- History Classics

- Your Profile

- Find History on Facebook (Opens in a new window)

- Find History on Twitter (Opens in a new window)

- Find History on YouTube (Opens in a new window)

- Find History on Instagram (Opens in a new window)

- Find History on TikTok (Opens in a new window)

- This Day In History

- History Podcasts

- History Vault

Stock Market Crash of 1929

By: History.com Editors

Updated: November 16, 2023 | Original: May 10, 2010

The Stock Market Crash of 1929 occurred on October 29, 1929, when Wall Street investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of that event, sometimes called “Black Tuesday,” America and the rest of the industrialized world spiraled downward into the Great Depression, the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time.

What Caused the 1929 Stock Market Crash?

During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929 after a period of wild speculation in the Roaring Twenties . By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value.

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

Did you know? The New York Stock Exchange was founded in 1817, although its origins date back to 1792 when a group of stockbrokers and merchants signed an agreement under a buttonwood tree on Wall Street.

Black Tuesday

Stock prices began to decline in September and early October 1929, and on October 18 a big drop in stock prices began. Panic soon set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded. Investment companies and leading bankers attempted to stabilize the market by buying up great blocks of stock, producing a moderate rally on Friday.

On Monday, however, the storm broke anew, and the market went into free fall. Black Monday was followed by Black Tuesday —October 29, 1929—during which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading.

Effects of the 1929 Stock Market Crash: The Great Depression

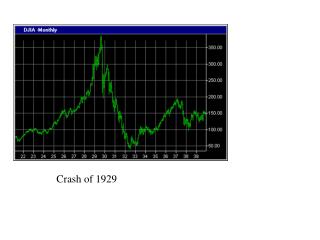

After October 29, 1929, stock prices had nowhere to go but up, so there was considerable recovery during succeeding weeks. Overall, however, prices continued to drop as the United States slumped into the Great Depression , and by 1932 stocks were worth only about 20 percent of their value in the summer of 1929.

The stock market crash of 1929 was not the sole cause of the Great Depression, but it did act to accelerate the global economic collapse which it was also a symptom. Stock prices continued to drop through 1932 when the Dow Jones Industrial Average—a widely-used benchmark for blue-chip stocks in the United States—closed at 41.22, its lowest value of the 20th century, 89 percent below its peak.

By 1933, nearly half of America’s banks had failed, and unemployment was approaching 15 million people or 30 percent of the U.S. workforce. The Dow Jones Industrial Average would not return to its pre-1929 heights until November of 1954, about 25 years later.

African Americans were particularly hard hit, as they were the “ last hired, first fired .” Women during the Great Depression fared slightly better, as traditionally female jobs of the era like teaching and nursing were more insulated than those dependent on fluctuating markets.

Life for the average family during the Great Depression was difficult. Storms and a severe drought in the Southern Plains ruined crops, causing the area to be nicknamed the Dust Bowl . “Okies,” as fleeing residents were called, moved to big cities looking for work.

Did you know? The Great Depression helped bring an end to Prohibition . Politicians believed legalizing the consumption of alcohol could help create jobs and stimulate the economy .

The relief and reform measures in the New Deal programs enacted by the administration of President Franklin D. Roosevelt helped lessen the worst effects of the Great Depression; however, the U.S. economy would not fully turn around until after 1939, when World War II revitalized American industry.

Sign up for Inside History

Get HISTORY’s most fascinating stories delivered to your inbox three times a week.

By submitting your information, you agree to receive emails from HISTORY and A+E Networks. You can opt out at any time. You must be 16 years or older and a resident of the United States.

More details : Privacy Notice | Terms of Use | Contact Us

- Search Search Please fill out this field.

- Laws & Regulations

Plunge Protection Team (PPT): Definition and How It Works

:max_bytes(150000):strip_icc():format(webp)/troypic__troy_segal-5bfc2629c9e77c005142f6d9.jpg)

What Is the Plunge Protection Team?

The "Plunge Protection Team" (PPT) is a colloquial name given to the Working Group on Financial Markets. Created in 1988 to provide financial and economic recommendations to the U.S. President during turbulent market times, this group is headed by the Secretary of the Treasury; other members include the Chair of the Board of Governors of the Federal Reserve , the Chair of the Securities and Exchange Commission and the Chair of the Commodity Futures Trading Commission (or the aides or officials they designate to represent them).

The name "Plunge Protection Team" was coined by The Washington Post and first applied to the group in 1997.

Key Takeaways

- The "Plunge Protection Team" (PPT) is a colloquial name given to the Working Group on Financial Markets by The Wall Street Journal.

- The Plunge Protection Team's official mission is to advise the U.S. president during times of economic and stock market turbulence.

- Critics fear the Plunge Protection Team doesn't just advise, but actively intervenes to prop up stock prices—colluding with banks to rig the market, in effect.

The Plunge Protection Team, composed of high-ranking government financial officials, reports directly and privately to the president of the United States.

How the Plunge Protection Team (PPT) Works

In March 1988, in the wake of the stock market crash of 1987, then-President Ronald Reagan created by executive order the President’s Working Group on Financial Markets. The concept was to create an informed, but informal, advisory group on the markets for the president and regulators. Charged with "enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence."

Its original purpose was to report specifically on the Black Monday events of October 19, 1987—during that event, the Dow Jones Industrial Average fell 22.6%—and, what actions, if any, should be taken. However, the group has continued to meet and report to various presidents over the years, usually (but not always) during turbulent times in the financial markets.

In 1999, it issued a recommendation to Congress, requesting changes in the derivatives markets regulations. It convened during the global credit crisis of 2008. The Plunge Protection Team's latest gathering (as of March 2019) was on Christmas Eve, 2018. Treasury Secretary Steven Mnuchin chaired a conference call with other members of the group, in addition to representatives from the Comptroller of the Currency and the Federal Deposit Insurance Corporation.

Concerns About the Plunge Protection Team (PPT)

Though not exactly a secret, the Plunge Protection Team isn't widely covered and doesn't release the minutes of its meetings or its recommendations, reporting only to the president. This behavior leads some observers to wonder if the government's most important financial officials are doing more than analyzing and advising—in fact, that are actively intervening in the markets.

