How to Make Risk Management Presentations Engaging and Actionable Across Your Organization

Life is full of risk. We face risks from the moment we wake up in the morning until we fall asleep at night. Will the alarm fail to sound? Will I get into a car accident on my way to work? Will I catch a virus when I go to dinner? Heck, there’s a risk— no matter how small— that we will die in our sleep during each night.

Risk is simply an inherent element of everything we do, and business is no exception. Will a vital employee quit, or will there be a labor shortage? What will happen in the stock market, and how will it impact the economy? What if there is an accident or a lawsuit involving the company? What happens if a new product fails? What actions will be taken in the event of a security breach or equipment failure?

We might not be able to prevent risk, but we can manage it. Managing business risk requires identifying and understanding risks while seeking ways to reduce risk in a way that also supports other business goals.

Companies heavily invest every year in ways to mitigate and respond to risk. But how do they make sure everyone is on board?

There might be a variety of ways to communicate a risk management plan to all the relevant players, but a visual presentation can be effective in not only presenting the risk management plan, but also ensuring that it is engaging and actionable across your organization.

What to include when you prepare a risk management plan:

A written risk management plan for business should not only include a listing of possible risks, but it also should feature plans to manage risk and respond to incidents.

- Identify risks

Risk management refers to a variety of business aspects, both internal weaknesses, and external threats. Like much in life, knowing is half the battle, and therefore identifying risks is key in addressing them.

Risk management should be considered before embarking on any new task or project, and everyone connected to a business should be encouraged to identify additional risks. Not only should the risk itself be considered, but companies also should identify possible consequences to better prepare to address each one.

- Minimize risks

A variety of strategies are available to manage and minimize risks once they are identified. One popular method of mitigating risk involves the 4Ts:

- Transfer risk by assigning a responsible team or party to each identified risk.

- Tolerate risk by monitoring it before taking further action.

- Treat risk by taking actions that reduce the likelihood that it will occur.

- Terminate risk by adopting or amending processes that eliminate it.

- Assign roles

Staff members should be assigned to each potential risk or risk category. These individuals will be responsible for mitigating their assigned risks, as well as reporting and responding to applicable incidents. A list of these roles should be included in the risk management plan.

- Plan recovery

Each risk included in the management plan must be followed by a strategy for preventing and addressing issues. An effective risk management plan will include a compilation of business projects, the risk applicable to each and an operational plan to respond and recover from incidents. Part of that plan also should include updating mitigation efforts following an incident to prevent it from repeating.

- Communicate plan

A risk management plan can’t be effective unless everyone within a company is on board. In addition to presenting the plan to principle players, be sure that it is also published somewhere that the full risk management plan can be accessed and understood by anyone within the company at any time.

- Rinse and repeat

The most effective risk management plans are living documents, continually updated with new or changed risks and new strategies to address them. Each risk outlined in the plan should be periodically reevaluated and new risks identified. The plan also should be monitored along with staff turnover to ensure no tasks fall through the cracks.

Tips to make risk management presentations engaging and actionable across your organization:

Audience engagement is vital to a successful risk management training presentation. After all, if staff and executives are asleep they will hardly become familiar with the plan and their assigned roles.

- Include visual assets

About 90 percent of human thought is visually-based. Therefore, it’s no shocker that including visual assets within a presentation is one of the most effective strategies for engaging all types of audiences .

Releasing the risk management plan through a visual presentation is a great start, but the content within the slide deck is just as important. After all, the average PowerPoint slide includes 40 words , which is entirely too many. Instead, include more images, videos and animations within a financial risk management presentation or any other risk management training presentations.

- Illustrate data

Data is one of the most convincing sorts of content that can be presented to an audience. As anyone can attest— at least in most cases— numbers don’t lie. In fact, they can tell their own stories. A crowded slide full of stats and figures is a quick way to send your audience off to Dreamland.

Instead, illustrate your data through infographics. Beautiful.ai offers a host of various infographics through our smart slide templates. Just input your data and watch our artificial intelligence-powered presentation software design the infographic accordingly. Choose from infographics like scattergraphs , process diagrams , pie charts and bar graphs to tell the story of different risks and strategies to address them.

- Tell a story

According to the 2018 State of Attention survey, almost 90 percent of respondents said a strong narrative or story backing a presentation is critical in maintaining audience engagement. Sure, facts and data can persuade audiences and get them on board, but only if people are paying attention.

Stories have kept audiences engaged since before recorded history. Tell the story of your risk management plan by including real-life examples or by creating a character for hypothetical scenarios. Those unsure how to incorporate a story into the structure of their presentation can look to Beautiful.ai’s various presentation templates for inspiration.

- Include your audience

If you really want to keep your audience engaged with your risk management presentation slides, be sure you talk with people, not at them. Include your audience in your presentation by asking questions, taking surveys or presenting group activities. Of course, the first step is identifying who makes up that audience. You won’t necessarily present the same content to an executive board as to a room full of new hires.

One effective way to engage an audience with a risk management plan presentation from the very start is through a pre-presentation quiz or survey that gauges how much participants already know about risk management, like this example from the U.S. Small Business Association. Not only will the activity engage the audience, but it will alert participants to what they don’t know from the very start. Other engagement tools include Q&A sessions, humor and gamification.

As mentioned, the average PowerPoint slide consists of 40 words… way too many to keep audiences engaged. Remember, your presentation should be based on an outline of your plan, not a verbatim recitation of it.

Not only are uncluttered slides more effective, but shorter presentations also are more effective than longer ones, based on both audience attention and respect for time. Especially when delivering a risk management board presentation, it’s vital to respect your audience’s time. Beautiful.ai’s library of presentation templates can serve as a guideline to effective presentation lengths for a variety of topics.

Samantha Pratt Lile

Samantha is an independent journalist, editor, blogger and content manager. Examples of her published work can be found at sites including the Huffington Post, Thrive Global, and Buzzfeed.

Recommended Articles

How to craft a thought leadership marketing strategy to become a subject matter expert, what is high ticket affiliate marketing, and does it work for your brand, the leadership guide to sales prospecting, the top 6 ai presentation makers.

- Business Slides

- Risk Management

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

- Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

- Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Risk Management PowerPoint Templates, Risk Management PPT Slides

- Sub Categories

- 30 60 90 Day Plan

- About Us Company Details

- Action Plan

- Annual Report

- Audit Reports

- Balance Scorecard

- Brand Equity

- Business Case Study

- Business Communication Skills

- Business Plan Development

- Business Problem Solving

- Business Review

- Capital Budgeting

- Career Planning

- Change Management

- Color Palettes

- Communication Process

- Company Location

- Company Vision

- Competitive Analysis

- Corporate Governance

- Cost Reduction Strategies

- Custom Business Slides

- Customer Service

- Data Management

- Decision Making

- Digital Marketing Strategy

- Disaster Management

- Equity Investment

- Financial Analysis

- Financial Services

- Growth Hacking Strategy

- Human Resource Management

- Innovation Management

- Interview Process

- Knowledge Management

- Lean Manufacturing

- Legal Law Order

- Market Segmentation

- Media and Communication

- Meeting Planner

- Mergers and Acquisitions

- Operations and Logistics

- Organizational Structure

- Performance Management

- Pitch Decks

- Pricing Strategies

- Process Management

- Product Development

- Product Launch Ideas

- Product Portfolio

- Purchasing Process

- Quality Assurance

- Quotes and Testimonials

- Real Estate

- Sales Performance Plan

- Sales Review

- Service Offering

- Social Media and Network

- Software Development

- Solution Architecture

- Stock Portfolio

- Strategic Management

- Strategic Planning

- Supply Chain Management

- System Architecture

- Team Introduction

- Testing and Validation

- Time Management

- Timelines Roadmaps

- Value Chain Analysis

- Value Stream Mapping

- Workplace Ethic

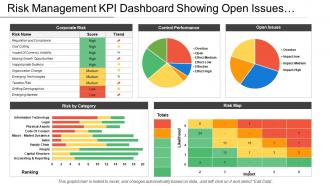

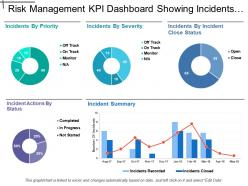

Presenting this set of slides with name - Risk Management Kpi Dashboard Showing Open Issues And Control Performance. This is a five stage process. The stages in this process are Risk Management, Risk Assessment, Project Risk.

Presenting this set of slides with name - Risk Management Module Powerpoint Presentation Slides. The stages in this process are Risk Management Module, Risk Management Framework, Risk Management Structure.

Introducing Mitigation Plan PowerPoint Presentation Slides. This PowerPoint presentation includes set of 41 professionally designed slides This complete deck 100% editable you can edit text font as per your convenience. Easy to download. The presentation can be downloaded in both widescreen and standard format. The user can download the PowerPoint presentation in PDF or JPG format. These templates are supported with Google Slides too.

