- Search Search Please fill out this field.

What Is the Current Ratio?

- Formula and Calculation

Understanding the Current Ratio

- Interpretation

- How It Changes Over Time

- Current Ratio vs. Other Ratios

- Limitations

The Bottom Line

- Corporate Finance

- Financial Ratios

Current Ratio Explained With Formula and Examples

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

The current ratio is a liquidity ratio that measures a company’s ability to pay short-term obligations or those due within one year. It tells investors and analysts how a company can maximize the current assets on its balance sheet to satisfy its current debt and other payables.

A current ratio that is in line with the industry average or slightly higher is generally considered acceptable. A current ratio that is lower than the industry average may indicate a higher risk of distress or default . Similarly, if a company has a very high current ratio compared with its peer group, it indicates that management may not be using its assets efficiently.

The current ratio is called current because, unlike some other liquidity ratios, it incorporates all current assets and current liabilities . The current ratio is sometimes called the working capital ratio.

Key Takeaways

- The current ratio compares all of a company’s current assets to its current liabilities.

- These are usually defined as assets that are cash or will be turned into cash in a year or less and liabilities that will be paid in a year or less.

- The current ratio helps investors understand more about a company’s ability to cover its short-term debt with its current assets and make apples-to-apples comparisons with its competitors and peers.

- One weakness of the current ratio is its difficulty of comparing the measure across industry groups.

- Others include the overgeneralization of the specific asset and liability balances, and the lack of trending information.

Investopedia / Lara Antal

Formula and Calculation for the Current Ratio

To calculate the ratio , analysts compare a company’s current assets to its current liabilities.

Current assets listed on a company’s balance sheet include cash , accounts receivable , inventory , and other current assets (OCA) that are expected to be liquidated or turned into cash in less than one year.

Current liabilities include accounts payable , wages, taxes payable, short-term debts, and the current portion of long-term debt.

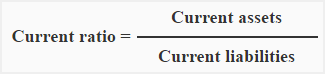

Current Ratio = Current assets Current liabilities \begin{aligned} &\text{Current Ratio}=\frac{\text{Current assets}}{ \text{Current liabilities}} \end{aligned} Current Ratio = Current liabilities Current assets

The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables.

In many cases, a company with a current ratio of less than 1.00 does not have the capital on hand to meet its short-term obligations if they were all due at once, while a current ratio greater than 1.00 indicates that the company has the financial resources to remain solvent in the short term. However, because the current ratio at any one time is just a snapshot, it is usually not a complete representation of a company’s short-term liquidity or longer-term solvency .

For example, a company may have a very high current ratio, but its accounts receivable may be very aged , perhaps because its customers pay slowly, which may be hidden in the current ratio. Some of the accounts receivable may even need to be written off. Analysts also must consider the quality of a company’s other assets vs. its obligations. If the inventory is unable to be sold , the current ratio may still look acceptable at one point in time, even though the company may be headed for default.

Public companies don't report their current ratio, though all the information needed to calculate the ratio is contained in the company's financial statements.

Interpreting the Current Ratio

A ratio under 1.00 indicates that the company’s debts due in a year or less are greater than its assets—cash or other short-term assets expected to be converted to cash within a year or less. A current ratio of less than 1.00 may seem alarming, although different situations can negatively affect the current ratio in a solid company.

For example, a normal cycle for the company’s collections and payment processes may lead to a high current ratio as payments are received, but a low current ratio as those collections ebb. Calculating the current ratio at just one point in time could indicate that the company can’t cover all of its current debts , but it doesn’t necessarily mean that it won’t be able to when the payments are due.

Additionally, some companies, especially larger retailers such as Walmart, have been able to negotiate much longer-than-average payment terms with their suppliers. If a retailer doesn’t offer credit to its customers, this can show on its balance sheet as a high payables balance relative to its receivables balance. Large retailers can also minimize their inventory volume through an efficient supply chain , which makes their current assets shrink against current liabilities, resulting in a lower current ratio. Walmart’s current ratio as of January 31, 2023 was 0.82.

In theory, the higher the current ratio, the more capable a company is of paying its obligations because it has a larger proportion of short-term asset value relative to the value of its short-term liabilities. However, though a high ratio—say, more than 3.00—could indicate that the company can cover its current liabilities three times, it also may indicate that it is not using its current assets efficiently, securing financing very well, or properly managing its working capital .

The current ratio can be a useful measure of a company’s short-term solvency when it is placed in the context of what has been historically normal for the company and its peer group. It also offers more insight when calculated repeatedly over several periods.

How the Current Ratio Changes Over Time

What makes the current ratio good or bad often depends on how it is changing. A company that seems to have an acceptable current ratio could be trending toward a situation in which it will struggle to pay its bills. Conversely, a company that may appear to be struggling now could be making good progress toward a healthier current ratio.

In the first case, the trend of the current ratio over time would be expected to harm the company’s valuation. Meanwhile, an improving current ratio could indicate an opportunity to invest in an undervalued stock amid a turnaround.

Imagine two companies with a current ratio of 1.00 today. Based on the trend of the current ratio in the following table, for which would analysts likely have more optimistic expectations?

Two things should be apparent in the trend of Horn & Co. vs. Claws Inc. First, the trend for Claws is negative, which means further investigation is prudent. Perhaps it is taking on too much debt or its cash balance is being depleted—either of which could be a solvency issue if it worsens. The trend for Horn & Co. is positive, which could indicate better collections, faster inventory turnover , or that the company has been able to pay down debt.

The second factor is that Claws’ current ratio has been more volatile , jumping from 1.35 to 1.05 in a single year, which could indicate increased operational risk and a likely drag on the company’s value.

Example Using the Current Ratio

In its Q4 2022 fiscal results, Apple Inc. reported total current assets of $135.4 billion, slightly higher than its total current assets at the end of the last fiscal year of $134.8 billion. However, the company's liability composition significantly changed from 2021 to 2022. At the 2022, the company reported $154.0 billion of current liabilities, almost $29 billion greater than current liabilities from the prior period.

For 2021, Apple had more current assets than current liabilities. Its current ratio was ($134.836b / $125.481b) 1.075. This means that if all current liabilities of Apple were immediately due, the company could pay all of its bills without leveraging long-term assets.

At the end of 2022, it was a slightly different story. Apple's current ratio was ($135.405b / $153.982b) 0.88. This means that Apple technically did not have enough current assets on hand to pay all of its short-term bills. Analysts may not be concerned due to Apple's ability to churn through production, sell inventory, or secure short-term financing (with its $217 billion of non-current assets pledged as collateral, for instance).

Current Ratio vs. Other Liquidity Ratios

Other similar liquidity ratios can supplement a current ratio analysis. In each case, the differences in these measures can help an investor understand the current status of the company’s assets and liabilities from different angles, as well as how those accounts are changing over time.

The commonly used acid-test ratio , or quick ratio , compares a company’s easily liquidated assets (including cash, accounts receivable, and short-term investments, excluding inventory and prepaid expenses) to its current liabilities. The cash asset ratio, or cash ratio , also is similar to the current ratio, but it only compares a company’s marketable securities and cash to its current liabilities.

Companies may use days sales outstanding to better understand how long it takes for a company to collect payments after credit sales have been made. While the current ratio looks at the liquidity of the company overall, the days sales outstanding metric calculates liquidity specifically to how well a company collects outstanding accounts receivables.

Finally, the operating cash flow ratio compares a company’s active cash flow from operating activities (CFO) to its current liabilities. This allows a company to better gauge funding capabilities by omitting implications created by accounting entries.