Conspiracy theorists have speculated that the group executes trades on several exchanges when prices are heading downward, collaborating with big banks such as Goldman Sachs and Morgan Stanley in unrecorded transactions. They often point to a 1989 speech published in The Wall Street Journal by former Federal Reserve Board of Governors member Robert Heller, which suggested the Fed could directly support the stock market by purchasing index futures contracts.

How the Plunge Protection Team (PPT) Might Work

On Monday, February 5, 2018, the Dow Jones Industrial Average (DJIA) experienced a drop that was twice as large as its biggest point decline in history. However, arbitrary and aggressive buying cut the decline in half in one day. On Tuesday and Wednesday of that week, stocks opened lower, and each time aggressive buying buoyed the markets. That aggressive buying, some say, was being orchestrated by the Plunge Protection Team.

Or, to take a more recent example: The Plunge Protection Team's aforementioned teleconference on Dec. 24, 2018. That whole month, the S&P 500 had been heading towards a record decline—the motive for the team's meeting—and the DJIA dropped 650 on the 24th alone. But when trading resumed after Christmas, the DJIA rallied over 1,000 points. On the 27th, it lost half those gains, until a late-day reversal stopped the slide, and caused the market to close 600 points up. That's no coincidence, conspiracy theorists argue.

If true, this sort of manipulation is not unlike the actions of consortia of private bankers and financiers in the late 19th and early 20th century who, during financial panics, would step in to shore up the stock market with massive purchases. The difference, of course, is that the Working Group on Financial Markets is composed of U.S. government officials, and the U.S. is supposed to operate on a free-market system. And also an open one, not one influenced by mysterious forces.

- Guide to Stock Market Crashes 1 of 26

- October: The Month of Market Crashes? 2 of 26

- How Do Investors Lose Money When the Stock Market Crashes? 3 of 26

- Timeline of U.S. Stock Market Crashes 4 of 26

- October Effect: Definition, Examples, and Statistical Evidence 5 of 26

- Financial Crisis: Definition, Causes, and Examples 6 of 26

- What Is a Circuit Breaker in Trading? How Is It Triggered? 7 of 26

- Plunge Protection Team (PPT): Definition and How It Works 8 of 26

- Tulipmania: About the Dutch Tulip Bulb Market Bubble 9 of 26

- Black Friday Stock Market Crash Overview 10 of 26

- Bank Panic of 1907: Causes, Effects, and Importance 11 of 26

- Stock Market Crash of 1929: Definition, Causes, Effects 12 of 26

- The Stock Market Crash of 1929 and the Great Depression 13 of 26

- What Is Black Tuesday? Definition, History, and Impact 14 of 26

- What Is Black Thursday? History, Significance, and Aftermath 15 of 26

- What Was the Stock Market Crash of 1987? What Happened and Causes 16 of 26

- Black Monday: Definition in Stocks, What Caused It, and Losses 17 of 26

- What Caused Black Monday, the 1987 Stock Market Crash? 18 of 26

- The 2007–2008 Financial Crisis in Review 19 of 26

- The Fall of the Market in the Fall of 2008 20 of 26

- Components of the 2008 Bubble 21 of 26

- Financial Regulations: Glass-Steagall to Dodd-Frank 22 of 26

- Consequences of the Glass-Steagall Act Repeal 23 of 26

- Lessons From the 2008 Financial Crisis 24 of 26

- Major Players in the 2008 Financial Crisis: Where Are They Now? 25 of 26

- Too Big to Fail Banks: Where Are They Now? 26 of 26

:max_bytes(150000):strip_icc():format(webp)/janet-yellen_round2-444d00b0128f4bdf8f0be609f22a08f3.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

The Stock Market Crash Mr. Dodson.

Published by Imogene Hill Modified over 9 years ago

Similar presentations

Presentation on theme: "The Stock Market Crash Mr. Dodson."— Presentation transcript:

Causes of the Stock Market Crash

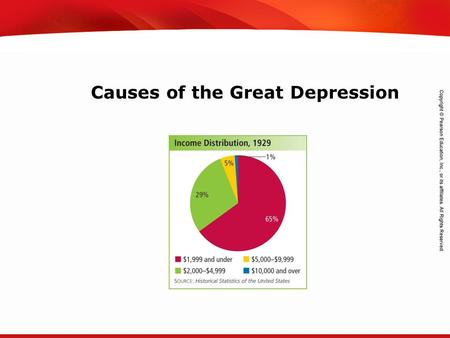

TEKS 8C: Calculate percent composition and empirical and molecular formulas. Causes of the Great Depression.

The Great Depression. Rising Market The rising stock market dominated the news People who were invested were waiting for the fall of the Market, so.

Warm-Up People who own stock in companies may receive cash payments based on how much profit the companies make. Name 2 companies you would invest in.

The Great Depression Depression

BOOM (Prosperity) High Consumer Spending (Cash in Victory Bonds, Installment Buying) Federal Reserve Keeps Interest Rates Low: Easy Credit for Individuals.

The Stock Market Crash of 1929 and the beginning of the Great Depression.

The Market Crashes The market crash in October of 1929 happened very quickly. In September, the Dow Jones Industrial Average, an average of stock prices.

The Stock Market Crash (22.1)

The Downward Spiral The Stock Market Crash Chapter 22 Section 1.

BELLWORK What is a Depression? What are some signs of a booming economy? (How do you know when an economy is doing well?) How would you cut back on your.

CHAPTER 15 Crash and Depression

1920) World economy = a delicately balanced house of cards. Key card that held up the rest was American economic prosperity. HoJun.

1. The Gap Between the Rich and the Poor. 2. Easy Credit Led to Larger Amounts of Personal Debt. 3. Unregulated Stock Speculation! 4. Industrial Overproduction.

DESCRIBE SOCIAL AND ECONOMIC CONDITIONS FROM THE 1920S THROUGH THE GREAT DEPRESSION REGARDING FACTORS LEADING TO A DEEPENING CRISIS, INCLUDING THE COLLAPSE.

Origins of the Great Depression

Chapter 15 The Great Depression

The Stock Market Crash Angela Brown Chapter 22 Section 2.

The Great Depression The Stock Market Crashes. The Market Crashes Black Thursday Stocks begin to drop following Dow Jones peak Brokers called.

The Causes of the Great Depression

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

Stock Market Crash PowerPoint Template

PowerPoint slides for presenting, analyzing and discussing price drops on the stock exchange.

