- The Excel Capital Team

- Partner With Us

- Small Business Loans

- Unsecured Business Loans

- Business Line of Credit

- Bad Credit Business Loans

- Merchant Cash Advance

- Equipment Financing

- Invoice Factoring

- Business Education

- Business Blog

- Business Loan Calculators

- Write For Us

SS4 Letter – What is it and how to get a copy of yours

When running a business it’s important to understand what legal documents are crucial to keep on file one of the most frequently used is the SS-4 Letter.

When starting a new business the IRS makes you file a variety of forms to register an entity for tax purposes.

The most basic of these forms is a form SS-4. Essentially this is your EIN or Tax ID registration Card.

This form must be kept in a secure place because you will be required to provide the Form SS-4 during various phases of your business.

Acquiring a small business loan is one of them. The business loan process can be a bit overwhelming at times.

You need to research your loan options, gather documentation, and complete paperwork.

The thing is, more of us have enough on our plate and the loan process is wholly unfamiliar to us. Especially when it comes to the documentation that needs to be gathered to apply for a loan.

One such document is Form SS-4, which lenders may request when submitting your application.

What does a ss-4 form look like?

Here is what an ss-4 letter looks like after it is filed and submitter –

If you’re unsure of how to get your Form SS-4 Letter, don’t worry, we’ve got you covered.

You might be thinking what is Form SS-4? Or, What is an ss4 letter?

Form SS-4/ ss4 letter is an IRS form that corporations use to apply for an employer identification number (or EIN) Also known as an SS4 IRS Notification Letter which lists your EIN number and is a formal confirmation you may need frequently.

An EIN is required for several reasons, including:

- Federal tax reporting

- Opening a business bank account

- And applying for a business license

In a nutshell, your EIN is what the IRS uses to identify your business and Form SS-4 Letter is the official IRS form that allows you to obtain an EIN number.

