- Search Search Please fill out this field.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

- Trust & Estate Planning

Best Online Will Makers of April 2024

Nolo’s Quicken WillMaker & Trust is our top pick because it's comprehensive and affordable

:max_bytes(150000):strip_icc():format(webp)/sarah-8d0efdc695e04e3bb6fb78d4467c509b.png)

According to our research, Nolo's Quicken WillMaker & Trust is the best overall online will maker due to its downloadable software, free software updates, and access to a catalog of estate planning documents. We researched 13 companies and evaluated them on several factors, including company history, price, availability in all states, offerings for online resources, ease of use, compatibility with various devices, and whether it was easy to make updates.

The 6 Best Online Will Makers of April 2024

- Best Overall: Nolo’s Quicken WillMaker & Trust

- Best Value: U.S. Legal Wills

- Best for Ease of Use: Trust & Will

- Best Comprehensive Estate Plan: TotalLegal

- Best for Free: Do Your Own Will

- Best for Making Changes: Rocket Lawyer

- Our Top Picks

- Nolo’s Quicken WillMaker & Trust

- U.S. Legal Wills

- Trust & Will

- Do Your Own Will

- Rocket Lawyer

- See More (3)

The Bottom Line

- Compare Providers

How to Write a Will

Alternative to a will, why you should trust us.

- Methodology

Best Overall : Nolo’s Quicken WillMaker & Trust

- Price : Starting at $99

- Legal support : No

- Free trial : No

- Update period : One year of software updates included

Customers get access to a large number of estate planning documents with this Nolo product, and the software itself is easy to use. You’re not required to have an internet connection except to download and update the software.

Get comprehensive estate planning documents for a flat rate

Free software updates for version year

Downloadable software

Estate planning documents aren’t valid in Louisiana

Must meet minimum operating system requirements

Downloadable software not available for Starter price tier

Nolo, which is headquartered in Pleasanton, California, started by publishing DIY legal guides back in 1971. It was one of the first websites to provide online legal assistance and information. It's branched out into other products, like its Quicken WillMaker & Trust software tools.

You can download the program for $99 to $209, depending on the version. They include key estate planning documents like a legal will, a living trust, a financial power of attorney (POA) , a healthcare directive, final arrangements, and a letter to survivors, in addition to other types of personal finance and home and family management documents.

The software is compatible with both Mac and Windows, and it's easy to use. It allows you to create customized legal documents using a simple interview survey to fill out forms. You can then save your information and download completed documents in PDF format. You can update your will at any time and receive legal and technical updates via the internet.

There's a legal manual to help you answer common questions within Quicken WillMaker & Trust, and you can contact technical support for additional help. Louisiana residents won’t be able to use this software because it doesn’t address the estate planning requirements for this state.

Best Value : U.S. Legal Wills

US Legal Wills

- Price : Starting at $49.95

- Legal support : Yes

- Update period : Unlimited

U.S. Legal Wills is one of the most affordable will options we've seen. It offers 40% off forms for partners or spouses, and it also has an add-on service to get an attorney to review your estate plan. It’s one of the only websites that accommodates affordable wills for expats and those who have personal property or other assets located outside the U.S.

Free unlimited updates

Includes forms for assets outside the U.S. and for expats

Discounts for documents for your spouse or partner

No living revocable trust available

Website not as intuitive as other competitors

Signup process for spouses can be clunky

Formed in 2000 and based in New York City, U.S. Legal Wills is operated by PartingWishes Inc., an independent organization that works with U.S.-based lawyers to create legal documents, without being tied to a particular law firm. Services are available in all U.S. states (except Louisiana) and provide some of the best values and discounts of all the websites we reviewed.

Starting at $49.95 for a last will and testament, U.S. Legal Wills customers also get free storage for their documents on the company's secure servers, in addition to unlimited updates. You can pay annually or opt for the lifetime feature if you want to keep storing your documents with U.S. Legal Wills, which is only $129.95. It's a more economical choice if you plan on storing your will on its servers for more than a few years. Spouses or partners can get mirror wills (plus additional documents) for 40% off.

You can create a variety of estate planning documents on the U.S. Legal Wills website, then designate what the company calls Keyholders. These are people who have access to your documents, such as trusted family members or the individual you've named as executor .

Members can receive additional support by submitting a ticket through the customer service portal.

Best for Ease of Use : Trust & Will

Trust & Will

- Price : Starting at $199

- Update period : One year

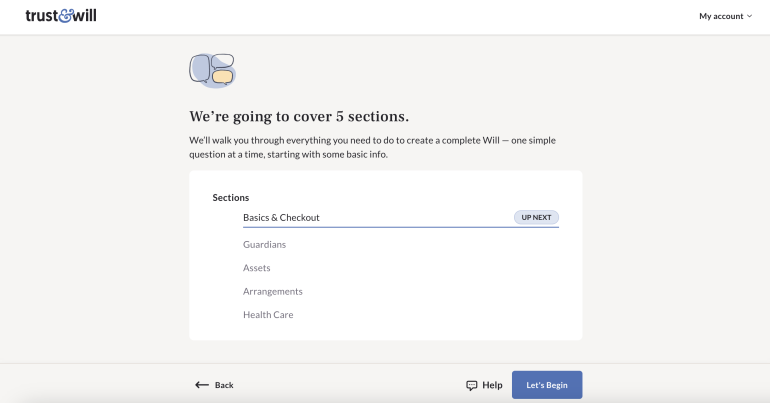

Customers can create their estate planning documents quickly and simply with Trust & Will. The company offers an easy way to decide which option is best through the "Get Started" section of its site. You can then fill in relevant details using an interview-style format.

We also like that Trust & Will makes it easy for you to make your documents legally binding by mailing you your completed documents for free and providing complete instructions.

Comprehensive learning center

Choose from three options so you can feel less overwhelmed

The website is intuitive to use

Only one year of unlimited updates available

Doesn’t offer free upfront legal consultations

Founded in 2017, Trust & Will aims to modernize the estate planning services industry by providing an easy and secure way to create your estate plan online. Document creation is seamless using its user-friendly website and its step-by-step path to getting started. The process can take as little as 15 minutes, and the company even mails your completed documents to you for no extra charge, along with instructions to make sure everything is legally binding.

The fintech expert's state-specific trusts offer pretty much everything you'll need, including a living will’s schedule of assets and a revocable living trust to help your loved ones avoid probate. It's one of the only do-it-yourself companies to offer this option.

Trust & Will has a flat fee for wills of $199 for an individual and $299 for couples. A customized trust costs $499, or $599 for couples. This includes unlimited updates for a year. You'll pay $19 annually after the first year for unlimited updates for wills and $39 for trusts.

Best Comprehensive Estate Plan : TotalLegal

Total Legal

- Price : Starting at $19.95 or $99 per year

- Update period : 60 days

TotalLegal is one of the only companies that provides comprehensive legal services that include do-it-yourself business and estate planning documents plus free and discounted access to attorneys through its TotalLegal™ plan.

Low annual or monthly fee

Premium members have access to free and discounted legal services

Ability to create a wide variety of documents

Customers who purchase one-off documents have limited update period

No living trusts available

No online access for executors

TotalLegal is part of Pro Se Planning Inc., which provides self-guided legal products, including estate planning and business formation documents. Pro Se Planning was founded in 2000 and is headquartered in Bellevue, Washington. Customers can purchase and complete individual estate planning documents starting at $19.95 for a last will and testament, which remains available in your online account for 60 days, then offers unlimited updates.

The biggest advantage of TotalLegal is its yearly subscription plan. You get access to legal services for $99 a year, including a consultation, attorney-reviewed documents, and a will with free updates each year. All this provides the most comprehensive resources for those who need some guidance.

Document creation is simple. You’ll go through a series of questions to inform and complete your document, which can then be downloaded and printed. TotalLegal’s help center provides extensive information, and you can always call or email customer support if you have any additional questions.

There are discounted services that include creating a simple will with a trust. You'll also get access to its document storage digital vault service, where there are no storage limits.

