Please scroll down for links to county deeds offices.

Androscoggin

Aroostook South

Aroostook North

Piscataquis

The Maine Registers of Deeds Association is providing this official Statewide Single Web Portal through which the public can access and make copies of land records on file at the State of Maine's 18 county Registries of Deeds. This official website is the common entry point- or link - to all registries. This official Statewide Single Web Portal is under the operation and control of the individual Maine Registries of Deeds.

On all county Registry of Deeds websites there will be no charge for the first 500 pages per calendar year. After the first 500 pages have been acquired in the calendar year the charge thereafter will be $.50 per page. When printing or downloading, please be sure to select non subscriber unless you wish to be billed monthly as a subscriber.

County Fraud Alert Services:

Property owners across the state may have heard about LD 2240, “An Act to Implement Protections Against Deed Fraud.” This was heard at public hearing on March 4th before the Legislature’s Judiciary Committee.

While state and county officials work on a legally-binding process of protection, the registry offices are doing their best to alert landowners to documents being recorded in their name.

The following counties have implemented Fraud Alert as a FREE service to their property owners. Please contact your local Registry of Deeds for further information as process varies per county.

Cumberland County: Property Fraud Alert ( uslandrecords.com )

Hancock County: https://records.hancockcountymaine.gov/PublicRecordsNotificationLive/Subscribe

Knox County: https://searchiqs.com/fraudalert/?CC=MEKNO

Lincoln County: https://searchiqs.com/fraudalert/?CC=MELIN

Oxford County: https://searchiqs.com/fraudalert/?CC=MEOXE

Penobscot County: https://penobscotdeeds.com/ALIS/WW400R.HTM?WSIQTP=SY40DC

Piscataquis County: https://searchiqs.com/fraudalert/?CC=MEPIS

Sagadahoc County: www.propertyfraudalert.com

Waldo County: https://searchiqs.com/fraudalert/?CC=MEWAL

Washington County: https://searchiqs.com/fraudalert/?CC=MEWAS

York County: https://searchiqs.com/fraudalert/?CC=MEYOR

The Official Land Records Website Maine Registers of Deeds Association

Please scroll down for links to all the individual county deeds offices.

The Maine Registers of Deeds Association present the information on this web site as a service to the public. We have tried to ensure that the information contained in this electronic search system is accurate. The Maine Registers of Deeds Association makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link. Assessing accuracy and reliability of information is the responsibility of the user. The user is advised to search on all possible spelling variations of proper names, in order to maximize search results. The Maine Registers of Deeds Association shall not be liable for errors contained herein or for any damages in connection with the use of the information contained herein.

Statewide Single Web Portal Disclaimer:

Contact the local deeds office.

Click here to see the list.

Powered by DigitalMarketingSuccess.biz

Deed of Assignment: Everything You Need to Know

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. 3 min read updated on January 01, 2024

Updated October 8,2020:

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date. In order to be valid, a deed of assignment must contain certain types of information and meet a number of requirements.

What Is an Assignment?

An assignment is similar to an outright transfer, but it is slightly different. It takes place when one of two parties who have entered into a contract decides to transfer all of his or her rights and obligations to a third party and completely remove himself or herself from the contract.

Also called the assignee, the third party effectively replaces the former contracting party and consequently assumes all of his or her rights and obligations. Unless it is stated in the original contract, both parties to the initial contract are typically required to express approval of an assignment before it can occur. When you sell a piece of property, you are making an assignment of it to the buyer through the paperwork you sign at closing.

What Is a Deed of Assignment?

A deed of assignment refers to a legal document that facilitates the legal transfer of ownership of real estate property. It is an important document that must be securely stored at all times, especially in the case of real estate.

In general, this document can be described as a document that is drafted and signed to promise or guarantee the transfer of ownership of a real estate property on a specified date. In other words, it serves as the evidence of the transfer of ownership of the property, with the stipulation that there is a certain timeframe in which actual ownership will begin.

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the “assignor,” while the party who is receiving the rights is called the “assignee.”

A deed of assignment is required in many different situations, the most common of which is the transfer of ownership of a property. For example, a developer of a new house has to sign a deed of assignment with a buyer, stating that the house will belong to him or her on a certain date. Nevertheless, the buyer may want to sell the house to someone else in the future, which will also require the signing of a deed of assignment.

This document is necessary because it serves as a temporary title deed in the event that the actual title deed for the house has not been issued. For every piece of property that will be sold before the issuance of a title deed, a deed of assignment will be required.

Requirements for a Deed of Assignment

In order to be legally enforceable, an absolute sale deed must provide a clear description of the property being transferred, such as its address or other information that distinguishes it from other properties. In addition, it must clearly identify the buyer and seller and state the date when the transfer will become legally effective, the purchase price, and other relevant information.

In today's real estate transactions, contracting parties usually use an ancillary real estate sale contract in an attempt to cram all the required information into a deed. Nonetheless, the information found in the contract must be referenced by the deed.

Information to Include in a Deed of Assignment

- Names of parties to the agreement

- Addresses of the parties and how they are binding on the parties' successors, friends, and other people who represent them in any capacity

- History of the property being transferred, from the time it was first acquired to the time it is about to be sold

- Agreed price of the property

- Size and description of the property

- Promises or covenants the parties will undertake to execute the deed

- Signatures of the parties

- Section for the Governors Consent or Commissioner of Oaths to sign and verify the agreement

If you need help understanding, drafting, or signing a deed of assignment, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Define a Deed

- Contract for Deed California

- Contract for Deed in Texas

- Assignment Law

- Deed Contract Agreement

- Assignment Of Contracts

- Legal Assignment

- Deed vs Agreement

- Assignment Legal Definition

- Contract for a Deed

CHART OF REGISTRATION FEES

1. DEED OF ASSENT } 2. DEED OF TRUST } 3. DEED OF MOIETY } 4. DEED OF SEVERANCE } K83.40 + K166.80 CERTIFICATE OF TITLE FEE 5. SUBSTITUTION OF DIAGRAM } 6. DEED OF GIFT } 7. FULL CERTIFICATE OF TITLE } 8. DEED OF PARTITION } 9. COMMON LEASEHOLD } K 83.40 + K166.80 FOR EACH CERTIFICATE OF TITLE 10. SEPARATE CERTIFICATE OF TITLE } 11. DEED OF EXCHANGE } 12. LETTERS OF ADMINISTRATOR/PROBATE } 13. COURT ORDERS/JUDGMENTS } 14. CAVEAT/WITHDRAWAL OF CAVEAT } K83.40 15. DISCHARGE OF MORTGAGE } 16. MEMORANDUM OF DEPOSIT OF TITLE } 17. DEATH CERTIFICATE (MEMORISING ON TITLE) } 18. DEATH CERTIFICATE LEADING TO NEW TITLE K83.40 + K166.80 CERTIFICATE OF TITLE FEE 19. CERTIFICATION OF DOCUMENTS (DEGREES, NRC, DIPLOMAS ETC) K83.40 20. CERTIFICATION OF DOCUMENTS /PAGE TITLES, LEASES ETC) K33.60 21. REMARKS AND CANCELLATION OF REMARK K 83.40 22. PHOTOCOPIES K 16.80 23. COMPUTER PRINTOUT (LAND REGISTER) K 41.70 24. OFFICIAL SEARCH K166.80 25. SEARCH BY NAME/PER NAME K 33.60 26. REPLACING CERTIFICATE OF TITLE COVER K 83.40 27. DEFACED TITLE K250.20 28. MISCELLANEOUS DOCUMENTS EXCEPT DEBENTURES K 83.40 29. CERTIFICATE OF INCORPORATION K500.00 30. BILL OF SALE K166.80 31. DUPLICATE CERTIFICATE OF TITLE K333.60 32. MORTGAGES K4000.00 MAXIMUM OTHERWISE 1% OF MORTGAGE 33. ASSIGNMENTS K15000.00 MAXIMUM + K166.80 OTHERWISE 1% OF ZRA VALUE 34. LEASE AGREEMENTS K15000.00 MAXIMUM OTHERWISE 2% AVERAGE ANNUAL RENT 35. REGISTRATION AND NUMBERING/PER PROPERTY K 166.80 36. OFFICE COMPILATION K1668.00 37. CERTIFIED TRUE COPY DIAGRAMS (CTC’s) K 166.80 38. SUPERSEDE DIAGRAMS K 333.30 39. NEW DIAGRAMS K1668.00 40. DIAGRAMS FOR GOVERNMENT HOUSES K 166.80 41. SKETCH PLANS K 250.20 42. MARKING OFF (PER PROPERTY) K 250.20 43. STAT FILING (PER COPY) K 83.40 44. SEARCH FEE (UNDER SURVEYS DEPARTMENT) K 83.40 45. DATA PROCESSING (PER DAY) K 250.20 46. EXAMINATION FEE (STANDS/LOTS/FARMS IN URBAN AREAS) K 116.70 47.EXAMINATION FEE (LOTS/FARMS OUTSIDE URBAN AREAS) 48. MAP SALES K 166.80 HARD COPY K 100.00 SOFT COPY K 150.00 49. EXPIRATION FEE K 333.60 49. SURRENDER FEE K 333.60 50. CONSENT FEE K 333.60 ( FOR ZAMBIANS) 51. CONSENT FEE K 667.20 (FOR NON-ZAMBIANS) 52. NUMBERING FEE/PER PROPERTY K 166.80 LANDS TRIBUNAL FEES 53. COMPLAINT K 8.40 54. AFFIDAVIT IN SUPPORT OF COMPLAINT K 8.40 57. CERTIFICATE OF EXHIBITS K 8.40 58. CERTIFICATE OF URGENCY K 33.60 59. AFFIDAVIT OF SERVICE K 8.40 60. APPOINTMENT OF ADVOCATES K 83.40 61. APPLICATION TO APPEAL OUT OF TIME K 33.60 62. FILE SEARCH K 41.00 63. INJUNCTION K125.10 64. ALL SUMMONS K 8.40 65. AFFIDAVIT IN OPPOSITION K 8.40 66. NOTICE TO DISCONTINUE WITH ADVOCATES K 83.40 67. SKELETONS ARGUMENTS K 8.40 68. OTHER ORDERS AND DOCUMENTS K 8.40 69. NOTICE TO ADJOURN K 8.40 PLEASE OBTAIN AN OFFICIAL RECEIPT AND PRESENT IT TO THE TRIBUNAL SECRETARIAT FOR YOUR DOCUMENTS TO BE ACCEPTED FOR FILING

