- Is Ethereum better understood as a technology platform or store of value?

- How should investors interpret staking and its attributes as a form of yield?

- What technical risks and unknowns could potentially slow or hinder Ethereum’s growth?

Ethereum Investment Thesis: The Fidelity Digital Assets℠ Ethereum Investment Thesis analyzes the investment prospects of Ethereum the network and its underlying token, ether (ETH). First, Ethereum’s economics, or “tokenomics,” are considered to understand how ether accrues value. Second, Ethereum is viewed through a lens of two different investment theses: aspiring money, and a yield-bearing asset. Traditional and new methods are used to attempt to value Ethereum based on growth, usage, price valuation, supply and demand, yield, and more. The data shows that, while Bitcoin continues to dominate the broader digital asset market in terms of market cap and asset price, Ethereum adoption and network activity have continued to grow year-over-year. However, viewing Bitcoin and Ethereum side by side is not an apples-to-apples comparison. The two networks have distinctly different use cases, underlying infrastructure, consensus mechanisms, yield opportunities, monetary policies, and decentralization, among others. Read the Full Report About Ethereum: While many digital assets have failed or proved inferior to Bitcoin, Ethereum has solidified itself as a uniquely different digital asset. Inspired by Bitcoin, the second-largest digital asset by market cap offers alternative value propositions, potential use cases, and exciting network upgrades. For an introductory primer on the basics of Ethereum, such as its history, potential investment thesis, and risks, read the full report here. Featured Guests:

(All fields below are required)

- Financeflux

- Latest Stories

- Submit Guest Post

- Press Releases

- Sponsored Posts

- Submit Your Content

- CRYPTO MARKETS

- Press Release

- Sponsored Post

$4,500,000,000,000 Asset Manager Says Ethereum (ETH) Is Currently Undervalued – Here’s Why

The crypto-focused subsidiary of investing giant Fidelity Investments says Ethereum ( ETH ) is currently trading at a discount.

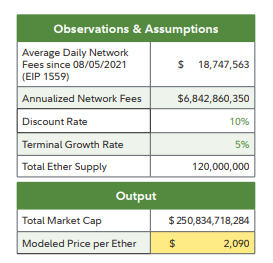

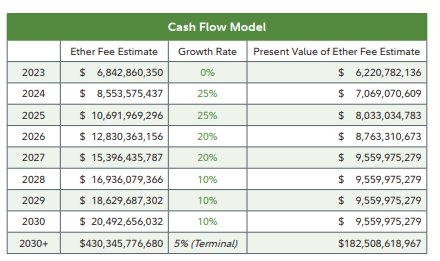

In a new report titled ‘Ethereum Investment Thesis’, Fidelity Digital Assets says that at the current Ethereum supply of around 120 million and annualized network fees of over $6.8 billion, the modeled price of ETH when a discounted cash flow model is applied is around $2,090 – around 28% above the current price.

The asset manager says that Ethereum’s value is correlated to network activity and by extension the fees generated, a figure that Fidelity expects to grow by double digits over the next seven years and hit over $20 billion in 2030.

“The value assigned to ether is more easily modeled following the network’s shift to proof-of-stake. Demand for block space can be measured via transaction fees. These fees are both burned or passed on to validators, thereby accruing value for ether holders.

As a result, fees and ether value accrual should be inherently related over the long term. An increased number of Ethereum use cases creates greater demand for block space, which leads to higher fees and greater value and utility in the form of yield rewarded to validators.”

On the risks that could hamper the fees generated on the Ethereum network, Fidelity Digital Assets says,

“The relationship between ether and the value it provides to network users may weaken if scaling technology erodes fee revenue unless volumes increase and offset this margin compression.”

Ethereum is trading at $1,630 at time of writing.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Industry Announcements

Covering the future of finance, including macro, bitcoin, ethereum, crypto, and web 3. Categories Bitcoin • Ethereum • Trading • Altcoins • Futuremash • Financeflux • Blockchain • Regulators • Scams • HodlX • Press Releases

ABOUT US | EDITORIAL POLICY | PRIVACY POLICY TERMS AND CONDITIONS | CONTACT | ADVERTISE

COPYRIGHT © 2017-2024 THE DAILY HODL

© 2023 The Daily Hodl

Ethereum Investment Thesis

Ever found yourself scratching your head, trying to figure out why someone would invest in ether (ETH) instead of just using it on the Ethereum network? Let’s look at Fidelity’s recent report on Ethereum’s Investment Thesis .

