- 302B Port Harcourt - Aba Express way Rumukurushi Port Harcourt, Nigeria

- Email: [email protected]

- Call Us: +234803 3185 898

- [email protected]

- +234803 3185 898

TIN, VAT or TCC Application Letter Sample

Sample letter that you can use to make application for TIN, VAT or TCC Application in Nigeria.

We explained how you can draft Tax Clearance Certificate Application Letter, TIN Application Letter and VAT Application Letter with sample in Nigeria

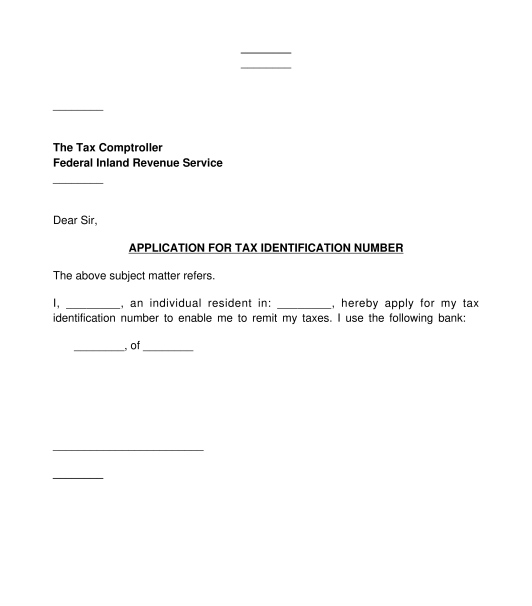

What is TIN Application Letter? TIN Application Letter is an application letter a person or a company representative wrote to Federal Inland Revenue Service to obtain Tax Identification Number (TIN).

Read: How to obtain Tax Clearance Certificate in Nigeria

All you need to do is to remove the write-up in bracket and replace them with your details and print.

Here is the Tax Clearance Certificate Application Sample Letter below.

———————————————–Starts here—————————————————

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx Your Company Letterhead comes in Here xxxxxxxxxxxxxxxxxxxxxxxxxxxxxx)

The Tax Controller Federal Inland Revenue Service (FIRS branch name) MSTO (FIRS Address) . APPLICATION FOR TIN and VAT CERTIFICATE

We humbly apply for TIN and VAT Certificate for the above named company. This will assist us in our business operations.

Yours faithfully,

(Your Name, the applicant)

– —————————————-Ends here——————————————————

Read : How to obtain DPR Permit

For Business Support Service in Nigeria ,

Contact Aziza Nigeria: Mobile: +234 8033 185 898 Email: [email protected]

Mobile: +234 8033 185 898 Email: [email protected] Address: 302B Port Harcourt – Aba Express way Rumukurushi Port Harcourt, Nigeria.

Our Locations Port Harcourt Abuja Nigeria Lagos Nigeria Owerri Nigeria

Rate Our Services

- Terms of Use

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Letter of Application for Tax Identification Number

Rating: 4.6 - 19 votes

The Letter of Application for Tax Identification Number (TIN) is a document an individual or business sends to the Federal Inland Revenue Service (FIRS), requesting to be registered for tax remittance .

Tax registration is a legal obligation for everyone in Nigeria regardless of whether the individual or organization is required to pay tax or exempted from tax . Hence, every Nigerian individual and organization in Nigeria must be registered.

Upon registration, the individual, business, or organization receives a TIN, which is used to remit taxes in Nigeria. For example, to charge and remit VAT, the taxpayer must hold a TIN. This a unique number that is issued to a party after registration. The TIN shows that an individual or organization is a registered taxpayer in Nigeria and is required information on all tax returns filed at the FIRS .

Note: Application for TIN is free , except an attorney is contracted to make the application on behalf of the taxpayer.

Who Needs to Obtain a TIN?

Every Nigerian individual is required to obtain TIN for remitting taxes. Additionally, every registered business in Nigeria , including companies, organizations, and business entities is required by law to obtain a TIN and corporate account.

For more information about obtaining a TIN, please refer to the legal guide on " How to Obtain a Tax Identification Number ."

How to use this document

This letter outlines the particulars of the sender, and the address of the FIRS office the sender will be addressing its application. If the sender is a company , the date of registration, objects, and particulars of directors and shareholders of the company will be required. If the sender is a business name , the date of registration, nature of the business and particulars of the proprietors will also be required.

Once this document is completed, the sender should print and sign the letter before sending it to the nearest FIRS office. The letter can also be electronically signed, printed, and then sent to the FIRS office.

Note that this application can be submitted to any FIRS office convenient for the sender .

If the sender is a company, only one director of the company is required to sign the document and send this letter with the following documents to the requisite FIRS office:

- a duly completed TIN application form ( the form can be obtained at any FIRS office );

- one copy of the certificate of incorporation of the company;

- one copy of the company's memorandum and articles of association of the company;

- utility bill of the company.

