Free PDF Business Plan Templates and Samples

By Joe Weller | September 9, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve gathered the most useful collection of business plan PDF templates and samples, including options for organizations of any size and type.

On this page, you’ll find free PDF templates for a simple business plan , small business plan , startup business plan , and more.

Simple Business Plan PDF Templates

These simple business plan PDF templates are ready to use and customizable to fit the needs of any organization.

Simple Business Plan Template PDF

This template contains a traditional business plan layout to help you map out each aspect, from a company overview to sales projections and a marketing strategy. This template includes a table of contents, as well as space for financing details that startups looking for funding may need to provide.

Download Simple Business Plan Template - PDF

Lean Business Plan Template PDF

This scannable business plan template allows you to easily identify the most important elements of your plan. Use this template to outline key details pertaining to your business and industry, product or service offerings, target customer segments (and channels to reach them), and to identify sources of revenue. There is also space to include key performance metrics and a timeline of activities.

Download Lean Business Plan Template - PDF

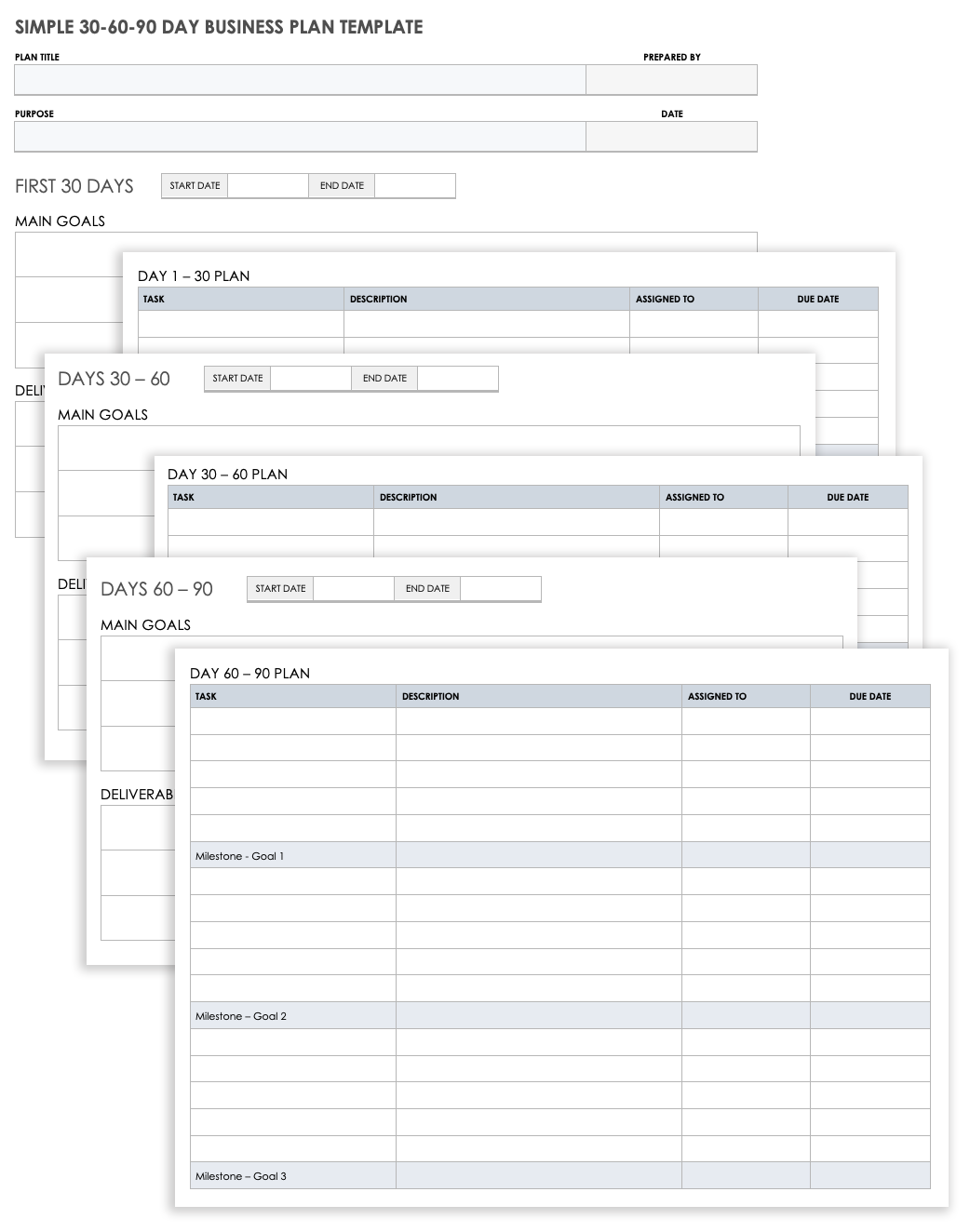

Simple 30-60-90 Day Business Plan Template PDF

This template is designed to help you develop and implement a 90-day business plan by breaking it down into manageable chunks of time. Use the space provided to detail your main goals and deliverables for each timeframe, and then add the steps necessary to achieve your objectives. Assign task ownership and enter deadlines to ensure your plan stays on track every step of the way.

Download Simple 30-60-90 Day Business Plan Template

PDF | Smartsheet

One-Page Business Plan PDF Templates

The following single page business plan templates are designed to help you download your key ideas on paper, and can be used to create a pitch document to gain buy-in from partners, investors, and stakeholders.

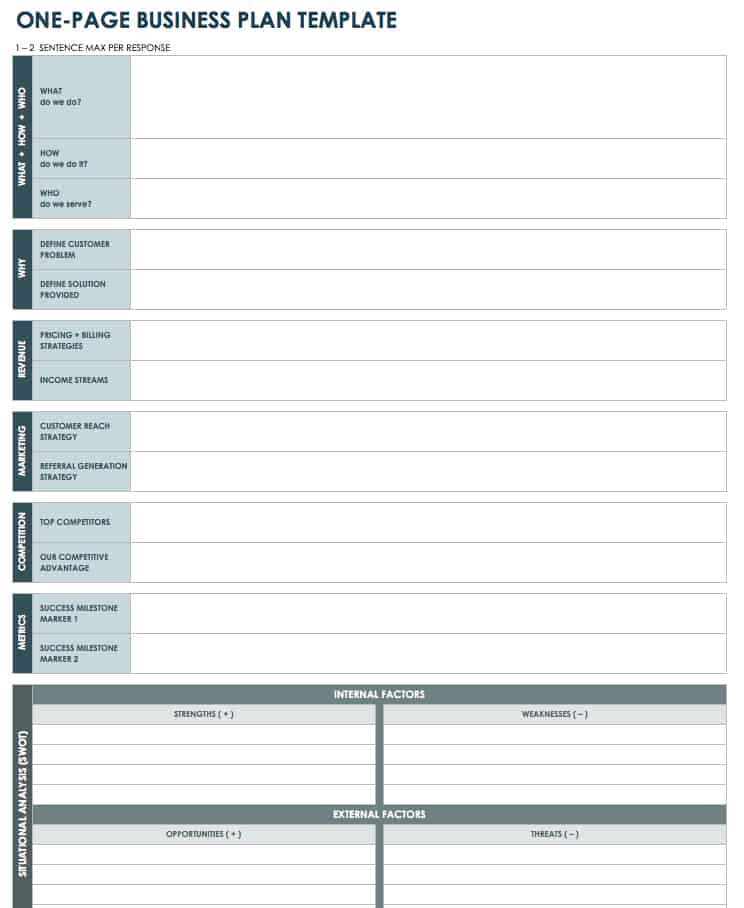

One-Page Business Plan Template PDF

Use this one-page template to summarize each aspect of your business concept in a clear and concise manner. Define the who, what, why, and how of your idea, and use the space at the bottom to create a SWOT analysis (strengths, weaknesses, opportunities, and threats) for your business.

Download One-Page Business Plan Template

If you’re looking for a specific type of analysis, check out our collection of SWOT templates .

One-Page Lean Business Plan PDF

This one-page business plan template employs the Lean management concept, and encourages you to focus on the key assumptions of your business idea. A Lean plan is not stagnant, so update it as goals and objectives change — the visual timeline at the bottom is ideal for detailing milestones.

