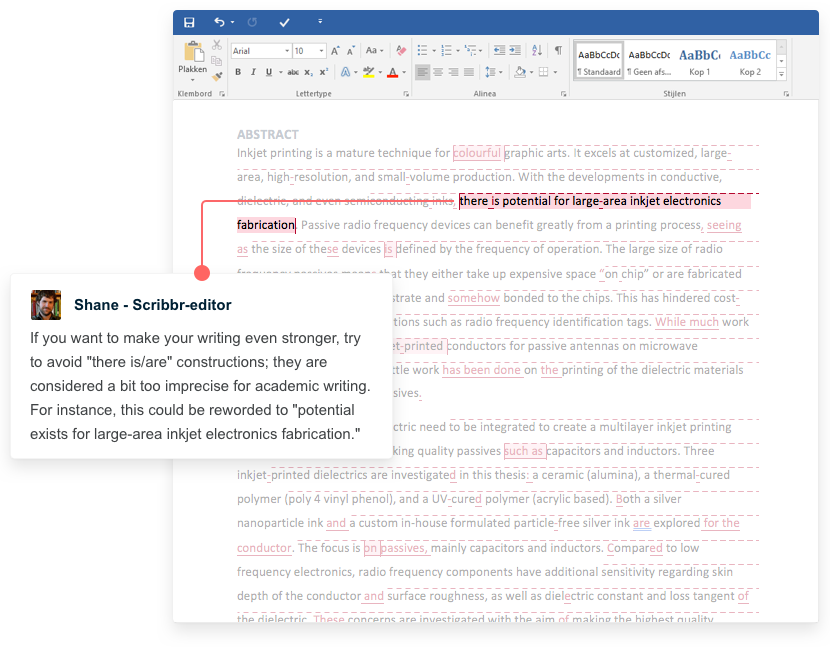

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Methodology

- Questionnaire Design | Methods, Question Types & Examples

Questionnaire Design | Methods, Question Types & Examples

Published on July 15, 2021 by Pritha Bhandari . Revised on June 22, 2023.

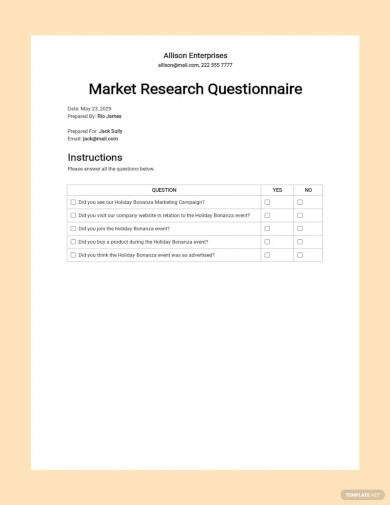

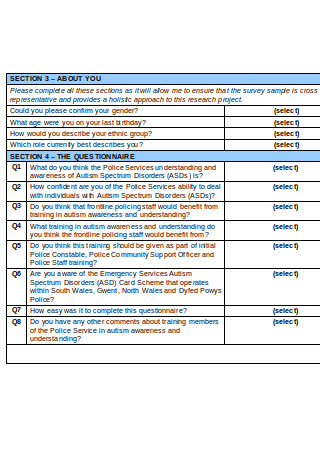

A questionnaire is a list of questions or items used to gather data from respondents about their attitudes, experiences, or opinions. Questionnaires can be used to collect quantitative and/or qualitative information.

Questionnaires are commonly used in market research as well as in the social and health sciences. For example, a company may ask for feedback about a recent customer service experience, or psychology researchers may investigate health risk perceptions using questionnaires.

Table of contents

Questionnaires vs. surveys, questionnaire methods, open-ended vs. closed-ended questions, question wording, question order, step-by-step guide to design, other interesting articles, frequently asked questions about questionnaire design.

A survey is a research method where you collect and analyze data from a group of people. A questionnaire is a specific tool or instrument for collecting the data.

Designing a questionnaire means creating valid and reliable questions that address your research objectives , placing them in a useful order, and selecting an appropriate method for administration.

But designing a questionnaire is only one component of survey research. Survey research also involves defining the population you’re interested in, choosing an appropriate sampling method , administering questionnaires, data cleansing and analysis, and interpretation.

Sampling is important in survey research because you’ll often aim to generalize your results to the population. Gather data from a sample that represents the range of views in the population for externally valid results. There will always be some differences between the population and the sample, but minimizing these will help you avoid several types of research bias , including sampling bias , ascertainment bias , and undercoverage bias .

Receive feedback on language, structure, and formatting

Professional editors proofread and edit your paper by focusing on:

- Academic style

- Vague sentences

- Style consistency

See an example

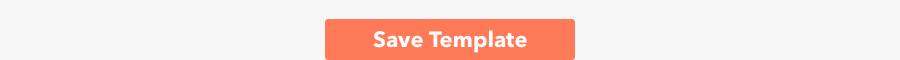

Questionnaires can be self-administered or researcher-administered . Self-administered questionnaires are more common because they are easy to implement and inexpensive, but researcher-administered questionnaires allow deeper insights.

Self-administered questionnaires

Self-administered questionnaires can be delivered online or in paper-and-pen formats, in person or through mail. All questions are standardized so that all respondents receive the same questions with identical wording.

Self-administered questionnaires can be:

- cost-effective

- easy to administer for small and large groups

- anonymous and suitable for sensitive topics

But they may also be:

- unsuitable for people with limited literacy or verbal skills

- susceptible to a nonresponse bias (most people invited may not complete the questionnaire)

- biased towards people who volunteer because impersonal survey requests often go ignored.

Researcher-administered questionnaires

Researcher-administered questionnaires are interviews that take place by phone, in-person, or online between researchers and respondents.

Researcher-administered questionnaires can:

- help you ensure the respondents are representative of your target audience

- allow clarifications of ambiguous or unclear questions and answers

- have high response rates because it’s harder to refuse an interview when personal attention is given to respondents

But researcher-administered questionnaires can be limiting in terms of resources. They are:

- costly and time-consuming to perform

- more difficult to analyze if you have qualitative responses

- likely to contain experimenter bias or demand characteristics

- likely to encourage social desirability bias in responses because of a lack of anonymity

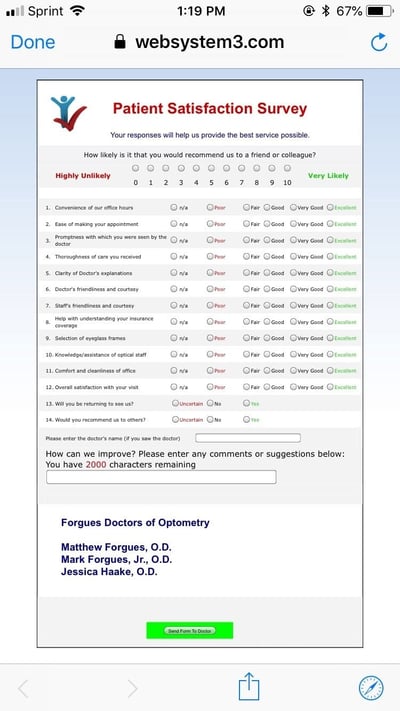

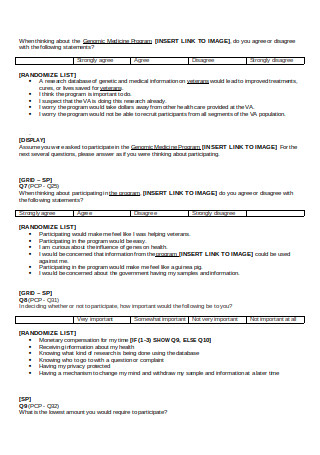

Your questionnaire can include open-ended or closed-ended questions or a combination of both.

Using closed-ended questions limits your responses, while open-ended questions enable a broad range of answers. You’ll need to balance these considerations with your available time and resources.

Closed-ended questions

Closed-ended, or restricted-choice, questions offer respondents a fixed set of choices to select from. Closed-ended questions are best for collecting data on categorical or quantitative variables.

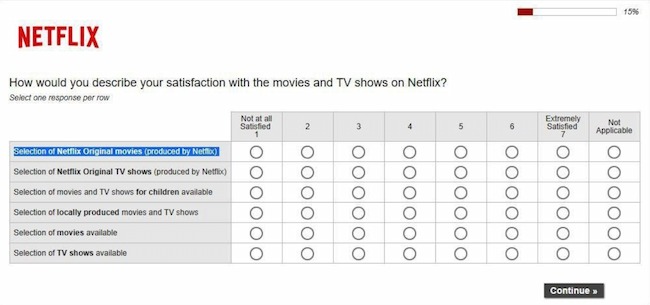

Categorical variables can be nominal or ordinal. Quantitative variables can be interval or ratio. Understanding the type of variable and level of measurement means you can perform appropriate statistical analyses for generalizable results.

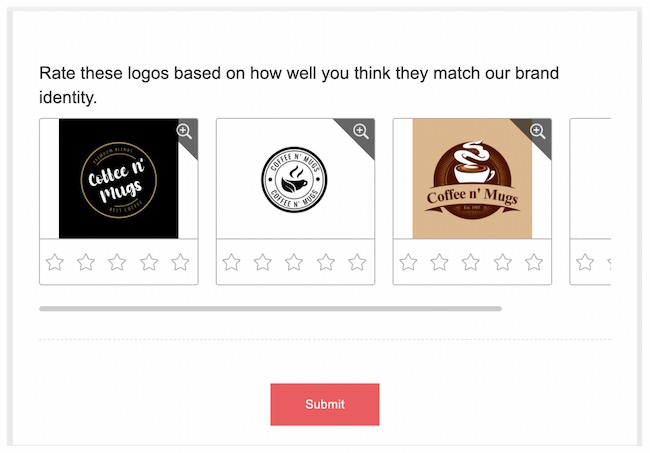

Examples of closed-ended questions for different variables

Nominal variables include categories that can’t be ranked, such as race or ethnicity. This includes binary or dichotomous categories.

It’s best to include categories that cover all possible answers and are mutually exclusive. There should be no overlap between response items.

In binary or dichotomous questions, you’ll give respondents only two options to choose from.

White Black or African American American Indian or Alaska Native Asian Native Hawaiian or Other Pacific Islander

Ordinal variables include categories that can be ranked. Consider how wide or narrow a range you’ll include in your response items, and their relevance to your respondents.