Ethereum vs Ether

Ethereum vs. Ether : Picture Ethereum as a bustling digital city, and ether (ETH) as the currency people use within that city. While the city’s infrastructure might be booming, it doesn’t always mean the currency’s value is skyrocketing. Similarly, a digital network and its native token don’t always rise and fall together.

The relationship between a digital asset network and its native token is intricate, and their successes don’t always mirror each other. Some networks can offer significant utility, processing numerous intricate transactions daily, without necessarily enhancing the value for their token holders.

Conversely, some networks exhibit a more direct connection between the network’s activity and the value of its token. This dynamic is often referred to as “tokenomics,” a contraction of “token economics.” Tokenomics delves into how a network or application’s structure can generate economic benefits for its token holders.

Over recent years, the Ethereum network has experienced transformative changes that have reshaped its tokenomics. One notable change was the decision to burn a segment of transaction fees, termed the base fee, introduced in August 2021 through the Ethereum Improvement Proposal 1559 (EIP-1559).

🔗 Recommended : MEV Burn Ethereum: Greatest Supply Shock in ETH History?

When ether is burned , it’s essentially removed from existence, meaning every transaction on Ethereum reduces the total ether in circulation. Moreover, the shift from proof-of-work to proof-of-stake in September 2022 reduced the rate at which new tokens are introduced and introduced staking.

This staking process permits participants to earn returns in the form of tips, new token issuance, and maximal extractable value (MEV). These pivotal updates have redefined ether’s tokenomics, prompting a reevaluation of the bond between Ethereum and its native token, ether.

Understanding Tokenomics: The Value Dynamics of Ether

Ether’s value is intrinsically tied to its tokenomics, which can be broken down into three primary mechanisms that convert usage into value. Here’s how it works:

- Transaction Fees : When users transact on Ethereum, they incur two types of fees: a base fee and a priority fee (also known as a tip). Additionally, transactions can create value opportunities for others through MEV (Maximum Extractable Value). This represents the maximum value a validator can gain by manipulating the sequence or selection of transactions during block creation.

- Base Fee Dynamics : The base fee, which is paid in ether, is “burned” or permanently removed from circulation once it’s included in a block (a collection of transactions). This act of burning reduces the overall ether supply, creating a deflationary effect.

- Priority Fee and MEV : The priority fee, or tip, is a reward given to validators, the entities or individuals tasked with updating the blockchain and ensuring its integrity. When validators create blocks, they’re motivated to prioritize transactions offering higher tips since this becomes a primary source of their earnings. Additionally, MEV opportunities, often arising from arbitrage, are typically introduced by users. In the current ecosystem, the majority of this MEV value is channeled to validators through competitive MEV markets.

These value-generating mechanisms can be likened to various revenue streams for the network. The burning of the base fee acts as a deflationary force, benefiting existing token holders by potentially increasing the value of their holdings.

On the other hand, the priority fee and MEV serve as compensation for validators, rewarding them for their crucial role in the network. In essence, as platform activity rises, so does the amount of ether burned and the rewards for validators, illustrating the dynamic relationship between usage and value in Ether’s tokenomics.

Investment Perspective: Ether’s Monetary Potential

Bitcoin is often framed as an emerging form of digital money. This naturally prompts the question: Can ether be seen in the same light?

While some might argue in favor, ether faces more challenges than bitcoin in its journey to be universally recognized as money.

Although ether shares many monetary characteristics with bitcoin and traditional currencies, its scarcity model and historical trajectory differ. Unlike bitcoin’s fixed supply, ether’s supply is dynamic, influenced by factors like validator count and the amount burned.

Additionally, Ethereum’s frequent network upgrades mean its code is constantly evolving, requiring time and scrutiny to establish a robust track record. This continuous evolution, while beneficial for innovation, can be a hurdle in building unwavering trust among stakeholders.

Also, many would argue that Ether is more security-like than Bitcoin in that it is more controlled by a few highly interested parties than Bitcoin. The Ethereum foundation (EF) is controlled by a handful of people. If the EF proposes protocol upgrades, even hard forks, these upgrades have a high chance of going through. The decentralization in terms of number of nodes and distribution of nodes globally is much less than Bitcoin.

