What to do if you are denied a loan: Reasons for denials & ways to improve

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal loans

- • Debt consolidation

- Connect with Heidi Rivera on Twitter Twitter

- Connect with Heidi Rivera on LinkedIn Linkedin

- Get in contact with Heidi Rivera via Email Email

- • Personal finance

- Connect with Rhys Subitch on LinkedIn Linkedin

- Get in contact with Rhys Subitch via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Lenders tend to tighten credit requirements during tough economic times, making it harder to get approved for credit products, including loans.

- Credit score, income and debt-to-income ratio are the main factors lenders consider when reviewing applications.

- Paying down debts, increasing your income, applying with a co-signer or co-borrower and looking for lenders that specialize in loans within your credit band could increase your approval odds.

If you recently applied for a personal loan and got denied you’re not alone. Bankrate’s credit denials survey found that half of Americans who’ve applied for a loan or another financial product since the Fed hiked its benchmark rate in March 2022, have gotten denied.

This is likely in part due to the fact that lenders tend to tighten their credit requirements during tough economic times to mitigate risks, which in turn makes it harder to get approved for a loan. Luckily, there are a few steps you can take to improve your approval odds, even in a tough economy.

- 50% of Americans who have applied for credit products since the Fed rate hikes in March 2022 have gotten denied, according to Bankrate’s Credit Denials survey.

- 17% were denied more than one loan or financial product.

- 21% of Americans say it has gotten harder to access credit since the Fed increased interest rates, with 11% saying it has gotten much harder.

- New credit card applications, including balance transfer cards, accounted for the majority of credit denials at 19%.

- Credit card limit increase denials (at 11%) came in second, followed by personal loans (at 10%).

Why it’s been harder to get approved for a loan

Borrowers with good to excellent credit are still most likely to get approved for a loan, although the APRs (annual percentage rates) offered are likely to be much higher than they would have been last year.

The cost of borrowing has greatly increased as lenders adjust to the Federal Reserve raising the benchmark rate . What’s more, lenders have also become more selective about who qualifies for approval as the inflation rate remains stubbornly high, despite the Fed’s recent behaviors.

Reasons for personal loan rejections

There are several reasons someone may have their loan application rejected:

- Bad credit history: Bad credit history may indicate to creditors that you are having or had trouble repaying what you owe based on past transactions. Although your credit score is generally a good indicator of credit history, lenders also look at your overall financial history to establish your creditworthiness.

- High DTI: If you have a DTI — or debt-to-income — ratio of 50 percent or higher, you might have too much debt for a lender to give you a new loan. If that’s the case, it’s best to apply after reducing your overall debt, as this will increase your chances of approval.

- Incomplete application: Your loan rejection could be as simple as missing a key field or document needed for verification. If you are rejected for a loan, double-check that you fully completed the application and submitted all the proper documentation .

- Lack of proof of steady income: Consistency is key because it helps lenders understand your job landscape moving forward. Because jobs can vary depending on the line of work, lenders may look at tax returns to get a better overview.

- Loan doesn’t fit the purpose: Lenders might have certain restrictions on what you can and can’t do with loan money. The lender may be able to offer you alternative suggestions to better fit your needs.

- Unsteady employment history: Lenders like to see a steady income stream over time. If you are between jobs or have a history of unsteady employment, this could indicate to lenders that you may not be a reliable borrower.

How to improve your chances of qualifying for a loan

There are a few measures you can take to improve your approval odds when applying for a personal loan. But for any of these steps to work you must know why you got denied in the first place.

Under the Equal Credit Opportunity Act , lenders must disclose the reason for denying your loan application as long as you inquire about it within 60 days of the decision. This is known as an adverse action notice. Knowing this information is key to developing an effective strategy to get approved next time.

Review and build your credit score

Lower your dti, find ways to increase your income, compare lenders, prepare with personal loan preapproval, when to apply for a loan again after denial.

Each time you apply for a loan or credit product there is a hard inquiry that can temporarily lower your score. That’s why it’s a good idea to wait at least 30 days before you apply again. However, if you don’t need the funds urgently, experts recommend waiting at least six months.

How to get a loan with bad credit

There are a few ways you could still get approved for a personal loan, even with less-than-perfect credit.

Add a co-borrower or co-signer

Co-borrowers and co-signers are typically creditworthy family members or friends who sign the loan agreement with the primary applicant and take on equal legal responsibility for the loan. This, in turn, can boost the chances of approval of the primary applicant, plus help them secure a better rate.

The main difference between the two is that the co-borrower has access to the loan funds, while the co-signer doesn’t. Both co-borrowers and co-signers are equally responsible for payments, but co-signers typically only make payments if the borrower is at risk of defaulting on the loan.

Consider the potential relational risks before enlisting the assistance of a co-borrower or co-signer. Also make sure the monthly payment is well within your budget, both now and in the future, to avoid negatively impacting their credit as well as yours.

