- Money Museum

- Community Development

- TEN Magazine

The Appeal and Proliferation of Buy Now, Pay Later: Consumer and Merchant Perspectives

Use of buy now, pay later (BNPL) payment products has been growing in the United States. We explore the benefits and risks of BNPL products for consumers and merchants.

- Payments System Research Briefing

- Banking and Finance

In the last decade, buy now, pay later (BNPL) has become an increasingly popular payment option in the United States. This Payments System Research Briefing explores how BNPL compares with other “purchase/pay-over-time” options, and the benefits and risks BNPL presents to the consumers and merchants who adopt them. A forthcoming Briefing will consider BNPL from the perspective of financial institutions, payment networks, and regulators.

What Is BNPL?

BNPL is a type of short-term loan that allows consumers to make purchases and pay for them at a future date over a series of installments. BNPL divides a consumer’s purchase into multiple equal payments, with the first due at checkout. Shorter-term BNPL products are usually interest free, while longer-term BNPL products may charge interest. Although BNPL was initially used mainly for online purchases, it has expanded to purchases in stores and has become an increasingly popular payment option to purchase electronics, clothing and fashion items, furniture, and appliances. Today, BNPL is beginning to be available for services such as travel and even health care.

BNPL products can be grouped into two main types, depending on how they are offered to consumers. One type of BNPL product is offered directly to consumers by fintechs before a purchase is made; the other is offered during a purchase through a merchant who partners with a fintech or financial institution. _ Although five BNPL fintech providers—Affirm, AfterPay, Klarna, Sezzle, and Zip (formerly known as QuadPay)—are the most prominent, there are approximately two dozen domestic providers.

The first type of BNPL products generally targets millennials, Generation Z (Gen Z) consumers, and financially underserved consumers such as those with no credit or bad credit. The credit limits associated with these services tend to be lower, ranging from hundreds of dollars up to thousands, with only a soft credit check that verifies credit history, age, and salary but does not rely on a consumer’s credit score. However, credit limits may increase as a consumer demonstrates creditworthiness. BNPL services include a virtual or physical payment card to make purchases, which typically can only be used at participating merchants. Repayment of a purchase with these services usually involves four equal, interest-free installments, with 25 percent paid at the time of purchase and the remaining balance paid in three two-week cycles. _ These services allow multiple BNPL purchases up to the predetermined credit limit.

Compared with the first type of BNPL products, the type offered through merchants targets broader consumer segments and offers longer-term installments. In addition to millennials and Gen Z consumers, baby boomers and affluent customers may also be targeted. BNPL products offered through merchants tend to have higher credit limits that may reach up to tens of thousands of dollars and repayment terms that range from six weeks to 60 months (depending on the type of merchant). Unlike shorter-term loans, longer-term loans (3 months or more) typically require no upfront payment at the time of purchase. Interest rates vary according to the length and value of the loan and can range from 0 percent to nearly 30 percent.

Revenue for the fintechs or financial institutions that provide both types of these loans is primarily derived from fees charged to the merchants that accept the loans as a customer payment option. However, revenue may also be generated from late fees or penalties charged to consumers who fail to comply with the terms of repayment. _

BNPL Compared with Other Installment Options

BNPL products may look and feel new, but they share similarities with existing installment payments, such as layaway and credit cards. Layaway is a pay-over-time service offered by a merchant that allows a consumer to reserve an item by making interest-free, predetermined installment payments until the item is paid for in full. Consumers who use layaway may have bad or no credit or limited income. Like BNPL, layaway enables consumers to acquire a good they may not otherwise be able to afford, but without taking on debt. Layaway is relatively low risk for both the consumer and merchant. Consumers may be charged a nonrefundable service fee and may incur a cancellation fee if they do not complete the purchase. For merchants, layaway enables sales that might not occur otherwise; however, if the consumer fails to pay in full, the value of the good may decrease over the loan term. _ Although still available—especially during the holiday season—layaway programs began declining during the 1980s as the ubiquity of credit cards decreased their utility. Now, with BNPL products increasing, even more merchants are eliminating layaway services (Kenton 2020; Bruce 2021).

BNPL products also share similarities with credit cards, which enable consumers to take immediate possession of goods and delay payment. Consumers use credit cards for their rewards, cash-free convenience, and as a cushion for emergencies, among other reasons. Some consumers carry a balance from month to month, while others may pay each month’s balance in full. However, a consumer’s ability to obtain a credit card hinges on their creditworthiness (Weliver 2021). Even among those deemed creditworthy, younger generations are less likely to use credit cards than previous generations; only about one-third of Gen Z and about one-half of millennials has a credit card (Rossman 2021).

Although credit cards are a viable form of installment payment for many, products like layaway and BNPL offer a means for a broader range of consumers—especially those with bad or no credit—to access goods and services. Generally, interest-free BNPL loans and layaway are comparable in their terms and costs, but BNPL enables consumers to take immediate possession of a product at the point-of-purchase while layaway requires consumers to wait until the product has been paid for in full. When using layaway requires a service fee, BNPL can be the least expensive method of payment. Interest-bearing BNPL loans may be less expensive than credit cards, as the average interest charge of BNPL is typically lower. (See the appendix to compare a purchase made with BNPL, credit card, and layaway installment options.)

Consumer Adoption, Benefits, and Risks

Many U.S. consumers have already adopted BNPL, and the number of adopters is growing rapidly. According to a September 2021 report by Accenture, the number of BNPL users in the United States has grown by more than 300 percent per year since 2018, reaching 45 million active users in 2021 (Accenture 2021). Spending with BNPL has also increased and now represents about 2 percent of U.S. online retail sales (Tighe 2021). Information provided by the Financial Technology Association indicates that BNPL users are predominantly female and younger, with the vast majority being millennials and Gen Z consumers (Financial Technology Association 2021). The user base also includes lower-income consumers who may lack access to traditional forms of credit or banking services.

For consumers, BNPL offers various benefits. Credit may be the most important BNPL benefit, especially for consumers with limited means. In a poll by Ascent in March 2021, 45 percent of U.S. adults who were BNPL users said they used these services to make purchases that otherwise would not fit their budget (Backman 2021). Predetermined repayment schedules may be another important benefit. Unlike credit card debt, for which consumers need to make their own repayment plan, consumers simply follow the repayment schedule set by the BNPL product. The broad availability of BNPL may be another benefit relative to the limited availability of layaways; moreover, unlike layaway, BNPL enables consumers to immediately take possession of a product as they are still paying for it. Among other reasons for adopting BNPL, consumers cite convenience, transparency of terms, interest avoidance, cash conservation, and less impact to their credit score. For users with little or no credit, or bad credit history, some BNPL providers have begun offering programs for users to submit their repayment behavior to a credit bureau to help build their credit file and improve their credit score (Sezzle 2021).

However, BNPL products also carry risks. Unlike credit card issuers, BNPL lenders are not required to consider a consumer’s ability to repay loans. _ Most BNPL providers only run a soft credit check for interest-free installment loans. As a result, consumers may use multiple BNPL products—in addition to other credit products—and risk financial overextension. New research from consumer research firm Piplsay found that though 74 percent of BNPL users were able to make their BNPL payments on time, 14 percent missed a payment once, and 12 percent missed a payment more than once (Piplsay 2021). _ As some BNPL providers do report to credit bureaus, late payments may affect an individual’s credit scores (Paul 2021; Lapera 2021).

Another potential risk for consumers is that the availability of BNPL credit during the checkout process could encourage impulse buying. The March 2021 Ascent survey found that 16 percent of BNPL users reported making five or more purchases with BNPL in an average month. BNPL purchases can be difficult for consumers to track in aggregate when multiple purchases are made from multiple providers. This could result in late and missed payment fees and interest may accrue with some providers if a BNPL balance is not paid in accordance with the terms and conditions.

BNPL products also have longer-term risks. Users of BNPL products tend to skew younger, so any financial trouble could hinder their ability to access credit in the future or even obtain certain types of employment. Identity fraud is also possible. In instances where BNPL loans are not reported to credit bureaus, an individual may be unaware that BNPL credit has been fraudulently established and used in their name, and alert and monitoring services would have no insight. Because some merchants have eliminated layaway services in favor of BNPL options, some consumers may feel nudged into using a credit product they cannot effectively manage.

Merchant Adoption, Benefits, and Risks

Merchants receive several benefits by adopting BNPL products as payment options for their customers. A study by BNPL firms shows that merchants experience a decrease in cart abandonment and an increase in repeat business (Todorov 2021). The predefined, fixed-dollar installments—with or without interest—can make goods more attainable for new customers, increase existing customers’ propensity to purchase, and increase transaction value. BNPL products also provide merchants the ability to settle sales quickly and may eliminate a merchant’s chargeback and fraud risks because BNPL firms assume those risks (Eckler 2020). Furthermore, BNPL products decrease a risk associated with layaway—that the value of a good may decrease. Additionally, at least for now, BNPL may provide merchants an opportunity to gain or maintain a competitive advantage because consumers may choose merchants that offer BNPL over those that do not.

