Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Methodology

- What is Secondary Research? | Definition, Types, & Examples

What is Secondary Research? | Definition, Types, & Examples

Published on January 20, 2023 by Tegan George . Revised on January 12, 2024.

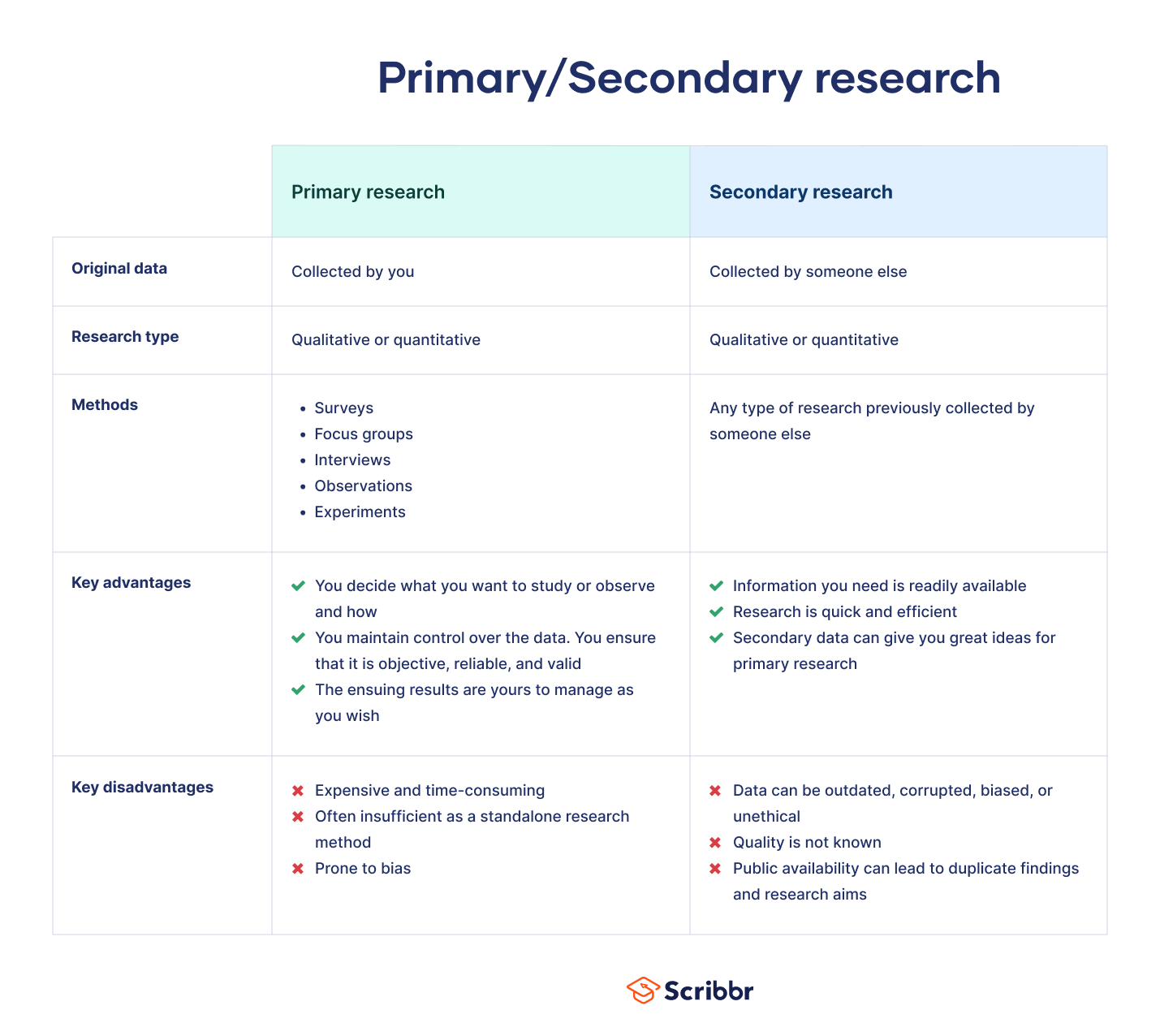

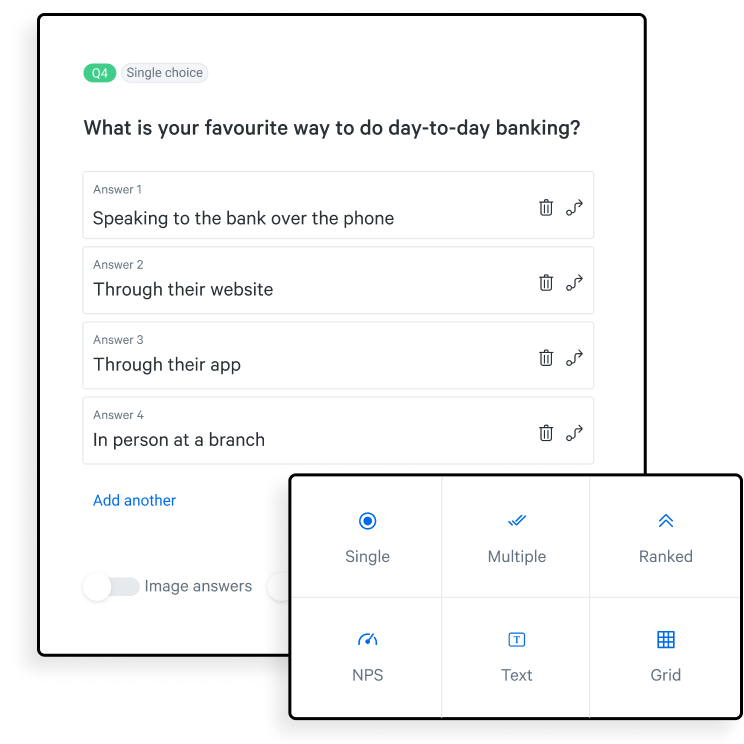

Secondary research is a research method that uses data that was collected by someone else. In other words, whenever you conduct research using data that already exists, you are conducting secondary research. On the other hand, any type of research that you undertake yourself is called primary research .

Secondary research can be qualitative or quantitative in nature. It often uses data gathered from published peer-reviewed papers, meta-analyses, or government or private sector databases and datasets.

Table of contents

When to use secondary research, types of secondary research, examples of secondary research, advantages and disadvantages of secondary research, other interesting articles, frequently asked questions.

Secondary research is a very common research method, used in lieu of collecting your own primary data. It is often used in research designs or as a way to start your research process if you plan to conduct primary research later on.

Since it is often inexpensive or free to access, secondary research is a low-stakes way to determine if further primary research is needed, as gaps in secondary research are a strong indication that primary research is necessary. For this reason, while secondary research can theoretically be exploratory or explanatory in nature, it is usually explanatory: aiming to explain the causes and consequences of a well-defined problem.

Here's why students love Scribbr's proofreading services

Discover proofreading & editing

Secondary research can take many forms, but the most common types are:

Statistical analysis

Literature reviews, case studies, content analysis.

There is ample data available online from a variety of sources, often in the form of datasets. These datasets are often open-source or downloadable at a low cost, and are ideal for conducting statistical analyses such as hypothesis testing or regression analysis .

Credible sources for existing data include:

- The government

- Government agencies

- Non-governmental organizations

- Educational institutions

- Businesses or consultancies

- Libraries or archives

- Newspapers, academic journals, or magazines

A literature review is a survey of preexisting scholarly sources on your topic. It provides an overview of current knowledge, allowing you to identify relevant themes, debates, and gaps in the research you analyze. You can later apply these to your own work, or use them as a jumping-off point to conduct primary research of your own.

Structured much like a regular academic paper (with a clear introduction, body, and conclusion), a literature review is a great way to evaluate the current state of research and demonstrate your knowledge of the scholarly debates around your topic.

A case study is a detailed study of a specific subject. It is usually qualitative in nature and can focus on a person, group, place, event, organization, or phenomenon. A case study is a great way to utilize existing research to gain concrete, contextual, and in-depth knowledge about your real-world subject.

You can choose to focus on just one complex case, exploring a single subject in great detail, or examine multiple cases if you’d prefer to compare different aspects of your topic. Preexisting interviews , observational studies , or other sources of primary data make for great case studies.

Content analysis is a research method that studies patterns in recorded communication by utilizing existing texts. It can be either quantitative or qualitative in nature, depending on whether you choose to analyze countable or measurable patterns, or more interpretive ones. Content analysis is popular in communication studies, but it is also widely used in historical analysis, anthropology, and psychology to make more semantic qualitative inferences.

Secondary research is a broad research approach that can be pursued any way you’d like. Here are a few examples of different ways you can use secondary research to explore your research topic .

Secondary research is a very common research approach, but has distinct advantages and disadvantages.

Advantages of secondary research

Advantages include:

- Secondary data is very easy to source and readily available .

- It is also often free or accessible through your educational institution’s library or network, making it much cheaper to conduct than primary research .

- As you are relying on research that already exists, conducting secondary research is much less time consuming than primary research. Since your timeline is so much shorter, your research can be ready to publish sooner.

- Using data from others allows you to show reproducibility and replicability , bolstering prior research and situating your own work within your field.

