Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Methodology

- Survey Research | Definition, Examples & Methods

Survey Research | Definition, Examples & Methods

Published on August 20, 2019 by Shona McCombes . Revised on June 22, 2023.

Survey research means collecting information about a group of people by asking them questions and analyzing the results. To conduct an effective survey, follow these six steps:

- Determine who will participate in the survey

- Decide the type of survey (mail, online, or in-person)

- Design the survey questions and layout

- Distribute the survey

- Analyze the responses

- Write up the results

Surveys are a flexible method of data collection that can be used in many different types of research .

Table of contents

What are surveys used for, step 1: define the population and sample, step 2: decide on the type of survey, step 3: design the survey questions, step 4: distribute the survey and collect responses, step 5: analyze the survey results, step 6: write up the survey results, other interesting articles, frequently asked questions about surveys.

Surveys are used as a method of gathering data in many different fields. They are a good choice when you want to find out about the characteristics, preferences, opinions, or beliefs of a group of people.

Common uses of survey research include:

- Social research : investigating the experiences and characteristics of different social groups

- Market research : finding out what customers think about products, services, and companies

- Health research : collecting data from patients about symptoms and treatments

- Politics : measuring public opinion about parties and policies

- Psychology : researching personality traits, preferences and behaviours

Surveys can be used in both cross-sectional studies , where you collect data just once, and in longitudinal studies , where you survey the same sample several times over an extended period.

Prevent plagiarism. Run a free check.

Before you start conducting survey research, you should already have a clear research question that defines what you want to find out. Based on this question, you need to determine exactly who you will target to participate in the survey.

Populations

The target population is the specific group of people that you want to find out about. This group can be very broad or relatively narrow. For example:

- The population of Brazil

- US college students

- Second-generation immigrants in the Netherlands

- Customers of a specific company aged 18-24

- British transgender women over the age of 50

Your survey should aim to produce results that can be generalized to the whole population. That means you need to carefully define exactly who you want to draw conclusions about.

Several common research biases can arise if your survey is not generalizable, particularly sampling bias and selection bias . The presence of these biases have serious repercussions for the validity of your results.

It’s rarely possible to survey the entire population of your research – it would be very difficult to get a response from every person in Brazil or every college student in the US. Instead, you will usually survey a sample from the population.

The sample size depends on how big the population is. You can use an online sample calculator to work out how many responses you need.

There are many sampling methods that allow you to generalize to broad populations. In general, though, the sample should aim to be representative of the population as a whole. The larger and more representative your sample, the more valid your conclusions. Again, beware of various types of sampling bias as you design your sample, particularly self-selection bias , nonresponse bias , undercoverage bias , and survivorship bias .

There are two main types of survey:

- A questionnaire , where a list of questions is distributed by mail, online or in person, and respondents fill it out themselves.

- An interview , where the researcher asks a set of questions by phone or in person and records the responses.

Which type you choose depends on the sample size and location, as well as the focus of the research.

Questionnaires

Sending out a paper survey by mail is a common method of gathering demographic information (for example, in a government census of the population).

- You can easily access a large sample.

- You have some control over who is included in the sample (e.g. residents of a specific region).

- The response rate is often low, and at risk for biases like self-selection bias .

Online surveys are a popular choice for students doing dissertation research , due to the low cost and flexibility of this method. There are many online tools available for constructing surveys, such as SurveyMonkey and Google Forms .

- You can quickly access a large sample without constraints on time or location.

- The data is easy to process and analyze.

- The anonymity and accessibility of online surveys mean you have less control over who responds, which can lead to biases like self-selection bias .

If your research focuses on a specific location, you can distribute a written questionnaire to be completed by respondents on the spot. For example, you could approach the customers of a shopping mall or ask all students to complete a questionnaire at the end of a class.

- You can screen respondents to make sure only people in the target population are included in the sample.

- You can collect time- and location-specific data (e.g. the opinions of a store’s weekday customers).

- The sample size will be smaller, so this method is less suitable for collecting data on broad populations and is at risk for sampling bias .

Oral interviews are a useful method for smaller sample sizes. They allow you to gather more in-depth information on people’s opinions and preferences. You can conduct interviews by phone or in person.

- You have personal contact with respondents, so you know exactly who will be included in the sample in advance.

- You can clarify questions and ask for follow-up information when necessary.

- The lack of anonymity may cause respondents to answer less honestly, and there is more risk of researcher bias.

Like questionnaires, interviews can be used to collect quantitative data: the researcher records each response as a category or rating and statistically analyzes the results. But they are more commonly used to collect qualitative data : the interviewees’ full responses are transcribed and analyzed individually to gain a richer understanding of their opinions and feelings.

Next, you need to decide which questions you will ask and how you will ask them. It’s important to consider:

- The type of questions

- The content of the questions

- The phrasing of the questions

- The ordering and layout of the survey

Open-ended vs closed-ended questions

There are two main forms of survey questions: open-ended and closed-ended. Many surveys use a combination of both.

Closed-ended questions give the respondent a predetermined set of answers to choose from. A closed-ended question can include:

- A binary answer (e.g. yes/no or agree/disagree )

- A scale (e.g. a Likert scale with five points ranging from strongly agree to strongly disagree )

- A list of options with a single answer possible (e.g. age categories)

- A list of options with multiple answers possible (e.g. leisure interests)

Closed-ended questions are best for quantitative research . They provide you with numerical data that can be statistically analyzed to find patterns, trends, and correlations .

Open-ended questions are best for qualitative research. This type of question has no predetermined answers to choose from. Instead, the respondent answers in their own words.

Open questions are most common in interviews, but you can also use them in questionnaires. They are often useful as follow-up questions to ask for more detailed explanations of responses to the closed questions.

The content of the survey questions

To ensure the validity and reliability of your results, you need to carefully consider each question in the survey. All questions should be narrowly focused with enough context for the respondent to answer accurately. Avoid questions that are not directly relevant to the survey’s purpose.

When constructing closed-ended questions, ensure that the options cover all possibilities. If you include a list of options that isn’t exhaustive, you can add an “other” field.

Phrasing the survey questions

In terms of language, the survey questions should be as clear and precise as possible. Tailor the questions to your target population, keeping in mind their level of knowledge of the topic. Avoid jargon or industry-specific terminology.

Survey questions are at risk for biases like social desirability bias , the Hawthorne effect , or demand characteristics . It’s critical to use language that respondents will easily understand, and avoid words with vague or ambiguous meanings. Make sure your questions are phrased neutrally, with no indication that you’d prefer a particular answer or emotion.

Ordering the survey questions

The questions should be arranged in a logical order. Start with easy, non-sensitive, closed-ended questions that will encourage the respondent to continue.

If the survey covers several different topics or themes, group together related questions. You can divide a questionnaire into sections to help respondents understand what is being asked in each part.

If a question refers back to or depends on the answer to a previous question, they should be placed directly next to one another.