Bitcoin, for many, represents the pinnacle of digital money due to its security, decentralization, and sound monetary principles. Any attempt to “better” it would involve compromises. However, the dominance of bitcoin as a digital monetary standard doesn’t preclude the existence of other forms of digital money tailored for specific markets, use cases, or communities.

Ethereum, for instance, offers functionalities not present in Bitcoin (at least on the base layer, although many functionalities, such as smart contracts and executing complex transactions, are already being implemented on Bitcoin layer 2s).

Mainstream applications built on Ethereum could naturally boost demand for ether, positioning it as a potential alternative form of money. Several real-world integrations with Ethereum are already evident:

- MakerDAO, an Ethereum-based project, invested in $500 million worth of Treasuries and bonds.

- A U.S. house was sold on Ethereum as a non-fungible token (NFT).

- The European Investment Bank issued bonds directly on the blockchain.

- Franklin Templeton’s money market fund leveraged Ethereum via Polygon for transaction processing and share ownership recording.

While these integrations are promising, widespread adoption of Ethereum for mainstream transactions might still be years away, requiring enhancements, regulatory clarity, and public education. Until then, ether might remain a specialized form of money.

In a way, Ethereum currently doesn’t have use cases beyond trading digital assets as can be seen in the current “Burn Leaderboard” on Ultrasound Money :

I’m not a huge proponent of “trading applications” because I believe it goes more in the direction of a zero-sum game. Where’s the value of swapping tokens on Uniswap or NFTs on OpenSea? Yet, I understand you could use similar arguments for much of the “real world” industry with banks, online marketplaces, and financial services providers.

Regulation is a significant concern for Ethereum’s future. Given that many major centralized exchanges holding and staking ether are U.S.-based, regulatory decisions in this jurisdiction could profoundly impact Ethereum’s valuation and overall health. Recent regulatory actions and shutdowns of crypto services in the U.S. underscore the gravity of this risk.

Ether’s Dual Monetary Roles: Store of Value and Medium of Exchange

Store of Value : A reliable store of value demands scarcity. While Bitcoin’s fixed supply of 21 million is well-established, ether’s issuance is more fluid, influenced by factors like validator activity and burn rates.

Future Ethereum upgrades could further complicate predictions about ether’s supply. Despite these complexities, current structures ensure ether’s annual inflation remains below 1.5%, assuming no transactions occur. With transaction revenue, Ethereum can even remain deflationary, meaning more ETH is burned than paid out to stakers each year.

However, the potential for future changes to ether’s supply dynamics contrasts sharply with Bitcoin’s steadfast supply narrative.

Means of Payment : Ether is already used for payments, especially for digital assets. Seemingly, Ethereum’s faster transaction finality compared to Bitcoin makes it an appealing payment option.

In reality, however, all payments will be made on second and third layers, such as Bitcoin lightning or Ethereum Polygon, which reduces practical transaction costs for even small payments to almost zero.

As more physical and digital assets integrate with blockchain ecosystems, ether, along with other tokens and stablecoins, could become more prevalent for payments, especially if transaction fees decrease due to the increasing infrastructure of the network application ecosystems.

Valuing Ether Based on Demand

Ether’s value could rise with increased Ethereum network adoption due to basic supply-demand principles. As Ethereum scales, understanding where new users originate and their sought-after use cases can provide insights into potential value trajectories.

Current data suggests that Ethereum’s base layer continues to attract consistent value, even as layer 2 solutions gain traction. However, ether’s value might be more influenced by network usage than mere asset holding.

In a recent article, I analyzed Bitcoin’s price based on Metcalfe’s Law and network effects and found there’s a positive relationship:

💡 Recommended : Want Exploding Bitcoin Prices North of $500,000 per BTC? “Grow N” Says Metcalfe’s Law

A similar study has been done by Fidelity that found more evidence of Bitcoin’s price scaling exponentially with the number of addresses than Ethereum’s price . But the relationship is still there for both monetary networks ( source ):

Emily Rosemary Collins is a tech enthusiast with a strong background in computer science, always staying up-to-date with the latest trends and innovations. Apart from her love for technology, Emily enjoys exploring the great outdoors, participating in local community events, and dedicating her free time to painting and photography. Her interests and passion for personal growth make her an engaging conversationalist and a reliable source of knowledge in the ever-evolving world of technology.

Fidelity plans to roll out Ether trading for hedge funds by March 2022

Fidelity is making plans for its debut in Ether trading—and eventually in other cryptocurrencies.