The current ratio is most useful when measured over time, compared against a competitor, or compared against a benchmark.

Limitations of Using the Current Ratio

One limitation of the current ratio emerges when using it to compare different companies with one another. Businesses differ substantially among industries; comparing the current ratios of companies across different industries may not lead to productive insight.

For example, in one industry, it may be more typical to extend credit to clients for 90 days or longer, while in another industry, short-term collections are more critical. Ironically, the industry that extends more credit actually may have a superficially stronger current ratio because its current assets would be higher. It is usually more useful to compare companies within the same industry.

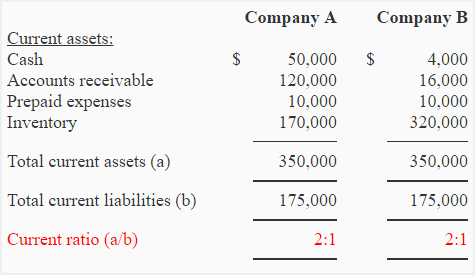

Another drawback of using the current ratio, briefly mentioned above, involves its lack of specificity. Unlike many other liquidity ratios, it incorporates all of a company’s current assets, even those that cannot be easily liquidated. For example, imagine two companies that both have a current ratio of 0.80 at the end of the last quarter . On the surface, this may look equivalent, but the quality and liquidity of those assets may be very different, as shown in the following breakdown:

In this example, Company A has much more inventory than Company B, which will be harder to turn into cash in the short term. Perhaps this inventory is overstocked or unwanted, which eventually may reduce its value on the balance sheet. Company B has more cash, which is the most liquid asset, and more accounts receivable, which could be collected more quickly than liquidating inventory. Although the total value of current assets matches, Company B is in a more liquid, solvent position.

The current liabilities of Company A and Company B are also very different. Company A has more accounts payable, while Company B has a greater amount in short-term notes payable. This would be worth more investigation because it is likely that the accounts payable will have to be paid before the entire balance of the notes-payable account. Company A also has fewer wages payable, which is the liability most likely to be paid in the short term.

In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position. An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio.

What Is a Good Current Ratio?

What counts as a good current ratio will depend on the company’s industry and historical performance. Current ratios of 1.50 or greater would generally indicate ample liquidity.

What Happens If the Current Ratio Is Less Than 1?

As a general rule, a current ratio below 1.00 could indicate that a company might struggle to meet its short-term obligations, whereas ratios of above 1.00 might indicate a company is able to pay its current debts as they come due. If a company's current ratio is less than one, it may have more bills to pay than easily accessible resources to pay those bills.

What Does a Current Ratio of 1.5 Mean?

A current ratio of 1.5 would indicate that the company has $1.50 of current assets for every $1 of current liabilities. For example, suppose a company’s current assets consist of $50,000 in cash plus $100,000 in accounts receivable. Its current liabilities, meanwhile, consist of $100,000 in accounts payable. In this scenario, the company would have a current ratio of 1.5, calculated by dividing its current assets ($150,000) by its current liabilities ($100,000).

How Is the Current Ratio Calculated?

Calculating the current ratio is very straightforward: Simply divide the company’s current assets by its current liabilities. Current assets are those that can be converted into cash within one year, while current liabilities are obligations expected to be paid within one year. Examples of current assets include cash, inventory, and accounts receivable. Examples of current liabilities include accounts payable, wages payable, and the current portion of any scheduled interest or principal payments.

The current ratio is a useful liquidity measurement used to track how well a company may be able to meet its short-term debt obligations. It compares the ratio of current assets to current liabilities, and measurements less than 1.0 indicate a company's potential inability to use current resources to fund short-term obligations.

Accounting Tools. " Current Ratio Definition ."

Accounting Tools. " Current Asset Definition ."

Accounting Tools. " Current Liability Definition ."

Walmart. " Walmart Releases Q4 and FY23 Earnings ," Download Full Report, Page 6.

Apple. " Apple Reports Fourth Quarter Results ."

Duke University, Fuqua School of Business. " FSA Note: Summary of Financial Ratio Calculations ," Page 2.

- Guide to Financial Ratios 1 of 31

- What Is the Best Measure of a Company's Financial Health? 2 of 31

- Which Financial Ratios Are Used to Measure Risk? 3 of 31

- Profitability Ratios: What They Are, Common Types, and How Businesses Use Them 4 of 31

- Understanding Liquidity Ratios: Types and Their Importance 5 of 31

- What Is a Solvency Ratio, and How Is It Calculated? 6 of 31

- Solvency Ratios vs. Liquidity Ratios: What's the Difference? 7 of 31

- Key Ratio: Meaning, Example, Pros and Cons 8 of 31

- Multiples Approach 9 of 31

- Return on Assets (ROA): Formula and 'Good' ROA Defined 10 of 31

- How Return on Equity Can Help Uncover Profitable Stocks 11 of 31

- Return on Investment (ROI): How to Calculate It and What It Means 12 of 31

- Return on Invested Capital: What Is It, Formula and Calculation, and Example 13 of 31

- EBITDA Margin: What It Is, Formula, and How to Use It 14 of 31

- What Is Net Profit Margin? Formula for Calculation and Examples 15 of 31

- Operating Margin: What It Is and the Formula for Calculating It, With Examples 16 of 31

- Current Ratio Explained With Formula and Examples 17 of 31

- Quick Ratio Formula With Examples, Pros and Cons 18 of 31

- Cash Ratio: Definition, Formula, and Example 19 of 31

- Operating Cash Flow (OCF): Definition, Types, and Formula 20 of 31

- Receivables Turnover Ratio Defined: Formula, Importance, Examples, Limitations 21 of 31

- Inventory Turnover Ratio: What It Is, How It Works, and Formula 22 of 31

- Working Capital Turnover Ratio: Meaning, Formula, and Example 23 of 31

- Debt-to-Equity (D/E) Ratio Formula and How to Interpret It 24 of 31

- Total Debt-to-Total Assets Ratio: Meaning, Formula, and What's Good 25 of 31

- Interest Coverage Ratio: Formula, How It Works, and Example 26 of 31

- Shareholder Equity Ratio: Definition and Formula for Calculation 27 of 31

- Can Investors Trust the P/E Ratio? 28 of 31

- Using the Price-to-Book (P/B) Ratio to Evaluate Companies 29 of 31

- Price-to-Sales (P/S) Ratio: What It Is, Formula To Calculate It 30 of 31

- Price-to-Cash Flow (P/CF) Ratio? Definition, Formula, and Example 31 of 31

:max_bytes(150000):strip_icc():format(webp)/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

A Refresher on Current Ratio

How to calculate whether your company has enough cash.

One of the biggest fears of a small business owner is running out of cash. But large businesses in financial trouble face the same risk. To know whether a company is truly on the cusp of hitting a $0 balance in their accounts, you can’t simply look at the income statement. You need to run a simple calculation using a few figures.

- Amy Gallo is a contributing editor at Harvard Business Review, cohost of the Women at Work podcast , and the author of two books: Getting Along: How to Work with Anyone (Even Difficult People) and the HBR Guide to Dealing with Conflict . She writes and speaks about workplace dynamics. Watch her TEDx talk on conflict and follow her on LinkedIn . amyegallo

Partner Center

.png)

How to Calculate (And Interpret) The Current Ratio

Janet Berry-Johnson, CPA

Reviewed by

March 10, 2022

This article is Tax Professional approved

All businesses have bills to pay. Your ability to pay them is called "liquidity," and liquidity is one of the first things that accountants and investors will look at when assessing the health of your business.

