Finance Business Partner Cover Letter Example

The Finance Business Partner is responsible for developing and maintaining financial models, forecasting cash flow, analyzing financial results, and providing financial guidance to the organization. They may also be involved in managing risk, developing financial strategies, and helping to identify areas for cost savings.

While it may be easy to draft a resume, it may seem difficult for many to write a well-polished and attractive Cover letter. If you feel that you need a helping hand, feel free to download our Finance Business Partner Cover Letter and get a chance to impress your hiring Manager.

- Cover Letters

- Accounting & Finance

A Finance Business Partner is a high-level financial professional who works in close collaboration with operational teams to provide financial planning, analysis, and strategic advice. They are responsible for ensuring that financial decisions are well-informed and aimed at achieving business goals. They often act as a bridge between the finance department and other departments, providing insight and expertise to help ensure that resources are allocated effectively.

What to Include in a Finance Business Partner Cover Letter?

Roles and responsibilities.

- Analyze financial performance and provide financial advice to ensure the best use of resources.

- Develop financial strategies to maximize profits.

- Monitor and analyze budget performance to ensure budget goals are met.

- Analyze financial data to identify trends and issues.

- Develop financial models and forecasts to project future performance.

- Prepare financial statements and reports to be used for decision making.

- Work closely with other departments to develop and implement financial plans .

Education & Skills

Finance business partner skills:.

- Knowledge of financial principles and practices.

- Analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- Attention to detail and accuracy.

- Ability to work independently and as part of a team.

- Proficient with Microsoft Office Suite and financial analysis software.

- Ability to manage multiple tasks and prioritize accordingly.

Finance Business Partner Education Requirements:

- Bachelor’s or Master’s degree in Accounting, Business, Finance, or a related field.

- CPA or CFA certification preferred.

Finance Business Partner Cover Letter Example (Text Version)

Dear Mr./Ms.

I am writing in response to your recent advertisement for a Finance Business Partner. With my extensive experience managing financial operations and providing strategic business guidance, I am confident that I would be an excellent addition to your team.

Throughout my career, I have managed financial operations for prominent organizations, providing key insights that have enabled them to increase their profitability. I am highly skilled in financial modeling, data analysis, forecasting, and budgeting, and I have an excellent understanding of financial regulations and reporting requirements. I also have a proven track record of providing strategic guidance to management teams, helping to shape the future direction of the company.

In my current role as a Financial Business Analyst, I have consistently delivered outstanding results. My accomplishments include:

- Developed a comprehensive budgeting and forecasting system that increased the accuracy of financial projections by 15%.

- Minimized cost by implementing a new purchasing system, resulting in an 8% reduction in expenses and a 6% increase in profitability.

- Led the financial planning process for multiple business units, delivering accurate financial plans on time and within budget.

- Streamlined financial reporting processes, resulting in a 20% reduction in time spent on reports.

- Leveraged financial data to identify trends and make strategic business decisions, resulting in increased efficiency and cost savings.

In addition to my technical skills, I am an excellent communicator and I have the ability to explain complex financial concepts in an easy-to-understand manner. I am also a team player who can easily collaborate with other departments and build strong working relationships.

I am excited at the prospect of bringing my skills to your organization, and I am confident that I can make a positive contribution. Please find my resume attached to this letter. I look forward to discussing my application further.

Sincerely, [Your Name]

- Highlight your qualifications: Show employers why you are the ideal candidate for the role by emphasizing the key qualifications listed in the job description.

- Use concrete examples: Use concrete examples from your past experience to illustrate why you are the perfect candidate for the job.

- Demonstrate a commitment to finance: Demonstrate your commitment to finance through your past experiences and your enthusiasm for the role.

- Show your personality: Show employers why you would be a great fit for the team by highlighting your personality and enthusiasm for the job.

- Keep it short and to the point: Make sure your cover letter clearly communicates your value to the employer and is not too lengthy.

Worried your resume is past the expiration date? We’ll help you create a new one that leaves a positive impression and beats luck. Refer to our Finance Business Partner Resume Samples !

Customize Finance Business Partner Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Accounting & Finance Cover Letters

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Financial Services

Finance Business Partner Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the finance business partner job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Ownership of total Supply Chain and service accounting and reporting including all financial and operational KPI’s, budgeting and forecasting

- You will play an active role in supporting the business in using and developing the system further as well as developing the operating model

- Building and maintaining a relationship with the IT and project teams, acting in a business partnering capacity in order to provide commercial support

- Drive performance culture by challenging key stakeholders, and ensuring accurate data, forecasting and target setting

- Business planning process including full budgeting and forecasting cycle

- To define, own and drive the cycles of planning, forecasting, closing and reporting (Opex, COGS, RTB, CTB, CTP)

- Handling all aspects of the reporting and planning including preparation of presentation and commentary

- Project completion reviews to assess project performance, ensure existence of proposed business benefits and manage transition into business as usual (BAU)

- Work closely with IT Operations Management Team

- Build effective relationship with the Project Managers and the Head of Delivery and in all aspects behave as a value adding trusted finance business partner

- Present financial figures to top management at month-end and highlight risks and opportunities

- Assisting with the capitalisation of assets and forecasting the subsequent depreciation

- Provide Financial Leadership in determining strategic Business direction

- Work with the Regional Offices to ensure accurate flow-through of their activity to the Global IT summary

- Working closely with Forecasting on setting gross revenue targets

- Keep track of important KPIs/trends/events impacting the business (IMS share and volume data, payor mix, price increases, new contracts, renegotiated rebate amounts, etc) and incorporate the information into the last forecast for the year

- Assisting with prioritizing projects and maximizing return on invested capital (ROIC)

- For the quarterly close, works closely with Corporate Accounts and Finance Ops to estimate Medicaid and Managed Care rebates

- Manage the preparation of presentations for SP (POG reports), the BU, Group (CFO packs on a quarterly basis) and SP finance summarizing results and providing explanations

- Ad hoc work as necessary (e.g., finance systems work)

- 10% - Responsible for managing and developing the analyst supporting the GIBU team

- Strong Stakeholder management skills and ability to build good, effective Relationships

- Strong analytical skills, including the ability quickly to grasp the "big picture" and exhibit judgment in drawing conclusions and solving problems

- Strong attention to detail and ability to work accurately

- A strong attention to detail and commitment to quality

- Able to work on own initiative, with excellent attention to detail

- Highly personable - able to build relationships with budget holder and retain independence

- Excellent interpersonal, listening and communication skills combined with ability to condense detailed subject matter into clear and effective communications

- Strong PC modeling skills, including excellent knowledge of Microsoft Excel, Access, and SQL

- Analyse revenue, net sales and cost drivers, to provide and track actionable recommendations to ensure profitable growth

