Loan Repayment Letter Sample: Free & Effective

Drawing on years of experience writing loan repayment letters, this article provides a comprehensive guide and customizable template to enhance your communication, ensuring clear loan status and positive lender relations.

Key Takeaways

- What You’ll Learn: The essentials of drafting a loan repayment letter that is clear, professional, and effective.

- Why It Matters: A well-written loan repayment letter can help maintain a positive relationship with your lender and ensure clarity about your repayment status.

- Personal Tips: Insights from my experience on making your letter stand out and effectively communicate your message.

- Template Included: A simple yet powerful template to get you started, customizable to your specific needs.

Step-by-Step Guide to Writing a Loan Repayment Letter

Step 1: start with your information.

Begin your letter by clearly stating your name, address, and any other contact information at the top. This ensures the lender knows who the letter is from and how to contact you if necessary.

Step 2: Include the Date and Lender’s Information

Directly below your information, write the date of the letter. Following that, add the lender’s name and address. This formalizes the letter and directs it appropriately.

Step 3: Reference Your Loan

Start the body of your letter by referencing your loan. Include any relevant details such as the loan account number, the type of loan, and any other identifiers. This helps the lender quickly locate your account and understand the purpose of your letter.

Step 4: Detail Your Payment

Clearly state the amount you’ve paid towards the loan and the date of payment. If applicable, mention the method of payment (e.g., check, bank transfer) and any transaction reference numbers.

Step 5: Express Your Intentions

Briefly outline your intentions regarding future payments or any requests you have concerning the loan terms. This shows your commitment to repaying the loan and any considerations you wish the lender to make.

Step 6: Close with a Thank You and Signature

Conclude your letter by thanking the lender for their understanding and cooperation. Sign off with a formal closing, such as “Sincerely,” followed by your signature and printed name.

Personal Tips from Experience

- Be Concise but Detailed: Ensure your letter is straightforward and to the point but includes all necessary details about your payment and loan.

- Proofread: A letter free of typos and grammatical errors reflects well on your professionalism and attention to detail.

- Keep a Copy: Always keep a copy of the letter for your records. This can be crucial for tracking your repayment history.

Real-Life Example

In my experience, a well-timed and clearly articulated loan repayment letter can turn a potentially tense situation into a positive exchange.

For instance, after sending a detailed repayment letter for a personal loan, I received a response from the lender appreciating my transparency and offering a flexible repayment plan for future installments.

Template for a Loan Repayment Letter

[Your Name] [Your Address] [City, State, Zip] [Email Address] [Phone Number] [Date]

[Lender’s Name] [Lender’s Address] [City, State, Zip]

Dear [Lender’s Name],

I am writing to inform you of my recent payment towards my loan with the account number [Loan Account Number]. On [Payment Date], I made a payment of [Payment Amount] via [Payment Method]. The transaction reference number is [Transaction Number].

I am committed to repaying my loan and intend to continue making regular payments as per our agreement. Please find enclosed [any additional documents or proof of payment].

Thank you for your attention to this matter and your continued cooperation.

[Your Signature (if sending by mail)] [Your Printed Name]

Final Thoughts and Comment Request

Writing a loan repayment letter doesn’t have to be a daunting task. With the right structure and personal touches, it can be an effective tool in managing your loans and maintaining good relationships with lenders.

I hope my insights and tips from years of experience have equipped you to write your own letters with confidence.

I’d love to hear your thoughts and experiences with loan repayment letters. Have you found a particular strategy effective? Any challenges you’ve faced? Please share your comments below.

Your feedback not only enriches our discussion but also helps others navigate their financial journeys more smoothly.

Frequently Asked Questions (FAQs)

1. what is a personal loan repayment letter.

Answer: A personal loan repayment letter is a formal letter written by a borrower to a lender, indicating the intention to repay a personal loan. The letter typically includes details such as the loan amount, repayment terms, and a promise to repay the loan according to the agreed terms.

2. Why is a Personal Loan Repayment Letter important?

Answer: A personal loan repayment letter is important because it serves as a formal record of the borrower’s commitment to repay the loan. It also helps establish clear communication between the borrower and lender, and provides a reference point if there are any disputes or misunderstandings about the loan repayment terms.

3. What information should be included in a Personal Loan Repayment Letter?

Answer: A personal loan repayment letter should include the following information:

- The loan amount

- The loan repayment terms

- The loan repayment schedule

- The borrower’s contact information

- A promise to repay the loan according to the agreed terms

4. How should a Personal Loan Repayment Letter be formatted?

Answer: A personal loan repayment letter should be formatted as a formal business letter, with a clear and professional tone. It should include a heading with the borrower’s address and the date, followed by the lender’s address.

The body of the letter should clearly state the purpose of the letter, and include all relevant details about the loan repayment. The letter should end with a closing, followed by the borrower’s signature.

5. Is a Personal Loan Repayment Letter legally binding?

Answer: A personal loan repayment letter is not a legally binding document

Related Articles

Sample letter to bank for name change after marriage, request letter for cancelling auto debit: the simple way, sample letter informing change of email address to bank: free & effective, sample letter for cheque book request, sample letter to creditors unable to pay due to death, sample letter to close current bank account and transfer funds, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Submit an Income-Driven Repayment Application

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

You’ll need to submit an income-driven repayment application at studentaid.gov or download a paper request form and submit it to your servicer (the company that sends you a bill every month).

Applying for income-driven repayment online is typically faster and easier than submitting a paper form; the Federal Student Aid office estimates the process takes 10 minutes or less.

The application is available on the Federal Student Aid website. You’ll be able to access your tax records and receive a confirmation email after submitting.

You can temporarily self-report income

You can self-report your income until six months after forbearance ends — until roughly March 2024 — according to the latest Education Department guidance.

That means you don't have to submit tax documentation when you report your income. This can be completed online when you submit the IDR application.

What you'll need to apply for income-driven repayment

To apply online, you’ll need to log into your account using your FSA ID . All applicants (online or paper) will need to provide personal information, such as:

Email address.

Phone number.

The application also requires you to provide financial information, such as:

Your family size.

Most recent federal income tax return or transcript. (The IDR Data Retrieval tool will link your tax information directly to your application.)

Information about your spouse’s income if you filed taxes jointly.

If you didn’t file taxes or your income has changed since your most recent tax return, you’ll typically need to submit proof of income earned within the last 90 days, such as:

Letter from your employer stating your gross pay.

Signed statement explaining your income, if formal documentation is unavailable.

If you’re unemployed and receiving unemployment benefits, you’ll still need to submit proof of unemployment income. If you don’t have any income, you can self-certify as such on the application.

Once you fill in the application, you'll see which repayment plans you qualify for. You'll select one, then confirm all the information you supplied is accurate and sign the application.

» MORE: Q&A: The new IDR account adjustment

What happens after you apply for income-driven repayment?

Once you submit your application, your servicer will confirm receipt via email or letter. It’ll also put your loans into a payment pause, called a forbearance, while your application processes. You don’t need to make any payments during this time, but interest will accrue and be added to the amount you owe when you start repayment.

It takes around four weeks for servicers to process IDR applications after they're received, Secretary of Education Miguel Cardona said in an August press briefing.

When your application process is complete, you’ll receive a new bill with the amount you now owe and payment will restart.