I am the text that will be copied.

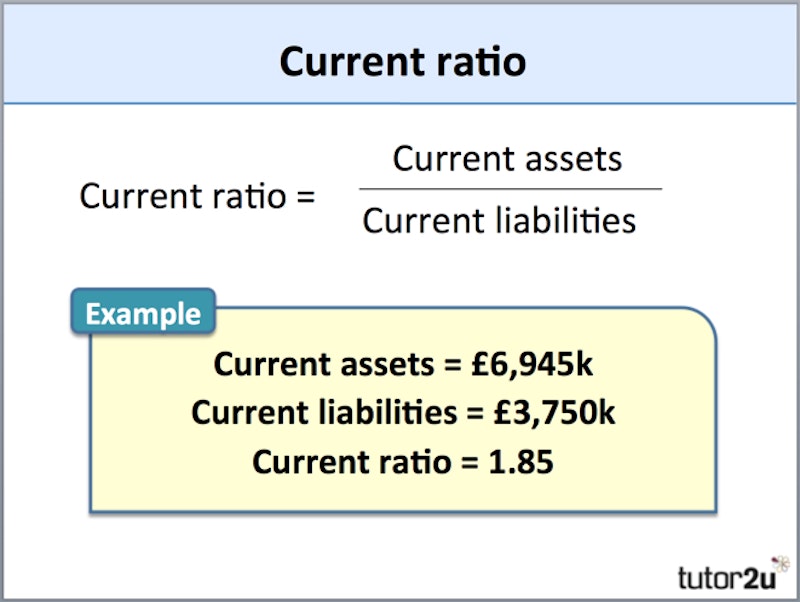

The current ratio (also known as the current asset ratio , the current liquidity ratio , or the working capital ratio ) is a financial analysis tool used to determine the short-term liquidity of a business. It takes all of your company’s current assets, compares them to your short-term liabilities, and tells you whether you have enough of the former to pay for the latter.

In other words, the current ratio is a good indicator of your company’s ability to cover all of your pressing debt obligations with the cash and short-term assets you have on hand. It’s one of the ways to measure the solvency and overall financial health of your company.

Here, we’ll go over how to calculate the current ratio and how it compares to some other financial ratios.

How do you calculate the current ratio?

You calculate your business’s overall current ratio by dividing your current assets by your current liabilities .

To do this, you’ll need to get familiar with your balance sheet —as one of the three primary financial statements your business produces, your balance sheet helps you get a sense of the big picture and serves as a historical record of a specific moment in time.

Current assets (also called short-term assets) are cash or any other asset that will be converted to cash within one year . You can find them on the balance sheet, alongside all of your business’s other assets.

The five major types of current assets are:

Cash and cash equivalents . These include cash and short-term securities that your business can quickly sell and convert into cash, like treasury bills, short-term government bonds, and money market funds.

Marketable securities . These typically have a maturity period of one year or less, are bought and sold on a public stock exchange, and can usually be sold within three months on the market. Examples include common stock, treasury bills, and commercial paper.

Accounts receivable . This account is used to keep track of any money customers owe for products or services already delivered and invoiced for.

Inventory . This includes all the goods and materials a business has stored for future use, like raw materials, unfinished parts, and unsold stock on shelves.

Prepaid expenses . These are future expenses that have been paid in advance that haven’t yet been used up or expired. Generally, prepaid expenses that will be used up within one year are initially reported on the balance sheet as a current asset. As the amount expires, the current asset is reduced and the amount of the reduction is reported as an expense on the income statement.

Your current liabilities (also called short-term obligations or short-term debt) are:

- Any outstanding bill payments

- Short-term loans

- Any other kind of short-term liability that your business must pay back within the next 12 months

You can find them on your company’s balance sheet, alongside all of your other liabilities.

Current liabilities do not include long-term debt, like bonds, lease obligations, and long-term notes payable.

Here are a few common examples of current liabilities:

- Credit card debt

- Notes payable that mature within one year

- Wages payable

- Deferred revenue

- Accounts payable

- Accrued liabilities (also known as accrued expenses) like dividend, income tax, and payroll

What is the current ratio formula?

You calculate the current ratio by dividing your company’s current assets by your current liabilities, i.e.:

Current ratio = total current assets / total current liabilities

Let’s imagine that your fictional company, XYZ Inc., has $15,000 in current assets and $22,000 in current liabilities. Its current ratio would be:

Current ratio = $15,000 / $22,000 = 0.68

That means that the current ratio for your business would be 0.68.

A company with a current ratio of less than one doesn’t have enough current assets to cover its current financial obligations. XYZ Inc.’s current ratio is 0.68, which may indicate liquidity problems.

But that’s also not always the case.

A low current ratio could also just mean that you’re in an industry where it’s normal for companies to collect payments from customers quickly but take a long time to pay their suppliers, like the retail and food industries.

Or it could mean that your company is very good at keeping inventory low. (Remember: inventory is included in current assets.)

A high current ratio, on the other hand, may indicate inefficient use of assets, or a company that’s hanging on to excess cash instead of reinvesting it in growing the business.

What is a good current ratio?

As with many other financial metrics, the ideal current ratio will vary depending on the industry, operating model, and business processes of the company in question.

In general, a current ratio between 1.5 and 3 is considered healthy. Ratios lower than 1 usually indicate liquidity issues, while ratios over 3 can signal poor management of working capital.

The definition of a “good” current ratio also depends on who’s asking. In many cases, lenders prefer high current ratios, since it indicates that the company won’t have any issues paying the creditor back, while investors may take a high current ratio as a signal of operational inefficiencies.

Current vs. quick ratio

The quick ratio (also sometimes called the acid-test ratio) is a more conservative version of the current ratio.

The quick ratio differs from the current ratio in that it leaves inventory out and keeps the three other major types of current assets: cash equivalents, marketable securities, and accounts receivable.

So the equation for the quick ratio is:

Quick ratio = (cash equivalents + marketable securities + accounts receivable) / current liabilities

Because inventory levels vary widely across industries, in theory, this ratio should give us a better reading of a company’s liquidity than the current ratio. But it’s important to put it in context.

A lower quick ratio could mean that you’re having liquidity problems, but it could just as easily mean that you’re good at collecting accounts receivable quickly.

Similarly, a higher quick ratio doesn’t automatically mean you’re liquid, especially if you encounter unexpected problems collecting receivables

Current vs. cash ratio

Looking for an even purer (in theory) liquidity test? You want the cash ratio.

The cash ratio takes accounts receivable out of the equation, leaving you with only cash equivalents and marketable securities to cover your current liabilities:

Cash ratio = (cash equivalents + marketable securities) / current liabilities

If you have a high cash ratio, you’re sitting pretty. It’s the most conservative measure of liquidity and, therefore, the most reliable, industry-neutral method of calculating it.

Advanced ratios

Financial analysts will often also use two other ratios to calculate the liquidity of a business: the current cash debt coverage ratio and the cash conversion cycle (CCC) .

The current cash debt coverage ratio is an advanced liquidity ratio. It measures how capable a business is of paying its current liabilities using the cash generated by its operating activities (i.e., money your business brings in from its ongoing, regular business activities).

The cash conversion cycle (CCC) is a metric that expresses the time (in days) it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

These calculations are fairly advanced, and you probably won’t need to perform them for your business, but if you’re curious, you can read more about the current cash debt coverage ratio and the CCC .

