The 66 Best Businesses To Start In Germany [2024]

Interested in starting a business in Germany in 2024?

As one of the largest economies in Europe, Germany has a very stable socioeconomic condition, and a highly developed political and economic framework, making it one of the most stable countries to start a business.

We put together 66 of the best businesses you can start in Germany today.

In this list of ideas, you can find:

- Home-based businesses to start in Germany

- Profitable online business ideas

- Unique business opportunities for Germany

- Low investment business ideas (under $5k to start)

- Easy businesses you can start in Germany today

For each business idea, we’ll show you real-world examples, revenue expectations for each idea, + a step-by-step on how to start your small business in Germany.

Here's the full list:

1. Start an affiliate marketing business

Are you looking for a side hustle to pay you a passive income? Affiliate marketing is one of those side hustles that will pay you well over the long term. It is a way to earn money online by promoting other companies' products and services. You will be paid a commission for each sale you make as an affiliate marketer.

To get started, learn how to find the right product and brand to partner with. For example, you may prefer becoming an affiliate marketer for an eCommerce store, partnering with a manufacturer, and marketing their products for a commission.

How much you can make: $500 — $773,000/month

How much does it cost to start: $500 (?)

How long does it take to build: 55 days (?)

German finance blog founder Sascha shares how he turned his website into a monthly 2,000 USD income with minimal social media and no ads, by creating high-quality content that solves real-world problems for readers in areas like loans, banking accounts and car leasing, and leveraging affiliate marketing.

2. Start a blog

In recent years, blogging has become a highly sought-after & lucrative Business. This location-independent business is a creative outlet to reach a broader audience and even work at any time. According to Optinmonster’s list of blogging statistics and facts:

- Blogs have been rated as the 5th most trustworthy source of gathering online information.

- 77% of internet users read blogs.

- Each month, approximately 409 million people view more than 20 billion pages.

Originally blogging started as an online journal, but today it is a highly profitable career option. Many people are choosing blogging as their full-time career and are earning their bread and butter from this profession.

If you want to start blogging as a side hustle or as a full-time profession, choose a niche you will enjoy writing about and have a content strategy ready. Then, create a mailing list, and decide on a good blog posting routine to keep your audience engaged.

How much you can make: $200 — $160,000/month

How long does it take to build: 37 days (?)

Time commitment per week: Min. 5 hours/week

Learn how one couple created a successful personal finance blog, The Savvy Couple, that now makes over $20,000 per month and has sold thousands of digital workbooks and courses, by focusing on purposeful content and optimizing their ROI with efficient time management.

3. Start a food startup

Starting a food business can involve opening your own restaurant, bakery, food truck, cake shop, or even starting a business or blog online.

Other kinds of food businesses include manufacturers, wholesalers, and retailers. Food businesses prepare a wide range of foods such as snacks, sweets, and meals to sell directly to consumers and also include cafeterias at workplaces and similar facilities.

If you have a passion for food, starting a food business can be an extremely fun, challenging, and rewarding business venture.

How much you can make: $2,000 — $61,650,000/month

How long does it take to build: 150 days (?)

Janori, an online store founded by Raphael and Johanna Spannocchi, sells local, organic food and offers monthly food boxes with 80+ products from 14 vendors, with its best-seller being the Christmas box, and aims to create a circle of support for suppliers by focusing on the people and creating compelling content.

4. Start a graphic design app

A graphic design application is a SaaS application that allows users create online graphics. Examples of graphic design applications include Snappa , adobe Photoshop , and GIMP .

Modern businesses need digital branding, holograms, and poster designs, to maximize the customer reach abilities. Therefore, graphic designers are becoming the most in-demand professionals.

The high demand is a good basis for choosing graphic design applications as one of the best app business ideas in 2022. Before you kick start the graphics design app business idea, here are technical skills you may consider:

- Design principles

- Idea generation

- Branding skills

- Print designing

- UX and UI Design

While coding skills and cross-platform development skills are important to start developing applications, you can hire developers online.

How much you can make: $100 — $83,500/month

How long does it take to build: 130 days (?)

This case study is about Janina, the founder of SP-Studio, a popular website with over 60,000 visitors per day that allows anyone to create unique cartoon characters for free without drawing skills, and how she built the website without focusing on generating revenue for many years.

5. Start an art business

Starting an art business can be a great idea if you have a passion for art.

You’ll be able to work on your schedule, set your prices, and do something you love—while supporting yourself or even making money!

There are so many different avenues available to you as an artist-entrepreneur right now—from selling your work online (on sites like Etsy), through galleries or museums, or even at craft fairs and flea markets.

How much you can make: $876 — $415,000/month

How much does it cost to start: $2,000 (?)

How long does it take to build: 60 days (?)

Hoagard is a profitable metal wall decor brand with an average annual turnover of 4.5-5.5 million Euros, which started out as a new hobby and transformed into a successful e-commerce business with 85% of sales coming from the brand's own website.

6. Build an iPhone app

The iPhone is the most popular mobile device in the world. It has changed how we interact with information, entertainment, and communication.

The iPhone has also changed the way we interact with each other. Since its release in 2007, it has become a staple in most people’s lives. It is more than just a phone; it is a tool for staying connected to friends and family and creating new connections.

The iPhone app market is an ever-changing landscape of innovation: it’s not just about making something that works well; it’s about creating something that stands out from the crowd.

It would help if you had something that appeals to your audience to succeed in this market. This can be as simple as ensuring your app has a catchy name or as complex as developing an entire brand identity around your app’s functionality.

How much you can make: $150 — $2,000,000/month

How much does it cost to start: $6,500 (?)

How long does it take to build: 180 days (?)

Gikken is a small, profitable European company founded by Alex that makes browser extensions and apps used by 800,000 people every month, with their flagship product, Mate Translate, generating around $18,000 a month, but monetizing their user base better is their top priority for the next year.

7. Start a product development services business

How much you can make: $60,000 — $200,000/month

VIPERdev is an accelerator program that helps founders turn their digital business ideas into products and bring them to market within 8-12 weeks, releasing an average of 2-5 products per month.

8. Start a language translation service

Language translation services bridge the linguistic barriers, helping businesses reach a wider audience outside of a single language. A language translation job is an opportunity to cover a wide range of topics and meet people from different cultures.

To become a language translator in Germany, master a second language and earn some experience so you become fluent in the second language.

How much you can make: $40,000 — $550,000/month

How long does it take to build: 70 days (?)

DEMAN Translations grew from 6 employees and 1.5 million euros in turnover in 2015 to 17 team members and 3.5 million euros in sales in 2020 after acquiring 12 other translation agencies, with a goal to reach 6 million euros this year and 10 million euros in 2022.

9. Start a saas product developer business

SaaS product is online software that uses a license to access. With cloud computing omnipresent, starting a SaaS company is a low barrier to entry idea with exponential growth potential.

Modern users recognize the SaaS cost-saving benefits and the ability to offer project collaboration. Besides, there are multiple technologies you can use to build SaaS platforms.

To build a successful SaaS product, you need database management skills, programming language, cloud computing, design & development skills.

If you decide to build a SaaS solution, start by conducting market research and competition analysis.

Before starting the development, you must choose a good app monetization model and select an appropriate technology stack.

How much you can make: $40 — $18,933,333/month

How long does it take to build: 114 days (?)

FeedLetter.co, a simple feedback system for newsletters that started as a personal app, now has 14 customers and relies on Twitter and word-of-mouth for acquiring new users, with founder Jens Boje emphasizing the importance of focusing on publishing and growing your product instead of waiting to perfect it.

10. Start a hair salon

Hair salons offer a wide range of beauty services including hair-cutting, waxing, nail treatment, massages, and complementary care such as aromatherapy.

With the increased demand for high fashion beauty services, starting a hair salon could be a profitable venture.

To start a hair salon in Germany, you need a strong business plan and find a niche that attracts a local client base. To succeed, hire knowledgeable and experienced employees, and encourage them to maintain a good customer service culture,

How much you can make: $550,000/month

How long does it take to build: 90 days (?)

This case study follows the founder of Urban Betty, who started her salon business with only one contractor, and now has two locations with over 50 employees, growing from 1.5 million to 3.4 million in revenue from 2014-2018, and investing around 2% of its gross income every year in Yelp, Google, and Facebook Ads.