Instant Download:

- 100% Editable Powerpoint Slides / Graphics

- Outstanding Customer Support

- SSL Secure Payment

- Made in Germany

- Information

- Template (16:9)

- Template (4:3)

Illustrate Stock Market Crashes with a Range of Professional Graphs and Charts.

Strategic Preparation for a Market Collapse

Present, Analyze, and Discuss

With Our Stock Market Crash Set You Can

- present and discuss stock exchange crashes

- develop structured plans and measures to mitigate bear markets

- visualize topics relating to the stock exchange

- prepare your company for stock price downturns

This PowerPoint Template Includes:

- Venn diagrams and pie and donut charts

- line graphs to present stock market developments

- images of business situations, buildings and people

- graphics of stock market developments

- customizable tables for comparing stock market events

Infographics Bundle

Flat design – presentation people bundle, change management bundle, 150 strategy & management models, agile management bundle, gearwheel bundle, project charter, growth mindset, project canvas, artificial intelligence, gdpr: data protection powerpoint template, digital transformation, corporate services.

We’ll optimize your existing PowerPoint presentation and create slides in your corporate design.

New PowerPoint Templates

We are continually bringing you new PowerPoint templates on current business topics and in modern designs.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

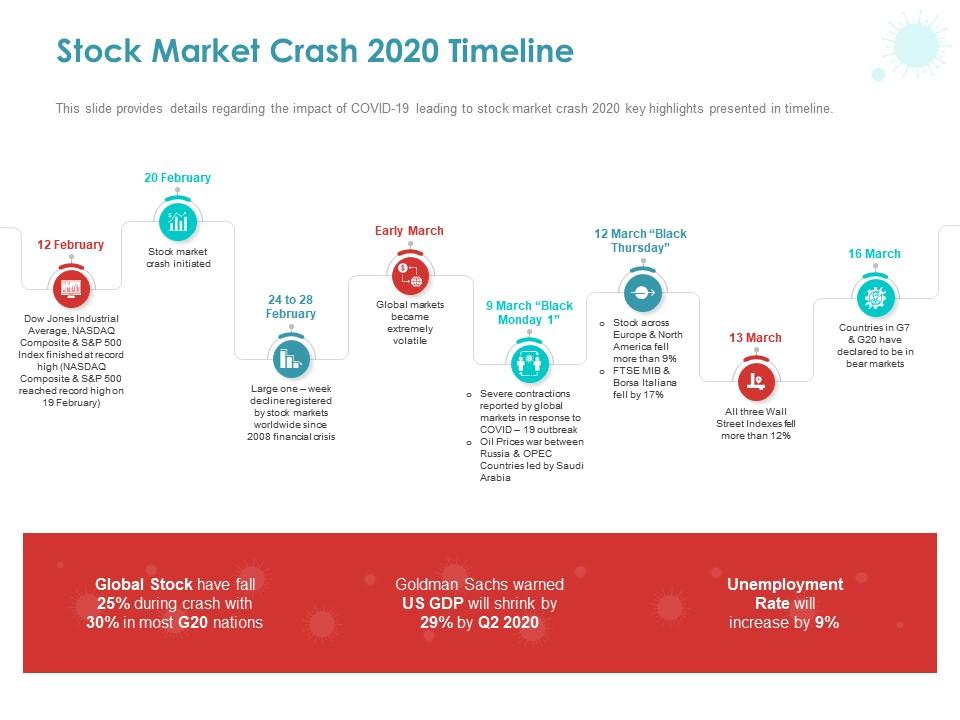

Stock market crash 2020 timeline ppt powerpoint presentation diagram lists

This slide provides details regarding the impact of COVID-19 leading to stock market crash 2020 key highlights presented in timeline.

These PPT Slides are compatible with Google Slides

Compatible With Google Slides

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

Want Changes to This PPT Slide? Check out our Presentation Design Services

Get Presentation Slides in WideScreen

Get This In WideScreen

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

- Add a user to your subscription for free

You must be logged in to download this presentation.

Do you want to remove this product from your favourites?

PowerPoint presentation slides

This slide provides details regarding the impact of COVID-19 leading to stock market crash 2020 key highlights presented in timeline. Presenting this set of slides with name Stock Market Crash 2020 Timeline Ppt Powerpoint Presentation Diagram Lists. The topics discussed in these slides are 12 Feb TO 16 March, Stock Market Crash Initiated, Global Markets Became Extremely Volatile, Financial Crisis, Global Stock, Goldman Sachs Warned, Unemployment Rate Will Increase. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

People who downloaded this PowerPoint presentation also viewed the following :

- Diagrams , Business , Strategy , Icons , Business Slides , Timelines Roadmaps , Compare , Flat Designs , Roadmaps and Timelines , Tables and Matrix

- Coronavirus ,

Stock market crash 2020 timeline ppt powerpoint presentation diagram lists with all 2 slides:

Folks find your arguments highly convincing due to our Stock Market Crash 2020 Timeline Ppt Powerpoint Presentation Diagram Lists. Getting their consent is guaranteed.

Ratings and Reviews

A 32-year market vet warns the S&P 500 is set to fall 50%-70% in the years ahead with valuations at historic highs — and says that an imminently weakening labor market will be the catalyst for the crash

- Jon Wolfenbarger warns against long-term investment in the stock market due to high valuations.

- Wolfenbarger believes a weakening labor market and impending recession could trigger a sell-off.

- While some indicators suggest an economic slowdown, consensus views remain optimistic.

There has seldom been a worse time to invest money in the stock market for the long term, according to Jon Wolfenbarger .

That's because valuations are historically elevated today, and over the period of around a decade, they carry significant weight in determining return outcomes. According to Bank of America, valuation levels explain 80% of the market's return over a 10-year period.

There are many ways to measure valuation levels in the overall market. Wolfenbarger, the founder of investing newsletter BullAndBearProfits.com and a former investment banker at JPMorgan and Merrill Lynch, cites John Hussman's ratio of the market cap of all non-financial stocks to the gross value added of those stocks. Hussman says it's the most accurate indicator of future market returns that he's found.

Right now, the metric shows -5% returns annually over the next 12 years. In the chart below, the valuation measure is shown in blue and is inverted, and actual subsequent S&P 500 returns are shown in red.

