Student Good Guide

The best UK online resource for students

- Finance Personal Statement Examples

Here are two finance personal statement examples from some of the best students in undergraduate and postgraduate programmes. Both examples you can use as inspiration and motivation to write your own personal statement for university .

Finance Personal Statement

Ever since I discovered my passion for the finance industry at a young age, I have been determined to pursue a career as a financial consultant and advisor. It is this unwavering ambition that has led me to apply for the MSc course in Finance at the esteemed London School of Economics and Political Science (LSE). I firmly believe that this course will provide me with the necessary tools and knowledge to achieve my career goals by expanding my understanding of financial products, the intricate workings of financial markets, and investment banking.

The reputation of LSE as a university of academic excellence is one of the key reasons for my decision to apply. I am aware of the university’s ability to equip students with critical analysis skills that are essential for becoming leaders in their chosen sectors. Moreover, being located in the heart of London provides unparalleled opportunities for networking and professional development in the world of business and finance. The course’s comprehensive approach, which strikes a balance between theoretical and practical modules, is also highly appealing to me.

My educational background in accounting has laid a solid foundation for my advanced studies in finance. Through my coursework in accounting, I have developed strong numerical skills and gained practical experience in management accounting and reporting roles within financial firms. It was during my studies that I discovered a particular interest in Strategic Financial Management, where I was introduced to financial products such as equities, derivatives, fixed income, and bonds, along with their significance in financial markets. Building on this knowledge, I have become a qualified accountant and have gained valuable work experience as an Associate at Deloitte, where I am part of the project management team, responsible for decision support. This role has honed my ability to work under pressure and within tight time constraints, allowing me to meet urgent and conflicting deadlines.

To stay up-to-date with the dynamic financial market, I avidly follow financial news through subscriptions to reputable media platforms such as the Financial Times, the Economist, and Bloomberg. Additionally, I engage in various hobbies such as travelling, watching movies and documentaries, and reading to broaden my knowledge and stay informed about current affairs. As a sports enthusiast, I follow tennis, football, boxing, and Formula One racing. These diverse interests have cultivated qualities such as ambition, intuition, focus, and self-discipline, which drive me to excel in any endeavour. I value the input and opinions of others, making me an effective team player, while also possessing the independence and initiative to work autonomously. I firmly believe that these qualities will contribute to my success as a finance analyst and enable me to excel academically.

Looking toward the future, I aspire to establish a reputable financial consulting firm in my home country, Nigeria. This firm would provide a range of financial services to both companies and public institutions. I recognise that achieving this goal will require years of experience, cultivating the right connections, and personal determination. Pursuing an MSc in Finance from LSE will better equip me to manage corporate, strategic, and financial opportunities, while also providing the opportunity to learn from talented professors and compete with exceptional graduates. I am convinced that this course is a crucial step toward realizing my long-term aspirations.

The increasingly evident impact of financial risk on our world has captivated my interest like never before. The interplay between the financial sector, government, and the general public dominates news stories, emphasizing the significance of understanding the industry. With my passion for finance nurtured from an early age, I have dedicated myself to attaining a comprehensive understanding of both the theoretical and practical aspects of global finance through high-level studies and extensive work experience in diverse industrial and international contexts.

Currently, in my fourth year of a degree in Finance, Risk, and Investment at Caledonian University, I have developed a strong foundation of knowledge in the field. Moreover, I have delved deeper into specific areas

Finance Personal Statement Example

Since my early years, extensive international travel has shaped my perspective on the world, particularly the stark economic contrasts between the ‘Third World’ and the ‘Western World.’ Having the privilege of experiencing different cultures and economies through my parents, who have lived in Africa, Europe, and the USA, I have developed a deep curiosity about the mechanisms that drive global economies. This curiosity has led me to pursue Economics at A Level, as I believe it is at the core of world discussions and can provide a comprehensive understanding of current news articles and their correlation to the subject.

Through my readings, such as Tim Harford’s ‘The Undercover Economist,’ I have come to appreciate the analogy that economics is like engineering, offering insights into how things work and the consequences of changing them. I see economics as an intricate puzzle, requiring economists to integrate economic theories with government policies to solve complex economic problems. Attending conferences at prestigious institutions like the University of Warwick and Oxbridge has broadened my perspective on economics, with theories like Freakonomics intriguing me and sparking a desire to explore the unexpected links between seemingly unrelated phenomena.

My passion for economics is complemented by a strong affinity for mathematics , which has been nurtured since my childhood. From playing mental maths games to tackling complex problem-solving at A Level, I have developed analytical abilities that were put to the test during a taster day at Cass Business School. Through quick thinking and effective teamwork, I excelled in a trading shares simulation, resulting in my group being the most profitable. Furthermore, my participation in a business management enterprise day at the University of the West of England allowed me to showcase my skills, leading to the recognition of the ‘Best Business Idea.’

To gain practical experience in the finance sector, I sought work opportunities that would provide me with invaluable insights. My time at Britannia Building Society exposed me to the inner workings of retail banking, allowing me to shadow the branch manager, work closely with financial planning advisors, and handle transactions at the tills. This experience introduced me to financial assets, including options for investing in bonds, shares, and increasing savings. Additionally, working at Harrison’s Accountancy and Insolvency Agency gave me valuable knowledge about liquidations and insolvencies of businesses, further solidifying my interest in pursuing a career in finance.

Staying updated with current financial affairs is crucial to me, and I regularly read the economy sections of reputable sources such as the BBC website and The Economist. Subscribing to a weekly update from RBS provides me with topical developments in the financial markets. Alongside my commitment to academic and professional pursuits, I have also developed essential skills through my job at O2 Retail. This experience has sharpened my interpersonal skills and honed my ability to negotiate mutually beneficial deals for both customers and the company. As a captain of my football team, I have learned the value of leadership, motivation, and maintaining high team morale, skills that have translated into success in class debates and the trading shares simulation at Cass Business School.

During a recent trip to Switzerland, I had the opportunity to meet with the assistant vice president at Credit Suisse, who shared insights into exchange rate processes within a leading investment bank. These conversations further solidified my understanding of the close relationship between economics and the finance sector.

Through a comprehensive study of Level Economics and practical experiences, I have been able to bridge the gap between theory and real-world situations. Engaging with professionals in the field has deepened my appreciation for the vital connection between economics and finance. I am confident that pursuing a university education will equip me with the necessary knowledge and skills to navigate the dynamic and fast-paced world of financial markets.