» NEWS: Student debt canceled for 804K longtime borrowers

Submit recertification information every year

Applying for income-driven repayment is not a one-and-done application process. You’ll typically need to recertify every year. Otherwise, your payments will revert back to the standard repayment plan, and that could mean a bigger monthly bill.

Your student loan servicer will let you know when you need to recertify well before the deadline.

You’ll have to recertify similarly to when you first applied using the same form on studentaid.gov or by submitting a paper form to your servicer. You’ll need to provide the same information you submitted when you first applied. Due to the payment pause, the earliest you'd have to recertify is March 1, 2024.

If you're on the new IDR plan called SAVE , recertification will happen automatically starting in July 2024. As long as you agree to disclose of your tax information, your servicer and the Department of Education will automatically reenroll you each year. You'll get a notification when this happens, including potential payment amount changes, and you can still manually recertify if you prefer.

» MORE: Everything you need to know about SAVE, the new IDR plan

If you need help applying, contact your servicer

Your servicer can help you through the process of applying for or recertifying income-driven repayment.

Third-party sources that ask for money to get you enrolled are often a student loan scam . There is never a fee to process an income-driven repayment application, and you never need to pay anyone to apply on your behalf.

» MORE: Student loan customer servicer: What your servicer can do

On a similar note...

Watch CBS News

Biden administration forgives $6 billion in student debt. Here's who qualifies for forgiveness.

By Aimee Picchi

Edited By Anne Marie Lee

Updated on: March 21, 2024 / 10:31 AM EDT / CBS News

The Biden administration on Thursday said it is forgiving almost $6 billion in student debt for 77,700 borrowers, with those recipients scheduled to receive an email from President Joe Biden alerting them about their debt cancellation.

The people who qualify for the latest round of student loan forgiveness are public service employees, such as teachers, nurses, social workers and firefighters, the White House said in a statement. On a per-person basis, the forgiveness amounts to about $77,000 per person.

Ever since the Supreme Court last year invalidated the Biden administration's plan for broad-based student loan forgiveness, the Biden administration has sought to rely on existing and new loan repayment plans to provide debt relief to almost 4 million people. Americans are carrying about $1.77 trillion in student debt, a financial burden that some college grads say has made it tougher to achieve financial milestones like buying a home.

The Biden administration has sought to fix problems in the nation's student loan repayment system by rolling out a new program called SAVE and making it easier for public servants to get their debt erased.

"For too long, our nation's teachers, nurses, social workers, firefighters and other public servants faced logistical troubles and trapdoors when they tried to access the debt relief they were entitled to under the law," said U.S. Secretary of Education Miguel Cardona. "With this announcement, the Biden-Harris Administration is showing how we're taking further steps not only to fix those trapdoors, but also to expand opportunity to many more Americans."

Who qualifies for student loan forgiveness?

The Biden administration said 77,700 borrowers who are enrolled in the Public Service Loan Forgiveness (PSLF) program will receive debt forgiveness.

Those who are receiving debt forgiveness include public servants who enrolled in the Biden administration's limited PSLF waiver , which allows public sector workers who haven't previously qualified for loan relief to receive credit for past repayments, the administration said.

What were the prior problems with the PSLF program?

The PSLF program, which has been around since 2007, had the lofty goal of forgiving the student debt of Americans who work in public sector jobs, such as teachers or government employees, for at least 10 years.

But its notoriously Byzantine regulations and misleading guidance from some loan-servicing companies meant that few public servants managed to get debt relief. In fact, only 7,000 people received forgiveness through the PSLF prior to the Biden administration.

Since the White House made changes to PSLF, about 871,000 Americans have received student loan forgiveness through the program, the Biden administration said.

How will I know if I got PSLF debt forgiveness?

The 77,700 borrowers who qualify will receive a letter from President Biden next week congratulating them on their relief.

I'm enrolled in PSLF. Will I get loan forgiveness, too?

Another 380,000 people enrolled in PSLF will receive an email from Biden next week letting them know they are within one to two years of qualifying for debt forgiveness through the program.

According to a sample email, Biden will congratulate them and urge them to continue working in public service to qualify for forgiveness. One email reads, "I hope you continue the important work of serving your community — and if you do, in less a year you could get your remaining student loans forgiven through Public Service Loan Forgiveness."

- Biden Administration

- Student Debt

- Student Loan

Aimee Picchi is the associate managing editor for CBS MoneyWatch, where she covers business and personal finance. She previously worked at Bloomberg News and has written for national news outlets including USA Today and Consumer Reports.