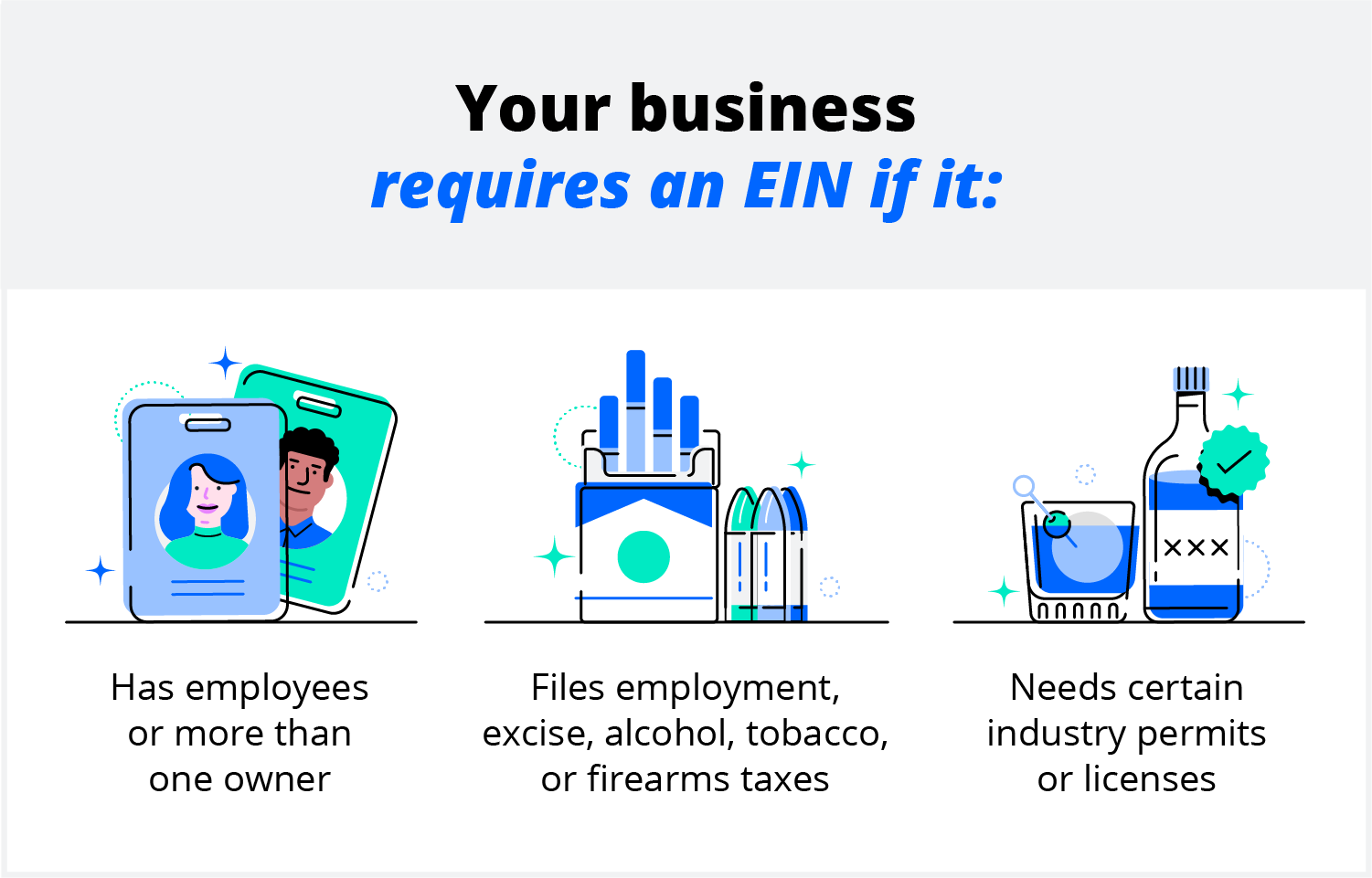

How do you know if you need an EIN? An EIN is required for your business if:

- You have employees

- You’re applying to obtain a business bank account, license, or credit

- Or operate as either a partnership or corporation

- Are operating under any class of incorporation (LLC, S-Corp, C Corp, Non profit ) instead of being a sole proprietor

How to get a copy of your Form SS-4 / EIN Assignment Letter

If you don’t have a copy of Form SS-4 , or have not yet applied for an EIN, you can now use the IRS’ online application tool to submit your Form SS-4 and obtain it.

If you do not wish to apply online through the online application tool on the IRS website you can complete a form and send it off it to the department of treasury.

This is IRS Form SS-4:

If your lender requires a Form SS-4 copy, you’ll need to provide a copy or obtain proof of having submitted the form to the IRS.

Keep in mind that the IRS won’t give you a copy of Form SS-4 itself if you’ve already filled it out previously, but rather an EIN assignment letter which will serve as proof to lenders of having submitted Form SS-4 to the IRS and obtained your EIN.

Here’s how to obtain a copy of your EIN assignment letter:

Step 1: Grab your EIN

First, you’re going to need your EIN handy, so if you don’t know it you can find it on either:

- Any bank accounts that you opened under the corporation required a Tax ID – call your bank to retrieve a copy.

- Or prior corporate tax returns

Once you have your EIN, you’re ready for the next step.

Step 2: Call the IRS

Now, it’s time to take your EIN and call the IRS’ Business & Specialty Tax Line at (800) 829-4933.

The B&S Tax Line is open between 7 A.M. and 7 P.M., Monday through Friday, so make sure you call between those days and hours.

Step 3: Provide the B&S Tax Specialist with your information

Next, once you’ve been connected with a B&S Tax specialist, provide them with the requested information about your company for verification. This will include your EIN and is the reason you gathered it in the previous step.

You’ll also need to verify that you yourself are an authorized contact from within the company. This typically means you’ll be asked to provide your title in the company.

Step 4: Request a copy of your EIN assignment letter

Once verified, all you need to do is request a copy of your EIN assignment letter from the specialist.

It’s important that you not try to request a copy of Form SS-4 as the IRS doesn’t authorize providing copies of completed tax documents like Form SS-4 letter. You need to request a copy of your EIN assignment letter specifically.

Also, keep in mind that, in most cases, the IRS will mail the requested letter copy to the corporate address on file. You can also offer an alternative address or business fax, though, if you need it faster for your loan application.

Get your Form SS-4 Letter

Obtaining a copy of Form SS-4 is just one document required to apply for and obtain a business loan. However, as you can see it’s not at all difficult to obtain. All it requires a bit of know-how and some time spent on the phone.

Whether you’re already beginning the process of obtaining a business loan or are considering it for the future, it’s wise to begin collecting the necessary documents now so you’ll have less to worry about later.