My passion for finance and economics was sparked by the Lehman Brothers’ bankruptcy and the subsequent financial crisis when I was 21 years old. The events of that

Other Personal Statements

- Statistics Personal Statements

- PPE Oxford Personal Statement Example

- Classics Personal Statement Examples

- Theology Personal Statement Examples

- Physics Personal Statement Examples

- Chemical Engineering personal statement examples

- Oncology Personal Statement Examples

- Psychiatry Personal Statement Examples

- Earth Sciences Personal Statement Example

- History Personal Statement Examples

- Veterinary Personal Statement Examples For University

- Civil Engineering Personal Statement Examples

- User Experience Design Personal Statement Example

- Neuroscience Personal Statement Examples

- Graphic Design Personal Statement Examples

- Film Production Personal Statement Examples

- Events Management Personal Statement Examples

- Counselling Personal Statement Examples

- Forensic Science Personal Statement Examples

- Children’s Nursing Personal Statement Examples

- Chemistry Personal Statement Examples

- Sports Science Personal Statement Examples

- Mechanical Engineering Personal Statement Examples

- Electrical and Electronic Engineering Personal Statement Examples

- Quantity Surveying Personal Statement Examples

- Social Work Personal Statement Examples

- Physiotherapy Personal Statement Examples

- Journalism Personal Statement Examples

- English Literature Personal Statement Examples

- Marketing Personal Statement Examples

- Computer Science Personal Statement Examples

- Fashion Marketing Personal Statement Examples

- Dietetic Personal Statement Examples

- Product Design Personal Statement Examples

- Aerospace Engineering Personal Statement Examples

- Geography Personal Statement Examples

- Business Management Personal Statement Examples

- Politics Personal Statement Examples

- Psychology Personal Statement Examples

- Oxbridge Personal Statement Examples

- Zoology Personal Statement Example

- Sociology Personal Statement Example

- Fashion Personal Statement Example

- Mathematics Personal Statement Examples

- Software Engineering Personal Statement Examples

- Philosophy Personal Statement

- International Relations Personal Statement Example

- Biochemistry Personal Statement Example

- Dentistry Personal Statement Examples

- Midwifery Personal Statement

- Law Personal Statement Example

- Medicine Personal Statement for Cambridge

- ICT Personal Statement

- Primary Teacher PGCE Personal Statement

- PGCE Personal Statement Example

- Games Design Personal Statement

- Paramedic Science Personal Statement Examples

- Occupational Therapy Personal Statement

- Pharmacy Personal Statement Example

Financial Tips, Guides & Know-Hows

Home > Finance > Personal Financial Statement: Definition, Uses, And Example

Personal Financial Statement: Definition, Uses, And Example

Published: January 7, 2024

Learn about the definition, uses, and example of a personal financial statement in the world of finance. Understand its importance and impact on your financial planning.

- Definition starting with P

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

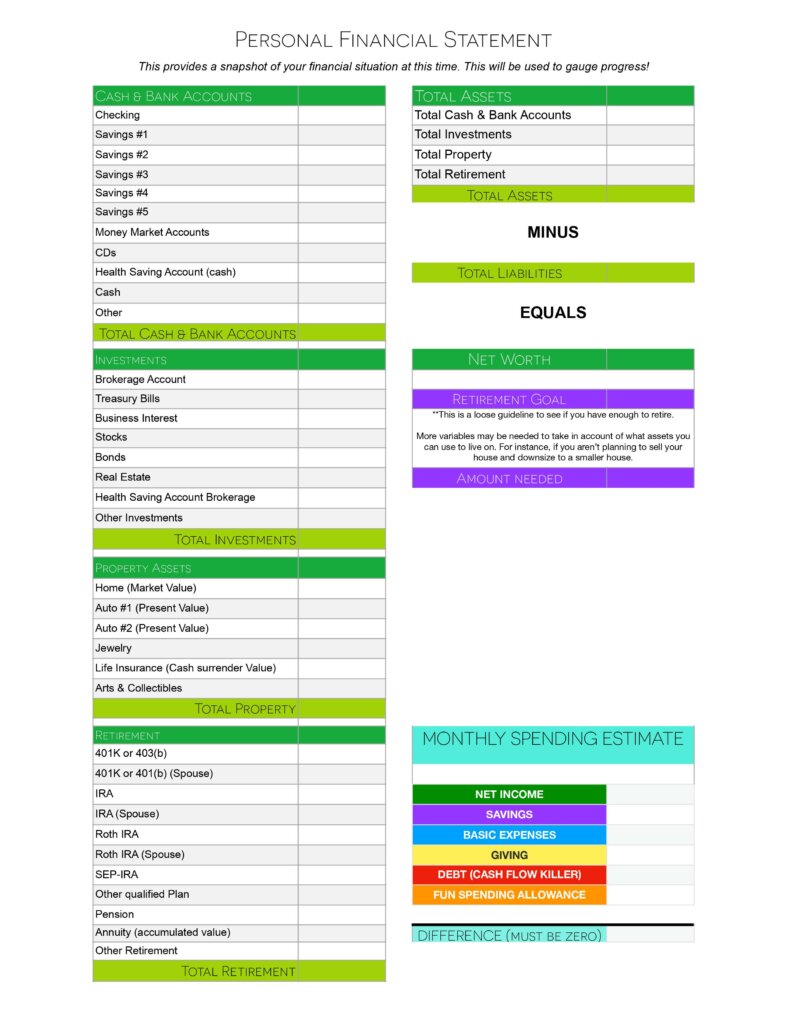

Understanding Personal Financial Statements

When it comes to managing your finances, having a clear understanding of your financial position is essential. This is where personal financial statements come into play. In this article, we’ll explore the definition, uses, and provide an example of a personal financial statement.

Key Takeaways:

- Personal financial statements provide a snapshot of an individual’s financial position.

- These statements are useful for assessing one’s net worth, cash flow, and financial health.

A personal financial statement is a document that summarizes an individual’s financial situation, including their assets, liabilities, income, and expenses. It provides a comprehensive overview of one’s financial health and can be an invaluable tool for making informed financial decisions.

Let’s delve deeper into the various components of a personal financial statement:

Assets refer to items of financial value that an individual owns. This can include cash, savings accounts, investments, real estate, vehicles, and personal belongings. In the personal financial statement, these assets are listed at their current market value. By calculating the total value of assets, one can determine their net worth.

Liabilities

Liabilities encompass the debts and obligations that an individual owes. This can include credit card debt, mortgages, student loans, car loans, and any other outstanding debts. Similar to assets, liabilities are also listed in the personal financial statement, giving a clear picture of one’s overall financial obligations.

Income and Expenses

The personal financial statement also includes an individual’s income and expenses. Income refers to all sources of money inflow, such as salary, rental income, investments, or any other forms of income. Expenses, on the other hand, encompass all the money outflows, including rent/mortgage payments, utilities, groceries, transportation costs, and other personal expenses. By analyzing this section, one can assess their cash flow and determine if they are living within their means.

Uses of Personal Financial Statements:

- Assessing net worth: By calculating the total value of assets and subtracting liabilities, one can determine their net worth.

- Evaluating financial health: Personal financial statements provide a holistic view of an individual’s financial health, helping identify areas for improvement.

- Applying for loans: Lenders often require personal financial statements when assessing an individual’s creditworthiness.

- Planning for the future: These statements serve as a foundation for setting financial goals and creating a budget.

Example of a personal financial statement:

Let’s take a look at a simple example of a personal financial statement:

Personal Financial Statement of John Doe

- Cash: $10,000

- Savings Account: $20,000

- Investments: $50,000

- Real Estate: $150,000

- Total Assets: $230,000

- Mortgage: $100,000

- Student Loans: $20,000

- Credit Card Debt: $5,000

- Total Liabilities: $125,000

- Salary: $60,000

- Rental Income: $12,000

- Total Income: $72,000

- Monthly Rent/Mortgage: $1,500

- Utilities: $200

- Groceries: $400

- Transportation: $300

- Total Expenses: $2,400

In this example, John Doe’s net worth is calculated by subtracting his liabilities ($125,000) from his assets ($230,000), resulting in a net worth of $105,000. His monthly cash flow can also be determined by subtracting expenses ($2,400) from income ($6,000), resulting in a positive cash flow of $3,600.