If the sender of this document is an individual , the individual is required to send this letter with a duly completed TIN application form and original and photocopies of valid means of identification (Staff I.D. Card (for employed persons only), National Driver's License, National I.D. Card or International Passport).

Applicable law

The Finance Act, 2020 makes it compulsory for every person intending to operate a business bank account to obtain their TIN.

How to modify the template?

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Form a Company

- How to Obtain a Tax Identification Number (TIN)

Other names for the document:

Application for Tax Identification Number, Application for TIN, Application to FIRS for Tax Identification Number, Letter of Request for Tax Identification Number, Request for Tax Identification Number

Country: Nigeria

Norebase Blog

A Complete Guide to Doing Business Anywhere

VAT in Nigeria: Everything You Need to Know

Value Added Tax (VAT) is a consumption tax that is ultimately paid by the end consumer of goods and services. It is incorporated into the price paid, and sellers are obliged to include the VAT amount as a separate item on the tax invoice. They collect this amount along with the price of the goods and remit it to the government

All businesses that meet certain thresholds are required to register for VAT and charge VAT on taxable goods and services. In this article, we will explore the process of registering for VAT in Nigeria.

VAT rate : The VAT rate in Nigeria is 7.5%

Eligibility for VAT Registration

To be eligible to register for VAT, your business must meet one of the following requirements:

- Annual turnover of N25 million or more for goods and services.

- Render taxable services such as consultancy, professional services and operate an enterprise with an annual turnover of N25 million.

- Consume goods or services worth N10 million or more per annum in Nigeria in the course of business.

Registration Process for VAT in Nigeria

To register for VAT, you need to fill out a VAT registration form (Form 001) and submit it to the Federal Inland Revenue Service (FIRS) along with the following documents:

For a Business name

- Business name registration certificate.

- Application letter

- Utility bill

For a Limited Liability Company

- Memorandum and Articles of Association

- Certificate of Incorporation

- Application Letter on company letterhead

- Utility Bill

You can submit your application in person at the FIRS office or the state internal revenue office nearest to you. Once the registration is approved, a VAT certificate containing your VAT number will be issued.

Obligations After VAT Registration

Once registered, you need to:

- Charge VAT on taxable supplies and issue VAT invoices.

- Pay VAT due monthly by filing VAT returns and remitting the amount to designated bank accounts.

- Maintain proper VAT records such as purchase/sales records and invoices.

- Display your VAT certificate at your business premises.

- Notify FIRS of any changes in business details within 30 days.

Filing of VAT and Remittance

The filing of VAT returns is a monthly requirement that must be fulfilled with the FIRS. These returns need to be submitted by the 21st day of the month that follows the transaction period. VAT returns should contain comprehensive information about sales, purchases, output VAT, and input VAT. Additionally, payment for the VAT liability should be submitted alongside the filed returns within the designated timeframe.

Failure to comply with the requirements outlined in the VAT Act can lead to the imposition of penalties and interest charges. Therefore, it is crucial for businesses to have a clear understanding of their VAT obligations and ensure that they fulfill them appropriately in order to steer clear of penalties and potential legal repercussions.

VAT Exemptions in Nigeria

The VAT Act lists certain goods and services that are exempt or zero-rated for VAT purposes. Below are the exemptions:

Exempted Goods

- All medical and pharmaceutical products

- Basic food items

- Educational Books and materials

- Baby products

- Fertilizers, locally produced agricultural chemicals and veterinary medicines

- All exports

- Plant and Machinery

- Locally produced sanitary towels, pads or tampons

- Commercial aircrafts, aircraft engines and aircraft spare parts

- Petroleum products – (aviation turbine kerosene, premium motor spirit, household

- kerosene, locally produced Liquefied Petroleum Gas (LPG), and crude petroleum

- Renewable energy equipment.

- Raw materials for the production of baby diapers and sanitary towels.

- Raw materials for production of pharmaceutical products

- Locally produced animal feeds.

- Military hardware, arms, ammunition and locally manufactured uniforms used by

- the armed forces, paramilitary and other security agencies of governments in

- Gas supplied by gas producing companies to Generating companies (GENCOs),

- Electricity generated by GENCOs and supplied to National Grid or Nigeria Bulk

- Electricity Trading Company (NBET) and Electricity transmitted by

- Transmission Company of Nigeria (TCN) to Electricity Distribution Companies

- Agricultural seeds and seedlings.

Exempted Services

- Medical Services

- Services rendered by unit microfinance banks and mortgage institutions

- Plays and performances conducted by educational institutions as part of learning

- All exported services

- Tuition relating to nursery, primary, secondary and tertiary education

- Airline transportation tickets issued and sold by commercial airlines registered in

- Hire rental or lease of tractors, ploughs and other agricultural equipment for agricultural Purposes

- Shared passengers road transport service

It is important to note that registration for VAT is free. If you meet the eligibility criteria, then you should register and begin filing as and when due.

