- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

IRS Form SS-4 Instructions: What It Is and How to Find Yours

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is IRS Form SS-4?

IRS Form SS-4, Application for Employer Identification Number, is an IRS form businesses use to apply for an employer identification number (EIN). Business lenders may require an IRS Form SS-4 notice to verify a business’s EIN when evaluating a loan application.

Applying for a small business loan can be overwhelming, but there are a few things you can do in advance to make applying for a business loan go smoothly. Along with filing your most recent year’s business income tax return (and any past due tax returns , too), you’ll also want to locate and make copies of the documents your lender is likely to request. Among these documents is your IRS Form SS-4. Lenders often ask for the IRS Form SS-4 notice you receive after filing the form, not the form itself.

Here’s everything you need to know about IRS Form SS-4, why it’s important to your lenders, and how to obtain yours.

IRS Form SS-4, “Application for Employer Identification Number,” is the form businesses use to apply for an employer identification number (EIN). A business's EIN is its business tax ID number for use when filing small business taxes.

What is an EIN and why apply for it?

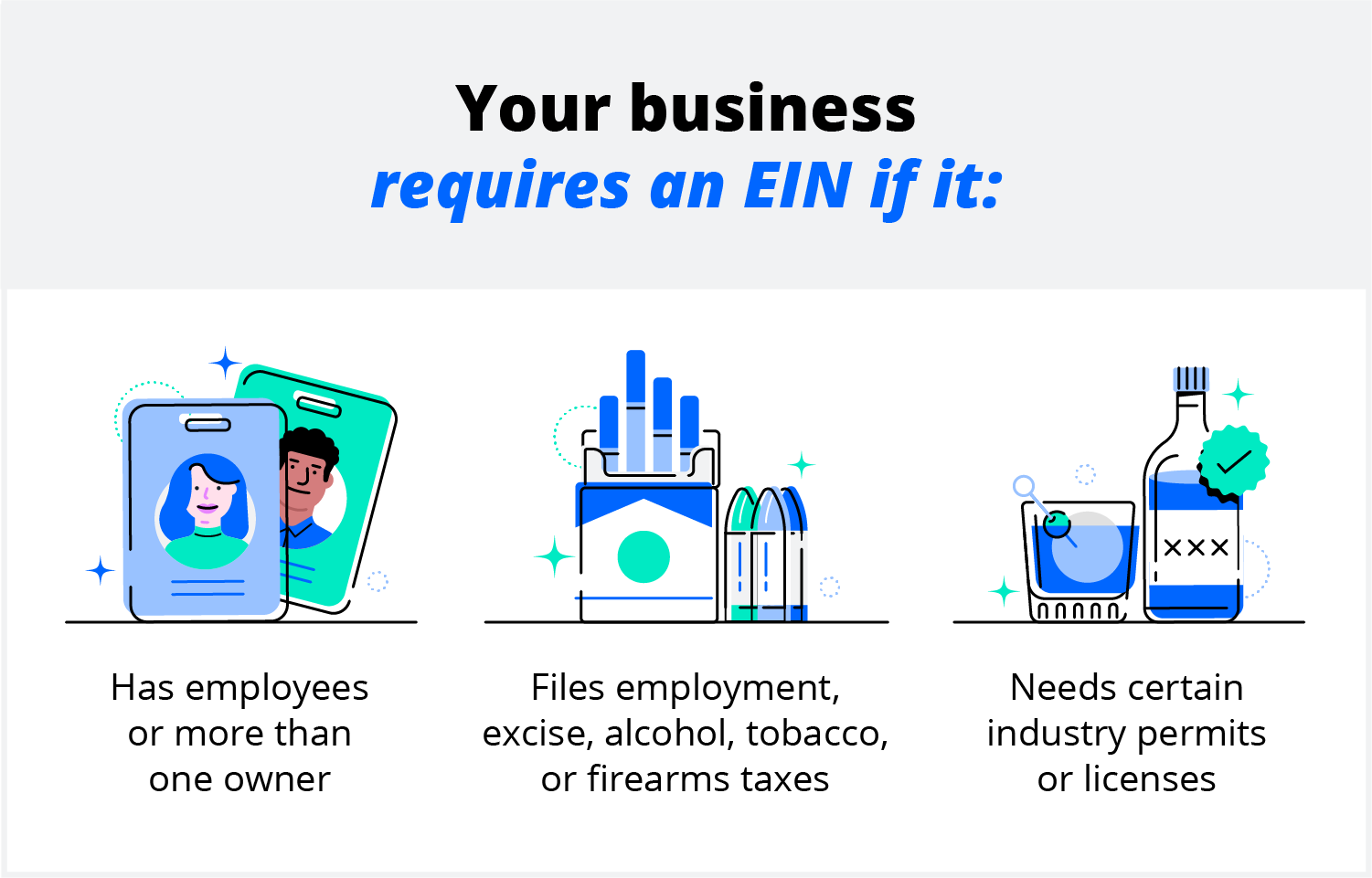

An employer identification number, aka an EIN, is a unique, nine-digit number that many types of businesses need for tax purposes.

If a business has employees, it needs an EIN to pay and file payroll taxes. And certain types of business entities need an EIN to file a business income tax return.

Sole proprietorships and single-person LLCs with no employees are the only types of business entities that are exempt from this requirement.

All U.S.-based businesses have the option of getting an EIN.

There are lots of benefits to having an EIN. For example, with an EIN, you can streamline your bookkeeping processes by separating your personal and business finances, open a business bank account, establish business credit, and even speed up your business loan application.

How to use IRS Form SS-4

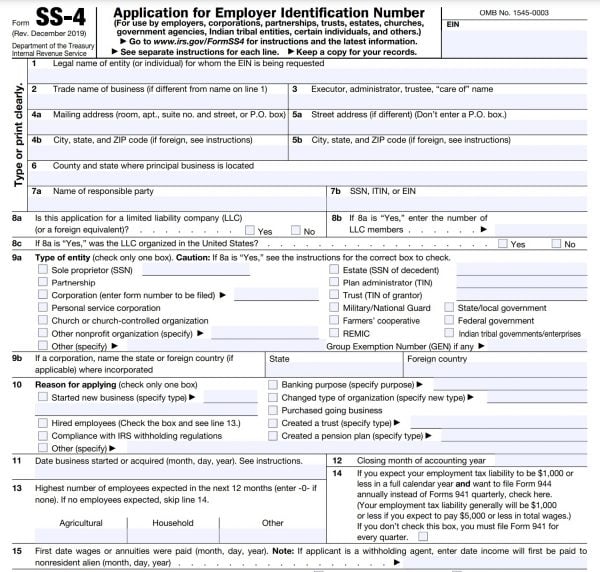

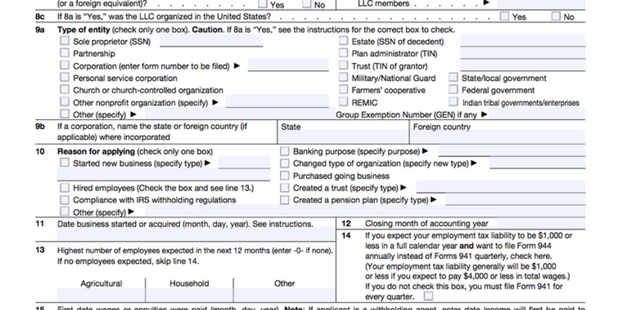

You can get the IRS Form SS-4 on the IRS website. The form is only one page long.