Related Posts

LIFO: The Last In First Out Inventory Method

Last In, First Out (FIFO) is a method of inventory valuation that assumes you sell your newest inventory first. How does this affect the books? Read on for a definition and examples!

.png)

Owner’s Equity: What It Is and How to Calculate It

If you had to liquidate your business today, how much could you get out of it? Your owner’s equity account has the answers.

Pro Forma Financial Statements (with Templates and Examples)

As an essential ingredient in financial forecasting, pro forma statements let you try on the future for size—and see which business moves are the right fit for you.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

How to Use These Common Business Ratios

2 min. read

Updated October 27, 2023

What business ratios should you know and be using? Here’s a breakdown of common ratios, how they’re used, and in some cases how you’ll calculate them.

Main ratios

- Current. Measures company’s ability to meet financial obligations. Expressed as the number of times current assets exceed current liabilities. A high ratio indicates that a company can pay its creditors. A number less than one indicates potential cash flow problems.

- Quick. This ratio is very similar to the Acid Test (see below), and measures a company’s ability to meet its current obligations using its most liquid assets. It shows Total Current Assets excluding Inventory divided by Total Current Liabilities.

- Total Debt to Total Assets. Percentage of Total Assets financed with debt.

- Pre-Tax Return on Net Worth. Indicates shareholders’ earnings before taxes for each dollar invested. This ratio is not applicable if the subject company’s net worth for the period being analyzed has a negative value.

- Pre-Tax Return on Assets. Indicates profit as a percentage of Total Assets before taxes. Measures a company’s ability to manage and allocate resources.

Additional ratios

- Net Profit Margin. This ratio is calculated by dividing Sales into the Net Profit, expressed as a percentage.

- Return on Equity. This ratio is calculated by dividing Net Profit by Net Worth, expressed as a percentage.

Activity ratios

- Accounts Receivable Turnover. This ratio is calculated by dividing Sales on Credit by Accounts Receivable. This is a measure of how well your business collects its debts.

- Collection Days. This ratio is calculated by multiplying Accounts Receivable by 360, which is then divided by annual Sales on Credit. Generally, 30 days is exceptionally good, 60 days is bothersome, and 90 days or more is a real problem.

- Inventory Turnover. This ratio is calculated by dividing the Cost of Sales by the average Inventory balance.

- Accounts Payable Turnover. This ratio is a measure of how quickly the business pays its bills. It divides the total new Accounts Payable for the year by the average Accounts Payable balance.

- Payment Days. This ratio is calculated by multiplying average Accounts Payable by 360, which is then divided by new Accounts Payable.

- Total Asset Turnover. This ratio is calculated by dividing Sales by Total Assets.

Debt ratios

- Debt to Net Worth. This ratio is calculated by dividing Total Liabilities by total Net Worth.

- Current Liab. to Liab. This ratio is calculated by dividing Current Liabilities by Total Liabilities.

Liquidity ratios

- Net Working Capital. This ratio is calculated by subtracting Current Liabilities from Current Assets. This is another measure of cash position.

- Interest Coverage. This ratio is calculated by dividing Profits Before Interest and Taxes by total Interest Expense.

- Assets to Sales. This ratio is calculated by dividing Assets by Sales.

- Current Debt/Total Assets. This ratio is calculated by dividing Current Liabilities by Total Assets.

- Acid Test. This ratio is calculated by dividing Current Assets (excluding Inventory and Accounts Receivable) by Current Liabilities.

- Sales/Net Worth. This ratio is calculated by dividing Total Sales by Net Worth.

- Dividend Payout. This ratio is calculated by dividing Dividends by Net Profit.

In the real world, financial profile information involves some compromise. Very few organizations fit any one profile exactly. Variations, such as doing several types of business under one roof, are quite common. If you cannot find a classification that fits your business exactly, use the closest one and explain in your text how and why your business is different from the standard.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

Related Articles

5 Min. Read

How to Improve the Accuracy of Financial Forecasts

6 Min. Read

How to Forecast Sales for a Subscription Business

10 Min. Read

How to Create a Cash Flow Forecast

11 Min. Read

How to Create a Sales Forecast

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Current Ratio: Essential Guide for Financial Health Analysis

- Banking & Finance

- Bookkeeping

- Business Operations

- Starting a Business

The current ratio is a crucial financial metric that gauges a company’s ability to meet its short-term obligations with its available assets. It is a liquidity ratio that compares a company’s current assets to its current liabilities, reflecting its financial health and liquidity position. A higher current ratio generally indicates a greater ability to cover short-term liabilities, while a lower ratio might signify potential financial difficulties.

Understanding and calculating the current ratio can provide valuable insights into a company’s performance and stability. This financial metric takes into account various components such as cash, accounts receivable, inventory, and other current assets, as well as current liabilities like accounts payable and short-term debt. By dividing current assets by current liabilities, we obtain the current ratio, which can help stakeholders evaluate a company’s short-term liquidity and overall financial health.

Key Takeaways

- The current ratio is a significant financial metric that measures a company’s ability to meet short-term obligations using its available assets.

- Calculation of the current ratio involves dividing a company’s current assets by its current liabilities, providing insights into its liquidity and financial health.

- While informative, the current ratio alone might not suffice for a comprehensive financial analysis, necessitating consideration of other liquidity ratios and metrics.

Understanding the Current Ratio

Definition and importance.

The Current Ratio is a liquidity ratio that helps measure a company’s ability to pay its short-term obligations or those due within one year. This financial metric is crucial for investors and analysts in determining how a company can maximize the use of its current assets to meet its financial obligations.

Being a liquidity ratio, it compares a company’s current assets, which are convertible into cash within a year, with its current liabilities, which must be paid off within the same period. A healthy current ratio indicates that the company is capable of meeting its short-term liabilities and can be a sign of sound financial management. However, it is essential to note that the current ratio may vary across different industries, so comparing companies within the same industry group is recommended.

Current Ratio Formula

Calculating the current ratio is relatively straightforward. The formula is as follows:

Current Ratio = Current Assets / Current Liabilities

Let’s break it down:

- Current Assets : These include cash, cash equivalents, marketable securities, accounts receivable, inventory, and other assets expected to be realized, sold, or consumed within one year.

- Current Liabilities : These are obligations that the company must repay within one year, such as accounts payable, short-term debt (e.g., bank loans), taxes payable, and other accrued expenses.

Consider the following example:

In this case, the current ratio of Company XYZ is:

Components of Current Ratio

The current ratio is a vital financial metric that assesses a company’s ability to cover its short-term debts using its most liquid assets. To properly analyze the current ratio, it’s essential to understand its components, consisting of current assets and current liabilities .

Assessing Current Assets

Current assets are resources that are expected to be converted into cash, sold, or consumed within one year or the company’s normal operating cycle, whichever is longer. They usually include:

- Cash : Physical currency and demand deposit balances held by financial institutions.

- Cash Equivalents : Highly liquid, low-risk investments that can be easily converted to cash, typically within three months (e.g., U.S. Treasury bills and certain money market funds).

- Accounts Receivable : Amounts owed to the company by customers for goods or services provided on credit.

- Inventory : Goods available for sale or materials used in production.

Evaluating Current Liabilities

Current liabilities are financial obligations that a company needs to fulfill within one year or its normal operating cycle, whichever is longer. Common types of current liabilities include:

- Accounts Payable : Amounts owed by the company to suppliers or service providers, usually as a result of purchasing goods or services on credit.

