Letters in English

Sample Letters, Letter Templates & Formats

Home » Letters » Bank Letters » Premature Fixed Deposit Withdrawal Application – Fixed Deposit Closure Letter Before Maturity

Premature Fixed Deposit Withdrawal Application – Fixed Deposit Closure Letter Before Maturity

To, The Branch Manager, ______ (Bank Name) ______ (Branch) ______ ( Branch Address)

Date: __/__/____ (DD/MM/YYYY)

Subject Premature Closure of Fixed Deposit No. _______ (Fixed Deposit Number)

l am holding a Fixed Deposit A/C No. ____ (FD Number) in the name of ____ (Name). My fixed deposit no. ________ which is due for maturity on ______ (date of maturity). I need this money for _______ (personal) reasons.

Kindly close the FD before maturity and credit the amount in my _______ (type of account) account No. ____ (Account Number). I hereby enclosing FD Receipt/ FD Bond / FD Advice and KYC document /Customer request form (if applicable) with the application for fixed deposit closure.

Thanking You,

Signature: ________ Name: ________ Contact: ________

- FD Receipt/ FD Advice

- KYC Documents (if applicable)

- Customer Request Form (if applicable)

Incoming Search Terms:

- Grievance Letter Against Wrongful Termination – Termination Without Notice Complaint Letter

- Appreciation Certificate to Employee for Outstanding Performance

Leave a Reply Cancel reply

You must be logged in to post a comment.

Privacy Overview

Fixed Deposit Closure Application Letter to Bank Manager

Closing a fixed deposit (FD) account with your Bank can seem daunting. However, writing an application letter to your bank manager requesting the closure of your FD account is simple. This comprehensive guide provides step-by-step instructions and sample letters to help you easily write a practical FD closure application.

Fixed Deposit Liquidation Application to Bank Manager

You may need to close or liquidate your fixed deposit account prematurely due to an unexpected financial emergency. Here is a sample application letter to request your bank manager for premature closure of the FD account:

Date: DD/MM/YYYY

The Manager

[Bank Name]

[Bank Address]

Subject: Request for premature closure of Fixed Deposit Account No. [xxxxxx]

Respected Sir/Madam,

I, [Your Name], presently reside at [Your Address] and hold a fixed deposit account [FD Account Number] at your [Branch Name] branch. The details related to the account are:

- FD Account Number:

- Date Opened:

- Original Tenure:

- Maturity Date:

- Original Deposit Amount:

- Interest Rate:

I opened this [1/2/3 years] FD account [days/months/years] ago for [purpose, e.g., children’s education/wedding/vacation]. Unfortunately, due to [state reason], I am facing an urgent financial crisis and need money.

Therefore, I request that you let me close my fixed deposit account prematurely. I request you to [waive off penalties for pre-closure/deduct minimum pre-closure penalties] and pay the principal deposit amount along with accrued interest earned to date.

I will be highly thankful to you for considering my application favorably. Please let me know if you need any other documents from my end to process this closure request.

[Your name]

[Your signature]

Encl: Copy of FD account statement/passbook

This application letter clearly states your requirement for premature FD closure while providing critical details about your FD account. Customize the letter with your personal details and account information. Politely request the bank manager to consider waiving off or minimizing penalties to improve the chances of approval.

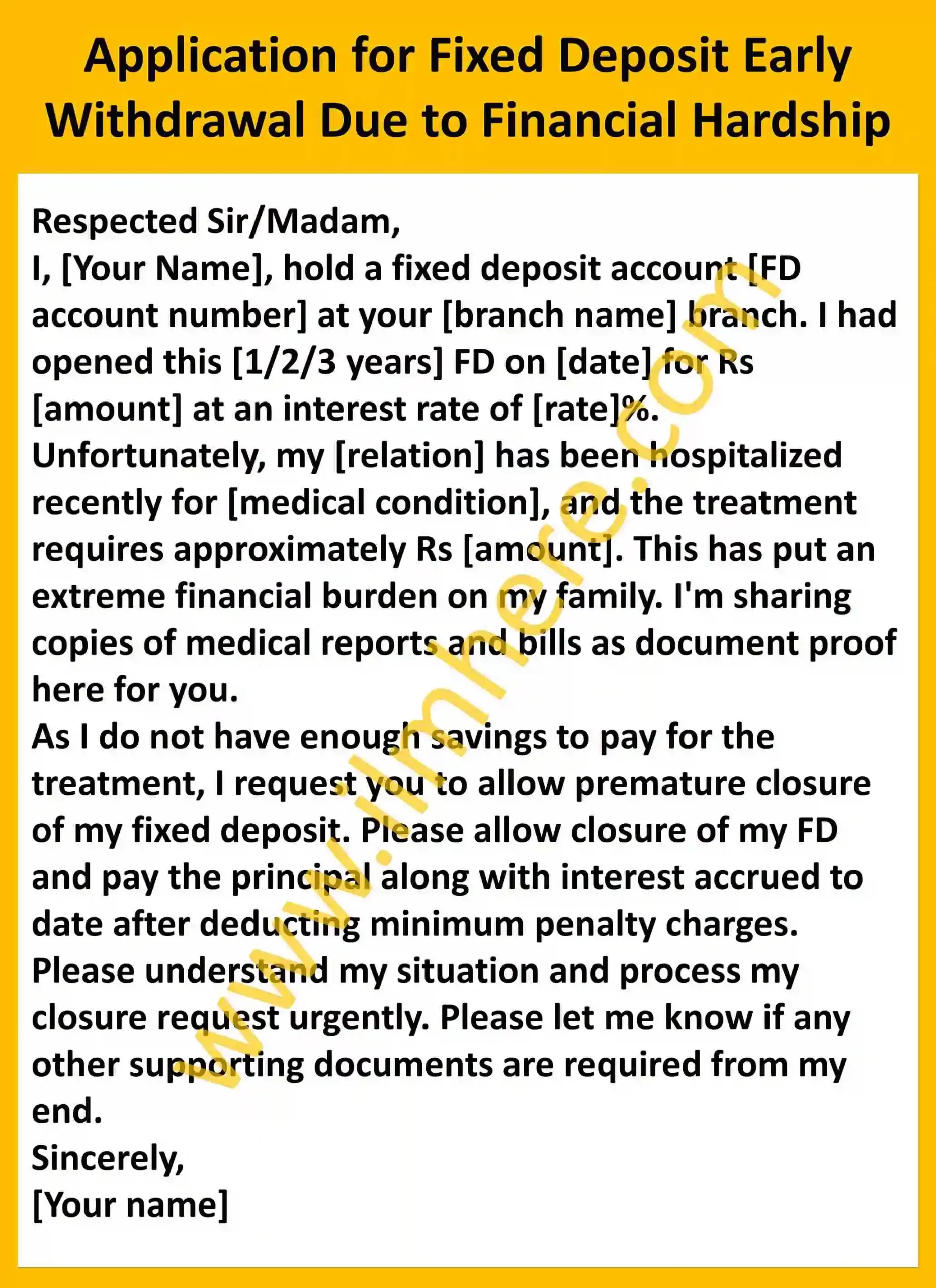

Application for Fixed Deposit Early Withdrawal Due to Financial Hardship

Are you facing unexpected medical expenses, job loss, or other emergencies? Here is how to write an application to withdraw your FD principal prematurely:

Fixed Deposit Early Withdrawal Application Due to Medical Emergency

Subject: Request for Fixed Deposit premature closure due to medical emergency

I, [Your Name], hold a fixed deposit account [FD account number] at your [branch name] branch. I had opened this [1/2/3 years] FD on [date] for Rs [amount] at an interest rate of [rate]%.

Unfortunately, my [relation] has been hospitalized recently for [medical condition], and the treatment requires approximately Rs [amount]. This has put an extreme financial burden on my family. I’m sharing copies of medical reports and bills as document proof here for you.