Consider getting a secured loan

Secured loans are those that are backed by an asset, such as a car or a savings account. Though not many, some personal loan lenders do offer these products. If you have enough equity built in your home, you may also be able to apply for a home equity loan or a home equity line of credit (HELOC) . Both are second mortgages backed by your home.

Because secured loans are guaranteed by an asset, lenders tend to be more lenient with credit requirements and offer lower rates. That said, if you default on the loan, the lender could take legal action to seize the asset. Additionally, home equity loans and HELOCs usually entail a lengthy approval process and are best suited if you need a considerable amount. Otherwise, they may not be worth the trouble or risk.

Target your search toward lenders within your credit band

If you need money quickly there are loans for bad credit borrowers that tend to have more relaxed requirements. However, be aware that your interest rates may potentially be higher than if you qualified for a good credit loan. Regardless, if you can handle the higher payments and interest, without tilting your budget, it may be a good option to explore .

The bottom line

If you have been denied a loan, take the time to review your application and see what went wrong. Then, work on improving the aspects that got you denied in the first place. For instance, if the main issue is that your DTI is too high, consider paying down debt before reapplying.

But if you’re in a crunch, there are lenders that offer loans to those with bad credit. But be sure to carefully consider the interest rates and your ability to make payments before you apply. It’s also important to wait at least one month before reapplying after getting denied and to only borrow an amount that you can comfortably repay.

What to do when your credit card application is denied

Can you get a balance transfer card with bad credit?

- ATM / Branch

- Open an Account

- View All Credit Cards

- 0% Intro APR Credit Cards

- Balance Transfer Credit Cards

- Cash Back Credit Cards

- Rewards Credit Cards

- See If You're Pre-Selected

- Small Business Credit Cards

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- Small Business Banking

- Personal Loans & Lines of Credit

- Home Equity

- Small Business Lending

- Investing with Citi

- Self Directed Trading

- Personal Loans

- Learning Center

What to Do if Your Personal Loan Keeps Getting Declined

When you apply for a personal loan, there is always the risk of having your request denied. This can be due to several reasons, including a low credit score, incomplete paperwork, or having a limited income.

This article will detail several personal loan denial reasons and cover the actions you can take after a loan denial.

Common Reasons for Personal Loan Denials

Your personal loan could be denied for many reasons, some obvious and others less so. Below are some of the most common reasons for personal loan denials:

Low credit score

Borrowers will often run into loan denial problems because they have a low credit score. Falling below the limit set by a lender will make it challenging to qualify for a loan.

Missing information or paperwork

Applying for a personal loan involves a lot of paperwork, and sometimes you may lose some information in the shuffle. Carefully reading through the requirements and understanding exactly what the lender wants is key to qualifying for a personal loan. Be sure to review your application before sending it off. You could also consider contacting the lender directly to double-check their requirements.

High debt-to-income ratio

A high debt-to-income (“DTI”) ratio could spoil your personal loan plans. This ratio compares your monthly debt total with your monthly gross income. For example, monthly debt payments of $3,000 on a monthly income of $5,000 leads to a DTI ratio of 60%. This may show lenders you could have trouble affording debt repayment.

In general, your DTI ratio should be 35% or less. Many DTI ratios in this range indicate that you are an attractive borrower.

Insufficient or unstable income

When deciding whether to offer a loan, a lender will investigate your recent income history to determine if you can pay them back. They may reject your application if they deem your income insufficient or unstable. From the lender’s perspective, a borrower with unreliable income has a higher chance of defaulting on the loan when the monthly payments become unaffordable.

Basic requirements are not met

Basic requirements vary among lenders, but in general, you must have three primary qualifications. Before applying, make sure to review the lender’s requirements and ensure the following:

- You are at least 18

- You are a U.S. citizen (or have qualifying documentation that proves your permanent or non-permanent U.S. residency)

- You have proof of income and meet the requirements for creditworthiness

Incorrect loan usage

You can take out a personal loan for almost any expense, but some restrictions exist. Be sure to read the lender’s requirements and understand the scope of their rules to avoid having your application declined.

Actions to Take After a Personal Loan Denial

It is not the end of the world when your personal loan is declined. Review these options to learn the actions you can take to get a new personal loan.

Review your decline notice

The decline notice you receive includes the reasons for your loan denial. Review this notice and identify what needs to be fixed before you can resubmit your application.

Review your credit report

If the loan decline notice cited issues with your credit score, try requesting a copy of your credit report to figure out the problem. To do this, you can go to AnnualCreditReport.com and request a copy. You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies.

Build your credit score before applying again

You may need to take time to build your credit score before applying for another loan. Remember to review how to build your credit score, including paying down your credit card balances and lowering your credit utilization rate.

Apply for a lower loan amount

If you’ve been denied a loan, the amount you requested may have been unrealistic, so seeking a lower loan amount may help your next application. Evaluate your budget and consider using a personal loan calculator to figure out how much you can afford to spend on a monthly payment.