Download One-Page Lean Business Plan Template - PDF

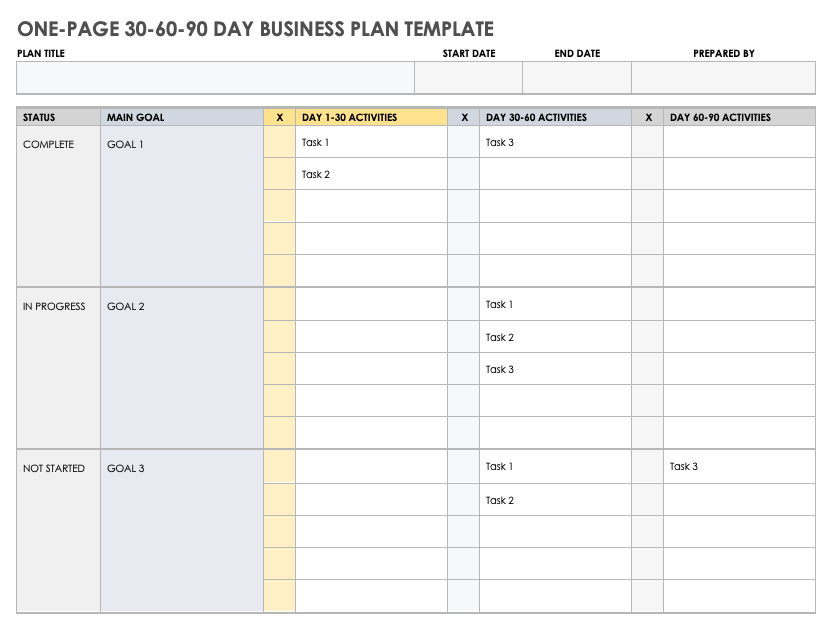

One-Page 30-60-90 Day Business Plan Template

Use this business plan template to identify main goals and outline the necessary activities to achieve those goals in 30, 60, and 90-day increments. Easily customize this template to fit your needs while you track the status of each task and goal to keep your business plan on target.

Download One-Page 30-60-90 Day Business Plan Template

For additional single page plans, including an example of a one-page business plan , visit " One-Page Business Plan Templates with a Quick How-To Guide ."

Small Business Plan PDF Templates

These business plan templates are useful for small businesses that want to map out a way to meet organizational objectives, including how to structure, operate, and expand their business.

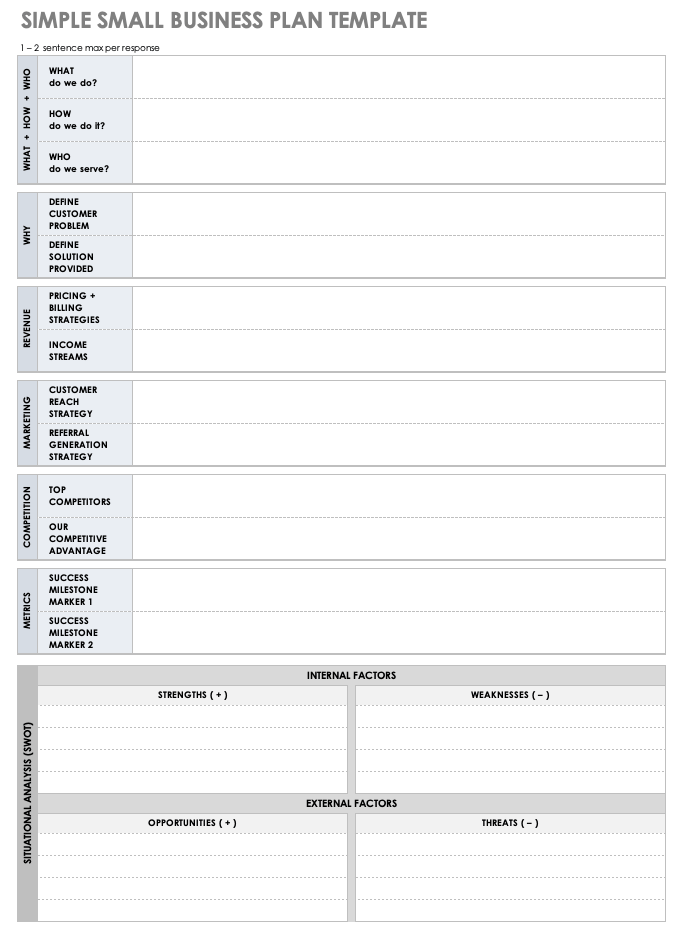

Simple Small Business Plan Template PDF

A small business can use this template to outline each critical component of a business plan. There is space to provide details about product or service offerings, target audience, customer reach strategy, competitive advantage, and more. Plus, there is space at the bottom of the document to include a SWOT analysis. Once complete, you can use the template as a basis to build out a more elaborate plan.

Download Simple Small Business Plan Template

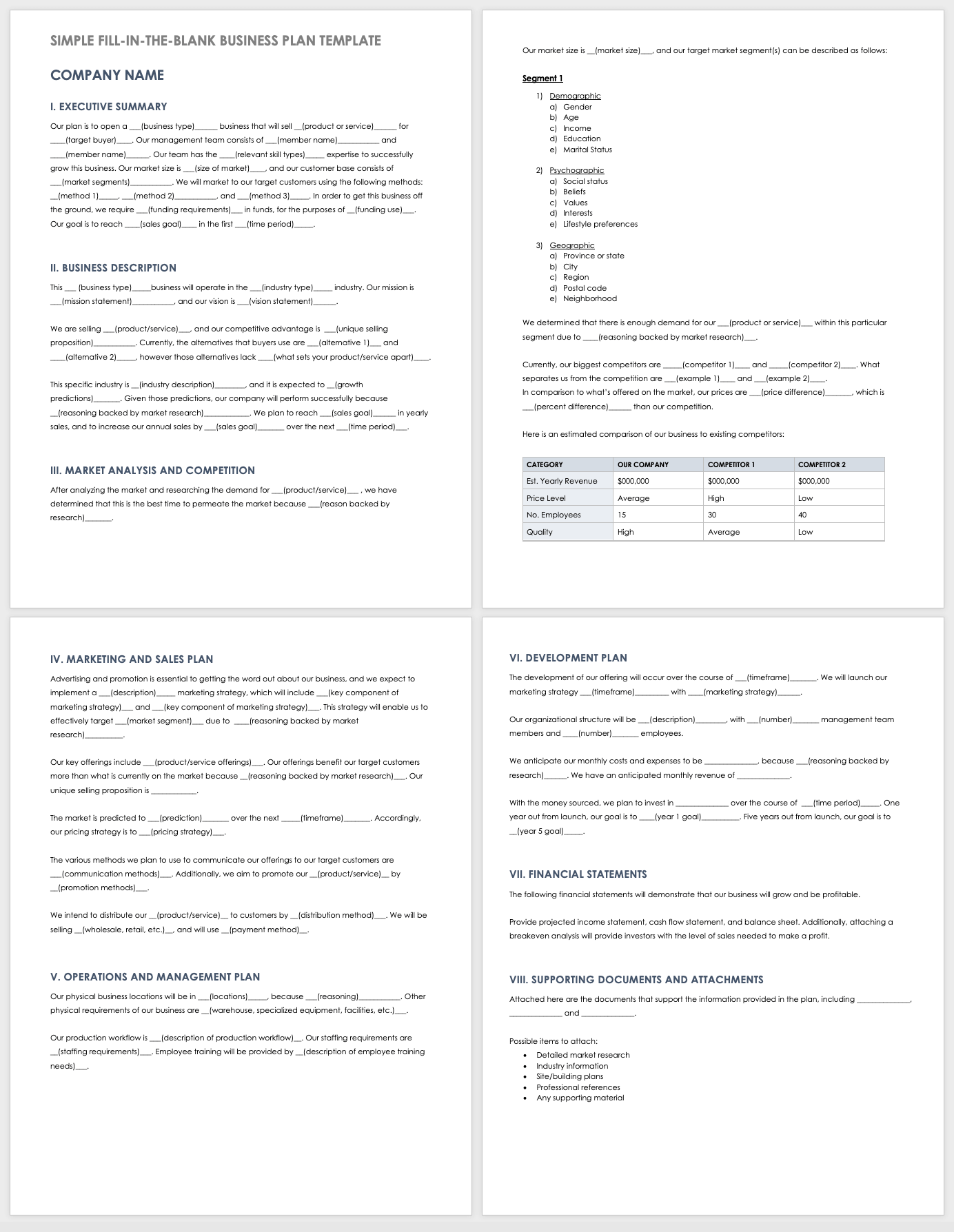

Fill-In-the-Blank Small Business Plan Template PDF

This fill-in-the-blank template walks you through each section of a business plan. Build upon the fill-in-the-blank content provided in each section to add information about your company, business idea, market analysis, implementation plan, timeline of milestones, and much more.

