protected]. Thank you for your time and consideration and I look forward to speaking with you in the near future.

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Finance Analyst Auditor Investment Advisor Office Staff Personal Assistant Tax Services Facilities Manager Administration Insurance Agent Accountant Bookkeeper Front Desk Receptionist

Related administrative resume samples

Related tax services cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

- Toll Free 1800 309 8859 / +91 80 25638240

Home GST GST Notices

GST Notices

Tally Solutions | Updated on: August 23, 2021

--> published date: | updated on: --> <--, introduction, what is a show cause gst notice.

- Case I: No Fraud – And the motivation was not to evade taxes

- Case II: Fraud - With the intention to evade taxes

Handling a show cause GST notice and GST notice reply letter format

As we all know, the Goods & Service Tax (GST) is payable on self-assessment basis i.e. assessee himself has to determine its tax liability.

If the determination of assessee goes wrong i.e. assessee has short paid any taxes or not paid any taxes or has wrong availed and utilized any input tax credit or has erroneously been refunded, then, under such circumstances, demand would be raised by the GST officials by way of issuing GST notices - to be called as Show cause notices under taxation parlance.

The provisions of demand, manner of serving of GST notice and the consequent recovery provisions are similar to the provisions of Service Tax and Central Excise Act.

Show cause notice is the first stage in any investigation in tax laws. In Goods and Services Tax Act, show cause notice is to be issued before any penalty is levied or demand is raised. SCN is also required to be issued while taking action for payment of Goods and Services tax collected from any person which has not been deposited with the Central Government.

When does a GST notice served on a tax payer?

GST notice shall be served on a tax payer depending upon the motivation of the tax payer in evading taxes.

- Tax is unpaid/short paid by the tax payer or,

- Refund is wrongly made by him or where,

- Input tax credit has been wrongly availed/utilized

The proper officer (i.e., GST authorities) will serve a show cause GST notice on the taxpayer. The tax payer will then be required to pay the amount due, along with interest and penalty.

Handling a GST notice: The points stated below are important to note while handling show cause GST notices:

- Date of notice and date of receipt of GST notice could be different. While acknowledging the Show cause GST notice, always remember to put date and time over the acknowledgement copy.

- Don't avoid the receipt of SCN. If such notice is being served, there is no point in avoiding receiving it. First, it has to be received and then contested/replied. Non-receipt is considered as a service.

- If the service of notice is time barred, it could be suitably replied with substantiating evidence.

- If the SCN is beyond one year, it will have to be proved that there was no suppression etc. on assessees part so that department cannot invoke the provision of five years. SCN has to prove suppression.

- In case you are contemplating any SCN, and you feel that service tax has to be paid, it would be advisable to pay service tax before SCN is issued. SCN cannot be issued for the amounts already paid.

- Whenever SCN is intended to enhance the liability of assessee or reduce the amount of refund, an opportunity of being heard is necessary and it cannot be denied by the revenue.

- You can challenge the validity and legality of SCN served on you on the basis of facts, time or even jurisdiction.

- SCN is always issued in writing. There is nothing like GST notice.

- SCN must mention amount demanded any SCN without amount is not valid. Also, the amount of the proposed penalty should be mentioned.

- SCN is to be issued for a particular period. Where demand is raised, admitted and paid, SCN will still be required in those scenarios to be served for the subsequent period.

- Department cannot go beyond what is mentioned in SCN and adjudicate an issue which is not a subject matter of SCN.

- SCN is required to be replied within the stipulated time mentioned in the notice and must be replied accordingly.

- While efforts must be made to comply with the same, it would be advisable to seek an extension of time or adjournment which is normally granted.

- Try to provide reply or explanation to all points covered in SCN and wherever necessary, substantiate the reply with documentary evidence.

- Detailed reply may be submitted along with earlier decided case laws.

- A list of evidence on which you are relying must also be submitted.

- Even where you have submitted a detailed and convincing reply to SCN, you should seek the option of personal hearing and carve to alter or amend or modify your reply to show cause at any stage during adjudication proceedings.

- Where the penalty is levied or demand is confirmed or refund is revoked, you can always seek alternative measures for relief that there was a reasonable cause which prevented you from compliance of provisions.

- Orders issued against show cause notice are appealable.

- If you are not in a position to represent your case personally, better hire a professional to guide you in drafting a reply to SCN and represent your case at adjudication stage.

- SCNs have to be properly defended and argued for this stage builds the foundation for further actions.

It is felt that the above points if borne in mind by the assessees and service providers shall help them in appropriately replying to the show cause notice issued by the Department.

GST notice Reply letter format: Form – GST CMP 06

Note 1: The reply should not be more than 500 characters. If it is more than 500 characters, then it should be uploaded separately.

Note 2: Supporting documents, if any, may be uploaded in PDF format.

Conclusion: How Tally.ERP 9 provides you assistance with relation to show causes notices. No, it doesn’t have provisions for replying to a show cause notice but with Tally, you can file GST returns before due date effectively and efficiently.

Tally.ERP 9 validates maximum information to be filed in the returns like GSTIN , HSN code , tax rates and its calculation, the applicability of a type of supply i.e intra-state and inter-state etc. It helps taxpayers in preparing GSTR 1 i.e. outward supplies return and reconcile it with GSTR 3B so that tax liability shown in GSTR 3B matches with the final return for outward supplies. (GSTR 1)

Tally Solutions | Nov-28-2019

- Business Guides

- ERP Software

Latest Blogs

How to Easily Shift/Migrate Your Data to TallyPrime

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide

Compliance is NO MORE complex! Ease of e-invoicing & accurate GST return filing with TallyPrime!

Thanks for Applying

We will be in touch with you shortly.

AI Summary to Minimize your effort

Consent Letter For GST Registration: Format and Requirements

Updated on : Nov 7th, 2023

In an e-commerce era where budding entrepreneurs carry out business remotely or from homes, without an office space, there are scenarios where businesses must register under GST declaring a place of business which are neither owned nor rented out by them. It invokes the use of the consent letter.

They must still comply with the GST law since that will legally authorise them to collect taxes from their buyers and pass on the input credit of taxes paid. Only such GST registered businesses will be legally recognised as suppliers of goods or services, made mandatory to sell on e-commerce sites. If you want to verify the authenticity of the GST number of such sellers, you can use the GST search tool.

