Four Steps to Delightful Accounting Presentations

By Charles Hall | Technology

- You are here:

In this article, I provide you with four steps to delightful accounting presentations–even if you are a CPA. Yes, this can be done!

If you’ve read the book Presentation Zen , you know that many speakers –without intending to– hide their message . In watching CPE presentations and board presentations, I have noticed that (we) CPAs unwittingly hide our message. How? We present slide decks that look like intermediate accounting textbooks–chock full of facts, but too much to digest. And do we really believe that those attending will take those slides back to the office and study them?

Probably not.

My experience has been those slides end up in the office dungeon, never to be seen again. We have one chance to communicate–in the session.

It is the presenter’s duty to cause learning . So how can we engage our audience (even those sitting on the back row playing with their cell phones)? Let’s start with the slide deck.

1. Make Simple Slides

Make simple slides.

I try to have no more than two points per slide , and I leave out references to professional standards (at least on the slides).

What happens when you see a slide that looks like it contains the whole of War and Peace ? If you’re like me, you may think, “Are you kidding? You want me to consume all of that in the next three minutes. Forget it. I will not even try.” And then you begin to think about your golf game or your next vacation. So, how much information should you include on a slide?

Nancy Duarte recommends the glance test for each slide . “People should be able to comprehend it in three seconds.”

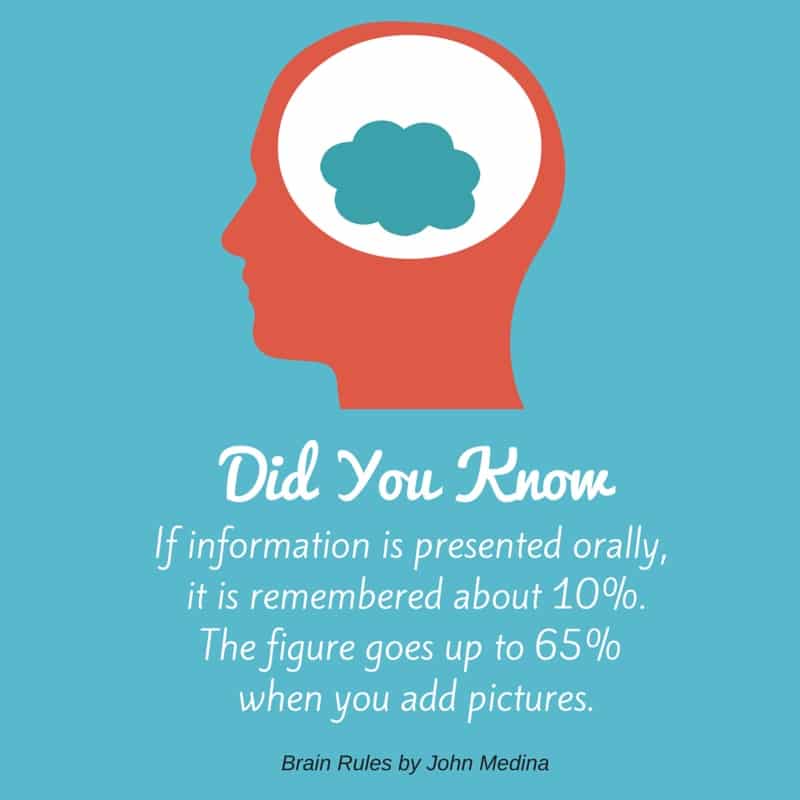

2. Include a picture related to the topic

Include a picture.

For example, if I am presenting to auditors, I might display a picture of someone being bribed. Verbal information is remembered about ten percent of the time. If a picture is included, the figure goes up to sixty-five percent. Quite a difference.

3. Tell a story (and ask questions)

Tell a story and ask questions.

People love stories. If your presentation is about bribes and you have not audited a bribery situation, Google bribes, and you will find all the stories you need. If you can’t find a story, use a hypothetical. Why? You are trying to draw your audience in–then maybe they will put that cell phone down (your most triumphant moment as a speaker!).

Telling your story at the right pace and volume is also important.

Also engage your audience with questions. Stories get the juices going; questions make them dig. And, if they answer you, there is dialog. And what’s the result? Those talking learn, the audience learns, and, yes, you learn.

Move. Not too much, but at least some.

A statue is not the desired effect. Moving like Michael Jackson is also not what you desire (moonwalking was never in my repertoire anyway). But movement, yes. I walk slowly from side to side (without moonwalking) and will, at times, move toward the audience when I want to make a point. So, am I constantly roaming? No. Balance is important.

Now, let me provide a few thoughts about presentation software and handouts.

Presentation Software and Handouts

Presentation Software

If you have an Apple computer, let me recommend Keynote as your presentation software . I do think PowerPoint (for you Windows users) has improved, but personally, I prefer Keynote.

Another option—though there is a cost—is using Canva to create your slide deck . Your creativity is almost unlimited with this software—pictures, graphics, templates, colors, resizing, and more. Once the slides are created, you can download them as a PDF. Then present the slides (in the PDF) using the full screen option in Adobe Acrobat . I’ve done this a lot lately. Love it.

Here’s a sample Canva slide:

If you need to provide detailed information, give your participants handouts (examples of what you are discussing).

I prefer not to provide copies of slides. Why? Your participants will read ahead. You want to keep your powder dry. If they already know what you’re going to say, they’ll stop listening.