Other valuation measures are also hovering at historically high levels. The so-called Warren Buffett indicator of total market cap-to-GDP well exceeds dot-com bubble levels and is reapproaching its 2022 highs. And, the Shiller cyclically-adjusted price-to-earnings ratio is above 1929 levels and trails levels only seen in 1999 and 2021.

Based on historical long-term returns when valuations are this high, Wolfenbarger said that the S&P 500 is likely to suffer a long and drawn-out sell-off. By the bottom of the market cycle, the index will have likely fallen 50%-70%, he said.

While it sounds like a doomsday call, it's important to remember that these kinds of scenarios have in fact played out in recent decades. Stocks took two years to bottom when they crashed almost 50% after the dot-com bubble. They took a year-and-a-half from peak-to-trough in the Great Financial Crisis. And nine years following the dot-com bubble peak in 2000, the S&P 500 was still down about 50%.

Why will stocks crash?

Valuations by themselves aren't typically a good enough catalyst for a stock-market sell-off. Another look at the Bank of America chart above shows they matter very little in the short term.

A sufficient catalyst, Woflenbarger said, is weakening in the labor market and a subsequent recession, which he believes is about to unfold.

Wolfenbarger shared with Business Insider multiple indicators he's watching that show the unemployment rate could rise in the months ahead.

Related stories

The first is the National Federation of Independent Business' hiring plans index. Its three-month moving average has surged, indicating the unemployment rate could soon follow.

Second, The Conference Board's Employment Trends Index (in blue) has declined in recent years. Historically, this has meant trouble for total non-farm employment in the US, which has not yet unfolded.

Third, the number of US states with a rising unemployment rate is spiking, meaning that the overall unemployment rate should see further upside.

And fourth, about five quarters after the US Treasury yield curve inverts (using the 10-year and 2-year durations), unemployment has historically started to tick up. April will mark the start of the sixth quarter since the yield curve officially inverted, which according to the indicator's founder, Cam Harvey, is when the curve stays inverted for a duration of three months.

The US unemployment rate is already on a slight uptrend, having climbed from 3.4% in April 2023 to 3.9% as of February. According to the Sahm Rule, named after former Fed economist Claudia Sahm, once the three-month moving average of the unemployment rate moves up by 0.5% from its low over the previous 12 months, the US economy is in a recession in real time. The indicator has a perfect track record of identifying downturns. Today, it sits at 0.27.

Wolfenbarger's views in context

Wolfenbarger's stock market call is on the more extreme end of Wall Street outlooks. Fellow market bears Jeremy Grantham, John Hussman, and David Rosenberg have all stuck to their significant downside expectations. But most top strategists at major banks see limited downside from here, if any at all. Many, including Goldman Sachs' David Kostin and Bank of America's Savita Subramanian, have had to revise upward their 2024 targets already this year.

Wolfenbarger's recession call is also out of consensus these days, with many bearish forecasters abandoning their downbeat outlooks. But many see slower growth and a softening labor market going forward, even if that doesn't mean an outright recession.

This week, Pantheon Macroeconomics Founder and Chief Economist Ian Shepherdson laid out several reasons he sees unemployment ticking up in the coming months.

For example, layoffs are rising, which is usually followed by rising unemployment claims.

"For the first time in this cycle, an array of indicators point tentatively to a meaningful slowdown in economic growth, driven by the consumer, and a clear weakening in the labor market, as soon as the second quarter," Shepherdson said in a client note.

For now, however, bad data simply hasn't shown up yet, and bulls have ridden the wave to all-time highs — a trend that could very well continue. Only time will tell how Wolfenbarger's forecasts hold up in the near- and long-terms.

Watch: How bitcoin halving affects crypto prices

- Main content

Home Collections Market Stock market

Stock Market Presentation Templates

Captivate your audience with compelling insights and data-driven visuals using our pre-made free stock market powerpoint templates and google slides themes. with visually stunning infographics, charts, and graphs, you can deliver impactful presentations, that will effectively communicate complex market concepts and share valuable information. try now.

Discover the Best Stock Market PowerPoint Templates and Google Slides Themes for Financial Experts!

The stock market stands out as a whirlwind of opportunity, challenges, and intricate details. At its core, it's a bustling marketplace where companies trade their shares. From the busy streets of Wall Street to the electric buzz of the Bombay Stock Exchange, traders, brokers, and investors constantly juggle numbers, forecasts, and strategies. To a novice, it might seem like a different world altogether. However, to those in the know, it's a dance of numbers, a song of predictions, and a play of strategies. But when you are trying to present stock market-related information, the success of your presentation often hinges on the clarity and appeal of your slides. This is where our slides are ready to help you out.

Slide Egg's Stock Market Presentation Templates:

Gone are the days of drab and dreary presentations. Slide Egg offers a range of stock market templates available for free download, designed to capture your audience's attention and ensure your message is clear, crisp, and compelling. Our slides breathe life into the complex world of stock trading, with stock market theme backgrounds that transport your viewers straight into the heart of the bustling trade floor. We offer various themes like stock exchange intricacies, share market dynamics, stock market basics, detailed survey findings, Indian stock market nuances, predictive analysis, and much more. Our expansive collection ensures you have the right slide for the right moment.

What Makes Our Slides Stand Out?

Our slides aim to be the silent partner, enhancing and amplifying your message, making sure it's not just heard but also remembered.

- Editable Slides: Our slides aren’t just one-size-fits-all. They’re crafted to be easily adjustable, ensuring each presentation can be fine-tuned to fit your unique needs and audience. Want to change a color, adjust a shape, or add your branding? Go right ahead!

- Creative Infographics: Our slides will transform complex data into visually appealing graphics that drive understanding and engagement. Every infographic will tell a story!

- Uncluttered Designs: Our designs are stripped of unnecessary distractions, focusing solely on the message, ensuring it gets the spotlight it deserves. No clutter, no fuss. Just straightforward and effective designs that hit the mark every time.

- Engaging Graphs & Arrows: Our graphs are meticulously designed to make your data jump off the slide and into the minds of your viewers. Using arrows effectively can guide your audience's eyes, making sure they focus on what truly matters.

- Forex Charts: Forex can be complex, but our charts simplify the narrative, providing a clear snapshot of currency movements and trends. It ensures that you’re always presenting the most up-to-date information.

- Bear vs. Bull: The age-old battle between pessimism (Bear) and optimism (Bull) in markets is now visually represented, helping audiences instantly grasp market sentiments. These visual aids provide an instant, recognizable cue, ensuring complex market dynamics are instantly understood.