Personal financial statements are crucial for managing your finances effectively. By regularly updating and analyzing your personal financial statement, you can gain valuable insights into your financial standing and make informed decisions to achieve your financial goals. Whether you’re applying for a loan, evaluating your financial health, or simply aiming to improve your financial well-being, personal financial statements are an essential tool in your financial toolkit.

20 Quick Tips To Saving Your Way To A Million Dollars

Our Review on The Credit One Credit Card

How Much Does Hertz Hold On Credit Card

Quid Pro Quo: Definition, Examples, And Legality

Latest articles.

Understanding XRP’s Role in the Future of Money Transfers

Written By:

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Navigating Disability Benefits Denial in Philadelphia: How a Disability Lawyer Can Help

Preparing for the Unexpected: Building a Robust Insurance Strategy for Your Business

Custom Marketplace Development: Creating Unique Online Shopping Experiences

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/personal-financial-statement-definition-uses-and-example/

- Personal Financial Statement

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on November 15, 2023

Get Any Financial Question Answered

Table of contents, what is a personal financial statement.

A personal financial statement is a report or set of documents that summarizes an individual's financial situation at a particular time.

It is often divided into two sections: the balance sheet and the income statement.

The balance sheet provides a breakdown of assets and liabilities, while the income statement summarizes income and expenses.

General information about an individual, such as name and address, may also be included in a personal financial statement.

Individuals can use personal financial statements to monitor their current economic situation.

What Personal Financial Statement Includes

A personal financial statement is typically divided into two sections. These are:

Balance Sheet

The financial statement contains a section known as a balance sheet, which summarizes a person's assets, including cash and investments , and liabilities like debts or loans.

The balance sheet is also used to calculate an individual’s net worth, which is the value of assets minus the amount of liabilities.

Income Statement

The next section, the income statement , details the flow of income and expenses that influences a person's financial situation.

Income statements list all sources of income, such as salaries, bonuses, and dividends .

Expenses such as insurance payments, electricity, or grocery bills are also included.

What Personal Financial Statement Excludes

A personal financial statement does not include the following items:

Company Assets and Liabilities

Company resources and debts are removed from the financial statement unless the individual has direct and personal responsibility.

When someone personally guarantees a loan for their business, the loan is included in their personal financial statement.

Loaned Items

Loaned assets are not owned, so they are not included in personal financial statements.

However, if an individual owns a property and rents it out to others, then the property's value is included in the financial statement list.

Personal Belongings

Furniture and home goods are often not shown as assets on a personal balance sheet since they cannot be easily sold to pay off a loan.

Personal goods with high monetary value, such as jewels and antiques, may be included if their worth can be shown by an evaluation.

Personal Financial Statement Example

Let us look at an example of a personal financial statement using the hypothetical case of Jeffrey.

Below is an example of what Jeffrey’s balance sheet may look like in spreadsheet form.

As shown above, Jeffrey has $295,500 worth of assets. This includes the assets like a house, a vehicle, bank accounts, and a retirement account.

Now let us say he has $101,000 in liabilities as well. This includes credit card debts, student loans and mortgages.

With this information, his balance sheet should reflect a net worth of $194,500.

Here is an example of what Jeffrey’s income statement may look like in spreadsheet form:

As shown above, Jeffrey receives a total monthly income of $14,200 and spends a total of $8,610 in expenses.

After subtracting expenses from income, Jeffrey has a net income of $5,590.

Taken together, Jeffrey’s balance sheet and income statement provide useful information about his current financial situation.

How to Create a Personal Financial Statement

Let us look at a guide on how to create a personal financial statement.

How to Create a Personal Balance Sheet

- List All Assets

Indicate the dollar value of the assets to be declared. Accuracy is important, particularly when creating a statement for the purpose of borrowing.

Find the total value of all available assets.

- List All Debts

Liabilities come from debts. State the obligations that have to be settled and debts to be paid.

Common items include credit card debts, mortgage debts, and student loans.

Find the total value of all liabilities.

- Determine the Net Worth

Net worth is calculated by deducting total liabilities from total assets.

How to Create a Personal Income Statement

- List all Money Received from Various Sources

Determine the amount of money coming in from various sources. This usually includes regular income received monthly.

- List all Expenses

Make a list of all monthly spending. Start with fixed costs before moving to variable costs.

- Determine Net Profit or Loss

The net profit or loss can be calculated by subtracting the total monthly expenses from the total income or revenue generated in that month.

Importance of a Personal Financial Statement

Here are some reasons why it is important to create a personal financial statement.

Financial Planning

A personal financial statement is an important tool that can be used for financial planning.

It provides a snapshot of an individual's financial situation at a particular point in time, which can be helpful in making future projections and plans.

The statement can also be used to track progress over time and to identify areas where improvements can be made.

Personal financial statements are essential when filing taxes because they summarize income made throughout the year.

They also provide an idea of possible deductions that can be made to lower an individual’s tax rate.

Loan Application

Personal financial statements are often required when applying for credit, such as a loan or mortgage .

Lenders use the information in the statement to assess an individual's ability to repay the debt and to determine the interest rate that will be charged.

In some cases, a personal financial statement may be used in lieu of a credit report when applying for credit.

Final Thoughts

A personal financial statement can be a helpful tool in managing finances and making future plans.

Personal financial statements include balance sheets to monitor assets and liabilities and income statements to track an individual’s income and expenses.

Details on the assets and liabilities related to an individual’s businesses, any rented items and personal belongings are not included in a personal financial statement.

Personal financial statements can be used for a variety of purposes, including financial planning, overviewing an individual's financial situation, and loan applications.

Personal financial statements must be updated on a regular basis to provide an accurate picture of an individual’s current economic situation.

Personal Financial Statement FAQs

What is a personal financial statement.

A personal financial statement is a report or set of documents that summarizes an individual's financial situation at a particular time.

What is included in a personal financial statement?

A personal financial statement includes information on an individual's balance sheet and income statements. The balance sheet provides a summary of assets and liabilities, whereas the income statement summarizes revenue and costs.

What is excluded from a personal financial statement?

Personal financial statements do not include details of a company’s assets and liabilities, loaned items, and personal belongings.

Why is a personal financial statement important?

It is important because it provides a snapshot of an individual's financial situation at a particular point in time. It can help to identify areas where expenses may be excessive or where there is room to make cuts in order to save money. The statement can also be used to track progress toward financial goals.

What does a personal financial statement show?

A personal financial statement shows an individual's assets, liabilities, income, and expenses. It can help to identify areas of financial strength and weakness and to track progress over time.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Articulation

- Cash Flow Analysis

- Cash Flow Management

- Cash Flow Planning

- Classified Financial Statement

- Components of the Accounting Equation

- Financial Statement Footnotes

- Financial Statement Preparation

- How to Read an Annual Report

- Interim Statements

- Multi-Step Income Statement

- Net Worth Statement

- Profit and Loss Statement (P&L)

- Single-Step Income Statement

- Statement of Changes in Financial Position

- 1040 US Individual Tax Return Form

- 1040EZ Form

- 183-Day Rule

- 90-Day Letter

- Ad Valorem Tax

- Additional Child Tax Credit

- After-Tax Income

- American Opportunity Tax Credit (AOTC)

- Capital Gains Tax Accountant

- Child Tax Credit

- Cryptocurrency Tax Accountant

- Do You Need a Tax Accountant?