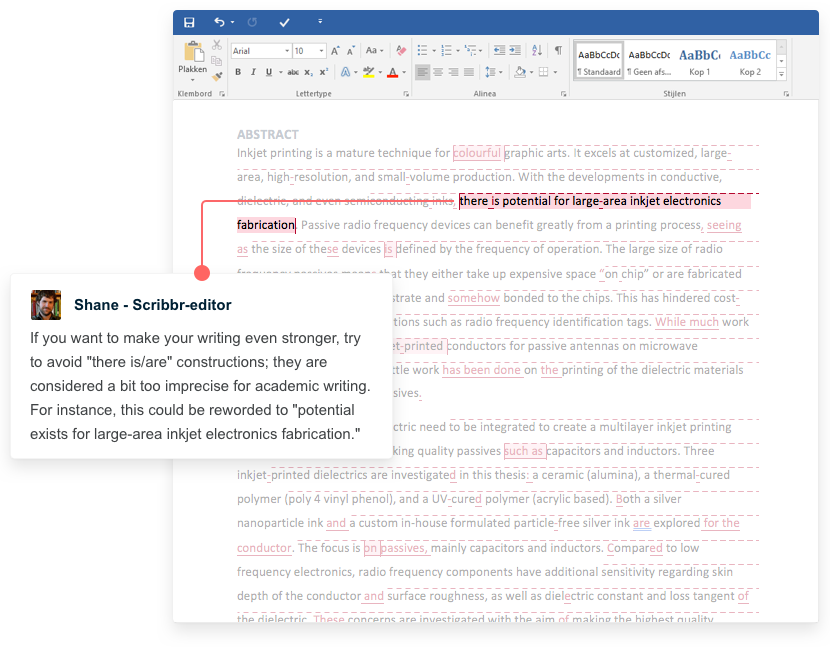

Receive feedback on language, structure, and formatting

Professional editors proofread and edit your paper by focusing on:

- Academic style

- Vague sentences

- Style consistency

See an example

Before you start, create a clear plan for where, when, how, and with whom you will conduct the survey. Determine in advance how many responses you require and how you will gain access to the sample.

When you are satisfied that you have created a strong research design suitable for answering your research questions, you can conduct the survey through your method of choice – by mail, online, or in person.

There are many methods of analyzing the results of your survey. First you have to process the data, usually with the help of a computer program to sort all the responses. You should also clean the data by removing incomplete or incorrectly completed responses.

If you asked open-ended questions, you will have to code the responses by assigning labels to each response and organizing them into categories or themes. You can also use more qualitative methods, such as thematic analysis , which is especially suitable for analyzing interviews.

Statistical analysis is usually conducted using programs like SPSS or Stata. The same set of survey data can be subject to many analyses.

Finally, when you have collected and analyzed all the necessary data, you will write it up as part of your thesis, dissertation , or research paper .

In the methodology section, you describe exactly how you conducted the survey. You should explain the types of questions you used, the sampling method, when and where the survey took place, and the response rate. You can include the full questionnaire as an appendix and refer to it in the text if relevant.

Then introduce the analysis by describing how you prepared the data and the statistical methods you used to analyze it. In the results section, you summarize the key results from your analysis.

In the discussion and conclusion , you give your explanations and interpretations of these results, answer your research question, and reflect on the implications and limitations of the research.

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Student’s t -distribution

- Normal distribution

- Null and Alternative Hypotheses

- Chi square tests

- Confidence interval

- Quartiles & Quantiles

- Cluster sampling

- Stratified sampling

- Data cleansing

- Reproducibility vs Replicability

- Peer review

- Prospective cohort study

Research bias

- Implicit bias

- Cognitive bias

- Placebo effect

- Hawthorne effect

- Hindsight bias

- Affect heuristic

- Social desirability bias

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analyzing data from people using questionnaires.

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviors. It is made up of 4 or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with 5 or 7 possible responses, to capture their degree of agreement.

Individual Likert-type questions are generally considered ordinal data , because the items have clear rank order, but don’t have an even distribution.

Overall Likert scale scores are sometimes treated as interval data. These scores are considered to have directionality and even spacing between them.

The type of data determines what statistical tests you should use to analyze your data.

The priorities of a research design can vary depending on the field, but you usually have to specify:

- Your research questions and/or hypotheses

- Your overall approach (e.g., qualitative or quantitative )

- The type of design you’re using (e.g., a survey , experiment , or case study )

- Your sampling methods or criteria for selecting subjects

- Your data collection methods (e.g., questionnaires , observations)

- Your data collection procedures (e.g., operationalization , timing and data management)

- Your data analysis methods (e.g., statistical tests or thematic analysis )

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

McCombes, S. (2023, June 22). Survey Research | Definition, Examples & Methods. Scribbr. Retrieved April 1, 2024, from https://www.scribbr.com/methodology/survey-research/

Is this article helpful?

Shona McCombes

Other students also liked, qualitative vs. quantitative research | differences, examples & methods, questionnaire design | methods, question types & examples, what is a likert scale | guide & examples, "i thought ai proofreading was useless but..".

I've been using Scribbr for years now and I know it's a service that won't disappoint. It does a good job spotting mistakes”

Dissertation surveys: Questions, examples, and best practices

Collect data for your dissertation with little effort and great results.

Dissertation surveys are one of the most powerful tools to get valuable insights and data for the culmination of your research. However, it’s one of the most stressful and time-consuming tasks you need to do. You want useful data from a representative sample that you can analyze and present as part of your dissertation. At SurveyPlanet, we’re committed to making it as easy and stress-free as possible to get the most out of your study.

With an intuitive and user-friendly design, our templates and premade questions can be your allies while creating a survey for your dissertation. Explore all the options we offer by simply signing up for an account—and leave the stress behind.

How to write dissertation survey questions

The first thing to do is to figure out which group of people is relevant for your study. When you know that, you’ll also be able to adjust the survey and write questions that will get the best results.

The next step is to write down the goal of your research and define it properly. Online surveys are one of the best and most inexpensive ways to reach respondents and achieve your goal.

Before writing any questions, think about how you’ll analyze the results. You don’t want to write and distribute a survey without keeping how to report your findings in mind. When your thesis questionnaire is out in the real world, it’s too late to conclude that the data you’re collecting might not be any good for assessment. Because of that, you need to create questions with analysis in mind.

You may find our five survey analysis tips for better insights helpful. We recommend reading it before analyzing your results.

Once you understand the parameters of your representative sample, goals, and analysis methodology, then it’s time to think about distribution. Survey distribution may feel like a headache, but you’ll find that many people will gladly participate.

Find communities where your targeted group hangs out and share the link to your survey with them. If you’re not sure how large your research sample should be, gauge it easily with the survey sample size calculator.

Need help with writing survey questions? Read our guide on well-written examples of good survey questions .

Dissertation survey examples

Whatever field you’re studying, we’re sure the following questions will prove useful when crafting your own.

At the beginning of every questionnaire, inform respondents of your topic and provide a consent form. After that, start with questions like:

- Please select your gender:

- What is the highest educational level you’ve completed?

- High school

- Bachelor degree

- Master’s degree

- On a scale of 1-7, how satisfied are you with your current job?

- Please rate the following statements:

- I always wait for people to text me first.

- Strongly Disagree

- Neither agree nor disagree

- Strongly agree

- My friends always complain that I never invite them anywhere.

- I prefer spending time alone.

- Rank which personality traits are most important when choosing a partner. Rank 1 - 7, where 1 is the most and 7 is the least important.

- Flexibility

- Independence

- How openly do you share feelings with your partner?

- Almost never

- Almost always

- In the last two weeks, how often did you experience headaches?

