Monetary Policy Higher Education Questions

Help students understand monetary policy and currencies through these essay and discussion questions.

Why are economies around the world so interconnected? What are the differences between expansionary and contractionary monetary policies? What are the consequences of each? With the largest economy, are the policies of the United States sufficient to promote stability of the global economy? Why or why not?

- In what ways is the United States vulnerable to financial pressure from other countries? What factors mitigate that vulnerability?

- What can the Great Recession tell us about the risks of future global financial crises?

- How did the United Kingdom’s situation in 1956 make it vulnerable to financial pressure from the United States?

What is the role central banks play in the global economy? In particular, what is the role of the U.S. Federal Reserve (also known as “the Fed”)? What is its legal mandate? To what extent have the policies of the Federal Reserve proven to be useful tools in ensuring global financial stability? Defend your answer by citing specific examples.

- How does the Federal Reserve conduct monetary policy?

- How does the Fed influence money supply?

- How does the Fed influence interest rates?

- How did the Great Recession of 2008 impact the world? How did the Fed address these challenges?

How did the U.S. dollar become the most popular currency in the world? Why is the U.S. dollar so desirable to other countries, considering they have their own currency? How important is the role of the dollar to U.S. wealth and power? Evaluate the benefits of maintaining the global role of the U.S. dollar.

- What were the advantages and disadvantages of the gold standard?

- What is de-dollarization?

- How does the global role of the dollar benefit the United States?

- How does the global role of the dollar benefit the international community?

Why do most countries have their own currency, rather than sharing with other countries? Why do exchange rates between currencies fluctuate? Evaluate the advantages and disadvantages of a world with one currency. Use the European Union (and the Euro) as a case study.

Macro Economic Essays

These are a collection of essays written for my economic blogs.

Exchange Rate Essays

- Effects of a falling Dollar

- Why Dollar keeps falling

- Discuss Policies to Stop the Dollar Falling

- Does Devaluation Cause Inflation?

- Benefits and Costs of Falling Dollar

- Reasons for Falling Dollar

- The Dollar as the World’s Reserve Currency

Economic Growth Essays

- Evaluate Benefits of Economic Growth

- Essays on Recessions

- Causes of Recessions

- Problems of Recovering from a Recession

- What can Increase Long-Run Economic Growth?

- Discuss Effect of a fall in the Savings Ratio

Inflation Essays

- Discuss the Difficulties of Controlling Inflation

- Should the aim of the Government be to Attain Low Inflation?

- Explain What Can Cause a Sustained Increase in the Rate of Inflation

- Reasons for low inflation in the UK

- Inflation Explained

- Difficulties of Inflation targeting

- Hyperinflation

Unemployment Essays

- Explain what is meant by Natural Rate of Unemployment?

- Should the Main Macro Economic Aim of the Government be Full Employment?

- The True Level of Unemployment in the UK

- What explains low inflation and low unemployment in the UK?

Demand Side Policies

- Discuss effect of Expansionary demand-side policies on Balance of Payments and Environment

- Effects of a Falling Stock Market

- How do Mortgage Defaults affect and Economy?

- Discuss the effect of increased Government spending on education

- Phillips Curve – Trade-off between Inflation and Unemployment

Development Economics

- Why Growth may not benefit developing countries

- Does Aid Increase Economic Welfare?

- Problems of Free Trade for Developing Economies

Fiscal Policy

- Will US Economy benefit from Tax Cuts?

- Can Fiscal Policy solve Unemployment?

- Explain Reasons for UK Current Account Deficit

- Benefits of Globalisation for Developing and Developed Countries

Monetary Policy

- Discuss Effects of an Increase in Interest Rates

- How MPC set Interest Rates

- Benefits of High-Interest Rates (and recessions)

- Who Sets interest rates – Markets or Bank of England?

Economic History

- Economics of the 1920s

- What Caused Wall Street Crash of 1929?

- UK economy under Mrs Thatcher

- Economy of the 1970s

- Lawson Boom of the 1980s

- UK recession of 1991

- The great recession 2008-13

General Economic Essays

- The Dismal Science

- Difference Between Economists and Non Economists

- War and Recessions

- The Economics of Fear

- The Economics of Happiness

- Can UK and US avoid Recession?

- 3 Of the Worst Economic Policies

- Overvalued Housing Markets

- What Went Wrong with US Economy?

- Problem with Bailing out financial sector

- Problems of Personal Debt

- Problem of Inflation

- National Debt in the UK

- How To Survive a Recession

- Can A recession be a good thing?

Chinese Economy

- Problems of Chinese Economic Growth

- Should we worry about a strong China

- Chinese Growth and Costs of Growth

- Chinese Interest Rates and Economic Growth

Model essays

- A2 model essays

- AS model essays

- Top 10 Reasons For Studying Economics

- Inflation explained by Victor Borge

- Funny Exam Answers

- Humorous look at Subprime crisis

Home — Essay Samples — Economics — Political Economy — Monetary Policy

Essays on Monetary Policy

Monetary policy is an important tool used by central banks to manage the money supply and achieve economic goals such as price stability, full employment, and economic growth. It involves the use of interest rates, open market operations, and reserve requirements to influence the level of economic activity. Given its significance in shaping the overall economic landscape, there are numerous topics that can be explored in essays related to monetary policy.

Importance of the Topic

Understanding monetary policy is crucial for individuals, businesses, and policymakers alike. For individuals, it can affect their borrowing and saving decisions, as well as their purchasing power. For businesses, it can impact their investment decisions and access to credit. For policymakers, it is essential for making informed decisions on interest rates and other monetary policy tools to achieve macroeconomic objectives.