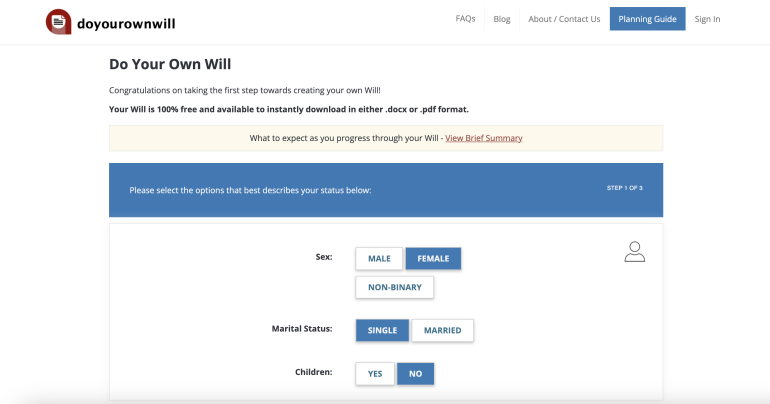

Best for Free : Do Your Own Will

Do Your Own Will

- Price : Free

- Free trial : N/A

This free option offers one of the widest varieties of forms without paying for extras. There's no need to create an account or hand over any credit card details. You can download your documents instantly.

No need to sign up for an account to get access to documents

Available to residents of all 50 states

Ability to save your will as either a PDF or Word document

No legal support

You must check state laws yourself

Do Your Own Will is a completely free way to make a last will and testament, POA, or a living will. Beyond the unbeatable price, one of the major perks is that it’s simple to use. There's no need to sign up for an account, but you'll have to provide your email address if you want to make updates or changes later.

Users complete forms online by filling in details such as marital status, information on your dependents, how you want your assets to be divided, and who you want to name as your executor. Download the document as a PDF or Word document, then you can sign it.

Originally founded in 1999, Do Your Own Will is headquartered in Seattle, Washington. It’s available nationwide, but there's one caveat: There's no legal support, so make sure you do your own research to ensure your will is legally binding.

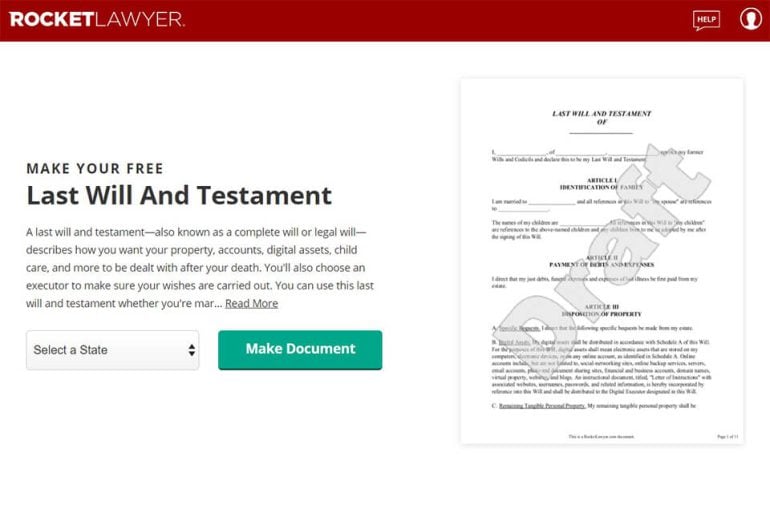

Best for Making Changes : Rocket Lawyer

Rocket Lawyer

- Price : Starting at $39.99 per month by subscription

- Free trial : Yes

- Update period : Unlimited with subscription

You get access to all Rocket Lawyer's estate planning documents for one monthly price and you can make updates whenever you like. What makes Rocket Lawyer stand out is its ability to get legal advice for new legal issues and the ability to sign your documents securely online. This allows any changes you make to go into effect immediately.

Offers a wide variety of legal and estate planning documents

A free seven-day trial to try out its services

Ability to pay a low monthly fee for premium access

Monthly membership pricier than other options

You must provide credit card information even for a free trial

Founded in 2008 and headquartered in San Francisco, California, Rocket Lawyer offers online legal services that include documents and attorney services. Rocket Lawyer provides customers with two monthly subscription models, which cost $39.99 per month or $239.88 per year, depending on the membership chosen. You get unlimited access to all its legal documents, including the ability to make updates and attorney services. The price also includes a free 30-minute consultation on new legal matters, an “ask a lawyer” option for your legal questions, and other professional services.

You can download wills, trusts, and powers of attorney immediately after you complete all the required information online, and then you'll receive instructions to make the documents legally binding. They can be securely signed online, plus you can invite others to sign them digitally as well. This allows you to make updates and changes quickly. You can also contact customer service by email, online chat, or calling its hotline.

We’re a fan of Nolo’s Quicken WillMaker & Trust because you can make your will or trust and other documents with one download for one flat price. But you may want to choose another option if you want additional help from a live lawyer. Nolo’s Quicken WillMaker & Trust is an option with great features for your estate planning forms if you're computer savvy.

Compare Online Will Makers

While writing your own will may seem like an intimidating task, the actual complexity will depend on the nature of your estate. You may be better served hiring an estate planning attorney if you possess an intricate web of assets. If your estate is relatively uncomplicated, then you can follow the steps below to put a will together yourself (though it may still be a good idea to have a lawyer review the finished document).

- Catalog your assets : Before you start writing your will, take an inventory of every asset you own/have in your name that you are legally permitted to bequeath in your state. You'll want to be as detailed as possible when you list these assets in your will to avoid any confusion about what a beneficiary should receive.

- Find a template : You can certainly write a will from scratch, but you can also make things easier on yourself by utilizing a free online template from a reputable source. This will reduce the amount of time you'll spend writing and minimize the chances of making any errors. Ensure the template you choose includes any additional clauses important to you, such as what powers your executor should have or how assets not assigned to any beneficiaries ought to be handled.

- Start with your name and address : While the exact identifying information you'll need in your will may vary based on the template, you'll typically have to include your full legal name, city (and possibly county), and state. Make sure your template includes a sentence revoking any prior wills you may have had.

- Name your executor(s) and guardian(s) (if applicable) : In your will, you'll need to identify the executor administering your will (as well as their successor if your first choice is unavailable) and the guardian (plus their successor) you're granting custody of your minor children (if you have any). You'll also likely have to include the mailing address and Social Security number (SSN) of each individual you name in your will. Be sure to first communicate with each individual you want to name as an executor or guardian to ensure they're willing to accept their respective roles.

- Choose your beneficiaries and the asset(s) they will receive : As with your executor(s) and guardian(s), you'll have to name the beneficiaries receiving your assets, in addition to potentially providing their mailing addresses, SSNs, and relations to you. You'll then need to specify which asset(s) each person or organization will be given.

- Sign and date your will : Once you've finished writing your will, the final step is signing it before the witnesses required by your state. If you don't complete this step, then your will won't be legally binding.

After making copies of your completed will, store the original somewhere safe and inform your executor(s) of where they can find it. You'll also want to review and revise your will every few years and after any major upheavals in your life.

The primary alternative to a will is a living trust. The latter is a legal arrangement wherein an individual designates assets that are transferred to a trust account, which is managed by a trustee of the account opener's choosing. A living trust is created when the account opener signs a trust agreement, which typically specifies the trust's purpose, what kinds of assets it holds, the trustee's duties and responsibilities, and which assets each beneficiary will receive after the grantor dies.

Wills and living trusts share many similarities, but there are a few key differences that set them apart from one another:

- A will is a straightforward document that only details how the testator's assets should be distributed after their passing. Meanwhile, a living trust is a complicated arrangement wherein the grantor sets aside specific assets to fund a trust account while they're alive.

- A will doesn't go into effect until after the testator dies, whereas a living trust is in effect as soon as it's signed.

- In most cases, a will goes into probate after the testator dies, and a trust avoids the probate process entirely.

- A will becomes part of the public record, whereas a living trust's details will only be known to the grantor, trustee, and beneficiaries.