Disadvantages of secondary research

Disadvantages include:

- Ease of access does not signify credibility . It’s important to be aware that secondary research is not always reliable , and can often be out of date. It’s critical to analyze any data you’re thinking of using prior to getting started, using a method like the CRAAP test .

- Secondary research often relies on primary research already conducted. If this original research is biased in any way, those research biases could creep into the secondary results.

Many researchers using the same secondary research to form similar conclusions can also take away from the uniqueness and reliability of your research. Many datasets become “kitchen-sink” models, where too many variables are added in an attempt to draw increasingly niche conclusions from overused data . Data cleansing may be necessary to test the quality of the research.

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Normal distribution

- Degrees of freedom

- Null hypothesis

- Discourse analysis

- Control groups

- Mixed methods research

- Non-probability sampling

- Quantitative research

- Inclusion and exclusion criteria

Research bias

- Rosenthal effect

- Implicit bias

- Cognitive bias

- Selection bias

- Negativity bias

- Status quo bias

A systematic review is secondary research because it uses existing research. You don’t collect new data yourself.

The research methods you use depend on the type of data you need to answer your research question .

- If you want to measure something or test a hypothesis , use quantitative methods . If you want to explore ideas, thoughts and meanings, use qualitative methods .

- If you want to analyze a large amount of readily-available data, use secondary data. If you want data specific to your purposes with control over how it is generated, collect primary data.

- If you want to establish cause-and-effect relationships between variables , use experimental methods. If you want to understand the characteristics of a research subject, use descriptive methods.

Quantitative research deals with numbers and statistics, while qualitative research deals with words and meanings.

Quantitative methods allow you to systematically measure variables and test hypotheses . Qualitative methods allow you to explore concepts and experiences in more detail.

Sources in this article

We strongly encourage students to use sources in their work. You can cite our article (APA Style) or take a deep dive into the articles below.

George, T. (2024, January 12). What is Secondary Research? | Definition, Types, & Examples. Scribbr. Retrieved April 8, 2024, from https://www.scribbr.com/methodology/secondary-research/

Largan, C., & Morris, T. M. (2019). Qualitative Secondary Research: A Step-By-Step Guide (1st ed.). SAGE Publications Ltd.

Peloquin, D., DiMaio, M., Bierer, B., & Barnes, M. (2020). Disruptive and avoidable: GDPR challenges to secondary research uses of data. European Journal of Human Genetics , 28 (6), 697–705. https://doi.org/10.1038/s41431-020-0596-x

Is this article helpful?

Tegan George

Other students also liked, primary research | definition, types, & examples, how to write a literature review | guide, examples, & templates, what is a case study | definition, examples & methods, unlimited academic ai-proofreading.

✔ Document error-free in 5minutes ✔ Unlimited document corrections ✔ Specialized in correcting academic texts

What Is Secondary Market Research?

Rev › Blog › Marketing › What Is Secondary Market Research?

Secondary market research refers to any data that comes from third-party sources.

But no matter which type of research you conduct, it can be a complicated undertaking. You need to consider the outcomes you want to achieve and plan your research methods upfront. Often, researchers find it helpful to start with broad concepts first, and then go more narrow. That’s why many researchers start with secondary market research first. But the best market research programs use a mix of both research approaches.

Keep in mind that primary research can be quite expensive. According to a recent study by Vernon Research , market research surveys can cost between $15,000 and $50,000. Focus groups can cost $4,000 to $6,000 per group. Conducting secondary research can help you keep costs in check early on in the process.

Before your next research project, you need foundational knowledge of secondary research, including insight into the common secondary market research tools and techniques. This awareness will help you maximize the value of the data collected. Let’s dive in!

A Brief Overview of Secondary Market Research

When you hear the words “primary” and “secondary,” what comes to mind? You may assume primary research is more valuable, or that you would do primary research first. The reality is, market researchers typically perform secondary research first. And both types of research are essential.

In short, secondary research is data and insights that you do not collect yourself . It can include quantitative and qualitative information. There are many types of secondary research sources, such as:

- Published market studies

- Competitive information

- White papers

- Analyst reports

- Previous in-house studies

- Prior internal focus groups

- Customer emails

- Customer surveys and feedback

- Recordings of internal and external meetings

By contrast, primary market research is research that you conduct yourself . You can customize your research approaches or target specific audiences to gather information. Primary research is also a useful tool to explore a hypothesis created through secondary research.

Why Perform Secondary Market Research?

You should perform secondary market research because it can give you critical insights into competitors, trends, and market size. You can use this information to guide decision-making and product positioning.

When designing studies, researchers want to know what relevant information already exists. Conducting a review of this research is an essential first step. This review will uncover secondary research sources that you can use to frame a new study. If you conduct secondary research, you may find that others have already examined your idea. You won’t want to waste resources researching the same topic. Instead, you may wish to refine your concept to study the issue at a deeper level.

Often, secondary market research sources are readily available. You may be able to gather information and draw meaningful conclusions in a short time. At times, an Internet search can be adequate. On other occasions, you may need to buy published reports from analysts or research firms. Also, you may have access to secondary research sources within your organization.

How Primary and Secondary Market Research Work Together

Consider this scenario. Imagine that you work for a company that wants to launch a new accounting solution for small businesses. You want to know how customers perceive your current solution portfolio. And you’ll also want insights on current global expenditures on accounting solutions. Plus, you need perspective on primary competitors and distribution channels. All of this information can be gathered through secondary market research.

In this example, secondary research can help make a smart business decision. You can gather information and decide if you should launch a new accounting product. If you choose to move ahead, primary research is a wise idea.

Primary research can tell you how people react to your design, product name, and messaging. You may use surveys or focus groups to refine your product and optimize your launch. Remember that you must abide by privacy-protection laws — such as the European Union General Data Protection Regulation (GPDR). You’ll need to ensure you have consent to collect data from research participants. Also, you’ll need to ensure that participants know how you’ll use their information.

As you can see, primary and secondary market research go hand-in-hand. Both approaches are necessary for a well-rounded research program.

Secondary Market Research Tools And Techniques

How can you perform secondary market research? First, you’ll need to gather secondary data from internal and external sources. Then you can determine the right approach to collect the data you need.

Here are the secondary market research sources marketing professionals should know.

Internal Sources

Internal sources are ones that exist within your company, such as:

- Feedback from customer support or sales professionals

- Emails from current customers

- Prior market studies completed by your company

Make the most of any data collected. Perhaps you will use this research to identify valuable new product features. Or you could find that your onboarding process needs some refinement. All the information collected can inform your product design and launch.

Qualitative Internal Sources

Many companies have qualitative internal sources that you can use in secondary research:

- Recordings of support calls that contain customers’ spoken-word feedback

- Previous focus groups conducted by your company

- Recordings of customer events or user forums

When it comes to gaining accurate insights from these recordings, you’ll need professional transcription services — they’re the easiest way to transform these recordings into written content that is easy to search through and pull information from.