Advice on Choosing a Topic

When selecting a monetary policy essay topic, it is important to consider current events and trends in the economy. Some potential areas of focus could include the impact of monetary policy on inflation, the effectiveness of unconventional monetary policies such as quantitative easing, or the role of central banks in financial stability. Additionally, exploring the relationship between monetary policy and other economic variables such as exchange rates, asset prices, and economic growth can provide valuable insights.

Another approach could be to analyze the historical evolution of monetary policy and its impact on different economic periods. This could involve examining the effectiveness of various monetary policy regimes, such as fixed exchange rates versus floating exchange rates, or the implications of different monetary policy rules such as inflation targeting or nominal GDP targeting.

Furthermore, essays could delve into the challenges and limitations of monetary policy in the current global economic environment. This might include discussing the constraints faced by central banks in the aftermath of the 2008 financial crisis, as well as the implications of low and negative interest rates on monetary policy effectiveness.

Monetary policy is a multifaceted topic with a wide range of potential essay topics to explore. Whether delving into contemporary issues, historical perspectives, or theoretical debates, there is no shortage of interesting and relevant subjects to examine. By choosing a well-defined and relevant topic, students and researchers can contribute to the ongoing discourse on monetary policy and deepen their understanding of its impact on the economy. As the economic landscape continues to evolve, the study of monetary policy will remain a crucial area of research and analysis.

The Use of Monetary Policies that Are Focused on Growth

The issue of fiscal and monetary policy in usa, made-to-order essay as fast as you need it.

Each essay is customized to cater to your unique preferences

+ experts online

Monetary Policy and Inflation in Nigeria

A look at recession's fiscal and monetary policies, overview of globalization in the monetary approach, the classical and neo-classical perspectives in economics, let us write you an essay from scratch.

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

The Government Tools and Means to Alleviate Pressure from Consumers and Businesses Alike

Methods to control inflation, quantitative easing in the usa economy, how primark's monetary and fiscal policy changes impacted, get a personalized essay in under 3 hours.

Expert-written essays crafted with your exact needs in mind

The Monetary Crisis in Europe

Monetary manipulation: punishment through money, crr and slr monetary policy working in india, ronald reagan’s initiatives to reduce the budget deficit, fiscal policy: navigating economic stability and growth, relevant topics.

- Penny Debate

- Unemployment

- Universal Basic Income

- Gross Domestic Product

- National Debt

- Central Bank

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

The Complete List of HSC Economics Essay Questions

It can sometimes be difficult to find practice HSC Economics Essay questions.

To make it easy for you, we’ve compiled a list of 20 HSC Economics essay questions into their respectful topic and written a small blurb on what you will need to cover in each topic!

Read through the questions and have a go at writing a practice essay! Ideally, you want to be aiming to write at least 3 pages for your essay .

All of the following questions have been adapted directly from the HSC Economics Syllabus from the NSW Education Standards Authority (NESA) .

Remember, feedback on your Economics essays is key to improving! We’ve got you covered with HSC Economics Tutoring Sydney !

So, what are you waiting for? Dive in!

HSC Topic 1: The Global Economy HSC Topic 2: Australia’s Place in the Global Economy HSC Topic 3: Economic Issues HSC Topic 4: Economic Policies and Management

HSC Topic 1: The Global Economy

This topic focuses on the workings of the global economy from a very macroeconomic viewpoint and looks at the impact of globalisation on individual economies.

Discuss the impact of globalisation and trade liberalisation (removal of trade barriers) on the global economy.

Discuss the advantages and disadvantages of free trade and analyse how technology has increased the quantity of world trade.

Discuss the advantages of free trade and the role of international organisations (WTO, IMF, World Bank, United Nations, OECD ) and free trade agreements in promoting trade in the global economy.

Evaluate the policies used to promote economic growth and economic development of a country other than Australia.

Explain how globalisation has led to variations in the standard of living and differences in the level of development between nations.

HSC Topic 2: Australia’s Place in the Global Economy

This topic is more specific (and often more difficult) than the previous topic and asks the student to have an understanding of Australia’s place in the global economy, what our largest trading partners are, and what changes to the global economy can effect Australia.

Using diagrams, explain how movements in the Australian dollar can affect the performance of the Australian economy.

Analyse the impact of the changes in the global economy on Australia’s Balance of Payments.

Explain the causes of Australia’s sustained Current Account Deficit (CAD) and explain the impacts of a high CAD on the Australian economy.

Discuss the impact of changes in the domestic and global economy on Australia’s exchange rates and analyse the causes of recent trends in Australia’s exchange rate with the global economy.

Explain the factors that influence Australia’s Balance of Payments.

HSC Topic 3: Economic Issues

This is perhaps my favourite of all the HSC Economics topics as it asks us to examine the nature, causes and consequences of the economic issues that are facing contemporary economies including; unemployment, inflation, distribution of income and wealth as well as sustainable development.

Analyse the causes of unemployment and their effects on the Australian economy.

Explain the causes of inflation and the impacts of high inflation on the Australian economy.

Discuss the consequences of an unequal distribution of income and wealth and the impact of fiscal policy on the distribution of income in Australia.

Analyse the changing sources of economic growth and their effects on the Australian economy and business cycle.

Examine the economic issues associated with the goal of ecologically sustainable development.

HSC Topic 4: Economic Policies and Management

This topic looks at the aims and implementation of economic policies in the Australian economy and asks us to respond to hypothetical situations.

Analyse how macroeconomic policy (i.e. Fiscal and Monetary Policy) can be used to achieve external stability.

Explain the method behind how a Government can finance a budget deficit.

Evaluate the rationale behind the Reserve Bank of Australia’s target inflation rate and explain why monetary policy suffers from a time lag limitation.

Discuss the benefits and disadvantages of having a minimum wage and explain the national system for determining the minimum wage.