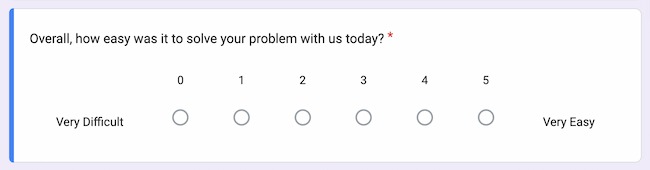

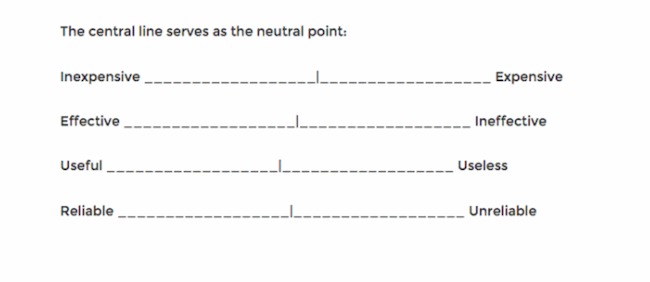

Likert scale questions collect ordinal data using rating scales with 5 or 7 points.

When you have four or more Likert-type questions, you can treat the composite data as quantitative data on an interval scale . Intelligence tests, psychological scales, and personality inventories use multiple Likert-type questions to collect interval data.

With interval or ratio scales , you can apply strong statistical hypothesis tests to address your research aims.

Pros and cons of closed-ended questions

Well-designed closed-ended questions are easy to understand and can be answered quickly. However, you might still miss important answers that are relevant to respondents. An incomplete set of response items may force some respondents to pick the closest alternative to their true answer. These types of questions may also miss out on valuable detail.

To solve these problems, you can make questions partially closed-ended, and include an open-ended option where respondents can fill in their own answer.

Open-ended questions

Open-ended, or long-form, questions allow respondents to give answers in their own words. Because there are no restrictions on their choices, respondents can answer in ways that researchers may not have otherwise considered. For example, respondents may want to answer “multiracial” for the question on race rather than selecting from a restricted list.

- How do you feel about open science?

- How would you describe your personality?

- In your opinion, what is the biggest obstacle for productivity in remote work?

Open-ended questions have a few downsides.

They require more time and effort from respondents, which may deter them from completing the questionnaire.

For researchers, understanding and summarizing responses to these questions can take a lot of time and resources. You’ll need to develop a systematic coding scheme to categorize answers, and you may also need to involve other researchers in data analysis for high reliability .

Question wording can influence your respondents’ answers, especially if the language is unclear, ambiguous, or biased. Good questions need to be understood by all respondents in the same way ( reliable ) and measure exactly what you’re interested in ( valid ).

Use clear language

You should design questions with your target audience in mind. Consider their familiarity with your questionnaire topics and language and tailor your questions to them.

For readability and clarity, avoid jargon or overly complex language. Don’t use double negatives because they can be harder to understand.

Use balanced framing

Respondents often answer in different ways depending on the question framing. Positive frames are interpreted as more neutral than negative frames and may encourage more socially desirable answers.

Use a mix of both positive and negative frames to avoid research bias , and ensure that your question wording is balanced wherever possible.

Unbalanced questions focus on only one side of an argument. Respondents may be less likely to oppose the question if it is framed in a particular direction. It’s best practice to provide a counter argument within the question as well.

Avoid leading questions

Leading questions guide respondents towards answering in specific ways, even if that’s not how they truly feel, by explicitly or implicitly providing them with extra information.

It’s best to keep your questions short and specific to your topic of interest.

- The average daily work commute in the US takes 54.2 minutes and costs $29 per day. Since 2020, working from home has saved many employees time and money. Do you favor flexible work-from-home policies even after it’s safe to return to offices?

- Experts agree that a well-balanced diet provides sufficient vitamins and minerals, and multivitamins and supplements are not necessary or effective. Do you agree or disagree that multivitamins are helpful for balanced nutrition?

Keep your questions focused

Ask about only one idea at a time and avoid double-barreled questions. Double-barreled questions ask about more than one item at a time, which can confuse respondents.

This question could be difficult to answer for respondents who feel strongly about the right to clean drinking water but not high-speed internet. They might only answer about the topic they feel passionate about or provide a neutral answer instead – but neither of these options capture their true answers.

Instead, you should ask two separate questions to gauge respondents’ opinions.

Strongly Agree Agree Undecided Disagree Strongly Disagree

Do you agree or disagree that the government should be responsible for providing high-speed internet to everyone?

You can organize the questions logically, with a clear progression from simple to complex. Alternatively, you can randomize the question order between respondents.

Logical flow

Using a logical flow to your question order means starting with simple questions, such as behavioral or opinion questions, and ending with more complex, sensitive, or controversial questions.

The question order that you use can significantly affect the responses by priming them in specific directions. Question order effects, or context effects, occur when earlier questions influence the responses to later questions, reducing the validity of your questionnaire.

While demographic questions are usually unaffected by order effects, questions about opinions and attitudes are more susceptible to them.

- How knowledgeable are you about Joe Biden’s executive orders in his first 100 days?

- Are you satisfied or dissatisfied with the way Joe Biden is managing the economy?

- Do you approve or disapprove of the way Joe Biden is handling his job as president?

It’s important to minimize order effects because they can be a source of systematic error or bias in your study.

Randomization

Randomization involves presenting individual respondents with the same questionnaire but with different question orders.

When you use randomization, order effects will be minimized in your dataset. But a randomized order may also make it harder for respondents to process your questionnaire. Some questions may need more cognitive effort, while others are easier to answer, so a random order could require more time or mental capacity for respondents to switch between questions.

Step 1: Define your goals and objectives

The first step of designing a questionnaire is determining your aims.

- What topics or experiences are you studying?

- What specifically do you want to find out?

- Is a self-report questionnaire an appropriate tool for investigating this topic?

Once you’ve specified your research aims, you can operationalize your variables of interest into questionnaire items. Operationalizing concepts means turning them from abstract ideas into concrete measurements. Every question needs to address a defined need and have a clear purpose.

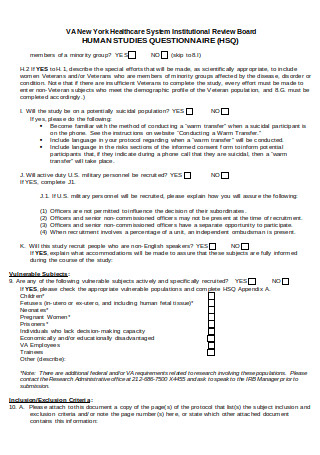

Step 2: Use questions that are suitable for your sample

Create appropriate questions by taking the perspective of your respondents. Consider their language proficiency and available time and energy when designing your questionnaire.

- Are the respondents familiar with the language and terms used in your questions?

- Would any of the questions insult, confuse, or embarrass them?

- Do the response items for any closed-ended questions capture all possible answers?

- Are the response items mutually exclusive?

- Do the respondents have time to respond to open-ended questions?

Consider all possible options for responses to closed-ended questions. From a respondent’s perspective, a lack of response options reflecting their point of view or true answer may make them feel alienated or excluded. In turn, they’ll become disengaged or inattentive to the rest of the questionnaire.

Step 3: Decide on your questionnaire length and question order

Once you have your questions, make sure that the length and order of your questions are appropriate for your sample.

If respondents are not being incentivized or compensated, keep your questionnaire short and easy to answer. Otherwise, your sample may be biased with only highly motivated respondents completing the questionnaire.

Decide on your question order based on your aims and resources. Use a logical flow if your respondents have limited time or if you cannot randomize questions. Randomizing questions helps you avoid bias, but it can take more complex statistical analysis to interpret your data.

Step 4: Pretest your questionnaire

When you have a complete list of questions, you’ll need to pretest it to make sure what you’re asking is always clear and unambiguous. Pretesting helps you catch any errors or points of confusion before performing your study.

Ask friends, classmates, or members of your target audience to complete your questionnaire using the same method you’ll use for your research. Find out if any questions were particularly difficult to answer or if the directions were unclear or inconsistent, and make changes as necessary.

If you have the resources, running a pilot study will help you test the validity and reliability of your questionnaire. A pilot study is a practice run of the full study, and it includes sampling, data collection , and analysis. You can find out whether your procedures are unfeasible or susceptible to bias and make changes in time, but you can’t test a hypothesis with this type of study because it’s usually statistically underpowered .

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Student’s t -distribution

- Normal distribution

- Null and Alternative Hypotheses

- Chi square tests

- Confidence interval

- Quartiles & Quantiles

- Cluster sampling

- Stratified sampling

- Data cleansing

- Reproducibility vs Replicability

- Peer review

- Prospective cohort study

Research bias

- Implicit bias

- Cognitive bias

- Placebo effect

- Hawthorne effect

- Hindsight bias

- Affect heuristic

- Social desirability bias

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analyzing data from people using questionnaires.

Closed-ended, or restricted-choice, questions offer respondents a fixed set of choices to select from. These questions are easier to answer quickly.

Open-ended or long-form questions allow respondents to answer in their own words. Because there are no restrictions on their choices, respondents can answer in ways that researchers may not have otherwise considered.

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviors. It is made up of 4 or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with 5 or 7 possible responses, to capture their degree of agreement.

You can organize the questions logically, with a clear progression from simple to complex, or randomly between respondents. A logical flow helps respondents process the questionnaire easier and quicker, but it may lead to bias. Randomization can minimize the bias from order effects.

Questionnaires can be self-administered or researcher-administered.

Researcher-administered questionnaires are interviews that take place by phone, in-person, or online between researchers and respondents. You can gain deeper insights by clarifying questions for respondents or asking follow-up questions.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

Bhandari, P. (2023, June 22). Questionnaire Design | Methods, Question Types & Examples. Scribbr. Retrieved April 3, 2024, from https://www.scribbr.com/methodology/questionnaire/

Is this article helpful?

Pritha Bhandari

Other students also liked, survey research | definition, examples & methods, what is a likert scale | guide & examples, reliability vs. validity in research | difference, types and examples, "i thought ai proofreading was useless but..".

I've been using Scribbr for years now and I know it's a service that won't disappoint. It does a good job spotting mistakes”

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Surveys Questionnaire

21 Questionnaire Templates: Examples and Samples

Questionnaire: Definition

A questionnaire is defined a market research instrument that consists of questions or prompts to elicit and collect responses from a sample of respondents. A questionnaire is typically a mix of open-ended questions and close-ended questions ; the latter allowing for respondents to enlist their views in detail.