- Attention to detail and excellent Excel and data analytics

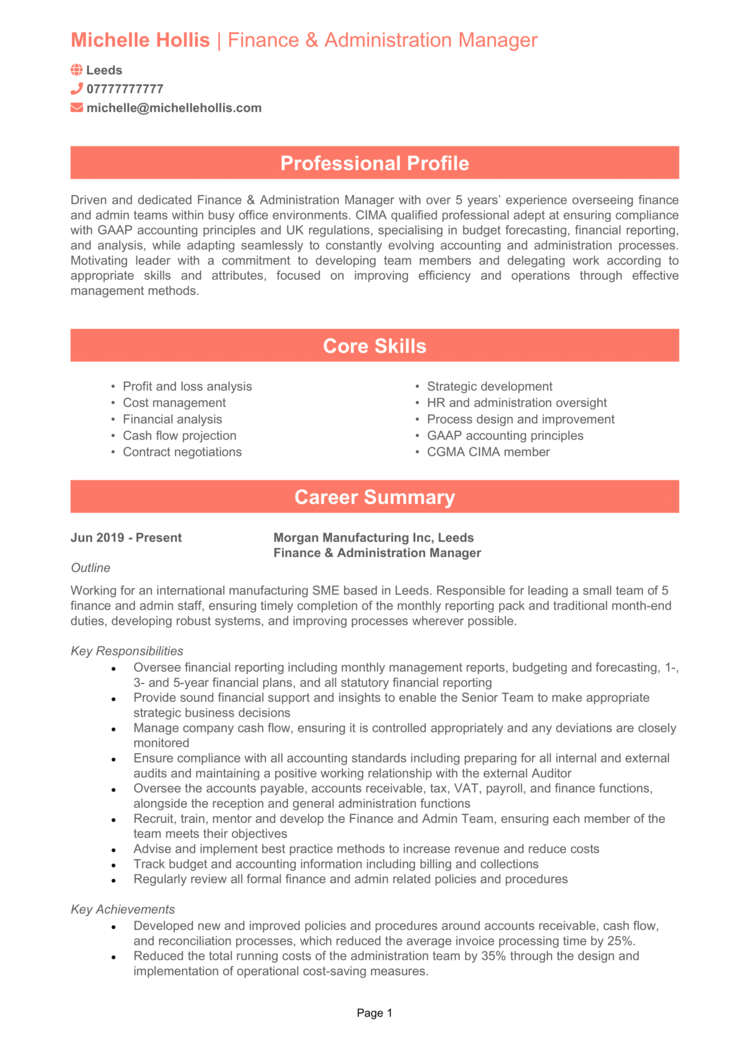

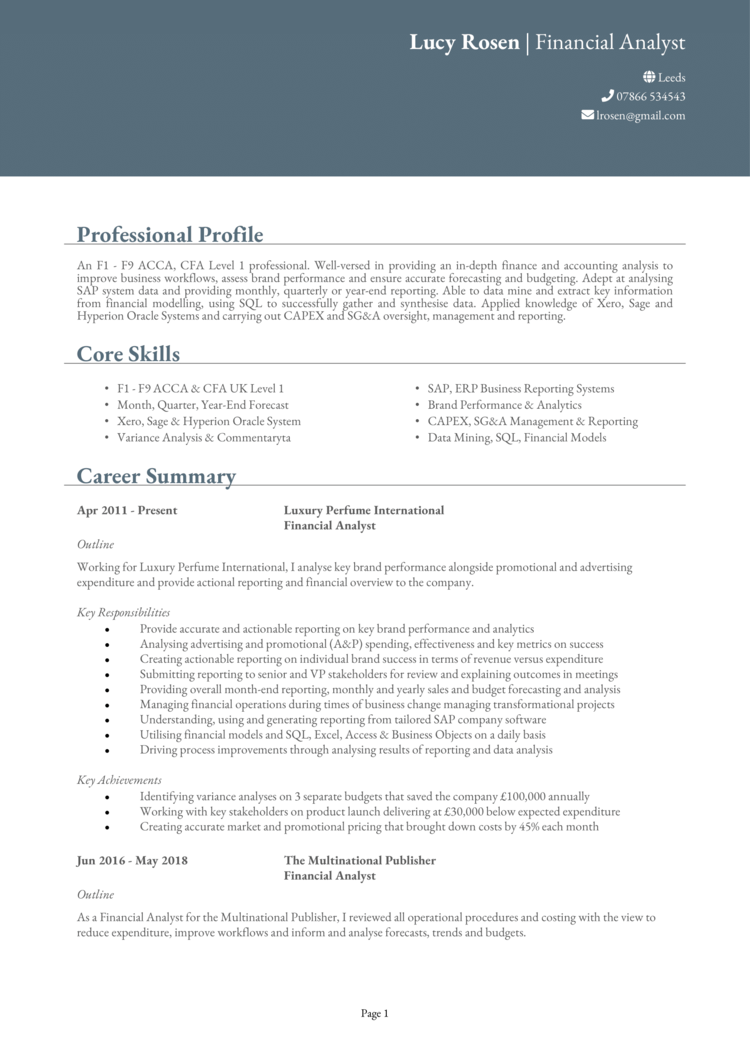

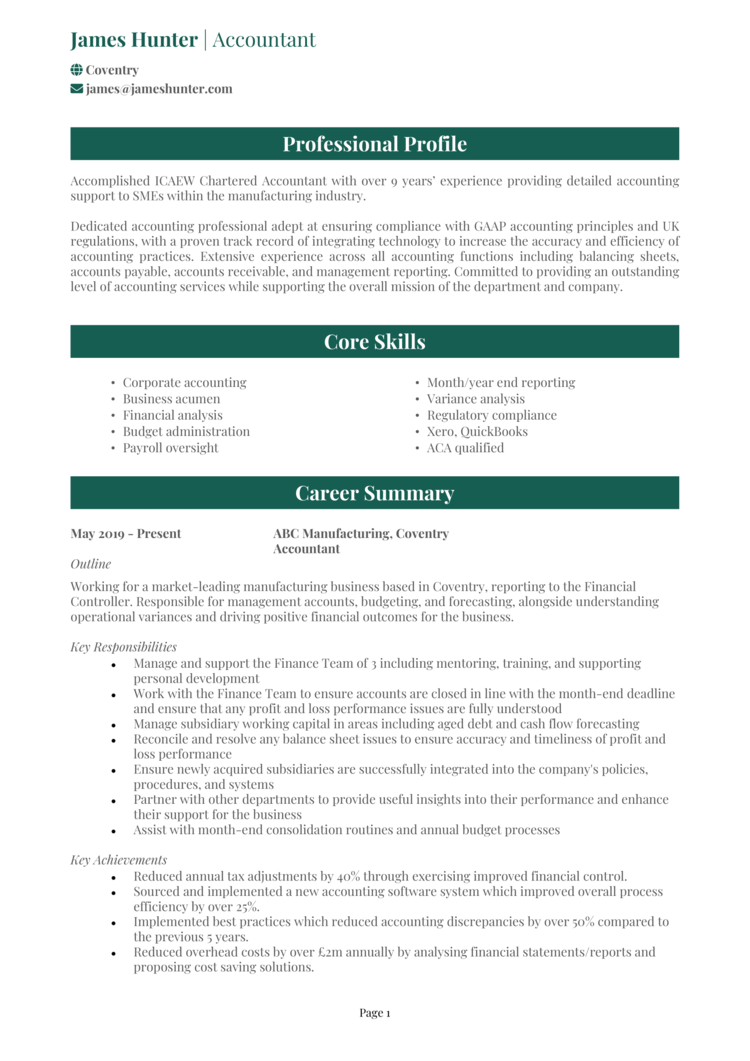

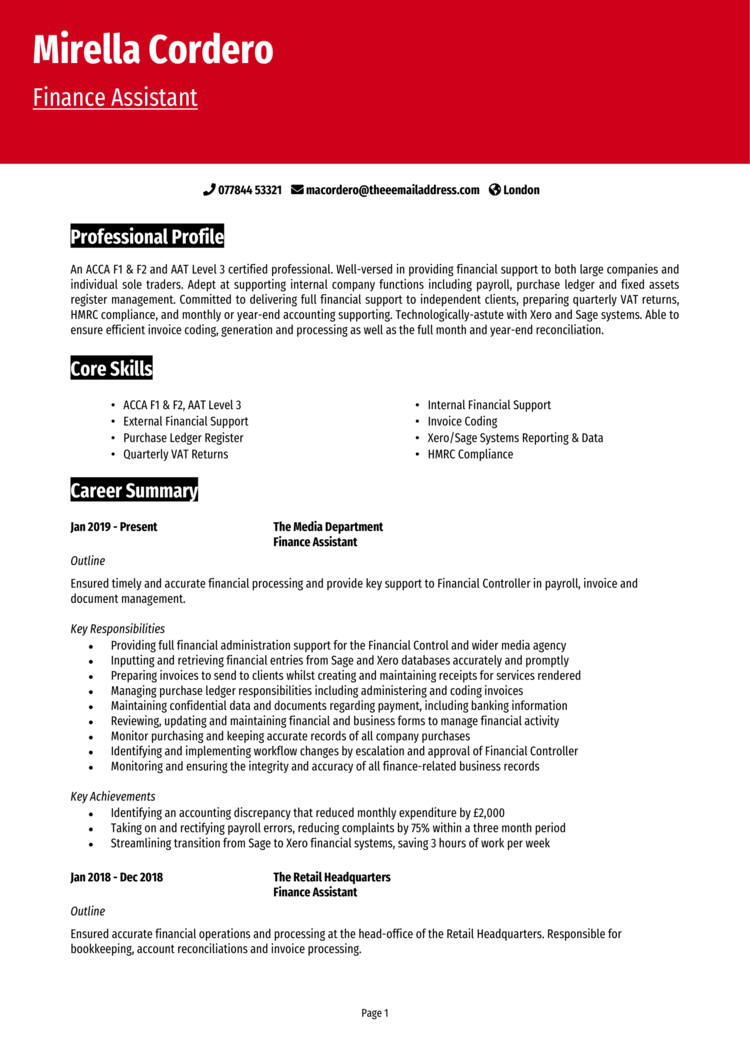

15 Finance Business Partner resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, finance business partner ba europe resume examples & samples.