The article provides details on using a consent letter, who should sign it, format for downloading the consent letter for GST registration.

Meaning of GST consent letter or NOC

Many businesses are carrying out their work from home as they do not have a registered commercial place of business. If such premises on which work is being carried out is owned, then a document supporting the taxpayer’s ownership is to be uploaded at the time of registration.

If the premises are rented, then a valid rent/lease agreement is to be uploaded. If it’s neither owned nor rented, then such taxpayers are required to submit a consent letter at the time of upload of their proof of place of business.

It is a No Objection Certificate (NOC) from the owner of the premises stating that he doesn’t have any objection to the taxpayer using the premises for carrying out business. Under GST, there is no specific format for the consent letter. It can be any written document.

Who must sign the consent letter?

The owner of the premises should sign a consent letter. In some cases, GST officers ask for a consent letter on a stamp paper, and the same should be notarised as well. However, one can upload the consent letter without even printing it on stamp paper. If a GST officer specifically asks for the content letter to be printed on stamp paper, the taxpayer can get the needful done.

Other documents with consent letter

The consent letter should be uploaded along with address proof of business like a Municipal Khata copy or an electricity bill.

Steps to upload the consent letter

Step 1: Visit the GST portal and go to ‘Services’ -> ‘Registration’ -> ‘New Registration’.

Step 2: While filling up the form, select ‘Consent’ under the nature of possession of premises if the place of business is a rented premise or the taxpayer uses the premises of a relative. The owner of the premises must sign the consent letter.

Step 3: The consent letter can be uploaded in PDF or JPEG format, but the file size cannot be more than 1 MB.

Format of a consent letter

CONSENT LETTER

TO WHOMSOEVER IT MAY CONCERN

This is to certify that I ……………………..(Name of the owner), owner of the property …………………………………………………. (Principal address) have permitted and allowed …………………………. (Name of the Proprietor) for operating and conducting their business from the ADDRESS MENTIONED ABOVE.

I further state that I have no objection if …………………………. (Name of the proprietor) uses the address of the said premises as their mailing address.

This is no objection certificate issued to obtain registration under GST.

Owner of the property

……………………………. (Name of the owner)

Date: …….……….

Place: …………….

Download GST Consent Letter

Please click on the below link to download the Word format of the GST Consent letter.

Failure to submit a consent letter

If a taxpayer forgets to submit the consent letter and the address proof while filing the GST registration application in Form GST REG-01, the GST officer may put the application on hold. In such cases, the taxpayers may receive communication via email or phone. On receiving such communication, the taxpayer will be required to submit the consent letter with the application.

Popular FAQs on GST Consent Letter

Is the trade name of the proprietor needed in the consent letter.

No, the trade name of the sole proprietor is not required to be mentioned in the consent letter.

What type of stamp paper is required for GST registration NOC?

Not all of the applicants need to submit the NOC on stamp paper. They can use normal paper. Only if the jurisdictional officer insists on submitting it on the stamp paper, they can go for it.

Why is NOC required for GST registration?

NOC or consent letter is needed for GST registration of such taxpayers who are neither doing business on their own premises nor doing business in rented premises. For instance, Mr. Ram is staying with his parents in their own flat. He starts his practice as a chartered accountant and wants to obtain GST registration. He does not have any other place of business as he works from home. In this case, he must obtain the signed consent letter from his parents.

How do I write a business consent letter?

You can download the consent letter format provided in the above section, and fill up the details of the owner and your business. Thereafter, obtain their signature.

Does a rent agreement need to be notarised for GST registration?

No, you do not need to notarise the consent letter unless insisted so by the jurisdictional officer who is processing your GST registration application.

About the Author

Athena Rebello

A Chartered Accountant by profession and a writer by passion, my expertise extends to creating insightful content on topics such as GST, accounts payable, and invoice discounting.. Read more

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- Login/Register

@2022 - All Right Reserved. Designed and Developed by PenciDesign

Consent Letter for GST Registration: Format and Requirements

In the contemporary e-commerce world, where emerging entrepreneurs often conduct business remotely or from home without a dedicated office space, situations arise where businesses need to undergo GST registration , declaring a place of business that is neither owned nor rented by them. In such instances, the use of a consent letter for GST becomes vital.

Despite the absence of a physical office, these businesses are obligated to comply with GST laws. This compliance is crucial as it legally empowers them to collect taxes from their buyers and avail themselves of input credits for taxes paid. Additionally, GST registration is a precondition for legal recognition as suppliers of goods or services, particularly for those mandated to sell on e-commerce platforms. To authenticate the GST number of such sellers, one can utilise the GST search tool . In this blog, we shall go into details of using a consent letter for GST.

Unlock your business potential with expert CA, CS, and Legal Services

Start Your GST Registration With Us

Get a free consultation today

Understanding Consent Letter for GST Registration

In the context of Goods and Services Tax registration, businesses operating from home without a registered commercial place of business need to provide documentation to support their location. The nature of the documentation depends on whether the premises are owned or rented. The following points must be noted in this context:

Ownership Documentation for Owned Premises

If the premises where business activities are conducted are owned, the taxpayer must upload a document verifying their ownership at the time of GST registration.

Rent/Lease Agreement for Rented Premises

For businesses operating in rented premises, a valid rent or lease agreement is required to be uploaded during the registration process.

Consent Letter for Unowned or Unrented Premises

In cases where the premises are neither owned nor rented, taxpayers are obligated to submit a consent letter during the upload of their proof of place of business.

No Objection Certificate

The consent letter for GST registration, in this context, serves as a No Objection Certificate from the owner of the premises. This certificate explicitly states that the owner has no objection to the taxpayer utilising the premises for conducting business activities.

It’s important to note that under GST regulations, there is no prescribed format for the consent letter for GST registration. It can take any written form and serves as a formal acknowledgment from the premises owner regarding their lack of objection to business operations on the premises.

Signatory for the Consent Letter for GST Registration

The consent letter in GST registration must be signed by the owner of the premises. This ensures that the acknowledgment of the owner’s non-objection to the taxpayer using the premises for business is officially documented.

Notarisation and Stamp Paper Requirements

In certain instances, GST officers may request a consent letter to be executed on a stamp paper, and in some cases, notarised as well. However, it is worth noting that a consent letter in GST registration can be uploaded without being printed on stamp paper. If a GST officer explicitly requires the consent letter to be on stamp paper, the taxpayer should comply with the request accordingly.