©2022. SMART Zambia Institute. All Rights Reserved.

0807 794 3514, 0703 668 1104

What is a Deed of Assignment and the Foolish Risk your taking for not having a Deed of Assignment for your Land

By omonilelawyer | july 15, 2017 | 42,741 | 39.

A deed of Assignment is one of the most important documents YOU MUST HAVE when you conclude a Land Transaction. In fact it baffles me that 6 out of 10 people I know who have bought lands in the past have no deed of assignment . They are always the first to complain that Omonile has defrauded them but they have no proof to show the property has been sold to them other than a receipt.

It’s funny that everyone has the title documents to their car showing who the seller was and how it was transferred from the Seller of that car to you the new owner but when it comes to landed properties which are 10 times more valuable than cars, we fail to ask for this one simple important document that can prove ownership of that land. What then is this all important deed of Assignment I am alluding to? This can be found from the following definitions below:

A deed of Assignment is an Agreement between the Seller of a Land or Property and a Buyer of that Land or property showing evidence that the Seller has transferred all his rights, his title, his interest and ownership of that land to that the Seller that has just bought land.

The Deed of Assignment acts a main document between the buyer and seller to show proof of ownership in favour of the seller . The person or Seller who transfers his rights or interests in that property is usually called the Assignor and the person who receives such right or interest from the Seller is called the Assignee.

A Deed of Assignment therefore is an Agreement where an assignor states his promise that from the date of the assignment or any date stipulated therein, the assignor assigns his ownership in that Land to the assignee. The deed contains very pertinent information for a real estate transaction. For one, it spells out the date when the ownership of the property transfers from one owner to the other. The deed also gives a specific description of the property that is included in the transfer of ownership.

Signing a Deed of Assignment and having that Deed is your number 1 evidence against another person that is trying to claim ownership of that same land too. If you have a land and no deed yet, i feel sorry for you! Better consult your Lawyer to go draft one for you now to save yourself future problems

In most situations, when the Deed of Assignment has been exchanged between both parties, it has to be recorded in the land registry to show legal proof that the land has exchanged hands and the public should be aware of the transaction. Such recorded Deed of Assignment come in the form of either a Governor’s consent or registered conveyance.

The Deed of Assignment spells out the key issues in the transaction between the Seller and the Buyer so that there won’t be any confusion or assumption after the property has been transferred to the new owner . Such Key issues include:

1. The Parties’ to the Agreement e.g between Mr A and Mrs K

2. The addresses of both parties and how it is binding on their successors, friends, colleagues and those representing them in any capacity.

3. The history of the land in question how it was first obtained down to the moment its about to be sold including and documents it previously had till this date

4. The agreed cost of the land and the willingness of the Seller to finally accept that price paid for the land

5. The description and size of the land to be transferred.

6. The covenants or promises both parties choose to undertake to perfect the transfer of the document

7. The signature of the parties to the Assignment and Witnesses to the Transaction

8. Finally the section for the Commissioner of Oaths or Governors Consent to sign and validate the agreement.

These are the important features of a Deed of Assignment and must be included in all Documents for it to be valid. Don’t listen to any Omonile who tells you he doesn’t or the family doesn’t sign a deed of assignment and that it is only a receipt you need. He is only looking for a way to resell your land to another person and to use receipt as a ploy to prevent you from establishing true ownership of your land.

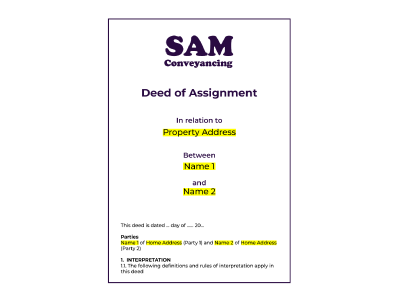

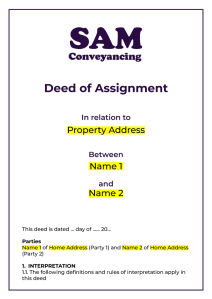

Always consult a property lawyer before you buy a land to help prepare a deed of assignment. It will be your greatest mistake if you don’t have one. Below is a sample deed of assignment and how it looks so that you don’t fall victim of land swindlers

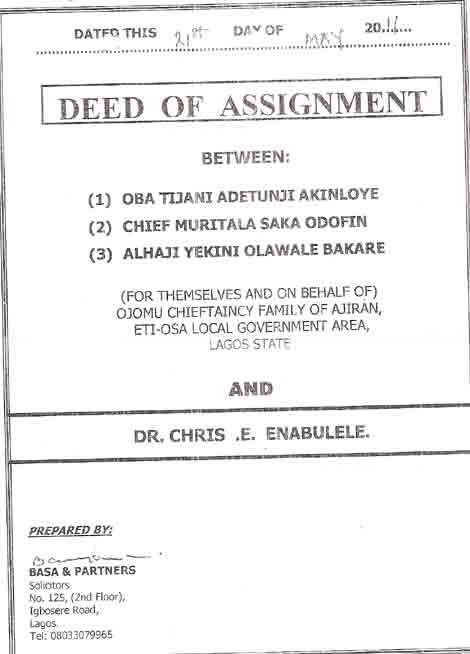

SAMPLE DEED OF ASSIGNMENT

The Cover of the Deed of Assignment must show the parties to the transaction and the description of the land sold

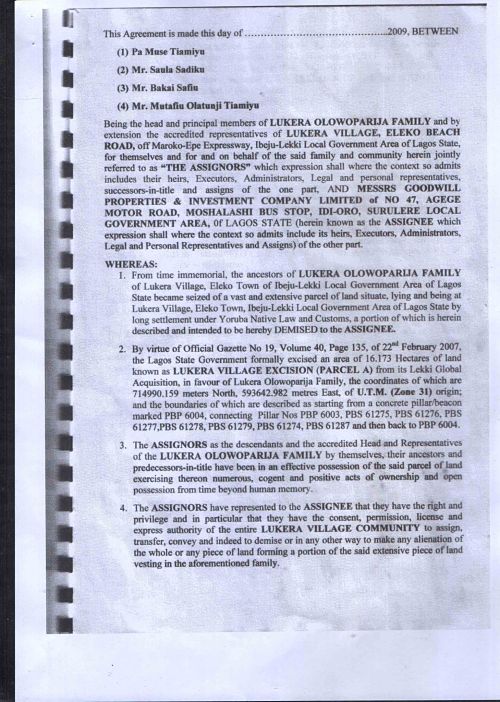

The first page of the Deed of Assignment must contain the parties to the transaction and the brief history of how the land became the Sellers property