- Support BA finance task delivery mandated by Division or BA Management

- Setup, planning and monitoring of initiatives and programs with impact on financials such as P&L or Balance Sheet

- Ensure relationship management to BA Management / Program / Project heads and stakeholders and act as trusted advisor for these management team for finance related questions

- Perform finance ad-hoc tasks (e.g. preparation of ad-hoc client lists which relate to CID critical tasks which cannot be supported from off-shoring capacities

- Support BA mandated special tasks assigned by the Finance head to support deep dives and other finance related tasks (e.g. footprint setup, structure implementation, LE setup efficiency etc)

- Support for NBC cases and SAP extract business case reviews and approvals

- Support Finance projects with local preferably local participation (e.g. GMIS, Insight WM, Standard reporting/PMS) and related communication and education measurement (road shows, trainings etc)

- University degree in Business administration / controlling

- Controlling experience in banking and/or financial intermediaries, used to interact with management positions

- Excellent command on MS Office (Excel, Access, Powerpoint), Hyperion Essbase, Business Objects, SAP Business Explorer

- Good command of English; German, French and Italian are an advantage

- Hands on mentality, active communication attitude, team player

Finance Business Partner Resume Examples & Samples

- An ability to acquire skills quickly to interrogate systems e.g. SAP / TM1 etc

- Good communication skills, particularly the ability to summarise large amounts of data and present in a concise and readily understood format. Including the ability to communicate complex financial analysis to non-financial people

- Part qualified/ newly qualified accountant (those training towards accounting qualifications will be considered)

- Experience of working in a financially focused role

- Good understanding of business strategic objectives

- Good understanding of business processes and activities and the underlying cost drivers

- Qualified Accountant with two years + PQE

- Experience of working in a multi-site or multi-national business

- Excellent time management skills and the ability to juggle multiple tasks and prioritise workload appropriately

- Able to work with many stakeholders and meet their requirements

- Execute strategic objectives as articulated by the Chief Operating Officer

- Review and present financials and variance commentary at Divisional Management Committee meeting

- Implement and monitor cost control initiatives within the different functional areas within the Business Units

- Track cost savings benefits for the different centres within the Business Unit

- Allocate duties to team members where required to execute and coordinate finance activities required within the business unit

- Monitor financial trends and identify gaps, based on gaps identified, motivate requests and new ways of work to the Senior Business Partner

- Provide financial advice and guidance to line managers and business owners on new initiatives, current budget management practices and trends in expenditure in their areas of accountability

- Explain targets and take accountability for the monitoring and achievement of own and team performance objectives

- Partner with the departments and the Business Unit line managers to complete sound annual financial plans within the agreed timeframes – this includes the review of forecasts for short term, medium term plans

- Ensure that processes, control requirements and risk management frameworks that have been designed for the area are understood

- NQF Level 7: Honours/Master’s Degree BCom Accounts

- Proficient in MS Office (Word, Excel, PowerPoint and Outlook)

- Understand the commercial drivers of the business function

- Lead the development and implementation of best practice in financial processes and link across Group O&T Finance to share best practice

- Primary AP Ops client face for SMT- Michael Teo and COO- Teresa Koh

- Provide highly effective performance management information, commercially challenging key business decisions through detailed analysis of the financial and business implications of such decisions

- Prepare and ensure the completeness and accuracy of, the books and records for the respective Function / Business Units, reporting externally and to Senior Management, whilst advancing the firm's aspirations in a controlled manner

- Provide business support using accurate, timely and reliable MI / Analytics to enhance the quality of decision making. The team drives the firms overall budget process and supports regular forecasting and accurate reporting

- Partnering, Strategy & Planning (30 - 35%)

- Deep and technical business partnering – build and develop FBP relationships across Ops and Central Operations and Technology teams

- Drive the completion of the annual Budget and Planning processes, manage financial upload into BPC system ensuring most effective approach

- Production of Financial Projections to support Flash submissions and identification of Risks and Opportunities

- Ensure effective tracking of Asia financials and budgets and mitigation of risks with continuous review with key stakeholders on overall AP Ops cost shape

- Actively manage AP budgets and forecasts and highlight business challenges which will impact reasonableness of gross cost base and headcount

- Implementation and embedding specific financial targets

- Regular P&L Forecasting updates and month end P&L analysis and commentary

- Project costing, analysis and tracking such as Transform and IPP

- Ability to prioritize effectively and being able to see the macro picture

- Tenacious and control focused

- Analysis of financial and strategic requirements for the business

- Provide specialist advice to the business

- Ad-hoc finance projects

- Analysis of industry trends, growth and drivers

- Review of monthly management reports

- Financial modelling/scenario analysis

- Review business cases

- Responsible for driving and supporting strategic, financial and operational performance of the business

- Work with the Managing Director and the Senior Leadership team delivering sound financial analysis to support decision making

- Promote a better understanding of financial issues among all levels of the business by creation of a coaching programme for improving commercial and financial acumen

- Support the business with proposals to challenge profitability and cash flow

- Use commercial understanding, financial and non-financial information with local and external knowledge and experience to drive improvements in operational and strategic business performance

- Ensure good understanding of performance drivers in local business

- Monitor performance against plan for business, work with departmental heads to forecast future business performance

- Review the large projects to ensure appropriate contract accounting and controls properly exercised

- Graduate with at least five years in a senior finance role including decision support

- Fully qualified in Accountancy

- Understanding of Financial accounting and controls

- Consulting experience would be an advantage

- Confident in influencing business managers

- Ability to work on own initiative

- Data management, analysis and interpretation skills

- Awareness of wider commercial environment

- Assist the Business Finance lead in providing decision support and strategic insight to the Business Head, COO and management team

- Be the primary point of contact for a number of different Continental Europe Institutional business heads, their COOs and other key stakeholders. Offering decision support assistance and management reporting

- Manage the review Sales KPIs and performing an adjustment process to overcome system limitations

- Support the business through annual financial budgeting processes and periodic business performance reviews

- Revenue & Expense monitoring and forecasting

- Produce monthly & quietly management reporting

- Work closely with the COO team to analyse and report on weekly and monthly sales activity

- Knowledge of asset management revenue drivers would be an advantage, knowledge of financial services is essential

- Strong Excel skills - at a minimum must be competent with data manipulation, using pivot tables, vlookups, sumifs etc

- University degree in a numerical subject preferable

- Good general MS Office skills

Finance Business Partner of Operations Resume Examples & Samples

- Significant demonstrable management & leadership experience of a division or company including a strong ability to influence across lines in a matrix organisation

- Developing a clear understanding of the billing cycle, the impact on call volumes and cash flow. Identifying opportunities to improve our processes, customer service and cash flow

- Developing a clear commend of the debt path, the impact on customer service and cash flow. Segmenting our debt and driving process improvements to enhance customer service improve cash flow

- Formulate and lead the implementation of Operations finance policy and goals and develop and maintain a strong control environment

- Partner with commercial teams to meet commercial goals and objectives and ensure disciplined approach to capital investment decisions

- Partner with Financial Controller's team and other functional groups to create appropriate level of controls and ensure effective and efficient controls exist

- Lead the Operations strategic planning and forecasting process

- Preparation and ownership of management accounts and cost analysis for a number of the Group's major schemes, including responsibility for the scheme's balance sheets and cash flow reporting

- Key point of contact for the business for the provision of financial information and wider financial support in relation to their designated schemes

- Working with the ledgers team to effectively manage the sales and intercompany ledgers of their schemes

- Acting as a mentor and source of knowledge for more junior members of the management accounting team

- Ability to identify process improvements and support the continuing development of the finance function

- Qualified accountant (ACA, ACCA, CIMA) with at least 2-3 years of PQE

- Experience in the preparation of management accounts and variance analysis

- Excellent interpersonal skills and ability to communicate orally and in writing with all levels of management and non-finance personnel, including external joint venture partners

