- REALTOR® Store

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency. Close

- Social Media

- Sales Tips & Techniques

- MLS & Online Listings

- Starting Your Career

- Being a Broker

- Being an Agent

- Condominiums

- Smart Growth

- Vacation, Resort, & 2nd Homes

- FHA Programs

- Home Inspections

- Arbitration & Dispute Resolution

- Fair Housing

- All Membership Benefits

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®. Close

- Directories Complete listing of state and local associations, MLSs, members, and more. Close

- Dues Information & Payment

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed. Close

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms. Close

- Your Membership Account Review your membership preferences and Code of Ethics training status. Close

- Highlights & News Get the latest top line research, news, and popular reports. Close

- Housing Statistics National, regional, and metro-market level housing statistics where data is available. Close

- Research Reports Research on a wide range of topics of interest to real estate practitioners. Close

- Presentation Slides Access recent presentations from NAR economists and researchers. Close

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work. Close

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends. Close

- Statistical News Release Schedule

- Advocacy Issues & News

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you. Close

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States. Close

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party. Close

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment. Close

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice. Close

- All Education & Professional Development

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base. Close

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members. Close

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license. Close

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates. Close

- Library & Archives Offering research services and thousands of print and digital resources. Close

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Close

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees. Close

- Latest News

- NAR Newsroom Official news releases from NAR. Close

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools. Close

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Close

- Newsletters Stay informed on the most important real estate business news and business specialty updates. Close

- NAR NXT, The REALTOR® Experience

- REALTORS® Legislative Meetings

- AE Institute

- Leadership Week

- Sustainability Summit

- Mission, Vision, and Diversity & Inclusion

- Code of Ethics

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more. Close

- Committee & Liaisons

- History Founded as the National Association of Real Estate Exchanges in 1908. Close

- Affiliated Organizations

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan. Close

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations. Close

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation. Close

- NAR's Consumer Outreach

- Find a Member

- Browse All Directories

- Find an Office

- Find an Association

- NAR Group and Team Directory

- Committees and Directors

- Association Executive

- State & Local Volunteer Leader

- Buyer's Rep

- Senior Market

- Short Sales & Foreclosures

- Infographics

- First-Time Buyer

- Window to the Law

- Next Up: Commercial

- New AE Webinar & Video Series

- Drive With NAR

- Real Estate Today

- The Advocacy Scoop

- Center for REALTOR® Development

- Leading with Diversity

- Good Neighbor

- NAR HR Solutions

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency.

- Marketing Social Media Sales Tips & Techniques MLS & Online Listings View More

- Being a Real Estate Professional Starting Your Career Being a Broker Being an Agent View More

- Residential Real Estate Condominiums Smart Growth Vacation, Resort, & 2nd Homes FHA Programs View More Home Inspections

- Legal Arbitration & Dispute Resolution Fair Housing Copyright View More

- Commercial Real Estate

- Right Tools, Right Now

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®.

- Directories Complete listing of state and local associations, MLSs, members, and more.

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed.

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms.

- Your Membership Account Review your membership preferences and Code of Ethics training status.

- Highlights & News Get the latest top line research, news, and popular reports.

- Housing Statistics National, regional, and metro-market level housing statistics where data is available.

- Research Reports Research on a wide range of topics of interest to real estate practitioners.

- Presentation Slides Access recent presentations from NAR economists and researchers.

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work.

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends.

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you.

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States.

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party.

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment.

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice.

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base.

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members.

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license.

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates.

- Library & Archives Offering research services and thousands of print and digital resources.

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism.

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees.

- NAR Newsroom Official news releases from NAR.

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools.

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends.

- Newsletters Stay informed on the most important real estate business news and business specialty updates.

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more.

- History Founded as the National Association of Real Estate Exchanges in 1908.

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan.

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations.

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation.

- Top Directories Find a Member Browse All Directories Find an Office Find an Association NAR Group and Team Directory Committees and Directors

- By Role Broker Association Executive New Member Student Appraiser State & Local Volunteer Leader

- By Specialty Commercial Global Buyer's Rep Senior Market Short Sales & Foreclosures Land Green

- Multimedia Infographics Videos Quizzes

- Video Series First-Time Buyer Level Up Window to the Law Next Up: Commercial New AE Webinar & Video Series

- Podcasts Drive With NAR Real Estate Today The Advocacy Scoop Center for REALTOR® Development

- Programs Fair Housing Safety Leading with Diversity Good Neighbor NAR HR Solutions

- Writing a Business Plan

Writing a business plan may seem a daunting task as there are so many moving parts and concepts to address. Take it one step at a time and be sure to schedule regular review (quarterly, semi-annually, or annually) of your plan to be sure you on are track to meet your goals.

Why Write a Business Plan?

Making a business plan creates the foundation for your business. It provides an easy-to-understand framework and allows you to navigate the unexpected.

Quick Takeaways

- A good business plan not only creates a road map for your business, but helps you work through your goals and get them on paper

- Business plans come in many formats and contain many sections, but even the most basic should include a mission and vision statement, marketing plans, and a proposed management structure

- Business plans can help you get investors and new business partners

Source: Write Your Business Plan: United States Small Business Association

Writing a business plan is imperative to getting your business of the ground. While every plan is different – and most likely depends on the type and size of your business – there are some basic elements you don’t want to ignore.

Latest on this topic

NAR Library & Archives has already done the research for you. References (formerly Field Guides) offer links to articles, eBooks, websites, statistics, and more to provide a comprehensive overview of perspectives. EBSCO articles ( E ) are available only to NAR members and require the member's nar.realtor login.

Defining Your Mission & Vision

Writing a business plan begins by defining your business’s mission and vision statement. Though creating such a statement may seem like fluff, it is an important exercise. The mission and vision statement sets the foundation upon which to launch your business. It is difficult to move forward successfully without first defining your business and the ideals under which your business operates. A company description should be included as a part of the mission and vision statement. Some questions you should ask yourself include:

- What type of real estate do you sell?

- Where is your business located?

- Who founded your business?

- What sets your business apart from your competitors?

What is a Vision Statement ( Business News Daily , Jan. 16, 2024)

How to Write a Mission Statement ( The Balance , Jan. 2, 2020)

How to Write a Mission Statement ( Janel M. Radtke , 1998)

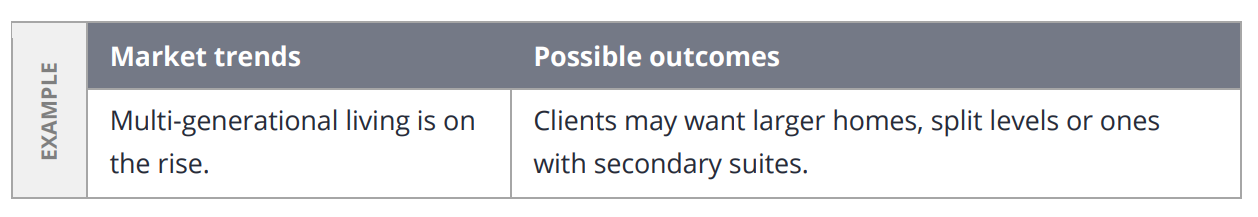

Using a SWOT Analysis to Structure Your Business Plan

Once you’ve created a mission and vision statement, the next step is to develop a SWOT analysis. SWOT stands for “Strengths, Weaknesses, Opportunities, and Threats.” It is difficult to set goals for your business without first enumerating your business’s strengths and weaknesses, and the strengths and weaknesses of your competitors. Evaluate by using the following questions:

- Do you offer superior customer service as compared with your competitors?

- Do you specialize in a niche market? What experiences do you have that set you apart from your competitors?

- What are your competitors’ strengths?

- Where do you see the market already saturated, and where are there opportunities for expansion and growth?

Strength, Weakness, Opportunity, and Threat (SWOT) ( Investopedia , Oct. 30, 2023)

How to Conduct a SWOT Analysis for Your Small Business ( SCORE , Apr. 28, 2022)

SWOT Analysis Toolbox ( University of Washington )

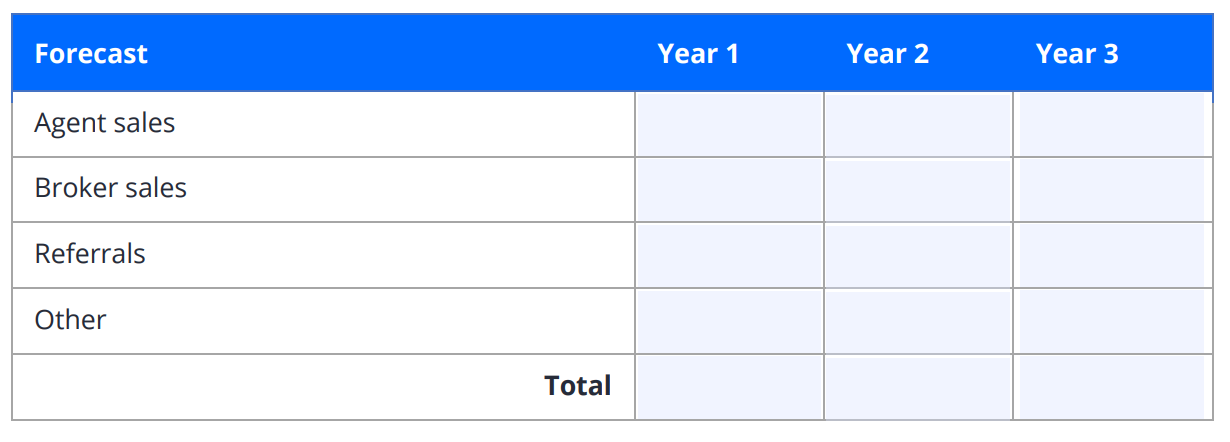

Setting Business Goals

Next, translate your mission and vision into tangible goals. For instance, if your mission statement is to make every client feel like your most important client, think about the following:

- How specifically will you implement this?

