Capitalization | Sources and Uses of Funds

What is a sources and uses of funds section in a business plan, a sources and uses of fund section is a summary of how much money will be required for startup expenses and operating capital, and where you expect that money to come from..

The sources and uses of funds section of a business plan is an important financial component that outlines where the funds for the business will come from and how they will be used. This section typically includes information on the business’s funding requirements, the sources of funding that have been secured or are being sought, and a detailed breakdown of how the funds will be used to support the business’s operations and growth. It is important for a business to have a clear understanding of its funding needs and how the funds will be used in order to attract investors and secure financing.

The level of detail in the sources and uses of funds section of a business plan can depend on the intended audience and purpose of the plan. For example, if the plan is being used to attract investors or secure financing, it may need to be more detailed and include specific numbers and projections.

In this case, the section should include spreadsheets or tables that clearly show the funding requirements, sources of funding, and detailed breakdown of how the funds will be used.

If the plan is being used as an internal tool for current investors or the board, it may be more high-level and not include as much detail. It should still however, provide a clear overview of the funding needs, sources and usage of funds.

As a best practice, it’s always a good idea to include financial projections in the form of spreadsheets or tables, this way the audience can see the financial viability of the business, in a clear and easy-to-understand format.

Why the Sources of Uses of Funds Section is Vitally Important

Many entrepreneurs and business owners rely far too much on intuition and positive expectations. “I’m not an accountant” is not a good enough reason to forego having an understanding of the basics of cash flow. Of all the traditional financial statements including the balance sheet and income statement, a reliable cash flow statement is most important. The sources and uses of funds section of your business plan is in effect a high-level cash flow statement for investors. The primary purpose of fund statements is to demonstrate that the business will have sufficient capital to start, grow and thrive.

Your company’s financial health is critical to investors and the use of funds document is a simple financial statement they’ll expect to see.

If Charles Lindberg or Emelia Earhart came to a group of equity investors or providers of debt financing, they probably would have known very little about transatlantic flying, particularly since it had never been done. But the business minds would have quickly converged on the sources and uses of funds statement. The investors would want to know that the funds statement accounted for sufficient capital to build the plane and fly it across the ocean. After all, who would want to provide funding to get a plane halfway across the ocean?

Now, this a light-hearted way to talk about a funds statement, but it makes the point: Your sources and uses of funds statements will ensure that you have thought through the business requirements and are raising sufficient capital to get your business to the next investable milestone or profitability.

Creating Your Statement of Sources and Uses of Funds

The various sections of your business plan spell out how you will go about finding new customers, creating products and services they need, and building your business. The details regarding the costs and revenues from your “word plan” make it to the “numbers plan” in the financial section. So, what’s left?

This section on Capitalization and Use of Funds summarizes how much money will be required for startup expenses and operating capital, and where you expect that money to come from. Show your financial needs for a minimum of one year into the future, or until your business will become cash-flow positive, whichever is longer.

Business Plan Outline for Capitalization and Use of Funds Should Include:

Use of Funds

Startup Costs

Working Capital

Sources of funds.

Owner’s investment

Debt or senior debt (from lenders)

Equity (from investors)

Important Considerations

This section of your business plan is intended to provide an overview of the funds your business will require. The specific details regarding terms for investing in your company must be in a separate document, which will be governed by specific legal guidelines. By law, securities can be offered for sale or solicited only by a private placement memorandum, which is a formal legal document.

Start with the Use of Funds Section

The Use of Funds section of your business plan must include all of the costs required as well as the capital to sustain your business until it becomes cash-flow positive. The initial costs are those costs required to open the business. Working capital is the money it takes to pay your bills (including labor) until your business is generating sufficient cash to fund itself. Your financial projections (Section 9) will have taken you through the hard work required to arrive at these numbers.

A simple table or spreadsheet should be used to show your use of funds or costs. Summarize costs into major categories. Customize the example below for your business. Most importantly, include all expenses that are listed on your financial statements.

For the working capital number, look at your cash flow statement. If you had no funding whatsoever, how much money would your business consume before it starts to turn a profit or become cash-flow positive? That’s how much working capital your business will need, plus a contingency fund.

The example below is meant to be easily understood and is modeled around a startup business. It also includes rolled up numbers at a high level. It is okay to present your numbers in this manner, so long as you have the detailed version –that totals to the same amounts- if asked.

Sample Start-up Costs

Office Build-Out $12,000

Prepaid Rent $ 4,000

Office Equipment $ 6,000

Grand Opening $ 3,000

90-Day Ad Campaign $ 5,000

Website Design $ 2,000

Administrative Costs

Insurance $2,000

Fees & Permits $ 1000

Miscellaneous Startup Costs, $15,000

Total Startup Costs $50,000

Annual Salaries for 3 employees $300,000

Contingency capital funds $50,000

Total W/C $350,000

Total Use of Funds $400,000

Let’s start with the obvious. The sources of funds needs to meet or exceed the use of funds from the section above.

Now that you have laid out the financial needs of the business, where will that money come from? Ideally, at least some of that will be coming directly from you. Perhaps you’ll even include a “family and friends” round of investment. The balance will be the amount you need to bring in either as loans or outside investments. Customize the example below to your business.

Sources of Funds Table

Owner’s Cash Investment $50,000

Family and Friends Investment (Equity) $20,000

Loan Sought $330,000

While you don’t have to include it in your business plan, you should be prepared to talk about your collateral, or how you will guarantee that the lender will be repaid. Most financial institutions require a primary and secondary source of collateral. This topic is covered in the section titled, Exit Strategy or Payback Analysis.

Many people think about the balance sheet and income statement as the most important financial statements. It’s the cash flow statement that tells most about the company’s financial health and ability to continue. The “sources and uses of funds” section of your business plan is a means of looking ahead at the cash flows of the business – both incoming and outgoing – to determine how much cash you’ll need to raise.

Ready to complete your business plan in just 1 day?

Click GET STARTED to learn more about our fill-in-the-blank business plan template. We’ll step you through all the details you need to develop a professional business plan in just one day!

Successfully used by thousands of people starting a business and writing a business plan. It will work for you too!

7 Sources of Capital and How to Evaluate Them

by William Lieberman | Feb 8, 2021 | Capital Raising , Capital Structure , Financial Strategy

Raising capital and deciding what sources of capital to pursue is a challenge both large and small businesses share. In the early stages of a company, you lack credibility, which limits your options. Then, as your business matures, you have more choices, but there are trade-offs. So, how do you determine what’s right for your business?

Let’s discuss how you can develop criteria for evaluating sources of capital so you can build a capital raising strategy . Then, we’ll examine the options and how each source stacks up.

Developing Criteria for Evaluating Sources of Capital

There are hundreds of funding sources available to businesses, and it can be challenging to make sense of them. Yet, it’s crucial to find the right balance because your choice of funding will impact your ability to achieve your goals.

So, before diving into a list of options, when I work with clients who want to raise capital, we start by looking at the state of the business and setting goals. This allows us to establish criteria to guide our decisions and narrow our choices to the right mix and types of capital for their needs.

There is much to consider. But, ultimately, I want to get to the bottom of the following questions:

How Much Capital Do You Need and When?

It is critical to be clear about why you need money, what you plan to spend it on, and when you will need it. Not only will potential investors and lenders require this information, but it can help you determine which sources of capital are suitable for you.