Your Presentation Tips

What do you do to make your presentations sizzle?

About the Author

Charles Hall is a practicing CPA and Certified Fraud Examiner. For the last thirty-five years, he has primarily audited governments, nonprofits, and small businesses. He is the author of The Little Book of Local Government Fraud Prevention, The Why and How of Auditing, Audit Risk Assessment Made Easy, and Preparation of Financial Statements & Compilation Engagements. He frequently speaks at continuing education events. Charles consults with other CPA firms, assisting them with auditing and accounting issues.

Amit, I have seen Prezi on the Internet, but I have not used it myself – though it looks inviting. Have you tried it or have you seen anyone use it?

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Accounting Policies – Fair Presentation and Faithful Representation for IFRS

What does fair presentation mean.

Financial statements are described as showing a ‘true and fair view’ when they are free from material misstatements and faithfully represent the financial performance and position of an entity.

In some countries, this is an essential part of financial reporting.

Under International Financial Reporting Standards, financial statements are required to present fairly the financial position, financial performance and cash flows of the entity.

This issue is not dealt with directly by the Framework.

However, if an entity complies with International Financial Reporting Standards, and if its financial information is both relevant and faithfully represented, then the financial statements ‘should convey what is generally understood as a true and fair view of such information’.

Under IAS 1, ‘Fair presentation requires the faithful representation of the effects of transactions, other events and conditions in accordance with the definitions and recognition criteria for assets, liabilities, income and expenses set out in the IASB Framework.

What does faithful representation mean?

Faithful representation means more than that the amounts in the financial statements should be materially correct.

The information should present clearly the transactions and other events that it is intended to represent.

Also, the financial information must account for transactions and other events in a way that reflects their true substance and economic reality, their commercial impact, rather than their strict legal form.

If there is a difference between substance and legal form, the financial information should represent the economic substance.

An example of this is when a company enters into a finance lease, the substance of the transaction requires the entity to record an asset in its financial statements and a corresponding liability for the lease payments due.

Faithful representation also requires the presentation of financial information in a way that is not misleading to users, and that important information is not concealed or obscured as this may be misleading.

Fair presentation and compliance with IFRSs

“Fair presentation” is presumed when the International Financial Reporting Standards are applied with necessary disclosures.

Under IAS 1:

- When the financial statements of an entity fully comply with International Financial Reporting Standards, this should be disclosed.

- Financial statements should not be described as compliant with IFRSs unless they comply with all of the International Financial Reporting Standards.

So IAS 1 assumes financial statements are presented fairly when they comply with accounting standards.

However, it is important to remember the spirit and nature of the accounting standard, and not its strict definition when preparing financial statements.

This is especially true for complex transactions which may not be covered by an accounting standard.

In these cases, the substance of the transaction should take precedence over the strict legal form of the transaction.

Under IAS 1, fair presentation also requires an entity:

- to select and apply accounting policies in accordance with IAS 8 Accounting policies, changes in accounting estimates and errors. IAS 8 sets out guidance for management on how to account for a transaction if no accounting standard is applicable

- to present information in a manner that provides relevant, reliable, comparable and understandable information

- to provide additional disclosures where these are necessary to enable users to understand the financial position and performance of the entity, even where additional disclosure is not required by the accounting standards.

Privacy Overview

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

About the IFRS Foundation

Ifrs foundation governance, stay updated.

IFRS Accounting Standards are developed by the International Accounting Standards Board (IASB). The IASB is an independent standard-setting body within the IFRS Foundation.

IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. The IASB is supported by technical staff and a range of advisory bodies.

IFRS Accounting

Standards and frameworks, using the standards, project work, products and services.

IFRS Sustainability Disclosure Standards are developed by the International Sustainability Standards Board (ISSB). The ISSB is an independent standard-setting body within the IFRS Foundation.

IFRS Sustainability Standards are developed to enhance investor-company dialogue so that investors receive decision-useful, globally comparable sustainability-related disclosures that meet their information needs. The ISSB is supported by technical staff and a range of advisory bodies.

IFRS Sustainability

Education, membership and licensing.

IAS 1 Presentation of Financial Statements

You need to Sign in to use this feature

IAS 1 sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. It requires an entity to present a complete set of financial statements at least annually, with comparative amounts for the preceding year (including comparative amounts in the notes). A complete set of financial statements comprises:

- a statement of financial position as at the end of the period;

- a statement of profit and loss and other comprehensive income for the period. Other comprehensive income is those items of income and expense that are not recognised in profit or loss in accordance with IFRS Standards. IAS 1 allows an entity to present a single combined statement of profit and loss and other comprehensive income or two separate statements;

- a statement of changes in equity for the period;

- a statement of cash flows for the period;

- notes, comprising a summary of significant accounting policies and other explanatory information; and

- a statement of financial position as at the beginning of the preceding comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it reclassifies items in its financial statements.

An entity whose financial statements comply with IFRS Standards must make an explicit and unreserved statement of such compliance in the notes. An entity must not describe financial statements as complying with IFRS Standards unless they comply with all the requirements of the Standards. The application of IFRS Standards, with additional disclosure when necessary, is presumed to result in financial statements that achieve a fair presentation. IAS 1 also deals with going concern issues, offsetting and changes in presentation or classification.

