- Insights & Analysis

- Nonprofit Jobs

Business Planning for Nonprofits

Business planning is a way of systematically answering questions such as, “What problem(s) are we trying to solve?” or “What are we trying to achieve?” and also, “Who will get us there, by when, and how much money and other resources will it take?”

The business planning process takes into account the nonprofit’s mission and vision, the role of the board, and external environmental factors, such as the climate for fundraising.

Ideally, the business planning process also critically examines basic assumptions about the nonprofit’s operating environment. What if the sources of income that exist today change in the future? Is the nonprofit too reliant on one foundation for revenue? What happens if there’s an economic downturn?

A business plan can help the nonprofit and its board be prepared for future risks. What is the likelihood that the planned activities will continue as usual, and that revenue will continue at current levels – and what is Plan B if they don't?

Narrative of a business plan

You can think of a business plan as a narrative or story explaining how the nonprofit will operate given its activities, its sources of revenue, its expenses, and the inevitable changes in its internal and external environments over time. Ideally, your plan will tell the story in a way that will make sense to someone not intimately familiar with the nonprofit’s operations.

According to Propel Nonprofits , business plans usually should have four components that identify revenue sources/mix; operations costs; program costs; and capital structure.

A business plan outlines the expected income sources to support the charitable nonprofit's activities. What types of revenue will the nonprofit rely on to keep its engine running – how much will be earned, how much from government grants or contracts, how much will be contributed? Within each of those broad categories, how much diversification exists, and should they be further diversified? Are there certain factors that need to be in place in order for today’s income streams to continue flowing?

The plan should address the everyday costs needed to operate the organization, as well as costs of specific programs and activities.

The plan may include details about the need for the organization's services (a needs assessment), the likelihood that certain funding will be available (a feasibility study), or changes to the organization's technology or staffing that will be needed in the future.

Another aspect of a business plan could be a "competitive analysis" describing what other entities may be providing similar services in the nonprofit's service and mission areas. What are their sources of revenue and staffing structures? How do their services and capacities differ from those of your nonprofit?

Finally, the business plan should name important assumptions, such as the organization's reserve policies. Do your nonprofit’s policies require it to have at least six months of operating cash on hand? Do you have different types of cash reserves that require different levels of board approval to release?

The idea is to identify the known, and take into consideration the unknown, realities of the nonprofit's operations, and propose how the nonprofit will continue to be financially healthy. If the underlying assumptions or current conditions change, then having a plan can be useful to help identify adjustments that must be made to respond to changes in the nonprofit's operating environment.

Basic format of a business plan

The format may vary depending on the audience. A business plan prepared for a bank to support a loan application may be different than a business plan that board members use as the basis for budgeting. Here is a typical outline of the format for a business plan:

- Table of contents

- Executive summary - Name the problem the nonprofit is trying to solve: its mission, and how it accomplishes its mission.

- People: overview of the nonprofit’s board, staffing, and volunteer structure and who makes what happen

- Market opportunities/competitive analysis

- Programs and services: overview of implementation

- Contingencies: what could change?

- Financial health: what is the current status, and what are the sources of revenue to operate programs and advance the mission over time?

- Assumptions and proposed changes: What needs to be in place for this nonprofit to continue on sound financial footing?

More About Business Planning

Budgeting for Nonprofits

Strategic Planning

Contact your state association of nonprofits for support and resources related to business planning, strategic planning, and other fundamentals of nonprofit leadership.

Additional Resources

- Components of transforming nonprofit business models (Propel Nonprofits)

- The matrix map: a powerful tool for nonprofit sustainability (Nonprofit Quarterly)

- The Nonprofit Business Plan: A Leader's Guide to Creating a Successful Business Model (David La Piana, Heather Gowdy, Lester Olmstead-Rose, and Brent Copen, Turner Publishing)

- Nonprofit Earned Income: Critical Business Model Considerations for Nonprofits (Nonprofit Financial Commons)

- Nonprofit Sustainability: Making Strategic Decisions for Financial Viability (Jan Masaoka, Steve Zimmerman, and Jeanne Bell)

Disclaimer: Information on this website is provided for informational purposes only and is neither intended to be nor should be construed as legal, accounting, tax, investment, or financial advice. Please consult a professional (attorney, accountant, tax advisor) for the latest and most accurate information. The National Council of Nonprofits makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Free Nonprofit Business Plan Templates

By Joe Weller | September 18, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up the most useful list of nonprofit business plan templates, all free to download in Word, PDF, and Excel formats.

Included on this page, you’ll find a one-page nonprofit business plan template , a fill-in-the-blank nonprofit business plan template , a startup nonprofit business planning timeline template , and more. Plus, we provide helpful tips for creating your nonprofit business plan .

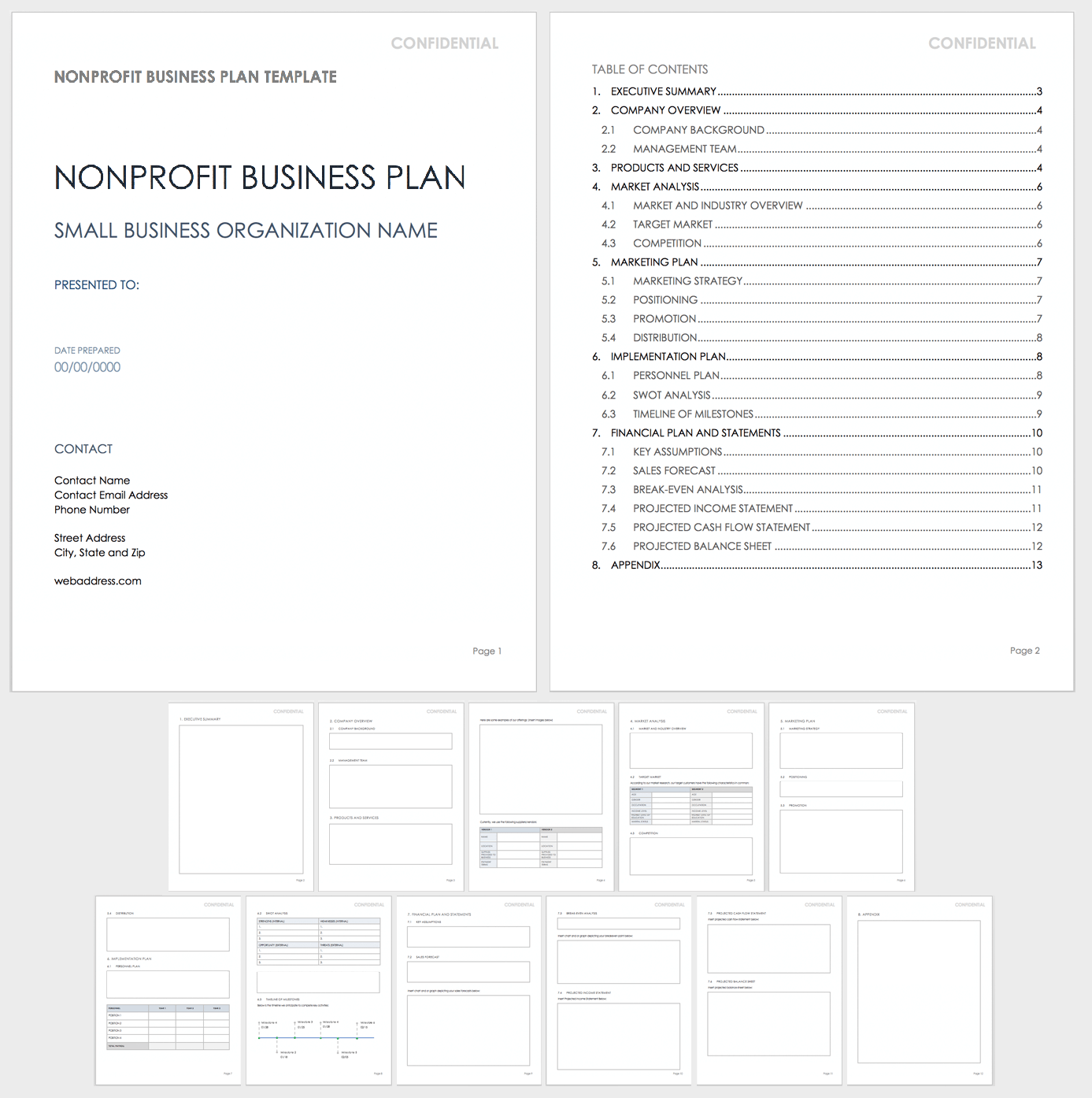

Nonprofit Business Plan Template

Use this customizable nonprofit business plan template to organize your nonprofit organization’s mission and goals and convey them to stakeholders. This template includes space for information about your nonprofit’s background, objectives, management team, program offerings, market analysis, promotional activities, funding sources, fundraising methods, and much more.