If you would like to register a business name or incorporate a company, head over to our website

Share this:

More like this...

Obligations you need to know about C-Corp

Whilst we have previously examined the general nature and benefits of a C-Corporation (C-Corp), it is also necessary to examine …

Types of Taxes in South Africa

South Africa has a complex tax system, with a wide variety of taxes levied on individuals, businesses, and goods and…

Requirements for Registering a Company in Nigeria as a Foreigner

As Africa’s largest economy and most populous nation, Nigeria presents a wealth of opportunities for businesses seeking to serve regional…

One thought on “ VAT in Nigeria: Everything You Need to Know ”

- Pingback: How to Structure Taxes for Your Startup in Nigeria: A Guide for Founders and Employees | Norebase Blog

Leave a Reply Cancel reply

Norebase uses the information you provide to personalize the content and products we share with you. You may unsubscribe from these communications at any time.

Discover more from Norebase Blog

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

+44 (0) 1273 022400

- VAT Customs duties, import taxes

- Sales tax Retail, ecommerce, manufacturing, software

- Import One-Stop Shop (IOSS) Simplify VAT registration requirements

- Selling Internationally Customs duties and import taxes

- Retail For online, ecommerce and bricks-and-mortar shops

- Software For apps, downloadable content, SaaS and streaming services

- Manufacturing For manufacturers with international supply chains

- Accounting professionals Partnerships, automated solutions, tax research, education, and more

- Business process outsourcers Better serve the needs of clients

- Marketplace sellers Online retailers and ecommerce sellers

- Shared service centres Insource VAT compliance for your SSC

- Enterprise An omnichannel, international sales solution for tax, finance, and operations teams

- Our platform

- Calculations Calculate rates with AvaTax

- Returns & Reporting Prepare, file and remit

- VAT Registrations Manage registrations, simply and securely

- Fiscal Fiscal representation

- Content, Data, and Insights Research, classify, update

- Exemption Certificate Management Collect, store and manage documents

- Avalara E-Invoicing and Live Reporting Compliant in over 60 countries

- Making Tax Digital (MTD) Comply with MTD Phase 2

- Webinars Free advice from indirect tax experts

- Events Join us virtually or in person at Avalara events and conferences hosted by industry leaders

- Whitepapers Expert guidance and insights

- Brexit VAT and customs guidance

- Digitalisation of tax reporting Realtime VAT compliance (including MTD)

- Ecommerce VAT reforms 2021 EU and UK VAT reforms

- Selling into the USA Sales tax for non-US sellers

- EU Rates At-a-glance rates for EU member-states

- Global Rates At-a-glance rates across countries

- U.S. Sales Tax Risk Assessment Check U.S. nexus and tax responsibilities

- EU VAT Registration

- EU VAT Returns

- Distance Selling

- EU VAT digital service MOSS

- About Avalara

- Customer Stories

- Nigerian VAT registration

Businesses supplying taxable supplies must VAT register. This is a requirement for services, as well as goods, since there is no reverse charge provision. This requirement covers incorporated companies and individuals providing supplies on a habitual basis. There is no provision for VAT group registrations.

A VAT registration with FIRS is carried out by completing Form 001. The applicant must provide an incorporation number or personal ID if not incorporated. Upon being granted a VAT registration, a unique 10-digit VAT identification number is provided to the tax payer to use on invoices or when submitting VAT returns.

Non-resident traders must also register with the FIRS if providing taxable supplies – note this includes services since there is no reverse charge. They are not required to appoint a fiscal representative or other type of VAT agent.

What are the Nigerian VAT registration thresholds?

The VAT registration threshold is nil; businesses must therefore register before providing their first taxable sale of goods or services. Failing to register will incur a fine of NGN 10,000 for the first month; and then NGN 5000 for any subsequent months.

Non-resident traders operating in Nigeria

Businesses without a permanent establishment in Nigeria are also required to VAT register if they are providing any taxable supplies. They must provide a representative contact for this, which is typically a customer.

Get help solving your VAT challenges

+44 (0)1273 022400

Africa and Middle East

- Nigerian VAT returns

- Nigerian VAT rates and VAT compliance

- South Africa

- Saudi Arabia

- United Arab Emirates

Central & South America

North America

Nigeria: VAT registration required for foreign suppliers of taxable goods and services

- Link copied

Show resources

Executive summary.

The Finance Act, 2020 (the Act) was signed by the President of the Federal Republic of Nigeria in December 2020 and took effect from 1 January 2021. From a Value Added Tax (VAT) perspective, the Act intends to reinforce existing VAT rules and introduce new rules, among others.

As the 23rd largest consumer market globally with close to 200 million consumers, the new rule regarding services rendered to businesses and individuals in Nigeria will impact many global service suppliers with customers in Nigeria.