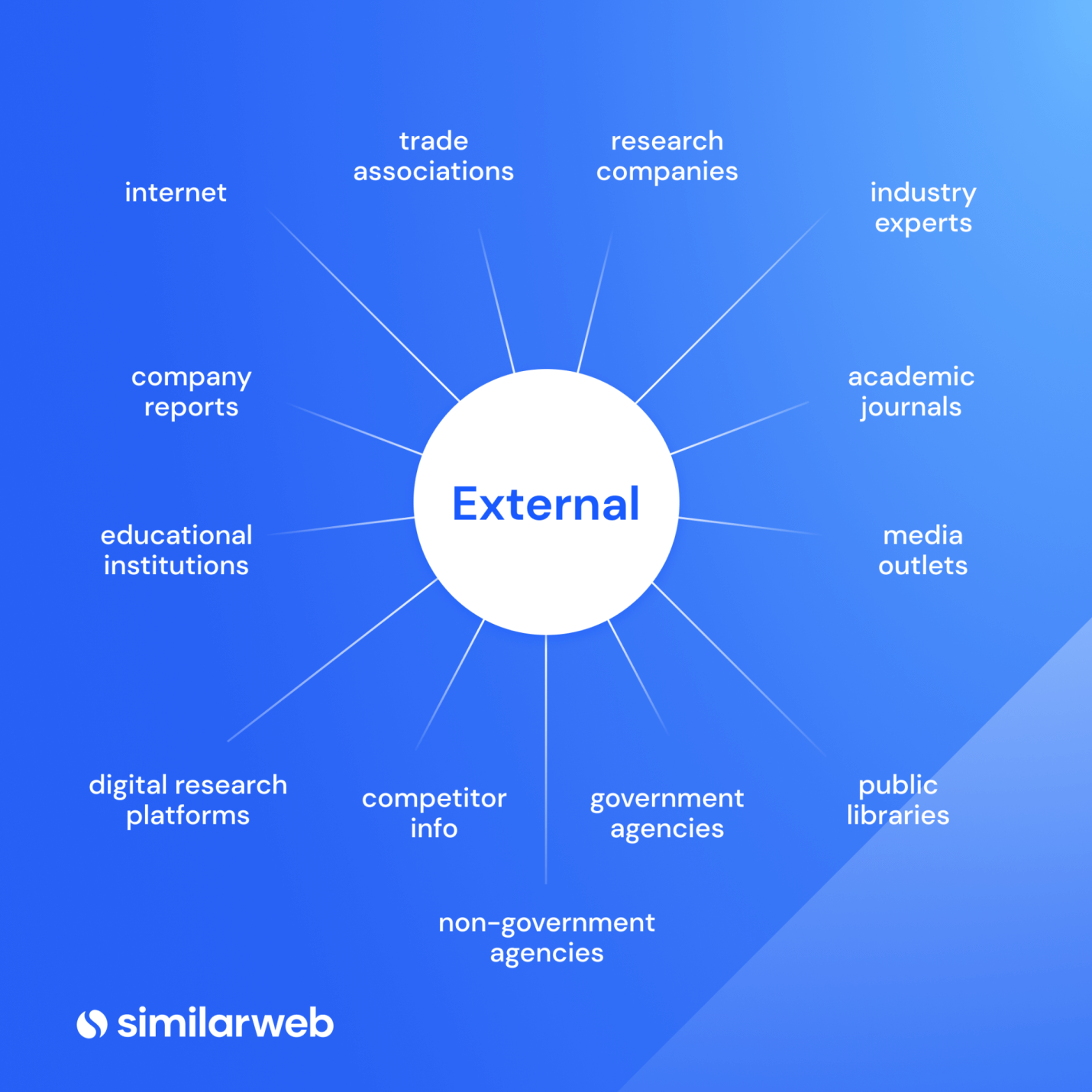

External Sources

External sources exist outside your organization. These sources can include research firms and government organizations. Published articles, white papers, and studies fit into this category as well. While you can find free external data sources, some publications and reports do require purchase.

Qualitative External Sources

You can access many other qualitative external sources as well:

- Social media is a significant source of external secondary research — you may think that social media is a primary source since you control your feed’s content, but you cannot influence posts and comments people share about your company.

- Recordings of industry meetings or presentations in your research.

- Notes or journals detailing information collected by other researchers are also secondary sources.

Often, these qualitative sources provide critical insights that aren’t available through statistical research.

How to Maximize the Value of Your Secondary Market Research

Secondary research is often widely available. But you may need to take specific steps to extract meaning. This scenario is especially true when working with qualitative, spoken-word sources.

For example, companies may have huge volumes of customer feedback from support calls. Remember that message that lets you know calls may be recorded for quality assurance? Too often, businesses capture those calls but never transcribe those audio recordings, meaning they are losing out on valuable direct feedback from their customers.

Similarly, companies may record company meetings or customer events. Chances are, those recordings exist in an archive. They may contain a goldmine of product, industry, and customer insight. But without transcriptions of those recordings, all that intelligence is difficult to access.

When conducting external research, you may uncover high-value recordings as well. These sources may include event proceedings, lectures, and webinars.

Why Transcription is Essential in Secondary Market Research

You should seek professional market research transcription services for any recordings. This approach saves you significant time and improves the research process . Instead of needing to listen to recordings over and over, you can have accurate texts to review. Plus, you can make transcripts accessible to team members with ease. You can make your analysis and reporting much more efficient and meaningful.

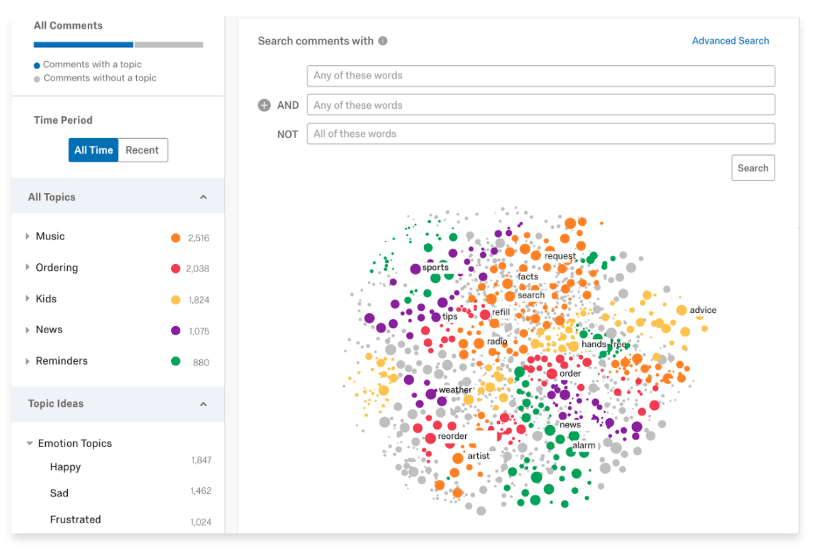

With transcripts , you can also use keyword analysis techniques. These approaches are especially valuable when analyzing large volumes of customer feedback. You can search through transcripts to determine words that customers use often.

For example, you may find customers commenting often on “pricing,” “data input,” or “dashboards.” Then, you can explore those comment categories in more depth to identify themes. You can also assign sentiments, such as positive, negative, or neutral.

With these steps, you can discern how customers feel about your company and products. Then, you can use that insight to improve products and increase customer engagement.

Unlock the Power of Secondary Market Research

When conducting market research, it’s tempting to want to dive right into primary research. Study design can be fascinating. However, you need to perform secondary market research to ensure the best outcomes.

Secondary research provides important context for your primary analysis. You can go into any research project with clarity on industry and competitive trends. Also, you can use internal secondary data for perspective on customer expectations.

When conducting secondary market analysis, researchers often find many valuable recordings. But listening to recordings to capture insight is very time-consuming. It can take up to four hours to understand the content of one hour of audio.

Don’t waste precious time or risk missing enlightening points buried in audio recordings. Turn to Rev for transcription services of your secondary information collected in audio.

Related Content

Latest article.

How to Analyze Focus Group Data

Most popular.

Differences in Focus Groups & In-Depth Interviews for a Successful Market Research

Featured article.

How to Use Automatic Transcription as a Marketing Professional

Everybody’s favorite speech-to-text blog.

We combine AI and a huge community of freelancers to make speech-to-text greatness every day. Wanna hear more about it?

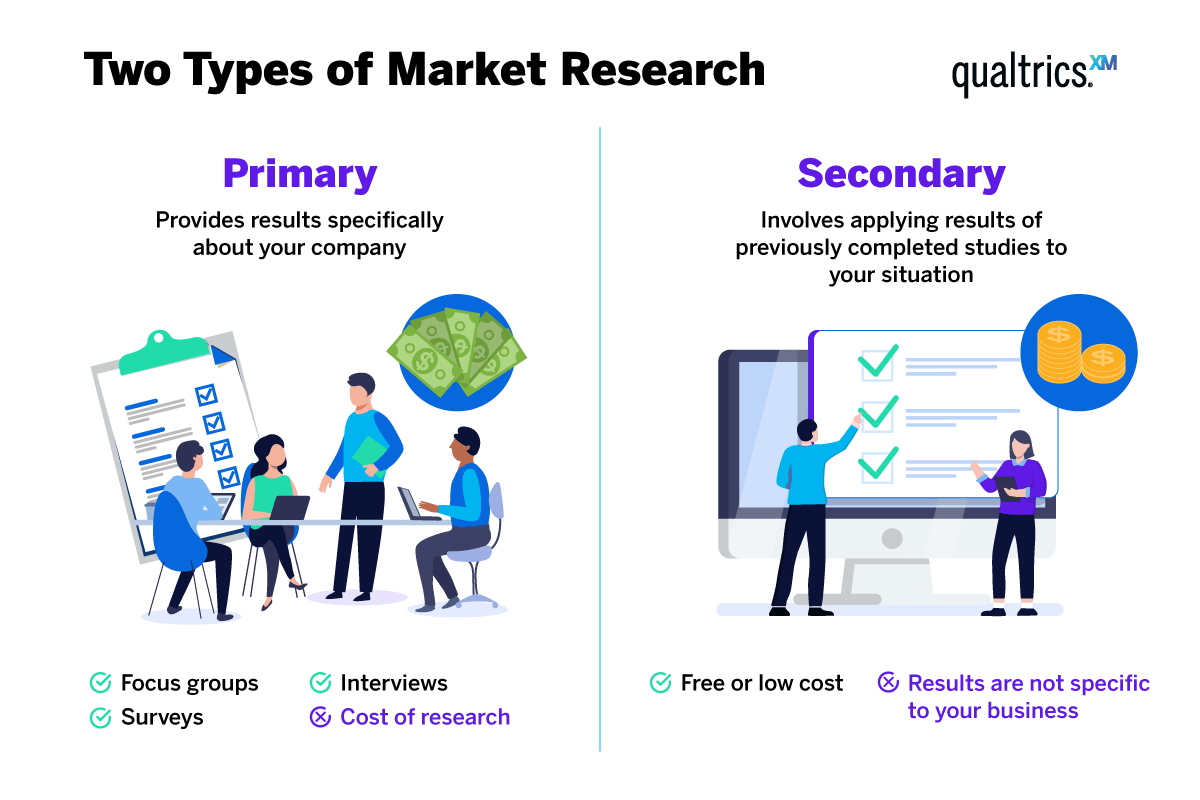

What is Secondary Research? Types, Methods, Examples

Appinio Research · 20.09.2023 · 13min read

Have you ever wondered how researchers gather valuable insights without conducting new experiments or surveys? That's where secondary research steps in—a powerful approach that allows us to explore existing data and information others collect.