Slides are 100% editable in PowerPoint. This is the complete deck on project risk with 31 slides. Templates are compatible with both the standard and widescreen. Presentations are 100% risk-free. Graphics are compatible with Google slides. Premium support for our customers. Templates are useful for project manager, business persons, and senior management. The deck constituents are project risk, risk management, risk response plan, risk analysis, risk tracker, project management etc.

Presenting this set of slides with name - Introduction To Risk Management Powerpoint Presentation Slides. This is a one stage process. The stages in this process are Introduction To Risk Management, Risk Management Overview, Risk Management Outline.

This deck covers 80 templates. All slides are fully editable. Easy to download. High-resolution design templates. Compatible with google slides. This deck can be converted to PDF formats. Compatible with standard and widescreen. The presentation is 100% risk-free.

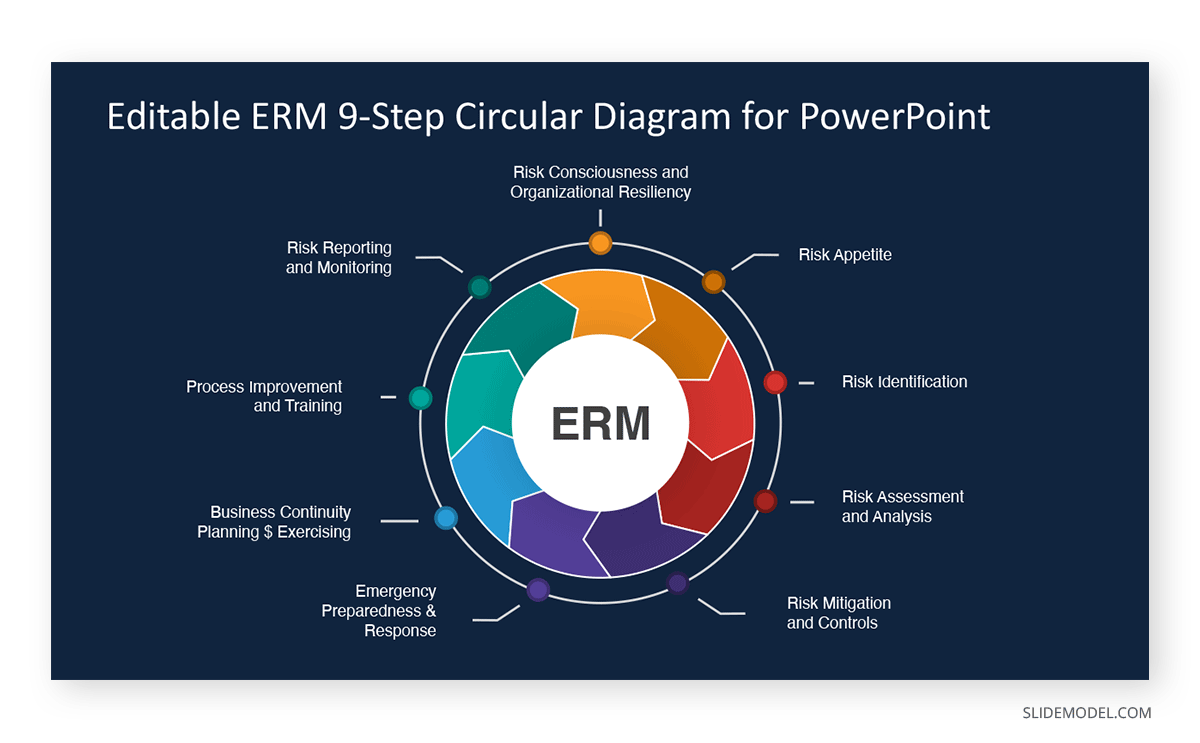

Presenting Enterprise Risk Management PowerPoint Presentation Slides. Fully editable colours, text, photos, and graphics. Picture quality stays same still when resize the image and project it on big screen. These presentation templates are fully compatible with Google slides. PowerPoint slide can be changed by changing business details. Change the presentation design into JPG and PDF formats. Useful for corporate users and business entrepreneurs and managers.

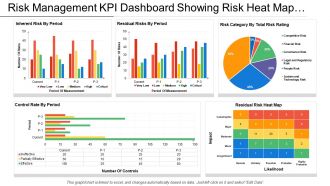

Presenting this set of slides with name - Risk Management Kpi Dashboard Showing Risk Heat Map And Control Rate By Period. This is a five stage process. The stages in this process are Risk Management, Risk Assessment, Project Risk.

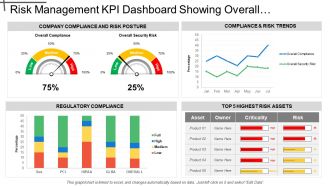

Presenting this set of slides with name - Risk Management Kpi Dashboard Showing Overall Security Risk And Regulatory Compliance. This is a four stage process. The stages in this process are Risk Management, Risk Assessment, Project Risk.

Presenting this set of slides with name - Risk Management Overview Powerpoint Presentation Slides. The process constituents are Introduction To Risk Management, Risk Management Overview, Risk Management Outline. Edit, convert and utilise the deck at will.

Businessmen, competing agencies and enterprises can use the PPT visual to keep a record. PowerPoint presentation supports effective use of graphs and charts to give more meaning to your text. Every single graphic can be resized and altered in the presentation slide. Text color and size can be easily modified in the PPT layout. There is no space issue in the PowerPoint design, therefore, company logo and name can be associated easily. Smooth performance is ensured by the presentation slide show on all software.

Presenting Training Deck on Understanding Components of Cybersecurity. This deck comprises of 116 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content and present it with confidence.

Presenting risk meter icon ppt example. This is a risk meter icon ppt example. This is a one stage process. The stages in this process are hazard symbol, risk icon, risk management icon.

The PowerPoint presentation supports editing with ease.Utmost useful to management professionals, big or small organizations and business start ups.Text and graphic blend well and synchronize well in PowerPoint slide.Allows easy editing of color, size and background of presentation slide show. Professional color combinations on each slide is extended by PPT graphic. High quality resolution ensures graphics quality in PPT layout when viewed on a larger screen. nHarmonious and smooth running with Google slides.

Businessmen, sales and marketing professionals and brand managers can use the presentation effectively. Graphics, text placeholders and related pictures are additional helpful feature of PPT layout. All diagrams are 100% editable in the presentation slide Presentation allows changes in color, size and orientation of any slide to your liking without affecting the resolution. Presentation slide show supports quality functioning on all software.

EduDecks are professionally-created comprehensive decks that provide complete coverage of the subject under discussion. These are also innovatively-designed for a powerful learning experience and maximum retention

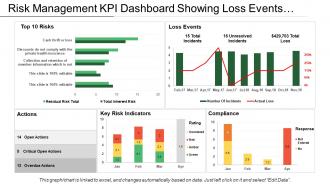

Presenting this set of slides with name - Risk Management Kpi Dashboard Showing Loss Events Actions And Compliance. This is a four stage process. The stages in this process are Risk Management, Risk Assessment, Project Risk.

It covers all the important concepts and has relevant templates which cater to your business needs. This complete deck has PPT slides on Risk Management Process Steps Powerpoint Presentation Slides with well suited graphics and subject driven content. This deck consists of total of fifty four slides. All templates are completely editable for your convenience. You can change the colour, text and font size of these slides. You can add or delete the content as per your requirement.Download PowerPoint templates in both widescreen and standard screen. The presentation is fully supported by Google Slides. It can be easily converted into JPG or PDF format.

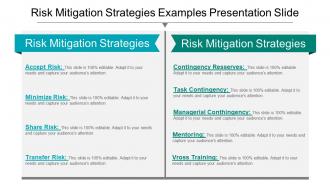

Presenting risk mitigation strategies examples presentation slide. This is a risk mitigation strategies examples presentation slide. This is a two stage process. The stages in this process are risk management, risk mitigation, risk planning, risks and mitigating strategies.

Presenting Training Deck on Comprehending Cyber Threats. This deck comprises of 90 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content, and present it with confidence.

Presenting Training Deck on Prevention of Cyber Attacks. This deck comprises of 88 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content, and present it with confidence.

Presenting this set of slides with name - Risk Management Lifecycle Process Powerpoint Presentation Slides. This deck consists of a total of fifty-eight slides. It has PPT slides highlighting important topics of Risk Management Lifecycle Process Powerpoint Presentation Slides. The best part is that these templates are easily customizable. Edit the color, text, font size, add or delete the content as per the requirement. Download PowerPoint templates in both widescreen and standard screen. The presentation is fully supported by Google Slides. It can be easily converted into JPG or PDF format.