- Do You Need an Accountant to File Your Taxes?

Ask a Financial Professional Any Question

Search for local tax preparers, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

What Is Personal Financial Statement: A Comprehensive Guide

Wajiha Danish | August 17 2023

Managing your finances is crucial for achieving financial stability and long-term goals. One of the fundamental tools at your disposal is the personal financial statement to assess your financial health and make informed decisions. In this in-depth blog, we will delve into the intricacies of evaluating your financial statement, helping you better understand your financial position and charting a course toward a more secure future.

Understanding the Personal Financial Statement

A blank personal financial statement is a snapshot of your financial situation at a specific time. It outlines your assets, liabilities, and net worth. Let’s break down each component:

Assets encompass everything you own that holds monetary value. It includes cash, investments, real estate, vehicles, personal belongings, and more. Categorizing and valuing your assets is essential for a realistic assessment.

2. Liabilities

Liabilities represent your debts and financial obligations. It includes credit card debt, loans, mortgages, and outstanding payments. Identifying your liabilities is crucial to gauge your financial obligations accurately.

3. Net Worth

Net worth is calculated by subtracting your total liabilities from your total assets. It is a key indicator of your financial health and can help you understand whether you’re building wealth or accumulating debt.

Assessing Your Financial Goals

Before diving into the evaluation process, establish clear financial goals. These could include saving for a down payment on a house, paying off debt, funding your children’s education, or retiring comfortably. Understanding your goals will guide your assessment and help you allocate resources accordingly.

Evaluating Your Financial Statement

1. accuracy and completeness.

Begin by ensuring that your blank personal financial statement is accurate and comprehensive. Update it regularly to reflect your current financial position and ensure you haven’t omitted any assets or liabilities.

2. Liquidity

Liquidity refers to your ability to access cash quickly without incurring significant losses. Evaluate how much of your assets can be easily converted to cash, such as savings accounts, money market funds, and liquid investments. A healthy liquidity ratio ensures you can handle unexpected expenses or capitalize on opportunities.

3. Debt-to-Income Ratio

Your debt-to-income ratio measures the percentage of your monthly income for servicing debt. A high ratio indicates that a significant portion of your income is tied up in debt payments, which could affect your ability to save and invest. Strive for a manageable debt-to-income ratio to maintain financial flexibility.

4. Net Worth Growth

Regularly monitor your net worth to track your financial progress. A growing net worth suggests effective financial management, while a declining net worth may necessitate adjustments to your spending, saving, or investment strategies.

5. Emergency Fund

Evaluate the adequacy of your emergency fund, which acts as a safety net during unforeseen events like medical emergencies or job loss. A good rule of thumb is to save three to six months’ worth of living expenses in an easily accessible account.

6. Investment Portfolio

Assess the composition of your investment portfolio. Diversification across different asset classes helps manage risk and potentially enhance returns. When reviewing your portfolio, consider your risk tolerance, investment horizon, and financial goals.

7. Retirement Planning

Analyze your retirement savings and contributions to retirement accounts such as 401(k)s or IRAs. Use retirement calculators to estimate if your current savings rate will provide the income you need in retirement.

8. Budget Analysis

Compare your monthly income and expenses to identify areas where you can cut back or allocate more funds toward your financial goals. A detailed budget can help you make informed spending decisions.

9. Tax Efficiency

Examine your tax strategies to minimize tax liabilities. Maximize the use of tax-advantaged accounts and consider tax-efficient investment strategies.

10. Professional Guidance

If navigating your blank financial statement seems overwhelming, seek guidance from financial advisors or professionals. Their expertise can provide valuable insights and help you create a personalized plan.

Steps for Effective Personal Finance Planning and Management

Effective personal finance planning and management is crucial for achieving financial stability, reaching your goals, and building wealth. Here’s a detailed step-by-step guide to help you navigate this process:

1. Set Clear Financial Goals

Start by defining your short-term, medium-term, and long-term financial goals. These could include saving for a vacation, buying a house, paying off debt, building an emergency fund, or planning retirement.

Make your goals specific, measurable, achievable, relevant, and time-bound (SMART).

2. Assess Your Current Financial Situation

Gather all your financial information, including income sources, expenses, debts, assets, and investments.

Create a net worth statement to understand your financial health – assets minus liabilities.

3. Create a Budget

Develop a detailed budget outlining your monthly income and all expenses, including fixed and variable costs.

Prioritize essential expenses (housing, utilities, groceries) and allocate a portion of your income to savings and investments.

4. Track Your Spending

Use budgeting tools, apps, or spreadsheets to monitor your spending habits.

Regularly review your expenses to identify areas where you can cut back and save more.

5. Manage debt

Prioritize paying off high-interest debts, such as credit cards, as quickly as possible.

Consider consolidating or refinancing debts at lower interest rates.

Avoid taking on unnecessary debt and use credit responsibly.

6. Build an Emergency Fund

Save three to six months’ living expenses in an easily accessible account.

This fund acts as a safety net in case of unexpected expenses or job loss.

7. Save and Invest

Contribute to retirement accounts (401(k), IRA) and use any employer matching.

Diversify your investments across various asset classes (stocks, bonds, real estate, etc.) to manage risk.

Regularly contribute to investment accounts and take advantage of compounding returns.

8. Plan for Major Expenses

Set up separate savings accounts for specific goals (e.g., car buying, home down payment, education).

Allocate a portion of your budget towards these savings goals.

9. Review and Adjust

Regularly review your budget, financial goals, and investment portfolio.

Adjust your plan as needed based on income, expenses, or goals changes.

10. Educate Yourself

Stay informed about personal finance concepts, investment strategies, and tax implications.

Attend financial literacy workshops, read books, and follow reputable financial experts.

11. Insurance and Estate Planning

Ensure you have adequate insurance coverage, including health, life, and disability insurance.

Create or update your will, designate beneficiaries, and establish a power of attorney and healthcare proxy.

12. Minimize Taxes

Optimize your tax strategy by taking advantage of tax-advantaged accounts and deductions.

Consult a tax professional to ensure you’re making informed decisions.

13. Seek Professional Advice

Consult a certified financial planner (CFP) or financial advisor to help you create a comprehensive financial plan tailored to your goals and circumstances.

14. Practice Discipline and Patience

Stick to your budget and financial plan over the long term.

Avoid impulsive spending and emotional decisions regarding investments.

15. Celebrate Milestones

Celebrate your financial achievements and milestones to stay motivated on your journey to financial success.

Remember that personal finance is a continuous process, and adjusting as your circumstances change is okay. By following these steps and staying disciplined, you’ll be well on your way to effective personal finance planning and management.

Evaluating your blank personal financial statement is a fundamental step toward achieving financial well-being. Regular assessment of your assets, liabilities, and net worth, along with a thorough analysis of your financial goals, provides a comprehensive view of your financial health. By understanding key indicators such as liquidity, debt-to-income ratio, net worth growth, and investment portfolio, you can make informed decisions to secure your financial future. Remember, financial success is a journey, and continuous evaluation and adjustments are essential to stay on the path to achieving your goals. For more information and new insights on ongoing accounting and financial topics, contact Monily at [email protected] or visit www.monily.com.