In a nutshell, the clarity and appeal of your slides can mean the difference between a successful pitch and a missed opportunity. So, don't leave your presentation to chance. Choose Slide Egg's stock market slides for assured success. In the stock market, it's often said, "The trend is your friend." With Slide Egg, let trendsetting, engaging, and visually captivating slides be your allies in your next big presentation!

We're here to help you!

What is stock market.

The stock market is a public market where stocks and other securities are bought and sold. It is a collection of exchanges, such as the New York Stock Exchange and the Nasdaq, where stocks and other securities are traded.

What are Stock Market Presentation Templates?

Stock Market Presentation Templates are pre-designed slides and presentation templates used in Microsoft PowerPoint to help presenters create presentations about the stock market. These template designs include stock charts, stock market trends, stock trading strategies, stock exchange information, and other related topics.

Where can we use these Stock Market Slides?

Anyone can use these Stock Market Slides in presentations to illustrate the performance of stocks or compare the performance of different stores or markets. You could also use them in classrooms to educate students on the basics of the stock market.

How can I make Stock Market PPT Slides in a presentation?

Begin by researching the stock market and gathering relevant information for your presentation. Including graphs, charts and tables can help explain the data in your report and make it easier for the audience to understand. Suppose you want to create slides by yourself. Visit Tips and tricks for detailed instructions.

Who can use Stock Market PPT Templates?

Anyone who needs to create a presentation about stock market topics or related topics can benefit from using stock market PPT templates. These slides are used by investors, financial advisors, educators, and business professionals.

Why do we need Stock Market Presentation Slides?

Stock market presentation slides help to create a visual representation of market performance, offering a clearer picture of the market for investors and traders. They can help illustrate important stock market concepts and events and provide an opportunity to show current market trends.

Where can I find free Stock Market PPT Templates?

Many websites offer free Stock Market PPT templates. Slide egg is one of the best PowerPoint providers. Our websites have uniquely designed templates that allow you to explain the company’s financial performance.

- Preferences

Why Stock Markets Crash - PowerPoint PPT Presentation

Why Stock Markets Crash

The motion of stock markets are not entirely random in the 'normal' sense. ... relies on agents not using yt in their pricing of futures (no copying each other) ... – powerpoint ppt presentation.

- Sornettes argument in his book/article is as follows

- The motion of stock markets are not entirely random in the normal sense.

- Crashes in particular are abnormal and have a certain statistical signature.

- A plausible model of trader behaviour during crashes is based on copying or herd mentality.

- The statistical signature produced by such models is close to that seen in the markets.

- Fitting parameters of copying models to stock market data gives a reasonable fit.

- Sornette and his colleagues have predicted the occurance of particular crashes.

- Sornettes argument in his book is as follows

- The motion of stock markets are not entirely random in the normal sense (observation).

- Crashes in particular are abnormal and have a certain statistical signature (observation/statis tics).

- A plausible model of trader behaviour during crashes is based on copying or herd mentality (model).

- The statistical signature produced by such models is close to that seen in the markets (solution).

- Fitting parameters of copying models to stock market data gives a reasonable fit (data fitting).

- Sornette and his colleagues have predicted the occurance of particular crashes (prediction).

- Short, Medium and Long Term Fluctuations

- Pricing Derivatives (Johan Tysk)

- Positive feedbacks, negative feedbacks and herd behaviour.

- Networks and phase transitions. (Andreas Grönlund)

- Log-periodicity and predicting crashes.

- Stock Market Crash Day.

- Returns are usually defined as (p(tdt)-p(t))/p(t) .

- Can use correlation with past to predict the expected future.

- Profit is determined by standard deviation of return fluctuations (say approx 0.03).

- Invest 10,000, 20 trades a day, 250 days a year 10000(1.0003)5000 44,806 (!).

- But transaction cost must be less than 3 per 10,000.

- (Samuelson 1965)

- Axiom of expected price formation based on rational, all-knowing agents.

- Noise generated by underlying noise in the value of the world (similar variance).

- Any irrational, ill-informed agents will generate more noise, but will over time be pushed out the market by rational agents.

- Relies on agents not using Yt in their pricing of futures (no copying each other).

- Autocorrelation does not detect all patterns.

- Look at drawdowns instead.

- Take all days of time series and reshuffle them.

- Find the distribution of resulting drawdowns.

- Costs too high to gain from short term correlations.

- Medium term fluctations are usually exponentially distributed.

- In the long term there are occasional drawdowns (crashes) which are inconsistent with the exponential model.

- Other apparent structures in the market.

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics , the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.

JPMorgan Warns Of Potential For 'Flash Crash' As Stocks Wrap Historic Stretch

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Stocks are on a historic tear, but market experts maintain there’s still plenty of potential for a painful stretch for investors this year.

Traders work on the floor of the New York Stock Exchange on Wednesday.

The returns for major stock indexes are impressive as the first quarter of trading wrapped Thursday, with the Dow Jones Industrial Average up 5% this quarter or 2,000 points and the S&P 500 and the tech-heavy Nasdaq up 11% apiece.

Stock superlatives for 2024’s opening stretch are numerous, including each of the three indexes setting respective all-time highs and the benchmark S&P notching its best first-quarter return since 2019 and its second consecutive quarter of double-digit percentage gains since 2011-12.

Yet the rally, which few on Wall Street saw coming in 2022 and early 2023 as the typically painful interest rate hikes took hold, still shows signs of a potentially damaging drawdown, according to strategists at top firms.

JPMorgan Chase’s top global equity strategist Dubravko Lakos-Bujos told clients this week to brace for the possibility of a “flash crash” which could “come one day out of the blue.”

Lakos-Bujos cited the “high degree of crowding” which could lead to a major “momentum unwind” from fund managers if there’s a domino effect of repositioning , an unwinding which would translate to noticeable declines in stock indexes.

Goldman Sachs strategists, whose year-end S&P forecast of 5,200 indicates they expect the index to decline about 1%, warned clients last week that the market’s high concentration in the most valuable technology stocks “could exacerbate” a major selloff scenario, with the Goldman group led by David Kostin laying out such a situation in which the S&P ends 2024 at 4,500, about 17% below its Thursday price.

