Get science-backed answers as you write with Paperpal's Research feature

How to Write a Conclusion for Research Papers (with Examples)

The conclusion of a research paper is a crucial section that plays a significant role in the overall impact and effectiveness of your research paper. However, this is also the section that typically receives less attention compared to the introduction and the body of the paper. The conclusion serves to provide a concise summary of the key findings, their significance, their implications, and a sense of closure to the study. Discussing how can the findings be applied in real-world scenarios or inform policy, practice, or decision-making is especially valuable to practitioners and policymakers. The research paper conclusion also provides researchers with clear insights and valuable information for their own work, which they can then build on and contribute to the advancement of knowledge in the field.

The research paper conclusion should explain the significance of your findings within the broader context of your field. It restates how your results contribute to the existing body of knowledge and whether they confirm or challenge existing theories or hypotheses. Also, by identifying unanswered questions or areas requiring further investigation, your awareness of the broader research landscape can be demonstrated.

Remember to tailor the research paper conclusion to the specific needs and interests of your intended audience, which may include researchers, practitioners, policymakers, or a combination of these.

Table of Contents

What is a conclusion in a research paper, summarizing conclusion, editorial conclusion, externalizing conclusion, importance of a good research paper conclusion, how to write a conclusion for your research paper, research paper conclusion examples.

- How to write a research paper conclusion with Paperpal?

Frequently Asked Questions

A conclusion in a research paper is the final section where you summarize and wrap up your research, presenting the key findings and insights derived from your study. The research paper conclusion is not the place to introduce new information or data that was not discussed in the main body of the paper. When working on how to conclude a research paper, remember to stick to summarizing and interpreting existing content. The research paper conclusion serves the following purposes: 1

- Warn readers of the possible consequences of not attending to the problem.

- Recommend specific course(s) of action.

- Restate key ideas to drive home the ultimate point of your research paper.

- Provide a “take-home” message that you want the readers to remember about your study.

Types of conclusions for research papers

In research papers, the conclusion provides closure to the reader. The type of research paper conclusion you choose depends on the nature of your study, your goals, and your target audience. I provide you with three common types of conclusions:

A summarizing conclusion is the most common type of conclusion in research papers. It involves summarizing the main points, reiterating the research question, and restating the significance of the findings. This common type of research paper conclusion is used across different disciplines.

An editorial conclusion is less common but can be used in research papers that are focused on proposing or advocating for a particular viewpoint or policy. It involves presenting a strong editorial or opinion based on the research findings and offering recommendations or calls to action.

An externalizing conclusion is a type of conclusion that extends the research beyond the scope of the paper by suggesting potential future research directions or discussing the broader implications of the findings. This type of conclusion is often used in more theoretical or exploratory research papers.

Align your conclusion’s tone with the rest of your research paper. Start Writing with Paperpal Now!

The conclusion in a research paper serves several important purposes:

- Offers Implications and Recommendations : Your research paper conclusion is an excellent place to discuss the broader implications of your research and suggest potential areas for further study. It’s also an opportunity to offer practical recommendations based on your findings.

- Provides Closure : A good research paper conclusion provides a sense of closure to your paper. It should leave the reader with a feeling that they have reached the end of a well-structured and thought-provoking research project.

- Leaves a Lasting Impression : Writing a well-crafted research paper conclusion leaves a lasting impression on your readers. It’s your final opportunity to leave them with a new idea, a call to action, or a memorable quote.

Writing a strong conclusion for your research paper is essential to leave a lasting impression on your readers. Here’s a step-by-step process to help you create and know what to put in the conclusion of a research paper: 2

- Research Statement : Begin your research paper conclusion by restating your research statement. This reminds the reader of the main point you’ve been trying to prove throughout your paper. Keep it concise and clear.

- Key Points : Summarize the main arguments and key points you’ve made in your paper. Avoid introducing new information in the research paper conclusion. Instead, provide a concise overview of what you’ve discussed in the body of your paper.

- Address the Research Questions : If your research paper is based on specific research questions or hypotheses, briefly address whether you’ve answered them or achieved your research goals. Discuss the significance of your findings in this context.

- Significance : Highlight the importance of your research and its relevance in the broader context. Explain why your findings matter and how they contribute to the existing knowledge in your field.

- Implications : Explore the practical or theoretical implications of your research. How might your findings impact future research, policy, or real-world applications? Consider the “so what?” question.

- Future Research : Offer suggestions for future research in your area. What questions or aspects remain unanswered or warrant further investigation? This shows that your work opens the door for future exploration.

- Closing Thought : Conclude your research paper conclusion with a thought-provoking or memorable statement. This can leave a lasting impression on your readers and wrap up your paper effectively. Avoid introducing new information or arguments here.

- Proofread and Revise : Carefully proofread your conclusion for grammar, spelling, and clarity. Ensure that your ideas flow smoothly and that your conclusion is coherent and well-structured.

Write your research paper conclusion 2x faster with Paperpal. Try it now!

Remember that a well-crafted research paper conclusion is a reflection of the strength of your research and your ability to communicate its significance effectively. It should leave a lasting impression on your readers and tie together all the threads of your paper. Now you know how to start the conclusion of a research paper and what elements to include to make it impactful, let’s look at a research paper conclusion sample.

How to write a research paper conclusion with Paperpal?

A research paper conclusion is not just a summary of your study, but a synthesis of the key findings that ties the research together and places it in a broader context. A research paper conclusion should be concise, typically around one paragraph in length. However, some complex topics may require a longer conclusion to ensure the reader is left with a clear understanding of the study’s significance. Paperpal, an AI writing assistant trusted by over 800,000 academics globally, can help you write a well-structured conclusion for your research paper.

- Sign Up or Log In: Create a new Paperpal account or login with your details.

- Navigate to Features : Once logged in, head over to the features’ side navigation pane. Click on Templates and you’ll find a suite of generative AI features to help you write better, faster.

- Generate an outline: Under Templates, select ‘Outlines’. Choose ‘Research article’ as your document type.

- Select your section: Since you’re focusing on the conclusion, select this section when prompted.

- Choose your field of study: Identifying your field of study allows Paperpal to provide more targeted suggestions, ensuring the relevance of your conclusion to your specific area of research.

- Provide a brief description of your study: Enter details about your research topic and findings. This information helps Paperpal generate a tailored outline that aligns with your paper’s content.

- Generate the conclusion outline: After entering all necessary details, click on ‘generate’. Paperpal will then create a structured outline for your conclusion, to help you start writing and build upon the outline.

- Write your conclusion: Use the generated outline to build your conclusion. The outline serves as a guide, ensuring you cover all critical aspects of a strong conclusion, from summarizing key findings to highlighting the research’s implications.

- Refine and enhance: Paperpal’s ‘Make Academic’ feature can be particularly useful in the final stages. Select any paragraph of your conclusion and use this feature to elevate the academic tone, ensuring your writing is aligned to the academic journal standards.

By following these steps, Paperpal not only simplifies the process of writing a research paper conclusion but also ensures it is impactful, concise, and aligned with academic standards. Sign up with Paperpal today and write your research paper conclusion 2x faster .

The research paper conclusion is a crucial part of your paper as it provides the final opportunity to leave a strong impression on your readers. In the research paper conclusion, summarize the main points of your research paper by restating your research statement, highlighting the most important findings, addressing the research questions or objectives, explaining the broader context of the study, discussing the significance of your findings, providing recommendations if applicable, and emphasizing the takeaway message. The main purpose of the conclusion is to remind the reader of the main point or argument of your paper and to provide a clear and concise summary of the key findings and their implications. All these elements should feature on your list of what to put in the conclusion of a research paper to create a strong final statement for your work.

A strong conclusion is a critical component of a research paper, as it provides an opportunity to wrap up your arguments, reiterate your main points, and leave a lasting impression on your readers. Here are the key elements of a strong research paper conclusion: 1. Conciseness : A research paper conclusion should be concise and to the point. It should not introduce new information or ideas that were not discussed in the body of the paper. 2. Summarization : The research paper conclusion should be comprehensive enough to give the reader a clear understanding of the research’s main contributions. 3 . Relevance : Ensure that the information included in the research paper conclusion is directly relevant to the research paper’s main topic and objectives; avoid unnecessary details. 4 . Connection to the Introduction : A well-structured research paper conclusion often revisits the key points made in the introduction and shows how the research has addressed the initial questions or objectives. 5. Emphasis : Highlight the significance and implications of your research. Why is your study important? What are the broader implications or applications of your findings? 6 . Call to Action : Include a call to action or a recommendation for future research or action based on your findings.