If you don’t have these answers, start by building a cash flow forecast . A cash flow forecast will show you how certain costs, initiatives, and seasonality affect your business. It will also help you decide precisely how much capital you need to cover both your short-term cash requirements and long-term growth plans.

How Much are You Willing to “Pay” for Capital?

There is always a cost to raising money. Some forms of capital are cheap, like friends and family or low-interest bank loans. But there are still long-term financial or emotional costs that you must factor into your decision.

Equity capital or grants, on the other hand, can be a huge relief for companies in growth mode who can’t afford to spend money on interest. But there is a significant amount of time involved in securing and servicing such funding. And, in most cases, you must be willing to give up some control.

What Level of Effort or Risk Can You Absorb?

Certain types of capital are easy to secure and manage, while others take time and have more strings attached. That doesn’t mean you should always take the simple route, however. Easy money sometimes poses a higher risk. If you’ve reached a point of maturity with your business where you have the resources and desire to pursue and manage less risky sources of capital, it may be worth your while. For those who are just getting started, however, this may not be an option.

Answering these questions is challenging for my clients because it requires them to dissect their business and feelings about the capital-raising process. But it also gives them a lens through which they can evaluate the merits of debt vs. equity and any other alternatives they wish to consider.

So, what are the main sources of capital for a business?

7 Sources of Capital to Fund Your Business

Bootstrapping.

When someone starts a business using their personal savings and no outside funding, we call it bootstrapping. It’s an appealing option for small business owners who want to maintain control and ownership of their company. Bootstrapping can work famously if you’re disciplined, generate revenue quickly, and then reinvest earnings back into the business.

The challenge, however, is that you can only spend whatever money your business generates or what is in your savings. This means bootstrapping can inhibit your ability to grow if you can’t afford to hire top talent or make big investments, so it’s not a viable option for some business models. It can also strain familial relationships because, if you’re not careful, it can consume most of your time and money. There’s nothing wrong with bootstrapping. But, for most growth-minded companies, the costs eventually outweigh the benefits, and they need to adjust.

How does it stack up?

- Since you only spend what you have, you can establish a budget and get started immediately.

- The cost of capital is low since you’re not actually raising funds.

- High effort and high risk.

- Best for early-stage businesses.

Friends and Family

Borrowing money from people in your life who know and trust you is the easiest way to fund a business. Yet, I would encourage you to exercise caution because, like bootstrapping, it can put a strain on your relationships.

If you decide to go this route, I’d recommend you only ask people who can afford to part with their money. Then, treat the exchange like a real business transaction.

For example, if you intend to pay the loan back (vs. giving your loved one equity), set an interest rate and establish a payment plan. Then draft legal documents (with the help of your attorney or a service like LegalZoom ) that both parties can sign. This way, you will have everything in writing should a dispute arise.

- Once you know how much you need, you can get the funds as soon as you find the courage to ask.

- The cost of capital is low.

- The effort and risk, however, can be quite high as these are special relationships, and you may find yourself answering piercing questions at family dinners. If you are transparent and timely with your payments, however, you should be fine.

Crowdfunding

One of the more interesting, but perplexing, sources of capital that stems from the rise of social media is crowdfunding. Crowdfunding is when an organization pursues funds by pitching its idea to a “crowd” of investors on a platform like Kickstarter or Fundable . Most businesses offer equity or discounted products in exchange for the funds, but there are also donation-based options where you can raise money for special causes.

While crowdfunding is fascinating, it’s not exactly cheap or easy to pull off. A crowdfunding page doesn’t automatically attract thousands of investors. You need to drive them there, and that requires a marketing machine.

Crowdfunding does work for some, such as low-price, high-volume product-based businesses. But it is not a sensible option for most endeavors.

- Some companies are successful, but many flop – wasting time, effort, and money.

- Contrary to popular belief, successful crowdfunding can be expensive.

Debt Financing

Most businesses raise at least some funding using debt capital. Put simply, debt financing is when you borrow money and pay it back over time with interest. Before agreeing to the loan, the lender will check your credit and review important financial documents (like your income statement and balance sheet). Then, they will often require some type of security (rights to an asset should you default on the loan) and your acceptance of certain “covenants.”

Covenants are rules about how you will run your business for the duration of the loan. They protect the lender from business practices that could result in a failure to pay. There may be reporting requirements, for instance, or maintenance of a certain level of profitability. So, make sure you understand the lender’s expectations and can adhere to them.

The main benefit of debt financing is that you don’t have to give up equity in your business. Also, the interest you pay is tax-deductible as long as it’s a business loan, not a personal one. Interest rates can vary though, and there are some shady companies, so be sure to shop around.

The bottom line is, as long as you’re capable of meeting the terms of the loan while continuing to run and invest in your company, debt financing is a sensible source of funds.

Below are some options to consider:

- Credit Cards – The advantage of using credit cards is that payments can be very flexible, as long as you make the minimum payment each month.

- Bank Loans – Typical loans for businesses include unsecured personal loans, cash advances, microloans, and term loans.

- Government-backed loans , such as Small Business Administration (SBA) loans.

- Alternative and non-bank lenders – These institutions are more flexible but be careful because the loans can be costly.

- Specialized loans like equipment or real estate loans.

- Invoice Factoring – Instead of waiting 30 to 90 days for customers to pay, get access to working capital quickly by selling outstanding invoices to a 3rd party for a discount.

- Revenue-Based Financing – Some lenders will provide you with capital in exchange for a percentage of your future revenues. Although there is technically no interest, you make payments until you pay off the “loan,” and then some.

How does this source of capital stack up?

- If your company has a good credit score, you can borrow the money you need quickly.

- Bank loans are inexpensive but watch out for companies that prey on desperate business owners with high-interest loans.

- You can apply for a loan easily as long as your finances are in order. But you’re on the hook for payments, so there is a risk.

- Suitable to all types of businesses.

Equity Financing

Equity capital is an enticing, yet challenging, source of funds to pursue. This is when you invite people or companies to invest in your business, but instead of repaying the money, you agree to give up a certain percentage of ownership. Many find equity financing attractive because you get the funds you need to grow without negatively affecting your cash flow. Yet, it is not a decision to take lightly. Equity capital raising is a serious undertaking that can consume a great deal of your time and resources. You must be ready to deal with increased levels of governance, legal requirements, and administration. Furthermore, it means you will no longer have complete, autonomous control of your business.

As stakeholders, investors will have a keen interest in how you run your company because they want a return on their money. Some investors take a purely financial interest in the company and require little more than reporting. Others, however, are strategic. Strategic investors may partner with you and become deeply involved in your decision-making. And shareholders have certain legal rights that differ significantly from lenders, including the right to elect the Board of Directors, information rights, dividends, and more.

What are the main sources of equity capital?

Angel Investors

Sometimes referred to as high-net-worth individuals (HNW), private investors, or seed investors, angel investors provide financial support to startups. You can find angel investors among your community – the rich uncle or wealthy friend, for instance. And some angel investors form groups to pool their resources and diversify their risk across multiple investments.

Business Accelerators and Incubators

These are organizations that fund and support startups. In addition to money, they offer advice, training, affordable office space, and other resources fledgling companies require to succeed. These organizations can be especially helpful for startups whose founders have limited experience in launching new ventures.