Also Read: Accounts Receivable Turnover Ratio – Key To Better Finances

Wajiha is a Brampton-based CPA, CGA, and Controller with 17+ years of experience in the financial services industry. She holds a Bachelor of Science Degree in Applied Accounting from Oxford Brookes University and is a Chartered Certified Accountant. Wajiha spearheads Monily as its Director and is a leader who excels in helping teams achieve excellence. She talks about business financial health, innovative accounting, and all things finances.

Visit the Monily Blogs

Bookkeeping Struggles for Startups and How to Overcome Them

Nida Bohunr | December 17 2021

Accounting For Startups: Guide To Startup Accounting

Wajiha Danish | June 13 2022

How To Do Market Research For a Startup?

Farwah Jafri | October 27 2021

- Search Search Please fill out this field.

- Financial Planning

What Is a Personal Financial Statement?

:max_bytes(150000):strip_icc():format(webp)/IMG_0031-a6116af31d5a4783a969390cd325367c.jpg)

- Definition and Examples

How Does a Personal Financial Statement Work?

Do i need a personal financial statement.

Xavier Lorenzo / Getty Images

A personal financial statement is a physical snapshot of your assets compared to your liabilities. It gives you a real-time view of your wealth and helps you assess your current financial situation. While it's beneficial for your own financial growth, lenders may ask for a personal financial statement if you’re applying for a loan

Key Takeaways

- A personal financial statement is a document that lists all your assets, liabilities, and resulting net worth.

- Personal financial statements can be used by individuals and businesses.

- A personal financial statement is important because it shows you if you’re building wealth, and can play a critical role in helping you get approved for loans.

- The most efficient way to keep your personal financial statement up-to-date is to use budgeting software that tracks your net worth for you.

Definition and Examples of a Personal Financial Statement

A personal financial statement is a physical snapshot of your assets compared to your liabilities . It gives you a real-time view of your wealth and helps you assess your current financial situation. While it's beneficial for your own financial growth, lenders may ask for a personal financial statement if you’re applying for a loan

But what are assets and liabilities? Your assets refer to all items you can easily convert to cash, including:

- Bank accounts

- Retirement accounts

- Investment balances

- Real estate

- Personal property with significant value, such as rare art collections, coin collections, antiques, and jewelry

Your liabilities refer to all the debt you owe. They can be:

- Student loans

- Credit card debt

- Car and boat loans

- Loans where you’re the co-signer

- Unpaid taxes

- Medical debt

If your total assets are higher than your liabilities, your personal financial statement reflects a positive net worth . This is a sign that you’re building wealth and signals to lenders that you may be a trustworthy borrower.

If your liabilities are higher than your assets, however, you have a negative net worth. This signals you may be living paycheck to paycheck or spending more than you earn, and you could be seen as a high-risk borrower to lenders.

If you are in a committed partnership or married and share assets, you and your partner can combine assets and liabilities to create a joint personal financial statement.

Suppose you have $200,000 worth of assets. This includes your house, a bank account, and a retirement account. Now let’s say you have $130,000 in liabilities. This includes your mortgage, some student loans , and credit card debt. In this case, your net worth is $70,000.

Here’s an example of how your personal financial statement may look in spreadsheet form:

The Balance

Your personal financial statement will be a lot more complex if you’re creating one for your business. For small business owners, the Small Business Administration (SBA) has a sample personal financial statement you can use as a guide.

Wealth is not defined by the income you accumulate, but by your net worth. A personal financial statement is important because it shows if your net worth is improving or decaying over time. It sheds light on your entire financial picture so you can see if you’re moving closer or farther away from your goals .

For example, suppose your financial goal is to retire early . You’ve officially paid off your debt (minus your mortgage), but you’re not sure how close you are to reaching your retirement goals. You decide to create a personal financial statement to see where you stand.

Below is a guide to how you would fill out your personal financial statement, using the above example.

Step 1: List All Your Assets

Most assets have a clear dollar value (i.e., you can look in your bank account and see what your balance is). But some assets—such as your car, home, or an art collection—may require an appraisal first.

If you’re creating a personal financial statement for a lender, it’s important to be as accurate as possible (and get an appraisal if you’re unsure of the amount). But if it’s just for your own personal records, an educated guess may be fine. This may look like:

- $600,000 in your home

- $150,000 in your 401(k)

- $125,000 in your investment account

- $40,000 in your checking and savings accounts

- $30,000 in your traditional IRA

- $5,000 for your car

Total assets = $950,000

Anything you rent does not count as an asset because you don’t own it. So if you rent a house or lease a car, leave it off your personal financial statement.

Step 2: List All Your Debt

Your debts are your liabilities. In this example, we’ve stated you’ve paid off all your debt except your mortgage, so that’s the only thing listed here.

- $300,000 on your mortgage

Total liabilities = $300,000

If you pay your credit card bill off in full every month, it’s not considered debt, so don’t include it on your personal financial statement.

Step 3: Subtract the Two Numbers To Get Your Net Worth

In this example, when you subtract the assets from your liabilities, you see that your total net worth is $650,000.

Now, suppose you know you need $1.2 million to reach financial freedom and retire early. Your personal financial statement would show that you’re $550,000 away from your goal. You could then update it again next month to track your progress, and make changes to your spending and saving as needed.

Personal financial statements help individuals understand the overall state of their personal or business finances, and calculate their net worth. They can also be used as a tool when applying for credit such as a mortgage, personal loan, or business loan . To get a snapshot of your financial health, it’s a good idea to create a personal financial statement.

Even if you have a positive net worth, it is not guaranteed you will receive a loan you apply for. Credit history and past debts are also taken into consideration by lenders.

The biggest drawback of personal financial statements is that it’s a frozen snapshot of your financial health at any given time. For it to have a positive impact, you have to update it regularly.

The good news is that there are many online tools you can use to automate your personal financial statement. Two popular options include:

- You Need a Budget (YNAB) : This is a personal finance software with strong financial budgeting features that can automatically track your assets and liabilities for you. As you earn income and pay off debt, your net worth updates in real time.

- Personal Capital : This tool for tracking your net worth acts as more of a wealth management tool, praised for helping you track and optimize investments and spot ways to diversify and manage risk. It connects with more than 14,000 financial institutions and provides a moving snapshot of your net worth.

Clearview Credit Union. " What Is a Personal Financial Statement? " Accessed Oct. 28, 2021.

Personal Capital. " Our Mission: We Transform Financial Lives Through Technology and People ." Accessed Oct. 28, 2021.

ACDS PUBLISHING

Understanding Personal Financial Statements: A Comprehensive Guide

Table of content, what’s in this guide, personal balance sheet, how to create a personal balance sheet, calculating and interpreting your net worth, pros of creating a personal balance sheet, personal balance sheet limitations, pro tips on creating and maintaining a personal balance sheet, personal cash flow statement, how to create a personal cash flow statement, calculating and interpreting your net cash flow, pros of creating a personal cash flow statement, personal cash flow statement limitations, pro tips on creating and maintaining a personal cash flow statement, personal balance sheet case study, personal cash flow statement case study, grab your free personal financial statement template here, the bottom line.

Financial literacy isn’t just a skill; it’s a necessity in our complex modern economy. Our financial landscape is filled with many challenges—from managing debt and investments to planning for retirement. A personal financial statement is one key financial document that makes navigating these challenges easy.