As I do not have enough savings to pay for the treatment, I request you to allow premature closure of my fixed deposit. Please allow closure of my FD and pay the principal along with interest accrued to date after deducting minimum penalty charges.

Please understand my situation and process my closure request urgently. Please let me know if any other supporting documents are required from my end.

Encl: Medical reports/bills copy

To support your application, submit additional documents like doctor prescriptions, medical test reports, hospital bills, etc. Being polite and highlighting urgency may help get it approved faster.

Fixed Deposit Premature Withdrawal Request Due to Job Loss

The Manager,

Subject: Fixed Deposit Premature Closure Request Due to Job Loss

This is to inform you that I, [Your Name], working as [designation] at [company name], have recently lost my job due to the company winding up operations.

I have an existing fixed deposit account [FD account number] at your [branch name] branch, which I opened [months/years ago]. The details related to it are:

- Maturity Amount:

As I have lost my primary source of income, I am facing severe financial constraints to manage monthly household expenses. I would therefore like to request that you please allow me to close my fixed deposit account prematurely.

I would be grateful if you waive any penalty charges for premature withdrawal and sanction closure as soon as possible. Please feel free to contact me if any clarification or documents are required for expediting this closure request.

Encl: Company closure notice/termination letter

Customize this sample letter with your employment and FD details. Including authentic evidence of job loss will portray genuineness.

Application to Close Fixed Deposit Due to Other Financial Emergency

Subject: Fixed Deposit Premature Closure Application

I opened a [1/2/3 years] fixed deposit account [FD account number] at your [branch name] branch on [date] with an interest rate of [rate]%, which totals a maturity amount of Rs [amount].

[Explain your situation briefly – a medical emergency, accident expense, house repair due to damage, etc.]

Due to this [financial/medical] emergency, I have inadequate funds to meet the expenses. Please allow the premature closure of my FD account.

Please waive off or charge minimum penalties on closure so I can withdraw the principal and accrued interest urgently to meet my financial needs. I’m sharing the necessary supporting documents here.

Please feel free to contact me at +91-xxxxxxxxxx for any clarifications needed to process this request as soon as possible.

Encl: Supporting documents

Briefly explain your situation and financial constraints while requesting to waive off penalties. Submit relevant proofs to validate your emergency.

Application for Fixed Deposit Closure for Investment Opportunities

Sometimes, better investment avenues that provide higher returns may arise. Here is how you can request to close your existing FD and reinvest funds:

[Bank Branch]

Subject: Application for Fixed Deposit closure to reinvest funds

I, [Your name], hold a Fixed Deposit account [FD account number] at your branch, which was opened on [date] for a tenure of [1/2/3 years] years at an interest rate of [rate]%.

Recently, my [relationship] informed me about some [property purchase/stock market investment] opportunity that promises [higher / better] returns compared to my existing FD account’s interest earnings.

I request that my Fixed Deposit account be closed to reinvest the maturity proceeds into this new [real estate/equity] opportunity for better wealth creation. Please deduct the minimum pre-closure penalty and provide me closure proceeds as soon as possible to avail of this time-bound offer.

Don’t hesitate to contact me on my mobile number, +91-X, in case any clarification or documents are required from my end to process this request.

Briefly explain the new investment opportunity and expected higher gains to justify your closure request logically. Submitting any proof of such offers will add more credibility.

Application to Revoke Fixed Deposit Auto-renewal and Request Closure

If you don’t wish to continue your FD account post maturity, write an application letter to the bank manager requesting cancellation of auto-renewal and closure of the account after maturity payment.

[Branch Address]

Subject: Request for Fixed Deposit Auto Renewal Cancellation and Account Closure

This is to inform you that I have a fixed deposit account [FD account number] with your branch. As per the FD agreement terms, the performance is set to auto-renew on maturity for the existing tenure.

However, I want to cancel my FD account’s auto-renewal option. Kindly ensure the account is not renewed automatically when it matures on [maturity date].

On maturity, please credit the principal plus accrued interest to date to my savings account [savings account number]. Post this, kindly close my FD account with your Bank permanently.

Please revert if you need any other supporting documents to process this request.

Clearly instruct the Bank not to renew your FD automatically, along with an account closure request after maturity payment proceeds are credited.

Application for Fixed Deposit Account Termination After Maturity Date

Here is how to formally request the closure of your fixed deposit account post-completion of its tenure:

Subject: Fixed Deposit Account Closure after Maturity

Please note that I hold a fixed deposit account [FD account number] at your [branch name]. The said FD account was opened on [date] for the tenure of [months/years] at [interest rate]% interest rate, which is set to mature on [maturity date].

My account shall complete its stipulated tenure next week upon maturity. Please credit the entire principal deposit amount and accrued interest for a full term to my Savings Account [savings account number] on [maturity date].

Post this payment, kindly close my FD account [FD account number] with your Bank permanently. Please revert if any other supporting documents are required from my end for this closure procedure.

[Your Signature]

Inform the Bank about your matured FD details while requesting account termination post-maturity payout. Keep the letter formal and polite for quick processing.

Application to Consolidate Multiple Fixed Deposits and Close Accounts

If you hold multiple FDs, here is how to request combining them into one consolidated FD account:

[Bank Name ]

Subject: Fixed Deposit Accounts Consolidation and Closure Request

I have been banking with your esteemed branch for the past [years] and hold [number] fixed deposit accounts as per the following details:

FD Account No.

Maturity Date

Current Value

Interest Rate

Rs [amount]

To simplify management, I want to consolidate all my existing FDs into one Fixed Deposit account. Request you to combine all my FDs into one consolidated account with an aggregate principal value of Rs [total amount].

Please set the new consolidated FD for [1/2/3 years] tenure at the maximum interest rate applicable. Also, please close my individual FD accounts post successful funds transfer into the new consolidated account.

Please confirm the latest procedural formalities for FD consolidation and associated charges, if applicable. Eagerly await your response.

Furnish all your existing FD details in a table for clarity. Specify tenure, interest rate desired for new consolidated accounts, and closure requests for old accounts.

Fixed Deposit Closure Application Letter to Bank Manager With Pictures

How to Write Fixed Deposit Closure Application Letter to Bank Manager

Follow these quick steps to draft a practical fixed deposit account closure request application to your Bank:

- Open with Salutation – Start by formally addressing your bank manager with a ‘Dear Sir/Madam’ salutation.

- Mention Account Details – Provide your complete FD account details like account number, date opened, tenure, interest rate, etc.

- Reason for Closure – Outline specific reasons for submitting the FD closure request application.

- Supporting Documents – Furnish copies of supporting documents like medical bills, termination letters, etc., based on closure reason.

- Closure & Settlement Request – Request the bank manager to process FD account closure and settlement of maturity proceeds into your savings account.

- Signature & Contact Info – Close the letter with your name, signature and contact details for further communication.

Being polite, highlighting the urgency for funds (if applicable), and enclosing relevant documents can significantly improve the chances of approval. Adapt provided samples and follow guidelines to quickly draft an effective FD account closure application letter suitable to your specific requirements!

We hope this comprehensive guide with detailed samples for different scenarios helps you easily write an appropriate fixed deposit closure application letter to your bank manager without any hassles. Remember to be polite, explain the rationale clearly, and enclose supporting proofs wherever feasible to fast-track closure approval! Let us know if you have any other queries.

What documents are required for a fixed deposit closure request?

Ans. The Bank may request documents like FD account statements, ID/address proofs, PAN, supporting proofs like medical bills, etc., for closure.

How much time does the Bank take to close an FD account?

Ans. Banks usually process FD account closure requests within 5-7 working days after letter submission and any other documents sought.

Can I get my FD money back before the maturity date?

Ans. Yes, you can submit a request for premature FD closure in case of emergency, though banks may levy penalty charges on the principal amount.