A questionnaire can be used in both, qualitative market research as well as quantitative market research with the use of different types of questions .

LEARN ABOUT: Open-Ended Questions

Types of Questionnaires

We have learnt that a questionnaire could either be structured or free-flow. To explain this better:

- Structured Questionnaires: A structured questionnaires helps collect quantitative data . In this case, the questionnaire is designed in a way that it collects very specific type of information. It can be used to initiate a formal enquiry on collect data to prove or disprove a prior hypothesis.

- Unstructured Questionnaires: An unstructured questionnaire collects qualitative data . The questionnaire in this case has a basic structure and some branching questions but nothing that limits the responses of a respondent. The questions are more open-ended.

LEARN ABOUT: Structured Question

Types of Questions used in a Questionnaire

A questionnaire can consist of many types of questions . Some of the commonly and widely used question types though, are:

- Open-Ended Questions: One of the commonly used question type in questionnaire is an open-ended question . These questions help collect in-depth data from a respondent as there is a huge scope to respond in detail.

- Dichotomous Questions: The dichotomous question is a “yes/no” close-ended question . This question is generally used in case of the need of basic validation. It is the easiest question type in a questionnaire.

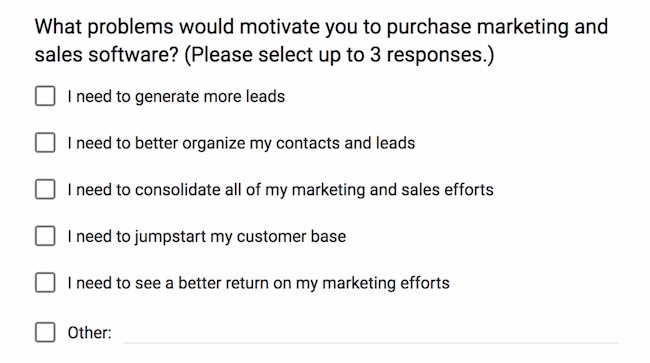

- Multiple-Choice Questions: An easy to administer and respond to, question type in a questionnaire is the multiple-choice question . These questions are close-ended questions with either a single select multiple choice question or a multiple select multiple choice question. Each multiple choice question consists of an incomplete stem (question), right answer or answers, close alternatives, distractors and incorrect answers. Depending on the objective of the research, a mix of the above option types can be used.

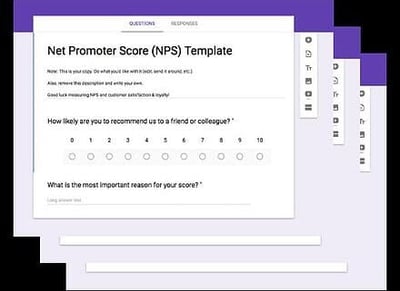

- Net Promoter Score (NPS) Question: Another commonly used question type in a questionnaire is the Net Promoter Score (NPS) Question where one single question collects data on the referencability of the research topic in question.

- Scaling Questions: Scaling questions are widely used in a questionnaire as they make responding to the questionnaire, very easy. These questions are based on the principles of the 4 measurement scales – nominal, ordinal, interval and ratio .

Questionnaires help enterprises collect valuable data to help them make well-informed business decisions. There are powerful tools available in the market that allows using multiple question types, ready to use survey format templates, robust analytics, and many more features to conduct comprehensive market research.

LEARN ABOUT: course evaluation survey examples

For example, an enterprise wants to conduct market research to understand what pricing would be best for their new product to capture a higher market share. In such a case, a questionnaire for competitor analysis can be sent to the targeted audience using a powerful market research survey software which can help the enterprise conduct 360 market research that will enable them to make strategic business decisions.

Now that we have learned what a questionnaire is and its use in market research , some examples and samples of widely used questionnaire templates on the QuestionPro platform are as below:

LEARN ABOUT: Speaker evaluation form

Customer Questionnaire Templates: Examples and Samples

QuestionPro specializes in end-to-end Customer Questionnaire Templates that can be used to evaluate a customer journey right from indulging with a brand to the continued use and referenceability of the brand. These templates form excellent samples to form your own questionnaire and begin testing your customer satisfaction and experience based on customer feedback.

LEARN ABOUT: Structured Questionnaire

USE THIS FREE TEMPLATE

Employee & Human Resource (HR) Questionnaire Templates: Examples and Samples

QuestionPro has built a huge repository of employee questionnaires and HR questionnaires that can be readily deployed to collect feedback from the workforce on an organization on multiple parameters like employee satisfaction, benefits evaluation, manager evaluation , exit formalities etc. These templates provide a holistic overview of collecting actionable data from employees.

Community Questionnaire Templates: Examples and Samples

The QuestionPro repository of community questionnaires helps collect varied data on all community aspects. This template library includes popular questionnaires such as community service, demographic questionnaires, psychographic questionnaires, personal questionnaires and much more.

Academic Evaluation Questionnaire Templates: Examples and Samples

Another vastly used section of QuestionPro questionnaire templates are the academic evaluation questionnaires . These questionnaires are crafted to collect in-depth data about academic institutions and the quality of teaching provided, extra-curricular activities etc and also feedback about other educational activities.

MORE LIKE THIS

Healthcare Staff Burnout: What it Is + How To Manage It

Apr 4, 2024

Top 15 Employee Retention Software in 2024

Top 10 Employee Development Software for Talent Growth

Apr 3, 2024

Top 5 Insight Community Platforms to Elevate Your Research

Other categories.

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

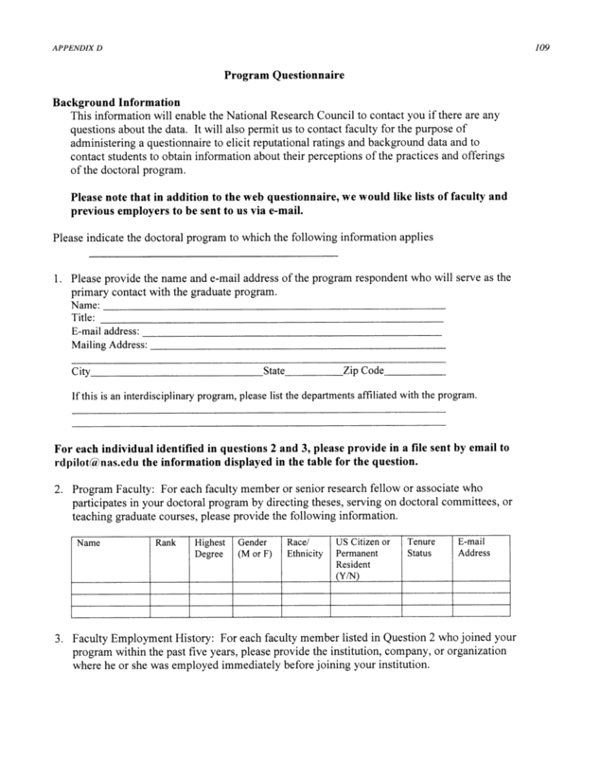

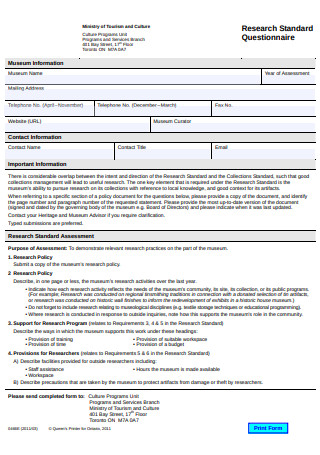

Research Questionnaire

When a researcher creates a research paper using the scientific method they will need to use a gathering method that is adjacent to the research topic. This means that the researcher will use a quantitative research method for a quantitive topic and a qualitative method for a qualitative one. The research questionnaire is one of the quantitative data-gathering methods a researcher can use in their research paper.

[bb_toc content=”][/bb_toc]