Plus, you’ll avoid any potential delays when applying, which is especially important if you’ll need the funds fast when it comes time to apply.

The Form SS-4 Letter is very important to keep on hand. You never know when you will need it.

See What Your Business Qualifies For

Check out our funding calculators, unsecured business loan calculator.

SBA Loan Calculator

What Is a Form SS-4 & How Do I Get a Copy of Mine?

Running a business involves a lot of information and new documents. You’re probably learning that you have a business credit score for example, and that you can check it for free with places like Nav . If you’re filing your business taxes or thinking of applying for business financing for the first time, you might be scrambling to find a few things for the application. One thing that likely stands out is your Employer Identification Number (EIN), a unique nine-digit number assigned to your business by the IRS. You can think of it as your company’s social security number. In order to know what your EIN is, you’ll need to file Form SS-4 with the IRS. Once the IRS has assigned an EIN to your business, you’ll receive your Form SS-4 notice, which serves as verification of your EIN to potential lenders.

The Form SS-4 notice differs from the Form SS-4 in that a Form SS-4 is simply the application for an EIN, and the notice is proof that you have an EIN.

Why You Need Your Form SS-4 Notice

Anytime you apply for a business loan, you’ll likely see ‘Form SS-4’ listed as one of the required documents. Be aware that this does NOT refer to the Form SS-4, but to the Form SS-4 n otice , which is proof that your entity has been issued an EIN by the IRS. It’d be like submitting your application for a driver’s license instead of providing the actual issued license, although there are no cards issued for an EIN.

Improve your business’s financial health profile to unlock better financing options

Improve your business credit history through tradeline reporting, know your borrowing power from your credit details, and access the best funding – only at Nav.

You won’t be able to use your tax returns as verification of your EIN, because errors on business tax returns are common and your lender knows this. Without the Form SS-4 Notice, your loan application process could be delayed, putting your business behind schedule on any big plans you may have.

How to Get Your Form SS-4 Notice

Form SS-4 , the application for an EIN, is available online. You’ll need information about your business, including the administrator or trustee of your business, and name of responsible party along with their social security number or tax ID. You’ll also need to know what type of entity your business is (sole proprietor, partnership, corporation, non-profit, etc.). You can apply online as well.

While your Form SS-4 notice will usually arrive within two weeks, it is recommended that you apply at least four or five weeks prior to when you need your EIN in case of any hangups in the process. That means you should look ahead to when you anticipate you’ll be applying for credit, filing taxes, or any other activity for which you’ll need your EIN, and time it out correctly.

What If I Lose My Form SS-4 Notice?

In the unfortunate situation that you can’t find your Form SS-4 notice, you will not be able to receive a new physical copy. However, hope is not lost. You can contact a lender with whom you previously applied for credit, check old tax returns, or look for the computer-generated notice that was sent to you when your entity was issued an EIN. You should always verify in this situation that you have the correct number by calling the IRS . As long as an authorized person makes the call and has verifiable information available, they should be able to provide the number over the phone.

Despite stereotypes, the IRS has a system in place to help you out in this situation. Be sure to use the resources available to make sure your information is in your hands and correct. By having all the necessary information in place, you can be prepared to take the next steps with your business.

Accelerate your path to better funding

Build business credit history, see your business credit-building impact, and secure new funding options — only with Nav Prime.

This article was originally written on June 15, 2018.

Rate This Article

This article currently has 12 ratings with an average of 3 stars.

Connor Wilson

Connor Wilson is Nav's Content Manager. With experience in loan underwriting and credit review, he brings a strong desire to help business owners make the best financial decisions possible to every piece he writes and edits.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

How to get IRS Form SS-4 for your company

File IRS Form SS-4 to get an Employer Identification Number (EIN) so you can hire employees, open a business bank account, or change business structures.

Ready to start your business? Plans start at $0 + filing fees.

by LegalZoom staff

Read more...