Although a living trust can be considered an alternative to a will, they aren't mutually exclusive. If you want to have an especially comprehensive estate plan, you can have both a will and a living trust. However, if your estate isn't particularly complex, then a will by itself may be sufficient.

Investopedia collected and analyzed several key data points from over 13 companies to identify the most important factors for readers choosing an online will maker. We used this data to review each company for price, availability, compatibility with various devices, and other features to provide unbiased, comprehensive reviews to ensure our readers make the right financial decisions for their needs. Investopedia launched in 1999, and has been helping readers find the best online will makers since 2020.

Frequently Asked Questions

Are online wills legitimate.

Online wills are legitimate as long as they comply with federal and state laws. Online will companies hire licensed attorneys and legal professionals to carefully word their estate planning documents so that each is legally binding, but you'll want to make sure that your final documents will carry the same weight as one that an attorney creates. Check the fine print of the online will company to make sure it’s compliant in your state.

Is Paying for an Online Will Maker Worth It?

Using a free online will service can suffice if your estate is simple and straightforward: You don’t have any children, your only beneficiary is your spouse, and your estate is very small. But you'll probably benefit from using a paid service if you have a larger estate or a more complex situation, or if you want a legal professional to help you work through your documents and other financial matters.

Who Should Draw Up a Will?

It's a good idea for anyone with assets that multiple heirs can legitimately claim. Not dividing up assets can cause litigation among family members, creating resentment and heartache after the individual passes.

Should an Individual Write Their Own Will?

It's inadvisable to write your own will without any sort of legal guidance unless you have an up-to-date background in and knowledge of estate law. Otherwise, it's too easy to inadvertently sidestep a rule or law in your state that you didn't even know about. This could result in your final wishes not being carried out, throwing your estate into chaos as the court looks for alternate solutions. Always touch base with a legal professional before writing and finalizing your own will.

What Should You Avoid Putting in a Will?

Your will is not a private document after your death, so don't include anything that you don't want to become a matter of public record. Forming a living trust is a much more private estate-planning alternative. It will avoid airing out all the most intimate details of your life in probate court. A will must pass through probate in order for your estate to be settled.

What Is the Best Site to Create a Will?

According to our research, Nolo's Quicken WillMaker & Trust website offers the best online will maker. However, depending on your needs, you may be better suited with another company. Do Your Own Will, for example, is a great free option, so long as you're confident in your ability to create a legally binding will without any legal support.

Are Wills Really Necessary?

In most cases, a will is an indispensable part of an estate plan. If you pass away without a will, then you risk your assets being distributed to different persons or parties than you might have wished for. Having a will in place can give you the peace of mind that this won't come to pass. There are a few cases where a will isn't strictly necessary, such as if you lack sufficient assets or any beneficiaries.

How to Make a Will Online?

When creating a will online, you'll first need to determine whether you want to work with a will maker. If so, you should shop around to find the best online will maker to suit your needs.

If you decide to make your will yourself, you'll need to take stock of your assets, such as any real estate in your name. Next, you should choose your beneficiaries and how you'll want your assets divided between them. After that, you'll need to pick an executor you trust to distribute your assets to the correct beneficiaries. All that's left at this point is to fill out a will template online and store a physical copy somewhere safe.

It would likely be a good idea to hire an attorney to review your will to ensure it's legally binding. Don't forget to also ensure that the beneficiary designations for any of your assets with death benefits (such as bank accounts, retirement accounts, or a life insurance policy) are aligned with your new estate plan.

How We Pick the Best Online Will Makers

Our goal is to make sure our recommendations are ones we would share with our family and friends when looking to choose an online will maker company. We looked at 13 companies before choosing the top providers. Factors we looked at include company history, price, availability in all states, offerings for online resources, whether the product was simple to use, compatibility with various devices, and whether it was easy to make updates.

Investopedia publishes unbiased product reviews. Our opinions are our own and are not influenced by the payment we receive from advertisers. Click here to learn more about our review process.

Getty Images / Putilich

LinkedIn. " Nolo ."

Nolo. " About Us ."

Quicken Willmaker & Trust 2024. " A Powerful Estate Planner Without the High Costs ."

US Legal Wills. " About Us ."

United States Legal Wills. " Prices ."

Trust & Will. " Founding Story ."

Trust & Will. " Pricing for Our Estate Planning Products ."

LinkedIn. " Pro Se Planning, Inc ."

TotalLegal. " Prices ."

CBInsights. " DoYourOwnWill.com ."

Rocket Lawyer. " Rocket Lawyer Introduces Rocket Tax ."

LinkedIn. " Rocket Lawyer ."

Rocket Lawyer. " Memberships and Pricing ."

National Council on Aging. " Living Trust vs. Will: Key Differences ."

American College of Trust and Estate Counsel. " How Does a Revocable Trust Avoid Probate? "

:max_bytes(150000):strip_icc():format(webp)/iStock-493213662.FatCamera.inheritance.retirement.black-af08c547084d46e7851c8198191684b8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Online Will Makers of 2024

on LegalZoom's website

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

A will ensures your possessions go to the right people after your death. If you have a complicated family situation or large estate, you may want to hire an attorney to help craft yours. But online wills and online will makers can cost less and meet your state’s legal requirements, too.

Best online will makers

The best online will makers are reasonably priced, easy to use and tailored to each state’s requirements and offer online wills that are customizable to your life circumstances. Online will makers also can guide you through the process with good support and help you start estate planning on your timeline. Here are our top picks.

Nolo’s Quicken WillMaker: Best all-inclusive

Nolo’s Quicken WillMaker

Nolo’s services are among the most comprehensive on the market.

- Straightforward, user-friendly process.

- One year of free updates to your documents.

- Access to over 35 estate planning documents depending on plan.

- Software download available with only Windows 8.1/10/11 or macOS 10.13 and higher.

- Documents aren’t valid in Louisiana or U.S. territories.

- No access to attorney support.

on Nolo's website

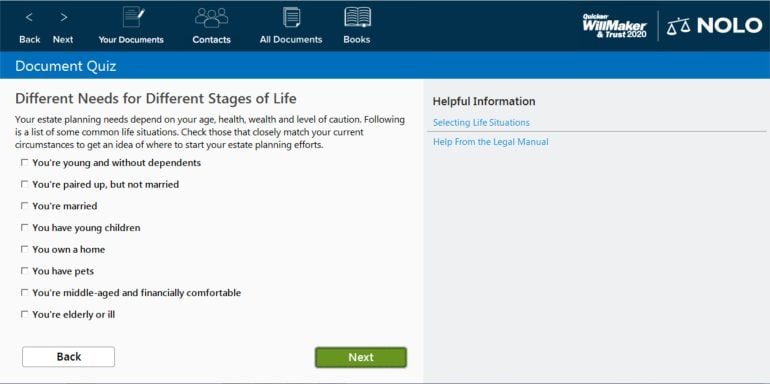

What it looks like

Why we like it

Nolo’s services are among the most comprehensive on the market. Its Quicken WillMaker offers over 35 state-specific estate planning documents in one place, available online or as a software download. The service can be used to make a pour-over will, health care directive , living trust , letters to survivors and other financial management documents, depending on your annual plan.

All three plans help you craft a will via a simple, straightforward questionnaire that guides you to the documents you need. If you decide not to use the cloud version, be sure you have enough space on your computer (54 megabytes) to download the software.

» MORE: See our full review of Quicken WillMaker

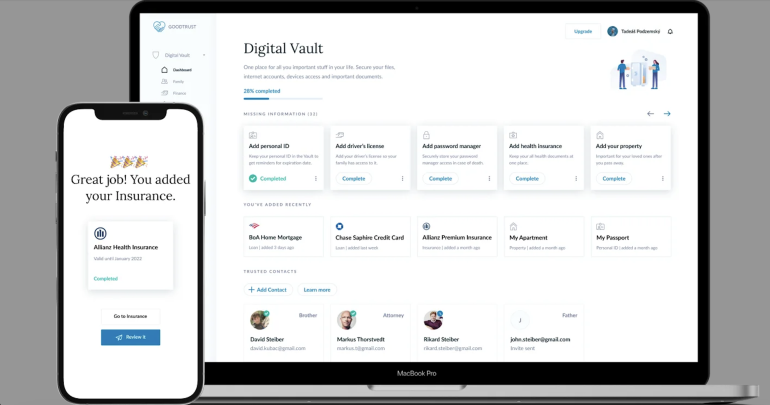

GoodTrust: Best for digital assets

GoodTrust's “Digital Vault” feature is helpful for incorporating your online assets into your estate plan for a reasonable cost.