Whether you're a student, a professional, or someone seeking to make informed decisions, understanding the art of secondary research opens doors to a wealth of knowledge.

What is Secondary Research?

Secondary Research refers to the process of gathering and analyzing existing data, information, and knowledge that has been previously collected and compiled by others. This approach allows researchers to leverage available sources, such as articles, reports, and databases, to gain insights, validate hypotheses, and make informed decisions without collecting new data.

Benefits of Secondary Research

Secondary research offers a range of advantages that can significantly enhance your research process and the quality of your findings.

- Time and Cost Efficiency: Secondary research saves time and resources by utilizing existing data sources, eliminating the need for data collection from scratch.

- Wide Range of Data: Secondary research provides access to vast information from various sources, allowing for comprehensive analysis.

- Historical Perspective: Examining past research helps identify trends, changes, and long-term patterns that might not be immediately apparent.

- Reduced Bias: As data is collected by others, there's often less inherent bias than in conducting primary research, where biases might affect data collection.

- Support for Primary Research: Secondary research can lay the foundation for primary research by providing context and insights into gaps in existing knowledge.

- Comparative Analysis : By integrating data from multiple sources, you can conduct robust comparative analyses for more accurate conclusions.

- Benchmarking and Validation: Secondary research aids in benchmarking performance against industry standards and validating hypotheses.

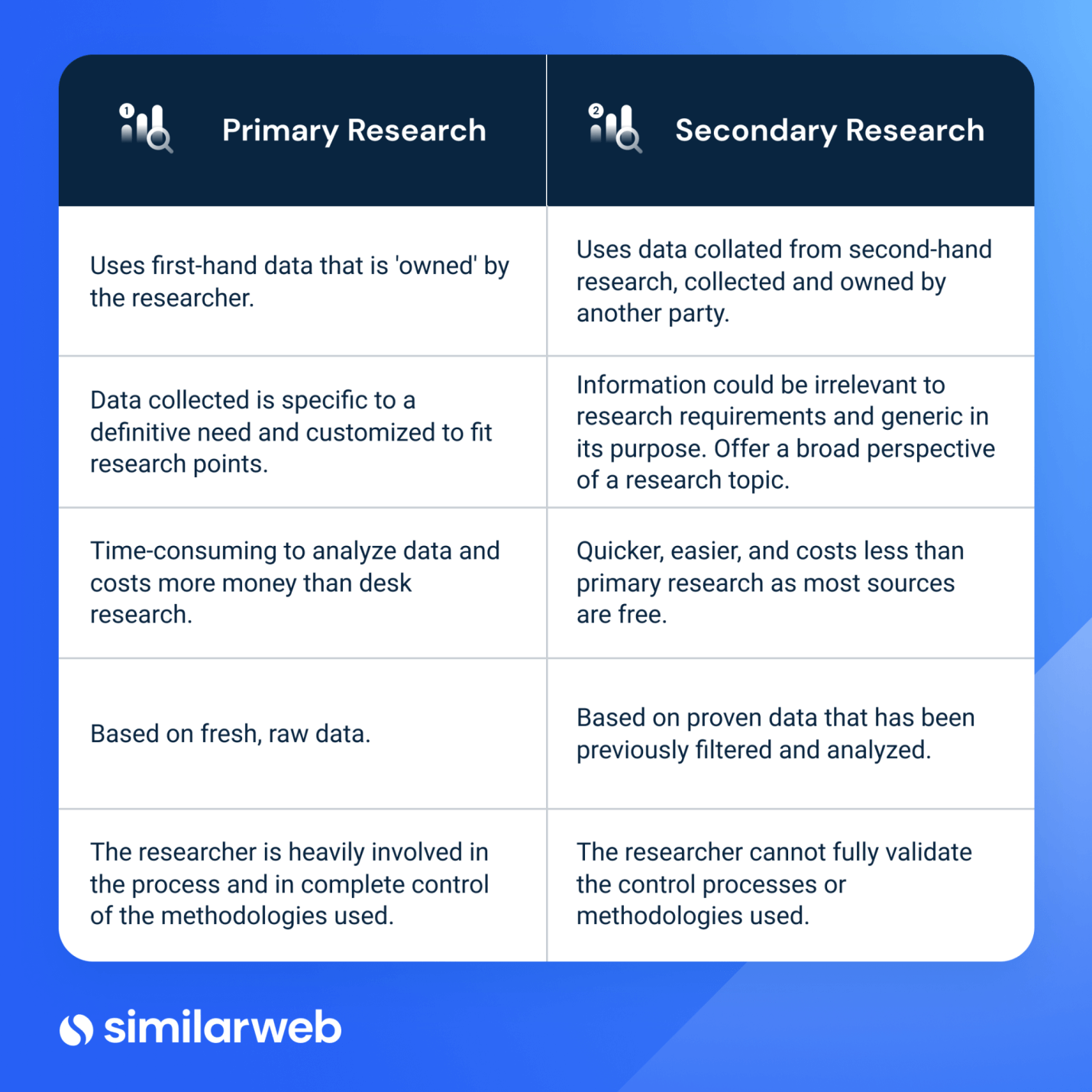

Primary Research vs. Secondary Research

When it comes to research methodologies, primary and secondary research each have their distinct characteristics and advantages. Here's a brief comparison to help you understand the differences.

Primary Research

- Data Source: Involves collecting new data directly from original sources.

- Data Collection: Researchers design and conduct surveys, interviews, experiments, or observations.

- Time and Resources: Typically requires more time, effort, and resources due to data collection.

- Fresh Insights: Provides firsthand, up-to-date information tailored to specific research questions.

- Control: Researchers control the data collection process and can shape methodologies.

Secondary Research

- Data Source: Involves utilizing existing data and information collected by others.

- Data Collection: Researchers search, select, and analyze data from published sources, reports, and databases.

- Time and Resources: Generally more time-efficient and cost-effective as data is already available.

- Existing Knowledge: Utilizes data that has been previously compiled, often providing broader context.

- Less Control: Researchers have limited control over how data was collected originally, if any.

Choosing between primary and secondary research depends on your research objectives, available resources, and the depth of insights you require.

Types of Secondary Research

Secondary research encompasses various types of existing data sources that can provide valuable insights for your research endeavors. Understanding these types can help you choose the most relevant sources for your objectives.

Here are the primary types of secondary research:

Internal Sources

Internal sources consist of data generated within your organization or entity. These sources provide valuable insights into your own operations and performance.

- Company Records and Data: Internal reports, documents, and databases that house information about sales, operations, and customer interactions.

- Sales Reports and Customer Data: Analysis of past sales trends, customer demographics, and purchasing behavior.

- Financial Statements and Annual Reports: Financial data, such as balance sheets and income statements, offer insights into the organization's financial health.

External Sources

External sources encompass data collected and published by entities outside your organization.

These sources offer a broader perspective on various subjects.

- Published Literature and Journals: Scholarly articles, research papers, and academic studies available in journals or online databases.

- Market Research Reports: Reports from market research firms that provide insights into industry trends, consumer behavior, and market forecasts.

- Government and NGO Databases: Data collected and maintained by government agencies and non-governmental organizations, offering demographic, economic, and social information.

- Online Media and News Articles: News outlets and online publications that cover current events, trends, and societal developments.

Each type of secondary research source holds its value and relevance, depending on the nature of your research objectives. Combining these sources lets you understand the subject matter and make informed decisions.

How to Conduct Secondary Research?

Effective secondary research involves a thoughtful and systematic approach that enables you to extract valuable insights from existing data sources. Here's a step-by-step guide on how to navigate the process:

1. Define Your Research Objectives

Before delving into secondary research, clearly define what you aim to achieve. Identify the specific questions you want to answer, the insights you're seeking, and the scope of your research.

2. Identify Relevant Sources

Begin by identifying the most appropriate sources for your research. Consider the nature of your research objectives and the data type you require. Seek out sources such as academic journals, market research reports, official government databases, and reputable news outlets.

3. Evaluate Source Credibility

Ensuring the credibility of your sources is crucial. Evaluate the reliability of each source by assessing factors such as the author's expertise, the publication's reputation, and the objectivity of the information provided. Choose sources that align with your research goals and are free from bias.

4. Extract and Analyze Information

Once you've gathered your sources, carefully extract the relevant information. Take thorough notes, capturing key data points, insights, and any supporting evidence. As you accumulate information, start identifying patterns, trends, and connections across different sources.

5. Synthesize Findings

As you analyze the data, synthesize your findings to draw meaningful conclusions. Compare and contrast information from various sources to identify common themes and discrepancies. This synthesis process allows you to construct a coherent narrative that addresses your research objectives.

6. Address Limitations and Gaps

Acknowledge the limitations and potential gaps in your secondary research. Recognize that secondary data might have inherent biases or be outdated. Where necessary, address these limitations by cross-referencing information or finding additional sources to fill in gaps.

7. Contextualize Your Findings

Contextualization is crucial in deriving actionable insights from your secondary research. Consider the broader context within which the data was collected. How does the information relate to current trends, societal changes, or industry shifts? This contextual understanding enhances the relevance and applicability of your findings.