- Do you want to grow your business?

- Is this growth measured by gross revenue, profit, personnel, or physical office space?

- How much growth do you aim for annually?

- What specific targets will you strive to hit annually in the next few years?

Setting Business Goals & Objectives: 4 Considerations ( Harvard Business School , Oct. 31, 2023)

What are Business Goals? Definition, How To Set Business Goals and Examples ( Indeed , Jul. 31, 2023)

Establishing a Format

Most businesses either follow a traditional business plan format or a lean startup plan.

Traditional Business Plan

A traditional business plan is detailed and comprehensive. Writing this business plan takes more time. A traditional business plan typically contains the following elements:

- Executive Summary

- Company description

- Market analysis

- Organization and management

- Service or product line

- Marketing and sales

- Funding request

- Financial projections

Lean Startup Plan

A lean startup plan requires high-level focus but is easier to write, with an emphasis on key elements. A lean startup plan typically contains the following elements:

- Key partnerships

- Key activities

- Key resources

- Value proposition

- Customer relationships

- Customer segments

- Cost structure

- Revenue stream

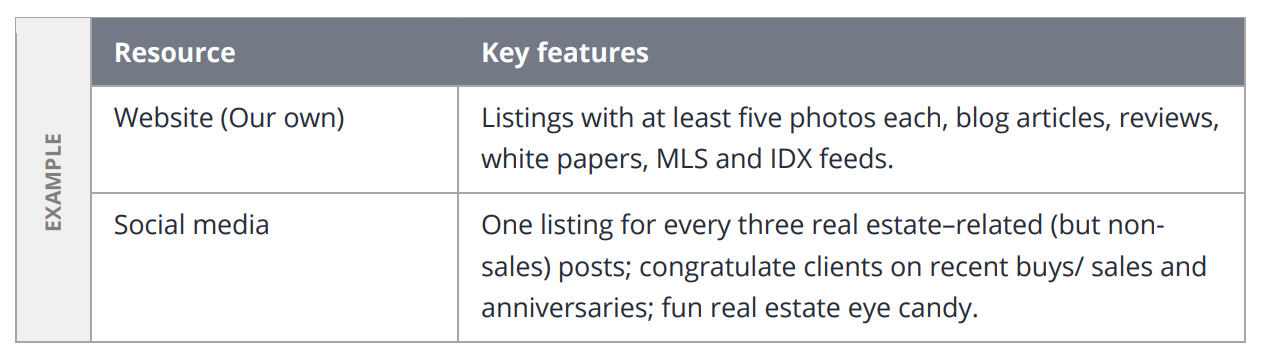

Creating a Marketing Plan

You may wish to create a marketing plan as either a section of your business plan or as an addendum. The Marketing Mix concerns product , price , place and promotion .

- What is your product?

- How does your price distinguish you from your competitors—is it industry average, upper quartile, or lower quartile?

- How does your pricing strategy benefit your clients?

- How and where will you promote your services?

- What types of promotions will you advertise?

- Will you ask clients for referrals or use coupons?

- Which channels will you use to place your marketing message?

Your Guide to Creating a Small Business Marketing Plan ( Business.com , Feb. 2, 2024)

10 Questions You Need to Answer to Create a Powerful Marketing Plan ( The Balance , Jan. 16, 2020)

Developing a Marketing Plan ( Federal Deposit Insurance Corporation )

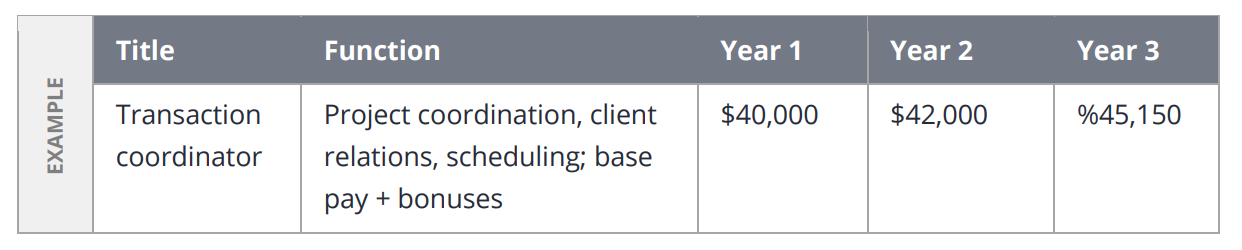

Forming a Team

Ensuring the cooperation of all colleagues, supervisors, and supervisees involved in your plan is another important element to consider. Some questions to consider are:

- Is your business plan’s success contingent upon the cooperation of your colleagues?

- If so, what specifically do you need them to do?

- How will you evaluate their participation?

- Are they on-board with the role you have assigned them?

- How will you get “buy in” from these individuals?

How to Build a Real Estate Team + 7 Critical Mistakes to Avoid ( The Close , May 17, 2023)

Don’t Start a Real Estate Team Without Asking Yourself These 8 Questions ( Homelight , Jan. 21, 2020)

Implementing a Business Plan and Reviewing Regularly

Implementation and follow-up are frequently overlooked aspects to the business plan, yet vital to the success of the plan. Set dates (annually, semi-annually, quarterly, or monthly) to review your business plans goals. Consider the following while reviewing:

- Are you on track?

- Are the goals reasonable to achieve, impossible, or too easy?

- How do you measure success—is it by revenue, profit, or number of transactions?

And lastly, think about overall goals.

- How do you plan to implement your business plan’s goals?

- When will you review and refine your business plan goals?

- What process will you use to review your goals?

- What types of quantitative and qualitative data will you collect and use to measure your success?

These items are only a few sections of a business plan. Depending on your business, you may want to include additional sections in your plan such as a:

- Cover letter stating the reasoning behind developing a business plan

- Non-disclosure statement

- Table of contents

How To Write a Business Proposal Letter (With Examples) ( Indeed , Jul. 18, 2023)

How To Implement Your Business Plan Objectives ( The Balance , Aug. 19, 2022)

The Bottom Line

Creating a business plan may seem daunting, but by understanding your business and market fully, you can create a plan that generates success (however you choose to define it).

Real Estate Business Plans – Samples, Instructional Guides, and Templates

9 Steps to Writing a Real Estate Business Plan + Templates ( The Close , Apr. 3, 2024)

How to Write a Real Estate Business Plan (+Free Template) ( Fit Small Business , Jun. 30, 2023)

The Ultimate Guide to Creating a Real Estate Business Plan + Free Template ( Placester )

Write Your Business Plan ( U.S. Small Business Administration )

General Business Plans – Samples, Instructional Guides, and Templates

Business Plan Template for a Startup Business ( SCORE , Apr. 23, 2024)

Guide to Creating a Business Plan with Template (Business News Daily, Mar. 28, 2024)

Nine Lessons These Entrepreneurs Wish They Knew Before Writing Their First Business Plans ( Forbes , Jul. 25, 2021)

How to Write a Business Plan 101 ( Entrepreneur , Feb. 22, 2021)

Books, eBooks & Other Resources

Ebooks & other resources.

The following eBooks and digital audiobooks are available to NAR members:

The Straightforward Business Plan (eBook)

Business Plan Checklist (eBook)

The SWOT Analysis (eBook)

The Business Plan Workbook (eBook)

Start-Up! A Beginner's Guide to Planning a 21st Century Business (eBook)

Complete Book of Business Plans (eBook)

How to Write a Business Plan (eBook)

The Easy Step by Step Guide to Writing a Business Plan and Making it Work (eBook)

Business Planning: 25 Keys to a Sound Business Plan (Audiobook)

Your First Business Plan, 5 th Edition (eBook)

Anatomy of a Business Plan (eBook)

Writing a Business Plan and Making it Work (Audiobook)

The Social Network Business Plan (eBook)

Books, Videos, Research Reports & More

As a member benefit, the following resources and more are available for loan through the NAR Library. Items will be mailed directly to you or made available for pickup at the REALTOR® Building in Chicago.

Writing an Effective Business Plan (Deloitte and Touche, 1999) HD 1375 D37w

Have an idea for a real estate topic? Send us your suggestions .

The inclusion of links on this page does not imply endorsement by the National Association of REALTORS®. NAR makes no representations about whether the content of any external sites which may be linked in this page complies with state or federal laws or regulations or with applicable NAR policies. These links are provided for your convenience only and you rely on them at your own risk.

- Coaching Team

- Investor Tools

- Student Success

- Real Estate Investing Strategies

Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

How To Write A Real Estate Business Plan

What is a real estate business plan?