11. Start a film production company

A film production company is responsible for producing video content for social media, corporate promotions, television programs, commercials,s or other media-related fields. Ideally, the responsibilities of a video production company include scripting, location scouting, and also logistics to ensure a successful film.

Starting a film production company can be a daunting task. However, you can set up your business for success with proper guidance. Here are important steps for creating a video production company:

- Determine the company niche

- Choose a suitable company name

- Draft a solid business plan

- Hire an advocate to lead all legal matters of starting a company

- Fund your business

- Acquire video production equipment and skills

- Create a website and market your film production company

If you are starting a video production company from scratch, consider creating some proof-of-concept projects so you can market the business. Alternatively, you may buy a franchise or an existing business.

How much you can make: $10,000 — $1,500,000/month

How much does it cost to start: $1,500 (?)

How long does it take to build: 165 days (?)

Lemonlight CEO, Hope Horner, co-founded an on-demand video production company that has produced over 7,000 videos for more than 3,000 brands, generating over $6 million in sales and growing to a 45-person team, all without taking any outside capital and being recognized in Inc 5000 and Entrepreneur 360 for three years in a row.

12. Start a veterinary clinic

Another thriving and profitable business is to open a veterinary clinic. This one of the most suitable business ideas for veterinarians to start.

If interested, make sure that you locate one near an area with lots of dog owners and animal farms. These people are your target market, and it's wise to take your business there. You’ll also need to learn how to market yourself so that you can reach out to those people who might need your services.

The average veterinarian salary in the United States is $100,000 annually or $51.28 per hour . Beginning salaries start at $70,783 annually, while most experienced workers earn up to $144,023 annually.

How much you can make: $200,000/month

Discover how Dr. Ellie Scott grew Stringtown Animal Hospital from a staff of four to a team of 23, with five veterinarians, and now has $200K in monthly revenue, by focusing on individual pet risks and the needs of the pet family.

13. Start a dog walking business

Are you a dog lover? If so, you can turn your passion for animals into a profitable side hustle that allows you to earn extra income for your mortgage, a vacation, or paying off student loans.

As a dog walker, sitter, or boarder, you can earn an average annual income of between $10,000 and $30,000 by offering your services to dog owners in need of a caregiver for their furry friends.

To get started, register on a credible dog-walking app and create a compelling profile that showcases your experience, skills, and love for dogs.

With your dedication and expertise, you can help dog owners ensure their pets receive the care and attention they need while building a thriving business that fulfills your passion for animals.

How much you can make: $15,000 — $54,000/month

Time commitment per week: Min. 2 hours/week

Furry Fellas Pet Service LLC is a successful pet sitting and dog walking business that brings in over half a million dollars in sales per year, boasts 3,500-4,000 social media followers, employs 42 individuals and has been voted in the top 3 pet sitting/dog walking companies in the RI/MA area for eight years in a row.

14. Start a pet blog

A pet blog business is all about creating and managing a website that shares information, tips, and stories about pets. This can include articles on pet care, training, product reviews, and heartwarming pet stories.

With the increasing number of pet owners seeking reliable information and a sense of community, starting a pet blog business is a great opportunity to connect with a passionate audience and potentially earn income through advertising, sponsored content, and affiliate marketing.

The love and enthusiasm people have for their pets make this niche both rewarding and financially promising.

How much you can make: $400 — $4,000/month

How long does it take to build: 272 days (?)

Dog with Blog, a content-driven pet adoption network in India led by founder Abhishek Joshi, has successfully driven 900+ dog adoptions using social media and content marketing, and has an active community of 116k fans across its social handles.

15. Start an ecommerce platform

Over the past decade, eCommerce has become an indispensable part of the global retail framework. According to statistics, over 2 billion people prefer shopping online.

While brick-and-mortar stores are still making more sales compared to online sales, the adoption of eCommerce is still rising, mainly because of the increased speed and convenience of online shopping.

Therefore, starting an eCommerce platform could set you on the right path to building a futuristic business.

How much you can make: $100 — $83,333,333/month

How long does it take to build: 110 days (?)

StoreYa co-founders Eyal Reich and Yariv Dror, along with CTO Pasha Zaft, created a suite of marketing and advertising apps that include Traffic Booster, which has generated an average of $700,000 MRR and helped the business win a 2018 Google Acquisition Performance award, as well as becoming a PayPal exclusive advertising partner.

16. Start a travel company

Travel companies sell transportation, lodging, plan trips, and admission to entertainment activities to individuals and groups.

If you love traveling, you can start a company that organizes trips for different people. Choose a niche and ensure travel packages that suit them best.

How much you can make: $10,000 — $114,200,000/month

Under30Experiences is a travel company for people aged 21-35 that runs small group trips around the world, with over 800 five-star reviews on Facebook, Google, and Yelp combined, and nearly hitting $5M in revenue before the COVID-19 pandemic.

17. Start a consulting business

Consulting businesses are booming, more so than ever before, and seeing year-over-year growth. With an accumulated value of about $250B , the global consulting industry is one of the biggest markets within the professional services sector.

If you want to start your own consulting business with valuable insights from industry experts, reading about their entrepreneurial journey will help you decide how you should go about it.

How much you can make: $100 — $2,500,000/month

How much does it cost to start: $1,000 (?)

Cybersecurity consulting firm Eden Data, launched in March 2020, scaled to four team members and generated over $45k MRR without large startup costs through their unique Virtual CISO offering, which outsources cybersecurity and compliance needs for a flat monthly price, rather than charging by the hour or for long-term commitments.

18. Start an event planning business

Event planners handle different tasks related to making the business a success. Some of the event planner’s responsibilities include:

- Conducting research

- Creating the event design

- Finding an ideal site

- Arranging for food, décor, and entertainment

- Planning logistics to and from the event

- Sending invitations

- Supervising at the site etc

To start this business on a budget, begin by honing your organizational and communication skills.

Next, create a detailed business plan outlining your services, target market, and pricing structure.

Utilize free or low-cost online tools for marketing, and consider starting small by offering services for smaller events before expanding your business as you gain experience and resources.

How much you can make: $35,000 — $500,000/month

Akshay Patel's event rental and decor business, Simply Decor, Tents, and Events, saw an average ticket price of $2,000, as their advertising budget decreased from $20k to $5k, leading to 40% of their clients coming through social media advertising, 30% from expos, and 30% online in google, yahoo, and other platforms.

19. Start a career coaching business

A career coaching business involves providing personalized guidance, support, and strategy services to help clients navigate professional transitions and growth opportunities.

As a career coach, you design custom sessions to assist with resume building, interview prep, and workplace advancement goals tailored to each client’s aspirations.

With flexibility for in-person or virtual meetings, building a client base lets you empower breakthroughs through specialized advice and accountability.

Launching a coaching practice can be a great opportunity for those with speaking talents and human resources expertise to monetize their natural motivational abilities while setting their own schedule.

How much you can make: $1,000 — $500,000/month

How much does it cost to start: $750 (?)

How long does it take to build: 75 days (?)

Wall Street Oasis, the largest online community focused on careers in finance, has over 100 million visitors during its 14-year history and is currently receiving over 2 million visits per month, offering interview courses and mentorship services, in addition to building and investing in a thriving online community.

20. Start an IT company

How much you can make: $500 — $2,400,000/month

How much does it cost to start: $850 (?)

How long does it take to build: 120 days (?)

Marine Digital is a deep-tech company that aims to make modern instruments of decarbonization available for the mass market and has made massive progress in performance digital twin cost reduction (10 times lower than the average market cost), providing opportunities for non-giant marine companies to use it, with 3 pilots earning about €60k.

21. Start a tour company

Starting a tour company is a great way to bring your love of travel to life. You can share your passion with others and help make their dream vacations come true!

There are many types of tour businesses, so choosing something you are passionate about and knowledgeable about is best. Here are a few of the most popular tour companies to start in Germany:

- Food & Drink Tours

- Adventure & Sporting Tours

- Sightseeing & Historical Tours

- Shopping Tours

- and many more!

It’s also essential to determine what mode of transportation you want for your tour company, as this will determine the initial startup costs needed for your company.

To get started, find out if you need a license to operate in your state. Some states require tour companies to be licensed, while others do not. If you are required to be licensed, talk with the licensing agency to find out what steps must be taken before you can apply for that license.

How much you can make: $3,750 — $43,300,000/month

How much does it cost to start: $2,500 (?)