Expect to provide information like:

Your business’s legal name and address

Name of applicant and their SSN, ITIN , or EIN

Type of entity

Reason for applying for an EIN

Date your business started

Highest number of expected employees in the next year

Principal business activity

Principal type of products or services sold or rendered

Also, note that business owners themselves don’t need to apply for their business’s EIN—you can delegate that task to any responsible party, which the IRS defines as the individual or entity that “controls, manages, or directs the applicant entity and the disposition of its funds and assets.” [0] IRS.gov . . Accessed May 10, 2022. View all sources You can apply via mail, fax, or phone (phone for international applicants only).

Why lenders ask for a copy of the IRS Form SS-4

Lenders need to verify EINs, which is why they often request a business’s IRS Form SS-4. However, when a lender asks for your IRS Form SS-4, it's not asking for a copy of your EIN application; it wants the notice the IRS sends out once it assigns your EIN. (Because IRS Form SS-4 is referenced on this notice, the notice itself is often referred to as Form SS-4.)

Why you need IRS Form SS-4 to verify your EIN

Lenders can't just use a tax return to verify an EIN. Clerical errors and typos happen. It’s possible that your tax preparer entered your EIN incorrectly, and the IRS hasn’t notified you of the error yet. This is a common error for returns filed on paper rather than electronically. It can take the IRS months—sometimes even longer—to identify the error and notify you of it.

The SS-4 allows lenders to go straight to the source of the information, which can speed up the underwriting process.

What if you don’t have an SS-4 notice?

If you’re a sole proprietor or an LLC with no employees, you might not have an EIN (these are the only two types of business entities that aren’t required to get an EIN for tax purposes). In that case, the loan will be in your name, and your lender will use your social security number in lieu of an EIN.

But for all other kinds of business entities, the business is a separate and distinct legal entity from the individual. Even if you provide a personal guarantee for a loan, you’ll still need to complete the loan application in the corporation's name, using the corporation’s EIN instead of your Social Security number. That requires an SS-4.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How to get an IRS Form SS-4 notice: Instructions

Look on your hard drive or cloud-based filing system. If you applied for your EIN online, you received an IRS Form SS-4 notice — along with your EIN — immediately as a PDF.

U.S.-based banks require a copy of the IRS Form SS-4 notice in order to open a business bank account. Your banker may be able to get you a copy.

Your accountant might have completed your EIN application form for you and may have a copy.

Call the IRS Business and Specialty Tax Line at (800) 829-4933. After providing your EIN and identifying information about your business, the IRS sends a copy of your EIN assignment letter by mail or by fax. For security purposes, the letter will be sent to the address or fax number the IRS has on file for your business.

» MORE: See our list of IRS phone numbers

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

On a similar note...

- The Excel Capital Team

- Partner With Us

- Small Business Loans

- Unsecured Business Loans

- Business Line of Credit

- Bad Credit Business Loans

- Merchant Cash Advance

- Equipment Financing

- Invoice Factoring

- Business Education

- Business Blog

- Business Loan Calculators

- Write For Us

SS4 Letter – What is it and how to get a copy of yours

When running a business it’s important to understand what legal documents are crucial to keep on file one of the most frequently used is the SS-4 Letter.

When starting a new business the IRS makes you file a variety of forms to register an entity for tax purposes.

The most basic of these forms is a form SS-4. Essentially this is your EIN or Tax ID registration Card.

This form must be kept in a secure place because you will be required to provide the Form SS-4 during various phases of your business.

Acquiring a small business loan is one of them. The business loan process can be a bit overwhelming at times.

You need to research your loan options, gather documentation, and complete paperwork.

The thing is, more of us have enough on our plate and the loan process is wholly unfamiliar to us. Especially when it comes to the documentation that needs to be gathered to apply for a loan.

One such document is Form SS-4, which lenders may request when submitting your application.

What does a ss-4 form look like?

Here is what an ss-4 letter looks like after it is filed and submitter –

If you’re unsure of how to get your Form SS-4 Letter, don’t worry, we’ve got you covered.

You might be thinking what is Form SS-4? Or, What is an ss4 letter?

Form SS-4/ ss4 letter is an IRS form that corporations use to apply for an employer identification number (or EIN) Also known as an SS4 IRS Notification Letter which lists your EIN number and is a formal confirmation you may need frequently.

An EIN is required for several reasons, including:

- Federal tax reporting

- Opening a business bank account

- And applying for a business license

In a nutshell, your EIN is what the IRS uses to identify your business and Form SS-4 Letter is the official IRS form that allows you to obtain an EIN number.

How do you know if you need an EIN? An EIN is required for your business if:

- You have employees

- You’re applying to obtain a business bank account, license, or credit

- Or operate as either a partnership or corporation

- Are operating under any class of incorporation (LLC, S-Corp, C Corp, Non profit ) instead of being a sole proprietor

How to get a copy of your Form SS-4 / EIN Assignment Letter

If you don’t have a copy of Form SS-4 , or have not yet applied for an EIN, you can now use the IRS’ online application tool to submit your Form SS-4 and obtain it.

If you do not wish to apply online through the online application tool on the IRS website you can complete a form and send it off it to the department of treasury.

This is IRS Form SS-4:

If your lender requires a Form SS-4 copy, you’ll need to provide a copy or obtain proof of having submitted the form to the IRS.

Keep in mind that the IRS won’t give you a copy of Form SS-4 itself if you’ve already filled it out previously, but rather an EIN assignment letter which will serve as proof to lenders of having submitted Form SS-4 to the IRS and obtained your EIN.

Here’s how to obtain a copy of your EIN assignment letter:

Step 1: Grab your EIN

First, you’re going to need your EIN handy, so if you don’t know it you can find it on either:

- Any bank accounts that you opened under the corporation required a Tax ID – call your bank to retrieve a copy.

- Or prior corporate tax returns

Once you have your EIN, you’re ready for the next step.

Step 2: Call the IRS

Now, it’s time to take your EIN and call the IRS’ Business & Specialty Tax Line at (800) 829-4933.

The B&S Tax Line is open between 7 A.M. and 7 P.M., Monday through Friday, so make sure you call between those days and hours.

Step 3: Provide the B&S Tax Specialist with your information

Next, once you’ve been connected with a B&S Tax specialist, provide them with the requested information about your company for verification. This will include your EIN and is the reason you gathered it in the previous step.

You’ll also need to verify that you yourself are an authorized contact from within the company. This typically means you’ll be asked to provide your title in the company.

Step 4: Request a copy of your EIN assignment letter

Once verified, all you need to do is request a copy of your EIN assignment letter from the specialist.

It’s important that you not try to request a copy of Form SS-4 as the IRS doesn’t authorize providing copies of completed tax documents like Form SS-4 letter. You need to request a copy of your EIN assignment letter specifically.

Also, keep in mind that, in most cases, the IRS will mail the requested letter copy to the corporate address on file. You can also offer an alternative address or business fax, though, if you need it faster for your loan application.

Get your Form SS-4 Letter

Obtaining a copy of Form SS-4 is just one document required to apply for and obtain a business loan. However, as you can see it’s not at all difficult to obtain. All it requires a bit of know-how and some time spent on the phone.