Detailed discussion

The changes introduced by the Act impact many facets of VAT operations in Nigeria. However, this Alert specifically addresses the obligations of nonresident companies (NRCs) supplying taxable goods and services to Nigerian customers, which includes physical, remote or electronic/digital supplies of goods and services.

The required obligations for such NRCs are summarized below.

VAT registration of foreign suppliers of taxable goods and services to Nigeria

From a VAT perspective, the Act intends to reinforce the provision of section 10 of the VAT Act (the Principal Act), which requires foreign suppliers of taxable goods and services in Nigeria to register for VAT and include VAT on invoices issued to Nigerian customers, effective February 2020. The VAT charged on an invoice is required to be withheld and remitted to the Federal Inland Revenue Service (FIRS), by the Nigerian customers (traditionally).

At the time the above provision was enacted, it was not anticipated that there would be any form of tax leakage with respect to such taxable transactions. However, most business to consumer (B2C) customers are not tax registered and therefore they are not taxable persons for VAT purposes. Consequently, they are unable to remit the VAT directly to the FIRS. As a result, in practice, for B2C sales, the FIRS expects the NRCs to collect the VAT portion on such supplies and remit the VAT directly to the Revenue Authority to prevent loss of tax revenue.

NRCs may appoint a representative for compliance purposes

In line with the amendments introduced by the Act, NRCs may appoint a representative for the purpose of complying with their VAT obligations in Nigeria. An example is provided below.

ABC Germany makes both B2B (business-to-business) and B2C supplies to Nigerian customers. Based on the provision of the law, ABC Germany is required to register for VAT in Nigeria, issue tax invoices with a VAT charge at 7.5% (i.e., the standard VAT rate) and submit monthly VAT returns to the FIRS. While the B2B customers are required to withhold the VAT charge on invoices issued to them, and remit the same directly to the FIRS as they are tax registered, there is no practical mechanism for similar compliance by B2C (Nigerian customers) i.e., for remitting the VAT charged on invoices to the FIRS since they are not tax registered.

As such, the FIRS expects NRCs to collect the VAT portion on B2C supplies and remit same directly to the Revenue Authority.

Summary of obligations

ABC Germany makes B2B and B2C supplies of taxable services in Nigeria.

- ABC is now required to register for VAT in Nigeria

- ABC is required to charge VAT at 7.5% on its invoices to its Nigerian customers (i.e., B2B and B2C) after registration

For B2B supplies:

- Nigerian B2B customer is responsible for accounting for the VAT on ABC’s invoice(s), it settles ABC’s invoice net of the VAT i.e., it withholds the VAT charged on the invoice(s)

- Nigerian B2B customer remits the VAT withheld on payments made to ABC

- ABC submits a monthly VAT return to the FIRS showing the amount withheld at source by the Nigerian B2B customer

For B2C sales (FIRS expects the following):

- Nigerian B2C customer pays ABC (inclusive of VAT)

- ABC to collect the VAT and remit the same to the FIRS

- ABC submits a monthly VAT return showing the VAT amount collected and remitted to FIRS

It appears that the FIRS is currently working on a circular that will mandate foreign companies providing goods and services to customers in Nigeria through an online or digital platform to collect VAT from their customers, regardless of whether they are B2B or B2C. This is mainly to prevent the possible loss of tax revenue.

It is important to note that VAT registration does not in itself trigger a permanent establishment (PE) exposure or income tax implications. There are specified criteria for determining the PE status of an NRC. As such, if the foreign supplier does not meet any of the various criteria for establishing a PE, mere registration for VAT purpose should not expose a company to a PE risk.

However, NRCs supplying goods and services to Nigerian residents, should proactively review and document their Nigerian tax position to prevent an unanticipated tax position at a later stage.

Other changes made by the Act in respect of VAT, include but are not limited to:

- Inclusion of incorporeal right in the definition of taxable supply of service

- Definition of time of supply

- Exclusion of land and building, lease, outright sale or interest in land from the scope of VAT

- Exemption of hire, rental or lease of tractors, ploughs and other agricultural equipment for agricultural purposes from VAT

Action steps for NRCs

Affected NRCs are required to comply with the following obligations:

Connect with us

Our locations

Legal and privacy

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY | Assurance | Consulting | Strategy and Transactions | Tax

EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

© EYGM Limited. All Rights Reserved.

EYG/OC/FEA no.

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

Welcome to EY.com

In addition to cookies that are strictly necessary to operate this website, we use the following types of cookies to improve your experience and our services: Functional cookies to enhance your experience (e.g. remember settings), and Performance cookies to measure the website's performance and improve your experience . , and Marketing/Targeting cookies , which are set by third parties, allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with content or service offerings in accordance with your preferences.