8. Cite Your Sources

Maintain academic integrity by properly citing the sources you've used for your secondary research. Accurate citations not only give credit to the original authors but also provide a clear trail for readers to access the information themselves.

9. Integrate Secondary and Primary Research (If Applicable)

In some cases, combining secondary and primary research can yield more robust insights. If you've also conducted primary research, consider integrating your secondary findings with your primary data to provide a well-rounded perspective on your research topic.

You can use a market research platform like Appinio to conduct primary research with real-time insights in minutes!

10. Communicate Your Findings

Finally, communicate your findings effectively. Whether it's in an academic paper, a business report, or any other format, present your insights clearly and concisely. Provide context for your conclusions and use visual aids like charts and graphs to enhance understanding.

Remember that conducting secondary research is not just about gathering information—it's about critically analyzing, interpreting, and deriving valuable insights from existing data. By following these steps, you'll navigate the process successfully and contribute to the body of knowledge in your field.

Secondary Research Examples

To better understand how secondary research is applied in various contexts, let's explore a few real-world examples that showcase its versatility and value.

Market Analysis and Trend Forecasting

Imagine you're a marketing strategist tasked with launching a new product in the smartphone industry. By conducting secondary research, you can:

- Access Market Reports: Utilize market research reports to understand consumer preferences, competitive landscape, and growth projections.

- Analyze Trends: Examine past sales data and industry reports to identify trends in smartphone features, design, and user preferences.

- Benchmark Competitors: Compare market share, customer satisfaction, and pricing strategies of key competitors to develop a strategic advantage.

- Forecast Demand: Use historical sales data and market growth predictions to estimate demand for your new product.

Academic Research and Literature Reviews

Suppose you're a student researching climate change's effects on marine ecosystems. Secondary research aids your academic endeavors by:

- Reviewing Existing Studies: Analyze peer-reviewed articles and scientific papers to understand the current state of knowledge on the topic.

- Identifying Knowledge Gaps: Identify areas where further research is needed based on what existing studies still need to cover.

- Comparing Methodologies: Compare research methodologies used by different studies to assess the strengths and limitations of their approaches.

- Synthesizing Insights: Synthesize findings from various studies to form a comprehensive overview of the topic's implications on marine life.

Competitive Landscape Assessment for Business Strategy

Consider you're a business owner looking to expand your restaurant chain to a new location. Secondary research aids your strategic decision-making by:

- Analyzing Demographics: Utilize demographic data from government databases to understand the local population's age, income, and preferences.

- Studying Local Trends: Examine restaurant industry reports to identify the types of cuisines and dining experiences currently popular in the area.

- Understanding Consumer Behavior: Analyze online reviews and social media discussions to gauge customer sentiment towards existing restaurants in the vicinity.

- Assessing Economic Conditions: Access economic reports to evaluate the local economy's stability and potential purchasing power.

These examples illustrate the practical applications of secondary research across various fields to provide a foundation for informed decision-making, deeper understanding, and innovation.

Secondary Research Limitations

While secondary research offers many benefits, it's essential to be aware of its limitations to ensure the validity and reliability of your findings.

- Data Quality and Validity: The accuracy and reliability of secondary data can vary, affecting the credibility of your research.

- Limited Contextual Information: Secondary sources might lack detailed contextual information, making it important to interpret findings within the appropriate context.

- Data Suitability: Existing data might not align perfectly with your research objectives, leading to compromises or incomplete insights.

- Outdated Information: Some sources might provide obsolete information that doesn't accurately reflect current trends or situations.

- Potential Bias: While secondary data is often less biased, biases might still exist in the original data sources, influencing your findings.

- Incompatibility of Data: Combining data from different sources might pose challenges due to variations in definitions, methodologies, or units of measurement.

- Lack of Control: Unlike primary research, you have no control over how data was collected or its quality, potentially affecting your analysis. Understanding these limitations will help you navigate secondary research effectively and make informed decisions based on a well-rounded understanding of its strengths and weaknesses.

Secondary research is a valuable tool that businesses can use to their advantage. By tapping into existing data and insights, companies can save time, resources, and effort that would otherwise be spent on primary research. This approach equips decision-makers with a broader understanding of market trends, consumer behaviors, and competitive landscapes. Additionally, benchmarking against industry standards and validating hypotheses empowers businesses to make informed choices that lead to growth and success.

As you navigate the world of secondary research, remember that it's not just about data retrieval—it's about strategic utilization. With a clear grasp of how to access, analyze, and interpret existing information, businesses can stay ahead of the curve, adapt to changing landscapes, and make decisions that are grounded in reliable knowledge.

How to Conduct Secondary Research in Minutes?

In the world of decision-making, having access to real-time consumer insights is no longer a luxury—it's a necessity. That's where Appinio comes in, revolutionizing how businesses gather valuable data for better decision-making. As a real-time market research platform, Appinio empowers companies to tap into the pulse of consumer opinions swiftly and seamlessly.

- Fast Insights: Say goodbye to lengthy research processes. With Appinio, you can transform questions into actionable insights in minutes.

- Data-Driven Decisions: Harness the power of real-time consumer insights to drive your business strategies, allowing you to make informed choices on the fly.

- Seamless Integration: Appinio handles the research and technical complexities, freeing you to focus on what truly matters: making rapid data-driven decisions that propel your business forward.

Join the loop 💌

Be the first to hear about new updates, product news, and data insights. We'll send it all straight to your inbox.

Get the latest market research news straight to your inbox! 💌

Wait, there's more

05.04.2024 | 27min read

What is Field Research? Definition, Types, Methods, Examples

03.04.2024 | 29min read

What is Cluster Sampling? Definition, Methods, Examples

01.04.2024 | 26min read

Cross-Tabulation Analysis: A Full Guide (+ Examples)

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Secondary Research: Definition, Methods and Examples.

In the world of research, there are two main types of data sources: primary and secondary. While primary research involves collecting new data directly from individuals or sources, secondary research involves analyzing existing data already collected by someone else. Today we’ll discuss secondary research.

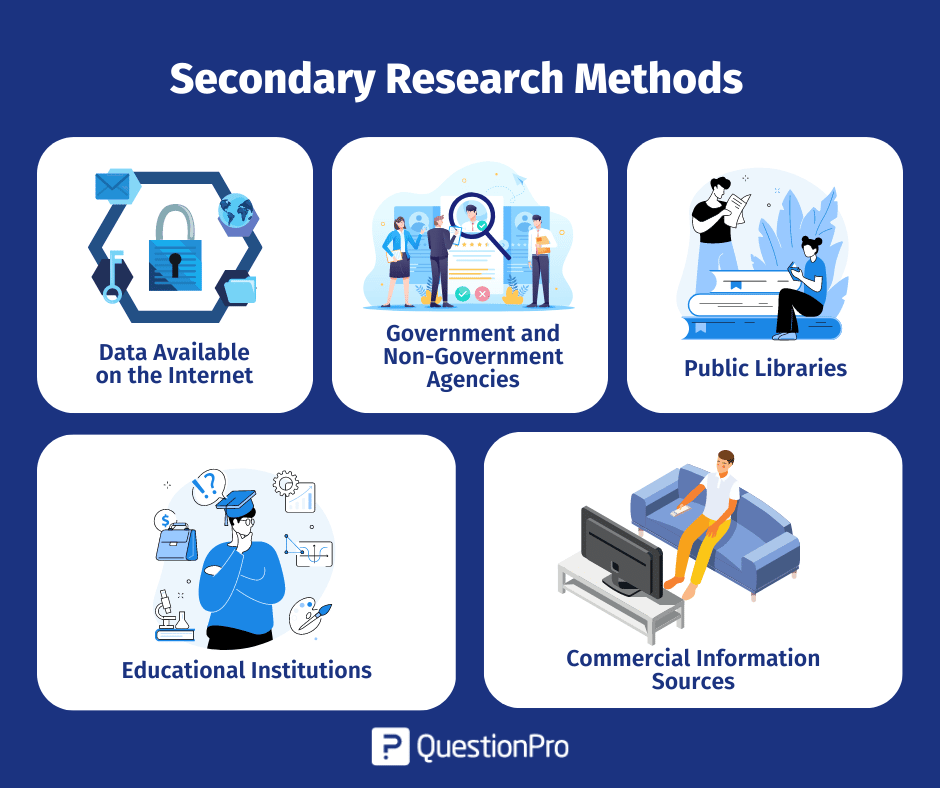

One common source of this research is published research reports and other documents. These materials can often be found in public libraries, on websites, or even as data extracted from previously conducted surveys. In addition, many government and non-government agencies maintain extensive data repositories that can be accessed for research purposes.

LEARN ABOUT: Research Process Steps

While secondary research may not offer the same level of control as primary research, it can be a highly valuable tool for gaining insights and identifying trends. Researchers can save time and resources by leveraging existing data sources while still uncovering important information.

What is Secondary Research: Definition

Secondary research is a research method that involves using already existing data. Existing data is summarized and collated to increase the overall effectiveness of the research.

One of the key advantages of secondary research is that it allows us to gain insights and draw conclusions without having to collect new data ourselves. This can save time and resources and also allow us to build upon existing knowledge and expertise.