Surprising Fact

Even if the stock rally storms ahead, history suggests it’s highly likely there will be some speed bumps. The S&P’s 1.7% maximum intra-year decline so far in 2024 would be by far the lowest such drawdown dating back to 1928, far below 1995’s prior record of a 2.5% drawdown, according to Creative Planning chief market strategist Charlie Bilello.

Key Background

Stocks have mostly been on fire for the last 18 months, and the S&P has gained almost 50% from its October 2022 bottom. The rally somewhat miraculously came as interest rates climbed to their highest level since 2001 at a balmy 5.25% to 5.5%, defying typical logic that monetary policy tightening tends to bring pain for equity investors due to the lower consumer spending and weaker corporate earnings power associated with higher borrowing costs. Buoying much of the rally are the tech stocks benefiting the most from investor hype about artificial intelligence, such as Nvidia, whose shares are up more than 700% over the last 18 months.

Stocks are at a historically rich valuation compared to companies’ actual financial results. The S&P currently trades at about 25 times its constituent companies’ earnings over the last 12 months, up about 50% from its late 2022 price-to-earnings ratio and sitting at its highest relative valuation of the last two decades, excluding the pandemic-skewed stretch in 2020 and 2021. The significantly higher price-to-earnings ratio indicates that investors are highly bullish on companies’ ability to rake in higher future profits and is a strong sign of a bull market.

Further Reading

- Editorial Standards

- Reprints & Permissions

The Stock Market Crash of 1929

Mar 20, 2019

140 likes | 326 Views

The Stock Market Crash of 1929. Mr. Teller’s Students. The Roaring Twenties. Inventions Automobile Radio Airplane Literature Langston Hughes Robert Frost Ernest Hemmingway Entertainment Charlie Chaplin Radio Jazz Music Movies Dr. Jekyll and Mr. Hyde The Jazz Singer King Kong

Share Presentation

- factory production

- unemployment grew

- stock prices

- unemployment rates rose

- unemployment rates increased dramatically

Presentation Transcript

The Stock Market Crash of 1929 Mr. Teller’s Students

The Roaring Twenties • Inventions • Automobile • Radio • Airplane • Literature • Langston Hughes • Robert Frost • Ernest Hemmingway • Entertainment • Charlie Chaplin • Radio • Jazz Music • Movies • Dr. Jekyll and Mr. Hyde • The Jazz Singer • King Kong • Fashion • Men • Suits • Baggy pants • Women • War apparel (goggles, helmets, scarfs) • More skin

Black Thursday • Thursday, October 24 of 1929 marked the beginning of the stock market crash • Everyone was selling, nobody was buying • The following week, stock prices kept falling • Billions of dollars disappeared

Reactions • People were afraid to buy stocks • For months, the economy went spiraling downwards • Businesses, brokers, and people went bankrupt • Many committed suicide • Legend has it that some chose to leap from windows to escape the tragedy that had occured

Immediate Effects • Unemployment rates rose • Industrial production dropped • Prices fell • Wages Declined • The Great Depression had started

The Great Depression • Fast Facts: • Factory production was cut in half by 1932 • 86,000 businesses failed • 9,000 banks closed • 9 million people lost their savings accounts • Unemployment grew to 25% by 1933 • All of these things happened because of the Stock Market Crash of 1929 • Western Europe was impacted as well • The loans that Americans were sending to Germany and Austria were called back • World manufacturing production dropped • International trade fell • Unemployment rates increased dramatically

Unemployment In Europe x1000

The New Deal • President Franklin Delano Roosevelt implemented the New Deal which stressed… • Relief • Recovery • Reform • Public works projects helped to provide jobs • The government gave help to businesses and farms • Elderly and disabled citizens were given insurance • The New Deal helped the United States get out of the Great Depression, with the help of World War II

Looking Back • Three important factors led to the stock market crash and ultimately the Great Depression • Overproduction and underconsumption • Businesses could not sell all of their goods, which led to the growth of unemployment • The dilemma of farmers • Prices of agricultural products dropped, resulting in an abundance of farmers who could not pay their loans • Speculation in stocks • Stockholders lost an estimated $74 billion • Americans were overly cautious with their money and consumer spending dropped

Sources • www.newprophecy.net • www.jeffrey-feldman.typepad.com • www.straightdope.com • www.time.com • www.mutualfunds.com • www.oldhistoricnewspapers.com • www.phys.ntnu.no • www.bergen.org • www.jmcolberg.com • www.time.com • www.keithboykin.com • www.online-cash-advance.com • www.societies.ncl.ac.uk • www.webtech.kennesaw.edu • Heath World History: Perspectives on the Past

- More by User

The Stock Market Crash

The Stock Market Crash. Wednesday, March 21, 2007. Collapse. Have you ever felt like all was going great in your life… But then everything collapsed? What did that feel like? Why did it happen? Today we will learn about the greatest economic fall in our history.

704 views • 14 slides

Stock Market Crash

Stock Market Crash. In October 1929, panic selling caused the United States stock market to crash. The crash led to a worldwide economic crisis called the Great Depression. People did not see the crash coming – kept investing their money with confidence of continued prosperity.

862 views • 60 slides

The Stock Market Crash of 1929. AP US History Unit 9. What happened in the election of 1928?. When Americans elected Herbert Hoover President in 1928, the mood of the general public was one of optimism and confidence in the United States economy.

306 views • 7 slides

CRASH of 1929

CRASH of 1929 . What do you know about the Great Depression in the United States in 1930s? Discuss in pairs. Crowds gather in the Wall Street district of Manhattan due to the heavy selling on the stock market in New York City on Oct. 24, 1929, less than a week before the Oct. 28-29 crash.

521 views • 32 slides

The Stock Market Crash. Chapter 14-1. The Nation’s Sick Economy. The prosperity of the 1920s was superficial: Major industries are not making a profit ; Demand for industrial goods decreases after WWI; There is a c risis in farming Demand for farm goods decreases after WWI;

352 views • 13 slides

The Stock Market Crash. Chapter 15, Section 1. How did speculation, buying on credit, the unstable economy, and government policies lead to the Great Depression?. The Market Crashes. Chapter 15, Section 1. The market crash in October of 1929 happened very quickly.