We have detected that Do Not Track/Global Privacy Control is enabled in your browser; as a result, Marketing/Targeting cookies , which are set by third parties that allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with content or service offerings in accordance with your preferences are automatically disabled.

You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website.

Review our cookie policy for more information.

Customize cookies

I decline optional cookies

How to register for VAT in Nigeria

What is vat.

Value Added Tax (VAT) is a tax imposed on the supply of goods and services. Under Nigerian law, the tax is charged at 7.5% of the value of the taxable goods and services.

An illustration of this is if you sell shoes for N10, 000, the VAT chargeable on that is 7.5% of the value – N750, the business is therefore supposed to sell the shoes to members of the public for N10, 750. The company retains N10, 000 and then remits the N750 to the FIRS.

Who needs to register for VAT?

Section 8 of the Value Added Tax Act which was amended by the Finance Act 2020, states that a taxable person shall upon commencement of business register with the FIRS and failure to register within the period specified is liable to pay a penalty of N50,000 for the first month, and N25,000 for each subsequent month. . However, certain goods and services are exempt , they include:

- All medical and pharmaceutical products

- Basic food items

- Books and educational materials

- Baby products

- Fertilizer, locally produced agricultural and veterinary medicine, farming machinery and farming transportation equipment

- All exports

- Plant and machinery imported for use in Export Processing zone or free trade zone

- Plant, machinery and equipment purchased for utilization of gas in downstream petroleum operations

- Tractors, ploughs and agricultural equipment and implements purchased for agricultural purpose

- Medical services

- Services rendered by community banks, people’s bank and mortgage institutions

- Plays and performances conducted by educational institutions as part of learning

How do you apply?

To apply for VAT, you will need to go to the Federal Inland Revenue Service (FIRS) office that is closest to your registered address. You can find the locations on the FIRS website with the following documents:

- Memorandum & Articles of Association

- Certificate of Incorporation: CAC2, CAC7

- Duly filled and officially stamped VAT form 001

- Utility bill

- Application letter on company letter headed paper

If your business is a registered business name, and not a limited liability company then the only documents which you will need to provide are:

- Business Name Registration Certificate

- Application letter on business letter headed paper

You should take the original copy and 2 photocopies of each document. The originals are required for sighting only, 1 copy will be left with the FIRS, and 1 copy will be stamped and signed by an FIRS official as evidence that you have made an application.

How much does it cost?

Registering for your VAT IS FREE .

You do not have to pay any fees to register for it, and you do not need to employ someone to apply on your behalf. However, most people decide to engage the services of 3 rd parties to assist them.

How long does it take to get my VAT?

Ordinarily, VAT registration should be completed instantly or at most by the next day, however, it appears that a number of the FIRS offices are struggling with backlogs, and so it is not uncommon for the process to drag on for about a week or in some instances 2 weeks.

Remember payment of tax is a civic duty. If you are providing goods and services in Nigeria, which are not exempt, then you should register for VAT.

Thank you for reading this article, we hope you have found it useful. If you have please share with your network using one of the share buttons below.

DO YOU NEED A LAWYER?

Request a Legal Assessment

We hope you have found this information helpful . Please note that this information is provided for general informational purposes only and is not intended to be legal advice. No lawyer-client relationship is formed nor should any such relationship be implied. It is not intended to substitute for the advice of a qualified lawyer. If you require legal advice, please consult with a qualified lawyer .

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to email a link to a friend (Opens in new window)

29 Sep 2021

Value Added Tax(VAT )Registration

Introduction

It is a civic obligation to pay taxes. If you provide non-exempt products and services in Nigeria, you must register for VAT. Requests must be sent to the Federal Internal Revenue Service (FIRS) or the State Internal Revenue Service, whichever is nearest to the officially registered business address.

Meaning of VAT

Related Posts:

Value Added Tax (VAT) can be described as an indirect consumption tax imposed on goods and services, this will be done at each stages of production and at the final sale. The tax is 7.5 percent of the value of the taxable products and services under Nigerian legislation.

Who need to apply for VAT?

According to Section 8 of the Value Added Tax Act amended by the Finance Act 2020, every business must register for VAT with the FIRS within six months of starting operations and failure to do so will attract a penalty of N50,000 for the first month and N25,000 in each subsequent month.

How to apply for VAT in Nigeria?

For a new company, you have to go to the nearest Federal Inland Revenue Service (FIRS). The documents that will be required are as follows;

- Articles and memorandum of Association.

- Certificate of Incorporation.

- Completely filed and officially stamped VAT form 001

- Utility bill

- Application letter with the company letterhead paper.

- Taxpayer Update Form

For an already register business that is not a Limited Liability Company, the only documents needed are:

- Certificate of Incorporation

- Status Report

Registration duration

VAT registration can be done almost immediately or the next day at most. Sometimes, FIRS offices struggles with backlogs so it is possible that the process will be stretched for a week or two

Cost of registration

Registration of VAT in Nigeria is free, but it will be advisable to employ assistant of a professional like Matog in order to avoid mistake while filing or filing wrong documents.