Standard history

In April 2001 the International Accounting Standards Board (IASB) adopted IAS 1 Presentation of Financial Statements , which had originally been issued by the International Accounting Standards Committee in September 1997. IAS 1 Presentation of Financial Statements replaced IAS 1 Disclosure of Accounting Policies (issued in 1975), IAS 5 Information to be Disclosed in Financial Statements (originally approved in 1977) and IAS 13 Presentation of Current Assets and Current Liabilities (approved in 1979).

In December 2003 the IASB issued a revised IAS 1 as part of its initial agenda of technical projects. The IASB issued an amended IAS 1 in September 2007, which included an amendment to the presentation of owner changes in equity and comprehensive income and a change in terminology in the titles of financial statements. In June 2011 the IASB amended IAS 1 to improve how items of other income comprehensive income should be presented.

In December 2014 IAS 1 was amended by Disclosure Initiative (Amendments to IAS 1), which addressed concerns expressed about some of the existing presentation and disclosure requirements in IAS 1 and ensured that entities are able to use judgement when applying those requirements. In addition, the amendments clarified the requirements in paragraph 82A of IAS 1.

In October 2018 the IASB issued Definition of Material (Amendments to IAS 1 and IAS 8). This amendment clarified the definition of material and how it should be applied by (a) including in the definition guidance that until now has featured elsewhere in IFRS Standards; (b) improving the explanations accompanying the definition; and (c) ensuring that the definition of material is consistent across all IFRS Standards.

In February 2021 the IASB issued Disclosure of Accounting Policies which amended IAS 1 and IFRS Practice Statement 2 Making Materiality Judgements . The amendment amended IAS 1 to replace the requirement for entities to disclose their significant accounting policies with the requirement to disclose their material accounting policy information.

In October 2022, the IASB issued Non-current Liabilities with Covenants . The amendments improved the information an entity provides when its right to defer settlement of a liability for at least twelve months is subject to compliance with covenants. The amendments also responded to stakeholders’ concerns about the classification of such a liability as current or non-current.

Other Standards have made minor consequential amendments to IAS 1. They include Improvement to IFRSs (issued April 2009), Improvement to IFRSs (issued May 2010), IFRS 10 Consolidated Financial Statements (issued May 2011), IFRS 12 Disclosures of Interests in Other Entities (issued May 2011), IFRS 13 Fair Value Measurement (issued May 2011), IAS 19 Employee Benefits (issued June 2011), Annual Improvements to IFRSs 2009–2011 Cycle (issued May 2012), IFRS 9 Financial Instruments (Hedge Accounting and amendments to IFRS 9, IFRS 7 and IAS 39) (issued November 2013), IFRS 15 Revenue from Contracts with Customers (issued May 2014), Agriculture: Bearer Plants (Amendments to IAS 16 and IAS 41) (issued June 2014), IFRS 9 Financial Instruments (issued July 2014), IFRS 16 Leases (issued January 2016), Disclosure Initiative (Amendments to IAS 7) (issued January 2016), IFRS 17 Insurance Contracts (issued May 2017), Amendments to References to the Conceptual Framework in IFRS Standards (issued March 2018) and Amendments to IFRS 17 (issued June 2020).

Related active projects

IFRS Accounting Taxonomy Update—Primary Financial Statements

Primary Financial Statements

Related completed projects

Clarification of the Requirements for Comparative Information (Amendments to IAS 1)

Classification of Liabilities as Current or Non-current (Amendments to IAS 1)

Definition of Accounting Estimates (Amendments to IAS 8)

Disclosure Initiative (Amendments to IAS 1)

Disclosure Initiative (Amendments to IAS 7)

Disclosure Initiative—Accounting Policies

Disclosure Initiative—Definition of Material (Amendments to IAS 1 and IAS 8)

Disclosure Initiative—Principles of Disclosure

Disclosure Initiative—Targeted Standards-level Review of Disclosures

IFRS Accounting Taxonomy Update—Amendments to IAS 1, IAS 8 and IFRS Practice Statement 2

IFRS Accounting Taxonomy Update—Amendments to IFRS 16 and IAS 1

Joint Financial Statement Presentation (Replacement of IAS 1)

Non-current Liabilities with Covenants (Amendments to IAS 1)

Presentation of Items of Other Comprehensive Income (Amendments to IAS 1)

Presentation of Liabilities or Assets Related to Uncertain Tax Treatments (IAS 1)

Presentation of interest revenue for particular financial instruments (IFRS 9 and IAS 1)

Puttable Financial Instruments and Obligations Arising on Liquidation (Amendments to IAS 32 and IAS 1)

Revised IAS 1 Presentation of Financial Statements: Phase A

Supply Chain Financing Arrangements—Reverse Factoring

Related IFRS Standards

Related ifric interpretations.

IFRIC 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities

Unconsolidated amendments

Implementation support, your privacy.

IFRS Foundation cookies

We use cookies on ifrs.org to ensure the best user experience possible. For example, cookies allow us to manage registrations, meaning you can watch meetings and submit comment letters. Cookies that tell us how often certain content is accessed help us create better, more informative content for users.

We do not use cookies for advertising, and do not pass any individual data to third parties.

Some cookies are essential to the functioning of the site. Other cookies are optional. If you accept all cookies now you can always revisit your choice on our privacy policy page.

Cookie preferences

Essential cookies, always active.

Essential cookies are required for the website to function, and therefore cannot be switched off. They include managing registrations.