This is a unique form of equity financing where a company can pitch its idea to a “crowd” of investors through an online platform.

Venture Capital / Private Equity

Venture capitalists are investors that offer funds and/or services to businesses with high growth potential in exchange for a minority stake in the business. By limiting their investments to highly promising companies, they reduce their risk and increase the possibility of a significant return. People that offer venture capital often do so as part of a private-equity firm or investment bank (organizations that assume a majority stake of certain companies), but they can also function on their own.

Initial Public Offering (IPO)

An IPO is when you decide to sell ownership of your company through the public stock market instead of private equity sources. However, this is only a viable option for companies with a high valuation – upwards of a billion dollars. It’s appealing because you gain access to a whole other source of capital and can sell or buy shares to access more funds or affect your company’s value. An IPO can also boost your reputation, empower you to buy out private shareholders who wish to exit the business , and allow you to compensate your employees in different ways. But it also means you will be subject to strict regulations.

How does equity financing stack up?

- Raising equity can be simple if you personally know the investor and you agree to very simple terms. However, the more capital you need, the more complex the process becomes and, therefore, the longer it could take. For example, series A rounds can take 6-9 months from start to finish.

- Equity financing is more expensive than debt because you are giving up a piece of the company, which might be worth a significant amount down the road.

- This is a high-effort source of capital, but it is less risky than bootstrapping, taking on debt, or involving your loved ones. And you don’t have to repay the money.

- Certain types of equity are available to early-stage companies, while others are more suitable to mature organizations.

Hybrid Financing

Considering the dramatic difference between debt and equity financing, it should be no surprise that there’s a middle ground. Hybrid financing promises a better risk/benefit balance for businesses, investors, and lenders with deal structures that combine elements of both.

Hybrid structures have simpler terms and, therefore, are easier to implement (i.e., faster and less expensive in terms of legal fees). More importantly, when companies are starting out and growing quickly, it is often difficult to determine the valuation for a priced equity round. Using a hybrid instrument provides significant flexibility since you are deferring the valuation discussion to a later date.

As you might imagine, there are a variety of alternatives. Here are a few examples.

Convertible Debt

A great option for early-stage companies that don’t know how to price their equity, convertible debt allows a business to borrow money without agreeing to a rigorous payment schedule. Instead, you pay a modest interest rate now and convert the debt into discounted equity at a future date.

Similar to convertible debt, SAFE stands for “Simple Agreement for Future Equity.” In this case, however, a SAFE is actually not debt at all. You pay no interest and agree to convert the investment into equity when a subsequent equity fundraise occurs. SAFE holders are not legal shareholders, so this is not an equity instrument either.

KISS (Keep It Simple Security)

KISS securities can use either a debt model (interest rate and maturity date) or an equity model (no interest or maturity date). However, these deals often favor investors and leave business owners vulnerable. So read the terms carefully before signing.

- Once you know the amount of money you need, you can obtain hybrid financing quicker than traditional equity capital.

- The costs are low, but you must give up some ownership.

- There’s risk involved in some types of hybrid financing, so be mindful of the fine print.

- Best for early-stage businesses that don’t have a good sense of their value.

Applying for Grants

Companies in certain sectors, such as those that do medical research, develop environmental solutions, or perform services for the greater good (educational institutions or charities, for instance), may be eligible for grants. Governments, organizations, and even high-net-worth individuals can offer grants, and they are a wonderful source of capital because, well, it’s free. Unless you fail to meet the terms of the agreement, you don’t have to pay it back or give up equity in your company.

This doesn’t mean grants are easy to come by, though. Organizations award grants for a specific purpose, so first, you must find suitable grants for your needs. Then, you must go through an application process that can be quite lengthy and competitive to the extent that companies will hire “grant writers” for this purpose. If grants are an option for your business, however, it’s worth the effort.

- If you qualify, grants are great, but it takes time to apply, and it’s competitive.

- The costs are very low, although you may need a grant writer.

- High effort, low risk.

- This is only a viable option for certain types of businesses, often non-profits.

What Source of Capital is Right for You?

Over time, your company will develop what we call a capital structure – a balance of debt, equity, and retained earnings that empower you to run your business and fuel its growth. The right mix for you will depend on how much capital you need, when you need it, and the amount of effort, risk, and cost you can absorb. A good fractional CFO , such as those found at The CEO’s Right Hand, can work with you to create this balance. Contact us directly to discuss your questions and explore options.

Related Posts

Mr. Lieberman is the founder and CEO of The CEO’s Right Hand, Inc., a New York-based consulting services firm that provides the full breadth of strategic, financial and operational advice to founders, CEOs and Executive Teams. As an experienced entrepreneur himself, he has served in various C-suite leadership and advisory roles across a wide spectrum of industries.

His first venture was CMR Technologies, a FinTech company based in San Francisco serving the investment management consulting space. From CMR, Mr. Lieberman formed Xtiva Financial Systems, a software company specializing in sales compensation solutions for the financial services industry. Mr. Lieberman served as Xtiva’s CEO, building the company to over $10 million in revenues and 100+ clients. He also served as the President and CFO for Interactive Donor, a New York-based Benefit Corporation which incentivizes charity through rewards.

Mr. Lieberman holds double Masters degrees, one in Business Administration and the other in Computer Science from the University of California at Los Angeles. He completed his Bachelors in Computer Engineering from the University of California at San Diego.

Contact William Lieberman [email protected] 646-277-8728

Recent Posts

- What is Workplace Culture and Why Every CEO Should Care

- How to Read an Income Statement for a Service Company

- How to Minimize Inefficiencies in Your Real Estate Business

- What Is a Revenue Model and Why Does It Matter?

- How to Avoid Goal-Setting Mistakes as a Financial Services CEO

- Top 5 Employment Law Issues for 2024

Are you ready to get back to running your business?

The CEO’s Right Hand takes charge of your finance, accounting, human resources, and other foundational functions so you can focus on what you do best – running your company. We then arm you with reliable data so you can make confident and timely business decisions.

Fill out the form to get in touch. One of our team members will contact you within one business day.

- Line of Credit

- How It Works

- Small Business Resources

- Small Business Blog

- Business Stories

- Our Platform

- Lender and Partner Resources

- Our Company

- Source of Funds Examples in a Business Plan: 8 Suggestions

- Learning Center

- Small Business Loans

A solid business plan is one of the most important documents you’ll need to create for your company. This document provides a roadmap for your company’s future developments. However, no growth can occur without a sufficient amount of working capital. That’s why your business plan should include a source of funds section – it can remind you how to maintain the cash flow your company needs.

There’s another reason this part of your business plan matters. It can show certain lenders how much money you need beyond what the funding sources in your business plan can get you. That said, not all lenders will require you to share a business plan. For example, SmartBiz’s loan approval requirements don’t include business plans among the necessary paperwork. Either way, below are some source of funds examples in business plans.

What is a business plan?

A business plan is a document that guides your company’s growth. It helps define your business goals and provides a clear overview of how you’ll achieve them. You can also use it to plot out your marketing, operational, and sales approaches. Your business plan can be the foundation of a strategy to minimize risk and maximize growth.