Presenting Risk Assessment Strategies PowerPoint Presentation Slides. Easy data placement such as company logo, name or trademark. This PowerPoint theme is fully aligned with Google slides. Picture quality does not change even when you project this template on large screen. Fast downloading speed and formats can be simply altered to JPEG and PDF. Ideal for managers and entrepreneurs. Adjust PPT slide’s font, text, and colors as per your requirements.

Presenting our well-structured Organization Cybersecurity Risk Management And Compliance Model. The topics discussed in this slide are Governance, Risk, Compliance. This is an instantly available PowerPoint presentation that can be edited conveniently. Download it right away and captivate your audience.

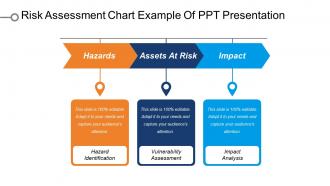

Presenting risk assessment chart example of ppt presentation. This is a risk assessment chart example of ppt presentation. This is a three stage process. The stages in this process are risk assessment, risk management.

Quality content having 79 slides. This PPT Can download with a just single click. Standard and widescreen compatible templates.100% editable slides to match your needs. You will get Premium Customer support. Can be seen in Google Slides.The stages in this process are process management, product portfolio, project management, quality assurance, strategic management, strategic planning, supply chain management, value chain analysis, value stream mapping.

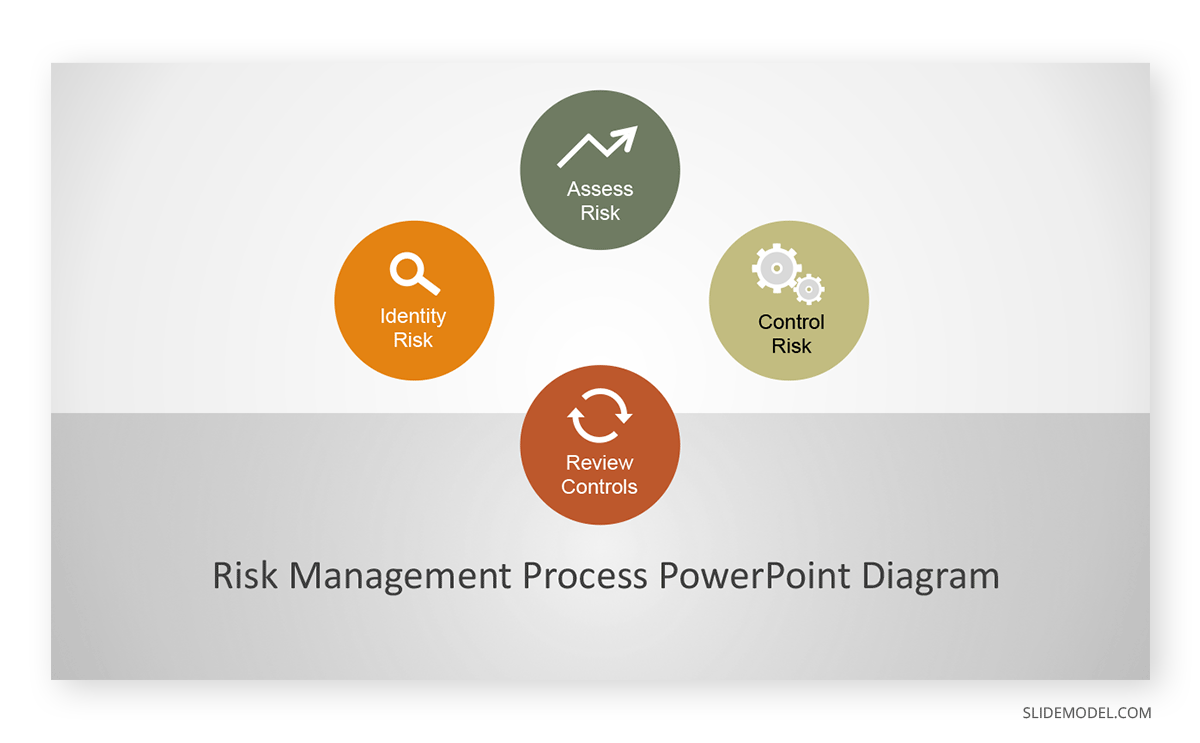

Introducing our premium set of slides with Key Elements Of Risk Management Process. Ellicudate the four stages and present information using this PPT slide. This is a completely adaptable PowerPoint template design that can be used to interpret topics like Identification, Evaluation, Controlling. So download instantly and tailor it with your information.

Introducing risk management maturity model PowerPoint templates. You can download the template design with different nodes and stages. Instructional slides are provided with the template for your guidance. You can modify the color, text, font size and font type of the template whenever required. Templates slide allows you to remove the watermark. Personalize the template by inserting your won organization logo, trademark, copyright or signature. Top quality graphics have been used to craft this template that are editable in PowerPoint. You can display the graphics on large screen as the picture quality does not get harm. Available in both standard and widescreen view.

Presenting this set of slides with name - Risk Identification Process Powerpoint Presentation Slides. This aptly crafted editable PPT deck contains forty-five slides. Our topic-specific Risk Identification Process Powerpoint Presentation Slides presentation deck helps devise the topic with a clear approach. We offer a wide range of custom made slides with all sorts of relevant charts and graphs, overviews, topics subtopics templates, and analysis templates. Download PowerPoint templates in both widescreen and standard screen. The presentation is fully supported by Google Slides. It can be easily converted into JPG or PDF format.

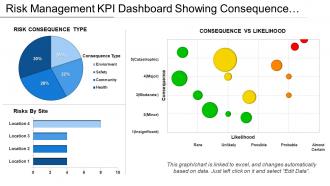

Presenting this set of slides with name - Risk Management Kpi Dashboard Showing Consequence Vs Likelihood. This is a three stage process. The stages in this process are Risk Management, Risk Assessment, Project Risk.

Presenting this set of slides with name - Reconciliation Process Business Process Centric Risk Management System. This is an editable four stages graphic that deals with topics like Reconciliation Process, Business Process Centric Risk, Management System to help convey your message better graphically. This product is a premium product available for immediate download, and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

Presenting this set of slides with name - Risk Assessment Step Powerpoint Presentation Slides. We bring to you to the point topic specific slides with apt research and understanding. Putting forth our PPT deck comprises of forty-five slides. Our tailor-made Risk Assessment Step Powerpoint Presentation Slides editable presentation deck assists planners to segment and expound the topic with brevity. The advantageous slides on Risk Assessment Step Powerpoint Presentation Slides are braced with multiple charts and graphs, overviews, analysis templates agenda slides, etc. to help boost important aspects of your presentation. Download PowerPoint templates in both widescreen and standard screen. The presentation is fully supported by Google Slides. It can be easily converted into JPG or PDF format.

Presenting Training Deck on Business Impact of Cyber Attacks. This deck comprises of 39 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content, and present it with confidence.

Presenting Training Deck on Understanding Types of Cyber Attacks. This deck comprises of 116 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content, and present it with confidence.

Presenting risk management icons ppt diagrams. This is a risk management icons ppt diagrams. This is a six stage process. The stages in this process are hazard symbol, risk icon, risk management icon.

The PowerPoint presentation supports easy way to add, edit and compile data. Helpful to management professionals, big or small organizations and business start ups. Text and graphic can arranged to complement each other in all the PPT slides. Ensures recasting the color, size and orientation in presentation slide show as per business need. High quality resolution in color and graphics is supported by PPT graphic. Each slide offers good resolution without disturbing the pixels quality in PPT layout when viewed on widescreen. Flexible in approach with Google slides.

Presenting this set of slides with name - Risk Management Plan Analysis PowerPoint Presentation Slides. Highlighting risk management plan analysis PowerPoint presentation. Visually appealing PowerPoint presentation pattern. The presentation template consists of a set of 51 editable slides which can be downloaded and saved in any desired format. Access to transform the Presentation design into JPG and PDF. High quality images and visuals used in the PPT designs. Beneficial for industry professionals, managers, executives, researchers, sales people, etc. Privilege of insertion of logo and trademarks for more personalization. Download is quick and can be easily shared.

Make changes to designs as per your liking. 57 slides having quality content. Instantly downloadable with just a single click. Standard and widescreen compatible visuals. Can be opened in Google Slides also. Suitable for use by marketers, analysts, managers and firms. Premium Customer support provided. The stages in this process are success, business, management, equity, process.

Grab our professionally designed Quantitative Investment Strategies And Portfolio Management PowerPoint presentation that is sure to impress investors, inspire team members and other audience. With a complete set of 79 slides, this PPT is the most comprehensive summary for QIS you could have asked for. The content is extensively researched, and designs are professional. Our PPT designers have worked tirelessly to craft this deck using beautiful PowerPoint templates, graphics, diagrams and icons. On top of that, the deck is 100% editable in PowerPoint so that you can enter your text in the placeholders, change colors if you wish to, and present in the shortest time possible.