Additional Documents for Upload with Consent Letter

When submitting the consent letter, it is necessary to include supporting documents as proof of the business address. Typically, documents such as a Municipal Khata copy or an electricity bill that verifies the business location should be uploaded along with the consent letter for GST.

This collective documentation helps establish the legitimacy of the business’s address and the owner’s authorisation for the use of the premises for commercial activities under the GST framework.

Process for Uploading the Consent Letter for GST Registration on the GST Portal

Mentioned below is the process for uploading consent letter on the portal:

Step 1: Access the GST Portal

Visit the GST portal and navigate to the registration section by selecting ‘Services’ -> ‘Registration’ -> ‘New Registration’.

Step 2: Indicate Nature of Possession in the Registration Form

While completing the registration form, specifically choose ‘Consent’ under the nature of possession of premises if the place of business is a rented premise or if the taxpayer utilises the premises of a relative. Ensure that the consent letter is signed by the owner of the premises.

Step 3: Upload the Consent Letter

The consent letter, signed by the owner, can be uploaded in either PDF or JPEG format . It’s important to note that the file size should not exceed 1 MB . Make sure that the uploaded document clearly reflects the owner’s approval for the taxpayer to use the premises for business purposes.

By following these steps, businesses can efficiently upload the required consent letter on the GST portal during the registration process, ensuring compliance with the necessary documentation for GST registration.

Consequences of Failing to Submit Consent Letter in GST Registration

Failure to submit the required consent letter and address proof during the filing of the GST registration application using Form GST REG-01 may lead to certain consequences:

1. Application Hold by GST Officer:

If the consent letter and address proof are not provided as part of the initial application, the GST officer has the authority to put the application on hold.

2. Communication from GST Officer:

In such instances, taxpayers can expect to receive communication from the GST officer, often through email or phone. This communication serves as a notice, indicating the missing documentation and the need for compliance.

3. Required Action by Taxpayer:

Upon receiving communication, it becomes the responsibility of the taxpayer to rectify the omission. This involves submitting the necessary consent letter along with the application promptly.

Ensuring the timely submission of the consent letter and address proof is important to avoiding delays and complications in the GST registration process.

Unlock your business potential with expert

CA, CS & Legal Services

Final thoughts.

The consent letter for GST registration holds paramount importance in the GST registration process, serving as a formal declaration from the premises owner that they have no objection to the taxpayer conducting business activities on the specified premises. Failure to submit the consent letter alongside the registration application may result in the application being put on hold by GST officers. In such cases, prompt attention and compliance are necessary, as indicated by communication from the GST officer. Timely submission of the consent letter, along with other required documents, are essential steps to ensure a seamless and efficient GST registration process, facilitating legal compliance for businesses operating within the Goods and Services Tax framework.

Aishwarya Agrawal

Ms. Aishwarya Agrawal is a graduate from Hidayatuallah National Law University, Raipur [HNLU Raipur]. Aishwarya holds a great interest in adding value to the legal fin-tech sector. She joined "StartupFino" with a motive to help budding lawyers in their day-to-day journey in the field of Law.

Latest GST News Updates, Notification, and Announcements

Gst share between central and state, related posts, how to check the gst registration revocation status, what is the eligibility for gst registration, understanding tds on professional fees: limits and regulations, rights and responsibilities of doing independent itr filing, benefits of using online itr filing tools for..., document checklist for gst registration under the updated..., step-by-step guide for gst registration under the new..., threshold turnover for gst registration: what small businesses..., common misconceptions about the minimum turnover limit for..., future trends in gst registration: potential changes to..., leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Startupfino is one and only platform in India which is exclusively formed to support startups for their financial and legal matters. Startupfino is working in the ecosystem since a decade and is well equipped to handle the complexities in a startup faced by founders. View More…

LetsGoLegal Advisory Private Limited

Quick Links

- Business Incorporation

- IPR & Trademark

- Accounting & Compliance

Learning Section

Mobile: 829-829-1011 Mail: [email protected]

Head Office

22, 2nd Floor Vaishali, Pitampura, Delhi 110034

Gurgaon Office

880, Udhyog Vihar Phase-V, Gurugram, Haryana

Bangalore Office

Indiqube Sigma 3B 4th Floor Wing A2,7th C Main 3rd Block Koramangala Bangalore-560034

Faridabad Office

59/9, Faridabad, Haryana, 121006

© startupfino, 2024

📞 Call to Expert

Keep me signed in until I sign out

Forgot your password?

A new password will be emailed to you.

Have received a new password? Login here

WhatsApp us

Find new career advice, career planning tips and letter formats

- Letters and Emails

Reply Letter Format to GST Department

There are various kinds of GST notices that a business can receive but no matter what kind of a notice it is, you must always reply to it. Whether it is a GST letter to supplier or a trader, you must know how to write a letter to GST department for notice reply . You must be able to answer the questions that have been posed in the letter using letter to GST officer format . A perfect letter is one which has a formal tone and is specific to the point.

If you are clueless about framing a reply letter format to GST department then you can always use the formally drafted GST notice reply letter format in Word.

Rakesh Sharma, Manager, The Fresh and Crunch Pvt. Ltd. New Delhi

Date: April 7 th , 2020

The GST Officer,

Sub: Response to letter no. A-111/222/333 dated 09-04-2020.

I am writing this letter on behalf of M/s The Fresh and Crunch Pvt. Ltd., in response to the letter no. A-111/222/333 dated 09-04-2020 in relation with GST recovery of Rs. 52,485 (Rupees Fifty Two Thousand Four Hundred and Eighty Five Only) for the III Quarter of FY 2019-20.

As you can see from our track record that we have always been punctual with our GST payments except for that particular quarter because one of our units in Gandhi Nagar was shut down because of some property matters. This seriously affected our cash inflow because of which we were not able to make the timely payments.

Though things are much better now and we are in a position to clear our dues. We ensure that all the GST dues will be cleared by the end of this month.

Thanks for considering our situation

Click here to Download all types of GST Letter Formats in Word

Related Posts

Welcome Letter to New Employee from HR Manager

Appointment Letter for Employee

10 Differences Between Business Letter & Personal Letter

1 thought on “ reply letter format to gst department ”.