8 must-haves in a business plan

How to write a business plan

Real estate business plan tips

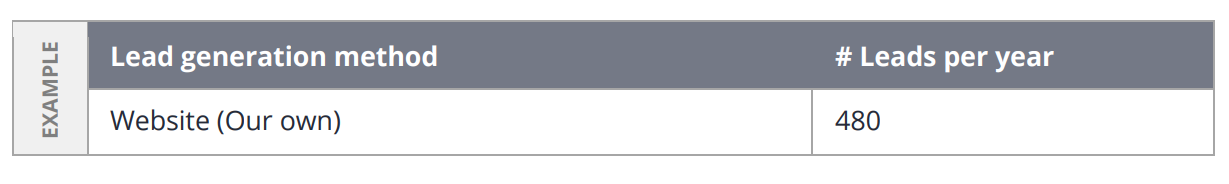

Success in the real estate investing industry won’t happen overnight, and it definitely won’t happen without proper planning or implementation. For entrepreneurs, a real estate development business plan can serve as a road map to all of your business operations. Simply put, a real estate business plan will serve an essential role in forming your investing career.

Investors will need to strategize several key elements to create a successful business plan. These include future goals, company values, financing strategies, and more. Once complete, a business plan can create the foundation for smooth operations and outline a future with unlimited potential for your investing career. Keep reading to learn how to create a real estate investment business plan today.

What Is A Real Estate Investing Business Plan?

A real estate business plan is a living document that provides the framework for business operations and goals. A business plan will include future goals for the company and organized steps to get there. While business plans can vary from investor to investor, they will typically include planning for one to five years at a time.

Drafting a business plan for real estate investing purposes is, without a doubt, one of the single most important steps a new investor can take. An REI business plan will help you avoid potential obstacles while simultaneously placing you in a position to succeed. It is a blueprint to follow when things are going according to plan and even when they veer off course. If for nothing else, a real estate company’s business plan will ensure that investors know which steps to follow to achieve their goals. In many ways, nothing is more valuable to today’s investors. It is the plan, after all, to follow the most direct path to success.

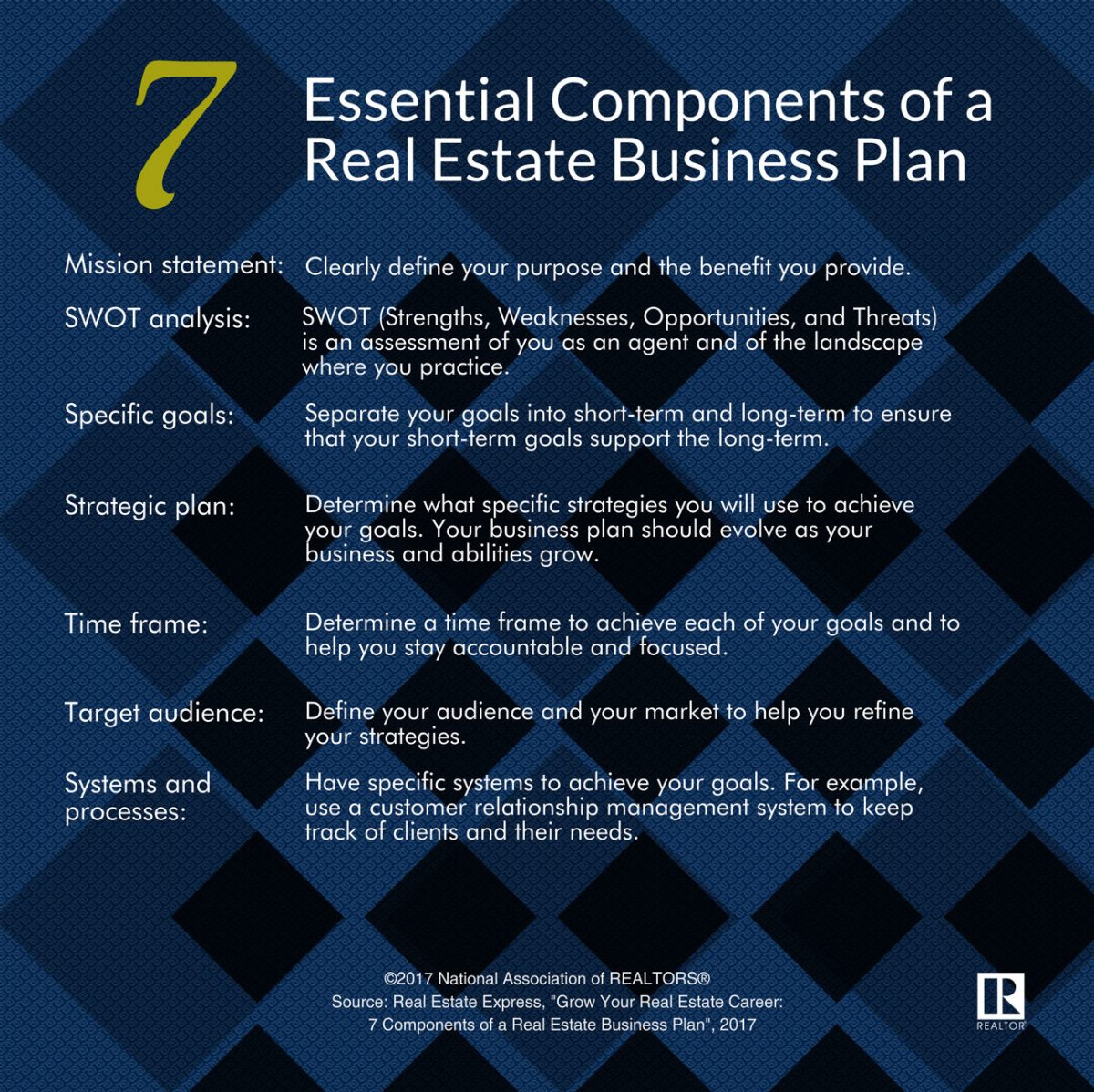

8 Must-Haves In A Real Estate Business Plan

As a whole, a real estate business plan should address a company’s short and long-term goals. To accurately portray a company’s vision, the right business plan will require more information than a future vision. A strong real estate investing business plan will provide a detailed look at its ins and outs. This can include the organizational structure, financial information, marketing outline, and more. When done right, it will serve as a comprehensive overview for anyone who interacts with your business, whether internally or externally.

That said, creating an REI business plan will require a persistent attention to detail. For new investors drafting a real estate company business plan may seem like a daunting task, and quite honestly it is. The secret is knowing which ingredients must be added (and when). Below are seven must-haves for a well executed business plan:

Outline the company values and mission statement.

Break down future goals into short and long term.

Strategize the strengths and weaknesses of the company.

Formulate the best investment strategy for each property and your respective goals.

Include potential marketing and branding efforts.

State how the company will be financed (and by whom).

Explain who is working for the business.

Answer any “what ifs” with backup plans and exit strategies.

These components matter the most, and a quality real estate business plan will delve into each category to ensure maximum optimization.

A company vision statement is essentially your mission statement and values. While these may not be the first step in planning your company, a vision will be crucial to the success of your business. Company values will guide you through investment decisions and inspire others to work with your business time and time again. They should align potential employees, lenders, and possible tenants with the motivations behind your company.

Before writing your company vision, think through examples you like both in and out of the real estate industry. Is there a company whose values you identify with? Or, are there mission statements you dislike? Use other companies as a starting point when creating your own set of values. Feel free to reach out to your mentor or other network connections for feedback as you plan. Most importantly, think about the qualities you value and how they can fit into your business plan.

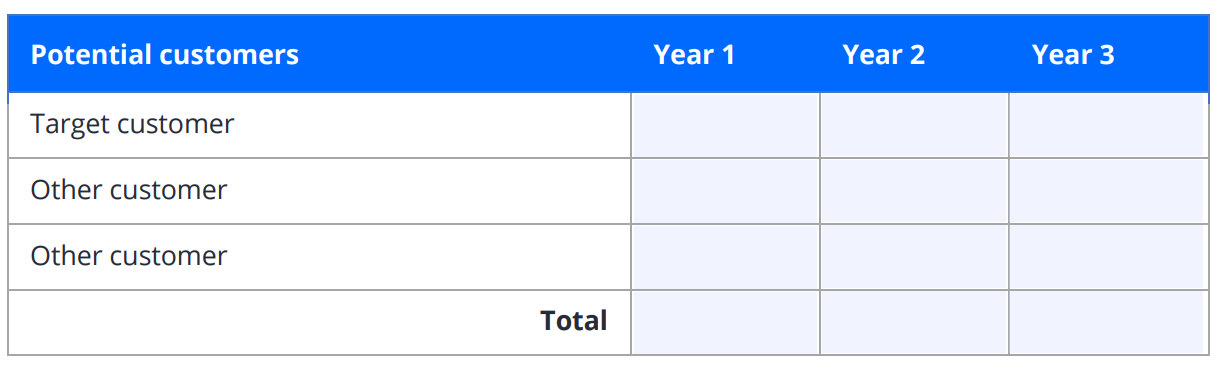

Goals are one of the most important elements in a successful business plan. This is because not only do goals provide an end goal for your company, but they also outline the steps required to get there. It can be helpful to think about goals in two categories: short-term and long-term. Long-term goals will typically outline your plans for the company. These can include ideal investment types, profit numbers, and company size. Short-term goals are the smaller, actionable steps required to get there.

For example, one long-term business goal could be to land four wholesale deals by the end of the year. Short-term goals will make this more achievable by breaking it into smaller steps. A few short-term goals that might help you land those four wholesale deals could be to create a direct mail campaign for your market area, establish a buyers list with 50 contacts, and secure your first property under contract. Breaking down long-term goals is a great way to hold yourself accountable, create deadlines and accomplish what you set out to.

