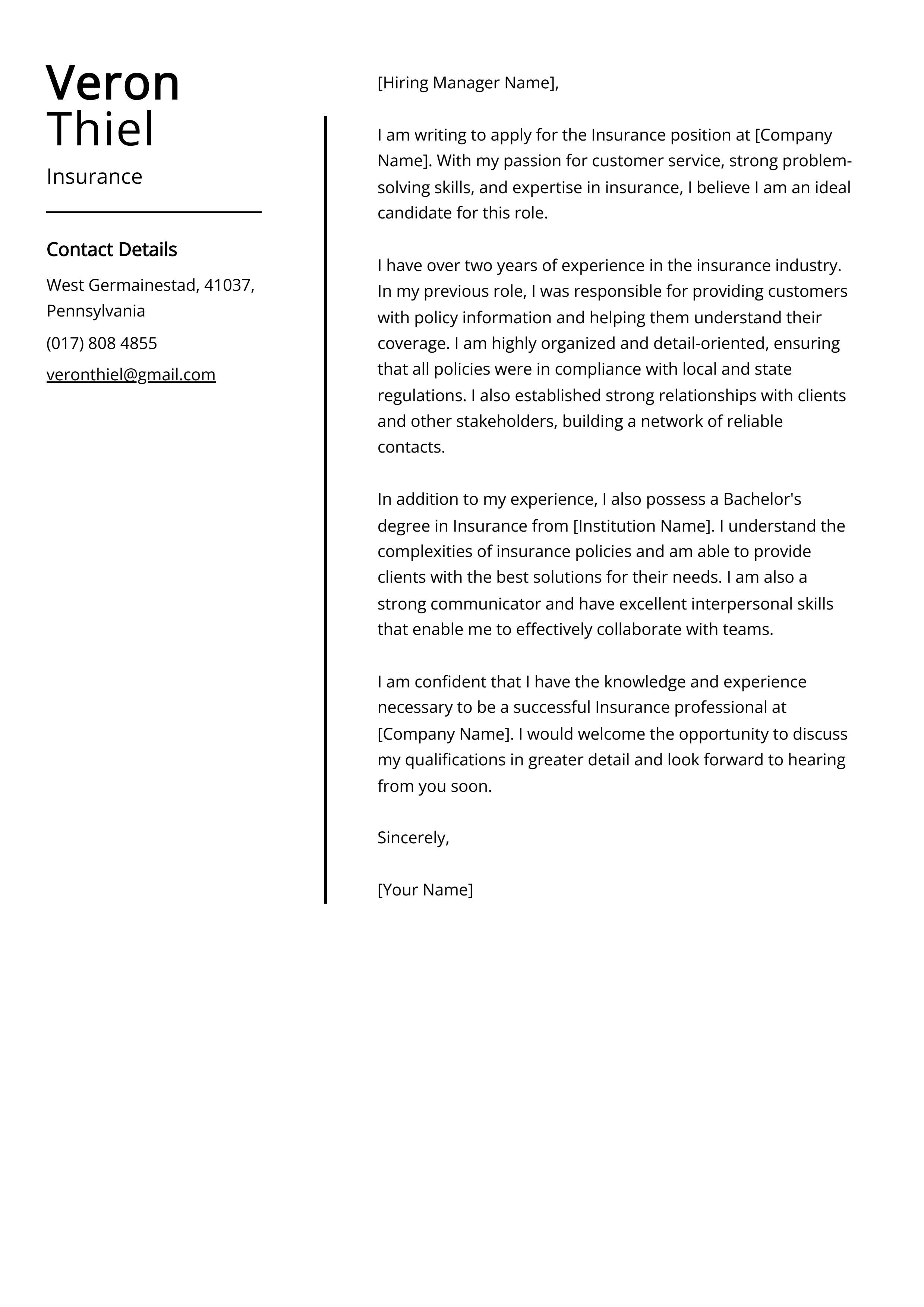

Professional Insurance Agent Cover Letter Example for 2024

Read for inspiration or use it as a base to improve your own Insurance Agent cover letter. Just replace personal information, company application data and achievements with your own.

Cover Letter Guide

Make your insurance agent cover letter stand out.

So are cover letters necessary for Insurance Agent jobs?

Well, the cover letter is your chance to tell a personal story to the hiring manager. It can help you prove you’re a real professional who knows what they bring to the table.

It’s also your opportunity to get into more detail about your personal qualities and success stories. But most importantly – it’s the first place to show your motivation.

So yes, having a cover letter is essential.

But what should yours look like? Let’s see…

So what does a good cover letter look like?

Well, it’s written in a tone of voice that matches the specific company’s culture, and it’s not just a long-form resume. It’s also focused on making the right impression.

We advise you to talk about your achievements, goals, and motivations, rather than just plainly listing your skills and experience. Try to tell a personal story.

And if that’s not enough, we have some additional pro tips for you.

Stand out with a strong introduction and an appropriate salutation

Choosing the right salutation for your cover letter is crucial – after all, it’s the first thing the hiring manager will read.

For this reason, we’ve gathered several classic salutations. Note that some of them could be used even if you don't know the hiring manager's name.

- Dear Ms. Smith,

- Dear Peter Roberts,

- To the [company name] Recruitment Team,

- Dear Hiring Manager

Coming up with a good introduction is your chance to make the right impression and give the hiring manager a solid reason to remember you.

So instead of going for popular opening lines such as “I found your job advert on website X”, prove that you are actually passionate about the position. Share why you would like to grow in this field and what makes the company exciting.

Talk about your hard and soft skills

While the resume is considered the best place to showcase your hard skills and achievements, the cover letter should tell a story and prove your enthusiasm for the field.

This is why we advise you to focus on soft skills and results. Think about all your soft skills and how they have helped you grow as a professional and crush your goals. Then turn this into your own very short success story.

Make sure to include some hard skills too, especially the ones listed as part of the requirements section of the job advert. This will guarantee that you pass applicant tracking systems (ATS) that screen applicant documents for keywords.

And remember – the cover letter should include new information without repeating your whole resume. It needs to offer additional value to the recruiter.

Show that you did your research before applying

Proving that you are familiar with the company, its problems, and its goals is without a doubt one of the best ways to stand out.

If you want to show your passion for the company, mention how your skills and previous achievements can help the team grow.

It’s also worth mentioning how your experience can help resolve some of the most common industry issues.

Finish your cover letter with a call to action

By now you’ve managed to make a good impression on the hiring manager, and it’s important not to ruin it. That’s why you need your ending to be just as great as your cover letter’s body.

But what are the things that make up a memorable closing line? Expressing gratitude for the reader’s time and consideration, and saying that you look forward to their reply, to name a couple.