- Advanced Excel user and experience of working with complex financial models

- Construction and development industry experience ideal but not essential

- Commitment to the company values of delivering excellence, working collaboratively and doing the right thing

- Production of monthly management accounts including variance analysis

- Preparing required accruals to ensure accurate reporting of month end results

- Business partner with product teams to challenge and collate the proposed annual budget

- Produce annual budget and quarterly forecasts as per the agreed timetable and entered correctly into reporting system

- To provide analysis of KPIs, profitability and trends to identify areas of opportunity or concern

Finance Business Partner / FP&A Manager Resume Examples & Samples

- Financial analysis, forecasting and budgeting

- Strong business partnering with Sales and Marketing team

- Commercial involvement in deal making and contract negotiation

- Working closely with the APAC and Country team to drive initiatives and performance

- Working closely with internal stakeholders to achieve excellence

- Minimally a degree or professional certificate

- 10-12 years of experience in Finance and/or Accounting

- FMCG or Pharmaceutical industry experience

- Strong business acumen and good communication skills

- Experience in deal-making or contract negotiation would be a plus

- 50% Provide financial leadership by acting as the financial partner to several R&D functions. Specific responsibilities include

- Prepare functional long range finance plans that feed into program portfolio prioritization as well as program business

- 35% Serve as the lead finance representative to multiple clinical development teams. Specific responsibilities include

- 15% Lead special ad-hoc projects which could include post merger integration support to Shire future M&A deals or financial systems optimization

- Candidate must have 5+ years’ experience in a finance managerial role demonstrating strong technical and analytical skills and a track record of success working in a team-based environment

- Support Operational or Commercial Managers in delivering targets through influencing and challenging on margins

- Provide effective business partnering through building strong working relationships with Sales, Marketing

- Challenge and influence the business on costs, business cases and revenue generating activity

- Provide detailed reporting on category performance, complete with analysis of KPI's and variances

- Deliver category budgets and forecasts, ensuring there is integrity behind the numbers

- Production of the Monthly Management Accounts

- Forecasting on a rolling monthly basis

- Support the Management Team in the Business Planning process

- Financial and commercial support to Operations leaders

- Working with the Operations & Finance Teams to assess the impact of change control

- Promote strong financial control and cost control within the business

- Ad-hoc analysis and project work

Collaboration Finance Business Partner Resume Examples & Samples

- Perform as a trusted advisor, business partner and liaison to the management team

- Technical revenue recognition and offer support partnering with Revenue Accounting

- Strategize with Product and Promotions to develop incentive programs from a Finance perspective

- Direct business partnership with the Strategic Pricing and Licensing teams

- Ownership and project management of key finance initiatives

- Solid revenue accounting background (Sales-Finance/Service/Corporate Revenue preferred)

- Understanding of P&L management

- Ability to gain a functional understanding of Cisco’s collaboration platforms such as WebEx, Cisco Meeting Room, Cloud, On Premise, CUWL (Unified Communications Portfolio) and other bundled offerings

- Ability to work and succeed within a deadline-driven environment

- Candidates possessing a CPA certification will be highly considered

- Strong business partnership skills

- Track record of achievement and results orientation

- Excellent analytical and critical thinking skills

- Proven Ability to build cross functional relationships

- Advanced degree (MBA/MSA)

- 10+ years of Finance/Accounting experience

- Prior experience with Cisco's planning cycle (preferred)

- Prior experience with information technology finance and/or knowledge of project management concepts a plus

- Prior experience with Budget vs. Actual variance analysis

Finance Business Partner G&a Resume Examples & Samples

- Assist these functions in achieving their financial objectives

- Coordinating with Finance Operations and Group Finance in developing, modifying and executing finance best practices throughout these functions

- Liaison with the Management Information Team to enhance monthly management reports and improve efficiency

- Collaborate with other Finance Functions on cross-finance projects, such as development and support of an allocation methodology and refining our forecast processes

- When appropriate, support G&A functions on integration and restructuring initiatives

- Provide input to Group Reporting and Group Finance to ensure legal reporting requirements are properly disclosed

- Preparing a full cost analysis for Legal Cases in order to monitor cases that span multiple years

- Deliver value-added analysis of company benefit plans

- Collaborate with Group Finance on the development of the Global Annual Budget HR Guidelines

- Act as key point of contact between HR and Finance for coordinated communications as well collaborating to identify improvements to finance dependent processes

- Job candidate must possess a BS/BA degree in Finance or Accounting. An MBA in Finance or Management, CPA or equivalent accreditation, is preferred

- Minimum seven years of experience in a financial or management reporting position preferably in the pharmaceutical industry

- Experience of managing a team and of working in a matrix structure is desirable

- Experience with management reporting, financial analysis, budgeting, forecasting is highly preferred

- Participating on NBU product strategy teams as needed

- Participating or ensuring appropriate support for GMAc meetings as need

- Providing financial decision support

- Assist head of NBU finance in providing Investor Relations with appropriate analytics to support presentations and quarterly earnings calls; and

- Participating in ad hoc BU projects as needed

- Previous experience managing a team is preferred

- Proficiency in Microsoft Excel and PowerPoint, including Excel modeling, and experience creating presentations in PowerPoint is required

- Previous experience with SAP R3 and BW is desired

- Hyperion Financial Management / Hyperion Planning knowledge preferred

- Pharmaceutical experience is preferred

- Client Face Finance Business Partner for Compliance

- Focusing on providing both functional and Business support

- Direct ownership of a series of functions within Compliance

- Partnering with and acting as a control function for functions owned

- Day-to-day responsibility for cost reporting, MI, stakeholder management and ad hoc

- Providing support to stakeholders in both Compliance and finance

- Managing the month end position and flash process for assigned Businesses

- Month end reviews and in depth analysis for assigned functions within Compliance

- Reporting of the Compliance Change/ Strategic Invesment budget and project specific

- Adhoc analysis and MI for senior management, including headcount

Finance Business Partner Gi & Im Bu Resume Examples & Samples

- 30% - Manages and leads the financial LRP planning process as well as the annual budget for the GIBU

- Leading Budget/LRP review meetings

- Working closely with Corporate Accounts understanding Managed Care and Medicaid rebate estimates

- Working closely with the brand teams on developing marketing strategies in order to effectively allocate spend to execute the plans, coordinate with brand team to develop coupon strategies

- Working closely with the PSLs and R&D finance team in understanding components of R&D spend

- Managing the preparation of presentations for the BU as well as SP finance identifying risks/opportunities with the financial plans

- Coordinating the preparation of appropriate sensitivities

- Delegating appropriate activities to analyst on the team

- 30% - Manages and leads the monthly and quarterly close for the GIBU

- Reviewing the results for reasonableness and understanding causes for variances from budget and/or forecast

- Ensure understanding of actual vs budget/forecast GTN differences

- Identifying trends that could potentially impact ability to achieve full year results

- Responding to inquiries from Group finance on results

- Delegating appropriate activities to financial analyst on the team

- 8-10 years of experience with management reporting, financial analysis, budgeting, forecasting, and financial valuations is highly preferred

- Experience in dealing with people with a keen focus on customer service is required

- Experience working in a matrix organization preferred

- Working as part of a team is required

Finance Business Partner Ophthalmology & Co E Resume Examples & Samples

- Bachelors Degree in an accounting / financial discipline is required or equivalent experience. CPA, MBA or equivalent is desired

- 5+ years of experience with management reporting, financial analysis, budgeting, forecasting, and financial valuations is highly preferred

- Biopharmaceutical experience is preferred

- Act as a relationship-manager for the end-to-end delivery of Financial solutions to the business

- Interface between the client business and centralised functions within Finance (centres of

- Working closely with the central finance teams to design necessary reporting to support

- Provide advice to internal clients, both proactively and as requested (including such matters as

- Significant and relevant reporting, controlling, accounting experience

- Strong commercial acumen, as well as knowledge and understanding of the client business and

- Develop and prepare monthly analysis of acquisition and retention cost trends by major product type, customer segment and channel to meet needs of commercial business units and wider organisation

- Working cross functionally across the business and finance to provide mid-month outlook of customer investment cost performance to internal stakeholders

- Review of effectiveness of subsidies and promotions with business owners to include post investment analysis