This will help you find a loan range you may be more likely to be approved for, help you get a picture of your current financial situation, and prevent you from taking on more debt than you can handle.

Pay down debt

Your existing debt is important to lenders when they look at how much you owe relative to your monthly income. Paying down debt improves your DTI ratio and makes you look more trustworthy as a borrower. Doing this will also free up more monthly income to repay a new loan.

You may consider the debt snowball method. With this approach, you pay off the smallest debt first, then the next-smallest debt, and so on. Conversely, the debt avalanche approach involves paying off the highest-interest debt first before paying off the next highest-interest debt. The avalanche method could help minimize interest costs, while the snowball approach offers short-term wins that could keep you motivated over time.

Increasing income and paying down debt at the same time is the quickest way to improve your DTI ratio.

Frequently Asked Questions

How long should you wait to reapply after a loan denial.

For several reasons, it may be wise to wait several months before reapplying for a loan following a denial, and experts recommend waiting six months to give yourself the best chance of qualifying. First, every time you apply for a loan, the lender conducts a hard credit inquiry that could temporarily lower your credit score. Being subject to several hard credit inquiries could harm your credit even more and make you less attractive as a borrower.

It also takes a while to increase income and improve your financial situation. Building credit is not an overnight process, and lowering your DTI ratio can take time.

If your loan application was declined because of an error you made on the application, you should contact the lender immediately to address the mistake and rerun the application.

How many times can you apply for a personal loan?

There isn’t a set number of times you can apply for a personal loan. But the more you apply, the more hard inquiries into your credit file you’ll be subject to, negatively impacting your credit score.

How does a declined personal loan affect your credit report?

Getting declined for a personal loan does not show up on your credit report or impact it by itself. Again, the biggest concern is the hard inquiry into your credit file that occurs when you apply. The rejection itself does not affect your report.

Bottom Line

The loan application process has several pitfalls that could limit your ability to qualify. Careful planning and patience are vital in ensuring you can reapply for a loan after being denied.

Citi offers personal loans to both existing Citi customers and new Citi customers that meet specific eligibility criteria, including an established credit and income history along with additional factors determined by Citi. If you think you could benefit from a Citi Personal Loan, apply online today.

Disclosure : This article is for educational purposes. It is not intended to provide legal, investment, or financial advice and is not a substitute for professional advice. It does not indicate the availability of any Citi product or service. For advice about your specific circumstances, you should consult a qualified professional.

Additional Resources

Get Started

Start your personal loan application now!

FICO® Score

Learn how FICO® Scores are determined, why they matter and more.

Review financial terms & definitions to help you better understand credit & finances.

- Consumer: 1-800-347-4934

- Consumer TTY: 711

- Business: 1-866-422-3091

- Business TTY: 711

- Lost/Stolen: 1-800-950-5114

- Lost/Stolen TTY: 711

Terms & Conditions

- Card Member Agreement

- Notice At Collection

- Do Not Sell or Share My Personal Information

Copyright © 2023 Citigroup Inc

Important Information

- Search Search Please fill out this field.

- Building Your Business

What To Do If Your SBA Loan Application Is Denied

Why SBA Loans Are Denied and How To Appeal

Why Was Your SBA Loan Declined?

How to appeal your denial, steps to reapply for sba loan, alternatives to sba loans, the bottom line, frequently asked questions (faqs).

Tempura / Getty Images

Small Business Administration (SBA) loans provide another option for small businesses that otherwise can’t qualify for loans. In this case, the SBA does not act as a lender, but instead works with lenders to set the guidelines and guarantees the loan will provide the funds. Businesses look to SBA loans when they’ve run out of options. But what do you do if your application is denied?

There are still options for those who don’t qualify or have issues with their SBA loan application. Learn what factors come into play that may impact your SBA loan application’s approval, how to appeal if you’ve been denied, and what alternatives are available.

Key Takeaways

- The U.S. Small Business Administration (SBA) works with lenders to provide loans to support small businesses that are in need of financial assistance.

- The SBA sets the qualifications and eligibility requirements for businesses applying for loans.

- SBA loans may be denied if the application is incomplete or if certain eligibility standards are not met, such as the location of where the business is operated or the amount of equity the owner has invested.

- Businesses that receive a denial for their SBA loans can file an appeal directly with the Small Business Administration’s Office of Hearings and Appeals, as long as it is filed within 45 days of receiving the denial.

There are a number of factors that could impact your SBA loan application or even cause it to be denied. Usually, an application is denied if it is incomplete or if certain requirements are not met.

Since the SBA provides funding through its lenders, these requirements may vary depending on the bank or financial institution that processes the loan.

Generally, eligibility comes down to the type of business, its ownership, and the location of the business. Basic requirements for small businesses are as follows:

- It must be an officially registered for-profit business. Registration statuses include a limited liability company (LLC), limited liability partnership (LLP), or a sole proprietorship .

- The business must operate in the U.S. or its territories.

- The owner of the company must have invested equity.