- Digital vault for organizing online accounts and digital assets.

- Unlimited updates.

- Family plan (each adult member can create their own documents) for no additional cost.

- No attorney support.

- Documents aren’t state-specific but are binding in all 50 states when following state-specific instructions.

on GoodTrust's website

GoodTrust stands out for its “Digital Vault” feature, an encrypted online platform for secure storage of any online asset, including social media accounts, subscriptions and online banking information. You can add a trusted contact to any account on an item-by-item basis and provide detailed instructions, such as how to memorialize your Facebook account or where to transfer your Venmo balance.

GoodTrust offers key estate planning documents for a reasonable fee compared to other estate planning services. The service includes customer support via email ticket and live chat during the will-making process.

» MORE: Learn what can happen if you die intestate (without a will)

Trust & Will: Best for ease of use

Trust & Will

Trust & Will stands out for its quick and easy-to-use process.

- Simple and straightforward process for an online will.

- Unlimited updates with an annual membership.

- Add a year of attorney support for $300.

- Not great for complex family or financial situations.

on Trust & Will's website

Trust & Will stands out for its quick and easy-to-use process. The online will maker service includes HIPAA authorization, living will and power of attorney documents. You can download your documents, but all documents also ship free for first-time users with state-specific notarization instructions.

The Trust & Will website also includes a library of educational content to help users understand estate planning, and unlimited attorney support is available for $200 per year.

» MORE: See our full review of Trust & Will

Rocket Lawyer: Best customer service

Rocket Lawyer

Rocket Lawyer stands out for its customer service, which includes the option to contact a lawyer for legal assistance via phone, email or online chat.

- Free seven-day membership trial.

- 30-minute phone consultation with a lawyer included with membership.

- Built-in chat feature to ask a lawyer questions.

- Membership can be costly.

- Must have membership to make changes after the trial period expires.

on Rocket Lawyer's website

Rocket Lawyer stands out for its customer service, which includes the option to contact a lawyer for legal assistance via phone, email or online chat. This service is included in Rocket Lawyer’s $39.99 monthly fee, which gives you access to all estate planning documents on the platform.

Otherwise, you can fill out the company’s free will template. The seven-day free trial is a great way to take advantage of the upgraded customer service, but you’ll have to pay to make updates after the trial ends.

» MORE: See our full review of Rocket Lawyer's Online Will

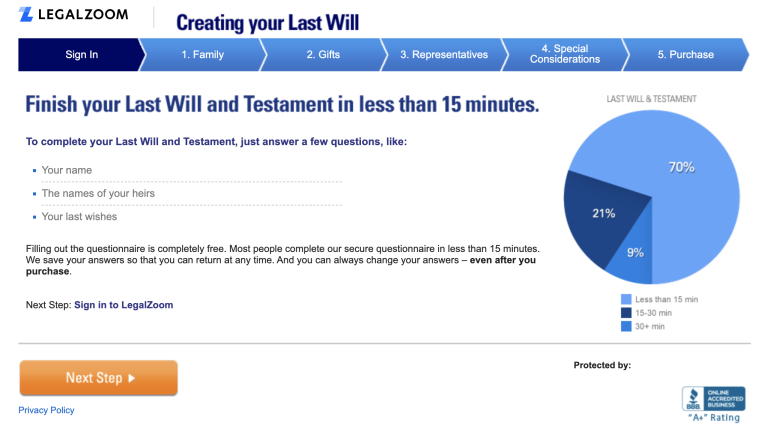

LegalZoom: Best state-specific legal advice

LegalZoom’s online will maker, like its other legal services, uses flat-fee pricing and offers attorney assistance for an added fee.

- Attorneys available for consultation in all 50 states.

- Flat-fee pricing.

- More expensive than some other online will makers.

- Relatively narrow document offerings.

LegalZoom’s online will maker, like its other legal services, uses flat-fee pricing and offers attorney assistance for an added fee. The company has independent attorneys available in all 50 states who can help make sure your documents comply with your state’s laws.

You can craft an online will starting at $89 and add other forms, such as a power of attorney for $35 and a living will for $39.

» MORE: See our full review of LegalZoom's online will maker

Do Your Own Will: Best free will software

Do Your Own Will

Do Your Own Will offers wills, living wills and power of attorney documents for download as PDFs and Word documents.

- Free documents, including living will and power of attorney.

- No account or credit card information needed.

- You’ll need to check state laws to make sure your will complies.

- No legal support available.

on Nerdwallet

Do Your Own Will offers wills, living wills and power of attorney documents for download as PDFs and Word documents. You can select your state and fill in basic information to craft a basic will at no cost. This service doesn’t have all the bells and whistles of other online will makers, and you may need to double-check the legal standards for your state, but it’s simple, functional and free.

» MORE: See our full review of Do Your Own Will

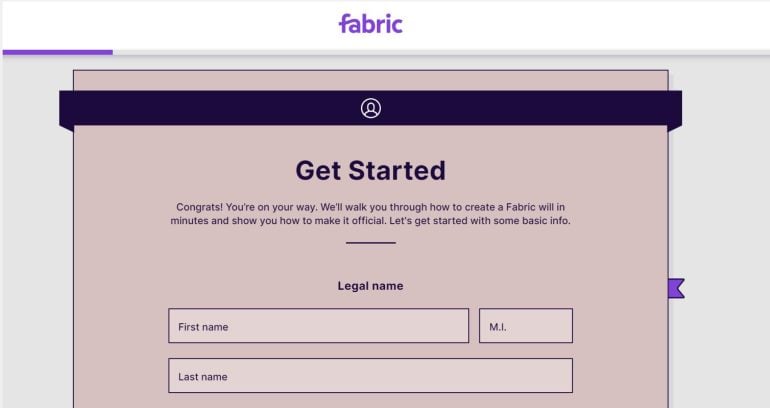

Fabric by Gerber Life: Best online will maker for young families

Fabric by Gerber Life

Fabric by Gerber Life offers a free online will maker catered to families with young children.

- Free online will template.

- Option to buy life insurance through the website.

- Specifically made for families with young children.

- No attorney access available.

- Wills aren’t state-specific.

Fabric by Gerber Life offers a free online will maker catered to families with young children. Fabric’s will template isn’t state-specific, though the website does provide instructions to make your will legally binding in your state. The process is fairly quick and offers an easy way to appoint guardians and beneficiaries , with the option to sign up for life insurance through the platform as well.

» MORE: See our full review of Fabric by Gerber Life Will

What other services does each will maker offer?

Are online wills legit.

Online wills can be legally binding if they’re specific to your state and properly notarized. Notarization requirements can vary from state to state; in some, you may need only two witnesses to sign and won’t need an attorney. Also, make sure to use a reputable, well-reviewed online will maker if you’re going the do-it-yourself route.

Other ways to write a will

Download a template.

Many websites have free and low-priced will templates available for download. You can find templates specific to your state and estate situation, though more specific forms may cost extra.

A template is a decent starter option if you can’t invest in a more comprehensive effort, but make sure the template meets your needs and state legal requirements.

Hire an attorney or estate tax professional

If your estate is complex or large, it might be worth your time and money to consult an estate planning attorney right away, especially if you live in a state with its own estate or inheritance taxes .

Hiring a professional can help ensure that you’re protected in specific situations you may have concerns about, including special child care provisions, business issues or a blended family with multiple heirs.

Hybrid approach

You can start writing your will yourself and then ask an attorney any lingering questions. By starting the process, you'll have answered or anticipated most questions a legal adviser would have and be able to discuss any concerns.

Your fees might also be lower because you’ll have done much of the prep work before consulting an attorney. However, even a partial lawyer's fee is more expensive than other will-writing methods, and working with a professional can be time-consuming and require multiple appointments.