Tax Identification Number (TIN)

The Taxpayer Identification Number (TIN) is a one-of-a-kind number assigned and issued by the Federal Inland Revenue Service to identify a person (individual or company) as a properly registered taxpayer. It is only to be used by that particular taxpayer. Every person who is obligated to remit tax in Nigeria is liable to register for tax purposes. This unique tax number will be used to pay all sorts of taxes in Nigeria.

How to obtain a Tax Identification Number (TIN)

As a business owner in Nigeria, The first step is to apply for a Tax Identification Number (TIN) and VAT registration at your local tax office.

The VAT Registration Form (001) and the Taxpayer Registration Input Form can be obtained from the Tax Office.

Using your company’s letterhead paper, you must also apply for Income Tax Registration and another for VAT Registration. Answers to the following questions will be provided in the Income Tax Registration application:

- Company name

- Registered Office

- Business Location

- Nature of the Company

- Incorporation Date

- Date of business commencement

- Accounting date

- Details of Banker(s)

- Particulars of Shareholders

- Particulars of Directors

- Details of Auditors

- Personal details of Tax representative

The information you give will be used by the tax authority to describe your firm for tax registration purposes. The later application that will be printed on your company’s letterhead paper, is for VAT Registration, as previously mentioned which will be duly signed by any authorized company’s registration.

WANT TO KNOW MORE?

If you are interested in Complying in the Value Added Tax Act as amended by the Finance Act 2019 and Finance Act 2020 , you can reach us today to help.

GIVE US A CALL-08023200801 or Contact Us

Or DROP A MESSAGE

You can also schedule a free call on

Your Name (required)

Your Email (required)

Your Message

Facebook Comments

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Bulls Capital Limited is a leading management consulting firm that helps clients develop strategies,implement processes and disciplines to drive business performance for results

We deploy a holistic, science-based approach, tools, combining training, consulting, coaching, and diagnostics to help you get the results you want.

- Business Solutions

- Training Programs

- Advisory Services

- Company History

- Leadership Team

- Awards & Recognition

- Testimonials

- Partners / Clients

- Case Studies

- Sales Books

Subscribe to Newsletter

How to Register for VAT in Nigeria in 2023

- by Eunice Olopade

- May 20, 2023 October 18, 2023

Value Added Tax (VAT) is a consumption tax levied on goods and services supplied in Nigeria and imported into Nigeria. It is currently charged at the rate of 7.5% . It can also be defined to be a tax on spending or consumption levied at every stage of transaction but eventually borne by the final consumer of such goods and services.

There are some goods in Nigeria, which are specifically exempted from paying VAT as contained in the first schedule of the VAT Act, and they include medical and pharmaceutical products; basic food items; books and educational material; newspapers and magazines; baby products; commercial vehicles and their spare parts; agricultural equipment and products; and veterinary medicine.

Recommended reading : NIPC Registration Online For Foreigners Doing Business in Nigeria?

In Nigeria, only taxable persons with taxable supplies of Twenty-Five Million Naira and above are required to charge, remit, collect the tax, and file monthly returns to FIRS. In essence, a vatable person who has not attained N25 Million threshold is exempted from VAT obligations and penalties. VAT is paid through all FIRS-designated revenue-collecting banks into the VAT Pool Account. Taxes are to be paid in the currency of the transaction.

Recommended reading : The complete guide to Obtaining a Business Permit in Nigeria

Who Should Register For Vat In Nigeria?

Both individual and corporate bodies so long as they are trading in goods and services. Businesses are expected to register for VAT within the first six months of the commencement of the business. Non-resident companies must register with the VAT office using the address of the person or business that is doing business within Nigeria. Correspondences related to VAT for this business will be sent to this address.

How To Register For VAT In Nigeria?

A VAT registration with FIRS is carried out by completing Form 001 at the FIRS office. The applicant must provide an application letter, incorporation documents, and utility bill. Upon being granted a VAT registration, a unique 10-digit VAT identification number will be provided to the tax payer to use on invoices or when submitting VAT returns.

How Much Is VAT Registration?

Registering for VAT is free.

Filing Of VAT Returns

The due date for the filing of VAT returns is on or before the 21st day of the month following the month of the transaction.

Recommended reading : Filling Your Business Annual Return With CAC

What Is The Penalty For Not Registering For VAT in Nigeria?

A penalty of N10,000 for the first month in which the failure occurs and N5,000 for each subsequent month. If this persists, the business premises will be sealed up after a considered reasonable period.

Penalty for Non-Remittance of VAT

A penalty of a sum equal to 5% per annum plus interest at a commercial rate payable within 30 days of notification by the Tax Authority.