Presenting this set of slides with name - Risk Management Kpi Dashboard Showing Cost Of Control And Risk Score. This is a five stage process. The stages in this process are Risk Management, Risk Assessment, Project Risk.

Presenting this set of slides with name - Risk Management Procedure And Guidelines Powerpoint Presentation Slides. This deck consists of total of forty eight slides. It has PPT slides highlighting important topics of Risk Management Procedure And Guidelines Powerpoint Presentation Slides. This deck comprises of amazing visuals with thoroughly researched content. Each template is well crafted and designed by our PowerPoint experts. Our designers have included all the necessary PowerPoint layouts in this deck. From icons to graphs, this PPT deck has it all. The best part is that these templates are easily customizable. Just click the DOWNLOAD button shown below. Edit the colour, text, font size, add or delete the content as per the requirement. Download this deck now and engage your audience with this ready made presentation.

Proficiently constructed available to use PowerPoint template. Efficiently adjustable into distinctive configurations. Easy to add your brand name or company emblem in the PPT templates. Reinstate able subject matter, PowerPoint images, symbols etc. Consistent with all Google slides and other systems. Delightful presentation graphic designs to give an immaculate experience to the viewers.

This slide portrays information regarding the dashboard that firm will use to manage cyber risks. The dashboard will provide clear picture of risk prevailing and how they are treated to technical engineers and board level executives. Presenting this set of slides with name Dashboard Cyber Risk Management Breakdown Ppt Infographics. The topics discussed in these slides are Dashboard Cyber Risk Management. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

Presenting this set of slides with name - High Risk Indicating Maximum Danger And Risks. This is a three stage process. The stages in this process are Risk Meter, Risk Speedometer, Hazard Meter.

Presenting Information Security a Cybersecurity Component. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content and present it with confidence.

Presenting Network Security a Cybersecurity Component. These slides are 100 percent made in PowerPoint and are compatible with all screen types and monitors. They also support Google Slides. Premium Customer Support available. Suitable for use by managers, employees, and organizations. These slides are easily customizable. You can edit the color, text, icon, and font size to suit your requirements.

Presenting Password Attack Types in Cyber Security. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content and present it with confidence.

Your one pager is certain to hit bulls eye, with our minimalistic yet sophisticated One Page Risk Management Framework Presentation Report Infographic PPT PDF Document one pager design. Our innovative solution will help you to enjoy the liberty of exercising absolute customisation. We would keep you away from extensive data cluttering by ensuring that on point highlights reach your prospects just in time. Our bright and hard hitting template design will come across as a complete visual delight. We understand that a one pager should be able to create a lasting impression. Our research and performance oriented template ensures just that. Focus on core activities by leaving the burden of template designing on the shoulder of experts like us.

This complete deck can be used to present to your team. This deck consists of a total of twenty-four slides. All the slides are completely customizable for your convenience. You can change the color, text and font size of these templates. You can add or delete the content if needed. Can be converted into various formats like PDF, JPG and PNG. It is available in both standard and widescreen. Get access to this professionally designed complete presentation by clicking the download button below.

Presenting this set of slides with name - Risk Management Kpi Dashboard Showing Incidents By Priority And Severity. This is a four stage process. The stages in this process are Risk Management, Risk Assessment, Project Risk.

Keep your audience glued to their seats with professionally designed PPT slides. This deck comprises of total of thirty two slides with creative visuals and well researched content. Our PowerPoint professionals have crafted this deck with appropriate diagrams, layouts, icons, graphs, charts and more. This content ready presentation deck is fully editable. Just click the DOWNLOAD button below. Change the colour, text and font size. You can also modify the content as per your need. This PowerPoint template is Google Slides compatible and is easily accessible. This easy to download PPT theme can be easily opened and saved in various formats like JPG, PDF, and PNG.

Introduce your topic and host expert discussion sessions with this Risk Management Procedure Framework Organization Assessment Evaluation Communication. This template is designed using high-quality visuals, images, graphics, etc, that can be used to showcase your expertise. Different topics can be tackled using the twelve slides included in this template. You can present each topic on a different slide to help your audience interpret the information more effectively. Apart from this, this PPT slideshow is available in two screen sizes, standard and widescreen making its delivery more impactful. This will not only help in presenting a birds-eye view of the topic but also keep your audience engaged. Since this PPT slideshow utilizes well-researched content, it induces strategic thinking and helps you convey your message in the best possible manner. The biggest feature of this design is that it comes with a host of editable features like color, font, background, etc. So, grab it now to deliver a unique presentation every time.

Presenting this set of slides with name - Risk Management Kpi Dashboard Showing Risk Distribution By Country Office And Business Process. This is a six stage process. The stages in this process are Risk Management, Risk Assessment, Project Risk.

PowerPoint is Ideal for business experts, entrepreneurs, thinkers and marketers. Impactful Presentation design and can be shared with large audience. Does not pixelate into Blur while showing on large screens. Highly customizable presentation giving wing to your creativity. easy and hassle free interface to use. The PPT Graphic can be used in Google Slides. PowerPoint template can be personalized by adding business details.

Are you worried about conveying complex data to your target audience without leaving them confused Well, our tailor made One Page Major Risks And Risk Management Strategies Template 470 Report Infographic PPT PDF Document template will bring an end to all your worries. This one pager is fully editable and thus you can tweak it in line with your individual preferences and audience needs. Being a multi purpose design, every time there are circumstantial differences, our template will stand up to the occasion. You can play with the graphics and fine tune the same to suit your sector specific catering. Be assured that your audience will be impressed.

Presenting our set of slides with Enterprise Project Risk Management Process. This exhibits information on sevan stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Project Planning With Authorized Budget, Communicate Plan With Top Management, Risk, Monitoring.

We are proud to present our 0614 risk management word cloud word cloud powerpoint slide template. The above template is an illustration of Word cloud of risk management. A word cloud is a tool that can analyze text from various sources. Word clouds are especially impactful when shaped into an image that reflects your topic or theme.

Presenting this set of slides with name - Risk Indicator With Extreme Level. This is a five stage process. The stages in this process are Risk Meter, Risk Speedometer, Hazard Meter.

Presenting this set of slides with name Risk Management With Caution Icon. This is a three stage process. The stages in this process are Risk Management, Caution Icon. This is a completely editable PowerPoint presentation and is available for immediate download. Download now and impress your audience.

This complete presentation has PPT slides on wide range of topics highlighting the core areas of your business needs. It has professionally designed templates with relevant visuals and subject driven content. This presentation deck has total of twenty three slides. Get access to the customizable templates. Our designers have created editable templates for your convenience. You can edit the colour, text and font size as per your need. You can add or delete the content if required. You are just a click to away to have this ready-made presentation. Click the download button now.

Item 1 to 60 of 1206 total items

- You're currently reading page 1

Home Blog Business Risk Management Techniques

Risk Management Techniques

Risk and business cannot be separated! For an entrepreneur, the possibility of a loss is as real as the possibility of profitability; what lies in between the two is risk. In simple terms, the risk is the possibility of loss for a business, with financial implications. There are risks that are avoidable and risks that need to be better managed to reduce the likelihood of negative consequences.

Basic Elements of Risk Management

Risk management is the identification, assessment, and controlling of risks. Businesses around the world plan and spend a significant amount of money in managing risks. However, risk management has implications beyond business. Risk management is applicable for businesses and disaster management and can even be used by an individual at the household level . The latter can be a form of financial management, retirement-related risks, and identification of financial shocks that can affect a household.

Risk management broadly has five basic elements, covering the structure of how it can be incorporated for anticipating and controlling risks.

1. Identify Threats

In order to anticipate and manage risks, one must first identify what might be deemed as a risk. For a business, it can include the possibility of financial loss, an injury to an employee, the possibility of a lawsuit, accidents affecting customers, etc. These risks can arise due to a number of factors, be it economic conditions of a country, competition from competitors, lack of safety measures at the workplace for employees, faulty products, and the like.

2. Assess Vulnerability of Critical Assets

The next step includes an evaluation and assessment of risks. This is to identify the vulnerability of critical assets due to the risk. For example, if there is a production process that can lead to an employee’s injury or death, there seems to be a high probability of such an accident occurring. Such a process needs to be changed or replaced.

3. Determine the Threat the Risk Poses

Different risks can pose different types of threats. An injury caused due to a hazardous production process can lead to a lawsuit by the employee, cause reputation damage, and might even lead to a decline in sales due to bad reputation.

4. Reducing Risks

There are several ways that businesses can reduce risks. If a production process has the potential to cause harm, it might be worth revising how the process is carried out or finding alternative methods for performing certain tasks to make the process safe. There might even be a need for safety equipment or machinery and regular equipment inspection and maintenance that can help manage such a risk in a better way by reducing the probability of an accident. Some risks however can be hard to reduce. This might include accounting for an economic meltdown, economic policy changes due to a change of government in a country, or viz majors like the COVID-19 pandemic or an unforeseen natural disaster.