3. SWOT Analysis

SWOT stands for strengths, weaknesses, opportunities, and threats. A SWOT analysis involves thinking through each of these areas as you evaluate your company and potential competitors. This framework allows business owners to better understand what is working for the company and identify potential areas for improvement. SWOT analyses are used across industries as a way to create more actionable solutions to potential issues.

To think through a SWOT analysis for your real estate business plan, first, identify your company’s potential strengths and weaknesses. Do you have high-quality tenants? Are you struggling to raise capital? Be honest with yourself as you write out each category. Then, take a step back and look at your market area and competitors to identify threats and opportunities. A potential threat could be whether or not your rental prices are in line with comparable properties. On the other hand, a potential opportunity could boost your property’s amenities to be more competitive in the area.

4. Investment Strategy

Any good real estate investment business plan requires the ability to implement a sound investment strategy. If for nothing else, there are several exit strategies a business may execute to secure profits: rehabbing, wholesaling, and renting — to name a few. Investors will want to analyze their market and determine which strategy will best suit their goals. Those with long-term retirement goals may want to consider leaning heavily into rental properties. However, those without the funds to build a rental portfolio may want to consider getting started by wholesaling. Whatever the case may be, now is the time to figure out what you want to do with each property you come across. It is important to note, however, that this strategy will change from property to property. Therefore, investors need to determine their exit strategy based on the asset and their current goals. This section needs to be added to a real estate investment business plan because it will come in handy once a prospective deal is found.

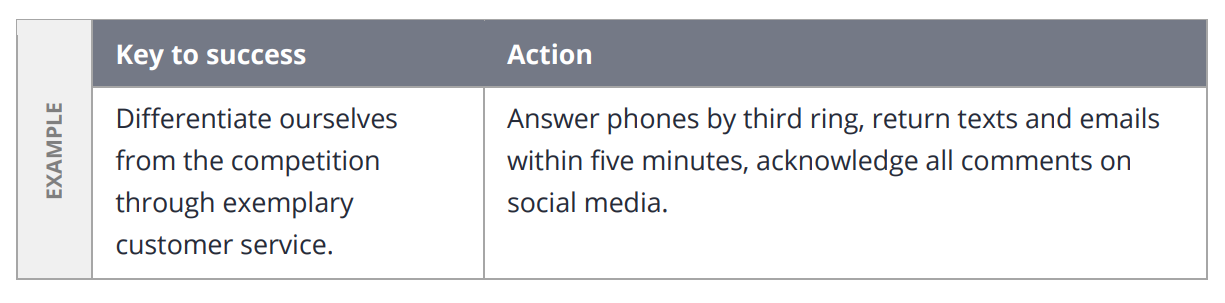

5. Marketing Plan

While marketing may seem like the cherry on top of a sound business plan, marketing efforts will actually play an integral role in your business’s foundation. A marketing plan should include your business logo, website, social media outlets, and advertising efforts. Together these elements can build a solid brand for your business, which will help you build a strong business reputation and ultimately build trust with investors, clients, and more.

First, to plan your marketing, think about how your brand can illustrate the company values and mission statement you have created. Consider the ways you can incorporate your vision into your logo or website. Remember, in addition to attracting new clients, marketing efforts can also help maintain relationships with existing connections. For a step by step guide to drafting a real estate marketing plan , be sure to read this guide.

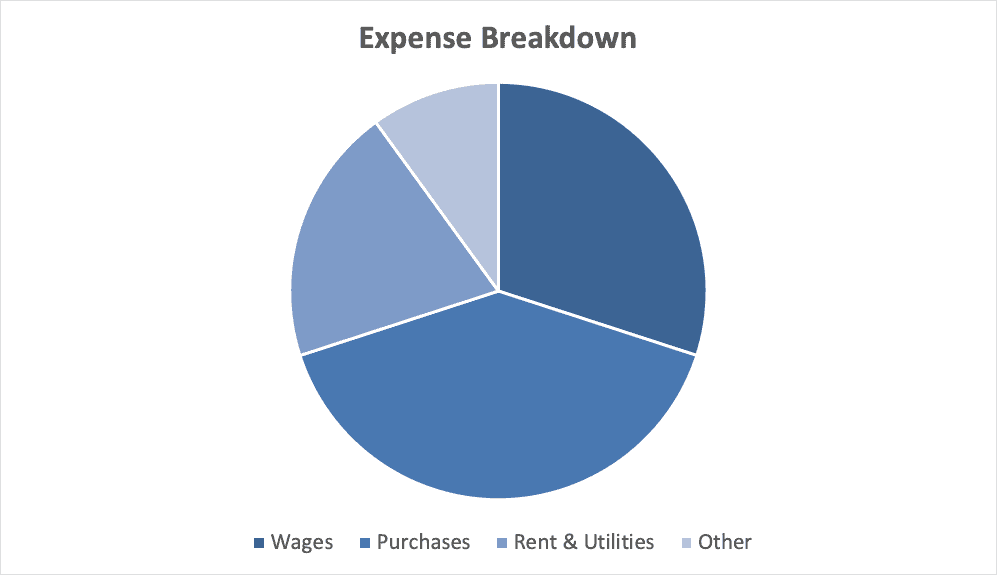

6. Financing Plan

Writing the financial portion of a business plan can be tricky, especially if you are starting your business. As a general rule, a financial plan will include the income statement, cash flow, and balance sheet for a business. A financial plan should also include short and long-term goals regarding the profits and losses of a company. Together, this information will help make business decisions, raise capital, and report on business performance.

Perhaps the most important factor when creating a financial plan is accuracy. While many investors want to report on high profits or low losses, manipulating data will not boost your business performance in any way. Come up with a system of organization that works for you and always ensure your financial statements are authentic. As a whole, a financial plan should help you identify what is and isn’t working for your business.

7. Teams & Small Business Systems

No successful business plan is complete without an outline of the operations and management. Think: how your business is being run and by whom. This information will include the organizational structure, office management (if any), and an outline of any ongoing projects or properties. Investors can even include future goals for team growth and operational changes when planning this information.

Even if you are just starting or have yet to launch your business, it is still necessary to plan your business structure. Start by planning what tasks you will be responsible for, and look for areas you will need help with. If you have a business partner, think through your strengths and weaknesses and look for areas you can best complement each other. For additional guidance, set up a meeting with your real estate mentor. They can provide valuable insights into their own business structure, which can serve as a jumping-off point for your planning.

8. Exit Strategies & Back Up Plans

Believe it or not, every successful company out there has a backup plan. Businesses fail every day, but investors can position themselves to survive even the worst-case scenario by creating a backup plan. That’s why it’s crucial to strategize alternative exit strategies and backup plans for your investment business. These will help you create a plan of action if something goes wrong and help you address any potential problems before they happen.

This section of a business plan should answer all of the “what if” questions a potential lender, employee, or client might have. What if a property remains on the market for longer than expected? What if a seller backs out before closing? What if a property has a higher than average vacancy rate? These questions (and many more) are worth thinking through as you create your business plan.

How To Write A Real Estate Investment Business Plan: Template

The impact of a truly great real estate investment business plan can last for the duration of your entire career, whereas a poor plan can get in the way of your future goals. The truth is: a real estate business plan is of the utmost importance, and as a new investor it deserves your undivided attention. Again, writing a business plan for real estate investing is no simple task, but it can be done correctly. Follow our real estate investment business plan template to ensure you get it right the first time around:

Write an executive summary that provides a birds eye view of the company.

Include a description of company goals and how you plan to achieve them.

Demonstrate your expertise with a thorough market analysis.

Specify who is working at your company and their qualifications.

Summarize what products and services your business has to offer.

Outline the intended marketing strategy for each aspect of your business.

1. Executive Summary

The first step is to define your mission and vision. In a nutshell, your executive summary is a snapshot of your business as a whole, and it will generally include a mission statement, company description, growth data, products and services, financial strategy, and future aspirations. This is the “why” of your business plan, and it should be clearly defined.

2. Company Description

The next step is to examine your business and provide a high-level review of the various elements, including goals and how you intend to achieve them. Investors should describe the nature of their business, as well as their targeted marketplace. Explain how services or products will meet said needs, address specific customers, organizations, or businesses the company will serve, and explain the competitive advantage the business offers.

3. Market Analysis

This section will identify and illustrate your knowledge of the industry. It will generally consist of information about your target market, including distinguishing characteristics, size, market shares, and pricing and gross margin targets. A thorough market outline will also include your SWOT analysis.

4. Organization & Management

This is where you explain who does what in your business. This section should include your company’s organizational structure, details of the ownership, profiles on the management team, and qualifications. While this may seem unnecessary as a real estate investor, the people reading your business plan may want to know who’s in charge. Make sure you leave no stone unturned.

5. Services Or Products

What are you selling? How will it benefit your customers? This is the part of your real estate business plan where you provide information on your product or service, including its benefits over competitors. In essence, it will offer a description of your product/service, details on its life cycle, information on intellectual property, as well as research and development activities, which could include future R&D activities and efforts. Since real estate investment is more of a service, beginner investors must identify why their service is better than others in the industry. It could include experience.