Analytics cookies

We use analytics cookies to generate aggregated information about the usage of our website. This helps guide our content strategy to provide better, more informative content for our users. It also helps us ensure that the website is functioning correctly and that it is available as widely as possible. None of this information can be tracked to individual users.

Preference cookies

Preference cookies allow us to offer additional functionality to improve the user experience on the site. Examples include choosing to stay logged in for longer than one session, or following specific content.

Share this page

- Subscriber Services

- For Authors

- Publications

- Archaeology

- Art & Architecture

- Bilingual dictionaries

- Classical studies

- Encyclopedias

- English Dictionaries and Thesauri

- Language reference

- Linguistics

- Media studies

- Medicine and health

- Names studies

- Performing arts

- Science and technology

- Social sciences

- Society and culture

- Overview Pages

- Subject Reference

- English Dictionaries

- Bilingual Dictionaries

Recently viewed (0)

- Save Search

- Share This Facebook LinkedIn Twitter

Related Content

Related overviews.

true and fair view

International Accounting Standard

International Accounting Standards Board

financial statements

More Like This

Show all results sharing these subjects:

fair presentation

Quick reference.

The requirement that financial statements should not be misleading. ‘Fair presentation’ is the US and International Accounting Standards equivalent of the British requirement that financial statements give a true and fair view.

From: fair presentation in A Dictionary of Finance and Banking »

Subjects: Social sciences — Economics

Related content in Oxford Reference

Reference entries.

View all related items in Oxford Reference »

Search for: 'fair presentation' in Oxford Reference »

- Oxford University Press

PRINTED FROM OXFORD REFERENCE (www.oxfordreference.com). (c) Copyright Oxford University Press, 2023. All Rights Reserved. Under the terms of the licence agreement, an individual user may print out a PDF of a single entry from a reference work in OR for personal use (for details see Privacy Policy and Legal Notice ).

date: 03 April 2024

- Cookie Policy

- Privacy Policy

- Legal Notice

- Accessibility

- [66.249.64.20|185.148.24.167]

- 185.148.24.167

Character limit 500 /500

More results...

- Wednesday, April 3, 2024

- The Financial Encyclopedia

- February 15, 2022

Fair Presentation

An accounting standards’ requirement that an entity’s financial statements should be presented in a fair way to all relevant users of these statements. In other words, it is premised on the requirement that these statements should not be misleading. Under the principle of fair presentation, financial statements must fairly present the financial position, financial performance and cash flows of the entity. Fair presentation requires the faithful (unbiased) representation of the monetary effects of transactions, other events and circumstances in accordance with the applicable concepts and recognition criteria for assets , liabilities , income and expenses .

Fair presentation is the US and International Accounting Standards (IAS) equivalent of the British requirement that financial statements provide a true and fair view (which entails that statements/ accounts have been truly prepared and fairly presented in accordance with applicable accounting standards and framework . It also implies that the financial statements are free from material misstatements and faithfully represent the financial position and performance of an entity, subject-matter of an audit process.).

- Face of Balance Sheet

- Primary Currency

- Accounting Currency

- Reporting Currency

- Presentation Currency

- Presentation Statement

- Comparability

Latest Terms

- Financial Statement Variable

- Financial Variable

- Factory Overhead Control Account

- Finance Cost

- FV Approximation

- Fair Value Approximation

- Fair Value Hierarchy

Leave Your Comment Cancel Reply

Your email address will not be published.*

Save my name, email, and website in this browser for the next time I comment.

What Is Accounting? Definition, Types, History, & Examples

Accounting is a broad discipline that focuses on the current state of an organization’s financial activities. But today’s accountants are a far cry from the stereotypical “numbers person” who’s more comfortable with a spreadsheet than a strategic business plan. In fact, the insights produced by accountants—and finance teams overall—inform and shape strategy for all corners of the business.

Accountants work closely with stakeholders including executives, investors and boards as well as human resources, IT and sales and marketing teams and act as liaisons between their companies and government, tax and regulatory agencies.

Startups, nonprofits and small companies may work with fractional CFOs—an experienced CFO who works on a contract or part-time basis—or accounting partners, but whether internal or outsourced, the accounting function is vital to success.

What Is Accounting?

Accounting is the process of recording and categorizing a company’s transactions, and then summarizing, analyzing and reporting on these activities. The resulting information—in the form of the balance sheet, income and cash flow statement, forecasts and other reports—is used to inform business leaders as they:

- Evaluate staffing and payroll

- Balance or assess inventory levels

- Investigate new business opportunities

- Maximize profitability

- Manage cash flow

- Analyze the financial health of the business

The reports and other information that accountants produce are also used outside of the company, by lenders, investors, auditors and, in the case of public companies, investors.

Key Takeaways

- Accounting encompasses a broad set of activities, from basic bookkeeping to analyzing the company’s financial health, forecasting revenue, preparing taxes and ensuring legal compliance.

- Businesses use five main types of accounting: managerial, cost, project, tax and financial accounting.

- U.S. public companies must use Generally Accepted Accounting Principles (GAAP).

How Does Accounting Work?

Every business needs some form of accounting function. Deciding when to hire an in-house accountant is a major decision for entrepreneurs. For small businesses, a single person may perform all accounting tasks and act as the CFO. Alternatively, hiring an outside accountant may make sense, especially for tax purposes. Many small businesses use software to keep track of income and expenses and then send that information to an outsourced accountant for review.