What happens if the FD account auto-renewal is not canceled before maturity?

Ans. If auto-renewal is active and not revoked before maturity, the FD amount will be automatically reinvested post-tenure for the existing lock-in period.

Also Reads,

Bilal Rafique, the person behind Ilmhere.com, works hard to create real and detailed educational content that helps people get better at English. Ilmhere.com is a website where you can learn English online. It covers lots of topics like English grammar, how to write applications, and other useful things to make learning easier.

View all posts

7+ Best Application For Hostel Leave With Complete Guide (2024)

7+ application to bank manager for minor to major account (2024), related articles.

10+ Best Leave Extension Application (2023)

10+ Best Application For Admission To School (2024)

7+ Best Leave Application For Own Marriage/Wedding In English (2023)

11+ Application for Closing Bank Account [Format with Sample]

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Fixed Deposit Closure Application Letter to Bank Manager (with Samples & PDFs)

I have listed sample templates to help you craft an effective and professional fixed deposit closure application letter to bank manager.

Also, I would like to point out that you can also download a PDF containing all the samples at the end of this post.

Fixed Deposit Liquidation Application to Bank Manager

First, find the sample template for fixed deposit closure application letter to bank manager below.

To, The Branch Manager, [Bank Name], [Branch Address], [City Name], [Postal Code]

Subject: Request for Closure of Fixed Deposit Account

Dear Sir/Madam,

I am writing this letter to bring to your attention that I wish to close my Fixed Deposit account with your esteemed bank. My Fixed Deposit account number is [Fixed Deposit Account Number].

The reasons for this closure are strictly personal and in no way reflect any dissatisfaction with the bank’s services. I have always appreciated the quality of service provided by [Bank Name], and it has been a pleasant banking experience for me so far.

I request you to kindly process my application at the earliest and arrange for the funds along with the accrued interest to be transferred to my savings account with the same bank. My savings account number is [Savings Account Number].

I understand that there may be some penalties or charges due to the premature closure, and I am ready to bear those, as per the bank’s policy.

Please let me know of any formalities or documents that I need to provide to facilitate the closure process. I am ready to visit the bank in person if required.

Thank you for your prompt attention to this matter. I apologize for any inconvenience this may cause to the bank.

Yours sincerely,

[Your Name] [Your Address] [City Name, Postal Code] [Phone Number] [Email Address]

Date: [Date of Writing]

Below I have listed 5 different sample applications for “fixed deposit closure application letter to bank manager” that you will certainly find useful for specific scenarios:

Application for Fixed Deposit Early Withdrawal Due to Financial Hardship

To, The Branch Manager, [Bank Name], [Branch Name], [Branch Address],

Subject: Application for Fixed Deposit Early Withdrawal Due to Financial Hardship

I, [Your Name], holding a Fixed Deposit account (A/C No: [Account Number]) with your esteemed bank, humbly request an early withdrawal of my fixed deposit due to unforeseen financial hardships.

The recent challenges, including the loss of my job and unexpected medical expenses, have caused a severe strain on my finances. In such a situation, I am left with no option but to withdraw my fixed deposit prematurely to manage my expenses and fulfill my financial obligations.

I understand that early withdrawal of fixed deposit will result in a reduced interest rate and may be subject to penalties as per the bank’s policy. However, under these circumstances, I kindly request you to consider waiving or reducing any penalties, if possible, to alleviate my financial burden.

I would appreciate your prompt assistance in processing the early withdrawal of my fixed deposit. Kindly let me know the necessary documentation and procedures to complete the process.

Thank you for understanding my situation, and I look forward to your favorable response.

Yours faithfully, [Your Name] [Mobile Number] [Email ID] [Address]

Application for Fixed Deposit Closure for Investment Opportunities

To, The Branch Manager, [Bank Name], [Branch Address],

Subject: Application for Fixed Deposit Closure for Investment Opportunities

Respected Sir/Madam,

I, [Your Name], holding a Fixed Deposit (FD) account with your esteemed bank, kindly request the closure of my Fixed Deposit account bearing number [FD Account Number]. The Fixed Deposit was initiated on [Date of FD Start] and is due to mature on [Date of FD Maturity].

I have decided to close the FD account prematurely due to some lucrative investment opportunities that I have recently come across. I believe that investing in these opportunities will yield better returns in the long run. I understand that closing the FD account before its maturity date may result in a reduced interest rate and a penalty, as per the bank’s terms and conditions.

Please find the original Fixed Deposit Receipt enclosed with this application. I kindly request you to close the FD account at the earliest and transfer the maturity amount (principal + accrued interest) to my savings account number [Savings Account Number] with your branch.

I would also like to apologize for any inconvenience this request may cause to the bank. I assure you that I have thoroughly evaluated the alternative investment options and made this decision after careful consideration. I appreciate your understanding and prompt assistance in this matter.

Thanking you.

Yours faithfully,

[Your Name] [Your Address] [Your Contact Number] [Date]

Application to Revoke Fixed Deposit Auto-renewal and Request Closure

To, The Branch Manager, [Bank Name], [Bank Branch], [City],

Subject: Application to Revoke Fixed Deposit Auto-renewal and Request Closure

I, [Your Name], am holding a Fixed Deposit (FD) account (FD Account No. [FD Account Number]) with your esteemed bank since [FD start date]. The fixed deposit is set to auto-renew on maturity, and the current maturity date is [Maturity Date]. However, due to my current financial requirements, I wish to revoke the auto-renewal option and request the closure of my fixed deposit account upon its maturity.

Kindly process my request and deposit the matured amount (including the interest earned) into my savings account (Account No. [Savings Account Number]) on the date of maturity. I would appreciate it if you could provide me with a written confirmation of the same at your earliest convenience.

Please let me know if any additional information or documentation is required to proceed with the request. I am enclosing a photocopy of my fixed deposit receipt for your reference.

Thanking you in advance for your assistance.

[Your Name] [Address] [Contact Number] [Email ID]

Application for Fixed Deposit Account Termination After Maturity Date

Subject: Application for Fixed Deposit Account Termination After Maturity Date

I, [Your Name], holder of Savings Account number [Account Number], had opened a Fixed Deposit Account bearing number [FD Account Number] on [Date of Opening] in your esteemed bank. The maturity date of the Fixed Deposit was [Maturity Date]. I now wish to terminate this Fixed Deposit Account post its maturity.

I kindly request you to close the said Fixed Deposit Account and transfer the maturity amount, along with any interest accrued, to my Savings Account number [Account Number]. I have attached a photocopy of my passbook, Fixed Deposit receipt, and a cancelled cheque for your reference.

Your prompt action in this matter would be highly appreciated. Kindly acknowledge the termination of my Fixed Deposit Account and inform me once the transfer of funds has been completed.

Thanking you in anticipation.

[Your Name] [Your Address] [City, Postal Code] [Phone Number] [Email Address]

Date: [Date of Application]

Application to Consolidate Multiple Fixed Deposits and Close Accounts

Subject: Application to Consolidate Multiple Fixed Deposits and Close Accounts

I, [Your Name], maintain multiple fixed deposit accounts at your esteemed bank. I would like to request the consolidation of these fixed deposits and the closure of the respective accounts.

The details of my fixed deposit accounts are as follows:

1. Account Number: [FD Account No. 1] Amount: [Amount 1] Date of Maturity: [Maturity Date 1]

2. Account Number: [FD Account No. 2] Amount: [Amount 2] Date of Maturity: [Maturity Date 2]

3. Account Number: [FD Account No. 3] Amount: [Amount 3] Date of Maturity: [Maturity Date 3]

Please consolidate the above fixed deposits and credit the total amount to my savings account (Account Number: [Savings Account Number]) upon the maturity of each fixed deposit. Subsequently, I request the closure of the above-mentioned fixed deposit accounts.