Form GSTR-3A [See rule 68] Reference No: ZA270421030212A Date: 06/04/2021 To 27AAFCT0493G1Z9 TANAYA TECH INFRA PRIVATE LIMITED 87, BUTEEWADGAO,, GANGAPUR, Aurangabad,Maharashtra,433702 Notice to return defaulter u/s 46 for not filing return Tax Period: February, 2021-22 Type of Return: GSTR-3B Being a registered taxpayer, 1. you are required to furnish return for the supplies made or received and to discharge resultant tax liability for the aforesaid tax period by due date. It has been noticed that you have not filed the said return till date. 2. You are, therefore, requested to furnish the said return within 15 days failing which the tax liability may be assessed u/s 62 of the Act, based on the relevant material available with this office. Please note that in addition to tax so assessed, you will also be liable to pay interest and penalty as per provisions of the Act. 3. Please note that no further communication will be issued for assessing the liability. 4. The notice shall be deemed to have been withdrawn in case the return referred above, is filed by you before issue of the assessment order. 5. This is a system generated notice and will not require signature.

Note: PLEASE REPLY THIS LETTER

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- +919643203209

- [email protected]

For Indian Entrepreneur

- Private Limited Company

- Public Limited Company

- Limited Liability Partnership

- One Person Company (OPC)

- Sole Proprietorship

- Partnership

- Hindu Undivided Family (HUF), HUF Deed

- E-Commerce Business

- Company Registration in UK New

- Company Registration in USA New

For Foreign Entrepreneur

- Indian Subsidiary

- Company Registration by Foreigner

Special Entities

- Non Profit Organization

- Nidhi Company

- Producer Company

Tax Registrations

- GST Registration

- GST Modification

- PAN Application

- TAN Application

Other Registration

- IEC Registration

- IEC Modification

- ESIC Registration

- Digital Signature

- DIN Application

- EPF Registration

- SSI/MSME/Udyog Aadhar Registration

- GST Returns

- Income Tax Returns

- TDS Returns

- TDS Returns Revision

- ESI Returns

Annual Filings

- Private Limited Company Annual Filing

- LLP Annual Filing

- Public Limited Company Annual Filing

- OPC Annual Filing

- NPO/Section 8 Company Annual Filing

- Nidhi Company Annual Filing

- Producer Company Annual Filing

- Trust Annual Filing

Change Services

- Add A Director

- Removal/Resignation of Director

- Add/Remove a Partner in LLP

- Change in LLP Agreement

- Change of Registered Office Address

- Increase in Authorized Capital

- Change in DIN

- Surrender Your DIN

- Appointment of Auditors

- Share Transfer & Transmission

- Company Name Change

- LLP Name Change

- MOA/AOA Amendment

- MOA/AOA Printing

- Strike Off Company

- Strike Off LLP

- Dissolution of Firms

- Strike Off OPC

Legal Drafting

- Download Library

- Customized Drafting

- GST LUT Letter of Undertaking New

- GST Cancellation

- ROC Search Report New

- Commencement of Business (INC 20A) Filing New

- Trademark Registration

- Trademark Objections

- Trademark Assignment

- Trademark Renewal

- Trademark Opposition

- Trademark Withdrawal

- Trademark Rectification

- Trademark Watch Services

- International Trademark Registration

- Copyright Application

- Patent Registration

Designing & Marketing

- Logo Designing New

- Digital Marketing New

- --> Accounting

- --> Payroll

- --> CMA Report Prepartion

- --> Business Plan Preparation (Project Report)

- --> +919643203209

- --> [email protected]

- Posted On October 15, 2022

- Posted By By Zarana Mehta

- Articles - GST

- Goods and Service Tax Act

- GST Registration in India

- LUT under GST

What is a Letter of Undertaking under GST? And Process for filling LUT under GST

Table of Content

Introduction

To export goods or services without paying IGST (Integrated Goods and Service Tax), all registered taxpayers who do so must submit a Letter of Undertaking (LUT) in GST RFD-11 form via the GST portal. Today this article will focus on “What is Letter of Undertaking under GST?”, Process for filling LUT under GST, Documents required for LUT under GST, and Eligibility criteria for filing LUT under GST (Goods and Service Tax).

What is Letter of Undertaking under GST?

Exporters might use a letter of undertaking to export products or services without paying taxes. All exports are subject to IGST under the new GST system, which can later be reclaimed via a refund against the tax paid. Exporters can avoid the hassle of seeking a refund and avoid the blockage of cash through tax payments by using a LUT (Letter of Undertaking).

Eligibility criteria for filing LUT under GST

All GST-registered exporters of goods and services must file a GST LUT. Exporters who have been charged with a crime or committed tax evasions totaling more than INR 250 lakhs under the CGST Act, the Integrated Goods and Services Act of 2017, or any other applicable legislation are ineligible to submit a GST LUT. They would need to provide an export bond in these circumstances.

Any registered person may submit an export bond or LUT under GST RFD 11 in accordance with the CGST Rules, 2017 without having to pay the integrated tax. They may apply for LUT if;

- They are GST-registered and plan to provide goods or services to India, other countries, or SEZ (Special Economic Zone).

- They want to sell items without having to pay the integrated tax.

How exporter will be benefited from Letter of Undertaking under GST?

- Regular exporters benefit greatly from filing LUT online because the reimbursement process via another way is time-consuming.

- It is not necessary for the applicant to appear in front of the officials for approval. The entire process can be completed faster and in a simple way.

- If an exporter files a LUT under GST, they can export goods or services without paying taxes.

- The Letter of Undertaking is valid for the whole financial year in which it was filed.

Documents required for Letter of Undertaking (LUT) under GST

- PAN Card of an entity

- IEC Code Certificate

- LUT Cover Letter – acceptance request and signed by an authorized person

- GST RFD11 Form

- KYC of Authorized Person

- Cancelled Cheque

Process for filling LUT under GST

- Visit to the GST Portal and Login with your valid credentials

- Click on the Service tab and from there click on user service select furnish Letter of Unertaking (LUT) command

- The GST RFD-11 form is shown. From the LUT Applied for Financial Year drop-down list, choose the fiscal year for which LUT is requested.

- For the previous LUT to be uploaded, click the Choose File button.