More from CBS News

"Cowboy Carter," Beyoncé's first country album, has arrived

Michael Douglas on "Franklin," and his own inspiring third act

3 cheapest ways to pay off credit card debt

California set to hike wages for fast-food workers to $20 per hour

Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

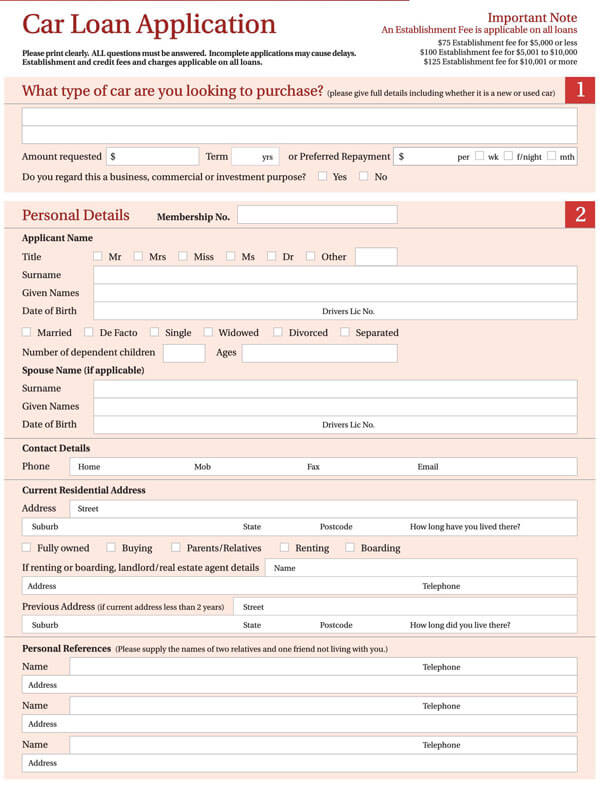

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

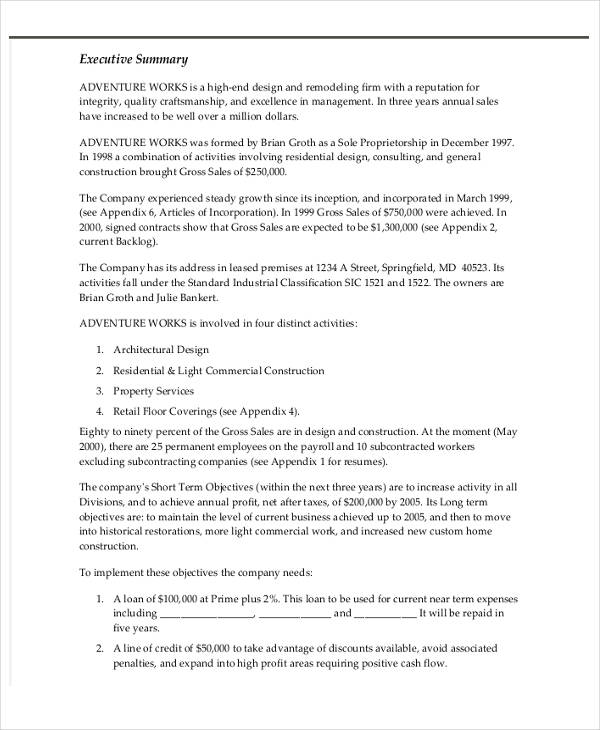

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

- Bank Loan Repayment Letter Format

These templates serve various purposes related to bank loan repayment correspondence. The first template offers a standard loan repayment acknowledgment letter, ensuring clarity and documentation of a successful repayment. The second template is designed for borrowers seeking an extension on their loan repayment schedule due to unforeseen financial difficulties. The third template addresses borrowers who intend to make prepayments on their loans, seeking guidance on the process and implications. Finally, the fourth template provides a confirmation letter from the bank to borrowers, acknowledging the receipt of loan repayments and offering assurance of accurate record-keeping and balance updates. These templates can be tailored to meet individual needs in various loan-related scenarios.

Template Standard Loan Repayment Acknowledgment:

[Your Name] [Your Address] [City, State, ZIP Code] [Date]

[Bank Name] [Bank Address] [City, State, ZIP Code]

Dear [Bank Name],

I am writing to confirm the repayment of my loan with account number [Loan Account Number] in the amount of [Loan Amount]. The payment was made on [Date of Payment] through [Payment Method], and the transaction reference number is [Transaction Reference Number].

I kindly request you to update my loan account status to reflect the cleared balance, and I would appreciate receiving a written confirmation of the same for my records.

Thank you for your prompt attention to this matter.

[Your Name]

Template Loan Repayment Extension Request:

I am writing to request an extension for the repayment of my loan with account number [Loan Account Number]. Due to unforeseen circumstances, I am currently facing financial difficulties, and I am unable to meet the originally agreed-upon repayment schedule.

I kindly request an extension of [Proposed Extension Duration], which will allow me to better manage my financial situation. I understand that this may result in additional interest charges, and I am willing to discuss the terms and conditions associated with this extension.

Please let me know the process and any necessary documentation required to proceed with this request.

Thank you for your understanding and cooperation.

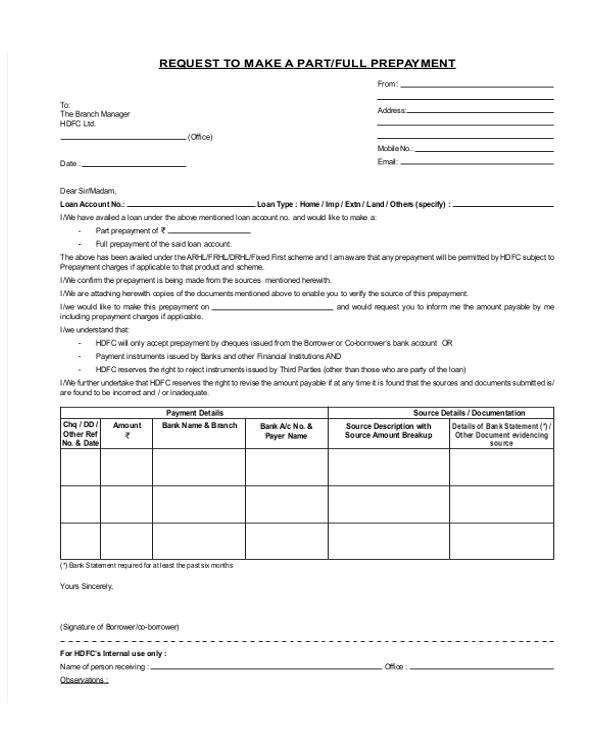

TemplateLoan Prepayment Letter:

I am writing to inform you of my intention to make a prepayment on my loan with account number [Loan Account Number]. I wish to reduce the outstanding balance and potentially shorten the loan term.

Please let me know the procedure for making a prepayment, any penalties or charges associated with it, and how this will affect my future repayment schedule.

Thank you for your assistance in facilitating this prepayment.

Template Loan Repayment Confirmation Letter:

[Bank Name] [Bank Address] [City, State, ZIP Code] [Date]

[Your Name] [Your Address] [City, State, ZIP Code]

Dear [Your Name],

We are writing to confirm the receipt of your loan repayment made on [Date of Payment]. The payment in the amount of [Loan Amount] was successfully processed and credited to your loan account with account number [Loan Account Number].

Your loan balance has been reduced accordingly. If you have any questions or require further information regarding your loan account, please do not hesitate to contact our customer service team at [Bank Customer Service Number].

Thank you for choosing [Bank Name] for your financial needs.

[Bank Representative Name] [Bank Representative Title]

We are delighted to extend our professional proofreading and writing services to cater to all your business and professional requirements, absolutely free of charge at Englishtemplates.com . Should you need any email, letter, or application templates, please do not hesitate to reach out to us at englishtemplates.com. Kindly leave a comment stating your request, and we will ensure to provide the necessary template at the earliest.

Posts in this Series

- Causes Of Corruption, And Their Solutions Letter To Editor

- Chair Request Letter For Office, Teacher, Employee

- Change Of Address Letter For Customers

- Change Of Engineer Of Record Letter, Change Engineer Of Record Florida

- Change Of Residential Address Letter Sample

- Character Reference Letter From Mother To Judge

- Character Reference Letter Sample For Jobs

- Cheque Date Correction Letter Request Format

- Clarification Letter From Shipper On Mistake To Customs

- Closure Letter To Someone You Love

- Clothing Store Manager Cover Letter

- Company Address Change Letter To Bank

- Compensation Letter For Damages

- Complaint Letter About A Rude Staff

- Complaint Letter Against Father In Law

- Disability Insurance Recovery Letter

- Disappointment Letter To Boss On Appraisal

- Disappointment Letter To Client

- Disappointment Letter To My Wife

- Dishonoured Cheque Letter Before Action

- Diwali Holiday Announcement Email To Employees, Customers

- Donation Letter For Football Team

- Donation Request Letter For Laptop

- Donation Request Letter For Orphanage

- Donor Meeting Request Letter

- Down Payment Request Letter Sample

- Draft A Letter Of Interest To Contract, Or Lent Cars To Government Departments, And Agencies