I am enclosing copies of my fixed deposit certificates as required. Kindly acknowledge this application and carry out the requested actions at the earliest. Please inform me when the consolidation and closure process is completed.

Thank you for your prompt attention to this matter.

[Your Name] [Your Address] [City, State, Postal Code] [Contact Number] [Email Address]

Date: [Date of Submission]

How to Write Fixed Deposit Closure Application Letter to Bank Manager

Some writing tips to help you craft a better application:

- Begin with your name, address, and contact details.

- Include the date of writing the letter.

- Add the bank manager’s name, bank name, and branch address.

- Choose an appropriate subject line such as “Request for Fixed Deposit Closure.”

- Start the letter with a formal salutation, like “Dear Sir/Madam.”

- Introduce yourself and mention your fixed deposit account number.

- Explain the reason for closing the fixed deposit account.

- Specify the maturity date of the fixed deposit.

- Request a prompt closure of the account and the balance to be transferred to your savings account or disbursed via check.

- If required, attach relevant documents for proof and reference.

- Provide your savings account details for the transfer.

- Thank the bank manager for their assistance and cooperation.

- Close the letter with a formal sign-off, like “Yours sincerely,” followed by your name and signature.

Related Topics:

- Application for Current Account Closure

- Loan Close Application

- SBI Account Closure Application

View all topics →

I am sure you will get some insights from here on how to write “fixed deposit closure application letter to bank manager”. And to help further, you can also download all the above application samples as PDFs by clicking here .

And if you have any related queries, kindly feel free to let me know in the comments below.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search This Blog

Search letters formats here, letter to bank for closing fixed deposit fd before/after maturity.

submit your comments here

Thank you very much for the format.

Was helpful in writing my letter.

What if we just wanted to withdraw some amount after maturity of FD and then want to reinvest the remaining amount as fd

Then, at first, you will have to submit a request to mature the FD in full and after receipt of the maturity amount, you can keep whatever amount you want to keep out of it and open a new FD for the rest of the amount with the bank. Options to mature an existing FD and open a new FD are available both through online medium and at branch office.

Is it possible if nominee can request for FD withdrawal as the account holder is being hospitalized and money is required for same.

Generally, only after death of the FD holder, withdrawal is possible by the nominee by providing necessary documents. But if the FD holder is alive and hospitalised, you can get the FD withdrawal/maturity form signed from that person in the hospital and submit it to the bank. Some banks have made available the form online too. Please call at the customer care executive number of the bank or email them to know the exact process. If the FD was created online, you can use the netbanking website to mature the FD. An OTP might be sent in online withdrawal case.

Thank you Ramesh :)

If the fixed deposit is in joint name what to do for encashment of it prematurely?

Both holders' signatures will be required in application form. Please visit bank's branch office. They might have printed application form for you to fill up and submit.

Can I claim fd amount after 10 years ? And how

Yes, you may. But, please contact the bank for accurate procedure for this.

Post a Comment

Leave your comments and queries here. We will try to get back to you.

- Learn English

- Universities

- Practice Tests

- Study Abroad

- Knowledge Centre

- Ask Experts

- Study Abroad Consultants

- Post Content

- General Topics

- Articles/Knowledge Sharing

- Sample Letters and Letter Formats

Sample Letter for Premature Withdrawal of Fixed Deposit

The customers of the banks open Fixed Deposit Accounts in the same branches where they have Savings Accounts. However, due to the emergency, the customers may have to close the Fixed Deposit Account before maturity. The present article provides a sample letter for premature withdrawal of Fixed Deposit.

Sub: Request to prematurely close Fixed Deposit Account. Date: {Put the date here} From The customer (Name as per the bank record) Address {As per the bank record} To The Branch Manager XYZ Bank ABC Street New Delhi – 11000* Dear Sir/ Madam, I (name of the customer) hold the Savings Bank Account No. (indicate the Savings Bank Account No.) in your Branch. I would further like to state that I also opened a Fixed Deposit Account (indicate the Fixed Deposit Account No.) on (the date on which the Fixed Deposit was opened) depositing an amount of Rs. (put the principal amount). The tenure of the Fixed Deposit was (the tenure) years. However, I urgently need the money for some personal purpose. So you are requested to close my aforesaid Fixed Deposit account prematurely and transfer the entire amount (principal + accumulated interest) to my Savings Bank Account (Savings Account No.) maintained in your branch. Hoping for you to comply my request at the earliest. With regards. Yours sincerely, {Signature of the Customer} {Name of the Customer}

More Sample Letter

Sample letter to bank to close sb account sample letter to bank to merge one account to another sample letter to bank to close account and transfer fund to another account sample letter to bank for demat account opening.

Related Articles

Fixed deposits – a contra approach 2011, nri fixed deposit and its various aspects, smart things to know before investment in fixed deposits, fixed deposits – a risk free investment scheme, latest fixed deposit and bank deposit schemes for safeguarding investment portfolio, comparison of various e-fixed deposit schemes by sbi, do company fixed deposits make a safe investment, factors to consider while investing in corporate fixed deposits, banks with highest interest rates on fixed deposits in india, bank sample letter for premature withdrawal of fixed deposit.

More articles: Fixed Deposit

- Do not include your name, "with regards" etc in the comment. Write detailed comment, relevant to the topic.

- No HTML formatting and links to other web sites are allowed.

- This is a strictly moderated site. Absolutely no spam allowed.

Top Contributors

- DR.N.V. Sriniva... (29)

- Neeru Bhatt (28)

- DR.N.V. Sriniva... (217)

- Vandana (169)

- Umesh (162)

About IndiaStudyChannel.com

Being the most popular educational website in India, we believe in providing quality content to our readers. If you have any questions or concerns regarding any content published here, feel free to contact us using the Contact link below.

- Admissions Consulting

- Adsense Revenue

- Become an Editor

- Membership Levels

- Winners & Awards

- Guest Posting

- Help Topics

STUDY ABROAD

- Study in Foreign Universities

- Study in Germany

- Study in Italy

- Study in Ireland

- Study in France

- Study in Australia

- Study in New Zealand

- Indian Universities

- Nursing in Mangalapuram

- BDS in Mangalore

- MBA in Bangalore

- Nursing admissions in Mangalore

- Distance MBA

- B Pharm in Mangalore

- MBBS in Mangalore

- BBA in Mangalore

- MBA Digital Marketing

- Privacy Policy

- Terms of Use

Promoted by: SpiderWorks Technologies, Kochi - India. ©

- Login / Sign-up

- Logout Get Support

- Mutual Funds Home

- Know your Investor Personality

- All about Mutual Funds

- Explore Mutual Funds

- Check Portfolio Health

- Equity funds

- Hybrid funds

- Explore Genius

- Genius Portfolios

- MF Portfolios

- Stocks Portfolios

- Term Life Insurance

- Health Insurance

- SIP Calculator

- Mutual Fund Calculator

- FD Calculator

- NPS Calculator

- See all calculators

- Help & Support

Great! You have sucessfully subscribed for newsletters for investments

Subcribed email:

- Fixed Deposit

- SIP related queries

- About Fixed Deposit

Can I close my FD prematurely?

FD can be closed prematurely after completing a lock in period of 3 months from the date of booking of FD. You can either submit the following documents to the nearest Bajaj Finserv branch for premature withdrawal of FD with the following documents

- Original copy of FDR

- Re 1/- revenue stamp to be affixed on the above FDR copy and signed by the FD holder. You can skip this step if your FD is booked on or after Oct 2021

- Application letter requesting premature closure of your FD

If there is no branch near you, courier the above documents to the following address. Once received, the Bajaj Finserv team will credit the amount to your registered bank account. Bajaj Finance Limited Fixed Deposit Department 4th Floor, Bajaj Finserv Corporate Office, Off Pune-Ahmednagar Road Viman Nagar, Pune – 411014

Thank you for your feedback!