Dissertation survey best practices

There are a lot of DOs and DON’Ts you should keep in mind when conducting any survey, especially for your dissertation. To get valuable data from your targeted sample, follow these best practices:

Use the consent form.

The consent form is a must when distributing a research questionnaire. A respondent has to know how you’ll use their answers and that the survey is anonymous.

Avoid leading and double-barreled questions

Leading and double-barreled questions will produce inconclusive results—and you don’t want that. A question such as: “Do you like to watch TV and play video games?” is double-barreled because it has two variables.

On the other hand, leading questions such as “On a scale from 1-10 how would you rate the amazing experience with our customer support?” influence respondents to answer in a certain way, which produces biased results.

Use easy and straightforward language and questions

Don’t use terms and professional jargon that respondents won’t understand. Take into consideration their educational level and demographic traits and use easy-to-understand language when writing questions.

Mix close-ended and open-ended questions

Too many open-ended questions will annoy respondents. Also, analyzing the responses is harder. Use more close-ended questions for the best results and only a few open-ended ones.

Strategically use different types of responses

Likert scale, multiple-choice, and ranking are all types of responses you can use to collect data. But some response types suit some questions better. Make sure to strategically fit questions with response types.

Ensure that data privacy is a priority

Make sure to use an online survey tool that has SSL encryption and secure data processing. You don’t want to risk all your hard work going to waste because of poorly managed data security. Ensure that you only collect data that’s relevant to your dissertation survey and leave out any questions (such as name) that can identify the respondents.

Create dissertation questionnaires with SurveyPlanet

Overall, survey methodology is a great way to find research participants for your research study. You have all the tools required for creating a survey for a dissertation with SurveyPlanet—you only need to sign up . With powerful features like question branching, custom formatting, multiple languages, image choice questions, and easy export you will find everything needed to create, distribute, and analyze a dissertation survey.

Happy data gathering!

Sign up now

Free unlimited surveys, questions and responses.

Quantitative Research

Qualitative research.

- Free plan, no time limit

- Set up in minutes

- No credit card required

7+ Reasons to Use Surveys in Your Dissertation

Writing a dissertation is a serious milestone. Your degree depends on it, so it takes a lot of effort and time to figure out what direction to choose. Everything starts with the topic: you read background literature, consult with your supervisor and seek approval before you start writing the first draft. After that, you need to decide how you will collect the data that is supposed to contribute to the research field.

This is where it gets complicated. If you have never tried conducting primary research (i.e. working with human subjects), it can seem quite scary. Analyzing articles may sound like the safest and the coolest option. Yet, there might not be enough information for you to claim that your research is somehow novel.

To make sure it is, you might need to conduct primary research, and the survey method is the most widespread tool to do that. The number of advantages surveys present is huge. However, there are various perks depending on what approach you pursue. So, let’s go through all of them before you decide to pay for essay and order a dissertation that will go on and on about analyzing literature and nothing else except it.

In the quantitative primary research, students have to calculate the data received from typical a, b, c, d questionnaires. The latter provides precise answers and helps prove or reject the formulated hypothesis. For the research to be legit, there are several stages to go through like:

- Discarding irrelevant or subjective questions/answers included in questionnaires.

- Setting criteria for credible answers.

- Composing an explanation of how you will manage ethical concerns (for participants and university committee).

However, all this is done to prevent issues in the future. Provided you have taken care of all the points above, you will get to enjoy the following benefits.

Data Collection Is Less Tedious

There are numerous services, like Survey Monkey, that the best write my essay services use. It can help you distribute your questionnaire among potential participants. These platforms simplify the data collection process. You don’t have to arrange calls or convince someone that they can safely share the information. Just upload the consent letter each participant has to sign and let the platform guide them further.

Data Analysis Is Fast

In quantitative analysis, all you have to take care of is mainly data entry. It requires focus and accuracy, but the rest can be done with the help of software. Whether it’s ordinary Excel or something like SPSS, you don’t have to reread loads of text. Just make sure you download the collected data from the platform correctly, remove irrelevant fields, and feed the rest to your computer.

Numbers Rule

Numbers don’t lie (unless you miscalculated them, of course). They give a clear answer: it’s either ‘yes’ or ‘no’. Moreover, they leave more room for creating good visuals and making your paper less boring. Just make sure you explain the numbers properly and compare the results between various graphs and charts.

No Room For Subjectivity

A quantitative dissertation is mostly a technical paper. It’s not about creativity and your ability to impress like in admission essays students usually delegate to admission essay writing services to avoid babbling about things they deem senseless. It’s about following particular procedures. And there is also a less abstract analysis.

Qualitative-oriented surveys are about conducting full-fledged personal interviews, working with focus groups, or distributing open-ended questionnaires requiring short but unique answers. Let’s talk about what makes this approach worth trying!

First-Hand Experience

The ability to gain a unique perspective is what distinguishes interviews from other surveys. Close-ended questions may be too rigid and make participants omit a lot of information that might help the research. In an interview, you may also correct some of your questions, and add more details to them, thus improving the outcomes.

More Diverse and Honest Answers

When participants are limited by only several options, they might choose something they cannot fully relate to. So, there is no guarantee that the results will be authentic. Meanwhile, with open-ended questions, participants share a lot of details.

Sure, some of them may be less relevant to your topic, but the researcher gains a deeper understanding of the issues lying beneath the topic. Of course, all of it is guaranteed only if the researcher provides anonymity and a safe space for the interviewees to share their thoughts freely.

No Need For Complex Software

In contrast to quantitative analysis, here, you won’t have to use formulae and learn how to perform complex tests. You might not even need Excel, except for storing some data about your participants. However, no calculations will be needed, which is also a relief for those who are not used to working with such kind of data.

Both types of research have also other advantages:

- With surveys, you have more chances to fill the literature gap you’ve discovered.

- Primary research may not be quite easy, but it’s highly valued at the doctoral level of education.

- You receive a lot of new information and stay away from retelling literature that has been published before.

- Primary research is less boring.

However, there is a must-remember thing: not every supervisor or university committee approves of surveys and primary research in general. It depends on numerous aspects like topic and subject, the conditions of research, your approach to handling human subjects, etc.

It means that the methodology you are going to use should be approved by your professor first. Otherwise, you may have to discard some parts of your draft and lose time gathering data you won’t be able to use. So, take care and good luck!

7+ Reasons to Use Surveys in Your Dissertation FAQ

What are the benefits of using surveys in a dissertation, surveys can provide a large amount of data in a short amount of time, they are cost-effective and can allow for anonymity, they can reach a wide audience, and they can be used to obtain feedback from the participants., how can i ensure that my survey results are accurate, make sure to ask questions that are clear and concise and that there are no bias in the questions. make sure to have a good sample size and to have a response rate that is high enough to provide accurate results., how can i analyze the survey results, depending on the type of survey, there are various analysis techniques that can be used. these include descriptive statistics, inferential statistics, correlation analysis, and regression analysis., what are the limitations of surveys, surveys can be subject to sampling errors, response bias, and interviewer effects. they may also not be able to capture the full range of opinions and attitudes of the population., like what you see share with a friend..

Sarath Shyamson

Sarath Shyamson is the customer success person at BlockSurvey and also heads the outreach. He enjoys volunteering for the church choir and loves spending time with his two year old son.