When conducting secondary research, it’s important to be thorough and thoughtful in our approach. This means carefully selecting the sources and ensuring that the data we’re analyzing is reliable and relevant to the research question . It also means being critical and analytical in the analysis and recognizing any potential biases or limitations in the data.

LEARN ABOUT: Level of Analysis

Secondary research is much more cost-effective than primary research , as it uses already existing data, unlike primary research, where data is collected firsthand by organizations or businesses or they can employ a third party to collect data on their behalf.

LEARN ABOUT: Data Analytics Projects

Secondary Research Methods with Examples

Secondary research is cost-effective, one of the reasons it is a popular choice among many businesses and organizations. Not every organization is able to pay a huge sum of money to conduct research and gather data. So, rightly secondary research is also termed “ desk research ”, as data can be retrieved from sitting behind a desk.

The following are popularly used secondary research methods and examples:

1. Data Available on The Internet

One of the most popular ways to collect secondary data is the internet. Data is readily available on the internet and can be downloaded at the click of a button.

This data is practically free of cost, or one may have to pay a negligible amount to download the already existing data. Websites have a lot of information that businesses or organizations can use to suit their research needs. However, organizations need to consider only authentic and trusted website to collect information.

2. Government and Non-Government Agencies

Data for secondary research can also be collected from some government and non-government agencies. For example, US Government Printing Office, US Census Bureau, and Small Business Development Centers have valuable and relevant data that businesses or organizations can use.

There is a certain cost applicable to download or use data available with these agencies. Data obtained from these agencies are authentic and trustworthy.

3. Public Libraries

Public libraries are another good source to search for data for this research. Public libraries have copies of important research that were conducted earlier. They are a storehouse of important information and documents from which information can be extracted.

The services provided in these public libraries vary from one library to another. More often, libraries have a huge collection of government publications with market statistics, large collection of business directories and newsletters.

4. Educational Institutions

Importance of collecting data from educational institutions for secondary research is often overlooked. However, more research is conducted in colleges and universities than any other business sector.

The data that is collected by universities is mainly for primary research. However, businesses or organizations can approach educational institutions and request for data from them.

5. Commercial Information Sources

Local newspapers, journals, magazines, radio and TV stations are a great source to obtain data for secondary research. These commercial information sources have first-hand information on economic developments, political agenda, market research, demographic segmentation and similar subjects.

Businesses or organizations can request to obtain data that is most relevant to their study. Businesses not only have the opportunity to identify their prospective clients but can also know about the avenues to promote their products or services through these sources as they have a wider reach.

Key Differences between Primary Research and Secondary Research

Understanding the distinction between primary research and secondary research is essential in determining which research method is best for your project. These are the two main types of research methods, each with advantages and disadvantages. In this section, we will explore the critical differences between the two and when it is appropriate to use them.

How to Conduct Secondary Research?

We have already learned about the differences between primary and secondary research. Now, let’s take a closer look at how to conduct it.

Secondary research is an important tool for gathering information already collected and analyzed by others. It can help us save time and money and allow us to gain insights into the subject we are researching. So, in this section, we will discuss some common methods and tips for conducting it effectively.

Here are the steps involved in conducting secondary research:

1. Identify the topic of research: Before beginning secondary research, identify the topic that needs research. Once that’s done, list down the research attributes and its purpose.

2. Identify research sources: Next, narrow down on the information sources that will provide most relevant data and information applicable to your research.

3. Collect existing data: Once the data collection sources are narrowed down, check for any previous data that is available which is closely related to the topic. Data related to research can be obtained from various sources like newspapers, public libraries, government and non-government agencies etc.

4. Combine and compare: Once data is collected, combine and compare the data for any duplication and assemble data into a usable format. Make sure to collect data from authentic sources. Incorrect data can hamper research severely.

4. Analyze data: Analyze collected data and identify if all questions are answered. If not, repeat the process if there is a need to dwell further into actionable insights.

Advantages of Secondary Research

Secondary research offers a number of advantages to researchers, including efficiency, the ability to build upon existing knowledge, and the ability to conduct research in situations where primary research may not be possible or ethical. By carefully selecting their sources and being thoughtful in their approach, researchers can leverage secondary research to drive impact and advance the field. Some key advantages are the following:

1. Most information in this research is readily available. There are many sources from which relevant data can be collected and used, unlike primary research, where data needs to collect from scratch.

2. This is a less expensive and less time-consuming process as data required is easily available and doesn’t cost much if extracted from authentic sources. A minimum expenditure is associated to obtain data.

3. The data that is collected through secondary research gives organizations or businesses an idea about the effectiveness of primary research. Hence, organizations or businesses can form a hypothesis and evaluate cost of conducting primary research.

4. Secondary research is quicker to conduct because of the availability of data. It can be completed within a few weeks depending on the objective of businesses or scale of data needed.

As we can see, this research is the process of analyzing data already collected by someone else, and it can offer a number of benefits to researchers.

Disadvantages of Secondary Research

On the other hand, we have some disadvantages that come with doing secondary research. Some of the most notorious are the following:

1. Although data is readily available, credibility evaluation must be performed to understand the authenticity of the information available.

2. Not all secondary data resources offer the latest reports and statistics. Even when the data is accurate, it may not be updated enough to accommodate recent timelines.

3. Secondary research derives its conclusion from collective primary research data. The success of your research will depend, to a greater extent, on the quality of research already conducted by primary research.

LEARN ABOUT: 12 Best Tools for Researchers

In conclusion, secondary research is an important tool for researchers exploring various topics. By leveraging existing data sources, researchers can save time and resources, build upon existing knowledge, and conduct research in situations where primary research may not be feasible.

There are a variety of methods and examples of secondary research, from analyzing public data sets to reviewing previously published research papers. As students and aspiring researchers, it’s important to understand the benefits and limitations of this research and to approach it thoughtfully and critically. By doing so, we can continue to advance our understanding of the world around us and contribute to meaningful research that positively impacts society.

QuestionPro can be a useful tool for conducting secondary research in a variety of ways. You can create online surveys that target a specific population, collecting data that can be analyzed to gain insights into consumer behavior, attitudes, and preferences; analyze existing data sets that you have obtained through other means or benchmark your organization against others in your industry or against industry standards. The software provides a range of benchmarking tools that can help you compare your performance on key metrics, such as customer satisfaction, with that of your peers.

Using QuestionPro thoughtfully and strategically allows you to gain valuable insights to inform decision-making and drive business success. Start today for free! No credit card is required.

LEARN MORE FREE TRIAL

MORE LIKE THIS

AI Question Generator: Create Easy + Accurate Tests and Surveys

Apr 6, 2024

Top 17 UX Research Software for UX Design in 2024

Apr 5, 2024

Healthcare Staff Burnout: What it Is + How To Manage It

Apr 4, 2024

Top 15 Employee Retention Software in 2024

Other categories.

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Secondary Market Research: What It Is and How to Do It Fast

Secondary market research is cost-effective. There’s no professional training needed. And it’s a great place to find inspiration and ideas for growth, or explore a topic deeper before making strategic decisions. When you think about it, it’s how most types of research start out.

Whether you’re digging around on a rival’s website, reading industry news, or snooping on social media, it all counts.

So, sit back and take ten to discover everything you need to know about the what, why, and how to do secondary market research right.

For good measure, I’ve included examples of secondary market research and a detailed review of secondary research methods.

What is secondary market research?

By definition, secondary market research uses pre-existing data collected or published by a third party. It’s mainly used to establish key facts about a market, product, or service. It’s also known as desk-based research , and all you need is an internet connection to get started. There are plenty of places to obtain secondary data for free. These include internal and external sources, such as company sales and analytics data, industry or government reports, and published market research surveys .

To save time:

Choose the right secondary market research methods from the onset. And use a methodical approach to help you analyze a topic, spot trends, and decide whether further primary market research is worth it, or not.

Why is secondary market research important?

Finding cost and time-efficient ways to do market research is key. By leveraging prior efforts, you can build on existing research, uncover insights, and make informed decisions faster.

This type of market research presents a huge window of opportunity! As long as you’re willing to invest the time needed to gather and analyze the data. Particularly when you consider how much data is out there, and is never reviewed.

Less than 0.5% of all #data is analyzed and used. #Data quality gives firms a competitive advantage: https://t.co/mc89XcFslE @Adweek — Forrester (@forrester) August 28, 2017

Examples of secondary market research

All secondary market research types can be split into two subsets; internal and external.

- Internal sources come from data held within your organization.

These examples of secondary market research are for your eyes only. And because it’s data your rivals won’t be able to benefit from, it’s one of the most valuable activities you can do.

2. External sources come from outside your business.

External secondary research examples can be accessed by almost anyone, being openly available by nature.

By choosing the right secondary market research methods, you can significantly cut your research time and increase your speed to insight.

In June this year, over 500 business leaders and analysts shared their go-to sources of secondary market research with me via a survey on the HARO platform . The key ranking factors were speed, value, and ROI.

With these findings, I’ve collated a list of the best types of secondary market research.

Internal examples of secondary market research

1. Website and mobile app analytics

Think Google Analytics or your mobile app intelligence software . Both show data about people who interact with your business online. They can also help you understand the device split between desktop and mobile .