BNPL firms can also assist the merchant by directly marketing the merchant’s offers to consumers. In addition, BNPL products with direct API integration capabilities (which allow different apps to exchange data) enable merchants to offer consumers a seamless checkout experience: the consumer can apply for a loan, receive the loan approval, and pay for the first installment easily and quickly during checkout (CB Insights 2021). As a result, an increasing number of merchants—including big-box merchants such as Amazon, Target, and Walmart—are offering BNPL options for e-commerce as well as for in-store purchases. According to a Zip.co survey of more than 1,000 U.S. merchants, 25 percent accept BNPL; of those that do not, 46 percent say they are either likely or extremely likely to accept BNPL within the next year (Willson 2021).

Although BNPL provides benefits to many merchants, not all merchants may find it optimal. Offering BNPL as a payment option comes at a premium. The cost of a BNPL transaction for merchants ranges from 1.5 to 7 percent of the purchase value (including tax), while the cost of a typical debit or credit-card transaction ranges from 1 to 3 percent. As a result, merchants should consider whether BNPL products fit what they sell and whether a minimum transaction value is needed to justify offering BNPL as a payment option. Although BNPL products may earn a merchant a new customer, BNPL providers may cap the number of concurrent loans a consumer can have, which can limit a merchant’s ability to maintain a recurring relationship. _

Offering BNPL also comes with the risk that the interest-free BNPL payments will attract existing customers away from payment options that cost merchants less to accept, such as debit and prepaid cards (Southall 2021). Long-term effects could include lasting shifts in payments that result in the cost of accepting BNPL outweighing the value. Once consumers have widely adopted BNPL, merchants may not be able to discontinue accepting it even if the cost has become greater than the benefit—and the cost may not decline without regulatory intervention.

Additionally, the use of BNPL can complicate a merchant’s returns process and damage customer satisfaction. Although merchants experience lower return rates with BNPL purchases, returns that do occur can be cumbersome due to the extra steps involved. Some BNPL firms may even hold a consumer responsible for the total cost of a purchase after an item has been returned (Akeredolu and others 2021).

The number of BNPL providers is increasing and consumers and merchants appear to be readily adopting the products they offer. Although BNPL has benefits for both consumers and merchants, the offerings are new enough that potential risks may not yet be well understood. The risks to consumers have resulted in calls for regulatory attention domestically and internationally. As a result, the Consumer Financial Protection Bureau has encouraged BNPL providers in the United States to take steps to ensure users are adequately informed of the risks BNPL presents. For merchants, BNPL cost of acceptance may warrant careful consideration as regulatory intervention is uncommon in the United States. In our forthcoming Payments System Research Briefing , we will examine the regulatory considerations of offering BNPL products in addition to the perspectives of financial institutions and payment networks.

Appendix: Comparison of Consumer Payments across BNPL, Credit Card, and Layaway

Table 1 below compares a consumer’s payment for the purchase of a $500 TV (including tax) using BNPL, a credit card, or layaway for three different durations of loans: six weeks with three biweekly payments (in addition to the upfront payment at the time of purchase for BNPL and layaway); three months with three monthly payments (in addition to the upfront payment for layaway); and 12 months with 12 monthly payments. For BNPL and credit cards, all three durations are possible, while for layaway only the first two durations (six weeks and three months) are possible.

In the table, we assume “typical” fees or interest charges. For BNPL, we assume interest-free or 0 percent annual percentage rate (APR) for the six-week and three-month durations and 15 percent APR for the 12-month duration. _ For credit cards, we assume 17 percent APR for all three durations. _ For layaway, we assume a service fee of $5 for the six-week duration and $10 for the three-month duration. We make additional assumptions for a credit card. We assume that the consumer has an unpaid balance at the time of the TV purchase, and therefore no grace period applies for the purchase. We also assume that the consumer pays almost equal amounts for each biweekly or monthly payment.

Table 1 shows that BNPL is generally the least expensive among the three products, because BNPL typically assesses no service fee and no interest charge for short-term loans. However, if BNPL has an interest charge for longer-term loans that is the same as the credit card interest charge, the total payment the consumer makes is similar between the two products.

Table 1: BNPL Is Generally the Least Expensive among the Three Loan/Installment Products

Recently, a third type of BNPL product has emerged, which credit card issuers can offer to their cardholders after purchases have been made. We discuss this type more thoroughly in the next BNPL Briefing .

Some providers offer longer-term loans up to 60 months, which may carry an interest rate as high as 30 percent.

Financial institutions may also derive revenue from interest charges on longer-term BNPL loans.

Merchants may offset this depreciation with service or cancellation fees.

BNPL providers also may not offer the same disclosures or the same billing error resolution procedures.

The research is based on the online survey conducted September 28–30, 2021, which gathered 30,880 responses. It found that 43 percent of Gen Z users missed a BNPL payment at least once this year, compared with 31 percent of millennials and 26 percent of Gen X users.

However, BNPL firms could nudge the consumer back to the merchant when they are done paying off a loan.

Typically, interest-free BNPL is available for the six-week and three-month durations (Affirm 2021). For the 12-month duration, the average interest charge is not available. We assume the midpoint of the typical range of APR between 0 percent and 30 percent.

As of August 2021, the average APR of credit cards is 17.01 percent, according to the Federal Reserve Bank of St. Louis, FRED, External Link Commercial Bank Interest Rate on Credit Card Plans, Accounts Assessed Interest .

Accenture. 2021. “ External Link The Economic Impact of Buy Now, Pay Later In the US .” September.

Affirm. 2021. “ External Link Welcome to the Affirm Investor Forum .” September 28.

Akeredolu, Nelson, Andrew Braden, Joshua Friedman, and Laura Udis. 2021. “ External Link Should You Buy Now and Pay Later? ” Consumer Financial Protection Bureau, July 6.

Backman, Maurie. 2021. “ External Link Study: Buy Now, Pay Later Services Continue Explosive Growth .” The Ascent, March 22.

Bruce, Beverly. 2021. “ External Link Major Retailers Are Starting to Ged Rid of This Popular Perk .” BestLife, September 27.

CB Insights. 2021. “ External Link Disrupting the $8T Payment Card Business: The Outlook On ‘Buy Now, Pay Later’ .” Research Report, March 2.

Eckler, Mike. 2020. “ External Link What Merchants Should Know about ‘Buy Now, Pay Later’ .” Practical Ecommerce, August 24.

Financial Technology Association. 2021. “ External Link Just the Facts: Buy Now Pay Later (BNPL) .” July 8.

Kenton, Will. 2020. “ External Link What Is Layaway? ” Investopedia, December 30.

Lapera, Gaby. 2021. “ External Link 72% of Americans Saw Their Credit Scores Drop After Missing a ‘Buy Now, Pay Later’ Payment, Survey Finds .” Credit Karma, February 8.

Paul, Trina. 2021. “ External Link ‘Buy Now, Pay Later’ Loans Can Decrease Your Credit Score Even If You Pay on Time—Here’s What You Need to Know .” CNBC.com, September 3.

Piplsay. 2021. “ External Link ‘Buy Now, Pay Later’ Programs: How Interested Are U.S. Shoppers? ” October 4.

Rossman, Ted. 2021. “ External Link Do Young Adults Want Credit Cards? ” Bankrate, February 1.

Tighe, D. 2021. “ External Link Most Popular Online Payment Methods in the U.S. 2020 .” Statista, July 19.

Sezzle. 2021. “ External Link Sezzle Expands Partnership with TransUnion .” October 14.

Southall, Martha. 2021. “ External Link Buy Now, Pay Later—Three Key Lessons from Australia .” The Paypers, October 1.

Todorov, Svetlio. 2021. “ External Link Entering the Mainstream: The Growth of BNPL .” Payments Journal, October 21.

Weliver, David. 2021. “ External Link What Credit Score Do You Need to Get Approved For a Credit Card? ” Money Under 30, November 1.

Willson, Amelia. 2021. “ External Link Is 2021 the Year of BNPL? 6 Facts You Need to Know about This Payment Method .” Zip, July 10.

Julian Alcazar is a payments specialist and Terri Bradford is a senior payments specialist at the Federal Reserve Bank of Kansas City. The views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of Kansas City or the Federal Reserve System.

Share Article:

Julian alcazar, senior payments specialist.

Julian Alcazar is a Senior Payments Specialist for the Office of the Chief Payments Executive for Federal Reserve Financial Services. Julian received a B.A. in Sociology from Cal…

Terri Bradford

Terri R. Bradford is a Specialist in the Payments System function of the Economic Research Department at the Federal Reserve Bank of Kansas City. Among her responsibilities are m…

Additional Resources

Market structure of core banking services providers.

Three core providers dominate the market for core banking systems for depository institutions (DIs). These providers also have...

Financial Literacy, Risk Tolerance, and Cryptocurrency Ownership in the United States

Consumers who use cryptocurrencies for transactions tend to have lower financial literacy and risk tolerance than crypto...

The KCFSI suggests financial stress decreased slightly in February

The Kansas City Financial Stress Index (KCFSI) decreased slightly from -0.39 in January to -0.43 in February, remaining below...