Augustin Ndikuriyo founded Augustine Tours, a travel company that offers wildlife safari and cultural tour experiences around East Africa, which makes a monthly average of €50K/Month and focuses on transformative tourism that benefits visitors and the local communities.

22. Start a coffee cafe business

A coffee shop is a popular spot for customers to enjoy freshly brewed coffee, tea, and light snacks in a comfortable and welcoming environment.

These cafes are typically furnished with comfortable seating, free Wi-Fi, and a pleasant ambiance that provides a relaxed environment for people to gather, work or unwind.

To succeed in this business, it is essential to offer high-quality coffee, create a pleasant atmosphere, and provide excellent customer service.

With the increasing demand for specialty coffee experiences, starting a coffee cafe can be a lucrative business opportunity that caters to the widespread love for coffee and the need for communal spaces to enjoy it.

How much you can make: $13,000/month

Chicago based Ignite Technology and Innovation-owned Momentum Coffee & Coworking, which focuses on coffee, coworking, community, and event space, rakes in about $17-20k a month in revenue, mostly from online and offline advertising, and just celebrated their first anniversary, with plans to open 2 more locations in Chicago in under-resourced communities.

23. Become an online fitness coach

Online fitness coaching is using live or recorded video to offer fitness classes to an online audience at a fee. To become successful in business, online fitness coaches should possess the following personal qualities:

- Stay focused on clients’ needs and goals

- Be ready to walk the talk

- Ask the clients questions

- Focused on educating the client

- Adjust to a language clients understand

Increase in number of internet users and more hours spent online , online businesses will keep thriving.

Therefore, fitness coaches looking to expand their businesses or venture into new markets can consider starting an online fitness coach business.

How much you can make: $250 — $39,875,000/month

How long does it take to build: 142 days (?)

This case study is about a former personal trainer who launched his online personal training platform, TeamFFLEX, starting with no money and a lot of drive, and grew it into a 6-figure business in less than a year, now doing $48,000 a month with potential for continued growth.

24. Start an appliance repair business

An appliance repair business helps clients install, repair, and maintain common household appliances like microwaves, dishwashers, refrigerators, cookers, etc. An appliance repair technician can specialize in certain lines of appliances or offer general services.

To become an appliance repair technician, apply for the prerequisite training course and focus on acquiring the necessary work experience. You may work under an appliance engineer and kickstart your business when you have relevant skills.

How much you can make: $4,000 — $100,000/month

Retro Radio Farm founder, Allen Chiang, earns $50k per year as a side business restoring old radios and offering Bluetooth MP3 upgrades, with the business growing 20% every year.

25. Start an online advertising agency

An online advertising agency helps businesses promote their products or services on the internet.

To start this business on a budget, first learn the basics of digital marketing through free online resources.

Create a professional website and set up profiles on social media platforms to showcase your skills.

Build a portfolio by working on mock campaigns or offering discounted services to friends and family, and gradually market your services to attract clients.

With dedication, you can grow your agency over time.

How much you can make: $2,797 — $1,250,000/month

How long does it take to build: 45 days (?)

Iman Gadzhi made over $1.2M in profit within two years with his social media marketing agency and education company, where he teaches entrepreneurs how to start and scale a profitable SMMA, with over 45 of his students making over six figures with their SMMA, and over 300 students having quit their regular jobs.

26. Start a zapier consulting agency

People are buzzing about Zapier and its potential to be a game-changer in the Salesforce ecosystem. So you should get ahead of the curve and start your own Zapier consulting business.

The growth of the internet and technology has made new firms and industries possible. Zapier is an excellent example of how you can be an agent of change that comes with great income potential. Zapier's estimated annual revenue is currently $122.5M per year . Thousands of companies rely on Zapier today for everything from product development and IT operations to marketing, sales, and support.

How much you can make: $5,000 — $17,500/month

Luhhu, an agency that helps businesses automate their processes using Zapier, was built as a result of the founder's accidental stumble into a freelance career as a Zapier expert, and has become profitable with low fixed running costs and around 1-3 inquiries per day coming mostly from organic search and the Zapier Experts Directory.

27. Start a marketing agency

Marketing agencies can be a great option for businesses looking to advertise in different ways. For businesses, hiring a marketing company can help them achieve success as they don't have to spend money on employees or needed equipment. Marketing agencies are not inexpensive and there are many different variables that come into play when deciding which one is the best fit for your business.

You want to start a marketing agency, but don't know where to begin. You're not alone, there are thousands of entrepreneurs across the globe that have the same ambition. Luckily for you, compiled a list of how other agencies were able to grow their agency and scale effectively.

How much you can make: $1,300 — $465,583,333/month

How long does it take to build: 36 days (?)

A successful podcast production company that grew from one client making $15/hour to a team of 10 contractors producing over 30 shows per week with revenue of over $10k/mo, primarily through referrals and with a focus on providing high personal touch and being picky about working only with clients who are a good fit.

28. Start a freelance writing business

Freelance writing can be a good career choice if you are looking for a flexible online job.

Working as a freelancer gives you the flexibility to define your work schedule. You can work from home at any time. Freelance writers work across various niches, writing about various topics assigned by the client,

To earn good money as a freelance writer, you need the following personal qualities:

- Strong writing skills

- Ability to meet deadlines

- Stay on the cutting edge

- Be a self-starter

- Be up-to-date with the current writing tools & writing trends

- Proper communication skills

How much you can make: $700 — $320,000/month

How much does it cost to start: $300 (?)

How long does it take to build: 30 days (?)

How David Tile turned a freelance writing gig into an $80k/month business, discussing lessons learned through managing growing demands and maintaining a remote team operation.

29. Design a wearable for musicians

How much you can make: $280,000/month

How much does it cost to start: $5,000 (?)

How long does it take to build: 540 days (?)

Soundbrenner raised $1.6M on Indiegogo and sold close to 100,000 smart wearables for musicians, featuring a vibration metronome that can be felt, rather than heard, and released a full smartwatch for musicians; the company's mobile app is the world's most popular metronome with over 6 million downloads and over 600,000 musicians that use it every month.

30. Become a music blogger

A music blog covers different topics of interest among music lovers. With the music industry so popular in 2024, it is a great time to start a music blog. A music blog offers you a chance to get as creative as possible and is also a precious tool to help you promote and publicize music genres.

Starting a music blog is as easy as selecting a music niche. Identify topics of interest and create shareable content.

How much you can make: $996 — $160,000/month

How much does it cost to start: $50 (?)

How long does it take to build: 48 days (?)

Learn how DJ Tobander created a successful niche info-product business generating $1,000 a month through selling collections of DJ sets for special occasions and working with affiliates, with only modest costs and simple tools like WordPress, AWeber, LeadPages, and Digistore24.

31. Start a freelancer platform

Freelancer platform is a place where people come with skills and services to offer and people come who need those skills and services. So we can say freelancer platforms are a marketplace for sellers and buyers of services and skills.

The freelancing industry is growing rapidly and it's becoming a popular career option for people who are "non-traditional" employees. The global Freelance Platforms market size is expected to reach $6.7B by the year 2025 . While working on a full-time job, freelancers simultaneously work on a freelance career. The platforms available online help them to increase their business by attracting new clients.

With all of the businesses looking for help on their websites, it would be a good idea to start a freelancer platform. Freelance platforms do well because people have jobs that need to be done and businesses have the resources to pay for the job at hand.

How much you can make: $3,000 — $5,000,000/month

How long does it take to build: 80 days (?)

Uplink, a German network for IT freelancers, has surpassed 1,000 members and offers job placements for companies with a simple process that charges a commission of 10% to freelancers for the first six months of working with a client through the platform.

32. Start a sustainable mug brand

How much you can make: $650/month

German outdoor enthusiast Melanie founded environmental-friendly business alpengraphics, which creates zero plastic, minimalist campfire mugs with environmentally-friendly practices, earning up to €3,000 ($3,200) per month depending on season, and targeting corporate business customers and recreational companies to gift her products to employees or customers.

33. Start a time tracking app

A time tracking app is a tool used allows its user to clock in/out via an internet-connected device or to use a stopwatch to record the start and end of tasks. The time tracker apps also have analytics and reporting features that consolidate the data so that users can gain insights into time spent on different tasks, projects, and clients.

The growing need among managers and enterprises to improve employee productivity and adopt a remote work culture contribute to the high demand for time-tracking apps.