The financial services company’s crypto arm, Fidelity Digital Assets, should have Ether available to its hedge fund, family office, and institutional clients by the end of March 2022, Tom Jessop, president of Fidelity Digital Assets, tells Fortune . Fidelity currently only offers Bitcoin, and it has yet to roll out any cryptocurrencies to the retail investor side of the business, or to announce plans to do so.

Jessop says Fidelity’s move to expand its crypto lineup is in response to demand from its more than 100 institutional clients—most of whom are either hedge funds or family offices. Bitcoin may be the currency that initially draws people into the ecosystem, Jessop says, but institutions are starting to set their gaze beyond it on other opportunities in the digital currency market.

To meet the demand, Fidelity is building out systems to support Ether trading, and eventually other currencies, too, although, he says, “we’re still trying to figure that out.” Jessop told Bloomberg earlier this week that the company was expanding its employee ranks by about 100—a 70% increase in size. The vast majority of those hires are engineers who will be building out support for new asset classes and extending operational hours for a crypto market that runs 24/7, he tells Fortune .

Fidelity itself is still forming its own opinions on other tokens and a central bank digital currency as well as on the innovation potential stemming from the decentralized finance—or DeFi—market, much of which is happening on Ethereum blockchain.

“I think it represents a new financial infrastructure that institutions and others can take advantage of,” Jessop says of DeFi. Regulatory uncertainty throws into question how they can bring those capabilities into the mainstream, however. “It’s something that we are developing a point of view and a thesis around,” he says.

Fidelity, which reported holding $9.8 trillion in assets across its various business lines in 2020, made its first jaunt into crypto in 2018, when it launched Fidelity Digital Assets and became one of the largest financial institutions to embrace Bitcoin. Fidelity Digital Assets is working on adding new order types, as well as additional liquidity providers to support volume and boost price competition. Right now, the company works with around seven market makers and one crypto exchange, Jessop says. He declined to specify who any of its partners were, nor the amount of Bitcoin assets its clients held at the company.

While most of its crypto clients are hedge funds or family offices, Fidelity is starting to see more and more companies that want in on the burgeoning market. Over the past few months, pension funds, endowments, corporations, and asset managers have started using its services as well, Jessop says—an indicator that crypto “is going more and more mainstream.”

Latest in Finance

- 0 minutes ago

Avian influenza spreads to dairy herds in Michigan and Idaho, expert ‘wouldn’t be surprised if there are infections in cows in Europe too’

Momentum trading just had its best quarter in over 20 years thanks to bets like Nvidia. Here’s why Wall Street is on edge

Young people in India are more likely to be unemployed if they’re educated, says International Labour Organization

Older office buildings ‘will be stranded,’ says Morgan Stanley: ‘They simply don’t have long-term cash flow growth potential’

Harvard applications fall 5%, rival universities see increases after some students seek a ‘more comfortable environment on campus’

Jerome Powell doesn’t want to ‘jinx’ his war on inflation: ‘I’m a superstitious person’

Most popular.

Do turmeric supplements really treat pain, boost mood, and improve allergies? Experts say they work best for 2 conditions

Don’t brush right after you eat. Dentists say there’s one thing you should do after every meal that’s better for oral—and overall—health

Ozempic maker Novo Nordisk facing pressure as study finds $1,000 appetite suppressant can be made for just $5

Ford is slashing two-thirds of employees at its F-150 Lightning plant as its ambitious electric-car plans sputter

A woman purchased a vacant Hawaiian lot for about $22,000. She was surprised to see a $500,000 home was built on it by mistake

- Latest news

- X (Twitter)

Fidelity Executive Says Ethereum Investment Thesis Could Be Easier for Institutions To Grasp Than Bitcoin – Here’s Why

An executive from financial services giant Fidelity says that the investment thesis centered around Ethereum (ETH) may be easier for institutions to understand compared to Bitcoin (BTC).

In a new interview on the Bankless YouTube channel, Fidelity’s director of research Chris Kuiper says that the firm’s Ethereum investment thesis could be an easier concept for blue-chip firms to understand.

“WIth traditional investors, you could probably more easily go to them with something like Ether and show them these things and they would grasp that much quicker than the investment thesis for Bitcoin.”