At the New York Fed, our mission is to make the U.S. economy stronger and the financial system more stable for all segments of society. We do this by executing monetary policy, providing financial services, supervising banks and conducting research and providing expertise on issues that impact the nation and communities we serve.

Introducing the New York Innovation Center: Delivering a central bank innovation execution

Do you have a Freedom of Information request? Learn how to submit it.

Learn about the history of the New York Fed and central banking in the United States through articles, speeches, photos and video.

Markets & Policy Implementation

- Effective Federal Funds Rate

- Overnight Bank Funding Rate

- Secured Overnight Financing Rate

- SOFR Averages & Index

- Broad General Collateral Rate

- Tri-Party General Collateral Rate

- Treasury Securities

- Agency Mortgage-Backed Securities

- Repos & Reverse Repos

- Securities Lending

- Central Bank Liquidity Swaps

- System Open Market Account Holdings

- Primary Dealer Statistics

- Historical Transaction Data

- Agency Commercial Mortgage-Backed Securities

- Agency Debt Securities

- Discount Window

- Treasury Debt Auctions & Buybacks as Fiscal Agent

- Foreign Exchange

- Foreign Reserves Management

- Central Bank Swap Arrangements

- ACROSS MARKETS

- Actions Related to COVID-19

- Statements & Operating Policies

- Survey of Primary Dealers

- Survey of Market Participants

- Annual Reports

- Primary Dealers

- Reverse Repo Counterparties

- Foreign Exchange Counterparties

- Foreign Reserves Management Counterparties

- Operational Readiness

- Central Bank & International Account Services

- Programs Archive

As part of our core mission, we supervise and regulate financial institutions in the Second District. Our primary objective is to maintain a safe and competitive U.S. and global banking system.

The Governance & Culture Reform hub is designed to foster discussion about corporate governance and the reform of culture and behavior in the financial services industry.

Need to file a report with the New York Fed? Here are all of the forms, instructions and other information related to regulatory and statistical reporting in one spot.

The New York Fed works to protect consumers as well as provides information and resources on how to avoid and report specific scams.

The Federal Reserve Bank of New York works to promote sound and well-functioning financial systems and markets through its provision of industry and payment services, advancement of infrastructure reform in key markets and training and educational support to international institutions.

The New York Fed provides a wide range of payment services for financial institutions and the U.S. government.

The New York Fed offers several specialized courses designed for central bankers and financial supervisors.

The New York Fed has been working with tri-party repo market participants to make changes to improve the resiliency of the market to financial stress.

- High School Fed Challenge

- College Fed Challenge

- Teacher Professional Development

- Classroom Visits

- Museum & Learning Center Visits

- Educational Comic Books

- Lesson Plans and Resources

- Economic Education Calendar

We are connecting emerging solutions with funding in three areas—health, household financial stability, and climate—to improve life for underserved communities. Learn more by reading our strategy.

The Economic Inequality & Equitable Growth hub is a collection of research, analysis and convenings to help better understand economic inequality.

This Economist Spotlight Series is created for middle school and high school students to spark curiosity and interest in economics as an area of study and a future career.

« Measuring Treasury Market Depth | Main | Businesses See Inflationary Pressures Moderating »

How and Why Do Consumers Use “Buy Now, Pay Later”?

Felix Aidala, Daniel Mangrum, and Wilbert van der Klaauw

In a previous post , we highlighted that financially fragile households are disproportionately likely to use “buy now, pay later” (BNPL) payment plans. In this post, we shed further light on BNPL’s place in its users’ household finances, with a particular focus on how use varies by a household’s level of financial fragility. Our results reveal substantially different use patterns, as more-fragile households tend to use the service to make frequent, relatively small, purchases that they might have trouble affording otherwise. In contrast, financially stable households tend to not use BNPL as frequently and are more likely to emphasize that BNPL allows them to avoid paying interest on credit-finance purchases. We explore below what drives these differences and consider the implications for future BNPL use.

While the exact terms of BNPL plans can vary, they have been defined by the Office of the Comptroller of the Currency as “loans that are payable in four or fewer installments and carry no finance charges.” They are generally offered to online shoppers at checkout. BNPL plans have grown increasingly prominent in recent years, and today can be used for a wide variety of online purchases, ranging from standard retail orders to fast food deliveries. Still, because of the general lack of regulation surrounding BNPL loans, little is known about how and why households use them. To examine how BNPL use varies with a consumer’s financial situation, we draw on special questions added to the October 2023 Survey of Consumer Expectations (SCE) Credit Access Survey . The survey is fielded every four months as a rotating module of the “core” SCE, which is itself a monthly, nationally representative, internet-based survey of a rotating panel of household heads that has been conducted by the Federal Reserve Bank of New York since June 2013. Our sample consists of about 1,000 households, with about 200 reporting BNPL use.

We differentiate between two types of respondents: 1) the financially fragile, whom we define as having a credit score below 620, having been declined for a credit application in the past year, or having fallen thirty or more days delinquent on a loan in the past year, and 2) all other respondents, whom we refer to as financially stable. Our results reveal different use patterns between the two groups, with the financially fragile being more likely to use BNPL for frequent small purchases. As we discuss below, this finding contrasts with past survey evidence suggesting that BNPL use is mostly experimental, and it provides further evidence that the option is particularly attractive to those who have trouble obtaining credit otherwise. We also show that across levels of financial stability, it is rare for people to use BNPL just once. Indeed, about 72 percent of financially stable users and 89 percent of financially fragile users have made multiple BNPL purchases over the past twelve months. While we cannot determine if this relationship is causal, it is suggestive that a first use often results in repeat use, and it will be a factor to watch as more consumers try BNPL for the first time.

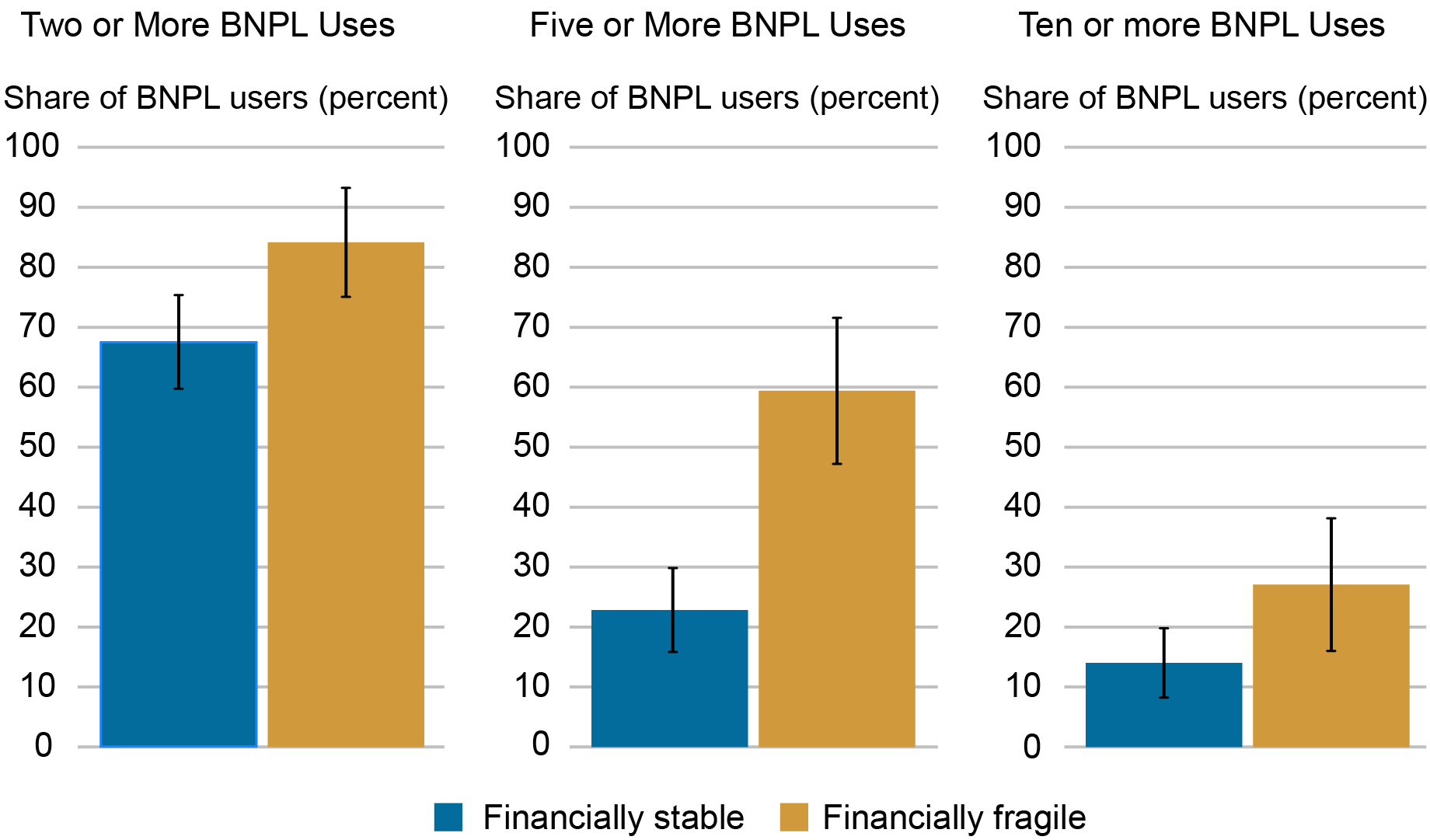

How Often Do Households Use BNPL?