6. Marketing Strategy

A marketing strategy will generally encompass how a business owner intends to market or sell their product and service. This includes a market penetration strategy, a plan for future growth, distribution channels, and a comprehensive communication strategy. When creating a marketing strategy for a real estate business plan, investors should think about how they plan to identify and contact new leads. They should then think about the various communication options: social media, direct mail, a company website, etc. Your business plan’s marketing portion should essentially cover the practical steps of operating and growing your business.

Additional Real Estate Business Plan Tips

A successful business plan is no impossible to create; however, it will take time to get it right. Here are a few extra tips to keep in mind as you develop a plan for your real estate investing business:

Tailor Your Executive Summary To Different Audiences: An executive summary will open your business plan and introduce the company. Though the bulk of your business plan will remain consistent, the executive summary should be tailored to the specific audience at hand. A business plan is not only for you but potential investors, lenders, and clients. Keep your intended audience in mind when drafting the executive summary and answer any potential questions they may have.

Articulate What You Want: Too often, investors working on their business plan will hide what they are looking for, whether it be funding or a joint venture. Do not bury the lede when trying to get your point across. Be clear about your goals up front in a business plan, and get your point across early.

Prove You Know The Market: When you write the company description, it is crucial to include information about your market area. This could include average sale prices, median income, vacancy rates, and more. If you intend to acquire rental properties, you may even want to go a step further and answer questions about new developments and housing trends. Show that you have your finger on the pulse of a market, and your business plan will be much more compelling for those who read it.

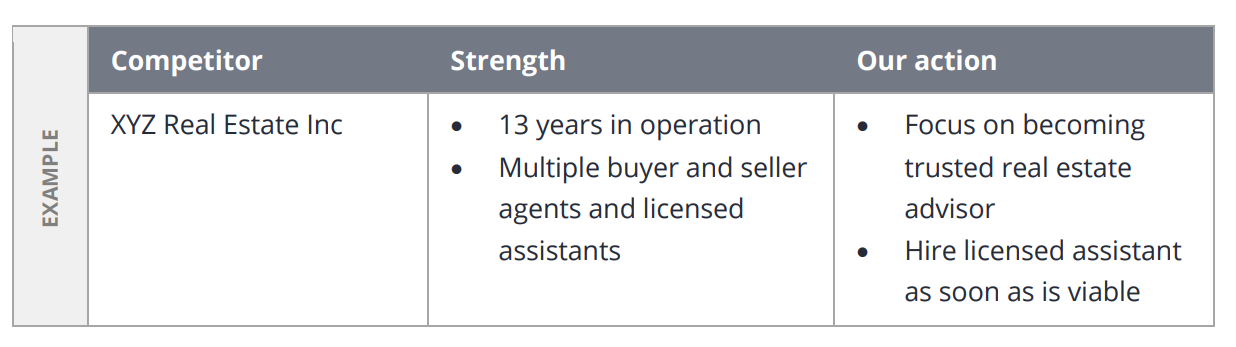

Do Homework On The Competition: Many real estate business plans fail to fully analyze the competition. This may be partly because it can be difficult to see what your competitors are doing, unlike a business with tangible products. While you won’t get a tour of a competitor’s company, you can play prospect and see what they offer. Subscribe to their newsletter, check out their website, or visit their open house. Getting a first-hand look at what others are doing in your market can greatly help create a business plan.

Be Realistic With Your Operations & Management: It can be easy to overestimate your projections when creating a business plan, specifically when it comes to the organization and management section. Some investors will claim they do everything themselves, while others predict hiring a much larger team than they do. It is important to really think through how your business will operate regularly. When writing your business plan, be realistic about what needs to be done and who will be doing it.

Create Example Deals: At this point, investors will want to find a way to illustrate their plans moving forward. Literally or figuratively, illustrate the steps involved in future deals: purchases, cash flow, appreciation, sales, trades, 1031 exchanges, cash-on-cash return, and more. Doing so should give investors a good idea of what their deals will look like in the future. While it’s not guaranteed to happen, envisioning things has a way of making them easier in the future.

Schedule Business Update Sessions: Your real estate business plan is not an ironclad document that you complete and then never look at again. It’s an evolving outline that should continually be reviewed and tweaked. One good technique is to schedule regular review sessions to go over your business plan. Look for ways to improve and streamline your business plan so it’s as clear and persuasive as you want it to be.

Reevauating Your Real Estate Business Plan

A business plan will serve as a guide for every decision you make in your company, which is exactly why it should be reevaluated regularly. It is recommended to reassess your business plan each year to account for growth and changes. This will allow you to update your business goals, accounting books, and organizational structures. While you want to avoid changing things like your logo or branding too frequently, it can be helpful to update department budgets or business procedures each year.

The size of your business is crucial to keep in mind as you reevaluate annually. Not only in terms of employees and management structures but also in terms of marketing plans and business activities. Always incorporate new expenses and income into your business plan to help ensure you make the most of your resources. This will help your business stay on an upward trajectory over time and allow you to stay focused on your end goals.

Above all else, a real estate development business plan will be inspiring and informative. It should reveal why your business is more than just a dream and include actionable steps to make your vision a reality. No matter where you are with your investing career, a detailed business plan can guide your future in more ways than one. After all, a thorough plan will anticipate the best path to success. Follow the template above as you plan your real estate business, and make sure it’s a good one.

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

NAR Settlement: What It Means For Buyers And Sellers

What is the assessed value of a property, what is bright mls a guide for agents and investors, how to pass a 4 point home inspection, defeasance clause in real estate explained, what is the federal funds rate a guide for real estate investors.

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Business 5 Real Estate Business Plan Examples & How to Create One?

5 Real Estate Business Plan Examples & How to Create One?

Written by: Danesh Ramuthi Nov 28, 2023

Crafting a business plan is essential for any business and the real estate sector is no exception. In real estate, a comprehensive business plan serves as a roadmap, delineating a clear path towards business growth.

It guides owners, agents and brokers through various critical aspects such as identifying target markets, devising effective marketing strategies, planning finances and managing client relationships.

For real estate businesses, a well-written plan is crucial in attracting potential investors, showcasing the company’s mission statement, business model and long-term income goals.

So, how can you write one?

Leveraging tools like Venngage Business Plan Make r with their Business Plan Templates to create your own real estate business plan can be transformative.

They offer a lot of real estate business plan examples and templates, streamlining the process of crafting a comprehensive plan.

Click to jump ahead:

- 5 real estate business plan examples

How to write a real estate business plan?

- Wrapping Up

5 Real estate business plan examples

As I have said before, a well-crafted business plan is a key to success. Whether you’re a seasoned agent or just starting out, examples of effective real estate business plans can offer invaluable insights.

These examples showcase a range of strategies and approaches tailored to various aspects of the real estate market. They serve as guides to structuring a plan that addresses key components like market analysis, marketing strategies, financial planning and client management, ensuring a solid foundation for any real estate venture.

Real estate business plan example

There are various elements in a real estate business plan that must be integrated. Incorporating these elements into a real estate business plan ensures a comprehensive approach to launching and growing a successful real estate business.

What are they?

- Executive summary: The executive summary is a concise overview of the real estate business plan. It highlights the mission statement, outlines the business goals and provides a snapshot of the overall strategy.

- Company overview: An overview on the history and structure of the real estate business. It includes the company’s mission and vision statements, information about the founding team and the legal structure of the business.

- Service: Here, the business plan details the specific services offered by the real estate agency. This could range from residential property sales and leasing to commercial real estate services. The section should clearly articulate how these services meet the needs of the target client and how they stand out from competitors.

- Strategies: A very crucial part of the plan outlines the strategies for achieving business goals. It covers marketing strategies to generate leads, pricing strategies for services, and tactics for effective client relationship management. Strategies for navigating market shifts, identifying key market trends and leveraging online resources for property listings and real estate listing presentations to help with lead generation are also included.

- Financial plan: The financial plan is a comprehensive section detailing the financial projections of the business. It includes income statements, cash flow statements, break-even analysis and financial goals. Besides, a financial plan section also outlines how resources will be allocated to different areas of the business and the approach to managing the financial aspects of the real estate market, such as average sales price and housing market trends.

Read Also: 7 Best Business Plan Software for 2023

Real estate investment business plan example

A real estate investment business plan is a comprehensive blueprint that outlines the goals and strategies of a real estate investment venture. It serves as a roadmap, ensuring that all facets of real estate investment are meticulously considered.

Creating a business plan for real estate investment is a critical step for any investor, regardless of their experience level Typically, these plans span one to five years, offering a detailed strategy for future company objectives and the steps required to achieve them.

Key components:

- Executive summary: Snapshot of the business, outlining its mission statement, target market, and core strategies. It should be compelling enough to attract potential investors and partners.

- Market analysis: A thorough analysis of the real estate market, including current trends, average sales prices and potential market shifts.

- Financial projections: Detailed financial plans, including income statements, cash flow analysis, and break-even analysis.

- Strategy & implementation: Outlines how the business plans to achieve its goals. This includes marketing efforts to generate leads, pricing strategies and client relationship management techniques.

- Legal structure & resource allocation: Details the legal structure of the business and how resources will be allocated across various operations, including property acquisitions, renovations and management.

Real estate agent business plan example

A real estate agent business plan is a strategic document that outlines the operations and goals of a real estate agent or agency. It is a crucial tool for communicating with potential lenders, partners or shareholders about the nature of the business and its potential for profitability.

A well-crafted real estate agent business plan will include

- Where you are today: A clear understanding of your current position in the market, including strengths, weaknesses and market standing.