- Ownership of externally reported information to Group and making sure of alignment with the internal view of costs across segments and major product lines

- Attendance at key decision forums with consumer business units and provide insight into performance drivers of costs

- Ownership of the production of insightful driver based customer investment trend analysis on a monthly/weekly basis to segment & channel leads

- Working cross functionally within the finance community and the business owners to harmonise reporting

- Financial planning & forecasting

- Qualified accountant (CIMA, ACCA,ACA) with 2+ years PQE

- Excellent PC skills with proficiency in Excel front ends

- Previous financial modelling experience

- Planning, forecasting and budgeting experience

- Working knowledge of SAP, Hyperion Enterprise, Essbase and VIP would be advantageous

- Provide Commercial Finance Support to the UK Finance and Sales team

- Analysis and review of financials to provide insight on key drivers and underlying trends

- Provide financial support and analysis for marketing investment cases across all products within the channel

- Provide financial support and analysis for launches of new Propositions and offers to the market

- Performance of post investment reviews for any propositions, offers, capex, marketing and other investments impacting the channel

- Track and monitor performance of transformation activities working with the business to ensure we have the most effective structures in place to deliver profitable revenue growth

- Responsible for the development and tracking of the UK capex budget, working in collaboration with the Finance team and Digital, Product and Strategy team

- Financial support for business cases supporting transformation across ensuring the appropriate level of challenge is provided to the business

- Produce appropriate briefings for senior / executive management

- Ad-hoc analysis to understand business drivers and resolve issues

- Revised Annual Forecast (RAF) and Medium Term Plan (MTP)

- Performance Cost Forecasting

- Review the modelling of the high level and detailed forecasts

- Prepare presentations for senior management meeting (e.g. Finance Committees, Monthly Business Reviews) with additional analysis for cribs, to assist the governance process for the IB plan, including liaising with other teams for their inputs where required

- Incorpore of new Group/regulatory requirements such as Structural Reform into the forecast processs

- Development of reporting suite and toolkit to support restructure of the Investment Bank

- Manage performance cost forecast and monthly reporting to senior management. This includes performance costs, review/challenge monthly flash reporting from Financial Control, prepare presentation of monthly performance costs deck

- Assist in competitor analysis reporting where IB quarterly results are benchmarked against the peer set. This information is reviewed by senior management and used to assist in communication to the market for external results announcement

- Other ad-hoc analysis as required

- Assertive, determined and resilient

- Well-developed communication and coaching skills

- Proven project management abilities with a track record of delivery

- Evaluate the company business with analysis on KPI and financial analysis on business performance

- Conduct market research studies and analysis to assess current market trends

- Conduct analysis to identify risks & opportunities on a monthly basis

- Work closely with Sales and Marketing to conduct sales trend analysis, pricing analysis and product mix analysis

Finance Business Partner With Administration Resume Examples & Samples

- Provide Business Partner support to a broad, diverse and senior level client base

- Measure and analyze financial performance against key metrics and provide qualitative analysis to Senior Management

- Manage annual budget and quarterly forecast processes

- Represent clients in annual McLagan Benchmark Study

- Liaise with Business Units and Business Unit Controllers on client expenses, forecast/budgets and strategic business reviews

- Manage audit of annual REM Savings Initiative Validation

- Partner with Corporate Services on presentation of quarterly firm wide transparency reviews

- Oversee Business Unit Due Diligence Reporting

- Firm wide PRA Reporting

- Manage firm wide rebate process and report to Senior Management

- Oversee compensation expense analysis and reporting

- Represent clients in MS Bank and MSPBNA regulatory reviews

- Quarterly Lobbyist reporting for the Firm

- Oversee Community Affairs philanthropy spend and provide complex accounting guidance

- Firm Management allocation weighting and monitoring

- Oversee controllable expense review

- Liaise and oversight with colleagues in Budapest on key deliverables

- Strong organizational skills and attention to detail, including the ability to coordinate, prioritize and manage multiple activities

- High self-motivation and the ability to work both independently and as an effective team member

- Ability and willingness to adapt to new challenges in a dynamic environment

Finance Business Partner With Operations Resume Examples & Samples

- Developing strong personal and team relationships across a multitude of Operations, Business and Support Services stakeholders

- Building, developing and coaching a strong finance team, promoting mobility, risk mitigation, performance recognition

- Bachelors and/or advanced degree

- 10+ year’s financial analysis / financial management experience - preferably within Financial Services

- Highly developed knowledge of - and demonstrated success in architecting / implementing - strategic and tactical data management and financial reporting solutions

- Highly developed and polished communication and influencing skills

- High level of energy, self-confidence and professionalism

- Strong desktop technology skills

- This position is part of a Finance department that supports the infrastructure functions of the firm, and specifically resides within the Corporate Support Finance (CSF) Business Partner team

- This position is an FP&A aligned role which supports the Global Operations function. The role is largely focused on the development of the cost base and headcount for the entirety of the Global Operations group, but provides support and direction to the business aligned Operations functions for Wealth Management, Institutional Securities, Asset Management - as well as other Operations shared-services functional groups

- This role will provide information and analysis to various constituents regarding the drivers of cost, as well as forward looking cost projections, productivity measures and other leading performance indicators

- The position leads the Global budget and forecast execution process - steering other CSF Finance team members and liaising with Technology and Operations teams. Furthermore, the position provides an overarching review and analysis / communication of Global Operations monthly performance results, risks and opportunities. This position also develops and maintains EUC developed databases which are integral to Budget / Forecast and other monthly / Qtrly cyclical deliverables

- The position provides the vision and drives the execution of other strategic and tactical approaches in building the technical and analytical framework / solutions in response to strategically focused senior Operations and Finance requests

- Strong interpersonal and communication skills. Demonstrated experience and success in leading and managing people in a matrix structure is a prerequisite

- Highly developed data management / technical skills - leveraging desktop applications and corporate accounting / management reporting systems and tools. - Advanced to expert level skill in Excel is critical and advanced Access experience and skills is highly desirable

- The candidate must have a demonstrated track record of success working / multi-tasking in a very demanding, fast paced and deadline driven environment

- 5-10 years of relevant experience (financial analysis and budgeting / forecasting FP&A type of role) - preferably in Financial Services. Optimally, strong expense management experience

- Minimum of a Bachelor's degree in a Finance or related field. Additional professional certifications, advanced degree a plus

VP-analytics Finance Business Partner Resume Examples & Samples

- Coordinating and delivering requested analysis of the P&L, balance sheet, key value drivers and financial performance of the cluster with responsibility for working with the business unit teams to critically assess forward looking performance

- Establishing a cross-functional analytical community to support ad-hoc deep dive analysis of portfolio's, including vintage analysis, product specific analysis and marketing optimisation

- To provide incremental band-width for key activities including M&A, strategic projects, NPV hurdle rate setting, CEO business reviews and investor relations support

- Strong commercial acumen and strategic thinking, with a deep interest in the drivers of performance within the business and a drive for high standards and continuous improvement

- Experience of developing financial goals and targets and analysing financial returns

- Excellent communication and presentation skills, with the ability to clearly synthesise large amounts of data and explain the implications for the business

- The confidence to deal effectively with senior colleagues in all parts of the business

- Strong experience of developing informal networks and building strong relationships across numerous geographies

- Monthly review of P&L, related trends and allocations. Support F/L/R/A clients in an advisory capacity regarding financial activities especially around month-end and quarter end close, Budget and Forecast cycles and client-initiated adhoc business needs. This involves working directly with the client COO and CAO teams, BU stakeholders and respective controllers and support services counterparts (including senior management levels)

- Key role in Budget & Forecasting cycles: communicate guidance and scope and lead on data gathering efforts with clients as well as the intra-departmental facilitation with support services counterparts. Responsible for coordinating dependencies via cross-functional calendars, setting timelines and managing deliverables within for required execution, data quality check points and reporting - in partnership with controllership groups (ie: comp modeling, headcount analytics, CTB/RTB activities, non-comp and allocations, and overall financial storylines)

- Assist with (non-standard) financial schedules and reporting on behalf of decision making client groups. Draft effective qualitative write-ups in support of lead business partners and clients (monthly client financial snapshots, Budget/Forecast presentations, Firm NonComp Expense management)