Whether you’re already beginning the process of obtaining a business loan or are considering it for the future, it’s wise to begin collecting the necessary documents now so you’ll have less to worry about later.

Plus, you’ll avoid any potential delays when applying, which is especially important if you’ll need the funds fast when it comes time to apply.

The Form SS-4 Letter is very important to keep on hand. You never know when you will need it.

See What Your Business Qualifies For

Check out our funding calculators, unsecured business loan calculator.

SBA Loan Calculator

How to get IRS Form SS-4 for your company

File IRS Form SS-4 to get an Employer Identification Number (EIN) so you can hire employees, open a business bank account, or change business structures.

Ready to start your business? Plans start at $0 + filing fees.

by LegalZoom staff

Read more...

Updated on: February 22, 2024 · 8 min read

What is an SS-4?

When does your business need to fill out irs form ss-4.

- What does an SS-4 Form look like, and what’s included?

What information do you need for an EIN application?

How to complete form ss-4, 3 ways to file form ss-4, how to get a copy of your ss-4 form, why get an ein for your business.

Whether you want to hire employees, open a business bank account, or apply for an operating permit, your business needs legal recognition. An employer identification number (EIN) identifies your company for legal and tax purposes. But you can only get one if you file an SS-4 form with the Internal Revenue Service (IRS).

An EIN will allow your business to expand or adapt to new challenges, and proper filing can ensure you get your new tax ID in time for smooth operations. To help your growing business along, we'll explain SS-4s, EINs, and how to move through the application process.

IRS Form SS-4 is the application form for an employer identification number (EIN). Like other tax ID numbers, EINs aren't issued automatically; you can only receive an EIN by filing this specific form.

Not just anyone can fill out and submit Form SS-4. The IRS wants a "responsible party" to complete the document, with or without help from an attorney. The IRS defines a responsible party as the owner or individual who exercises effective control over the entity. Government entities can also serve as responsible parties.

EIN definition

An EIN is a taxpayer identification number (TIN) required for certain businesses and other entities. EINs don't only apply to employers or owners; they identify an organization itself. EINs allow a company or other entity to:

- File certain forms with the IRS

- Legally operate under local or federal laws

- Open business bank accounts

- Apply for business licenses

Note: A Social Security number, individual taxpayer identification number, and employer identification number are all different TINs. An EIN has nine digits, the same as a Social Security number. However, it uses one dash instead of two, such as 66-6666666.

Why do you need an SS-4 for EIN verification?

Banks and other lenders need to verify a business' EIN before lending to them. Since SS-4s go through the IRS, lenders consider them the most reliable source, unlike tax returns or W-9s that could contain typos. Ultimately, sharing an EIN with Form SS-4 speeds up the underwriting and lending process.

What’s the difference between a W-9 and an SS-4?

SS-4s help businesses apply for an EIN, while Form W-9 allows companies to share and verify their EIN with other entities. Over a business's life cycle:

- Form SS-4 provides the tax ID (EIN) it needs to operate

- Form W-9 shares that same tax ID (EIN) with business partners for payment, ID verification, or compliance purposes.

Note: As mentioned above, lenders may not accept a W-9. Other organizations may prefer an SS-4, as well.

- Files business taxes as anything but a sole proprietorship

- Hires employees and pays employment taxes

- Pays alcohol, tobacco, firearm, or excise taxes

- Operates as a limited liability company (LLC), partnership, or corporation

- Opens a business bank account

- Has a qualified retirement plan (also called a Keogh plan)

- Applies for certain permits or licenses

In other words, your business needs an EIN unless you’re a sole proprietor who doesn’t pay employment, alcohol, tobacco, firearm, or excise taxes. However, sole proprietors can still choose to operate under an EIN at their discretion.

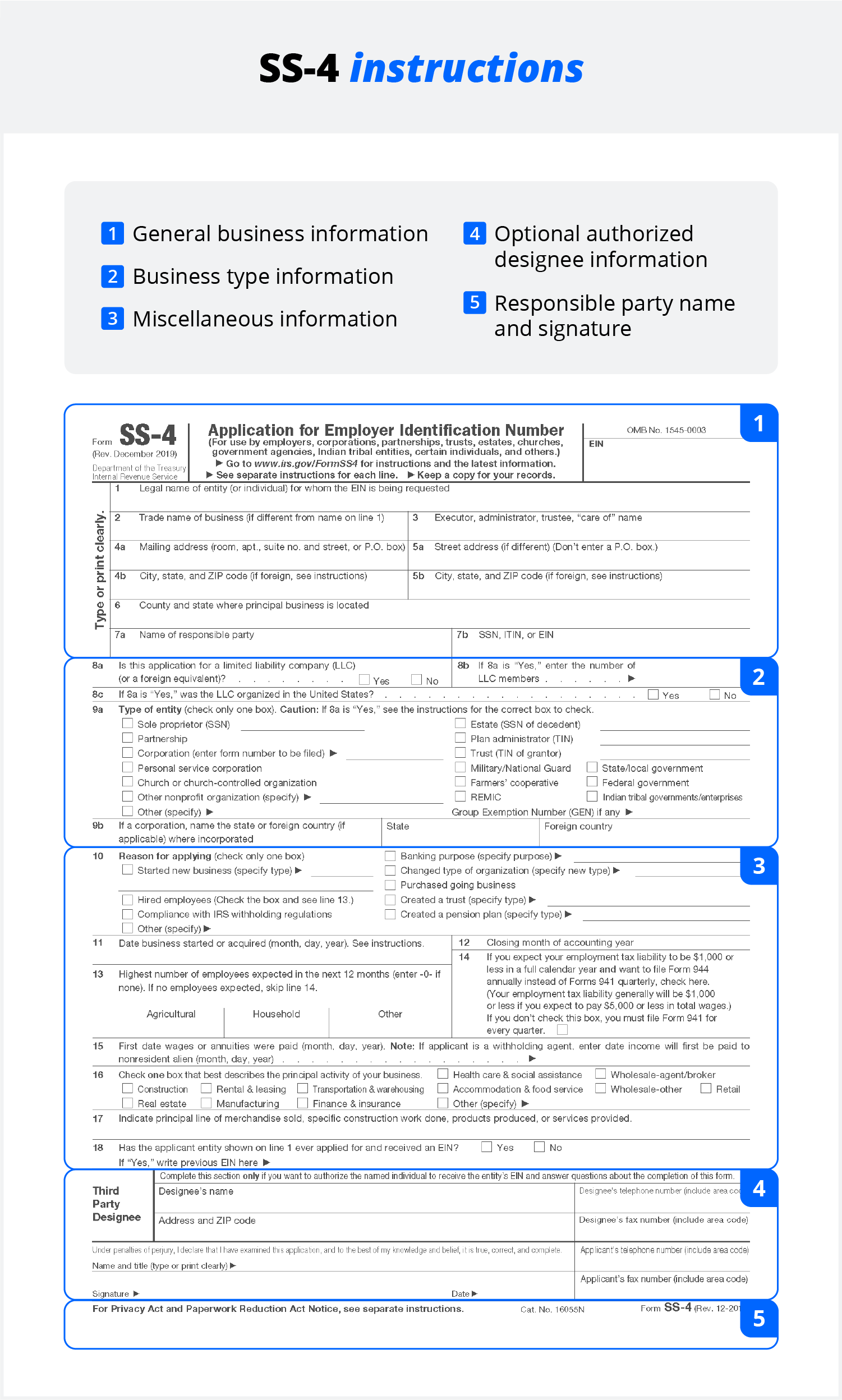

What does an SS-4 Form look like, and what’s included ?