Another reason why solid business plans are essential is that you’ll often need to provide them as you apply for business loans. Business plans provide an in-depth look at a company’s plan for profits, so lenders can more easily judge the borrower’s likelihood of repayment. Lenders are much more likely to finance borrowers whom they believe can pay back the loan amount in a reasonable timeframe.

8 source of funds examples

Having a source of funds – sometimes several sources of funding – is vital to growing your business . Common funding options include business loans, and sometimes, to qualify for them, you must show lenders your other funding sources. Understanding the below source of funds examples in business plans can help you better structure yours.

1. Personal savings

When you’re just getting your business off the ground, sometimes, the fastest way to fund it is directly from your current savings. However, entwining your personal savings into a company that could fail is a risky prospect – but it also shows commitment. Lenders and investors often respond well to a borrower who’s ready to go the distance with their ideas.

2. Money from friends and family

Money from family and friends, which you’ll also see called “love money,” is a viable source of funds in your business plan. However, just as it’s risky to get your own money wrapped up in a business, it’s dangerous with other people’s finances too. Plus, accepting money from a loved one can come with drawbacks. For starters, not everyone in your life has much to spare in the first place. Furthermore, if you borrow money from friends or family and you can’t repay it, the relationship could be damaged.

3. Federal and private grants

Occasionally, your business model can put you in line for federal grants. That said, rare is the business that qualifies for federal grants – technically, the government does not provide grants for small businesses growth. However, private companies ranging from FedEx to the NBA offer grants to small businesses that fit certain criteria. If there’s a chance your company could fit these criteria, you can include private grants as sources of funding in your business plan.

4. Share sales and dividends

Selling shares of your company to investors – as in, anyone who buys stocks – falls under a category of funding known as equity financing. This arrangement can be lucrative, which is a main reason why you see so many companies having initial public offerings (IPOs).

However, equity financing has a few drawbacks. For one, you’ll no longer have complete control over your company's future, as stockholders dilute your ownership. Additionally, you’ll have to account for dividends in your financial planning. You pay these sums to your shareholders every quarter.

5. Venture capital

If you need a large amount of cash, venture capitalists can be a viable option. Typically, though, venture capitalists are only interested in funding startup businesses in the tech sector with high growth potential.

Venture capital is a high-reward but high-risk funding source. It often requires you ceding a certain amount of ownership – and thus control – of your business. Furthermore, if your business fails, you may still need to repay any venture capitalists or firms that have funded your operations.

6. Angel investors

An angel investor is a wealthy private individual who invests in small businesses to help them get off the ground. They tend not to offer as much starting capital as a venture capitalist, but they can make up for the smaller amount with experience. Angel investors are often experts within a specific industry and put money back into it by investing in newer businesses within that sphere.

Although you’ll have to give an angel investor some control over your company, their experience and network can help your business grow. Additionally, the word “angel” in their name reflects that they typically don’t ask for their money back if your business fails. That makes them a safer bet than venture capitalists.

7. Business incubators

Unlike the previous funding options, a business incubator doesn’t offer direct monetary support. Instead, incubators help fledgling businesses thrive by allowing them into their workspace and letting them share resources as they get started. This type of funding is indirect – you’ll rarely get direct cash infusions, but you’ll get resources that would otherwise cost you money. It’s common in high-tech industries such as biotechnology, industrial technology, and multimedia.

8. Bank loans

Bank loans probably ring a bell for you. When a current or aspiring small business owner needs additional funds, these loans are often the first thing that comes to mind. They’re among the most in-demand funding options available given their large funding amounts, long-term repayment periods, and low interest rates . However, their high amounts introduce lender risk that can make them difficult to obtain. To minimize risk, most lenders impose strict qualification criteria that you might not make.

Why do you need to provide sources of funds in your business plan?

Providing a source of funds in your business plan paves a path toward obtaining and using your funding. Knowing where your money is coming from and what you’re spending can help with strategic financial planning. It also minimizes the chances of your business partners spending money the company doesn’t actually have.

In a lending context, your sources of funds may help you qualify for any loans you need in the future. Depending on the funding sources you’re using, lenders may view you as someone able to repay the debt financing they offer. For example, using personal savings shows your commitment to your business, meaning you’re likely a reliable borrower who won’t flake on a loan. You’ll show your commitment to your company and your business at the same time.

Parting thoughts

Reliable funding sources are essential to achieving your company’s objectives, and their presence in your business plan can help you obtain more funding. Namely, certain entities that offer small business loans require business plans as part of the borrower approval process. When your approval plan clearly shows why you need the loan money and how else you’re getting funding, lenders may trust you more.

However, certain lenders don’t require business plans. In fact, when you apply for SBA 7(a) loans , bank term loans, or custom financing through SmartBiz ® , you don't need a business plan. Check now to see if you pre-qualify * – the business funding you need might be closer than you think.

Have 5 minutes? Apply online

- Follow SmartBiz

Access to the right loan for right now

- Business Credit

- Business Finances

- Business Marketing

- Business Owners

- Business Technologies

- Emergency Resources

- Employee Management

- SmartBiz University

- More SBA Articles

Related Posts

National small business week 2024: the ultimate guide, smartbiz helps facilitate access to financing for underrepresented entrepreneurs, women-owned business certification: learn about how to get yours, smart growth is smart business.

See if you pre-qualify, without impacting your credit score. 1

*We conduct a soft credit pull that will not affect your credit score. However, in processing your loan application, the lenders with whom we work will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and happens after your application is in the funding process and matched with a lender who is likely to fund your loan.

The SmartBiz® Small Business Blog and other related communications from SmartBiz Loans® are intended to provide general information on relevant topics for managing small businesses. Be aware that this is not a comprehensive analysis of the subject matter covered and is not intended to provide specific recommendations to you or your business with respect to the matters addressed. Please consult legal and financial processionals for further information.

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Stratrgic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

Key Considerations of the Sources and Uses of Funds Statements

Free Startup Fundraising Checklist

Rudri Mehta

- January 2, 2024

A flow of funds statement is a document created to examine the factors that led to changes in a company’s financial position between two balance sheets . It displays the movement of money in and out, i.e. funding sources and applications for a specific period.

In other words, the source and uses of funds statement explain where a company’s money came from and how the organization has put it to use in the past and how they will use the funds in the future. It is also one of the business plan elements.

It contains the cash inflows into the company, the cash received, the cash outflows from the company, or the money spent.

So, what purpose does it serve?

Mostly, lenders will ask for these statements when you apply for a business loan . It will also help investors understand where the funds have been used.

If sources and uses of funds statement are accurately prepared, it can communicate well with the readers, and hence, it is quite crucial to prepare compelling sources and uses of funds statement.

This article explains the sources and uses of funds statements and the step in creating the statements with examples.

Table of Contents

What is the Sources and Uses of the Funds Statement?

Steps to create the sources and uses of funds statement, sample sources and uses of funds statement.

A company’s sources and uses of funds is a statement that provides information on how much did the company raise the money and how they were applied to achieve the company’s goals.

The sources and use of funds statements reflect the impact of changes in the balance sheet contents on the organization’s cash-in-hand. These are the statements that also guide organizations in their short-term planning decisions that involve available funds.

These statements are widely used for

- For business loan purposes,

- Attracting investors, and

- Predicting the impact of changes in the balance sheet

The Sources and Uses of Funds have two parts,

- The first part is the sources from which the company gets its funds, and

- The second part is the uses, applications, or spending of the money

Let’s understand both sections of the statement in detail.