Personal financial statements, which comprise a balance sheet and cash flow statement, provide a snapshot of your financial health, allowing you to evaluate your current financial condition, track changes over time, and plan for the future. Imagine seeing, at a glance, areas where you can reduce spending, if your net worth is increasing or decreasing, or if you are on track to meet your financial goals.

That’s the kind of clarity these statements provide. They don’t just contain numbers; they provide insights into your financial health, facilitating better decisions and effective long-term planning. For example, a cash flow statement can reveal if you are spending too much on non-essential items, while a balance sheet can show if your debt is becoming unmanageable.

Additionally, analyzing these statements together provides a broad view of your financial situation, helping you identify potential issues before they become significant problems. For instance, if your cash flow statement shows a consistent surplus, but your balance sheet reveals increasing debt, that might be a sign that you are not using your surplus efficiently to pay down debt.

In this guide, we’ll walk you through the two common types of personal financial statements: the personal balance sheet and the personal cash flow statement. We’ll explain each statement, their typical line items, the benefits of creating them, and their limitations.

Finally, we’ll share some pro tips on creating and maintaining each statement, and we’ll examine two case studies that illustrate how each statement can help individuals make better financial choices. At the end of the guide, you will be able to download a free template to get you started on monitoring your finances.

Let’s dive right in.

In a hurry and can’t read this guide in one go? Download the free PDF version to read whenever you have the chance!

Download Link: Understanding Personal Financial Statements: A Comprehensive Guide

A personal balance sheet provides a snapshot of your financial position at a specific period, typically a month or a year. It outlines what you own (assets), what you owe (liabilities), and the difference between the two, known as your net worth. Assets include your house, car, investments, and savings, while liabilities encompass debts such as your mortgage, car loan, and credit card balances.

For instance, say your assets include a $350,000 house, a $30,000 car, $80,000 in investments, $30,000 in savings, and $10,000 in other assets, totaling $500,000. On the other hand, your liabilities include a $150,000 mortgage, $20,000 car loan, $10,000 credit card debt, $15,000 student loan, and $5,000 in other debts totaling $200,000. In this scenario, your net worth would be $500,000 (Total Assets) – $200,000 (Total Liabilities) = $300,000.

Understanding, creating, and maintaining a personal balance sheet helps you make informed decisions about investments, loans, and other financial matters. For example, by knowing your net worth, you can determine how much debt you can afford for a new home or car, how much you can reasonably invest, or whether you need to focus on paying down existing debt.

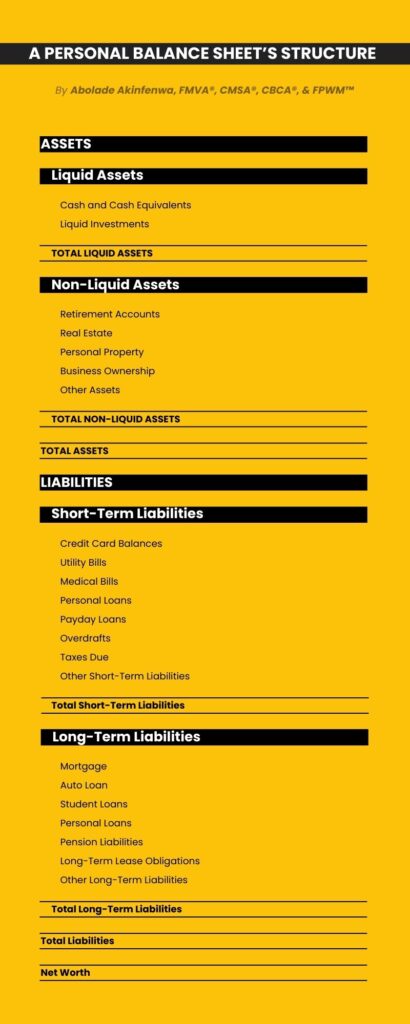

A personal balance sheet consists of two major categories: assets and liabilities. You can further divide these categories into subcategories that outline what you own and owe. Let’s briefly examine the typical structure of a personal balance sheet.

“Assets” is the first section on a personal balance sheet, and it covers everything you own that has a monetary value. These include tangible items like your home, car, and personal belongings, as well as intangible items like investments and savings accounts. Essentially, anything you could sell or cash in for money is considered an asset.

Assets are typically categorized into two groups: liquid and non-liquid assets. Let’s briefly examine the types of assets that fall under each group.

Liqui d Assets

“Liquid Assets” is the first category under the “Assets” section. It includes all assets that can be quickly and easily converted into cash without losing much value. Such assets include the following:

- Cash and Cash Equivalents: This subcategory accounts for physical cash, checking accounts, savings accounts, certificates of deposit, and money market accounts, which are investments easily convertible to cash, making them as liquid as cash.

- Liquid Investments: This subcategory covers stocks, bonds, mutual funds, exchange-traded funds, and other liquid investment assets. You can convert these assets to cash relatively quickly without losing much value.

Non-Liq uid Assets

“Non-Liquid Assets” is the second category under the “Assets” section. This subcategory covers all assets that cannot be easily converted into cash or would lose value in the process. Such assets include the following:

- Retirement Accounts: This subcategory includes all forms of retirement funds you have. While the assets within a retirement account (like a 401(k) or an IRA) may be liquid, there are often penalties and tax consequences for withdrawing funds before a certain age. This is why it is usually classified as a non-liquid asset.

- Real Estate: This subcategory covers the market value of your home, rental properties, or any other real estate properties you own.

- Personal Property: This subcategory includes the value of tangible assets such as cars, jewelry, furniture, electronics, collectibles, and other personal belongings. Note that these items should be valued at what they could be sold for now, not what was initially paid for them, as the value of many items depreciates over time, and overvaluing your assets can result in an inflated net worth.

- Business Ownership: If you own a business, the value of your ownership stake is an asset and should be recorded under this subcategory.

- Other Assets: This subcategory accounts for any other assets not included in the preceding subcategories, such as loans you have given to others, tax refunds expected, etc.

Liabilities

“Liabilities” is the second section on your personal balance sheet, and it represents all debts and financial obligations. These can include various forms of debt, such as mortgages, car loans, credit card balances, and personal loans. Essentially, anything you need to pay back to others, whether to a bank, a credit card company, or a friend, is considered a liability.

Just as with assets, liabilities are also usually categorized into two groups: short-term and long-term liabilities. Let’s briefly examine the types of liabilities that fall under each group.

Shor t-Term Liabilities

“Short-Term Liabilities” is the first category under the “Liabilities” section. It includes all debts that are due within a year. Such liabilities include the following:

- Credit Card Balances: This subcategory highlights all you owe to credit card companies.

- Utility Bills: This subcategory covers all your utility bills, such as electricity, water, gas, and internet.

- Medical Bills: This subcategory includes any outstanding bills you owe for medical services or treatments. This can include doctor’s visits, hospital stays, and prescription medications.

- Personal Loans: This subcategory accounts for any loan you take out for personal reasons, such as to cover unexpected expenses or to consolidate debt, and are due within a year.

- Payday Loans: This subcategory covers all short-term loans typically due on your next payday.

- Overdrafts: This subcategory highlights the amount by which withdrawals from your bank account exceed the available balance.

- Taxes Due: This subcategory includes everything you owe to the government in taxes. This can include income, property, and any other taxes due within a year.