- Where you aim to be: Sets specific, measurable goals for future growth, whether it’s expanding the client base, entering new markets or increasing sales.

- How can you get there: Outlines the strategies and action plans to achieve these goals, including marketing campaigns, client acquisition strategies and business development initiatives.

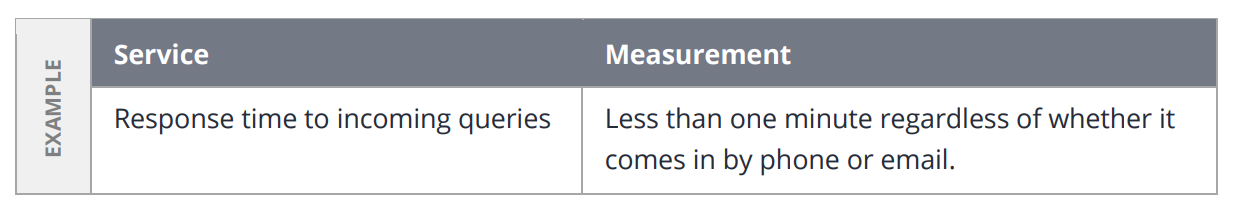

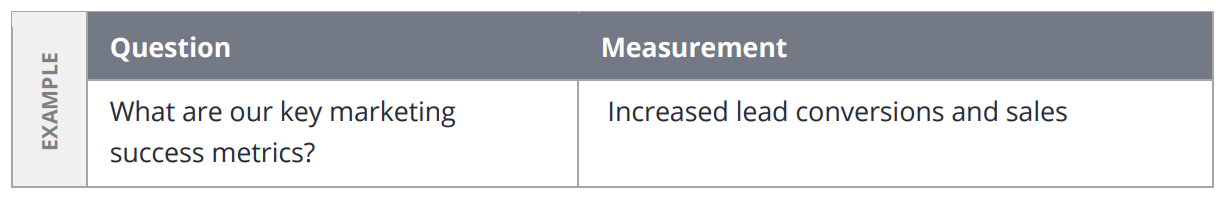

- Measuring your performance: Defines the key performance indicators (KPIs) and metrics to assess progress towards the set goals, such as sales figures, client satisfaction rates and market share.

- Course correction: Establishes a process for regular review and adjustment of the plan, ensuring flexibility to adapt to market changes, shifts in client needs and other external factors.

For real estate agents, a comprehensive business plan is not just a roadmap to success; it is a dynamic tool that keeps them accountable and adaptable to market changes.

Realtor business plan example

A realtor business plan is a comprehensive document that outlines the strategic direction and goals of a real estate business. It’s an essential tool for realtors looking to either launch or expand their business in the competitive real estate market. The plan typically includes details about the company’s mission, objectives, target market and strategies for achieving its goals.

Benefits of a realtor business plan and applications:

- For launching or expanding businesses: The plan helps real estate agents to structure their approach to entering new markets or growing in existing ones, providing a clear path to follow.

- Securing loans and investments: A well-drafted business plan is crucial for securing financing for real estate projects, such as purchasing new properties or renovating existing ones.

- Guideline for goal achievement: The plan serves as a guideline to stay on track with sales and profitability goals, allowing realtors to make informed decisions and adjust strategies as needed.

- Valuable for real estate investors: Investors can use the template to evaluate potential real estate businesses and properties for purchase, ensuring they align with their investment goals.

- Improving business performance: By filling out a realtor business plan template , realtors can gain insights into the strengths and weaknesses of their business, using this information to enhance profitability and operational efficiency.

A realtor business plan is more than just a document; it’s a roadmap for success in the real estate industry.

Writing a real estate business plan is a comprehensive process that involves several key steps. Here’s a detailed guide to help you craft an effective business plan :

- Tell your story : Start with a self-evaluation. Define who you are as a real estate agent, why you are in this business and what you do. Develop your mission statement, vision statement and an executive summary.

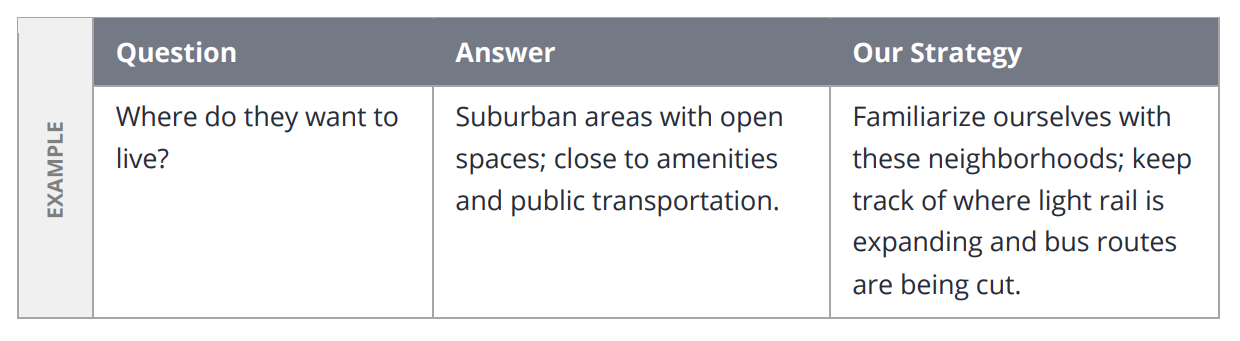

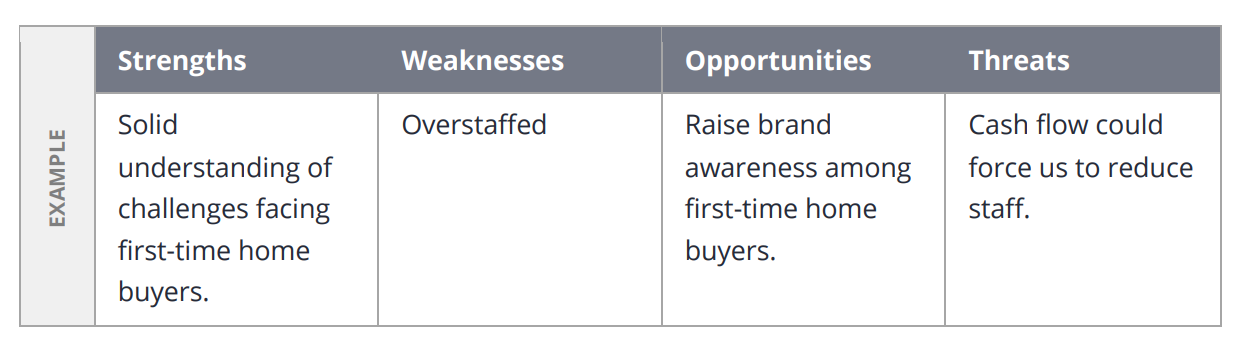

- Analyze your target real estate market : Focus on local market trends rather than national or state-wide levels. Examine general trends, market opportunities, saturations, and local competition. This step requires thorough research into the real estate market you plan to operate in.

- Identify your target client : After understanding your market, identify the niche you aim to serve and the type of clients you want to target. Create a client persona that reflects their specific needs and concerns.

- Conduct a SWOT analysis : Analyze your business’s Strengths, Weaknesses, Opportunities and Threats. This should reflect a combination of personal attributes and external market conditions.

- Establish your SMART goals : Set specific, measurable, attainable, realistic and timely goals. These goals could be financial, expansion-related or based on other business metrics.

- Create your financial plan : Account for all operating expenses, including marketing and lead generation costs. Calculate the number of transactions needed to meet your financial goals. Remember to separate personal and business finances.

- Revisit your business plan to monitor & evaluate : Treat your business plan as a living document. Plan periodic reviews (quarterly, semi-annually or annually) to check if your strategies are advancing you toward your goals.

- Defining your mission & vision : Include a clear mission and vision statement. Describe your business type, location, founding principles and what sets you apart from competitors.

- Creating a marketing plan : Develop a marketing plan that addresses the product, price, place and promotion of your services. Determine your pricing strategy, promotional methods and marketing channels.

- Forming a team : Ensure the cooperation of colleagues, supervisors and supervisees involved in your plan. Clarify their roles and how their participation will be evaluated.

Related: 15+ Business Plan Examples to Win Your Next Round of Funding

Wrapping up

The journey to a successful real estate venture is intricately linked to the quality and depth of your business plan. From understanding the nuances of the real estate market to setting strategic goals, a well-crafted business plan acts as the backbone of any thriving real estate business. Whether you’re developing a general real estate business plan, focusing on investment, working as an agent, or operating as a realtor, each plan type serves its unique purpose and addresses specific aspects of the real estate world.

The examples and insights provided in this article serve as a guide to help you navigate the complexities of the real estate industry. Remember, a real estate business plan is not a static document but a dynamic blueprint that evolves with your business and the ever-changing market trends.

Crafting a strategic real estate business plan is a crucial step towards achieving your business goals. So, start shaping your vision today with Venngage.

Explore venngage business plan maker & our business plan templates and begin your journey to a successful real estate business now!

Discover popular designs

Infographic maker

Brochure maker

White paper online

Newsletter creator

Flyer maker

Timeline maker

Letterhead maker

Mind map maker

Ebook maker

- Sample Business Plans

- Real Estate & Rentals

Real Estate Business Plan

People would always need to find places. Be it for offices, homes, and whatnot.

Finding the ideal place irrespective of your needs and requirements is never a cakewalk, to begin with.