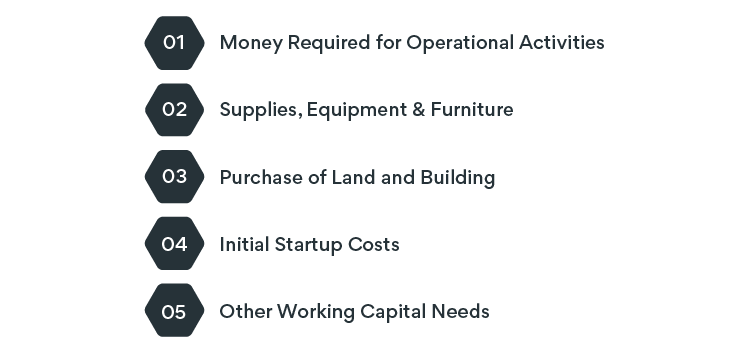

Uses of Funds

It generally consists of the following components:

1. Money Required for Operational Activities

Organizations will need cash and working capital to run the business and perform day-to-day activities.

2. Opening Quantities of Supplies, Equipment, and Furniture

The opening balance of the supplies, equipment, and furniture tells us where the organization has already spent its money.

3. Purchase of Land and Building

The amount spent on acquiring land and building for business use is a huge capital expense and results in cash outflow.

4. Initial Startup Costs

These costs include rent, deposits paid for the rented building/apartment, machinery acquisition costs, initial payments for insurance, company setup costs, etc.

5. Other Working Capital Needs

These include other operating costs such as the rental expenses of the leased machinery, repairs and maintenance expenses, outsourcing costs, etc.

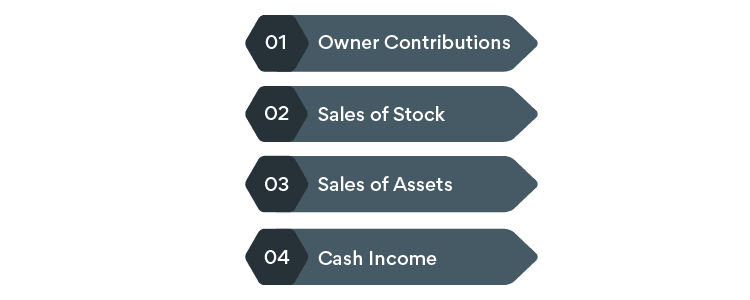

Sources of Funds

Hence, the sources of funds also include the money your investors have given to you.

Below are the other elements of the sources of funds for most businesses.

1. Owner Contributions

Owners of the businesses bring specific amounts of capital to start the company and they also contribute more capital as and when needed from time to time.

2. Sales of Stock

It includes the sale of finished goods and any other inventory that will not be used by the company.

3. Sales of Assets

The assets that the companies sell due to the discontinuance of some of the operations or assets becoming non-operatable are another source of funds.

4. Cash Income

Any other cash income generated from the sale is also considered one of the sources of funds.

Funds statement’s uses

The following are prominent uses of funds:

- Adjusting operating net loss

- Purchase of non-current assets

- Repayment of either long-term or short-term debt , such as bank loans (debentures or bonds)

- Redeemable preference share redemption

- Payment of dividends in cash

One of the essential tasks of an organization in preparing the financial statements of the company would be to prepare the sources and uses of funds statement.

It is because the statement reflects the efficiency of the business in depicting how effectively funds were utilized from the available sources. Even if you want to fund, then you will need these fund statements in your business plan. If you are not aware of that, then worry not, visit our business plan app .

The uses of funds section are prepared first, and then the sources of funds.

Let’s learn how to prepare the uses of funds section of the sources and uses of the fund’s statement.

Steps to Create Uses of Funds

- Note down all the costs included in the uses of funds, such as plant and machinery, initial startup costs, suppliers and marketing expenses, and other working capital costs.

- Add all the numbers and make a total to name ‘total of startup costs’ as shown in the example below.

- The capital costs required for purchasing the buildings, machinery, and vehicles and

- The working capital requirements to fund day-to-day operations.

While generating the uses of funds statement, focus on all the needs for the smooth and profitable functioning of the business rather than on the sources of funds.

Steps to Create Sources of Funds

- This section lists all the sources of funds, depicting where the money has come to fund the business.

- List the contributions received from the owners and the investors.

- Write the security that you offer for the loan you wish to secure.

- Any other sources of funds that you can use to fund the business in case you cannot pay the loan?

- It is also advisable to include all details concerning the contribution particulars.

While preparing the statement for sources and uses of funds, please note it has to be simple, and easy to understand. If you complicate the statement by adding difficult terms or complex numbers, readers may misinterpret the statement, and you may lose a potential investor or a bank loan.

Statement of Sources and Uses of Funds:

The Bottom Line

As you grow your business , you may need more funds to meet the business expansion costs, and hence, it is important not only the startup companies but the well-established businesses as well to craft a compelling statement of sources and uses of funds.

How Can We Help?

We can help you prepare the statement of sources and uses of funds faster and more accurately along with other reports such as financial statements , and ratio analysis to help you better understand the financial position of your company.

Request your free demo at Upmetrics ~ a business plan app to input only the minimum elements so that we can compute it for you.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

What are the factors to be considered in choosing the source of funds.

- Tax benefits

- Flexibility & ease

- Purpose & time period

What are the 2 most important sources of funds?

- Equity shares

- Retained earnings

What is the importance of the sources and uses in the fund flow statement?

An organization’s working capital movements are described in a flow of funds statement. It takes into account the inflows and outflows of money (the sources and uses of money) throughout a specific period. The statement aids in analyzing how the financial situation of a company has changed across two balance sheet periods.

What are the uses of the funds flow statement?

Thus, the funds flow statement help in locating liquidity blockages and in formulating an efficient dividend policy. This declaration also acts as a company’s financial road map. It highlights the monetary difficulties that an organization can have soon.

About the Author

Rudri is a passionate financial content writer and a Chartered Accountant by profession. She enjoys sharing knowledge through her writing skills in finance, investments, banking, and taxation while also exploring graphic designing for her own content.

Related Articles

Write the Funding Request Section of Your Business Plan

How to Write a Business Plan Complete Guide

How to Prepare a Financial Plan for Startup Business (w/ example)

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

The Sources & Uses of Funds Spreadsheet: What You Need to Know

by Diane Tarshis | Financials

If you’re not a numbers person, I recommend reading or listening to Financial Projections Explained (Even If You’re Not a Numbers Person) and The Difference Between P&L and Cash Flow Projections before reading this article.

- How much money do you really need?

- What will you be spending that money on?

- How, exactly, are you coming up with that number?

Even if you’re bootstrapping, you’re not off the hook.

Answering these questions helps to ensure that you have enough access to cash (also known as working capital or liquidity) to keep your business afloat until you become what I call “reliably profitable.” I say “reliably” because a single month or quarter isn’t enough time to guarantee that you’re on solid enough financial footing to be self-sustaining.

Where to start…

To answer these questions, you first need to build realistic financial projections using the standard spreadsheets I covered in Financial Projections Explained (Even If You’re Not a Numbers Person) . Specifically, you’re going to need the Sources & Uses of Funds.