Download Fill-In-the-Blank Small Business Plan Template - PDF

One-Page Small Business Plan Template PDF

Use this one-page template to create a scannable business plan that highlights the most essential parts of your organization’s strategy. Provide your business overview and management team details at the top, and then outline the target market, market size, competitive offerings, key objectives and success metrics, financial plan, and more.

Download One-Page Business Plan for Small Business - PDF

Startup Business Plan PDF Templates

Startups can use these business plan templates to check the feasibility of their idea, and articulate their vision to potential investors.

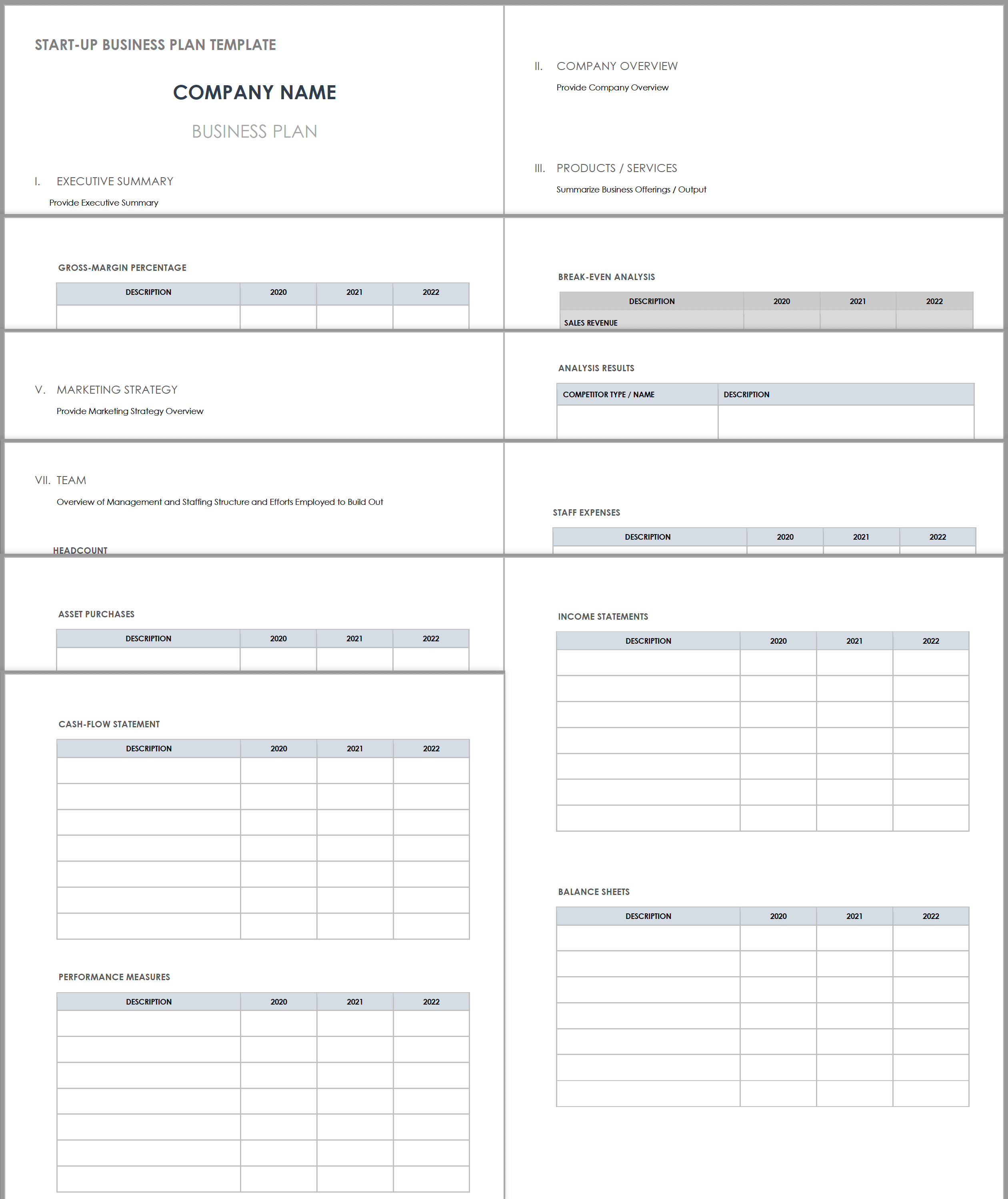

Startup Business Plan Template

Use this business plan template to organize and prepare each essential component of your startup plan. Outline key details relevant to your concept and organization, including your mission and vision statement, product or services offered, pricing structure, marketing strategy, financial plan, and more.