Important Note:

- The only acceptable file types are PDF and JPEG.

- There is a 2 MB limit on file size for upload.

- Check the boxes next to the declarations.

- Enter the names and addresses of two witnesses under “Name, Address, and Occupation of Independent and Reliable Witnesses.”

- Enter the location in the Place of Filing LUT field.

- Choose the name of the authorised signatory from the Name of Primary/Other Authorized Signatory drop-down list.

- Enter the location where the form will be filed in the Place field.

- Click the SAVE button to save the form if you wish to save it and retrieve it later.

- When an application is successfully saved, a confirmation message is shown.

- To view a preview of the form, click Preview.

- Once the above step is completed. The next thing you need to do is click on Sign and file with DSC (Digital Signature Certificate) or Sign and file with EVC Button.

- Once the above step is completed, click on the Proceed button.

- A message will appear on the screen regarding the successful submission of a form.

- Once it done you can click on the download button to download acknowledgement for LUT.

To export products, services, or both without paying IGST, LUT must be provided. Exporters are required to pay IGST or post an export bond if they don’t furnish the LUT. In the past, LUT could only be submitted in person at the relevant GST office. But the government has made LUT filing online in order to make the procedure more simpler.

POPULAR ARTICLES

- All you need to know on Disqualification of…

- All you need to know on Rights and Duties of…

- Process of shifting a Registered Office from one…

- A guide on Section 111A of Income Tax Act, Section…

- “What is Ordinary Resolution and Special…

RECENT ARTICLES

- MSME Registration Fees: Recognizing the Relevant Charges

- Frequently Asked Questions (FAQs): A Guide to Understanding Form 15CA and Form 15CB

- Comprehending Taxation and Compliance for Transport Business Startup

BROWSE BY TOPICS

- 46th GST Council Meeting

- 47th GST Council Meeting

- 48th GST Council Meeting

- Article- Copyright

- Articles – Company Law

- Articles – Entrepreneurship

- Articles – GST

- Articles – Income Tax

- Articles – Non Residents

- Articles – Tradmark

- Company law

- Designing and Marketing

- Digital Marketing

- Entrepreneurship

- GST Council Meeting

- Human Resources

- Logo Designing

- Non residents

- Notifications

- Notifications – Company Law

- Notifications – Entrepreneurship

- Notifications – GST

- One Person Company

- Uncategorized

Letter of Undertaking under GST

All registered tax payers who export the goods or services have to furnish Letter of Undertaking (LUT) in GST RFD-11. File with Ebizfiling.

About Ebizfiling -

Author: zarana-mehta

Zarana Mehta is an MBA in Finance from Gujarat Technology University. Though having a masters degree in Business Administration, her upbeat and optimistic approach for changes led her to pursue her passion i.e. Creative writing. She is currently working as Content Writer at Ebizfiling.

Follow Author

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Deepika Khan

I would rate 5/5 for their services, pricing and transparency.

Ishwar Prasad

I took trade mark registration from Ebizfiling india private limited thank you for registration and service was excellent and received the certificate from Anitha KV.

It's an awesome experience with Ebizfiling India Pvt Ltd. My special thank you to LATA Mam and i really appreciate her for the services she provide. LATA Mam is so cooperative always and always ready to help and solve any query related to their services.The way they communicate as per the time schedule is really awesome and satisfying, This is second financial year we are connected with Ebizfiling for Annual Returns filing as I really like their work culture, every employees are so cooperatives and available to respond any query whenever needed.Thank you so much to Ebizfiling Team!

- Articles - Income Tax

April 2, 2024 By Team Ebizfiling

- Compliance Calendar

- Due dates for GST Returns

- Due dates for Income tax Returns

- Monthly compliance calendar

Compliance Calendar For The Month of April 2024 As the new financial year begins in April, businesses and taxpayers around the country have new opportunities and responsibilities. It provides an excellent opportunity for strategic planning and budgeting, allowing businesses to […]

March 9, 2024 By Dharmik Joshi

- File GST Return

- Goods and Service Tax

- GSTR Filing

Frequently Asked Questions on the GSTR 1 Form Introduction The Goods and Services Tax (GST) has significantly transformed India’s taxation landscape. Among the various GST forms, GSTR 1 holds a pivotal place. It is a return form that necessitates the […]

March 2, 2024 By Siddhi Jain

- Cancel GST Registration

- GST cancellation

What are the reasons for GST Cancellation & how to avoid them? Introduction The Goods and Services Tax (GST) has drastically changed the tax structure for Indian Companies. However, it’s important to realize that keeping a GST registration current involves […]

Hi, Welcome to EbizFiling!

Hello there!!! Let us know if you have any Questions.

Thank you for your message.

M.P.Tony's Blog

Tony & Associates, Chartered Accountants, 4th Floor, Sreelakshmi Narayana Palace, Casino Complex, Kokkalai, T B Road, Thrissur 680 021, Kerala, INDIA. Email: [email protected] Mobile: 09447080631

Saturday, August 22, 2020

Authorisation letter ...... to appear before gst officer ....... a model format.........

MODEL AUTHORISATION FORMAT TO APPEAR BEFORE GST OFFICERS

I, xxxxxxxxxxxxxxxxxx , Proprietor , M/s. xxxxxxxx (GSTIN: ....................... ), ......................................... Kerala, 680002 , hereby authorize Tony M P, Practicing Chartered Accountant, 4 th Floor, Sreelakshmi Narayana Palace, Casino Complex, Kokkalai, Thrissur - 680021, to represent us as our Authorized Representative under Section 116 of Central Goods and Services Tax Act, 2017/ Kerala Goods & Services tax Act, 2017, in connection with all proceedings before the Appellate Authorities / Adjudication Authorities ( SCN No:/ Appeal N. / Other Reference No) and to produce accounts and other documents connected therewith and whatever explanations or statements he gives or make on our behalf will be binding on us.

Place: Thrissur

Date: 23.08. 2020 Signature

I , Tony M P, Practicing Chartered Accountant, 4 th Floor, Sreelakshmi Narayana Palace, Casino Complex, Kokkalai, Thrissur – 680021 do hereby declare that I am a Practicing Chartered Accountant duly qualified under Section 116 (2) (c) of Central Goods and Services Tax Act, 2017/ Kerala Goods & Services tax Act, 2017 and I agree to attend on behalf of xxxxxxxxxxxxxxxxxx , Proprietor , M/s. xxxxxxxx (GSTIN: ....................... ), ......................................... Kerala, 680002 , and I shall state the facts and give explanations to the best of my knowledge and belief.