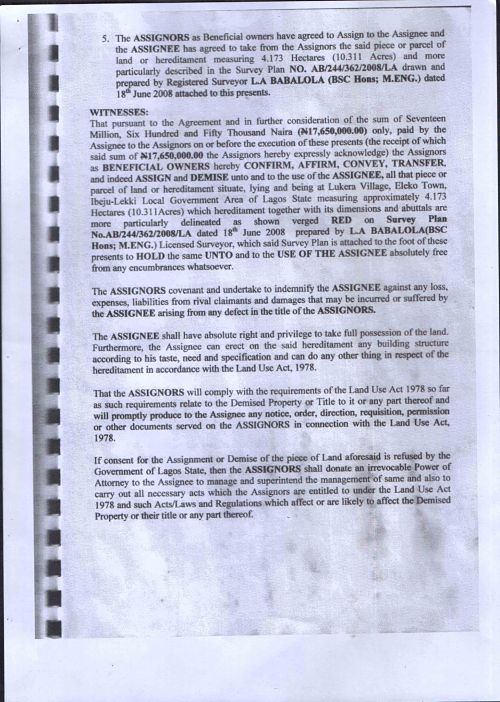

The third page must contain the description of the land to be sold, the surveyor that did it, the cost of the land, the acceptance of the cost of the land and the promises both parties will make to themselves to abide with after the deal has been sealed.

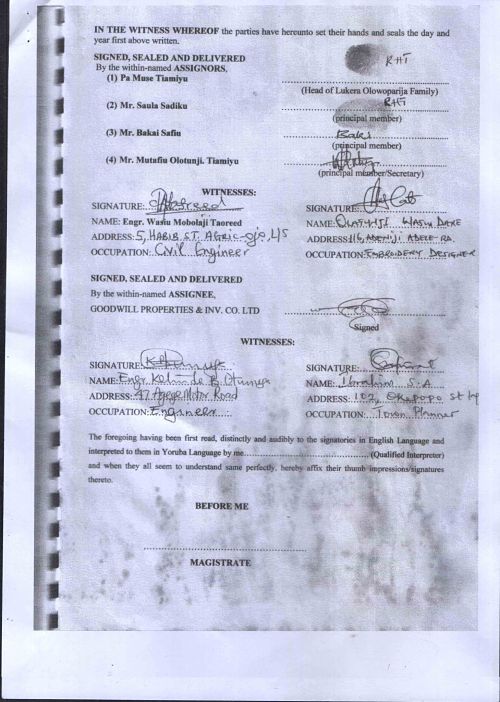

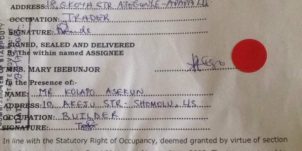

The last page must show the signatures of the parties and the witnesses to that transaction and finally below , the section for the commissioner of oaths to endorse or the Governor to assent his consent to this transaction

Always consult a property lawyer before entering a legal contract.

Omonile Lawyer in your inbox

Subscribe to Omonile Lawyer's Newsletter and stay up to date with more great news and articles like this one

WRITTEN BY: OmonileLawyer

Hey, I'm the Omonile Lawyer. Do you want expert verification on that new land? Contact me now!

Related Post

Beware-A Contract of sale is not a good title. Don’t be fooled

THE DANGERS OF BUYING AN “EXCISION IN PROCESS” LAND IN LAGOS

9 Extremely Dangerous Land Survey Plan Scams by Fraudulent Land Surveyors You Must be Aware of

Omonile Lawyer’s 25 Critical Questions To Ask To Avoid Falling For A Real Estate Scam In Lagos

How Deceitful Sellers Lure Innocent Buyers To Buy Lands With Fake Governor’s Consent

39 comments.

owolabi animashaun

how much is it to obtain governor consent of 3plots of land at okegbegun phase 2.,winner church along laspotech road ikorodu? or if there is C OF O Availiable? thanks

Barr. Matthew Ottah

I need the square meters of the survey plan so that I can fathom out N estimate of what it would cost. Cheers

I have a parcel of Land i had alredy built a 3-Bedroom Bungalow on at Magada behind MFM Prayer City. I only have a Signed Agreement from the One I bought it from. I have paid to the Omonile but yet to get a receipt from them. I have not done a survey yet. Kindly advice.

babatunde Ogunnowo

good morning. what is the difference bewteen a deed of sublease and a deed of assignment? which is preferable 2. what are the cost implications for processing any tyeo of deed. thanks. keep up the good work

Sir, I have plot at ogun state and for the deed of assignment, the land owners said I will pay 100K for them to get it done that there are four signatories to it. The issue now is that the said amount is too much. Pls I need your input on this. Thank You

Matthew Ottah

You need to negotiate with them to reduce the price

Please Mr Ottah can you send your number so I can call to ask for help?

My numbers are everywhere on the site. Cheers

sir,this deed…who is resposible to issusing it,i.e is it part of the document the omonile will give you when you have paid for the land or the buyer contracts a lawyer to draw it up after payment and takes to family(olori ebi) to sign their portions.

Your very correct sir. Both options are the right way to go about it.

how do you know a false land

I wanted to buy a land from one of this estate, I was told the estate has a Global C of O from Ogun state government and that upon payment I will be issued a Deed of Assignment. There after I can do the survey. My questions are: 1. I was told since the Estate has Global C of O, I might not necessarily need individual C of O. 2. What other documents do I need to process apart from the survey. You sincere advice will be appreciated. Thanks

sir, thank you very much sir for your advise, all what u said above is true even i presently find myself in dat situation, i bought just half plot of land from a family representative at abeokuta in which i only collected receipt from them without the deed of assigmnet and i started work on the land, im even through with the foundation about to start the main building. Sir, i will be very glad and happy if you can put me through on what are d next steps to take, though i have printed out all the deed of assignment you pasted up for me to rewrite and give them to sign.

Thanks you very much sir

Hi, I bought a land from a relative of which the land have a c of o under my Anty family name, my question is; 1. Do I have to do personal c of o on my name. 2. is’t secure under my Anty family name. I need an advice, and I will be looking forward to hear back from you because I don’t know what to do before is too late…thanks!

Good evening barrister, Pls must I first so a survey before I do a deed. We Purchased a land and we have just a receipt. Thank you

please is it legal for a non lawyer to prepare a deed of assignment? Thanks.

Please explain to me the difference between Deed of Assignment and Deed of Agreement. I am getting different interpretation and it is confusing. When I buy a family land, which one should I prepare for the family to sign?

They are the same thing sir and perform the same function.

Could you please tell me the importance of that red seal in a deed? What is its significance? How important is it? Thanks

Its of no serious importance in modern day execution of documents. As long as the parties have signed or attested to the documents with their signatures or personal thumbprint, the document is as good as been executed properly. People who use it are mostly Customary Land Families to show how important their signatures are

Giulia Devey

I have a deed of assignment which is signed but the property has an outstanding mortgage on the property. I have been paying this, however it fell into arrears and now the assignor is claiming against me for receiving adverse credit. This person did not take their name off the mortgage therefore would I be liable for her claim in court?

Yes you would because you have chosen to continue paying the outstanding mortgage. Your lawyer should have advised you on the perils of continuing the mortgage payment in your name

Pls. must a land have C of O before Governor conscent can be acquired if purchased from the owner? What happen when the land doesnot have C of O? can the buyer seek to get C of O in place of Governors conscent

Please can a commissioner for oath of Lagos State endorse the dead while the land is situated in ogun state

Can a deed of assignment be prepared for land that does not have C of O yet but which Allocation paper or R of O is ready?

name withheld

my friend bought a property an does not know how much to pay his attorney, the attorney are asking for 500k 180, and claimed they have to bribe some people to get them to follow the deed of assignment , is it a fraud of are the lawyers just trying to be a fraudulent?? thanks and have a good day

Good day Sir, I found this site and info therein helpful. Is it possible for a the seller to issue a 2 Deed of assignment to different person on the sme land.