You can stick to traditional phrases (e.g. Looking forward to hearing from you soon) if you wish to be on the safe side. Just make sure that the language you use matches the company culture.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

Recession-Proof Jobs to Consider in an Unstable Economy

How hotjar built a 100% distributed company, google docs resume templates, prepare for a job interview with these 40+ chatgpt prompts, how to write cold emails for job opportunities, how to answer 'what was your greatest accomplishment' in an interview.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Insurance Cover Letter: Sample & Guide [Entry Level + Senior Jobs]

Create a standout insurance cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Writing a cover letter for an insurance job can be intimidating. With this guide, you'll understand how to write a competitive and professional cover letter that will give you the best chance of landing the job. We'll walk you through crafting your cover letter, from understanding the basics of insurance cover letters to actionable tips for creating an impressive and unique document.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Community Health Nurse Cover Letter Sample

- Clinical Nurse Educator Cover Letter Sample

- Clinical Research Associate Cover Letter Sample

- Infusion Nurse Cover Letter Sample

- Hospital Pharmacist Cover Letter Sample

- Dental Lab Technician Cover Letter Sample

- General Practitioner Cover Letter Sample

- Athletic Trainer Cover Letter Sample

- Nursing Attendant Cover Letter Sample

- Assistant Director Of Nursing Cover Letter Sample

- Staff Pharmacist Cover Letter Sample

- ER Nurse Cover Letter Sample

- Orthodontist Cover Letter Sample

- Staff Nurse Cover Letter Sample

- Pediatric Nurse Cover Letter Sample

- Pharmacy Assistant Cover Letter Sample

- Care Manager Cover Letter Sample

- Experienced Psychiatrist Cover Letter Sample

- Director Of Nursing Cover Letter Sample

- Nursing Assistant Cover Letter Sample

Insurance Cover Letter Sample

Dear Hiring Manager,

I am submitting my application for the position of Insurance with your organization. With over 10 years of experience in the insurance industry, I have the knowledge and expertise to be an effective member of your team.

I am currently working as an Insurance Agent with ABC Insurance Company, where I am responsible for providing customers with a variety of insurance products and services. I specialize in life and health insurance, and have been successful in helping customers develop comprehensive insurance plans tailored to their needs. My experience also includes providing customers with quotes, explaining policy coverage options, and negotiating premium rates.

In addition to my technical knowledge of the insurance industry, I possess strong customer service skills. I have had success in building relationships with customers and helping them to understand their policy coverage. I am also skilled in resolving customer complaints and handling difficult conversations with professionalism and empathy.

I am confident that my experience and qualifications make me an ideal candidate for the position. I am excited at the prospect of joining your team and contributing to the growth of your organization.

Thank you for your time and consideration. I look forward to hearing from you.

Sincerely, John Doe

Why Do you Need a Insurance Cover Letter?

- A insurance cover letter is a great way to make sure that you are adequately covered for any eventuality.

- It can help to protect you from financial losses and provide peace of mind in the event of an accident or other unexpected event.

- Insurance cover letters provide an assurance that any losses you suffer will be covered by the insurance company.

- Having an insurance cover letter also helps to ensure that you are not left with a large financial burden if something unexpected happens.

- Having a insurance cover letter is also important if you have any assets such as a house or a car that you would like to be protected.

- In the event of an accident, the insurance cover letter will provide you with the financial assistance that you need in order to recover any losses.

- Having an insurance cover letter also helps to ensure that your medical costs are covered in the event of an illness or injury.

A Few Important Rules To Keep In Mind

- Start with a professional greeting. Address your letter to the hiring manager by name if you know it.

- Outline your most relevant qualifications and experience in your opening paragraph.

- Include specific details that relate to the position and demonstrate why you are the ideal candidate.

- Explain why you are interested in the position and why you are the best candidate for the job.

- Keep your letter brief and to the point. Avoid using flowery language and excessive detail.

- Provide examples that demonstrate your experience and qualifications.

- Close with a thank you and a call to action.

- Proofread your letter carefully to ensure that there are no spelling or grammar errors.

What's The Best Structure For Insurance Cover Letters?

After creating an impressive Insurance resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Insurance cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Insurance Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

A Insurance Cover Letter Body Should Typically Include:

- A brief introduction that states the position you are applying for and why you are a good fit for the role.

- A description of your relevant experience and skills, including any industry-specific knowledge.

- Examples of how you have demonstrated the required skills in past positions (if applicable).

- A statement of your enthusiasm for the job and the company.

- A closing paragraph that summarizes your qualifications and expresses your interest in the position.

When writing a cover letter for an insurance job, it is important to focus on the specific skills that you possess that make you a qualified candidate. It is important to demonstrate your knowledge of the insurance industry and your interest in the position. Your cover letter should also focus on the benefits that you can bring to the organization.

When highlighting my relevant experience, I focus on the skills and knowledge I have acquired through my past positions. For example, I have years of experience in the insurance industry, so I am well versed in the industry's regulations and procedures. I am also knowledgeable about the various types of insurance policies available and the various coverage levels. Additionally, I possess excellent customer service and communication skills, which I have utilized in my past roles.

In my previous positions, I have demonstrated my ability to handle customer inquiries and complaints in a timely and professional manner. I am also highly organized and have experience in processing and filing paperwork. My strong attention to detail ensures that all documents are accurate and up to date. I have the ability to work independently and as part of a team, and I am comfortable taking on additional tasks when needed.

I am excited about the opportunity to join your organization and am confident that I can make a positive contribution. I am eager to use my knowledge and experience to help your organization succeed. Please do not hesitate to contact me if you have any questions. I look forward to hearing from you.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing an Insurance Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Failing to customize the cover letter for the specific position and company.

- Including irrelevant personal information.

- Using a generic greeting such as "To whom it may concern" or "Dear Sir or Madam".

- Using too much technical jargon.

- Making spelling and grammar mistakes.

- Using overly flowery or fancy language.

- Including information that has already been included in the resume.

- Not mentioning any of the skills or qualifications the employer is looking for.

- Failing to provide contact information.

Key Takeaways For an Insurance Cover Letter

- Highlight relevant skills and qualifications that are relevant to the insurance industry.

- Express a clear understanding of the job role and how your skills will help the company.

- Explain the value you can bring to the company in terms of experience and qualifications.

- Outline the unique benefits of the insurance product and explain how it can help the customer.

- Communicate your enthusiasm and commitment to the insurance company and the customer.

- Provide examples of how you have successfully solved customer problems in the past.

- Convey a deep understanding of the customer’s needs and explain how the insurance product can meet them.

- Be professional and courteous in your correspondence.

- Ensure that all relevant information is included in the letter.

1 Insurance Agent Cover Letter Example

Insurance Agents excel at assessing risk, tailoring policies to individual needs, and providing peace of mind in uncertain situations. Similarly, your cover letter is your opportunity to assess and present your own professional 'risks' and 'policies' - your skills, experiences, and unique value - in a way that provides recruiters with confidence in your potential. In this guide, we'll navigate through top-notch Insurance Agent cover letter examples, ensuring your application stands out in the competitive insurance industry.