Penalty for Non-Deduction of VAT

Non-deduction or failure to collect tax by a taxable person attracts a penalty of 150% of the uncollected tax plus 5% interest above the CBN’s rediscount rate.

Is VAT Number the Same as TIN Number in Nigeria?

Recommended reading : Tax Identification Number in Tanzania (TIN)

Who Receives VAT in Nigeria?

Sidebrief is a RegTech startup that has helped founders, entrepreneurs, and business owners across borders to register their companies with ease and comply with regulations. We provide the tools for founders to start and scale businesses across borders from a single interface.

For further information, contact us today.

Email – [email protected]

Phone Number – + 234901808129

Register For Your VAT Now

Share this post, 9 thoughts on “how to register for vat in nigeria in 2023”.

I would like to apply for a vat

Yes I will to get a VAT number now

Hey guys thank you for this opportunity I really appreciate it

I need a vat registration number on this company

Hello, Willinco,

We help you get VAT for your company for N10,000.

Let me know if you want to proceed, for further enquiries, you can send a mail to [email protected]

I think am interested

I need a vat number

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Guide for new tax payers

FIRS Tax Forms

FIRS-CIT FORM

TRANSFER PRICING Forms

PART B C OF DISCLOSURE FORM

TRANSFER PRICING DECLARATION FORM

TRANSFER PRICING DISCLOSURE FORM

VAT FORM 20-02-20

WITHHOLDING VAT RETURNS AND GUIDES FORM

WITHHOLDING TAX RETURNS AND GUIDES FORM

Taxpayer Update Form

TAX PAYER UPDATE FORM

- View Certificate

- Staff Login

FIRS releases new value added tax (VAT) form in Nigeria

- March 24, 2023

The Federal Inland Revenue Service (FIRS) has released three new forms for filing monthly Value Added Tax (VAT) returns. Two VAT Form 002 that applies to head office and branch office while the third Form 006 is for withholding VAT at source as below.

- Headquarter Form 002 – Head office will provide the aggregate details of all branch remittances.

- Branch office Form 002 – Branch office will report remittances to the Headquarters on the transactions for the branch.

- Form 006 for self-charge and agents– By filing a Form 006, a taxpayer will act as an agent of FIRS. Form 006 will show the VAT withheld at Source or self-charge VAT not invoiced. A taxable person can also use the form to file one-off transactions that are not stock in trade or relating to expatriates.

Depending on the nature of the transaction, a taxable person may be an agent and taxpayer at the same time. In such an instance, the taxpayer will file Form 002 as well as Form 006. A taxpayer will include schedules of the input and output VAT as well as other adjustments to a submission. Taxpayers may submit the completed form at the tax office or online; if the business registered for electronic filing.

The due date for filing monthly VAT returns and remitting amount FIRS is the 21st day of the following month of transaction. Penalty for late filing is NGN50,000 in the first month and NGN25,000 in the subsequent month(s) of default.

Even though Nigeria does not have branch taxation, the separate tax Form 002 will give FIRS complete information on the VAT records of companies that operate in different locations. Taxpayers must complete Form 006 for VAT withheld at source or self-charged amount rather than Form 002. A copy of the three tax forms is available here .

Updated on 24 March 2023:

VAT returns should be filed online using TaxPro Max portal. FIRS no longer accepts manual submission of tax returns except returns for foreign currency denominated taxes.

Editor’s pick

Related Posts

How to register a foreign company for tax with firs.

- April 25, 2024

How to get individual tax clearance certificate

- May 2, 2024

FIRS launches self-registration on TaxPro Max

- March 12, 2024

IMAGES

VIDEO

COMMENTS

For Business Support Service in Nigeria, Contact Aziza Nigeria: Mobile: +234 8033 185 898. Email: [email protected]. TIN VAT or TCC Application Letter Sample, We explained how you can draft Tax Clearance Certificate Letter, TIN Application Letter and VAT sample in Nigeria.

Online company registration with the Corporate Affairs Commission Nigeria (CAC). www.LegalForms.ng contact us at [email protected]. This short article will show you a sample of our Application ...

The Letter of Application for Tax Identification Number (TIN) is a document an individual or business sends to the Federal Inland Revenue Service (FIRS), requesting to be registered for tax remittance. Tax registration is a legal obligation for everyone in Nigeria regardless of whether the individual or organization is required to pay tax or exempted from tax.

Written by Legal Forms. Online company registration with the Corporate Affairs Commission Nigeria (CAC). www.LegalForms.ng contact us at [email protected]. VAT is an acronym for Value Added ...

Registration Process for VAT in Nigeria. To register for VAT, you need to fill out a VAT registration form (Form 001) and submit it to the Federal Inland Revenue Service (FIRS) along with the following documents: For a Business name. Business name registration certificate. Application letter; Utility bill; For a Limited Liability Company

A VAT registration with FIRS is carried out by completing Form 001. The applicant must provide an incorporation number or personal ID if not incorporated. Upon being granted a VAT registration, a unique 10-digit VAT identification number is provided to the tax payer to use on invoices or when submitting VAT returns.