Download Nonprofit Business Plan Template

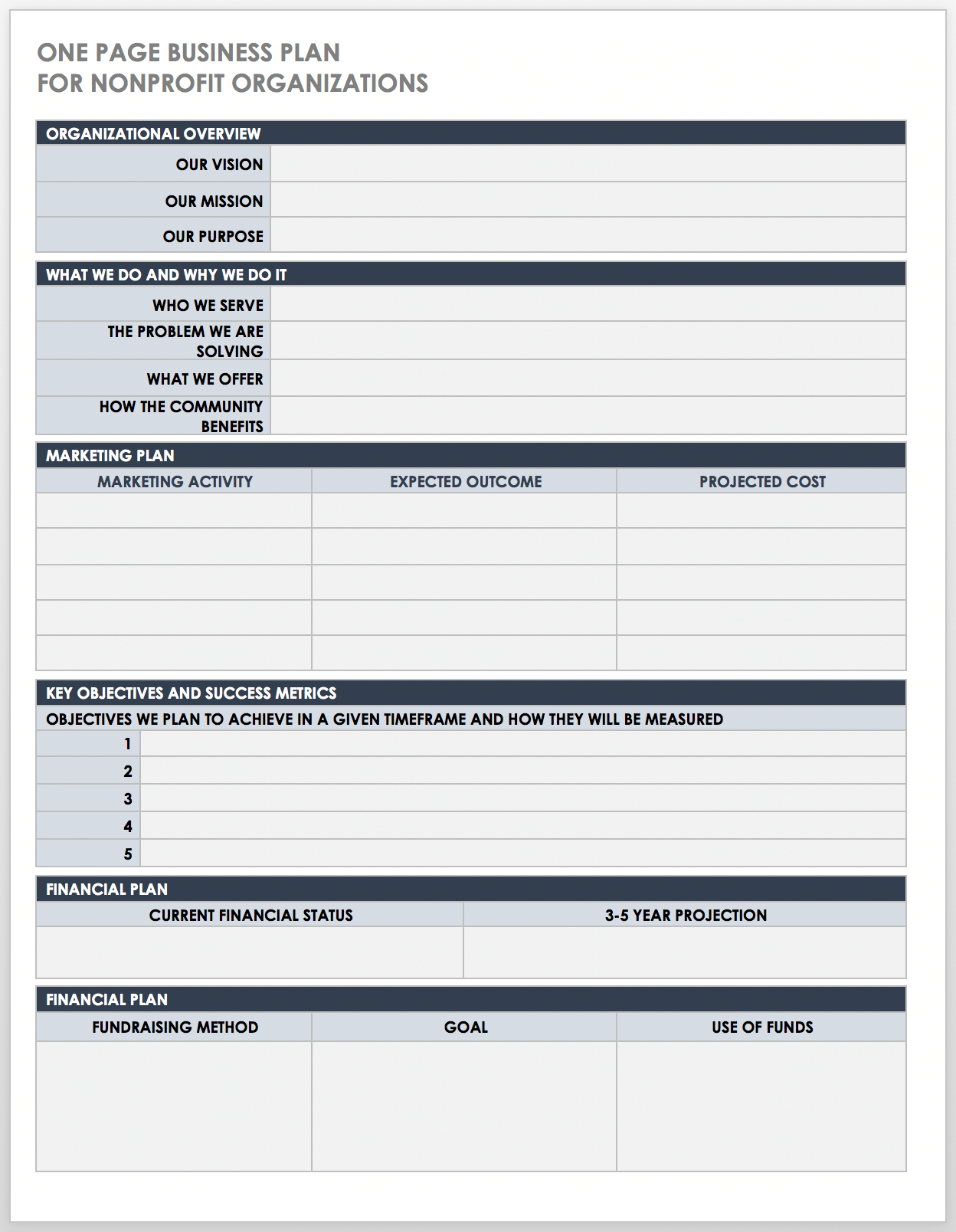

One-Page Business Plan for Nonprofit Template

This one-page nonprofit business plan template has a simple and scannable design to outline the key details of your organization’s strategy. This template includes space to detail your mission, vision, and purpose statements, as well as the problems you aim to solve in your community, the people who benefit from your program offerings, your key marketing activities, your financial goals, and more.

Download One-Page Business Plan for Nonprofit Template

Excel | Word | PDF

For additional resources, including an example of a one-page business plan , visit “ One-Page Business Plan Templates with a Quick How-To Guide .”

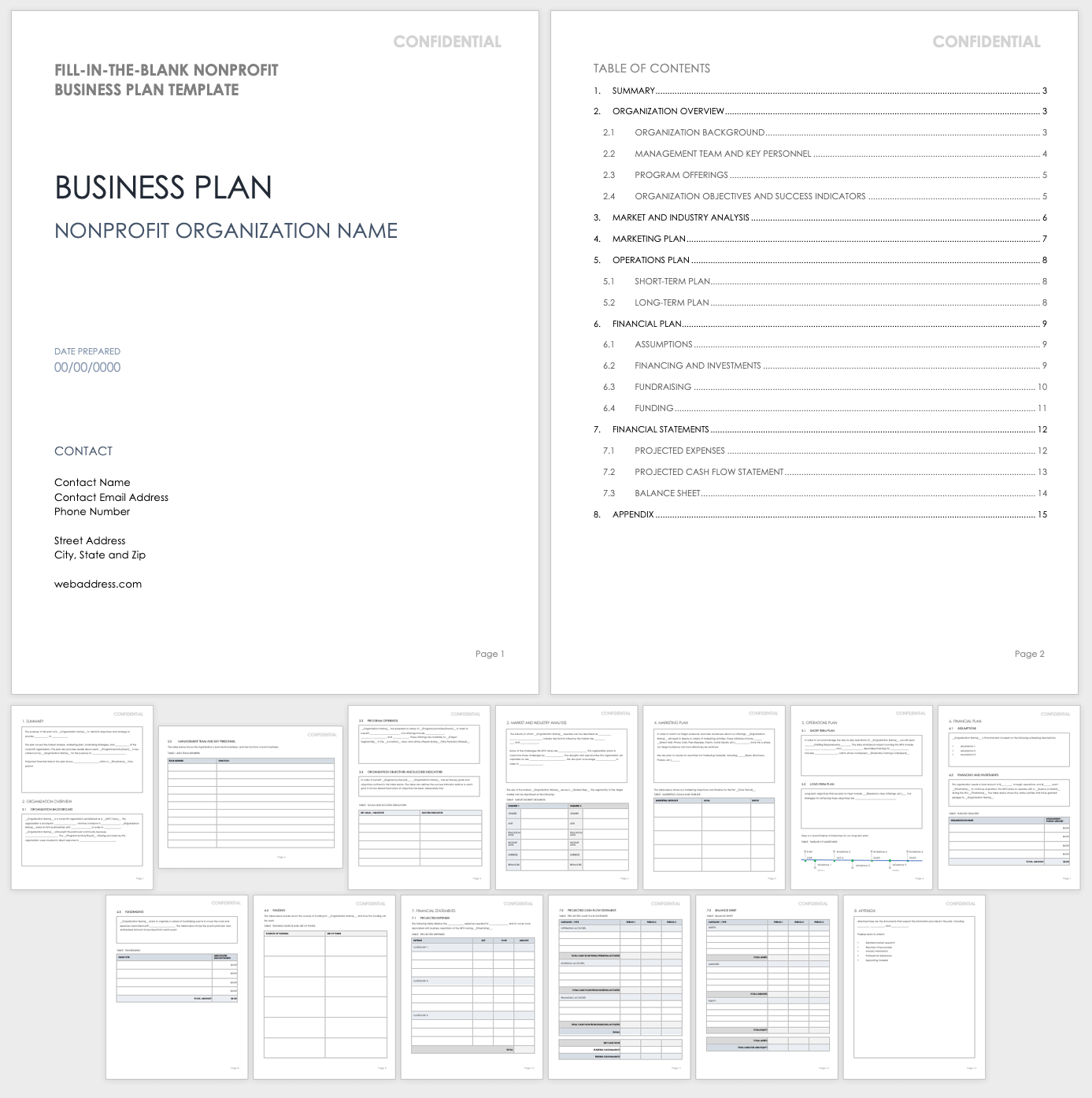

Fill-In-the-Blank Nonprofit Business Plan Template

Use this fill-in-the-blank template as the basis for building a thorough business plan for a nonprofit organization. This template includes space to describe your organization’s background, purpose, and main objectives, as well as key personnel, program and service offerings, market analysis, promotional activities, fundraising methods, and more.

Download Fill-In-the-Blank Nonprofit Business Plan Template

For additional resources that cater to a wide variety of organizations, visit “ Free Fill-In-the-Blank Business Plan Templates .”