Cover Letter Examples

Cover letter guidelines, insurance agent cover letter example, how to format a insurance agent cover letter, cover letter header, what to focus on with your cover letter header:, cover letter header examples for insurance agent, cover letter greeting, get your cover letter greeting right:, cover letter greeting examples for insurance agent, cover letter introduction, what to focus on with your cover letter intro:, cover letter intro examples for insurance agent, cover letter body, what to focus on with your cover letter body:, cover letter body examples for insurance agent, cover letter closing, what to focus on with your cover letter closing:, cover letter closing paragraph examples for insurance agent, pair your cover letter with a foundational resume, cover letter writing tips for insurance agents, highlight your expertise in the insurance industry, showcase your sales skills, demonstrate your customer service abilities, emphasize your attention to detail, express your adaptability, cover letter mistakes to avoid as a insurance agent, failing to highlight relevant skills, using generic language, not proofreading, being too lengthy, not showing enthusiasm, cover letter faqs for insurance agents.

The best way to start an Insurance Agent cover letter is by addressing the hiring manager directly, if their name is known. Then, introduce yourself and state the position you're applying for. Make sure to include a compelling hook in your opening paragraph that highlights your relevant experience, skills, or achievements. For instance, you could mention how your expertise in risk management strategies led to a significant decrease in claims at your previous company. This not only grabs the reader's attention but also shows that you understand the role and its requirements.

Insurance Agents should end a cover letter by summarizing their key skills and experiences that make them a suitable candidate for the role. They should express enthusiasm for the opportunity and show interest in the company's mission or values. It's also crucial to include a call to action, such as a request for an interview or a meeting. For example: "I am excited about the opportunity to bring my unique blend of skills and experience to your team and am confident that I can contribute to your company's success. I look forward to the possibility of discussing my application with you further. Thank you for considering my application." Remember to end the letter professionally with a closing like "Sincerely" or "Best regards," followed by your full name and contact information.

An Insurance Agent's cover letter should ideally be about one page long. This length is sufficient to introduce yourself, explain why you're interested in the insurance field, highlight your relevant skills and experiences, and express your interest in the specific agency you're applying to. It's important to keep it concise and to the point, as hiring managers often have many applications to review and may not spend a lot of time on each one. A well-written, one-page cover letter can effectively convey your qualifications and enthusiasm for the job without overwhelming the reader with too much information.

Writing a cover letter with no experience as an Insurance Agent can seem challenging, but it's all about showcasing your transferable skills, eagerness to learn, and passion for the industry. Here's a step-by-step guide on how to do it: 1. Start with a Professional Greeting: Address the hiring manager by name if possible. If you can't find the name, use a professional greeting such as "Dear Hiring Manager". 2. Opening Paragraph: Begin by stating the position you're applying for. Express your enthusiasm for the role and the company. If someone referred you, mention their name and connection to the company here. 3. Highlight Transferable Skills: Even if you don't have direct experience as an Insurance Agent, you likely have skills that can be applied to the role. These could include customer service, sales, problem-solving, or analytical skills. Use specific examples from your past work, education, or volunteer experience to demonstrate these skills. For example, if you've worked in retail, you might discuss how you upsold products or handled customer complaints. 4. Show Industry Knowledge: Show that you understand the insurance industry and the role of an Insurance Agent. You could mention relevant coursework, certifications, or self-study. Discuss why you're interested in insurance and how you plan to contribute to the company. 5. Show Enthusiasm and Willingness to Learn: Employers value candidates who are eager to learn and grow. Express your willingness to undergo training and learn the ins and outs of the industry. 6. Closing Paragraph: Reiterate your interest in the role and the company. Thank the hiring manager for considering your application and express your hope for further discussion. 7. Professional Sign-off: Close the letter with a professional sign-off such as "Sincerely" or "Best regards", followed by your full name. Remember to keep your cover letter concise and to the point, and always proofread before sending it. Tailor each cover letter to the specific job and company, showing that you've done your research and are genuinely interested in the role.

Related Cover Letters for Insurance Agents

Insurance agent cover letter, call center cover letter.

Customer Service Manager Cover Letter

Customer Success Manager Cover Letter

Flight Attendant Cover Letter

Personal Trainer Cover Letter

Related Resumes for Insurance Agents

Insurance agent resume example.

Try our AI-Powered Resume Builder

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Insurance Agent Cover Letter Sample

Increase your chances of scoring a job & find ideas for your next cover letter with this editable Insurance Agent cover letter sample. Use this cover letter sample as it is or try to redesign it using our powerful cover letter maker.

Related resume guides and samples

How to craft an appealing administration resume?

How to create a professional facilities manager resume

How to write an effective front desk receptionist resume?

How to build an effective office staff resume

How to build an effective personal assistant resume?

Insurance Agent Cover Letter Sample (Full Text Version)

Ludovic Cortot

Dear Hiring Managers,

As an experienced and results-oriented finance professional, I am pleased to submit my application for the Insurance Agent job at Varbsy & Co., Ltd. Not only I am confident that I possess the qualifications necessary to execute the role and all associated duties but I also believe that I could become a great addition to your team and company.

With over three years of extensive career experience in this industry, I am especially adept at providing financial recommendations and expertise to clients based on their financial goals, ensuring that their needs are always fulfilled. At Insurance Revolution, Inc., I was mainly in charge of conducting professional financial market analysis, promoting the company's financial services, and developing new strategies and plans in order to meet sales goals and increase revenue and profits. There, I had proved multiple times that I excel at working well independently or in a team setting. Moreover, this valuable experience has helped to significantly improve my communication and customer service skills.

I am a native French speaker with a proficiency in English and Spanish and the important ability to use multiple industry software programs, for instance, QuickBooks, SIBRO, Aspire, and A1 Tracker at an expert level. Furthermore, I am offering excellent problem-solving skills and the ability to remain calm in stressful situations. On top of that, I am a Certified Insurance Counselor with a Finance & Risk Management degree from the ESLSCA Business School. I have enclosed my up-to-date resume for your further review and I would welcome the opportunity to meet with you and discuss the job in more detail.

Thank you for your time and consideration and I look forward to hearing back from you soon.

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Facilities Manager Investment Advisor Bookkeeper Personal Assistant Accountant Auditor Insurance Agent Finance Analyst Office Staff Tax Services Front Desk Receptionist Administration

Related insurance agent resume samples

Related insurance agent cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Insurance Cover Letter Examples

A great insurance cover letter can help you stand out from the competition when applying for a job. Be sure to tailor your letter to the specific requirements listed in the job description, and highlight your most relevant or exceptional qualifications. The following insurance cover letter example can give you some ideas on how to write your own letter.

or download as PDF

Cover Letter Example (Text)

Hallie Glant

(793) 597-4266

Dear Aubrynn Faden,

I am writing to express my interest in the insurance position available at Allstate Corporation, as advertised. With a solid foundation of five years of experience in the insurance industry, gained through my tenure at AXA SA, I am excited about the opportunity to contribute to your esteemed company and further hone my skills in a new environment.

During my time at AXA SA, I was fortunate to have honed a comprehensive skill set that I believe aligns well with the expectations for the role at Allstate Corporation. My experience has equipped me with a deep understanding of insurance policies, underwriting, risk assessment, and customer service excellence. I have consistently demonstrated my ability to manage and grow client portfolios while maintaining a high standard of compliance and due diligence.

I take pride in my ability to build and maintain strong relationships with clients, offering them tailored solutions that meet their unique needs. My analytical skills, coupled with my attention to detail, have enabled me to identify potential risks and make informed decisions that benefit both the company and our clients. Furthermore, I have actively contributed to team success through collaboration, sharing best practices, and innovative thinking.