If you need more help, kindly get in touch with us

Hey there! Our team is actively working on your ticket and will respond to you soon. We appreciate your patience while we resolve this.

I have a different query.

The below response might help in resolving your query

Welcome to support.

Letter Formats and Sample Letters

Searching for letter formats? We howtoletter realized your need and thus come up with several types of sample letters and format of letters. Dig into the website and grab what you want.

Saturday, July 15, 2017

Sample letter for premature withdrawal of fixed deposit.

Related Articles

Emoticon Emoticon

19+ FD Closure Letter Format – Explore Writing Tips, Examples

- Letter Format

- March 22, 2024

- Request Letters , Bank Letters , Legal Letters

FD Closure Letter Format: A FD Closure Letter Format is a formal communication sent by an individual or organization to a bank or financial institution requesting the closure of a Fixed Deposit account . This FD Closure Letter Format is typically sent when the depositor needs to withdraw the funds from the account before the maturity date .

A Fixed Deposit (FD) account is a type of savings account where the depositor agrees to keep a fixed amount of money with the bank or financial institution for a specific period of time, usually ranging from a few months to several years . The interest rate offered on a Fixed Deposit is generally higher than that offered on a regular savings account .

However, there may be situations when the depositor needs to withdraw the funds from the FD account before the maturity date. In such cases, the depositor must inform the bank or financial institution and request the closure of the account. This is where the FD Closure Letter Format comes into play.

The FD Closure Letter Format must be written in a formal tone and include all the necessary details, such as the name of the depositor, account number, and the reason for the closure. It is important to clearly state the date on which the account should be closed and the mode of payment for the withdrawn amount.

- 20+ Ad Code Letter Format – Meaning, Purpose, Examples

- Surrender Letter Format In Word – 13+ Samples, Email Template

- 18+ Bank Address Change Letter Format – Templates, Writing Tips

FD Closure Letter Format Writing Tips

Content in this article

When an individual or a business wants to close a fixed deposit (FD) account with their bank, they will need to write a formal FD Closure Letter Format to inform the bank of their decision. While this may seem like a straightforward task , there are certain tips and considerations to keep in mind when drafting an FD closure letter. In this article, we will discuss the essential elements of an FD Closure Letter Format and provide tips to help ensure that your Request letter is effective.

- Include the Account Details : The first and most crucial aspect of your FD closure letter is to provide the account details. This should include the account number, account holder’s name, and any other relevant details such as the branch where the account was opened. Providing these details will ensure that the bank can easily locate and close the account in question.

- State the Reason for Closure: It is essential to state the reason for closing the account. This could be due to a variety of reasons, such as financial difficulties, a change in investment plans, or simply because the account has matured. Stating the reason for closure will help the bank understand your situation and may even offer you alternative investment options.

- Request for Account Closure: The next step is to make a request for the account closure. Be clear in your language and state that you want the bank to close the FD account. This will ensure that there is no confusion or misunderstandings between you and the bank.

- Provide Contact Information: It is important to provide your contact information, such as your phone number and email address. This will help the bank to contact you if there are any issues or questions regarding your account closure request.

- Signature and Date: Finally, your FD closure Bank letter should include your signature and the date. This will provide proof that you have authorized the account closure request and ensure that the bank can process your request promptly.

FD Closure Letter Format – Sample format

Below is a sample format of FD Closure Letter Format:

[Your Name] [Your Address] [City, State, Zip Code] [Your Email Address] [Your Phone Number] [Date]

[Bank/Branch Manager’s Name] [Bank/Branch Name] [Bank/Branch Address] [City, State, Zip Code]

Subject: Closure of Fixed Deposit Account No. [Your Account Number]

Dear [Bank/Branch Manager’s Name],

I hope this letter finds you well. I am writing to inform you of my decision to close my Fixed Deposit (FD) Account No. [Your Account Number] with your esteemed bank.

Please find below the details of my FD account:

Account Holder’s Name: [Your Name] Account Number: [Your Account Number] Principal Amount: [Principal Amount] Maturity Date: [Maturity Date] Current Balance: [Current Balance]

I would like to request the closure of this account and the transfer of the remaining balance to my savings account [Savings Account Number]. Kindly process the closure at your earliest convenience and initiate the transfer to the specified savings account.

I would also appreciate it if you could provide me with a confirmation letter stating the closure of the FD account and the transfer of funds to my savings account for my records.

Thank you for your prompt attention to this matter. Please do not hesitate to contact me if any further information is required.

[Your Name]

FD Closure Letter Format – Example

Here’s an Example of FD Closure Letter Format:

I hope this letter finds you well. I am writing to inform you of my intention to close my Fixed Deposit (FD) Account No. [Your Account Number] with your bank.

I kindly request you to close the above-mentioned FD account and transfer the remaining balance to my savings account [Savings Account Number]. Please ensure that all interest accrued up to the closure date is included in the transfer.

I would appreciate it if you could confirm the closure of the FD account and the transfer of funds to my savings account via email or postal mail.

Thank you for your prompt attention to this matter. Should you require any further information or documentation, please do not hesitate to contact me.

FD Closure Letter Format – Example

Basic FD Closure Letter Format

Here is a Basic FD Closure Letter Format

[Your Name] [Your Address] [City, State Zip Code] [Date] [Bank Name] [Branch Name] [City, State Zip Code]

Dear Sir/Madam,

I am writing to request the closure of my fixed deposit account [Account Number] with immediate effect. The reason for this request is [state reason]. I kindly request you to transfer the funds to my savings account [Savings Account Number] as soon as possible.

I would like to thank you for the services provided during my tenure with your bank.

[Your Signature] [Your Name]

FD Closure Letter Format with Request for Cheque

Here’s a FD Closure Letter Format With Request For Cheque:

I am writing to request the closure of my fixed deposit account [Account Number] with immediate effect. The reason for this request is [state reason]. I kindly request you to issue a cheque for the outstanding balance in the account and mail it to my address [Your Address].

FD Closure Letter Format – Template

Here’s a Template of FD Closure Letter Format:

I am writing to request the closure of my Fixed Deposit (FD) Account No. [Your Account Number] with your esteemed bank. Please find the details of my FD account below:

I kindly request you to process the closure of this FD account and transfer the remaining balance to my savings account [Savings Account Number]. I would appreciate it if you could provide me with a confirmation letter stating the closure of the FD account and the transfer of funds to my savings account.

Thank you for your prompt attention to this matter. Should you require any additional information, please feel free to contact me.

FD account closure letter due to emergency

Here’s a FD account closure letter due to emergency:

[Bank Manager’s Name] [Bank Name] [Bank Address] [City, State, Zip Code]

Dear [Bank Manager’s Name],

I am writing to you with a sense of urgency regarding my Fixed Deposit (FD) account, [Your FD Account Number], held with your esteemed bank. Due to unforeseen circumstances and financial emergency, I am compelled to request the closure of this account.

Account Holder’s Name: [Your Name] FD Account Number: [Your FD Account Number] Principal Amount: [Principal Amount] Maturity Date: [Maturity Date] Current Balance: [Current Balance]

I kindly request you to expedite the closure process and transfer the remaining balance to my linked savings account [Savings Account Number]. It is crucial that the funds be made available as soon as possible to address the emergency situation.

Additionally, I would appreciate receiving a confirmation letter from the bank once the closure and transfer have been successfully processed.

Thank you for your understanding and prompt attention to this matter. Should you require any further information or documentation, please do not hesitate to contact me.

FD Account Closure Letter Due to Emergency

FD closure letter to bank manager

This is a FD closure letter to bank manager:

I hope this letter finds you well. I am writing to formally request the closure of my Fixed Deposit (FD) account with your esteemed bank.