Download Startup Business Plan Template

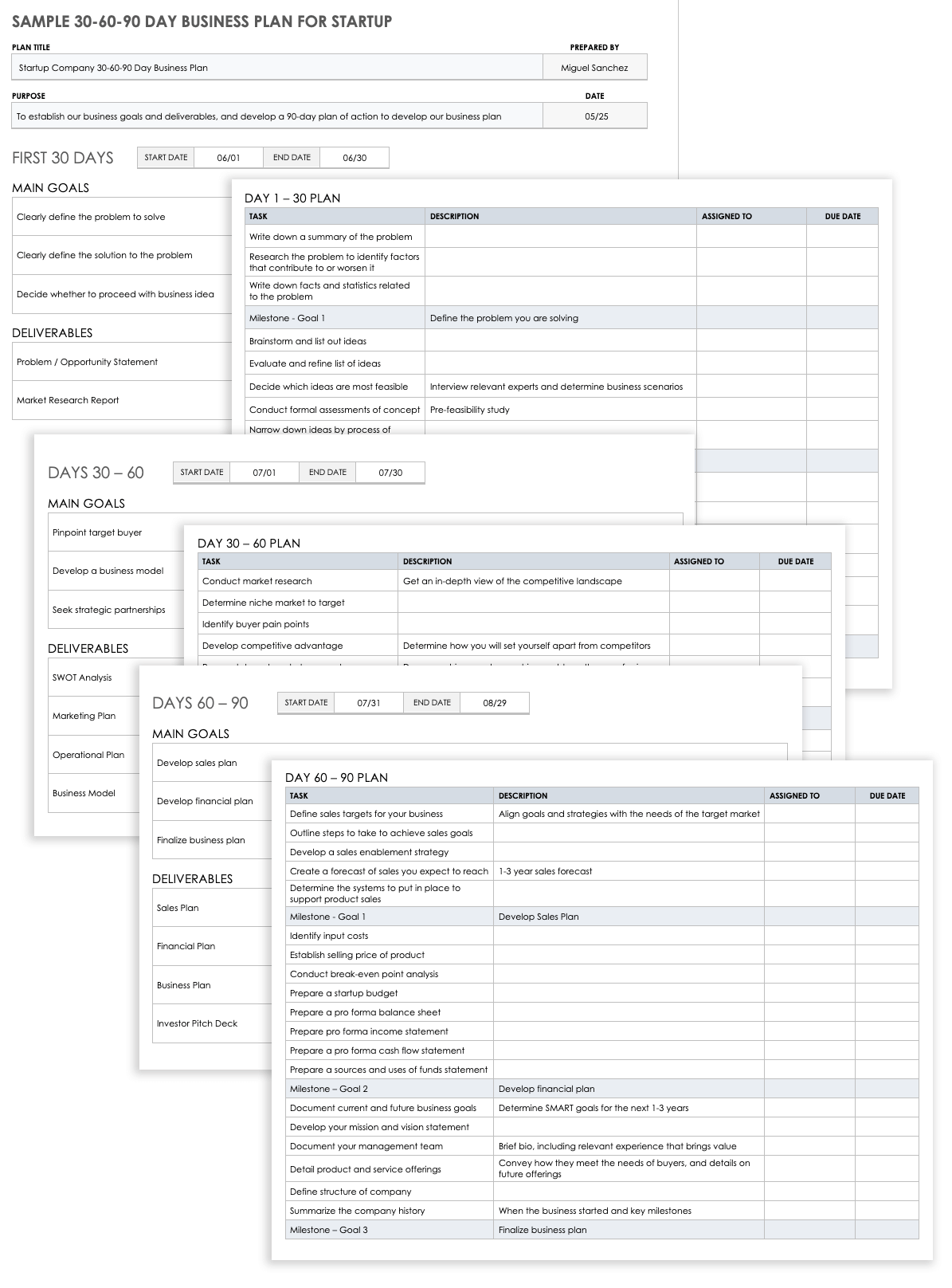

Sample 30-60-90 Day Business Plan for Startup

Startups can use this sample 30-60-90 day plan to establish main goals and deliverables spanning a 90-day period. Customize the sample goals, deliverables, and activities provided on this template according to the needs of your business. Then, assign task owners and set due dates to help ensure your 90-day plan stays on track.

Download Sample 30-60-90 Day Business Plan for Startup Template

For additional resources to create your plan, visit “ Free Startup Business Plan Templates and Examples .”

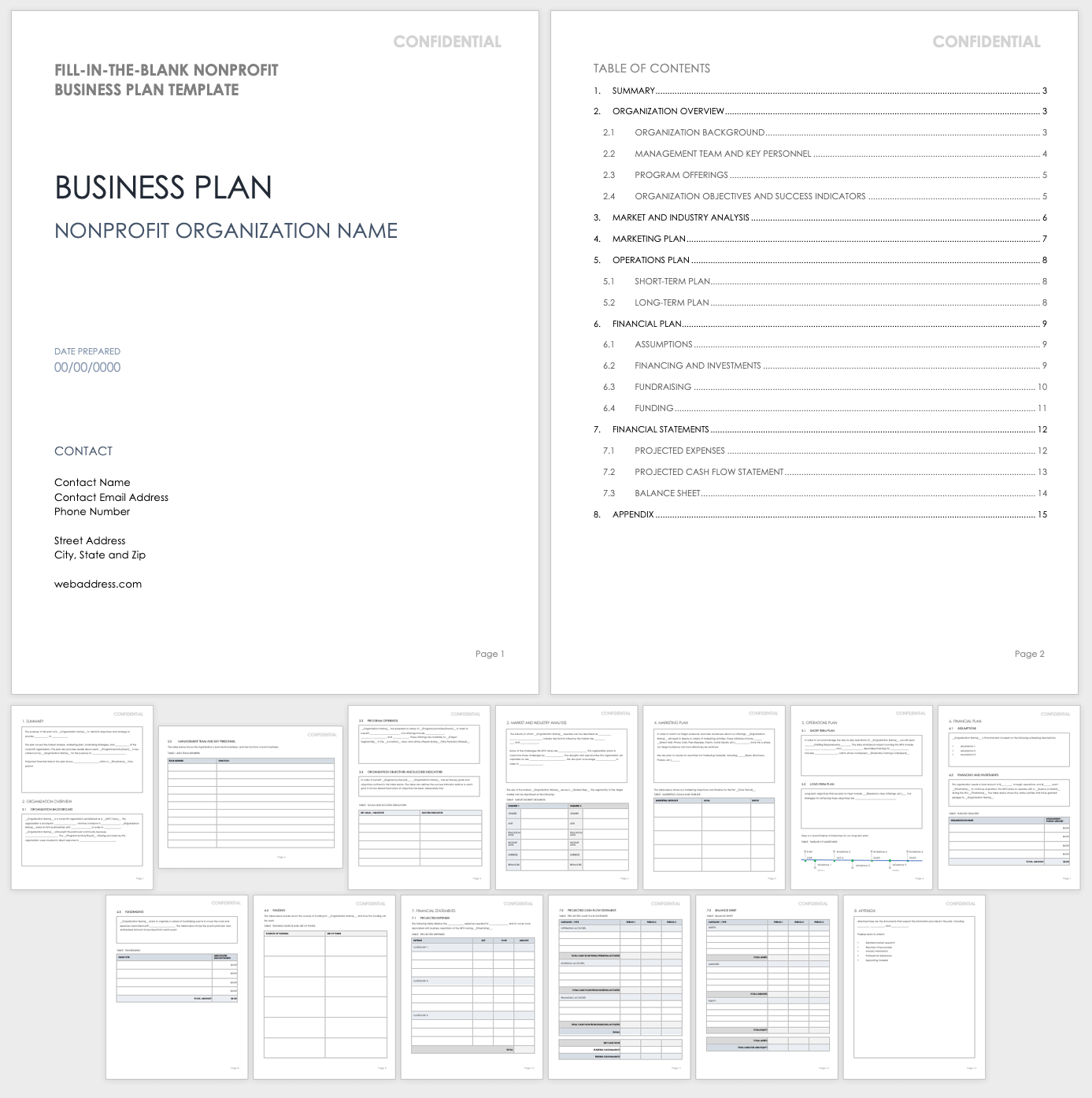

Nonprofit Business Plan PDF Templates

Use these business plan PDF templates to outline your organization’s mission, your plan to make a positive impact in your community, and the steps you will take to achieve your nonprofit’s goals.

Nonprofit Business Plan Template PDF

Use this customizable PDF template to develop a plan that details your organization’s purpose, objectives, and strategy. This template features a table of contents, with room to include your nonprofit’s mission and vision, key team and board members, program offerings, a market and industry analysis, promotional plan, financial plan, and more. This template also contains a visual timeline to display historic and future milestones.