- Summarize key financial highlights and qualitative commentary that contributes to setting the agenda and framing the dialogue for client meetings (monthly, quarterly, YoY, plan v. actual etc…). Prepare meeting materials and/or presentations

- Assist with strategy based exercises, cost modelling, savings projections, financial business plan justifications, exit rates and multi-year planning. Participate in comp modeling, strategic metrics, analysis efforts and overall client relationship management

- Help drive the departmental agenda by coordinating with the controllership teams on day-to-day tasks and related execution. Focus on processes and provide guidance to drive value add reporting and related process efficiency enhancement efforts (globally)

- Very strong team player who is comfortable multi-tasking and works well under pressure

- Effective communicator with client facing experience

- Good facilitator, confident in working with others at all levels

- Very strong Excel and Power Point skills

- Experience in working through day-to-day tasks and project work with global teams

- Omega, Abacus System experience

Channel Finance Business Partner Resume Examples & Samples

- Professional Accounting (CA, CPA)

- Technology background and experience with a US multi-national

- Cloud business and software term based licensing model experience

- Manager experience

- Providing Finance and senior client management with clear, focused and sound financial assessment and guidance (strategic insights, risks and opportunities, linkages across segments)

- Supporting Quarterly / Annual budgeting and forecasting activities (complex and time sensitive, cycle driven and continuous forward look approaches)

- Bachelors and/or advanced degree in a relevant discipline

- 2 to 5 years financial planning and analysis management experience - preferably within Financial Services

- Optimally having experience in expense management role, expense accounting knowledge

- Strong time management skills, able to prioritize, adapt and manage to deadlines

- Provide finance coverage and support to Institutional & Corporate Technology and department Senior Business Managers, COO and CIO

- Provide comprehensive financial advice and expertise; financial management support, including strategic and tactical business decision support

- Prepare reporting of monthly/quarterly financials and present insights to Technology Management in a consolidated and standardized fashion, enabling key decisions and actions

- Manage relationships and partner effectively within the global IT Finance teams

- Deriving labor rates (both compensation and consulting) during quarterly Budget/Forecast cycle; reviewing/updating fully loaded rates in Finance Systems in collaboration with the Finance IT support team

- Look for opportunities to improve or streamline existing processes/reporting

- Bachelor degree in Finance, Accounting, Economics or MIS, with 3-5 years of experience in IT Finance or FP&A

- Technology Finance experience supporting large Application Development organization, with portfolio of multi-year initiatives

- Excellent written and verbal communication skills, interpersonal and collaborative skills, and the ability to communicate finance technology concepts

- Must be a critical thinker with strong problem-solving skills

- Project management skills; financial/budget management

- Ownership of the divisional P&L

- Monthly FP&A explanation and presentation of trends/variance

- 1st point of contact for the division's finances

- Produce monthly total performance pack including Fixed Line, coordinating inputs from other team members

- Key team member for upcoming promotional or marketing activity

- Excellent time management skills and ability to work under time pressure

- Ability to influence and manage key stakeholders

- Ability to challenge effectively on budgets and forecasts

- Ability to acquire new skills quickly in order to interrogate systems

- Ability to communicate financial information and analysis to a very senior audience

- Candidates should be a fully qualified accountant or have relevant job experience

- Strong analytical ability - experience in banking / insurance or in an industry which requires complex analysis

- Experience in the preparation of financial reporting outputs

- Ability to manage work load between operational deadlines

- Ability to plan project work and deliver results to an agreed timetable

- Ability to present findings clearly, verbally and in writing

- Managing the budgeting process and forecasting processes, helping the project team manage their budget vs forecast

- Provide WIP analysis and report back on key areas of risk and opportunity

- Drive process improvement initiatives and seek to outline opportunities for potential efficiencies

- Providing support to the business on coding of purchase orders in the SRM / SAP tool

- Managing new master data requirements with the Management Information team (e.g. new cost centres, % cost allocations etc.)

- Conducting monthly accruals phasing reviews with the budget owners and assist in online phasing on SAP tool

- The ideal candidate should have 8+ years of financial analyses and detail modeling experience

- Proven ability to be flexible, manage multiple priorities, work autonomously and learn quickly in a fast environment

- SAP & Business Objects experience is a plus

- Cost accounting experience is a plus

- Must have very strong Excel skills, particularly with regard to financial modeling

- Bachelor's degree in finance or economics; MBA is preferred

- Attention to detail, accuracy, resourcefulness, analyses and follow through skills

- Ability to complete projects/reports within established deadlines

- Must have excellent communication skills, both written and verbal

- Monitor and report on the performance of a product portfolio, with a particular focus in assessing the financial impact of pricing and business volume decisions

- Market Analysis to ensure products are attractive to customers yet profitable

- Develop comprehensive financial models

- Monthly reporting of income and costs, regular forecasting and input into the annual budget

- Driving profitability across multiple product ranges and geographies

- Building close working relationships with internal customers to ensure a clear understanding of their needs for financial support

- Driving the 12-month rolling budget process, including quota target setting and product budgets

- Successfully operating as the primary contact person for cost analysis and creation of the cost budget

- Preparation of ad-hoc analysis and reporting to provide accurate and timely information in order to support commercially-sound business decisions

- Analyse price proposals on commercial viability

- Regular review of margins including the use of price-mix volume variance analysis

- Qualified accountant (ACA/CIMA/ACCA)

- Significant Commercial Business Partnering experience, preferably gained in an FMCG or commercial environment within a in a large blue chip company

- Excellent communication, interpersonal, influencing and relationship building skills

- The capability to progress to a senior leadership position within the function

Finance Business Partner International Operations Resume Examples & Samples

- Support the development of the business units or department’s annual operating budgets and the development of strategic and operating plans. Build and maintain complex financial and analytical models using advanced Excel skills and SAP Queries and automating them

- Perform due diligence for new initiatives. Perform sensitivity and incremental cost-benefit decision analyses. Provide analytical support for business initiatives. Identify, analyze, and communicate trends and issues affecting the business

- Provides analysis and feedback on financial performance and key performance measure. Provides root cause variance explanations and highlights opportunities and risks

- Provides financial information and guidance to all levels of management. Perform in-depth variance analysis between actual operating, budgets and identify and investigate any resulting variance

- Analysis of financial performance and production of management reports

- Engage and manage relationships with stakeholders

- Develop forecasting models

- Detailed business channel reporting and analysis

- Business case analysis

- Providing day to day support to the Customer Service operational teams, working with the Head of CS and his team to ensure that KPIs and costs are understood and monthly results are shared back with the Exec

- Lead on Customer Service budget & forecast cycles, working with business to ensure that these are agreed and passed to the Financial Planning team according to the agreed timetables

- Evaluate the investment priorities of the Customer Service Team, performing relevant investment appraisal and undertaking financial due diligence in measuring financial benefits

- Perform investment appraisal for other business areas as required, working with business owners to capture financial benefits, build a business case and support through the Tesco Mobile Change Process

- Collate budget for recharged sales channel costs, and work with the Shareholders to communicate and agree these in line with agreed planning timelines

- Manage all sales channel operational costs, ensuring these are identified, approved and recharged to the Shareholders in a timely & accurate manner

- Agree proportions of regular and ad hoc opex spend to recharge to Shareholders both periodically and when changes to base & scope occur and support the financial accounting team by providing details of agreed cost allocations

- Act as finance lead for coordination of all Shareholder cost recharge queries and reporting

- Supporting on other ad-hoc and regular tasks as required

- Qualified accountant with experience of commercially focussed financial analysis

- The ability to articulate the financial risks and impact of a proposal

- Experience of Business Partnering operational teams

- Ability to establish a strong working relationship across different teams

- Strong Influencing and communication skills

- Provide financial and strategic advice to the Leadership Teams in order to actively contribute to delivery of overall financial and functional performance

- Actively contribute to delivery of overall financial and business performance through effective reporting and analysis

- Establish strong business partnerships with functional senior management, budget owners and project managers by understanding the business area, objectives, needs and issues

- Educate customer groups on financial aspects of business decisions and resource allocations

- Good interpersonal skills demonstrated by creation of a network of key partners within Finance and the business

- Identify and support simplification projects and implementation of best practices

- Prepare detailed financial analysis and ad hoc reports to the Board including full KPI & sensitivity analysis and actuals v budget reporting