- The business must have exhausted or denied all other financing options.

There are a few other requirements for small businesses to be approved, which are detailed below.

Business Doesn’t Meet Size Standards

SBA loans are only available for small businesses as defined by the SBA. To meet the standard, companies need to employ a certain amount of workers or bring in a certain amount of revenue, depending on the industry. Businesses above the specified threshold for their industry do not qualify.

Credit Worthiness

Your SBA loan application may have been denied due to your credit score . Lenders reference your business credit, if available, and personal credit if needed.

Maintaining your credit when applying for business loans is crucial, so check both your business credit score and your personal credit score prior to applying for the loan. You can check your business credit score using several free online sites, and you can check your personal score through the three major credit reporting agencies.

Financial Ability To Repay a Loan

Lenders determine whether your business has the ability to pay back the loan. Some of the things that may be considered include collateral , tax returns, cash flow projection, and other financial documents. In some cases, you may be able to appeal this decision if you can show your ability to repay.

Other Reasons Regarding Eligibility

There are several other reasons regarding general eligibility that a business might be denied for an SBA loan. The reasons depend on your industry, need for funds, and your business’s general history. Other reasons for a denial could include the fact that your company is a startup, your business’s finance history, or the type of industry you are in does not qualify for an SBA loan.

Depending on the reason your SBA loan application was denied, you may be able to file an appeal. For example, you may submit an appeal if you were denied based on the size of your business and other eligibility concerns. The SBA makes decisions on appeals through its Office of Hearings and Appeals (OHA), and it will depend on the type of loan you applied for.

If you would like to appeal the denial of your SBA loan application, there are a few steps you need to take.

Determine Why You Were Denied

Before you can send in an appeal, it’s important to understand why your application was denied so you can provide the proper information as needed. Knowing why you weren’t approved can help to provide insight as to what steps you need to take to overturn the decision with an appeal or to improve your business and reapply.

There are many reasons an SBA loan might be denied. If you don’t understand the reason for the denial, contact your lender to determine whether you can file an appeal.

Gather the Necessary Documentation

Regardless of the decision you are appealing, you’ll need to have documents to back up the facts and provide proof. You’ll need a copy of the determination for the SBA loan, as well as supporting documents for your appeal. For example, if you’re filing an appeal regarding the size of your business, make sure to include financial statements that show the amount of revenue your business has made, or payroll documentation that outlines how many employees are currently at your company.

Filing Your Appeal

When filing your appeal, include all important documents pertaining to the reason for the denial and follow any specific instructions for your appeal, such as contacting other departments and including certificates of service and contact information.

You can file an appeal through the Hearings and Appeals Submission Upload Application , by email, or by fax.

Generally, appeals must be filed within 45 calendar days of receiving denial, although some must be filed within 10 or 15 days, as it depends on the loan you applied for. With the 8(a) business development program, for example, appeals must be filed within 45 calendar days. Generally, appeals can take up to 90 days to process.

If you are unable to appeal or tried but still could not be approved, you can work toward improving your business where needed so you can reapply in the future. If you were denied for a reason such as your credit score or the amount of time and money invested into your business, those are goals to work toward that will help you attain funds in the future.

There are a few steps that could increase your chances of approval when you reapply for the SBA loan:

- Improving personal credit and business credit score by paying bills on time.

- Improving business cash flow to show ability to repay the loan.

- Increasing equity by investing more time or money into your business.

Applying for an SBA loan is a tedious process that can be very time-consuming, so if you plan to apply again, it is best to ensure you meet all eligibility requirements.

There are other financing options available for businesses that need immediate funding or do not meet the criteria for an SBA loan. Some of the alternatives to SBA loans include:

- Business credit cards : Applying for business credit cards is a great option for those looking to build business credit. With options like secured credit cards , companies are able to separate their personal credit from business.

- Online lenders : Although they may have higher interest rates, online lenders can help provide funds for your business. Before going this path, conducting research is crucial, as each online lender sets its own standards.

- Microloans: Similar to traditional loans, microloans are meant to cover smaller expenses, such as a piece of equipment, and they are also offered by the SBA. The approval process is more simplified, and can provide your business with up to $50,000 in coverage. On average, microloans are about $13,000.

Whether you’re looking to appeal a denied SBA loan or you’re simply looking for alternative financing options, it’s important to understand where your business stands financially. Knowing this can help you gauge which steps to take next to improve your business.

How do I check the status of my SBA loan application?

If you are applying for an SBA loan for the first time, you’ll need to contact your lender for the status. Businesses with existing SBA loans can check their statuses online by accessing SBA Capital Access Financial System (CAFS).

How long does the SBA loan approval process take?

The approval process for an SBA loan can be a long process for business owners. Some SBA applications may take a few weeks, but some may take several months.

Can I reapply for an SBA loan if I was denied?