I kindly request you to initiate the closure of my FD account and transfer the remaining balance to my savings account [Savings Account Number]. Please ensure that all accrued interest up to the closure date is included in the transfer.

Additionally, I would appreciate receiving a confirmation letter from the bank confirming the closure of the FD account and the transfer of funds to my savings account for my records.

FD Closure Letter to Bank Manager

Letter to close FD account due to maturity

Here is a Letter to close FD account due to maturity:

I am writing to inform you that my Fixed Deposit (FD) account, [Your FD Account Number], with your esteemed bank is reaching its maturity date. In light of this, I would like to proceed with the closure of the account and the withdrawal of funds.

Please initiate the closure process and transfer the matured amount along with the accrued interest to my linked savings account [Savings Account Number].

Additionally, I kindly request a confirmation letter from the bank confirming the closure of the FD account and the transfer of funds to my savings account.

Letter to Close FD Account Due to Maturity

Email Format about FD Closure Letter Format

Here’s an Email Format of FD Closure Letter Format:

Subject: Request for FD Account Closure – [Account Number]

Dear [Bank Name],

Please find attached a copy of my ID proof for verification purposes. Kindly let me know if any additional documentation is required.

Sincerely, [Your Name]

FD Closure Letter Format with Change of Address

This is a FD Closure Letter Format With Change Of Address:

[Your Name] [Your Old Address] [City, State Zip Code] [Date] [Bank Name] [Branch Name] [City, State Zip Code]

I am writing to request the closure of my fixed deposit account [Account Number] with immediate effect. The reason for this request is [state reason]. I kindly request you to transfer the funds to my savings account [Savings Account Number] and to update my address to [Your New Address].

FD Closure Letter Format with Joint Account Holder

This is a FD Closure Letter Format With Joint Account Holder:

I am writing to request the closure of our joint fixed deposit account [Account Number] with immediate effect. The reason for this request is [state reason]. We kindly request you to transfer the funds to our joint savings account [Savings Account Number] as soon as possible.

We would like to thank you for the services provided during our tenure with your bank.

[Joint Account Holder’s Signature] [Joint Account Holder’s Name]

FAQS About FD Closure Letter Format – Explore Writing Tips, Examples

What information should be included in an fd closure letter.

An FD closure letter should include details such as your name, address, FD account number, principal amount, maturity date, current balance, and a formal request for the closure of the account.

How do I address the recipient of an FD closure letter?

If you’re writing to the bank manager, you can address them as “Dear [Bank Manager’s Name]” or “To the Bank Manager.” Ensure to use a formal salutation appropriate for business correspondence.

What should I mention in the body of the letter?

In the body of the letter, specify your intention to close the FD account, provide relevant account details, request the transfer of funds to your savings account, and express gratitude for their assistance.

Is it necessary to mention the reason for closing the FD account?

It’s not always necessary to mention the reason for closing the FD account, especially if it’s due to maturity. However, if there’s a specific reason such as financial emergency or reinvestment, you may choose to include it.

How can I ensure my FD closure letter is formal and professional?

To ensure your FD closure letter is formal and professional, use a clear and polite tone, avoid using slang or informal language, and proofread the letter for any errors before sending it.

Can I request a confirmation letter from the bank after closing the FD account?

Yes, it’s common to request a confirmation letter from the bank confirming the closure of the FD account and the transfer of funds to your savings account. This serves as proof of the transaction for your records.

Writing an FD Closure Letter Format may seem like a simple task , but it is crucial to get the details right. By including the essential elements of an FD Closure Letter Format and following these tips, you can ensure that your letter is effective and that your account closure request is processed smoothly . Remember to be clear and concise in your language and to provide all relevant details to ensure that your letter is successful .

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

24+ Car Parking Letter Format – How to Write, Email Templates

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

11+ Authorized Signatory Letter Format – Templates, Writing Tips

20+ Authorization Letter Format for ICEGATE Registration – Examples

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

The Economic Times daily newspaper is available online now.

How to close a bank fd: forms and documents to be submitted, interest rate.

How to close a bank FD (whether opened online or offline by visiting a bank branch), both on maturity and premature closure.

Closure of FD on maturity

- Auto-renew : On the due date, the bank may renew the FD automatically for one year or for the original term of the FD.

- Auto liquidation: On the due date, the FD gets liquidated and the bank transfers the proceeds to the savings account.

Premature closure of FD

- Partial closure: For the deposit amount remaining after the part withdrawal, interest rate will be reset as the rate applicable for the amount remaining, for the original tenure, as prevailing on the date of opening of the deposit.

- Full closure and reinvestment into new FD: In case of the fixed deposit being prematurely closed for the purpose of reinvestment into another scheme of fixed deposit, the existing deposit would be subject to penal rate of interest as prescribed by the bank on the date of deposit. Interest will be paid for the period the deposit has remained with the bank. The interest rate prevailing on the date of re-investment of term deposit will be applicable for the new term deposit.

Read More News on

(Your legal guide on estate planning, inheritance, will and more.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Falling Adani Group stocks keep MFs away. Will Sandeep Tandon’s contra bet work?

Was Dalal Street underestimating the potential of Maruti’s first EV?

Tata Motors boards Chennai express, reaches Hyundai’s doorstep with an INR9,000 crore plant

The missing link: How criminals teamed up with bank employees to orchestrate cyber frauds.

Nifty financial service index stocks: Are headwinds slowing down?

Is all the bad news and views priced in ? 4 stocks from the natural gas sector for contrarian trade.

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

- Business Business Topics Big Shots Startups Brand Games Juicy Scams Under Business

- Finance Finance Topics News Platter Tax Club Macro Moves Your Money Under Finance

- Invest Invest Topics Stock Market Financial Ratios Investor's Psychology Mutual Funds Under Invest

Trending Topics

Premature fixed deposit withdrawal: penalty & how to avoid it.

Deb P Samaddar

Created on 14 Sep 2022

Wraps up in 6 Min

Read by 4.4k people

Updated on 01 Dec 2022

72% of Indians don't have adequate emergency funds! Most people aren't ready to handle financial crunches, whether it is a medical emergency or sudden repair/maintenance. A go-to alternative to meet these emergencies is premature withdrawal from fixed deposits.

The average interest rate for fixed deposits is around 7% per annum , slightly above a normal savings account. Fixed deposits, also known as term deposits, are usually preferred due to their assured returns when compared to equities. However, due to limitations and penalties, people are apprehensive about prematurely closing their FD.

So, should you break your FD prematurely? How much of your returns are lost when you do? How do you even break an FD? Read on and find out.

Procedure for Premature Withdrawal of Fixed Deposit

Generally, the penalty charges range from 0.5% or 1% of the interest rate, based on the value of the FD being up to ₹5 lakh or more. The penalty is the amount charged by the bank when the depositor takes out the money from the bank before the date of maturity.

The fine is levied on the interest to be paid to the depositor. Very few banks offer zero penalty charges on premature withdrawal. However, the bank is liable to pay no interest if the FD is prematurely closed before completing seven days from the booking date.

You can apply for premature withdrawal in two ways, offline and online.

For the offline method , you need to visit the bank, submit the required documents, fill out the application form, visit the home branch and get the FD closed.

For the online method , you must have booked the FD in online mode in the first place, and internet banking should be enabled for it. Your account should have a net banking facility. Customers can close their FD accounts prematurely using the banks' online web portal or app. The steps vary from one bank's portal to another, but the general procedure is similar.

If you need a lesser amount of funds than your fixed deposit , you can also save on the penalty by going for a partial withdrawal.

Tax-Saver fixed deposits do not allow any withdrawals, partial or otherwise. Most banks have a lock-in period of five years for Tax Saver Fixed Deposit.

Did you know that you need to maintain AMB (Average Monthly Balance) on the bank account linked to your Fixed Deposit?