Updated on: February 22, 2024 · 8min read

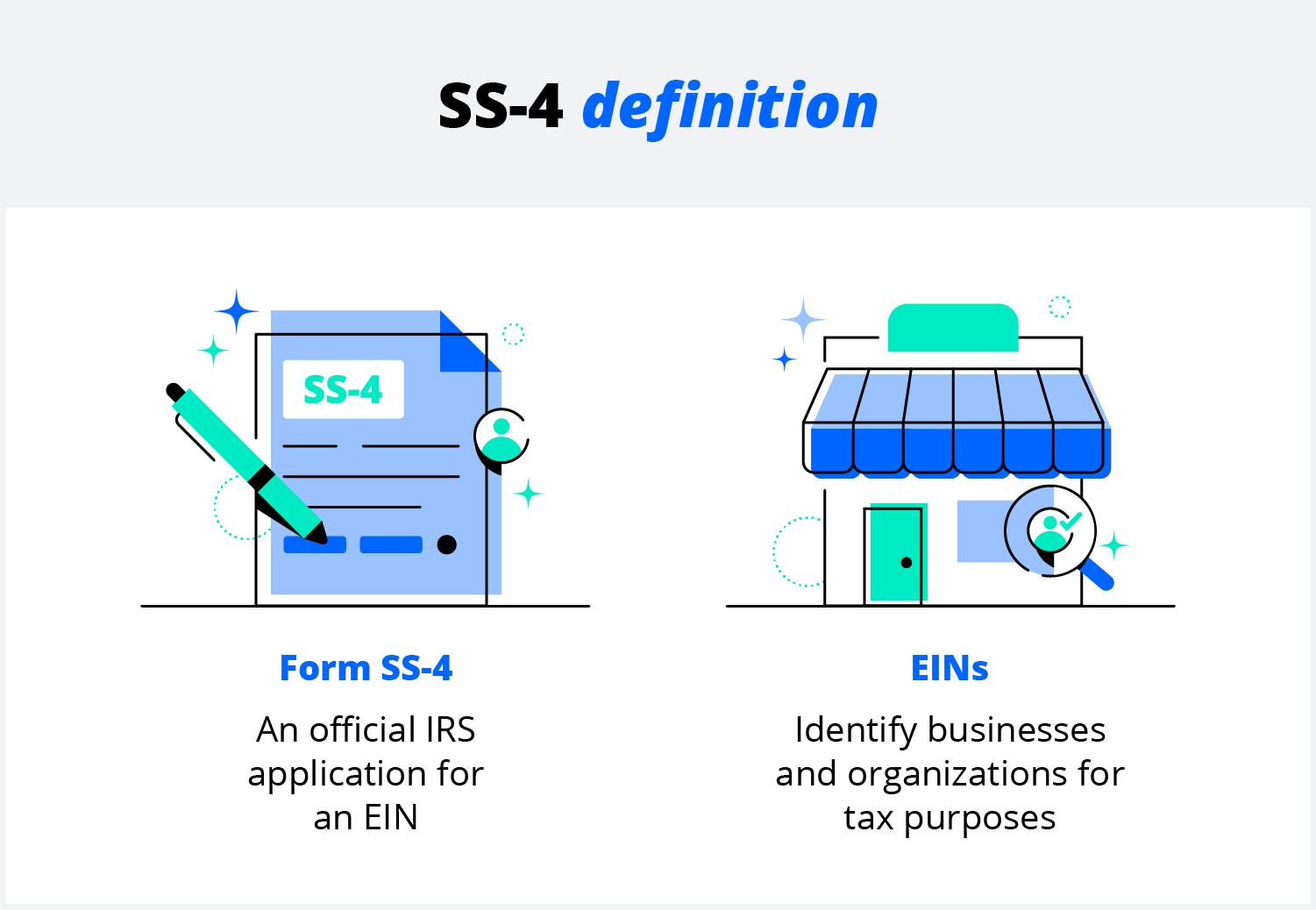

What is an SS-4?

When does your business need to fill out irs form ss-4.

- What does an SS-4 Form look like, and what’s included?

What information do you need for an EIN application?

How to complete form ss-4, 3 ways to file form ss-4, how to get a copy of your ss-4 form, why get an ein for your business.

Whether you want to hire employees, open a business bank account, or apply for an operating permit, your business needs legal recognition. An employer identification number (EIN) identifies your company for legal and tax purposes. But you can only get one if you file an SS-4 form with the Internal Revenue Service (IRS).

An EIN will allow your business to expand or adapt to new challenges, and proper filing can ensure you get your new tax ID in time for smooth operations. To help your growing business along, we'll explain SS-4s, EINs, and how to move through the application process.

IRS Form SS-4 is the application form for an employer identification number (EIN). Like other tax ID numbers, EINs aren't issued automatically; you can only receive an EIN by filing this specific form.