America 's .css-rqgsqp{position:relative;z-index:1;} .css-6n7j50{display:inline;} Online Will Writers

Ours wills include.

Guardians for your children

Ensure that your children will be protected

Protection for your partner

Ensure your partner is sufficiently provided for

Legal in America

Our Wills are based on precedence and are kept up to date

Data protection

Your information is encrypted and will never be shared

Real human support

Speak with our Will specialists when you need help

Legacy donations

Leave a legacy by giving back to charities in your Will

Protect your pets

Make sure all members of your family are looked after

Assets list

Organize all your assets and help your executors find what you own

Gift giving

Give away items, properties, or cash gifts to loved ones

Unlimited updates

Keep your Will up to date with our editing membership

A Human Touch

We don't leave your family's future up to bots. All our documents are personally reviewed by our own Will specialists, who are themselves qualified lawyers (and real humans).

Online Will service

Writing and maintaining your Will just got much easier with NobleWill's online Will writing service. Answer some questions about yourself and your wishes in as little as 15 minutes to receive an estate planning bundle custom tailored for you.

Premium Personalized Will Service

Plan your worldwide estate with the personalized guidance of our Will writing experts. Write Wills for every country where you own assets, each with their own customizations to fit your specific wishes, save on taxes, and speed up the process for your family.

Unsure which Will service is best for you? Take our quick questionnaire.

Why use NobleWills?

Your data is encrypted and the Wills are based off precedence and are carefully written by qualified Lawyers and STEP members.

Complete the questions in as little as 15 minutes. Receive the completed Will within 2 working days.

Flat fees starting from $149 for a single Will. $223.5 for couple Wills. Unlimited edits for $39 per year.

See how NobleWills compares with other options out there.

Personalized attention

Help from real Will writing experts is always a click away. When you use our on-site chat window, our Will specialists will personally tend to your questions and concerns. Have a question about the process? Want advice on who you should appoint as a guardian? Or perhaps you just want to give some feedback? Simply click on the green chat button in the bottom right corner of the screen to speak with us! We are available Monday to Friday .

Invite your partner

Save time and money when doing your Will together with your partner! How does it work?

- Complete the online Will process for yourself.

- Invite your partner and share details you have in common.

- Select to pay for you and your partner at a discounted rate.

Charities we support

Did you know that you can give away part of your estate or even cash gifts to charities when you use our online Will service? NobleWills is proud to support these charities and we hope you will consider doing so too!

Over $153,000 in donations committed so far

Free Guides

Our Will writing experts have written useful articles about general estate planning, guides to help you with our online Will writing service, and explanations about the contents of our products.

UK Inheritance Tax and how you can mitigate your liability

We are happy to have David Snelling from Charlton House Wealth Management (“CHWM”) to share their financial planning expertise through this…

One Will vs Multiple Wills: Managing International Assets

If you are considering estate planning and have assets in different jurisdictions, you may be wondering whether having one Will to cover ev…

Can I use ChatGPT to write my Will?

Spoiler Alert: Read to the end to see how ChatGPT responded to our questions. A Will is an essential document that forms the foundation of …

Looking for help?

Check out our help center for answers to common questions or our guides to help you navigate the estate planning process. Still can't find what you're looking for? Send us a message!

Plan your future with us .

Protect your family Write a will from home

- Legally valid and built based on state-specific laws

- Flat $99, Enjoy 50% off for spouse will

- Online support, 9am-6pm everyday

Introduction from our CEO

Priya Surya quickly shows how Goodwill can work for you.

Why Goodwill?

Verified will documents.

Ironclad, legally enforceable documents based on state-specific laws.

Privacy and Convenience

Modern estate planning from comfort and safety of home through a secure interface.

Global Coverage

Made in the US, to cover assets locally and abroad, for common law countries.

Update Anytime

Adding a new home, or changing your distribution? Just log in, take a minute to make the change, and print your new will.

Help from Live Experts

Speak with real humans online, via video or over the phone. Talk to us

How does it compare?

Traditional estate planning.

Lots of questions and paperwork

Find, visit, and pay for a lawyer

3-6 weeks for a will

Bait and switch pricing

Using Goodwill

Create a legally valid will at home, live help from will writing experts, flat, affordable pricing, update your will, anytime, doing nothing.

What are the consequences?

Who looks after your family?

Where are all your accounts?

How will the bills get paid?

Our partners:

Interested in offering wills to your affiliate audience, customers, or employees? Chat to us online.

Create your will in minutes, store online and update anytime

Answer a few easy questions.

Easily decide what is right for you and your family, with all the options you would have if you used a lawyer.

Review & sign

We pack everything you need into a handy, easy to understand document that you just need to sign.

Store forever, update anytime

Lifetime account with every will. Access your will at anytime and update it as life circumstances change.

Proud Military.com Partner

Serving DBS customers since 2020

I was dreading doing this and spending lots of money on a lawyer, but their price is affordable!

David Williams, Father of 2

So easy and fast, there’s no reason to wait or put if off. One big item off the to-do list!

Sara Thompson, New Zealand native, Singapore resident

Built by lawyers

Our will writing tool has been created based on statutes such as the Wills Act, the Probate and Administration Act, and US case law.

Your will is designed around your state's laws and your specific cirumstances.

Based on US law, your will is:

Fully legal after proper signing

No need to notarise your will

No need to register your will

Your will is built around you, with expert support when you need it

Guardians for children.

Ensure your children’s wellbeing by naming someone you trust. If they live abroad, name a temporary guardian as well.

Gift anything to anyone

Anything you own can be gifted to any individual you want. Got that record collection that you want to go to that special person, not a problem. You can also choose to leave vehicles, collections of items and even simple money gifts.

Your estate split how you want

Your will, your way. Ultimate flexibility around who gets your assets and possessions.

Naming an executor

Guidance on how to choose the right person to distribute your assets. Read about Choosing an executor

Organise all your assets

Give your executor all the information about your finances and properties in one place, attached to your will.

Personal Messages to loved ones

Leave personal messages to make your gifts even more meaningful.

Commonly asked questions

What happens when someone passes away in the us.

If they have a will , their appointed executor locates the will, applies to the courts for a ‘Grant of Probate’, approaches financial institutions to close accounts, distributes assets from the accounts according to the will.

If they don’t have a will , someone step up to represent the deceased in the middle of your family’s grief. Others who qualify must give their written consent.

They must create a Schedule of Assets, and apply to the court for ‘Letter of Administration’, and once granted, approach financial institutions, and then distribute assets according to the state’s own formula. You and your family have no say.

Do I need a will?

Main reasons

- Ensures your assets are not lost/go unclaimed by your family

- Secure guardianship for any minor children, and ensure they are financially and emotionally cared for by someone you trust

- Appoints a person you trust and have informed to execute your estate

- Prevents confusion regarding your wishes

- Give to charitable causes you care about

It is particularly important if:

- you have children under 21

- you have no clear heirs, and there’s a high likelihood your assets could go to the state

- you are in a domestic partnership

When do I not need a will?

If you have assets less than $50,000, then your estate need not go through the probate process. In this case, it may not be necessary to set out your assets in a will. If your wishes exactly match the law of intestacy, and you don’t have any minor children, and don’t care about who executes your estate,

What do I put in my will?

Seems like you’ll have to pull your hair out with sorting out bank statements and insurance policies, while the lawyer runs an expensive hourly bill.

At Goodwill, we want to remove all the stress and make it easy to create a will in minutes, and keep it updated throughout your life.

Step 1: About you

When you write your will, you’ll be asked some basic information that goes into your will such as your full name, address, marital status, children, pets

Step 2: Guardians for children

If you have children under 21 or pets, you’ll be able to appoint guardians here

Step 3: Distributing your wealth

You’ll have a chance to indicate who gets what percentage of your overall wealth between your family, friends, and social causes you care about.

We’ll ask for:

- Your primary beneficiaries (for example, your spouse or partner)

- Your secondary beneficiaries (children, parents, friends, others) if your primary beneficiaries pass away before you do.