The length of a research paper conclusion can vary depending on several factors, including the overall length of the paper, the complexity of the research, and the specific journal requirements. While there is no strict rule for the length of a conclusion, but it’s generally advisable to keep it relatively short. A typical research paper conclusion might be around 5-10% of the paper’s total length. For example, if your paper is 10 pages long, the conclusion might be roughly half a page to one page in length.

In general, you do not need to include citations in the research paper conclusion. Citations are typically reserved for the body of the paper to support your arguments and provide evidence for your claims. However, there may be some exceptions to this rule: 1. If you are drawing a direct quote or paraphrasing a specific source in your research paper conclusion, you should include a citation to give proper credit to the original author. 2. If your conclusion refers to or discusses specific research, data, or sources that are crucial to the overall argument, citations can be included to reinforce your conclusion’s validity.

The conclusion of a research paper serves several important purposes: 1. Summarize the Key Points 2. Reinforce the Main Argument 3. Provide Closure 4. Offer Insights or Implications 5. Engage the Reader. 6. Reflect on Limitations

Remember that the primary purpose of the research paper conclusion is to leave a lasting impression on the reader, reinforcing the key points and providing closure to your research. It’s often the last part of the paper that the reader will see, so it should be strong and well-crafted.

- Makar, G., Foltz, C., Lendner, M., & Vaccaro, A. R. (2018). How to write effective discussion and conclusion sections. Clinical spine surgery, 31(8), 345-346.

- Bunton, D. (2005). The structure of PhD conclusion chapters. Journal of English for academic purposes , 4 (3), 207-224.

Paperpal is a comprehensive AI writing toolkit that helps students and researchers achieve 2x the writing in half the time. It leverages 21+ years of STM experience and insights from millions of research articles to provide in-depth academic writing, language editing, and submission readiness support to help you write better, faster.

Get accurate academic translations, rewriting support, grammar checks, vocabulary suggestions, and generative AI assistance that delivers human precision at machine speed. Try for free or upgrade to Paperpal Prime starting at US$19 a month to access premium features, including consistency, plagiarism, and 30+ submission readiness checks to help you succeed.

Experience the future of academic writing – Sign up to Paperpal and start writing for free!

Related Reads:

- 5 Reasons for Rejection After Peer Review

- Ethical Research Practices For Research with Human Subjects

7 Ways to Improve Your Academic Writing Process

- Paraphrasing in Academic Writing: Answering Top Author Queries

Preflight For Editorial Desk: The Perfect Hybrid (AI + Human) Assistance Against Compromised Manuscripts

You may also like, ai in education: it’s time to change the..., is it ethical to use ai-generated abstracts without..., what are journal guidelines on using generative ai..., quillbot review: features, pricing, and free alternatives, what is an academic paper types and elements , should you use ai tools like chatgpt for..., publish research papers: 9 steps for successful publications , what are the different types of research papers, how to make translating academic papers less challenging, self-plagiarism in research: what it is and how....

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

- Research paper

Writing a Research Paper Conclusion | Step-by-Step Guide

Published on October 30, 2022 by Jack Caulfield . Revised on April 13, 2023.

- Restate the problem statement addressed in the paper

- Summarize your overall arguments or findings

- Suggest the key takeaways from your paper

The content of the conclusion varies depending on whether your paper presents the results of original empirical research or constructs an argument through engagement with sources .

Instantly correct all language mistakes in your text

Upload your document to correct all your mistakes in minutes

Table of contents

Step 1: restate the problem, step 2: sum up the paper, step 3: discuss the implications, research paper conclusion examples, frequently asked questions about research paper conclusions.

The first task of your conclusion is to remind the reader of your research problem . You will have discussed this problem in depth throughout the body, but now the point is to zoom back out from the details to the bigger picture.

While you are restating a problem you’ve already introduced, you should avoid phrasing it identically to how it appeared in the introduction . Ideally, you’ll find a novel way to circle back to the problem from the more detailed ideas discussed in the body.

For example, an argumentative paper advocating new measures to reduce the environmental impact of agriculture might restate its problem as follows:

Meanwhile, an empirical paper studying the relationship of Instagram use with body image issues might present its problem like this:

“In conclusion …”

Avoid starting your conclusion with phrases like “In conclusion” or “To conclude,” as this can come across as too obvious and make your writing seem unsophisticated. The content and placement of your conclusion should make its function clear without the need for additional signposting.

Prevent plagiarism. Run a free check.

Having zoomed back in on the problem, it’s time to summarize how the body of the paper went about addressing it, and what conclusions this approach led to.

Depending on the nature of your research paper, this might mean restating your thesis and arguments, or summarizing your overall findings.

Argumentative paper: Restate your thesis and arguments

In an argumentative paper, you will have presented a thesis statement in your introduction, expressing the overall claim your paper argues for. In the conclusion, you should restate the thesis and show how it has been developed through the body of the paper.

Briefly summarize the key arguments made in the body, showing how each of them contributes to proving your thesis. You may also mention any counterarguments you addressed, emphasizing why your thesis holds up against them, particularly if your argument is a controversial one.

Don’t go into the details of your evidence or present new ideas; focus on outlining in broad strokes the argument you have made.

Empirical paper: Summarize your findings

In an empirical paper, this is the time to summarize your key findings. Don’t go into great detail here (you will have presented your in-depth results and discussion already), but do clearly express the answers to the research questions you investigated.

Describe your main findings, even if they weren’t necessarily the ones you expected or hoped for, and explain the overall conclusion they led you to.

Having summed up your key arguments or findings, the conclusion ends by considering the broader implications of your research. This means expressing the key takeaways, practical or theoretical, from your paper—often in the form of a call for action or suggestions for future research.

Argumentative paper: Strong closing statement

An argumentative paper generally ends with a strong closing statement. In the case of a practical argument, make a call for action: What actions do you think should be taken by the people or organizations concerned in response to your argument?

If your topic is more theoretical and unsuitable for a call for action, your closing statement should express the significance of your argument—for example, in proposing a new understanding of a topic or laying the groundwork for future research.

Empirical paper: Future research directions

In a more empirical paper, you can close by either making recommendations for practice (for example, in clinical or policy papers), or suggesting directions for future research.

Whatever the scope of your own research, there will always be room for further investigation of related topics, and you’ll often discover new questions and problems during the research process .

Finish your paper on a forward-looking note by suggesting how you or other researchers might build on this topic in the future and address any limitations of the current paper.

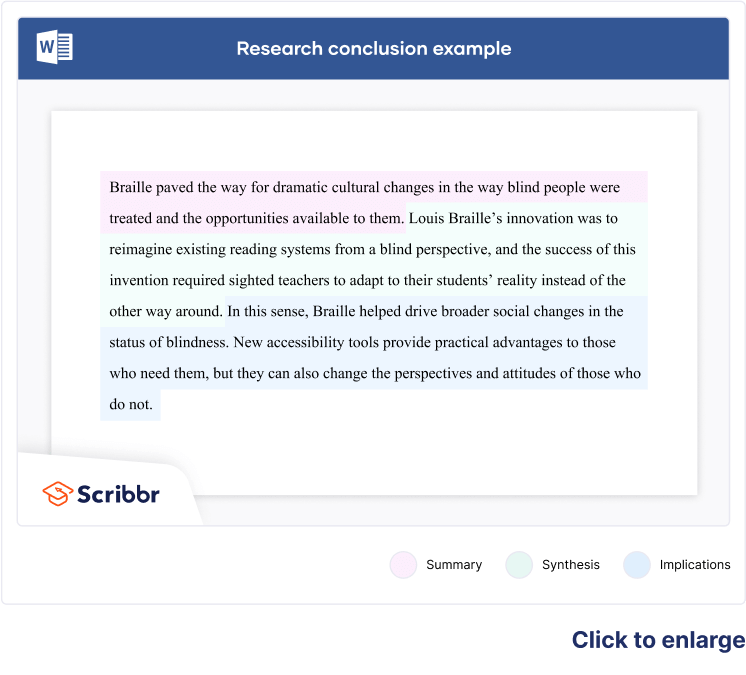

Full examples of research paper conclusions are shown in the tabs below: one for an argumentative paper, the other for an empirical paper.