Using diagrams, explain how market-based policies can assign a price to a negative externality (e.g. pollution) and improve the quality of life through a paradoxical reduction in consumption.

And that wraps up our list of 20 HSC Economics essay questions! Good luck!

On the hunt for other HSC Economics resources?

Check out some of our other articles and guides below:

- How to Write a Band 6 HSC Economics Essay

- HSC Economics Past Papers Master List

- How to Write Effective HSC Economics Study Notes

If you’re also taking Business Studies as a subject, you should check out our essential guide to writing a Business Studies report !

Looking for some extra help with HSC Economics?

We pride ourselves on our inspirational hsc economics coaches and mentors.

We offer tutoring and mentoring for Years K-12 in a variety of subjects, with personalised lessons conducted one-on-one in your home, online or at one of our state of the art campuses in Hornsby or the Hills!

To find out more and get started with an inspirational tutor and mentor get in touch today!

Give us a ring on 1300 267 888, email us at [email protected] or check us out on TikTok !

Thomas Woolley loves Economics and Business Studies. He completed his HSC in 2013 and has been working at Art of Smart since 2014. He enjoys helping out his students whilst studying B Commerce / B Education at UNSW to become an actual economics/business studies teacher in 2018. Since high school Thomas has also learned to scuba dive, salsa dance, and he can fly a quadcopter like a pro. However, he still cannot skateboard.

- Topics: 🏦 Economics , ✍️ Learn

Related Articles

The ultimate guide to getting a band 6 in hsc economics, how to step up from year 11 and ace hsc economics, hsc economics review ep #29: exam question predictions 2021, 45,861 students have a head start....

Get exclusive study content & advice from our team of experts delivered weekly to your inbox!

Looking for Economics Support?

Discover how we can help you!

We provide services in

New south wales, queensland and victoria.

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

Monetary policy

Monetary policy involves changes in interest rates, the supply of money & credit and exchange rates to influence the economy.

- Share on Facebook

- Share on Twitter

- Share by Email

In the News Teaching Activity – Will the Bank of England cut base rates this summer? (May 2024)

16th May 2024

In the News Teaching Activity – what does the latest data tell us about the state of the UK macroeconomy? (Apr 2024)

22nd April 2024

Edexcel A-Level Economics (A) Theme 2 Knowledge Organiser Pack 2

Exam Support

AQA A-Level Economics - Year 12 Macro Knowledge Organisers

End of an Era - Japan Moves away from Negative Interest Rates

19th March 2024

In the News Teaching Activity – the UK’s unemployment rate may be lower than the statistics suggest (Feb 2024)

12th February 2024

In the News Teaching Activity –the UK macroeconomy 2023 highlights (Jan 2024)

4th January 2024

UK interest rates likely to remain high for some time

28th November 2023

Super Villains: Macroeconomic Policies Teaching Activity

Teaching Activities

In the News Teaching Activity: IMF Predicts That UK Economy Will Have Highest Inflation and Slowest Growth in the G7 in 2024 (Oct 2023)

16th October 2023

What is the difference between tight and loose monetary policy?

Study Notes

4.1.8 Exchange Rates (Edexcel)

4.2.4.3 central banks and monetary policy (aqa a-level economics teaching powerpoint).

Teaching PowerPoints

In the News Teaching Activity: A Surprise Fall in the Rate of Inflation (Sept 2023)

25th September 2023

2.6.2 Monetary Policy (Edexcel A-Level Economics Teaching PowerPoint)

Why Table Mountain holds a clue for the path of UK interest rates

22nd September 2023

In the News Teaching Activity: UK House Prices Are Falling More Rapidly (Sept 2023)

7th September 2023

Financial Market Failure - Banks Under Pressure to Improve Savings Interest Rates

31st July 2023

Rising interest rates - zombie firms may get wiped out

12th July 2023

Monetary squeeze continues as BoE raises base rates to 5%

23rd June 2023

What makes up the money supply in the UK economy?

Micro and macro aspects of rising interest rates | synoptic paper 3.

Topic Videos

UK Interest Rates Climb to 4.5% - Highest since 2008

12th May 2023

UK Economy - Do Higher Interest Rates Control Inflation?

Uk economy - how best to bring down inflation, interest rates and aggregate demand and supply.

12th February 2023

Monetary Policy - Interest Rates and Aggregate Supply

Monetary policy - how rising interest rates affect aggregate demand, boe raises interest rates to 4% - the highest for 14 years.

3rd February 2023

How can a central bank combat high inflation?

Policies to control inflation, what are the key ideas behind monetarism, monetary policy - what is quantitative tightening, monetary policy - uk base interest rates climb to 3.5%.

15th December 2022

Are we reaching a turning point for inflation?

14th December 2022

Interest Rates and Consumer Spending - Chain of Reasoning

Practice Exam Questions

UK Economy - Why a workforce exodus might cause interest rates to climb higher

24th November 2022

Biggest Rise in UK Interest Rates for 33 Years!

3rd November 2022

UK Interest Rates and House Prices - A Quick Update

Monetary policy - bank of england starts to reverse qe.

1st November 2022

Bank of England raises interest rates to 2.25% - highest level for 14 years

22nd September 2022

UK inflation and interest rates - a quick update

14th September 2022

Is this a time for central banks to be more cautious in raising interest rates?

12th September 2022

Bank of England raises interest rates and now forecasts a recession in 2023

4th August 2022

US Federal Reserve raises interest rates by 0.75%

28th July 2022

European Central Bank raises interest rates for the first time in 11 years to zero percent!

22nd July 2022

Monetary Policy - How does raising interest rates control inflation?

17th July 2022

Japanese Economy - Abenomics

2022 exams - key statistics on the uk economy, 2022 exam application context - high and low interest rates, monetary policy (quizlet revision activity).