FD Premature Withdrawal Penalty Calculator

There are two cases that may arise in the case of a premature withdrawal of a fixed deposit. The difference between these two cases is the annual rate of interest provided by the two bank accounts; the Fixed Deposit account and the Savings Account. The scenario changes based on which account has the higher interest rate.

Case 1: FD interest rate is more than the Savings Account interest rate Assuming that a customer has created an FD worth ₹1 lakh that provides 7% interest for 2 years. For the same scenario, let's assume that the prevalent savings account interest rate is 6.5%. She withdraws from the FD after completing 1 year. In one year, she would have earned around ₹7,000 in interest at the FD's rate of 7%. However, the new interest rate for the sake of premature withdrawal would be 6.5% – 0.5%= 6%. Therefore, the new rate will be 6%, and interest shall be paid at this rate instead of the previous 7%.

Case 2: Savings Account interest rate is higher than FD interest rate Assuming that another customer has invested in an FD of Rs. 1 lakh at a rate of 6% for 2 years. Let us also believe that the interest rate for a normal savings bank account for 1 year at the time of the creation of the FD is 7%. The penalty rate for premature withdrawal shall be 0.5% of the effective interest rate in this case. The effective interest rate, in this situation, will be the lower of the two rates, and the lower rate shall be used for the calculation of the revised interest rate on the FD.

He withdraws from the FD after completing 1 year. For this period, he has accrued interest @ 6%. But the effective FD rate in the case of this premature withdrawal will be 6% – 0.5%= 5.5%. The holder of the FD account shall receive a reduced amount of interest after the reduction of the penalty.

Note: These are hypothetical scenarios only. The actual numbers and calculations may vary at the time of withdrawal.

You can use online premature FD penalty calculators to gauge how big of a penalty you will pay, how much the interest will be lowered, and the disadvantages (if any) of withdrawing the money prematurely. In addition, you can analyse the returns you will get on withdrawal and how much you lose due to penalty so that you can either hold on to the FD amount or withdraw the amount partially.

FD Withdrawal -Some Points To Ponder

FDs are considered a haven to park your money if you are a risk-averse investor. Breaking your FD prematurely may lead to some adverse consequences; you need to give thought to:

- Reduced interest,

- Reduction in the matured amount of FD.

- For retirees, premature withdrawal can stress one's retirement funds. Individuals can consider taking a loan on the FD.

- The documentation and filing processes are often cumbersome.

Ways To Avoid Making a Premature Withdrawal

1. Bank FD laddering: Laddering is buying multiple FDs maturing at different periods. Divide your lumpsum investment into smaller investments that will mature at different times, say, one year, two years, five years and so on.

2. Sweep-in facility: The facility enables you to transfer any sum over a preset amount specified by you from your savings account to a sweep-in deposit account. The interest rate varies according to the tenure of the deposit, from one year to five years. However, the preset amount mentioned above needs to be at least ₹25,000.

3. Avail of a loan against the FD: In many cases, most banks provide a loan against the FD. The amount that can be received as a loan can go as much as 90 % of the deposit account. The interest rate is usually 1-2% above the interest paid on the deposit.

The Bottom Line

Fixed deposits and their greater security as a result of low risk are often used by risk-averse investors. These include individuals with inflexible horizons, and a premature withdrawal can jeopardise their financial standing. Thus, proper research is necessary before taking a decision with such serious consequences. That being said, go for a premature withdrawal of your FD if it helps fulfil your requirements. When you need funds, breaking your FD can be a better option than other lending instruments based on your financial appetite.

Would you still go for premature withdrawal if you had other options?

Tell us in the comments section below.

How was this article?

Like, comment or share.

An Article By -

19.6m Views

488 Post Likes

If people could be named after idioms, Deb would be called "I'm all ears." His brain is a storehouse, ever overflowing with derelict information. So, while most things he talks about are as useless as occasion-less greeting cards, everything he writes has the potential of bagging you multiple diplomas!

Topics under this Article

Share your thoughts.

We showed you ours, now you show us yours (opinions 😉)

Why not start a conversation?

Looks like nobody has said anything yet. Would you take this as an opportunity to start a discussion or a chat fight may be.

Related Articles

More titbits on the go

All you need to know about the Indian Banking Sector

13 Dec 2023

Stock Market

Value Investing 101: Making Money the Smart Way

30 Nov 2023

ESG Excellence in India: A Deep Dive into the Top Performing Companies

26 Oct 2023

How to do Sector-Wise Comparison of Companies?

20 Oct 2023

Under Your Money

"A few" articles ain't enough! Explore more under this category.

Gold Saving Schemes in India

27 Mar 2024

NRI remittances: Why You Must Choose NRI Savings Accounts?

30 Jan 2024

7 Behaviours that You Must Avoid to Become Rich!

23 Jan 2024

Pay 0 Tax with an Income of upto ₹12 Lakh

16 Jan 2024

Share this post

Or copy the link to this post -

https://insider.finology.in/your-money/premature-withdrawal-of-fixed-deposit

🤩 Reading never goes out of fashion.

You need to login to continue. Let's take your love for reading to the next level with:

- Custom feed of your chosen topics.

- Personal library of Liked & Bookmarked articles.

- Live to & fro comments with Insider.

How to break your FDs before maturity

How to break your FDs: Emergencies warrant immediate cash flow, which is why most people opt for breaking their fixed deposits. Fixed deposits are excellent investment instruments for emergencies, where you can set aside some amount. Financiers like Bajaj Finance Limited provide you with an option to take a loan against fixed deposits , so that you can tend to emergencies easily.

To avoid delays and speed up premature FD withdrawals, here’s what you need to know:

Online application process for breaking Fixed Deposits

Breaking an FD online can help you save time and avoid unnecessary hassle. Here’s what could help you with an online process to withdraw your funds prematurely:

- Visit your lender’s website

- Login by entering your user ID and password and go to the service request section

- Select the option prompting for ‘Premature Closure of Fixed Deposits’

- Enter your FD number and submit a cancellation request

Usually, the process for premature fixed deposit closure remains the same throughout all financiers. An online option evades the hassles of paperwork and appointments with the lender.

Offline application process for breaking Fixed Deposits

Though the online procedure is much more convenient, offline methods are popular when you cannot access the internet. The two primary steps for this procedure are:

- Complete and submit the premature FD withdrawal form. Make sure you enter the requested details such as your FD number, your name, bank account details and so on.

- Submit this form with ID proof, such as a photocopy of your PAN card, after which your FD will end. The money will be credited to your account either online or offline through a cheque into your bank account.

What should you remember when you break your FDs prematurely?

- The offline application procedure could be time-consuming if you have to travel a long distance to your financier.

- The online application requires you to have access to high-speed internet and a computer.

- Have all documents and details about your fixed deposit handy to speed up the process further.

Understand both procedures so that you can make the right choice. Also, avoid investing in long-term FDs if you anticipate several financial commitments.

Fixed deposit variants

Digital fd only on app/web, fd - age below 60, systematic deposit plan, fd - senior citizen, fd – special tenure, how does the premature withdrawal of fixed deposits affect your interest calculation.

This is because when you break an FD, you might also lose out on interest or be eligible to pay the penalty. So, evaluate other ways of raising finance before you decide to break your fixed deposit, or you can check FD Interest Rates first before going further.

Bajaj Finance is now offering an attractive rate of interest of up to 8.85% p.a. on our fixed deposits.

Important Points to Remember When Breaking FD Prematurely

When determining whether to make an early withdrawal of FD, there are some crucial considerations that you should keep in mind. As follows:

- Breaking FD offline can take some time, especially if the branch is far away. Online premature withdrawal of FD requires both a gadget that can handle the process and high-speed internet.

- Keep all the documentation and documents close at hand to expedite the premature withdrawal of FD.

- Make sure you are familiar with both processes before choosing any approach, then decide.