Download Nonprofit Business Plan Template - PDF

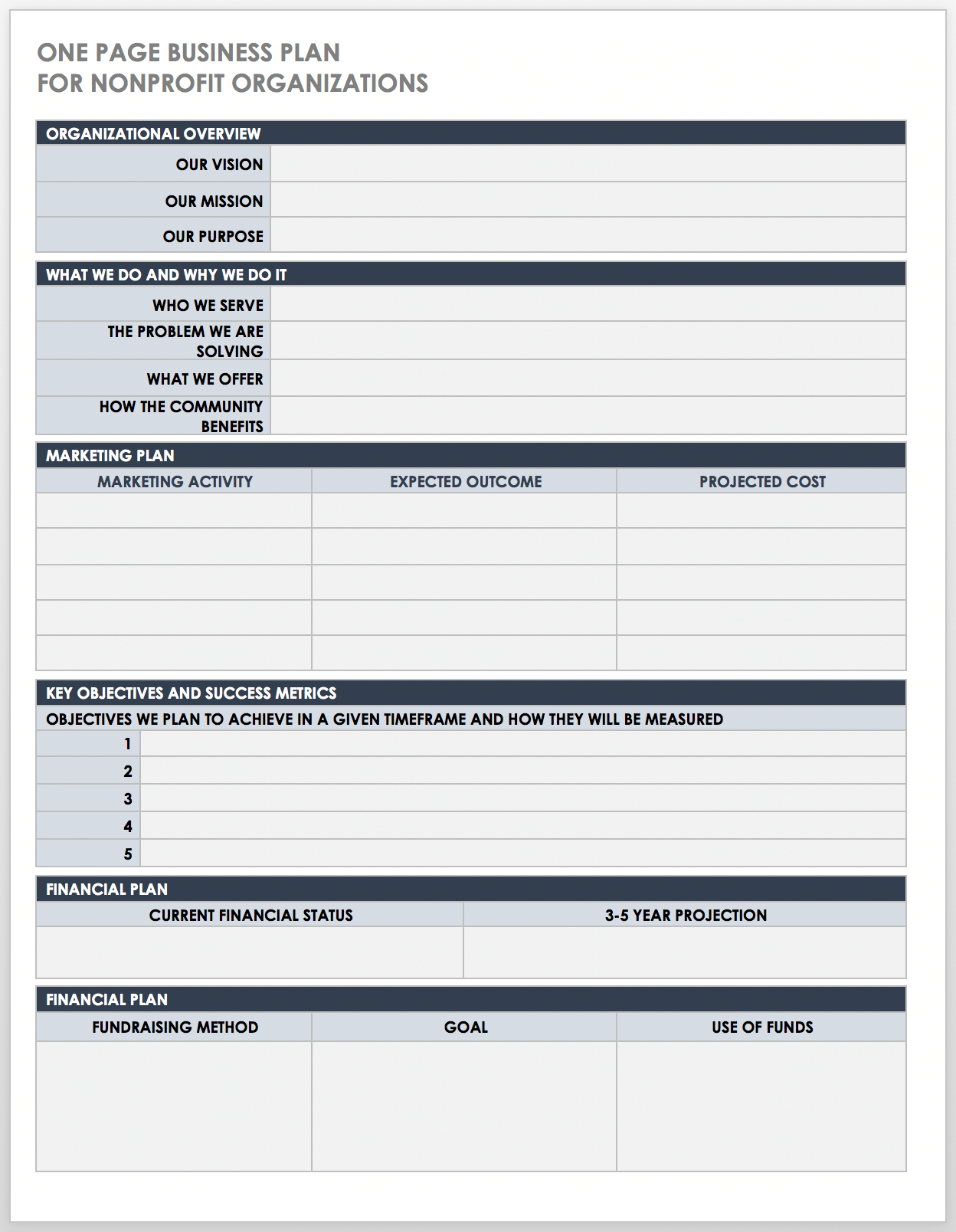

One-Page Business Plan for Nonprofit Organization PDF

This one-page plan serves as a good starting point for established and startup nonprofit organizations to jot down their fundamental goals and objectives. This template contains all the essential aspects of a business plan in a concise and scannable format, including the organizational overview, purpose, promotional plan, key objectives and success metrics, fundraising goals, and more.

Download One-Page Business Plan for Nonprofit Organization Template - PDF

Fill-In-the-Blank Business Plan PDF Templates

Use these fill-in-the-blank templates as a foundation for creating a comprehensive roadmap that aligns your business strategy with your marketing, sales, and financial goals.

Simple Fill-In-the-Blank Business Plan PDF

The fill-in-the-blank template contains all the vital parts of a business plan, with sample content that you can customize to fit your needs. There is room to include an executive summary, business description, market analysis, marketing plan, operations plan, financial statements, and more.

Download Simple Fill-In-the-Blank Business Plan Template - PDF

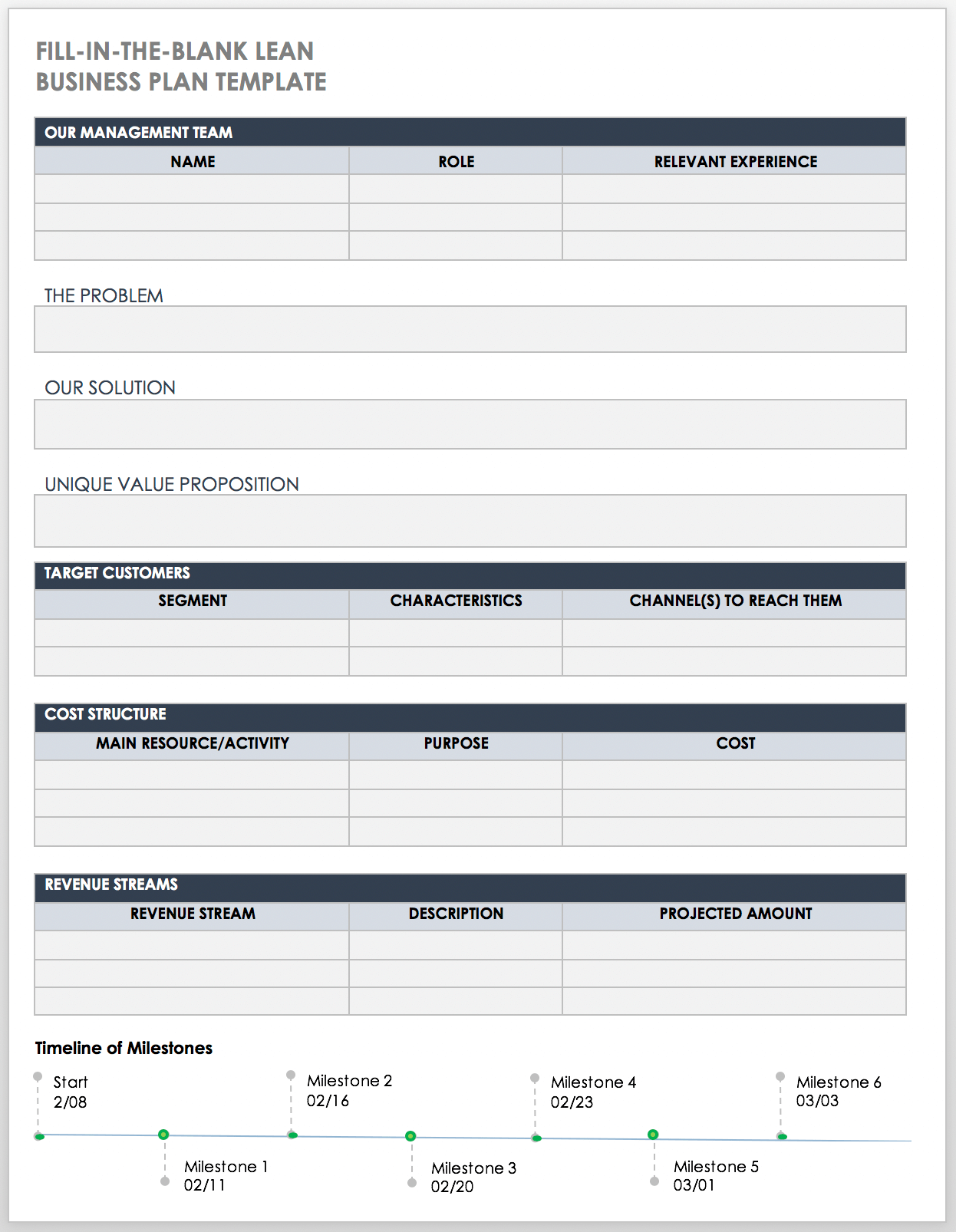

Lean Fill-In-the-Blank Business Plan PDF

This business plan is designed with a Lean approach that encourages you to clarify and communicate your business idea in a clear and concise manner. This single page fill-in-the-blank template includes space to provide details about your management team, the problem you're solving, the solution, target customers, cost structure, and revenue streams. Use the timeline at the bottom to produce a visual illustration of key milestones.

Download Fill-In-the-Blank Lean Business Plan Template - PDF

For additional resources, take a look at " Free Fill-In-the-Blank Business Plan Templates ."

Sample Business Plan PDF Templates

These sample business plan PDF templates can help you to develop an organized, thorough, and professional business plan.