A growing number of surveys, including our own, have shown that BNPL use is particularly likely among financially fragile individuals. Still, relatively little is known about how often households use BNPL. One exception is survey evidence presented by our colleagues at the Federal Reserve Bank of Philadelphia’s Consumer Finance Institute (CFI) suggesting that BNPL use is largely experimental, with most users not using the service as a regular payment option. That said, given that the CFI’s survey was conducted in November 2021 and that the landscape surrounding BNPL is fast changing, it is possible that many first-time users in the CFI survey have continued to use BNPL since.

Conditional on using BNPL at least once, we asked respondents about their use frequency and average purchase sizes. Similar to our findings on which households use BNPL at all , we find that the financially fragile are disproportionately likely to use BNPL at higher frequencies and appear to have embraced BNPL as a regular payment option, as shown in the chart below. Indeed, among financially fragile BNPL users, about 60 percent have used the product five or more times in the past year, which translates to about 18 percent of all survey respondents deemed financially fragile (which includes those who have not used BNPL in the last year). This implies that financially fragile users are almost three times as likely as financially stable users to use BNPL five or more times and suggests that high-frequency use may grow if the product continues to be adopted by financially fragile households. Given that BNPL use in the U.S. has not been observed over a full business cycle, this factor will be particularly important to track, as households may turn to BNPL if their financial conditions worsen.

BNPL Use Frequency by Financial Fragility

Source: SCE Credit Access Survey.

Our results also indicate interesting aspects of financially stable households’ use patterns. While about 68 percent of financially stable BNPL users have taken advantage of the product at least twice in the past year, just 23 percent and 14 percent have used it five or more times and ten or more times, respectively. This reveals that use by the financially stable tends to drop off substantially after a few instances, but that there is a small group of financially stable individuals who use BNPL frequently.

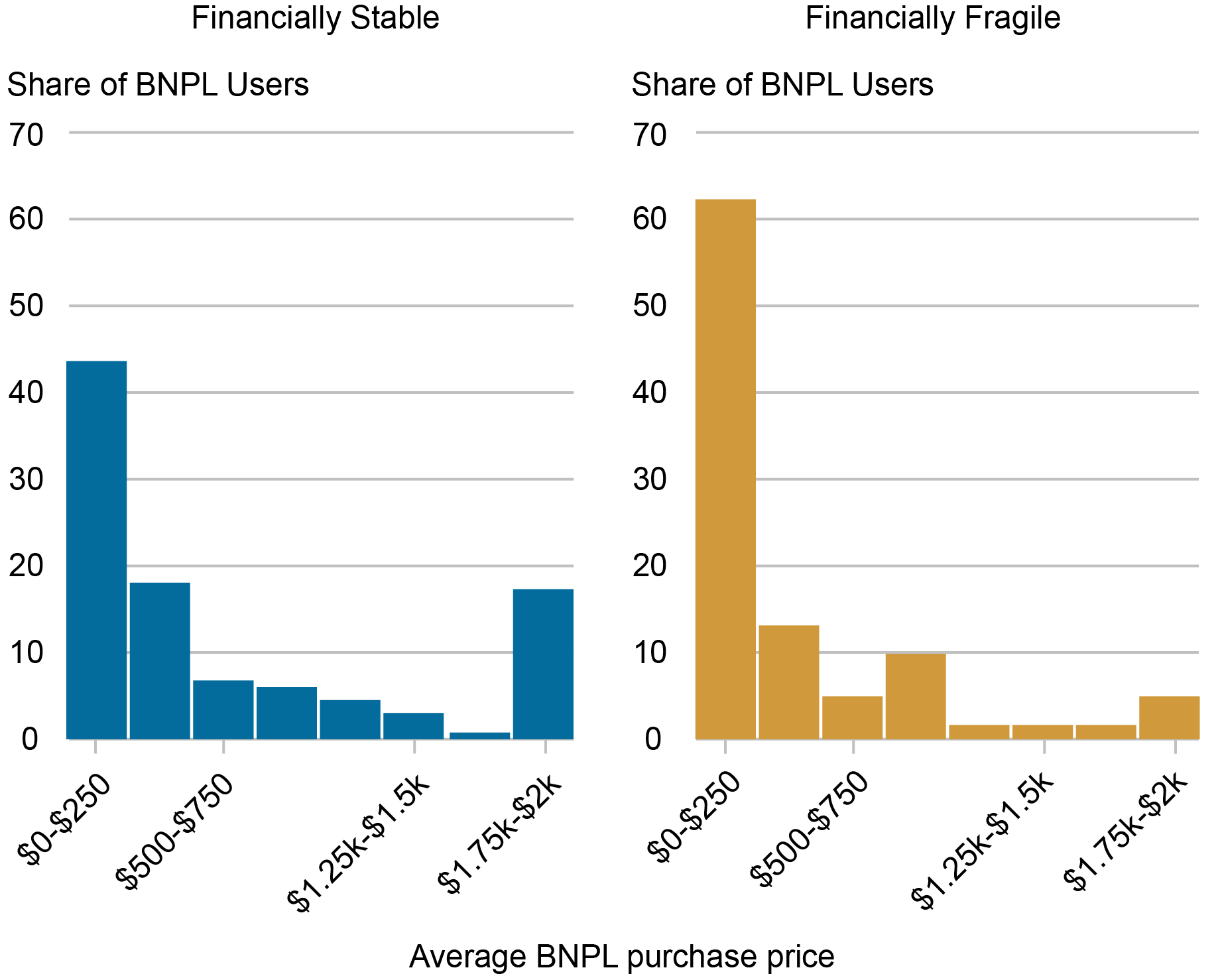

Purchase Sizes

Another distinguishing factor between the two groups is the size of the purchases they make. While both groups are skewed toward relatively smaller purchases, 62 percent of financially fragile users have a mean purchase price under $250, compared to about 44 percent of the financially stable (see chart below). Looking at the rest of the distribution, this gap is largely made up in the right tail, as financially stable households are significantly more likely to have a mean purchase price between $1,750 and $2,000.

Share of BNPL Purchases by Price

Importantly, we do not find household income to be a primary driver of these disparities. Even after we control for income, financially fragile households make BNPL purchases that are on average about $220 smaller than financially stable households, and they make more purchases, averaging about four more BNPL purchases than stable household respondents in the past year.