Step 4: Choosing executors

Choosing someone you trust who is capable of navigating the legal and financial process if something happens to you is one of the most important parts of writing a will.

You can appoint a family, friend, or a professional in this section in minutes.

Optional step: Gifts

You may wish to give sums of money to the caretaker of your pet, or a beloved possession to your favourite niece or nephew. Here’s where you specify who gets what, along with a personal message to them.

You can leave:

- A specified sum of money

- An specific possession such as an heirloom ring, or automobile

- A collection of items

You can leave these items to anyone you wish, because US laws allow for full testamentary freedom.

If you leave a gift or percentage of estate to a child under 21, it will be held by the guardian for safekeeping until they reach adulthood.

Optional step: Assets

This is a helpful list of your assets so your executor and family can locate them easily. You can add just the name of the institutions where you have accounts, or more information such as account number and current balance. This is not required or legally binding.

How do I make my will legally valid?

Goodwill ensures your will is written in accordance with the laws in the US.

But until your will is printed and signed properly (with two witnesses), it’s just a piece of paper.

After you create a will on Goodwill, you’ll be able to download your will. Check your Downloads folder for the file.

Print and bind you will

Three staples down the left side will do nicely

Choose two people to witness your signing

They must be over 21 and they cannot be a beneficiary in your will or their spouse. They must also be identified clearly in the will.

The Signing

Together, you and your witnesses all watching, sign the will.

According to the Wills Act in the US, your will is now legally valid.

Store your will

Store in a safe place at home, or somewhere accessible to your executor. Inform him/her of its location.

According to the Wills Act in the US, your will is fully legal:

Do I need to submit my will to the authorities?

- after it is signed properly with two neutral witnesses

- no need to notarise your will

- no need to register your will

After signing, store in a safe place that your executor can access, and inform them.

Can I register my will?

It is not required but if you wish, you can register your will with the US Will Registry . The service only notes that you have a will, and does not store original or copies of your actual will.

How do I update my will?

Goodwill provides unlimited lifetime access. Simply login using your user name and password (or social login), make necessary changes, and re-download your will.

The remainder of your information is securely stored and accessible at any time

Why is Goodwill so much more affordable than going to a lawyer?

Our mission at Goodwill is to create an affordable and accessible will writing service that anyone can use. Using technology allows us to create efficiencies in how we serve our customers.

Goodwill offers live expert customer support 7 days a week, and unlimited lifetime access for only $99.

Who is behind Goodwill?

Goodwill was started by estate planning experts Priya Surya and Jonathan Summers-Muir, with support from Entrepreneur First, and SG Innovate, an effort to create a digital ecosystem in the US.

Priya is a Fulbright scholar and graduate of Harvard University where she obtained her MPA/ID in 2010. She previously worked with World Bank in Washington DC to bring technology to financial inclusion, and was head of New Market Growth in Asia for Bima Mobile, a company that makes insurance accessible to millions of emerging market consumers. Her interest in legal and financial planning stems from her own experience as a mother and daughter was the impetus behind starting Goodwill.

Jonathan is a web developer and graphic designer. He has led teams across a diverse range of data sensitive products from professional football software, door access security and data analytic aggregation software. He has a keen interest in making the complicated processes of estate planning into a straight forward simple process. He was born in the UK, and now calls the US home.

Can I have a will expert double check my will?

Yes, your will includes full post-sales support every day of the week. Click on the chat icon at the bottom of the screen to speak to us over chat or easily schedule a call.

After receiving your will, we advise you read it from top to bottom, and speak with us about any questions.

We can also refer a lawyer for thorny legal issues specific to your situation.

Should my spouse and I have a separate will or joint will?

Joint wills.

Joint wills are highly inflexible. Both partners must agree to make any changes. If one person passes away, it’s difficult for the other person to make changes.

Individual wills

With Individual wills, both partners create an account with their own email address and password.

Individual wills are as easy as mirror wills, and have the benefits without the draw backs.

The advantages are the following:

- Flexible - you can make your will exactly like your partner’s or completely different, or anywhere in between. It is up to you.

- Affordable - it’s even more pocket-friendly with our partner discount

- Update anytime. No back and forth, just login, make your changes, and print your new ill.

- Support from expert will writing team with any questions you may have

Get started here

Why would I want to update my will?

If you bought a new home, added a new family member, gotten married or divorced, if your pet passed away or if you have started investing in a new robo advisory investment account, you should update your will to reflect these changes.

Often our children may be more or less independent as they grow older, and one might need more help than another.

Change is the only constant. Don’t let an outdated will disturb your peace of mind.

Still not sure? Explore our learning centre

Learn about will writing and probate

- 5 min read How to choose the right executor for your will?

- 6 min read The Ultimate Guide to Writing a Will

- 1 min read How do I get started with writing a will?

Update anytime

All your documents can be accsesed at anytime, and can be updated whenever you like. No more future lawyer fees.

30-day money back guarantee

If you are dissatisfied in any way with your will, you can contact us within 30 days and we’ll refund you, no strings attached.

We’re here to help anytime

Our expert will writing team of real humans are ready to talk to you 7 days a week

Make a will online

We use cookies to help provide a better website experience for you, as well as to understand how people use our website and to provide relevant advertising.

By clicking "I agree", you'll be letting us use cookies to improve your website experience. To find out more or to change your cookie preferences, click "Manage Cookies".

Like many other websites, our website uses cookies. Cookies are small files placed on your computer when you visit our site. They serve a number of purposes, including ensuring that certain parts of the website work properly, allowing us to understand which areas of our website are the most popular and allowing us to provide more relevant advertising messages. They don't allow us to identify you directly.

If you'd prefer that cookies weren't placed on your computer when you visit our site, you can use the controls below to allow or disallow different types of cookie. Some cookies are essential for the website to work, so they can't be disallowed.

These cookies give us anonymised information on how people use our website. We use these cookies to help us tailor our site to meet the needs of our visitors, for example by making sure our most popular pages are easy to find.

These cookies serve a number of purposes, such as allowing you to share our content with your friends and social networks. We also use these cookies to provide targeted advertising, so you may see relevant adverts based on the pages you look at on our website.

We're here 24/7, 365 days a year.

- Wills, Trusts & Estates

Will Writing Services

A Will is a legal document that lets you decide what happens to your money, property, and possessions (your ‘estate’) after your death. It allows you to clearly set out your wishes and decide who’s responsible (executor) for dealing with your estate. It also sets out any procedures the executor may need to follow. With effective planning, a Will can also make sure that your loved ones are provided for in the most tax-efficient way.

If you don’t make a Will, the law will divide your estate according to what’s known as the rules of intestacy. These rules are very fixed and may not reflect what you’d like to happen to your wealth, or what’s most tax efficient.

More information about Wills can be found in our Wills Guide . You can also choose one of the options listed:

- Making A Will

- Our Online and Postal Will Service

- Our Bespoke Will Service

- Reviewing And/Or Changing Your Existing Will

- Accessing Your Documents

- Contesting Or Defending A Will

- Choosing Or Being Named As An Executor

Making a Will

Our friendly team of experts can help you prepare a Will to:

- Make sure your money and property go to the people you want them to go to

- Minimise inheritance tax

- Name trusted people as executors* to sort out your affairs when you die

- Appoint legal guardians for any children who are still minors

- Reflect changes in your life circumstances, such as marriage or divorce, or the birth of children or grandchildren

- Ensure gifts of personal items are left to the right people

- Set up trusts and make gifts to charity.

*We act as executors for many clients and have administered thousands of estates.

Choosing the right Will service for you

Our Will services are easy to use and can be tailored to your needs. We can help you decide what type of service would suit you best.

Our online and postal Will service

This fixed fee service may be perfect for you if:

- Your estate, personal circumstances and wishes are relatively straightforward

- You’re happy to complete a secure online questionnaire or complete and return a postal form

- You don’t want advice on inheritance tax planning, trusts or other aspects covered by our bespoke service.

And with this service, if you appoint Irwin Mitchell as your executor, you’ll also get access to our Wills Assured service.