You can go through a number of real estates business plan templates before you write your plan.

Industry Overview

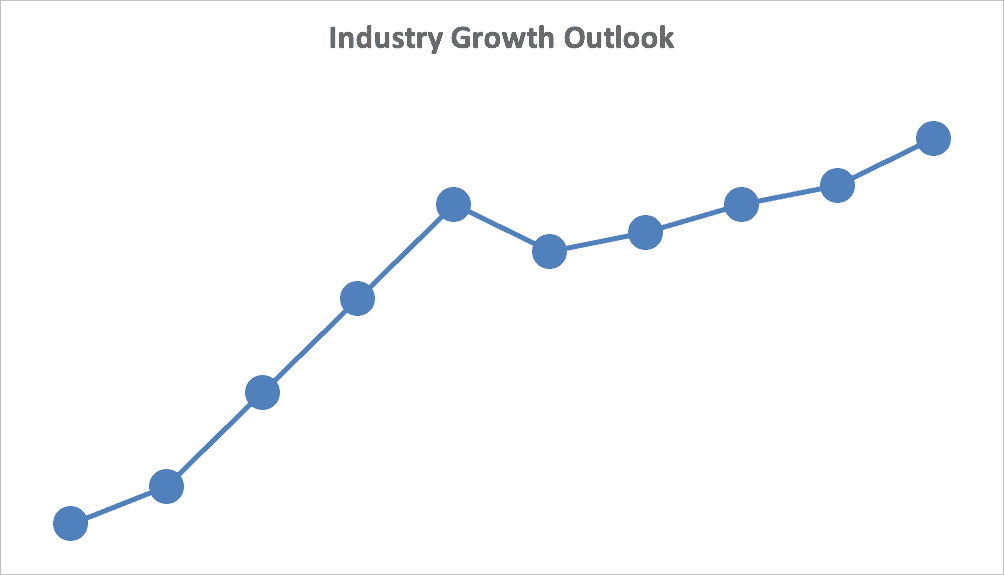

The market size, measured by revenue, of the Real Estate Sales and brokerage industry, is $156.2bn in 2021, and the industry is expected to increase by 0.4% in 2021.

Also, the market is changing at a rapid rate and the way people use spaces is changing at a rapid rate too.

Hence, to get on or stay on the higher end of the spectrum you’ll need to upskill and change the way you do business constantly.

But that is a fair trade for the amount of growth and profitability this industry has to offer.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

Things to Consider Before Writing a Real Estate Business Plan

Be specific.

The real estate industry is broad when it comes to work and what you can do. It can either be a source of primary or passive income. At the same time, you might be involved in the industry as an investor, agent, or builder. Decide what you want to do and plan on that basis.

Do your research

The trends of the real estate business change constantly, hence doing your research and updating it constantly is a crucial part of your profession.

As your knowledge and expertise is your greatest asset in this industry, keep expanding it to stay at the top of things.

Build a team of skilled professionals

Having a team you can build your real estate business with is essential.

Select a group of individuals with a diverse set of talents ranging from good communication skills to brilliant analytical skills. Given the dynamics of the real estate business, you never know what skills might come in handy in your business journey.

Be ready for change

As we have constantly discussed, real estate is a dynamic industry. Change is the only constant you’ll have in this business.

Thus, it is important for everything from your plan and way of doing business to be change-friendly.

Sources of Funding for a Real Estate Business

Gaining funds is one of the major reasons for writing a business plan. And here are a few good funding options for your real estate business:

A traditional loan is one of the most basic options for getting funded. You can opt for this if you have a good credit score.

Non-bank mortgage lending

This is a good option if you don’t want to go through a lot of paperwork.

The asset-based mortgage

For this, the lenders look at the rental value of your property and provide a loan on that basis. It is a good option if you don’t want or can’t get a loan based on your personal assets or income.

Above all, it is essential to plan your business to figure out your funding requirements and the right way to fulfill the same.

Write Your Business Plan

If you have enough connections, and the ability to find places for people that have attributes they want and need then a real estate business can be a profitable one for you.

A business plan helps you get funded, explain your ideas to the stakeholders of your business, and make better decisions.

Hence, planning is an important aspect of starting or growing your business.

It has been created using Upmetrics online business plan software that helps you create dynamic and customizable plans anywhere and at any time.

Our sample real estate business plan can help you with writing a well-rounded business plan for your business. It can act as a guide and prevent you from getting stuck in a certain section for too long.

Real Estate Business Plan Outline

This is the standard real estate business plan outline which will cover all important sections that you should include in your business plan.

- Market Opportunity

- Demand for Housing

- Financing & Investment Forecast

- Introducing Kegan

- Business Model

- Short Term Goals

- Long Term Strategies

- Keys to Success

- Contemporary Living for the 21″ Century

- The Complete Package

- Pricing Strategy

- Implementation Strategy – Action Plan

- Target Market Overview

- Housing Shortage Overview in Saudi Arabia

- Housing Shortage Overview in Riyadh

- Housing Prices

- Kegan Home Prices

- Market Positioning & Brand

- Marketing Strategies

- Sales Strategies

- Sales Process

- Competitive Landscape

- Competitive Advantages

- Rashid Bin Said

- Director of Construction

- Member name

- Chief Accountant

- Director of Marketing & Sales

- Other Staff

- Independent Directors

- Solid Balance Sheet

- Impressive Cashflow

- Financial Summary

- Financial Assumptions

- Income Statement (Five-Year Projections)

- Balance Sheet (Five-Year Projections)

- Cash Flow Statement (Five-Year Projection)

After getting started with Upmetrics , you can copy this sample real estate business plan into your business plan and modify the required information and download your real estate business plan pdf or doc file.

It’s the fastest and easiest way to start writing your business plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Download a sample real estate business plan

Need help writing your business plan from scratch? Here you go; download our free real estate business plan pdf to start.

It’s a modern business plan template specifically designed for your real estate business. Use the example business plan as a guide for writing your own.

Related Posts

Real Estate Development Business Plan

Real Estate Agent Business Plan

Factor to Choosing Business Location

400+ Business Plan Sample Template

Business Plan Writers

Best AI Business Plan Generator

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Real Estate Business Plan Examples

Home » Services » Business Plan Consulting » Business Plan Examples » Real Estate

Several of our real estate clients have graciously provided permission for us to share their plans with you. A professional real estate business plan is an important step towards building a business in this challenging industry. Here are two real estate business plan samples created by Cayenne Consulting:

Baxter Development Company

This plan is an example of what we can create when visual impact is a top priority.

Jolly Roger Storage

This plan is a sample a business plan for a large self-storage facility in need of debt financing.

Daari Real Estate

This plan is an example of what we will produce for a real estate client seeking a moderate amount of debt financing.

How to Create a Commercial Real Estate Business Plan

My step-by-step blueprint for success.

By Lee Muhl

Cayenne maintains a very active practice in real estate business plans – including funds and development plans for commercial, residential, and agricultural uses, along with many specialty projects aimed at mixed-use, live-work, hospitality, medical, entertainment centers, smart/sustainable developments, and others. Also created for our clients are detailed “ capital stacks ,” including debt, equity, “impact/cause funding” along with consideration of public investment, grants, and special tax opportunities.

Cayenne’s practice in real estate is broad, but commercial real estate (CRE) makes up a large portion of Cayenne’s real estate consulting services to developers, sponsors, owners, contractors, and vendors.

While each client project is unique and is accorded special consideration and treatment, there are some important issues that arise in many commercial real estate business plan projects.

This post will mention a few of the types of issues that owners, developers, sponsors, or other stakeholders in commercial real estate might take into consideration when you create a commercial real estate business plan.

Keep it Exciting, Simple, and Digestible

While any commercial real estate project will have many details, it’s important to create a compelling, simple, and understandable story.

Who is the audience for the business plan? Funders come in every shape and color. On the debt side, there are direct lenders, traditional banks, convertible debt lenders, etc. On the equity side, real estate investors range from family offices to angels, to angel funds, to private investors who may be HNW (high net worth) or to F&F (friends and family) investing from a self-directed IRA. Your business plan will differ depending on what types of funders are going to see it.

On that note, it’s always a good idea to include two things: (i) a simple Guidance and Disclaimer that the business plan is for funder/stakeholder information and not a securities offering; and (ii) a Glossary of commercial real estate terms which not only helps the reader, but reinforces the reader’s impression that the project’s team is expert in commercial real estate concepts. By way of example, while a funder might be very familiar with IRR (internal rate of return), he/she/it might not be as conversant with terms like CRA (Community Reinvestment Act), FAR/Bonus FAR (Floor Area Ratio/Bonus Floor Area Ratio), flex (multi-use) space, MSA/CSA (Metropolitan Statistical Area/Combined Statistical Area) or New Market Tax Credits. A good business plan helps educate the reader on these items.

Text, Deck, Financials, Artwork, or All?

A commercial real estate business plan can be scribbles on a napkin, 120 pages of text, a 10-slide deck, or a 50-slide beautifully illustrated digital presentation . For example, if the format you want is a presentation deck, it’s good to decide in advance approximately how long it should be, what type of content, and what type of visual look you desire. Should it be page after page of charts and colored shapes, or should it be a nice, illustrated presentation of your concept and market?