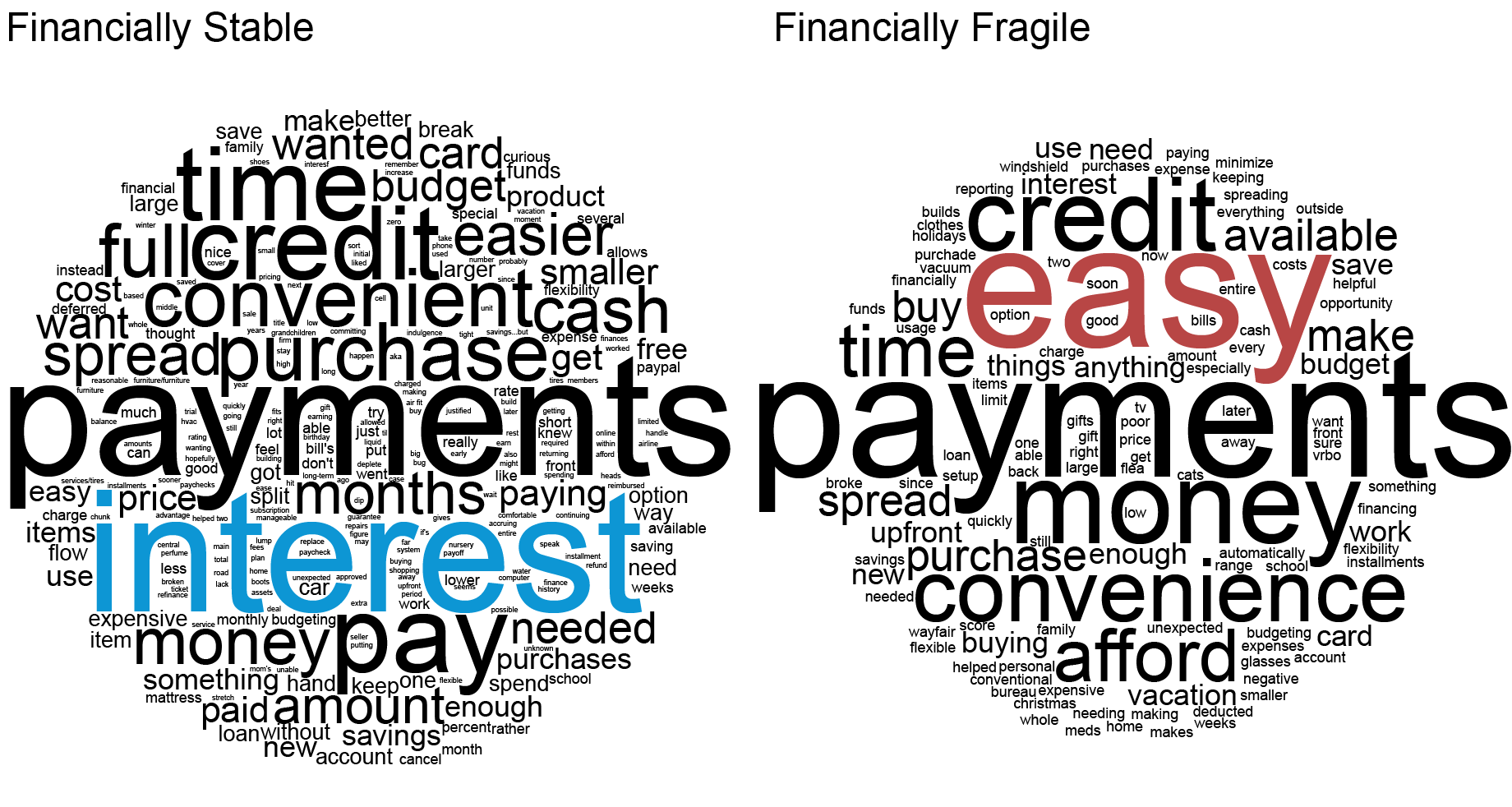

The Anatomy of BNPL Use

To assess what’s driving these differences in use, we asked respondents an open-ended question on why they used BNPL. The word clouds below offer a visual representation of the responses of the two groups, with the size of each word indicating its frequency and prominence in answers overall.

Reasons for BNPL Use Vary by Level of Financial Stability

While both groups emphasize the appeal of spreading out payments, they also display key differences. The financially stable, for example, frequently mention the advantages associated with zero interest, while the financially fragile are more likely to describe ease of access and convenience. Both groups are likely to mention credit, but for different reasons. For example, the financially fragile are generally more likely to mention having poor credit, whereas the financially stable often mention that they’d like to avoid using their credit card or that they see BNPL as a good method of building credit. (Because BNPL lenders generally do not furnish data to credit bureaus, the latter statements may indicate some degree of misunderstanding among the product’s users, unless they are referring to building credit with BNPL lenders specifically.) Lastly, the financially fragile are more likely to state that they are making a purchase that they do not have money for up front or that they could otherwise not afford, while the financially stable tend not to emphasize this point.

Relating our qualitative responses to results on frequency and spending amounts, we can begin to paint a picture of differential BNPL use by financial fragility. For the financially stable, BNPL use appears to be more centered on a few purchases and seems to be largely driven by a desire to avoid paying interest on high-priced items. Meanwhile, use among the financially fragile appears to be more akin to a credit card, as shoppers use the service to make medium-size, out-of-budget purchases frequently. One primary driver of this difference could be access to short-term debt through credit cards. For individuals near their credit limit, BNPL may be particularly attractive as a way to smooth consumption over the short term. Meanwhile, those with ample credit available may choose to use BNPL for medium-size purchases as a way to avoid carrying a balance and accruing interest. That said, our results also reveal some misunderstanding of the product, even among its users, including the financially stable, given that some users seem to assume that BNPL will help them build credit, as mentioned above. Those with this view may be better off using a credit card.

Our results also have implications for future BNPL use. They suggest that the largest barrier to consumer take-up is their first use, and that after this initial use consumers tend use BNPL again. With about 80 percent of households not using BNPL in the past year, there may still be a great deal of room for increased adoption of the product. This will be particularly important to watch in the coming months, as many shoppers used BNPL for the first time this past holiday season .

Felix Aidala is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Daniel Mangrum is a research economist in Equitable Growth Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Wilbert van der Klaauw is the economic research advisor for Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post: Felix Aidala, Daniel Mangrum, and Wilbert van der Klaauw, “How and Why Do Consumers Use “Buy Now, Pay Later”?,” Federal Reserve Bank of New York Liberty Street Economics , February 14, 2024, https://libertystreeteconomics.newyorkfed.org/2024/02/how-and-why-do-consumers-use-buy-now-pay-later/.

You may also be interested in:

Who Uses “Buy Now, Pay Later?”

- Credit Card Delinquencies Continue to Rise—Who Is Missing Payments?

An Update on the Health of the U.S. Consumer

Disclaimer The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

Share this:

Very nice study. Thank you for publishing it. I wondered many times, what made this option of financing method rise. Though I never used it, the findings are thought-provoking. It is essentially a great financial tool.

The comments to this entry are closed.

Liberty Street Economics features insight and analysis from New York Fed economists working at the intersection of research and policy. Launched in 2011, the blog takes its name from the Bank’s headquarters at 33 Liberty Street in Manhattan’s Financial District.

The editors are Michael Fleming, Andrew Haughwout, Thomas Klitgaard, and Asani Sarkar, all economists in the Bank’s Research Group.

Liberty Street Economics does not publish new posts during the blackout periods surrounding Federal Open Market Committee meetings.

The views expressed are those of the authors, and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.

Economic Inequality

Most Read this Year

- Deposit Betas: Up, Up, and Away?

- The Great Pandemic Mortgage Refinance Boom

- The Post-Pandemic r*

- Spending Down Pandemic Savings Is an “Only-in-the-U.S.” Phenomenon

- Economic Indicators Calendar

- FRED (Federal Reserve Economic Data)

- Economic Roundtable

- OECD Insights

- World Bank/All about Finance

We encourage your comments and queries on our posts and will publish them (below the post) subject to the following guidelines:

Please be brief : Comments are limited to 1,500 characters.

Please be aware: Comments submitted shortly before or during the FOMC blackout may not be published until after the blackout.

Please be relevant: Comments are moderated and will not appear until they have been reviewed to ensure that they are substantive and clearly related to the topic of the post.

Please be respectful: We reserve the right not to post any comment, and will not post comments that are abusive, harassing, obscene, or commercial in nature. No notice will be given regarding whether a submission will or will not be posted.

Comments with links: Please do not include any links in your comment, even if you feel the links will contribute to the discussion. Comments with links will not be posted.

Send Us Feedback

The LSE editors ask authors submitting a post to the blog to confirm that they have no conflicts of interest as defined by the American Economic Association in its Disclosure Policy. If an author has sources of financial support or other interests that could be perceived as influencing the research presented in the post, we disclose that fact in a statement prepared by the author and appended to the author information at the end of the post. If the author has no such interests to disclose, no statement is provided. Note, however, that we do indicate in all cases if a data vendor or other party has a right to review a post.

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- Request a Speaker

- International, Seminars & Training

- Governance & Culture Reform

- Data Visualization

- Economic Research Tracker

- Markets Data APIs

- Terms of Use

- Search Search Please fill out this field.

- What Is BNPL?

- How BNPL Works

- BNPL Trends

- How BNPL Affects Credit

- Risks of BNPL Apps

- Pros and Cons

- Teaching Teens

The Bottom Line

- Credit & Debt

- Buy Now Pay Later

Buy Now, Pay Later (BNPL): What It Is, How It Works, Pros and Cons

:max_bytes(150000):strip_icc():format(webp)/20171019_172018-5a12f5cdbeba3300373b7964-3d8c34a5e28d41cdb3c4e2df355329f4.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

What Is Buy Now, Pay Later (BNPL)?

Buy now, pay later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them over time. BNPL is also commonly known as a point-of-sale (POS) installment loan that doesn't charge interest. Using BNPL financing can be convenient, but there are also some potential traps to consider. Consumers can make purchases using BNPL services offered by traditional and online retailers or through apps provided by third-parties.

Key Takeaways

- Buy now, pay later is a type of short-term financing.

- Consumers can make purchases and pay for them over time after an up-front payment.

- Buy now, pay later plans typically charge no interest.

- Compared to traditional credit cards and personal loans, BNPL loans are fairly easy for consumers to get approved for.

- BNPL generally won’t affect your credit score unless you make late payments or fail to pay.

Investopedia / Joules Garcia

How Buy Now, Pay Later (BNPL) Works

Buy now, pay later programs have different terms and conditions. They generally offer short-term loans with fixed payments, no interest , and no additional charges. This means you know your payment amounts up front, and each payment will be the same. You can use a BNPL app to make the purchase, or you may have BNPL options through your credit card.

With BNPL, you can make a purchase at a participating retailer and opt for buy now, pay later at checkout. If approved, you make a small down payment , such as 25% of the overall purchase amount. You then pay off the remaining amount in a series of interest-free installments, usually over a few weeks or months.

Payments can be deducted automatically from your debit card , bank account , or credit card . You may also be able to pay via check or bank transfer in some cases, although the Consumer Financial Protection Bureau (CFPB) says that most BNPL lenders give consumers no choice other than autopay .