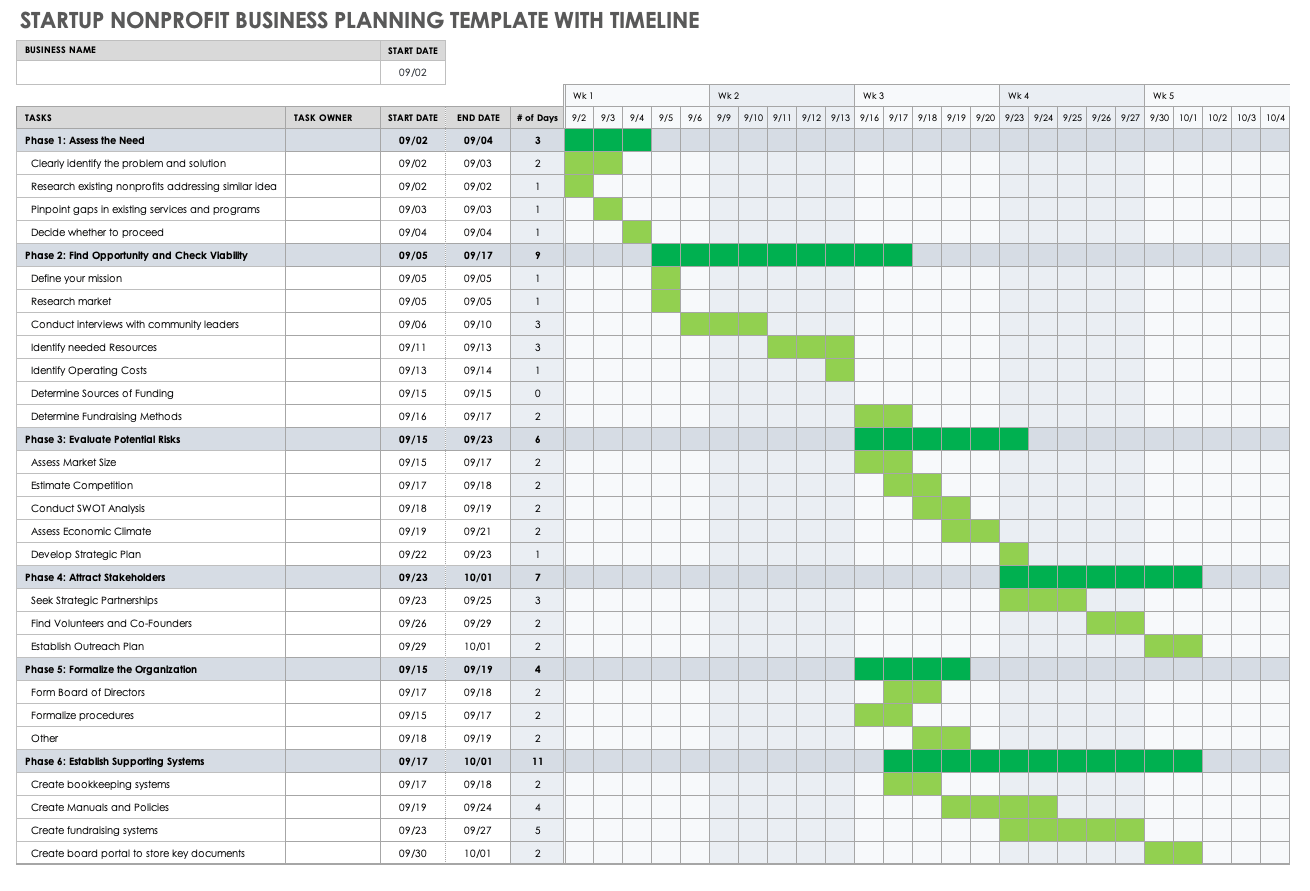

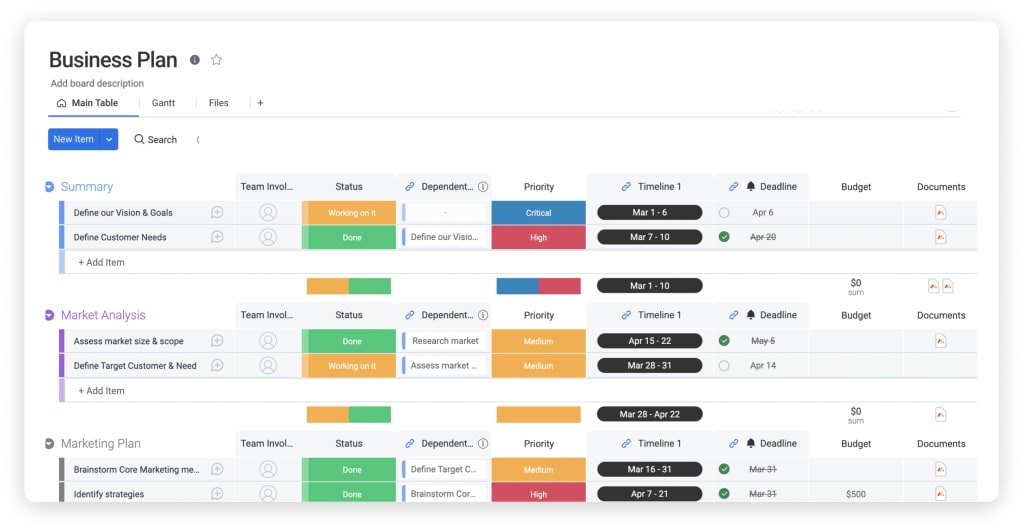

Startup Nonprofit Business Planning Template with Timeline

Use this business planning template to organize and schedule key activities for your business. Fill in the cells according to the due dates, and color-code the cells by phase, owner, or category to provide a visual timeline of progress.

Download Startup Nonprofit Business Planning Template with Timeline

Excel | Smartsheet

Nonprofit Business Plan Template for Youth Program

Use this template as a foundation for building a powerful and attractive nonprofit business plan for youth programs and services. This template has all the core components of a nonprofit business plan. It includes room to detail the organization’s background, management team key personnel, current and future youth program offerings, promotional activities, operations plan, financial statements, and much more.

Download Nonprofit Business Plan Template for Youth Program

Word | PDF | Google Doc

Sample Nonprofit Business Plan Outline Template

You can customize this sample nonprofit business plan outline to fit the specific needs of your organization. To ensure that you don’t miss any essential details, use this outline to help you prepare and organize the elements of your plan before filling in each section.

Download Sample Nonprofit Business Plan Outline Template

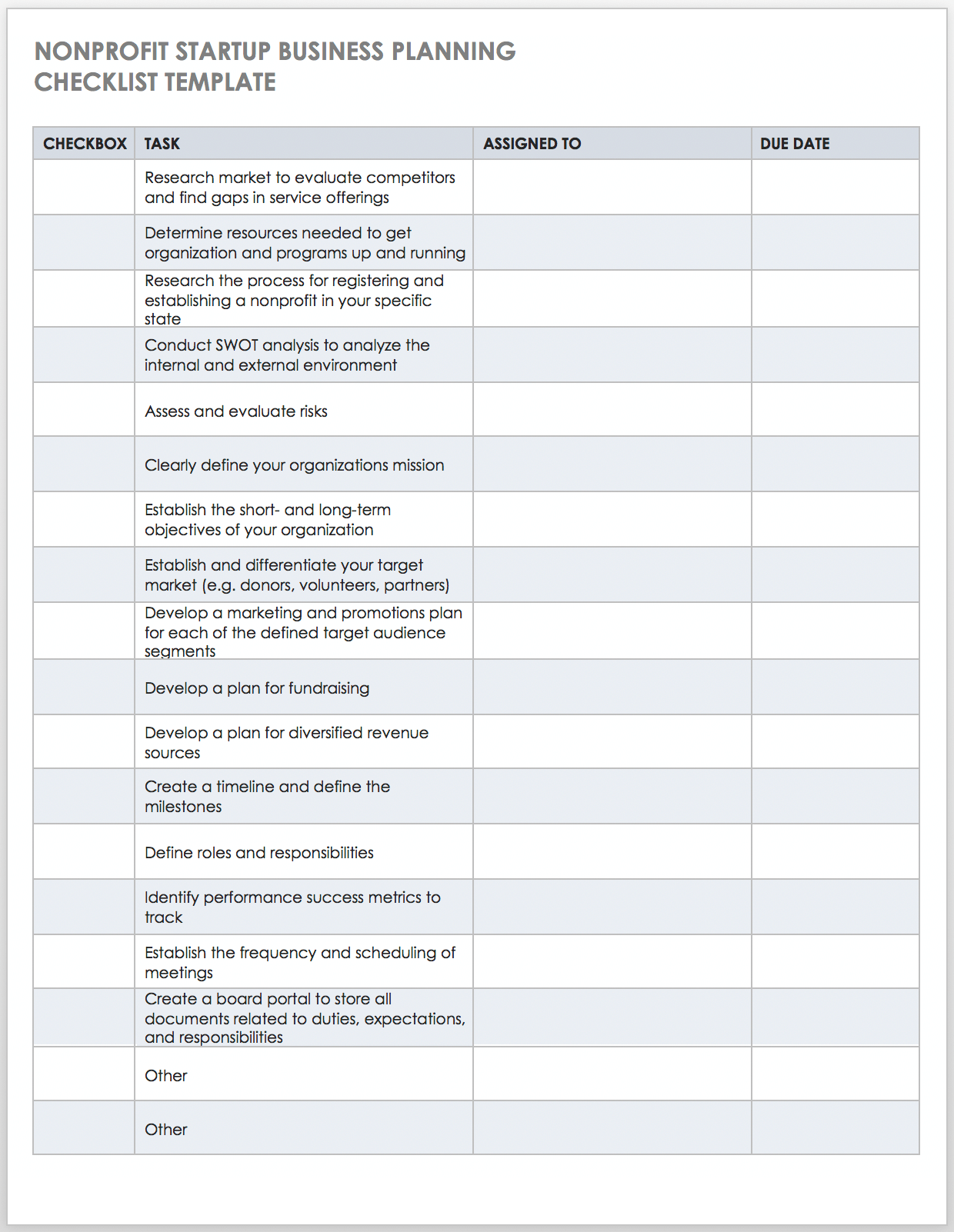

Nonprofit Startup Business Planning Checklist Template

Use this customizable business planning checklist as the basis for outlining the necessary steps to get your nonprofit organization up and running. You can customize this checklist to fit your individual needs. It includes essential steps, such as conducting a SWOT analysis , fulfilling the research requirements specific to your state, conducting a risk assessment , defining roles and responsibilities, creating a portal for board members, and other tasks to keep your plan on track.

Download Nonprofit Startup Business Planning Checklist Template

Tips to Create Your Nonprofit Business Plan

Your nonprofit business plan should provide your donors, volunteers, and other key stakeholders with a clear picture of your overarching mission and objectives. Below, we share our top tips for ensuring that your plan is attractive and thorough.

- Develop a Strategy First: You must aim before you fire if you want to be effective. In other words, develop a strategic plan for your nonprofit in order to provide your team with direction and a roadmap before you build your business plan.

- Save Time with a Template: No need to start from scratch when you can use a customizable nonprofit business plan template to get started. (Download one of the options above.)

- Start with What You Have: With the exception of completing the executive summary, which you must do last, you aren’t obligated to fill in each section of the plan in order. Use the information you have on hand to begin filling in the various parts of your business plan, then conduct additional research to fill in the gaps.

- Ensure Your Information Is Credible: Back up all the details in your plan with reputable sources that stakeholders can easily reference.

- Be Realistic: Use realistic assumptions and numbers in your financial statements and forecasts. Avoid the use of overly lofty or low-lying projections, so stakeholders feel more confident about your plan.

- Strive for Scannability: Keep each section clear and concise. Use bullet points where appropriate, and avoid large walls of text.

- Use Visuals: Add tables, charts, and other graphics to draw the eye and support key points in the plan.

- Be Consistent: Keep the voice and formatting (e.g., font style and size) consistent throughout the plan to maintain a sense of continuity.

- Stay True to Your Brand: Make sure that the tone, colors, and overall style of the business plan are a true reflection of your organization’s brand.

- Proofread Before Distribution: Prior to distributing the plan to stakeholders, have a colleague proofread the rough version to check for errors and ensure that the plan is polished.