- Argumentative paper

- Empirical paper

While the role of cattle in climate change is by now common knowledge, countries like the Netherlands continually fail to confront this issue with the urgency it deserves. The evidence is clear: To create a truly futureproof agricultural sector, Dutch farmers must be incentivized to transition from livestock farming to sustainable vegetable farming. As well as dramatically lowering emissions, plant-based agriculture, if approached in the right way, can produce more food with less land, providing opportunities for nature regeneration areas that will themselves contribute to climate targets. Although this approach would have economic ramifications, from a long-term perspective, it would represent a significant step towards a more sustainable and resilient national economy. Transitioning to sustainable vegetable farming will make the Netherlands greener and healthier, setting an example for other European governments. Farmers, policymakers, and consumers must focus on the future, not just on their own short-term interests, and work to implement this transition now.

As social media becomes increasingly central to young people’s everyday lives, it is important to understand how different platforms affect their developing self-conception. By testing the effect of daily Instagram use among teenage girls, this study established that highly visual social media does indeed have a significant effect on body image concerns, with a strong correlation between the amount of time spent on the platform and participants’ self-reported dissatisfaction with their appearance. However, the strength of this effect was moderated by pre-test self-esteem ratings: Participants with higher self-esteem were less likely to experience an increase in body image concerns after using Instagram. This suggests that, while Instagram does impact body image, it is also important to consider the wider social and psychological context in which this usage occurs: Teenagers who are already predisposed to self-esteem issues may be at greater risk of experiencing negative effects. Future research into Instagram and other highly visual social media should focus on establishing a clearer picture of how self-esteem and related constructs influence young people’s experiences of these platforms. Furthermore, while this experiment measured Instagram usage in terms of time spent on the platform, observational studies are required to gain more insight into different patterns of usage—to investigate, for instance, whether active posting is associated with different effects than passive consumption of social media content.

If you’re unsure about the conclusion, it can be helpful to ask a friend or fellow student to read your conclusion and summarize the main takeaways.

- Do they understand from your conclusion what your research was about?

- Are they able to summarize the implications of your findings?

- Can they answer your research question based on your conclusion?

You can also get an expert to proofread and feedback your paper with a paper editing service .

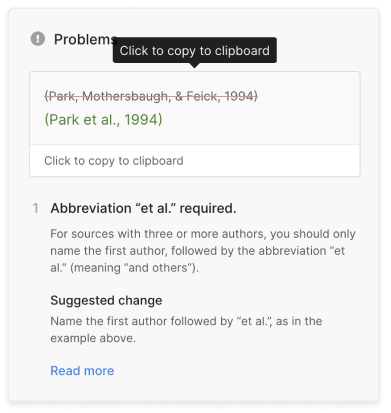

Scribbr Citation Checker New

The AI-powered Citation Checker helps you avoid common mistakes such as:

- Missing commas and periods

- Incorrect usage of “et al.”

- Ampersands (&) in narrative citations

- Missing reference entries

The conclusion of a research paper has several key elements you should make sure to include:

- A restatement of the research problem

- A summary of your key arguments and/or findings

- A short discussion of the implications of your research

No, it’s not appropriate to present new arguments or evidence in the conclusion . While you might be tempted to save a striking argument for last, research papers follow a more formal structure than this.

All your findings and arguments should be presented in the body of the text (more specifically in the results and discussion sections if you are following a scientific structure). The conclusion is meant to summarize and reflect on the evidence and arguments you have already presented, not introduce new ones.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

Caulfield, J. (2023, April 13). Writing a Research Paper Conclusion | Step-by-Step Guide. Scribbr. Retrieved April 13, 2024, from https://www.scribbr.com/research-paper/research-paper-conclusion/

Is this article helpful?

Jack Caulfield

Other students also liked, writing a research paper introduction | step-by-step guide, how to create a structured research paper outline | example, checklist: writing a great research paper, unlimited academic ai-proofreading.

✔ Document error-free in 5minutes ✔ Unlimited document corrections ✔ Specialized in correcting academic texts

How to Write a Research Paper Conclusion

Wrapping up a paper may seem simple enough, but if you don’t know how to write a research paper conclusion, it can sometimes be the hardest part of the paper-writing process.

In this guide, we share expert advice on how to write a research paper conclusion. We explain what to put (and what not to put) in a research paper conclusion, describe the different types of conclusions, and show you a few different research paper conclusion examples.

Give your writing extra polish Grammarly helps you communicate confidently Write with Grammarly

What is a research paper conclusion?

A research paper conclusion should summarize the main points of the paper, help readers contextualize the information, and as the last thing people read, be memorable and leave an impression. The research paper conclusion is the best chance for the author to both reiterate their main points and tie all the information together. All in all, it’s one of the most important parts of writing a research paper .

Research paper conclusions are generally one paragraph long , although more complicated topics may have longer conclusions. Although conclusions don’t normally present new information or data that wasn’t mentioned in the article, they often reframe the issues or offer a new perspective on the topic.

6 elements to include in a research paper conclusion

1 urgency or consequences.

A good conclusion answers the question, Why should the reader care? To connect the information to the reader, point out why your topic should matter to them. What happens if the problem persists, or how can the problem be solved? Feel free to mention common obstacles that feed the problem, implications of the data, or a recommended action for fixing it.

2 Reminder of thesis statement

Research paper conclusions are a great place to revisit your initial thesis statement , a sentence that encapsulates the main topic or problem your paper addresses. Thesis statements are discussed heavily at the beginning of a paper, but they can be even stronger when you reintroduce them at the end, after you’ve presented all your evidence.

3 Recap of main points

Although you don’t want to repeat yourself just for the sake of repetition, a recap of your main points can be helpful to your reader. Think of these as your paper’s “key takeaways,” the parts you want readers to remember. Save the details for the body text and use the conclusion to remind the reader of your strongest supporting evidence before they put your paper down.

4 Parallels to the introduction

The introduction and the conclusion are two sides of the same coin. A useful strategy to consider as you approach writing a research paper conclusion is to follow the same structure or address the same themes as you do in the introduction. For example, if you pose a question in your introduction, you can answer it directly in your conclusion. Keep this in mind when writing your research paper outline so you can properly plan both parts.

5 Limitations of the study

Although this isn’t applicable to every research paper, if you’re writing about actual tests or studies you’ve conducted, there are some ethical requirements for what you put in a research paper conclusion. Specifically, you’re expected to address the limitations of your study; these may include criticisms or flaws in your process that might have affected the results, such as using suboptimal participation groups. It’s best to call these out yourself rather than having a colleague call them out later.

6 Conciseness

Above all, every research paper conclusion should be written with conciseness . In general, conclusions should be short, so keep an eye on your word count as you write and aim to be as succinct as possible. You can expound on your topic in the body of your paper, but the conclusion is more for summarizing and recapping.

5 elements not to include in a research paper conclusion

1 dry summary.

Summarizing may be a crucial part of research paper conclusions, but it’s not the only part. Your conclusion should be more than just a summary; it should shape the way your reader thinks about your topic. Don’t just repeat the facts: Contextualize them for the reader, offer a new perspective, or suggest a step for solving the problem.

2 Generic or clichéd phrasing

Just like our advice for how to write a conclusion for a more general essay, you should also avoid generic or clichéd phrasing in research paper conclusions. Some words or phrases are overused in conclusions to the point of becoming trite. If you want your conclusion to seem fresh and well-written, avoid these phrases:

- in conclusion

- in summary or in summation

3 New data or evidence

Conclusions are not the place to introduce new evidence or data, especially if they are significant enough to reframe your entire argument. Hard facts and supporting evidence belong in the body of the paper; when the reader is absorbing this section, they’re still actively learning about the topic. By the conclusion, the reader is almost done forming their opinion. The conclusion is more about retrospection; introducing unexpected information there can frustrate readers just as much as it surprises them.

4 Ignoring negative results

It might be tempting to sugarcoat negative results or ignore them completely, but that will only harm your paper in the end. It’s always best to own up to any shortcomings in your research and admit them overtly. Your transparency not only helps validate your other research, but it also prevents critics from pointing out these same shortcomings in a more damaging way.

5 Ambiguous resolutions

Part of the appeal of research paper conclusions is the closure they bring; they’re supposed to wrap up arguments and clean up any loose ends. If your conclusion is ambiguous, it can give the impression that your research was incomplete, inadequate, or fundamentally flawed. Rather, write your conclusion with direct language and take a firm stance. Even if the data was inconclusive, state definitively that it was inconclusive. This kind of clarity in writing makes you sound both confident and competent.