Regardless of whether the company uses outside accounting partners or in-house employees, the accounting functions include recording, categorizing, analyzing and reporting financial activities. Internally focused reports help managers allocate funds and make business decisions such as how much to charge for products. Other reports are used for compliance, taxes, attracting investors and applying for loans.

What Are the Types of Accounting Practices?

There are many accounting specialties. Businesses use five main types: managerial, cost, project, tax and financial accounting.

Managerial accounting

Managerial accounting provides the reporting, analysis and interpretation of financial data that decision-makers need to create and refine business strategy. Managerial accountants support planning by performing cost-volume-profit analysis, weigh in on organizational structure and analyze variances.

Cost accounting

Cost accounting, a specialty within managerial accounting, is focused on how much a business spends to create its products, including labor and supply costs. The information gleaned from cost accounting is used to optimize operations—to value inventory, set selling prices for products and create budgets for similar projects.

Tax accounting

Tax accounting, which is governed by the U.S. Internal Revenue Code, deals with preparing tax returns and making tax payments. Accountants ensure that companies comply with complex and changing laws.

Project accounting

Professionals such as project managers and accountants use project accounting to integrate key financial tasks on a project-by-project basis and report their progress and success to management.

Project managers rely on project accounting to inform them of the status of direct costs, overhead costs and any revenues in a specific project. Project accountants generate these figures in financial reports. A project manager uses these reports to determine if they need to adjust the project’s budget and work breakdown structure (WBS).

Financial accounting

This discipline focuses on providing information to outside parties interested in the business. A financial accountant typically prepares balance sheets, income statements and cash flow statements to help investors understand the company’s performance or to make a case to a bank to loan money to the business.

Why Is Accounting Important?

Accounting supports several critical business functions. At a basic level, it enables the business to track revenue, expenses, assets, liabilities and shareholder equity, and manage cash flow and know whether customers have paid, and whether the company has paid its own bills.

Accounting provides a business with insights that can help it plan for the future. For example, managers can use inventory accounting methods to learn whether the cost to produce a product has increased and adjust the price or change suppliers accordingly. They can examine sales data to inform decisions on what new products to add and which customers should get more attention.

Accountants also help their companies secure financing and find investors. Most lenders, whether they’re loaning money to small businesses or large corporations, need to see proof that the business is viable. Investors also want to assess the potential return they’ll get on their investments.

Finally, accounting helps with taxes and compliance. Producing accurate financial statements is necessary to report income to the IRS for public companies, while both private and public companies are required to provide quarterly tax estimates and a yearly tax return. If reports are incorrect, a company could be under-reporting and subject to an audit or fines from the government or, conversely, over-reporting and paying more than it should. Other compliance issues include reporting for loan covenants and for U.S. Securities and Exchange Commission (SEC) reporting regulations for public companies.

History of Accounting

Accounting has existed since ancient civilizations first began trading goods. The earliest evidence of accounting is found on clay tablets dating as far back as 3,300 BCE in Egypt and Mesopotamia.

Some of today’s accounting concepts emerged in Medieval Europe. Merchant Benedetto Cotrugli is credited with inventing the debit/credit accounting system in 1458. However, Italian mathematician and Franciscan monk Luca Bartolomes Pacioli is commonly known as the father of accounting and bookkeeping. He described double-entry bookkeeping in his 1494 book Summa de Arithmetica, Geometria, Proportioni et Proportionalita —“The Collected Knowledge of Arithmetic, Geometry, Proportion, and Proportionality”—a work that has influenced the teaching and practice of accounting to this day.

The Accounting Profession

Suffice it to say, the accounting profession has come a very long way since those days of ancient civilization and early accounting books. Today it is considering one of the best business jobs, according to U.S. News & World Report’s “2019 Best Jobs.”

What Does an Accountant Do?

An accountant generally performs a variety of financial duties. The most common include reviewing financial information, analyzing accounts, providing insights about the company’s finances and preparing budgets and reports. Accountants at small businesses may also be tasked with bookkeeping, in which case they may maintain the general ledger, pay bills, handle payroll and reconcile accounts.

A certified public accountant (CPA) is an accountant licensed by a state board of accountancy. Obtaining a CPA license requires a candidate to complete an appropriate education, obtain real-world experience and pass a CPA exam. CPAs typically provide business and tax advice and help create financial strategies that enable businesses to maximize profits.

Roles & Titles

Accounting areas of expertise.

Corporate finance encompasses several areas of expertise. Larger companies may hire accountants who specialize in one or more of these areas:

- Payroll: Ensure that employees are paid accurately and on time and that the appropriate deductions, like taxes and health insurance premiums, are withheld from their paychecks.

- Cost: Value inventory, set selling prices for products and create budgets using historical data.

- Accounts receivable/accounts payable (AR/AP): Focus on sending invoices, collecting payments and paying bills.

- Bookkeeping: Record transactions and balance the books.

- Collections: Track whether customers pay on time and take steps to obtain payment if they don’t.

- Tax: Ensure the business pays applicable taxes and maximizes the deductions to which it is entitled.

Accounting vs. Bookkeeping

Although the terms “accounting” and “bookkeeping” are sometimes used interchangeably, bookkeeping is just one function within the broad discipline of accounting.