Therefore, if you are looking for the best App-based business, you may consider developing a time tracker application. Here is a high-level overview of some steps to get you started working on your business idea of the time tracker App

- Define the project scope

- Choose a software development methodology

- Formulate the approach for your development project

- Create a project team

- Develop the project plan with timelines

- Test the prototypes

- Find suitable API solutions

- Publish the Apps

How much you can make: $350 — $500,000/month

How much does it cost to start: $3,000 (?)

Klokki, an automatic time-tracking Mac app for freelancers and makers, was founded by Stas Moor and launched in November 2018; after being featured by Apple in 2019, the app saw 7000 downloads and brought in $400 in one month due to its new add-on feature.

34. Start a selling business on etsy

Etsy is a marketplace where millions of people around the world connect to make, sell and buy unique goods. You can sell unique handmade goods, vintage items and craft supplies on the platform.

Here are steps for starting a selling business on Etsy:

- Create your Etsy Account

- Define the Shop preferences and set a name

- Create a viable product

- Input the payment settings and enter the credit card details

- Open the Etsy shop, set up your bio and shop policies

- Take images of your products and upload

- Include compelling product descriptions and set reasonable prices

Your Etsy shop policies should indicate the processing time, shipping policies, payment options and the returns/exchanges policy.

How much you can make: $1,000 — $40,000/month

Galen Leather, an Istanbul-based e-commerce store specializing in handmade leather goods, experienced a 138% increase in revenue to hit an average of around $40,000 in sales each month, with products like their Moleskine Cover helping the company achieve success.

35. Create an online course

An online course business involves creating and selling digital classes teaching specialized skills or knowledge to subscribed students.

As an entrepreneurial course creator, you identify educational gaps around topics you have expertise in and develop engaging video lessons and supplementary materials.

With flexibility around self-paced or cohort-based structures, building a student base provides passive income potential.

For founders who enjoy information-sharing, launching an online course platform presents a lucrative way to monetize your instructional talents with small startup costs by serving eager lifelong learners seeking convenient access to emerging subjects.

How much you can make: $350 — $3,735,000/month

How much does it cost to start: $1,850 (?)

Lucas Chevillard turned his email marketing consulting for startups into an actionable course that over 1050 people have taken, which he has accomplished through word of mouth, blog posts, and reviews rather than paid acquisition.

36. Start a specialty food business

Specialty food refers to a category of food prepared in small quantities using premium and unique ingredients sourced globally. Quality ingredients add an extra health dimension to produced foods and provide a wide range of micro-ingredients like vitamins, minerals, and enzymes.

According to research, the global specialty food ingredients market is expanding at an annual growth rate of 6.4%.

Therefore, starting a specialty food business in 2024 could be your big-time business idea. Identify a niche and pick a reliable supplier for your business. Decide on the business type and register it before applying for business licenses and permits.

How much you can make: $2,000 — $124,998/month

How much does it cost to start: $7,500 (?)

37. Start a biotechnology business

How much you can make: $45,200,000/month

38. Start a laundry business

Starting a laundry business can be a fulfilling and lucrative venture for entrepreneurs looking to make a difference in their communities. With the right equipment and a commitment to providing excellent customer service, this business idea has the potential to thrive in a variety of locations.

One unique aspect of starting a laundry business is the opportunity to offer specialized services, such as eco-friendly detergent options or same-day turnaround for busy professionals. Additionally, partnering with local dry cleaners or offering pickup and delivery services can set your business apart from competitors and attract a loyal customer base.

In terms of upfront costs, starting a laundry business will require a significant investment in commercial-grade washing machines and dryers, as well as a convenient and well-located storefront. However, with the right marketing strategies and a focus on providing top-notch service, this investment can quickly pay off and result in a thriving business.

Overall, starting a laundry business is a rewarding and potentially profitable venture for entrepreneurs who are passionate about making a positive impact in their communities. With the right approach and a commitment to excellence, this business idea has the potential to succeed in a variety of settings.

How much you can make: $24,000 — $83,333/month

Dhobilite disrupted the laundry market in India by using smartphone technology and becoming India's first app-based, on-demand cleaning service provider, expanding to more than 15 cities, with 20+ stores and 30+ franchises, offering premium online dry cleaning and laundry services, with revenue equally distributed between dry-cleaning and laundry.

39. Start a financial service business

How much you can make: $21,000 — $3,141,666/month

How long does it take to build: 100 days (?)

Contrarian Thinking is a premium membership community that teaches its 1.5 million members how to implement cash flow strategies to achieve financial freedom, with a current run rate of $3 million and a goal of $50 million ARR in five years.

40. Start a transportation service

Transportation businesses offer ridesharing services, haul consumer goods, or ship supplies and products from one location to another. They target individual passengers, other companies, or global business partners.

If you are starting a transportation service in Germany, decide who and what you will serve, set up the business structure, register the business, and apply for the required business licenses or permits. To ensure a profitable business, incorporate proper hiring procedures and keep up with maintenance and recertifications.

How much you can make: $12,000 — $364,000/month

How long does it take to build: 410 days (?)

Mirai Flights is an app-forward private jet booking service with a focus on UK, Europe, Middle East and CIS states, that allows customers to bypass the long wait times with more than 30 parameters analysed in less than 30 seconds, achieving $4.37m turnover from March to December 2021, and planning to increase it up to $10.2m and expand internationally in the future.

41. Start an in-home senior care business

With the busy lifestyle, family members are often absent and employ in-home caregivers to look after the elderly parents.

Caregivers assist the elderly with personal care routines, including bathing, grooming, dressing, toileting, and exercising. Caregivers also oversee medication & prescription usage and administer medicine.

Researchers anticipate a shortage of more than 100,000 caregivers for the elderly in the next decade. Therefore, starting an in-home senior care business is a great opportunity if you enjoy caring for the elderly and spending time with them. You can choose to work as an overnight caregiver or whichever work schedule suits you.

How much you can make: $250,000/month

The CareSide scaled to $5 million in revenue over 3 years by utilizing a data-driven approach to sales and marketing, with a focus on Google Adwords and Facebook ads, and implementing extensive automation into back end systems.

42. Become a delivery driver

The delivery driver side hustle can be a fantastic idea if you own a delivery car and a valid driver’s license. Receiving deliveries at home or at the office has become an almost undeniable convenience for most people. There are more and more platforms that deliver all kinds of products and, therefore, the demand for couriers is also increasing.

As an independent delivery driver in Germany, you choose your most convenient working hours, and the more deliveries you complete, the more your earnings. Besides, you interact with a wide range of people from different backgrounds.

Your core roles will include loading and unloading cargo, delivering goods to the customer, accepting any payments for shipments, and handling paperwork.

How much you can make: $4,000 — $25,000/month

Time commitment per week: Min. 10 hours/week

Muver is a mobile app for gig workers allowing them to multi-app seamlessly between Uber, Uber Eats, Doordash, Grubhub, Lyft, Instacart, and more within a single app with over $270k revenue in the past 12 months.

43. Start a home tutoring business

A home tutoring company is an educational company that offers private tutoring from a tutor who visits the students at the student’s home.

Home tutoring is a growing business opportunity for motivated people and comes with the flexibility of working anytime, anywhere, and creates a passive income.

If you love teaching and helping others, one way to make money is to start a home tutoring business in Germany. Whether you want to tutor kids or adults, there’s a niche for you.

Once you have started your home tutoring business, promote it by putting fliers at other stores and on bulletin boards at colleges and libraries. Also, engage parents and guardians for home tutoring opportunities.