According to Kuiper, to truly understand Bitcoin, institutions would first have to dabble in politics, philosophy, game theory, economics, and other concepts while with Ethereum, they can be shown simpler metrics and cash flow data.

“I imagine that you could probably get in front of an institutional investor and say, ‘look here’s the metrics, here’s the cash flow, put in your inputs,’ and they’re looking at it like another financial instrument and they’re like ‘oh yeah, that makes sense to me.’”

Kuiper says Ethereum’s economic ecosystem may allow institutional investors to construct more cohesive investment strategies and price analyses.

“It’s not about making point predictions with these models of a certain price, it’s about getting their head around the probabilities. Investing is a game of probability, so now you can start playing out these scenarios and you can get some guardrails about what you think are the ranges that this thing could trade within…

You can have these scenario analyses where you can now get your head around the probabilities and then that way people can size their position accordingly. That’s how an institutional Investor thinks, that’s how a good investor thinks – they think around probability scenario analysis.”

Ethereum is trading for $1,601 at time of writing, a fractional increase during the last 24 hours.

Generated Image: Midjourney

Is Daftar Slot A Scam?

Ark Invest and 21Shares Elevate Bitcoin ETF Security with Chainlink Integration

IOTA Foundation Pioneers a New Era in Global Trade with Strategic Alliances

XRP’s Chart Echoes Past Glory: A Prelude to Another Historic Surge?

Terra Luna Classic’s Governance Upgrade Spurs Price Surge and Investor Optimism

Fidelity digital assets report explores ethereum’s multifaceted investment potential.

- Fidelity Digital Assets presents an in-depth report on Ethereum’s investment potential and intrinsic value.

- The report highlights the connection between Ethereum’s core token, ether, and network activity.

Fidelity Digital Assets, the crypto-focused arm of Fidelity Investments, has released a comprehensive report that delves into the multifaceted investment potential of Ethereum. This study aims to demystify the valuation dynamics surrounding Ethereum’s native token, ether, and its intricate relationship with the Ethereum network.

According to the report titled ‘Ethereum Investment Thesis,’ Ethereum’s current supply and its annualized network fee contribute to an estimated value for ETH , which stands at approximately $2,090. This valuation represents a significant 28% increase from the current market price. Fidelity emphasizes the intrinsic link between Ethereum’s value and network activity, projecting substantial fee growth over the next seven years, potentially reaching $20 billion by 2030.

The report explores the complexities of Ethereum and its native token, ether, and how recent structural changes, such as Ethereum Improvement Proposal 1559 (EIP-1559) and the transition to proof-of-stake, have impacted Ethereum’s evolving tokenomics.

Post the transition to proof-of-stake, the report sheds light on the transparent value determination of ether. Block space demand within the network is quantifiable through transaction fees, which are either burned or relayed to validators. This process accumulates value for ether holders, with an expanding array of Ethereum applications driving increased block space demand, resulting in higher fees and enhanced utility for validators.

Ethereum’s shift to proof-of-stake offers ether holders a unique opportunity to earn yields, driven in part by increased network engagement. The report applies financial models like the discounted cash flow model, adapted to Ethereum’s characteristics, to illustrate the utility of ether as a yield-centric asset.

While Ethereum’s future appears promising, the report also highlights potential risks. Fidelity Digital Assets underscores the importance of addressing scalability challenges, as scaling technologies could impact fee revenues. Maintaining the link between ether’s value and its utility to network participants may require surges in transaction volumes to compensate for fee compression.

Current Market Snapshot

At the time of the report’s release, Ethereum was trading at $1,630.

You May Also Like

Is The SEC Manipulating BTC? Regulator Approves Bitcoin ETF Pushing Prices to $48,000 After X Account Hack

Cryptocurrency Giants Dogecoin and Bitcoin Join Historic Lunar Journey Aboard ULA’s Vulcan Centaur Rocket

Solana’s Strategic Shift: Prioritizing Layer 1 Scalability Over Layer 2 Solutions

More from author, press release:.

Struct Finance Transforms DeFi Landscape on Avalanche With the Launch of Tranche-based BTC.B-USDC Vaults

cheqd debuts Credential Service – an easy way for anyone to issue credentials

Boxwind Allies With Exinity Group To Streamline Access To Digital Asset Markets

Ethereum Blockchain Game Pikamoon Raises $3.6m, Final ICO Phase Selling Out Fast

WOW EARN Wallet Offers One-Stop Shop Features, Now Available on iOS and Google Play

Swaap v2 Launches: Revolutionizing DeFi Market Making with Secure, Autopilot Strategies

Developing an Investment Thesis: A Crucial Step for Investors

"investing is a process. one important task an investor should perform before putting money into an opportunity is to develop an investment thesis.".