- Other Short-Term Liabilities: This subcategory accounts for every other bill or money you owe and is due within a year, such as insurance premiums, subscription services, gym memberships, and contingent liabilities, which are potential liabilities that depend on a future event.

Long-Term Liabil ities

“Long-Term Liabilities” is the second category under the “Liabilities” section. It includes all debts that are due in more than a year. Such liabilities include the following:

- Mortgage: This subcategory covers every mortgage you’ve taken on your home. It is typically the most significant liability for most people and is paid off over many years, often 15 to 30 years.

- Auto Loan: This subcategory includes any car loans you’ve taken out. These loans are typically paid off over a period of 3 to 7 years.

- Student Loans: This subcategory highlights any student loans you’ve taken out, which typically have a 10- to 30-year repayment period.

- Personal Loans: This subcategory accounts for any loan you take out for personal reasons, such as to cover unexpected expenses or to consolidate debt, and are due after a year.

- Pension Liabilities: This subcategory spotlights the amount you owe to your pension plan if you have borrowed against it.

- Long-Term Lease Obligations: This subcategory includes the amount you owe on any long-term lease, such as a car or equipment lease.

- Other Long-Term Liabilities: This subcategory covers any other long-term obligations that do not fit the preceding categories, such as a lawsuit settlement being paid off over time.

“Net Worth” is the final figure on a personal balance sheet. This figure is a clear indicator of your financial health, and you can calculate it using the following formula:

- Net Worth = Total Assets – Total Liabilities

For instance, let’s assume you own a house valued at $350,000, have a car worth $20,000, a retirement account with $50,000, and a savings account with $10,000, putting your total assets at $430,000. Let’s further assume you have a mortgage balance of $200,000 and a car loan of $15,000, putting your total liabilities at $215,000. In this scenario, your net worth would be:

- Net Worth = $430,000 (Total Assets) – $215,000 (Total Liabilities) = $215,000

This positive net worth of $215,000 implies that you own more than you owe, which is the ideal financial position to be in. Suppose your liabilities had exceeded your assets in the preceding scenario. In that case, you’d have a negative net worth, meaning you owe more than you own.

Your net worth is a crucial measure of your financial stability. A high positive net worth implies that you are in a strong financial position and have effectively managed your income, savings, investments, and debts. A negative net worth, on the other hand, signals the need to reevaluate your financial habits to reduce debts and increase assets to avoid financial insolvency.

Understanding your financial situation is crucial for making informed decisions about your future. A personal balance sheet is a valuable tool for gaining this understanding. Here are some key benefits of creating and maintaining this financial statement:

Increased Financial Awareness

Regularly creating and reviewing your balance sheet increases your awareness of your financial situation. This heightened awareness can lead to better financial decisions, such as avoiding unnecessary debt and expenses, making better investment choices, and being more disciplined with savings.

For instance, if you notice that a large portion of your income is spent on dining out and entertainment, this awareness could lead you to make more disciplined spending choices, such as cooking at home or choosing free entertainment options.

Moreover, understanding your financial situation can also lead to psychological benefits. For example, knowing that you have a manageable level of debt and a solid savings plan reduces financial anxiety and increases confidence in your ability to achieve your financial goals. Additionally, this awareness fosters a sense of control over your finances, encourages a more disciplined approach to spending and saving, and promotes a more positive and proactive outlook towards your financial future.

Snapshot of Financial Health

A balance sheet provides a quick, overall view of your financial health by showing your assets and liabilities at a glance, making it easier to identify financial strengths and weaknesses. For example, if your balance sheet reveals that your credit card debt is more than 50% of your total assets, it’s a clear sign that you need to focus on debt reduction. Ignoring this signal could lead to escalating debt, higher interest payments, and a lower credit score.

Conversely, if your balance sheet shows that your assets are three times greater than your liabilities, that implies positive financial strength. You could leverage this strength by investing in higher-yield assets or taking on manageable debt to invest in opportunities with a high return on investment.

However, it is crucial to approach this cautiously and consider the potential risks involved. Do thorough research or consult a financial advisor before making significant financial decisions.

Wealth Tracking

Creating and updating your personal balance sheet regularly helps you monitor your wealth over time. This ongoing tracking lets you see if you’re progressing toward your financial goals and pinpoint areas needing improvement.

For example, if you observe that the value of your stock portfolio has decreased significantly over the past year, this might indicate that your investment strategy needs to be reevaluated. Failing to take action could result in further losses, considerably reducing your overall wealth.

It’s important to factor in economic variables like inflation when assessing your financial growth. A nominal increase in wealth doesn’t always equate to an actual increase in financial well-being. For instance, a 3% increase in your wealth over the past year may seem positive, but if the inflation rate is 5%, your real wealth has actually decreased by 2%. It’s great to see your wealth grow year after year, but it’s essential to ask yourself: does the growth rate outpace or at least keep up with inflation?

Financial Planning

A personal balance sheet is an effective tool for planning financial goals. By knowing your net worth, you can devise better strategies for saving, investing, or debt repayment, helping you make informed decisions to achieve your financial goals. Let’s say you notice that your net worth is decreasing; it might be time to cut expenses, pay down debt, or reconsider large purchases or investments.

For example, if your net worth has decreased by 10% over the past year, you might decide to sell non-essential assets, reduce discretionary spending, or refinance your debt to lower interest rates. Doing a mix of the preceding will help you increase your net worth.

Additionally, a personal balance sheet can help you create a clear and detailed financial plan. For example, by knowing your net worth, you can set realistic savings and investment goals for the next year.

Remember, it is necessary to regularly revisit and adjust your financial plan and goals as your financial situation changes. Factors that may necessitate a change in your plan include a change in income, unexpected expenses, or changes in your financial goals. For example, if you receive a promotion and a salary increase, you may want to adjust your savings and investment goals accordingly. Similarly, if you incur unexpected medical expenses, you may need to adjust your budget and debt repayment plan .

Advanced Financial Analytics

Creating and maintaining a personal balance sheet makes it easier to calculate and track important personal financial ratios like the debt-to-asset ratio and capitalization ratio. These ratios are crucial for assessing your financial health and stability. For example, the debt-to-asset ratio helps you understand how much of your assets are financed by debt. In contrast, the capitalization ratio helps you understand your financial structure by showing the proportion of debt owed relative to equity owned.

While a personal balance sheet is an indispensable tool for understanding your financial health, planning your financial future, and making informed financial decisions, it’s also important to recognize its limitations. Knowing them helps you better interpret the information your balance sheet provides and understand what additional steps you may need to take to neutralize each limitation. Here are some key limitations of a personal balance sheet:

Doesn't Show Cash Flow

A balance sheet provides a snapshot of your financial situation at a specific point in time but doesn’t show cash flow. A cash flow statement provides a dynamic view of how money is earned and spent over a specific period. This can highlight issues not immediately apparent from the balance sheet, such as a negative cash flow despite a positive net worth. For example, someone might have a high net worth and still have cash flow problems because most of their assets are illiquid (e.g., real estate, long-term investments, etc.). Creating and maintaining a balance sheet and a cash flow statement is a great way to overcome this limitation.

Fluctuating Values

The values of assets and liabilities can fluctuate over time, making the balance sheet a snapshot accurate only at the moment it’s prepared. And this variability can significantly impact your financial planning and decision-making. For example, if you intend to sell some of your stocks, the value of those stocks when preparing the balance sheet may differ from the value at the time of the sale. This discrepancy could result in overestimating or underestimating the sale proceeds in your budget, each having distinct repercussions.