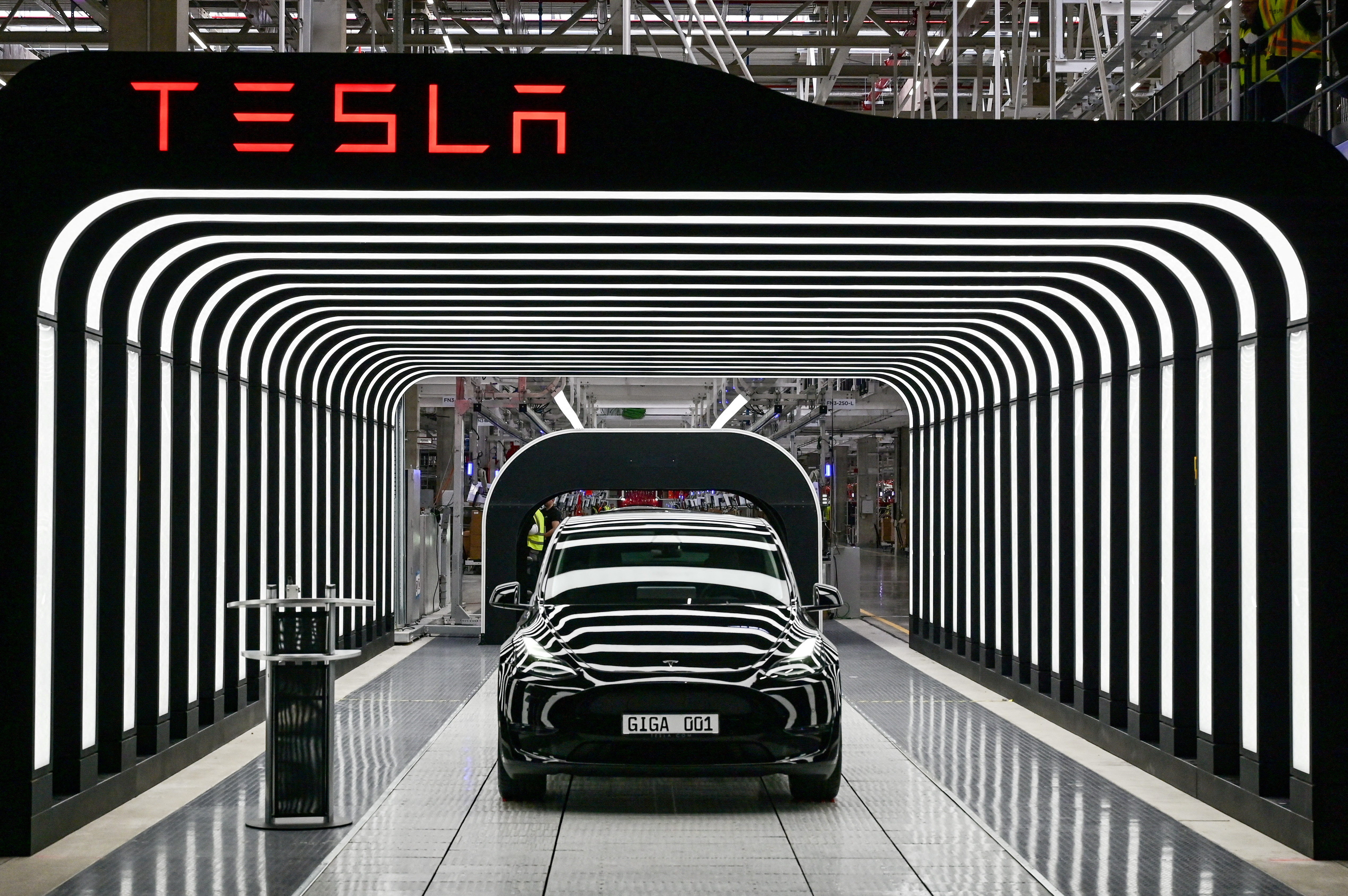

44. Start an auto parts shop

If you want to start a retail business in the automobile industry, consider an auto parts business in Germany.

The auto parts business is one of the most successful businesses in the world. There are many Auto Parts Businesses in the United States, Canada, and the UK, where most are part-time.

Listed are the steps on how to start an auto parts shop business.

- Pick a location

- Do your market research

- Secure all permits and licenses

- Open a bank account for business transactions

How much you can make: $45,000 — $600,000/month

This case study follows an inspiring 22-year-old entrepreneur who started an eCommerce store for aftermarket vehicle accessories, making 5x the amount of money he used to make per month, and generated over $90,000 in sales last year.

45. Start an e-commerce implementation consulting business

E-Commerce consulting business targets sellers who lack experience and resources, helping them create, optimize, and execute product listings and storefronts to achieve their business goals and objectives.

eCommerce implementation consultant can provide complete catalog management or selected services, where the agency will assist online sellers on things like online advertising campaigns. Therefore, the consulting agency plays an essential role in helping the business meet its goals.

Starting an e-commerce implementation consulting agency is a massive and lucrative business opportunity. To be successful, you must put in hard work, research, dedication, and an adequate budget. By working hard and researching, you can maximize your potential to start and build a successful business.

How much you can make: $290,000 — $2,033,333/month

How much does it cost to start: $4,000 (?)

Digital Position, a digital marketing agency, was founded by Roger Parent, who was unhappy being underpaid at his job; the company is now generating over $330k/month in revenue, and aims to generate $5m in 2022, with a long-term goal of hitting $30m before Parent is 40.

46. Start a grocery delivery service

Grocery delivery is an on-demand service where clients shop for groceries, and you deliver to their commercial or residential premises.

As a carrier in grocery delivery, you have an opportunity to maximize your output, as you can serve multiple customers in one trip. Besides, you get to choose your preferred working time and location.

How much you can make: $83,333,333/month

47. Start a daycare

Daycares provide educational, medical, and social services for the children of working parents either during school hours or when the parents are out of the home for an extended period of time. This can be a lucrative enterprise if you start a daycare in an area where it is needed.

As the growth of families has become dependent on two incomes, the need for quality daycare has skyrocketed. Starting a daycare business in Germany is challenging but rewarding. You will face many challenges but can overcome them as long as you are ready to make the sacrifices required.

48. Become a crypto miner

Crypto mining is creating new bitcoins by solving complicated math problems that verify bitcoin transactions.

To get established as a crypto mining expert, you need to have a wallet for your cryptocurrency so that the tokens or coins have a place to land. Each crypto miner has to be a member of an online crypto mining community. Besides, crypto miners need specialized machines built and tuned specifically to mine cryptocurrencies. The interesting thing about crypto mining is that more people mining bitcoin does not lead to an increase in the number of coins being mined.

49. Start a government contractor business

How much you can make: $6,800 — $600,000/month

PVM, Inc offers software engineering services related to big data storage and analytics to customers in both the private and public sectors, ranging from local police departments to federal agencies, with partnerships with Palantir, Amazon, and MicroFocus.

50. Start an errand service

Errand services help people and businesses who have daily errands to run but need an extra hand. So, they seek professional help who can do their chores on time with utmost efficiency.

You can provide various services as an errand business, including grocery shopping, picking up + sorting through mail, going to the bank, and much more.

Starting an errand business in Germany is relatively easy. Consider offering package deals as a way of getting and retaining customers. Most errand businesses charge per hour, and you may charge per mileage if the task involves driving.

51. Sell auto alarms

Although cars come with an inbuilt alarm system, owners choose to upgrade the alarm systems to keep the vehicles safe from thieves.

Therefore, the auto alarm sales and installation business is in high demand and can be lucrative to start as long as you love things to do with car alarms and GPS tracker systems. To ensure professional services, consider undertaking the alarm technician’s course. Through the course, you will learn how to install or service the alarm systems and related components.

Some of the services offered by alarm sales and installation professionals include fitting alarms and immobilizers, tracking devices, upgrading the existing systems, fault diagnosis, and repairs.

Before starting, research the car alarm industry in your area and check the current alarm installation prices, the alarm trends, and find out what customers want.

52. Become a cake decorator

Becoming a cake decorator can be an enjoyable and uncomplicated venture to embark on, particularly if you have a passion for baking and creativity. It enables you to explore the thriving bakery and wedding industries while showcasing your artistic abilities.

This business involves designing and hand-decorating specialty cakes for various events and occasions, using your artistic abilities to create beautiful, custom-edible works of art.

To start a successful cake decorating company, learn proper cake decorating techniques, purchase quality ingredients and equipment, build a portfolio to showcase your skills, and implement good marketing tactics to attract potential clients like wedding planners, event companies, bakeries, and direct consumers.

How much you can make: $4,000/month

From pastry chef to owner of a successful bakery, learn how Bradford Bakery achieved a 550% increase in SEO in just a few months through community outreach, building a website, and utilizing social media and advertising on platforms like Facebook and Groupon.

53. Start a toy manufacturing

Toys are an integral part of childhood. The toy market is expected to reach $103.8 billion by 2027. So if you are looking for manufacturing business ideas to start on your own, entering the toys industry could be a great start.

Before getting started, you want to choose a niche, there are various types of toys available in the market. You can start by making : Educational toys, Soft toys, Outdoor toys, creative toys, electronic toys, arcade games etc.

How much does it cost to start: $20 (?)

How long does it take to build: 1 days (?)