What is the functional different between C of O and deed of assignment

Two people bought a plot of land. The seller bought it from another person. What documents must the new buyers get? Must each survey his own portion before the agreement?

omonile lawyer, pls i have power of attorney and deed of partition for a piece of land in abuja (4 of us bought and shared the land), do i still need deed of assignment?

Sir, I want you to send a soft copy of deed of assignment to my email. How much would it cost? [email protected]

Good day sir. I bought a plot of land, have a signed deed of assignment. But resently, d surveyor called me that there is need to create a road at my (land) back i.e a plot will b inbetween two roads and that i should shift my pillar and the corner piece. Now, i need ur advice on what to do sir. Thanks. N.B He is d one who sold d land, measured, pegged and put d pillar.

l can get in touch with the company l signed deed of assignment with 4 times no reply to me

Gabriel Joseph

To be honest with you this is really helpful. Thanks

how do I submit my deed of assignment for record purpose

pls sir,I bought a land with power of attorney from estate management.Am I entitle to omonile receipt and deed of assignment?

i have a land which was purchased from the estate developers but i lost all documents to it by an act of God. what can i do

please sir, can u help us with a sample of the shedule page so that i ccan coinfirm that the schedule page of the deed of assignment for my land is made in the right form

Ola Abiodun

I bought a land in my name and wife’s name. I have now built a property on this land and all the paper works including CofO and the plan have our names both. The land and the property was solely bought and built with my money. I understand we both have claim because her name is on the documents.

What do I need to do to take her name off the the property, both the land and the building? Can you also please advise the likely cost?

I look forward to hearing from you

Leave a Comment Cancel Reply

How can we help?

- Our Services

- Independent Legal Advice Solicitors

- Settlement Agreement Review

- Transfer of Equity

- Equity Release

- Occupier Waiver Form

- Director Guarantee

- Loan Agreement

- Bridging Loan

- Sole Borrower Joint Proprietor

- Borrower and Proprietor

- Joint Borrower Sole Proprietor

- Personal Guarantee Insurance

- Auction Legal Pack Review

- Auction Pack Searches

- Sole Borrower Joint Proprietor - Independant Legal Advice

- Transfer of Equity - Independant Legal Advice

- ID1 / ID5 Form

- ID2 / ID5 Form

- Form LL Verification

- Form LL Restriction Removal

- Statutory Declaration

- Statutory Declaration for Landlord

- Statutory Declaration for PE3

- Statutory Declaration for Solvency

- Deed of Trust

- Tennants in Common to Joint Tennants - Deed of Trust

- Buy to Let Partnership LLP - Deed of Trust

- Floating Deed of Trust

- Joint Mortgage Sole Proprietor Deed of Trust

- Deed of Assignment

- Declaration of No Interest in Property

- Sever Joint Tenancy

- Form A Restriction

- Form LL Restriction

- Form LL Registration

- Remove Mortgage Restriction

- Bankruptcy Restriction Order

- Property Dispute Solicitors

- Property Dispute Initial Review

- Property Misrepresentation Claims

- Loan Agreement - Independent Legal Advice

- Loan Repayment Calculator

- Cohabitation Agreement

- Bridging Loan - Independant Legal Advice

- Equity Release - Independant Legal Advice

- Employment Solicitors

- Employment Settlement Agreement

- Commercial Loan Agreement

- Shareholders Agreement

- About Parachute Law

- Claudine Boast - CEO

- Meet the Team

- Services & Pricing

Book a meeting

Deed of Assignment Cost

How do i get a deed of assignment.

- Accessibility Statement

- Privacy Policy

- Complaint Handling Procedure

- Zero Tolerance Policy

- Terms and Conditions

This website uses cookies.

Some of these cookies are necessary, while others help us analyse our traffic, serve advertising and deliver customised experiences for you. For more information on the cookies we use, please refer to our Privacy Policy .

- Now Trending:

- UNDERSTANDING TENANCIES ...

- THE SENIOR PARTNER OF PR...

- Dr. Prince O. Williams-J...

- How To Pick The Right Ho...

DEED OF ASSIGNMENT: EVERYTHING YOU NEED TO KNOW.

A Deed of Assignment refers to a legal document in which an assignor states his willingness to assign the ownership of his property to the assignee. The Deed of Assignment is required to effect a transfer of property and to show the legal right to possess it. It is always a subject of debate whether Deed of Assignment is a contract; a Deed of Assignment is actually a contract where the owner (the “assignor”) transfers ownership over certain property to another person (the “assignee”) by way of assignment. As a result of the assignment, the assignee steps into the shoes of the assignor and assumes all the rights and obligations pertaining to the property.

In Nigeria, a Deed of Assignment is one of the legal documents that transfer authentic legal ownership in a property. There are several other documents like a deed of gifts, Assent, etc. However, this article focuses on the deed of assignment.

It is the written proof of ownership that stipulates the kind of rights or interests being transferred to the buyer which is a legal interest.

Read Also: DIFFERENCE BETWEEN TRANSFER OF PROPERTY THROUGH WILLS AND DEED OF GIFT

CONTENTS OF A DEED OF ASSIGNMENT

Content of a Deed of Assignment matters a lot to the transaction and special skill is needed for a hitch-free transaction. The contents of a deed of assignment can be divided into 3 namely; the introductory part, the second (usually the operative part), and the concluding part.

- THE INTRODUCTORY PART: This part enumerates the preliminary matters such as the commencement date, parties in the transaction, and recitals. The parties mentioned in the deed must be legal persons which can consist of natural persons and entities with corporate personality, the name, address, and status of the parties must be included. The proper descriptions of the parties are the assignor (seller) and assignee (buyer). The Recitals give the material facts constituting the background to the current transaction in chronological order.

- THE SECOND PART (USUALLY THE OPERATIVE PART): This is the part where the interest or title in the property is actually transferred from the assignor to the assignee. It is more like the engine room of the deed of assignment. The operative part usually starts with testatum and it provides for other important clauses such as the consideration (price) of the property, the accepted receipt by the assignor, the description of the property, and the terms and conditions of the transaction.

- The testimonium : this shows that all the parties are involved in the execution of the deed.

- Execution : this means signing. The capacity of the parties (either individual, corporate bodies, illiterates) is of great essence in the mode of execution. It is important to note that the type of parties involved determines how they will sign. Example 2 directors or a director/secretary will sign if a company is involved. In the same way, if an association, couple, individual, illiterate, family land (omonile), firm, unregistered association, etc. is involved the format of signature would be different.

- Attestation : this refers to the witnessing of the execution of the deed by witnesses.

For a Deed of Assignment to be effective, it must include a column for the Governor of the state or a representative of the Government where the property is, to sign/consent to the transaction. By virtue of Sec. 22 of the Land Use Act, and Sec. 10 Land Instrument Registration Law, the Governor must consent to the transaction.

Do you have any further questions? feel free to call Ibejulekkilawyer on 08034869295 or send a mail to [email protected] and we shall respond accordingly.

Disclaimer: The above is for information purposes only and should not be construed as legal advice. Ibejulekkilawyer.com (blog) shall not be liable to any person(s) for any damage or liability arising whatsoever following the reliance of the information contained herein. Consult us or your legal practitioner for legal advice.

Only 22% of poorest Nigerian households have electricity access –World Bank

Related Posts

Drafting a Deed of Assignment

Try our Legal AI - it's free while in beta 🚀

Genie's Legal AI can draft , risk-review and negotiate 1000s of legal documents

Note: Want to skip the guide and go straight to the free templates? No problem - scroll to the bottom. Also note: This is not legal advice.

Introduction

A Deed of Assignment is a vital legal document used to transfer rights, interests or assets between parties. It is regularly used in business transactions, and often regarding real estate or intellectual property. A well-crafted deed of assignment can protect both sides from potential legal disputes, ensuring that everyone involved understands their obligations and responsibilities.

The Genie AI team has seen many instances where having a valid deed of assignment can make all the difference - without it businesses could be exposed to considerable risk. That’s why we offer free templates and step-by-step guides to help those wishing to draft their own deed.

When creating a Deed of Assignment it is important to take the specific circumstances into account - any changes or additions should be accurately documented and agreed by all involved parties beforehand. Furthermore, it is essential that the terms are clearly written out in an unambiguous way so every party knows exactly what they have signed up for. Beyond protecting both sides’ interests, this type of agreement can also be used for copyright assignments, leases, debt transfers and trusts.