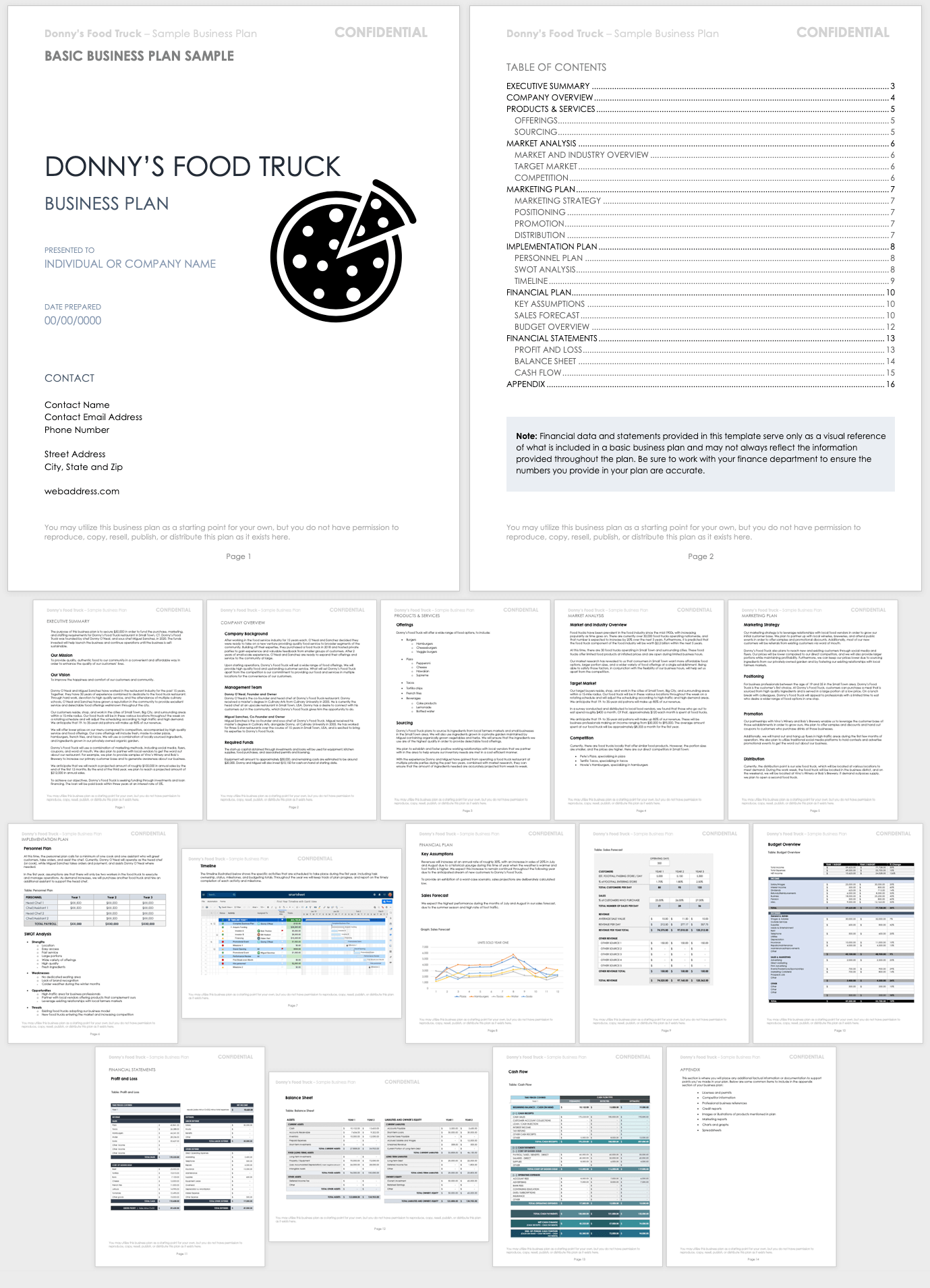

Business Plan Sample

This business plan example demonstrates a plan for a fictional food truck company. The sample includes all of the elements in a traditional business plan, which makes it a useful starting point for developing a plan specific to your business needs.

Download Basic Business Plan Sample - PDF

Sample Business Plan Outline Template

Use this sample outline as a starting point for your business plan. Shorten or expand the outline depending on your organization’s needs, and use it to develop a table of contents for your finalized plan.

Download Sample Business Plan Outline Template - PDF

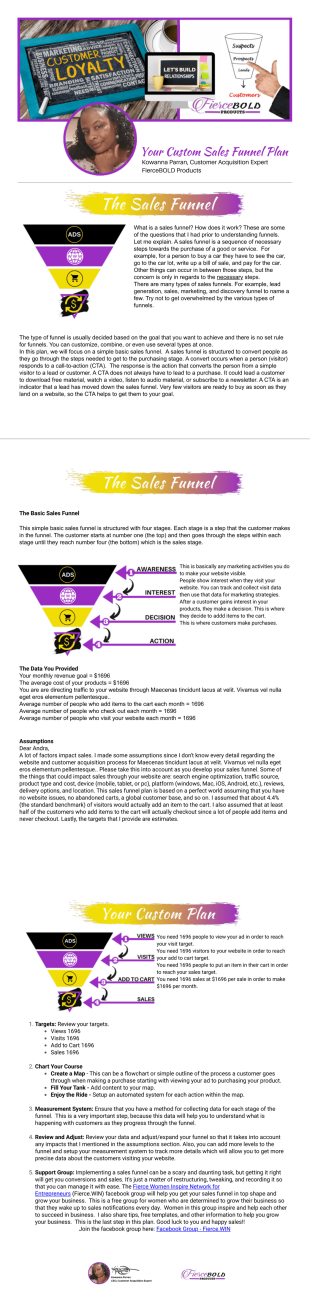

Sample Business Financial Plan Template

Use this sample template to develop the financial portion of your business plan. The template provides space to include a financial overview, key assumptions, financial indicators, and business ratios. Complete the break-even analysis and add your financial statements to help prove the viability of your organization’s business plan.

Download Business Financial Plan Template

PDF | Smartsheet

For more free, downloadable templates for all aspects of your business, check out “ Free Business Templates for Organizations of All Sizes .”

Improve Business Planning with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

Frequently Asked Questions

- Business Credit Cards

- Talk to Us 1-800-496-1056

14 Professional Business Plan Samples [Downloadable pdf]

Looking for business plan examples for inspiration? Download or view 14 business plans examples/samples, vetted by our MBA business plan writers. Download in PDF format or read like a book. These real business plan samples would help in writing your own business plan.

- View Real Business Plan Examples/Samples

As an entrepreneur, effectively pitching your idea to attract investors and secure funding can be a challenge. Moreover, when launching a business, creating a comprehensive business plan is paramount.

To aid you in these crucial tasks, we offer a collection of real-world and sample business plan examples across diverse industries. A well-structured business plan is indispensable in the fast-paced entrepreneurial landscape, as it delineates your goals, strategies, and financial projections, providing a clear roadmap for your venture.

Our aim is to facilitate the creation of an effective business plan by integrating real-life examples to elucidate the key elements involved. Below, you’ll find a range of 14 detailed business plan examples available for download and use.

Important Sections to Include in Business Plan

Practical business plan examples illustrating strategies for startup success, 1. e-commerce plan sample or example, 2. online marketplace business plan example or sample, 3. snack bar business plan sample / business plan example, 4. coffee shop business plan sample/business plan example pdf, 5. food hall business plan sample/business plan example pdf, 6. printing shop business plan sample/business plan example plan, 7. acquisition business plan sample/ example pdf, 8. l-1 visa business plan example with sample pdf, 9. e-2 visa business plan sample/ example pdf, 10. eb-5 business plan sample/ example pdf, 11. investor business plan sample/ example pdf, 12. nonprofit business plan sample/ example pdf, 13. bank business plan sample/ example pdf, 14. cannabis business plan sample/ example pdf, detailed overview of key components of a business plan, 1. executive summary, tips for writing executive summary, 2. company overview or description, tips for writing company description, 3. market analysis, tips for writing market analysis, 4. product and services, tips for writing product and services, 5. marketing and sales plan, tips for writing marketing and sales plan, 6. operation planning, tips for writing operational planning, 7. organization and management, tips for writing organization and management summary, 8. financial plan, tips for writing financial plan, 9. key external drivers, tips for writing key external drivers, 10. startup summary, tips for writing startup summary, 11. projected industry growth, tips for writing projected industry growth, 12. break-even analysis, tips for writing break-even analysis, 13. management summary, tips for writing management summary, 14. financial indicators, tips for writing financial indicators, discover business plan formats and free templates, business plan examples for students pdf, common types of business plan, 1. one page business plan, 2. start-up business plan, 3. strategic business plan, 4. feasibility business plan, 5. internal business plan, conclusion, download pack of 14 business plan examples, are you looking for top business plan writer.