I am particularly drawn to the prospect of working for Allstate Corporation because of your commitment to customer satisfaction and your innovative approach to insurance products and services. I am eager to bring my background in insurance and customer service to your team, where I am confident that my proactive approach and dedication to excellence will lead to successful outcomes.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my experience and skills will be beneficial to Allstate Corporation. I am enthusiastic about the possibility of joining your team and contributing to your company’s continued success.

Warm regards,

Related Cover Letter Examples

- Insurance Sales Agent

- Insurance Account Executive

- Insurance Billing Specialist

- Insurance Sales Manager

- Insurance Sales Representative

- Insurance Verification Specialist

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

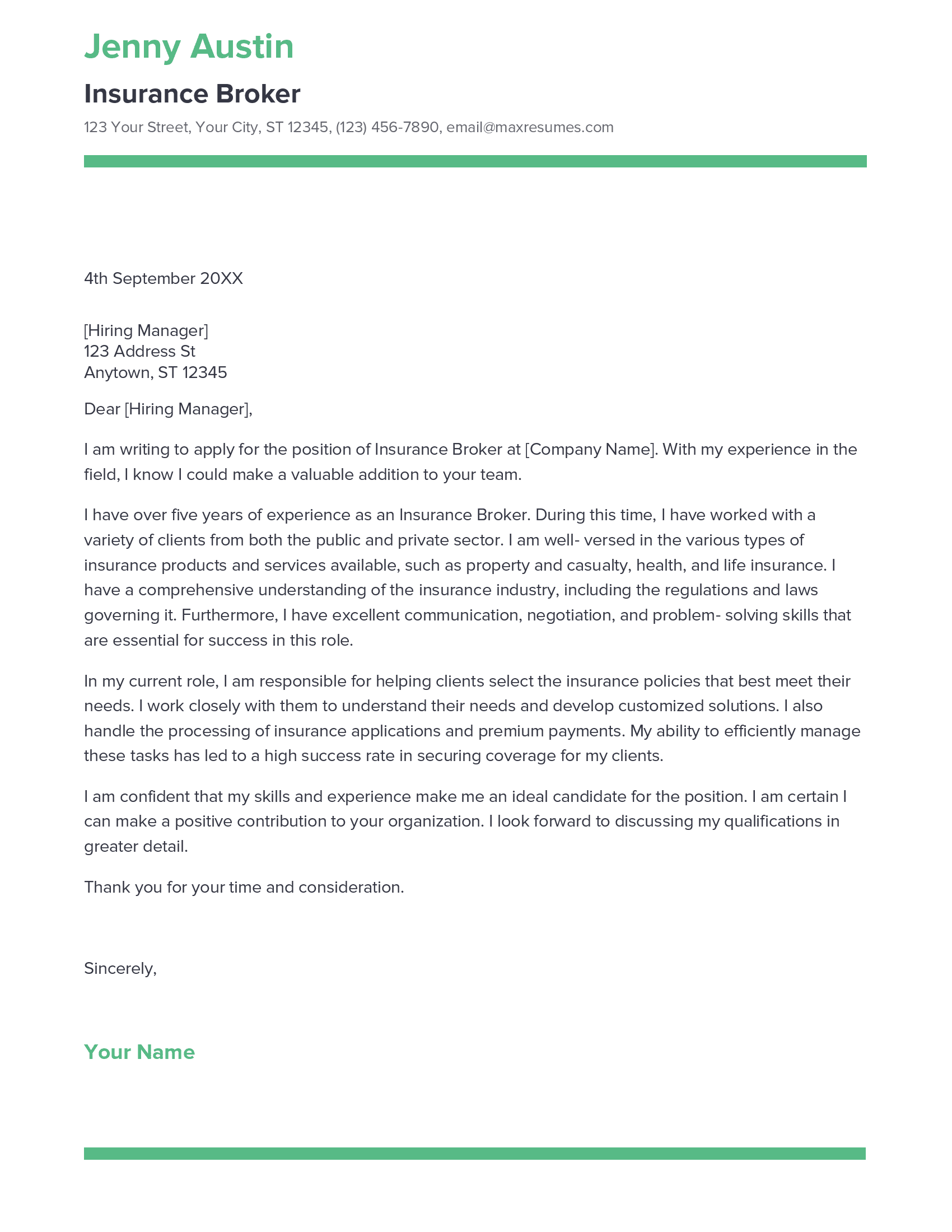

Insurance Broker Cover Letter Example

Writing a cover letter for a job as an insurance broker can be a challenging and time-consuming task. It requires a combination of research into the job requirements, a thorough understanding of the insurance industry and the development of a tailored, well-crafted and professional letter. This guide provides a comprehensive overview of what should be included in an insurance broker cover letter, along with an example to give you a better idea of what the final product should look like.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Insurance Broker Cover Letter Sample

Dear [Hiring Manager],

I am writing to apply for the position of Insurance Broker at [Company Name]. With my experience in the field, I know I could make a valuable addition to your team.

I have over five years of experience as an Insurance Broker. During this time, I have worked with a variety of clients from both the public and private sector. I am well- versed in the various types of insurance products and services available, such as property and casualty, health, and life insurance. I have a comprehensive understanding of the insurance industry, including the regulations and laws governing it. Furthermore, I have excellent communication, negotiation, and problem- solving skills that are essential for success in this role.

In my current role, I am responsible for helping clients select the insurance policies that best meet their needs. I work closely with them to understand their needs and develop customized solutions. I also handle the processing of insurance applications and premium payments. My ability to efficiently manage these tasks has led to a high success rate in securing coverage for my clients.

I am confident that my skills and experience make me an ideal candidate for the position. I am certain I can make a positive contribution to your organization. I look forward to discussing my qualifications in greater detail.

Thank you for your time and consideration.

Sincerely, [Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Insurance Broker cover letter include?

A Insurance Broker Cover Letter should include some key information to help you stand out from other applicants.

First, you should introduce yourself and explain why you are the right fit for the position. Explain the experience and knowledge you have in the insurance industry and how you can benefit the organization. Mention any certifications you have as an insurance broker and highlight how your skills and expertise can be an asset to the company.

Next, discuss your professional accomplishments and how they can help the organization achieve its goals. Be sure to mention any awards or recognition you’ve received that demonstrate your success in the industry.

Finally, express your enthusiasm for the chance to join the team and indicate that you would be a great fit for the position. Let the hiring manager know that you are eager to start working and committed to going above and beyond.

By providing this information in your cover letter, you will stand out from the competition and demonstrate your commitment to the insurance industry.

Insurance Broker Cover Letter Writing Tips

Writing a cover letter for a position as an insurance broker can be a daunting task. However, with the right approach, you can make your cover letter stand out from the competition and increase your chances of success. Here are some tips to help you write an effective cover letter for an insurance broker position.

- Research the Company: Before you begin writing your cover letter, thoroughly research the company. Look into their values and mission, as well as their history and successes. This will help you tailor your letter to the company and show them that you have a genuine interest in the position.