Quizzes & Activities

Monetary Policy - Bank of England walks tightrope on interest rates

15th February 2022

Interest Rates and Inflation - Chains of Reasoning

Monetary policy - bank of england raises interest rates from 0.1% to 0.25%.

17th December 2021

Monetary Policy - Different Approaches to Tackling Inflation

26th November 2021

Monetary Policy - Who should lead the US Federal Reserve?

10th November 2021

Monetary Policy - The US Fed Tapers QE

4th November 2021

Monetary Policy - UK Base Interest Rates set to Rise

2nd November 2021

Inflation - Are the musings of the MPC irrelevant in the inflation debate?

21st October 2021

Monetary Policy - UK interest rate rise likely before the end of 2021

12th October 2021

UK Economy - Policy Focus - Quantitative Easing

Monetary policy - selection of revision mcqs, managed floating exchange rates, exchange rate - the most important variable in a global economy, the folly of negative interest rates.

13th September 2016

Quantitative Easing - BBC Briefing Room

30th September 2016

Forward Guidance Triggers Behavioural Change

21st November 2016

Carney on popular disillusionment with capitalism

6th December 2016

US Fed raises interest rates driving the dollar higher

15th December 2016

An Animated Guide to Abenomics

30th December 2016

Monetary Policy & Exchange Rates (Revision Presentation)

Monetary policy - central banks and monetary policy, inflation - policies to control inflation, monetary policy - managing demand, monetary policy - forward guidance, monetary policy - quantitative easing (qe), monetary and fiscal policy revision quiz, monetary policy revision quiz, monetary policy in the uk, exchange rates, evaluation on low interest rates and the uk economy, quantitative easing (qe), revision webinar: monetary policy, should smaller eu countries join the euro, negative interest rates (financial economics), interest rates: a quick primer, monetary policy: should uk interest rates rise, macroeconomic objectives and macro stability, factors affecting the supply of and demand for money (financial economics), interest rates - 2021 revision update, monetary policy: are negative interest rates on the horizon.

9th February 2021

Macroeconomic Policy Revision (Online Lesson)

Online Lessons

From our Economics Correspondent: The state of the UK economy in 2025 [Year 12 Enrichment Task]

7th May 2020

Evaluating Monetary Policy (Online Lesson)

Introduction to monetary policy (online lesson), fiscal and monetary policy - connection wall activity, the government game - economic simulation activity, macro policies to prevent an economic depression, real interest rates, economics of negative interest rates, what next for uk interest rates in 2020, what happens when interest rates rise.

25th January 2020

Negative Interest Rates Short Answers

Synoptic economics: micro and macro effects of a rise in interest rates, advantages and disadvantages of higher interest rates, economic effects of higher interest rates (revision essay plan), exchange rates - five key definitions, uk economy update 2019: monetary and fiscal policy, quantitative easing (monetary policy update - 2019), the uk economy in 2018 - essential exam update, life inside the euro zone - focus on the baltic states.

Resources from the Reserve Bank of Australia

9th July 2018

Liquidity Trap

Monetary policy - exchange rates, explaining price deflation - causes, effects and policies, monetary policy - effects of interest rate changes, monetary policy - the bank of england, monetary policy in the uk (revision webinar video), bank of england school visits.

14th May 2018

Test 6: A Level Economics: MCQ Revision on Monetary Policy

How the fed works: after the great recession.

5th April 2018

Shaking the Magic Money Tree

29th January 2018

How the US Federal Reserve sets interest rates

28th November 2017

Interest Rates - play the 'Reach the Peak' Activity

2nd November 2017

Why the Bank of England has raised interest rates

Normalising interest rates.

30th October 2017

The absurdity of controlling inflation by adjusting interest rates

25th October 2017

UK interest rate rise a sign of economic healing

28th September 2017

Sterling's slide yet to help the UK economy rebalance

4th August 2017

Bank of England comes close to raising interest rates

15th June 2017

Analysis of Interest Rate Changes (MCQ Revision Questions)

Monetary policy - the impact of a monetary stimulus, european monetary union (revision webinar video), key macro topics to revise for june 2017.

17th May 2017

Monetary Policy and Inflation (MCQ Revision Questions)

Monetary and supply-side policies and competitiveness (essay technique video), 10 question multi-choice quiz on demand and supply-side policies.

20th April 2017

Risks from prolonged low interest rates

4th November 2016

Negative interest rates defy gravity

9th June 2016

Keynes & Phillips vs Von Mises & Hayek - the tag team fight of the century!

15th April 2016

Fantasy Economics for AS and A2 students!

14th April 2016

How Negative Interest Rates Work

12th April 2016

Macro Economic Policy Conflict for the BoE - balancing the needs of the MPC and FPC

5th April 2016

Exam answer: Monetary policy and economic growth

16th March 2016

An Excellent Podcast for A2 Economics Students! Count the Economic Concepts

14th March 2016

Has the ECB shot their last bazooka?

10th March 2016

China cuts reserve requirement ratio to stimulate credit

2nd March 2016

Bank of Japan moves to set Negative Interest Rates

29th January 2016

Why might the US raise its interest rate?

14th December 2015

Monetary Policy less powerful in recessions

9th October 2013

Monetary Policy: Key Factors Affecting Interest Rates

17th August 2014

Do interest rates affect business investment?

17th October 2014

How The Bank Of England Tries To Control House Prices

6th April 2015

Deflation and the Exchange Rate

19th April 2015

Mark Carney on the Today programme

14th May 2015

Fiscal and Monetary policy – limited by a lack of ‘wriggle room’?

15th June 2015

Magna Carta and the Bank of England - Carney on Interest Rates

17th July 2015

Will UK Interest Rates Rise?