Fees for our online will service are £175 for a single Will or £260 for ‘mirror’ Wills.

If you prefer to use our postal service, fees are £195 for a single Will or £295 for ‘mirror’ Wills and you can download the form and send it back to us.

Our bespoke Will service

We know that life can sometimes be more complex, involving scenarios that are unique to you and your family. This means your Will may need to reflect this, with a more tailored and bespoke solution to give you and your loved ones the confidence and security you need.

You may prefer dedicated legal and tax advice tailored to your needs if:

- You prefer to discuss your wishes and options with an adviser at an in person or virtual meeting or on the phone

- You would like to talk about inheritance tax planning or trusts

- You need advice on how to provide for your beneficiaries, taking into account their particular circumstances

- You have business interests, agricultural assets, overseas assets, international connections or your estate is over £1m

- You are a beneficiary of a trust

- You have made gifts over £3,000 in any tax year

- You or your partner have children from a previous relationship.

Our fees for the Will drafting elements of this service start from £850 plus VAT for a single Will or from £1,050 plus VAT for ‘mirror’ Wills and depend on your particular requirements. We’ll be able to give you an indication of the likely cost after an initial chat and, once we know more, we’ll confirm fees in writing before we proceed. We’ll also highlight other services that may be of interest to you such as advice on estate planning, powers of attorney, trusts and tax.

Sharia-compliant Islamic Wills

A Sharia-compliant Islamic Will (Wasiyyah) can be suitable for Muslims who’d like their assets to pass in accordance with the principles of Sharia law. Our solicitors are experts in Sharia law compliance and can help you provide for your family in a way that follows your faith.

Wills Assured Service

As part of our online and postal Will Service, we also offer our Wills Assured Service. Once finalised, we can store your Will for you. If you appoint Irwin Mitchell Trustees Limited as the executor of your estate, you’ll also able to make free amendments as part of our Wills Assured Service .

This package of additional benefits is designed to make life simpler for you and your loved ones knowing:

- Your Will is kept safe and will be easy to access after your death

- You can update it at any time if your circumstances change

- All your important digital information is in one place.

Reviewing or changing your existing Will (Adding a Codicil)

An up-to-date Will is essential for making sure your wishes reflect your current situation and includes everyone you wish.

It’s good practice to recheck your Will every five years, especially to make sure it considers any changes in tax regulations that might affect you.

We suggest reviewing your Will following major life changes, for example if:

- You get married or divorced

- Any of your beneficiaries get married or die

- New children or grandchildren are born, and you want them to inherit

- There’s a significant change in your financial circumstances

- You come into any inheritance – this could change the value of your estate and the Inheritance Tax payable.

With our Wills Assured Service , standard updates are free. That means you don’t have to worry about paying extra fees to keep your Will fit for purpose.

Deciding whether to make changes to your existing Will (adding a codicil) or to write a new one will depend on the scale and number of changes you want to make. A codicil is an addition to a Will that can amend or revoke parts of it. This can be suitable if there are just one or two small changes.

If you need any large revisions, it’s often better to write a new Will to avoid confusion. We can explore these options with you and advise on what’s best for you and your loved ones.

Accessing your documents

Your Will belongs to you, and we’ll happily store it for you and provide you with a copy when you need one. If at any stage you’d like your original Will returned to you, just let us know and we’ll tell you what we need to send it to you. When you die, your executors will need the original Will. We can explain the terms of the Will to them and help them deal with the probate process .

Contesting or defending a Will

If you’ve been left out of a Will, haven’t been left as much as you expected, or think the Will is wrong in some way, you might be able to contest it.

Contesting a Will can be challenging and feel daunting. With the help of our Will Disputes Team, we can support and guide you through the process. We can also help if you are an executor defending against a Will dispute .

Lasting Power Of Attorney

At the same time as thinking about your Will, it makes sense to also consider making a Lasting Power of Attorney (LPA) . These are useful if you’re worried about losing the ability to manage your own affairs in the future. We can discuss the options with you and help you appoint the right person to make decisions on your behalf if you lose mental capacity.

If you want to find out more, contact the team today .

For general enquiries

Or we can call you back at a time of your choice

Contact us today

And let us know how we can help

0370 1500 100

Prefer not to call?

Use our form

This data will only be used by Irwin Mitchell for processing your query and for no other purpose.

Will Writing Services - More Information

How do i make a will.

Making a Will is simple. There’s a few ways to do it:

- Online – the questionnaire only takes ten minutes to complete

- By post – download the form and send it back to us

- By phone – call and speak to us

- In person – come and speak to us in one of our national offices

We recommend our online or postal service if your estate is relatively straightforward. If you have more complex requirements, or you’d like to talk about tax-planning or asset protection options such as setting up a trust, we advise speaking to us on the phone or coming in to see one of our experts.

Call us today for an initial consultation on 0370 1500 100 – or use our online enquiry form and we’ll give you a call back.

How Much Does It Cost?

This depends on your requirements and the complexity of your estate. Standard Wills offered through our online service cost:

- £175 (including VAT) for a single Will

- £260 (including VAT) for ‘mirror’ Wills (for couples - if your needs are very similar).

If your estate is fairly straightforward we recommend this option. Get started with our online wills service today.

You can also use our postal service by downloading the form and sending it in to us. The fees for this service are:

- £195 (including VAT) for a single Will

- £295 (including VAT) for ‘mirror’ Wills.

For both these services there may be additional costs if you need more complex advice. We would let you know about these before drafting your Will.

More complex and high value estates require more dedicated legal advice tailored to your needs, to ensure you and your loved ones are provided for in the most tax-efficient way .

For this service we recommend contacting the team to arrange an appointment with one of our experts who can let you know the options available to you.

What Should I Think About When Making My Will?

Everyone’s circumstances are different, but some of the things to consider when making a Will are:

- The value of your estate – inheritance tax (IHT) is generally due on anything over the £325,000 threshold (£650,000 for married couples and civil partners) once mortgage and other debts are deducted

- A new IHT allowance of £125,000 may apply if you own a property and leave some of your estate to relatives like children and grandchildren.

- How you own your assets – if you co-own property with your spouse, the type of tenancy you have will affect whether or not they can continue to live there after your death

- Who you want to leave your assets to (i.e. your beneficiaries)

- Who you would like to be the executors of your estate

- Whether some assets would be best placed in a trust for asset protection purposes.

These are important decisions to make and you should seek legal advice to make sure your estate is structured in the best way for you and your beneficiaries.

Read through our Wills Checklist to see if you’ve got everything covered.

Can You Store My Will?

Yes we can. Our specialist storage facility ensures your Will is kept secure from the risk of theft, fire or water damage. It also means it’s easily accessed after your death, giving you peace of mind and making things easier for your loved ones.

This service is free for our standard, bespoke and Wills Assured clients.

Meet The Team

Our team has decades of experience helping people prepare, amend and execute Wills. We’re regularly appointed as executors and are very experienced in estate administration.

We also have experts in trust administration and tax compliance, which means we have everything you need to plan effectively.

We have considerable experience in complex estates and frequently work with international and high net worth clients.

Irwin Mitchell are a very professional, trustworthy and straightforward company to deal with. I would recommend them to anyone."

Elderly Care Crisis: A Tipping Point

Our new research predicts that the UK retirement living sector will run out of beds and face a multi-billion pound funding gap in the next 10 years.

This upcoming crisis means that planning ahead is more important then ever - find out more about how our Later Life Planning experts can help you prepare

"It’s never too late to start but the earlier you do the easier it is." - Richard Potts, CEO of IM Asset Management

Frequently Asked Questions

When do you need to review your will.

Having an up-to-date Will is essential to make sure your plans for your estate reflect your current situation and include everyone you want to include.

Its good practice to recheck your Will every five years, especially to make sure it takes into account any changes in tax regulations that might affect you.

You should also review your Will following major life changes, for example if:

- New children or grandchildren are born who you want to inherit

- You come into any inheritance – this could change the value of your estate and the Inheritance Tax payable

With our Wills Assured service, standard updates are free – so you don’t have to worry about paying extra fees to keep your Will fit for purpose. Find out more.