- Personalize the Letter: When writing your cover letter, make sure to customize the content to the specific company and the job opening. Make sure to highlight your experience and qualifications that are relevant to the role and demonstrate how they can benefit the company.

- Outline Your Professional Experience: Use your cover letter to outline your professional experience and accomplishments. Make sure to highlight any relevant roles and responsibilities, as well as any successes that you have achieved.

- Explain Your Passion: Use your cover letter to explain why you are passionate about working as an insurance broker. Show the hiring manager that you understand the role and are excited to contribute to their team.

- Proofread Your Letter: Before sending your cover letter, make sure to proofread it for any spelling and grammar errors. This will demonstrate to the hiring manager that you are detail- oriented and take your application seriously.

Following these tips will help you create a successful cover letter for an insurance broker position. With the right approach, you can increase your chances of getting the job. Good luck!

Common mistakes to avoid when writing Insurance Broker Cover letter

Writing an effective cover letter is one of the most important steps when applying for an insurance broker position. Not only does it showcase your relevant qualifications and skills, but it also serves as a way to introduce yourself and make a good first impression. Unfortunately, many people make some common mistakes when writing their cover letter and end up not getting the job. Here are some tips to help you avoid those common mistakes and write an insurance broker cover letter that will get you noticed:

- Keep it brief: Most hiring managers have a lot of cover letters to read, so it’s important to keep yours brief and to the point. Aim for no more than three paragraphs and make sure that each point is clearly stated and easy to read.

- Research the company: Showing that you’ve done your research on the company will demonstrate your interest and commitment to the position. You can mention specific products or services the company provides, or any recent success stories the company has had.

- Be specific: When describing your qualifications and experience, make sure you are specific. Don’t just say that you “have experience in the insurance industry”; explain what type of experience, such as customer service, sales, or marketing.

- Avoid clichés: Cover letters are often full of clichés, such as “I am a hard worker” or “I have a great attitude”. These statements may be true, but they don’t stand out and won’t help you differentiate yourself from other applicants.

- Proofread: Make sure you proofread your cover letter multiple times before sending it. A single spelling or grammar mistake can make you appear unprofessional and could cost you the job.

Following these tips will help you avoid common mistakes when writing an insurance broker cover letter and increase your chances of getting an interview. Good luck!

Key takeaways

Writing an impressive cover letter is an important part of applying for a job as an insurance broker. A well- written cover letter can be the difference between securing an interview and having your resume ignored. Therefore, it is important to make sure your cover letter is not only well- crafted but also highlights the skills and experience that make you the ideal candidate. Here are some key takeaways for writing an impressive cover letter for an insurance broker position:

- Outline Your Qualifications: Your cover letter should include a brief summary of your qualifications, including relevant experience and education that make you an ideal candidate.

- Showcase Your Knowledge: Include examples of your knowledge and understanding of the insurance industry. Highlight any special skills or certifications you may have, such as a license to practice in a certain state or any specialized training you may have received.

- Demonstrate Your Ability to Connect: Emphasize your ability to connect with clients on a personal level. This is an important skill for insurance brokers, as they are responsible for building relationships with clients and helping them purchase the best possible insurance coverage for their needs.

- State Your Goals: Explain why you are the best candidate for the position and why you would be a valuable asset to the company. Be sure to explain what you can bring to the table and why you are the best person for the job.

- Use Positive Language: Make sure you use positive language throughout your letter. Avoid using overly formal or technical language, as this can be off- putting to employers. Focus instead on expressing your enthusiasm for the role and your commitment to helping clients find the best possible coverage.

- Proofread Your Letter: Finally, make sure you proofread your letter multiple times. This will ensure that your cover letter is free of typos and grammatical errors.

By following these key takeaways, you can craft an impressive cover letter that

Frequently Asked Questions

1. how do i write a cover letter for an insurance broker job with no experience.

Writing a cover letter for an Insurance Broker job when you have no experience can be a daunting task. However, having a well- crafted, professional cover letter can make all the difference in helping you land the job. Start by introducing yourself and highlighting your interest in the position. Be sure to mention any relevant experience or coursework you have completed, even if it is unrelated to Insurance Broker jobs, as this can give the employer insight into your skills and abilities. You should also explain why you are interested in the job and what qualifies you for the role. Finally, express your enthusiasm and thank the employer for their time.

2. How do I write a cover letter for an Insurance Broker job experience?

When writing a cover letter for an Insurance Broker job with experience, it is important to showcase your qualifications and experience. Begin by introducing yourself and outlining the position you are applying for. Next, you should list any relevant qualifications, such as a degree in insurance or relevant certifications. Be sure to highlight any relevant experience you have in the field, such as previous roles or projects. Additionally, provide examples of how you have gone above and beyond in your current or past positions. Finally, express your enthusiasm and thank the employer for their time.

3. How can I highlight my accomplishments in Insurance Broker cover letter?

It is important to highlight your accomplishments in a cover letter for an Insurance Broker job. Make sure to mention any awards, certifications, or accomplishments you have achieved related to insurance. Also, provide specific examples of how you have gone above and beyond in your current or past roles, such as taking on extra projects or helping to increase sales. Finally, make sure to mention any customer service skills you have acquired and how you have used them in your current or past positions.

4. What is a good cover letter for an Insurance Broker job?

A good cover letter for an Insurance Broker job should include an introduction that outlines your interest in the job and any relevant experience or qualifications. Include specific examples of how you have gone above and beyond in your previous roles, and highlight any accomplishments or awards you have achieved in the field. Make sure to note any customer service skills you have and how you have used them in your current or past positions. Lastly, express your enthusiasm and thank the employer for their time.

In addition to this, be sure to check out our cover letter templates , cover letter formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

Let us help you build your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder

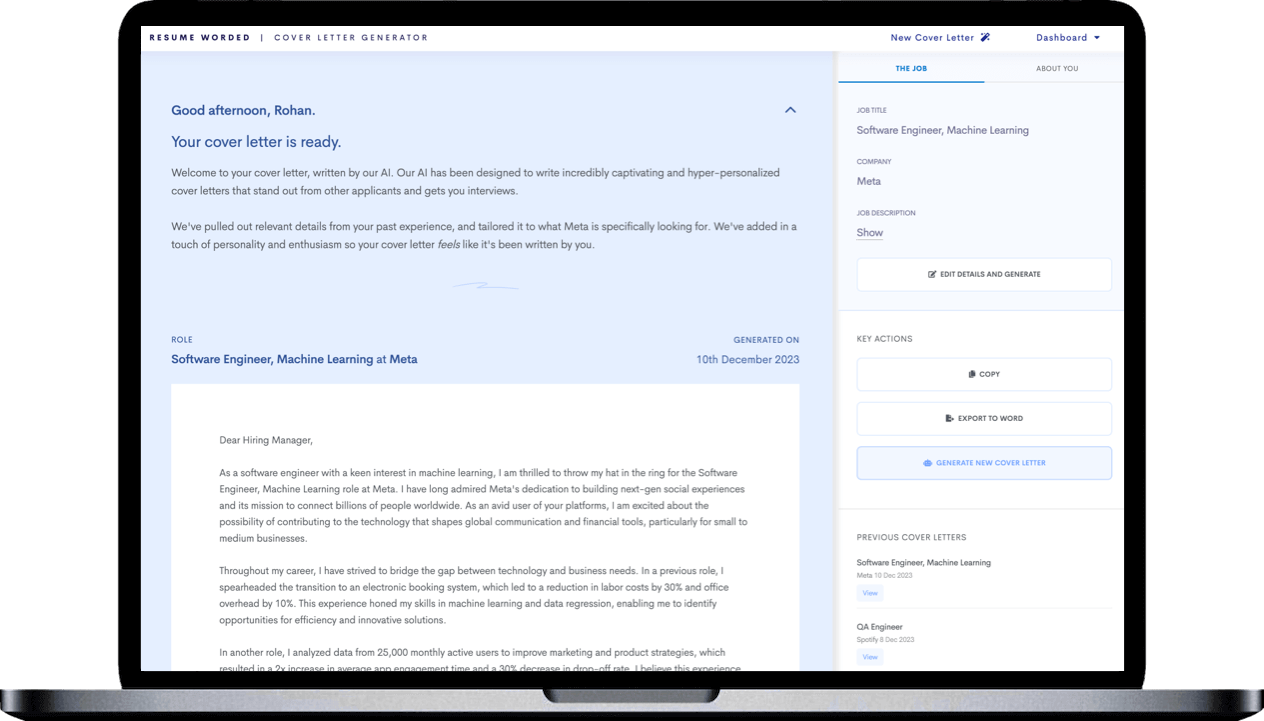

Resume Worded | Career Strategy

7 life insurance agent cover letters.

Approved by real hiring managers, these Life Insurance Agent cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Life Insurance Agent

- Senior Life Insurance Agent

- Senior Life Insurance Specialist

- Senior Life Insurance Sales Representative

- Alternative introductions for your cover letter

- Life Insurance Agent resume examples

Life Insurance Agent Cover Letter Example

Why this cover letter works in 2024, exceeding sales targets.

By showcasing a specific achievement and linking it to the company's needs, this cover letter demonstrates the candidate's ability to excel in the role and contribute to the company's success.

Generating Leads and Referrals

Mentioning a specific strategy for generating leads and the resulting increase in new clients shows the candidate's ability to adapt their approach to the company's objectives and make a tangible impact on their business.

Showcasing Proven Results

This cover letter does a great job of highlighting past achievements in a tangible way. By stating specific statistics like "closing 75% of my leads and exceeding targets by 30%," you demonstrate your ability to not only meet but exceed expectations. Remember, it's not about bragging, it's about showing your potential employer that you can deliver results.

Passion goes a long way

Passion is a powerful tool that can sometimes tip the scales in your favor during the hiring process. The excitement expressed about the role and the opportunity to make a difference in people's lives is infectious. It tells me, as a recruiter, that this isn't just a job for you but a mission you're eager to be a part of.

Expressing Alignment with Company Values

By sharing your admiration for the company's values, you show you've done your homework and that you align with their mission. This tells me that you're not just looking for any job, but specifically this one. It also signals that you might fit in well with the company culture.

Highlighting Community Outreach

Detailing your community outreach work shows that you're proactive and understand the importance of educating potential clients. This signals that you're not just about selling policies, but also about making sure people understand what they're buying. It's an excellent way to show you're both results-oriented and customer-focused.

Enthusiasm for Continuous Learning

When you express excitement about the company's learning and development programs, it shows me that you have a growth mindset and are eager to keep improving. This is a great trait in an employee and tells me that you're likely to stay engaged and motivated on the job.

Passion for the Industry

Telling me that you're passionate about making a difference through insurance is a good sign. It suggests that you find meaning in your work, which can translate into greater job satisfaction and better performance. Plus, it shows that you understand the human impact of what you do, which is crucial in this industry.

Confidence and Forward Thinking

Signing off as the company's "future Life Insurance Agent" is a bold move. It shows confidence, which can be crucial in a sales-oriented role like this. It also hints at your positive attitude and forward-thinking mindset, which can be appealing to employers.

Align your values with the company's

Showing that your personal values match the company’s goals helps me see you as a good fit for our team.

Use real results to showcase your skills

By mentioning specific achievements, like exceeding sales targets, you prove your ability to succeed in this role.

Highlight moments that show your impact

Telling about times you've made a real difference in someone’s life reveals your commitment and the positive outcomes you can create.

Show appreciation for the company's mission

Expressing admiration for what the company stands for indicates that you will be a passionate and dedicated team member.

Express eagerness for an interview

Politely asking for an interview shows your enthusiasm and proactive attitude towards securing the role.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Senior Life Insurance Agent Cover Letter Example

Leadership and collaboration.

This sentence paints a clear picture of your ability to lead a team towards success. It shows that you're not only a strong individual contributor but also someone who can inspire your colleagues to reach their maximum potential. Key achievements should be highlighted, but adding context about teamwork and leadership makes them even more impactful.

Align Your Passion and Role

Just like in the first cover letter, expressing passion for the role is a strong move. However, you took it up a notch by aligning your passion with the actual role. It makes a big difference when you're not just passionate about the field or the company, but about the position you're applying for. This shows that you've thought carefully about how this role fits into your professional journey and personal values.

Senior Life Insurance Specialist Cover Letter Example

Appreciation for tech and personal touch.

Talking about your appreciation for the blending of technology and personal touch reveals that you understand the balance needed in today's insurance industry. This shows you're not just tech-savvy, but also empathetic and human-focused, which is increasingly important in the digital age.

Showcasing Innovative Initiatives

By detailing your experience in introducing AI-driven tools that boosted customer satisfaction, you demonstrate your ability to leverage technology for business benefits. This tells me that you're an innovator, which is valuable in an industry that's evolving rapidly.

Expressing Desire to Make a Difference

When you talk about wanting to impact the lives of millions in a meaningful way, it shows that you're driven by more than just money or status. It signals that you have a strong sense of purpose, which can make you more motivated and effective in your work.

Alignment with Company’s Approach

Asserting that your background aligns with the company's forward-thinking approach shows that you haven't just researched the company, but also seen where your skills fit into their strategy. This shows me that you're likely to be a good fit and can hit the ground running.

Professional and Direct Sign Off

Your sign off is professional and straightforward, which is always a good approach. It also subtly reiterates your desire to contribute to the company's success, while expressing enthusiasm for potential discussions about the role. This keeps the conversation open and forward-focused.

Senior Life Insurance Sales Representative Cover Letter Example

Demonstrate your industry experience.

Mentioning your years of experience helps establish your credibility and expertise in the life insurance field.

Showcase your achievements with metrics

Detailing your success in numbers, like sales performance, provides concrete evidence of your effectiveness in previous roles.

Share personal success stories

Describing how you helped specific clients adds a personal touch and shows your ability to address individual needs effectively.

Explain your motivation for joining the company

Highlighting what attracts you to the company demonstrates that you have done your research and are genuinely interested in being part of their team.