- Bookkeeping involves maintaining systematic records of financial transactions in the appropriate accounts, or ledgers. These records are ultimately reflected in the company’s general ledger, a master accounting document containing a complete record of the company’s transactions.

- Accounting encompasses much more than bookkeeping. It includes advanced functions like summarizing, analyzing and communicating data; preparing taxes; and ensuring legal compliance. For example, a senior accountant in a business would manage the general ledger, prepare financial statements and work with external auditors.

Bookkeeping vs. Accounting

What is gaap (generally accepted accounting principles).

Generally Accepted Accounting Principles (GAAP) are U.S. accounting guidelines and standards issued by the Financial Accounting Standards Board (opens in a new tab) (FASB).

Public companies must comply with GAAP in their accounting practices, including when preparing financial statements. This helps investors and authorities assess and compare financial statements from different companies. Privately held companies do not need to comply with GAAP, but these businesses often choose to do so—especially if they plan to go public in the future.

Steps of the Accounting Cycle

The accounting cycle consists of eight main steps during each accounting period. Accounting software can automate most of these tasks.

- Identify and categorize transactions: For example, an accountant would categorize sales orders as income.

- Record journal entries: Individual transactions are entered in the appropriate accounts.

- Post journal entries in the general ledger: This task must be performed in accordance with the rules of double-entry accounting.

- Prepare an unadjusted trial balance: This report includes all the business’s accounts and their balances, comparing debits and credits. Debits and credits must balance.

- Adjust accounting entries: At the end of an accounting period, an accountant will add any entries that haven’t been recorded previously, such as interest from bank accounts.

- Prepare an adjusted trial balance: This report includes the adjustments made in the previous step.

- Prepare financial statements: Use the account balances from Step 6 to create financial statements, including an income statement, balance sheet and cash flow statement.

- Close the books: Prepare for the next accounting period.

Accounting for Small Business vs. Enterprise

While many principles of accounting are the same for a small business and a large enterprise, there are a few key practical differences—the biggest being the volume of financial activities. A small business may have only a few hundred transactions per month, while an enterprise may handle many thousands or even millions.

Another common difference is the method of recording transactions. There are two primary methods: cash basis accounting and accrual basis . Smaller businesses often use cash basis accounting , which is simpler. With this method, revenue and expenses are recorded when cash changes hands.

Businesses that need to comply with GAAP, such as public companies, must use accrual basis accounting. Accrual basis accounting is more complex but generally gives a more accurate picture of a company’s financial position. With accrual basis accounting, a company records income when it is earned and expenses when they are incurred, regardless of when money changes hands. For example, a company that is paid in advance for a multi-year contract would record a portion of the revenue in each year.

Accounting Example

Accountants use the double-entry bookkeeping method to record transactions. Each transaction is recorded as a journal entry, with a credit to one account and a corresponding debit to another. These entries must balance each other. This method helps to ensure that each transaction is recorded in the appropriate amount and that the five major account types—revenue, expenses, assets, liabilities and equity—all balance.

Here’s an example of double-entry bookkeeping in accounting: A business sends an invoice to a customer. Using the double-entry method, the accountant records a debit to accounts receivable. The balancing credit is recorded in the sales revenue account.

When the customer pays the invoice, the accountant credits the accounts receivable account and debits the cash report.

The bookkeeping journal entries for this event are:

Improve Expense Management Efficiency

Managing an Accounting System

Using an accounting system helps businesses automate many routine accounting tasks, like paying bills and running reports. Accounting software can eliminate a lot of manual work, especially if the system is integrated with other business applications. That automation saves businesses money and reduces errors. Typically, the finance department will play a key role in setting up the system, particularly when it comes to creating custom reports and approval workflows.

The work involved in maintaining and updating the accounting software depends on the type of system you choose. Companies generally have a choice between on-premises and cloud-based accounting software. On-premises software typically requires IT expertise to install and manage on-site software and hardware. Cloud-based software or software-as-a-service systems are easier to manage because the provider updates the software automatically and users access the system over the internet using a browser.

No matter whether your business uses in-house skills or hires an independent provider, accountants provide expertise that’s essential to manage everyday financial activities, comply with tax and regulatory requirements and generate insights into the company’s performance.

What Is Corporate Travel Management?

Corporate travel management addresses all functions associated with supporting business travel for employees, customers, vendors and business partners. Companies may rely on…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

- Search Search Please fill out this field.

- Financial Statement Assertions

- How They Work

Accuracy and Valuation

Completeness, rights and obligations, presentation and disclosure.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

What Are Financial Statement Assertions?

J.B. Maverick is an active trader, commodity futures broker, and stock market analyst 17+ years of experience, in addition to 10+ years of experience as a finance writer and book editor.

:max_bytes(150000):strip_icc():format(webp)/picture-53889-1440688003-5bfc2a8846e0fb0083c04dc5.jpg)

Financial statement assertions are statements or claims that companies make about the fundamental accuracy of the information in their financial statements . These statements include the balance sheet, income statement, and cash flow statement. Also referred to as management assertions, these claims can be either implicit or explicit.

So why do corporate financial statement assertions matter? They are the official statement that the figures reported are a truthful presentation of the company's assets and liabilities following the applicable standards for recognition and measurement of such figures. In this article, we go through each assertion and what they mean.