An SS-4 looks like a standard IRS document. Like most business-oriented IRS forms, it contains sections for different types of business information:

- Section 1: Lines 1–7 account for general business information. This includes the entity’s names, addresses, and your responsible party.

- Section 2: Lines 8–9 confirm your business structure.

- Section 3: Lines 10–18 highlight business activities and why you need an EIN.

- Third-party designee: This section allows you to appoint a third party who receives the EIN and answers questions about the form. Business partners and lawyers often work as designees.

- Name and signature: The bottom portion where a responsible party signs and dates the form.

You will need the following information to complete the form, including:

- Legal name of your business

- Trade name of your business, also called a DBA, if you will operate under a name that is different from the legal name

- Optional “in care of" person if you wish to designate someone to receive tax information

- Mailing and street addresses of the business

- County and state where the principal place of business is located

- Responsible party—this is typically the owner, a general partner, or a principal officer

- Social Security number, Individual Taxpayer Identification Number, or EIN of the responsible party

- Business entity type (e.g., sole proprietorship, partnership, LLC, corporation)

- Date your business began or got acquired

In addition, you will need to provide information about your business’ expected employees, principal activities, and history.

An EIN will allow your business to expand or adapt to new challenges.

You can complete the application by planning ahead, obtaining the right documents, filling out the application, authorizing the form, and sending it to the IRS.

1. Plan ahead: How long does it take to complete Form SS-4?

Businesses can complete Form SS-4 within an hour with the right information on hand. Owners with less IRS experience can also consult a tax expert for help. Depending on your application method, you may have to wait days or weeks to receive your EIN. The average turnaround times include:

- Mail: Four to five weeks

- Fax: Approximately four business days

- Online: Immediately after the IRS verifies your information

2. Obtain the form and your business info

As with other IRS forms, you must prepare information such as the business’s legal name, address, and current tax ID (see the full list of items above). You can find this information on tax statements, founding documents, and other federal or state forms.

How to get Form SS-4

There are three ways to obtain an SS-4 form from the IRS. You can obtain the document from:

- The IRS website

- Your local IRS office

- Mail order forms

Applicants can also obtain an SS-4 from local libraries or various tax websites.

3. Fill out the application

An SS-4 includes sections for business and designee information. While the designee section is optional, it can ensure your EIN falls into the most qualified hands. To ensure accuracy, you can ask a lawyer to review the form. They will make sure the SS-4 reflects accurate business information.

4. Authorize the document

A responsible party must sign the SS-4. The responsible party is the fiduciary of an estate or trust, the president or principal officer of a corporation, and the owner or authorized member of other business structures.

- Fiduciary of an estate or trust example: An executor, guardian, or conservator of an estate will qualify.

- Principal officer of a corporation example: Chairs, CEOs, COOs, CFOs, and vice presidents may all qualify as principal officer.

- Other authorized member example: Secretaries, controllers, treasurers, or top managers can authorize the form at a principal officer’s request.

5. Send your SS-4 to the IRS

After reviewing the form, you can send it to the IRS for review—submission methods include online, by fax, and by mail.

You can find details on the full submission process below.

Note: If they encounter any issues, they will contact you or the form-appointed designee.

There are three ways to file an SS-4 form with the IRS: online, through fax, or by mail. Even if you file your form via fax or mail, you should consult the IRS website to ensure you send it to the correct fax number or address, as these may change over time.

Online filing process

You can complete the form and file it on the IRS website. This will enable you to get your EIN immediately.

Fax filing process

You will get your number in about four business days if you file by fax. The correct fax number depends on your location:

- If your principal place of business or legal residence is in one of the 50 states or the District of Columbia, fax your SS-4 to 855-641-6935.

- If your principal place of business and your residence is outside of the U.S., fax it to (855) 215-1627 from inside the U.S. or (304) 707-9471 from outside the U.S.

Be sure to check the most current version of the IRS Instructions for Form SS-4 and the most current version of the SS-4 form itself to be sure you have the most current information.

Mail filing process

It will take about four weeks to get your number if you file by mail. Send Form SS-4 to Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999. Check the current version of the IRS Instructions for Form SS-4, and the SS-4 form itself, to be sure you have current information.

You can obtain a copy of your verified SS-4 by:

- Returning to the IRS online portal where you applied for an EIN. From here, you can re-download the form as a PDF.

- Contacting the IRS at its Business and Specialty Tax Line and EIN Assignment line. The number is: (800) 829-4933.

While you may not need an EIN to operate, getting one opens the door to new avenues of growth.

You may also like

How to write a will: A comprehensive guide to will writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

May 17, 2024 · 11min read

How to get an LLC and start a limited liability company

Considering an LLC for your business? The application process isn't complicated, but to apply for an LLC, you'll have to do some homework first.

March 21, 2024 · 11min read

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

What Is Form SS-4?

Form SS-4 Explained

Who Uses Form SS-4?

Where to get form ss-4, how to fill out form ss-4, can form ss-4 be e-filed, where to mail form ss-4, a word of warning about form ss-4.

Form SS-4 is used by small businesses to apply for a Tax ID/ Employer ID Number (EIN) from the IRS. The form is used for identification of employers, but the number is required for other legal purposes as well. You'll most likely be required to provide an EIN to open a business bank account, as well as for loan applications and for accepting debit and credit cards.

There's no fee to apply for an Employer ID Number from the IRS.

Form SS-4 is a request made to the IRS to assign an EIN to your business. The EIN is nine digits, similar to a Social Security number for individuals but assigned to businesses. Submitting Form SS-4 establishes a tax account for your business tax with the IRS.

Corporations, partnerships , estates, and trusts can use Form SS-4 to request a business tax account and EIN. Sole proprietors don't typically need EINs because they file their tax returns under their Social Security numbers, but they can apply for one if they want to.

You might also have to resubmit a Form SS-4 if you already had an EIN, but the organization structure or ownership of your business has changed.

The IRS provides Form SS-4 online . You can download it, print it out to complete by hand, or fill it in online then print it out. The IRS also provides an online application , but it times out if you take a break and don't keep entering data for a while.

It can be a good idea to print out and work on a draft copy first before you actually apply because Form SS-4 is relatively complicated.

You'll need some information at your fingertips to get started:

- Your business's legal name, its DBA/fictitious name, and address

- The legal business entity you'll be forming, such as a corporation, partnership, sole proprietorship, or LLC

- Whether your LLC is one-member or multiple-member, if this is the entity you've chosen

- Information about your responsible party

- An estimate of how many employees you'll have and how much you anticipate paying them each year

Now you can move on to the various lines on the form.

Line 1: Legal name of entity

This is the business name that every transaction and record will be linked to, so be sure it's absolutely correct. Enter your own name, not the business name, if you're a sole proprietor and applying for an EIN. Enter the business name exactly as it appears on your business registration with your state if you're a corporation, partnership, or LLC.

Line 2: Trade name of the business

Use the "DBA" or fictitious name under which you'll be operating the business. For example, its legal name might be Smith and Smith, LLC, but the operating name might be "Smith Accounting Services." Your operating name is what appears on your signs and other items that customers and clients will see.