- Don’t Set It and Forget It: You should treat your nonprofit business plan as a living document that you need to review and update on a regular basis — as objectives change and your organization grows.

- Use an Effective Collaboration Tool: Use an online tool to accomplish the following: collaborate with key personnel on all components of the business plan; enable version control for all documents; and keep resources in one accessible place.

Improve Your Nonprofit Business Planning Efforts with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

How to Write a Nonprofit Business Plan

Angelique O'Rourke

13 min. read

Updated October 27, 2023

Believe it or not, creating a business plan for a nonprofit organization is not that different from planning for a traditional business.

Nonprofits sometimes shy away from using the words “business planning,” preferring to use terms like “strategic plan” or “operating plan.” But, the fact is that preparing a plan for a for-profit business and a nonprofit organization are actually pretty similar processes. Both types of organizations need to create forecasts for revenue and plan how they’re going to spend the money they bring in. They also need to manage their cash and ensure that they can stay solvent to accomplish their goals.

In this guide, I’ll explain how to create a plan for your organization that will impress your board of directors, facilitate fundraising, and ensures that you deliver on your mission.

- Why does a nonprofit need a business plan?

Good business planning is about setting goals, getting everyone on the same page, tracking performance metrics, and improving over time. Even when your goal isn’t to increase profits, you still need to be able to run a fiscally healthy organization.

Business planning creates an opportunity to examine the heart of your mission , the financing you’ll need to bring that mission to fruition, and your plan to sustain your operations into the future.

Nonprofits are also responsible for meeting regularly with a board of directors and reporting on your organization’s finances is a critical part of that meeting. As part of your regular financial review with the board, you can compare your actual results to your financial forecast in your business plan. Are you meeting fundraising goals and keeping spending on track? Is the financial position of the organization where you wanted it to be?

In addition to internal use, a solid business plan can help you court major donors who will be interested in having a deeper understanding of how your organization works and your fiscal health and accountability. And you’ll definitely need a formal business plan if you intend to seek outside funding for capital expenses—it’s required by lenders.

Creating a business plan for your organization is a great way to get your management team or board to connect over your vision, goals, and trajectory. Even just going through the planning process with your colleagues will help you take a step back and get some high-level perspective .

- A nonprofit business plan outline

Keep in mind that developing a business plan is an ongoing process. It isn’t about just writing a physical document that is static, but a continually evolving strategy and action plan as your organization progresses over time. It’s essential that you run regular plan review meetings to track your progress against your plan. For most nonprofits, this will coincide with regular reports and meetings with the board of directors.

A nonprofit business plan will include many of the same sections of a standard business plan outline . If you’d like to start simple, you can download our free business plan template as a Word document, and adjust it according to the nonprofit plan outline below.

Executive summary

The executive summary of a nonprofit business plan is typically the first section of the plan to be read, but the last to be written. That’s because this section is a general overview of everything else in the business plan – the overall snapshot of what your vision is for the organization.

Write it as though you might share with a prospective donor, or someone unfamiliar with your organization: avoid internal jargon or acronyms, and write it so that someone who has never heard of you would understand what you’re doing.

Your executive summary should provide a very brief overview of your organization’s mission. It should describe who you serve, how you provide the services that you offer, and how you fundraise.

If you are putting together a plan to share with potential donors, you should include an overview of what you are asking for and how you intend to use the funds raised.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Opportunity

Start this section of your nonprofit plan by describing the problem that you are solving for your clients or your community at large. Then say how your organization solves the problem.

A great way to present your opportunity is with a positioning statement . Here’s a formula you can use to define your positioning:

For [target market description] who [target market need], [this product] [how it meets the need]. Unlike [key competition], it [most important distinguishing feature].

And here’s an example of a positioning statement using the formula:

For children, ages five to 12 (target market) who are struggling with reading (their need), Tutors Changing Lives (your organization or program name) helps them get up to grade-level reading through a once a week class (your solution).

Unlike the school district’s general after-school homework lab (your state-funded competition), our program specifically helps children learn to read within six months (how you’re different).

Your organization is special or you wouldn’t spend so much time devoted to it. Layout some of the nuts and bolts about what makes it great in this opening section of your business plan. Your nonprofit probably changes lives, changes your community, or maybe even changes the world. Explain how it does this.

This is where you really go into detail about the programs you’re offering. You’ll want to describe how many people you serve and how you serve them.

Target audience

In a for-profit business plan, this section would be used to define your target market . For nonprofit organizations, it’s basically the same thing but framed as who you’re serving with your organization. Who benefits from your services?

Not all organizations have clients that they serve directly, so you might exclude this section if that’s the case. For example, an environmental preservation organization might have a goal of acquiring land to preserve natural habitats. The organization isn’t directly serving individual groups of people and is instead trying to benefit the environment as a whole.

Similar organizations

Everyone has competition —nonprofits, too. You’re competing with other nonprofits for donor attention and support, and you’re competing with other organizations serving your target population. Even if your program is the only one in your area providing a specific service, you still have competition.

Think about what your prospective clients were doing about their problem (the one your organization is solving) before you came on this scene. If you’re running an after-school tutoring organization, you might be competing with after school sports programs for clients. Even though your organizations have fundamentally different missions.

For many nonprofit organizations, competing for funding is an important issue. You’ll want to use this section of your plan to explain who donors would choose your organization instead of similar organizations for their donations.

Future services and programs

If you’re running a regional nonprofit, do you want to be national in five years? If you’re currently serving children ages two to four, do you want to expand to ages five to 12? Use this section to talk about your long-term goals.

Just like a traditional business, you’ll benefit by laying out a long-term plan. Not only does it help guide your nonprofit, but it also provides a roadmap for the board as well as potential investors.

Promotion and outreach strategies

In a for-profit business plan, this section would be about marketing and sales strategies. For nonprofits, you’re going to talk about how you’re going to reach your target client population.

You’ll probably do some combination of:

- Advertising: print and direct mail, television, radio, and so on.

- Public relations: press releases, activities to promote brand awareness, and so on.

- Digital marketing: website, email, blog, social media, and so on.

Similar to the “target audience” section above, you may remove this section if you don’t promote your organization to clients and others who use your services.

Costs and fees

Instead of including a pricing section, a nonprofit business plan should include a costs or fees section.

Talk about how your program is funded, and whether the costs your clients pay are the same for everyone, or based on income level, or something else. If your clients pay less for your service than it costs to run the program, how will you make up the difference?

If you don’t charge for your services and programs, you can state that here or remove this section.

Fundraising sources

Fundraising is critical for most nonprofit organizations. This portion of your business plan will detail who your key fundraising sources are.

Similar to understanding who your target audience for your services is, you’ll also want to know who your target market is for fundraising. Who are your supporters? What kind of person donates to your organization? Creating a “donor persona” could be a useful exercise to help you reflect on this subject and streamline your fundraising approach.

You’ll also want to define different tiers of prospective donors and how you plan on connecting with them. You’re probably going to include information about your annual giving program (usually lower-tier donors) and your major gifts program (folks who give larger amounts).

If you’re a private school, for example, you might think of your main target market as alumni who graduated during a certain year, at a certain income level. If you’re building a bequest program to build your endowment, your target market might be a specific population with interest in your cause who is at retirement age.

Do some research. The key here is not to report your target donors as everyone in a 3,000-mile radius with a wallet. The more specific you can be about your prospective donors —their demographics, income level, and interests, the more targeted (and less costly) your outreach can be.

Fundraising activities

How will you reach your donors with your message? Use this section of your business plan to explain how you will market your organization to potential donors and generate revenue.

You might use a combination of direct mail, advertising, and fundraising events. Detail the key activities and programs that you’ll use to reach your donors and raise money.

Strategic alliances and partnerships

Use this section to talk about how you’ll work with other organizations. Maybe you need to use a room in the local public library to run your program for the first year. Maybe your organization provides mental health counselors in local schools, so you partner with your school district.

In some instances, you might also be relying on public health programs like Medicaid to fund your program costs. Mention all those strategic partnerships here, especially if your program would have trouble existing without the partnership.

Milestones and metrics

Without milestones and metrics for your nonprofit, it will be more difficult to execute on your mission. Milestones and metrics are guideposts along the way that are indicators that your program is working and that your organization is healthy.

They might include elements of your fundraising goals—like monthly or quarterly donation goals, or it might be more about your participation metrics. Since most nonprofits working with foundations for grants do complex reporting on some of these, don’t feel like you have to re-write every single goal and metric for your organization here. Think about your bigger goals, and if you need to, include more information in your business plan’s appendix.

If you’re revisiting your plan on a monthly basis, and we recommend that you do, the items here might speak directly to the questions you know your board will ask in your monthly trustee meeting. The point is to avoid surprises by having eyes on your organization’s performance. Having these goals, and being able to change course if you’re not meeting them, will help your organization avoid falling into a budget deficit.

Key assumptions and risks

Your nonprofit exists to serve a particular population or cause. Before you designed your key programs or services, you probably did some research to validate that there’s a need for what you’re offering.

But you probably are also taking some calculated risks. In this section, talk about the unknowns for your organization. If you name them, you can address them.

For example, if you think there’s a need for a children’s literacy program, maybe you surveyed teachers or parents in your area to verify the need. But because you haven’t launched the program yet, one of your unknowns might be whether the kids will actually show up.

Management team and company

Who is going to be involved and what are their duties? What do these individuals bring to the table?

Include both the management team of the day-to-day aspects of your nonprofit as well as board members and mention those who may overlap between the two roles. Highlight their qualifications: titles, degrees, relevant past accomplishments, and designated responsibilities should be included in this section. It adds a personal touch to mention team members who are especially qualified because they’re close to the cause or have special first-hand experience with or knowledge of the population you’re serving.

There are probably some amazing, dedicated people with stellar qualifications on your team—this is the place to feature them (and don’t forget to include yourself!).

Financial plan

The financial plan is essential to any organization that’s seeking funding, but also incredibly useful internally to keep track of what you’ve done so far financially and where you’d like to see the organization go in the future.