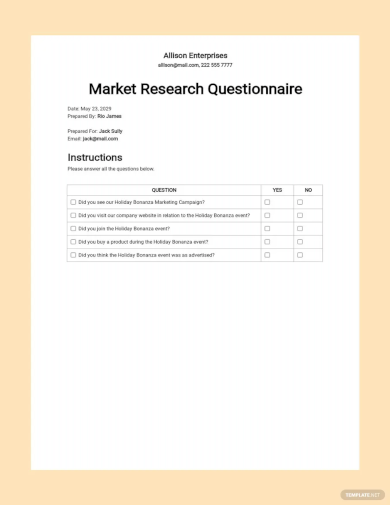

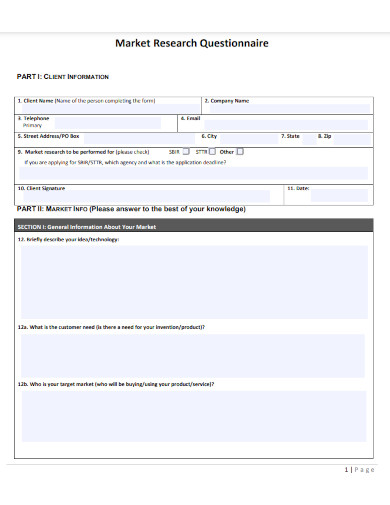

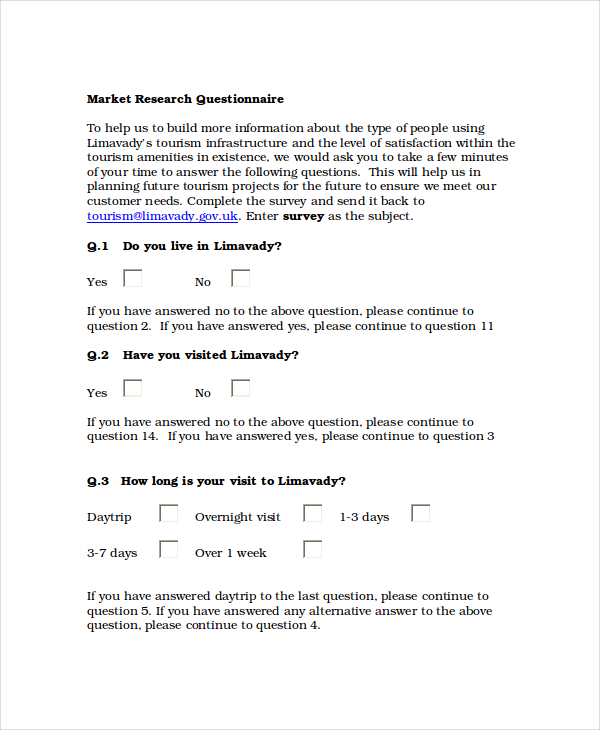

1. Market Research Questionnaire Template Example

- Google Docs

- Apple Pages

Size: 38 KB

2. Market Research Questionnaire Example

Size: 94 KB

3. Research Questionnaire Example

4. Sample Market Research Questionnaire

Size: 35 KB

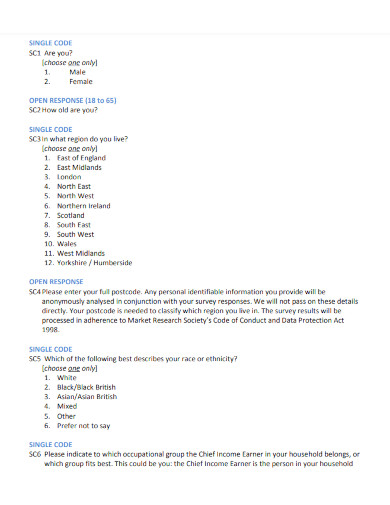

5. Research Survey Questionnaire

Size: 42 KB

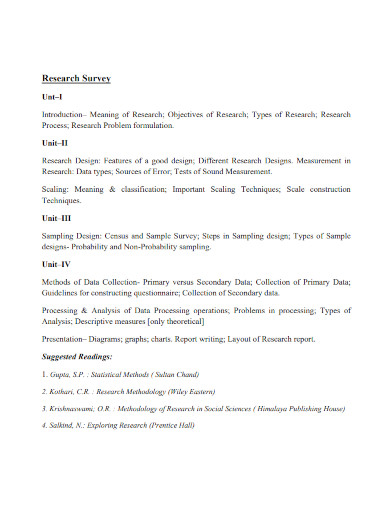

6. Research Survey Questionnaire Construction

Size: 80 KB

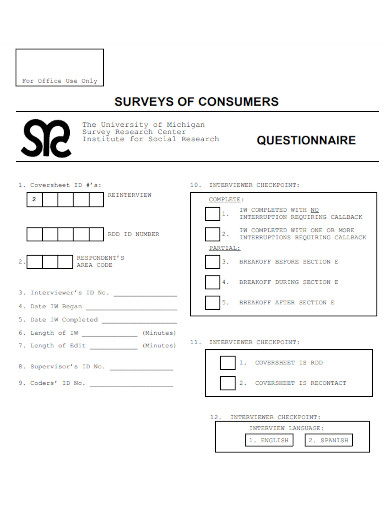

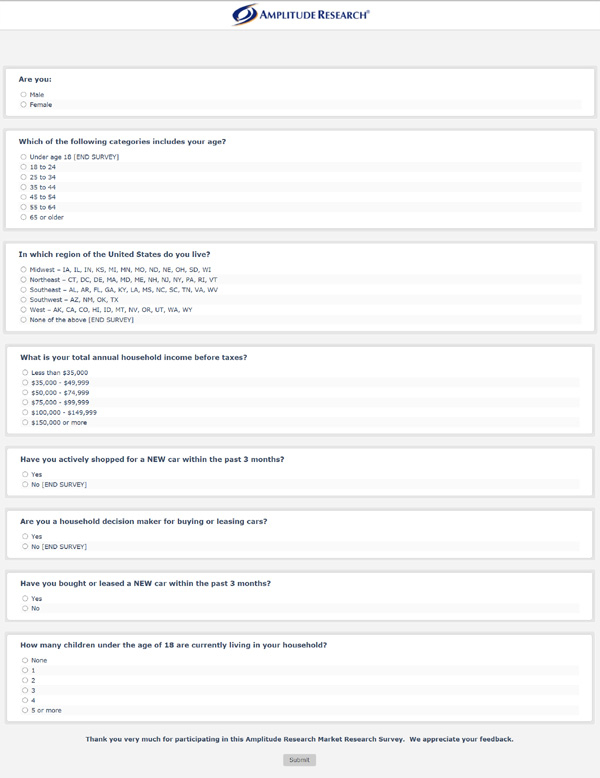

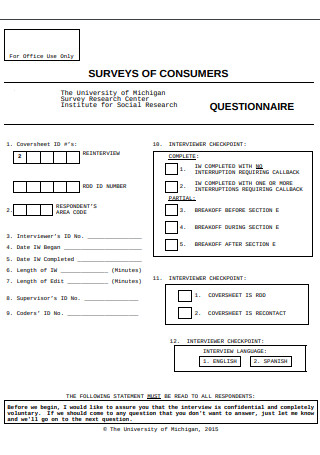

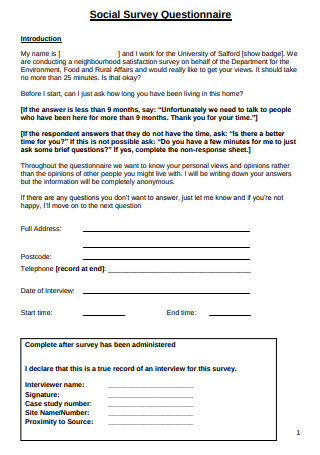

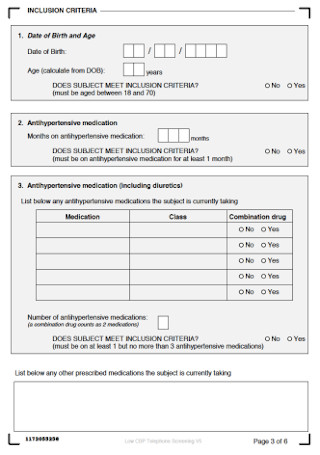

7. Research Questionnaire Survey of Consumers

Size: 39 KB

8. Guide to the Design of Research Questionnaires

Size: 77 KB

9. Planning Survey Research Questionnaires

Size: 85 KB

10. Climate Change Survey Questionnaires

Size: 41 KB

11. Survey Questionnaire Design

Size: 96 KB

12. Developing Questionnaires for Educational Research

Size: 81 KB

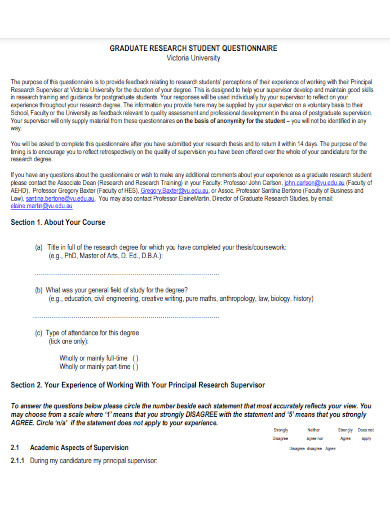

13. Graudate Research Student Questionnaires

14. Sample Research Survey Questionnaires

Size: 46 KB

15. Market Research Questionnaire Example

16. Research Survey Questionnaire Example

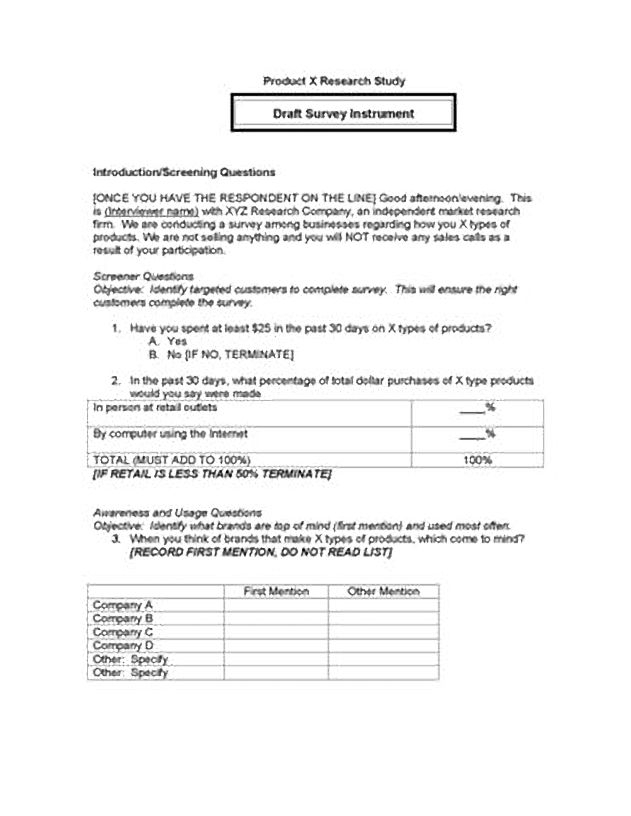

17. Product X Research Study Questionnaire Example

What Is a Research Questionnaire?

A research questionnaire is a physical or digital questionnaire that researchers use to obtain quantitative data. The research questionnaire is a more in-depth version of a survey as its questions often delve deeper than survey questions .

How to Write a Research Questionnaire

A well-made research questionnaire can effectively and efficiently gather data from the population. Creating a good research questionnaire does not require that many writing skills , soft skills , or hard skills , it just requires the person to properly understand the data set they are looking for.

Step 1: Select a Topic or Theme for the Research Questionnaire

Begin by choosing a topic or theme for the research questionnaire as this will provide much-needed context for the research questionnaire. Not only that but the topic will also dictate the tone of the questions in the questionnaire.

Step 2: Obtain or Use a Research Questionnaire Outline

You may opt to use a research questionnaire outline or outline format for your research questionnaire. This outline will provide you with a structure you can use to easily make your research questionnaire.

Step 3: Create your Research Questionnaire

Start by creating questions that will help provide you with the necessary data to prove or disprove your research question. You may conduct brainstorming sessions to formulate the questions for your research questionnaire.

Step 4: Edit and Have Someone Proofread the Questionnaire

After you have created and completed the research questionnaire, you must edit the contents of the questionnaire. Not only that but it is wise to have someone proofread the contents of your questionnaire before deploying the questionnaire.

How does a research questionnaire help businesses?

A successful business or company utilizes research questionnaires to not only obtain data from their customers but also to gather data about the performance and quality of the employees in the business. The research questionnaire provides the business or company with actionable data, which they can use to improve the product, service, or commodity to obtain more customers.

Do I need to provide a consent form when I ask someone to answer the research questionnaire?

Yes, consent is very important as without this the data you have gathered from your questionnaires or surveys are useless. Therefore it is important to provide a consent form with your research questionnaire when you are asking a participant to answer the document.