Before signing on the dotted line it’s also critical that executing such documentation is done properly - all parties must sign in the presence of a witness who will also affix their signature and date the document accordingly. Once this process has been completed filings must then be made with any relevant government authorities whenever necessary (especially in cases involving real estate or intellectual property transfers).

In summary, drafting a Deed of Assignment not only safeguards everyone’s best interests but also provides additional benefits depending on its use case - reading through our step-by-step guidance below should provide you with more information on how to access our template library today and start benefitting from its advantages without needing to sign up for an account with Genie AI first!

Definitions (feel free to skip)

Legal Binding: When a legally binding document is used, it means that all parties involved are legally obligated to follow the terms and conditions set forth in the document.

Assignor: The assignor is the person who is transferring rights, interests or assets to someone else.

Assignee: The assignee is the person who is receiving the rights, interests or assets from the assignor.

Witness: A witness is an independent third-party who is present when a document is signed, in order to ensure that the process is completed in a secure and legally binding manner.

Stamp: A stamp is an official seal or mark that is used to verify and authenticate a document.

Tax: A tax is a sum of money that is paid to a government or public authority.

Duty: Duty is an obligation or responsibility assigned to someone.

Defining the Deed of Assignment

What is a deed of assignment and what is its purpose, parties involved, who needs to be involved in the making of a deed of assignment, drafting the deed, determine what kind of deed of assignment needs to be drafted, consider the subject matter to be assigned in the deed, research the legal requirements for the kind of deed to be drafted, draft the deed of assignment in accordance with the legal requirements, executing the deed, check that the parties to the deed are correctly identified, confirm that the deed is correctly signed and dated by all parties, confirm that the deed is witnessed by an independent third party, have the deed of assignment properly executed by all parties, registration, determine whether the deed of assignment needs to be registered, if registration is necessary, confirm the registration procedures, take necessary steps to register the deed of assignment, considerations, consider any applicable tax or stamp duty implications of the deed of assignment, consider any restrictions or limitations on the rights being assigned, consider whether the deed of assignment needs to be registered in any public records, common mistakes, not accurately identifying all of the parties to the deed, not having the deed properly executed by all parties, not having the deed witnessed by an independent third party, not considering any applicable tax or stamp duty implications, not considering any applicable restrictions or limitations on the rights being assigned, record keeping, ensure that the original deed of assignment is securely stored, create a digital copy of the deed and store it in a secure manner, review the deed of assignment to ensure accuracy, confirm that all steps have been completed correctly, seek advice from legal professionals if necessary, get started.

- Establish the parties involved in the Deed of Assignment

- Identify the property or service being assigned

- Specify the terms of the assignment

- Ensure the Deed of Assignment is properly witnessed

- Check that all signatures are valid

When you have completed the steps above, you will have successfully defined the Deed of Assignment and can proceed to the next step.

- A deed of assignment is a legal document that is used to transfer the rights and responsibilities of one party (the assignor) to another party (the assignee)

- It is used to transfer contractual rights and obligations between parties

- It should include information such as the names of the parties, the date of the assignment, and the description of the rights transferred

- You will know that you have completed this step when you have an understanding of what a deed of assignment is and why it is used.

- Identify the party transferring their rights (the assignor) and the party receiving the rights (the assignee)

- Draft the deed in the name of both parties, including full names and contact details

- Ensure the deed is signed by both the assignor and assignee

- Once the deed is signed, the parties should exchange copies of the document

Once the assignor and assignee have been identified and the deed has been drafted and signed, you can check this step off your list and move on to the next step.

- Identify the parties involved in the Deed of Assignment. This would typically include the assignor (the party transferring their rights or interest) and the assignee (the party receiving the rights or interest).

- Ensure that all parties involved have the legal capacity to enter into a contract.

- When all parties have been identified and their legal capacity has been verified, you can check this step off your list and move on to drafting the Deed.

- Read the applicable laws in your jurisdiction to determine the required language and structure of the Deed of Assignment

- Gather the necessary information on the parties, the asset being assigned, and other relevant details

- Draft the Deed of Assignment, taking into account all the necessary details

- Make sure the language is clear and unambiguous

- Have the Deed of Assignment reviewed by a legal professional

- When the Deed of Assignment has been drafted and reviewed, you can move on to the next step.

- Identify the type of assignment that needs to be drafted and the legal requirements that need to be satisfied

- Consider the purpose of the Deed and the rights and obligations of the parties to the Deed

- Determine if the Deed is for an absolute or conditional assignment

- Consider if the Deed should be an express or implied assignment

- Determine if the Deed needs to be in writing or if it can be oral

- Check the applicable laws in your jurisdiction to ensure that you are drafting a valid Deed

- Check if there are any additional requirements that need to be included in the Deed

When you can check this off your list: Once you have identified the type of assignment and the relevant legal requirements, you can move on to considering the subject matter to be assigned in the Deed.

- Identify the subject matter of the Deed of Assignment, such as a patent, trademark, copyright, or other intellectual property

- Assess the value of the subject matter and any associated liabilities

- Understand the relationship between the assignor and assignee

- Have all necessary documents, such as a purchase agreement, to provide more detail about the assignment

Once you have identified the subject matter of the Deed of Assignment, assessed its value, understand the relationship between the assignor and assignee, and gathered any additional documents, you can move onto the next step of researching the legal requirements for the kind of Deed to be drafted.

- Research the relevant legislation, case law, and other materials related to the Deed of Assignment to be drafted

- Consult with a lawyer familiar with the relevant law to understand the requirements

- Take detailed notes on the legal requirements that must be adhered to in the Deed of Assignment

- Once you have all the necessary information, double-check that you understand the requirements before moving on to the next step.

- Prepare the text of the Deed, ensuring that all relevant information regarding the parties, the subject matter, and the consideration is included

- Check to make sure the language conforms with relevant laws and regulations

- Have the Deed reviewed by a solicitor to ensure that it complies with all legal requirements

- Once the Deed has been approved by a solicitor, have the parties sign the document

- Once the Deed has been signed by both parties, make multiple copies and ensure each party has a copy

- This step is complete once the Deed has been signed and each party has a copy of the document.

- Ensure both parties sign the Deed of Assignment in the presence of two witnesses who are over the age of 18 and not parties to the Deed

- Have both parties sign the deed in the presence of two witnesses and have the witnesses sign the deed to attest to witnessing the signature of the parties

- Check that the parties have signed the Deed in the presence of the witnesses by noting the signatures and the dates of signature in the execution clause of the Deed

- Once the Deed has been executed, have the parties date and keep a copy of the Deed in a secure place

- You will know that you have completed this step when the Deed has been properly executed by the parties in the presence of two witnesses.

- Identify all parties to the Deed and verify that their details are correct.

- Ensure that all parties to the Deed are identified in the document and that the details of each party are accurate and up-to-date.

- Check that the names, addresses and contact details of each party are correct.

- Once you have verified that the parties and their details are correctly identified, you can move on to the next step.

- Check that all parties have signed the Deed in the correct place, and that the date of signature is correct

- Ensure that each party has signed the Deed in the presence of an independent witness

- Check that all parties have signed the Deed with their full name and title, if applicable

- Confirm that the date of signature is correct and that all parties have signed on the same date

- Once you have verified that all parties have correctly signed and dated the Deed, you can proceed to the next step.

- Ensure that the Deed is witnessed by an independent third party who is not a party to the Deed.

- Ask the third party to sign the Deed and provide their name, address, occupation and date of signing.

- Check that the third party has signed and dated the Deed.

- Once the above is complete, you can check this step off your list and move on to the next step.

- Obtain signatures from all parties on the deed of assignment, ensuring that each party signs in the presence of a witness

- Have an independent third party witness each party’s signature

- Ensure that all parties have a valid form of identification, such as a driver’s license or passport, available for inspection by the witness

- Ensure that all parties sign the deed of assignment in the presence of the witness

- Obtain the witness’ signature, confirming that all parties signed in the presence of the witness

- You will know this step is completed once all parties have signed the deed of assignment and the witness has signed confirming they were present during the signing.

- Obtain a copy of the executed Deed of Assignment from all parties

- Contact the relevant state or territory office to determine whether the Deed of Assignment needs to be registered

- If registration is required, complete the necessary forms, pay the registration fee, and submit the required documents

- Once the Deed of Assignment is registered, the registrar will issue a certificate of registration

- Check off this step when you have received and reviewed the certificate of registration.

- Research the applicable laws and regulations in the relevant jurisdiction to decide if the Deed of Assignment needs to be registered

- Consult a legal professional if unsure

- When you have the answer, you can move on to the next step.