You can reapply for an SBA loan if you were denied, but it is important that you only do so after undergoing key changes that prevented you from receiving the loan the first time you applied. As the process for applying and receiving an SBA loan is lengthy, it is recommended to take some time to improve your business and ensure you will be approved before applying again. You may reapply 90 days after you submitted your application.

Do I need to establish business credit to be approved for an SBA loan?

SBA loans are processed through lenders, so the specific credit requirements are set by each lender. Generally, personal credit is considered if a business is new or has not yet established a business credit score.

U.S. Small Business Administration. " Loans ."

U.S. Small Business Administration. " 8(a) Eligibility Appeals ."

U.S. Small Business Administration. " Size Appeals ."

U.S. Small Business Administration. " Microloans ."

Small Business Administration. " SBA Account Login and Registration Portals ."

U.S. Small Business Administration. " Typical Application Timeline, and How to Interpret Your HCTS Messages ." Page 2.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1289906599-9d659876f4a74b6dbcc16fb5b227d87e.jpg)

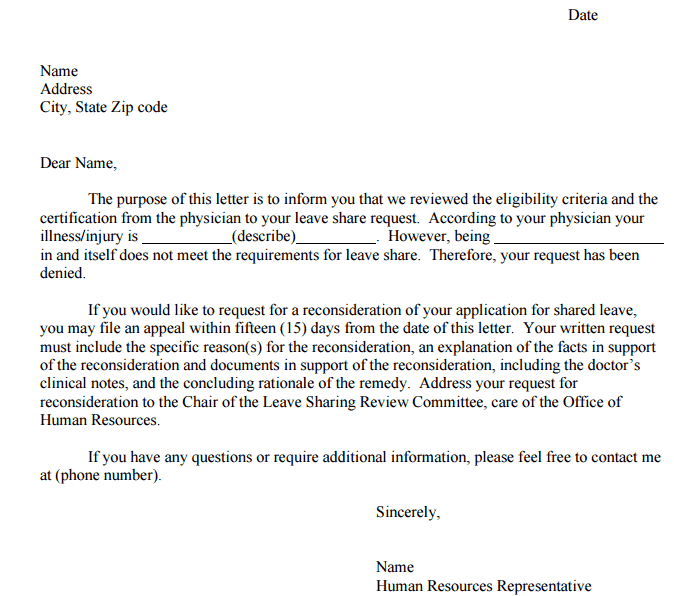

Sample Loan Rejection Letter format to Customer

[Here briefly describe on Sample letter to client for rejection of loan request application letter from a bank. These are the Letter to inform the client that loan request has been rejected and objections with causes. You can modify this format as your requirement.]

Date…

Client name…

Client Address…

Sub: Letter for Rejection of the loan request

Respected Customer,

This letter is to notify you about the rejection of your loan request that you submitted at (Bank and branch name). Unfortunately, You were failed to fulfill the criteria that are must for the loan approval at our bank or the credentials and assets that you provided failed to be verified by our verification team. (show actual problem and situation). Thanks for showing interest in our loan scheme.

You may contact the concerned branch for further queries if any.

Loan Department,

Bank name…

Branch name and Address…

Another format,

(Client Name)

Re.: Loan Rejection Letter

With reference to your application for loan dated (date), we have to say that it is against the bank policy to sanction loan for buying a (Product Name). I regret to say ‘no’ to your request but hope that you will appreciate that we cannot go against bank regulations. (show actual problem and situation).

We trust you will avail yourself of our other services.

Yours faithfully,

(Your Name)

Branch Manager.

Thank You Letter to Employee for Hard Work

Sample Post Annual Increment Request Letter by Teacher

Sample Complaint Letter format for not Getting Promotion

Sample Letter of Suggestion for Improvement to Student

Request Letter for Credited Salary to your Account

Dichloromethane (Properties, Production, Uses)

Annual Report 2017-2018 of TVS Motor Company

Loneliness Increasing among Older Adults is a Result of Social Distance

Annual Report 2012 of Bay Leasing & Investment Limited

Credit Management of National Credit and Commerce Bank Limited

Latest post.

Mass Flow Meter

Flow Control Valve

Ignitron – a type of gas-filled tube

Timelapse Photography reveals the Intricacies of Embryonic Cell Division

How did Seaweed become Multicellular?