The VAT Act CAP.VI LFN 2014 requires that you pay VAT on all goods manufactured /assembled in or imported into Nigeria, and all services rendered by any person in Nigeria except those specifically exempted under the law as follows: basic (raw) food items, baby products, medical services and services rendered by Community Banks etc. .

The VAT rate in Nigeria is 7.5%, but there are zero-rated and exempt items that do not attract a 7.5% rate. Goods exempt include; Medical and pharmaceutical products. Basic food items: Basic food items mean agro and aqua-based staple food. Educational books and materials.

VAT obligation. Penalty. Registration for VAT in Nigeria. NGN50,000 (US$131) in the first month of failure and NGN25,000 (US$66) for each subsequent month in which the failure continues. Issue tax invoices to Nigerian customers. 50% of the invoice amount. Prepare and file monthly VAT returns from February 2020 to date.

All goods and services supplied in Nigeria are liable to VAT in Nigeria except goods and services specifically listed in the First Schedule to the Act. To this end, all goods and services consumed or otherwise utilised in Nigeria are subject to VAT in Nigeria. This is in line with the "destination principle" of VAT. 3.0 Place of Supply

TIN Application Letter with FIRS Nigeria This short article will show you a sample of our TIN Application Letter addressed to the FIRS office in Lagos. 1 min read · Sep 15, 2016

To apply for VAT, you will need to go to the Federal Inland Revenue Service (FIRS) office that is closest to your registered address. You can find the locations on the FIRS website with the following documents: Memorandum & Articles of Association. Certificate of Incorporation: CAC2, CAC7. Duly filled and officially stamped VAT form 001.

As a business owner in Nigeria, The first step is to apply for a Tax Identification Number (TIN) and VAT registration at your local tax office. The VAT Registration Form (001) and the Taxpayer Registration Input Form can be obtained from the Tax Office. Using your company's letterhead paper, you must also apply for Income Tax Registration and ...

To register your business for VAT in Nigeria is free. All you need to do is go to the nearest FIRS office or your State Internal Revenue Service. Here are the documents you need to apply for a VAT number for registered business names and limited liability companies. Read: How to get your Business TIN online in Nigeria. For Incorporated companies.

May 20, 2023. 9 Comments. Value Added Tax (VAT) is a consumption tax levied on goods and services supplied in Nigeria and imported into Nigeria. It is currently charged at the rate of 7.5%. It can also be defined to be a tax on spending or consumption levied at every stage of transaction but eventually borne by the final consumer of such goods ...

VAT is governed by Value Added Tax Act Cap V1, LFN 2004 (as amended) VAT is a consumption tax paid when goods are purchased and services rendered. It is a multi-stage tax. VAT is borne by the final consumer. All goods and services (produced within or imported into the country) are taxable except those specifically exempted by the VAT Act.

ABSTRACT. This journal, Understanding the Nigeria Value Added Tax System provides a comprehensive guide to the Value Added Tax (VAT) system in Nigeria. It explores the historical context, legal framework, registration process, compliance obligations, administrative procedures, and key considerations for businesses operating in Nigeria.

Steps for registering as a new taxpayer with the FIRS: Check the status of taxpayer identification number (TIN): CAC may issue a TIN to a registered company, enterprise, or not-for-profit organization at the point of incorporation or business registration. In such cases, the certificate of incorporation will contain the TIN.

Transfer Pricing. Tax Circulars, Regulations and Public Notices. Our Publications (Gauge, Tax Journal, Comic Books) PEBEC MDA'S Transparency Report. Finance Act 2020. FIRS 2021 Annual Report. 2016- 2020 Medium Term Plan. 2021 - 2024 Medium Term Plan. 2020 Corporate Plan.

Taxpayer TIN (xxxxxxxx-000x) OR RC Num: Search type: ... © FIRS

VAT Suffered on Zero Rated Supplies: Enter on line 75 the result of adding lines 60 and 65 and multiplying it by 0.05 (i.e VAT rate of 5%) Purchased Imports: Enter on line 85 the import VAT paid on importation of chargeable goods. Chargeable goods are goods whose input tax are not to be expensed or

March 24, 2023. The Federal Inland Revenue Service (FIRS) has released three new forms for filing monthly Value Added Tax (VAT) returns. Two VAT Form 002 that applies to head office and branch office while the third Form 006 is for withholding VAT at source as below. Headquarter Form 002 - Head office will provide the aggregate details of all ...

The form can be used to file for one-off transactions that are not stock in trade related or for expatriates. The returns is filed manually or online and the schedule of withholdees will be required going foeward for upload at payment interface. FORM LINE. This form has 2 rows for completion as stated below.