Be sure you use the same name (either the legal name or the trade name) on all filings with the IRS to avoid confusion.

Line 3: Executor, administrator, trustee, "care of" name

Use the full first name, middle name, and last name of the person who will be in charge of all legal matters for your business. It should be your “principal officer, general partner , grantor, owner, or trustor," according to the IRS.

This is usually the same person listed on line 7a and the registered agent for an LLC or corporation. Include the Social Security number, ITIN, or EIN of this person or entity.

Lines 4a, 4b, 5a, 5b, and 6

These lines are for your business mailing address, street address, and the county and state where your principal business is located. Leave lines 5a and 5b blank if your street address and mailing address are the same. Line 6 is for the physical location of your business.

Line 7a: Responsible party

This is the individual who will control, manage, or direct the business and its income and assets. According to the IRS, it's the "principal officer, general partner, grantor, owner, or trustor."

Lines 8a, 8b, and 8c

These items are important if you're setting up an LLC. You must provide information in line 8b, "Number of members," and in 8c, "Organized in the United States" if you answer "yes" on line 8a.

Designate your type of business entity here. This is relatively simple unless you have a limited liability company. You'll have to make some distinctions if you have an LLC:

- You're considered by the IRS to be a " disregarded entity " if you're a single-member LLC.

- You would typically be taxed as a partnership if your business is a multiple-member LLC. Check "Partnership" at line 9a if you want your multiple-member LLC to be taxed this way.

- Select the "corporation" option if you want your limited liability company to be taxed as a corporation .

Check with your tax professional if you aren't sure what type of entity to select, or if you don't see your business type listed. The IRS emphasizes that what you check isn't an official election of a tax type. Actually electing a way to be taxed must be done with a different form.

This is for corporations. It asks you to name the state or country where you're incorporated.

Check the reason you're applying for an EIN. For example, you would check "Started a new business" if this is the case and provide a very brief description of your business. You don't have to go into a lot of detail.

Line 11: Date business started

You can choose any reasonable date, such as the day you actually opened your doors and began serving customers. Enter the date you first owned the business or the date you owned it as the business type you cited on line 9a if the business already exists.

The start date is important if you're starting around the end of your fiscal year.

Check with your accountant or tax attorney about the tax implications of startup dates and closing months.

Line 12: Closing month of accounting year

Select your fiscal (financial) year by designating the closing month. This would be December 31 for businesses operating as sole proprietorships , but there may be other reasons for choosing a different date.

This line asks you to select the highest number of employees you expect to hire in the first 12 months. Put the number under "Other" unless you're running a farm or you're hiring household help .

Consider whether you're likely to owe less than $1,000 in employment tax liability for Social Security, Medicare, employee income tax withholding, and unemployment taxes. Mark "no" if you'll have no employees, or if you'll be paying less than $4,000 in wages to all employees over the course of the year. Talk to your tax advisor if you aren't sure.

Complete this item if you'll have employees. Enter the estimated date of your first payroll.

Enter the business classification that best fits your type of business, or enter "Other" and specify what it is. Form SS-4 instructions include detailed definitions of these categories to help you along.

Provide more information on the types of products or services you'll be selling or providing. For example, you might add "dental office" if you checked "health care," or add "coffee shop" if you checked "retail."

Indicate whether your business has ever applied for or received an EIN previously under the legal name you gave on line 1. You can include the name and address of a "third-party designee" to receive your EIN and represent you. You might want your attorney to perform this function.

Finally, sign the form, noting that you declare the application to be "true, correct, and complete." You'll immediately receive your EIN if you've completed Form SS-4 online or by phone.

Print out the page or write down your EIN. You'll need it for a lot of documents and other applications during startup. You'll also receive a confirmation by mail, which you should keep in a safe place.

You can apply online, by phone, by mail, or by fax, but you can't e-file Form SS-4.

Mailing Form SS-4 to the correct IRS address depends on whether you have a principal office, principal agency, or legal residence in the United States. The IRS provides the applicable addresses on its website.

This article is intended to provide general guidelines for new business owners. Form SS-4 is complicated, and this isn't intended to provide legal or tax advice or give you specifics on how to complete the form.

Each business situation is different and your tax professional may have specific directions for you. Please consult with your attorney or CPA to make sure you're in compliance with the tax laws and that you receive the best tax advantage for your specific situation.

Key Takeaways

- IRS Form SS-4 is a business application for an employer identification number (EIN).

- The form and the number establish a business tax account with the IRS.

- The form is for corporations, partnerships, estates, and trusts. Sole proprietors can do business under their own Social Security numbers, but they can apply for an EIN if they elect to do so.

- Form SS-4 can be filed online or mailed to the IRS, but it can’t be e-filed. You can also apply by telephone.

IRS. " Instructions for Form SS-4 (12/2019) ." Accessed Aug. 9, 2020.

IRS. " Employer Identification Number Understanding Your EIN ," Page 3. Accessed Aug. 9, 2020.

IRS. " Frequently Asked Questions / Form SS 4 & Employer Identification Number (EIN) 2 ." Accessed Aug. 9, 2020.

IRS. " Apply for an Employer Identification Number (EIN) Online ." Accessed Aug. 9, 2020.

Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

What Is Form SS-4? Applying for an EIN for Your Business

Some businesses are required to have a Federal Employer Identification Number (FEIN). FEINs, or EINs, are used by employers and other businesses for tax filing and reporting purposes.

FEINs work similarly to Social Security numbers. When you include your business’s unique nine-digit number on documents, the IRS can easily identify your company.

One way to apply for this taxpayer identification number for your business is to file Form SS-4. What is Form SS-4?

Form SS-4, Application for Employer Identification Number, is a form you file with the IRS to apply for an EIN .

On this FEIN form, you must provide information about your business, including your business’s legal name, address, type of business structure , and reasons for applying.

Prior to 2007, completing Form SS-4 and filing it with the IRS was the only way business owners could apply for EINs. However, the IRS also lets businesses apply online. Business owners who apply online enter their information and, if they are accepted, instantly receive their EIN.

Who needs to file Form SS-4?

You need to file Form SS-4 if your business is required to have an FEIN.

You must have an EIN if:

- You have employees

- You’re structured as a corporation or partnership

- You meet other IRS requirements

When you file documents like Form W-2, you must include your EIN. That way, the IRS can identify your business.

Although you now have the option to conveniently apply for your FEIN online, some businesses prefer filing Form SS-4.

So, if you are required to have an FEIN and don’t want to apply online, you need to file the SS-4 form.

Download our free guide to learn what you need to do before, during, and after hiring your first employee (e.g., employer registration, payroll decisions, etc.).

Where to send Form SS-4 application

You must send Form SS-4 to the IRS. You may either mail or fax the form.

Mailing IRS Form SS-4 takes the longest time. According to the IRS, applications take up to four weeks to process if you mail them. If time is not an issue, you can complete Form SS-4 and send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Filling out Form SS-4 and faxing it to the IRS is a less lengthy process than mailing it. If you provide a return fax number, the IRS will send your EIN within four business days. If your principal business, office or agency, or legal residence is located in one of the 50 states or D.C., fax your form to 855-641-6935.

Form SS-4 instructions

To file Form SS-4, you need a copy of the official document. You can find Form SS-4 online on the IRS’s website . Type directly in the PDF or print the form and record your answers by hand.