- Short-term Debt : Borrowings with a maturity of less than one year, such as commercial paper, short-term loans, and notes payable.

- Accrued Expenses : Liabilities for expenses incurred but not yet paid, like wages, interest, and taxes.

To calculate the current ratio, divide the company’s total current assets by its total current liabilities:

Current Ratio = (Current Assets) / (Current Liabilities)

A higher current ratio typically indicates a stronger financial position, as it implies that a company has sufficient resources to settle its short-term obligations. However, it’s essential to compare the current ratio to industry benchmarks, as the optimal level can vary across different sectors.

Calculating the Current Ratio

Detailed calculation process.

The current ratio is a financial metric that helps determine a company’s ability to meet its short-term obligations, reflecting its liquidity. The current ratio formula is:

To calculate the current ratio, follow these steps:

- Identify Current Assets : Current assets typically include cash, accounts receivable, inventory, and other assets expected to be converted into cash or used up within a year. You can find these values on the company’s balance sheet.

- Identify Current Liabilities : Current liabilities consist of obligations that a company must fulfill within a year, such as accounts payable, short-term debt, and taxes payable. These values can also be found on the balance sheet.

- Divide Current Assets by Current Liabilities : Calculate the current ratio by dividing the value of current assets by current liabilities.

For example, consider a company with the following financials:

To calculate the current ratio:

Current Ratio = 100,000 / 75,000 = 1.33

Interpreting Results

The result of the current ratio calculation offers insights into the liquidity of the business. A higher current ratio indicates a greater ability to meet short-term obligations.

- A current ratio greater than 1 signifies that a company has more current assets than liabilities, suggesting adequate liquidity to cover short-term obligations.

- A current ratio equal to 1 indicates that current assets and liabilities are equal, which could imply potential difficulty in meeting obligations.

- A current ratio less than 1 reveals that a company has insufficient current assets to cover its current liabilities, potentially leading to liquidity issues.

It is essential to consider the industry context while interpreting the current ratio. Different industries may have varying acceptable norms for current ratios, and a good current ratio in one industry might be considered insufficient in another. Comparing the current ratio with industry peers can provide a better understanding of where a company stands in terms of liquidity.

Current Ratio in Financial Analysis

Assessment by investors and analysts.

The current ratio is a vital liquidity ratio in financial analysis, which serves as a measure of a company’s ability to meet its short-term obligations or those due within one year. This ratio is calculated by dividing a company’s total current assets by its total current liabilities. A current ratio greater than 1 signifies that the company can sufficiently cover its short-term liabilities using its current assets.

Investors and analysts use the current ratio to assess a company’s financial health, as it reflects the capacity of the company to effectively handle its financial obligations. Furthermore, the higher the current ratio, the stronger the company’s liquidity position becomes, while a lower ratio indicates potential difficulty in meeting its short-term financial obligations.

Comparing with Industry Averages

Apart from examining the current ratio individually, it is also crucial to compare it with industry averages and competitors’ ratios. Doing so allows investors and analysts to gauge the relative financial soundness of a company within its industry. However, one must remain cautious while making such comparisons, as different industries may have varying industry averages, which can lead to inaccurate conclusions if not considered appropriately.

A comparative analysis can be done in the following ways:

- Peer Group Comparison: By comparing the company’s current ratio with a group of similar-sized competitors within the same industry to determine its relative position.

- Industry Average Comparison: Analyzing the company’s current ratio against the industry average to assess its financial health in comparison to the overall industry.

- Historical Comparison: Evaluating the company’s current ratio trends over time to identify potential improvements or declines in its financial position.

In conclusion, the current ratio’s significance in financial analysis lies in its ability to measure a company’s ability to address short-term obligations while considering the industry context. By comparing current ratios and industry averages, investors, and analysts can make better-informed decisions regarding the financial health of a company.

Liquidity Measurements Beyond Current Ratio

Quick ratio and cash ratio.

The quick ratio and cash ratio are two other liquidity ratios that provide a deeper insight into a company’s financial health. The quick ratio, also known as the acid-test ratio , is a more stringent measure of liquidity than the current ratio. It excludes inventory from current assets, as not all businesses can quickly turn their inventory into cash. The calculation formula is as follows:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

This ratio reflects a company’s ability to meet its short-term obligations considering only its most liquid assets.

On the other hand, the cash ratio is an even stricter measure when compared to the quick ratio. This ratio considers only cash and cash equivalents to meet a company’s short-term obligations. The formula to calculate cash ratio is:

Cash Ratio = Cash and Cash Equivalents / Current Liabilities

A higher cash ratio indicates a company has enough readily available funds to cover its short-term debts.

Working Capital and Acid-Test Ratio

Working capital is a simple yet essential liquidity measurement. It is the difference between current assets and current liabilities. Working capital helps to identify potential financial issues and assess a company’s ability to meet its short-term obligations.

Positive working capital indicates that a company has more current assets than liabilities and can cover upcoming expenses. Negative working capital implies that the company may struggle to meet its financial obligations.

The acid-test ratio mentioned previously is another important liquidity measurement. Similar to the quick ratio, it takes into account the company’s highly liquid assets but excludes inventory, as it can take time to convert it into cash. A higher acid-test ratio suggests that a company is better equipped to settle its outstanding debts.

In conclusion, while the current ratio is a useful liquidity measurement, one should also consider other ratios like the quick ratio, cash ratio, working capital, and acid-test ratio for a more comprehensive understanding of a company’s financial position and liquidity.

Limitations of the Current Ratio

Understanding potential misinterpretations.

The current ratio, while useful in assessing a company’s short-term liquidity, has certain limitations that can lead to potential misinterpretations. One limitation is that the ratio assumes all current assets can be easily converted into cash. However, in reality, some current assets like inventory and marketable securities may not be as liquid as cash. Therefore, relying solely on the current ratio could provide a misleading sense of a company’s liquidity.

Another challenge is the possible over-emphasis on conservative measures. A high current ratio could indicate that a company has a surplus of current assets, which seems positive in terms of liquidity. However, this conservatism may also indicate inefficient use of resources, as excess current assets could be better utilized for growth and investment opportunities.

Considering Contextual Factors

It is important to consider contextual factors when evaluating the current ratio, as these factors influence the interpretation and significance of the ratio. Some of these factors include:

- Industry differences : Interpreting the current ratio may vary depending on the industry, as some industries may have longer short-term credit extensions or unique working capital requirements. Comparing the current ratio across different industries can result in inaccurate conclusions.

- Seasonal fluctuations : Some businesses experience seasonal fluctuations, which can impact their current assets and liabilities. These fluctuations may cause temporary distortions in the current ratio, making it less reliable as an indicator of short-term liquidity during certain periods.

- Accounting policies : Different accounting policies can affect the valuation of current assets, such as inventory valuation methods (i.e., LIFO and FIFO). These variations could lead to inconsistencies when comparing current ratios across different companies.

In conclusion, while the current ratio offers valuable insights into a company’s short-term liquidity, it is essential to recognize its limitations and consider contextual factors. This comprehensive analysis will help ensure that decision-makers have a more accurate understanding of a company’s liquidity position.

Case Studies and Real-world Examples

Notable company analyses.

One well-known example of the application of the current ratio in evaluating a company’s financial status is the analysis of Walmart . Walmart, a leading retail corporation, has consistently maintained a low current ratio . This is partly due to its efficient inventory management and strong supplier relationships, enabling the company to pay its short-term obligations with ease.