Key Takeaways:

- Financial statement assertions are a company's official statement that the figures the company is reporting are accurate.

- Assertions are made to attest to the authenticity of information on balance sheets, income statements, and cash flow statements.

- Investors and analysts rely on accurate statements to evaluate a company's stock.

- The Financial Accounting Standards Board requires publicly traded companies to prepare financial statements following the GAAP.

- Companies must attest to assertions of existence, completeness, rights and obligations, accuracy and valuation, and presentation and disclosure.

Understanding Financial Statement Assertions

As noted above, a company's financial statement assertions are a company's stamp of approval—that the information in its financial statements is a true representation of its financial position. This includes any information on the balance sheet, income statement, and cash flow statement, and pertains to each and every asset and liability that appears on these forms.

Investors should keep an eye on these assertions. That's because nearly every financial metric used to evaluate a company's stock is computed using figures from these financial statements. If the figures are inaccurate, the financial metrics such as the price-to-book ratio (P/B) or earnings per share (EPS), which both analysts and investors commonly use to evaluate stocks, would be misleading.

The Financial Accounting Standards Board (FASB) establishes accounting standards in the United States. These are regulations that companies must follow when preparing their financial statements. The FASB requires publicly traded companies to prepare financial statements following the Generally Accepted Accounting Principles (GAAP).

There are five different financial statement assertions attested to by a company's statement preparer. These include assertions of accuracy and valuation, existence, completeness, rights and obligations, and presentation and disclosure. More details on each of these assertions are listed below.

The assertion of accuracy and valuation is the statement that all figures presented in a financial statement are accurate and based on the proper valuation of assets, liabilities, and equity balances.

This financial assertion states that the different components of a financial statement, such as assets, liabilities, revenues, and expenses, have all been properly classified within the statement. One of the ways to test this assertion is to redo all the calculations.

For instance, the assertion of accurate valuation regarding inventory states that inventory is valued in accordance with the International Accounting Standards Board's (IASB) IAS 2 guidelines, which requires inventory to be valued at the lower figure of either cost or net realizable value.

The assertion of existence is the assertion that the assets, liabilities, and shareholder equity balances appearing on a company's financial statements exist as stated at the end of the accounting period that the financial statement covers. Put simply, this assertion assures that the information presented actually exists and is free from any fraudulent activity.

You can test the authenticity of the existence of the assertions by physically verifying all noncurrent assets and receivables.

For example, any statement of inventory included in the financial statement carries the implicit assertion that such inventory exists, as stated, at the end of the accounting period. The assertion of existence applies to all assets or liabilities included in a financial statement.

This assertion attests to the fact that the financial statements are thorough and include every item that should be included in the statement for a given accounting period. The assertion of completeness also states that a company's entire inventory (even inventory that may be temporarily in the possession of a third party) is included in the total inventory figure appearing on a financial statement.

The completeness included in a financial statement means that all transactions included in the statement occurred during the accounting period that the statement covers and that all transactions that occurred during the stated accounting period are included in the statement.

There are tests that you can conduct to ensure completeness. Some of these include reviewing accounts and reconciliation of payables to supplier statements.

When a company's financial statements are audited , the principal element an auditor reviews is the reliability of the financial statement assertions.

The assertion of rights and obligations is a basic assertion that all assets and liabilities included in a financial statement belong to the company issuing the statement. Put simply, the company confirms that it has legal authority and control of all the rights (to assets) and obligations (to liabilities) highlighted in the financial statements.

The rights and obligations assertion states that the company owns and has the ownership rights or usage rights to all recognized assets. For liabilities, it is an assertion that all liabilities listed on a financial statement belong to the company and not to a third party.

If you want to test out the authenticity of this assertion, you can review legal documents, such as deeds , and borrowing agreements for loans and other debts.

The final financial statement assertion is presentation and disclosure . This is the assertion that all appropriate information and disclosures are included in a company's statements and all the information presented in the statements is fair and easy to understand. This assertion may also be categorized as an understandability assertion.

Many professionals review and test the authenticity of this assertion by using certain checklists. This helps ensure that the financial statements in question comply with accounting standards and regulations.

Financial statement assertions are claims made by companies that attest that the information on their financial statements is true and accurate. Information related to the assertions is found on corporate balance sheets, income statements, and cash flow statements. There are five assertions, including accuracy and valuation, existence, completeness, rights and obligations, and presentation and disclosure.

What Are Accounting Management Assertions?

Accounting management assertions are implicit or explicit claims made by financial statement preparers. These assertions attest that the preparers abided by the necessary regulations and accounting standards when preparing the financial statements.

Are Financial Accounting Assertions Important in Auditing?

Financial accounting assertions are a very important part of auditing. That's because there is no other way to hold the preparers of financial statements accountable. By signing and attesting to the authenticity of the statements. the preparer essentially puts their stamp of approval on the paperwork.

What Are the Accounting Assertions?

There are generally five accounting assertions that the preparers of financial statements make. They are accuracy and valuation, existence, completeness, rights and obligations, and presentation and disclosure.

Financial Accounting Standards Board. " About the FASB ."

:max_bytes(150000):strip_icc():format(webp)/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

IMAGES

VIDEO

COMMENTS

The presentation and disclosure requirements discussed in this guide presume that the related accounting topics are considered to be material and applicable to the reporting entity. That assumption applies throughout the guide and will not be restated in every instance.