2. Customer data

Here, you get exclusive insights into your audience demographics. This is first-hand information about how people use your product or service, their likes, dislikes, and more.

3. Previously conducted research

Perhaps your business used analysts or carried out research in the past. So, even if it seems unrelated, it may be relevant to your research,

4. Historical marketing or campaign information

Things like conversions, website traffic , sales, and marketing data. It’s all going to help you build a picture that’ll impact your research.

External examples of secondary market research

Government and non-government agencies.

Whether you want to view global or country-specific data, there’s lots of free information here. See below for a quick guide to some of the best secondary data sources in the US.

- Congressional Research Service – Information is authoritative, objective, and timely. Topics include economy, finance, commerce, technology, and policy. Sources include infographics, reports, and posts.

- US Census Bureau – Produces more stats than any other agency in the US. Tables, articles, studies, and reports show current and historical data.

- US Small Business Administration – If you’re a small business, the SBA website is a goldmine. Use it to access reports and other data that are ideal for secondary market research purposes.

Read More: Get Growing with Small Business Market Research

- The Bureau of Labor Statistics – As an independent national statistical agency, it produces timely, unbiased reports that are highly relevant to modern-day economic and social issues. Its data retrieval tool is a game-changer for fast access to relevant data.

- Bureau of Transportation Statistics – Access reports about transportation, economics, IT, airlines, geographic information systems, safety, and more. View trends and annual reports, or use the ask-a-librarian live-chat service.

- US Government Publishing Office – View Federal Government reports from three branches: the White House, US passport office, and congress publications. It’s also home to the complete catalog of past and present government publications.

- Childstats.gov – If you’re in a business geared toward families, this is a great place to find valuable stats and trends relating to family characteristics, health, behavior, economic security, and education.

- Internal Revenue Service – Get comprehensive stats using this tax stats link. Great for income data, easily sorted by zip code. Access publications, articles, tables, and reports that measure elements of the tax system.

Competitor websites and apps

Your rival’s websites and apps are a goldmine for secondary research. Define your competitors; then take the following actions for each. Also, ensure you set up a systematic way to collect and record what you find.

- Sign-up for their newsletters or subscribe to their blog.

- Do they offer a free trial, consultation, or product demo – go ahead and try it out.

- Review their products or services; look at the add-ons or upgrades on offer.

- If a rival has an app, download it to get a feel for what they offer and what works (or not).

- Record their price points, discounts, offers, and pricing model.

- What type of customer support do they offer; email, phone, live chat? Note any service level agreements (SLAs) they promise to customers.

- Read their customer and employee reviews with a fine toothcomb: note both pros and cons.

- Look at what social media channels they’re active on. View their activities, engagement, and size of their following.

While it seems like a lot, you can uncover some genuine pearls of wisdom about your target audience’s likes and dislikes. You can also use this data to inform pricing, positioning, social, and marketing tactics .

Read more: how to do competitive analysis right.

Using the industry analysis feature, I see the industry leaders and rising stars. When I look at who is gaining the most unique visitors with the longest visit duration; there’s a clear leader with above-average stats. By expanding and clicking compare, I see the competitive landscape , including marketing and social channels, keywords, ads, traffic, and engagement metrics for all.

Commercial and Trade Association Reports

Whatever your business, there’s bound to be a trade association that provides relevant intel about your sector. Here are a few links to save time if you’re in the US. Google trade associations in your region to see what’s available for anyone outside the US.

- The Directory of Associations

- The National Trade and Professional Associations Directory

- The Encyclopedia of Associations

Online Media

Use the media to find out about stories and trends in any sector. But don’t just make it a one-and-done thing – sign-up for Google news alerts to be alerted to new things as they happen. You can create alerts in seconds based on competitors’ names, products, industries, popular keywords, and more.

Market Research Intelligence Tools

Get instant access to the most up-to-date insights about rivals, markets, or keywords for any audience or product. Another reason to use digital intelligence tools like Similarweb is the high dependency of data. It comes from reliable sources and is always up to date. You can instantly access web and mobile app intelligence from within a single platform, then drill down into any market to get actionable data – with key insights, trends, market intel, audience data, and more.

Traffic and engagement metrics are a gold mine when it comes to doing secondary research. Here’s a static shot of Similarweb Digital Research Intelligence in action. Here, you can quickly compare sites, and see in an instant who is winning in any market, and how they’re doing it.

Research Associations

Many research associations will charge you for their data, but if you find a timely and relevant report, it could be money well spent. Some of the most prominent players include IBIS World , Gartner , Statista , Forrester , and Dun & Bradstreet .

Educational Institutions

When you consider how academic research papers and journals are researched, you know their value. If you find one connected to your topic, you get instant confidence in the credibility of that data.

See below – there are many other examples of secondary market research using external data.

As this article is about how to do secondary market research fast, I’ve highlighted the most compelling examples of secondary research data.

Boost Your Market Research with Similarweb

Enjoy 360° visibility into your industry and instantly adapt to market changes

Pros and cons of secondary research

As with all things in life, there are good and bad aspects to consider. Knowing the best route requires some consideration. So, ask yourself these questions before deciding if secondary market research is right for you – and whether it will help you achieve your research goals:

- What do you want to learn from your research?

- Are there actions or decisions you can take from the data?

- How is the data relevant to your research questions ?

- Is information the most up-to-date there is?

- Could there be a quicker way to do this?

Always keep your research questions front of mind. It’ll help you determine if you’re using the best secondary market research methods, and keep you focused on the end result.

Advantages of secondary market research

- It can be quick to conduct.

- No professional training is needed to do it.

- Low-to-no cost.

- Data is easy to access.

- Initial findings shape future research efforts.

- Gain a broad understanding of a topic fast.

Disadvantages of secondary market research

- Data can quickly become outdated.

- Lack of control over the research methodologies used.

- Topics aren’t always relevant to the researcher’s needs.

- Extra steps are needed to validate the credibility of the research.

- Data is not proprietary and offers little advantage compared to primary research.

For all the benefits secondary market research offers, it’s impossible to ignore the disadvantages. Things like credibility, reliability, relevance, and timeliness all matter when you want to uncover insights to give you a competitive edge.

That’s where we come in.

The Ultimate Tool for Secondary Market Research

Similarweb Digital Research Intelligence is the only external secondary market research method that gives you all the pros and none of the cons. If you want to know what a successful example of secondary market research looks like; it’s this.

- It’s dynamic and updates on the fly – so you always get the most up-to-date information.

- Data collection methodologies are transparent, trustworthy, and reliable.

- Refine results to exactly match the research needs.

- The presentation of data is clear via an easy-to-use, intuitive platform.

Use it to uncover the most critical insights you need to succeed. Data about your rivals, market, product, topic-specific keywords, marketing effectivity, demographics, and consumer journey tracking – all from a single platform, and from the comfort of your desk.

How to do secondary market research in five steps

As you can see, there are many ways to approach it and even more secondary market research methods to choose from. One thing this post promised, was to show you how to do it better and faster. So without further ado, here are five quick steps to follow.

1 – Define research needs and establish goals.

2 – Choose the best sources of secondary market research.

3 – Access, collate, and verify research data.

4 – Analyze, compare, and identify trends.

5 – Confirm if the research questions are answered. If not, repeat steps 1-4 using different sources, or consider primary market research as an alternative.

The difference between primary and secondary market research methods

Wrapping up…

Many believe that doing secondary market research is a quick, cost-effective route to uncover insights that fuel growth. So, whether it’s through diversification, slicker marketing, or new product development. But with credible constraints about the relevance and timeliness of secondary research methods and their data, choosing your tools has never been so important.

We might be biased, but for relevant, timely, trustworthy information that’s always on-point, Similarweb Digital Research Intelligence is ideal. It’s the quickest way to get information about a target market , product, or audience. So, to get started doing secondary market research fast, sign-up for a free trial on the site today.

What are secondary market research methods?

The most widely used secondary market research methods include: the internet, government and agency reports, research journals, trade associations, media outlets, libraries, digital intelligence tools, competitor data, internal sales or customer data, and website or app analytics.

How is secondary market research used?

Secondary market research provides a background from existing data. Organizations can save time and money by identifying key perspectives, facts, and figures to support a topic of interest. It adds credibility and helps shape further primary research.

Should you do primary or secondary market research first?

Because primary market research requires more resources, it’s best to use secondary market research first. Doing so gives you a clearer understanding of a research topic and can help you shape any further research stages before you invest money.

What are primary research and secondary market research?

Primary and secondary market research are two types of market research. Primary research refers to data that’s collected first-hand, such as a survey or interview. Secondary research uses existing data to explore a topic, such as the internet or journals.

Related Posts

The Future of UK Finance: Top Trends to Watch in 2024

From AI to Buy: The Role of Artificial Intelligence in Retail

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Wondering what similarweb can do for you.

Here are two ways you can get started with Similarweb today!

What is secondary market research?

Last updated

3 April 2024

Reviewed by

There are two main types of market research: primary and secondary.

Market analysis template

Save time, highlight crucial insights, and drive strategic decision-making

- Primary market research

Primary research is research that is collected first-hand. Methods of obtaining primary market research include the following:

Interviews : Phone, online, or in-person interviews

Focus groups : Small groups that informally discuss an issue

Polls and surveys : Commonly sent to customers via email or social media sites

Observation : For example, observing how shoppers, drivers, children, or any other group of people behave in a certain situation

One of the main benefits of primary market research is that it's specific to the business or organization that collects it. For example, if you poll your customers, you get feedback from people who have bought your products. The downside of primary research is that it can be expensive and time-consuming to collect.