Another example in the tech industry is Advanced Micro Devices (NASDAQ: AMD), which has a current ratio of 2.1 . This means that AMD can cover its debt due within one year over two times with its liquid assets, indicating a strong financial position.

Industry-Specific Examples

Companies from different industries may have varying ideal current ratio ranges, as each industry has unique operational practices and financial resources. For instance, a manufacturing company might require a higher ratio due to substantial investments in inventory and fixed assets, while a service-based company might need a lower ratio due to lower overhead costs and inventory requirements.

Here are a few industry-specific examples with their respective current ratio ranges:

- Manufacturing : 1.5 to 3.0

- Retail : 1.2 to 2.0

- Service : 1.0 to 2.0

These industry-specific examples serve as a guideline for investors and analysts to better understand the ideal current ratio range in relation to the company’s sector of operation.

In certain cases, an undervalued stock may have a current ratio below the industry average due to temporary difficulties such as a turnaround or a drop in historical performance . In such scenarios, it is essential to examine other financial ratios and company-specific factors before making any investment decisions.

Improving Current Ratio and Liquidity

Strategies for business managers.

One essential aspect of managing a business’s financial health is improving its current ratio and liquidity. A company’s current ratio is calculated by dividing its current assets by its current liabilities. The higher the ratio, the better the company’s ability to meet its short-term obligations. To improve the current ratio, managers can focus on the following strategies:

- Increasing cash flow: Boosting cash inflow by optimizing pricing, collecting receivables faster, and managing inventory efficiently.

- Reducing debts: Managing liabilities by settling outstanding debts, negotiating better payment terms with creditors, and cutting non-essential expenses.

- Strategic investing: Allocating resources in profitable ventures and divesting underperforming assets to generate a positive return on investments.

By implementing these strategies, business managers can strengthen their company’s liquidity position and reduce the risk of financial distress.

Investor Perspective on Improvement

Investors also play a crucial role in a company’s efforts to improve its current ratio and liquidity. A company with a strong liquidity position is more attractive to investors, as it indicates a lower risk of default and higher chances of fulfilling short-term obligations. Investors can contribute to a company’s liquidity improvement by:

- Investing in short-term assets: Allocating funds to assets that generate quick returns, such as marketable securities, can help increase the company’s current assets.

- Providing credit: Investors can offer credit facilities that enable the company to manage its debts and negotiate better terms with its creditors.

- Supporting financial restructuring: Investors can back initiatives that involve debt refinancing or converting short-term debt into equity, which can help reduce the company’s liability burden.

By understanding and supporting a company’s efforts to improve its current ratio and liquidity, investors can make informed decisions that protect their interests and contribute to the overall stability of the business.

Frequently Asked Questions

How is the current ratio calculated in financial analysis.

The current ratio is calculated by dividing a company’s current assets by its current liabilities. Current assets include cash, accounts receivable, and other assets that can be converted to cash within one year. Current liabilities are the obligations a company must fulfill within one year, such as accounts payable and short-term debt.

What does a current ratio indicate about a company’s financial health?

The current ratio is a liquidity ratio that measures a company’s ability to meet its short-term obligations. A higher current ratio indicates that a company can easily cover its short-term debts with its liquid assets. Generally, a current ratio above 1 suggests financial stability, while a ratio below 1 may signify potential liquidity problems.

In what ways can a company improve its current ratio?

To improve its current ratio, a company can take several actions such as increasing its current assets by collecting receivables more quickly or investing in liquid assets. Additionally, the company can reduce its current liabilities by paying off short-term debts or negotiating better payment terms with suppliers.

How does the current ratio compare to the quick ratio in liquidity measurement?

While both the current ratio and the quick ratio measure a company’s liquidity, the quick ratio is considered a more stringent measure as it excludes inventory from current assets. The quick ratio, also known as the acid-test ratio, gauges a firm’s capacity to cover its current liabilities with its most liquid assets. Hence, it is a more conservative estimate of a company’s liquidity compared to the current ratio.

What are the implications of having a current ratio less than 1?

A current ratio below 1 indicates that a company might struggle to meet its short-term obligations, as its current assets are insufficient to cover its current liabilities. This situation could lead to potential cash flow issues, difficulties in obtaining financing, or even bankruptcy in extreme cases. However, it is important to consider the industry context and specific financial situation of a company before drawing conclusions.

What can be considered a generally good current ratio for a healthy business?

Although the ideal current ratio may vary by industry, a ratio above 1 is typically considered healthy, indicating that a company can cover its short-term obligations. A current ratio of 2 implies that the company has twice the amount of current assets as liabilities, providing a comfortable liquidity buffer. However, a very high current ratio might indicate that a company is not efficiently utilizing its assets, which can be detrimental to the business in the long run.

- 1-800-711-3307

- Expense management

- Corporate card

- Tax returns & preparation

- Payment processing

- Tax compliance

- Vision & clarity

- Accounting mobile app

- Reduce your accounting expenses

- What does a bookkeeper do

- Why outsource

- Cash vs. Accrual Accounting

- Guides & ebooks

- How Finally works

- Privacy policy

- Terms of service

*Finally is not a CPA firm © 2024 Finally, Backoffice.co , Inc. All rights reserved.

19 Key Small Business Financial Ratios to Track

Key performance indicators (KPIs) were top of mind for finance teams surveyed for NetSuite’s Winter Outlook report. Finance teams said they’re focused on using data more effectively, producing better reports on KPIs and finding ways to save money. But executives who didn't work in finance had different priorities. One possible explanation for the rift, according to the report analysts, is that financial data needs context. It needs an accompanying narrative to illustrate the point and show the state of the business' finances. One way to simplify the data and make it more accessible for investors, lenders and internal stakeholders is using financial ratios.

What Is a Financial Ratio?

A financial ratio is a measure of the relationship between two or more components on the company’s financial statements. These ratios give you a quick and straightforward way to track performance, benchmark against those within an industry, spot trouble and proactively put solutions in place.

Why Is Measuring Financial Ratios Important?

Ratios help business leaders compare the company with competitors and more generally with those within their given industry. They enable a business to benchmark its performance and target areas for improvement. They help companies see problematic areas and put measures in place to prevent or ease potential issues. And if the business is seeking outside funding from a bank or an investor, financial ratios provide those stakeholders with the information needed to see if the business will be able to pay the money back and produce a strong return on investment.

19 Key Financial Ratios to Track

Financial ratios measure profitability, liquidity, operational efficiency and solvency.

Ratios that help determine profitability

The data used to calculate these ratios are usually on the income statement.

Gross profit margin:

Higher gross profit margins indicate the company is efficiently converting its product (or service) into profits. The cost of goods sold is the total amount to produce a product, including materials and labor. Net sales is revenue minus returns, discounts and sales allowances.

Gross profit margin = net sales – cost of goods or services sold/net sales X 100

Net profit margin:

Higher net profit margins show that the company is efficiently converting sales into profit. Look at similar companies to benchmark success as net profit margins will vary by industry.

Net profit margin = net profit/sales X 100

Operating profit margin:

Increasing operating margins can indicate better management and cost controls within a company.

Operating profit margin = gross profit – operating expenses/revenue X 100

Gross profit minus operating expenses is also known as earnings before interest and taxes (EBIT ).

Return on equity:

This measures the rate of return shareholders get on their investment after taxes.

Return on equity = net profit/shareholder’s equity

Ratios that measure liquidity

These metrics measure how fast a company can pay back its short-term debts. Use information from the balance sheet and the cash flow statement for these ratios.