54. Start a legal services business

Cryptocurrency lawyers are professionals who offer sophisticated and knowledgeable legal counsel to clients navigating the rapidly evolving cryptocurrency and blockchain space. They provide clients guidance concerning litigation, money transmission, token offerings, and other crypto-related issues.

To become a cryptocurrency lawyer, you should have in-depth knowledge about token issues. Besides, you should have a certified degree of law from an accredited institution. Lawmakers in Washington D.C. and across the world continue figuring out how to establish laws and guidelines to make crypto safer for investors and less appealing to cybercriminals.

Therefore, this is a great opportunity for crypto lawyers to participate in shaping the future of crypto transactions.

How much you can make: $4,500 — $250,000/month

How long does it take to build: 365 days (?)

This case study follows the growth from scratch of a Personal Injury and Criminal Defense law firm that started from direct mail campaigns and has now expanded into a multi-million dollar-a-year business with the goal of becoming an 8 figure firm, while maintaining a customer-centric approach and fostering a culture of innovation and excellence.

55. Become a computer refurbisher

Computer refurbishing is the process of restoring used computers to working conditions. Refurbishers typically purchase used computers from individuals or businesses, and then they clean them up, install new parts, and test them to make sure they are in good working condition.

To start this business, you'll need skills in data recovery, hardware repair, and software troubleshooting. It is a perfect idea for those who have an interest in technology and a knack for repairing electronics.

The average Computer Repair Technician in the US makes $51,129. The salaries of Computer Repair Technicians range from $19,892 to $74,573, with a median salary of $55,440.

With the ever-growing popularity of laptops, tablets, and smartphones, there is a great demand for refurbished computers. And with data science and data analytics, you can easily identify which computers are in high demand and how to best refurbish them.

Starting this type of business is a great idea for those with an entrepreneurial spirit and a passion for technology. If you can navigate the regulations, this can be a lucrative business with a lot of growth potential.

How much you can make: $13,500,000/month

OWC Larry, founder and CEO of Other World Computing, shares how he started his business at a young age with just a credit card, now experiencing a solid year-over-year growth with a CAGR of 43.78% over the past 33 years.

56. Start a child care business

Starting a childcare business is a great way to build a steady income. You will have the opportunity to be your boss and set your hours even from home. You will have the satisfaction of building one-on-one relationships with children and watching them grow over the years.

A childcare business is an excellent idea. It is both a personal and economical investment for its owners. This is especially true if you are considering starting your non-profit organization or becoming licensed to provide child care. Running a childcare business allows you to help children develop while also making money. As with any business endeavor, running a childcare business has its ups and downs, but it can be very rewarding.

Twinkle Toes Nanny Agency has grown from a side hustle to over 20 locations in 5 states, offering an impressive franchise model with almost no overhead and a strong ROI, due to their online scheduling system, which creates a network of nannies and families ultimately providing quality in-home childcare for families.

57. Become a graphic designer

Graphic designing involves creating sketch designs and materials for corporate clients, advertising agencies, public relations firms, and publishers. Besides, graphic designers provide visual solutions to specific company images, log design, and branding problems.

Graphic design is an excellent career for creative thinkers who enjoy using their talent and artistic skills combined with technology and communication abilities to come up with unique solutions for their clients.

How much you can make: $8,000 — $81,000/month

Draftss.com is a productized graphic design and front-end code service on subscription that made $66k ARR in 2019, has an MRR of $9.6k as of July 2020, and offers add-ons such as designers being added to team in interacting tools and front-end code services on WordPress using various page builders like Elementor and Divi.

58. Start a gym

Over the last decade, more people across the globe have become self-aware of the importance associated with living a healthy lifestyle.

As a result, the gym has become a trend for millions of people, leading to a rapid increase in the size and popularity of the global fitness industry. According to statistics , the global fitness club industry is worth over $96 billion.

Therefore, starting a gym could be a great business opportunity.

How much you can make: $20,000 — $1,200,000/month

How long does it take to build: 227 days (?)

Live Fit, a personal training company founded in 2011, grew from earning $80,000 in their first year with two trainers to earning over $760,000 in 2019 with 12 trainers and two locations, thanks to a focus on building trusting relationships and providing a variety of services to clients.

59. Start a grocery store

A grocery store sells a wide variety of food products, fresh or packaged, and other household & personal care items. The grocery store industry is the largest retail channel that makes $682 billion in the United States.

To start a basic grocery store, you can expect to spend a minimum of $50,000. Ideally, the bigger expense would be the rent, equipment, labor cost, cash registers/POS systems, and software. Some of these are recurring monthly fees. However, the location, size of the store, competitors, and local customers will significantly impact the business. A new grocer should sell more items for a lower price to make a more significant profit.

A new grocer can also save costs by buying the items from local distributors. The distributor is the middleman between the manufacturer and the grocery store selling it. Once the store cost and location are decided, the next step is to obtain a seller license. In most states, a grocer's license is required to run a grocery store.

Thus an average grocery store has a profit margin of 3% to 5%. The profit rates depend on the store's location, size, and popularity. On average, a small to medium grocery store can make a profit of up to $300,000 annually if all the profit factors are considered.

Another way to make your business more profitable is to diversify your store and add amenities like a coffee shop or stocking up the front of the store with magazines, batteries, etc., as these items can cross a margin of up to 70%. As a rule of thumb, offering lower prices on higher purchases will ultimately win more customers and increase profitability.

60. Start an eco-friendly fashion business

How much you can make: $5,000 — $17,000/month

KAHINDO is a sustainable women's luxury fashion brand that celebrates African fashion and promotes ethical work practices, with annual sales of $60k and wholesale clients like Rent The Runway.

61. Become a handyman

Handyman offers various home repair services based on their skill set and the customer’s needs. Also known as a fixer, the handyman repairs works both on the interior and exterior.

The handyman business is a great part-time opportunity, and you can earn a high-profit margin while the overhead costs are low.

How much you can make: $8,000/month

Learn how a third generation business owner started a profitable pool service and installation business in Southern Ontario, earning an average of $8000/month net revenue during peak season and growing from servicing 0 to 350+ pools since May 2016 by doing things that don't scale, such as manually talking to customers and focusing on the ideal customer.

62. Start a car washing and detailing business

The carwash business is already a multi-billion-dollar industry with room for growth.

With the number of vehicles per household increasing daily, starting a car wash and detailing business could be a profitable idea.

If you have a piece of vacant land in the right location, you can get into the carwash business. You can set up an in-bay automatic carwash, self-washing carwash, touch-free carwash, or a wide range of other options.

63. Design a digital file platform

How much you can make: $6,500 — $40,000/month

How much does it cost to start: $30 (?)

DGLegacy is a global digital inheritance document and password manager service that has already gained 5,000 subscribers in one year and plans to reach 20,000 by the end of 2022, providing a solution for the multi-billion dollar global problem of abandoned assets and unclaimed assets.

64. Start an art consulting business

How much you can make: $100,000/month

Saleh Sokhandan, founder of Salso design studio, shares how he grew his business to $400k in revenue per year by using optical illusion techniques in decoration, advertising, entertainment, and product design for clients ranging from private individuals to big commercial companies and investors.

65. Start an ecommerce reselling business

An eCommerce reseller purchases services or goods for resale rather than consumption. Becoming an eCommerce reseller is a great way to launch an online business without worrying about production costs.

To start an eCommerce reseller business, you do not need a website immediately! You can focus on a social media-based reseller business and create a website later as your business grows.

How much you can make: $4,000 — $150,000/month

How much does it cost to start: $4,998 (?)

BitsForDigits is an acquisition marketplace for internet startups and online businesses looking to exit, with steady growth in the number of signups and making $6,000 per month, attracting customers organically with zero marketing spend.

66. Start a plant stands business

The ornamental indoor houseplant trends enhance aesthetics, complementing the interior design and bringing the room together. The hanging plants are among the favorite indoor plants you will find today. To create a strong aesthetic with climbing plants, décor experts use plant stands.

A plant stand is a wooden, metallic, or plastic material that holds potted houseplants. Plant stands are available in different shapes and sizes, and maybe a simple pillar to hold one pot or multiple levels to hold many plants.

Given the increased adoption of climbing plants in indoor space décor, introducing the plant stands can be a lucrative business opportunity. If you are starting a plant stand business, your customers or target market can include home décor experts, offices, and homeowners.