19th August 2015

Monetary Policy and Inequality - New Evidence

27th August 2015

China's Impossible Trinity

9th September 2015

When US Interest Rates Rise - A Short Primer

10th September 2015

Meet the UK Interest Rate Setters!

13th September 2015

What is Money

21st September 2015

Waiting for a Rate Move - UK Macro Analysis

5th November 2015

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

A Level Economics

Our extensive collection of resources is the perfect tool for students aiming to ace their exams and for teachers seeking reliable resources to support their students' learning journey. Here, you'll find an array of revision notes, topic questions, fully explained model answers, past exam papers and more, meticulously organized to simplify your search.

AQA A Level Economics

Cambridge (cie) a level economics, edexcel a level economics b, ocr a level economics, wjec a level economics, wjec eduqas a level economics, articles and resources for a level economics students.

A Level and AS Level Exam Dates 2024

Choosing A Level Subjects

Is Economics A Level Hard?

Retaking Your A Levels - Everything You Need to Know

A Level Results Day 2024

Got questions we've got answers, what is economics a level.

Economics is the study of how resources are used in societies and the factors that influence resource use. Microeconomics considers these decisions from an individual and firm's point of view. Macroeconomics considers these decisions from a government, national and international level. Typical topics covered include supply and demand; market failure; market structures; government intervention; fiscal and monetary policy, exchange rates and international trade.

How to revise Economics A Level?

1. Organise your study materials 2. Create a revision schedule 3. Familiarise yourself with your exam papers, format and timings 4. Use active recall techniques to consolidate knowledge 5. Practice past papers/topic questions 6. Balance work with healthy habits and rest 7. Review and self-test on a regular basis

How hard is A Level Economics?

Similar to Mathematics, Economics is a very logical subject. Basic principles are learnt and then these have to be applied to different situations. The difficulty (and enjoyment) in the subject lies in being able to apply theory to a situation and then analyse and evaluate the potential outcomes. 10 Economists may all have different interpretations based on their insight or different interpretation of data.

Why study Economics A Level?

Economics provides an excellent understanding of how economies function. Irrespective of your career, this understanding can help you to make better decisions - decisions about your career, your financial choices, and your health. The study of economics also provides insight into what and how government actions will have an influence on your life. This perhaps will make you a more informed voter and help you to be more connected to the political process in the country.

Economics Monetary Policy Essay (Rojina Parchizadeh)

DOWNLOAD THE RESOURCE

Resource Description

Evaluate the effectiveness of the RBA’s expansionary monetary policy in achieving economic objectives in the Australian economy. Intro: The Reserve Bank of Australia’s (RBA) use of expansionary monetary policy to countercyclically stimulate growth at a sustainable level has been moderately effective in the past. Monetary policy has successfully achieved the economic objectives of economic growth to a relatively high extent, maintaining low unemployment, inflation and a sustainable rate of economic growth through its Domestic Market Operations (DMOs) which influence the cash rate in the overnight money market. However, it has been unhelpful to the goal of maintaining a fair distribution of wealth and income whilst not being useful for the objective of external stability. In more recent years, as interest rates become increasingly low, expansionary monetary policy has diminished in its effectiveness, raising questions on the policy mix required to achieve economic objectives

Report a problem

Popular HSC Resources

- Speech on George Orwell ‘1984’ – Human Experiences

- How To Survive the HSC

- One Night the Moon – Analysis (Video)

- 2020 – Physics – PHS (Trial Paper)

- Business Studies Influences on HR (Quiz)

- Sci Ext – Portfolio Pack

- 2020 – Science Ext – Exam Choice (Trial Paper)

- Domino’s Marketing Case Study

Become a Hero

Easily become a resource hero by simply helping out HSC students. Just by donating your resources to our library!

What are you waiting for, lets Ace the HSC together!

Join our Email List

No account needed.

Get the latest HSC updates.

All you need is an email address.

Fiscal Policy Notes & Questions (A-Level, IB)

Relevant Exam Boards: A-Level (Edexcel, OCR, AQA, Eduqas, WJEC), IB, IAL, CIE Edexcel Economics Notes Directory | AQA Economics Notes Directory | IB Economics Notes Directory

Fiscal Policy Definition: Fiscal policy occurs when the government uses government spending or taxation to change the amount of aggregate demand (AD) and national income (GDP) in the economy.

Fiscal Policy Examples & Explanation: Fiscal policy is a type of demand-side policy, as it helps the government achieves its macroeconomic objectives by changing AD. For example, during the coronavirus pandemic in the UK, the government spent more by providing business grants , and reduced taxes for UK businesses. This increases AD in the economy as government spending (G) is part of AD (AD = C + I + G + X – M). Note that this will trigger the multiplier effect and also raise the price level (causing inflation). Hence, fiscal policy is often used to address a cyclical recession caused by a downturn in the business/economic cycle. On the other hand, an increase in taxation can be used to tackle inflationary pressure by decreasing AD, causing a withdrawal from the circular flow of income.

Fiscal Policy Revision Notes with Diagram

Fiscal policy video explanation – econplusdal.

The left video explains fiscal policy, the right evaluates the advantages and disadvantages of the policy.

Receive News on our Free Economics Classes, Notes/Questions Updates, and more

Fiscal policy multiple choice & essay questions (a-level), fiscal policy in the news, related a-level, ib economics resources.

Follow us on Facebook , TES and SlideShare for resource updates.

You may also like

Macroeconomic Objectives Notes & Questions (A-Level, IB Economics)

Relevant Exam Boards: A-Level (Edexcel, OCR, AQA, Eduqas, WJEC), IB, IAL, CIE Edexcel Economics Notes Directory | AQA Economics Notes Directory | […]

2018 A-Level Economics Predicted Questions

Below you can find the 2018 A-Level Economics predicted questions we came up with. It will be good practice for you to […]

Oligopoly Notes & Questions (A-Level, IB)

Profit Maximization Notes & Questions (A-Level, IB Economics)

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

- Black Americans’ Views on Success in the U.S.