Working capital or current ratio:

Working capital ratio = current assets/current liabilities

Cash ratio:

This measure is similar to the working capital ratio, but only takes cash and cash equivalents into account. This will not include inventory.

Cash ratio = cash and cash equivalents/current liabilities

Cash equivalents are investments that mature within 90 days, such as some short-term bonds and treasury bills.

Quick ratio :

Similar to the cash ratio, but also takes into account assets that can be converted quickly into cash.

Quick ratio = current assets – inventory – prepaid expenses/current liabilities

Cash flow to debt ratio:

Measures how much of the business' debt could be paid with the operating cash flow . For example, if this ratio is 2, the company earns $2 for every dollar of liabilities that it can cover. Another way of looking at it is that the business can cover its liabilities twice over.

Cash flow to debt ratio = operating cash flow/debt

There are a couple ways to calculate the operating cash flow. One is to subtract operating expenses from total revenue. This is known as the direct method.

Operating cash flow to net sales ratio:

Measures how much cash the business generates relative to sales. Accounting Tools says this number should stay the same as sales increase. If it’s declining, it could be a sign of cash flow problems .

Operating cash flow to net sales ratio = operating cash flow/net sales

Free cash flow to operating cash flow ratio:

Investors usually like to see high free cash flow. And a higher ratio here is a good indicator of financial health.

Free cash flow = cash from operations — capital expenditures

Free cash flow to operating cash flow ratio = free cash flow/operating cash flow

Ratios that measure operational efficiency

These ratios point to the company’s core business activities. They’re calculated using information found on the balance sheet and income statement.

Revenue per employee:

How efficient and productive are employees? This ratio is a good way to see how efficiently a business manages its workforce and should be benchmarked against similar businesses.

Revenue per employee = annual revenue/average number of employees in the same year

Return on total assets:

Looks at the efficiency of assets in generating a profit.

Return on total assets = net income/average total assets

Calculate average total assets by adding up all assets at the end of the year plus all the assets at the end of the prior year and divide that by 2.

Inventory turnover:

Examines how efficiently the company sells inventory. Start with the average inventory by taking the inventory balance from a specific period (a quarter, for example) and add it to the prior quarter inventory balance. Divide that by two for the average inventory.

Inventory turnover = cost of goods sold/average inventory

Accounts receivable turnover:

Accounts receivable turnover = net annual credit sales/average accounts receivable.

Average collection:

This is a related measure to give a business the sense of how long it takes for customers to pay their bills. Here’s the formula to calculate the average collection period for a given year.

Average collection = 365 X accounts receivable turnover ratio/net credit sales

To calculate net credit sales, use this formula:

Net credit sales = sales on credit — sales returns — sales allowances

Days payable outstanding (DPO):

The average number of days it takes the company to make payments to creditors and suppliers. This ratio helps the business see how well it's managing cash flow. To calculate DPO, start with the average accounts payable for a given time (could be a month, quarter or year):

Average accounts payable = accounts payable balance at beginning of period — ending accounts payable balance/2

DPO = average accounts payable/cost of goods sold x number of days in the accounting period

The resulting DPO figure is the average number of days it takes for a company to pay its bills.

Days Sales Outstanding:

Shows how long on average it takes for customers to pay a company for goods and services.

Days sales outstanding = accounts receivable for a given period/total credit sales X number of days in the period

Ratios that help determine solvency

These ratios look at a business’ ability to meet long-term liabilities using figures from the balance sheet.

Debt to equity ratio:

An indication of a company’s ability to repay loans.

Debt to equity ratio = total liabilities/shareholder’s equity

Debt to asset ratio:

Gives a sense of how much the company is financing its assets. A high debt to asset ratio could be a sign of financial trouble.

Debt to asset ratio = total liabilities/total assets

#1 Cloud Accounting Software

How to Use Financial Ratios

These financial ratios provide easy-to-access and insightful information for potential investors and lenders. The ratios are a way for startups to show investors that the business is financially solid. The ratios related to accounts receivable are especially important for small businesses seeking loans. According to peer-to-peer lending marketplace Funding Circle , banks appraise eligible receivables at 70%–80% of their value for asset-backed loans.

Financial ratios are for more than just securing funding. They can be used to provide KPIs and help guide strategic decisions to meet business goals. For example, calculating inventory turnover and comparing it to industry averages helps a company strike a balance between having too much cash tied up in inventory or too little inventory on hand to meet demand.

The Federal Reserve Bank of Chicago found that there is a direct correlation between financial management and financial health of small businesses. And the more often a small business analyzes the numbers from sound financial management practices, the higher its success rate. Those that do it annually, the U.S. Small Business Administration says, have a success rate as low as 25%. Done monthly or weekly, those rates climb to 75–85% and 95% respectively. And these small business financial ratios are a way to see and track insightful information.

All of this information will come from a company’s financial statements. Using technology to automate the accounting process to create the static financial statements saves time and eliminates human error. Using small business accounting software gives you more accurate and complete financial information and makes calculating the financial ratios quicker and simpler. Understanding the context of the ratios is the important first step. But automating the processes behind the ratios gives you a clearer, more accurate and easier-to-understand picture of your company’s finances.

Financial Management

Small Business Financial Management: Tips, Importance and Challenges

It is remarkably difficult to start a small business. Only about half stay open for five years, and only a third make it to the 10-year mark. That’s why it’s vital to make every effort to succeed. And one of the most fundamental skills and tools for any small business owner is sound financial management.

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

- Write Your Business Plan | Part 1 Overview Video

- The Basics of Writing a Business Plan

- How to Use Your Business Plan Most Effectively

- 12 Reasons You Need a Business Plan

- The Main Objectives of a Business Plan

- What to Include and Not Include in a Successful Business Plan

- The Top 4 Types of Business Plans

- A Step-by-Step Guide to Presenting Your Business Plan in 10 Slides

- 6 Tips for Making a Winning Business Presentation

- 12 Ways to Set Realistic Business Goals and Objectives

- 3 Key Things You Need to Know About Financing Your Business

- How to Perfectly Pitch Your Business Plan in 10 Minutes

- How to Fund Your Business Through Friends and Family Loans and Crowdsourcing

- How to Fund Your Business Using Banks and Credit Unions

- How to Fund Your Business With an SBA Loan

- How to Fund Your Business With Bonds and Indirect Funding Sources

- How to Fund Your Business With Venture Capital

- How to Fund Your Business With Angel Investors

- How to Use Your Business Plan to Track Performance

- How to Make Your Business Plan Attractive to Prospective Partners

- Is This Idea Going to Work? How to Assess the Potential of Your Business.

- When to Update Your Business Plan

- How to Write the Management Team Section to Your Business Plan

- How to Create a Strategic Hiring Plan

- How to Write a Business Plan Executive Summary That Sells Your Idea

- How to Build a Team of Outside Experts for Your Business

- Use This Worksheet to Write a Product Description That Sells

- What Is Your Unique Selling Proposition? Use This Worksheet to Find Your Greatest Strength.

- How to Raise Money With Your Business Plan

- Customers and Investors Don't Want Products. They Want Solutions.

- 5 Essential Elements of Your Industry Trends Plan

- How to Identify and Research Your Competition

- Who Is Your Ideal Customer? 4 Questions to Ask Yourself.