What type of answers are allowed in the research questionnaire?

Research questionnaires can host a multitude of types of questions each with its specific way of answering. A questionnaire can use multiple-choice questions, open-ended questions, and closed questions. Just be sure to properly pace the questions as having too many different types of answering styles can demotivate or distract the target audience, which might lead to errors.

A research questionnaire is a data-gathering document people can use to obtain information and data from a specific group of people. Well-made and crafted research questionnaires will provide much-needed information one can use to answer a specific research question.

Questionnaire Generator

Text prompt

- Instructive

- Professional

Create a fun quiz to find out which historical figure you're most like in your study habits

Design a survey to discover students' favorite school subjects and why they love them.

Read our research on: Gun Policy | International Conflict | Election 2024

Regions & Countries

Writing survey questions.

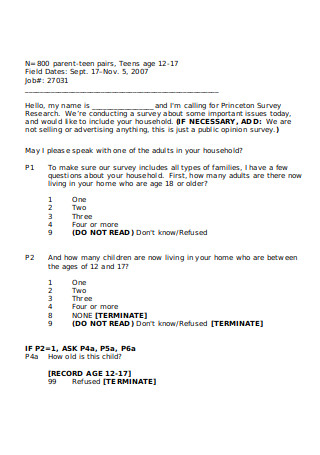

Perhaps the most important part of the survey process is the creation of questions that accurately measure the opinions, experiences and behaviors of the public. Accurate random sampling will be wasted if the information gathered is built on a shaky foundation of ambiguous or biased questions. Creating good measures involves both writing good questions and organizing them to form the questionnaire.

Questionnaire design is a multistage process that requires attention to many details at once. Designing the questionnaire is complicated because surveys can ask about topics in varying degrees of detail, questions can be asked in different ways, and questions asked earlier in a survey may influence how people respond to later questions. Researchers are also often interested in measuring change over time and therefore must be attentive to how opinions or behaviors have been measured in prior surveys.

Surveyors may conduct pilot tests or focus groups in the early stages of questionnaire development in order to better understand how people think about an issue or comprehend a question. Pretesting a survey is an essential step in the questionnaire design process to evaluate how people respond to the overall questionnaire and specific questions, especially when questions are being introduced for the first time.

For many years, surveyors approached questionnaire design as an art, but substantial research over the past forty years has demonstrated that there is a lot of science involved in crafting a good survey questionnaire. Here, we discuss the pitfalls and best practices of designing questionnaires.

Question development

There are several steps involved in developing a survey questionnaire. The first is identifying what topics will be covered in the survey. For Pew Research Center surveys, this involves thinking about what is happening in our nation and the world and what will be relevant to the public, policymakers and the media. We also track opinion on a variety of issues over time so we often ensure that we update these trends on a regular basis to better understand whether people’s opinions are changing.

At Pew Research Center, questionnaire development is a collaborative and iterative process where staff meet to discuss drafts of the questionnaire several times over the course of its development. We frequently test new survey questions ahead of time through qualitative research methods such as focus groups , cognitive interviews, pretesting (often using an online, opt-in sample ), or a combination of these approaches. Researchers use insights from this testing to refine questions before they are asked in a production survey, such as on the ATP.

Measuring change over time

Many surveyors want to track changes over time in people’s attitudes, opinions and behaviors. To measure change, questions are asked at two or more points in time. A cross-sectional design surveys different people in the same population at multiple points in time. A panel, such as the ATP, surveys the same people over time. However, it is common for the set of people in survey panels to change over time as new panelists are added and some prior panelists drop out. Many of the questions in Pew Research Center surveys have been asked in prior polls. Asking the same questions at different points in time allows us to report on changes in the overall views of the general public (or a subset of the public, such as registered voters, men or Black Americans), or what we call “trending the data”.

When measuring change over time, it is important to use the same question wording and to be sensitive to where the question is asked in the questionnaire to maintain a similar context as when the question was asked previously (see question wording and question order for further information). All of our survey reports include a topline questionnaire that provides the exact question wording and sequencing, along with results from the current survey and previous surveys in which we asked the question.

The Center’s transition from conducting U.S. surveys by live telephone interviewing to an online panel (around 2014 to 2020) complicated some opinion trends, but not others. Opinion trends that ask about sensitive topics (e.g., personal finances or attending religious services ) or that elicited volunteered answers (e.g., “neither” or “don’t know”) over the phone tended to show larger differences than other trends when shifting from phone polls to the online ATP. The Center adopted several strategies for coping with changes to data trends that may be related to this change in methodology. If there is evidence suggesting that a change in a trend stems from switching from phone to online measurement, Center reports flag that possibility for readers to try to head off confusion or erroneous conclusions.

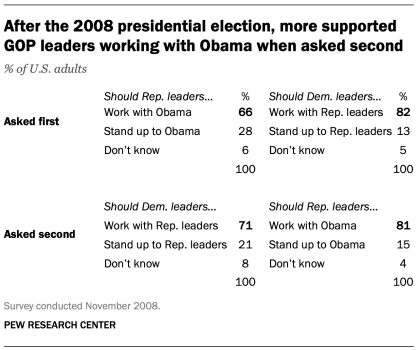

Open- and closed-ended questions

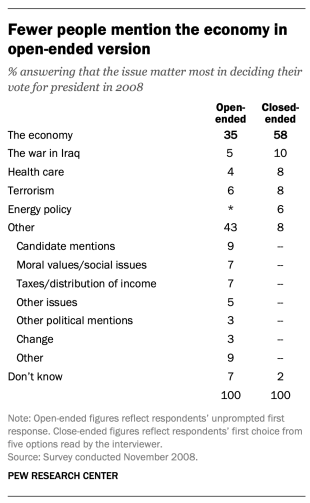

One of the most significant decisions that can affect how people answer questions is whether the question is posed as an open-ended question, where respondents provide a response in their own words, or a closed-ended question, where they are asked to choose from a list of answer choices.

For example, in a poll conducted after the 2008 presidential election, people responded very differently to two versions of the question: “What one issue mattered most to you in deciding how you voted for president?” One was closed-ended and the other open-ended. In the closed-ended version, respondents were provided five options and could volunteer an option not on the list.

When explicitly offered the economy as a response, more than half of respondents (58%) chose this answer; only 35% of those who responded to the open-ended version volunteered the economy. Moreover, among those asked the closed-ended version, fewer than one-in-ten (8%) provided a response other than the five they were read. By contrast, fully 43% of those asked the open-ended version provided a response not listed in the closed-ended version of the question. All of the other issues were chosen at least slightly more often when explicitly offered in the closed-ended version than in the open-ended version. (Also see “High Marks for the Campaign, a High Bar for Obama” for more information.)

Researchers will sometimes conduct a pilot study using open-ended questions to discover which answers are most common. They will then develop closed-ended questions based off that pilot study that include the most common responses as answer choices. In this way, the questions may better reflect what the public is thinking, how they view a particular issue, or bring certain issues to light that the researchers may not have been aware of.

When asking closed-ended questions, the choice of options provided, how each option is described, the number of response options offered, and the order in which options are read can all influence how people respond. One example of the impact of how categories are defined can be found in a Pew Research Center poll conducted in January 2002. When half of the sample was asked whether it was “more important for President Bush to focus on domestic policy or foreign policy,” 52% chose domestic policy while only 34% said foreign policy. When the category “foreign policy” was narrowed to a specific aspect – “the war on terrorism” – far more people chose it; only 33% chose domestic policy while 52% chose the war on terrorism.

In most circumstances, the number of answer choices should be kept to a relatively small number – just four or perhaps five at most – especially in telephone surveys. Psychological research indicates that people have a hard time keeping more than this number of choices in mind at one time. When the question is asking about an objective fact and/or demographics, such as the religious affiliation of the respondent, more categories can be used. In fact, they are encouraged to ensure inclusivity. For example, Pew Research Center’s standard religion questions include more than 12 different categories, beginning with the most common affiliations (Protestant and Catholic). Most respondents have no trouble with this question because they can expect to see their religious group within that list in a self-administered survey.

In addition to the number and choice of response options offered, the order of answer categories can influence how people respond to closed-ended questions. Research suggests that in telephone surveys respondents more frequently choose items heard later in a list (a “recency effect”), and in self-administered surveys, they tend to choose items at the top of the list (a “primacy” effect).

Because of concerns about the effects of category order on responses to closed-ended questions, many sets of response options in Pew Research Center’s surveys are programmed to be randomized to ensure that the options are not asked in the same order for each respondent. Rotating or randomizing means that questions or items in a list are not asked in the same order to each respondent. Answers to questions are sometimes affected by questions that precede them. By presenting questions in a different order to each respondent, we ensure that each question gets asked in the same context as every other question the same number of times (e.g., first, last or any position in between). This does not eliminate the potential impact of previous questions on the current question, but it does ensure that this bias is spread randomly across all of the questions or items in the list. For instance, in the example discussed above about what issue mattered most in people’s vote, the order of the five issues in the closed-ended version of the question was randomized so that no one issue appeared early or late in the list for all respondents. Randomization of response items does not eliminate order effects, but it does ensure that this type of bias is spread randomly.

Questions with ordinal response categories – those with an underlying order (e.g., excellent, good, only fair, poor OR very favorable, mostly favorable, mostly unfavorable, very unfavorable) – are generally not randomized because the order of the categories conveys important information to help respondents answer the question. Generally, these types of scales should be presented in order so respondents can easily place their responses along the continuum, but the order can be reversed for some respondents. For example, in one of Pew Research Center’s questions about abortion, half of the sample is asked whether abortion should be “legal in all cases, legal in most cases, illegal in most cases, illegal in all cases,” while the other half of the sample is asked the same question with the response categories read in reverse order, starting with “illegal in all cases.” Again, reversing the order does not eliminate the recency effect but distributes it randomly across the population.

Question wording

The choice of words and phrases in a question is critical in expressing the meaning and intent of the question to the respondent and ensuring that all respondents interpret the question the same way. Even small wording differences can substantially affect the answers people provide.

An example of a wording difference that had a significant impact on responses comes from a January 2003 Pew Research Center survey. When people were asked whether they would “favor or oppose taking military action in Iraq to end Saddam Hussein’s rule,” 68% said they favored military action while 25% said they opposed military action. However, when asked whether they would “favor or oppose taking military action in Iraq to end Saddam Hussein’s rule even if it meant that U.S. forces might suffer thousands of casualties, ” responses were dramatically different; only 43% said they favored military action, while 48% said they opposed it. The introduction of U.S. casualties altered the context of the question and influenced whether people favored or opposed military action in Iraq.