How Black adults define personal and financial success, and the pressures they feel to achieve their goals

Table of contents.

- Assessing personal success

- Defining personal success

- Pressure to be successful

- Strategies for becoming successful

- Defining financial success

- Financial challenges Black Americans experience

- Personal financial situation

- Economic worries

- Financial preparedness

- Acknowledgments

- The American Trends Panel survey methodology

Pew Research Center conducted this study to explore Black Americans’ views on personal and financial success in the United States and their current assessments of their financial situation.

We surveyed 4,736 U.S. adults who identify as Black and non-Hispanic, multiracial Black and non-Hispanic, or Black and Hispanic. The survey was conducted from Sept. 12 to Sept. 24, 2023, and includes 1,755 Black adults on the Center’s American Trends Panel (ATP) and 2,981 Black adults on Ipsos’ KnowledgePanel.

Respondents on both panels are recruited through national, random sampling of residential addresses. Recruiting panelists by mail ensures that nearly all U.S. Black adults have a chance of selection. This gives us confidence that any sample can represent the whole population (see our Methods 101 explainer on random sampling). For more information on this survey, refer to its methodology and questionnaire .

The terms Black Americans and Black adults are used interchangeably throughout this report to refer to U.S. adults who self-identify as Black, either alone or in combination with other races or Hispanic identity.

Throughout this report, Black, non-Hispanic respondents are those who identify as single-race Black and say they have no Hispanic background. Black Hispanic respondents are those who identify as Black and say they have Hispanic background. Multiracial respondents are those who indicate two or more racial backgrounds (one of which is Black) and say they are not Hispanic.

In this report, immigrant refers to people who were not U.S. citizens at birth – in other words, those born outside the U.S., Puerto Rico or other U.S. territories to parents who were not U.S. citizens.

To create the upper-, middle- and lower-income tiers, respondents’ 2021 family incomes were adjusted for differences in purchasing power by geographic region and household size. Respondents were then placed into income tiers: Middle income is defined as two-thirds to double the median annual income for the entire survey sample. Lower income falls below that range, and upper income lies above it.

Throughout this report, Black adults with upper incomes are those who have family incomes in the upper-income tier. Black adults with middle incomes and Black adults with lower incomes have family incomes in the middle- and lower-income tier, respectively. For more information about how the income tiers were created, read the methodology .

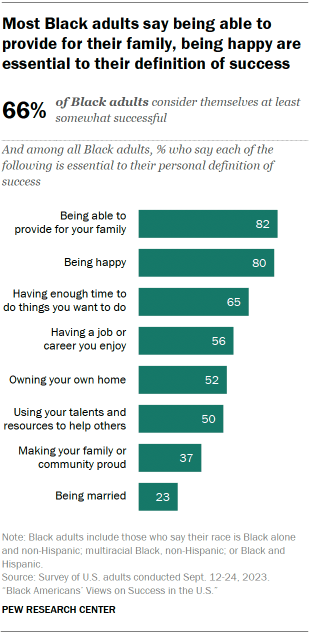

Most Black Americans consider themselves at least somewhat successful (66%). When asked to define what success means to them personally, 82% of Black adults point to the ability to provide for their family.

However, success isn’t exclusively related to financial achievements, a new Pew Research Center survey finds. Majorities of Black adults also cite quality-of-life measures such as personal happiness (80%), having enough time to do the things they want to do (65%) and having a job or career they enjoy (56%). A related analysis finds that most Black adults say they are at least somewhat happy and have enough time to do the things they want to do at least sometimes.

Roughly half of Black adults also say owning their own home (52%) and using their talents and resources to help others (50%) are essential to their personal definition of success.

Yet many of the measures Black adults use to define success are also major sources of pressure in their lives.

Among the pressures Black adults experience, the top two cited relate to personal finances: 71% say they face a great deal or fair amount of pressure to have enough money to do the things they want to do, and 68% say the same about being able to provide for their family.

Financial pressures are widespread among Black adults even when accounting for differences in family income. 1

- 73% of Black adults with lower family incomes, 70% of those with middle incomes and 69% with upper incomes say they face a great deal or fair amount of pressure to have enough money to do the things they want to do.

- 70% of Black adults with lower incomes, 68% with middle incomes and 64% with upper incomes say the same about pressures to provide for their family.

- 53% of Black adults with lower incomes, 48% with middle incomes and 50% with upper incomes say they feel that pressure to own their own home.

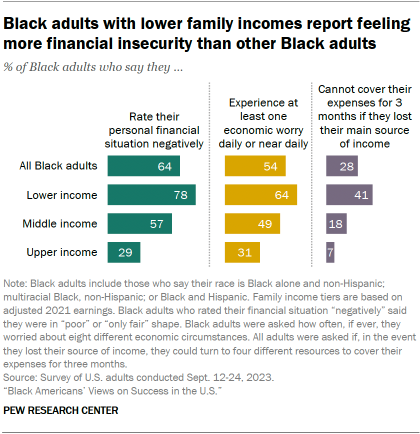

Although many Black adults experience similar levels of financial pressure, particular subgroups experience more financial insecurity than others. For example, Black adults with lower family incomes are more likely than those with middle or upper incomes to rate their personal financial situation negatively (78% vs. 57% and 29%, respectively).

Similarly, Black adults with lower incomes are more likely than those with middle or upper incomes to experience economic worries on a daily or near daily basis (64% vs. 49% and 31%). They are also more likely to say that if they lost their main source of income, they could not cover three months’ worth of expenses using several financial means we asked about (41% vs. 18% and 7%).