916 views • 72 slides

Crash of the Stock Market

Crash of the Stock Market. What is the Purpose of Stock?. In exchange for giving up a tiny fraction of control, businesses are given cash to expand. Stock Market Crash. Bull Market: long period of rising stock prices

274 views • 11 slides

The 1929 Stock Market Crash and the Great Depression

The 1929 Stock Market Crash and the Great Depression. Ch 14-15-16. The Causes of the 1929 Stock Market Crash. Economy appeared healthy in the 1920’s “Wonderful Prosperity” – normal people doing well, stock market Welfare Capitalism – employers gave workers benefits to keep strikes away

594 views • 28 slides

Causes of Stock Market Crash October, 1929

Causes of Stock Market Crash October, 1929. Business Cycle Terms. Inflation: demand is higher than production = prices fall Recession: demand falls, prices drop = supply is equal to or less than demand Deflation: demand is lower than production, prices fall, productivity drops

200 views • 9 slides

Stock Market Crash 1929

Stock Market Crash 1929. By: Keltie Ryan. Up until then:. Stocks, shares and other forms of investing were seen as a safe way to make good money…FAST. Everyone and their dog had at least one or two stocks purchased .

374 views • 9 slides

The stock Market Crash of 1929

The stock Market Crash of 1929. 1920s Booming Economy. Wages up 40% after WWI Stock Market was soaring Many people investing – get rich quick schemes 1920s fad – get into the market America has emerged as a world economic, industrial, and military power. Economic Danger Signs.

448 views • 21 slides

The Stock Market Crashes 1929

The Stock Market Crashes 1929. Video Recap . http://www.youtube.com/watch?v=ccNilnpvbJg&feature=related. The Crash . When: early September 1929 What: When: October 24, 1929 What: “ ” market plunged, panicked investors sold shares, bankers put more money into the market . The Crash .

264 views • 10 slides

The Stock Market Crash of 1929. Power point created by Robert L. Martinez Primary Content Source: A Story of US: War, Peace, and All That Jazz: by Joy Hakim. In 1927, ‘28, and ‘29 it was easy to get rich. All you had to do was put a little money in the stock market. Here is how it worked.

1.25k views • 38 slides

Stock Market Crash 1929. By Gwen Murphy and Lacey Delaney. When The Stock Market Crashed. On Black Tuesday October 24 1929. The stock market started after the Roaring Twenties. The crash lasted 4 days. The Crash .

434 views • 10 slides

Stock Market Crash. 1929. #1 Newspaper headlines from October 1929. Background: Experts believe that the Stock Market Crash was made worse the headlines used in the daily newspapers. #2 Newspaper headlines from October 1929.

399 views • 9 slides

Crash of 1929

Crash of 1929. Bonus Marchers 1932. Dorthea Lange Migratory Family. Tenant Farmer Boone County, AK. From the "One-Third of a Nation" series, New York City By Arnold Eagle and David Robbins, New York City Federal Art Project, May to August 1938. Eleanor Roosevelt 1915.

517 views • 35 slides

The Stock Market Crash. Angela Brown Chapter 22 Section 2. Stock Market. 1928 Dow Jones Industrial Average - average of stock prices of major industries March 1929 risen another 122 points September 3 all-time high of 381.

349 views • 20 slides

The Crash of 1929

The Crash of 1929. The Stock Market Crumbles. “ Bull ” Market – like a “ bull ” charging ever upward. in Sept., American stocks began to decrease in value Cdn. stocks did, too Investors start to lose confidence in the companies they ’ d invested in.

239 views • 9 slides

The Stock Market Crash. Black Friday October 29 th 1929. The crash originally started on October 24 th “Black Thursday.” By October 29 th banks started calling in loans when the market fell. An estimated $30 billion in stock values will "disappear" by mid-November.

261 views • 8 slides

The Stock Market Crash. The Great Crash. 1929 : Without new customers the bull market couldn’t continue. -Sept: Professional investors sensed danger and began selling off their holdings. Result: prices slipped Other investors sold shares to pay the interest on their brokerage loans.

213 views • 11 slides

2 Stock Market Crash Triggers Loom on March 29. Be Warned.

F ears of a stock market crash are swirling ahead of two major potential triggers coming this Friday, March 29. Indeed, the Federal Reserve’s favorite inflation gauge releases Friday morning, preceding commentary from Fed Chair Jerome Powell just hours later.

What does this mean for the stock market?

Well, if history is any indicator, probably not too much. Just a week out from the Fed’s policy meeting, it’s unlikely that Powell’s attitude will shift too much, assuming there isn’t a grave jump in inflation evident in the Personal Consumption Expenditures (PCE) report.

Powell adopted a relatively dovish tone at the press conference following the Fed decision. The Fed Chair held a fairly optimistic outlook on inflation progress thus far and maintained expectations for three rate cuts to come later in the year:

“We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

While he warned that economic data could stand to slow the process, that’s pretty much par for the course for Powell. Expect the Fed Chair to hold onto this demeanor come Friday.

Stock Market Crash Fears Loom Large Ahead of PCE Inflation Report

The PCE report is the major point of interest come Friday. The February PCE is expected to follow a similar trajectory to the Consumer Price Index ( CPI ) report released earlier this month.

If you recall, the February CPI came in hotter than expected, with inflation jumping 0.4% month-over-month, putting inflation at a 3.2% annual rate, higher than forecasts of a 3.1% annual increase.

Energy prices proved the difference maker in the CPI, swinging up 2.3% in the second month of the year, snapping a four-month deflationary streak for the inflation category.

Bloomberg expects the PCE will come in unchanged in February, reflecting an annual inflation rate of 2.4%. It predicts the core PCE, which excludes the volatile Food and Energy categories, will climb 0.2%, reflecting 2.6% inflation year-over-year.

Now, the major concern is that inflation comes in notably hotter than projections. This would put further pressure on the Fed to keep rates higher, a scary notion for Wall Street. Should this happen, Powell may attempt to stabilize expectations by taking a more hawkish tone this Friday.

On the date of publication, Shrey Dua did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines .

With degrees in economics and journalism, Shrey Dua leverages his ample experience in media and reporting to contribute well-informed articles covering everything from financial regulation and the electric vehicle industry to the housing market and monetary policy. Shrey’s articles have featured in the likes of Morning Brew, Real Clear Markets, the Downline Podcast, and more.