- Early Payment Discount Letter Sample

- Early Retirement Letter Due To Illness

- Early Retirement Letter Of Resignation

- Early Retirement Request Letter For Teachers

- Eid Greetings Letter From Company To Staff Members, Employees And Students

- Electrical Engineer Experience Letter Sample

- Employee Encouragement Letter Sample

- Employee Not Returning Uniforms

- Employee Recognition Letters Sample

- Employee Warning Letter Sample For Employers

- Best Thank You Letter After Interview 2023

- Beautiful Apology Letter To Girlfriend

- Babysitter Cover Letter No Experience

- Babysitter Letter Of Payment

- Babysitting Letter To Parents

- Back To School Letter From Principal In Florida

- Balance Confirmation Letter Format For Banks And Companies

- Bank Account Maintenance Certificate Request Letter

- Bank Balance Confirmation Letter Sample

- Bank Internship Letter Format, And Sample

- Authorization Letter To Collect Money On My Behalf

- Authorized Signatory Letter Format For Bank

- Aviation Management Cover Letter Example

- Attestation Letter For Employee

- Attestation Letter Of A Good Character

- Audit Document Request Letter

- Authority Letter For Degree Attestation Sample

- Authority Letter For Issuing Degree

- Authority Letter For Receiving Degree

- Authority Letter To Collect Documents

- Authority Letter To Collect Passport

- Authorization Letter For Air Ticket Refund

- Authorization Letter For Car Insurance Claim

- Authorization Letter For Driver License Renewal

- Authorization Letter For Getting Driver License

- Authorization Letter For Student Driver License

- Authorization Letter For Tree Cutting Permit

- Ask Permission From My Boss For Straight Afternoon

- Asking For Compensation In A Complaint Letter Example

- Appointment Letter With Probation Period

- Appreciation Letter For Good Performance On Duty

- Appreciation Letter For Hosting An Event

- Appreciation Letter For Manager

- Appreciation Letter From Hotel To Guest

- Appreciation Letter To Employee For Good Performance

- Apprenticeship Result Letter By Principal

- Approval Letter For Job Transfer

- Approval Letter For Laptop

- Approval Request To Govt Authorities For Sports Shop Approval

- Ask For A Letter Of Recommendation Taxas

- Apply For Government Contracts Letter

- Appointment Letter Daily Wages

- Appointment Letter For A Medical Representative Job

- Appointment Letter For Job In Word Free Download

- Appointment Letter For Patient

- Credit Card Address Change Request Letter To Hdfc Bank

- Customer Request Letter For Insurance Policy Pending

- Data Collection Application Letter Request From University

- Dealership Cancellation Request Letter

- Death Intimation Letter Format To Bank

- Debit Card Cancellation Letter Format

- Demand For Assurance Letter

- Demand Letter For Attorney Fees

- Demand Letter For Mortgage Payment

- Demand Letter For Property Return

- Demand Letter For Return Of Items

- Demanding Letter For The Competition Exams Books For Your College Library

- Denial Letter For Insurance Claim

- Compliment Letter To Hotel Staff

- Compromise Agreement Sample Letter

- Compromise Letter For The Reason Of Disturbance

- Compromise Letter To Police Station

- Computer Repair, And Replacement Complaining Letter

- Condolence Letter For Death Of Friend

- Condolence Letter For Death Of Mother

- Condolence Letter For Loss Of Child

- Condolence Letter For The Death Of Father, Mother, Or Someone Else

- Condolence Letter On Death Of Father In English

- Condolence Letter To A Friend Who Lost His Brother

- Condolence To My Player Lost A Parent

- Condolences Letter On Loss Of Wife

- Confessional Letter To Church

- Confirm Meeting Appointment Letter Sample

- Confirmation Letter For Airport Pick Up

- Confirmation Letter For Appointment In Email

- Confirmation Letter For Bank Account

- Confirmation Letter For Completion Of Training

- Confirmation Letter For Teacher After Completion Of 1 Year Of Probation With Necessary Terms, And Conditions

- Conflict Resolution Letter For Employees

- Congratulation Letter After Job Interview

- Congratulation Letter Business Success

- Congratulation Letter For Passing Board Exam

- Congratulation Letter For Promotion

- Congratulations Letter Receiving Award

- Consent Letter For Children Travelling Abroad

- Consent Letter For Guarantor

- Construction Contract Approval Letter

- Construction Delay Claim Letter Sample

- Contract Approval Letter Example

- Contract Extension Approval Letter

- Contract Renewal Letter To Manager

- Contract Termination Letter Due To Poor Performance

- Contract Termination Letter To Vendor

- Contractor Recommendation Letter Format

- Convert Residential To Commercial Property

- Courtesy Call Letter Sample

- Work From Home After Accident Letter Format

- Uniform Exemption Letter For Workers, Students, Employees

- Thanks Letter For Visitors Free Download

- Thanks Letter To Chief Guest And Guest Of Honor

- Apology For Resignation Letter

- Apply For Funds For Ngo Dealing With Disabled People, We Have A Land, And Want To Build The Proper Shelter

- Allow Vehicles For Lifting Auction Material Letter Format

- Address Change Request Letter For Credit Card

- Address Proof Letter Format

- Admission Confirmation Letter Format

- Admission Rejection Letter Samples

- Accreditation Letter For School

- Accreditation Letter For Travel Agency

- Accountant Letter For Visa

- Accreditation Letter For Organization

- Absence Excuse Letter For Professor-Lecturer

- Acceptance Letter By Auditor

- A Letter Of Support For A Graduation

- School Timing Change Notice

- Thank You Letter For Sponsoring An Event

- Sample Letter Of Data Collection, And Research Work

- Sample Letter Of Request For Borrowing Materials

- Sample Letter Of Thank You For Participation

- Sample Letter To Bank Manager For Unblock Atm Card

- Sample Letter To Claim Car Insurance

- Sample Letter To Close Bank Account Of Company

- Sample Letter To Parents About Fee Increase

- Sample Letter To Parents For School Fees Submission

- Sample Letter To Return Products, Or Ordered Items Or Replacement

- Sample Nomination Letter To Attend Training

- Sample Notice For Parent Teacher Meeting (Ptm)

- Sample Authority Letter For Cheque Collection

- Sample Experience Letter For Hotel Chef Or Cook

- Sample Experience Letter For Nurses

- Sample Holiday Notification Letter Format For Office

- Sample Invitation Letter To Chief Guest

- Sample Letter Asking Permission To Conduct Seminar

- Sample Letter For Acknowledging Delivery Of Goods, Or Services

- Sample Letter For Leave Without Permission

- Sample Letter For Requesting Quotations

- Sample Letter For Urgent Visa Request

- Salary Deduction Letter To Employee

- Request Letter For Any Suitable Job - Covering Letter Format

- Request Letter For Change Of Name In School Records

- Reply To Employment Verification Letter

- Request Application Letter To The College Principal -Vice-Chancellor -Admission Office For Taking Admission

- Request Final Payment Settlement After The Resignation

- Request For Fuel Allowance To Company-Employer

- Request For Meeting Appointment With Seniors - Other Employees-Clients Sample Letter