FSP 6.2 was updated to include a summary of recently-issued FASB guidance that affects the statement of cash flows.; FSP 6.5.2 was updated to clarify guidance on the definition of cash equivalents.; FSP 6.5.3 was updated to clarify guidance on the presentation and disclosure of amounts generally described as restricted cash or restricted cash equivalents.

Approval by the Board of Presentation of Items of Other Comprehensive Income issued in June 2011. Presentation of Items of Other Comprehensive Income (Amendments to IAS 1) was approved for issue by fourteen of the fifteen members of the International Accounting Standards Board. Mr Pacter dissented from the issue of the amendments.

Overview. IAS 1 Presentation of Financial Statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such as going concern, the accrual basis of accounting and the current/non-current distinction. The standard requires a complete set of financial statements to comprise a ...

2.3 General presentation requirements. The rules that govern balance sheet presentation are intended to aid comparability between reporting entities. Among other areas, reporting entities should consider the number of reporting periods presented, as well as chronology. While most reporting entities present the balance sheet in order of ...

155 IPSAS 1, "Presentation of Financial Statements" (IPSAS 1) is set out in paragraphs 1−155 and Appendices A−B. All the paragraphs have equal authority. IPSAS 1 should be read in the context of its objective, the Basis for Conclusions, and the "Preface to International Public Sector Accounting Standards.".

2. Include a picture related to the topic. Include a picture. For example, if I am presenting to auditors, I might display a picture of someone being bribed. Verbal information is remembered about ten percent of the time. If a picture is included, the figure goes up to sixty-five percent. Quite a difference. 3.

Under IAS 1, fair presentation also requires an entity: to select and apply accounting policies in accordance with IAS 8 Accounting policies, changes in accounting estimates and errors. IAS 8 sets out guidance for management on how to account for a transaction if no accounting standard is applicable. to provide additional disclosures where ...

Faithful representation is the concept that be produced that accurately reflect the condition of a business. For example, if a company reports in its that it had $1,200,000 of as of the end of June, then that amount should indeed have been present on that date. The faithful representation concept should extend to all parts of the financial ...

IAS 1 sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. It requires an entity to present a complete set of financial statements at least annually, with comparative amounts for the preceding year (including comparative amounts in the notes).

Quick Reference. The requirement that financial statements should not be misleading. 'Fair presentation' is the US and International Accounting Standards equivalent of the British requirement that financial statements give a true and fair view. From: fair presentation in A Dictionary of Finance and Banking ». Subjects: Social sciences ...

An accounting standards' requirement that an entity's financial statements should be presented in a fair way to all relevant users of these statements. In other words, it is premised on the requirement that these statements should not be misleading. Under the principle of fair presentation, financial statements must fairly present the financial position, financial performance

Practice, practice, practice. Practice your presentation until you know it inside and out. Rehearse in front of a mirror. Run through it with a colleague or friend. Ask for honest feedback about both your content and delivery, and make any necessary adjustments. Then practice some more.

SP1.2. The Conceptual Framework for Financial Reporting (Conceptual Framework) describes the objective of, and the concepts for, general purpose financial reporting. The purpose of the Conceptual Framework is to: assist the International Accounting Standards Board (Board) to develop IFRS Standards (Standards) that are based on consistent concepts;

IAS 1, Presentation of Financial Statements, part of the International Accounting Standards Board's stable of improved standards, includes a requirement for 'fair presentation' and, in narrowly defined circumstances, for departure from specific provisions of IASs/IFRSs where compliance would result in a conflict with the objectives of financial statements as outlined in the IASB's Framework.

Avoid too many details about your specific role—your work should be just one example. Illustrate your points with current events or stories. It's easier for students to connect with things that are relatable to what's happening in the world or relevant to them. Help students find meaning in accounting. Many see the purpose of their future ...

There are four types of account balance assertions: Existence: The assets, equity balances, and liabilities exist at the period ending time. Completeness: The assets, equity balances, and the liabilities that are completed and supposed to be recorded have been recognized in the financial statements. Rights and Obligations: The entity has ...

Accounting encompasses a broad set of activities, from basic bookkeeping to analyzing the company's financial health, forecasting revenue, preparing taxes and ensuring legal compliance. Businesses use five main types of accounting: managerial, cost, project, tax and financial accounting.

Accounting principles are the rules and guidelines that companies must follow when reporting financial data. The common set of U.S. accounting principles is the generally accepted accounting ...

Presentation and Disclosure . The final financial statement assertion is presentation and disclosure. This is the assertion that all appropriate information and disclosures are included in a ...

33.2.1 Thresholds for presenting separate revenue categories and related costs. Regulation S-X Rule 5-03 (1) requires separate presentation in the income statement for any of the following revenue categories that exceed 10% of total revenues: Net sales of tangible products (gross sales less discounts, returns, and allowances) Service revenues.

accounting policies leases deriv atives group inventories assets share-based payment performance s fair presentation presentation consolidation cash equivalents deposits frombanks materiality financial instruments functional currency impairment loans borrowings assumptions disposal ifrs ifrs guide to annual . financial statements: ifrs 9 ...

The purpose of this section is to explain the meaning of "present fairly" as used in the phrase "present fairly . . . in conformity with generally accepted accounting principles." In applying this section, the auditor should look to the requirements of the Securities and Exchange Commission for the company under audit with respect to the ...