- If you anticipate having multiple financial obligations, choose a short-term fixed deposit.

- Either you will forfeit interest income, or you will be responsible for paying FD breaking fees.

Calculate your expected investment returns with the help of our investment calculators

Frequently asked questions.

Bajaj Finance has launched a new FD type called "Bajaj Finance Digital FD" for a period of 42 months. Bajaj Finance is providing one of the highest interest rates of up to 8.85% p.a. for senior citizens and for the customers below the age of 60 they are providing up to 8.60% p.a. The Digital FD can be booked and managed only through the Bajaj Finserv website or app.

To break your fixed deposit online through the Bajaj Finance website or app.

To withdraw an FD online, log in to your account, locate the FD section, select the FD you wish to withdraw, and follow the online instructions provided by your FD provider. Keep in mind that online FD withdrawals may have specific conditions and processing times.

Yes, banks and NBFCs typically impose a penalty for prematurely closing an FD account, and the amount may vary between different financial institutions and types of deposits.

The penalty for premature closure is usually a percentage of the earned interest, with this percentage varying among different financial institutions.

While many financial institutions charge a penalty for breaking an FD, some exceptions exist.

Related Videos

Systematic Deposit Plan vs Recurring Deposit

Systematic Deposit Plan - Features and Benefits

Retirement Plan

Fixed Deposits and Recurring Deposits

As regards deposit taking activity of Bajaj Finance Ltd (BFL), the viewers may refer to the advertisement in the Indian Express (Mumbai Edition) and Loksatta (Pune Edition) furnished in the application form for soliciting public deposits or refer https://www.bajajfinserv.in/fixed-deposit-archives The company is having a valid Certificate of Registration dated March 5, 1998 issued by the Reserve Bank of India under section 45 IA of the Reserve Bank of India Act, 1934. However, the RBI does not accept any responsibility or guarantee about the present position as to the financial soundness of the company or for the correctness of any of the statements or representations made or opinions expressed by the company and for repayment of deposits/discharge of the liabilities by the company.

For the FD calculator the actual returns may vary slightly if the Fixed Deposit tenure includes a leap year.

Please wait

Your page is almost ready

IMAGES

VIDEO

COMMENTS

Premature Fixed Deposit Withdrawal Application - Fixed Deposit Closure Letter Before Maturity . March 7, 2020 August 24, 2022 0 Comments Letter to Branch Manager. To, The Branch ... __/__/____ (DD/MM/YYYY) Subject Premature Closure of Fixed Deposit No. _____ (Fixed Deposit Number) Sir/Madam, l am holding a Fixed Deposit A/C No. ____ (FD ...

Format of Letter for Premature Withdrawal of FD. A plain paper letter is always a better option. Write your name and contact details on the top left. email id, if you have one. I hold a Savings Bank account with your branch and my SB A/c no. is ________ (write here your SB a/c no.).

Follow these quick steps to draft a practical fixed deposit account closure request application to your Bank: Open with Salutation - Start by formally addressing your bank manager with a 'Dear Sir/Madam' salutation. Reason for Closure - Outline specific reasons for submitting the FD closure request application.

The Manager, [Bank Name], [Branch Address], [City, State], India. Subject: Application for Breaking Fixed Deposit. Dear Sir/Madam, I am writing this letter to request the premature closure of my Fixed Deposit Account (FD) with your bank. My FD Account number is [FD Account Number] and the maturity date is [Maturity Date].

Begin with your name, address, and contact details. Include the date of writing the letter. Add the bank manager's name, bank name, and branch address. Choose an appropriate subject line such as "Request for Fixed Deposit Closure.". Start the letter with a formal salutation, like "Dear Sir/Madam.".

I am enclosing herewith the original copy of the fixed deposit receipt. A copy of my PAN card self-attested by me is also enclosed herewith for verification purposes. Kindly process my application at the earliest. Thanking you, Yours faithfully, (Signature) (Name of the Account/ FD holder) Enclosure: (1) Original FD receipt.

New Delhi - 11000*. Dear Sir/ Madam, I (name of the customer) hold the Savings Bank Account No. (indicate the Savings Bank Account No.) in your Branch. I would further like to state that I also opened a Fixed Deposit Account (indicate the Fixed Deposit Account No.) on (the date on which the Fixed Deposit was opened) depositing an amount of Rs ...

You can skip this step if your FD is booked on or after Oct 2021; Application letter requesting premature closure of your FD; If there is no branch near you, courier the above documents to the following address. Once received, the Bajaj Finserv team will credit the amount to your registered bank account. Bajaj Finance Limited Fixed Deposit ...

Are you looking for premature closure form for your fixed deposit in a bank or post office? Then this letter format will help you write a suitable letter to close your FD. Check out the contents given below and make use of it. ... How to write application letter to apply for new cheque book in Indian Bank.

deducting the penalty and TDS, if any, in line with the terms and conditions of FD accepted by me/us, in the Bank account as mentioned in the FD application form signed by me/us at the time of opening of the below mentioned FD/s or as registered with BFL. Reason for Premature Withdrawal: _____ Sr. No. Fixed Deposit No.

Here's an Email Format of FD Closure Letter Format: Subject: Request for FD Account Closure - [Account Number] Dear [Bank Name], I am writing to request the closure of my fixed deposit account [Account Number] with immediate effect. The reason for this request is [state reason].

2. Through the Process of Bank Branch Visit: Go to a nearest branch of your bank. Get the closure form from the bank and fill it. Also fill the application for withdrawal of FD. Submit FD bond and any other paper that is required. The bank will verify all the details and will deposit the money in your account.

Visiting The Branch: Step 1: Visit the bank's local branch. Step 2: Fill out the fixed deposit closure form and the application for the fixed deposit withdrawal. Step 3: Submit fixed deposit bond and other required documents. Step 4: After verifying all the details, money will be deposited into your account.

Method 2. Suppose you invest in an FD of Rs 1 lakh for 2 years and at an interest rate of 6%. Now, assume that the rate of interest for 1 year is 7% at the time of booking. The penalty levied in case of premature withdrawal is 1% of the effective rate of interest, which is the lower of the rates. If you withdraw after the completion of 1 year ...

What is Premature Withdrawal. Fixed deposits , with a premature withdrawal facility, allow the depositor to close the FD before the date of maturity arrives. This comes as a relief in times of cash crunch. However, a certain amount may be required to be paid by the depositor as a penalty to the bank. This usually ranges between 0.5% and 1%.

Premature closure of FD An early closure of the bank FD is allowed but the interest rate may be revised and even a penalty may be levied. On premature closure of the FD, interest will be paid as per the rate of interest applicable for the tenure during which the deposit was kept with the bank and then a penalty may be levied thereafter. Once ...

Procedure for Premature Withdrawal of Fixed Deposit. Generally, the penalty charges range from 0.5% or 1% of the interest rate, based on the value of the FD being up to ₹5 lakh or more. The penalty is the amount charged by the bank when the depositor takes out the money from the bank before the date of maturity.

You can opt for FD withdrawal if you need funds urgently. However, you have to pay a penalty ranging from 0.50% to 2%. When you opt for premature fixed deposit withdrawal, the money is moved to your saving account. The process for premature withdrawal of a fixed deposit online and offline is given below:

Select the option prompting for 'Premature Closure of Fixed Deposits' Enter your FD number and submit a cancellation request; Usually, the process for premature fixed deposit closure remains the same throughout all financiers. An online option evades the hassles of paperwork and appointments with the lender. Offline application process for ...

Now, if you decide to withdraw the amount after one year, your interest will be calculated after factoring in the issuer's penalty rate. Assuming the bank levies a 1% penalty on the premature withdrawal of fixed deposits; your new interest rate is 5.50%-1% = 4.50%. The revised FD rates are lower than the original 5.80% rate.

sb-7b application for pre-mature closure of account