To create a robust business plan, ensure inclusion of the following key sections:

- Executive Summary: A brief snapshot of your business and the key highlights of your business plan. Read more

- Product and Services: An elaborate description of the offerings you will provide to your customers. Read more

- Marketing and Sales Plan: A strategic roadmap outlining how you intend to promote and market your business before, during, and after its launch. Read more

- Operating Planning: An explanation of the systems, processes, and tools necessary to efficiently run your business behind the scenes. Read more

- Organization and Management: Organization and management in a business plan outline the structure and leadership of the company. Read more

- Financial Plan: A comprehensive plan mapping out your short-term and long-term financial goals and the associated costs of running your business. If you require funding, this section is where you can outline your request and financial needs. Read more

- Key External Drivers: External drivers encompass factors like outsourcing, economic changes, industry competition, and business legislation complexity. Read more

- Startup Summary: The startup summary offers a comprehensive financial overview of , detailing expenses, asset value, and total requirements, crucial for transparency with entrepreneurs and investors. Read more

- Projected Industry Growth : Projected industry growth forecasts the sector’s expansion, offering a 10-year perspective and average annual growth rate, providing clarity to investors. Read more

- Break-even analysis: The break-even analysis visually presents key metrics and a 12-month revenue forecast to help stakeholders grasp the point where the business covers costs and starts generating profit . Read more

- Management Summary: The management summary provides a concise overview of organizational structure, key personnel, their roles, and financial commitments, ensuring stakeholders understand the business’s operational strength and leadership capability. Read more

- Financial Indicators: The financial indicators section evaluates organizational fiscal health, focusing on year-over-year profitability metrics, leverage ratios, liquidity ratios, and additional metrics, providing a comprehensive understanding of the business’s financial performance and efficiency in revenue generation from equity investments. Read more

Something Borrowed Something New is a burgeoning e-commerce enterprise specializing in wedding accessories and personalized gifts. Operating on a drop-shipping model, this business has the capability to make a significant impact in the market.

Moreover, leveraging social networking and blogging can be instrumental in generating awareness and capturing interest, thereby creating a robust online marketing strategy for Something Old and Something New.

To enhance their business operations, they are contemplating the integration of a WhatsApp CRM system. This initiative aims to optimize communication with potential customers, ensuring prompt responses to inquiries and fostering a seamless interaction process.

EPlace Solutions will be an innovative online marketplace business portal offering a variety of products to consumers throughout the globe. Founded by Mr. John Jones, a seasoned business visionary with an eye toward profit and achievement, the organization is set to enter the market in 2023.

Online shopping is at an all-time high with new consumer mindsets calling for them to shop for the types of deals and bargains that will be so much a part of the online marketplace business model.

There is an increasing demand for snack-type fast food to be consumed while window shopping and walking around inside a shopping mall.

Do you plan to start a snack bar business? Then here’s a complete snack bar startup business plan template and feasibility report you can use FREE of charge. It sounds easy to open a snack bar, but in reality, you need well-planned strategies to ensure that your business stands the test of time.

Our snack bar business plan sample includes a detailed description of the products and services offered, as well as a market a nalysis and competitive analysis.

It also includes a financial plan that outlines the startup costs, revenue projections, and break-even analysis. We like this sample plan because it demonstrates how to build a profitable snack bar business by creating a unique menu and offering healthy, high-quality snac ks that meet custome r demand.

Your snack shop business plan can look as polished and professional as the sample plan. It’s fun and easy, with Wise Business Plan. Let’s review the snack shop business plan sample and adjust them according to your audience for the best results.

A coffee shop business plan is a document that outlines what your business idea is and how it will be implemented. Its purpose is to answer questions such as what it costs to start a coffee shop, how these costs will be financed, and how much money you can expect to earn from your cafe.

Are you looking for the right business plan for your cafe? Let’s review the Coffee shop business plan sample to find out how cloud-based software can make your day-to-day work more efficient.

Our coffee shop business plan sample includes a detailed description of the products and services offered, as well as a market analysis and competitive analysis.

It also includes a financial plan that outlines the startup costs, revenue projections, and break-even analysis. We like this sample plan because it demonstrates how to build a profitable coffee shop business by creating a unique brand and offering high-quality products a nd customer service.

In the food industry, there is fierce competition. To ensure success, you need to hit the ground running with the right pitch. Our food house business plan is the ideal solution with an attractive design highlighting key information and conveying the right message.

This food business plan example features food images intended to tantalize the taste buds. It captures the theme perfectly and will convey the ultimate message to investors, clients and customers.

It is important to remember that the business plan template can be customized to meet your company’s specific needs and requirements. It will help showcase your business as a leader in the modern industry.

This food business plan template provides key slides to showcase everything from finances to marketing and key competitors. If you prefer, you can alter the content displayed to meet your specific needs, but this is a good starting point.

Ultimately, this food house business plan will be suitable for any business operating in the food industry and keen to get interested from key individuals. It will ensure that you can build up the rep of your company.

We provide a one-of-a-kind sales pitch deck designed to appeal to your prospective audience, as well as a custom presentation tailored to their information requirements.

When establishing a think tank, you will need to develop a business plan and document it properly. As a mass think tank, you need a special strategy to legalize the think tank as a non-profit organization and to raise funds for your project successfully.

Copy and print businesses offer a variety of services to both businesses and consumers. A copy and print shop can handle everything from single-page printing to large-volume jobs using several types of media.

Our printing shop business plan sample includes a detailed description of the products and services offered, as well as a market analysis and competitive analysis. It also includes a financial plan that outlines the startup costs, revenue projections, and break-even analysis. We like this sample plan because it demonstrates how to build a profitable printing shop business by offering high-quality, customized printing services with a focus on customer s ervice and efficient operations.

Let’s take a look at Printing and Photocopy Business Plan Sample that you can use to inspire your own and easily create one.

The acquisition business plan sample is intended for businesses seeking to acquire another company or merge with a competitor. This plan includes an analysis of the target company, a valuation, and a strategy for integrating the acquired business into the existing operations. We like this sample plan because it provides a clear roadmap for the acquisition process and demonstrates the potential benefits of the deal.

At Wisebusinessplans, we understand that obtaining an L1 visa for an executive or manager requires a thorough and compelling business plan.

Our L1 business plan sample includes all the necessary components to satisfy USCIS requirements and demonstrate your qualifications and your company’s viability in the US market.

The L1 business plan sample is a comprehensive plan for a new business seeking L1 visa approval for an executive or manager. This plan focuses on demonstrating the applicant’s qualifications and the company’s viability in the US market.

We like this sample plan because it is specific to the L1 visa process and includes all the necessary components to satisfy USCIS requirements.

If you’re an entrepreneur seeking E-2 visa approval, Wise Business Plans can help you create a persuasive business plan.

Our E-2 business plan sample outlines your investment, business operations, and financial projections, providing a clear and compelling case for your ability to successfully run a business and make a significant economic impact.

The E-2 business plan sample is designed for entrepreneurs seeking E-2 visa approval, which allows individuals to invest in and manage a business in the United States. This plan outlines the applicant’s investment, business operations, and financial projections. We like this sample plan because it provides a clear and compelling case for the applicant’s ability to successfully run a business and make a significant economic impact.

If you’re looking to obtain an EB-5 visa by investing in a new commercial enterprise in the United States, Wise Business Plans can help you create a compelling business plan.

Our EB-5 business plan sample includes a description of your business, a market analysis, and financial projections, providing a detailed and persuasive case for the potential success of your venture.

The EB-5 business plan sample is designed for individuals seeking to obtain an EB-5 visa by investing in a new commercial enterprise in the United States. This plan includes a description of the business, a market analysis, and financial projections. We like this sample plan because it provides a detailed and persuasive case for the potential success of the business, which is crucial for obtaining EB-5 visa approval.

If you’re seeking investment from angel investors, venture capitalists, or other private equity firms, Wise Business Plans can help you create a compelling pitch.

Our investor business plan sample includes a pitch deck, financial projections, and a detailed analysis of the market the potential return on investment and the scalability of your business.

The investor business plan sample is intended for businesses seeking to attract investment from angel investors, venture capitalists, or other private equity firms. This plan includes a pitch deck, financial projections, and a detailed analysis of the market opportunity. We like this sample plan because it emphasizes the potential return on investment and the scalability of the business.

At Wisebusinessplans, we’re committed to helping non-profit organizations achieve their social impact goals.

Our non-profit business plan sample includes a mission statement, programs and services, marketing and outreach strategies, and a financial analysis, providing a clear roadmap for establishing or expanding your organization.

The non-profit business plan sample is designed for organizations seeking to establish or expand a non-profit entity. This plan includes a mission statement, programs and services, marketing and outreach strategies, and a financial analysis. We like this sample plan because it demonstrates a strong commitment to social impact and outlines a clear strategy for achieving the organization’s goals.