Types of research paper conclusions with examples

Although there are no formal types of research paper conclusions, in general they tend to fall into the categories of summary , commentary , and new perspective . Bear in mind that these aren’t mutually exclusive—the same research paper conclusion can summarize and present a new perspective at the same time. Consider mixing and matching parts from each to create the unique blend your own paper needs.

Research paper conclusion example: Summary

The most common type of research paper conclusion is the straight summary, which succinctly repeats the key points of the paper. Keep in mind that a conclusion should do more than merely summarize, so be sure to add some lines that offer extra value or insight.

Like all great scientists, Isaac Newton was able to condense his ideas, however complicated, into the simple and brief laws discussed above. Newton’s law of inertia, his law of action/reaction, and his equation of F=ma —along with his law of gravity, also discussed above—combine to form the very foundation of classical mechanics. Without his laws, physics as we know it wouldn’t exist.

Research paper conclusion example: Commentary

The conclusion can be an opportunity for a writer to share their own personal views. This is especially useful in scientific writing, where the body of the paper is reserved for data and facts, and the conclusion is the only section for personal opinion. Just be careful about getting too subjective—this is still a research paper, not a personal essay .

As you can see by the cause-and-effect relationships pointed out above, an attack on journalism in one part of the world is an attack on journalism everywhere. Though the issue might seem distant, it’s actually right on our doorstep. All of us need to start standing up to the powers that censor the truth and defend the brave journalists who risk their lives to deliver it.

Research paper conclusion example: New perspective

Research paper conclusions are the perfect place to offer a new perspective on your topic. After presenting all your evidence and research, you can now draw connections and synthesize the data to create a unifying theory or new angle. The conclusion is the best place to include this, as the reader is already familiar with all the essential details.

You’ll notice that the studies we examined all come to the same conclusion: Remote working increases both production and employee satisfaction. Ultimately, the idea that remote work hinders productivity is a lie. In fact, the research suggests clearly that remote work should be increased, not done away with. If remote work becomes the norm instead of the exception, businesses could actually achieve new heights.

Research paper conclusion FAQs

What is the purpose of a research paper conclusion.

The purpose of a research paper conclusion is to summarize the main points of the paper, help the reader contextualize the information, and leave a lasting impression on the reader.

What should you include in a research paper conclusion?

A research paper conclusion should include a summary of the key points in your paper. Additionally, the conclusion can reframe the research in a way that’s easier for the reader to understand, often by adding urgency or explaining consequences. The conclusion is also used to mention the limitations of your research, such as an inadequate number of participants.

What are the different kinds of research paper conclusions?

Although there are no formal categories of research paper conclusion, in general research paper conclusions tend to fall into the categories of summary, commentary, and new perspective. Bear in mind that these aren’t mutually exclusive—the same research paper conclusion can both summarize the paper and present a new perspective.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

10.2 Steps in the Marketing Research Process

Learning objective.

- Describe the basic steps in the marketing research process and the purpose of each step.

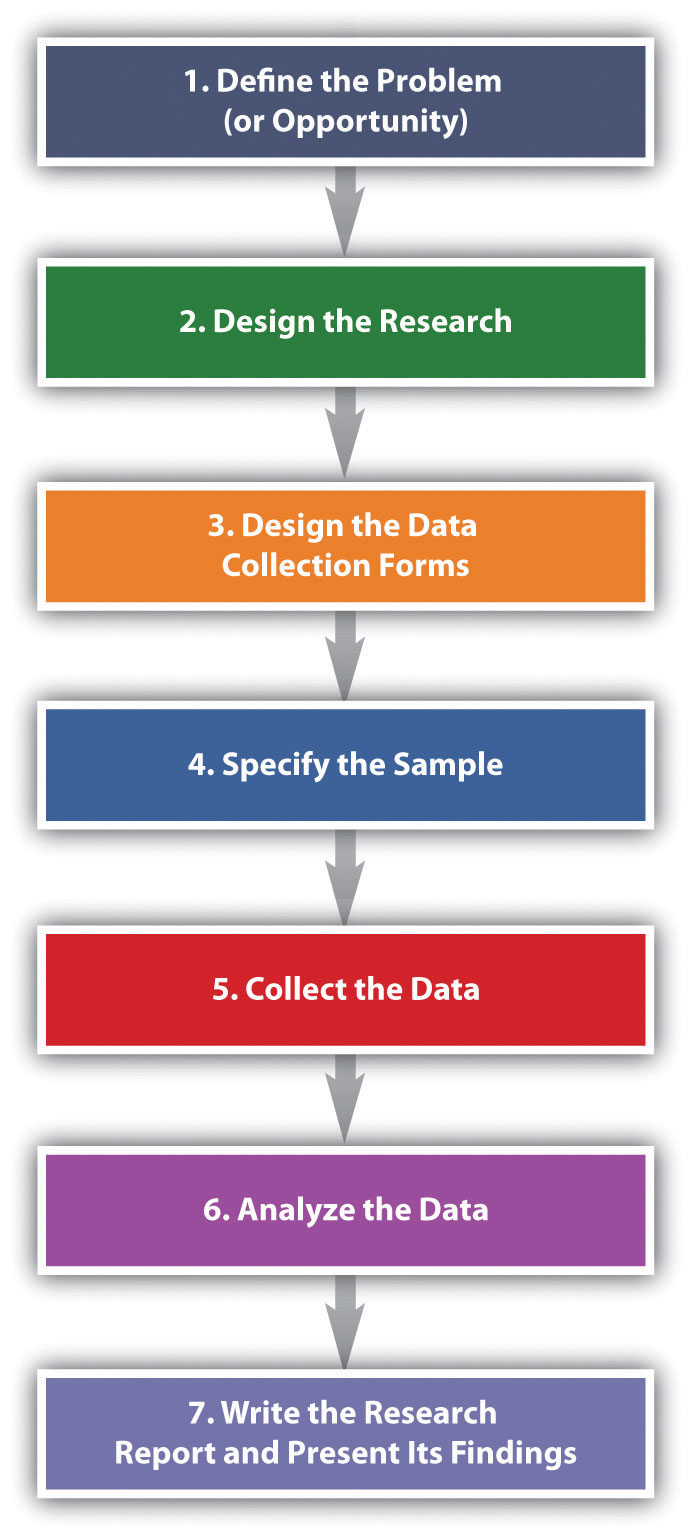

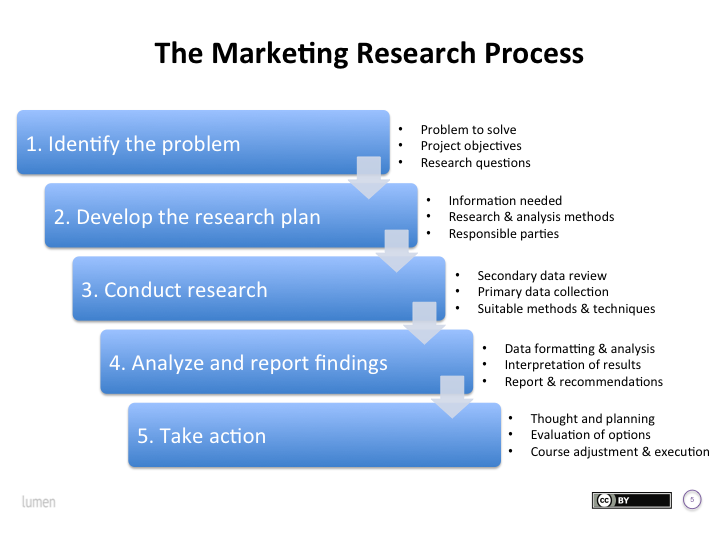

The basic steps used to conduct marketing research are shown in Figure 10.6 “Steps in the Marketing Research Process” . Next, we discuss each step.

Figure 10.6 Steps in the Marketing Research Process

Step 1: Define the Problem (or Opportunity)

There’s a saying in marketing research that a problem half defined is a problem half solved. Defining the “problem” of the research sounds simple, doesn’t it? Suppose your product is tutoring other students in a subject you’re a whiz at. You have been tutoring for a while, and people have begun to realize you’re darned good at it. Then, suddenly, your business drops off. Or it explodes, and you can’t cope with the number of students you’re being asked help. If the business has exploded, should you try to expand your services? Perhaps you should subcontract with some other “whiz” students. You would send them students to be tutored, and they would give you a cut of their pay for each student you referred to them.