The main difference between using BNPL and a credit card is that the credit card generally charges interest on any balance carried over to the next billing cycle. Although some credit cards offer 0% annual percentage rates (APRs) , it may only be for a limited time. With a credit card, you can carry a balance or use your credit line indefinitely.

Some purchases may not be eligible for buy-now-pay-later financing. Also, there are limits on the amount that you can finance this way.

Buy Now, Pay Later (BNPL) Trends

BNPL is a payment option you may see more now than you did in the earlier 2000s. During economic times when inflation is high and interest rates rise, BNPL may be a helpful option for people making purchases.

A September 2022 report from the CFPB found that from 2019 to 2021, the number of BNPL loans originated in the U.S. by the five lenders it surveyed grew from 16.8 million to 180 million. This kind of financing was once most popular for beauty and apparel purchases, but it has branched out into other areas like travel, pet care, groceries, and gas. Most BNPL loans range from $50 to $1,000. The CFPB's research showed that the average loan was $135 over six weeks.

Companies, such as Affirm and Klarna , offer buy-now-pay-later financing on purchases at participating retailers. Some credit card issuers, such as Chase and American Express, have also set up similar financing arrangements.

Another CFPB report from March 2023 found that:

- Users of buy-now-pay-later services were far more likely to have bank overdrafts , payday loans , pawn loans, and other high-interest financial products, indicating that they are more financially vulnerable than non-users of BNPL financing

- Black, Hispanic, and female consumers were more likely than average to use it, as were consumers with household incomes between $20,000 and $50,000

While BNPL can help you make purchases you wouldn't otherwise be able to make at that time, if you're not careful, you could put yourself into a situation where you have more debt than you can afford. And that can impact your credit.

Walmart-backed One Finance announced plans to offer BNPL financing to the retailer's customers in 2023. The service hasn't started yet as the company continues to use Affirm.

How Buy Now, Pay Later (BNPL) Affects Your Credit

Most buy-now-pay-later companies only require a soft credit check for approval, which doesn’t affect your credit score . However, others may conduct a hard pull of your credit file, which could knock a few points off your score temporarily.

BNPL loans are only reported to one or more of the three major credit bureaus for late payments or nonpayments and could show up on your credit reports and have an impact on your credit score .

It's important to ensure that you can pay the monthly installments after you agree to the BNPL loan. If you do not pay your monthly payment for the BNPL loan, you could become delinquent on it and your credit history, report, and score could all be negatively impacted.

The CFPB found that those who used BNPL loans often had delinquencies on their other credit lines. These users also tended to have lower credit scores.

Since a BNPL loan is not reported to a credit bureau, it won’t help you build a good credit history like a credit card would.

Risks of Using Buy Now, Pay Later (BNPL) Apps

There are some risks to consider before entering into a BNPL arrangement.

First, you’ll want to understand the repayment terms to which you’re agreeing because BNPL financing is not as closely regulated as credit cards are. Terms can vary significantly. For example, some companies may require you to pay the remaining balance with biweekly payments over a month-long period. Others may give you three months, six months, or even longer to pay off your purchases.

Understanding how your payments will work can help you plan for them in your budget. This ensures that you can afford your payments and make them on time. Missing a payment for a buy-now-pay-later agreement could result in late fees. Your late payment history could also be reported to the credit bureaus, which could hurt your credit score.

Finally, consider store return policies and how BNPL loans might affect your ability to return something that you’ve purchased. For example, a merchant may allow you to return the item, but you might not be able to cancel the buy now, pay later arrangement until you can provide proof that the return has been accepted and processed.

Advantages and Disadvantages of Buy Now, Pay Later (BNPL)

As mentioned, buy-now-pay-later financing agreements allow consumers to pay for things over time without interest charges. And it’s possible to get approved for this type of financing even if you’ve been shut out of other loan options due to a low credit score or the lack of credit history.

BNPL loans don’t add to your credit card debt , but they do add to your personal loan debt. They don’t usually affect your credit score unless you fail to pay.

Disadvantages

BNPL does come with certain downsides. For instance, paying off a BNPL loan generally won’t help you establish and build good credit, either. You also miss out on any perks that credit cards offer, such as cash-back or rewards points.

Also, if you want to return an item you bought via BNPL, it can get complicated. You should get your money back, but there can be a delay until the merchant informs the BNPL lender of the refund. You may have to keep making payments in the meantime. If you don’t, then the payment might be marked tardy or missing, resulting in added fees and a possible ding to your credit score.

Convenient way to pay for purchases over time

Frequently no interest or lower interest rates than credit cards

Good credit/high credit score not necessary to qualify

Fast approval

Payments can be hard to track

Missing or late payments result in late fees and may damage credit score

No rewards or cash back earned on purchases

Payments may continue even if item is returned

Teaching Teens About Buy Now, Pay Later (BNPL)

If you have a teenager in your life, there's a good chance they've seen buy now, pay later as an option when online shopping. It's important to explain to them how it works so they know the risks associated with installment loans.

Most BNPL loans require the borrower to be at least 18 years old. And even if they are that age, they could be denied and need someone who has a strong credit history and good credit score to apply for the BNPL financing. So if your teen is under 18, they likely won't be able to use a BNPL loan to purchase something on their own.

BNPL may be easy and fast to use for purchase, but it may not be the best way to go about buying that item. For example, if a teen wants to buy a $100 jacket, BNPL may break down the cost of the jacket into four installments of $25, but the teen could also work to save up the $100 and then buy the jacket outright. The latter approach would help teach the teen about saving and budgeting their money. By the time they save up $100, the teen may not even want to spend it on the jacket anymore.

On the flip side, BNPL could help teach a teen about paying monthly bills. If you agree to purchase the jacket with BNPL financing, you could require the teen to pay you $25 every month until it's paid off. There's still the chance that the teen doesn't pay you back, but it could be a good learning opportunity for them.

If your teen is old enough to use BNPL financing, make sure they know how it could impact their credit history, report, and score. Take the time to explain debt and the best ways to manage it, as well as how credit impacts teens and why it's important for their financial future.

What Credit Score Do You Need for a Buy Now, Pay Later (BNPL) Plan?

There is no set credit score required for signing up for a BNPL plan. In fact, some providers of the service won’t even check your credit score or credit reports when you apply. Some run a soft credit check to understand your creditworthiness.

What Are the Dollar Limits on BNPL Loans?

That also varies from provider to provider, and from retailer to retailer. In general, it may range from hundreds to thousands of dollars. Along with an overall limit, some plans set a per-purchase limit. That is worth checking out before you head to the store to buy a big-ticket item.

What Is the Interest Rate on a BNPL Loan?

Most plans charge 0% interest as long as you make your payments on time. However, if you fail to do so, interest rates can range up to 36%. The plans may also charge late fees, typically $7 or $8, according to the Consumer Financial Protection Bureau.

Buy now, pay later loans can let you make purchases immediately but pay them off over time with no interest. If you’re considering using a BNPL plan, be sure that you understand the terms and conditions, and that you’ll be able to make all the payments on time. Consider whether the payments are affordable and what penalties you may face if you’re unable to pay. Before you decide, it’s worth weighing the pros and cons of BNPL against other options, such as credit cards and personal loans .

Consumer Financial Protection Bureau. “ Buy Now, Pay Later: Market Trends and Consumer Impacts .” Page 74.

Consumer Financial Protection Bureau. “ Buy Now, Pay Later: Market Trends and Consumer Impacts ." Page 3.

Consumer Financial Protection Bureau. “ CFPB Study Details the Rapid Growth of ‘Buy Now, Pay Later’ Lending .”

Consumer Financial Protection Bureau. " Consumer Use of Buy Now, Pay Later ," Page 2.

Chase. " My Chase Plan ."

American Express. " Buy Now, Pay Later with Plan It by American Express ."

Consumer Financial Protection Bureau. " Consumer Use of Buy Now, Pay Later ." Pages 6-7.

Consumer Financial Protection Bureau. " What is a Buy Now, Pay Later (BNPL) Loan? "

Consumer Financial Protection Bureau. “ What’s a Credit Inquiry? ”

Consumer Financial Protection Bureau. " Will a Buy Now, Pay Later (BNPL) Loan Impact My Credit Scores? "

Consumer Financial Protection Bureau. " Consumer Use of Buy Now, Pay Later ." Pages 11-12.

Federal Reserve Bank of Kansas City. " The Rise of Buy Now, Pay Later: Bank and Payment Network Perspectives and Regulatory Considerations ."

Consumer Financial Protection Bureau. " Should You Buy Now Pay Later? "

Federal Trade Commission, Consumer Advice. " Cosigning a Loan FAQs ."

Consumer Financial Protection Bureau. " Do Buy Now, Pay Later (BNPL) Loans Have Fees? "

Affirm. " Here's What Customers Will Pay ."

Consumer Financial Protection Bureau. “ Buy Now, Pay Later: Market Trends and Consumer Impacts ." Page 23.