Related articles

A/b testing calculator for statistical significance.

Anounymous Feedback: A How to guide

A Beginner's Guide to Non-Profit Marketing: Learn the Tips, Best practices and 7 best Marketing Strategies for your NPO

4 Major Benefits of Incorporating Online Survey Tools Into the Classroom

7 best demographic questions to enhance the quality of your survey

Confidential survey vs Anonymous survey - How to decide on that

Conjoint analysis: Definition and How it can be used in your surveys

Cross-Tabulation Analysis: How to use it in your surveys?

What is Data Masking- Why it is essential to maintain the anonymity of a survey

The Art of Effective Survey Questions Design: Everything You Need to Know to Survey Students the Right Way

Focus group survey Vs Online survey: How to choose the best method for your Market Research

How Employee Satisfaction Affects Company's Financial Performance

How to create an anonymous survey

How to identify if the survey is anonymous or not

A Simple and Easy guide to understand: When and How to use Surveys in Psychology

How to write a survey introduction that motivates respondents to fill it out

Survey and Question Design: How to Make a Perfect Statistical Survey

Matrix Questions: Definition and How to use it in survey

Maxdiff analysis: Definition, Example and How to use it

How to Maximize Data Collection Efficiency with Web 3.0 Surveys?

Empowering Prevention: Leveraging Online Surveys to Combat School Shootings

Optimizing Survey Results: Advanced Editing And Reporting Techniques

Enhancing Student Engagement and Learning with Online Surveys

Student survey questions that will provide valuable feedback

Preparing Students for the Future: The Role of Technology in Education

When It’s Best To Use Surveys For A Dissertation & How To Ensure Anonymity?

Which Pricing Strategy Should You Choose for Your Product? A Van Westendorp Analysis

Want to create Anonymous survey in Facebook??- Know why you can't

How To Write The Results/Findings Chapter

For quantitative studies (dissertations & theses).

By: Derek Jansen (MBA). Expert Reviewed By: Kerryn Warren (PhD) | July 2021

So, you’ve completed your quantitative data analysis and it’s time to report on your findings. But where do you start? In this post, we’ll walk you through the results chapter (also called the findings or analysis chapter), step by step, so that you can craft this section of your dissertation or thesis with confidence. If you’re looking for information regarding the results chapter for qualitative studies, you can find that here .

Overview: Quantitative Results Chapter

- What exactly the results/findings/analysis chapter is

- What you need to include in your results chapter

- How to structure your results chapter

- A few tips and tricks for writing top-notch chapter

What exactly is the results chapter?

The results chapter (also referred to as the findings or analysis chapter) is one of the most important chapters of your dissertation or thesis because it shows the reader what you’ve found in terms of the quantitative data you’ve collected. It presents the data using a clear text narrative, supported by tables, graphs and charts. In doing so, it also highlights any potential issues (such as outliers or unusual findings) you’ve come across.

But how’s that different from the discussion chapter?

Well, in the results chapter, you only present your statistical findings. Only the numbers, so to speak – no more, no less. Contrasted to this, in the discussion chapter , you interpret your findings and link them to prior research (i.e. your literature review), as well as your research objectives and research questions . In other words, the results chapter presents and describes the data, while the discussion chapter interprets the data.

Let’s look at an example.

In your results chapter, you may have a plot that shows how respondents to a survey responded: the numbers of respondents per category, for instance. You may also state whether this supports a hypothesis by using a p-value from a statistical test. But it is only in the discussion chapter where you will say why this is relevant or how it compares with the literature or the broader picture. So, in your results chapter, make sure that you don’t present anything other than the hard facts – this is not the place for subjectivity.

It’s worth mentioning that some universities prefer you to combine the results and discussion chapters. Even so, it is good practice to separate the results and discussion elements within the chapter, as this ensures your findings are fully described. Typically, though, the results and discussion chapters are split up in quantitative studies. If you’re unsure, chat with your research supervisor or chair to find out what their preference is.

What should you include in the results chapter?

Following your analysis, it’s likely you’ll have far more data than are necessary to include in your chapter. In all likelihood, you’ll have a mountain of SPSS or R output data, and it’s your job to decide what’s most relevant. You’ll need to cut through the noise and focus on the data that matters.

This doesn’t mean that those analyses were a waste of time – on the contrary, those analyses ensure that you have a good understanding of your dataset and how to interpret it. However, that doesn’t mean your reader or examiner needs to see the 165 histograms you created! Relevance is key.

How do I decide what’s relevant?

At this point, it can be difficult to strike a balance between what is and isn’t important. But the most important thing is to ensure your results reflect and align with the purpose of your study . So, you need to revisit your research aims, objectives and research questions and use these as a litmus test for relevance. Make sure that you refer back to these constantly when writing up your chapter so that you stay on track.

As a general guide, your results chapter will typically include the following:

- Some demographic data about your sample

- Reliability tests (if you used measurement scales)

- Descriptive statistics

- Inferential statistics (if your research objectives and questions require these)

- Hypothesis tests (again, if your research objectives and questions require these)

We’ll discuss each of these points in more detail in the next section.

Importantly, your results chapter needs to lay the foundation for your discussion chapter . This means that, in your results chapter, you need to include all the data that you will use as the basis for your interpretation in the discussion chapter.

For example, if you plan to highlight the strong relationship between Variable X and Variable Y in your discussion chapter, you need to present the respective analysis in your results chapter – perhaps a correlation or regression analysis.

Need a helping hand?

How do I write the results chapter?

There are multiple steps involved in writing up the results chapter for your quantitative research. The exact number of steps applicable to you will vary from study to study and will depend on the nature of the research aims, objectives and research questions . However, we’ll outline the generic steps below.

Step 1 – Revisit your research questions

The first step in writing your results chapter is to revisit your research objectives and research questions . These will be (or at least, should be!) the driving force behind your results and discussion chapters, so you need to review them and then ask yourself which statistical analyses and tests (from your mountain of data) would specifically help you address these . For each research objective and research question, list the specific piece (or pieces) of analysis that address it.

At this stage, it’s also useful to think about the key points that you want to raise in your discussion chapter and note these down so that you have a clear reminder of which data points and analyses you want to highlight in the results chapter. Again, list your points and then list the specific piece of analysis that addresses each point.

Next, you should draw up a rough outline of how you plan to structure your chapter . Which analyses and statistical tests will you present and in what order? We’ll discuss the “standard structure” in more detail later, but it’s worth mentioning now that it’s always useful to draw up a rough outline before you start writing (this advice applies to any chapter).

Step 2 – Craft an overview introduction

As with all chapters in your dissertation or thesis, you should start your quantitative results chapter by providing a brief overview of what you’ll do in the chapter and why . For example, you’d explain that you will start by presenting demographic data to understand the representativeness of the sample, before moving onto X, Y and Z.

This section shouldn’t be lengthy – a paragraph or two maximum. Also, it’s a good idea to weave the research questions into this section so that there’s a golden thread that runs through the document.

Step 3 – Present the sample demographic data

The first set of data that you’ll present is an overview of the sample demographics – in other words, the demographics of your respondents.

For example:

- What age range are they?

- How is gender distributed?

- How is ethnicity distributed?

- What areas do the participants live in?