The form first asks you information about your business, including legal name of business, address, and name of responsible party. You will also need to provide your Social Security number on the form.

Next, the application will ask you how your business is structured. Your business might be structured as a:

- Sole proprietorship

- Partnership

- Corporation

You will also need to provide the reason you are applying for your EIN. Did you start a new business? Have you hired employees? The form lists many reasons for applying, so make sure you know why you’re applying.

The IRS also wants to know information about your industry, the date you first paid wages, and what kind of products or services you provide.

There is other information you will need to provide on Form SS-4, so be sure to read and fill it out carefully.

What to do if you need a copy of Form SS-4

Before you send in Form SS-4 to the IRS, you should make a copy of it to keep for your records. You cannot ask the IRS for a copy if you lose yours or forget to make one.

When you receive your EIN, make sure to keep it in a secure location. If you lose your EIN, do not fill out Form SS-4 again. Instead, look for copies of documents you’ve recorded it on. If you still cannot find it, you can call the IRS’s Business & Specialty Tax Line .

Although the IRS won’t give you a copy of Form SS-4, you can ask them to give a copy of your EIN assignment letter by calling the Business & Specialty Tax Line.

If you’re ready to hire employees, you need a simple way to pay them. Patriot’s online payroll software lets you run payroll in three easy steps. And, we offer free setup and support. Give us a try, for free, today!

This article has been updated from its original publication date of July 2, 2018.

This is not intended as legal advice; for more information, please click here.

Stay up to date on the latest payroll tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

What Is a Form SS-4 & How Do I Get a Copy of Mine?

Running a business involves a lot of information and new documents. You’re probably learning that you have a business credit score for example, and that you can check it for free with places like Nav . If you’re filing your business taxes or thinking of applying for business financing for the first time, you might be scrambling to find a few things for the application. One thing that likely stands out is your Employer Identification Number (EIN), a unique nine-digit number assigned to your business by the IRS. You can think of it as your company’s social security number. In order to know what your EIN is, you’ll need to file Form SS-4 with the IRS. Once the IRS has assigned an EIN to your business, you’ll receive your Form SS-4 notice, which serves as verification of your EIN to potential lenders.

The Form SS-4 notice differs from the Form SS-4 in that a Form SS-4 is simply the application for an EIN, and the notice is proof that you have an EIN.

Why You Need Your Form SS-4 Notice

Anytime you apply for a business loan, you’ll likely see ‘Form SS-4’ listed as one of the required documents. Be aware that this does NOT refer to the Form SS-4, but to the Form SS-4 n otice , which is proof that your entity has been issued an EIN by the IRS. It’d be like submitting your application for a driver’s license instead of providing the actual issued license, although there are no cards issued for an EIN.

Improve your business’s financial health profile to unlock better financing options

Improve your business credit history through tradeline reporting, know your borrowing power from your credit details, and access the best funding – only at Nav.

You won’t be able to use your tax returns as verification of your EIN, because errors on business tax returns are common and your lender knows this. Without the Form SS-4 Notice, your loan application process could be delayed, putting your business behind schedule on any big plans you may have.

How to Get Your Form SS-4 Notice

Form SS-4 , the application for an EIN, is available online. You’ll need information about your business, including the administrator or trustee of your business, and name of responsible party along with their social security number or tax ID. You’ll also need to know what type of entity your business is (sole proprietor, partnership, corporation, non-profit, etc.). You can apply online as well.

While your Form SS-4 notice will usually arrive within two weeks, it is recommended that you apply at least four or five weeks prior to when you need your EIN in case of any hangups in the process. That means you should look ahead to when you anticipate you’ll be applying for credit, filing taxes, or any other activity for which you’ll need your EIN, and time it out correctly.

What If I Lose My Form SS-4 Notice?

In the unfortunate situation that you can’t find your Form SS-4 notice, you will not be able to receive a new physical copy. However, hope is not lost. You can contact a lender with whom you previously applied for credit, check old tax returns, or look for the computer-generated notice that was sent to you when your entity was issued an EIN. You should always verify in this situation that you have the correct number by calling the IRS . As long as an authorized person makes the call and has verifiable information available, they should be able to provide the number over the phone.

Despite stereotypes, the IRS has a system in place to help you out in this situation. Be sure to use the resources available to make sure your information is in your hands and correct. By having all the necessary information in place, you can be prepared to take the next steps with your business.

Accelerate your path to better funding

Build business credit history, see your business credit-building impact, and secure new funding options — only with Nav Prime.

This article was originally written on June 15, 2018.

Rate This Article

This article currently has 13 ratings with an average of 3 stars.

Connor Wilson

Connor Wilson is Nav's Content Manager. With experience in loan underwriting and credit review, he brings a strong desire to help business owners make the best financial decisions possible to every piece he writes and edits.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

Still need to file? An expert can help or do taxes for you with 100% accuracy. Get started

What is IRS Form SS-4? A Step-by-Step Guide to Getting an EIN

Explore what IRS Form SS-4 is, why it's important, and how to fill it out correctly to get your Employer Identification Number (EIN).

Purpose of the SS-4 Form

Required information on the ss-4 form, the application process for an ein, how to file online, why file online, what to do if you can’t complete it online, third party designee, form ss-4: the first step in your entrepreneurial journey.

_1_11zon.jpg)

Key Takeaways

- IRS Form SS-4 is used to obtain an Employer Identification Number (EIN) for your business or other entity such as a trust or estate.

- The SS-4 form requires detailed information about the business, including the legal name, business type, and reason for applying.

- You can apply for an EIN directly through the IRS website or by mailing or faxing your SS-4 form.

- Filing your SS-4 online is faster and simpler, and in many cases, you’ll receive your EIN immediately.

The Federal Employer Identification Number (EIN) Application, otherwise known as IRS Form SS-4, is an official document used to request a Federal EIN. Essentially, you apply through Form SS-4 to obtain a unique nine-digit number that can be considered the Social Security number for your business entity.

An EIN is necessary for certain businesses, as it allows the IRS to identify your business for tax purposes when it is not appropriate to use your Social Security number. The EIN can be used in various business activities such as opening business bank accounts and paying employment taxes.

An EIN isn't just a recommendation, but it's often a requirement for many types of businesses. Let's explore some of the reasons why a business needs an EIN:

- Business Formation: When you form a business structure like a corporation or a partnership, an EIN is generally required, as it provides an ID for your business for tax purposes.

- Hiring Employees: If you're a business owner planning to hire employees, the IRS requires you to have an EIN to handle employment taxes, employee tax withholdings and reporting.

- Opening Business Bank Accounts: Traditional banks and online financial institutions often require an EIN to open business bank accounts. Having a separate business banking account can also help to differentiate personal finances from business transactions, aid in bookkeeping, and make tax time more straightforward.

- Obtaining Business Licenses and Permits: Business licenses and permits often require businesses to provide their EIN.

- Forming certain Trusts, Pension Plans, or Non-Profits: Certain entity types that aren't necessarily traditional businesses also often need an EIN. These can include trusts, pension plans, and non-profit organizations.

The SS-4 form requires detailed information about the business. This includes the legal name and taxpayer identification number (TIN) of the sole proprietor or authorized individual, details about the business type, and the reason for applying for an EIN.