Not just anyone can fill out and submit Form SS-4. The IRS wants a "responsible party" to complete the document, with or without help from an attorney. The IRS defines a responsible party as the owner or individual who exercises effective control over the entity. Government entities can also serve as responsible parties.

EIN definition

An EIN is a taxpayer identification number (TIN) required for certain businesses and other entities. EINs don't only apply to employers or owners; they identify an organization itself. EINs allow a company or other entity to:

- File certain forms with the IRS

- Legally operate under local or federal laws

- Open business bank accounts

- Apply for business licenses

Note: A Social Security number, individual taxpayer identification number, and employer identification number are all different TINs. An EIN has nine digits, the same as a Social Security number. However, it uses one dash instead of two, such as 66-6666666.

Why do you need an SS-4 for EIN verification?

Banks and other lenders need to verify a business' EIN before lending to them. Since SS-4s go through the IRS, lenders consider them the most reliable source, unlike tax returns or W-9s that could contain typos. Ultimately, sharing an EIN with Form SS-4 speeds up the underwriting and lending process.

What’s the difference between a W-9 and an SS-4?

SS-4s help businesses apply for an EIN, while Form W-9 allows companies to share and verify their EIN with other entities. Over a business's life cycle:

- Form SS-4 provides the tax ID (EIN) it needs to operate

- Form W-9 shares that same tax ID (EIN) with business partners for payment, ID verification, or compliance purposes.

Note: As mentioned above, lenders may not accept a W-9. Other organizations may prefer an SS-4, as well.

- Files business taxes as anything but a sole proprietorship

- Hires employees and pays employment taxes

- Pays alcohol, tobacco, firearm, or excise taxes

- Operates as a limited liability company (LLC), partnership, or corporation

- Opens a business bank account

- Has a qualified retirement plan (also called a Keogh plan)

- Applies for certain permits or licenses

In other words, your business needs an EIN unless you’re a sole proprietor who doesn’t pay employment, alcohol, tobacco, firearm, or excise taxes. However, sole proprietors can still choose to operate under an EIN at their discretion.