Date: 23.08 .2020 Signature

No comments:

Post a Comment

- Submit Post

- Union Budget 2024

- Goods and Services Tax

What is the process of filing a Letter of Undertaking (LUT) under Goods & Service Tax (GST)?

Introduction

All registered taxpayers who wish to export goods or services without paying IGST (Integrated Goods and Service Tax) must submit a Letter of Undertaking (LUT) in GST RFD-11 form through the GST website. This article is going to focus on “What is a Letter of Undertaking under GST?”, “Process for Filling LUT under GST,” “Documents Required for LUT under GST,” and “Eligibility requirements for Filing LUT under GST (Goods and Service Tax).

Page Contents

What is a Letter of Undertaking under GST?

Who is eligible to file lut under gst, what is the process of filing lut under gst, what are the documents required for filing lut, how will the gst letter of undertaking help exporters.

Exporters can use a letter of undertaking to export goods or services without paying taxes. Under the new GST system, all exports are subject to IGST, which may then be reclaimed through a refund against the tax paid. By applying for a LUT (Letter of Undertaking), exporters can avoid the effort of requesting a refund and avoid the freezing of cash through tax payments.

Any exporter of goods or services who has registered for GST is required to submit a GST LUT. Exporters who have been accused of committing a crime or tax evasion totaling more than INR 250 lakhs in violation of the CGST Act, the IGST Act, 2017 , or any other applicable law are disqualified from submitting a GST LUT. In this case, they would have to offer an export bond. According to the CGST Rules, 2017 , any registered person may submit an export bond or LUT under GST RFD 11 without having to pay the integrated tax. They could apply for LUT if:

- They want to offer goods or services to India, other nations, or SEZs (Special Economic Zones) and have registered for GST.

- They wish to avoid paying the integrated tax when they sell goods.

The following is the process of filing LUT under GST:

- Navigate to the GST Portal and sign in using your authorized credentials.

- The “USER SERVICES” drop-down menu under “SERVICE TAB” offers the option to furnish a Letter of Undertaking (LETTER OF UNDERTAKING (LUT).

- You must next choose the financial year for which you want to file the letter of undertaking after choosing this option.

- Next, attach a PDF of the LUT from the previous financial year, if applicable.

- Next, include two witnesses’ names, addresses, and occupations.

- The next step is to fill in the filing location. You can view a preview of the form after this process is finished.

- The application can be signed using an electronic verification code or a recognized digital signature certificate. On the form, both options are present. The form cannot be changed after it has been signed and submitted.

The following documents are required for filing LUT under GST:

- PAN Card of the Company

- Authorized Person’s KYC

- Certificate of IEC Code

- Form GST RFD 11

- LUT Cover Letter with an official signature serving as an acceptance request

- Returned/ Canceled Cheque

The following are the benefits of GST LUT for exporters:

- Regular exporters gain a lot by filing LUT electronically because doing so saves time compared to the alternative.

- The applicant does not have to show up in person for approval in front of the officials. The entire process can be finished more quickly and easily.

- An exporter may export products or services tax-free if they submit a LUT under the GST.

- The Letter of Undertaking is effective for the whole financial year for which it was submitted.

Filing a Letter of Undertaking under GST is crucial for exporters wishing to skip paying IGST on their exports. It not only saves time but also makes the entire process more efficient by cutting out the need for physical visits. With the facility to file LUT online, the government has certainly eased the administrative burden on exporters.

Disclaimer : The information provided in this article is for educational purposes only and does not substitute for professional advice. The author bears no responsibility for decisions made based on this article.

- Goods And Services Tax

- « Previous Article

- Next Article »

Name: Ishita Ramani

Qualification: graduate, company: ebizfiling india private limited, location: ahmedabad, gujarat, india, member since: 04 oct 2017 | total posts: 198, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Channel

- Join Our Telegram Group

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Notice: It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: e52c4d75f19b8dd43294581d4c307a8f

Subscribe to Our Daily Newsletter

Latest posts.

Live Webinar with Book on Section 43B(h) (Financial Fitness)

Export of 2,000 MT of White Onion under HS Code 0703 10 19 Approved

ICAI Mock Test Papers Series I: CA Foundation June 2024 Exams

ICAI Observer Empanelment: May/June 2024 Exams Announcement

CA Live Virtual Classes for Sept/Nov 2024 Exams: Schedule & Features

Heavy penalty cannot be imposed for lapsed e-way bill during transit

GST Registration can’t be Retrospectively Cancelled Without Cause: Delhi HC

Procedure for Shifting of Registered Office from One State to Another

CBDT Extends Due Dates: Form No. 10A/10AB Filing upto 30th June, 2024

Analysing ITAT Kolkata Decision on Britannia Industries Ltd.’s CSR Contributions & Tax Deductions

Relief to Taxpayers from Tax Demand raised due to Inoperative PAN, Date Extended till 31.05.2024

Featured posts.

Petitioner as a registered person Must Continuously Monitor GST Portal: Madras HC

Overstatement of profits: NFRA imposes Rs. 5 Lakh Penalty on Auditors of Vikas WSP Limited

Complexities of sending goods for Job work- Filing of Form GST ITC- 04

RBI Bars Kotak Bank from Onboarding New Online Customers & Issuing New Credit Cards

Arrest & Bail Under GST

GST Case Law Compendium – April 2024 Edition

FAQ On Reporting of Share Market Transaction in Income Tax Return

WhatsApp Image Cannot Be the Sole Basis for Additions: ITAT Surat

CA Sunil Kumar

Just another WordPress site

- CGST Notifications

- CGST Rate Notifications

- IGST Notifications

- IGST Rate Notifications

- CGST Orders

- CGST Circulars

- IGST Circulars

- Cess-Circulars

- Press Release

What are documents required for Letter of Undertaking (LUT)

What is letter of undertaking (lut) .

A Letter of Undertaking is an undertaking by authorized persons of an entity that they will not pay tax on their export sales and will always abide by GST laws at all times. In case of any default, all the undertakers will jointly or severally be liable for any penalty or other consequences.