Let's break down the key elements of the SS-4 form:

- Legal Name and Trade Name : Include your official business name and, if different, the name your business operates under.

- Executor, Administrator, Trustee, or “care of” name : The person handling the application process on the company's behalf.

- Mailing Address : The primary address where the business receives official mail.

- County and State where Principal Business is located : The physical business location.

- Entity Type : Specify your business structure (corporation, partnership, sole proprietorship, etc.).

- Reason for Application : List out why you need an EIN. This can range from starting a new business, hiring employees to changing organization type.

- Third Party Designee : If a third-party is handling this process, include their info.

- Business Details : Information about the goods you sell, services you provide, or other relevant activities.

Filing online for an EIN can be done directly through the IRS website. The immediate processing of forms ensures a streamlined application process. But don't worry if you can't apply online; there are alternative methods available.

Filing your Form SS-4 online is the faster and cleaner way to process your application. Visit the IRS website, navigate to the online registration process, and follow the step-by-step instructions.

Filing the SS-4 form online comes with several advantages. Along with being free, it's quicker and can be done anywhere, anytime. Once you submit the form, the information is processed immediately, and, if eligible, you’ll receive your EIN instantly. This speedy process can help streamline your business operations.

TurboTax Tip: Keep a copy of your EIN in your records after completing your form SS-4. This can be useful for future reference, such as if you need to verify your EIN later and simplify your daily operations and annual tax filing.

If you can't apply online, alternative options include mailing or faxing your SS-4 form to the IRS. Although these methods take longer, they still serve as viable ways to acquire your EIN.

If you'd rather have someone else complete the SS4 form process for you, you have the option of designating a third party to handle your application.

IRS Form SS-4 includes a section where you can specify a third party designee. This person acts on your behalf. They receive the EIN once it's assigned and can answer questions about the completion of Form SS-4.

Who can be a Third Party Designee? We're talking about either individuals you trust (like a family member or close friend) or professionals such as your accountant, attorney, or a paid tax preparer. It's someone who's familiar with your financial details and whom you trust to represent you accurately and responsibly.

The designee will need to provide their name, address, phone number, and their relationship to the business owner or company on the form.

Remember, you're giving considerable permission to your designee, so it's essential to take caution. Ensure that they fully understand their responsibilities and can handle the role effectively. Once your application is approved and you have received your EIN, the third-party designee’s authority to act on your behalf concludes.

Starting a business can feel complex, but the good news is the IRS SS-4 Form is straightforward and will secure the all-important EIN for your business. This isn't just paperwork; it’s concrete progress toward launching your business.

With TurboTax Live Business , get unlimited expert help while you do your taxes, or let a tax expert file completely for you, start to finish. Get direct access to small business tax experts who are up to date with the latest federal, state and local taxes. Small business owners get access to unlimited, year-round advice and answers at no extra cost, maximize credits and deductions, and a 100% Accurate, Expert Approved guarantee.

Let a small business tax expert do your taxes for you

Get matched with a tax expert who prepares and files everything for you. Your dedicated expert will find every dollar you deserve, guaranteed .

TurboTax Full Service Business is perfect for partnerships, S-corps, and multi-member LLCs.

Small Business taxes done right, with unlimited expert advice as you go

Get unlimited tax advice right on your screen from live experts as you do your taxes. All with a final review before you file.

TurboTax Live Assisted Business is perfect for partnerships, S-corps, and multi-member LLCs.

*Available in select states

Looking for more information?

Related articles, more in small business taxes.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

TaxCaster Tax Calculator

Estimate your tax refund and where you stand

I’m a TurboTax customer

I’m a new user

Tax Bracket Calculator

Easily calculate your tax rate to make smart financial decisions

Get started

W-4 Withholding Calculator

Know how much to withhold from your paycheck to get a bigger refund

Self-Employed Tax Calculator

Estimate your self-employment tax and eliminate any surprises

Crypto Calculator

Estimate capital gains, losses, and taxes for cryptocurrency sales

Self-Employed Tax Deductions Calculator

Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

ItsDeductible™

See how much your charitable donations are worth

Read why our customers love Intuit TurboTax

Rated 4.6 out of 5 stars by our customers.

(672347 reviews of TurboTax Online)

Star ratings are from 2023

Your security. Built into everything we do.

File faster and easier with the free turbotax app.

TurboTax Online: Important Details about Filing Form 1040 Returns with Limited Credits

A Form 1040 return with limited credits is one that's filed using IRS Form 1040 only (with the exception of the specific covered situations described below). Roughly 37% of taxpayers are eligible. If you have a Form 1040 return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax Live Assisted Basic or TurboTax Full Service at the listed price.

Situations covered (assuming no added tax complexity):

- Interest or dividends (1099-INT/1099-DIV) that don’t require filing a Schedule B

- IRS standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Student loan interest deduction

Situations not covered:

- Itemized deductions claimed on Schedule A

- Unemployment income reported on a 1099-G

- Business or 1099-NEC income

- Stock sales (including crypto investments)

- Rental property income

- Credits, deductions and income reported on other forms or schedules

* More important offer details and disclosures

Turbotax online guarantees.

TurboTax Individual Returns:

- 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2023 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current 2023 tax year and for individual, non-business returns for the past two tax years (2022, 2021). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

- 100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

TurboTax Business Returns:

- 100% Accurate Calculations Guarantee – Business Returns. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See Terms of Service for details.

- TurboTax Audit Support Guarantee – Business Returns. If you receive an audit letter from the IRS or State Department of Revenue on your 2023 TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current 2023 tax year. Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals for this question-and-answer support, we will refund the applicable TurboTax Live Business or TurboTax Live Full Service Business federal and/or state purchase price paid. Additional terms and limitations apply. See Terms of Service for details.

TURBOTAX ONLINE/MOBILE PRICING:

- Start for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. Special discount offers may not be valid for mobile in-app purchases. Strikethrough prices reflect anticipated final prices for tax year 2023.

- TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing Form 1040 and limited credits only, as detailed in the TurboTax Free Edition disclosures. Roughly 37% of taxpayers qualify. Offer may change or end at any time without notice.

- TurboTax Live Assisted Basic Offer: Offer only available with TurboTax Live Assisted Basic and for those filing Form 1040 and limited credits only. Roughly 37% of taxpayers qualify. Must file between November 29, 2023 and March 31, 2024 to be eligible for the offer. Includes state(s) and one (1) federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion. If you add services, your service fees will be adjusted accordingly. If you file after 11:59pm EST, March 31, 2024, you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here.

- Full Service $100 Back Offer: Credit applies only to federal filing fees for TurboTax Full Service and not returns filed using other TurboTax products or returns filed by Intuit TurboTax Verified Pros. Excludes TurboTax Live Full Service Business and TurboTax Canada products . Credit does not apply to state tax filing fees or other additional services. If federal filing fees are less than $100, the remaining credit will be provided via electronic gift card. Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. Must file by April 15, 2024 11:59 PM ET.

- TurboTax Full Service - Forms-Based Pricing: “Starting at” pricing represents the base price for one federal return (includes one W-2 and one Form 1040). Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes. Estimates are based on initial information you provide about your tax situation, including forms you upload to assist your expert in preparing your tax return and forms or schedules we think you’ll need to file based on what you tell us about your tax situation. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them.

- Pays for itself (TurboTax Premium, formerly Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2022. Actual results will vary based on your tax situation.