5. Risk Reduction Measures

Risks can be categorized, (e.g., low, medium, or high). It isn’t necessary for a business to try to manage all types of risks, since the possibility of some risks might be negligible, and committing resources for them might be very expensive. Risk reduction is a process that cannot be viewed in isolation. Organizations need to perpetually monitor risks and account for course correction if and when necessary.

Managing Different Types of Risks

Risk management entails various types of strategies, such as risk reduction, risk avoidance, risk sharing, and risk retaining. We covered these strategies in detail in our previous post about risk management and risk assessment . In the section below, we will provide you with examples of different types of risks a business might face and what can be a few ways of managing such risks.

Market Risk

When it comes to imagining risks, investors usually consider the term synonymous with market risk. Market risk is the possibility of investors losing money due to a decrease in the value of their investment. The most common strategy for investors to manage market risk is by diversifying investment portfolios to avoid tying too many assets in a single business entity. Furthermore, buying at various intervals and investing in less correlated investments, such as real estate, bonds, and other commodities can be another method to avoid market risks.

Inflation Risk

Inflation can affect a business in a number of ways. The cost of inputs can suddenly rise, whereas a business engaged in export of goods can find the real value of the currency decline, leading to a loss in selling goods at a previously agreed rate. Similarly, an increase in the price of imports due to a shift in exchange rate can adversely affect the price the business can charge for its products in the local market.

There are a number of ways businesses can manage inflation-related risks, such as by localization of production parts to avoid exchange rate volatility and owing ancillary firms. Likewise, an investor might choose to invest in assets that can offer a real rate of return above inflation. This might include real estate, mineral resources, or government-issued bonds.

Liquidity Risk

You might come across a house that you intend to buy to sell later on. The location of the house might be in an area that has good market value and is likely to increase in the near future. However, how long might it take you to sell the house? Is the property too expensive for an average buyer? Will your assets get tied up for too long after purchasing the property? This is an example of how a liquidity risk can occur. Businesses can end up with assets that are tied up for too long, leading to the risk of owning assets that can be hard to cash out.

A liquidity risk can be avoided by avoiding the purchase of assets that might be difficult to cash out. Some businesses might avoid giving products on credit to local retailers or selling raw material at deferred payments to avoid a liquidity risk.

Longevity Risk

As people receive better healthcare and lifestyles, it is expected that they might live longer. While this is good news, the increase in the lifespan of such individuals means that pensions and policyholders will live longer, leading to a higher payout ratio. Longevity risk is viewed differently by different individuals. For a business, a long lifespan of policyholders or pensioners will lead to an increase in the amount of money they need to pay. Whereas people receiving such benefits will be able to live longer with the assurance of the benefits they have worked hard for.

Many organizations, be it profitable businesses or government-run organizations operating on a loss for several years, have different coping mechanisms for such a risk. Many organizations now hire employees on a contractual basis, whereas pensioners in some cases might be paid out an amount after a ‘plan termination’ by the employer. Some countries might also look to encourage people to work longer and delay social security to rationalize pension plans.

Opportunity Risk

Let’s assume you have a large sum of money placed safely in a safe at home. While the money might appear secure, it might lose value over time due to inflation. You might also run the risk of missing out on a profitable opportunity because you failed to invest in the venture. Businesses can be risk-averse , leading to a competitor taking more of the market share by investing in R&D to improve their product.

An opportunity risk, therefore, requires careful consideration. Businesses might choose to keep a sum for cost overruns, emergency needs or to avoid losing money tied up in assets hard to liquidate while investing the rest to avoid an opportunity risk.

For any business, taxes, especially an increase in them, can lead to a reduction in profitability and loss of sales due to higher prices for their commodities. There’s also the issue of sales tax compliance as the company expands to new states or countries. For an investor, it is essential to determine which portfolio to invest in, considering the rate of tax applicable in relation to the anticipated rate of return. Some investors might opt for tax-deferred accounts to cope with tax risks, whereas businesses might try to reduce tac risks by investing in offers by the government in products which are less heavily taxed.

Many countries are offering fewer taxes on electric cars to help improve the air quality of cities and reduce the negative implications of cars running on petroleum-based products. Some countries have even announced a ban on petrol and diesel-based vehicles by 2035 .

Sequence of Returns Risk

An investor might invest in a portfolio or venture that gives it a return of 5% one year and a loss of 5% the following year. To avoid negative portfolio returns, investors might spend conservatively and account for spending flexibility. An investor might also avoid selling stocks on a loss and use a reserve to fund for a buffer stock to avoid short-term losses due to a sale of stocks at a loss when the chips are down. To have smart investment strategies, start using an all-in-one investment app , which allows you to prevent risks.

Using Different Techniques for Identifying and Presenting Risks

There are a number of techniques that businesses use to identify risks. If you need to create a PowerPoint presentation about risk management, you can use a number of handy templates and techniques listed below.

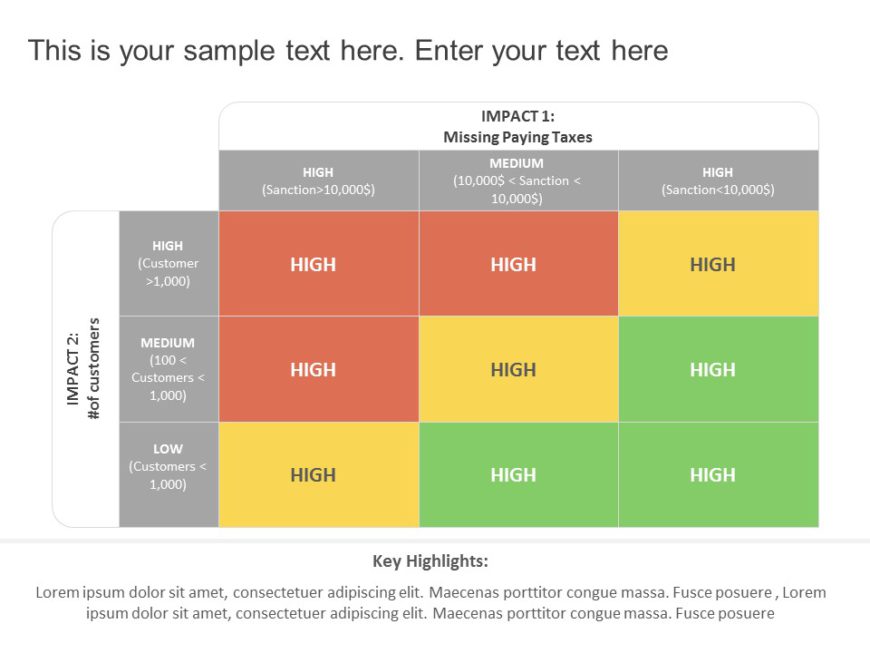

Risk Matrix

A risk matrix is used during the process of assessing risks to categorize them and determine the possibility of the occurrence of the risks. The matrix can be a very handy mechanism for visually identifying high-priority risks for important management decisions.

RAIDAR Model

RAIDAR model is a risk management model used to assess risks, assumptions, issues, dependencies, action, and repairs. The model can be useful for assessing project risks and for their effective management.

PEST or PESTEL Analysis

A PEST analysis looks at the political-economic, social and technological environment for macro-environmental factors. The analysis is often extended to also include environmental and legal factors, extending the term PEST to PESTEL. This strategic management component is used for the scanning for the aforementioned factors to determine the potential for market growth, decline, and the direction that the business needs to take.

SWOT Analysis

A SWOT Analysis is a famous strategic planning technique used for identifying strengths, weaknesses, opportunities, and threats. Be it a competitor, economic uncertainty, natural disasters, market volatility, or the potential of an opportunity risk, a SWOT analysis can be a handy tool to use in identifying and mitigating risks.

Decision Tree

A decision tree is used to support decisions by placing options and anticipating possible consequences in a tree-like structure. A decision tree can be used by businesses to assess chance events, resource costs, risks, and payoffs.

Final Words

There are risks that a business can account for and manage and risks that remain perpetual. Risks that might be associated with the national economy, a natural disaster, or sudden change in government policy can be hard to account for and need constant monitoring. This is different from risks that can be managed by changing a hazardous production process to a safer alternative or diversification of portfolio to avoid losses.

Risk management is a practice that businesses would ideally do away with if it were ever possible. As distasteful as it might be, it is impossible to avoid anticipating risks for business continuity and managing them, even if it comes with a burden of heavy costs that are sometimes unavoidable.

1. Enterprise Risk Management PowerPoint Template

The Enterprise Risk Management PowerPoint Template allows you to create a visual representation that is useful for any business presentation.