The purpose of this is to assess how representative the sample is of the broader population. This is important for the sake of the generalisability of the results. If your sample is not representative of the population, you will not be able to generalise your findings. This is not necessarily the end of the world, but it is a limitation you’ll need to acknowledge.

Of course, to make this representativeness assessment, you’ll need to have a clear view of the demographics of the population. So, make sure that you design your survey to capture the correct demographic information that you will compare your sample to.

But what if I’m not interested in generalisability?

Well, even if your purpose is not necessarily to extrapolate your findings to the broader population, understanding your sample will allow you to interpret your findings appropriately, considering who responded. In other words, it will help you contextualise your findings . For example, if 80% of your sample was aged over 65, this may be a significant contextual factor to consider when interpreting the data. Therefore, it’s important to understand and present the demographic data.

Step 4 – Review composite measures and the data “shape”.

Before you undertake any statistical analysis, you’ll need to do some checks to ensure that your data are suitable for the analysis methods and techniques you plan to use. If you try to analyse data that doesn’t meet the assumptions of a specific statistical technique, your results will be largely meaningless. Therefore, you may need to show that the methods and techniques you’ll use are “allowed”.

Most commonly, there are two areas you need to pay attention to:

#1: Composite measures

The first is when you have multiple scale-based measures that combine to capture one construct – this is called a composite measure . For example, you may have four Likert scale-based measures that (should) all measure the same thing, but in different ways. In other words, in a survey, these four scales should all receive similar ratings. This is called “ internal consistency ”.

Internal consistency is not guaranteed though (especially if you developed the measures yourself), so you need to assess the reliability of each composite measure using a test. Typically, Cronbach’s Alpha is a common test used to assess internal consistency – i.e., to show that the items you’re combining are more or less saying the same thing. A high alpha score means that your measure is internally consistent. A low alpha score means you may need to consider scrapping one or more of the measures.

#2: Data shape

The second matter that you should address early on in your results chapter is data shape. In other words, you need to assess whether the data in your set are symmetrical (i.e. normally distributed) or not, as this will directly impact what type of analyses you can use. For many common inferential tests such as T-tests or ANOVAs (we’ll discuss these a bit later), your data needs to be normally distributed. If it’s not, you’ll need to adjust your strategy and use alternative tests.

To assess the shape of the data, you’ll usually assess a variety of descriptive statistics (such as the mean, median and skewness), which is what we’ll look at next.

Step 5 – Present the descriptive statistics

Now that you’ve laid the foundation by discussing the representativeness of your sample, as well as the reliability of your measures and the shape of your data, you can get started with the actual statistical analysis. The first step is to present the descriptive statistics for your variables.

For scaled data, this usually includes statistics such as:

- The mean – this is simply the mathematical average of a range of numbers.

- The median – this is the midpoint in a range of numbers when the numbers are arranged in order.

- The mode – this is the most commonly repeated number in the data set.

- Standard deviation – this metric indicates how dispersed a range of numbers is. In other words, how close all the numbers are to the mean (the average).

- Skewness – this indicates how symmetrical a range of numbers is. In other words, do they tend to cluster into a smooth bell curve shape in the middle of the graph (this is called a normal or parametric distribution), or do they lean to the left or right (this is called a non-normal or non-parametric distribution).

- Kurtosis – this metric indicates whether the data are heavily or lightly-tailed, relative to the normal distribution. In other words, how peaked or flat the distribution is.

A large table that indicates all the above for multiple variables can be a very effective way to present your data economically. You can also use colour coding to help make the data more easily digestible.

For categorical data, where you show the percentage of people who chose or fit into a category, for instance, you can either just plain describe the percentages or numbers of people who responded to something or use graphs and charts (such as bar graphs and pie charts) to present your data in this section of the chapter.

When using figures, make sure that you label them simply and clearly , so that your reader can easily understand them. There’s nothing more frustrating than a graph that’s missing axis labels! Keep in mind that although you’ll be presenting charts and graphs, your text content needs to present a clear narrative that can stand on its own. In other words, don’t rely purely on your figures and tables to convey your key points: highlight the crucial trends and values in the text. Figures and tables should complement the writing, not carry it .

Depending on your research aims, objectives and research questions, you may stop your analysis at this point (i.e. descriptive statistics). However, if your study requires inferential statistics, then it’s time to deep dive into those .

Step 6 – Present the inferential statistics

Inferential statistics are used to make generalisations about a population , whereas descriptive statistics focus purely on the sample . Inferential statistical techniques, broadly speaking, can be broken down into two groups .

First, there are those that compare measurements between groups , such as t-tests (which measure differences between two groups) and ANOVAs (which measure differences between multiple groups). Second, there are techniques that assess the relationships between variables , such as correlation analysis and regression analysis. Within each of these, some tests can be used for normally distributed (parametric) data and some tests are designed specifically for use on non-parametric data.

There are a seemingly endless number of tests that you can use to crunch your data, so it’s easy to run down a rabbit hole and end up with piles of test data. Ultimately, the most important thing is to make sure that you adopt the tests and techniques that allow you to achieve your research objectives and answer your research questions .

In this section of the results chapter, you should try to make use of figures and visual components as effectively as possible. For example, if you present a correlation table, use colour coding to highlight the significance of the correlation values, or scatterplots to visually demonstrate what the trend is. The easier you make it for your reader to digest your findings, the more effectively you’ll be able to make your arguments in the next chapter.

Step 7 – Test your hypotheses

If your study requires it, the next stage is hypothesis testing. A hypothesis is a statement , often indicating a difference between groups or relationship between variables, that can be supported or rejected by a statistical test. However, not all studies will involve hypotheses (again, it depends on the research objectives), so don’t feel like you “must” present and test hypotheses just because you’re undertaking quantitative research.

The basic process for hypothesis testing is as follows:

- Specify your null hypothesis (for example, “The chemical psilocybin has no effect on time perception).

- Specify your alternative hypothesis (e.g., “The chemical psilocybin has an effect on time perception)

- Set your significance level (this is usually 0.05)

- Calculate your statistics and find your p-value (e.g., p=0.01)

- Draw your conclusions (e.g., “The chemical psilocybin does have an effect on time perception”)

Finally, if the aim of your study is to develop and test a conceptual framework , this is the time to present it, following the testing of your hypotheses. While you don’t need to develop or discuss these findings further in the results chapter, indicating whether the tests (and their p-values) support or reject the hypotheses is crucial.

Step 8 – Provide a chapter summary

To wrap up your results chapter and transition to the discussion chapter, you should provide a brief summary of the key findings . “Brief” is the keyword here – much like the chapter introduction, this shouldn’t be lengthy – a paragraph or two maximum. Highlight the findings most relevant to your research objectives and research questions, and wrap it up.

Some final thoughts, tips and tricks

Now that you’ve got the essentials down, here are a few tips and tricks to make your quantitative results chapter shine:

- When writing your results chapter, report your findings in the past tense . You’re talking about what you’ve found in your data, not what you are currently looking for or trying to find.

- Structure your results chapter systematically and sequentially . If you had two experiments where findings from the one generated inputs into the other, report on them in order.

- Make your own tables and graphs rather than copying and pasting them from statistical analysis programmes like SPSS. Check out the DataIsBeautiful reddit for some inspiration.

- Once you’re done writing, review your work to make sure that you have provided enough information to answer your research questions , but also that you didn’t include superfluous information.