- Secondary market research

Secondary research is research you obtain from another source rather than collecting it yourself. This is research that may be found online or in print. It may have been collected by businesses, governments, nonprofit organizations, or other sources.

- What are the main sources of secondary market research?

Common sources of secondary market research include the following:

Published data

Demographic data published online, such as on sites such as Statista and McKinsey, government sites such as the Census Bureau and the Bureau of Labor & Statistics, universities, and other sources. Publications such as magazines and academic and trade journals also publish valuable data.

Unsolicited customer feedback

This includes emails, social media posts, and reviews published on third-party sites such as Yelp, Facebook, Google, and elsewhere.

Previously collected data

Studies, focus groups , and other data collected in the past become secondary when you revisit it later.

Competitive research

Finding publicly available data on your competitors. For example, using a tool like Ahrefs or Semrush to get website SEO information.

- What is the purpose of secondary market research?

Secondary market research supplements or complements primary research. It's also a viable alternative when you don't have the time or resources to do primary research.

Why you should perform secondary market research

There are obvious advantages to doing primary market research. It's the most relevant and timely research you can do. However, there are also some compelling reasons to perform secondary market research. This type of research can be particularly useful for startups and newer organizations.

A startup or new business doesn't have a large pool of customers to draw from. While they can do other types of primary research, such as focus groups, they’re limited when it comes to methods requiring feedback from customers or members. In this case, looking at existing data from competitors or more general demographic data can fill the gap.

Primary and secondary market research are complementary

Primary and secondary research aren’t mutually exclusive as both have value. Secondary research can back up your primary research. It can allow you to see if your competitors' research or data is similar.

For example, suppose a company that creates fitness-related products and services wants to launch an app that helps people plan healthier meals. It would be helpful to conduct primary research, such as a focus group or user testing of a beta version. However, it could also help to study any existing research about competitor apps, such as the demographics of customers, most popular features, and how many customers upgrade from the free to the paid version.

Primary research can give you crucial feedback on how users react to your app. However, secondary research backs this up by giving you general data on your market and KPIs that you can benchmark from.

When is the best time to do secondary market research?

Ideally, you should undertake secondary market research before primary research. It provides an overview of a target audience, demand for products, the competition, and the typical price points for similar products and services.

- Secondary market research tools and strategies

Let's look at some guidelines for performing secondary market research.

Internal resources: analyzing data you already possess

Every company or organization has data that’s gathered as a byproduct of daily transactions or interactions. This includes feedback sent to you by customers or published on social media or review sites.

An example of a simple but important business metric is the return rates for products and services. Other data includes customer churn , comparing the popularity of different versions of a product, and tracking sales during different seasons. These are all metrics that most companies routinely collect.

Companies can also look at data regarding their employees and the hiring process. Metrics such as employee turnover and the effectiveness of training programs can help to inform future policies.

Qualitative vs quantitative research

Secondary research, like primary research, may include both quantitative and qualitative data . Metrics, such as sales figures and return rates, are quantitative. Qualitative feedback is equally worth studying. Examples of qualitative data include customer service calls and emails.

Listening to or reading the words used by customers can provide insights into sentiments about your product and business. Factors such as tone of voice, emotions, and body language (e.g., in a video review) provide qualitative information.

External resources

You can also access resources that are outside your organization. In addition to publicly released data, either online or in print, you can work with market research companies that specialize in market research data.

Social listening

Social media provides a rich and cost-free way to conduct market research. Studying social media posts, stories, groups, and pages is especially useful for gathering qualitative insights. You can research social media content for competitors and companies that are similar or adjacent to your own.

- How to conduct secondary research

The following are the steps for conducting secondary research.

1. Identify and define the research topic

To collect the data you need , you must first identify the topic and reason you want this data. Ask yourself several questions:

What is your primary goal?

For example, a store or restaurant may be considering opening a second location in another city. They would do market research to determine whether there's sufficient demand for such a business in the proposed location.

Who are your customers?

A company releasing a game might decide that their typical consumer is between the ages of 16 and 22. Identifying a buyer persona is a good starting point. A buyer persona identifies ‘typical’ customer traits such as gender, age, location, profession, education, and other factors.

Who are your main competitors?

Studying the competition is always a critical factor in market research.

2. Find research and existing data sources

For secondary research, you need to locate existing sources of data. You can search both internally and externally for research that matches your needs. Be open to researching any of the relevant sources, such as those listed above.

3. Begin searching and collecting the existing data

There is no shortage of data in the world today. The challenge is sifting through what you need, discarding what is not relevant, and placing it in the right categories. By selecting your parameters beforehand, you won't get distracted by data that isn't relevant.

4. Analyze the data

Once you have the data you need, it's time to organize it, put it into the appropriate categories, and analyze it.

Look for patterns and long-term trends

For example, if you're looking at numbers such as sales figures for a certain brand or product, look for trends over time. An isolated piece of data could just mean a temporary spike (or drop) in popularity.

Verify the validity of the data

Checking your data is especially important with secondary market research as you're relying on data collected by others. Consider if the sources are reliable. Some websites and publications, for example, may be biased or untrustworthy. While social listening is valuable, it can be misleading if you aren't careful verifying the sources. For example, reviews can be fake to artificially pump a product. Whenever possible, check data against other sources.

Be cautious of cognitive distortions when analyzing data

Researchers who are hoping for or expecting a certain result may fall victim to confirmation bias . One sign of this is prioritizing data confirming your biases and ignoring data contradicting them.

- Examples of secondary market research

Here are a few examples of both internal and external secondary market research:

External secondary market research: studying your target audience

For this type of research, you need to identify your target audience or buyer persona .

Publications, social media, journals, and interviews can provide useful qualitative data on many topics. For example, if you’re researching the shopping habits of millennials, you could look at data published by Retail Customer Experience , which reveals that 80% of millennial shoppers do most of their shopping online, up from 60% three years earlier.

You may need more specific data, of course. Your target audience may be older or younger millennials (or members of other generations).

Measuring the popularity of a product or trend

Another type of external secondary research involves studying consumer demand for a product based on current trends.

Suppose you have a chain of restaurants and you’re creating a new menu item, say a plant-based burger. As developing and releasing new products or services can be costly, it would be wise to do market research first.

Primary research might include taste tests and polls of favorite flavors for a new food offering. However, you could learn a great deal from secondary research. This might consist of trends for people seeking meatless alternatives, for example. You could also research the competition by looking at the popularity and price points of similar items sold by other restaurants or competitors.

Internal examples of secondary market research

Marketing Sherpa provides several insightful examples of both primary and secondary market research. One example of internal secondary research they mention is a virtual event company that created printable baby shower thank-you cards. The company knew from talking to customers that people preferred having a printable swipe as opposed to a virtual image on a screen.

Another example from Marketing Sherpa explains how Intel organized its existing databases to conduct more efficient market research. Databases were organized based on criteria such as customer segment and geography. The data was compiled from customer interviews . Intel was able to create multiple versions of the database that different departments within the company could use.

- Advantages of secondary research

Easy to find

It’s generally much faster to access secondary research than to do primary research. Whether you’re using internal or external sources, there is an abundance of data available on many topics.

Much is available for free online. Even paying to access secondary data is usually less expensive than conducting primary research.

Helps you conduct more insightful primary research

If you plan to do your own research, doing preliminary secondary research can help you save time and avoid unnecessary work. For example, if you discover insufficient demand for a product from secondary research, you won't need to do primary research on it.

- Disadvantages of secondary research

Data may not be specific to your needs

By definition, secondary research has been done by others and may not apply directly to your organization.

May be outdated

Trends change quickly in many industries. If you access data from a few years ago, it may no longer be accurate.

May not be accurate

When others collect data, it can be difficult to gauge its validity. You must be careful about verifying the sources and methods used to collect and analyze the data.

- Summary: what is the purpose of secondary research?

Secondary research is faster and less expensive to obtain than primary research. You can conduct a great deal of this type of research online.

You can do secondary research from both internal and external sources.

When analyzing data from external sources (e.g., websites, publications, social media), it's important to verify it.

Secondary market research is often best done when you’re starting out on your research journey. It can guide you on what further research is worth pursuing.

Primary and secondary research complement one another to give you a more comprehensive view of your market and target audience.

Get started today

Go from raw data to valuable insights with a flexible research platform

Editor’s picks

Last updated: 3 April 2024

Last updated: 26 May 2023

Last updated: 11 April 2023

Last updated: 22 July 2023

Last updated: 1 June 2023

Latest articles

Related topics, log in or sign up.

Get started for free

Everything you need to know about secondary market research

In a world where carbon footprints and climate crisis make the headlines every day, and the term “reuse, reduce, recycle” is becoming a mantra for a more ecological world, why shouldn’t marketers follow suit, if only to save a little money and speed up their processes?

Reusing and recycling data is the basis of secondary market research and, as such, provides easy access to inexpensive yet valuable commodities that pre-empt more costly EX research techniques.