- Financial Literacy: What It Is, and Why It Is So Important to Teach Teens 1 of 29

- Financial Goals for Students: How and Why to Set Them 2 of 29

- How To Teach Personal Finance 3 of 29

- How to Learn About Finance 4 of 29

- Principles of Building Wealth 5 of 29

- Finance Terms for Beginners 6 of 29

- Stock Market for Teens 7 of 29

- Investing for Teens: What They Should Know 8 of 29

- Saving vs. Investing: What Teens Should Know 9 of 29

- Talking to Teens About Financial Risk 10 of 29

- Portfolio Management Tips for Young Investors 11 of 29

- What Are Asset Classes? More Than Just Stocks and Bonds 12 of 29

- What Is Stock Trading? 13 of 29

- How to Use the Investopedia Simulator 14 of 29

- Credit Tips for Teens 15 of 29

- Credit Cards vs. Debit Cards: What’s the Difference? 16 of 29

- Banking 101 17 of 29

- Debt: What It Is, How It Works, Types, and Ways to Pay Back 18 of 29

- Financial Technology (Fintech): Its Uses and Impact on Our Lives 19 of 29

- What Is a Mobile Wallet? 20 of 29

- What Teens Need to Know About Cryptocurrency 21 of 29

- Buy Now, Pay Later (BNPL): What It Is, How It Works, Pros and Cons 22 of 29

- Best Ways to Send Money as a Teen 23 of 29

- 10 College Degrees With the Best Starting Salaries 24 of 29

- What Are the 5 Purposes of Budgeting? 25 of 29

- How to Read a Pay Stub 26 of 29

- Teens and Income Taxes: Do They Need to File? 27 of 29

- Renting an Apartment for the First Time: What You Need to Know 28 of 29

- Personal Finance Influencers You Should Know 29 of 29

:max_bytes(150000):strip_icc():format(webp)/layaway-58a3316d5f9b58819ce7f4c7.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Ad-free. Influence-free. Powered by consumers.

The payment for your account couldn't be processed or you've canceled your account with us.

We don’t recognize that sign in. Your username maybe be your email address. Passwords are 6-20 characters with at least one number and letter.

We still don’t recognize that sign in. Retrieve your username. Reset your password.

Forgot your username or password ?

Don’t have an account?

- Account Settings

- My Benefits

- My Products

- Donate Donate

Save products you love, products you own and much more!

Other Membership Benefits:

Suggested Searches

- Become a Member

Car Ratings & Reviews

2024 Top Picks

Car Buying & Pricing

Which Car Brands Make the Best Vehicles?

Car Maintenance & Repair

Car Reliability Guide

Key Topics & News

Listen to the Talking Cars Podcast

Home & Garden

Bed & Bath

Top Picks From CR

Best Mattresses

Lawn & Garden

TOP PICKS FROM CR

Best Lawn Mowers and Tractors

Home Improvement

Home Improvement Essential

Best Wood Stains

Home Safety & Security

HOME SAFETY

Best DIY Home Security Systems

REPAIR OR REPLACE?

What to Do With a Broken Appliance

Small Appliances

Best Small Kitchen Appliances

Laundry & Cleaning

Best Washing Machines

Heating, Cooling & Air

Most Reliable Central Air-Conditioning Systems

Electronics

Home Entertainment

FIND YOUR NEW TV

Home Office

Cheapest Printers for Ink Costs

Smartphones & Wearables

BEST SMARTPHONES

Find the Right Phone for You

Digital Security & Privacy

MEMBER BENEFIT

CR Security Planner

Take Action

The Hidden Risks of Buy-Now, Pay-Later Plans

Spreading out payments is convenient, but you don't get the same protections as credit cards

More online shoppers are encountering a new payment method at the checkout page: put down 25 percent of purchase price, then pay off the rest in three equal installments over six weeks—no fees or interest charges.

Known as Buy Now, Pay Later, or BNPL, this type of instant, no-cost financing has become increasingly popular during the COVID-19 pandemic. Some hard-pressed Americans use it to stretch out payments for necessities, while others are buying big-ticket items without having to put down the full amount.

These short-term loans are also popular with consumers who can't qualify for a credit card or other financing but would still like to enjoy the advantage of spreading out payments.

Leisa Meredith, a Tampa resident, for example, keeps a tight rein on spending as she rebuilds financially after a bankruptcy. So she opts for this payment method to buy shoes for her grandchildren.

“For folks looking to manage their cash flow, buy-now, pay-later is absolutely wonderful,” says Meredith, 51.

There are risks, however. Depending on the type of plan you use, you may be subject to fees and interest charges if you don't make the payments on time. You also may have trouble getting a refund for something you’ve purchased, even if it's defective or otherwise unsatisfactory. And there's the danger of getting carried away and buying much more than you can afford.

“Consumers don’t always understand how these loan programs work, or what help they can expect if something goes wrong,” says Chuck Bell, a program director with the advocacy division of Consumer Reports.

More big-name merchants are offering buy-now, pay-later options, often by partnering with financial tech companies. (The merchants pay a fee to these lenders, betting that consumers will buy more if they can stretch out payments.) Even banks and credit card issuers are offering their own versions of these deals.

More than 40 percent of American shoppers have used a buy-now-pay-later plan, according to a recent Credit Karma/Qualtrics survey , with the highest usage among Gen Z and younger millennials. Of those who participated in a BNPL program last year, 27 percent were aged 19 to 25, while 48 percent were 26 to 34, according to Cardify.ai, a firm that tracks consumer spending data.

Participation grew during the pandemic, which hit the incomes of many American families and drove more shoppers online. Afterpay, one of the leading lenders, saw its U.S. monthly sales more than double in November from a year earlier, to $2.1 billion.

How the System Works

Buy-now, pay-later programs, also called point-of-sale loans, work like a layaway plan in reverse. Instead of making payments over time in order to qualify for a purchase, you receive your item up front, then make your payments on schedule.

For online shoppers, you’ll see a pay later button when you reach the check-out page on a participating retailer’s website. For those shopping in brick-and-mortar stores, participating retailers typically let you set up a payment option through an app on your smartphone.

Getting approved for a BNPL account, if you haven’t done it ahead of time, usually takes only a few seconds. Most programs generally do only a soft credit check to confirm your information, with no impact to your credit score . You can choose to link your payments to your debit card, bank account, or even a credit card, depending on the lender.

The typical arrangement is to put down 25 percent of the bill and pay the rest every two weeks in three equal, interest-free installments. But BNPL plans may have varied payment arrangements (more on that below).

You may also be offered a pay-later plan from more established financial services firms. Last fall PayPal introduced Pay in 4—like the other BNPL offerings, this plan allows shoppers to split payments into four equal, interest free installments. PayPal customers must apply separately for this plan.

American Express, Citigroup, and JP Morgan Chase have launched installment plans for their cardholders, giving them the option of spreading large purchases into a series of payments when they get their statements. These programs generally carry a fee or interest charges that may be lower than regular credit card rates.

Be aware, when you click that BNPL button, not every purchase may be approved. The financial tech companies place limits on the amounts you can defer, which are geared to your payment history, as well as the retailer’s policies.

Afterpay, which can be used at thousands of retailers, including Dillard’s, Bed Bath & Beyond, and Lululemon, caps spending between $1,000 to $2,000, says Melissa Davis, head of North America, although customers with strong repayment records can qualify for higher amounts.

Most shoppers actually make relatively modest purchases. At Quadpay, another BNPL lender, transactions average $200, says Shira Schwartz, vice president of marketing, with customers often using the plan for fashion and beauty products, gaming items, as well as food delivery.

Some luxury retailers are starting to offer point-of-sale loans as well. Peloton, the high-end exercise bike (cost: nearly $2,000 or more), has partnered with Affirm to give customers the option of no-interest, no-fee installment plans for as long as 39 months. Peloton purchases recently accounted for 28 percent of Affirm’s revenue, according to its IPO filing.

What Can Go Wrong

One obvious risk with BNPL programs is that those seemingly affordable payments may tempt you to splurge.

In a survey last year by Cardify.ai, nearly half of BNPL shoppers said they increased their spending between 10 percent to over 40 percent when they use these plans compared with using a credit card. Two-thirds of BNPL customers said they are buying jewelry and other “want” items that they might not otherwise purchase, the survey found.

Consumers may also find that installment payments are harder to track. A study last year by Cornerstone Advisors, a banking consulting firm in Scottsdale, Ariz., found that over the past two years, 43 percent of those who used BNPL services were late with a payment. Of those, two-thirds said the reason for falling behind was that they simply lost track of the payments, not because they did not have the money.

“For most people having the money was not the problem—it was the management piece of it,” says Ron Shevlin, director of research at Cornerstone Advisors.

You may also face challenges if you have a problem with your purchase, such as obtaining a refund for a product that didn’t arrive or turned out to be defective. That’s because you will have to meet the requirements of both the BNPL lender and the retailer.

Unlike credit card issuers, which are subject to strong federal regulation , these short-term lending programs are relatively new and receive minimal, inconsistent oversight from federal and state bank regulators.

“Buy now pay later programs fall into a regulatory gray area and do not have the same consumer protections as credit cards,” says Chuck Bell, the Consumer Reports advocate.