- All the cash coming into your startup from loans, investments and grants (and from whom)

- How you plan to use that cash (by type or category)

The Sources & Uses of Funds will not only provide this information, but just as importantly, show that you’ve done your homework, which is a fantastic way to make sure you’re taken seriously. Gold star for you!

Why this spreadsheet is different from the others.

When you look closely at the 5 main spreadsheets startups use for their financial projections, you’ll see that the Sources & Uses of Funds is different from the all the others in one important aspect:

It’s the only spreadsheet that relies on information from other spreadsheets.

Specifically, you need to complete your Cash Flow Projections and Equipment List first. Then you can begin work on your Sources & Uses of Funds.

So let’s go over what you need to know to build this spreadsheet the right way, so you’ll have all your ducks in a row when you start asking for money.

First off, avoid this common mistake.

An unfortunate but common error many entrepreneurs make is including startup costs * in their profit and loss (P&L) and cash flow projections. Doing this is a problem because it distorts your financial picture.

The P&L relies on your estimated revenues and expenses to show your startup’s profitability, whereas cash flow projections rely on those same estimates to show your startup’s ability to pay its bills. Both are essential tools when it comes to setting your prices as well as budgeting. Including startup costs in these spreadsheets will throw your financial picture out of whack because they’re not part of your daily operations.

For example, money received from investors or other funding sources is not revenue. In fact, funding has nothing to do with measuring sales, which is what revenue is meant to show. And startup costs, such as building your website, buying a delivery van or hiring a consultant to write your business plan, have nothing to do with your daily operating expenses.

* When I refer to startup costs, I mean the one-time expenses you incur before you begin your normal daily operations.

Here’s what the Sources & Uses of Funds tells you:

Done right, a Sources & Uses of Funds will show you how much cash you’re going to need to:

- Launch your business.

- Cover your expenses until your startup is generating enough cash to cover its own expenses… or reach the next round of funding.

- Raise from investors, borrow from lenders or budget for yourself if you’re planning to bootstrap.

What goes in the “Sources” section.

In the Sources section you’re going to list everyone who is providing the startup funds that you need. Regardless of whether you’re planning to find outside investors, secure a loan, use your own money or some combination, this part of the spreadsheet has to show all the sources of funding for your business.

You’ll need to list each one on its own line, including the source’s name along with the amount they are investing or loaning to you.

Founder Contribution: Suzy Q. $xxx Founder Contribution: Andre M. xxx Investment from Tony Smith: xxx Investment from XYZ Ventures: xxx Total Sources: $xxx

When you’re completing this section, make sure not to leave out anything, including money coming from friends, family, co-founders or yourself, if you’re using your own money.

After each source is listed, you’ll total them up to determine the sum of all incoming funds. Then you’re ready to move on!

What goes in the “Uses” section.

The Uses section includes two different categories:

- Startup costs

- Working capital

1. Startup costs.

In the first category, you need to consider all of the expenses you’ll incur before you launch your business. This includes things like a website, furniture, equipment, legal fees, consultant fees, grand opening expenses and more.

Each category should be listed on its own line of the spreadsheet. For example, you’ll have one line for furniture, one for equipment, one for consultant fees and so on.

Reminder: If you need to purchase equipment for your startup — things like machinery, display cases, a delivery van, etc. — you’ll need to create a separate Equipment List spreadsheet where the individual items are listed in detail, along with delivery and installation fees, sales tax, etc. Then you put that total in the Uses section.

App Development $xxx Business Plan xxx Equipment xxx Legal xxx Grand Opening xxx Inventory/Supplies xxx Website xxx

Cash Needs for 17 Months of Operations xxx Cash Reserve for Contigencies xxx Total Uses: $xxx

Now we’ll look at the next thing you have to account for in the Uses section…

2. Working capital.

This category refers to the amount of cash you’ll need to bridge the gap until your business is generating enough cash to fund itself and become self-sustaining.

This number will appear as its own line item labeled “Cash Needs for ___ Months of Operations.”

Of course, to figure out how many months it will take to become profitable, you’ll have to refer back to your Cash Flow Projections. That’s why you need to prepare them before tackling your Sources & Uses of Funds.

To estimate when your business will be “reliably profitable,” take a look at the bottom two lines of your Cash Flow Projections spreadsheet. They show the cumulative beginning and ending cash on hand each month.

Find the month when the negative numbers become consistently positive. However many months it is from when you start your business, that’s the number you’ll use to fill in the blank of “Cash Needs for ___ Months of Operations.”

Finally, I recommend adding an additional line labeled “ Cash Reserve for Contingencies . ” It’s always smart to have a small cushion to cover any surprises that crop up.

Two important points about the Sources & Uses of Funds:

1. the totals have to match..

In other words, Total Sources needs to equal Total Uses. This isn’t my rule, it’s an accounting rule.

If there’s a significant difference between Total Sources and Total Uses, then there’s something important missing in one of the sections. It’s important for you to find and fix any discrepancies.

It’s especially important to do this before showing your numbers to other people. If your Total Sources and Total Uses don’t match up, it’s a red flag to banks and potential investors that you don’t understand your financials.

If, on the other hand, your two totals are close but not exact, I tweak the Cash Reserves line item slightly — and I do mean slightly — to make the numbers match.

2. Double-check that your financial projections are realistic and credible.

You’ll know you’ve done things right when you’re confident that you can defend your assumptions if an investor or banker dives in and asks how/where/why you chose the numbers you did. Pro Tip: It’s not really about the numbers per se, it’s about the thinking behind the numbers that they’re testing you on.

Helpful reading and resources.

For more information on the financial spreadsheets mentioned in this article, take a look at my DIY Business Plan Kit . It goes into far greater detail on the five main spreadsheets you need for your business plan, and includes Excel templates with some formulas already built in.

Also take a look at The Difference Between Profit & Loss and Cash Flow Projections to get a better understanding of how each of those spreadsheets works. And if all of this numbers talk is new to you, be sure to take a look at Financial Vocabulary for People Who Hate Numbers .

Last but not least, if you’d like help putting together your financial projections — as well as learning how to use them so that you can take charge and feel comfortable changing things as you move forward — consider working with me one on one ( see more details here ).

Want some one-on-one help? Book a free discovery call.

Everything you need and nothing you don’t.

Get more tips like these delivered straight to your inbox.

Recent Posts

- Stop Saying You Don’t Have Time to Start a Business

- 5 Reasons People Over 40 are More Likely to Succeed When Starting a Business

- How to Fund Your Business Without Selling Your Soul

- How to Start a Business in a Crowded Market

- First Steps

- How To…

Share this post:

Search Product category Any value Sample Label 1 Sample Label 2 Sample Label 3

Sources and Uses

- April 21, 2023

When it comes to finance, Sources and Uses (also referred to as “S&U”) is a common concept in finance that refers to where money is coming from (sources) and what it is used for (the “uses”).

This concept is critical for financial planning, budgeting, and forecasting. In this article, we’ll explain what sources and uses are, what typically falls into each category, and why they are important.

What Are Sources and Uses?

Sources and uses is a way of analyzing the inflows and outflows of money for a particular project, company, or investment. Think about it as a table , as it’s commonly presented in business plan and financial models (on the left side are sources and on the right the uses).

What is included in Sources?