Investing is a process that requires careful consideration and analysis. One important task an investor should perform before putting money into an opportunity is to develop an investment thesis. An investment thesis is a framework that guides investment decisions and outlines the rationale behind them. It helps investors identify potential risks and rewards, assess the market, and align their investment goals with their strategies.

Alteryx, a company striving to enhance sales execution, improve sales productivity , and implement cost-saving measures, is an example of a company that investors may consider as part of their investment thesis. By analyzing Alteryx's performance and potential, investors can determine if it aligns with their investment goals and if it presents a favorable opportunity for growth.

Artificial Intelligence (AI) is a technology that is expected to have a significant impact on various industries, including life sciences and health. The successful implementation of AI in specialist tasks like diagnoses and medical procedures could revolutionize these sectors. Investors who recognize this potential may include AI-focused companies in their investment thesis to take advantage of future growth opportunities.

Investors are increasingly interested in biodiversity and nature funds, which aim to support environmental conservation and sustainable practices. However, the outcomes of these investments remain unclear, as the long-term impact of such funds is yet to be determined. Investors should carefully assess the risks and potential returns associated with these funds before including them in their investment thesis.

CrowdStreet, a real estate investment platform, recently released its updated Investment Thesis, outlining the company's investment strategy and philosophy. Investors can refer to this thesis to gain insights into CrowdStreet's approach and evaluate whether it aligns with their investment goals.

The investment thesis centered around Ethereum (ETH) is gaining attention among investors. An executive of financial services giant Fidelity suggests that the investment potential of Ethereum may be easier to comprehend and analyze compared to other cryptocurrencies. Investors interested in the blockchain technology and the potential of Ethereum may consider including it in their investment thesis.

Affinity, led by its CEO Ray, aims to bring relationship intelligence to the world. Recognizing that every opportunity begins with a relationship, investors may consider incorporating relationship-driven investment strategies into their thesis. By leveraging technology and data, Affinity aims to enhance investment decision-making and identify valuable connections.

Arcfield, a company led by CEO Kevin Kelly, is actively involved in the WT 360 conversation, where they discuss and explain their recent activities. Investors interested in learning more about Arcfield and its investment strategy can gain valuable insights from this conversation. By understanding Arcfield's approach, investors can assess whether it aligns with their investment thesis.

An investor group controlling 9.5% of GAM shares has decided not to tender to the Liontrust offer. This decision reflects the investor group's assessment of the offer and its potential impact on their investment thesis. Investors should closely monitor such developments and evaluate their implications on their investment portfolio.

In summary, developing an investment thesis is an essential step for investors. It helps them analyze potential opportunities, align their investment goals with strategies, and assess risks and rewards. By considering factors such as sales execution, AI advancements, nature funds, company strategies, and emerging trends like Ethereum, investors can create a well-rounded investment thesis that guides their decisions.

May Interest You

VIDEO

COMMENTS

why the ether token may accrue value. In this paper, we examine this question more deeply on an investment thesis level and include some of the technical aspects related to the various investment theses. The following observations are discussed: • Ethereum may be best understood as a technology platform that uses ether (ETH) as a means of ...

An executive from financial services giant Fidelity says that the investment thesis centered around Ethereum may be easier for institutions to understand compared to Bitcoin ().In a new interview on the Bankless YouTube channel, Fidelity's director of research Chris Kuiper says that the firm's Ethereum investment thesis could be an easier concept for blue-chip firms to understand.

The thesis basically says that unlike Bitcoin, Ethereum can be used to facilitate complex transactions which gives it a unique money like utility that hasn't really been considered. Ether can be deflationary, as opposed to the fixed cap of Bitcoin. However, Fidelity notes that the rules are constantly changing due to protocol upgrades and ...

Ethereum Investment Thesis: The Fidelity Digital Assets℠ Ethereum Investment Thesis analyzes the investment prospects of Ethereum the network and its underlying token, ether (ETH). First, Ethereum's economics, or "tokenomics," are considered to understand how ether accrues value. Second, Ethereum is viewed through a lens of two ...