- Request For Office Supplies Templates

- Request Letter For Accommodation In University

- Request Letter For An Online Interview

- New Email Address Change Notification Letter

- Notice On Cleanliness In Your Office Compound

- Office Closing Reason For Business Loss Letter Format

- One Hour Leave Application Request Letter

- Permission Letter For Blood Donation Camp

- Promotion Request Letter And Application Format

- Proposal Letter For School Events And Activities

- Quotation Approval Request Letter With Advance Payment

- Recommendation Letter For Visa Application From Employer

- Remaining Payment Request Letter Sample For Clients, Customers

- Letter To Principal For Change Of School Bus Route

- Letter To Principal From Teacher About Misbehavior of a Student

- Letter To Remove Name From Joint Bank Account

- Letter To Renew Employment Contract Sample

- Letter To Subcontractor For Work Delay By The Contractor

- Letter To Your Friend About An Exhibition You Have Seen Recently

- Loan Cancellation Letter Sample

- Marriage Leave Extension Letter To Office-Manager Or Company

- Letter Of Introduction From A Company To An Employee For Visa

- Letter Of Recommendation For Further Studies By Employer

- Letter Regarding Visa Delay To Embassy

- Letter Requesting School Principal To Issue A New Student Identity Card

- Letter Requesting Sponsorship For Education From Ngo-Spouse-Court

- Letter To Airline For Refund Due To Illness, Death, Or Medical Grounds

- Letter To Cancel The Approved Leave Of Employee Due To Work In Office

- Letter To Customs Officer To Release Goods-Cargo

- Letter To Friend Telling About Your New School

- Letter To Friend Thanking Him For The Books He Lent To You

- Letter To Increase PF(Provident Fund) Contribution

- Letter To Inform Change Of Bank Account

- Letter To Insurance Company For Change Of Address

- Letter To Municipal Commissioner For Street Lights

- Letter To Municipal Corporation For Road Repair

- Letter To Parents Asking For Money

- Email Letter to Request Travelling Allowance

- 10 Examples of Letters of Recommendations

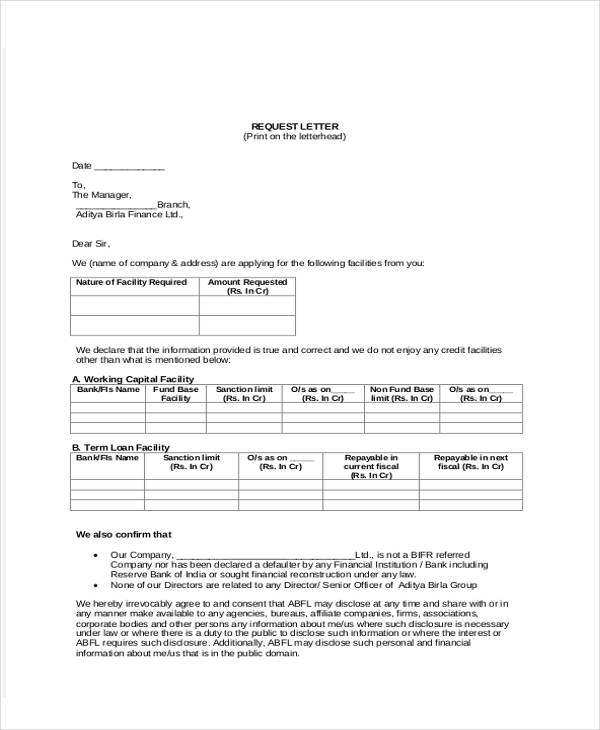

Formal Letter to Bank Manager for Repayment of Loan

If you have taken loan from your bank then repayment is a big responsibility. Sometimes you might find yourself in some financial crunch because of which you are unable to make the installments on time. In such a scenario, writing a formal letter to bank for repayment of loan is a must. It is a formal way of putting forward your request to give you some extension. Such letters have to be very precise, they should include all the necessary details as shown in the sample below.

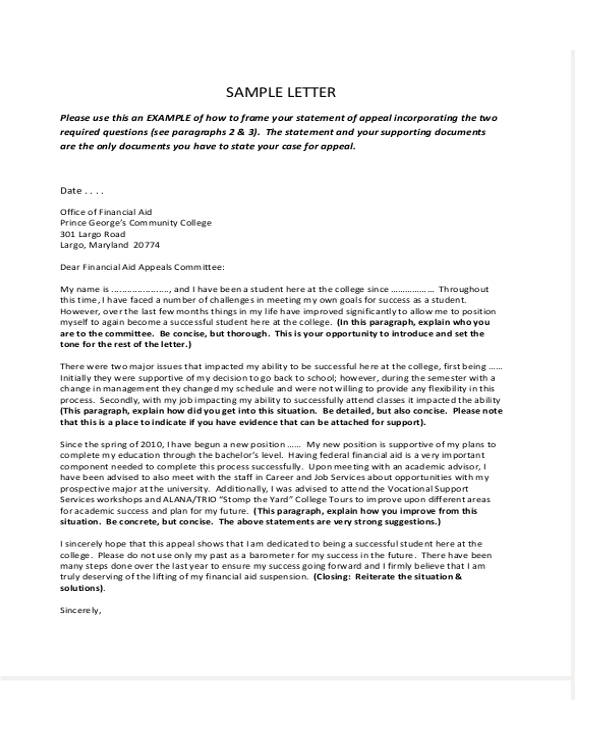

Here is a template using which you can frame a formal letter to bank management for loan repayment stating your reasons.

Format for Letter to Bank Manager for Loan Repayment

Ramesh Gupta

6/42 Sec 3, Jawahar Nagar

Date: 14.02.17

The Bank Manager

State Bank of India,

Jawahar Nagar,

Sub: Regarding loan repayment.

I, Ramesh Gupta, am writing this letter to request you to grant me some extension for repayment of my car loan with your bank. I would like to bring to your notice that my car loan started with your bank in the year 2014 in the month of June for three years. And according to the terms and conditions, the last installment of my loan will be in the month of May, 2017. I would request you to please give me an extension period of three months to repay the loan.

I maintain a savings account with your bank from last nine years and during all these years, the track record of my banking transactions has been quite good. I have made all the repayments of my car loan on time till date but because of certain circumstances, I am presenting this request to you. Recently, my mother got operated for kidney because of which I could not focus on my work and I have heavy medical expenses to take care of. This is the reason because of which I request for the extension period so that I can repay the loan comfortably.

I am hopeful that you will consider my request and grant me some extension.

Yours sincerely,

Other Related Formats

Collection Letter to offer Payment Plan Sample Project Report For Bank Loan In Excel Request Letter from Society for NOC for Mortgage Loan from Bank Application Letter for Loan Date Extension Letter Format to Bank to Rent Safe Deposit Locker Bank Account Opening Request Letter for Company Employees Account Cancellation Letter Due to Non-Payment

Top File Download:

- how to write a letter to bank manager for education loan repayment

- letter to bank manager for loan installment

- letter to bank manager for loan repayment

- request letter for repayment of loan

- sample letter to bank requesting extension of time for loan payment

- how to write a letter to bank manager for loan payment extension

- a letter to bank manager requesting a grace period for loan settlement

- letter to bank for loan repayment extension

- loan repayment letter to bank

- letter to bank manager for extension of loan payment

Related Files:

- Application Letter for Business Loan to Bank Manager

- Letter to the Bank Manager for Education Loan

- Application Letter for Loan Date Extension

- Formal Authorization Letter for Signing Authority to Bank

4 thoughts on “ Formal Letter to Bank Manager for Repayment of Loan ”

How do I write an application letter to the bank manager if I want to pay for car loan on behalf of my husband who died.

Thanks, i was looking for that sample letters

I want to re satart my car loan emi,bcz coved-19 time stoped, how to request write by email to bank managar, i m out off india. Pls sir give any applications samples for bank managar restart my car loan emi.

I have availed a housing reality loan from bank for the period of 15 years. I was not known about the terms that construction should be done within 3 years else the rate would increase. now I am paying the EMI as fixed at the time of availing the loan from the bank regularly. Now almost 14 years have crossed. till now the bank has not communicated anything to me. now suddenly I am getting calls from the bank stating that the loan account is irregular and that I have to pay the difference. and after 14 years now the loan outstanding is more than what I availed. I have already paid 3 times of loan amount availed. can you please guide me how to represent this and move further.