Why Choose Irwin Mitchell?

Irwin Mitchell is a leading law firm with considerable expertise in the area of wills and estates. We’ve helped thousands of clients prepare for the future with strategic estate planning.

The team frequently receives five star reviews from our customers on Trustpilot, and we’re recognised in the leading UK legal guide, including the Legal 500 and Chambers & Partners.

We’re adept at dealing with complex estates and also handling international probate issues for clients who have assets in different countries. We also have the benefit of acting as executor for many of our clients, which allows us to bring our detailed knowledge of the probate process into our will writing services.

We pride ourselves on providing clear advice in plain English, free from jargon, and our team is always on hand to discuss any questions you have.

Can You Help Me Change My Will?

Yes – we can help you write a new will or add a codicil to your existing will. A codicil is an addition to a Will that can amend or revoke parts of it. It can be enough if there are just one or two small changes, but if you need any substantial revisions it’s better to write a new Will to avoid confusion.

Our probate and tax experts can also check that your Will is structured in the best way for your estate and be able to advise on any amends where necessary.

Standard updates are free with our Wills Assured service.

Related Information - Will Writing Services

About irwin mitchell.

Founded in Sheffield in 1912, Irwin Mitchell has always been a bit different. Our advisers really get to know the people and business that we help.

We have offices around the UK so wherever you are, our experts can help.

Give us a ring to speak to a member of our team in the strictest confidence. Or you can fill out our contact form and we'll ring you back.

Our phone lines are open 24/7, 365 days a year

Get a call back

Fill in your details below and we'll be in touch as soon as possible

Request A Callback

Enter your details below and a member of our team will contact you within 24 hours

Write your will easily online with Which?. You can even get it reviewed by our specialists to make sure it’s completed correctly.

- How our process works

- Why write a will

- Get started

- Common questions

Our specialist lawyers and paralegals have thought of everything to make it quick and easy for you.

Get started, save where you’ve got to, take breaks, come back to it when you like.

Create professional, legally binding documents without paying expensive solicitors’ fees.

Our guidance notes should cover everything but we’re here to help if you get stuck.

If you die without leaving a will, your money and possessions won’t automatically go to those closest to you. The law will decide who gets what, not you, and this can cause distress for your loved ones. But a will correctly written and witnessed makes things clear-cut and conflict less likely. Best get your will done now with a name you can trust.

Things to think about

Who are we.

We are Which? part of the Which? group, wholly owned by the Consumers' Association.

Completely independent

The unique thing about Which? is that we are completely independent. We have no owners, shareholders or government departments to answer to and you'll never see an advert in our magazines or on our websites.

This means we work entirely on behalf of you, the consumer, and nobody else – so you can rest assured that you're getting the very best advice available.

The Which? Group

As a not-for-profit charitable organisation, all the money we make from our commercial operations is used to support the activities of the Which? Group.

Who reviews my documents?

One of our team of specialist paralegals. Each member of the team has undergone professional training in wills and powers of attorney. The team is supervised by a solicitor regulated by the Solicitors Regulation Authority (SRA).

Are you regulated?

We are part of Which? Limited that is an unregulated organisation. The team is supervised by a solicitor regulated by the Solicitors Regulation Authority (SRA).

Completing your document

What happens after i buy my document.

You can start filling it out when you’re ready with our easy to use software.

How long does it take to complete a document?

We suggest you set aside around 1 hour to complete a document, although it can take less or more time, depending on the type of document you're creating and how much information you have to hand.

Do I have to complete my document in a set time period?

No, there isn't a time limit, you are very much in control of when you complete your documents. So you can start, then pause and come back when you are ready. But now you have purchased your documents, we suggest you complete them sooner rather than later.

What happens once I've completed the document?

If you bought a 'Self Service' document, it is now ready to be printed, signed and witnessed.

If you have chosen a document that includes a review, you can now submit it to our specialists by clicking 'Send for review' next to your document. They’ll review it and send you any feedback, guidance and suggestions. Then we’ll send you an email confirming the next steps.

How long does the legal review take?

We aim to complete the review in 10 working days. At busy times it might take slightly longer.

Can I upgrade my self service document to get a review?

Yes. Log in to your account and go to the 'My documents’ section. Next to the document you want to be reviewed, click on 'Upgrade to legal review'.

You’ll need to pay the difference in the price between the two service levels.

Do you certify documents?

This isn’t a service we offer. Here are some ways you can get your document certified.

How will I know if my document is legally binding?

With our review service, specialist paralegals go through your document with a fine-tooth comb to iron out errors and to make sure it’s legally compliant. When they’re 100% satisfied that it is, and once it’s been printed, signed and witnessed correctly, it will be legally binding.

Which web browser do I need?

The website is designed to work in all current versions of Microsoft Edge, Mozilla Firefox and Google Chrome. If you do experience any technical difficulties, in the first instance try using an alternative browser. We recommend using Google Chrome.

What happens once my document has been reviewed?

Once your document has been reviewed, our specialists will return it to you with their feedback. You'll receive an email including the details. If there are no issues, your document will be approved. Alternatively, our feedback could highlight some changes you may need to consider. When you've taken any action needed, send the document back to our specialists to approve by clicking 'Send for review'. Once approved, you can then print your document by clicking 'Print' next to your document in the 'My documents' section of your account. It's really important to follow our guidance to make sure your document is signed and executed correctly. We do not review documents once they have been signed and executed, as this is not part of our service.

If the document is for someone else, do they need to create their own account?

No, all documents are completed within the same account. The person who created the account will be the person that fills in the details for all documents.

What’s the difference between mirror wills and a pair of wills?

Mirror wills are usually made by married couples or civil partners. Normally, the first to die leaves their estate to the survivor. When the survivor dies, the estate passes to the beneficiaries (who are the same people in both wills).

A pair of wills is two wills made by two people with the flexibility to make them similar to each other or completely different.

Who can witness my will?

In England & Wales, a will must be witnessed by two independent people over the age of 18. Your witnesses don’t need to know what’s in your will.

Witnesses cannot be:

- beneficiaries in your will,

- spouses or civil partners of beneficiaries in your will, or

- anyone related to you.

What type of gift can I make in my will?

- Specific gifts – such as your jewellery, shares or property

- Cash – known as ‘pecuniary’ gifts

- Residuary gifts – what's left after all debts have been paid and all other legacies have been accounted for.

Can I use Which? if I have foreign assets?

If you have assets outside the UK, you can include them in your will. But we cannot guarantee that it will be accepted in the country where your assets are located.

We strongly suggest you take independent specialist advice about whether or not our service is likely to meet your needs.

I own a business. Can I use your services?

Can you advise on things such as inheritance tax and care fees.

Unfortunately not. If you’re a member of Which? and your membership includes access to our legal advice service, you can discuss inheritance tax with one of their expert lawyers. Please call 0117 911 8270 to make an appointment.

The government’s MoneyHelper service may also be able to help. Visit www.moneyhelper.org.uk to find out more.

Payments and refunds

How and when do i pay for my document.

You can pay online once you’ve added a document to your basket. We accept all major debit and credit cards and your payment is processed securely.

I’ve paid for a document but now I’ve changed my mind. Can I have a refund?

You are entitled to a refund within 14 days of purchase unless:

- You’ve completed a Self Service document

- Your Legal review or Premium document has been reviewed by our specialists.

The easiest way to organise a refund is to log in to your account and send us a message via the 'Contact us' function.

We are only able to refund what you paid via the original method of payment.

Will Writing Firm of The Year (online) 2023

- Terms & conditions

Making a will

Why you need a will.

It’s important to make sure that after you die, your assets and possessions (known as your estate) will go to the people and organisations (known as your beneficiaries) you choose, such as family members and charities you want to support.

Your estate includes your personal possessions, as well as assets such as:

- property (in the UK or overseas)

- savings and investments

- insurance funds

- pension funds

If you die without a valid will, it could be difficult for your family to sort out your affairs. Your estate will be shared out according to the rules of intestacy .

Under the intestacy rules, only married partners, civil partners and certain close relatives can inherit your estate.