- Confirm what type of Deed of Assignment requires registration with the relevant government agency or registry.

- Research the registration procedures and the requirements you must meet in order to register the Deed of Assignment.

- Obtain any fees or additional documents that are necessary to complete the registration process.

- Ensure that all parties to the Deed of Assignment understand the registration process and the requirements for completing it.

You can check off this step once you have researched and confirmed the registration procedures for the Deed of Assignment.

- Gather the necessary documents for registration, such as the Deed of Assignment, supporting documents, and the applicable fee

- Visit the registration office to register the Deed of Assignment

- Submit the necessary documents to the registration office

- Pay the applicable fee

- Obtain a copy of the registered Deed of Assignment

- Upon completion of the above steps, you can check this off your list and move on to the next step.

- Review and understand the nature of the rights and obligations being assigned

- Determine if there are any restrictions or limitations in the assignment

- Assess if any approvals are needed from third parties before the assignment is valid

- Confirm that the assignor has the right to assign the interest being transferred

- Check to see if the assignee has the necessary capacity to accept the assignment

- Analyze if the assignment is subject to any applicable laws or regulations

- Determine if any additional documentation is needed to support the assignment

- Once you have considered all of the above, you can proceed with drafting the Deed of Assignment.

- Check with your local taxation authority or a qualified tax professional to see if the Deed of Assignment is subject to any taxes or stamp duty.

- Ensure that the Deed of Assignment includes any required taxes or stamp duty payments.

- Check to see if the tax or stamp duty implications vary by jurisdiction.

- Once you’ve considered the tax or stamp duty implications, you can move on to the next step.

- Identify any restrictions or limitations that could affect the transfer of rights in the Deed of Assignment

- Consider whether there are any legal restrictions that must be observed in the transfer of the rights being assigned

- Research any relevant industry standards or regulations to ensure that the restrictions or limitations on the rights being assigned are compliant

- Ensure that the Deed of Assignment clearly outlines the restrictions or limitations of the rights being assigned

- When all restrictions or limitations on the rights being assigned are taken into consideration, checked for compliance and outlined in the Deed of Assignment, this step is complete.

- Consider whether the Deed of Assignment needs to be registered with any government or public agencies.

- Determine if any registration is required or optional.

- Research the relevant regulations and laws to ensure that the assignments are properly recorded.

- Check any local requirements or restrictions.

- Once you have determined that the Deed of Assignment does or does not need to be registered, you can move on to the next step in the process.

• Read over the Deed of Assignment twice to make sure you’re accurately identifying all of the parties to the Deed. Make sure you include the full names and addresses of the assignor and assignee, as well as any other relevant parties. • Check that the legal description of the subject property is accurate. • Ensure that the consideration (the amount being exchanged for the assignment) is stated clearly and accurately. • Make sure that the names of the initial parties to the Deed are also included in the recitals. • Ensure that the recitals and the express terms of the Deed are consistent with one another. • Make sure that the Deed is signed, notarized, and delivered in accordance with state law.

Once you’ve completed the above steps, you can check off this task and move on to the next step in the guide.

- Identify the assignor and assignee. The assignor is the party transferring their rights and the assignee is the party receiving the rights.

- Check all of the details are correct. This includes the names, addresses and other contact information for both parties.

- Draft the deed to ensure that the assignor and assignee are accurately identified.

- You can check this off your list and move on to the next step once you have confirmed that the assignor and assignee have been accurately identified in the deed.

- Ensure that all parties to the Deed have read, understood and agreed to the terms and conditions of the agreement.

- Have all parties affix their signature to the Deed and the accompanying documents.

- Check that all the signatures are dated and in the presence of a witness.

- When all parties have properly executed the Deed, you can move on to the next step.

- Ensure all parties have signed the Deed in the presence of a witness.

- The witness must be an independent third party who is not a party to the Deed.

- The witness must sign each page of the Deed that contains a party’s signature.

- The witness must also include their full name, address and occupation on the Deed.

- Once all of the above requirements are met, then you can check this off your list and move on to the next step.

- Determine the applicable taxes or stamp duty implications for the Deed of Assignment.

- Research any applicable taxes or stamp duty fees for the Deed of Assignment.

- Calculate the applicable taxes or stamp duty fees for the Deed of Assignment.

- Make sure to include the applicable taxes or stamp duty fees in the Deed of Assignment.

Once you have determined the applicable taxes or stamp duty implications for the Deed of Assignment, and included them in the Deed of Assignment, you can move on to the next step.

- Determine the rights that you are assigning and review any applicable laws or regulations to ensure that the assignment of such rights is permitted.

- Consider any applicable contractual restrictions or limitations on the rights being assigned, such as any applicable confidentiality obligations or restrictions on the transfer of rights.

- Once you have determined that the assignment of the rights is permitted and there are no applicable restrictions or limitations, you can proceed to the next step of recording keeping.

- Create a record of the Deed of Assignment, including the date it was executed, by each party

- Maintain a copy of the Deed of Assignment in a secure place

- Record any additional related documents, such as any security documents, release documents, or other agreements

- When all of the above have been done, you can check this off your list and move on to the next step.

- Obtain a physical copy of the original Deed of Assignment

- Ensure the original Deed is signed by both parties

- Keep the original Deed in a safe and secure place, such as a locked filing cabinet or safe

- Make sure the document is stored in a location that is accessible to both parties

- Ensure that the original Deed is not destroyed or tampered with in any way

You can check this off your list and move on to the next step once the original Deed of Assignment is safely stored in a secure location.

- Scan or take a digital photo of the original Deed of Assignment and save it to a secure location.

- Ensure that the digital copy is readable and clearly displays all of the information contained in the original document.

- Ensure that the digital copy is stored in a secure location, preferably on a cloud-based storage system or other secure server.

- Make sure that only authorized personnel have access to the digital copy of the Deed.

- When finished, you will have created a digital copy of the Deed and stored it in a secure manner.

- Read over the Deed of Assignment to ensure accuracy

- Make sure all details are correct, and all parties are named

- Verify that all signatures are complete and accurate

- Make sure the date of the assignment is correct

- Check that the document is formatted and laid out correctly

- Once you are satisfied with the accuracy of the Deed of Assignment, you can move on to the next step.

- Read through the entire document to make sure all the information is correct

- Double check that the names and details of the parties involved are spelled correctly

- Ensure that all the dates are accurate, and that any and all parties have signed the deed in the right places

- Check that the terms and conditions in the deed are consistent with the agreement between the parties

- When you have verified all the details, you can check this off your list and move on to the next step.

- Check the Deed of Assignment to ensure that all required elements are present, including accurate information and signatures of all parties.

- Verify that any and all attachments to the Deed of Assignment are included and accurate.

- Ensure that all dates, signatures, and other pieces of information are accurate and up-to-date.

- Once you’ve confirmed that all of the steps have been completed correctly, you can move on to the next step.

- Seek professional advice from a lawyer or other legal professional to ensure that the deed of assignment is legally binding and enforceable.

- Request that the legal professional checks that all steps have been completed correctly, and that the deed of assignment meets all requirements under local law.

- Ask the legal professional to provide you with written advice on any changes or revisions that may be necessary to make the deed of assignment valid and enforceable.

- Once the legal professional has confirmed that the deed is legally sound, you can check off this step and proceed with the next one.

- Research legal professionals who are able to provide advice and assistance with the drafting of a deed of assignment

- Contact the legal professionals to discuss the specific requirements and details of the deed of assignment

- Ask the legal professionals if they are able to provide advice and assistance with the deed of assignment

- Receive advice from the legal professionals and make changes to the deed of assignment accordingly

- Once you are satisfied with the changes to the deed of assignment, you can move on to the next step.

Q: Does a Deed of Assignment need to be signed?

Asked by John on April 23rd 2022. A: Yes, a Deed of Assignment needs to be signed by both the assignor and the assignee in order for it to be legally binding. The signatures should be witnessed and dated, and should be in front of an independent witness who is not related to either party. It is also important to include the relevant clauses and provisions in the deed, as these will set out the rights and obligations of each party.

Q: What is the difference between an assignment and a novation?

Asked by Sarah on July 29th 2022. A: An assignment is a transfer of rights or obligations from one party to another, while a novation is a transfer of rights or obligations from one party to another with the consent of all parties involved. An assignment does not necessarily require the consent of all parties, while a novation always requires the consent of all parties. Additionally, an assignment can transfer rights or obligations without necessarily extinguishing any pre-existing agreements, while a novation extinguishes any pre-existing agreements.