Invite further discussion

Asking for the chance to talk more about your qualifications in an interview shows initiative and a readiness to contribute to the company’s success.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Life Insurance Agent Roles

- Health Insurance Agent Cover Letter Guide

- Insurance Agent Cover Letter Guide

- Insurance Case Manager Cover Letter Guide

- Insurance Claims Manager Cover Letter Guide

- Insurance Investigator Cover Letter Guide

- Insurance Sales Agent Cover Letter Guide

- Insurance Underwriter Cover Letter Guide

- Life Insurance Agent Cover Letter Guide

Other Other Cover Letters

- Business Owner Cover Letter Guide

- Consultant Cover Letter Guide

- Correctional Officer Cover Letter Guide

- Demand Planning Manager Cover Letter Guide

- Executive Assistant Cover Letter Guide

- Operations Manager Cover Letter Guide

- Orientation Leader Cover Letter Guide

- Plant Manager Cover Letter Guide

- Production Planner Cover Letter Guide

- Recruiter Cover Letter Guide

- Recruiting Coordinator Cover Letter Guide

- Site Manager Cover Letter Guide

- Supply Chain Planner Cover Letter Guide

- Teacher Cover Letter Guide

- Vice President of Operations Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

6 Insurance Customer Service Representative Cover Letter Examples

Introduction.

In today's competitive job market, a well-tailored cover letter can make all the difference when applying for a position as an insurance customer service representative. This document serves as an introduction to your skills, experience, and personality, allowing you to stand out from other applicants and catch the attention of hiring managers. A strong cover letter not only showcases your qualifications but also demonstrates your understanding of the insurance industry and your ability to provide exceptional customer service.

When crafting your cover letter, it's essential to tailor it to the specific job you're applying for, highlighting your relevant skills and experiences. This article will provide you with several examples of insurance customer service representative cover letters, along with key takeaways and common mistakes to avoid. By following these examples and tips, you can create a compelling cover letter that will impress potential employers and increase your chances of landing an interview.

Now, let's dive into the examples of insurance customer service representative cover letters and explore what makes them effective.

Example 1: Auto Insurance Customer Service Representative Cover Letter

Key takeaways.

Emily's cover letter effectively showcases her relevant experience and skills, positioning her as an ideal candidate for the Auto Insurance Customer Service Representative role at State Farm Insurance.

When applying for a customer service role, it is crucial to highlight your experience in handling customer inquiries, resolving issues, and providing personalized solutions. This demonstrates your ability to deliver exceptional customer service and build positive relationships with clients.

She emphasizes her achievements, such as successfully upselling additional coverage as an Insurance Sales Agent at GEICO, resulting in a 20% increase in policy sales and revenue. This demonstrates her ability to drive sales and contribute to the company's growth.

Highlighting specific achievements and quantifiable results in your cover letter can make a strong impression on hiring managers. It shows your ability to achieve tangible outcomes and contribute to the success of the organization.

Emily also mentions her track record of maintaining a high customer satisfaction rating while managing a high volume of calls and emails at Progressive Insurance. This highlights her ability to handle a fast-paced work environment and deliver exceptional service under pressure.

Emphasize your ability to handle high workloads and maintain excellent performance under pressure. This showcases your resilience and adaptability in a customer service role.

Overall, Emily's cover letter effectively highlights her relevant experience, achievements, and skills, making her a strong candidate for the Auto Insurance Customer Service Representative position at State Farm Insurance.

Example 2: Health Insurance Customer Service Representative Cover Letter

Michael's cover letter effectively demonstrates his suitability for the Health Insurance Customer Service Representative role at Aetna Inc.

When applying for a customer service role, it's crucial to showcase your relevant experience and highlight your ability to provide exceptional customer service. This demonstrates your understanding of the industry and your dedication to meeting customer needs.

He highlights his experience in the health insurance industry, mentioning his roles at Blue Cross Blue Shield, Cigna Corporation, and UnitedHealth Group Inc. This demonstrates his extensive knowledge of health insurance policies, procedures, and regulations.

Be sure to mention your previous experience in the field, emphasizing your familiarity with health insurance policies, claims processing, and customer inquiries. This shows that you are well-prepared to handle the responsibilities of the role.

Michael also emphasizes his strong customer service skills, highlighting his ability to effectively communicate complex information and receive positive feedback from customers.

Emphasize your soft skills, such as empathy, patience, and communication abilities. These qualities are essential for delivering exceptional customer service and fostering positive relationships with customers.

Overall, Michael's cover letter effectively positions him as a qualified candidate with the necessary experience and skills to excel in the Health Insurance Customer Service Representative role at Aetna Inc.

Example 3: Property Insurance Customer Service Representative Cover Letter

Olivia's cover letter effectively showcases her relevant experience and highlights her strong customer service skills, making her a compelling candidate for the Property Insurance Customer Service Representative position at Farmers Insurance Group.

When applying for a customer service role, it is important to emphasize your experience in providing exceptional customer service and your ability to effectively communicate with clients. This demonstrates your dedication to customer satisfaction and your skills in building positive relationships.

Olivia mentions her experience as an Insurance Agent at Liberty Mutual Insurance, where she consistently exceeded sales targets while maintaining high customer satisfaction. She also highlights her experience as a Claims Adjuster at Travelers Companies, Inc., showcasing her problem-solving and negotiation skills.

Highlighting specific achievements and skills from previous roles demonstrates your ability to handle different aspects of the job and showcases your adaptability and expertise in the insurance industry.

Olivia's current role as a Property Insurance Customer Service Representative at Nationwide Insurance further strengthens her application, as she has been recognized for her effective communication and ability to provide prompt and accurate assistance.

If you are currently employed in a similar role, be sure to mention any accomplishments or recognition you have received. This demonstrates your ongoing commitment to providing excellent customer service and adds credibility to your application.

Example 4: Life Insurance Customer Service Representative Cover Letter

Ethan's cover letter effectively highlights his relevant experience and skills, positioning him as an ideal candidate for the Life Insurance Customer Service Representative position at New York Life Insurance Company.

When applying for a customer service role in the insurance industry, it's crucial to emphasize your experience in insurance sales, underwriting, and customer service. This demonstrates your comprehensive understanding of the insurance industry and your ability to effectively support policyholders.

Ethan showcases his success as an Insurance Sales Representative by exceeding sales targets and building strong relationships with clients, demonstrating his ability to actively listen, understand customer needs, and recommend appropriate life insurance policies.

Highlight your sales achievements and your ability to establish trust and rapport with customers. This shows your capacity to provide personalized service and meet customer expectations, which is essential for a customer service role.

He also emphasizes his experience as an Insurance Underwriter, which showcases his analytical and problem-solving skills in assessing risks and making informed decisions. This experience highlights his ability to provide accurate and knowledgeable information to customers.

Highlight any underwriting experience you have, as it demonstrates your ability to evaluate insurance applications and provide accurate guidance to policyholders. This shows your attention to detail and your commitment to providing accurate information.

Ethan's current role as a Life Insurance Customer Service Representative further underscores his ability to handle policy inquiries, process changes, and address customer concerns with exceptional attention to detail and organizational skills.