Under GST, there are two options being provided to exporters of goods or services or both for effecting such supplies :-

- Pay IGST on exports and then after claim refund for the same; or

- Submit an LUT or Bond (as applicable) to Commissioner of GST. In this case, there is no need to pay tax on exports and assessee can claim refund of GST paid on its inward supplies.

Before 04 October 2017 , only those persons were eligible for Letter of Undertaking who fulfilled both of following conditions:

- A person who has not been prosecuted for any offence under the Central Goods and Services Tax Act, 2017 (12 of 2017) or under any of the existing laws for any amount of tax evasion. and

- a status holder as specified in paragraph 5 of the Foreign Trade Policy 2015-2020; or

- who has received the due foreign inward remittances amounting to a minimum of 10% of the export turnover, which should not be less than one crore rupees, in the preceding financial year.

However, w.e.f. 04 October 2017, government has open LUT route for all exporters without considering any turnover limit. CBEC has issued Notification CGST-37/2017 to allow all exporters to export their goods or services or both without payment of IGST by submitting LUT to department.

Submission of LUT online

GSTN has enabled the service of submission of LUT in GST RFD-11 through online mode. User has to login to his account at GST portal and choose ‘File Letter of Undertaking (LUT)’ under ‘USER Services’.

After submission of LUT through online portal, there in no requirement to file physical documents of such LUT with GST department. Once ARN generated after submission of LUT online, it will be deemed as accepted.

On 6th April 2018, CBIC has issued a Circular- CIR-40/14/2018-GST to provide clarity on this matter. Followings are key notes of this Circular :-

Form for LUT: The registered person (exporters) shall fill and submit FORM GST RFD-11 on the common portal. An LUT shall be deemed to be accepted as soon as an acknowledgement for the same, bearing the Application Reference Number (ARN), is generated online.

Documents for LUT: No document needs to be physically submitted to the jurisdictional office for acceptance of LUT.

Acceptance of LUT/bond: An LUT shall be deemed to have been accepted as soon as an acknowledgement for the same, bearing the Application Reference Number (ARN), is generated online. If, it is discovered that an exporter whose LUT has been so accepted, was ineligible to furnish an LUT in place of bond as per Notification No. 37/2017-Central Tax, then the exporter’s LUT will be liable for rejection. In case of rejection, the LUT shall be deemed to have been rejected ab initio.

Documents required for submission of LUT thru Online mode:-

Basically, there is no requirement of any documents to upload with online application. However, to complete the application, following documents/ information must be available :-

- Detail of witnesses along with their identity and address proofs

- Consent letter of witnesses for such LUT

- Acceptance letter from department acknowledging LUT of any previous year

- Although, there is no document required to submit manually to department, it is advisable to create a proper file with all documents as required in manual mode of submission of LUT.

Documents required for LUT (Manual)

Application for Letter of Undertaking (LUT) to be submitted in duplicate. Such application should have following documents:

- Cover Letter requesting acceptance of LUT: A cover letter addressing to Assistant/Deputy Commissioner of GST of respective division required on the top of application.

- A copy of GST Registration Certificate

- Form GST-RFD-11- Original Two Set

- Original Two Sets of Annexure of Letter of Undertaking (LUT) on Letter Head of entity. Signatures of all undertaker (s) should be verified by Bank Manager. It also require two witnesses.

- Such annexure of LUT should be notarized.

- Attach personal IDs of both witnesses. Ensure that name and address on personal IDs must match with the detail mentioned in LUT.

- Attach personal IDs and PAN of all undertakers.

- Attach Incorporation documents of entity. (e.g. Partnership deed for Partnership firm, Certificate of Incorporation for Company/LLP, etc.)

- PAN of Entity

- Copy of Board Resolution/Authorization Letter authorizing director/ partner to file application.

- Entity has not been prosecuted for any offence under the Central Goods and Services Tax Act, 2017 (12 of 2017) or under any of the existing laws for any amount of tax evasion.

- It’s eligible for LUT in terms of export sales and corresponding collections during the previous year. (This is not required after 04.10.2017 wherein turnover requirements waived off for exporters)

- Prepare a summary of invoices raised against export sales and get it certified from Chartered Accountant. Attach all invoices of export sales (This is not required after 04.10.2017 wherein turnover requirements waived off for exporters)

- Prepare a summary of collections against export sales during the year and get it certified from Chartered Accountant. Attach all evidences for such collections (e-brc or bank statement). (This is not required after 04.10.2017 wherein turnover requirements waived off for exporters)

- Copy of IEC code, if available.

Word Formatted files :

- LUT Format- Word file

- GST RFD-11- Word file

- Cover Letter – LUT – Word File

- Board resolution authorising Director to apply LUT-Word File

- LUT- Self declaration – a declaration in respect of non-prosecution

Related article: What is Letter of Undertaking (LUT) under GST? What are eligibility conditions for this?

Hello sir thank you for valuable article. Sir want some more help from u. The form no 11 should be on letter head?. What would be the wording of Cover Letter requesting acceptance of LUT, can you please provide me the formate. Another thing what is the matter described in point no 4 provide me detail about this

It is not mandatory to print Form 11 on Letter Head.

You can find format of Cover Letter at following link: https://ca-sunilkumar.com/wp-content/uploads/2017/04/Cover-Letter-LUT-Word-File.docx

At point no. 4, I am discussing about Letter of Undertaking. you can find the word file at https://ca-sunilkumar.com/wp-content/uploads/2017/04/LUT-Format-Word-file.docx . In some offices of GST, they ask for verification of signatures from Bank Manager, however some office does not require this at all. So, it is advised to ask your jurisdictional officer about the exact requirement of this.

Such annexure of LUT should be notarized this paper are notary

THANK YOU VERY MUCH.

Could you pls kindly share the format for – Self-Declaration on letter head for eligibility of LUT?

Please follow the link given below: https://ca-sunilkumar.com/wp-content/uploads/2017/11/LUT-Self-declaration.docx

Thank you so much sir. May i know how man days will it take to get the LUT.

Kindly let me know please.

As per Circular No. 5/5/2017 dtd 11.08.2017, If all the documents are correct and in order, Jurisdictional officer should accept the same within a period of three working days from the date of submission of such documents. ( https://ca-sunilkumar.com/wp-content/uploads/2017/09/circularno-5-gst.pdf )

Thanks for the article

Thank you sir for sharing this valuable information.