- A broad range of ad hoc commercial projects

Finance Business Partner ACG Finance Resume Examples & Samples

- Partner with and advise business leaders within ACG on financial decisions

- Develop reporting for various levels of ACG management and Finance stakeholders

- Work cross-functionally with Legal, HR, Accounting, Tax, etc. to support ACG

- Lead execution of special projects including M&A on behalf of ACG Finance team

- Has 5-7+ years of finance experience,

- Possesses strong business judgment and is able to frame issues in the context of the big picture,

- Thrives in a fast-paced, start-up environment but, at the same time, is able to maneuver the processes of a large public company,

- Is a self-starter that can manage projects without a lot of supervision,

- Deals well with uncertainty, complexity and change,

- Is a creative thinker that can find solutions and bring structure and process to the ambiguous,

- Is an excellent communicator and can build strong relationships with senior business leaders,

- Has the ability to influence senior business leaders, peers and cross-functional teams and,

- Has experience in forecasting, analyzing and managing budgets

- CIMA/ACCA/ACA Qualification

- Experience in financial modelling as well as significant research and analytical capabilities

- Proven commercial track record and ability to see the wider financial impact of business decision making

- Ability to communicate effectively with and influence both finance and non-finance personnel at all levels

IT Finance Business Partner Resume Examples & Samples

- Financial Planning including Budgeting (Annual) and Rolling Forecast (Monthly)

- Month end reporting - Financial Controlling, monitoring IT Transactions (IT Services & Assets) to ensure alignment with IT Accounting Key Data Structure (KDS), Accruals and maintain efficient financial data

- Build effective relationship with Head of End User Services and Head of Production Services and in all aspects behave as a value adding trusted finance business partner

- Work closely with End User Services Management Team to drive Financial Stability, accuracy of Data, Planning and Financial Analysis of new cost savings intiatives, financial impact from Central & Regional projects

- By understanding cost drivers and Business requirements of IT Services, contribute with developing new Cost saving opportunities and support in its implantation which is critical to deliver the IT Cost Leadership strategy

- Collect, understand and document relevant Business reasons to explain variances to budget, Accruals, Intercompany Charges within Maersk Group

- Ability to handle the pressures arising from meeting deadlines and targets

- Ability to Business partner across functions

- Well versed with PtP (Purchase to Pay) and AtR (Accounting to Reporting) processes

- Experienced in using SAP and Business Warehouse Reporting

- Experience with IT Industry is a distinct advantage

- Excellent knowledge of SAP and Microsoft applications especially Excel & PowerPoint

- Ability to demonstrate use of our values in the daily work

- Strong communication skills and an ability to influence decision makers and senior stakeholders

- Adaptable/Flexible approach with strong analytic mind-set

- Must be execution oriented in behavior, with strong problem solving skills and structured approach

- Communicating and translating complex financial / non-financial ideas to people outside the finance function

- Interpreting data, both financial and non-financial and understanding the impact of these on the business

- Advising and supporting on pricing decisions, provide support on tenders and contractual agreement

- Advising and challenging, where appropriate, key stakeholders in order to add value in terms of the analysis and commentary produced

- Understand the key business drivers and trends that will maximise profitability and cash generation

- Qualified Accountant (ACCA/CIMA or ACA) with post qualification experience

- Strong and confident communication skills, both orally and in writing, with the ability to interact with senior members of the business

- Experience of budgeting and forecasting discussions with senior business partners

- Strong finance skills, including experience of providing monthly management accounts

Interim Finance Business Partner, IT Resume Examples & Samples

- Develop strong and trusted partnerships with key budget holders within IT and with a commercial mind-set, provide analysis, challenge and insight on commercial finance matters and strategies – pro-actively addressing areas that may not have been previously considered including detailed supplier analysis

- Provide effective monthly management reports for key budget holders and Finance leadership team

- Support and influence key business decisions through the pro-active creation of business cases and ‘what-if’ scenario planning, ensuring there is a consistent approach applied within IT

- Ensure sufficient financial rigour is applied on all key investment decisions and post investment reviews are carried out, with learnings communicated and embedded in future assessments

- Play a key role in evaluating business performance and offering advice on the future direction to achieve business targets and KPIs. Track, report and monitor performance against these targets

- Help drive efficiencies through value adding activities by leading and delivering commercial finance analysis and identifying and managing KPIs for IT

- Oversee the financial planning process and ensure sufficient financial rigour has occurred in identifying efficiencies and cost savings

- Oversee preparation & review of documents for the OC and PMO project prioritisation

- Lead and co-ordinate delivery of the month end close and financial controlling of IT

- Maintain a balanced connection between your key budget holders and the Finance Leadership Team

- Partner with Regional Finance leads on the global overview of budgets

- Partner closely with Commercial Procurement , Marketing and Digital Commerce Finance teams and the PMO

- Manage direct / indirect reports to optimise their performance and oversee their development, both as individuals and as a team

Spanish Finance Business Partner Resume Examples & Samples

- Qualified accountant (CIMA, ACA or ACCA) with post qualification experience. This role will require an awareness of methods other than UK GAAP

- Fluent in business Spanish (essential)

- Experience of Finance Business Partnering, ideally gained in a professional services environment within a large finance function

- Drive and support Group IT

- Drive IT cost analytics

- Deliver insight into business performance

- Track transformation costs

- Feedback analytics to key stakeholders

- Challenge and influence stakeholders

- Accountancy Qualification (ACA, CIMA or equivalent)

- Experience business partnering with an IT function

- Ability to challenge and influence stakeholders

- Demonstrable ability to build and maintain relationships with key stakeholders across the business

- The ideal candidate should have 6+ years of financial analyses and detail modeling experience

- Bachelor's degree in accounting, finance or economics; MBA is preferred

- Must have excellent communication skills, both written and verbal, and strong influencing skills

- Developing effective relationships with senior managers and becoming the key business lead on all finance matters for the business areas of responsibility

- Embedding a culture of financial and commercial challenge, ensuring that all the impacts of business decisions are evaluated and communicated

- Understanding the key profit and cost drivers in the business, ensuring that risks are highlighted and mitigated in an efficient manner

- Presenting complex financial concepts in a way that can be easily understood by non-financial stakeholders

- Adding value financially and operationally to the business area and leading on initiatives in relation to Finance related issues

- Ensuring all investment projects are fully analysed and appraised

- Inputting to and advising on content and presentation of business cases prior to sign off for functional area

- ACA/ACCA/CIMA qualified

- Having big company background is a bonus

- Previous business partnering experience

- Investment appraisal and business case exposure

- Experience in reporting and planning procedures

- Demonstrable ability to communicate and influence at senior level

- Strong analytical financial management skills

- Produce financial packs

- Provide commercial acumen on business propositions and proposals

- Build relationships with key stakeholders

- Influence key stakeholders

- Financial planning and forecasting

- Financial reporting, month end, year end reporting etc

- Align business to financial reality of issues and projects

- Challenge senior managers, inlfuencing on their decisions

- Previous commercial finance experience

- Analytical experience

- Be confident with high levels of presentation skills

- Be a strong reporter

- Qualified accountant (ACA/ ACCA/ CIMA) or equivalent

- Prepare monthly review with business managers (provide budget holder with up to date information, challenge overspend / underspend)

- Support management team with costing and implementation of various change agendas and business cases

- Co-ordinate unit cost analysis while linking operational, customer and financial performance, to identify areas for focus/change

- Identify and recommend opportunities for cost reduction and/or revenue improvement

- Track and drive cost saving initiatives

- Present complex information in an accessible and meaningful way

- Manage Forecasting and Reporting activities

- Ensuring all month end activities are performed within deadline

- Guide financial analysts in resolving month end issues

- Balance sheet control

- Experience of working in the international TV production and/or format business, ideally in a multinational, multicurrency environment

- Qualified Accountant (ACA/ACCA/CIMA) or equivalent international, graduate or business-related qualification, with post-qualified experience

- Proven ability to work as a business partner to senior management, with a variety of functional responsibilities

- Strong analytical skills, including the ability quickly to grasp the "big picture" and exhibit judgment in drawing conclusions and solving problems

- Experience of working in a corporate environment undergoing significant change or growth of the underlying business