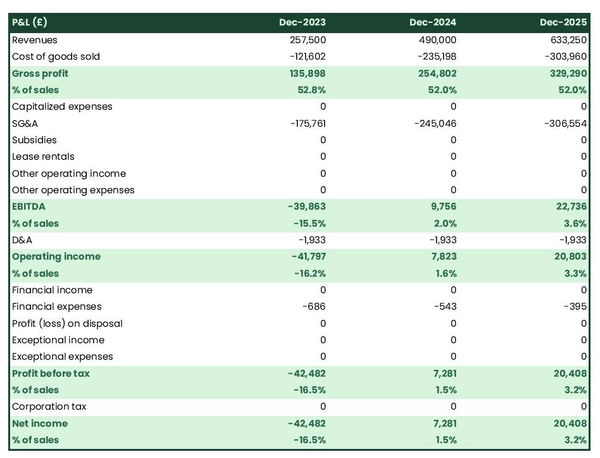

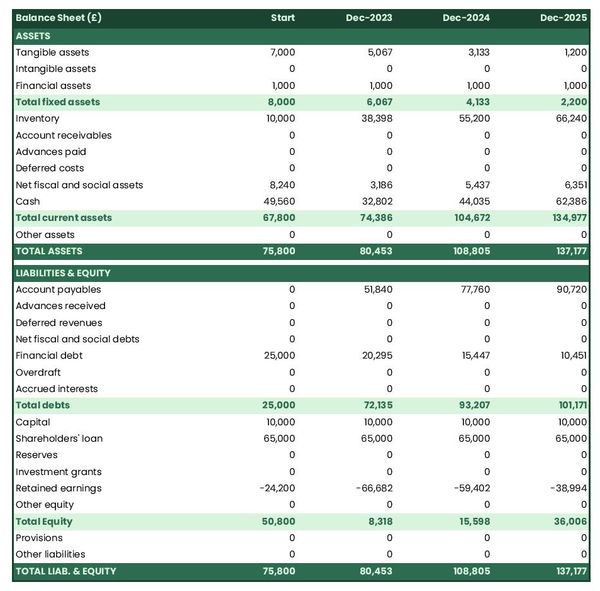

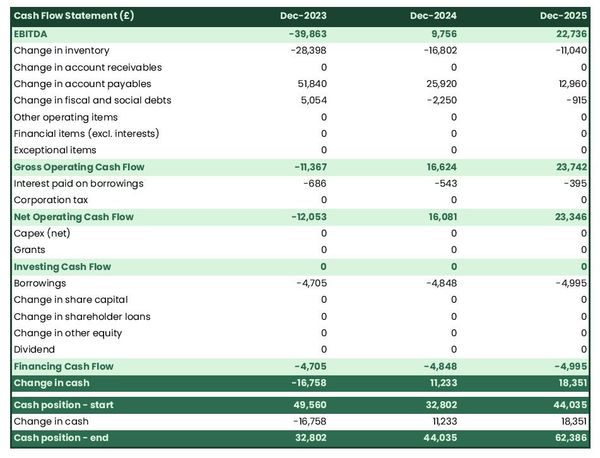

The financial section of your business plan should include a long-term budget and cash flow statement with a three to five-year forecast. This will allow you to see that the organization has its basic financial needs covered. Any nonprofit has its standard level of funding required to stay operational, so it’s essential to make sure your organization will consistently maintain at least that much in the coffers.

From that point, it’s all about future planning: If you exceed your fundraising goals, what will be done with the surplus? What will you do if you don’t meet your fundraising goals? Are you accounting for appropriate amounts going to payroll and administrative costs over time? Thinking through a forecast of your financial plan over the next several years will help ensure that your organization is sustainable.

Money management skills are just as important in a nonprofit as they are in a for-profit business. Knowing the financial details of your organization is incredibly important in a world where the public is ranking the credibility of charities based on what percentage of donations makes it to the programs and services. As a nonprofit, people are interested in the details of how money is being dispersed within organizations, with this information often being posted online on sites like Charity Navigator, so the public can make informed decisions about donating.

Potential contributors will do their research—so make sure you do too. No matter who your donors are, they will want to know they can trust your organization with their money. A robust financial plan is a solid foundation for reference that your nonprofit is on the right track.

- Business planning is ongoing

It’s important to remember that a business plan doesn’t have to be set in stone. It acts as a roadmap, something that you can come back to as a guide, then revise and edit to suit your purpose at a given time.

I recommend that you review your financial plan once a month to see if your organization is on track, and then revise your plan as necessary .

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Angelique is a skilled writer, editor, and social media specialist, as well as an actor and model with a demonstrated history of theater, film, commercial and print work.

Table of Contents

Related Articles

7 Min. Read

8 Steps to Write a Useful Internal Business Plan

11 Min. Read

Fundamentals of Lean Planning Explained

8 Min. Read

What Type of Business Plan Do You Need?

14 Min. Read

How to Write a Five-Year Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, how to write a nonprofit business plan.

A nonprofit business plan ensures your organization’s fundraising and activities align with your core mission.

Every nonprofit needs a mission statement that demonstrates how the organization will support a social cause and provide a public benefit. A nonprofit business plan fleshes out this mission statement in greater detail. These plans include many of the same elements as a for-profit business plan, with a focus on fundraising, creating a board of directors, raising awareness, and staying compliant with IRS regulations. A nonprofit business plan can be instrumental in getting your organization off the ground successfully.

Start with your mission statement

The mission statement is foundational for your nonprofit organization. The IRS will review your mission statement in determining whether to grant you tax-exempt status. This statement also helps you recruit volunteers and staff, fundraise, and plan activities for the year.

[Read more: Writing a Mission Statement: A Step-by-Step Guide ]

Therefore, you should start your business plan with a clear mission statement in the executive summary. The executive summary can also cover, at a high level, the goals, vision, and unique strengths of your nonprofit organization. Keep this section brief, since you will be going into greater detail in later sections.

Identify a board of directors

Many business plans include a section identifying the people behind the operation: your key leaders, volunteers, and full-time employees. For nonprofits, it’s also important to identify your board of directors. The board of directors is ultimately responsible for hiring and managing the CEO of your nonprofit.

“Board members are the fiduciaries who steer the organization towards a sustainable future by adopting sound, ethical, and legal governance and financial management policies, as well as by making sure the nonprofit has adequate resources to advance its mission,” wrote the Council of Nonprofits.

As such, identify members of your board in your business plan to give potential donors confidence in the management of your nonprofit.

Be as realistic as possible about the impact you can make with the funding you hope to gain.

Describe your organization’s activities

In this section, provide more information about what your nonprofit does on a day-to-day basis. What products, training, education, or other services do you provide? What does your organization do to benefit the constituents identified in your mission statement? Here’s an example from the American Red Cross, courtesy of DonorBox :

“The American Red Cross carries out their mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.”

This section should be detailed and get into the operational weeds of how your business delivers on its mission statement. Explain the strategies your team will take to service clients, including outreach and marketing, inventory and equipment needs, a hiring plan, and other key elements.

Write a fundraising plan

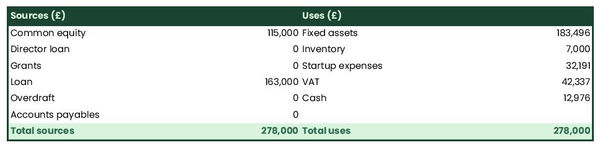

This part is the most important element of your business plan. In addition to providing required financial statements (e.g., the income statement, balance sheet, and cash flow statement), identify potential sources of funding for your nonprofit. These may include individual donors, corporate donors, grants, or in-kind support. If you are planning to host a fundraising event, put together a budget for that event and demonstrate the anticipated impact that event will have on your budget.

Create an impact plan

An impact plan ties everything together. It demonstrates how your fundraising and day-to-day activities will further your mission. For potential donors, it can make a very convincing case for why they should invest in your nonprofit.

“This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives,” wrote DonorBox . “These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.”

Be as realistic as possible about the impact you can make with the funding you hope to gain. Revisit your business plan as your organization grows to make sure the goals you’ve set both align with your mission and continue to be within reach.

[Read more: 8 Signs It's Time to Update Your Business Plan ]

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Join us for our Small Business Day event!

Join us at our next event on Wednesday, May 1, at 12:00 p.m., where we’ll be kicking off Small Business Month alongside business experts and entrepreneurs. Register to attend in person at our Washington, D.C., headquarters, or join us virtually!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business strategies

How startups contribute to innovation in emerging industries, how entrepreneurs can find a business mentor, 5 business metrics you should analyze every year.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Raise More & Grow Your Nonprofit.

The complete guide to writing a nonprofit business plan.

August 14, 2019

Leadership & Management

July 7, 2022

TABLE OF CONTENTS

Statistics from the National Center for Charitable Statistics (NCCS) show that there are over 1.5 million nonprofit organizations currently operating in the U.S. alone. Many of these organizations are hard at work helping people in need and addressing the great issues of our time. However, doing good work doesn’t necessarily translate into long-term success and financial stability. Other information has shown that around 12% of non-profits don’t make it past the 5-year mark, and this number expands to 17% at the 10-year mark.

12% of non-profits don’t make it past the 5-year mark and 17% at the 10-year mark

There are a variety of challenges behind these sobering statistics. In many cases, a nonprofit can be sunk before it starts due to a lack of a strong nonprofit business plan. Below is a complete guide to understanding why a nonprofit needs a business plan in place, and how to construct one, piece by piece.

The purpose of a nonprofit business plan

A business plan for a nonprofit is similar to that of a for-profit business plan, in that you want it to serve as a clear, complete roadmap for your organization. When your plan is complete, questions such as "what goals are we trying to accomplish?" or "what is the true purpose of our organization?" should be clear and simple to answer.