Dynamic Voltage Scaling – In Computer Architecture

Add custom text here or remove it

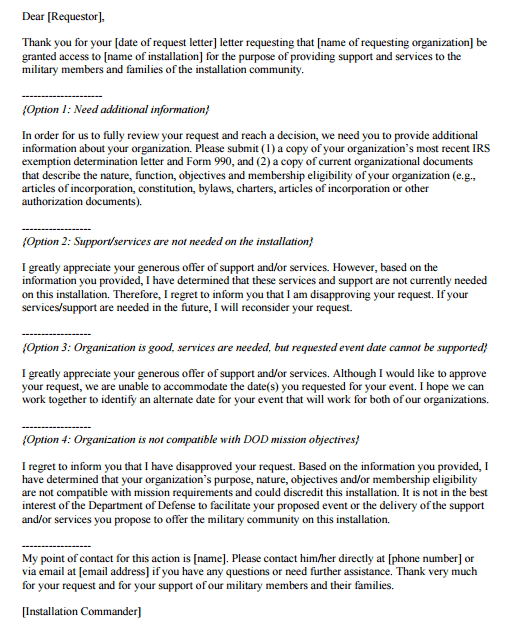

6+ Disapproval Letter Samples

Disapproval means you are disagreeing with a proposed agenda, option, or a suggestion. A letter of disapproval can be written in different situations, for example disapproval of an agenda in an organization, disapprove a suggestion of a coworker, a subordinate or a colleague, opposing a legislation, disapprove a pay bill, benefits or allowances. There could be many more reasons and grounds of disapproval. The purpose of writing this letter is to inform the reader that his or her suggestion or request has been disapproved for some reasons. Te letter of disapproval is a document that is used to disapprove any deal or business contract between the parties. It is a completely information letter.

The teller conveys your dissatisfaction with the deal, work or suggestion and informs recipient about it. This letter is an effective way of removing all doubts between the parties to a contract and it also helps to eliminate misunderstandings in business terms. The letter should be concise and brief; it must cover all points and should not leave any point unclear or any kind of misconceptions. Like all other business communication documents and letter the letter of disapproval should also be polite the tone should be kind but official.

You should entertain all the major points of the issue or situation and point out why you are disapproving it, though it is not mandatory to explain the reasons but you can mention to convey the real issue, it will provide a chance for the recipient to consider it and if you are in business terms for a longer time period, it will give a chance to the reader to avoid it next time. The letter should be written on the letter head of the company, must be signed and stamped by the authority. It is wise to proofread the letter before sending. Here is a sample of letter of disapproval attached with this template for your convenience.

We Have Added Disapproval Letter Samples Here

Disapproval letter for leave of absence.

Disapproval Letter Sample

Disapproval Letter To Employee

Request Disapproval Letter

Project Disapproval Letter

Letter Of Disapproval Format

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

Related Posts

25+ Free Letter of resignation Templates

8+ Authorization letters to Act on Behalf

2+ Disagreement Letter with a False Accusation

Loan Disapprove Letter

September 12, 2005 Ms. Lorna D. Cornejo Fairview St. Quezon City

Dear Ms. Cornejo:

As per inquiry with our Credit Evaluation.

Your loan application was fully validated but the system disapproved. The reason for disapproval are not being disclosed if system disapproved.

You can submit your loan application after six months to re evaluate.

Thanks for your interest doing transaction with us

Best Regards,

Hazel Anne dela Cruz Manager

- E-commerce Loan

- Small Business Loan

- Business Loan

- Personal Loan

- Salary Loan

Select Page

Vidalia Lending Blog

Find out the latest from our team and the latest news in our industry, unapproved loan here are possible reasons for declined loan.

Posted by Vidalia Lending Corp. | Jul 10, 2019 | Cash Loan Philippines , Cash Loans , Online Lenders , Online Loan , Online Loan Philippines , P2P Lending , Peer to Peer lending | 0 |

Living in a striving developing country, you would expect that not all people can live by their means. A financial crisis is a common predicament that Filipinos are facing or have faced as they live their everyday lives.

For a lot of Filipinos who lack finances, applying for loans has always been the answer to their financial dilemma. However, acquiring loans doesn’t necessarily mean that you will be easily granted the cash you need. You have to go through each process and there is no guarantee that everyone’s application will be approved.

It’s nerve-wracking to wait for the decision on your applied loan. This is very true especially if you badly need the money. For people who got their loans rejected, you must also know that some lending companies will not fully disclose why your application was not approved.

Vidalia Lending has different loan offers perfect for your monetary needs. Loan repayments are also fixed without any hidden charges. Interest rates are lower compared to other lending companies and to top it off, the application process will not take up much of your time. See which loan offer suits you!

Here are some possible reasons why loan applications usually get declined:

Fake documents.

We may have reached an era of technological advancements. Still, some people falsify their documents just to try their luck and get away with it. What these people tend to forget is that it is way easier now to determine whether a document is real or not.

Keep in mind that once a lender catches you, you will not only automatically lose your chance to get a loan, but legal actions may also be filed against you.

Not Able to Meet Eligibility Requirements

Some Lenders only provide loans for certain areas. In addition, some Lenders only provide for certain borrowers. Some only lend to pensioners and OFWs, and some to employed people.

This is why it is best that you check the Lender’s eligibility requirements before you apply for any of its loans. In addition, most Lenders here in the country have required age, source of income, and citizenship for their loan approvals.

Incomplete Documents

Note that all required documents you will be submitting will be used to validate your given information. Lenders will not start to process your application if you have not yet completed submitting all the documents needed. More so, if your submitted documents are not clear.

Requesting for More Than You Can Handle

One thing you have to consider when you apply for a loan is to use a loan calculator. This will help you determine the following:

- How much you can borrow?