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

All Formats

9+ Loan Letter Templates

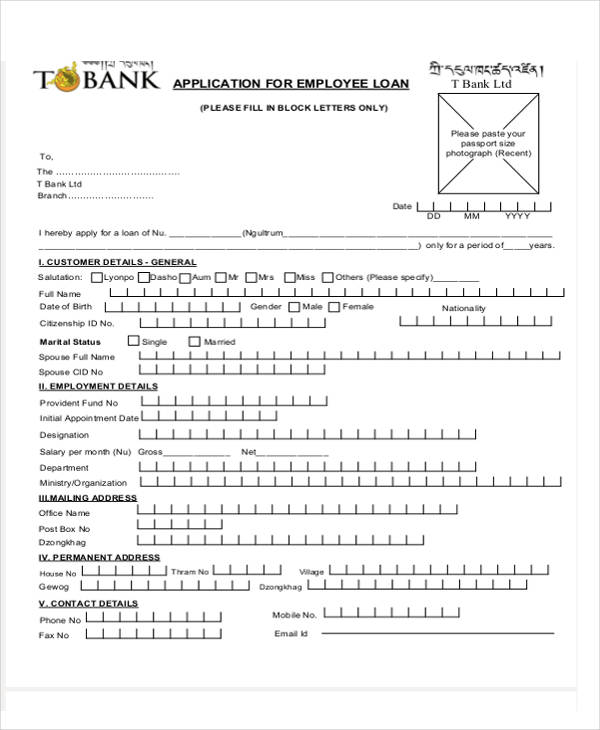

A loan letter or a loan application form is a structured, formatted legal document that is usually handed out by a loan agency or bank to the borrower. It usually states a request of a certain loan plan.

Employee Loan Application Template

Company Loan Letter Template

Bank Loan Letter Template

Student Loan Letter Template

A Few Tips on How to Format a Loan Letter

- Write down direct and straightforward information in regard with the terms and conditions of the loan transaction.

- Be formal and concise with your content. Make it short and simple.

- The words being used within the content should be easy to understand.

What Are the Benefits of a Loan Letter?

Types of loan letters.

- Loan Application or the Loan Request is a starting process wherein the borrower fills up an application form or sends out a request letter to the loan agency or bank for a loan plan.

- Loan Repayment is a process wherein the borrower decided to pay the loan, it can either be a half or full payment.

- Loan Approval is an indicator that the loan agency or the bank accepted your loan request. It will usually notify the borrower through email or traditional mail.

- Student Loan is a type of loan that is applicable for any students who wish to enter a university or college. The loan will be used in paying for the college tuition fee, which will more likely take years to pay, depending on the plan being applied.

Loan Approval Letter Template

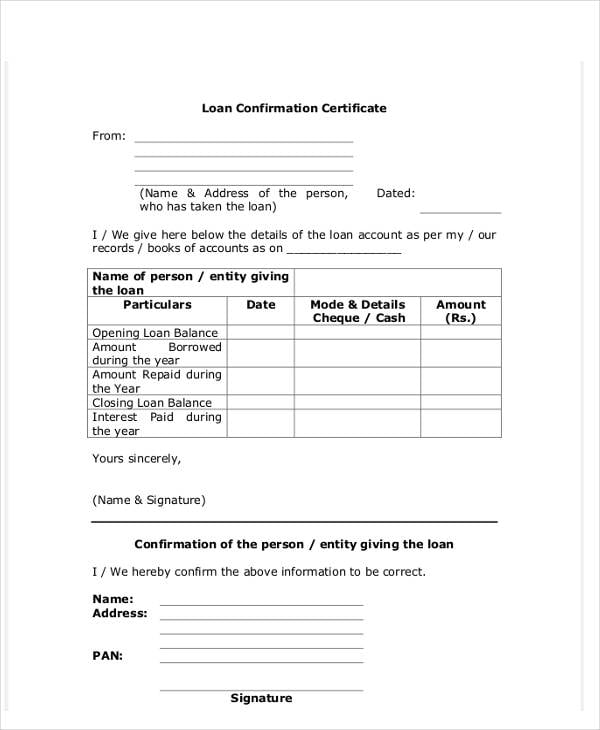

Loan Confirmation Letter Template

Loan Repayment Letter Template

Loan Request Letter Template

More Templates on Offer

- Graphic Elements that includes web and print posters, vector illustrations, sketch samples, icons, buttons, print banners, invitation cards, greeting cards, business calling cards, print logos, etc.

- Web Graphic Elements such as web design templates, icons, buttons, web banners and illustrations for web animations, header designs, and logos for websites .

- Print Documents that is tailored for both legal or personal purposes such as business application forms, job application forms, cover letters, resumes, contract forms, etc.

More in Letters

Loan letter template, loan requisition letter, loan application letter to bank manager template, sample follow up letter after interview template, simple loan application letter template, personal loan letter to company template, loan reschedule letter template, loan repayment letter to employee template, request for education loan letter template, loan agreement letter template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

- Bureaus and Offices

- Contact HRSA

- Loan Repayment

NHSC Students to Service Loan Repayment Program

We've closed the 2024 students to service loan repayment program application cycle..

Sign up for our emails , and we'll notify you when next year's application cycle opens.

- Read the 2024 Students to Service Loan Repayment Application and Program Guidance (PDF - 838 KB) . It has detailed information that you will need to know about the application.

- Check out our application checklist (PDF - 1 MB) to be sure you have everything you need to submit a complete application.

- Applied to the 2024 application? Check for our emails, as all applicants will be notified of their award status by April 15, 2024.

If you are a student in your last year of medical, nursing, or dental school, you may be eligible to receive loan repayment assistance from the NHSC Students to Service Loan Repayment Program (NHSC S2S LRP).

In return, you provide at least three years of service at an NHSC-approved site in a designated Health Professional Shortage Area (HPSA) .

Determine your eligibility | Sites | How to apply

By joining thousands of NHSC participants across the country, you have an opportunity to provide primary health services to communities in need.

You will receive funds to repay your outstanding, qualifying, educational loans.

- NHSC loan repayment funds are exempt from federal income and employment taxes.

- You will receive up to $120,000 in loan repayment funds payable in four annual installments (up to $30,000 per year) as long as you meet program requirements.

- In return, you agree to provide three years of full-time clinical practice at an NHSC-approved site in a HPSA. (Full-time clinical practice means at least 40 hours per week, for at least 45 weeks each service year.)

Once you complete the initial three-year service contract, you may be eligible to apply for additional loan repayment funds to pay any remaining educational loans through one-year continuation service contracts .

- There is no guarantee that you will receive a continuation contract.

- Application Launch Date: August 29, 2023 **

- Application Submission Deadline: December 7, 2023

- Medical and Dental Student Graduation Date: July 1, 2024 **

- Nurse Practitioner, Certified Nurse Midwife and Physician Assistant Graduation Date: August 31, 2024

- Notification of Award: April 15, 2024

- Contract Termination Deadline: 60 days from the effective date of the contract or at any time if the individual who has been awarded such contract has not received funds due under the contract.

Determine your eligibility

Read and follow the NHSC Students to Service LRP Application and Program Guidance (PDF - 838 KB) .