TURBOTAX ONLINE/MOBILE:

- Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app.

- Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Get your tax refund up to 5 days early: Individual taxes only. When it’s time to file, have your tax refund direct deposited with Credit Karma Money™, and you could receive your funds up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early. 5-day early program may change or discontinue at any time. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

- For Credit Karma Money (checking account): Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

- Fees: Third-party fees may apply. Please see Credit Karma Money Account Terms & Disclosures for more information.

- Pay for TurboTax out of your federal refund or state refund (if applicable): Individual taxes only. Subject to eligibility requirements. Additional terms apply. A $40 Refund Processing Service fee may apply to this payment method. Prices are subject to change without notice.

- TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premium, TurboTax Live Assisted and TurboTax Live Full Service; not included with Free Edition (but is available as an upgrade). TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Limitations apply See Terms of Service for details.

- Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live Assisted or as an upgrade from another version, and available through December 31, 2024. Intuit will assign you a tax expert based on availability. Tax expert and CPA availability may be limited. Some tax topics or situations may not be included as part of this service, which shall be determined in the tax expert’s sole discretion. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. The tax expert will sign your return as a preparer. The ability to retain the same expert preparer in subsequent years will be based on an expert’s choice to continue employment with Intuit. Administrative services may be provided by assistants to the tax expert. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

- TurboTax Live Full Service – Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. These situations may include but are not limited to multiple sources of business income, large amounts of cryptocurrency transactions, taxable foreign assets and/or significant foreign investment income. Offer details subject to change at any time without notice. Intuit, in its sole discretion and at any time, may determine that certain tax topics, forms and/or situations are not included as part of TurboTax Live Full Service. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Additional limitations apply. See Terms of Service for details.

- TurboTax Live Full Service - File your taxes as soon as today: TurboTax Full Service Experts are available to prepare 2023 tax returns starting January 8, 2024. Based on completion time for the majority of customers and may vary based on expert availability. The tax preparation assistant will validate the customer’s tax situation during the welcome call and review uploaded documents to assess readiness. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation.

- TurboTax Live Full Service -- Verified Pro -- “Local” and “In-Person”: Not all feature combinations are available for all locations. "Local" experts are defined as being located within the same state as the consumer’s zip code for virtual meetings. "Local" Pros for the purpose of in-person meetings are defined as being located within 50 miles of the consumer's zip code. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. Not all pros provide in-person services.

- Smart Insights: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits, and is available through 11/1/2024. Terms and conditions may vary and are subject to change without notice.

- My Docs features: Included with TurboTax Deluxe, Premium TurboTax Live, TurboTax Live Full Service, or with PLUS benefits and is available through 12/31/2024. Terms and conditions may vary and are subject to change without notice.

- Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premium, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2024. Terms and conditions may vary and are subject to change without notice.

- Easy Online Amend: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits. Make changes to your 2023 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10/31/2026. Terms and conditions may vary and are subject to change without notice. For TurboTax Live Full Service, your tax expert will amend your 2023 tax return for you through 11/15/2024. After 11/15/2024, TurboTax Live Full Service customers will be able to amend their 2023 tax return themselves using the Easy Online Amend process described above.

- #1 best-selling tax software: Based on aggregated sales data for all tax year 2022 TurboTax products.

- #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2023, tax year 2022. Self-Employed defined as a return with a Schedule C tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA prepared returns, 2022.

- CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees . Limitations apply. See Terms of Service for details.

- TurboTax Premium Pricing Comparison: Cost savings based on a comparison of TurboTax product prices to average prices set forth in the 2020-2021 NSA Fees-Acct-Tax Practices Survey Report.

- 1099-K Snap and Autofill: Available in mobile app and mobile web only.

- 1099-NEC Snap and Autofill: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). Available in mobile app only. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

- Year-Round Tax Estimator: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). This product feature is only available after you finish and file in a self-employed TurboTax product.

- **Refer a Friend: Rewards good for up to 20 friends, or $500 - see official terms and conditions for more details.

- Refer your Expert (Intuit’s own experts): Rewards good for up to 20 referrals, or $500 - see official terms and conditions for more details.

- Refer your Expert (TurboTax Verified Independent Pro): Rewards good for up to 20 referrals, or $500 - see official terms and conditions for more details

- Average Refund Amount: Sum of $3140 is the average refund American taxpayers received based upon IRS data date ending 2/17/23 and may not reflect actual refund amount received.

- Average Deduction Amount: Based on the average amount of deductions/expenses found by TurboTax Self Employed customers who filed expenses on Schedule C in Tax Year 2022 and may not reflect actual deductions found.

- More self-employed deductions based on the median amount of expenses found by TurboTax Premium (formerly Self Employed) customers who synced accounts, imported and categorized transactions compared to manual entry. Individual results may vary.

- TurboTax Online Business Products: For TurboTax Live Assisted Business and TurboTax Full Service Business, we currently don’t support the following tax situations: C-Corps (Form 1120-C), Trust/Estates (Form 1041), Multiple state filings, Tax Exempt Entities/Non-Profits, Entities electing to be treated as a C-Corp, Schedule C Sole proprietorship, Payroll, Sales tax, Quarterly filings, and Foreign Income. TurboTax Live Assisted Business is currently available only in AK, AZ, CA, CO, FL, GA, IL, MI, MO, NC, NV, NY, OH, PA, SD, TX, UT, VA, WA, and WY.

- Audit Defense: Audit Defense is a third-party add-on service provided, for a fee, by TaxResources, Inc., dba Tax Audit. See Membership Agreements at https://turbotax.intuit.com/corp/softwarelicense/ for service terms and conditions.

TURBOTAX DESKTOP GUARANTEES

TurboTax Desktop Individual Returns:

- 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state software license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2023 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax Desktop for the current 2023 tax year and, for individual, non-business returns, for the past two tax years (2021, 2022). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Satisfaction Guarantee/ 60-Day Money Back Guarantee: If you're not completely satisfied with TurboTax Desktop, go to refundrequest.intuit.com within 60 days of purchase and follow the process listed to submit a refund request. You must return this product using your license code or order number and dated receipt.

TurboTax Desktop Business Returns:

- 100% Accurate Calculations Guarantee – Business Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See License Agreement for details.

- Maximum Tax Savings Guarantee – Business Returns: If you get a smaller tax due (or larger business tax refund) from another tax preparation method using the same data, TurboTax will refund the applicable TurboTax Business Desktop license purchase price you paid. Additional terms and limitations apply. See License Agreement for details.

TURBOTAX DESKTOP

- Installation Requirements: Product download, installation and activation requires an Intuit Account and internet connection. Product limited to one account per license code. You must accept the TurboTax License Agreement to use this product. Not for use by paid preparers.

- TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees may apply for e-filing state returns. E-file fees may not apply in certain states, check here for details . Savings and price comparison based on anticipated price increase. Software updates and optional online features require internet connectivity.

- Fastest Refund Possible: Fastest federal tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Average Refund Amount: Sum of $3140 is the average refund American taxpayers received based upon IRS data date ending 02/17/23 and may not reflect actual refund amount received.

- TurboTax Product Support: Customer service and product support hours and options vary by time of year.

- #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2022 TurboTax products.

- Deduct From Your Federal or State Refund (if applicable): A $40 Refund Processing Service fee may apply to this payment method. Prices are subject to change without notice.