Your nonprofit business plan should provide answers to the following questions:

1. What activities do you plan to pursue in order to meet the organization’s high level goals?

2. What's your plan on getting revenue to fund these activities?

3. What are your operating costs and specifically how do these break down?

Note that there’s a difference between a business plan and a strategic plan, though there may be some overlap. A strategic plan is more conceptual, with different ideas you have in place to try and meet the organization’s greater vision (such as fighting homelessness or raising climate change awareness). A business plan serves as an action plan because it provides, in as much detail as possible, the specifics on how you’re going to execute your strategy.

More Reading

- What is the Difference Between a Business Plan and a Strategic Plan?

- Business Planning for Nonprofits

Creating a nonprofit business plan

With this in mind, it’s important to discuss the individual sections of a nonprofit business plan. Having a proper plan in a recognizable format is essential for a variety of reasons. On your business’s end, it makes sure that as many issues or questions you may encounter are addressed up front. For outside entities, such as potential volunteers or donors, it shows that their time and energy will be managed well and put to good use. So, how do you go from conceptual to concrete?

Step 1: Write a mission statement

Having a mission statement is essential for any company, but even more so for nonprofits. Your markers of success are not just how the organization performs financially, but the impact it makes for your cause.

One of the easiest ways to do this is by creating a mission statement. A strong mission statement clarifies why your organization exists and determines the direction of activities.

At the head of their ethics page , NPR has a mission statement that clearly and concisely explains why they exist. From this you learn:

- The key point of their mission: creating a more informed public that understands new ideas and cultures

- Their mechanism of executing that vision: providing and reporting news/info that meets top journalistic standards

- Other essential details: their partnership with their membership statement

You should aim for the same level of clarity and brevity in your own mission statement.

The goal of a mission statement isn’t just about being able to showcase things externally, but also giving your internal team something to realign them if they get off track.

For example, if you're considering a new program or services, you can always check the idea against the mission statement. Does it align with your higher level goal and what your organization is ultimately trying to achieve? A mission statement is a compass to guide your team and keep the organization aligned and focused.

Step 2: Collect the data

You can’t prepare for the future without some data from the past and present. This can range from financial data if you’re already in operation to secured funding if you’re getting ready to start.

Data related to operations and finances (such as revenue, expenses, taxes, etc.) is crucial for budgeting and organizational decisions.

You'll also want to collect data about your target donor. Who are they in terms of their income, demographics, location, etc. and what is the best way to reach them? Every business needs to market, and answering these demographic questions are crucial to targeting the right audience in a marketing campaign. You'll also need data about marketing costs collected from your fundraising, marketing, and CRM software and tools. This data can be extremely important for demonstrating the effectiveness of a given fundraising campaign or the organization as a whole.

Then there is data that nonprofits collect from third-party sources as to how to effectively address their cause, such as shared data from other nonprofits and data from governments.

By properly collecting and interpreting the above data, you can build your nonprofit to not only make an impact, but also ensure the organization is financially sustainable.

Step 3: Create an outline

Before you begin writing your plan, it’s important to have an outline of the sections of your plan. Just like an academic essay, it’s easier to make sure all the points are addressed by taking inventory of high level topics first. If you create an outline and find you don’t have all the materials you need to fill it, you may need to go back to the data collection stage.

Writing an outline gives you something simple to read that can easily be circulated to your team for input. Maybe some of your partners will want to emphasize an area that you missed or an area that needs more substance.

Having an outline makes it easier for you to create an organized, well-flowing piece. Each section needs to be clear on its own, but you also don’t want to be overly repetitive.

As a side-note, one area where a lot of business novices stall in terms of getting their plans off the ground is not knowing what format to choose or start with. The good news is there are a lot of resources available online for you to draw templates for from your plan, or just inspire one of your own.

Using a business plan template

You may want to use a template as a starting point for your business plan. The major benefit here is that a lot of the outlining work that we mentioned is already done for you. However, you may not want to follow the template word for word. A nonprofit business plan may require additional sections or parts that aren’t included in a conventional business plan template.

The best way to go about this is to try and focus less on copying the template, and more about copying the spirit of the template. For example, if you see a template that you like, you can keep the outline, but you may want to change the color scheme and font to better reflect your brand. And of course, all your text should be unique.

When it comes to adding a new section to a business plan template, for the most part, you can use your judgment. We will get into specific sections in a bit, but generally, you just want to pair your new section with the existing section that makes the most sense. For example, if your non-profit has retail sales as a part of a financial plan, you can include that along with the products, services and programs section.

- Free Nonprofit Sample Business Plans - Bplans

- Non-Profit Business Plan Template - Growthink

- Sample Nonprofit Business Plans - Bridgespan

- Nonprofit Business Plan Template - Slidebean

- 23+ Non Profit Business Plan Templates - Template.net

Nonprofit business plan sections

The exact content is going to vary based on the size, purpose, and nature of your nonprofit. However, there are certain sections that every business plan will need to have for investors, donors, and lenders to take you seriously. Generally, your outline will be built around the following main sections:

1. Executive summary

Many people write this last, even though it comes first in a business plan. This is because the executive summary is designed to be a general summary of the business plan as a whole. Naturally, it may be easier to write this after the rest of the business plan has been completed.

After reading your executive summary a person should ideally have a general idea of what the entire plan covers. Sometimes, a person may be interested in learning about your non-profit, but doesn’t have time to read a 20+ page document. In this case, the executive summary could be the difference between whether or not you land a major donor.

As a start, you want to cover the basic need your nonprofit services, why that need exists, and the way you plan to address that need. The goal here is to tell the story as clearly and and concisely as possible. If the person is sold and wants more details, they can read through the rest of your business plan.

2. Products/Services/Programs

This is the space where you can clarify exactly what your non-profit does. Think of it as explaining the way your nonprofit addresses that base need you laid out earlier. This can vary a lot based on what type of non-profit you’re running.

This page gives us some insight into the mechanisms Bucks County Historical Society uses to further their mission, which is “to educate and engage its many audiences in appreciating the past and to help people find stories and meanings relevant to their lives—both today and in the future.”

They accomplish this goal through putting together both permanent exhibits as well as regular events at their primary museum. However, in a non-profit business plan, you need to go further.

It’s important here not only to clearly explain who benefits from your services, but also the specific details how those services are provided. For example, saying you “help inner-city school children” isn’t specific enough. Are you providing education or material support? Your non-profit business plan readers need as much detail as possible using simple and clear language.

3. Marketing

For a non-profit to succeed, it needs to have a steady stream of both donors and volunteers. Marketing plays a key role here as it does in a conventional business. This section should outline who your target audience is, and what you’ve already done/plan on doing to reach this audience. How you explain this is going to vary based on what stage your non-profit is in. We’ll split this section to make it more clear.

Nonprofits not in operation

Obviously, it’s difficult to market an idea effectively if you’re not in operation, but you still need to have a marketing plan in place. People who want to support your non-profit need to understand your marketing plan to attract donors. You need to profile all the data you have about your target market and outline how you plan to reach this audience.

Nonprofits already in operation

Marketing plans differ greatly for nonprofits already in operation. If your nonprofit is off the ground, you want to include data about your target market as well, along with other key details. Describe all your current marketing efforts, from events to general outreach, to conventional types of marketing like advertisements and email plans. Specific details are important. By the end of this, the reader should know:

- What type of marketing methods your organization prefers

- Why you’ve chosen these methods

- The track record of success using these methods

- What the costs and ROI of a marketing campaign

4. Operations

This is designed to serve as the “how” of your Products/Services/Programs section.

For example, if your goal is to provide school supplies for inner-city schoolchildren, you’ll need to explain how you will procure the supplies and distribute them to kids in need. Again, detail is essential. A reader should be able to understand not only how your non-profit operates on a daily basis, but also how it executes any task in the rest of the plan.

If your marketing plan says that you hold community events monthly to drum up interest. Who is in charge of the event? How are they run? How much do they cost? What personnel or volunteers are needed for each event? Where are the venues?

This is also a good place to cover additional certifications or insurance that your non-profit needs in order to execute these operations, and your current progress towards obtaining them.

Your operations section should also have a space dedicated to your team. The reason for this is, just like any other business plan, is that the strength of an organization lies in the people running it.

For example, let’s look at this profile from The Nature Conservancy . The main points of the biography are to showcase Chief Development Officer Jim Asp’s work history as it is relevant to his job. You’ll want to do something similar in your business plan’s team section.

Equally important is making sure that you cover any staff changes that you plan to implement in the near future in your business plan. The reason for this is that investors/partners may not want to sign on assuming that one leadership team is in place, only for it to change when the business reaches a certain stage.

The sections we’ve been talking about would also be in a traditional for profit business plan. We start to deviate a bit at this point. The impact section is designed to outline the social change you plan to make with your organization, and how your choices factor into those goals.

Remember the thoughts that go into that mission statement we mentioned before? This is your chance to show how you plan to address that mission with your actions, and how you plan to track your progress.

Let’s revisit the idea of helping inner-city school children by providing school supplies. What exactly is the metric you’re going to use to determine your success? For-profit businesses can have their finances as their primary KPI, but it’s not that easy for non-profits. Let’s say that your mission is to provide 1,000 schoolchildren in an underserved school district supplies for their classes. Your impact plan could cover two metrics:

- How many supplies are distributed

- Secondary impact (improved grades, classwork completed, etc).

The primary goal of this section is to transform that vision into concrete, measurable goals and objectives. A great acronym to help you create these are S.M.A.R.T. goals which stands for: specific, measurable, attainable, relevant, and timely.

Vitamin Angels does a good job of showing how their action supports the mission. Their goal of providing vitamins to mothers and children in developing countries has a concrete impact when we look at the numbers of how many children they service as well as how many countries they deliver to. As a non-profit business plan, it’s a good idea to include statistics like these to show exactly how close you are to your planned goals.