Use This Template

Like this article? Please share

Business Diagrams, Business Intelligence, Business Planning, Business Presentations, Financial Risks, Risk Management Filed under Business

Related Articles

Filed under Business • May 17th, 2024

How to Make a Transition Plan Presentation

Make change procedures in your company a successful experience by implementing transition plan presentations. A detailed guide with PPT templates.

Filed under Business • May 8th, 2024

Value Chain Analysis: A Guide for Presenters

Discover how to construct an actionable value chain analysis presentation to showcase to stakeholders with this detailed guide + templates.

Filed under Business • April 22nd, 2024

Setting SMART Goals – A Complete Guide (with Examples + Free Templates)

This guide on SMART goals introduces the concept, explains the definition and its meaning, along the main benefits of using the criteria for a business.

Leave a Reply

< Go back to Login

Forgot Password

Please enter your registered email ID. You will receive an email message with instructions on how to reset your password.

Risk Management Templates

- Risk-Management-Flowchart - 4x3 – $4.99

- Risk-Management-Flowchart - 16x9 – $4.99

Risk Management Flowchart PowerPoint Template

A risk management process flowchart is a diagram that outlines the steps involved in the process of identifying, assessing and controlling risks.....

- Volcano Slide Template – $6.99

Volcano Slide Template

Volcanoes are often symbolized as destruction, and the eruption is associated with imminent danger. This Volcano Slide Template is a great tool t....

- Volcano Template For PowerPoint And Google Slides – $6.99

Volcano Template For PowerPoint And Google Slides

The Volcano Template For PowerPoint And Google Slides can be used to discuss possible reasons for the failure of a business plan or decision. The....

- Agenda Volcano PowerPoint Template – $6.99

Agenda Volcano PowerPoint Template

To a business, a volcano can be used to convey the stages of decline of a business plan. It portrays the weaknesses of the business to focus on t....

- Change Management PowerPoint Theme - 4x3 – $19.99

- Change Management PowerPoint Theme - 16x9 – $19.99

Change Management Theme PowerPoint Template

About Change Management Theme PowerPoint Template With the help of change management theme PowerPoint template, you can introduce a new way of th....

- ROAM-Chart-PowerPoint-Template - 4x3 – $5.99

- ROAM-Chart-PowerPoint-Template - 16x9 – $5.99

ROAM Chart PowerPoint Template

ROAM Chart Presentation Template Use this ROAM Chart PowerPoint template and Google Slides theme to create visually appealing presentations in an....

- Business-Challenges-PowerPoint-Template - 4x3 – $6.99

- Business-Challenges-PowerPoint-Template - 16x9 – $6.99

Business Challenges PowerPoint Template

Business Challenges Presentation Template Use this Business Challenges PowerPoint template to create visually appealing presentations in any prof....

- Startup-Risk-Factors-PowerPoint-Template - 4x3 – $4.99

- Startup-Risk-Factors-PowerPoint-Template - 16x9 – $4.99

Startup Risk Factors PowerPoint Template

Startup Risk Factors Presentation Template Use this Startup Risk Factors PowerPoint template to create visually appealing presentations in any pr....

- Business-Risk-Factors-PowerPoint-Template - 4x3 – $4.99

- Business-Risk-Factors-PowerPoint-Template - 16x9 – $4.99

Business Risk Factors PowerPoint Template

Business Risk Factors Presentation Template Use this Business Risk Factors PowerPoint template to create visually appealing presentations in any ....

- Hexagon-Highlights-PowerPoint-Template- - 4x3 – $4.99

- Hexagon-Highlights-PowerPoint-Template- - 16x9 – $4.99

Hexagon Highlights PowerPoint Template

Hexagon Highlights Presentation Template Use this Hexagon Highlights PowerPoint template to create visually appealing presentations in any profes....

- Risks-and-Opportunities-powerpoint-template - 4x3 – $4.99

- Risks-and-Opportunities-powerpoint-template - 16x9 – $4.99

Risks and Opportunities powerpoint template

Risks and Opportunities Presentation Template Use this Risks and Opportunities PowerPoint template to create visually appealing presentations in ....

- Impact-Matrix-PowerPoint-Template - 4x3 – $4.99

- Impact-Matrix-PowerPoint-Template - 16x9 – $4.99

Impact Matrix PowerPoint Template

Impact Matrix Presentation Template Use this Impact Matrix PowerPoint template to create visually appealing presentations in any professional set....

Related Presentations

Return on investment.

15 templates >

Change Management

91 templates >

Entrepreneurship

132 templates >

5,656 templates >

SWOT Analysis

130 templates >

Risk Management PowerPoint Templates For Presentations:

The Risk Management PowerPoint templates go beyond traditional static slides to make your professional presentations stand out. Given the sleek design and customized features, they can be used as PowerPoint as well as Google Slides templates . Inculcated with visually appealing unique and creative designs, the templates will double your presentation value in front of your audience. You can browse through a vast library of Risk Management Google Slides templates, PowerPoint themes and backgrounds to stand out in your next presentation.

Product Pricing

What is a risk management powerpoint template.

A Risk Management PowerPoint template is a ready-made presentation template that provides a structured framework for creating professional Risk Management presentations. The Risk Management PPT presentation template includes design elements, layouts, and fonts that you can customize to fit your content and brand.

How To Choose The Best Risk Management Presentation Templates?

Keep the following points in mind while choosing a Risk Management Presentation template for PowerPoint (PPT) or Google Slides:

- Understand your presentation goals and objectives.

- Make sure the Risk Management template aligns with your visual needs and appeal.

- Ensure the template is versatile enough to adapt to various types of content.

- Ensure the template is easily customizable.

Are Risk Management PowerPoint Templates Compatible With Google Slides?

Yes, all our Risk Management presentation templates are compatible and can be used as Risk Management Google Slides templates.

What Are The Advantages Of Risk Management Presentation Templates?

Risk Management PPT presentation templates can be beneficial because they:

- Add multiple visual and aesthetic layers to your slides.

- Ensure that complex information, insights and data is presented in a simplistic way.

- Enhance the overall visual appeal of the content.

- Save you a lot of time as you don’t have to start editing from scratch.

- Improve the professional outlook of your presentation.

Can I Edit The Elements In Risk Management PowerPoint Templates?

Yes, our Risk Management PowerPoint and Google Slides templates are fully editable. You can easily modify the individual elements including icons, fonts, colors, etc. while making your presentations using professional PowerPoint templates .

How To Download Risk Management PowerPoint Templates For Presentations?

To download Risk Management presentation templates, you can follow these steps:

- Select the resolution (16*9 or 4*3).

- Select the format you want to download the Risk Management template in (Google Slides or PowerPoint).

- Make the payment (SlideUpLift has a collection of paid as well as free Risk Management PowerPoint templates).

- You can download the file or open it in Google Slides.

Forgot Password?

Privacy Overview

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Login with:

No products in the cart.