Founder Monika Kalinowska turned her passion for plants into a sustainability and animal welfare-focused business, quadrupling revenue each year to reach +/-100k a month in 2021, by focusing on Instagram marketing, good SEO, a strong email list, and running workshops to attract and retain customers.

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings

I'm Pat Walls and I created Starter Story - a website dedicated to helping people start businesses. We interview entrepreneurs from around the world about how they started and grew their businesses.

Join our free newsletter to get unlimited access to all startup data. We just need your email:

Check your email

If there's a Starter Story account associated with that email you'll get an email with a link to automatically log in. The link will expire in 15 minutes.

Your existing password still works, should you want to log in with it later.

With Starter Story, you can see exactly how online businesses get to millions in revenue.

Dive into our database of 4,418 case studies & join our community of thousands of successful founders.

Join our free newsletter to get access now. We just need your email:

- 11 Steps to Start a Business in Germany

- Freiberufler vs Gewerbe

- Legal Forms in Germany

- Tax IDs Guide

- English Tax Filing Tools

- Health Insurance

- Gewerbeanmeldung

How to Start a Business in Germany

Steps to Success

We have compiled an overview of the most important steps on the path to self-employment for you – from finding ideas to the business plan to registration.

1. Sort out your German self-employment permit

This applies to Non-EU nationals who need a special self-employment visa or resident permit to start a business in Germany. The requirements for each nationality may differ so make sure to consult your local German embassy for preparing your visa application. If you want to freelance in Germany, then read our visa guide for non-EU citizens here.

Please note: In some cases, you may have to deal with Step 2-4 as a part of your visa application.

2. Find a business idea

At the beginning of every successful business is a viable business idea. You don’t have to reinvent the wheel with it, but there must be a market and a need, otherwise, you will have a hard time making the idea a success.

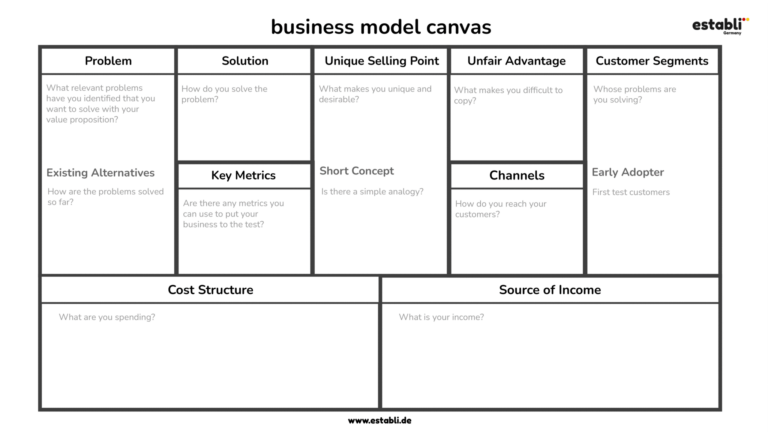

3. Write a business plan

As soon as you have a viable idea to start a business in Germany, you should start writing a detailed business plan. There are a number of templates available online. Watch this space since we are going to release a business plan template in English in near future.

4. Create a financial plan

You now know what your business goals are and how you want to achieve them. But to realise your business in Germany you need funds, especially in the early stages, until you make a profit. In order to approach investors (whether banks or private investors), you will need a financial plan that contains all the important figures.

5. Clarify trademark rights

Once the finances are secured, you need to think about a business name. On the one hand, it must be catchy, but on the other hand, it must not already be protected by another company. You must also think about protecting your brand name and domain if you want to use it permanently.

6. Obtain permits

So now that you have a name for your business in Germany, you need to obtain all the necessary permits. Whether it’s the building authority, the health authority or the trade inspectorate, you can find out which permits are important for your business in our guide to the authorities.

7. Company form, account and contracts

Before you formally start a business in Germany, you need to think about what legal form your business should take and what the consequences will be.

It is relatively easy to set up a sole proprietorship, but setting up a limited liability company is more complicated and requires you to go to a notary. For this, you also need a dedicated business account and necessary contracts.

Learn more about various legal forms in Germany.

8. Choose location

After all the paperwork, everything starts to come around gradually. In the case of a brick and mortar business in Germany, you should think about the location. It can make the difference between success and failure.

If you launching an online business in Germany, you should still know your geographical region and how you can reach your “local customers” there. This means: how to become visible to potential customers on Google, Facebook, Amazon etc.

9. Register with the authorities

Now you’re almost there in your journey of setting up a business in Germany.

- If you are a freelancer this is the process to register your freelance business and apply for a tax number at the local tax authorities.

- If you are a sole trader, this is the process to register your business in Germany.

10. Create your corporate identity

Finally, it’s time to get creative! Make your business in Germany instantly recognisable. Now you can design a logo, website, business cards, letterhead and much more. This step should not be underestimated. You want to stand out from the rest and have a memorable brand identity.

11. Start customer acquisition

You’re ready to go and launch your business in Germany. Hopefully, you have already worked this out customer acquisition in your business plan. Now you have to turn all those plans into reality, place advertisements, rank yourself in search engines and promote your business on social media, and get new clients to start a successful business in Germany.

Idea vector created by stories – www.freepik.com

Neve | Powered by WordPress

- Datenschutzerklärung

How To Start A Business in Germany As A Foreigner

Researched & written

by Yvonne Koppen

April 19, 2024

This guide will teach you how to start a business in Germany. It is not an easy task, but it is not impossible either. The German government is not only seeking skilled workers but also entrepreneurs from abroad to help grow the German economy. One thing that makes starting a company in Germany somewhat difficult is the language barrier; however, there are plenty of resources available in English to help with that!

This guide will only focus on how to start a small business in Germany as a foreigner and will not cover founding a company in Germany from abroad.

🖌️ Table of Contents

Can foreigners start a business in Germany?

If you are an EU citizen or from Norway or Switzerland, you can become self-employed or start your own business in Germany at any time, as long as you register as a resident.

If you are from outside the EU, you need to have a visa and residence permit allowing you self-employed work in Germany. Please refer to our other guide on how to obtain a freelance and self-employed visa in Germany .

Self-employed vs. freelancing in Germany

Suppose you are planning to start a business by yourself and join the trend of solopreneurs. In that case, you need to distinguish whether you will operate as a freelancer ( Freiberufler ) or self-employed trade person ( Gewerbetreibender ). Since you need to fulfill different requirements for both categories, you must identify the category for your business from the start.

Freelancers provide services in the so-called liberal professions ( Freie Berufe ). In Germany, those typically are artists, teachers, doctors, engineers, scientists, software developers, designers, lawyers, tax advisors, and others. You can find an unofficial list of professions here or take a look at the legal paragraph §18 EStG . We go into more detail about freelancing in Germany in our dedicated guide.

Read Our Related Guide

Freelancing In Germany As A Foreigner [How-To Guide]

If your business idea does not qualify as a liberal profession, you are subsequently a tradesperson. Thus, you will need to register with the trade office ( Gewerbeamt ) in your city to attain a trade license. Should you run an online business, whether it is an Etsy or Shopify shop or a blog that is earning money, you need to register it as a trade business.

Requirements for a visa for self-employment in Germany

To become self-employed in Germany, you need to provide proof of the following requirements for both the visa and the residence permit for self-employment:

- Proof of economic interest for your business in Germany or a specific area

- Expected positive impact of your business on the German economy

- Enough financial resources through equity capital or a loan approval

- Sufficient pension provisions if you are 45 years or older

- You will also require German health insurance already before applying for your visa. This is a complex topic, especially for self-employed foreigners, and we have written an in-depth guide on private vs. public health insurance in Germany . Your best option to get the matching German health insurance for you is to consult Feather . They provide insurance services for foreigners and have great experience with the self-employed.

- Insurance service provider with strong customer focus

- Website and customer support in English

- 100% digital

- Free travel insurance for your first 90 days in Germany

Types of businesses in Germany

Since there are many different trade business forms, let’s look at the various legal forms and their meanings. There are three main categories of business types:

1. Sole proprietorship ( Einzelunternehmen )

This is a favorite option for individuals starting their own businesses. As a sole trader, your business is generally referred to as a Gewerbe . If you earn less than 22.000 euros in the first year and not more than 50.000 euros in the second year, you can also run your company as a small business ( Kleingewerbe ) and benefit from less bureaucracy. As a sole proprietor, you are fully liable for all business actions and debts.