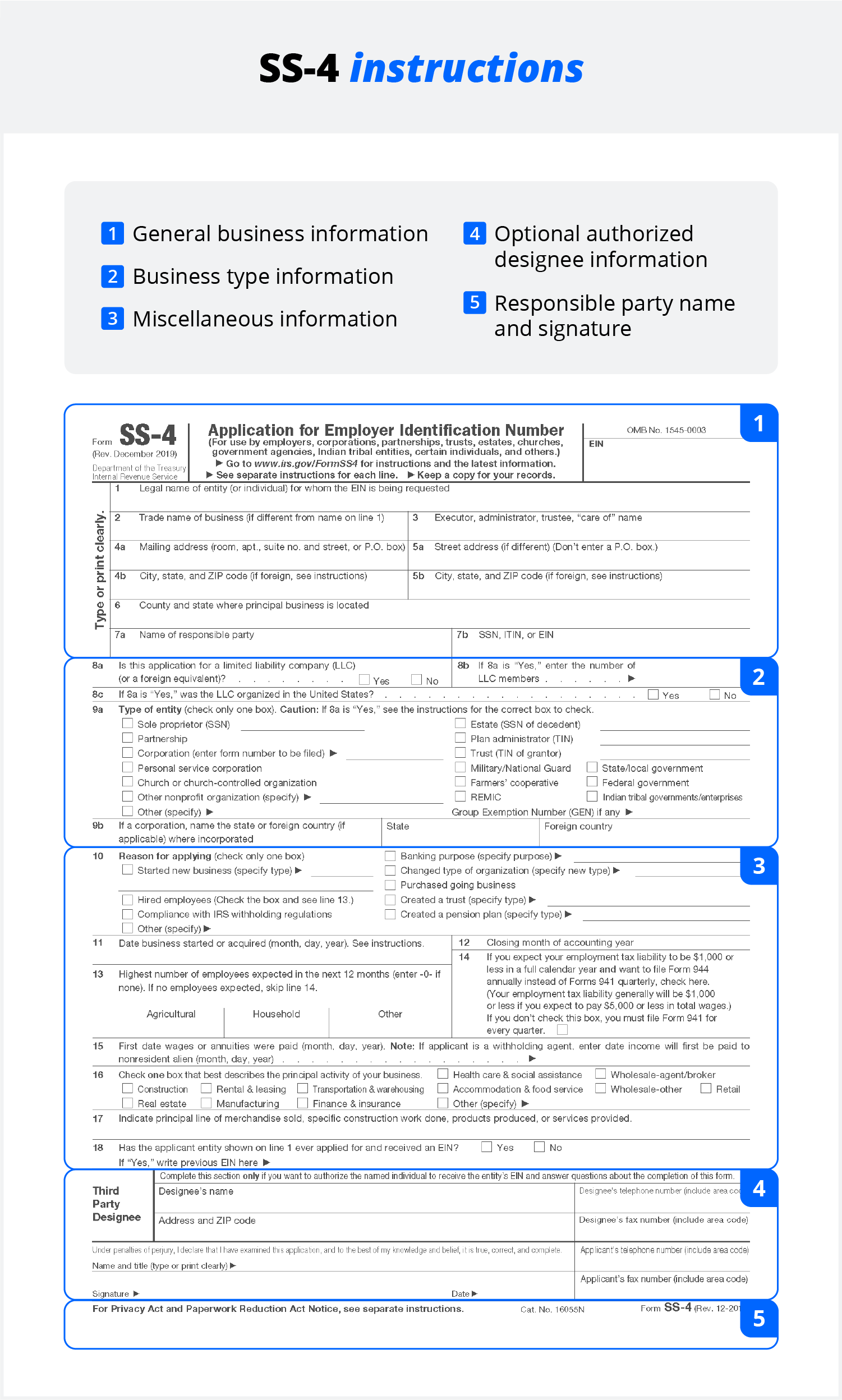

What does an SS-4 Form look like, and what’s included ?

An SS-4 looks like a standard IRS document. Like most business-oriented IRS forms, it contains sections for different types of business information:

- Section 1: Lines 1–7 account for general business information. This includes the entity’s names, addresses, and your responsible party.

- Section 2: Lines 8–9 confirm your business structure.

- Section 3: Lines 10–18 highlight business activities and why you need an EIN.

- Third-party designee: This section allows you to appoint a third party who receives the EIN and answers questions about the form. Business partners and lawyers often work as designees.

- Name and signature: The bottom portion where a responsible party signs and dates the form.

You will need the following information to complete the form, including:

- Legal name of your business

- Trade name of your business, also called a DBA, if you will operate under a name that is different from the legal name

- Optional “in care of" person if you wish to designate someone to receive tax information

- Mailing and street addresses of the business

- County and state where the principal place of business is located

- Responsible party—this is typically the owner, a general partner, or a principal officer

- Social Security number, Individual Taxpayer Identification Number, or EIN of the responsible party

- Business entity type (e.g., sole proprietorship, partnership, LLC, corporation)

- Date your business began or got acquired

In addition, you will need to provide information about your business’ expected employees, principal activities, and history.

An EIN will allow your business to expand or adapt to new challenges.

You can complete the application by planning ahead, obtaining the right documents, filling out the application, authorizing the form, and sending it to the IRS.

1. Plan ahead: How long does it take to complete Form SS-4?

Businesses can complete Form SS-4 within an hour with the right information on hand. Owners with less IRS experience can also consult a tax expert for help. Depending on your application method, you may have to wait days or weeks to receive your EIN. The average turnaround times include:

- Mail: Four to five weeks

- Fax: Approximately four business days

- Online: Immediately after the IRS verifies your information

2. Obtain the form and your business info

As with other IRS forms, you must prepare information such as the business’s legal name, address, and current tax ID (see the full list of items above). You can find this information on tax statements, founding documents, and other federal or state forms.

How to get Form SS-4

There are three ways to obtain an SS-4 form from the IRS. You can obtain the document from:

- The IRS website

- Your local IRS office

- Mail order forms

Applicants can also obtain an SS-4 from local libraries or various tax websites.

3. Fill out the application

An SS-4 includes sections for business and designee information. While the designee section is optional, it can ensure your EIN falls into the most qualified hands. To ensure accuracy, you can ask a lawyer to review the form. They will make sure the SS-4 reflects accurate business information.

4. Authorize the document

A responsible party must sign the SS-4. The responsible party is the fiduciary of an estate or trust, the president or principal officer of a corporation, and the owner or authorized member of other business structures.

- Fiduciary of an estate or trust example: An executor, guardian, or conservator of an estate will qualify.