You must be:

- A United States (U.S) citizen or U.S. national

- A school of allopathic medicine accredited by the Liaison Committee on Medical Education (sponsored by the American Medical Association and the Association of American Medical Colleges)

- A school of osteopathic medicine accredited by the American Osteopathic Association Commission on Osteopathic College Accreditation

- A school of dentistry accredited by the American Dental Association Commission on Dental Accreditation

A school or program of nurse practitioner education accredited by the Accreditation Commission for Education in Nursing or the Commission on Collegiate Nursing Education

At a school or program of nurse-midwifery education accredited by the American College of Nurse-Midwives, Division of Accreditation

A school or program of physician assistant education accredited by the Accreditation Review Commission on Education for the Physician Assistant at a college, university, or educational institution that is accredited by a U.S. Department of Education nationally recognized accrediting body or organization

- July 1 for physicians and dentists

- August 31 for nurse practitioners, certified nurse midwives or physician assistants

Note: Any classes that are not required or unrelated courses to the qualifying degree program will not count towards the hours required for full-time status.

*The application year applies to the fiscal year noted in the Application and Program Guidance (APG).

- You must be eligible to hold an appointment as a Commissioned Officer of the Public Health Service or as a federal civil servant.

Note : There are additional, specific requirements for both medical students and dental students—you can find them in the NHSC S2S LRP Application and Program Guidance.

Are military reservists eligible?

Yes. Find out about specific guidelines and requirements for military reservists .

Following medical, nursing, or dental school, you must plan to train and become licensed to provide patient care in one of these disciplines and specialties:

- Allopathic (MD)

- Family Medicine

- General Internal Medicine

- General Pediatrics

- Obstetrics/Gynecology

- Psychiatry (including Child and Adolescent Psychiatrists)

Nurse Practitioner (NP)

- Adult Practice

- Family Practice

- Women’s Health

- Certified Nurse Midwife (CNM)

- Doctor of Dental Surgery (DDS)

- General Dentistry

- Pediatric Dentistry

Physician Assistant (PA)

- Women's Health

Maternity Care Treatment Area (MCTA) Provider

- Family medicine physicians who practice obstetrics on a regular basis

Maternity Care Target Area (MCTA) Supplemental Award

We recently identified and designated Maternity Care Target Areas (MCTAs), or geographic areas within HPSAs that have a shortage of maternity care health professionals to help distribute NHSC-awarded maternity care health professionals to such areas. To support this effort, the Fiscal Year 2024 NHSC S2S LRP provides a supplemental award of up to $40,000 in loan repayment funding to maternity care health professional participants.

Students who receive an NHSC S2S LRP award and are found eligible for the MCTA supplement, will be contacted by the NHSC to accept it. The supplement is separate from your initial application for the up to $120,000 NHSC S2S LRP award.

To be eligible for the Maternity Care Target Area supplemental award, program participants must:

- Have unpaid qualifying educational loans that were not paid off using previously awarded NHSC funds

- Commit to providing primary health care services in Maternity Care Target Areas with a shortage score of 16 or above

S2S LRP participants who receive the supplemental award of up to $40,000 will receive supplemental award payments distributed equally through annual installment payments.

A program participant who initially received a $120,000 Students to Service Loan Repayment Program award which resulted in four annual installment payments of $30,000 and receives a $40,000 supplemental award would see the annual installment payment increased by $10,000 for a total annual installment payment of $40,000.

How to apply

We guide you through the application and award process:

- Application Process, Requirements, and Guidance

- Selection Factors

- Funding Priorities

Before you apply

On average, it takes three weeks to complete an application, including all required and supplemental documentation.

Be sure that the answers you provide in your application match your supporting documents. If we find they do not, we will reject your application.

You must submit a legible, complete online application—including all supporting documents—by the application deadline.

We will not:

- Accept requests to update a submitted application nor permit you to submit materials after the deadline.

- Fill in any missing information nor contact you regarding missing information.

What is a complete application?

A complete application consists of:

- Online application

- Required supporting documents

- Additional supplemental documentation (if applicable)

Application requirements

This is an overview of the application requirements. Refer to the Application and Program Guidance (APG) for complete requirements and instructions. We update the APG each year.

You must complete each of the following sections below to submit your application:

- Eligibility Screening . If you do not pass this initial screening portion of the application, you cannot continue with the application.

- General Information. Provide contact information such as your name, social security number, mailing and email addresses, as well as information about individual and family background.

- Education Information. Provide information related to the degree program you are currently pursuing.

- Name and contact information for the lender/holder

- Loan account number

- Original amount disbursed

- Original date of the loan

- Current outstanding balance (no more than 30 days from the date you submit your application)

- Current interest rate

- Original date of consolidation

- Original balance of consolidation

- Account number

- Purpose of loan

- Essay. Respond to the essay topic in 500 words or less, and upload it to the application.

An application is incomplete without these required supplemental documents:

- Proof of status as a United States citizen or United States national Acceptable documents: birth certificate, current U.S. passport’s ID page, or a certificate of citizenship or naturalization. Unacceptable documents: permanent resident card, driver’s license, marriage certificate or Social Security card.

- Authorization to Release Information This authorizes identified entities to disclose information about you. It must include the last four digits of your social security number, be dated and have your handwritten signature.

- Resume/Curriculum Vitae (CV) This must outline relevant work/volunteer experience and be fewer than five pages long.

- Proof of Passage of Required Licensing Examinations Medical students must submit documentation verifying that they have passed Step/Level 1 of the USMLE or the COMLEX. Dental students must submit documentation verifying that they have passed Part I of the National Board Dental Examination. Nursing students must submit documentation of appropriate specialized training and certification.

- Your enrollment

- You are in good standing

- Your last day of classes is no later than June 30, 2024

- You will graduate before July 1, 2024

- One letter from an instructor

- One additional letter of recommendation

- Transcript This must come from your current educational institution. An unofficial transcript is acceptable as long as it includes your name, school name, and grade point average (GPA) (may be pass/fail).

- Be on official letterhead or other clear verification that it comes from the lender/holder

- Include the name of the borrower (i.e., the NHSC S2S LRP applicant)

- Contain the account number

- Include the date of the statement (cannot be more than 30 days from the date you submit your application)

- Include the current outstanding balance (principal and interest) or the current payoff balance

- Include the current interest rate

- Include the name of the borrower

- Include the type of loan

- Include the original loan date (must be prior to the date you submit your application)

- Include the original loan amount

- Include the purpose of the loan

We may require you to submit additional documents if your responses on the online application indicate that they are relevant.

You should only submit these documents if we list them on the “Supporting Documents” page of the online application.

- Verification of Disadvantaged Background A school official must complete the Verification of Disadvantaged Background (PDF - 406 KB) .

- Verification of Existing Service Obligation Verification from the entity for which you have an existing service obligation stating you will complete service there prior to the NHSC application deadline.

After you apply

You will receive a receipt of submission once you successfully submit the online application.

What happens during the application review process?

The S2S LRP application review process occurs over several months through independent, objective review.

Allow at least 30 business days from submission for us to review your documentation and update your application status.

Do you provide status updates?

We provide email updates, as applicable, as well as updates on the status page of the online application. You must ensure your contact information is correct.

How do you evaluate me?

We use various selection factors and funding priorities to evaluate applicants of S2S LRP, and eventually determine who receives awards.

Notifying award finalists

If we select you as a finalist, you will receive a Confirmation of Interest email. In it, we will provide a deadline for your response.