There has been a substantial amount of research to gauge the impact of different ways of asking questions and how to minimize differences in the way respondents interpret what is being asked. The issues related to question wording are more numerous than can be treated adequately in this short space, but below are a few of the important things to consider:

First, it is important to ask questions that are clear and specific and that each respondent will be able to answer. If a question is open-ended, it should be evident to respondents that they can answer in their own words and what type of response they should provide (an issue or problem, a month, number of days, etc.). Closed-ended questions should include all reasonable responses (i.e., the list of options is exhaustive) and the response categories should not overlap (i.e., response options should be mutually exclusive). Further, it is important to discern when it is best to use forced-choice close-ended questions (often denoted with a radio button in online surveys) versus “select-all-that-apply” lists (or check-all boxes). A 2019 Center study found that forced-choice questions tend to yield more accurate responses, especially for sensitive questions. Based on that research, the Center generally avoids using select-all-that-apply questions.

It is also important to ask only one question at a time. Questions that ask respondents to evaluate more than one concept (known as double-barreled questions) – such as “How much confidence do you have in President Obama to handle domestic and foreign policy?” – are difficult for respondents to answer and often lead to responses that are difficult to interpret. In this example, it would be more effective to ask two separate questions, one about domestic policy and another about foreign policy.

In general, questions that use simple and concrete language are more easily understood by respondents. It is especially important to consider the education level of the survey population when thinking about how easy it will be for respondents to interpret and answer a question. Double negatives (e.g., do you favor or oppose not allowing gays and lesbians to legally marry) or unfamiliar abbreviations or jargon (e.g., ANWR instead of Arctic National Wildlife Refuge) can result in respondent confusion and should be avoided.

Similarly, it is important to consider whether certain words may be viewed as biased or potentially offensive to some respondents, as well as the emotional reaction that some words may provoke. For example, in a 2005 Pew Research Center survey, 51% of respondents said they favored “making it legal for doctors to give terminally ill patients the means to end their lives,” but only 44% said they favored “making it legal for doctors to assist terminally ill patients in committing suicide.” Although both versions of the question are asking about the same thing, the reaction of respondents was different. In another example, respondents have reacted differently to questions using the word “welfare” as opposed to the more generic “assistance to the poor.” Several experiments have shown that there is much greater public support for expanding “assistance to the poor” than for expanding “welfare.”

We often write two versions of a question and ask half of the survey sample one version of the question and the other half the second version. Thus, we say we have two forms of the questionnaire. Respondents are assigned randomly to receive either form, so we can assume that the two groups of respondents are essentially identical. On questions where two versions are used, significant differences in the answers between the two forms tell us that the difference is a result of the way we worded the two versions.

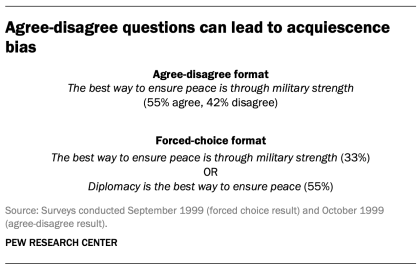

One of the most common formats used in survey questions is the “agree-disagree” format. In this type of question, respondents are asked whether they agree or disagree with a particular statement. Research has shown that, compared with the better educated and better informed, less educated and less informed respondents have a greater tendency to agree with such statements. This is sometimes called an “acquiescence bias” (since some kinds of respondents are more likely to acquiesce to the assertion than are others). This behavior is even more pronounced when there’s an interviewer present, rather than when the survey is self-administered. A better practice is to offer respondents a choice between alternative statements. A Pew Research Center experiment with one of its routinely asked values questions illustrates the difference that question format can make. Not only does the forced choice format yield a very different result overall from the agree-disagree format, but the pattern of answers between respondents with more or less formal education also tends to be very different.

One other challenge in developing questionnaires is what is called “social desirability bias.” People have a natural tendency to want to be accepted and liked, and this may lead people to provide inaccurate answers to questions that deal with sensitive subjects. Research has shown that respondents understate alcohol and drug use, tax evasion and racial bias. They also may overstate church attendance, charitable contributions and the likelihood that they will vote in an election. Researchers attempt to account for this potential bias in crafting questions about these topics. For instance, when Pew Research Center surveys ask about past voting behavior, it is important to note that circumstances may have prevented the respondent from voting: “In the 2012 presidential election between Barack Obama and Mitt Romney, did things come up that kept you from voting, or did you happen to vote?” The choice of response options can also make it easier for people to be honest. For example, a question about church attendance might include three of six response options that indicate infrequent attendance. Research has also shown that social desirability bias can be greater when an interviewer is present (e.g., telephone and face-to-face surveys) than when respondents complete the survey themselves (e.g., paper and web surveys).

Lastly, because slight modifications in question wording can affect responses, identical question wording should be used when the intention is to compare results to those from earlier surveys. Similarly, because question wording and responses can vary based on the mode used to survey respondents, researchers should carefully evaluate the likely effects on trend measurements if a different survey mode will be used to assess change in opinion over time.

Question order

Once the survey questions are developed, particular attention should be paid to how they are ordered in the questionnaire. Surveyors must be attentive to how questions early in a questionnaire may have unintended effects on how respondents answer subsequent questions. Researchers have demonstrated that the order in which questions are asked can influence how people respond; earlier questions can unintentionally provide context for the questions that follow (these effects are called “order effects”).

One kind of order effect can be seen in responses to open-ended questions. Pew Research Center surveys generally ask open-ended questions about national problems, opinions about leaders and similar topics near the beginning of the questionnaire. If closed-ended questions that relate to the topic are placed before the open-ended question, respondents are much more likely to mention concepts or considerations raised in those earlier questions when responding to the open-ended question.

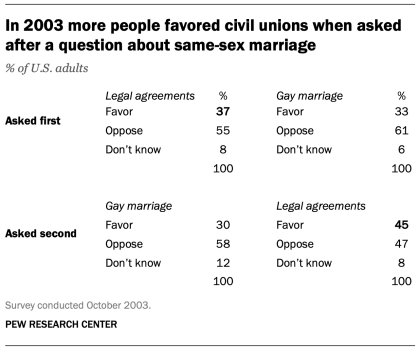

For closed-ended opinion questions, there are two main types of order effects: contrast effects ( where the order results in greater differences in responses), and assimilation effects (where responses are more similar as a result of their order).

An example of a contrast effect can be seen in a Pew Research Center poll conducted in October 2003, a dozen years before same-sex marriage was legalized in the U.S. That poll found that people were more likely to favor allowing gays and lesbians to enter into legal agreements that give them the same rights as married couples when this question was asked after one about whether they favored or opposed allowing gays and lesbians to marry (45% favored legal agreements when asked after the marriage question, but 37% favored legal agreements without the immediate preceding context of a question about same-sex marriage). Responses to the question about same-sex marriage, meanwhile, were not significantly affected by its placement before or after the legal agreements question.

Another experiment embedded in a December 2008 Pew Research Center poll also resulted in a contrast effect. When people were asked “All in all, are you satisfied or dissatisfied with the way things are going in this country today?” immediately after having been asked “Do you approve or disapprove of the way George W. Bush is handling his job as president?”; 88% said they were dissatisfied, compared with only 78% without the context of the prior question.

Responses to presidential approval remained relatively unchanged whether national satisfaction was asked before or after it. A similar finding occurred in December 2004 when both satisfaction and presidential approval were much higher (57% were dissatisfied when Bush approval was asked first vs. 51% when general satisfaction was asked first).

Several studies also have shown that asking a more specific question before a more general question (e.g., asking about happiness with one’s marriage before asking about one’s overall happiness) can result in a contrast effect. Although some exceptions have been found, people tend to avoid redundancy by excluding the more specific question from the general rating.

Assimilation effects occur when responses to two questions are more consistent or closer together because of their placement in the questionnaire. We found an example of an assimilation effect in a Pew Research Center poll conducted in November 2008 when we asked whether Republican leaders should work with Obama or stand up to him on important issues and whether Democratic leaders should work with Republican leaders or stand up to them on important issues. People were more likely to say that Republican leaders should work with Obama when the question was preceded by the one asking what Democratic leaders should do in working with Republican leaders (81% vs. 66%). However, when people were first asked about Republican leaders working with Obama, fewer said that Democratic leaders should work with Republican leaders (71% vs. 82%).

The order questions are asked is of particular importance when tracking trends over time. As a result, care should be taken to ensure that the context is similar each time a question is asked. Modifying the context of the question could call into question any observed changes over time (see measuring change over time for more information).

A questionnaire, like a conversation, should be grouped by topic and unfold in a logical order. It is often helpful to begin the survey with simple questions that respondents will find interesting and engaging. Throughout the survey, an effort should be made to keep the survey interesting and not overburden respondents with several difficult questions right after one another. Demographic questions such as income, education or age should not be asked near the beginning of a survey unless they are needed to determine eligibility for the survey or for routing respondents through particular sections of the questionnaire. Even then, it is best to precede such items with more interesting and engaging questions. One virtue of survey panels like the ATP is that demographic questions usually only need to be asked once a year, not in each survey.

U.S. Surveys

Other research methods.

About Pew Research Center Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

- Privacy Policy

Buy Me a Coffee

Home » Questionnaire – Definition, Types, and Examples

Questionnaire – Definition, Types, and Examples

Table of Contents

Questionnaire

Definition:

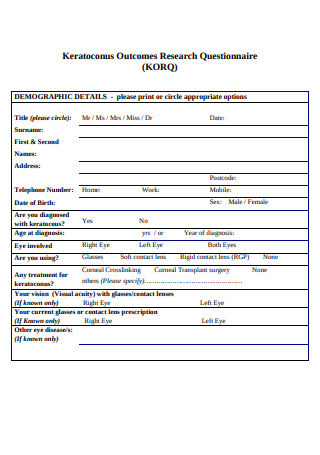

A Questionnaire is a research tool or survey instrument that consists of a set of questions or prompts designed to gather information from individuals or groups of people.

It is a standardized way of collecting data from a large number of people by asking them a series of questions related to a specific topic or research objective. The questions may be open-ended or closed-ended, and the responses can be quantitative or qualitative. Questionnaires are widely used in research, marketing, social sciences, healthcare, and many other fields to collect data and insights from a target population.