- Principal officer of a corporation example: Chairs, CEOs, COOs, CFOs, and vice presidents may all qualify as principal officer.

- Other authorized member example: Secretaries, controllers, treasurers, or top managers can authorize the form at a principal officer’s request.

5. Send your SS-4 to the IRS

After reviewing the form, you can send it to the IRS for review—submission methods include online, by fax, and by mail.

You can find details on the full submission process below.

Note: If they encounter any issues, they will contact you or the form-appointed designee.

There are three ways to file an SS-4 form with the IRS: online, through fax, or by mail. Even if you file your form via fax or mail, you should consult the IRS website to ensure you send it to the correct fax number or address, as these may change over time.

Online filing process

You can complete the form and file it on the IRS website. This will enable you to get your EIN immediately.

Fax filing process

You will get your number in about four business days if you file by fax. The correct fax number depends on your location:

- If your principal place of business or legal residence is in one of the 50 states or the District of Columbia, fax your SS-4 to 855-641-6935.

- If your principal place of business and your residence is outside of the U.S., fax it to (855) 215-1627 from inside the U.S. or (304) 707-9471 from outside the U.S.

Be sure to check the most current version of the IRS Instructions for Form SS-4 and the most current version of the SS-4 form itself to be sure you have the most current information.

Mail filing process

It will take about four weeks to get your number if you file by mail. Send Form SS-4 to Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999. Check the current version of the IRS Instructions for Form SS-4, and the SS-4 form itself, to be sure you have current information.

You can obtain a copy of your verified SS-4 by:

- Returning to the IRS online portal where you applied for an EIN. From here, you can re-download the form as a PDF.

- Contacting the IRS at its Business and Specialty Tax Line and EIN Assignment line. The number is: (800) 829-4933.

While you may not need an EIN to operate, getting one opens the door to new avenues of growth.

You may also like

How to write a will: A comprehensive guide to will writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

February 9, 2024 · 11min read

How to get an LLC and start a limited liability company

Considering an LLC for your business? The application process isn't complicated, but to apply for an LLC, you'll have to do some homework first.

March 21, 2024 · 11min read

IMAGES

VIDEO

COMMENTS

Español. Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes. Note: Keep the Form SS-4 information current.

Step 4: Request a copy of your EIN assignment letter. Once verified, all you need to do is request a copy of your EIN assignment letter from the specialist. It’s important that you not try to request a copy of Form SS-4 as the IRS doesn’t authorize providing copies of completed tax documents like Form SS-4 letter.

IRS Form SS-4, Application for Employer Identification Number, is a form businesses use to apply for an employer identification number (EIN). ... the IRS sends a copy of your EIN assignment letter ...

SS-4 (Rev. December 2023) Department of the Treasury Internal Revenue Service . Application for Employer Identification Number (For use by employers, corporations, partnerships, trusts, estates, churches, government agencies, Indian tribal entities, certain individuals, and others.) See separate instructions for each line. Keep a copy for your ...

You can think of it as your company’s social security number. In order to know what your EIN is, you’ll need to file Form SS-4 with the IRS. Once the IRS has assigned an EIN to your business, you’ll receive your Form SS-4 notice, which serves as verification of your EIN to potential lenders. The Form SS-4 notice differs from the Form SS-4 ...

If your principal place of business or legal residence is in one of the 50 states or the District of Columbia, fax your SS-4 to 855-641-6935. If your principal place of business and your residence is outside of the U.S., fax it to (855) 215-1627 from inside the U.S. or (304) 707-9471 from outside the U.S.

Form SS-4. Form SS-4, Application for Employer Identification Number, is a form you file with the IRS to apply for an EIN. On this FEIN form, you must provide information about your business, including your business’s legal name, address, type of business structure, and reasons for applying. Prior to 2007, completing Form SS-4 and filing it ...

Expect to receive it within four weeks from the time of the application. 2. Apply by faxing a copy of your business’s SS-4 form to the IRS. Download a copy of the official SS-4 form from the IRS website. It’s two pages, and you can view detailed instructions on the last section of this article on how to complete it.

The SS-4 for LLC form, also known as the Application for Employer Identification Number, is an Internal Revenue Service document that companies use to obtain an employer identification number. The IRS doesn't give you a physical copy of Form SS-4, but they will provide a copy of your EIN assignment letter to keep with your business records.