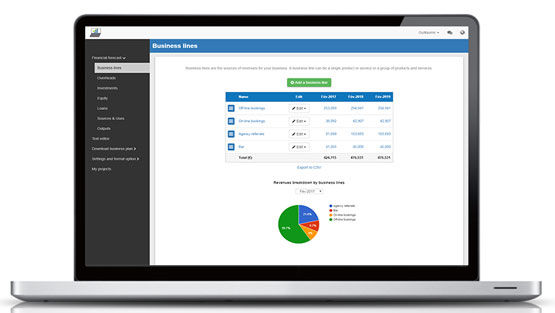

6. Finances

Every non-profit needs funding to operate, and this all-important section details exactly how you plan to cover these financial needs. Your business plan can be strong in every other section, but if your financial planning is flimsy, it’s going to prove difficult to gather believers to your cause.

It's important to paint a complete, positive picture of your fundraising plans and ambitions. Generally, this entails the following parts:

- Current financial status, such as current assets, cash on hand, liabilities

- Projections based off of your existing financial data and forms

- Key financial documents, such as a balance sheet, income statements, and cash flow sheet

- Any grants or major contributions received

- Your plan for fundraising (this may overlap with your marketing section which is okay)

- Potential issues and hurdles to your funding plan

- Your plans to address those issues

- How you'll utilize surplus donations

- Startup costs (if your non-profit is not established yet)

In general, if you see something else that isn’t accounted for here, it’s better to be safe than sorry, and put the relevant information in. It’s better to have too much information than too little when it comes to finances, especially since there is usually a clear preference for transparent business culture.

- How to Make a Five-Year Budget Plan for a Nonprofit

- Financial Transparency - National Council of Nonprofits

7. Appendix

Generally, this serves as a space to attach additional documents and elements that you may find useful for your business plan. This can include things like supplementary charts or a list of your board of directors.

This is also a good place to put text or technical information that you think may be relevant to your business plan, but might be long-winded or difficult to read. A lot of the flow and structure concerns you have for a plan don’t really apply with an appendix.

In summary, while a non-profit may have very different goals than your average business, the ways that they reach those goals do have a lot of similarities with for-profit businesses. The best way to ensure your success is to have a clear, concrete vision and path to different milestones along the way. A solid, in-depth business plan also gives you something to refer back to when you are struggling and not sure where to turn.

Alongside your business plan, you also want to use tools and resources that promote efficiency at all levels. For example, every non-profit needs a consistent stream of donations to survive, so consider using a program like GiveForms that creates simple, accessible forms for your donors to easily make donations. Accounting and budgeting for these in your plans can pay dividends later on.

Share this Article

Related articles, start fundraising today.

Get started

- Project management

- CRM and Sales

- Work management

- Product development life cycle

- Comparisons

- Construction management

- monday.com updates

The best nonprofit business plan template

If you’re looking to start a new charity but don’t know where to start, a nonprofit business plan template can help. There are more than 1.5 million nonprofit organizations registered in the US. While it’s awesome that there are so many charitable orgs, unfortunately, many of them struggle to keep their doors open.

Like any other business, a nonprofit needs to prepare for the unexpected. Even without a global pandemic, strategic planning is crucial for a nonprofit to succeed.

In this article, we’ll look at why a business plan is important for nonprofit organizations and what details to include in your business plan. To get you started, our versatile nonprofit business plan template is ready for you to download to turn your nonprofit dreams into a reality.

Get the template

What is a nonprofit business plan template?

A nonprofit business plan template is not that different from a regular, profit-oriented business plan template. It can even focus on financial gain — as long as it specifies how to use that excess for the greater good.

A nonprofit business plan template includes fields that cover the foundational elements of a business plan, including:

- The overarching purpose of your nonprofit

- Its long and short-term goals

- An outline of how you’ll achieve these goals

The template also controls the general layout of the business plan, like recommended headings, sub-headings, and questions. But what’s the point? Let’s dive into the benefits a business plan template offers nonprofits.

Download Excel template

Why use a nonprofit business plan template?

To get your nonprofit business plans in motion, templates can:

Provide direction

If you’ve decided to start a nonprofit, you’re likely driven by passion and purpose. Although nonprofits are generally mission-driven, they’re still businesses. And that means you need to have a working business model. A template will give your ideas direction and encourage you to put your strategic thinking cap on.

Help you secure funding

One of the biggest reasons for writing a nonprofit business plan is to attract investment. After all, without enough funding , it’s nearly impossible to get your business off the ground. There’s simply no business without capital investment, and that’s even more true for nonprofits that rarely sell products.

Stakeholders and potential investors will need to assess the feasibility of your nonprofit business. You can encourage them to invest by presenting them with a well-written, well-thought-out business plan with all the necessary details — and a template lays the right foundation.

Facilitate clear messaging

One of the essential characteristics of any business plan — nonprofits included — is transparency around what you want to achieve and how you are going to achieve it. A nebulous statement with grandiose aspirations but no practical plan won’t inspire confidence.

Instead, you should create a clear and concise purpose statement that sums up your goals and planned action steps. A good template will help you maintain a strong purpose statement and use clear messaging throughout.

Of course, there are different types of nonprofit plan templates you can use, depending on the kind of business plan you want to draw up.

What are some examples of a nonprofit business plan template?

From summary nonprofit plans to all encompassing strategies, check out a few sample business plan templates for different nonprofit use cases.

Summary nonprofit business plan template

New nonprofit ventures in the early stages of development can use this business plan template. It’s created to put out feelers to see if investors are interested in your idea. For example, you may want to start an animal shelter in your community, but aren’t sure if it’s a viable option due to a lack of funds. You’d use a summary business plan template to gauge interest in your nonprofit.

Full nonprofit business plan template

In this scenario, you have already laid the foundations for your nonprofit. You’re now at a point where you need financing to get your nonprofit off the ground.

This template is much longer than a summary and includes all the sections of a nonprofit business plan including the:

Executive summary

- Nonprofit description

- Needs analysis

- Product/service

- Marketing strategy

- Management team & board

- Human resource needs

It also typically includes a variety of documents that back up your market research and financial situation.

Operational nonprofit business plan template

This type of business plan template is extremely detail-oriented and outlines your nonprofit’s daily operations. It acts as an in-depth guide for who does what, how they should do it, and when they should do it.

An operational nonprofit business plan is written for your internal team rather than external parties like investors or board members.

Convinced to give a business plan template a go? Lucky for you, our team has created the perfect option for nonprofits.

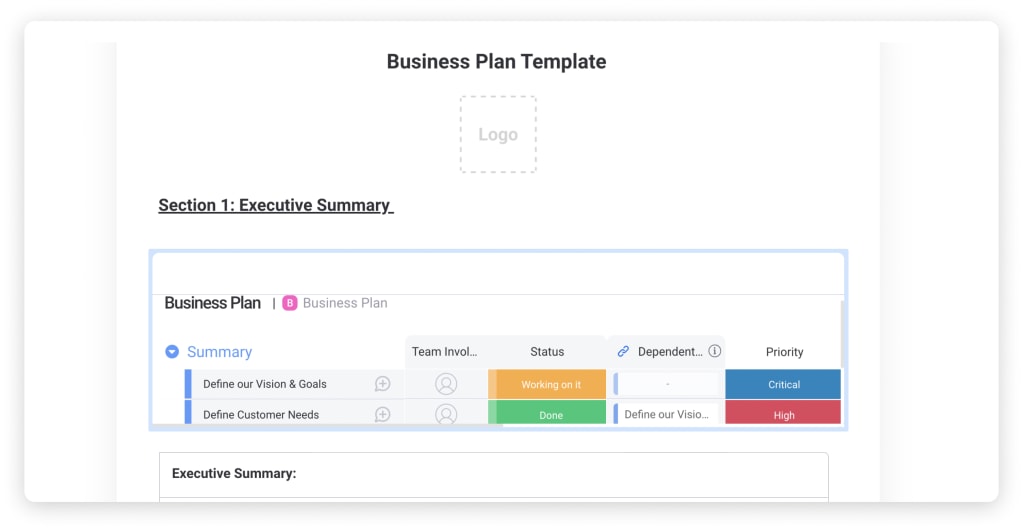

monday.com’s nonprofit business plan template

At monday.com, we understand that starting a nonprofit business can feel overwhelming — scrambling to line up investors, arranging fundraising events, filing federal forms, and more. Because we want you and your nonprofit to succeed, we’ve created a customizable template to get you started. It’s right inside our Work OS , a digital platform that helps you effectively manage every aspect of your work — from budgets and high-level plans to individual to-do lists.

Here’s what you can do on our template:

Access all your documents from one central location

Besides a business plan, starting a nonprofit requires a lot of other documentation. Supporting documents include a cash flow statement or a general financial statement, resumes of founders, and letters of support.

monday.com’s Work OS lets you store all these essential documents in one centralized location. That means you don’t need to open several tabs or run multiple programs to view your information. On monday.com, you can quickly and easily access documents and share them with potential investors and donors. Security features also help you control access to any board or document, only letting invited people or employees view or edit them. By keeping everything in one place, you save time on tracking down rogue files or statements and can focus on what really matters, such as running your nonprofit.

Turn your business plan into action

With monday.com’s nonprofit business plan template, you can seamlessly transform your plan into actionable tasks. After all, it’s going to take more than some sound strategic planning to bring your nonprofit to life.

Based on your business plan, you have the power to create interactive vision boards, calendars, timelines, cards, charts, and more. Because delegation is key, assign tasks to any of your team members from your main board. You can even set up notification automations so that everyone stays up to date with their responsibilities. Plus, to make sure the team stays on track, you can use the Progress Tracking Column that shows you the percent to completion of tasks based on the different status columns of your board.

Keep your finger on the pulse

From budgets to customer satisfaction, you need to maintain a high-level overview of your nonprofit’s key metrics.

monday.com keeps you well-informed on the status of your nonprofit’s progress, all on one platform. With customizable dashboards — for example, a real-time overview of donations received and projects completed — and visually appealing views, you can make confident decisions on how to take your nonprofit business forward.

Now that you have the template, let’s cover each section and how to fill it out correctly.

Essential sections of a nonprofit business plan template

So what exactly goes into a nonprofit business plan? Let’s take a look at the different sections you’ll find in most templates.