Emphasize your experience in handling customer inquiries and resolving issues promptly and accurately. This demonstrates your ability to provide excellent customer service and support policyholders effectively.

Overall, Ethan's cover letter effectively showcases his relevant experience and skills, making him a strong candidate for the Life Insurance Customer Service Representative position.

Example 5: Commercial Insurance Customer Service Representative Cover Letter

Ava's cover letter effectively highlights her relevant experience in the insurance industry and emphasizes her dedication to exceptional customer service, positioning her as an ideal candidate for the Commercial Insurance Customer Service Representative position at The Hartford Financial Services Group Inc.

When applying for a customer service role, it is crucial to showcase your experience in managing client relationships and providing outstanding service. This demonstrates your ability to effectively communicate with clients and meet their needs.

Ava highlights her achievements in previous positions, such as maintaining a high client retention rate and effectively communicating complex insurance concepts to clients.

It is important to quantify your achievements and highlight specific accomplishments in your cover letter. This demonstrates your ability to deliver results and showcases your expertise in the insurance industry.

To further strengthen her application, Ava could have mentioned any specific software or systems she is proficient in, as well as any additional certifications or training she has completed in the insurance field.

Including details about specialized software or systems you have experience with can demonstrate your technical skills and make you stand out as a candidate. Additionally, highlighting any relevant certifications or training can further reinforce your qualifications for the role.

Example 6: Claims Insurance Customer Service Representative Cover Letter

Benjamin's cover letter effectively positions him as an ideal candidate for the Claims Insurance Customer Service Representative role at Progressive Insurance.

When applying for a customer service role in the insurance industry, it is crucial to highlight your experience in claims management and exceptional customer service skills. This demonstrates your ability to handle complex claims while providing excellent service to clients.

He emphasizes his track record of exceeding performance goals and receiving positive feedback from clients and colleagues.

Quantify your achievements in claims management, such as exceeding performance goals and receiving positive feedback. This showcases your ability to consistently deliver high-quality work and build positive relationships.

Benjamin highlights his ability to effectively communicate complex information in a clear and concise manner, which is essential in a customer service role.

Showcase your strong communication skills, especially your ability to explain complex information in a clear and concise manner. This demonstrates your capacity to provide excellent customer service and effectively address client needs.

The cover letter could further emphasize Benjamin's familiarity with Progressive Insurance's values and commitment to innovation.

Research the company and highlight specific aspects of their values and commitment to innovation. This shows your genuine interest in the company and your ability to align with their vision.

Skills To Highlight

As an insurance customer service representative, your cover letter should highlight the unique skills that make you a strong candidate for the role. These key skills include:

Strong Communication : Effective communication is essential in providing exceptional customer service. As an insurance customer service representative, you will be interacting with clients on a daily basis, addressing their concerns, explaining policies, and providing assistance. Your cover letter should showcase your ability to communicate clearly and professionally, both verbally and in writing. Highlight any previous experience in customer service roles or positions that required strong communication skills.

Problem-Solving : Insurance customer service representatives often encounter complex situations and customer inquiries that require problem-solving skills. Your cover letter should emphasize your ability to analyze problems, identify potential solutions, and make informed decisions. Provide examples of times when you successfully resolved customer issues or found creative solutions to challenging problems. Highlight any relevant experience in handling insurance claims or processing policy changes.

Attention to Detail : In the insurance industry, accuracy is crucial. Insurance policies and regulations can be complex, and even minor errors can have significant consequences. Your cover letter should demonstrate your attention to detail and ability to work meticulously. Mention any experience you have in reviewing insurance documents, processing paperwork, or maintaining accurate records. Provide examples of how your attention to detail has helped you deliver high-quality customer service in the past.

Knowledge of Insurance Policies and Regulations : A strong understanding of insurance policies and regulations is vital for an insurance customer service representative. Your cover letter should highlight your knowledge of different insurance products, such as auto insurance, home insurance, or life insurance. Discuss any relevant certifications or training you have completed in the insurance field. Emphasize your ability to explain policy details to customers and ensure they have a clear understanding of their coverage.

Ability to Handle Customer Inquiries and Complaints : As an insurance customer service representative, you will often be dealing with customer inquiries and complaints. Your cover letter should showcase your ability to remain calm and professional in challenging situations. Highlight your experience in handling customer inquiries, resolving complaints, and providing excellent customer service. Discuss any strategies or techniques you have used to effectively manage customer interactions and maintain customer satisfaction.

By highlighting these key skills in your cover letter, you will demonstrate to potential employers that you have the necessary qualifications and abilities to excel as an insurance customer service representative.

Common Mistakes To Avoid

When crafting your cover letter for an insurance customer service representative position, it's important to avoid these common mistakes:

Using Generic Language : Your cover letter should be tailored to the specific job and company you are applying to. Avoid using generic language that could apply to any position. Instead, highlight your relevant skills and experiences that make you a strong candidate for the insurance customer service representative role.

Failing to Showcase Relevant Customer Service Experience : One of the key requirements for an insurance customer service representative is strong customer service skills. It's important to highlight any relevant experience you have in this area. Whether you have worked in a customer service role in the insurance industry or have transferable skills from a different field, make sure to showcase your ability to effectively communicate with customers and provide exceptional service.

Not Addressing the Specific Needs of the Insurance Company : Each insurance company may have unique needs and requirements for their customer service representatives. It's essential to research the company and understand their specific needs before writing your cover letter. Tailor your letter to address how your skills and experiences align with those needs. This shows the hiring manager that you have taken the time to understand their company and are genuinely interested in the position.

Neglecting to Highlight Relevant Technical Skills : In addition to customer service skills, many insurance customer service representative roles require knowledge of insurance policies, claims processing, and other technical aspects of the industry. Make sure to highlight any relevant technical skills or certifications you possess. This could include knowledge of insurance software systems, familiarity with industry regulations, or specific training you have completed.

Ignoring the Importance of Attention to Detail : As an insurance customer service representative, attention to detail is crucial. This includes accurately inputting customer information, reviewing policy details, and ensuring all necessary documentation is complete. Your cover letter should demonstrate your attention to detail by being well-written, error-free, and properly formatted. Avoid any typos or grammatical errors that could give the impression of carelessness.

Neglecting to Mention Soft Skills : In addition to technical skills, insurance customer service representatives need strong soft skills such as communication, problem-solving, and empathy. These skills are essential for effectively assisting customers and resolving issues. Make sure to mention any relevant soft skills you possess and provide examples of how you have demonstrated them in previous roles.

Exceeding the Recommended Length : While it's important to provide enough information in your cover letter, it's also important to keep it concise and to the point. Hiring managers may not have time to read lengthy cover letters, so aim for a length of one page or less. Focus on the most relevant information and avoid unnecessary details or repetition.

By avoiding these common mistakes, you can create a strong and compelling cover letter for an insurance customer service representative position. Remember to tailor your letter to the specific needs of the company and highlight your relevant skills and experiences.

In conclusion, a well-crafted cover letter is a crucial component of a successful job application for an insurance customer service representative. It provides an opportunity to showcase your skills, experiences, and qualifications that make you the ideal candidate for the position.