- How to Identify Market Trends in Your Business Plan

- How to Define Your Product and Set Your Prices

- How to Determine the Barriers to Entry for Your Business

- How to Get Customers in Your Store and Drive Traffic to Your Website

- How to Effectively Promote Your Business to Customers and Investors

- What Equipment and Facilities to Include in Your Business Plan

- How to Write an Income Statement for Your Business Plan

- How to Make a Balance Sheet

- How to Make a Cash Flow Statement

- How to Use Financial Ratios to Understand the Health of Your Business

- How to Write an Operations Plan for Retail and Sales Businesses

- How to Make Realistic Financial Forecasts

- How to Write an Operations Plan for Manufacturers

- What Technology Needs to Include In Your Business Plan

- How to List Personnel and Materials in Your Business Plan

- The Role of Franchising

- The Best Ways to Follow Up on a Buisiness Plan

- The Best Books, Sites, Trade Associations and Resources to Get Your Business Funded and Running

- How to Hire the Right Business Plan Consultant

- Business Plan Lingo and Resources All Entrepreneurs Should Know

- How to Write a Letter of Introduction

- What To Put on the Cover Page of a Business Plan

- How to Format Your Business Plan

- 6 Steps to Getting Your Business Plan In Front of Investors

How to Use Financial Ratios to Understand the Health of Your Business Comparing various elements of your financial reports will help you manage your company better and show investors that you are on the right track.

By Eric Butow • Oct 27, 2023

Opinions expressed by Entrepreneur contributors are their own.

This is part 5 / 11 of Write Your Business Plan: Section 5: Organizing Operations and Finances series.

Everything in business is relative. The numbers for your profits, sales, and net worth need to be compared with other components of your business for them to make sense. For instance, a $1 million net profit sounds great. But what if it took sales of $500 million to achieve those profits? That would be a modest performance indeed.

To help understand the relative significance of your financial numbers, analysts use financial ratios. These ratios compare various elements of your financial reports to see if the relationships between the numbers make sense based on prior experience in your industry.

Related: Financial Ratios Are How You Know If What You're Doing Is Working

Some of the common ratios and other calculations analysts perform include your company's break-even point, current ratio, debt-to-equity ratio, return on investment, and return on equity. You may not need to calculate all of these. Depending on your industry, you may also find it useful to calculate various others, such as inventory turnover, a useful figure for many manufacturers and retailers. But ratios are highly useful tools for managing, and most are quick and easy to figure out. Becoming familiar with them and presenting the relevant ones in your plan will help you manage your company better and convince investors you are on the right track.

There are four kinds of financial ratios: liquidity ratios like the current ratio, asset management ratios like the sales/receivable cycle, debt management ratios like the debt-to-equity ratio, and profitability ratios like return on investment.

Break-Even Point

One of the most important calculations you can make is figuring your break-even point. This is the point at which revenue equals costs. Another way to figure it is to say it's the level of sales you need to get to for gross margin or gross profit to cover all your fixed expenses. Knowing your break-even point is important because when your sales are over this point, they begin to produce profits. When your sales are under this point, you're still losing money. This information is handy for all kinds of things, from deciding how to price your product or service to figuring whether a new marketing campaign is worth the investment.

Related: How to Write an Income Statement for Your Business Plan

The process of figuring your break-even point is called break-even analysis. It may sound complicated, and if you were to watch an accountant figure your break-even point, it would seem like a lot of mumbo-jumbo. Accountants calculate figures with all sorts of arcane-sounding labels, such as variable cost percentage and semi-fixed expenses. These numbers may be strictly accurate, but given all the uncertainty there is with projecting your break-even point, there's some question as to whether extra accuracy is worth all that much.

There is, however, a quicker if somewhat dirtier method of figuring break-even. It is described in the below worksheet. Although this approach may not be up to accounting school standards, it is highly useful for entrepreneurs, and more importantly, it can be done quickly, easily, and frequently as conditions change.

Related: Tips and Strategies for Using the Balance Sheet as Your Franchise Scorecard

Once you get comfortable with working break-even figures in a simple fashion, you can get more complicated. You may want to figure break-even points for individual products and services. Or you may apply break-even analysis to help you decide whether an advertising campaign is likely to pay any dividends. Perform break-even analyses regularly and often, especially as circumstances change. Hiring more people, changing your product mix, or becoming more efficient all change your break-even point.

Break Even Worksheet

To determine your break-even point, start by collecting these two pieces of information:

1. Fixed costs. These are inflexible expenses you'll have to make independently of sales volume. Add up your rent, insurance, administrative expenses, interest, office supply costs, maintenance fees, and so on to get this number. Put your fixed costs here: ______________________.

2. Average gross profit margin. This will be the average estimated gross profit margin, expressed as a percentage, that you generate from sales of your products and services. Put your average gross profit margin here: ______________________.

Now divide the costs by profit margin, and you have your break-even point. Here's the formula:

Fixed costs / Profit Margin = Break-even point

If, for instance, your fixed costs were $10,000 a month and your average gross profit margin was 60 percent, the formula would look like this:

$10,000 / .6 = $16,667

So in this case, your break-even point is $16,667. When sales are running at $16,667 a month, your gross profits are covering expenses. Fill your own numbers into the following template to figure your break-even point:

$________________/________________= $________________

Related: How to Calculate Your Net Worth and Grow Your Wealth

Current Ratio

The current ratio is an important measure of your company's short-term liquidity. It's probably the first ratio anyone looking at your business will compute because it shows the likelihood that you'll be able to make it through the next twelve months.

Figuring your current ratio is simple. You divide current assets by current liabilities. Current assets consist of cash, receivables, inventory, and other assets likely to be sold for cash in a year. Current liabilities consist of bills that will have to be paid before 12 months pass, including short-term notes, trade accounts payable, and the portion of long-term debt due in a year or less. Here's the formula:

Current assets / Current ratio = Current liabilities

For example, say you have $50,000 in current assets and $20,000 in current liabilities. Your current ratio would be:

$50,000 / 2.5 = $20,000

The current ratio is expressed as a ratio: 2.5 to 1, or 2.5:1. That's an acceptable current ratio for many businesses. Anything less than 2:1 is likely to raise questions.

Related: How to Make Realistic Financial Forecasts

Quick Ratio

This ratio has the best name—it's also called the acid-test ratio. The quick ratio is a more conservative version of the current ratio. It works the same way but leaves out inventory and any other current assets that may be a little harder to turn into cash. You'll normally get a lower number with this one than with the current ratio—1:1 is acceptable in many industries.

Sales/Receivables Ratio

This ratio shows how long it takes you to get the money owed you. It's also called the average collection period and receivables cycle, among other names. Like most of these ratios, there are various ways of calculating your sales/receivables cycle, but the simplest is to divide your average accounts receivable by your annual sales figure and multiply it by 360, which is considered to be the number of days in the year for many business purposes. Like this:

Receivables x 360 = Sales

If your one-person consulting business had an average of $10,000 in outstanding receivables and was doing about $120,000 a year in sales, here's how you'd calculate your receivables cycle:

$10,000 x 12 = $120,000 1/12x360=30

If you divide one by twelve on a calculator, you'll get .08333, which gives you the same answer, accounting for rounding. Either way, your average collection period is thirty days. This will tell you how long, on average, you'll have to wait to get the check after sending out your invoice. Receivables will vary by customer, of course. You should also check the receivables cycle number against the terms under which you sell. If you sell on thirty-day terms and your average collection period is forty days, there may be a problem that you need to attend to, such as customer dissatisfaction, poor industry conditions, or simply lax collection efforts on your part.

Related: The Facts About Financial Projections

Inventory Turnover