Both of these scenarios would be a problem for you, wouldn’t they? They are problems insofar as they cause you headaches. But are they really the problem? Or are they the symptoms of something bigger? For example, maybe your business has dropped off because your school is experiencing financial trouble and has lowered the number of scholarships given to incoming freshmen. Consequently, there are fewer total students on campus who need your services. Conversely, if you’re swamped with people who want you to tutor them, perhaps your school awarded more scholarships than usual, so there are a greater number of students who need your services. Alternately, perhaps you ran an ad in your school’s college newspaper, and that led to the influx of students wanting you to tutor them.

Businesses are in the same boat you are as a tutor. They take a look at symptoms and try to drill down to the potential causes. If you approach a marketing research company with either scenario—either too much or too little business—the firm will seek more information from you such as the following:

- In what semester(s) did your tutoring revenues fall (or rise)?

- In what subject areas did your tutoring revenues fall (or rise)?

- In what sales channels did revenues fall (or rise): Were there fewer (or more) referrals from professors or other students? Did the ad you ran result in fewer (or more) referrals this month than in the past months?

- Among what demographic groups did your revenues fall (or rise)—women or men, people with certain majors, or first-year, second-, third-, or fourth-year students?

The key is to look at all potential causes so as to narrow the parameters of the study to the information you actually need to make a good decision about how to fix your business if revenues have dropped or whether or not to expand it if your revenues have exploded.

The next task for the researcher is to put into writing the research objective. The research objective is the goal(s) the research is supposed to accomplish. The marketing research objective for your tutoring business might read as follows:

To survey college professors who teach 100- and 200-level math courses to determine why the number of students referred for tutoring dropped in the second semester.

This is admittedly a simple example designed to help you understand the basic concept. If you take a marketing research course, you will learn that research objectives get a lot more complicated than this. The following is an example:

“To gather information from a sample representative of the U.S. population among those who are ‘very likely’ to purchase an automobile within the next 6 months, which assesses preferences (measured on a 1–5 scale ranging from ‘very likely to buy’ to ‘not likely at all to buy’) for the model diesel at three different price levels. Such data would serve as input into a forecasting model that would forecast unit sales, by geographic regions of the country, for each combination of the model’s different prices and fuel configurations (Burns & Bush, 2010).”

Now do you understand why defining the problem is complicated and half the battle? Many a marketing research effort is doomed from the start because the problem was improperly defined. Coke’s ill-fated decision to change the formula of Coca-Cola in 1985 is a case in point: Pepsi had been creeping up on Coke in terms of market share over the years as well as running a successful promotional campaign called the “Pepsi Challenge,” in which consumers were encouraged to do a blind taste test to see if they agreed that Pepsi was better. Coke spent four years researching “the problem.” Indeed, people seemed to like the taste of Pepsi better in blind taste tests. Thus, the formula for Coke was changed. But the outcry among the public was so great that the new formula didn’t last long—a matter of months—before the old formula was reinstated. Some marketing experts believe Coke incorrectly defined the problem as “How can we beat Pepsi in taste tests?” instead of “How can we gain market share against Pepsi?” (Burns & Bush, 2010)

New Coke Is It! 1985

(click to see video)

This video documents the Coca-Cola Company’s ill-fated launch of New Coke in 1985.

1985 Pepsi Commercial—“They Changed My Coke”

This video shows how Pepsi tried to capitalize on the blunder.

Step 2: Design the Research

The next step in the marketing research process is to do a research design. The research design is your “plan of attack.” It outlines what data you are going to gather and from whom, how and when you will collect the data, and how you will analyze it once it’s been obtained. Let’s look at the data you’re going to gather first.

There are two basic types of data you can gather. The first is primary data. Primary data is information you collect yourself, using hands-on tools such as interviews or surveys, specifically for the research project you’re conducting. Secondary data is data that has already been collected by someone else, or data you have already collected for another purpose. Collecting primary data is more time consuming, work intensive, and expensive than collecting secondary data. Consequently, you should always try to collect secondary data first to solve your research problem, if you can. A great deal of research on a wide variety of topics already exists. If this research contains the answer to your question, there is no need for you to replicate it. Why reinvent the wheel?

Sources of Secondary Data

Your company’s internal records are a source of secondary data. So are any data you collect as part of your marketing intelligence gathering efforts. You can also purchase syndicated research. Syndicated research is primary data that marketing research firms collect on a regular basis and sell to other companies. J.D. Power & Associates is a provider of syndicated research. The company conducts independent, unbiased surveys of customer satisfaction, product quality, and buyer behavior for various industries. The company is best known for its research in the automobile sector. One of the best-known sellers of syndicated research is the Nielsen Company, which produces the Nielsen ratings. The Nielsen ratings measure the size of television, radio, and newspaper audiences in various markets. You have probably read or heard about TV shows that get the highest (Nielsen) ratings. (Arbitron does the same thing for radio ratings.) Nielsen, along with its main competitor, Information Resources, Inc. (IRI), also sells businesses scanner-based research . Scanner-based research is information collected by scanners at checkout stands in stores. Each week Nielsen and IRI collect information on the millions of purchases made at stores. The companies then compile the information and sell it to firms in various industries that subscribe to their services. The Nielsen Company has also recently teamed up with Facebook to collect marketing research information. Via Facebook, users will see surveys in some of the spaces in which they used to see online ads (Rappeport, Gelles, 2009).

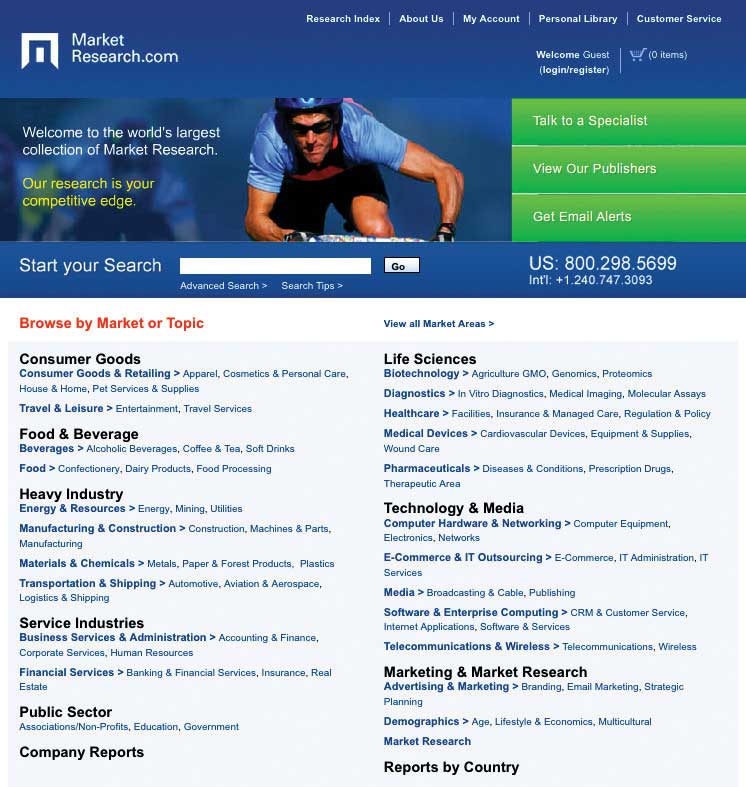

By contrast, MarketResearch.com is an example of a marketing research aggregator. A marketing research aggregator is a marketing research company that doesn’t conduct its own research and sell it. Instead, it buys research reports from other marketing research companies and then sells the reports in their entirety or in pieces to other firms. Check out MarketResearch.com’s Web site. As you will see there are a huge number of studies in every category imaginable that you can buy for relatively small amounts of money.

Figure 10.7

Market research aggregators buy research reports from other marketing research companies and then resell them in part or in whole to other companies so they don’t have to gather primary data.

Source: http://www.marketresearch.com .

Your local library is a good place to gather free secondary data. It has searchable databases as well as handbooks, dictionaries, and books, some of which you can access online. Government agencies also collect and report information on demographics, economic and employment data, health information, and balance-of-trade statistics, among a lot of other information. The U.S. Census Bureau collects census data every ten years to gather information about who lives where. Basic demographic information about sex, age, race, and types of housing in which people live in each U.S. state, metropolitan area, and rural area is gathered so that population shifts can be tracked for various purposes, including determining the number of legislators each state should have in the U.S. House of Representatives. For the U.S. government, this is primary data. For marketing managers it is an important source of secondary data.