If you’ve got any questions about writing up the quantitative results chapter, please leave a comment below. If you’d like 1-on-1 assistance with your quantitative analysis and discussion, check out our hands-on coaching service , or book a free consultation with a friendly coach.

Psst… there’s more (for free)

This post is part of our dissertation mini-course, which covers everything you need to get started with your dissertation, thesis or research project.

You Might Also Like:

Thank you. I will try my best to write my results.

Awesome content 👏🏾

this was great explaination

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Want to Get your Dissertation Accepted?

Discover how we've helped doctoral students complete their dissertations and advance their academic careers!

Join 200+ Graduated Students

Get Your Dissertation Accepted On Your Next Submission

Get customized coaching for:.

- Crafting your proposal,

- Collecting and analyzing your data, or

- Preparing your defense.

Trapped in dissertation revisions?

Survey vs. questionnaire: what’s the difference, published by branford mcallister on march 11, 2022 march 11, 2022.

Last Updated on: 29th August 2022, 08:09 am

Surveys are very common and effective (mostly) in scholarly research. They are an excellent way to collect data related to human behavior and opinions. And, a survey can support both qualitative and quantitative research and analysis.

In this article I explain the differences between surveys and questionnaires, discuss sampling, and talk about considerations for each of these concepts.

Survey vs. Questionnaire

Yes, there is a difference! A questionnaire is an instrument (like an interview protocol, an observation plan, or an experiment)—a written set of questions.

Survey is a broader term that encompasses both the instrument (questionnaire) and the process of employing the instrument—collecting and analyzing the responses from those questions.

So, you might say, the questionnaire is one component of the survey. Planning a survey is a different task from constructing a questionnaire. The potential errors and bias, and their impacts on reliability are different.

- In surveys, we’re concerned with coverage error (ensuring all prospective groups or characteristics have an opportunity to participate to avoid selection bias ), and nonresponse error (low response rate).

- For questionnaires, we’re concerned with clarity, length, and construct validity , which relates to measurement error (accurately measuring the constructs the questionnaire purports to measure).

Why Is This Difference Important?

Terms matter, and using them properly contributes to your credibility. And, from a practical perspective, understanding the tasks ensures that your research is rigorous, unbiased, and valid. The reliability of your research depends on how you handle both the questionnaire and the survey, and the reliability issues are different for each.

So, let’s delve into each in a little more detail.

Survey Research

The survey is the overall process of using a questionnaire to collect data.

There are some very important considerations when choosing the survey method. Any choice about your research methodology should fit the purpose and the research objectives. These questions should take you in the right direction:

- What is your research problem?

- What’s the gap in the current research?

- What must you learn to address that research question?

- What kind of data do you need?

- What’s the population about which you wish to infer some attribute?

- What method best generates those data? Quantitative or qualitative research? Survey, interviews, observation, experiment?

Once you choose the survey method, then the next set of questions help scope your effort. Needless to say, especially for busy, starving, stressed students, there are real-world constraints in terms of costs, time, and effort (which is why we sample).

- How much time do you have?

- How much money do you have to invest in it?

- How feasible is your plan? Can you reach members of the population? Are there any insurmountable hurdles to reaching your population?

You have options:

- Self-administered survey using mail or hand-delivery?

- Internet-based?

- Access your population through a professional or social group, association, or online social media platform (LinkedIn, Facebook)?

- Use a survey service (e.g., SurveyMonkey)?

There are advantages and disadvantages to each option. While self-administered surveys provide control and flexibility, they suffer from low response rates and potentially high costs. A service may guarantee a specified sample size of respondents who meet your criteria, and may help construct the questionnaire. But, they also incur some costs to the researcher. Using an association leads to convenience sampling (discussed a bit later).

Once you decide on the survey mode, many of your considerations relate to choosing or designing an instrument, or with sampling. Let’s tackle sampling now.

Sampling is a very important aspect of survey research (and, for that matter, most scholarly research). Some simple definitions:

- Sampling : It would be great to obtain data for the entire population. But, due to constraints on resources, you may need to sample and infer characteristics of the entire population.

- Population : The entire set of all objects (or participants) sharing characteristics or qualifications (e.g., all undergraduate students in the U.S.); and to which the researcher intends to infer something of interest.

- Target population : A subset of the population, delimited by some additional characteristics (e.g., undergraduate students in public universities); or, feasibility or access issue.

- Sample frame : The subset of the target population from which an actual sample will be drawn, to which the researcher has access (e.g., undergraduate students in California state universities). The sample frame may be the same as the target population.

- Sample : A subset of the sample frame—those who meet the participant criteria and are contacted to complete the questionnaire; selection is based on a sampling technique (e.g., random sample of candidates within the sample frame).

- Participant criteria : The people who comprise your sample must meet the criteria (characteristics and qualifications) you establish.

Sampling Techniques

- The purest form of sampling is a completely random sample from the sample frame. This requires the researcher to develop some mechanism for randomly selecting participants (or rely on a service to do it).

- Convenience sampling is using a mechanism to contact qualified candidates in the sample frame, such as LinkedIn; or people attending a conference.

- Stratified sampling divides the target population and sample frame into distinct cells: combinations of attributes (e.g., race, gender) proportionate to the population; then samples randomly within the cells.

A final consideration, no matter what sampling technique you use: How you will find and contact participants?

Sample Size

In quantitative studies for which you will test hypotheses and make inferences about population attributes, there are online tools to compute minimum sample size, including G*Power . Here’s an example:

Say you’re comparing GRE scores by race and gender, using ANOVA, medium effect size, α = .05, power = .90. Using G*Power, you compute a minimum sample size of n min = 270.

Hack Your Dissertation

5-Day Mini Course: How to Finish Faster With Less Stress

Interested in more helpful tips about improving your dissertation experience? Join our 5-day mini course by email!

Overcoming Response Error

With a minimum sample size ( n min ) calculated, you must ensure that either the survey service obtains the minimum sample size, or you must send out a sufficient number of questionnaires to account for the response rate . AND, you should consider the likelihood of incomplete, invalid, or corrupted questionnaires.

Continuing with the example:

Survey response rate (from a similar study documented in a journal article) is 30%. Rate of corrupted, incomplete, invalid questionnaires is 10%.

n min = 270 (min required sample size of valid questionnaires)

270 = .90 × n 2 ⇒ n 2 = 300 ( n 2 is the number of questionnaire returned)

300 = .30 × n 3 ⇒ n 3 = 1000 ( n 3 is the number of questionnaires sent out)

So, to ensure you have the minimum number of valid, complete questionnaires (270), you would need to send out 1000 questionnaires to prospective participants.

Minimum Sample Size

Some survey services may guarantee your minimum sample size. But, ( huge point! ), be sure to consider the rate of questionnaire validity, and call that the minimum sample size for the survey service .

There’s little you can do after data collection to obtain more data if later you find that some of it is corrupt. And, it’s tragic to get to data analysis only to find out your sample is too small.

Let’s turn now to the instrument used in the survey method.

Questionnaires

The style of a questionnaire should fit the purpose and the research objectives. That means, using the kind of vocabulary that your target population is comfortable with. And, choosing a format that serves your data collection needs.

Here are some considerations:

- In either case, you must provide evidence of instrument validity, and the details of development and purpose and prior use. If previously used, this information should be available in a citable source.