Q: Is a Deed of Assignment legally binding in different jurisdictions?

Asked by Tyler on October 17th 2022. A: Yes, a Deed of Assignment can be legally binding in different jurisdictions, though the exact requirements for validity may differ from jurisdiction to jurisdiction. In general, however, a Deed of Assignment needs to be signed by both parties and witnessed by an independent third party in order for it to be legally binding. Additionally, the deed should include all relevant clauses and provisions that are applicable in each jurisdiction.

Q: Are there any tax implications when drafting a Deed of Assignment?

Asked by Emma on January 15th 2022. A: Yes, there are tax implications that need to be taken into account when drafting a Deed of Assignment. Depending on the jurisdiction and specific tax laws, there may be tax implications for both parties if they are transferring rights or obligations under the deed. It is important to seek professional tax advice before entering into any agreement that involves transferring rights or obligations between parties as this could have significant financial implications for all involved.

Q: Do I need legal advice when drafting a Deed of Assignment?

Asked by Jacob on June 5th 2022. A: While it is not necessary to seek legal advice when drafting a Deed of Assignment, it is generally recommended in order to ensure that all relevant legal requirements are satisfied and that all involved parties are aware of their rights and obligations under the deed. It is also important to make sure that all language used in the deed is clear and unambiguous so that it can easily be understood by all parties involved.

Q: How can I ensure that my Deed of Assignment is valid?

Asked by Michael on August 28th 2022. A: In order for your Deed of Assignment to be valid, it must meet certain legal requirements which vary between jurisdictions. Generally speaking, your deed should include all relevant clauses and provisions applicable in your jurisdiction as well as signatures from both parties which should be witnessed by an independent third party who is not related to either party involved. Additionally, any language used within the document should be clear and unambiguous so that it can easily be understood by all involved parties.

Q: What information do I need to provide when drafting a Deed of Assignment?

Asked by Ashley on November 10th 2022. A: When drafting a Deed of Assignment, you will need to provide information about both parties involved such as their names, addresses, contact details and any other relevant information required under applicable laws in your jurisdiction. Additionally, you will need to include any relevant clauses or provisions applicable in your jurisdiction which will set out the rights and obligations of each party under the deed as well as any other information required for the document to be legally binding.

Q: What are common mistakes made when drafting a Deed of Assignment?

Asked by Joshua on February 20th 2022. A: One common mistake made when drafting a Deed of Assignment is failing to include all relevant clauses or provisions applicable in your jurisdiction which set out the rights and obligations of each party involved in the agreement. Additionally, failing to have the document signed by both parties or witnessed by an independent third party can render the document invalid or unenforceable under applicable law in some jurisdictions. Moreover, using ambiguous language within the document can also lead to misunderstandings and disputes further down the line which could be avoided if clear language was used throughout the document instead.

Example dispute

Lawsuit referencing a deed of assignment.

- The plaintiff may raise a lawsuit if they have been wronged by the defendant in a way that is outlined in the deed of assignment.

- For example, the deed of assignment may outline that the defendant is responsible for paying a certain amount of money to the plaintiff, and the defendant has failed to do so.

- The plaintiff may also raise a lawsuit if the defendant has failed to adhere to any other obligations laid out in the deed of assignment.

- The plaintiff would need to prove that the defendant has breached the deed of assignment in order to win the lawsuit.

- If successful, the plaintiff may be able to obtain a judgment in their favor, which may require the defendant to pay the plaintiff the money they are owed.

- In addition, the plaintiff may be able to seek other damages, such as punitive damages, if the breach of the deed of assignment was particularly egregious.

- Depending on the severity of the breach, the plaintiff may also be able to seek an injunction to prevent the defendant from continuing to breach the deed of assignment.

- Settlement of the dispute may also be possible, wherein the defendant agrees to pay a certain amount of money to the plaintiff, or agrees to adhere to the obligations laid out in the deed of assignment.

Templates available (free to use)

Deed Of Assignment For Rent Deposits Occupation Lease Deed Of Assignment Of Benefit Of Claim For The Freehold Or Extended Lease House Under Section 8 Or Section 14 Deed Of Assignment Of Equitable Interest In Residential Land Deed Of Assignment Of Goodwill And Intellectual Property Rights Transfer Of A General Partnership To An Llp Deed Of Assignment Of Property Sale Benefits [Section 42 Deed Of A

Helpful? Want to know more? Message me on Linkedin

Links to get you started

Our Legal AI Assistant (free while in beta) Contract Template Library Legal Clause Library

Try the world's most advanced AI Legal Assistant, today

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Housing, local and community

- Housing and communities

HM Land Registry: Registration Services fees

Fees for common applications, for example Scale 1 and Scale 2 transactions, charges of registered land, leases, large scale and fixed fee applications.

Applies to England and Wales

Use our Fee calculator to find the cost of each application type.

In response to customer feedback, clearer fee guidance for applications including a lease is now included in the Fee calculator . There will be an update to our Digital Registration Service on the portal in the coming weeks. This ensures that clearer guidance is given to reflect the HM Land Registry Fee Order 2021.

View and download the Registration Services fees document ( PDF , 197 KB , 18 pages ) .

Let us know what you think of this PDF document. Complete a short survey (5 minutes).

Scale 1 fees

When assessing fees under Scale 1, fees must be paid on the VAT-inclusive consideration or rent.

Fee reductions when using Scale 1

There are reduced fees for:

- voluntary first registrations (applications for first registration based on adverse possession or lost deeds are regarded as voluntary applications, unless the application includes a deed that triggers compulsory registration) (minimum 25% reduction)

- transfers of whole and surrenders of whole for registered titles when using the portal or Business Gateway (reduced by 55% compared with the fee for postal applications).

There are no reduced fees for:

- applications for first registration of title to a rentcharge, a franchise or a profit, or mines and minerals held apart from the surface (as these are not treated as voluntary applications for fee purposes)

- transfers of part and other applications affecting part of registered titles even when using the portal or Business Gateway

- applications to register leases when using the portal or Business Gateway

Transactions under Scale 1

- first registrations

- first registration of a rentcharge

- transfers of registered land for monetary consideration

- leases and surrenders

- large scale applications

- fee reductions Scale 1

First registrations

If the application is made within one year of an open market sale, base the fee on the consideration (including the amount outstanding under any continuing charge). However, for the following first registrations the fee is payable on the full current open market value of the property that is being registered:

- equity release transfers

- first mortgages

- first registrations where the conveyance on sale is more than one year old

- transfers by way of gift

- transfers of a share in property

In these cases we will accept a statement of value signed by the applicant, the applicant’s legal representative or some other person competent to make such a statement.

Sometimes the deed which induces registration (for example a transfer, assent or charge) will be of both registered and unregistered land. In these cases we need a separate AP1 application form for the registered land, and an FR1 application form for the unregistered land. Separate fees are required for both parts, based on apportioned value.

If HM Land Registry decide an inspection of the property is necessary, then an additional fee of £40 is required under article 11. This will be refunded if the inspection is not undertaken for any reason.

For this type of transaction, use Scale 1 fees .

First registration of a rentcharge

Scale 1 fees do not apply to rentcharges. The fee is £40 fee, irrespective of the value of the rentcharge.

Transfers of registered land for monetary consideration

This includes transfers giving effect to dispositions of shares in registered estates. The fee payable is based on the consideration, which is usually the purchase price.

If the transfer has a purchase price, use this as the consideration to assess the fee. If the transfer contains a consideration, not in pounds (eg euros or shares in a company), you will need to supply us with the equivalent value in pounds and assess the fee accordingly.

- Chris buys a property for £575,000. The fee is payable under Scale 1 on the price paid.

- England and Wales Property Portfolio Limited buys a new office building for £900,000. VAT of £180,000 is chargeable on the transaction. The fee is payable under Scale 1, assessed on the VAT inclusive price of £1,080,000.

- Europa Land Limited buys a property for €900,000. The fee is payable under Scale 1 on the sterling equivalent.

- Development Plan Limited assembles a site for development by buying sites from 3 separate landowners for £1.2 million, £1.7 million and £850,000. Three Scale 1 fees are payable, assessed on the price paid in each separate sale, regardless of whether 1 transfer form or 3 transfer forms are used.