- Current vs Future State

- Business Startup

- Buyer Persona

- Project Management

- Risk Management

- Real Estate

- Supply Chain

- Stakeholder

- Value Chain

- Venn Diagrams

- Digital Marketing

- 30 60 90 Days Plan

- KPI Dashboard

- Gantt Chart

- SWOT Analysis

- Sign In / Sign Up

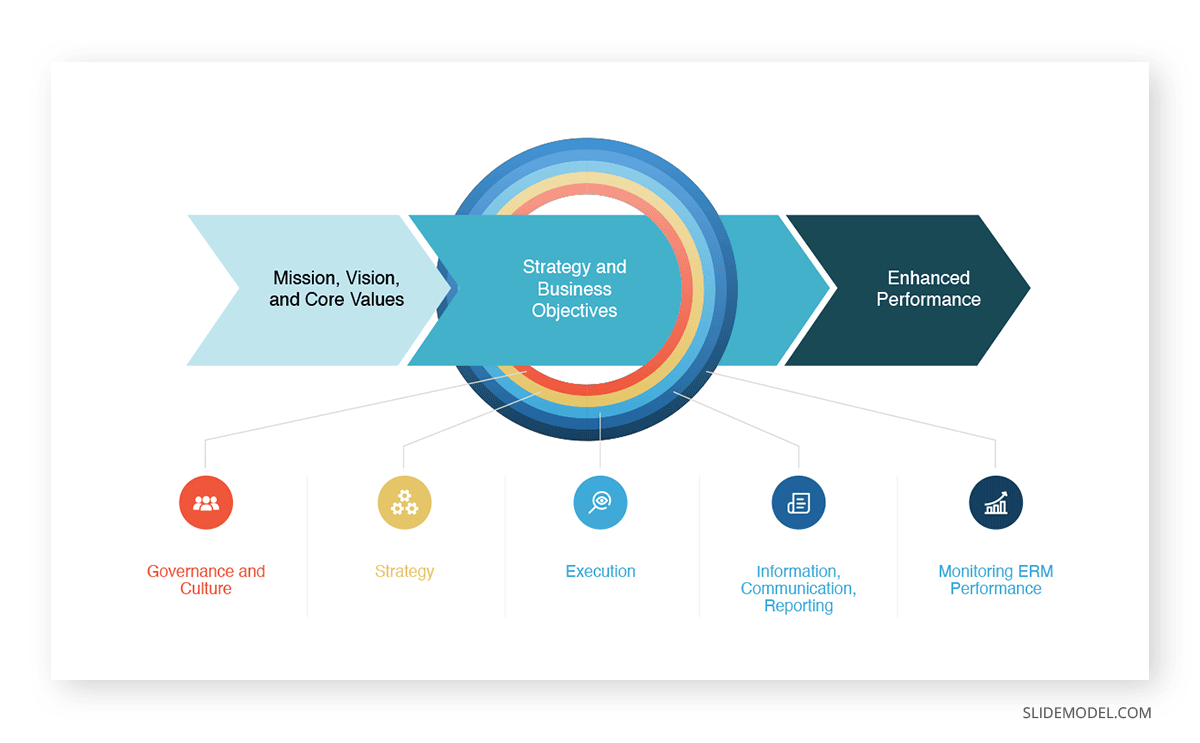

Enterprise Risk Management PowerPoint Presentation

Description

- Reviews (0)

Navigate the complexities of risk management and safeguard your enterprise with our “Enterprise Risk Management PowerPoint Presentation” template. This comprehensive and visually engaging template is designed to help organizations identify, assess, and mitigate risks effectively.

Featuring professionally crafted slides and an intuitive layout, this template covers all aspects of enterprise risk management (ERM), including risk identification, risk assessment, risk treatment, and risk monitoring. Whether you’re presenting to executives, board members, or department heads, this template provides a structured framework to communicate the importance of risk management and the strategies for mitigating potential threats.

With fully customizable slides compatible with PowerPoint and Google Slides, you can tailor the presentation to your organization’s specific risk management processes, industry regulations, and strategic objectives. Add your company logo, adjust colors and fonts, and incorporate relevant data and examples to create a presentation that resonates with your audience and drives action.

Empower your organization with a proactive approach to risk management using our “Enterprise Risk Management PowerPoint Presentation” template. Enhance risk awareness, foster a culture of accountability, and strengthen resilience in the face of uncertainty with this versatile tool.

Key Features:

- Professionally crafted slides covering all aspects of enterprise risk management.

- Intuitive layout to guide your audience through risk identification, assessment, treatment, and monitoring.

- Fully customizable slides compatible with PowerPoint and Google Slides for seamless integration into your presentation.

- Dynamic design elements and multimedia compatibility to enhance engagement and understanding.

There are no reviews yet.

Write a review Cancel reply

Your email address will not be published. Required fields are marked *

Related products

Supply Chain Risk Management PowerPoint Presentation

Risk Management PowerPoint Presentation

Project Risk Management Through Tree Powerpoint Presentation

Financial Risk Management PowerPoint Presentation

Risk Management Planning PowerPoint Presentation

Risk Management Example PowerPoint Presentation

Risk Management Framework PowerPoint Presentation

Risk Management Lifecycle PowerPoint Presentation

Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

11 templates

21 templates

holy spirit

35 templates

memorial day

12 templates

17 templates

art portfolio

81 templates

Risk Management Pitch

It seems that you like this template, risk management pitch presentation, premium powerpoint template and canva presentation template.

This template is the solution you need to have every potential risk under control. Its slides are a canvas ready to hold your ideas on risk management and its design is the icing on the cake: modern, abstract forms with purple gradients that will captivate your audience’s mind. In addition, we have prepared a series of resources that will represent business data in a way you’ve never seen before. Download the template at your own risk!

Features of this template

- 100% editable and easy to modify

- 15 different slides to impress your audience

- Contains easy-to-edit graphics such as graphs, maps, tables, timelines and mockups

- Includes 500+ icons and Flaticon’s extension for customizing your slides

- Designed to be used in Canva and Microsoft PowerPoint

- 16:9 widescreen format suitable for all types of screens

- Includes information about fonts, colors, and credits of the resources used

What are the benefits of having a Premium account?

What Premium plans do you have?

What can I do to have unlimited downloads?

Don’t want to attribute Slidesgo?

Gain access to over 24500 templates & presentations with premium from 1.67€/month.

Are you already Premium? Log in

Related posts on our blog

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

Risk Management

Download and customize this and 500+ other business templates

Start here ⬇️

Voila! You can now download this Presentation

Risk is unavoidable, but this doesn't mean that risk can't be planned for. To make better-calculated strategic choices, set clear expectations and always be prepared for different outcomes, use our Risk Management presentation. This presentation allows you to roll with the punches at all times and outline ways to monitor and control unpredictable events.

Slide highlights

Go over your risk assessment with this slide. List the hazards, and explain why and how they may affect your venture, propose precautions, introduce risk management strategy and obtain feedback to make necessary changes.

One of the risk assessment tools to consider is the risk assessment matrix . Identify risks, calculate consequences, determine risk rating, create an action plan, then plug data into your risk assessment matrix.

Introduce your risk mitigation plan to your audience with this slide. A risk mitigation plan helps to eliminate or minimize the impact of the hazards events and develop options and actions to enhance opportunities and reduce threats.

According to Risk Management , there are three categories of risk:

- Preventable risksn – these are internal risks, arising from within the organization, that are controllable and ought to be eliminated or avoided. Examples of preventable risks include the risks from employees' and managers' unauthorized, illegal, unethical, incorrect or inappropriate actions and the risks from breakdowns in routine operational processes.

- Strategy risks – companies voluntarily accept some risk in order to generate superior returns from their strategies. "A bank assumes credit risk, for example, when it lends money; many companies take on risks through their research and development activities," the experts say.

- External risks – some risks arise from events outside the company and are beyond its influence or control, such as natural and political disasters and major macroeconomic changes. External risks require unique approach. Because companies cannot prevent such events from occurring, their management must focus on identification and mitigation of their impact.

Application

To develop a risk management strategy, use this six-step process, recommended by business solution platform, EDC:

- Identify the risk – identify risks with regular brainstorming sessions that involve staff from all departments. The experts say it's crucial to look at current risks and have the vision to identify future risks.

- Analyze the risk – conduct an in-depth risk analysis. It can be difficult if you don't have all the information, but the checklist can best prepare you to identify those risks and how they can potentially impact your business in both operational and financial terms.

- Prioritize the risk – a large list of risks can be overwhelming, so it's critical to prioritize the risks so you can address the most pressing of them first. Once you have the checklist, go one step further and classify risks as high, medium or low.

- Assign responsibility to the risk – ensure there is someone in the organization that's going to own and oversee the risk management. "Determining who will be responsible is an internal company decision; it could be someone who works in a specific risk area who is best suited to tackle the risk or an arbitrary choice. It's a best practice to develop a risk management team consisting of both internal and, if applicable, external people in your supply chain," the experts say.

- Respond to the risk – develop a strong risk management plan that covers: risk management team, market information and market entry information, contracts and getting paid, quality and performance systems and processes, insurance and cash flow protection.

- Monitor the risk – things will change in your company and so will the risks. "As these changes occur, it's critical to update your plan to ensure that you don't become complacent or lose sight of potential threats to your business. Incorporating an ongoing review of your risk management plan into the company's planning activities will ensure you are on top of any potential risks," the EDC team says.

When COVID-19 crept up on the world, companies like Apple ended up being "especially vulnerable because of their large customer base in China and the dependence of their supply chain on Chinese manufacturers," Amiyatosh Purnanandam, professor of finance at the Ross School of Business, University of Michigan, writes in his article for Forbes .

Tim Cook named the impact of coronavirus as a significant source of uncertainty in the company during Q1 2020 earnings call. At the time, Apple had restricted employee travel and shut one store in China due to the virus outbreak, and was cutting back on retail store hours in China as well.

Purnanandam meditates on the question of what can the managers do to control risks that are not even identifiable? "Unlike exchange rates or commodity prices, there are no market-based derivatives contracts that can be used to hedge such a threat," Purnanandam writes. He's answer is cash balance. Cash balance is the best vaccine against unpredictable events such as the pandemic, Purnanandam writes. Moreover, he believes that cash is actually the best hedge against any risk that cannot be identified or quantified ahead of time. So in case of Apple, a $200 billion pile of cash is what makes it resistant to the risk.