For sizable commercial real estate business projects, multiple documents may be needed, that can range from, and include one or all of, Financial Book, Market Study, Business Plan, Deck, FAQs (frequently asked questions), Term Sheets, LOIs (letters of intent), Plats, Renderings, GC (general contractor) bids, 3D imagery, and so on. Much of the time, the whole menu isn’t needed up-front, but many, or all, could come into play before the project reaches completion.

Bottom line, there isn’t a “one size fits all” in commercial real estate business plans. So, before you opt for a Do-It-Yourself template, it’s always good to take a hard look at the actual Scope of Work, identify your end goals, the detailed stages that your business plan and fundings may proceed through, and in what order.

What’s the Simple Story?

Whatever the project is, there should be a way to encapsulate it in one or two sentences.

The idea is not to dumb it down, but to be able to say simply to any funder or stakeholder – here is what it is. The right one sentence can then beckon an audience to longer discussions of the concept.

What’s The Opportunity in the Market?

One key goal is to present to a potential funder or stakeholder the fundamental issue of how valuable the concept can be.

Sometimes this is obvious. Sometimes it isn’t, or it won’t be to your audience, so you will need a clear statement of how much money your company stands to make out of the target market. Far too many entrepreneurs, plans, and providers opt for high-level online overviews that say things like “The 2021 global market in multi-use commercial real estate is $__ billion and CAGR (cumulative annual growth rate) of 21% is expected over the next 5 years.” Those are positive statistics, but they don’t say anything about your project’s potential.

Rather, the core issue to include in your plan is – how much of that global market are you going to grab with your business model? And then prove it with defendable numbers.

Another great addition is a section on “market drivers” which can include concepts such as reduced risk, effective land use, limited competition in the area, a captive tenant base, portfolio diversification, diversity of tenants (e.g., in a multi-use project that combines retail, hospitality, and housing), convenience, and demographic appeal.

Who’s the Visionary/Sponsor/Developer and Who’s on the Team?

One thing we see again and again is that, after all the numbers are crunched, the i’s dotted and the t’s crossed, a funding decision comes down to this: does your funding audience have confidence that you and your team will execute on your commercial real estate business plan? A great team, with a great track record, helps get you past this speedbump, and you should try to include fairly detailed bios of the team showing experience, time in the commercial real estate industry, former companies, former titles and responsibilities, and educational background.

Another plus in this part of the story is a tight, powerful listing of key goals that the team has already accomplished, and a projection of what the next several years will bring.

The Business Model

It’s easy to look at commercial real estate as a familiar concept without a lot of new ideas. But there are many special aspects that a specific project can point to, such as: (i) the market niche is hot at the moment; (ii) planned diversification across regions, cities, and neighborhoods, or (iii) that the project arose from the owner/developer’s “nine-point” project evaluation set of criteria that profile the area, amenities, transportation, funding benefits, target project size and typical time to completion, occupancy rates in the area, expected hold until stabilization, and liquidity solutions available for funders.

Innovations and Success Drivers in the Business Model

While real estate is one of the oldest industries in the world, it is constantly changing in exciting ways. If your project is a multi-family development, why is it different – and hopefully better – than the apartment complex across the street? What are the “success drivers”? Is it better-constructed, greener, smarter, more sustainable, technology-enhanced, more likely to hold value, better designed, more attractive, or in an area with public funding or tax benefits available, etc.? One concept that is increasingly dominant in commercial real estate business plans is presenting amenities. What special amenities separate your development from the rest of the neighborhood?

Another consideration is the huge upsurge in “cause-related,” “social benefit,” or “impact” investing. If your project is designed to provide some real social benefit , it is great to flag this for funders and stakeholders. It can also open up new funding opportunities with CRE investors/funders who are seeking, or are required to seek, social benefit in their portfolios.

What is the Funding Opportunity?

Your commercial real estate business plan should explain how much funding is needed, and in detail, what it will be used for – e.g., development, acquisition, construction, construction take-out, and limited-term senior debt.

In commercial real estate, a presentation of the capital stack is critical, and it is often quite detailed. For example, the project’s capital stack might involve a combination of senior secured debt, additional subordinate debt, and equity financing, as well as grants and tax credits, in accordance with local community development, economic development, and workforce development interests in the municipality, plus tax incentive programs related to Historical Structures, New Markets, Low Income Housing, Opportunity Zones, and Business Improvement Districts.

Building Your Commercial Real Estate Financial Model

While simplicity in telling the story is always important, your financial model could often present a laundry list of benefits. You might point to five to seven different ways that the funding model uses leverage; or you might point to abundant collateralization, or to regulatory benefits such as CRA ( Community Reinvestment Act ) portfolio points, or to tax benefits for investing in an Opportunity Zone , or to the simple point that commercial real estate is, traditionally, a very safe investment, that goes up with inflation and, as a hard asset, it will always maintain some level of value and worth.

For prospective stakeholders, projected yield, MOIC (multiple on invested cash), IRR, and any special liquidity solutions are great to mention. At the end of the day, one point can always be made – commercial real estate is the type of investment that is safer than most, can provide steady income, and offers special financial protections from property value, lease payments, and, often, government incentives.

If the plan is for a commercial real estate fund, it’s always good to identify the special nature and characteristics of the fund, e.g., the fund might be a closed-end, leveraged, managed distribution fund that will only invest in certain types of assets, with certain target capitalization rates (a measure of how risky commercial real estate investment is).

The Property

It’s always good to have a section in the Plan that speaks to the property, or to possible properties that may be selected. This can be exemplified with photos, maps, renderings, drawings, plats, descriptions of the property, amenities, and the locale – in short, a part of the Plan that brings the concept to life – a moment of punctuation that delivers a moment of “Wow, there it is, that’s where the project will be built.”

Competitive Differentiation

A key question is always “how do the project and the funding opportunity stand apart from other developers and profit-seekers that focus on similar property investments?”

What helps here is to identify why the developer/sponsor/owner has a plan for development that is innovative, data-driven, and fueled by ground-level experience.

Another concept that helps here is to identify strategies for enhancing the value in the property/project, or, if applicable, in the portfolio.

Writing Your Commercial Real Estate Business Plan

Now that you’ve thought through all these issues, get ready to craft your commercial real estate business plan that features all the essential sections including: the business plan’s Highlights (a powerful type of Executive Summary), Introduction, the Company, Management, the Market, the Property, the Funding Opportunity, the Financial Strategy, and how you are different from, and better prepared for success than, the Competition. The business plan samples above should prove helpful.

If this all of this sounds overwhelming and you would like help preparing your commercial real estate business plan, contact us and we would be happy to help.

More Resources

- See more business plan examples .

- Learn more about our business plan preparation services .

- Learn more about our construction and real estate business planning experience .

- Read testimonials by our construction and real estate clients .

Help me write a great real estate business plan!

If you'd like an assessment of your needs and a fee estimate, please let us know how to reach you:

- Business Plan Preparation

- Pitch Deck (Investor Presentation) Design

- Financial Forecasting and Analysis

- Business Plan Makeover

- Business Plan and Financial Model Reviews

- Franchise Business Plans

- Immigration Visa Business Plans

- Business Model Design

- Business Valuation Services

- Market & Competitor Research

- Executive Education Seminars

- International Business Consulting

- SBA Certification Services

- Business Turnaround Consulting

- Chicago, IL

- Los Angeles, CA

- New York, NY

- Orange County, CA

- Philadelphia, PA

- Phoenix & Tucson, AZ

- Pittsburgh, PA

- Portland, OR

- Salt Lake City, UT

- San Francisco, CA

- Seattle, WA

- Sydney, Australia

- Tampa & Orlando, FL

- Washington, DC

- Cannabis, Hemp & CBD

- Consumer Products, Services & Retail

- Education & E-Learning

- Financial Services

- Healthcare, Biotech & Medical Devices

- Manufacturing, Industrial & Aerospace

- Media & Entertainment

- Mobile, Software & Internet

- Non-Profits

- Professional & Business Services

- Real Estate

- Restaurant, Lounge & Bar

- Semiconductor, Hardware & Networking

- Telecommunications

- Consumer Products & Services

- Hardware & Networking

- Healthcare & Medical

- International

- Manufacturing & Industrial

- Not-for-Profit

- Professional Services & B2B

- Real Estate & Hospitality

- Software, Internet & Mobile

- Consulting Team

- Senior Advisors

- In the Media

- Startup Resources

- Cannabis & CBD Business Plan Samples

- Internet, Mobile & Software Business Plan Samples

- Media & Entertainment Business Plan Samples

- Healthcare Business Plan Samples

- Real Estate Business Plan Samples

- Restaurant Business Plan Samples

- Telecommunication Business Plan Samples

- Business Plan Templates

- Entrepreneur’s Library

- High Tech Startup Valuation Estimator

- Capital Comparison Table

- Why Business Plans Don’t Get Funded

- What Kills Startups?

- Options for Creating Your Business Plan

- Request Quote

- Contact Information

- Send Feedback

Building a Solid Foundation: How to Create a Real Estate Business Plan That Works

A killer real estate business plan isn't just about setting a goal to hit 1 million in sales next year. (It would be a lot easier if it were!)

A truly great real estate business plan defines exactly what drives your business, where you're headed, and how you'll navigate the market's unpredictable currents. It should be a razor-sharp action plan to scale your real estate empire.

So, how do you craft this master blueprint without getting bogged down in the details?

If you’re ready to join the cast of Million Dollar Listings—or if you just want to grow your modest real estate business—we can help.