The Survey Research Center at the University of Michigan also conducts periodic surveys and publishes information about trends in the United States. One research study the center continually conducts is called the “Changing Lives of American Families” ( http://www.isr.umich.edu/home/news/research-update/2007-01.pdf ). This is important research data for marketing managers monitoring consumer trends in the marketplace. The World Bank and the United Nations are two international organizations that collect a great deal of information. Their Web sites contain many free research studies and data related to global markets. Table 10.1 “Examples of Primary Data Sources versus Secondary Data Sources” shows some examples of primary versus secondary data sources.

Table 10.1 Examples of Primary Data Sources versus Secondary Data Sources

Gauging the Quality of Secondary Data

When you are gathering secondary information, it’s always good to be a little skeptical of it. Sometimes studies are commissioned to produce the result a client wants to hear—or wants the public to hear. For example, throughout the twentieth century, numerous studies found that smoking was good for people’s health. The problem was the studies were commissioned by the tobacco industry. Web research can also pose certain hazards. There are many biased sites that try to fool people that they are providing good data. Often the data is favorable to the products they are trying to sell. Beware of product reviews as well. Unscrupulous sellers sometimes get online and create bogus ratings for products. See below for questions you can ask to help gauge the credibility of secondary information.

Gauging the Credibility of Secondary Data: Questions to Ask

- Who gathered this information?

- For what purpose?

- What does the person or organization that gathered the information have to gain by doing so?

- Was the information gathered and reported in a systematic manner?

- Is the source of the information accepted as an authority by other experts in the field?

- Does the article provide objective evidence to support the position presented?

Types of Research Design

Now let’s look specifically at the types of research designs that are utilized. By understanding different types of research designs, a researcher can solve a client’s problems more quickly and efficiently without jumping through more hoops than necessary. Research designs fall into one of the following three categories:

- Exploratory research design

- Descriptive research design

- Causal research design (experiments)

An exploratory research design is useful when you are initially investigating a problem but you haven’t defined it well enough to do an in-depth study of it. Perhaps via your regular market intelligence, you have spotted what appears to be a new opportunity in the marketplace. You would then do exploratory research to investigate it further and “get your feet wet,” as the saying goes. Exploratory research is less structured than other types of research, and secondary data is often utilized.

One form of exploratory research is qualitative research. Qualitative research is any form of research that includes gathering data that is not quantitative, and often involves exploring questions such as why as much as what or how much . Different forms, such as depth interviews and focus group interviews, are common in marketing research.

The depth interview —engaging in detailed, one-on-one, question-and-answer sessions with potential buyers—is an exploratory research technique. However, unlike surveys, the people being interviewed aren’t asked a series of standard questions. Instead the interviewer is armed with some general topics and asks questions that are open ended, meaning that they allow the interviewee to elaborate. “How did you feel about the product after you purchased it?” is an example of a question that might be asked. A depth interview also allows a researcher to ask logical follow-up questions such as “Can you tell me what you mean when you say you felt uncomfortable using the service?” or “Can you give me some examples?” to help dig further and shed additional light on the research problem. Depth interviews can be conducted in person or over the phone. The interviewer either takes notes or records the interview.

Focus groups and case studies are often utilized for exploratory research as well. A focus group is a group of potential buyers who are brought together to discuss a marketing research topic with one another. A moderator is used to focus the discussion, the sessions are recorded, and the main points of consensus are later summarized by the market researcher. Textbook publishers often gather groups of professors at educational conferences to participate in focus groups. However, focus groups can also be conducted on the telephone, in online chat rooms, or both, using meeting software like WebEx. The basic steps of conducting a focus group are outlined below.

The Basic Steps of Conducting a Focus Group

- Establish the objectives of the focus group. What is its purpose?

- Identify the people who will participate in the focus group. What makes them qualified to participate? How many of them will you need and what they will be paid?

- Obtain contact information for the participants and send out invitations (usually e-mails are most efficient).

- Develop a list of questions.

- Choose a facilitator.

- Choose a location in which to hold the focus group and the method by which it will be recorded.

- Conduct the focus group. If the focus group is not conducted electronically, include name tags for the participants, pens and notepads, any materials the participants need to see, and refreshments. Record participants’ responses.

- Summarize the notes from the focus group and write a report for management.

A case study looks at how another company solved the problem that’s being researched. Sometimes multiple cases, or companies, are used in a study. Case studies nonetheless have a mixed reputation. Some researchers believe it’s hard to generalize, or apply, the results of a case study to other companies. Nonetheless, collecting information about companies that encountered the same problems your firm is facing can give you a certain amount of insight about what direction you should take. In fact, one way to begin a research project is to carefully study a successful product or service.

Two other types of qualitative data used for exploratory research are ethnographies and projective techniques. In an ethnography , researchers interview, observe, and often videotape people while they work, live, shop, and play. The Walt Disney Company has recently begun using ethnographers to uncover the likes and dislikes of boys aged six to fourteen, a financially attractive market segment for Disney, but one in which the company has been losing market share. The ethnographers visit the homes of boys, observe the things they have in their rooms to get a sense of their hobbies, and accompany them and their mothers when they shop to see where they go, what the boys are interested in, and what they ultimately buy. (The children get seventy-five dollars out of the deal, incidentally.) (Barnes, 2009)

Projective techniques are used to reveal information research respondents might not reveal by being asked directly. Asking a person to complete sentences such as the following is one technique:

People who buy Coach handbags __________.

(Will he or she reply with “are cool,” “are affluent,” or “are pretentious,” for example?)

KFC’s grilled chicken is ______.

Or the person might be asked to finish a story that presents a certain scenario. Word associations are also used to discern people’s underlying attitudes toward goods and services. Using a word-association technique, a market researcher asks a person to say or write the first word that comes to his or her mind in response to another word. If the initial word is “fast food,” what word does the person associate it with or respond with? Is it “McDonald’s”? If many people reply that way, and you’re conducting research for Burger King, that could indicate Burger King has a problem. However, if the research is being conducted for Wendy’s, which recently began running an advertising campaign to the effect that Wendy’s offerings are “better than fast food,” it could indicate that the campaign is working.

Completing cartoons is yet another type of projective technique. It’s similar to finishing a sentence or story, only with the pictures. People are asked to look at a cartoon such as the one shown in Figure 10.8 “Example of a Cartoon-Completion Projective Technique” . One of the characters in the picture will have made a statement, and the person is asked to fill in the empty cartoon “bubble” with how they think the second character will respond.

Figure 10.8 Example of a Cartoon-Completion Projective Technique

In some cases, your research might end with exploratory research. Perhaps you have discovered your organization lacks the resources needed to produce the product. In other cases, you might decide you need more in-depth, quantitative research such as descriptive research or causal research, which are discussed next. Most marketing research professionals advise using both types of research, if it’s feasible. On the one hand, the qualitative-type research used in exploratory research is often considered too “lightweight.” Remember earlier in the chapter when we discussed telephone answering machines and the hit TV sitcom Seinfeld ? Both product ideas were initially rejected by focus groups. On the other hand, relying solely on quantitative information often results in market research that lacks ideas.

The Stone Wheel—What One Focus Group Said

Watch the video to see a funny spoof on the usefulness—or lack of usefulness—of focus groups.

Descriptive Research

Anything that can be observed and counted falls into the category of descriptive research design. A study using a descriptive research design involves gathering hard numbers, often via surveys, to describe or measure a phenomenon so as to answer the questions of who , what , where , when , and how . “On a scale of 1–5, how satisfied were you with your service?” is a question that illustrates the information a descriptive research design is supposed to capture.

Physiological measurements also fall into the category of descriptive design. Physiological measurements measure people’s involuntary physical responses to marketing stimuli, such as an advertisement. Elsewhere, we explained that researchers have gone so far as to scan the brains of consumers to see what they really think about products versus what they say about them. Eye tracking is another cutting-edge type of physiological measurement. It involves recording the movements of a person’s eyes when they look at some sort of stimulus, such as a banner ad or a Web page. The Walt Disney Company has a research facility in Austin, Texas, that it uses to take physical measurements of viewers when they see Disney programs and advertisements. The facility measures three types of responses: people’s heart rates, skin changes, and eye movements (eye tracking) (Spangler, 2009).

Figure 10.9

A woman shows off her headgear for an eye-tracking study. The gear’s not exactly a fashion statement but . . .

lawrencegs – Google Glass – CC BY 2.0.