- One measurement of internal construct validity is Cronbach’s alpha. For off-the-shelf questionnaires, did the author report Cronbach’s alpha? If self-developed, you as the researcher must report on Cronbach’s alpha.

- For self-developed questionnaires, perform a pilot study of your instrument to ensure it is understandable, with no confusing questions or potential bias; that the length is appropriate; and to compute Cronbach’s alpha.

- Provide an introduction to your study, which is clear and professional, and addresses your purpose.

- Consider return envelopes and postage, anonymity of the participants, deadlines, and incentives. ( Another important point! Consider the Institutional Review Board [IRB] policies for any agency with a stake in the research, such as a university or an organization targeted for a survey.)

- Will it be cross-sectional (one point in time across sample frame) or longitudinal (data collected over time)?

- If a structured questionnaire, what kind of responses are needed, which determines what kind of scale?

- Will the responses be categorical/nominal? Dichotomous (e.g., yes or no)? Ordinal (such as a Likert scale)? Or numerical (a measured or counted quantity such as age or test scores)?

- When writing the questions, consider objectivity and avoid language or questions that might be perceived to be biased.

- Consider complexity and length of time to complete.

- Use consistent ordinal responses (positive is high and negative is low); or reverse scoring will be needed.

Survey vs. Questionnaire: What’s It All Mean?

Surveys and questionnaires are different animals. A questionnaire is a component of a survey. And, there are different considerations for each, different sources of error and bias, impacting reliability and validity.

But, why is this all important?

The survey method, with a properly designed questionnaire and rigorous sampling, is very useful in scholarly research.

Performing good survey research boils down to these three principles:

- The purpose of the research, which drives research methodology, the survey process, and the questionnaire as a data collection instrument.

- Rigorous planning for each component of that research, to meticulously address each potential source of bias and error.

- Disciplined execution to obtain, through sampling, a valid data set and to perform analysis to make inferences about the population.

Happy surveying!

Branford McAllister

Branford McAllister received his PhD from Walden University in 2005. He has been an instructor and PhD mentor for the University of Phoenix, Baker College, and Walden University; and a professor and lecturer on military strategy and operations at the National Defense University. He has technical and management experience in the military and private sector, has research interests related to leadership, and is an expert in advanced quantitative analysis techniques. He is passionately committed to mentoring students in post-secondary educational programs. Book a Free Consultation with Branford McAllister

Related Posts

Dissertation

What makes a good research question.

Creating a good research question is vital to successfully completing your dissertation. Here are some tips that will help you formulate a good research question. What Makes a Good Research Question? These are the three Read more…

Dissertation Structure

When it comes to writing a dissertation, one of the most fraught questions asked by graduate students is about dissertation structure. A dissertation is the lengthiest writing project that many graduate students ever undertake, and Read more…

Choosing a Dissertation Chair

Choosing your dissertation chair is one of the most important decisions that you’ll make in graduate school. Your dissertation chair will in many ways shape your experience as you undergo the most rigorous intellectual challenge Read more…

Make This Your Last Round of Dissertation Revision.

Learn How to Get Your Dissertation Accepted .

Discover the 5-Step Process in this Free Webinar .

Almost there!

Please verify your email address by clicking the link in the email message we just sent to your address.

If you don't see the message within the next five minutes, be sure to check your spam folder :).

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- J Adv Pract Oncol

- v.6(2); Mar-Apr 2015

Understanding and Evaluating Survey Research

A variety of methodologic approaches exist for individuals interested in conducting research. Selection of a research approach depends on a number of factors, including the purpose of the research, the type of research questions to be answered, and the availability of resources. The purpose of this article is to describe survey research as one approach to the conduct of research so that the reader can critically evaluate the appropriateness of the conclusions from studies employing survey research.

SURVEY RESEARCH

Survey research is defined as "the collection of information from a sample of individuals through their responses to questions" ( Check & Schutt, 2012, p. 160 ). This type of research allows for a variety of methods to recruit participants, collect data, and utilize various methods of instrumentation. Survey research can use quantitative research strategies (e.g., using questionnaires with numerically rated items), qualitative research strategies (e.g., using open-ended questions), or both strategies (i.e., mixed methods). As it is often used to describe and explore human behavior, surveys are therefore frequently used in social and psychological research ( Singleton & Straits, 2009 ).

Information has been obtained from individuals and groups through the use of survey research for decades. It can range from asking a few targeted questions of individuals on a street corner to obtain information related to behaviors and preferences, to a more rigorous study using multiple valid and reliable instruments. Common examples of less rigorous surveys include marketing or political surveys of consumer patterns and public opinion polls.

Survey research has historically included large population-based data collection. The primary purpose of this type of survey research was to obtain information describing characteristics of a large sample of individuals of interest relatively quickly. Large census surveys obtaining information reflecting demographic and personal characteristics and consumer feedback surveys are prime examples. These surveys were often provided through the mail and were intended to describe demographic characteristics of individuals or obtain opinions on which to base programs or products for a population or group.

More recently, survey research has developed into a rigorous approach to research, with scientifically tested strategies detailing who to include (representative sample), what and how to distribute (survey method), and when to initiate the survey and follow up with nonresponders (reducing nonresponse error), in order to ensure a high-quality research process and outcome. Currently, the term "survey" can reflect a range of research aims, sampling and recruitment strategies, data collection instruments, and methods of survey administration.

Given this range of options in the conduct of survey research, it is imperative for the consumer/reader of survey research to understand the potential for bias in survey research as well as the tested techniques for reducing bias, in order to draw appropriate conclusions about the information reported in this manner. Common types of error in research, along with the sources of error and strategies for reducing error as described throughout this article, are summarized in the Table .

Sources of Error in Survey Research and Strategies to Reduce Error

The goal of sampling strategies in survey research is to obtain a sufficient sample that is representative of the population of interest. It is often not feasible to collect data from an entire population of interest (e.g., all individuals with lung cancer); therefore, a subset of the population or sample is used to estimate the population responses (e.g., individuals with lung cancer currently receiving treatment). A large random sample increases the likelihood that the responses from the sample will accurately reflect the entire population. In order to accurately draw conclusions about the population, the sample must include individuals with characteristics similar to the population.

It is therefore necessary to correctly identify the population of interest (e.g., individuals with lung cancer currently receiving treatment vs. all individuals with lung cancer). The sample will ideally include individuals who reflect the intended population in terms of all characteristics of the population (e.g., sex, socioeconomic characteristics, symptom experience) and contain a similar distribution of individuals with those characteristics. As discussed by Mady Stovall beginning on page 162, Fujimori et al. ( 2014 ), for example, were interested in the population of oncologists. The authors obtained a sample of oncologists from two hospitals in Japan. These participants may or may not have similar characteristics to all oncologists in Japan.

Participant recruitment strategies can affect the adequacy and representativeness of the sample obtained. Using diverse recruitment strategies can help improve the size of the sample and help ensure adequate coverage of the intended population. For example, if a survey researcher intends to obtain a sample of individuals with breast cancer representative of all individuals with breast cancer in the United States, the researcher would want to use recruitment strategies that would recruit both women and men, individuals from rural and urban settings, individuals receiving and not receiving active treatment, and so on. Because of the difficulty in obtaining samples representative of a large population, researchers may focus the population of interest to a subset of individuals (e.g., women with stage III or IV breast cancer). Large census surveys require extremely large samples to adequately represent the characteristics of the population because they are intended to represent the entire population.