Unlike credit card issuers, who typically stop payments when a transaction is disputed, BNPL lenders generally require consumers to first contact the merchant to get credit for a return or refund. Until the lender is notified by the retailer that the transaction has been voided or a refund issued, you may have to continue to make payments on your loan.

That often leaves consumers on their own to ensure that the merchant follows through and the payment is credited by the BNPL lender. These tasks can be challenging, especially during a pandemic.

For LT Horhn, 48, a Los Angeles resident, obtaining a refund from Sezzle for a $200 handbag turned out to be a long ordeal.

“I was shopping online last September and clicked—then I had second thoughts, since I didn’t know the retailer,” says Horhn.

She tried to cancel the purchase, but she could not reach the retailer by phone, and Sezzle’s customer representative told her that all requests must go through the merchant directly.

Horhn sent back the bag, which was poor quality, she says. But the address given to her by the retailer turned out to be false, and the package was returned as undeliverable. Unable to get a refund from Sezzle, she canceled payments through her bank, but the first one for $51 had already gone through.

Upon being contacted by Consumer Reports, Sezzle CEO Charlie Youakim reviewed Horhn's account, and she received a refund. Youakim also says Horhn should have initiated a dispute.

Horhn responded that she did not understand where to do this on the website.

How to Avoid Problems

1. Be realistic about spending. Your BNPL lender may allow you to spend as much as $1,000 in one shot, but that doesn’t mean you should.

So take a hard look at your budget and your income to understand how much free cash you will have coming in.

Once you understand your spending limits, make sure you stay on track, perhaps by keeping a strict list of planned purchases. And earmark an account for those future payments.

“You want to make sure you really have the money set aside for those bills, when they come due,” says Marguerita Cheng, a certified financial planner in Gaithersburg, Md.

2. Check for pitfalls in the FAQs. “These pay-later services are still the Wild West—they come in all types, some with fees and interest charges and some without,” says Matt Schulz, chief industry analyst at Lending Tree. “It’s easy to get confused, especially if you sign up with more than one lender.”

So check the terms of the loans on the lender’s website, which are typically laid out on a support or FAQ page, or call and ask. Is the late fee imposed automatically, or can you get it waived if you pay a day late? If you miss a payment, are you barred from future purchases? Will late or missed payments be reported to a credit bureau, possibly hurting your credit score ?

Be sure you are getting the rules for the specific type of loan you are using, since some lenders provide more than one type of financing program. Affirm, for example, offers loans of varying lengths, and the terms and interest rates can vary by retailer and your credit profile.

3. Set up automatic payments. As the Cornerstone Research showed, consumers can easily lose track of their BNPL payments. One likely reason these bills are short-term and come due biweekly rather than monthly, says Shevlin. Juggling multiple loans can add to the confusion.

Some consumers may also view the late fee as a minor cost, but they can defeat the purpose of using these programs, says Ted Rossman, industry analyst at CreditCards.com.

Say you end up paying $30 in late fees on a $100 item—that effectively raises the price of the item by 30 percent. If you don’t have enough money in the bank to pay that bill, you may get hit by a $35 overdraft fee on top of that.

The most foolproof way to avoid these costs is to automate the entire process. Schedule regular payments through your bank account or card.

You can also set up text or email reminders that payments are due. Some lenders do this automatically.

4. Don’t use for obscure retailers or travel. Unless you’re spending a small amount that you won’t miss, an installment loan program isn’t the best way to try out a new product or service.

“If you’re using a buy now pay later plan, you probably want to stick with well-known retailers with track records for delivering on time and responding quickly if there’s an issue with your purchase,” says Rossman.

You may also want to think twice about using these plans for travel arrangements, such as buying airline tickets, says Chuck Bell, the Consumer Reports advocate. When dealing with online travel booking sites, especially, you may come up against inflexible refund policies if your travel plans change or are canceled.

5. Consider using a credit card instead. While point of sale loans can be convenient, you may be better off in the long run if you use a credit card, as long you can pay off the full balance on time.

“By using a credit card, you can build a good credit score, which is important for your overall finances,” says Schulz. (Learn smart strategies for improving your credit score .) Your purchases may also qualify for rewards, such as cash back or discounts, which can boost your budget.

You also have stronger consumer protection when you use a credit card. In addition to investigation of disputed charges, some issuers may offer purchase protection that will cover your costs if items are damaged or stolen.

In these uncertain times, it can be a major benefit to have additional help if something goes wrong.

Penelope Wang

I cover everything from retirement planning to taxes to college saving. My goal is to help people improve their finances, so they have less stress and more freedom. What I enjoy: walks through the city, time with family, and reading mysteries, though I rarely guess who did it.

Sharing is Nice

We respect your privacy . All email addresses you provide will be used just for sending this story.

Trending in Shopping & Retail

Best Office Chairs

Best Spring Cleaning Deals on Vacuums, Carpet Cleaners, and More

Best Places to Buy Large Appliances

How to Choose the Best TV Mount

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

For Retailers, a Direct Link from ‘Buy Now, Pay Later’ to the Bottom Line

Sponsor content from PAYPAL.

Most corporate growth strategies are grounded in plans to enter new markets, launch new products, acquire another company, or enhance the customer experience. At the same time, companies have to negotiate an increasingly complex global digital economy where tech-savvy consumers have limitless shopping choices and higher expectations than ever before. As retailers jockey for customers, they should consider one growth tactic that can help meet consumers’ need for flexibility and increase conversion: updating checkout to offer more-flexible payment options.

Today’s online shoppers expect a range of payment choices. A 2021 TRC Market Research survey of ecommerce customers in the United States, the United Kingdom, Germany, France, and Australia found that the majority of shoppers decide how they’re going to pay for a purchase before they check out — and “buy now, pay later” (BNPL) payment options offered earlier in the shopping journey can help influence their decision to buy. 1

Unsurprisingly, the fintech industry has taken notice. In 2020, spurred by the financial shock of the pandemic, demand for BNPL increased substantially, 2 and a host of new providers quickly emerged to meet it. While the pandemic is subsiding, enthusiasm for paying by installment remains high across customer segments. 2

It looks like BNPL is here to stay. And to remain competitive, retailers need to know who uses it and why — and how offering it can help them increase sales.

Not Just for Millennials

BNPL is often associated with Millennials, 1 but today’s BNPL has broad appeal across demographics, from Gen Zs to Boomers. Despite some country-by-country variations, the TRC survey revealed significant uptake across all age segments:

- Millennials (ages 25-40) are the biggest users of BNPL, with usage ranging from 37% in France to 49% in the United States. 3

- Many Gen Xs (ages 41-56) also choose BNPL — from 25% in the United Kingdom to 33% in the United States.

- Younger and older generations are catching up, with more than 18% of Gen Zs (ages 18-25) and 11% of Boomers (ages 57-70+) using BNPL.

From young people settling into adulthood to retirees entering the next phases of their lives, interest-free credit options seem to be playing an increasing role in people’s purchases. 2

The Broad Appeal of BNPL

Consumers see many advantages to using BNPL. The most common are:

- Flexibility and convenience. The popularity of BNPL parallels a rise in the “subscription lifestyle” trend. Consumers like the convenience of automated monthly payments for streaming services, meal delivery plans, and curated fashion shopping. Even some airlines, recognizing that consumers enjoy a “set it and forget it” payment schedule, are exploring subscription travel plans. 4 BNPL offers similar consistency and transparency — automated repayments on a set schedule — as well as convenience.

- Appeal to a wide range of consumers. At least half of the TRC survey respondents in all five national markets said that spreading the cost of a purchase allows them to make better purchasing decisions. 1 This means BNPL may help retailers reach a wide range of shoppers who will purchase higher-quality and valued goods because they can pay over time. This can help increase revenue and average order values for retailers.

- Budgeting and cash flow support. While it may at first seem counterintuitive, many consumers use BNPL to help manage their finances and improve their financial health. In the TRC survey, 76% of respondents reported using BNPL to budget and manage cash flow 1 — a practice especially appealing to digital natives who may use investment and budgeting apps such as Ellevest and Acorns. 5 Knowing the payment schedule and costs associated with BNPL when a consumer uses it to make their purchase makes it easier for them to manage their cash flow.

- Streamlined application and approval. Shoppers can quickly access BNPL as part of the checkout process, without a lengthy approval process. They can get the flexibility to spread payments over time and the satisfaction of receiving purchases quickly.

Helping Retailers Grow Sales

Retailers, meanwhile, find that BNPL helps drive both sales and customer loyalty. The TRC survey revealed three major advantages:

- Conversion boost. Consumers paying with BNPL were up to three times more likely to complete a purchase after browsing. 1

- Bigger average cart size. BNPL users may be more likely to pull the trigger on big-ticket items. The most common purchases are clothing and shoes, while purchases of electronics, appliances, and other durable goods also raised the average basket size. Samsonite added a BNPL option in fall 2020 and saw a 25% increase in the average value of orders made through its leading payment provider in 2021. 6

- Fewer abandoned transactions. BNPL has become so much more commonplace that the absence of a BNPL option may turn off buyers. At least half of BNPL users in each country surveyed (66% in the United States 7 ) said they would abandon a purchase if BNPL wasn’t an option.