- How much you will have to pay including the interest.

- And lastly, how much will be your monthly repayment depending on your chosen term?

Some Lenders will reject your loan application if you ask for very high loans yet you don’t have enough means to pay for it.

Inconsistencies in your Given Information

All your given information together with your submitted documents will determine your creditworthiness. Inconsistencies in all information will give you the impression that you are not credible.

Financing corporations like Vidalia Lending offer loan programs that are perfect for your financial demands. Vidalia Lending lets clients borrow up to P500,000 depending on their applied loan feature with no hidden fees, and no prepayment penalty.

About The Author

Vidalia Lending Corp.

Vidalia Lending is a company based in Manila, Philiipines providing financial services. We offer personal loans and small business loans.

Related Posts

5 Ways to Get Approved for a Loan with Bad Credit History

May 3, 2024

Don’t Get Scammed: 8 Loan Pitfalls to Avoid

February 23, 2024

Salary Loan vs. Credit Card: Which is Better Amid COVID-19 Crisis?

August 19, 2020

Horoscope 101: Your Loan Application Destiny Before 2023 Ends

October 17, 2023

- Borrow and Lend

- Business Loans

- Business with Small Capital

- Cash Loan Philippines

- E-Commerce Loan

- Funding for Business

- Funding for Small Business

- Investing Money

- Investment Loan

- Lend and Borrow

- Lending Loans

- Loan Calculator

- Loan Philippines

- Micro Lending

- Money Investment

- Money Lenders

- Money Loans

- Online Investment

- Online Lenders

- Online Lending Company

- Online Loan

- Online Loan Philippines

- P2P Lending

- Peer Lending

- Peer to Peer lending

- Personal Finance

- Personal Loan Lenders

- Personal Loan Philippines

- Personal Loans

- Private Lenders

- Small Business Loans

- Social Lending

- Social Loan

Recent Posts

- Loan Sharks vs. Licensed Lenders: Know the 5 Key Differences May 6, 2024

- 5 Ways to Get Approved for a Loan with Bad Credit History May 3, 2024

- Boosting Efficiency: 6 Ways Loans Can Enhance Productivity May 3, 2024

- 9 PH Eyewear Brands To Get Your Glasses With Personal Loan May 2, 2024

- 7 Home-Based Creative Business Ideas with Business Loan April 30, 2024

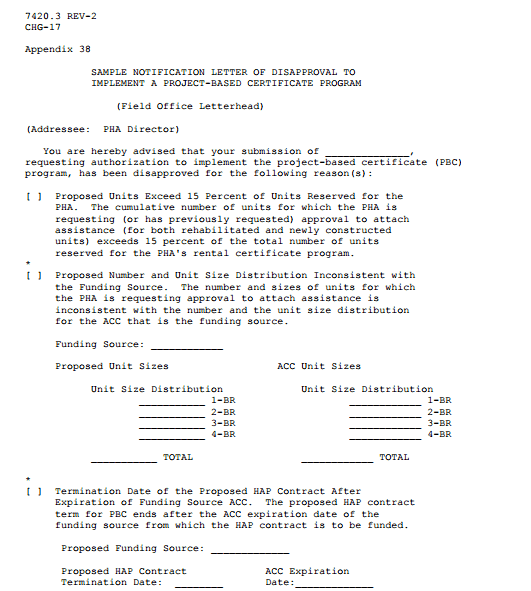

All Formats

5+ Disapproval Letter Samples

In the course of our lives, numerous circumstances necessitate us to submit formal applications either for acquiring a job, a leave grant, or even a scholarship grant. Afterward, we receive either an approval or disapproval letter. A disapproval letter informs the applicant that the request has been denied and states the accompanying reasons for such denial.

Loan Disapproval Letter

Disapproval of Agency Letter

Disapproval Notification Letter

Volunteer Disapproval Letter

Settlement Disapproval Letter

Disapproval Letter Sample for Commander

Steps in Writing a Disapproval Letter

- Write the pertinent details such as the name of applicant, date, and address at the upper part of the letter.

- Specify the request which you are disapproving. This is done for the sake of clarity as much as it is for formality.

- Enumerate through narration or in bulleted form the specific requirements which the applicant have failed to adequately meet. This is a crucial part because it offers the applicant a clear understanding of his or her rejection.

- Provide an alternative solution for the applicant. Preferably, a detailed delineation of the necessary steps the applicant can go through in order to reverse the disapproval into an approval. In this part, you can also state when and how to reapply or pass an appeal.

Things to Remember in Writing a Disapproval Letter

More in letters.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

IMAGES

VIDEO

COMMENTS

Loan Application Rejection Letter (15+ Samples) A loan rejection letter is a document that a credit provider issues to a loan applicant informing them of a rejection of the loan application. Every creditor has its own rules and regulations that govern loans. If you apply for a loan and you do not meet these requirements, the lender will reject ...