A strictly descriptive research design instrument—a survey, for example—can tell you how satisfied your customers are. It can’t, however, tell you why. Nor can an eye-tracking study tell you why people’s eyes tend to dwell on certain types of banner ads—only that they do. To answer “why” questions an exploratory research design or causal research design is needed (Wagner, 2007).

Causal Research

Causal research design examines cause-and-effect relationships. Using a causal research design allows researchers to answer “what if” types of questions. In other words, if a firm changes X (say, a product’s price, design, placement, or advertising), what will happen to Y (say, sales or customer loyalty)? To conduct causal research, the researcher designs an experiment that “controls,” or holds constant, all of a product’s marketing elements except one (or using advanced techniques of research, a few elements can be studied at the same time). The one variable is changed, and the effect is then measured. Sometimes the experiments are conducted in a laboratory using a simulated setting designed to replicate the conditions buyers would experience. Or the experiments may be conducted in a virtual computer setting.

You might think setting up an experiment in a virtual world such as the online game Second Life would be a viable way to conduct controlled marketing research. Some companies have tried to use Second Life for this purpose, but the results have been somewhat mixed as to whether or not it is a good medium for marketing research. The German marketing research firm Komjuniti was one of the first “real-world” companies to set up an “island” in Second Life upon which it could conduct marketing research. However, with so many other attractive fantasy islands in which to play, the company found it difficult to get Second Life residents, or players, to voluntarily visit the island and stay long enough so meaningful research could be conducted. (Plus, the “residents,” or players, in Second Life have been known to protest corporations invading their world. When the German firm Komjuniti created an island in Second Life to conduct marketing research, the residents showed up waving signs and threatening to boycott the island.) (Wagner, 2007)

Why is being able to control the setting so important? Let’s say you are an American flag manufacturer and you are working with Walmart to conduct an experiment to see where in its stores American flags should be placed so as to increase their sales. Then the terrorist attacks of 9/11 occur. In the days afterward, sales skyrocketed—people bought flags no matter where they were displayed. Obviously, the terrorist attacks in the United States would have skewed the experiment’s data.

An experiment conducted in a natural setting such as a store is referred to as a field experiment . Companies sometimes do field experiments either because it is more convenient or because they want to see if buyers will behave the same way in the “real world” as in a laboratory or on a computer. The place the experiment is conducted or the demographic group of people the experiment is administered to is considered the test market . Before a large company rolls out a product to the entire marketplace, it will often place the offering in a test market to see how well it will be received. For example, to compete with MillerCoors’ sixty-four-calorie beer MGD 64, Anheuser-Busch recently began testing its Select 55 beer in certain cities around the country (McWilliams, 2009).

Figure 10.10

Select 55 beer: Coming soon to a test market near you? (If you’re on a diet, you have to hope so!)

Martine – Le champagne – CC BY-NC 2.0.

Many companies use experiments to test all of their marketing communications. For example, the online discount retailer O.co (formerly called Overstock.com) carefully tests all of its marketing offers and tracks the results of each one. One study the company conducted combined twenty-six different variables related to offers e-mailed to several thousand customers. The study resulted in a decision to send a group of e-mails to different segments. The company then tracked the results of the sales generated to see if they were in line with the earlier experiment it had conducted that led it to make the offer.

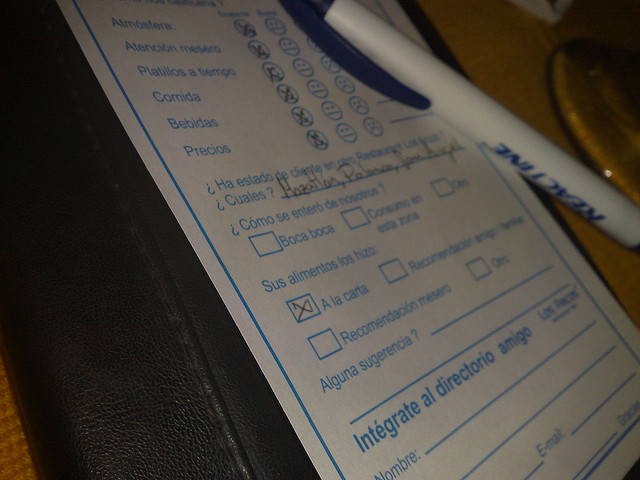

Step 3: Design the Data-Collection Forms

If the behavior of buyers is being formally observed, and a number of different researchers are conducting observations, the data obviously need to be recorded on a standardized data-collection form that’s either paper or electronic. Otherwise, the data collected will not be comparable. The items on the form could include a shopper’s sex; his or her approximate age; whether the person seemed hurried, moderately hurried, or unhurried; and whether or not he or she read the label on products, used coupons, and so forth.

The same is true when it comes to surveying people with questionnaires. Surveying people is one of the most commonly used techniques to collect quantitative data. Surveys are popular because they can be easily administered to large numbers of people fairly quickly. However, to produce the best results, the questionnaire for the survey needs to be carefully designed.

Questionnaire Design

Most questionnaires follow a similar format: They begin with an introduction describing what the study is for, followed by instructions for completing the questionnaire and, if necessary, returning it to the market researcher. The first few questions that appear on the questionnaire are usually basic, warm-up type of questions the respondent can readily answer, such as the respondent’s age, level of education, place of residence, and so forth. The warm-up questions are then followed by a logical progression of more detailed, in-depth questions that get to the heart of the question being researched. Lastly, the questionnaire wraps up with a statement that thanks the respondent for participating in the survey and information and explains when and how they will be paid for participating. To see some examples of questionnaires and how they are laid out, click on the following link: http://cas.uah.edu/wrenb/mkt343/Project/Sample%20Questionnaires.htm .

How the questions themselves are worded is extremely important. It’s human nature for respondents to want to provide the “correct” answers to the person administering the survey, so as to seem agreeable. Therefore, there is always a hazard that people will try to tell you what you want to hear on a survey. Consequently, care needs to be taken that the survey questions are written in an unbiased, neutral way. In other words, they shouldn’t lead a person taking the questionnaire to answer a question one way or another by virtue of the way you have worded it. The following is an example of a leading question.

Don’t you agree that teachers should be paid more ?

The questions also need to be clear and unambiguous. Consider the following question:

Which brand of toothpaste do you use ?

The question sounds clear enough, but is it really? What if the respondent recently switched brands? What if she uses Crest at home, but while away from home or traveling, she uses Colgate’s Wisp portable toothpaste-and-brush product? How will the respondent answer the question? Rewording the question as follows so it’s more specific will help make the question clearer:

Which brand of toothpaste have you used at home in the past six months? If you have used more than one brand, please list each of them 1 .

Sensitive questions have to be asked carefully. For example, asking a respondent, “Do you consider yourself a light, moderate, or heavy drinker?” can be tricky. Few people want to admit to being heavy drinkers. You can “soften” the question by including a range of answers, as the following example shows:

How many alcoholic beverages do you consume in a week ?

- __0–5 alcoholic beverages

- __5–10 alcoholic beverages

- __10–15 alcoholic beverages

Many people don’t like to answer questions about their income levels. Asking them to specify income ranges rather than divulge their actual incomes can help.

Other research question “don’ts” include using jargon and acronyms that could confuse people. “How often do you IM?” is an example. Also, don’t muddy the waters by asking two questions in the same question, something researchers refer to as a double-barreled question . “Do you think parents should spend more time with their children and/or their teachers?” is an example of a double-barreled question.

Open-ended questions , or questions that ask respondents to elaborate, can be included. However, they are harder to tabulate than closed-ended questions , or questions that limit a respondent’s answers. Multiple-choice and yes-and-no questions are examples of closed-ended questions.

Testing the Questionnaire

You have probably heard the phrase “garbage in, garbage out.” If the questions are bad, the information gathered will be bad, too. One way to make sure you don’t end up with garbage is to test the questionnaire before sending it out to find out if there are any problems with it. Is there enough space for people to elaborate on open-ended questions? Is the font readable? To test the questionnaire, marketing research professionals first administer it to a number of respondents face to face. This gives the respondents the chance to ask the researcher about questions or instructions that are unclear or don’t make sense to them. The researcher then administers the questionnaire to a small subset of respondents in the actual way the survey is going to be disseminated, whether it’s delivered via phone, in person, by mail, or online.