Consider a scenario where you plan to use the sale proceeds to repay debt. If the actual proceeds are lower than anticipated, you may find yourself unable to cover the debt fully, leading to additional interest charges or penalties. For this reason, it’s crucial to update your balance sheet frequently and exercise caution when making financial decisions based on it.

Subjective Asset Valuation

Some assets, like jewelry, art, or antiques, can be difficult to value accurately, making it challenging to create an accurate personal balance sheet. For instance, valuing a piece of art at $12,000 when it’s actually worth $5,000 will inflate your net worth and potentially mislead your financial planning. It’s advisable to consult a professional appraiser for items of significant value to mitigate this limitation.

Dependency on Accurate Data

The effectiveness of a balance sheet depends on the accuracy of the data inputted. Even minor errors in asset or liability values can lead to incorrect conclusions about your financial health. For example, an underestimation of debt by $1000 may seem inconsequential, but when interest is taken into account, the actual value of that debt could be significantly higher over time. This could lead to understating the time and money required to repay that debt.

Creating a personal balance sheet is crucial for anyone interested in managing their finances responsibly. However, the real benefit of a personal balance sheet lies not just in its creation but in regularly updating and using it wisely. Here are some pro tips to help you make the most of your personal balance sheet:

Start with Accurate Information

Gather all your financial documents, such as bank statements, mortgage statements, and credit card bills, before creating your balance sheet. Doing so will help ensure you don’t miss any assets or liabilities.

Categorize Your Assets and Liabilities

Break down your assets and liabilities into categories such as liquid assets (cash, savings), non-liquid assets (real estate, investments), short-term liabilities (credit card debt, other debts due within a year), and long-term liabilities (mortgage, student loans).

Consider Future Liabilities

Include expected future liabilities, such as a child’s college education, a planned home renovation, or future taxes, in your personal balance sheet. Doing so will help make your financial planning more accurate and effective.

For example, let’s say you’re planning for your child’s college education. You can estimate this future liability by researching the current tuition fees of the college your child might attend and its historical growth rate.

Suppose the current tuition fee is $30,000 per year, and historically, the tuition fee has increased by 5% annually. You can estimate that in 10 years, the tuition fee would be approximately $48,890 per year ($30,000 × (1 + 0.05)^10). This estimation will help you plan and save accordingly.

Use Conservative Values

Be conservative when estimating the value of your assets. This means using the lower end of an estimated value range and being cautious when including assets whose value is highly uncertain. Overestimating the value of your assets provides a false sense of financial security and leaves you unprepared for unexpected financial downturns.

Be Thorough

Being conservative matters a lot in creating an accurate personal statement, but so does being thorough. Ensure you include all your assets and liabilities, even if they seem insignificant. Small amounts can add up over time and may affect your financial health more than you realize. Assets and liabilities commonly overlooked include:

- Digital assets like cryptocurrency;

- Intellectual property (e.g., copyrighted material, patents);

- Collectibles (e.g., rare coins, stamps); and

- Prepaid expenses (e.g., prepaid insurance, prepaid rent).

Liabilities:

- Outstanding medical bills;

- Unpaid taxes;

- Personal loans from friends or family; and

- Any accrued interest on existing loans.

Update Regularly

Update your balance sheet at least every quarter or when there is a significant change in your assets or liabilities, such as receiving an inheritance, buying a house, and paying off or incurring a debt. Recording changes in your assets and liabilities is the best way to spot trends you would have otherwise missed. Moreover, doing so helps make your balance sheet more accurate.

Review Past Balance Sheets

While you should update your personal balance sheet at least four times a year, it’s a good idea to monitor it regularly. Set a schedule for reviewing your personal balance sheet, such as monthly or quarterly. Regularly reviewing past balance sheets can help you identify trends, understand how your financial situation has changed, and make more informed decisions about the future.

Use Alongside A Cash Flow Statement

To better understand your financial health, use your personal balance sheet together with a personal cash flow statement. While the balance sheet provides a snapshot of your financial health at a specific point in time, the cash flow statement shows how you earned your money or spent it over a specific period. Using both financial statements will help you identify trends, gain more insights, and make more informed financial decisions.

Take Advantage of Tools and Templates

There are various tools and templates available online, such as Microsoft Excel templates, personal finance apps, or online budgeting tools that offer personal balance sheet templates. You can start with a basic template from Microsoft Excel and customize it to include categories specific to your financial situation, like adding a section for digital assets or future liabilities.

Reflect and Act

After creating your balance sheet, reflect on your financial situation. Are you meeting your financial goals? Do you need to adjust your spending or saving habits? Use your balance sheet as a tool for making informed financial decisions.

Seek Professional Help

If you are dealing with a complex financial situation, such as managing investments across multiple platforms, dealing with significant debt, or planning for retirement, it might be beneficial to seek advice from a certified financial planner or wealth manager. A financial planner can help you create a comprehensive financial plan, while a wealth manager can help you manage your investments and optimize for tax efficiency.

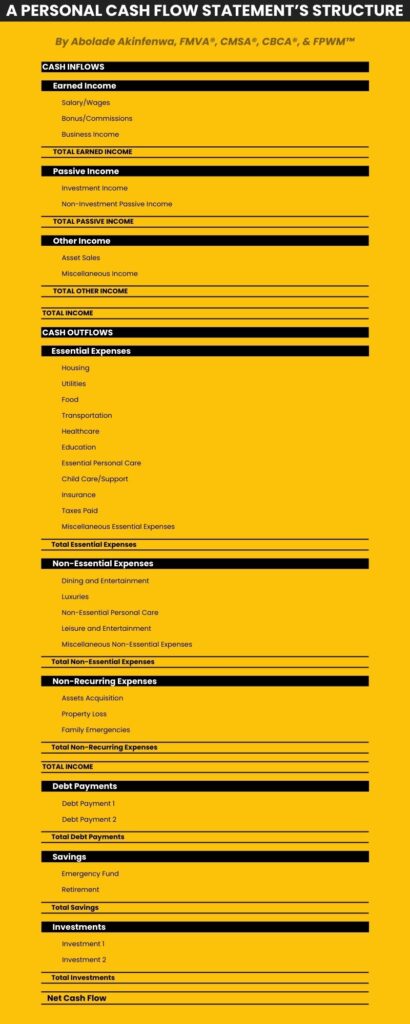

A personal cash flow statement tracks how much cash you’re earning and where it’s being spent over a specific period, typically a month or a year. This statement provides valuable insights into how you are managing your cash resources, enabling you to understand your spending patterns and make better financial decisions.

A personal cash flow statement records cash inflows and outflows during a specific period. Think of it as a story of your personal finances from a cash perspective, showing you where your money came from (inflows), where it went (outflows), and the net difference between the two. If your inflows exceed your outflows, then you’ll have a positive cash flow. Conversely, if your outflows exceed your inflows, then you’ll have a negative cash flow.

For example, let’s say your monthly cash inflows (salary, freelance work, etc.) are $5,000, and cash outflows (rent, utilities, groceries, etc.) amount to $3,200. In this scenario, your personal cash flow statement for that month would show a surplus of $1800, money you can put towards savings, investment, or other financial goals.