Loan Rejection Letter Template (PDF) A mortgage decline letter is an example of what a letter informing a client that his or her mortgage application has been declined should look like. With a sample to guide you through the process of drafting the letter, it will be much easier to write the letter.

38+ Payment Letter Templates. 29+ Sample Free Letter of Intent Templates - PDF, Word. Complaint Letter - 37+ Free Word, PDF Format Download! 10+ Writing Templates MS Word 2010 Format Free Download. 9+ Trainee Appointment Letters. Loan rejection letters are the formal documents that state the message of rejection for an entity's loan application.

Take these steps before you re-apply for a loan that was denied. By Justin Pritchard. Updated on March 26, 2022. Reviewed by Andy Smith. In This Article. View All. Identify the Cause of the Denial. Regroup Before You Re-Apply. Use Short-Term Strategies.

Contact your loan officer. When a lender rejects your loan application, "it shouldn't be a surprise," says Brian Koss, the Winchester, Mass.-based regional sales director of Movement ...

Under the Equal Credit Opportunity Act, you have the right to ask your lender why it rejected your application, as long as you ask within 60 days. After you request an explanation, the lender must ...

A credit denial letter is an official notification written by lenders to inform an individual or business of the rejection of their loan request. It is usually sent for applications for loans, mortgages, credit cards, and business credit lines. It also informs the applicant why their application was rejected.

The bottom line. If you have been denied a loan, take the time to review your application and see what went wrong. Then, work on improving the aspects that got you denied in the first place. For ...

It's essential to comprehend why your loan application was rejected. Common reasons include a low credit score, insufficient income, or high debt-to-income ratio. Typically, lenders will send you a letter or other form of communication explaining why your application was rejected. If you didn't receive a letter, contact the lender and ask ...

1. Review your decline notice. The very first thing you should do is understand why you were declined for a personal loan. Any lender who denies loan approval is required to send an adverse action notice, which lists the reason (s) your application was declined.

This document will contain an explanation for the denial. Here are some possible reasons why a personal loan application could be denied. 1. Your credit score is too low. Your FICO credit score indicates to lenders how likely you are to repay your debts.

Author: u/SarcasticPeace. Title: I received a denial letter for a loan I didn't apply for. Original Post: About a week ago I received a letter saying I was denied for a loan I never applied for. I am not sure what the loan was for, how much it was for, how it was processed, or at what location. Some information:

The best way to is to preemptively prepare before you even begin applying for a home loan. The basics steps for success are: 1. Know Your Credit Score. Request credit reports from all three major credit bureaus, since the information can vary. Work on correcting any inaccuracies or discrepancies between credit reports.

Review your credit report. If the loan decline notice cited issues with your credit score, try requesting a copy of your credit report to figure out the problem. To do this, you can go to AnnualCreditReport.com and request a copy. You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies.

An application letter for a loan is a formal letter written to a financial institution by a borrower requesting a loan, payable in a specified amount of time. The letter helps lenders get acquainted with the borrowers better to determine if they qualify for the loan based on the information provided or not. Writing it is important because it ...

Small Business Administration (SBA) loans provide another option for small businesses that otherwise can't qualify for loans. In this case, the SBA does not act as a lender, but instead works with lenders to set the guidelines and guarantees the loan will provide the funds. Businesses look to SBA loans when they've run out of options.

Re.: Loan Rejection Letter. Dear Sir, With reference to your application for loan dated (date), we have to say that it is against the bank policy to sanction loan for buying a (Product Name). I regret to say 'no' to your request but hope that you will appreciate that we cannot go against bank regulations. (show actual problem and situation).

A letter of disapproval can be written in different situations, for example disapproval of an agenda in an organization, disapprove a suggestion of a coworker, a subordinate or a colleague, opposing a legislation, disapprove a pay bill, benefits or allowances. There could be many more reasons and grounds of disapproval. The purpose of writing ...

Loan Disapprove Letter. Dear Ms. Cornejo: As per inquiry with our Credit Evaluation. Your loan application was fully validated but the system disapproved. The reason for disapproval are not being disclosed if system disapproved. You can submit your loan application after six months to re evaluate. Thanks for your interest doing transaction with us.

For people who got their loans rejected, you must also know that some lending companies will not fully disclose why your application was not approved. Vidalia Lending has different loan offers perfect for your monetary needs. Loan repayments are also fixed without any hidden charges. Interest rates are lower compared to other lending companies ...

Docx. Size: 29 kB. Download. Disapproval letters come in various forms depending on its purpose. We have collated samples of disapproval letters available for your perusal. A loan disapproval letter informs the applicant that he has failed to satisfy the requirements for loan.

Declined PAG-IBIG loan - need advice. Hi everyone! My PAG-IBIG loan application recently got declined, which is a surprise for me. I have good credit standing (I always pay my credit cards in full), and I was able to secure a car loan from a bank years ago. The reason was "Negative CI-Reduced loanable amount due to insufficient income".