Sources of funds refer to where the money is coming from to finance a particular project or investment. These sources could include:

It’s worth noting that sources can also come from operations, such as revenue generated from sales.

What is included in Uses?

Uses of funds refer to where the money is going or what it’s being used for. These uses could include:

Example of Sources and Uses

To illustrate how sources and uses work in practice, let’s consider an example of a small business that wants to expand its operations by purchasing a new building.

The business plans to finance the purchase through a combination of debt and equity. Here’s a breakdown of how the sources and uses for the project could look like:

Privacy Overview

- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

Top Sources of Capital for Business Owners

Marco Carbajo is a credit specialist and owner of Business Credit Insiders Circle. His expertise includes guiding businesses and start-ups in securing funding without putting personal assets at risk. He previously worked as a credit analyst for Credit Education Services.

:max_bytes(150000):strip_icc():format(webp)/marco-carbajo-photo-56a0a3383df78cafdaa37ede.jpg)

Many entrepreneurs do not know where to acquire funding when starting out or expanding. If you know where to look, you'll find that there are many different sources for entrepreneurs to raise capital.

However, not every source of capital is suitable for every business. An entrepreneur should choose one which meets the capital structure that best fits their business. A business' capital structure is the way that it is funded, either through debt (loans) or equity (shares sold to investors) financing.

Financial backing usually includes loans, grants, or investor funding. Some of the top ways to raise capital are through angel investors, venture capitalists, government grants, and small business loans. There are other methods for financing such as credit cards or invoice financing, but these should be used only if you need cash quickly and know the risks involved.

Angel Investors

Angel investors are generally individuals or groups who provide capital from their personal assets to assist you with starting your business. These types of investors are looking for startups that have good potential for earnings.

Since they are investors, you'll be expected to present them with a portfolio that is favorable. This differs from venture capitalists, who are more interested in organizations that are already doing well but need more sources of capital.

Venture Capitalists

Venture capitalists (VCs) are usually groups of individuals that provide capital through an organization they have established. Generally, VCs like to fund companies that are already somewhat established, and in need of more finances. However, VCs have been known to sponsor startups that show significant promise.

VCs are looking for high returns on their investments (your business). This is not unusual for investors, but some VCs may want to be involved in your business decisions after they grant you some funding.

In the past, VCs have wanted to make decisions for the businesses they have funded to protect their investments. However, many VCs have moved to more of a mentor role, assisting you with business decisions and offering guidance as a protective measure. Ensure you enquire about the role a VC would like to have before you accept any funds.

If you do not find any suitable VCs, a small business loan may be the next option.

Small Business Loans

The Small Business Administration (SBA) has been established to assist business owners with their businesses. A small business loan through SBA partner lenders, while competitive, are guaranteed by the SBA and come with generally lower rates than traditional loans.

Small business loans are not the only form of government assistance. A source of capital often overlooked by entrepreneurs is government grants.

Government Grants

The government offers grants through the SBA to entrepreneurs who have research-related businesses. The most attractive benefit of a grant is that it is free and you won't need to repay the government.

Crowdfunding

Crowdfunding is a method of raising funds from individuals, using an internet-based platform. This method depends upon the generosity of people, and upon the exposure your crowdfunding campaign receives.

To have a successful crowdsourcing endeavor, you must be able to win the crowd's support. They'll want to know why you need the money and may want a reason to contribute. Create a reasonable monetary goal, and decide on a reward for the crowd that assists you. This could be public recognition for donations or letting them be the first ones to receive your product.

These are small loans designed for small businesses and startups. What makes these loans attractive is that they are short-term loans with low-interest rates compared to traditional small business loans.

Invoice Factoring

Sometimes referred to as invoice advances, invoice factoring is a process where an entrepreneur agrees with a lender to sell their invoices due, and let the lender collect future payment by the customers.

This works by a lender purchasing your open invoices from you for a reduced amount, then collecting the amount that is due. For example, if you had a sale with receivables pending for $11,000 you could sell it to a lender who might buy it for $9,000. You receive cash, and the lender receives the $11,000 when it is paid.

This is a source of capital you might use if you were very much in need of capital, as you would lose $2,000 in the transaction.

Credit Cards

Many companies use personal and business credit cards to finance immediate expenses. Credit cards are convenient when you don't have the cash to make purchases at the moment.

If you do not have the means to make your monthly payments, credit cards can exponentially increase your debt with high annual percentage rates.

- Search Search Please fill out this field.

What Is Capital?

Understanding capital, how capital is used, business capital structure, types of capital, capital vs. money.

- Capital FAQs

The Bottom Line

Capital: definition, how it's used, structure, and types in business.

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

Capital is a broad term that can describe anything that confers value or benefit to its owners, such as a factory and its machinery, intellectual property like patents, or the financial assets of a business or an individual.

While money itself may be construed as capital, capital is more often associated with cash that is being put to work for productive or investment purposes. In general, capital is a critical component of running a business from day to day and financing its future growth.

Business capital may derive from the operations of the business or be raised from debt or equity financing. Common sources of capital include:

- Personal savings

- Friends and family

- Angel investors

- Venture capitalists (VC)

- Corporations

- Federal, state, or local governments

- Private loans

- Work or business operations

- Going public with an IPO

When budgeting, businesses of all kinds typically focus on three types of capital: working capital, equity capital, and debt capital. A business in the financial industry identifies trading capital as a fourth component.

Learn more about the types, sources, and structures of capital.

Key Takeaways

- The capital of a business is the money it has available to pay for its day-to-day operations and to fund its future growth.

- The four major types of capital include working capital, debt, equity, and trading capital. Trading capital is used by brokerages and other financial institutions.

- Any debt capital is offset by a debt liability on the balance sheet.

- The capital structure of a company determines what mix of these types of capital it uses to fund its business.

- Economists look at the capital of a family, a business, or an entire economy to evaluate how efficiently it is using its resources.

Investopedia / Matthew Collins

From the economists' perspective, capital is key to the functioning of any unit, whether that unit is a family, a small business, a large corporation, or an entire economy.

Capital assets can be found on either the current or long-term portion of the balance sheet. These assets may include cash, cash equivalents, and marketable securities as well as manufacturing equipment, production facilities, and storage facilities.

In the broadest sense, capital can be a measurement of wealth and a resource for increasing wealth. Individuals hold capital and capital assets as part of their net worth. Companies have capital structures that define the mix of debt capital, equity capital, and working capital for daily expenditures that they use.

Capital is typically cash or liquid assets being held or obtained for expenditures. In a broader sense, the term may be expanded to include all of a company’s assets that have monetary value, such as its equipment, real estate, and inventory. But when it comes to budgeting, capital is cash flow.

In general, capital can be a measurement of wealth and also a resource that provides for increasing wealth through direct investment or capital project investments. Individuals hold capital and capital assets as part of their net worth. Companies have capital structures that include debt capital, equity capital, and working capital for daily expenditures.

How individuals and companies finance their working capital and invest their obtained capital is critical for their prosperity.

Capital is used by companies to pay for the ongoing production of goods and services to create profit. Companies use their capital to invest in all kinds of things to create value. Labor and building expansions are two common areas of capital allocation. By investing capital, a business or individual seeks to earn a higher return than the capital's costs.