History of Questionnaire

The history of questionnaires can be traced back to the ancient Greeks, who used questionnaires as a means of assessing public opinion. However, the modern history of questionnaires began in the late 19th century with the rise of social surveys.

The first social survey was conducted in the United States in 1874 by Francis A. Walker, who used a questionnaire to collect data on labor conditions. In the early 20th century, questionnaires became a popular tool for conducting social research, particularly in the fields of sociology and psychology.

One of the most influential figures in the development of the questionnaire was the psychologist Raymond Cattell, who in the 1940s and 1950s developed the personality questionnaire, a standardized instrument for measuring personality traits. Cattell’s work helped establish the questionnaire as a key tool in personality research.

In the 1960s and 1970s, the use of questionnaires expanded into other fields, including market research, public opinion polling, and health surveys. With the rise of computer technology, questionnaires became easier and more cost-effective to administer, leading to their widespread use in research and business settings.

Today, questionnaires are used in a wide range of settings, including academic research, business, healthcare, and government. They continue to evolve as a research tool, with advances in computer technology and data analysis techniques making it easier to collect and analyze data from large numbers of participants.

Types of Questionnaire

Types of Questionnaires are as follows:

Structured Questionnaire

This type of questionnaire has a fixed format with predetermined questions that the respondent must answer. The questions are usually closed-ended, which means that the respondent must select a response from a list of options.

Unstructured Questionnaire

An unstructured questionnaire does not have a fixed format or predetermined questions. Instead, the interviewer or researcher can ask open-ended questions to the respondent and let them provide their own answers.

Open-ended Questionnaire

An open-ended questionnaire allows the respondent to answer the question in their own words, without any pre-determined response options. The questions usually start with phrases like “how,” “why,” or “what,” and encourage the respondent to provide more detailed and personalized answers.

Close-ended Questionnaire

In a closed-ended questionnaire, the respondent is given a set of predetermined response options to choose from. This type of questionnaire is easier to analyze and summarize, but may not provide as much insight into the respondent’s opinions or attitudes.

Mixed Questionnaire

A mixed questionnaire is a combination of open-ended and closed-ended questions. This type of questionnaire allows for more flexibility in terms of the questions that can be asked, and can provide both quantitative and qualitative data.

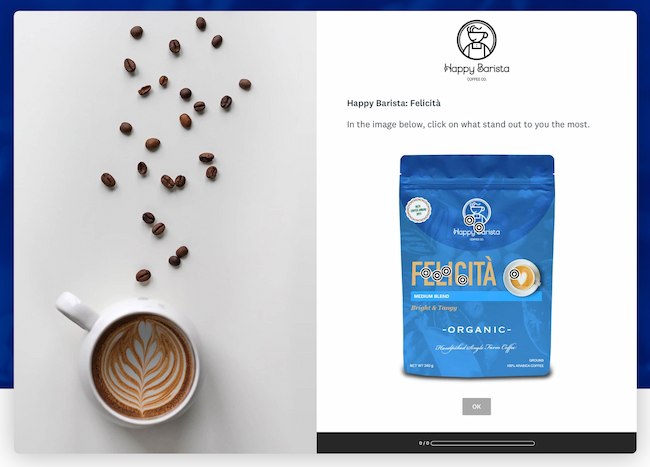

Pictorial Questionnaire:

In a pictorial questionnaire, instead of using words to ask questions, the questions are presented in the form of pictures, diagrams or images. This can be particularly useful for respondents who have low literacy skills, or for situations where language barriers exist. Pictorial questionnaires can also be useful in cross-cultural research where respondents may come from different language backgrounds.

Types of Questions in Questionnaire

The types of Questions in Questionnaire are as follows:

Multiple Choice Questions

These questions have several options for participants to choose from. They are useful for getting quantitative data and can be used to collect demographic information.

- a. Red b . Blue c. Green d . Yellow

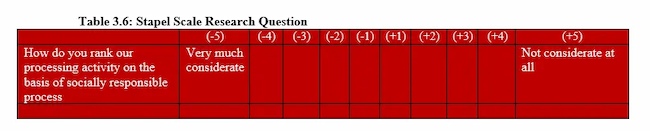

Rating Scale Questions

These questions ask participants to rate something on a scale (e.g. from 1 to 10). They are useful for measuring attitudes and opinions.

- On a scale of 1 to 10, how likely are you to recommend this product to a friend?

Open-Ended Questions

These questions allow participants to answer in their own words and provide more in-depth and detailed responses. They are useful for getting qualitative data.

- What do you think are the biggest challenges facing your community?

Likert Scale Questions

These questions ask participants to rate how much they agree or disagree with a statement. They are useful for measuring attitudes and opinions.

How strongly do you agree or disagree with the following statement:

“I enjoy exercising regularly.”

- a . Strongly Agree

- c . Neither Agree nor Disagree

- d . Disagree

- e . Strongly Disagree

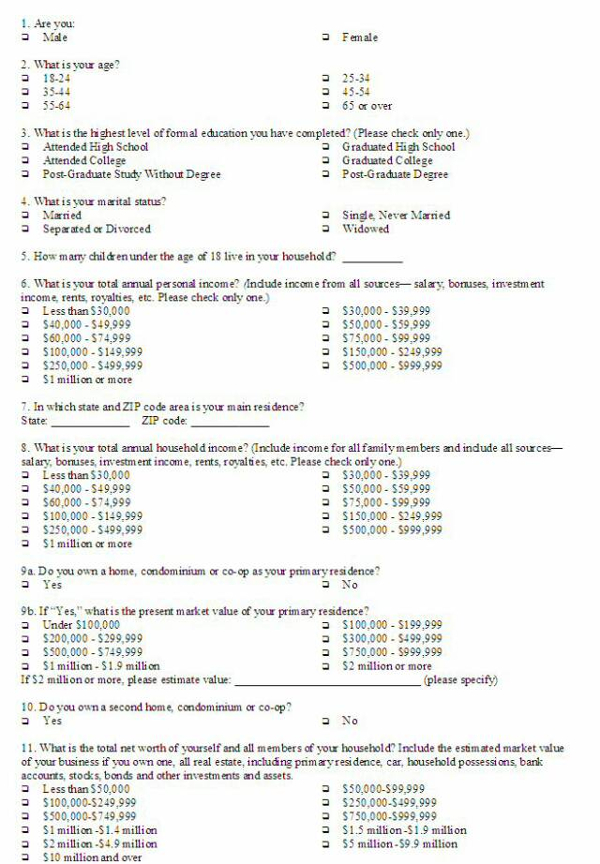

Demographic Questions

These questions ask about the participant’s personal information such as age, gender, ethnicity, education level, etc. They are useful for segmenting the data and analyzing results by demographic groups.

- What is your age?

Yes/No Questions

These questions only have two options: Yes or No. They are useful for getting simple, straightforward answers to a specific question.

Have you ever traveled outside of your home country?

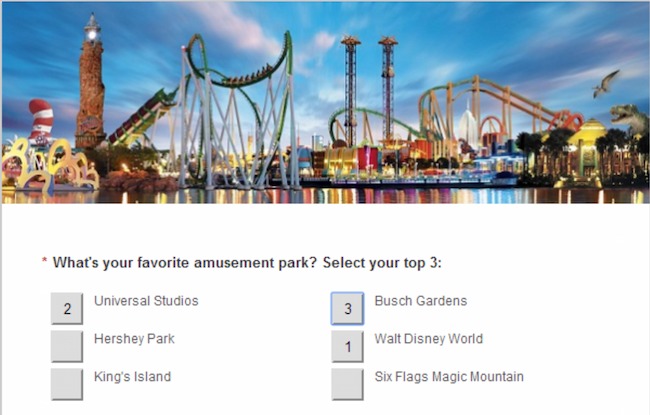

Ranking Questions

These questions ask participants to rank several items in order of preference or importance. They are useful for measuring priorities or preferences.

Please rank the following factors in order of importance when choosing a restaurant:

- a. Quality of Food

- c. Ambiance

- d. Location

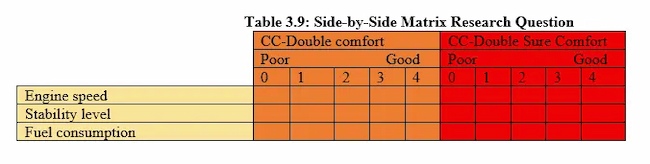

Matrix Questions

These questions present a matrix or grid of options that participants can choose from. They are useful for getting data on multiple variables at once.

Dichotomous Questions

These questions present two options that are opposite or contradictory. They are useful for measuring binary or polarized attitudes.

Do you support the death penalty?

How to Make a Questionnaire

Step-by-Step Guide for Making a Questionnaire:

- Define your research objectives: Before you start creating questions, you need to define the purpose of your questionnaire and what you hope to achieve from the data you collect.

- Choose the appropriate question types: Based on your research objectives, choose the appropriate question types to collect the data you need. Refer to the types of questions mentioned earlier for guidance.

- Develop questions: Develop clear and concise questions that are easy for participants to understand. Avoid leading or biased questions that might influence the responses.

- Organize questions: Organize questions in a logical and coherent order, starting with demographic questions followed by general questions, and ending with specific or sensitive questions.

- Pilot the questionnaire : Test your questionnaire on a small group of participants to identify any flaws or issues with the questions or the format.

- Refine the questionnaire : Based on feedback from the pilot, refine and revise the questionnaire as necessary to ensure that it is valid and reliable.

- Distribute the questionnaire: Distribute the questionnaire to your target audience using a method that is appropriate for your research objectives, such as online surveys, email, or paper surveys.

- Collect and analyze data: Collect the completed questionnaires and analyze the data using appropriate statistical methods. Draw conclusions from the data and use them to inform decision-making or further research.

- Report findings: Present your findings in a clear and concise report, including a summary of the research objectives, methodology, key findings, and recommendations.