To accept the S2S LRP award, you will electronically sign a copy of the contract and provide us with your banking information.

Once the Secretary of HHS or their designee countersigns the contract, your service obligation begins.

What if I don’t respond in time?

If you do not respond to us by the deadline, your offer of award expires and we will offer it to an alternate.

What if I decide not to accept the award?

If you decline the award prior to signing the contract , you may do so without penalty.

If you decide you do not want the award after signing the contract , notify us immediately through the BHW Customer Service Portal .

- If the Secretary of HHS’s designee has not yet countersigned the contract , you will not incur a service obligation or any penalty for withdrawing.

- If the Secretary of HHS’s designee has already signed the contract , you can request termination of the contract only under certain conditions.

Will you notify me if you don't select me for an award?

Yes. If we do not select you for an award, we will email you no later than April 15.

Related Resources

Application & program guidance (apg).

- NHSC SUD Workforce LRP APG (PDF - 722 KB)

- NHSC Rural Community LRP APG (PDF - 799 KB)

- NHSC S2S LRP APG (PDF - 838 KB)

Program comparison chart

- NHSC and Nurse Corps Loan Repayment Programs Comparison (PDF - 343 KB)

- NHSC Dental Scholarship Programs Comparison (PDF - 74 KB)

Related loan repayment & scholarship programs

- Nurse Corps

- School-based Loans & Scholarships

- Faculty Loan Repayment

- Native Hawaiian Health Scholarship

Fact sheets

- NHSC LRP Fact Sheet (PDF - 185 KB)

- NHSC SUD Workforce LRP Fact Sheet (PDF)

- NHSC Rural Community LRP Fact Sheet (PDF - 362 KB)

- NHSC S2S LRP Fact Sheet (PDF - 205 KB)

Spanish fact sheets

- NHSC LRP Fact Sheet – Spanish (PDF - 374 KB)

- NHSC Substance Use Disorder Workforce LRP Fact Sheet – Spanish (PDF - 882 KB)

- NHSC Rural Community LRP Fact Sheet – Spanish (PDF - 1 MB)

- NHSC S2S LRP Fact Sheet – Spanish (PDF - 323 KB)

- NHSC 11x17 Poster (PDF - 1 MB)

- NHSC 8.5x11 Poster (PDF - 932 KB)

- Share full article

Advertisement

Supported by

Biden Approves $5.8 Billion in Additional Student Debt Cancellation

The incremental relief brings the canceled total to $143.6 billion for nearly four million Americans.

By Tara Siegel Bernard

The Biden administration continued its effort to extend student debt relief on Thursday, erasing an additional $5.8 billion in federal loans for nearly 78,000 borrowers, including teachers, firefighters and others who largely work in the public sector.

To date, the administration has canceled $143.6 billion in loans for nearly four million borrowers through various actions, fixes and federal relief programs. That’s the largest amount of student debt eliminated since the government began backing loans more than six decades ago, but it’s still far less than President Biden’s initial proposal, which would have canceled up to $400 billion in debt for 43 million borrowers but was blocked by the Supreme Court.

The latest debt erasures apply to government and nonprofit employees in the Public Service Loan Forgiveness program, which can eliminate their balance after 120 payments. The P.S.L.F. program, which was plagued with administrative and other problems, has improved in recent years after the administration made a series of fixes .

“For too long, our nation’s teachers, nurses, social workers, firefighters and other public servants faced logistical troubles and trap doors when they tried to access the debt relief they were entitled to under the law,” Education Secretary Miguel Cardona said.

Since those October 2021, more than 871,000 public service and nonprofit workers have received debt cancellation totaling $62.5 billion; before that, just 7,000 had reached forgiveness since the program was created more than 15 years ago.

Starting next week, borrowers who are set to receive the latest round of debt cancellation through the P.S.L.F. program will receive an email notification from Mr. Biden — a reminder of his administration’s work just eight months before the presidential election.

An additional 380,000 federal borrowers in the P.S.L.F program who are on track to have their loans forgiven in less than two years will receive emails from the president notifying them that they will be eligible for debt cancellation if they continue their public service work within that period.

Many of these borrowers have been helped by programs that tried to address past errors that may have failed to credit individuals for payments. As a result, many borrowers received account adjustments, or additional credits, pushing them closer to the repayment finish line.

Millions of borrowers with certain types of loans are still eligible for some of those adjustments, but they will need to apply to consolidate those loans by April 30 to qualify.

“There are a lot of people who need to consolidate by this deadline to benefit and potentially access life-changing student loan relief,” said Abby Shafroth, co-director of advocacy at the National Consumer Law Center. They include borrowers with privately held loans in the Federal Family and Education Loan , Perkins Loan and Health Education Assistance Loan programs, she added. (People with direct loans or loans held by the Education Department don’t need to do anything to have their payment counts adjusted; it happens automatically.)

Besides P.S.L.F., the administration has extended relief through a variety of other federal relief programs: About 935,500 borrowers were approved for $45.6 billion in debt cancellation through income-driven repayment plans, which base monthly payments on a borrower’s earnings and household size. After a set period of repayment, usually 20 years, any remaining debt is erased.

Another 1.3 million people had $22.5 billion wiped out through the federal borrower defense program, which provides relief to those defrauded by their schools.

The administration’s latest round of completed debt relief comes on the heels of its bungled rollout of the new Free Application for Federal Student Aid, or FAFSA, which was supposed to simplify the process. Instead, technical and other problems have created delays, leaving colleges without student financial information that they need to make aid offers. Students have been left in limbo, unable to make decisions on where they’ll attend college.

Tara Siegel Bernard writes about personal finance, from saving for college to paying for retirement and everything in between. More about Tara Siegel Bernard

- Skip to primary navigation

- Skip to main content

Bank of North Dakota

Repay Your Student Loan

If you want to learn more about available options on your student loans, you will find all you need to know right here. If you aren’t sure where to find information, use the search button at the top right corner of this page. You may also contact us with questions Monday through Friday from 8 a.m. to 5 p.m. CT using one of the convenient options below.

Call Us (833) 397-0311

Email Us [email protected]

Start A Live Chat When active, connect by using the icon in the lower right corner to connect.

Log in to your account

Log in to make a payment, update contact information, send BND a secure message, and view account status, loan balances, payment history, statements, 1098 tax forms and more. Click here to log in to your online account .

Don’t have an account? Click here to create one .

Manage your student loan online

Simplify. You can manage student loans online with Bank of North Dakota (BND). Whether you’re a borrower or cosigner, there are benefits to creating an online account. Click here to learn more about managing your student loan online .

Information for cosigners

As a cosigner on a BND Student Loan, it’s important to know your options and understand how the loan may impact you. Click here for information on student loan repayment for cosigners .

How to make a payment

Are you unsure how to pay for your student loan? We can help you with that. Click here to learn about ways to make a payment .

Repayment plans

Repayment plan options vary depending on your situation. Typically, most borrowers need to start repaying student loans six months after graduation or leaving school. Click here to learn more about repayment plan options for BND Student Loans.

Difficulty making payments

If you are unable to make your payment on time, contact us immediately. Click here to learn more about options that may be available to you .

Career-based loan repayment options

Career-based loan repayment options may be available if you meet the eligibility criteria. Click here to learn about career-based loan repayment options .

Understand your statement