At the national and global levels, financial capital is analyzed by economists to understand how it is influencing economic growth. Economists watch several metrics of capital including personal income and personal consumption from the Commerce Department’s Personal Income and Outlays reports. Capital investment also can be found in the quarterly Gross Domestic Product report.

Typically, business capital and financial capital are judged from the perspective of a company’s capital structure. In the U.S., banks are required to hold a minimum amount of capital as a risk mitigation requirement (sometimes called economic capital ) as directed by the central banks and banking regulations.

Other private companies are responsible for assessing their capital thresholds, capital assets, and capital needs for corporate investment. Most of the financial capital analysis for businesses is done by closely analyzing the balance sheet.

A company’s balance sheet provides for metric analysis of a capital structure, which is split among assets, liabilities, and equity. The mix defines the structure.

Debt financing represents a cash capital asset that must be repaid over time through scheduled liabilities. Equity financing, meaning the sale of stock shares, provides cash capital that is also reported in the equity portion of the balance sheet. Debt capital typically comes with lower rates of return and strict provisions for repayment.

Some of the key metrics for analyzing business capital are weighted average cost of capital, debt to equity, debt to capital, and return on equity.

Below are the top four types of capital that businesses focus on in more detail

Debt Capital

A business can acquire capital by borrowing. This is debt capital, and it can be obtained through private or government sources. For established companies, this most often means borrowing from banks and other financial institutions or issuing bonds. For small businesses starting on a shoestring, sources of capital may include friends and family, online lenders, credit card companies, and federal loan programs.

Like individuals, businesses must have an active credit history to obtain debt capital. Debt capital requires regular repayment with interest. The interest rates vary depending on the type of capital obtained and the borrower’s credit history.

Individuals quite rightly see debt as a burden, but businesses see it as an opportunity, at least if the debt doesn't get out of hand. It is the only way that most businesses can obtain a large enough lump sum to pay for a major investment in the future. But both businesses and their potential investors need to keep an eye on the debt to capital ratio to avoid getting in too deep.

Issuing bonds is a favorite way for corporations to raise debt capital, especially when prevailing interest rates are low, making it cheaper to borrow. In 2020, for example, corporate bond issuance by U.S. companies soared 70% year over year, according to Moody's Analytics. Average corporate bond yields had then hit a multi-year low of about 2.3%.

Equity Capital

Equity capital can come in several forms. Typically, distinctions are made between private equity, public equity, and real estate equity.

Private and public equity will usually be structured in the form of shares of stock in the company. The only distinction here is that public equity is raised by listing the company's shares on a stock exchange while private equity is raised among a closed group of investors.

When an individual investor buys shares of stock, they are providing equity capital to a company. The biggest splashes in the world of raising equity capital come, of course, when a company launches an initial public offering (IPO). In 2021, the Duolingo IPO valued the company at $5 million and shook the Nasdaq market.

Working Capital

A company's working capital is its liquid capital assets available for fulfilling daily obligations. It is calculated through the following two assessments:

- Current Assets – Current Liabilities

- Accounts Receivable + Inventory – Accounts Payable

Working capital measures a company's short-term liquidity. More specifically, it represents its ability to cover its debts, accounts payable, and other obligations that are due within one year.

Note that working capital is defined as current assets minus its current liabilities. A company that has more liabilities than assets could soon run short of working capital.

Trading Capital

Any business needs a substantial amount of capital to operate and create profitable returns. Balance sheet analysis is central to the review and assessment of business capital.

Trading capital is a term used by brokerages and other financial institutions that place a large number of trades daily. Trading capital is the amount of money allotted to an individual or a firm to buy and sell various securities.

Investors may attempt to add to their trading capital by employing a variety of trade optimization methods. These methods attempt to make the best use of capital by determining the ideal percentage of funds to invest with each trade.

In particular, to be successful, traders need to determine the optimal cash reserves required for their investing strategies.

A big brokerage firm like Charles Schwab or Fidelity Investments will allocate considerable trading capital to each of the professionals who trade stocks and other assets for it.

At its core, capital is money. However, for financial and business purposes, capital is typically viewed from the perspective of current operations and investments in the future.

Capital usually comes with a cost. For debt capital, this is the cost of interest required in repayment. For equity capital, this is the cost of distributions made to shareholders. Overall, capital is deployed to help shape a company's development and growth .

What Does Capital Mean in Economics?

To an economist, capital usually means liquid assets. In other words, it's cash in hand that is available for spending, whether on day-to-day necessities or long-term projects. On a global scale, capital is all of the money that is currently in circulation, being exchanged for day-to-day necessities or longer-term wants.

What Is the Capital in a Business?

The capital of a business is the money it has available to fund its day-to-day operations and to bankroll its expansion for the future. The proceeds of its business are one source of capital.

Capital assets are generally a broader term. The capital assets of an individual or a business may include real estate, cars, investments (long or short-term), and other valuable possessions. A business may also have capital assets including expensive machinery, inventory, warehouse space, office equipment, and patents held by the company.

Many capital assets are illiquid—that is, they can't be readily turned into cash to meet immediate needs.

A company that totaled up its capital value would include every item owned by the business as well as all of its financial assets (minus its liabilities). But an accountant handling the day-to-day budget of the company would consider only its cash on hand as its capital.

What Are Examples of Capital?

Any financial asset that is being used may be capital. The contents of a bank account, the proceeds of a sale of stock shares, or the proceeds of a bond issue all are examples. The proceeds of a business's current operations go onto its balance sheet as capital.

What Are the 3 Sources of Capital?

Most businesses distinguish between working capital, equity capital, and debt capital, although they overlap.

- Working capital is the money needed to meet the day-to-day operation of the business and pay its obligations promptly.

- Equity capital is raised by issuing shares in the company, publicly or privately, and is used to fund the expansion of the business.

- Debt capital is borrowed money. On the balance sheet, the amount borrowed appears as a capital asset while the amount owed appears as a liability.

The word capital has several meanings depending on its context.

On a company balance sheet, capital is money available for immediate use, whether to keep the day-to-day business running or to launch a new initiative. It may be defined on its balance sheet as working capital, equity capital, or debt capital, depending on its origin and intended use. Brokerages also list trading capital; that is the cash available for routine trading in the markets.

When a company defines its overall capital assets, it generally will include all of its possessions that have a cash value, such as equipment and real estate.

When economists look at capital, they are most often looking at the cash in circulation within an entire economy. Some of the major national economic indicators are the ups and downs of all of the cash in circulation. One example is the monthly Personal Income and Outlays report from the U.S. Bureau of Economic Analysis.

Federal Reserve Board. " Policy Tools: Reserve Requirements ."

Moody's Analytics. " Corporate Bond Issuance Boom May Steady Credit Quality, On Balance ."

St. Louis Fed. " Moody's Seasoned Aaa Corporate Bond Yield ."

CNBC. " Duolingo Closes Up 36% in Nasdaq Debut ."

Bureau of Economic Analysis. " Personal Income ."

:max_bytes(150000):strip_icc():format(webp)/TermDefinitions_wacc_final-2c29855b4011430e97968a765d04792c.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to Prepare a Sources and Uses of Funds Statement

What Is a Sources and Uses of Funds Statement?

The sources and uses of fund statement is an accounting statement that summarizes the financial statement and financial plan . It shows the sources from which a business or a company obtains its cash and the uses to which this cash is put during a trading period.