DATA COLLECTION METHODS

Survey research may use a variety of data collection methods with the most common being questionnaires and interviews. Questionnaires may be self-administered or administered by a professional, may be administered individually or in a group, and typically include a series of items reflecting the research aims. Questionnaires may include demographic questions in addition to valid and reliable research instruments ( Costanzo, Stawski, Ryff, Coe, & Almeida, 2012 ; DuBenske et al., 2014 ; Ponto, Ellington, Mellon, & Beck, 2010 ). It is helpful to the reader when authors describe the contents of the survey questionnaire so that the reader can interpret and evaluate the potential for errors of validity (e.g., items or instruments that do not measure what they are intended to measure) and reliability (e.g., items or instruments that do not measure a construct consistently). Helpful examples of articles that describe the survey instruments exist in the literature ( Buerhaus et al., 2012 ).

Questionnaires may be in paper form and mailed to participants, delivered in an electronic format via email or an Internet-based program such as SurveyMonkey, or a combination of both, giving the participant the option to choose which method is preferred ( Ponto et al., 2010 ). Using a combination of methods of survey administration can help to ensure better sample coverage (i.e., all individuals in the population having a chance of inclusion in the sample) therefore reducing coverage error ( Dillman, Smyth, & Christian, 2014 ; Singleton & Straits, 2009 ). For example, if a researcher were to only use an Internet-delivered questionnaire, individuals without access to a computer would be excluded from participation. Self-administered mailed, group, or Internet-based questionnaires are relatively low cost and practical for a large sample ( Check & Schutt, 2012 ).

Dillman et al. ( 2014 ) have described and tested a tailored design method for survey research. Improving the visual appeal and graphics of surveys by using a font size appropriate for the respondents, ordering items logically without creating unintended response bias, and arranging items clearly on each page can increase the response rate to electronic questionnaires. Attending to these and other issues in electronic questionnaires can help reduce measurement error (i.e., lack of validity or reliability) and help ensure a better response rate.

Conducting interviews is another approach to data collection used in survey research. Interviews may be conducted by phone, computer, or in person and have the benefit of visually identifying the nonverbal response(s) of the interviewee and subsequently being able to clarify the intended question. An interviewer can use probing comments to obtain more information about a question or topic and can request clarification of an unclear response ( Singleton & Straits, 2009 ). Interviews can be costly and time intensive, and therefore are relatively impractical for large samples.

Some authors advocate for using mixed methods for survey research when no one method is adequate to address the planned research aims, to reduce the potential for measurement and non-response error, and to better tailor the study methods to the intended sample ( Dillman et al., 2014 ; Singleton & Straits, 2009 ). For example, a mixed methods survey research approach may begin with distributing a questionnaire and following up with telephone interviews to clarify unclear survey responses ( Singleton & Straits, 2009 ). Mixed methods might also be used when visual or auditory deficits preclude an individual from completing a questionnaire or participating in an interview.

FUJIMORI ET AL.: SURVEY RESEARCH

Fujimori et al. ( 2014 ) described the use of survey research in a study of the effect of communication skills training for oncologists on oncologist and patient outcomes (e.g., oncologist’s performance and confidence and patient’s distress, satisfaction, and trust). A sample of 30 oncologists from two hospitals was obtained and though the authors provided a power analysis concluding an adequate number of oncologist participants to detect differences between baseline and follow-up scores, the conclusions of the study may not be generalizable to a broader population of oncologists. Oncologists were randomized to either an intervention group (i.e., communication skills training) or a control group (i.e., no training).

Fujimori et al. ( 2014 ) chose a quantitative approach to collect data from oncologist and patient participants regarding the study outcome variables. Self-report numeric ratings were used to measure oncologist confidence and patient distress, satisfaction, and trust. Oncologist confidence was measured using two instruments each using 10-point Likert rating scales. The Hospital Anxiety and Depression Scale (HADS) was used to measure patient distress and has demonstrated validity and reliability in a number of populations including individuals with cancer ( Bjelland, Dahl, Haug, & Neckelmann, 2002 ). Patient satisfaction and trust were measured using 0 to 10 numeric rating scales. Numeric observer ratings were used to measure oncologist performance of communication skills based on a videotaped interaction with a standardized patient. Participants completed the same questionnaires at baseline and follow-up.

The authors clearly describe what data were collected from all participants. Providing additional information about the manner in which questionnaires were distributed (i.e., electronic, mail), the setting in which data were collected (e.g., home, clinic), and the design of the survey instruments (e.g., visual appeal, format, content, arrangement of items) would assist the reader in drawing conclusions about the potential for measurement and nonresponse error. The authors describe conducting a follow-up phone call or mail inquiry for nonresponders, using the Dillman et al. ( 2014 ) tailored design for survey research follow-up may have reduced nonresponse error.

CONCLUSIONS

Survey research is a useful and legitimate approach to research that has clear benefits in helping to describe and explore variables and constructs of interest. Survey research, like all research, has the potential for a variety of sources of error, but several strategies exist to reduce the potential for error. Advanced practitioners aware of the potential sources of error and strategies to improve survey research can better determine how and whether the conclusions from a survey research study apply to practice.

The author has no potential conflicts of interest to disclose.

- Utility Menu

Harvard University Program on Survey Research

- Questionnaire Design Tip Sheet

This PSR Tip Sheet provides some basic tips about how to write good survey questions and design a good survey questionnaire.

PSR Resources

- Managing and Manipulating Survey Data: A Beginners Guide

- Finding and Hiring Survey Contractors

- How to Frame and Explain the Survey Data Used in a Thesis

- Overview of Cognitive Testing and Questionnaire Evaluation

- Sampling, Coverage, and Nonresponse Tip Sheet

- Introduction to Surveys for Honors Thesis Writers

- PSR Introduction to the Survey Process

- Related Centers/Programs at Harvard

- General Survey Reference

- Institutional Review Boards

- Select Funding Opportunities

- Survey Analysis Software

- Professional Standards

- Professional Organizations

- Major Public Polls

- Survey Data Collections

- Major Longitudinal Surveys

- Other Links

Qualitative study design: Surveys & questionnaires

- Qualitative study design

- Phenomenology

- Grounded theory

- Ethnography

- Narrative inquiry

- Action research

- Case Studies

- Field research

- Focus groups

- Observation

- Surveys & questionnaires

- Study Designs Home

Surveys & questionnaires

Qualitative surveys use open-ended questions to produce long-form written/typed answers. Questions will aim to reveal opinions, experiences, narratives or accounts. Often a useful precursor to interviews or focus groups as they help identify initial themes or issues to then explore further in the research. Surveys can be used iteratively, being changed and modified over the course of the research to elicit new information.

Structured Interviews may follow a similar form of open questioning.

Qualitative surveys frequently include quantitative questions to establish elements such as age, nationality etc.

Qualitative surveys aim to elicit a detailed response to an open-ended topic question in the participant’s own words. Like quantitative surveys, there are three main methods for using qualitative surveys including face to face surveys, phone surveys, and online surveys. Each method of surveying has strengths and limitations.

Face to face surveys