- Exposure to international accounting and ideally a thorough knowledge and experience of US GAAP applicable to revenue recognition

- Good team player with an ability to operate in a collaborative manner across business units and functions

- Strong but diplomatic character, preferably having experience in working in a multicultural environment (Fluency in Spanish is desirable)

Finance Business Partner Wealth Management Latin Resume Examples & Samples

- Manage senior client relationships as a proactive partner and independent strategic advisor to deliver end-to-end financial insights to the business

- Primary interface between the business and Finance functions

- Develop and maintain internal stakeholders relationships through collaboration and challenge to deliver a service that fulfils the business's strategic objectives

- Provide an integrated view of financial analysis combined with non-financial information to provide the business with performance transparency

- Possess strong commercial acumen, as well as knowledge and understanding of the client business and environment to contrast an internal picture with the external view

- Communicate with, and explain financial concepts to non-finance people, influence key decision-makers and support the business in strategic decision making

- Support the development of business plan

- Support the month end close process with our other finance partners

- Perform monthly inventory accounting. Explain and track the following variances; volume and material usage

- Allocate budgeted overheads to products to determine total product costs as appropriate

- Support the raw material budget process in close conjunction with technical services and operations

- Work with designated process teams in delivering meaningful information on financial performance, in particular those production variances that the process teams influence

- Ensuring that all th internal controls are maintained and that local controls are compliant with corporate polices

- Support strategic initiatives for product portfolio analysis

- Qualified Accountant (ACA/CGMA, CPA etc)

- Some related experience in a similar role would be an advantage

- Strong interpersonal skills and ability to communicate with diverse groups and individuals

- Acting as a business partner (finance) and to act as a finance representative in business management meetings

- Provide regular analysis on the balance sheet and provide transparency around financial gaps and drives around cost efficiency

- Regular MIS reporting, and roll out MIS projects

- Playing a key role partnering with business stakeholders and management teams such as the COO and driving analytics

- Implementation of key initiatives

Group Finance Business Partner Resume Examples & Samples

- Build strong relationships with the business and act as a key point of contact for all queries

- Support Senior Stakeholders with all Finance related operational and strategic topics

- Improve business performance through influencing positive changes to process improvements, communications, systems and structures

- Understand the impacts of change, and communicating these to business lines and Finance to assist the business manage change effectively

- Qualified accountant (ACA/ ACCA / CIMA) with considerable business partnering experience ideally gained in the financial services arena

- Have in depth knowledge of IFRS, UK GAAP & Solvency II

- Experience of influencing senior stakeholders

- Insurance experience

- People management and leadership experience

- Preparation of strategic analysis and advice to support decision making, with local and global real estate management, by weighing various near-to-long term investment options

- Oversight of the financial month end process working with the deployed offshore team and branch controllers to ensure accuracy and completeness of financial data. This includes detailed review of the EMEA-wide cost pool, monthly accruals, allocation processes, month end postings and reconciliations & investigation of discrepancies to ensure compliance with applicable accounting policies / standards

- Preparation of regional monthly and quarterly business unit spend reports with the involvement of the offshore team; seeking delivery process improvement opportunities

- Assist in preparation of regular and ad-hoc global spend reports

- Perform ad hoc analysis to support requests from the Business Units to provide insightful data analysis enabling the Business Units to make effective business decisions and facilitate forecasting, cost control and to assist with their presentations to senior management

- Provision of month-end & ad-hoc analysis and reporting to support branch Finance, local Business management and global real estate

- Preparation of quarterly forecasts, meeting with various teams to discuss their submissions ensuring accuracy and completeness

- Assist in a variety of projects across different clients including in-depth cost reviews, enhancements of processes and creation of adhoc reporting

- Part or fully qualified accountant with at least 2 years' experience in a relevant role (e.g. financial accounting, management reporting)

- Strong PC skills in use of Excel & PowerPoint

- Strong written and oral communication skills to deal with varied clients across multiple locations and seniority levels

- Previous experience in financial scenario analysis

- Knowledge of Real Estate Leasor/Leasee Accounting is an advantage

- Being the first line review for investment business cases/funding requests

- Acting as Finance Business Partner to all Investment Funding bodies, including Budget and Plan construction and monthly financial reporting

- Identification of potential portfolio financial risks and opportunities

- Supporting Project Accounting and Finance Partnering to major programmes

- Support the FBP and senior manager to ensure income, balance sheet, capital, impairment and costs are accurate

- Establish and build relationships with stakeholders to support the provision of quality and timely information and analysis to inform business decisions

- Support the modelling for the forecasting for FI and support the senior manager and head of partnering to manage the interlock process

- Work with Centres of Excellence to provide a full suite of Finance services to the business, and provide feedback to Centres of Excellence on performance issues, business priorities and changing strategy

- Effectively work within and maintain internal networks for the purpose of optimising business results and add insight to business decisions, using established methods of analysis

- Builds effective and collaborative relationships across the organisation

- Full understanding/application of the provision of financial advice, support and challenge to internal stakeholders, and the articulation and consideration of external reporting dynamics

- Able to identify business performance drivers e.g. margin analysis, understand investment appraisal, cost & benefits tracking, cost and transfer pricing, income reporting & budgeting & forecasting

- Demonstrates knowledge the management of accruals, performance against budget & forecasts and able to improve processes related to these

- Full understanding / application of accounting skills, particularly P&L categorisation and interaction be

- Excellent stakeholder management skills together with analytical capability combined with a critical focus on accuracy and good commercial awareness

- In addition leadership potential, a proven ability to communicate and influence effectively at more senior levels and to work collaboratively across both direct and virtual teams will be key areas of focus

- Confidently lead client meetings, building effective stakeholder relationships

- Supporting the provision of relevant financial analysis and insight to support business decisions

- Effectively work within and maintain internal networks for the purpose of optimising business results, including development of local plans, cost models and project reporting

- Deliver month end processes to produce core outputs covering project activity

- Production of standard monthly performance reporting to support client reporting and MI, and other internal stakeholders

- Manage and minimise operational risks

- Support with ensuring income received is in line with expectations and work with clients as appropriate

- Work alongside the contracts & commercials team to build an understanding of the key financial contractual and commercial implications which impact financial deliverables and interaction with clients

- Manage financial aspects of Client change requirements; Support agreed change projects and strategic reviews to deliver continuous improvement and Group policy requirements

- Prepare MI for internal and client meetings

- Manage the month end process for client charges

- Build and nurture effective networks across the bank for the purpose of optimising business and financial results

- Support with providing input to internal and external audit processes

- Fully Qualified Accountant and a proven track record gained in a range of roles, ideally including exposure to finance business partnering and commercial experience together with financial planning and analysis discipline

- Core accounting knowledge with cost and income management experience

- Commercial awareness of external markets / factors

- Project management skills and ability to implement change

- Financial strategy, organisation and planning skills

- Practical understanding of financial systems and processes

- Developed presentational skills

- Experience supporting month end and forecasting cycles

- Ability to build effective, collaborative relationships at all levels, including a willingness to challenge and to receive challenges in a collaborative and professional manner

- Exemplary professional standards, in particular to ensure that commercially sensitive information is managed effectively and not disclosed other than as required by statute or contractual terms

- Drive innovation and simplification and automation of processes to achieve a YOY 15% productivity gain

- Develop requirements that are fit-for-purpose, accurate and display an understanding of the financial implications to the project or program and manage the requirements throughout the life of the project

- Propose measures that provide input to benefit metrics

- As required, assist with activities in implementing the change and embedding BAU transition

- Deliver Projects as per Plan and Budget

- Staff Annual Leave and Absenteeism are kept at acceptable levels

- Work with the Lead Manager MI to establish and execute the financial plan and direction for the team in hubs

- Be accountable for strong stakeholder relationships by providing regular detailed reporting to stakeholders on activities of the team and processes that the roles are accountable for. Including: Project Work Undertaken, Status of regular deliverables, issues and resolution progress

- Responsible for Pro-active stakeholder management by work prioritization

- Anticipate and Escalate production related issues in team meetings and with key stakeholders

- Provide the highest possible level of customer service by ensuring all duties are processed in an accurate and timely manner to meet or exceed customer expectations

- Demonstrate ability to independently resolve complex problems and show resilience in the face of adversity

- To become a trusted advisor and integral part of the Global MI & Analytics Team