Risk Management 101

May 03, 2013

630 likes | 1.43k Views

Risk Management 101. An Introductory Guide to Risk Management and Managing Risks. Definition of Risk. danger possibility peril chance exposure jeopardy consequence hazard menace threat gamble

Share Presentation

- financial risk

- worst case scenarios

- your vendors

- idl ndi ui program

- risk management authority csurma

- evaluate loss

Presentation Transcript

Risk Management 101 An Introductory Guide to Risk Management and Managing Risks

Definition of Risk danger possibility peril chance exposure jeopardy consequence hazard menace threatgamble We are concerned with the potential loss, including economic loss, human suffering, or that which may prevent the organization from being able to achieve its goals.

WHAT IS RISK MANAGEMENT? • A conscious effort of planning,organizing, directing, and controlling resources and activities. • To minimize the adverse effects of accidental loss at the LEAST POSSIBLE ACCEPTABLE COST.

Risk Management Decision Process Monitor results/ Modify methods Identify exposures Implement selected method Evaluate loss potential Select method

Types of Risk and Loss • General Liability • Workers’ Compensation • Property Loss – building & contents • Athletic Injury • Business Interruption • Institutional Reputation and Image Loss • Contractual Activities • Vehicle

Types of Risk and Loss continued • Financial Risk • Legal Liability • Environmental Health & Safety • Information Management • Intellectual Property • Student Activities • Auxiliary Enterprises

California State University Risk Management Authority CSURMA • Joint powers authority (JPA) formed under CA Gov’t Code section 6500 et seq.; ultimately allows CSURMA to provide insurance programs, self-insurance programs, and related services to the 23 campuses, Chancellor’s Office, and auxiliaries. • Separate legal entity from the CSU. • Subject to open meetings (Bagley-Keene Meeting Act).

Programs in the CSURMA • General Liability Program • Workers’ Compensation Program • Master Property Program • IDL/NDI/UI Program • Athletic Injury Medical Expense Program (AIME)

Programs in the CSURMA continued • Property – Inland Marine Program • AGPIP – Auxiliary Group Purchase Insurance Program – create market clout among the CSU Auxiliary Organizations to drive premium costs down through group purchase of insurance. • Student Health Insurance Program (CSUSHI) • Foreign Travel Liability Program

Campus Risk Exposures • On the Job Safety (internal & external) • EPL • Vehicle Accidents • Vendors (contracts & product) • Building Maintenance (repairs, IAQ, general maintenance, etc.) • Facilities Use (internal & external) • Reputation (internal & external)

Headlines: Eight killed in Utah State University Van Rollover By Paul Foy ASSOCIATED PRESS 10:09 p.m. September 26, 2005 TREMONTON, Utah – A Utah State University van returning to campus from a field trip blew a tire on Interstate 84 and rolled over, killing seven agriculture students and an instructor. Three other students were hospitalized. The van overturned Monday on the freeway near Tremonton, about 65 miles northwest of Salt Lake City. All 11 occupants were thrown from the van. The students were underclassmen, mostly freshmen. "Some have only been on campus a couple of weeks," university President Stan Albrecht said, calling the deaths an "incredible tragedy." No one in the 16-passenger van, driven by the instructor, was wearing a seatbelt, the Utah Highway Patrol said. Six men were pronounced dead at the scene. Two others died at hospitals. Two of the survivors were in critical condition at McKay-Dee Hospital in Ogden, hospital supervisor Robert Miller said. A third was taken to Ogden Regional Medical Center. .... The single-vehicle crash occurred at about 4:30 p.m. It appeared the left rear tire on the eastbound van had blown as it tried to pass another vehicle, said patrol Lt. Ed Michaud. The Dodge van rolled four times, coming to rest on its wheels about six feet from a 50-foot-deep ravine, troopers said. The van's roof was collapsed to the windows. Parts of the vehicle and personal belongings littered the area near the freeway. "It was a horrific, nasty accident," said Trooper Jason Jensen. "It was one of those things you don't want to drive up on." Albrecht said the students had been on a field trip to look at harvest equipment near Tremonton, west of the Logan campus. Utah State University has about 21,000 students. .....A similar rollover shocked the school in April 2001. Six members of the men's volleyball club were injured when their Dodge van flipped over near Laramie, Wyoming. The crash prompted a government safety warning for large-sized vans.

What we think…. The usual reality.. Field Trips

Obligations • Know where the students are going. • Prepare them for an emergency. • Know in advance if there are health issues that may have to be dealt with. • Review acceptable actions and unacceptable actions.

Student Travel • Approval = Acknowledged benefit • Prepare the students for the travel – risks, expectations, contacts • Waivers versus Informed Consents • Know who is where • Options for those with disabilities

The Accident • Have your contact information handy. • Report the accident to the campus (your supervisor or the Police) as soon as you can. • Do Not Admit Fault. • Do Not make promises.

The Claim • Their’s Victim’s Compensation & Government Claims • Your’s Victim’s Compensation & Government Claims • Our’s CSU Risk Management – Program Administrators

Government Claim Booklet • State of California Victim’s Compensation & Government Claims Program • Includes Instructions & Claim Form http://www.governmentclaims.ca.gov/

METHODS OF CONTROLLING RISK • Avoidance • Transfer of Risk • Retention of Risk • Reduce Risk through Loss Reduction Efforts • Finance Retained Risk • Define Meaningful Standards and Expectations

EVALUTE LOSS POTENTIAL • Evaluation Techniques • Frequency/Severity of Claims • Publications/Periodicals/Other Universities • Political/Litigation Climate • Anticipate

The Challenges We Face • Internal • “We’ve never had that kind of loss” • “What, change my procedure, I’ve always done it this way!” • “I’ve taught this class for 20 years without a problem!” • “All Risk Management has is: bad news with higher price tags!” • No communication!

The Challenges We All Face • External: • The Insurance Market • Your vendors • Your constituents • Unions • Auxiliary Organizations • Foundations • Athletic Corporations • Bookstores • Food Services • Health Centers

OTHER RISKS TO CAUSE YOU WORRY • Liability • General, a wide variety of exposures, including civil liability arising out of accidents resulting from the premises or operations of a public university • Employment- the trifecta of risk • Expensive to defend • Awarding of compensatory, special damages • Awarding of plaintiff’s attorney fees • Automobile • Public Officials’ Errors and Omissions

Risk Management’s Role • Manages insurance and claims • Looks for process improvement through feedback • Consults • Reviews • Forecasts • Play “what ifs” • Thinks worst case scenarios • Recommends

Let’s Team Up! RM&S Takes an Active Role: • G.O. • Observe • Inquire • Alert • Collaborate

Most Risks Do Have a Reward! Be prepared in order to enjoy.

- More by User

Risk Management

Youth Sports Programs. Charitable Organizations. Common Transfer Options. file://localhost ... by federal, state or local organizations such as schools and city ...

937 views • 24 slides

Insurance & Risk Management 101

Insurance & Risk Management 101. Insurance & Risk Management 101. Presenters: Kymberlee Keefe, National Director of Elder Services, Aon Risk Services Judy Cangealose, Atlanta Healthcare Practice Leader, Aon Risk Services

742 views • 33 slides

Risk Management. F29SO1 Software Engineering. Monica Farrow EM G30 [email protected] www.vision.hw.ac.uk. Risk Management. Risk concerns future happenings For today and yesterday, we are reaping what we sowed by our past actions/inactions

913 views • 29 slides

risk management

2. ????? ??????? ?????? ????? ???? ??????? ?? ????? ??? ?? ??? ?????? ???? ??? ? ???? ?? ???? ?????? : . ????? ?????? ???? risk management ????? ???? ?? ??? ??????? uncertainty ?? ?????? ????? chance of loss????? ???? ???? pure risk ?? ???? ??? ? ???? speculative risk????? ??????? ??????? ???

961 views • 62 slides

RISK MANAGEMENT

2. What is Risk Management ?. A system designed to protect the organization, its employees, patients and visitors from injury, lost work, and loss of tangible and intangible assets. 3. Clinical Risk Management. Program ResponsibilitiesProvide quality oversight for the components of the Risk Man

929 views • 64 slides

Clinical Risk Management: 101

1.36k views • 108 slides

Risk Management “101” Terminology

Risk Management “101” Terminology. Presented for Wisconsin 4-H Youth Development Staff. Youth Emphasis April 2005. Potential Liability Risks. Negligence

235 views • 8 slides

Risk Management 101. Presented at:. Illinois ASBO 61 st Annual Conference May 16, 2012. Presented by:. Michael McHugh Area Executive Vice President Arthur J. Gallagher Risk Management Services, Inc. Introductions. 31+ Years Insurance and Brokerage Experience

638 views • 33 slides

“Management 101”

“Management 101”. Tim Smith President, Gwinnett Cemeteries. I. The Most Important Aspect of Managing People Is …CONSISTENCY!. Examples: GOD PARENTS COACHES TEACHERS

327 views • 20 slides

Risk management

177 views • 4 slides