- Yamada Taro buys a house for £350,000. The house is registered, but the garage is not. He apportions the value as to £325,000 for the registered land and £25,000 for the unregistered land. A separate Scale 1 fee is payable for both parts (If this were a transfer not for value the registered land part would pay under Scale 2 and the unregistered part under Scale 1).

- Caroline voluntarily registers her house worth £400,000. As it is a voluntary first registration she pays the Scale 1 fee reduced by 25%.

- Fitzwilliam Darcy transfers 2 properties, title numbers CS1 and CS2, for £250,000 to Elizabeth Bennett, using one transfer form. A scale 1 fee is payable on the total consideration. However different considerations will apply if the properties are in different ownership. See practice guide 21 .

- Belvedere LLP buys 2 properties, part of 1 title for £30,000 and the whole of another for £300,000. One Scale 1 fee is payable based on the total consideration of £330,000 if a single transfer is used because the transfer affects part of a registered title. Separate fees would be payable if separate transfers were used.

- Court orders Mr Smith to transfer a property to Mrs Smith as a result of the breakdown of their marriage under the Matrimonial Causes Act 1973, and for Mrs Smith to pay £50,000. This is assessed under Scale 2: other applications affecting registered estates . Similar considerations apply to transfers by court orders under the Civil Partnerships Act 2004, but not court orders under any other act.

Leases and surrenders

Read the leases section .

Large scale applications

Where the deed affects 20 registered titles or more, or where a first registration comprises of 20 land units or more, refer to our guide ‘Large Scale Applications (Calculation of Fees)’ .

Scale 2 fees

Fee reductions when using scale 2.

The reduced fees in the middle column of the table above apply in the following circumstances:

- transfers or assents of whole

- charges of whole

- transfer of charges

and many other applications of whole for registered titles when using the portal or Business Gateway .

- transfers of part

- other applications affecting part of registered titles even when using the portal or Business Gateway

Transactions under Scale 2

- transfers or assents of registered estates not for monetary consideration

- transfers of registered charges

- charges of registered estates

- other applications affecting registered estates

- surrenders of leases not for monetary consideration

- large scale application

- charges of registered land

- fee reductions when using Scale 2

Transfers or assents of registered estates not for monetary consideration

Assess the fee on the value of the property, minus the amount outstanding on any continuing charge and any new charge ( see note 1 ). Where a transfer not for monetary consideration gives effect to the transfer of a share in a registered estate, the fee is payable on the value of that share.

For this type of transaction, use Scale 2 fees .

Examples: properties with no mortgage

John Smith transfers a property by gift to Sharon Jones, it is worth £200,000. The fee is assessed on the full £200,000 value and payable under Scale 2.

John Smith transfers a property by gift to himself and Sharon Jones in equal shares. It is worth £200,000. The fee is assessed on half the value of the property (£100,000), and payable under Scale 2.

Following the death of John Smith, Sharon Jones takes out probate and is appointed as the executor of his estate. She transfers the property, which is worth £200,000, to the beneficiary under John’s will by an assent. The fee is assessed on the full property value, £200,000, and is payable under Scale 2.

John Smith, Joseph Evans and Sharon Jones are trustees of a trust owning a property worth £200,000. They appoint Lucy Brown as a new trustee either by deed or by HM Land Registry transfer form. The fee is assessed under Scale 2 on the full value of the property.

John Smith, Joseph Evans and Sharon Jones were trustees of a trust owning a property worth £200,000. By a series of appointments and retirements of trustees that have not been registered, the new trustees are Lucy Brown and Rajwinder Kaur, who appoint George Murphy as an additional trustee. The three now apply to register all the changes. The fee is payable under Scale 2 on the last appointment of George Murphy only, assessed on the full £200,000 property value.

Examples: properties being transferred subject to a mortgage

John Smith transfers a property as a gift to Sharon Jones. The property is worth £200,000 and is subject to a mortgage to the Cornshire Building Society, where £100,000 remains outstanding and is not repaid on completion of the transfer. To calculate the fee for the transfer, subtract the outstanding mortgage amount (£100,000) from the full value of the property (£200,000). The fee is assessed on the result: £100,000, and payable under Scale 2.

John Smith transfers a property as a gift to himself and Sharon Jones in equal shares. The property is worth £200,000 and is subject to a mortgage to the Cornshire Building Society where £100,000 remains outstanding and is not repaid on completion of the transfer. First, determine the value of the share, by subtracting the amount outstanding on the mortgage (£100,000) from the full value of the property, £200,000. Then divide the result (£100,000) in half to reflect the equal shares - £50,000. The fee is assessed on this figure, £50,000, and is payable under Scale 2.

John Smith transfers a property as a gift to himself and Sharon Jones in equal shares. The property is worth £200,000 and is subject to a mortgage to the Cornshire Building Society where £100,000 remains to be paid. The existing mortgage is repaid and a new mortgage for £120,000 taken out in favour of Newcharge Bank. Calculate the value of the share by deducting the amount outstanding on the new mortgage, £120,000, from the full value of the property (£200,000). Then halve the result, £80,000, to reflect the transfer from John to John and Sharon - £40,000. The fee is assessed on this figure, £40,000, and is payable under Scale 2.

John Smith, Joseph Evans and Sharon Jones hold a property valued at £200,000 in unequal shares. John transfers his 20% share as a gift to Joseph and Sharon, who take out a new mortgage of £40,000. Calculate the value of the share being transferred by deducting the amount outstanding on the new mortgage, £40,000, from the full value of the property, £200,000. Then multiply the result, £160,000, by 20% (which was John’s share), leaving £32,000. The fee is therefore assessed on £32,000 and is payable under Scale 2.

John Smith and Sharon Jones own a property valued at £300,000 in equal shares. Sharon transfers her 50% share to John who takes out a mortgage of £170,000. John and Sharon had two mortgages on the property, the first will be discharged on completion of the transfer, the second will remain on the register post completion, postponed in favour of the new mortgage which John has arranged. The amount outstanding on the charge that is remaining is £40,000. The total amount outstanding will therefore be £210,000. Calculate the value of the share being transferred by deducting the total amount outstanding on the new and continuing charges, £210,000, from the full value of the property, £300,000. Then multiply the result, £90,000, by 50% (which is Sharon’s share), leaving £45,000. The fee is therefore assessed on £45,000 and is payable under Scale 2.

The reference to ‘amount outstanding’ is the amount outstanding on:

- any existing registered or noted charges, provided they have not been discharged on completion of the transfer; and

- any new charges, provided the application to register the charges is lodged along with the application to register the transfer. The registration of the charges and the transfer must be completed at the same time.

Transfers of registered charges

Fee payable on the consideration, or, where the transfer is not for value, on the amount secured by the charge at the time of the transfer. Where a transfer not for value gives effect to the transfer of a share in a registered charge the fee is payable on the value of that share.

Charges of registered estates

Read the charges section .

Other applications affecting registered estates

The fee for the registration of the following is payable on the value of the estate less the amount of any continuing registered charge (where this is transfer of a share, the fee is payable on the value of that share):

- appropriations

- assents of registered estates (not if first registration)

- transfers of matrimonial or civil partnership homes as a result of court orders (under the Matrimonial Causes Act 1973 or the Civil Partnership Act 2004), payable on the value of the property even if the court orders one party to pay a consideration

- transfers by operation of law on death or bankruptcy

- vesting orders or declarations (under section 27(5) of the Land Registration Act 2002)

- Jacob Marley dies owning a property worth £500,000 with no mortgage. His executor Ebenezer Scrooge takes out probate and then assents the property to the beneficiary Robert Cratchitt. The fee is assessed on the value of the property and payable under Scale 2.

- John and Mary Smith own a property worth £250,000 subject to a mortgage to the Cornshire Building Society on which £100,000 is outstanding. They are divorcing. The Court orders John and Mary to transfer the property to Mary, and for Mary to pay John £50,000. The fee is assessed on half the value of the property minus the value of the mortgage (£75,000, that is £250,000 value minus £100,000 mortgage, and then divided by 2) and payable under Scale 2. The money paid is disregarded for fee purposes.

Surrenders of leases not for monetary consideration

Large scale application.

Where the deed affects 20 registered titles or more, refer to our guide ‘Large Scale Applications (Calculation of Fees)’ .

Charges of registered land

Fees payable.

The fees are payable using Scale 2 , based on the amount of the charge (see No fee payable for exemptions):