Black Americans’ assessment of their financial situation today

While national economic conditions improved some in 2023 , inflation slowed and unemployment rates hovered near record lows , Black Americans are downbeat about their financial situation. Overall, 64% of Black adults rate their personal financial situation negatively, or in only fair or poor shape.

The new survey also finds many Black adults are not financially prepared for the sudden loss of their main source of income. We asked if they could use four different resources to cover expenses for three months if they lost their income: personal savings, credit cards, loans from family or friends, or the value of their assets.

- 45% say they could cover their expenses for three months with personal savings.

- 37% say they could borrow from family or friends.

- 28% say they would not be able to use any of the four resources we asked about to cover three months’ expenses.

Additionally, a majority of Black adults experience at least one of eight financial worries on a daily or near daily basis.

- Roughly three-in-ten worry about paying their bills (31%), the amount of debt they have (29%), and being able to save enough for their retirement (28%) on a daily or near daily basis.

- 24% worry about being able to buy enough food for themselves and their family every day or almost every day.

- 54% worry about at least one economic concern either every day or almost every day, such as paying bills, the amount of debt they hold, saving for retirement, and being able to buy enough food for their families.

In 2022, Black households had the lowest median income out of all racial and ethnic groups in the United States, at $52,860, according to the Census Bureau . And while Black household wealth rose during the pandemic , it remains significantly lower than other racial or ethnic groups’. Notably, 24% of all single-race, non-Hispanic Black households had no or negative wealth in December 2021, despite gains during the pandemic.

Earlier Pew Research Center findings show that Black Americans typically experience higher levels of economic insecurity than other Americans, are increasingly dissatisfied with capitalism , and believe the economic system in the U.S. does not treat Black people fairly. Nonetheless, Black adults are optimistic about their financial futures .

How Black Americans define financial success

No matter their financial situation, Black Americans define financial success in many ways. Among Black adults:

- Roughly two-thirds say being debt-free (67%) and having enough money to do the things they want to do (65%) are essential to their definition of financial success.

- About half (49%) say the same about owning a home.

- Fewer than half say being able to pass down financial assets to future generations (44%), having multiple streams of income (43%), being able to retire early (35%), or owning a business (22%) are essential to their definition of financial success.

For this report, we surveyed 4,736 Black adults in the U.S. from Sept. 12 to 24, 2023, in English and Spanish, to find out how they view personal and financial success in America, and to learn about the economic challenges they experience.

The following chapters take a closer look at:

How Black Americans view personal success

How Black Americans view financial success and the financial challenges they experience

- Throughout this report, Black adults with upper incomes are those who have family incomes in the upper-income tier. Black adults with middle incomes and Black adults with lower incomes have family incomes in the middle- and lower-income tier, respectively. For more information about how the income tiers were created, read the methodology. ↩

Sign up for our weekly newsletter

Fresh data delivery Saturday mornings

Sign up for The Briefing

Weekly updates on the world of news & information

- Black Americans

- Economic Inequality

- Family & Relationships

- Happiness & Life Satisfaction

- Income & Wages

- Income, Wealth & Poverty

- Personal Finances

Most Black Americans Believe Racial Conspiracy Theories About U.S. Institutions

An early look at black voters’ views on biden, trump and election 2024, a look at black-owned businesses in the u.s., 8 facts about black americans and the news, among black adults, those with higher incomes are most likely to say they are happy, most popular, report materials.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

© 2024 Pew Research Center

Trump Vows to Lower Prices. Some of His Policies May Raise Them.

Donald J. Trump has not released a detailed economic plan. But three of his key proposals would push prices up, economists say.

Supporters cheered for former President Donald J. Trump at a campaign rally in Wildwood, N.J., in May. Credit... Hiroko Masuike/The New York Times

Supported by

- Share full article

By Charlie Savage , Maggie Haberman and Jonathan Swan

- June 8, 2024

Former President Donald J. Trump routinely blames President Biden for higher prices at the grocery store and everywhere else Americans shop, and promises to “fix it.”

But Mr. Trump has offered little explanation about how his plans would lower prices. And several of his policies — whatever their merits on other grounds — would instead put new upward pressure on prices, according to interviews with half a dozen economists.

Mr. Trump says he plans the “largest domestic deportation in American history,” which would most likely increase the cost of labor. He intends to impose a new tariff on nearly all imported goods, which would probably raise their prices and those of any domestic-made competitors.

And he not only wants to make permanent the entire deficit-financed tax cut law he and congressional Republicans enacted in 2017, but also to add some kind of new “ big tax cut ” for individuals and businesses, which would stimulate an economy already at full employment.

As a matter of textbook economics, each of those three signature Trump policy plans would be likely to raise prices. Some could even cause continued, rather than one-time, price increases — adding to the possibility of inflation.

“I think we can say with a lot of confidence that President Trump’s trade policies and immigration policies would result in price spikes,” said Michael Strain, the director of economic policy studies at the right-leaning American Enterprise Institute.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in .

Want all of The Times? Subscribe .

Advertisement

IMAGES

VIDEO

COMMENTS

Explore the Tools of Economic Control! Learn about Expansionary Fiscal Policy and Monetary Policy, and how they impact inflation. Discover Strategies to Reduce and Control Inflation using both Policies. Dive into Policy Measures during a Recession and get insights on A Level Economics Essays for Fiscal and Monetary Policy. Unravel the concept of Liquidity Trap in Monetary Policy and explore ...

Essay and Discussion Questions from Economics. Monetary Policy High School Questions. Print. Help students understand monetary policy and currencies through these essay and discussion questions. Introduction. How did the U.S. dollar become the most popular currency in the world?

Question 3. How did the U.S. dollar become the most popular currency in the world? Why is the U.S. dollar so desirable to other countries, considering they have their own currency? How important is the role of the dollar to U.S. wealth and power? Evaluate the benefits of maintaining the global role of the U.S. dollar.