Sir is it necessary to get verified signatures of all undertakers from bank manager as mentioned in point 4 ?????

It is not a legal requirement. However, some officers required this.

Sir i am having one more question that is it necessary to submit bank guarantee along with LTU. if Yes then how we can determine the amount of bank Guarantee ??

There is no requirement of Bank Guarantee in any case of LUT after 04.10.2017.

ok thanks sir

Pls provide with board resolution format required for LUT

please find the same at https://ca-sunilkumar.com/wp-content/uploads/2017/12/Board-resolution-authorising-Director-to-apply-LUT.docx

Thank U very much

God Bless you :))

[…] Please refer our another detailed article on this :-Documents required for Letter of Undertaking in GST […]

thank u…

sir, is notarisation of the Annexure of LUT compulsory???

It is not compulsory, however some GST officers have made it mandatory.

sir, our company supplying cartons to sez units. what are the required documents to file lut.

all the above documents listed in article

To get LUT, RCMC registartion with FIEO or Capexil or other is must ?

Can we get LUT without RCMC registration ?

There is no requirement for any such registration to file LUT. Please refer CGST Notification 37/2017 dtd 04.10.2017

Really helpful. Thanks But can you tell me the reference of the list of relevant documents from Rules/Circular.

Please Read Rule 96A of CGST Rules 2017 along with CGST Notfn 37/2017 and GST Circular no. 8/2017 dtd 04.10.2017. You can find these files in ‘GST Downloads’ section.

sir wether it is necessary to get a a certificate from charted accountant regarding the transactions details

This is not required after 04.10.2017 because turnover requirements waived off for exporters from 04.10.2017 onwards

Dear Sir, I have the following queries in regards to online filling of LUT: 1. If we hadn’t filed offline LUT form before, then, whether we are eligible to file LUT online? 2. Can the independent witness be directors of the company? If no, then who can be the independent witness?

1. You are eligible to file LUT online even if not filed earlier. Till date, No restriction to this. 2. It’s better if witness are unrelated persons. Other employees of company can be witness subject to their prior confirmation for the same.

Nice Info! Thank you!

can u tell us where it is mentioned to submit export invoice in case of LUT.

It is not required now. (Earlier before 04.10.2017, it was required to satisfy monetary limit of export sales)..

THANK YOU SO MUCH SIR

Hello Sir. I want to apply for LUT for export of Goods or Services without payment of Tax. Is it mandatory to submit hard copy (declaration in Rs.100.00 non-judicial stamp paper) along with covering letter. Or we can apply thru online without stamp paper. Also do we need to submit GST RFD11 document for the same. Thanks.

Apply to Jurisdictional GST office to which BG was submitted for release of the same through a letter with copy of the notification by which this requirement was done away with. In some places, like Bengaluru, GST officers are saying that they are not authorised yet to approve LUT applied online for renewal. When hard copies are submitted, it is not being accepted in some offices. Still clarity is not there. Since provision is made for online submission for renewal ARN is generated, but approval & LUT Number is not available.

What are the role of the Witness to take LUT Bond for Central good and Service tax?

What are the implications for a Witness to a LUT Bond?

I am asking, as a business colleague has requested my Aadhar Card copy for submission as a ‘witness to take LUT Bond for Central good and Service tax’ for his company.

Kindly advise!

In our view, witness is taken to prove genuineness of undertaker signing LUT, (to avoid any undertaking by a person who is not eligible to give such undertaking)

Sir, for first time filing of LUT whether we have to upload all the required documents online ? or we have to just submit the RFD-11 online after filling the required details without any documents ? As we are applying first time.

Just submit RFD-11. no requirement to upload any documents in this case.

After online submission, If you receive notice for submission of hard copies of documents, then you have to submit it along with all attachments to the jurisdictional office.

Thank you very much Sirji for sharing clarity and valuable information with regards to LUT required under GST Act !!!

thank u so much for this valuable article

As per Circular No. 40/14/2018-GST no need to file the Hard copy of LUT application. Pls clarify. weather we can file online or we need to submit documents offline.

In this circular, it is also being clarified that “The registered person (exporters) shall fill and submit FORM GST RFD-11 on the common portal. An LUT shall be deemed to be accepted as soon as an acknowledgement for the same, bearing the Application Reference Number (ARN), is generated online”.

So, you should submit LUT thru online mode. After submission, download LUT and copy of ARN for future reference.

Can we furnish ARN number as LUT number? are both same?

ARN number is sufficient until you received LUT number from department. Both are different, however, as a temporary measure, ARN is sufficient.

Hi sir, we got ARN after submission of Form RFD 11 in GST portal, is we required submit any documents to department.

not required…..

do we have to charge IGST in the invoice, if we are dispatching material with LUT? What documents are to be prepared at the time of dispatch of material ?

GST is not required to charge in the invoice…. From the point of view of GST, “invoice, e-way bill, GST certificate, copy of LUT” are required.

who all can be independent witnesses?

Hi, regards the points I mentioned below if today I want to file LUT do I need to furnish these documents. If yes there are any conditions and please give some details about the documents

It’s eligible for LUT in terms of export sales and corresponding collections during the previous year. (This is not required after 04.10.2017 wherein turnover requirements waived off for exporters) Prepare a summary of invoices raised against export sales and get it certified by Chartered Accountant. Attach all invoices of export sales (This is not required after 04.10.2017 wherein turnover requirements waived off for exporters) Prepare a summary of collections against export sales during the year and get it certified by Chartered Accountant. Attach all evidence for such collections (e-brc or bank statement). (This is not required after 04.10.2017 wherein turnover requirements waived off for exporters)

Now, there is no document required to attach on GST portal for furnishing of LUT through online mode. Further the requirements referred by you (viz. turnover limit, certification, export invoces, e-brc, bank statement, etc.) are not applicable as on date.

my status is still Submitted still didn’t get approval and any LUT number. How many days it will take to get LUT to approved. Please guide on this matter. Almost 1 month Complete to apply Lut.

It is not required to wait for approval. Your obligation completed with the filing of application for LUT.

What is exact difference between Bond and LuT ? we are selling off goods to customer located in Sez area. So we have to submit Bond or Lut. Please confirm once