This is a concise summary of your business at the beginning of your plan. It should be both inspired and to the point. The executive summary is typically two pages long and dedicates about two sentences to each section of the plan.

Organization overview

This section gives some background on your company and summarizes the goal of your business. At the same time, it should touch on other important factors like your action plan for attracting potential external stakeholders. You can think of an organization overview as a mission statement and company description rolled into one.

Products, programs, and services

Any business exists to provide products, programs, and services — perhaps with a focus on the latter two for nonprofits. Your business plan should outline what you are bringing to your community. This will influence your target market , potential investors, and marketing strategies.

Marketing plan

An effective marketing strategy is the cornerstone of any successful business. Your marketing plan will identify your target audience and how you plan to reach them. It deals with pricing structures while also assessing customer engagement levels.

Operational plan

The operational plan describes the steps a company will take over a certain period. It focuses on the day-to-day aspects of the business, like what tasks need to be done and who is responsible for what. The operational section of a business plan works closely with strategic planning.

Competitive analysis

Even nonprofits face competition from other nonprofits with similar business profiles. A market analysis looks at the strengths and weaknesses of competing businesses and where you fit in. This section should include a strategy to overtake competitors in the market. There are many formats and templates you can use here, for example, a SWOT analysis .

Financial plan

Your financial plan should be a holistic image of your company’s financial status and financial goals. As well as your fundraising plan , make sure to include details like cash flow, investments, insurance, debt, and savings.

Before we wrap up, we’ll address some commonly asked questions about nonprofit business plan templates.

FAQs about nonprofit business plan templates

How do you write a business plan for a nonprofit.

The best way to write a nonprofit business plan is with a template so that you don’t leave anything out. Our template has all the sections ready for you to fill in, combined with features of a cutting-edge Work OS.

For some extra tips, take a look at our advice on how to write a business plan . We’ve detailed the various elements involved in business planning processes and how these should be structured.

How many pages should a nonprofit business plan be?

Business plans don’t have to be excessively long. Remember that concise communication is optimal. As a rule of thumb — and this will vary depending on the complexity and size of your business plan — a nonprofit business plan is typically between seven and thirty pages long.

What is a nonprofit business plan called?

A nonprofit business plan is called just that — a ‘nonprofit business plan.’ You may think that its nonprofit element makes it very different from a profit-oriented plan. But it is essentially the same type of document.

What is the best business structure for a nonprofit?

The consensus is that a corporation is the most appropriate and effective structure for a nonprofit business.

How do you start a nonprofit with no money?

Creating a business plan and approaching potential investors, aka donators, is the best way to start a nonprofit business if you don’t have the funds yourself.

Send this article to someone who’d like it.

How to Write a Nonprofit Business Plan in 12 Steps (+ Free Template!)

The first step in starting a nonprofit is figuring out how to bring your vision into reality. If there’s any tool that can really help you hit the ground running, it’s a nonprofit business plan!

With a plan in place, you not only have a clear direction for growth, but you can also access valuable funding opportunities.

Here, we’ll explore:

- Why a business plan is so important

- The components of a business plan

- How to write a business plan for a nonprofit specifically

We also have a few great examples, as well as a free nonprofit business plan template.

Let’s get planning!

What Is a Nonprofit Business Plan?

A nonprofit business plan is the roadmap to your organization’s future. It lays out where your nonprofit currently stands in terms of organizational structure, finances and programs. Most importantly, it highlights your goals and how you aim to achieve them!

These goals should be reachable within the next 3-5 years—and flexible! Your nonprofit business plan is a living document, and should be regularly updated as priorities shift. The point of your plan is to remind you and your supporters what your organization is all about.

This document can be as short as one page if you’re just starting out, or much longer as your organization grows. As long as you have all the core elements of a business plan (which we’ll get into below!), you’re golden.

Why Your Nonprofit Needs a Business Plan

While some people might argue that a nonprofit business plan isn’t strictly necessary, it’s well worth your time to make!

Here are 5 benefits of writing a business plan:

Secure funding and grants

Did you know that businesses with a plan are far more likely to get funding than those that don’t have a plan? It’s true!

When donors, investors, foundations, granting bodies and volunteers see you have a clear plan, they’re more likely to trust you with their time and money. Plus, as you achieve the goals laid out in your plan, that trust will only grow.

Solidify your mission

In order to sell your mission, you have to know what it is. That might sound simple, but when you have big dreams and ideas, it’s easy to get lost in all of the possibilities!

Writing your business plan pushes you to express your mission in the most straightforward way possible. As the years go on and new opportunities and ideas arise, your business plan will guide you back to your original mission.

From there, you can figure out if you’ve lost the plot—or if it’s time to change the mission itself!

Set goals and milestones

The first step in achieving your goals is knowing exactly what they are. By highlighting your goals for the next 3-5 years—and naming their key milestones!—you can consistently check if you’re on track.

Nonprofit work is tough, and there will be points along the way where you wonder if you’re actually making a difference. With a nonprofit business plan in place, you can actually see how much you’ve achieved over the years.

Attract a board and volunteers

Getting volunteers and filling nonprofit board positions is essential to building out your organization’s team. Like we said before, a business plan builds trust and shows that your organization is legitimate. In fact, some boards of directors actually require a business plan in order for an organization to run!

An unfortunate truth is that many volunteers get taken advantage of . With a business plan in place, you can show that you’re coming from a place of professionalism.

Research and find opportunities

Writing a business plan requires some research!

Along the way, you’ll likely dig into information like:

- Who your ideal donor might be

- Where to find potential partners

- What your competitors are up to

- Which mentorships or grants are available for your organization

- What is the best business model for a nonprofit like yours

With this information in place, not only will you have a better nonprofit business model created—you’ll also have a more stable organization!

Free Nonprofit Business Plan Template

If you’re feeling uncertain about building a business plan from scratch, we’ve got you covered!

Here is a quick and simple free nonprofit business plan template.

Basic Format and Parts of a Business Plan

Now that you know what a business plan can do for your organization, let’s talk about what it actually contains!

Here are some key elements of a business plan:

First of all, you want to make sure your business plan follows best practices for formatting. After all, it’ll be available to your team, donors, board of directors, funding bodies and more!

Your nonprofit business plan should:

- Be consistent formatted

- Have standard margins

- Use a good sized font

- Keep the document to-the-point

- Include a page break after each section

- Be proofread

Curious about what each section of the document should look like?

Here are the essential parts of a business plan:

- Executive Summary: This is your nonprofit’s story—it’ll include your goals, as well as your mission, vision and values.

- Products, programs and services: This is where you show exactly what it is you’re doing. Highlight the programs and services you offer, and how they will benefit your community.

- Operations: This section describes your team, partnerships and all activities and requirements your day-to-day operations will include.

- Marketing : Your marketing plan will cover your market, market analyses and specific plans for how you will carry out your business plan with the public.

- Finances: This section covers an overview of your financial operations. It will include documents like your financial projections, fundraising plan , grants and more

- Appendix: Any additional useful information will be attached here.

We’ll get into these sections in more detail below!

How to Write a Nonprofit Business Plan in 12 Steps

Feeling ready to put your plan into action? Here’s how to write a business plan for a nonprofit in 12 simple steps!

1. Research the market

Take a look at what’s going on in your corner of the nonprofit sector. After all, you’re not the first organization to write a business plan!

- How your competitors’ business plans are structured

- What your beneficiaries are asking for

- Potential partners you’d like to reach

- Your target donors

- What information granting bodies and loan providers require

All of this information will show you what parts of your business plan should be given extra care. Sending out donor surveys, contacting financial institutions and connecting with your beneficiaries are a few tips to get your research going.

If you’re just getting started out, this can help guide you in naming your nonprofit something relevant, eye-catching and unique!

2. Write to your audience

Your business plan will be available for a whole bunch of people, including:

- Granting bodies

- Loan providers

- Prospective and current board members

Each of these audiences will be coming from different backgrounds, and looking at your business plan for different reasons. If you keep your nonprofit business plan accessible (minimal acronyms and industry jargon), you’ll be more likely to reach everyone.

If you’d like, it’s always possible to create a one page business plan AND a more detailed one. Then, you can provide the one that feels most useful to each audience!

3. Write your mission statement

Your mission statement defines how your organization aims to make a difference in the world. In one sentence, lay out why your nonprofit exists.

Here are a few examples of nonprofit mission statements:

- Watts of Love is a global solar lighting nonprofit bringing people the power to raise themselves out of the darkness of poverty.

- CoachArt creates a transformative arts and athletics community for families impacted by childhood chronic illness.

- The Trevor Project fights to end suicide among lesbian, gay, bisexual, transgender, queer, and questioning young people.

In a single sentence, each of these nonprofits defines exactly what it is their organization is doing, and who their work reaches. Offering this information at a glance is how you immediately hook your readers!

4. Describe your nonprofit

Now that your mission is laid out, show a little bit more about who you are and how you aim to carry out your mission. Expanding your mission statement to include your vision and values is a great way to kick this off!

Use this section to highlight:

- Your ideal vision for your community

- The guiding philosophy and values of your organization

- The purpose you were established to achieve

Don’t worry too much about the specifics here—we’ll get into those below! This description is simply meant to demonstrate the heart of your organization.

5. Outline management and organization

When you put together your business plan, you’ll want to describe the structure of your organization in the Operations section.

This will include information like:

- Team members (staff, board of directors , etc.)

- The specific type of nonprofit you’re running

If you’re already established, make a section for how you got started! This includes your origin story, your growth and the impressive nonprofit talent you’ve brought on over the years.

6. Describe programs, products and services

This information will have its own section in your nonprofit business plan—and for good reason!

It gives readers vital information about how you operate, including:

- The specifics of the work you do

- How that work helps your beneficiaries

- The resources that support the work (partnerships, facilities, volunteers, etc!)

- If you have a membership base or a subscription business model

Above all, highlight what needs your nonprofit meets and how it plans to continue meeting those needs. Really get into the details here! Emphasize the work of each and every program, and if you’re already established, note the real impact you’ve made.