1. UNIVERSITY OF CALIFORNIA Economics 134. DEPARTMENT OF ECONOMICS Spring 2018. Professor David Romer. SAMPLE EXAM QUESTIONS. Notes: - Many of these questions are drawn from past Econ 134 exams. - The instructions accompanying some of the questions take the form, "Decide whether the statement is true, false, or uncertain and explain why.

Monetary Policy Definition: - Monetary policy occurs when the government uses interest rates or money supply to change the level of aggregate demand (AD) and national income (GDP) in the economy. - Interest rates is the monetary gain from lending money, and also the monetary cost of borrowing money. - Money supply is the total amount of ...

monetary policy shocks due to high marginal cost of external funds. This implies that monetary policy might be less effective during crisis time due to a larger fraction of constrained firms. My results reconcile previous empirical findings and argue that the seemingly contrary conclusions are, to some extent, consistent with each other.

Monetary policy is the use of control over money supply and interest rates in order to manage demand. There are a range of macroeconomic objectives, including stable inflation, high employment, economic growth, neutral balance of payments, equality and protecting the environment. Monetary policy can only be used to fix some of these. ...

Questions and model answers on 12. Financial Markets & Monetary Policy for the AQA A Level Economics syllabus, written by the Economics experts at Save My Exams. ... Essay 2. Since 1998, the Bank of England has had responsibility for the operation of monetary policy and maintaining price stability. In response to the financial crisis of 2007 ...

Humorous. Top 10 Reasons For Studying Economics. Inflation explained by Victor Borge. Funny Exam Answers. Humorous look at Subprime crisis. A collection of macro-economic essays on topics Inflation, Economic growth, government borrowing, balance of payments. Evaluation and critical analysis of all latest issues of the current day.

We've put together a data response set of questions that you could tackle. If you are doing AQA Economics then download this AQA-style data response. ... an essay-based activity, in which 2 example essays on monetary policy are provided (along with some examiner commentary) and students need to consider the strong features of these essays ...

Essay and Multiple-Choice Exam Questions for Fiscal Policy in GCE A-Level Economics for all exam boards (Edexcel, AQA, OCR, Eduqas) Role Of The Govt. Macro Economics Chap02 Perfect Competition Essay Questions - IB Economics

Monetary and fiscal policy Introduction Fiscal policy is defined as the power that the federal government poses that enables it to impose taxes and also spend to achieve its goals in the economy. On the other hand, the monetary policy is maintaining the programs that try to increase the nation's level of business through regulation the supply ...

Here is a video recording of a revision webinar looking at shaping an answer to this 25 mark question. "Monetary policy is as important as supply-side polici...

Monetary policy is a multifaceted topic with a wide range of potential essay topics to explore. Whether delving into contemporary issues, historical perspectives, or theoretical debates, there is no shortage of interesting and relevant subjects to examine. By choosing a well-defined and relevant topic, students and researchers can contribute to ...

It can sometimes be difficult to find practice HSC Economics Essay questions. ... Analyse how macroeconomic policy (i.e. Fiscal and Monetary Policy) can be used to achieve external stability. Question 2. Explain the method behind how a Government can finance a budget deficit.

Essays on Monetary Policy with Informational Frictions Abstract This dissertation presents three essays addressing the role of informational frictions in monetary policy. In particular, motivated by the observation that central banks around the world are often ... Together, these essays shed light on the unanswered questions of how the public ...

Monetary policy is crucial to the economy and impacts all types of economic and financial decisions individuals make. For example, depending on the state of the economy, individuals may decide whether to obtain a loan to purchase a new car or house or to start their own company, whether to expand a business by investing in a new plant or equipment, and whether to put savings in a bank, in ...

Monetary policy involves changes in interest rates, the supply of money & credit and exchange rates to influence the economy. ... (Revision Essay Plan) Practice Exam Questions. Exchange Rates - Five Key Definitions Topic Videos. UK Economy Update 2019: Monetary and Fiscal Policy ... 10 question multi-choice quiz on Demand and Supply-Side ...

4 answers. Jun 5, 2023. Fiscal balance such as reduction in the fiscal deficit and Current Account Deficit impacts the interest rates indirectly when the Monetary Policy is setting out the target ...

A Level Economics. Our extensive collection of resources is the perfect tool for students aiming to ace their exams and for teachers seeking reliable resources to support their students' learning journey. Here, you'll find an array of revision notes, topic questions, fully explained model answers, past exam papers and more, meticulously ...

Monetary policy has successfully achieved the economic objectives of economic growth to a relatively high extent, maintaining low unemployment, inflation and a sustainable rate of economic growth through its Domestic Market Operations (DMOs) which influence the cash rate in the overnight money market. However, it has been unhelpful to the goal ...

Economics. 10 Found helpful • 3 Pages • Essays / Projects • Year: Pre-2021. This essay provides a comprehensive discussion on Monetary Policy and answers the question: "Discuss the impacts of Monetary Policy on the Australian Economy". This document is 30 Exchange Credits. Add to Cart.

Fiscal policy is a type of demand-side policy, as it helps the government achieves its macroeconomic objectives by changing AD. For example, during the coronavirus pandemic in the UK, the government spent more by providing business grants, and reduced taxes for UK businesses. This increases AD in the economy as government spending (G) is part ...

The terms Black Americans and Black adults are used interchangeably throughout this report to refer to U.S. adults who self-identify as Black, either alone or in combination with other races or Hispanic identity.. Throughout this report, Black, non-Hispanic respondents are those who identify as single-race Black and say they have no Hispanic background.

In response to questions, the Trump campaign's policy director, Vince Haley, disputed the notion that Mr. Trump's second-term policy plans could raise prices further or even re-stoke inflation ...