Questionnaire Administration Modes

There are several modes of questionnaire administration. The choice of mode depends on the research objectives, sample size, and available resources. Some common modes of administration include:

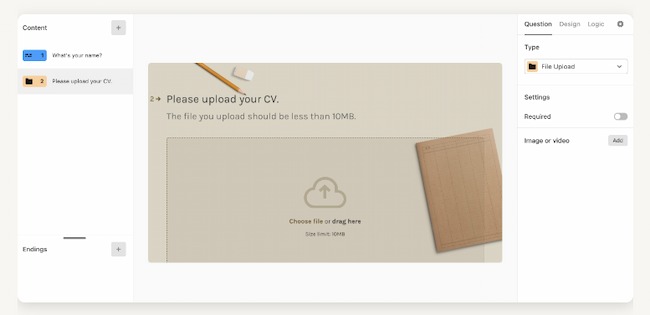

- Self-administered paper questionnaires: Participants complete the questionnaire on paper, either in person or by mail. This mode is relatively low cost and easy to administer, but it may result in lower response rates and greater potential for errors in data entry.

- Online questionnaires: Participants complete the questionnaire on a website or through email. This mode is convenient for both researchers and participants, as it allows for fast and easy data collection. However, it may be subject to issues such as low response rates, lack of internet access, and potential for fraudulent responses.

- Telephone surveys: Trained interviewers administer the questionnaire over the phone. This mode allows for a large sample size and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Face-to-face interviews : Trained interviewers administer the questionnaire in person. This mode allows for a high degree of control over the survey environment and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Mixed-mode surveys: Researchers use a combination of two or more modes to administer the questionnaire, such as using online questionnaires for initial screening and following up with telephone interviews for more detailed information. This mode can help overcome some of the limitations of individual modes, but it requires careful planning and coordination.

Example of Questionnaire

Title of the Survey: Customer Satisfaction Survey

Introduction:

We appreciate your business and would like to ensure that we are meeting your needs. Please take a few minutes to complete this survey so that we can better understand your experience with our products and services. Your feedback is important to us and will help us improve our offerings.

Instructions:

Please read each question carefully and select the response that best reflects your experience. If you have any additional comments or suggestions, please feel free to include them in the space provided at the end of the survey.

1. How satisfied are you with our product quality?

- Very satisfied

- Somewhat satisfied

- Somewhat dissatisfied

- Very dissatisfied

2. How satisfied are you with our customer service?

3. How satisfied are you with the price of our products?

4. How likely are you to recommend our products to others?

- Very likely

- Somewhat likely

- Somewhat unlikely

- Very unlikely

5. How easy was it to find the information you were looking for on our website?

- Somewhat easy

- Somewhat difficult

- Very difficult

6. How satisfied are you with the overall experience of using our products and services?

7. Is there anything that you would like to see us improve upon or change in the future?

…………………………………………………………………………………………………………………………..

Conclusion:

Thank you for taking the time to complete this survey. Your feedback is valuable to us and will help us improve our products and services. If you have any further comments or concerns, please do not hesitate to contact us.

Applications of Questionnaire

Some common applications of questionnaires include:

- Research : Questionnaires are commonly used in research to gather information from participants about their attitudes, opinions, behaviors, and experiences. This information can then be analyzed and used to draw conclusions and make inferences.

- Healthcare : In healthcare, questionnaires can be used to gather information about patients’ medical history, symptoms, and lifestyle habits. This information can help healthcare professionals diagnose and treat medical conditions more effectively.

- Marketing : Questionnaires are commonly used in marketing to gather information about consumers’ preferences, buying habits, and opinions on products and services. This information can help businesses develop and market products more effectively.

- Human Resources: Questionnaires are used in human resources to gather information from job applicants, employees, and managers about job satisfaction, performance, and workplace culture. This information can help organizations improve their hiring practices, employee retention, and organizational culture.

- Education : Questionnaires are used in education to gather information from students, teachers, and parents about their perceptions of the educational experience. This information can help educators identify areas for improvement and develop more effective teaching strategies.

Purpose of Questionnaire

Some common purposes of questionnaires include:

- To collect information on attitudes, opinions, and beliefs: Questionnaires can be used to gather information on people’s attitudes, opinions, and beliefs on a particular topic. For example, a questionnaire can be used to gather information on people’s opinions about a particular political issue.

- To collect demographic information: Questionnaires can be used to collect demographic information such as age, gender, income, education level, and occupation. This information can be used to analyze trends and patterns in the data.

- To measure behaviors or experiences: Questionnaires can be used to gather information on behaviors or experiences such as health-related behaviors or experiences, job satisfaction, or customer satisfaction.

- To evaluate programs or interventions: Questionnaires can be used to evaluate the effectiveness of programs or interventions by gathering information on participants’ experiences, opinions, and behaviors.

- To gather information for research: Questionnaires can be used to gather data for research purposes on a variety of topics.

When to use Questionnaire

Here are some situations when questionnaires might be used:

- When you want to collect data from a large number of people: Questionnaires are useful when you want to collect data from a large number of people. They can be distributed to a wide audience and can be completed at the respondent’s convenience.

- When you want to collect data on specific topics: Questionnaires are useful when you want to collect data on specific topics or research questions. They can be designed to ask specific questions and can be used to gather quantitative data that can be analyzed statistically.

- When you want to compare responses across groups: Questionnaires are useful when you want to compare responses across different groups of people. For example, you might want to compare responses from men and women, or from people of different ages or educational backgrounds.

- When you want to collect data anonymously: Questionnaires can be useful when you want to collect data anonymously. Respondents can complete the questionnaire without fear of judgment or repercussions, which can lead to more honest and accurate responses.

- When you want to save time and resources: Questionnaires can be more efficient and cost-effective than other methods of data collection such as interviews or focus groups. They can be completed quickly and easily, and can be analyzed using software to save time and resources.

Characteristics of Questionnaire

Here are some of the characteristics of questionnaires:

- Standardization : Questionnaires are standardized tools that ask the same questions in the same order to all respondents. This ensures that all respondents are answering the same questions and that the responses can be compared and analyzed.

- Objectivity : Questionnaires are designed to be objective, meaning that they do not contain leading questions or bias that could influence the respondent’s answers.

- Predefined responses: Questionnaires typically provide predefined response options for the respondents to choose from, which helps to standardize the responses and make them easier to analyze.

- Quantitative data: Questionnaires are designed to collect quantitative data, meaning that they provide numerical or categorical data that can be analyzed using statistical methods.

- Convenience : Questionnaires are convenient for both the researcher and the respondents. They can be distributed and completed at the respondent’s convenience and can be easily administered to a large number of people.

- Anonymity : Questionnaires can be anonymous, which can encourage respondents to answer more honestly and provide more accurate data.

- Reliability : Questionnaires are designed to be reliable, meaning that they produce consistent results when administered multiple times to the same group of people.

- Validity : Questionnaires are designed to be valid, meaning that they measure what they are intended to measure and are not influenced by other factors.

Advantage of Questionnaire

Some Advantage of Questionnaire are as follows:

- Standardization: Questionnaires allow researchers to ask the same questions to all participants in a standardized manner. This helps ensure consistency in the data collected and eliminates potential bias that might arise if questions were asked differently to different participants.

- Efficiency: Questionnaires can be administered to a large number of people at once, making them an efficient way to collect data from a large sample.

- Anonymity: Participants can remain anonymous when completing a questionnaire, which may make them more likely to answer honestly and openly.

- Cost-effective: Questionnaires can be relatively inexpensive to administer compared to other research methods, such as interviews or focus groups.

- Objectivity: Because questionnaires are typically designed to collect quantitative data, they can be analyzed objectively without the influence of the researcher’s subjective interpretation.

- Flexibility: Questionnaires can be adapted to a wide range of research questions and can be used in various settings, including online surveys, mail surveys, or in-person interviews.

Limitations of Questionnaire

Limitations of Questionnaire are as follows:

- Limited depth: Questionnaires are typically designed to collect quantitative data, which may not provide a complete understanding of the topic being studied. Questionnaires may miss important details and nuances that could be captured through other research methods, such as interviews or observations.

- R esponse bias: Participants may not always answer questions truthfully or accurately, either because they do not remember or because they want to present themselves in a particular way. This can lead to response bias, which can affect the validity and reliability of the data collected.

- Limited flexibility: While questionnaires can be adapted to a wide range of research questions, they may not be suitable for all types of research. For example, they may not be appropriate for studying complex phenomena or for exploring participants’ experiences and perceptions in-depth.

- Limited context: Questionnaires typically do not provide a rich contextual understanding of the topic being studied. They may not capture the broader social, cultural, or historical factors that may influence participants’ responses.

- Limited control : Researchers may not have control over how participants complete the questionnaire, which can lead to variations in response quality or consistency.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Case Study – Methods, Examples and Guide

Observational Research – Methods and Guide

Quantitative Research – Methods, Types and...

Qualitative Research Methods

Explanatory Research – Types, Methods, Guide

Survey Research – Types, Methods, Examples

Creating a Questionnaire

Create the perfect questionnaire and collect actionable data using our online guide!

Table of Contents

- How to Create

Questionnaire Types

- Collecting Responses

- Analyzing Results

- Getting Started

What is a Questionnaire?

Definition: A questionnaire is a convenient way to collect feedback. A questionnaire can be used to measure customer satisfaction, capture employee feedback, or even conduct product research. Responses can be collected via email, web link, QR code, or using a survey panel.

The term "survey" and "questionnaire" are commonly used interchangeably. A questionnaire refers to the questions used to collect feedback (the form itself). A survey relates to the entire research process, including summarizing and analyzing questionnaire data.

Getting Started + Tips

How to make a questionnaire: Keep questions short and focused on one topic at a time. Use multiple-choice questions to fit answers into a specific category. Use an open-ended question to capture comments. A Likert scale or MaxDiff question can be used for market research. Collect responses for your questionnaire using an email collector, an anonymous link, or even a QR code.

The following 6 tips will help you create the perfect questionnaire:

1) Use 10 Questions or Less

The shorter you keep your survey, the higher your completion rates. Longer questionnaires usually tend to have a high drop-off percentage. Keeping your surveys to 10 questions or fewer forces you to draft a study that only includes important questions; you should remove trivial questions during the draft process.

2) One Idea Per Question

Make sure each question only covers one topic. Try to include only one topic at a time. For example, in an employee survey, you would not want to ask, "Do you feel satisfied with your compensation and career advancement?". Instead, you would like to separate "compensation" and "career advancement" into two questions or use a Likert scale , putting each question on a separate row.

3) Group Similar Questions Together

Suppose the survey is more than ten questions; similar questions should be grouped on separate pages. If you don't want to use more than one page, add extra spacing between groups of the question; extra white space can increase the increase the readability of your questionnaire.

4) Use Skip/Display Logic

If you have questions that only apply to certain people, consider using skip or display logic to show those questions conditionally. This will help reduce the length of your survey and boost response rates.