Getting people to participate and complete questionnaires can be difficult. If the questionnaire is too long or hard to read, many people won’t complete it. So, by all means, eliminate any questions that aren’t necessary. Of course, including some sort of monetary incentive for completing the survey can increase the number of completed questionnaires a market researcher will receive.

Step 4: Specify the Sample

Once you have created your questionnaire or other marketing study, how do you figure out who should participate in it? Obviously, you can’t survey or observe all potential buyers in the marketplace. Instead, you must choose a sample. A sample is a subset of potential buyers that are representative of your entire target market, or population being studied. Sometimes market researchers refer to the population as the universe to reflect the fact that it includes the entire target market, whether it consists of a million people, a hundred thousand, a few hundred, or a dozen. “All unmarried people over the age of eighteen who purchased Dirt Devil steam cleaners in the United States during 2011” is an example of a population that has been defined.

Obviously, the population has to be defined correctly. Otherwise, you will be studying the wrong group of people. Not defining the population correctly can result in flawed research, or sampling error. A sampling error is any type of marketing research mistake that results because a sample was utilized. One criticism of Internet surveys is that the people who take these surveys don’t really represent the overall population. On average, Internet survey takers tend to be more educated and tech savvy. Consequently, if they solely constitute your population, even if you screen them for certain criteria, the data you collect could end up being skewed.

The next step is to put together the sampling frame , which is the list from which the sample is drawn. The sampling frame can be put together using a directory, customer list, or membership roster (Wrenn et. al., 2007). Keep in mind that the sampling frame won’t perfectly match the population. Some people will be included on the list who shouldn’t be. Other people who should be included will be inadvertently omitted. It’s no different than if you were to conduct a survey of, say, 25 percent of your friends, using friends’ names you have in your cell phone. Most of your friends’ names are likely to be programmed into your phone, but not all of them. As a result, a certain degree of sampling error always occurs.

There are two main categories of samples in terms of how they are drawn: probability samples and nonprobability samples. A probability sample is one in which each would-be participant has a known and equal chance of being selected. The chance is known because the total number of people in the sampling frame is known. For example, if every other person from the sampling frame were chosen, each person would have a 50 percent chance of being selected.

A nonprobability sample is any type of sample that’s not drawn in a systematic way. So the chances of each would-be participant being selected can’t be known. A convenience sample is one type of nonprobability sample. It is a sample a researcher draws because it’s readily available and convenient to do so. Surveying people on the street as they pass by is an example of a convenience sample. The question is, are these people representative of the target market?

For example, suppose a grocery store needed to quickly conduct some research on shoppers to get ready for an upcoming promotion. Now suppose that the researcher assigned to the project showed up between the hours of 10 a.m. and 12 p.m. on a weekday and surveyed as many shoppers as possible. The problem is that the shoppers wouldn’t be representative of the store’s entire target market. What about commuters who stop at the store before and after work? Their views wouldn’t be represented. Neither would people who work the night shift or shop at odd hours. As a result, there would be a lot of room for sampling error in this study. For this reason, studies that use nonprobability samples aren’t considered as accurate as studies that use probability samples. Nonprobability samples are more often used in exploratory research.

Lastly, the size of the sample has an effect on the amount of sampling error. Larger samples generally produce more accurate results. The larger your sample is, the more data you will have, which will give you a more complete picture of what you’re studying. However, the more people surveyed or studied, the more costly the research becomes.

Statistics can be used to determine a sample’s optimal size. If you take a marketing research or statistics class, you will learn more about how to determine the optimal size.

Of course, if you hire a marketing research company, much of this work will be taken care of for you. Many marketing research companies, like ResearchNow, maintain panels of prescreened people they draw upon for samples. In addition, the marketing research firm will be responsible for collecting the data or contracting with a company that specializes in data collection. Data collection is discussed next.

Step 5: Collect the Data

As we have explained, primary marketing research data can be gathered in a number of ways. Surveys, taking physical measurements, and observing people are just three of the ways we discussed. If you’re observing customers as part of gathering the data, keep in mind that if shoppers are aware of the fact, it can have an effect on their behavior. For example, if a customer shopping for feminine hygiene products in a supermarket aisle realizes she is being watched, she could become embarrassed and leave the aisle, which would adversely affect your data. To get around problems such as these, some companies set up cameras or two-way mirrors to observe customers. Organizations also hire mystery shoppers to work around the problem. A mystery shopper is someone who is paid to shop at a firm’s establishment or one of its competitors to observe the level of service, cleanliness of the facility, and so forth, and report his or her findings to the firm.

Make Extra Money as a Mystery Shopper

Watch the YouTube video to get an idea of how mystery shopping works.

Survey data can be collected in many different ways and combinations of ways. The following are the basic methods used:

- Face-to-face (can be computer aided)

- Telephone (can be computer aided or completely automated)

- Mail and hand delivery

- E-mail and the Web

A face-to-face survey is, of course, administered by a person. The surveys are conducted in public places such as in shopping malls, on the street, or in people’s homes if they have agreed to it. In years past, it was common for researchers in the United States to knock on people’s doors to gather survey data. However, randomly collected door-to-door interviews are less common today, partly because people are afraid of crime and are reluctant to give information to strangers (McDaniel & Gates, 1998).

Nonetheless, “beating the streets” is still a legitimate way questionnaire data is collected. When the U.S. Census Bureau collects data on the nation’s population, it hand delivers questionnaires to rural households that do not have street-name and house-number addresses. And Census Bureau workers personally survey the homeless to collect information about their numbers. Face-to-face surveys are also commonly used in third world countries to collect information from people who cannot read or lack phones and computers.

A plus of face-to-face surveys is that they allow researchers to ask lengthier, more complex questions because the people being surveyed can see and read the questionnaires. The same is true when a computer is utilized. For example, the researcher might ask the respondent to look at a list of ten retail stores and rank the stores from best to worst. The same question wouldn’t work so well over the telephone because the person couldn’t see the list. The question would have to be rewritten. Another drawback with telephone surveys is that even though federal and state “do not call” laws generally don’t prohibit companies from gathering survey information over the phone, people often screen such calls using answering machines and caller ID.

Probably the biggest drawback of both surveys conducted face-to-face and administered over the phone by a person is that they are labor intensive and therefore costly. Mailing out questionnaires is costly, too, and the response rates can be rather low. Think about why that might be so: if you receive a questionnaire in the mail, it is easy to throw it in the trash; it’s harder to tell a market researcher who approaches you on the street that you don’t want to be interviewed.

By contrast, gathering survey data collected by a computer, either over the telephone or on the Internet, can be very cost-effective and in some cases free. SurveyMonkey and Zoomerang are two Web sites that will allow you to create online questionnaires, e-mail them to up to one hundred people for free, and view the responses in real time as they come in. For larger surveys, you have to pay a subscription price of a few hundred dollars. But that still can be extremely cost-effective. The two Web sites also have a host of other features such as online-survey templates you can use to create your questionnaire, a way to set up automatic reminders sent to people who haven’t yet completed their surveys, and tools you can use to create graphics to put in your final research report. To see how easy it is to put together a survey in SurveyMonkey, click on the following link: http://help.surveymonkey.com/app/tutorials/detail/a_id/423 .

Like a face-to-face survey, an Internet survey can enable you to show buyers different visuals such as ads, pictures, and videos of products and their packaging. Web surveys are also fast, which is a major plus. Whereas face-to-face and mailed surveys often take weeks to collect, you can conduct a Web survey in a matter of days or even hours. And, of course, because the information is electronically gathered it can be automatically tabulated. You can also potentially reach a broader geographic group than you could if you had to personally interview people. The Zoomerang Web site allows you to create surveys in forty different languages.

Another plus for Web and computer surveys (and electronic phone surveys) is that there is less room for human error because the surveys are administered electronically. For instance, there’s no risk that the interviewer will ask a question wrong or use a tone of voice that could mislead the respondents. Respondents are also likely to feel more comfortable inputting the information into a computer if a question is sensitive than they would divulging the information to another person face-to-face or over the phone. Given all of these advantages, it’s not surprising that the Internet is quickly becoming the top way to collect primary data. However, like mail surveys, surveys sent to people over the Internet are easy to ignore.

Lastly, before the data collection process begins, the surveyors and observers need to be trained to look for the same things, ask questions the same way, and so forth. If they are using rankings or rating scales, they need to be “on the same page,” so to speak, as to what constitutes a high ranking or a low ranking. As an analogy, you have probably had some teachers grade your college papers harder than others. The goal of training is to avoid a wide disparity between how different observers and interviewers record the data.