2. Business partnership ( Personengesellschaft )

Most simply, a business partnership could be described as a sole proprietorship but with two or three people or companies. There are several different forms of a business partnership. The most common ones are the GbR ( Gesellschaft bürgerlichen Rechts ), a civil law partnership, an OHG ( offene Handelsgesellschaft ), a general commercial partnership, or a KG ( Kommanditgesellschaft ), a limited partnership. Except for the KG, all partners are fully liable for all business debts.

3. Corporation ( Kapitalgesellschaft )

The corporation is the favorite legal entity among German Start-Ups or funded companies. The most common German corporation is the GmbH ( Gesellschaft mit beschränkter Haftung ), a limited liability company. A GmbH requires 25.000 euros capital but protects your private finances since it is a limited company. The UG ( Unternehmergesellschaft ), also referred to as Mini-GmbH, may be an option for entrepreneurs who don’t have the necessary start capital for a GmbH, as the UG only requires 1 euro as a start capital.

We highly recommend consulting legal experts to find out which business formation is best for your company plans. The service provider firma.de (a company in Germany is often referred to as a Firma 😉) offers a free initial consultation . They also offer affordable packages to help you form and register your company and connect you to legal and tax professionals.

For the scope of this guide, we will continue focusing on small businesses and not on funded Start-Ups.

How to register a business in Germany?

These are the steps you need to take to register your Gewerbe in Germany, regardless of whether it is a physical or online business.

1. Register your address

After you have arrived in Germany, you need to register your address with your local Bürgeramt .

2. Get a residence permit for self-employment

Make an appointment with your foreigners office ( Ausländerbehörde ) to change your visa to a residence permit that allows you to start a business.

3. Get your trade license

Once you are registered and allowed to stay in Germany, it is time to register your business with the trade office ( Gewerbeamt ) to get your trade license. Your trade license ( Gewerbeschein or Gewerbeanmeldung ) gives you the right to get involved in business activities.

To register with the trade office, you need to fill out a registration form. Firma.de has a detailed English guide on how to fill it out. Once you complete the form, you need to sign it and send it by postal mail to your local Gewerbeamt . You can find the address of your responsible authority on this homepage . In the drop-down menu, select Gewerbeämter and then enter your postal code. We also have a guide on how to send a letter in Germany to help you out with that step as well.

In some trades, you also need to have special licenses; such areas are gastronomy, driving schools, taxi companies, skilled craft businesses, insurance brokers, and others. For more information, take another look at the very informative website of firma.de or check whether your qualification gets recognized in Germany on the homepage of the German government .

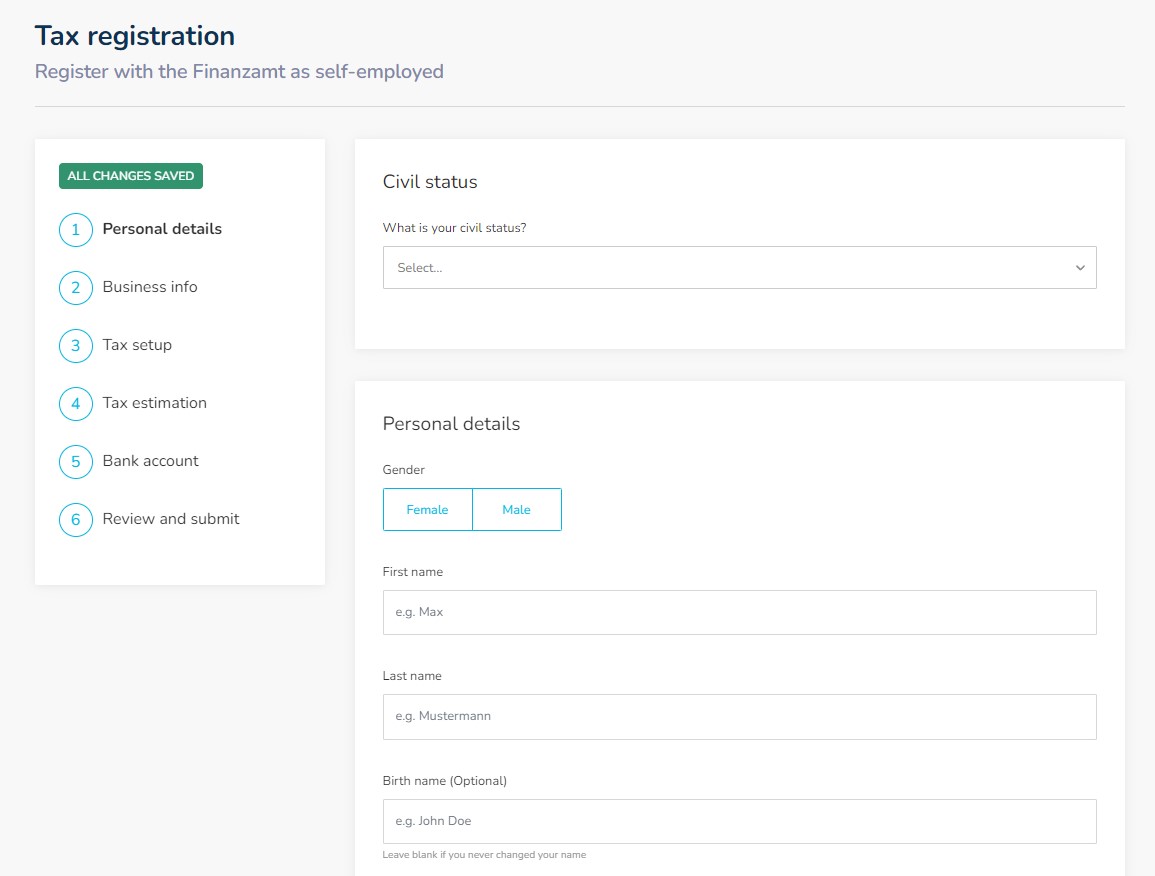

4. Register with the tax authorities

Next, you need to register your business with the tax authorities ( Finanzamt ). This is a very tedious task, even for Germans, as it requires you to fill out a very complicated seven-page questionnaire ( Fragebogen zur steuerlichen Erfassung ).

The easiest way to complete this step is for you to use the free services of a company called Sorted . They focus on making taxation for freelancers & self-employed in Germany easy and guide you through the process of filling the questionnaire all in English. They also submit it to the tax authorities. Upon processing, your Finanzamt will send you your business tax number and VAT number if you applied for it.

Tax Number And Tax ID In Germany [What’s The Difference?]

If steps 3 & 4 sound too complicated and bureaucratic for you, you can simply hire the services of firma.de , who guide you through the registration process in no time and fill out all the forms for you for a very affordable price.

5. Open your Business Bank Account

Although this is not an absolute must, we highly recommend you to set up a separate business bank account next to your private bank account in Germany .

There are two main reasons:

1. Most banks that offer private bank accounts exclude business use in their terms and conditions. So by using your regular bank account for such, you run the risk of getting your account closed.

2. Keeping the books of your company clean is very important in Germany. Therefore, having a clear overview of your income and expenses is crucial.

There are multiple banks tackling the growing need for modern banking for small and medium-sized businesses, such as Finom , Kontist , and N26 . Most of these banks also allow connecting specific accounting software to simplify the bureaucratic burden.

We have written an in-depth guide, highlighting and comparing the best bank accounts for freelancers in Germany , which also apply for the self-employed .

5 Best Banks For Freelancers In Germany

Is it difficult to start a business in Germany?

Technically it is not difficult to start a business in Germany. There are very clear steps that you need to take as a foreigner:

- Register your address in Germany

- Get a residence permit for self-employment

- Get your trade license

- Register with the tax authorities

- Open your Business Bank Account

We have explained the steps in detail above for a sole-proprietorship.

However, bureaucracy tends to be a tripwire for many foreigners when it comes to starting a business in Germany. If you are in doubt or would like assistance, you can reach out to firma.de , who happily guide you in English to start your business in Germany.

How much does it cost to start a business in Germany?

To start a Gewerbe , you really only need to pay the registration fee, which ranges between 10 and 40 euros, depending on the region you are in. And that’s it. You decide about all other costs, depending on what is necessary for your business.

To found a company as a GmbH, you should plan around 1.000 euros in fees for the necessary notary, contracts, additional registration in the commercial register, etc. Additionally, you need at least 50% of the required equity capital (25.000 euros) during the foundation, so 12.500 euros.

An overview of business tax in Germany