IMAGES

VIDEO

COMMENTS

The Stock Market Crash - 1929. 2 of 6. Stock Market Crash - 1929. 3 of 6. Causes of the Stock Market Crash - 1929 . Attitudes of the 1920s - Roaring 20s; Get rich quick; ... HTML view of the presentation. Turn on screen reader support To enable screen reader support, press Ctrl+Alt+Z To learn about keyboard shortcuts, press Ctrl+slash ...

The stock market crash of 1929—considered the worst economic event in world history—began on Thursday, October 24, 1929, with skittish investors trading a record 12.9 million shares.. On ...

The Stock Market Crash of 1929 ushered in the Great Depression, as some 16 million shares were traded on Black Tuesday, Oct. 29, 1929, wiping out many investors.

The panic began again on Black Monday (October 28), with the market closing down 12.8 percent. On Black Tuesday (October 29) more than 16 million shares were traded. The Dow lost another 12 percent and closed at 198—a drop of 183 points in less than two months. Prime securities tumbled like the issues of bogus gold mines. General Electric fell from 396 on September 3 to 210 on October 29.

Between October 24-29, 1929 investors sold as they lost confidence. October 29, 1929 was the Great Stock Market Crash, also called Black Tuesday. Examples of Stock Market Prices • Company Sept. 3, 1929 Nov. 13, 1929 RCA $505 $28 Montgomery Ward $466 $49 General Motors $ 73 $36.

The Financial Crisis of 1791 to 1792 was the first U.S. stock market crash preceded by the Crisis of 1772, which occurred in the 13 colonies. Oct. 19, 1987, also known as Black Monday, marked the ...

Presentation Transcript. When The Stock Market Crashed • On Black Tuesday October 24 1929. • The stock market started after the Roaring Twenties. • The crash lasted 4 days. The Crash Over the 4 days the Dow dropped 25% losing 30 billon dollars in a market value That was more than the total cost of World War 1.

Stock Market Crash Presentation Slides. Delve into the complex and ever-relevant concept of a stock market crash, where historical echoes of wall street crashes and modern-day market tumult converge. In today's volatile financial climate, comprehending the intricacies of a market crash today is essential, as it can drastically reshape economies ...

The Stock Market Crash of 1929 Mr. Wilson s English Class How it Began In the 1920 s, U.S. corporations, banks and individuals recklessly invested their money ... - A free PowerPoint PPT presentation (displayed as an HTML5 slide show) on PowerShow.com - id: 752a42-ZDQ5Y

Stock Market Crash: A stock market crash is a rapid and often unanticipated drop in stock prices. A stock market crash can be the result of major catastrophic events, economic crisis or the ...

Plunge Protection Team - PPT: A colloquial name given to the Working Group on Financial Markets. The Plunge Protection Team was created to make financial and economic recommendations to various ...

Presenting this set of slides with name Stock Market Crash Ppt Powerpoint Presentation Ideas Model Cpb. This is an editable Powerpoint eight stages graphic that deals with topics like Stock Market Crash to help convey your message better graphically. This product is a premium product available for immediate download and is 100 percent editable ...

11 The Great Depression The economic contraction that began with the Great Crash triggered the most severe economic downturn in the nation's history—the Great Depression. The Great Depression lasted from 1929 until the United States entered World War II in 1941. The stock market crash of 1929 did not cause the Great Depression.

Stock Market Crash - Illustrate Stock Market Crashes with a Range of Professional Graphs and Charts. Strategic Preparation for a Market CollapseHistory shows that stock market fluctuations, and even c ... Flat Design - Presentation People Bundle . $99.00* More-52%. Change Management Bundle . $179.00* More-50%. 150 Strategy & Management Models ...

Presentation Transcript. #1 Newspaper headlines from October 1929 Background: Experts believe that the Stock Market Crash was made worse the headlines used in the daily newspapers. #3 U.S. political cartoon about the Stock Market Crash, published ca. 1929 "A Crazy ride." "The Stock Market has taken us for a crazy ride and when it ended we ...

Traders Are Preparing for Stock Market Extremes. Investors who just booked profits from one of the strongest first quarters for the S&P 500 Index in decades are preparing for what comes next ...

Deliver a credible and compelling presentation by deploying this Stock Market Risk Powerpoint Ppt Template Bundles. Intensify your message with the right graphics, images, icons, etc. presented in this complete deck. This PPT template is a great starting point to convey your messages and build a good collaboration.

Presenting this set of slides with name Stock Market Crash 2020 Timeline Ppt Powerpoint Presentation Diagram Lists. The topics discussed in these slides are 12 Feb TO 16 March, Stock Market Crash Initiated, Global Markets Became Extremely Volatile, Financial Crisis, Global Stock, Goldman Sachs Warned, Unemployment Rate Will Increase. ...

A 32-year market vet warns the S&P 500 is set to fall 50%-70% in the years ahead with valuations at historic highs — and says that an imminently weakening labor market will be the catalyst for ...

Black Tuesday-October 29, 1929, the day on which. the Great Crash of the stock market began. Great Crash- The collapse of the stock market in. 1929. Business cycle- is a span in which the economy. grows the contracts. Great Depression- the most severe economic. downturn in the nations history, which lasted.

Captivate your audience with compelling insights and data-driven visuals using our pre-made free stock market PowerPoint templates and Google Slides themes. With visually stunning infographics, charts, and graphs, you can deliver impactful presentations, that will effectively communicate complex market concepts and share valuable information.

History of Biggest 5 Stock Market Crashes - In the history of the stock market, significant crashes have shown that when asset prices become detached from real value due to overconfidence. To navigate such uncertainties, Safe Fintech's stock trading courses online offers beginners comprehensive education, helping them understand market intricacies and make informed decisions, ultimately ...

Even if the stock rally storms ahead, history suggests it's highly likely there will be some speed bumps. The S&P's 1.7% maximum intra-year decline so far in 2024 would be by far the lowest ...

The 1929 Stock Market Crash and the Great Depression. The 1929 Stock Market Crash and the Great Depression. Ch 14-15-16. The Causes of the 1929 Stock Market Crash. Economy appeared healthy in the 1920's "Wonderful Prosperity" - normal people doing well, stock market Welfare Capitalism - employers gave workers benefits to keep strikes away

Stock Market Crash Fears Loom Large Ahead of PCE Inflation Report. The PCE report is the major point of interest come Friday. The February PCE is expected to follow a similar trajectory to the ...