On August 30, 2023, Fidelity Digital Assets released a groundbreaking report laying out their investment thesis for Ether (ETH), the native asset of the Ethereum blockchain. Shortly after releasing the report, Chris Kuiper and Jack Neureuter of Fidelity appeared on the Bankless podcast to discuss their conclusions.. In this article we'll talk about what's in the report and why it is so ...

The crypto-focused subsidiary of investing giant Fidelity Investments says Ethereum is currently trading at a discount.In a new report titled 'Ethereum Investment Thesis', Fidelity Digital Assets says that at the current Ethereum supply of around 120 million and annualized network fees of over $6.8 billion, the modeled price of ETH when a discounted cash flow model is applied is around ...

In a significant development for the cryptocurrency industry, the crypto-focused subsidiary of investing giant Fidelity Investments has highlighted the current trading discount of Ethereum (ETH). The company recognizes the potential of Ethereum as it continues to gain momentum and popularity in the market.

In a new research report, Fidelity examines the burning question: how does the utility of the Ethereum network translate into value for its native cryptocurrency, ETH?. While users have enjoyed the technological benefits of Ethereum's extensive ecosystem, the investment community has sought to understand the reasons behind acquiring and holding ETH beyond its utility as a transactional token.

Let's look at Fidelity's recent report on Ethereum's Investment Thesis. Ethereum vs Ether. Ethereum vs. Ether: Picture Ethereum as a bustling digital city, and ether (ETH) as the currency people use within that city. While the city's infrastructure might be booming, it doesn't always mean the currency's value is skyrocketing.

July 16, 2021, 1:13 PM PDT. Fidelity is making plans for its debut in Ether trading—and eventually in other cryptocurrencies. The financial services company's crypto arm, Fidelity Digital ...

The act of staking ether on the network has changed dramatically since the Shapella upgrade in April 2023. Fidelity said the payout structure for validators attesting to the blocks of each epoch and for block proposals proffer incentives to stake the maximum of 32 ETH. The base reward is proportional to validators' effective balance.

tldr; Fidelity's director of research, Chris Kuiper, believes that the investment thesis centered around Ethereum may be easier for institutions to understand compared to Bitcoin. He suggests that Ethereum's economic ecosystem allows for simpler metrics and cash flow data, making it easier for institutional investors to grasp.

27 votes, 60 comments. Fidelity, world's 3rd largest asset firm, released a Thesis on Ethereum Investment & It's Potential as Digital Money and a…

An executive from financial services giant Fidelity says that the investment thesis centered around Ethereum (ETH) may be easier for institutions to understand compared to Bitcoin (BTC). In a new interview on the Bankless YouTube channel, Fidelity's director of research Chris Kuiper says that the firm's Ethereum investment thesis could be ...

Delve into Fidelity Digital Assets' comprehensive report on Ethereum's potential. Explore Ethereum's intrinsic value, its relationship with ether, and the opportunities and challenges in the evolving tokenomics landscape.

While Bitcoin rallied for months before the spot ETFs were approved on January 10th, it's sold off since then and is currently down over 10%. Considering Bitcoin's history, a sell the news event ...

Fidelity Investments (Fidelity) has filed a registration with the United States Securities and Exchange Commission (SEC) to apply for a spot Ethereum (ETH) exchange-traded fund (ETF). Notably, the filing featured an option to stake a portion of the fund's assets. According to the S-1 filing, the ...

Investors can refer to this thesis to gain insights into CrowdStreet's approach and evaluate whether it aligns with their investment goals. The investment thesis centered around Ethereum (ETH) is gaining attention among investors. An executive of financial services giant Fidelity suggests that the investment potential of Ethereum may be easier ...

In this paper, we examine this question more deeply on an investment thesis level and include some of the technical aspects related to the various investment theses. Some of the following observations are discussed: • Ethereum may be best understood as a technology platform that uses ether (ETH) as a means of payment.

Justin d'Anethan. Market making for token listings - Follow me for crypto+macro market insights - Invested in BTC+ETH since 2015. 1mo. If ever you had any doubt that "institutions are coming ...

7.3M subscribers in the CryptoCurrency community. The leading community for cryptocurrency news, discussion, and analysis.

Fidelity Digital Assets released an Investment Thesis for Ethereum! The world's 3rd largest asset management firm with $4.2 Trillion of Assets Under Management (AUM) created a fantastic research ...