Whether you’re seeking financing from a bank or other financial institution, Wise Business Plans can help you create a detailed and persuasive business plan.

Our bank business plan sample includes a thorough financial analysis, market research, and a strategy for achieving profitability, highlighting the key factors that banks consider when evaluating loan applications.

The bank business plan sample is tailored for businesses seeking financing from a bank or other financial institution. This plan includes a detailed financial analysis, market research, and a strategy for achieving profitability. We like this sample plan because it highlights the key factors that banks consider when evaluating loan applications, and provides a strong case for the borrower’s ability to repay the loan.

The cannabis industry is rapidly growing, and Wise Business Plans can help you enter it with confidence.

Our cannabis business plan sample includes a market analysis, operational strategy, and regulatory compliance a comprehensive overview of the unique challenges and opportunities in the industry and offering a clear roadmap for success.

The cannabis business plan sample is tailored for entrepreneurs seeking to enter the rapidly growing cannabis industry. This plan includes a market analysis, operational strategy, and regulatory compliance plan. We like this sample plan because it provides a comprehensive overview of the unique challenges and opportunities in the cannabis industry, and offers a clear roadmap for success.

The executive summary is a concise overview of your business plan, highlighting the key points of each section. It should capture the essence of your business, its mission, and the purpose of the business plan. This section should be written last, but it’s placed at the beginning of the business plan. Here is an example executive summary from our professional business plan written for Eplace Solution , an innovative e-commerce portal.

- Keep it brief and focused on key points.

- Clearly define the problem and your solution.

- Highlight market opportunities and growth potential.

- Showcase your team’s qualifications.

- Include financial projections.

- End with a clear call to action.

- Tailor it to your audience.

- Review and update regularly.

In this section, provide a detailed description of your company, including its history, legal structure, location, and vision. Explain your mission statement and core values that guide your business decisions. Use real-life examples of successful companies and how their strong company descriptions have contributed to their growth. In addition, you can reuse your company description on your About page, Instagram page, or other properties that ask for a boilerplate description of your business.

This section also allows you to describe how you register your business . Here you must choose whether your business is a corporation, sole proprietorship, LLC , or another type of business .

- Describe your company’s mission and vision.

- Explain what your business does and the problems it solves.

- Mention your target market and customer base.

- Highlight your unique selling points.

- Provide a brief history and background.

A market analysis analyzes how you are positioned in the market, who your target customers are, what your product or service will offer them, and industry trends. It might be useful to do a SWOT analysis to discover your strengths and weaknesses to identify market gaps that you may be able to exploit to build your business.

As part of your market research, you’ll also need to perform a competitive analysis. It will give you an idea of who your competition is and how to differentiate your brand. Here’s an example of a competitive analysis we did for a food business.

- Research and understand your industry thoroughly.

- Identify market trends and growth opportunities.

- Analyze your competitors and their strengths and weaknesses.

- Define your target audience and their needs.

- Include data and statistics to support your analysis.

Adding products and services to a business plan involves more than listing your company’s offerings. If you intend to gain funding or partner with another business, your products, and services section needs to demonstrate your company’s quality, value, and benefits.

Here’s an example of a product and service section in the business plan we wrote for an e-commerce business that offers wedding accessories.

- Clearly describe your offerings and their features.

- Explain how your products/services address customer needs.

- Highlight any unique qualities or advantages.

- Discuss your pricing strategy.

- Mention any future product/service development plans.

Here is example of services section of a bank.

It is always a good idea to have a marketing plan before launching your business. A potential investor will want to know how you will advertise your business. Therefore, you should create a marketing plan that explains your planned promotion and customer acquisition strategies.

Discuss how you will make a sale. How will you attract customers and maximize their lifetime value? Ensure your marketing and sales forecasts align with your financial forecasts Marketing plans are usually based on the four Ps : product, price, place, and promotion. Breaking it down by marketing channels makes it easier. Discuss how you intend to market your business via blogs, email, social media, and word-of-mouth. Here is an example of marketing strategies we develop for a restaurant business.

- Define your marketing goals and objectives.

- Outline your marketing strategies, including channels and tactics.

- Explain your sales strategy and target sales goals.

- Include a budget for marketing and sales activities.

- Discuss your sales team and their roles.

- Detail your customer acquisition and retention strategies.

- Mention any partnerships or collaborations for marketing and sales.

Example of marketing and sales plan section of a bank

The operation plan should include all the steps needed to run the business in the long run. The plan should include details about logistics, duties for each department of the company, and responsibilities for the team.

The main aspect of running a business is its costs. Whether it’s machinery or services, each requires capital.

how to write an operation plan in a business plan

- Describe your day-to-day business operations.

- Explain your supply chain and production processes.

- Outline your facility and equipment requirements.

- Discuss your quality control and efficiency measures.

- Mention any legal and regulatory compliance considerations.

- Detail your staffing and management structure.

- Include contingency plans for potential disruptions.

In this section, you can describe your current team and the people you need to hire. You will need to highlight your team’s relevant experience if you intend to seek funding. Basically, this is where you demonstrate that this team can be successful in starting and growing the business.

- Introduce your leadership team and their roles.

- Highlight their relevant experience and qualifications.

- Explain your organizational structure and hierarchy.

- Discuss key personnel responsibilities and functions.

- Mention any plans for team growth or development.

- Address any advisory boards or external support.

Management summary of coffee shoppe business.

A financial plan should include sales and revenue forecasts, profit and loss statements , cash flow statements , and balance sheets .

Now, if you plan to pitch investors or submit a loan application, you’ll also need a “use of funds” report. Here you outline how you plan to leverage any funding you might acquire for your business.

With our business templates , you can create your own income statement, cash flow statement, and balance sheet.

- Include detailed financial projections (income statement, cash flow, balance sheet).

- Explain your funding requirements and sources.

- Discuss your pricing and revenue model.

- Describe your expense management and cost controls.

- Mention any financial risks and mitigation strategies.

- Highlight key financial milestones and goals.

Financial highlights of foodShack business.

External drivers refer to the external factors or influences that significantly impact the activity and growth of an industry. These drivers include outsourcing of non-core activities, changes in economic activity, competition from other industries, and the complexity of business legislation.

Additionally, external drivers encompass the effects of changes in new business formation, especially among small businesses, which directly affect the demand for services within the industry.

- Identify and analyze current and emerging market trends in your industry.

- Assess potential positive or negative impacts these trends may have on your business.

- Evaluate broader economic conditions, including inflation rates, interest rates, and GDP growth.

- Elucidate how changes in economic conditions could influence consumer behavior, product demand, and overall cost structure.

- Outline key industry regulations and compliance requirements, discussing potential impacts on operations, costs, and market access.

- Highlight relevant technological advancements and explain their potential effects on your product or service offerings, operations, and competitiveness.

- Analyze current and potential future competitors, emphasizing the evolving competitive landscape’s impact on market share, pricing strategy, and overall business strategy.

- Consider social and cultural factors influencing consumer preferences and behaviors, exploring how societal changes can affect product demand.

- Evaluate environmental trends and regulations, discussing potential impacts on operations, supply chain, and customer perceptions.

- Assess political stability, government policies, and geopolitical factors, exploring potential risks and opportunities from political changes.

- Discuss global market conditions, analyzing how global economic trends, trade policies, and currency fluctuations may affect operations and expansion plans.

- Identify and discuss potential risks in the supply chain, such as disruptions, shortages, or geopolitical issues.

- Consider demographic shifts affecting your target market and discuss how changes may impact your customer base and marketing strategies.

- Highlight key legal and regulatory factors affecting the business, discussing potential legal challenges, compliance costs, and regulatory changes.

- Outline comprehensive risk management strategies, including contingency plans and risk mitigation strategies.

- Explain how you will monitor external drivers and emphasize the importance of staying agile and responsive to changes in the external environment.

The startup summary serves as a comprehensive overview of essential financial aspects, encompassing total startup expenses, the overall value of startup assets, and the total requirements, which is the cumulative sum of all expenses and startup investments.

It provides a clear financial snapshot, outlining the costs involved in launching the business, the value of assets acquired, and the overall financial needs for the startup.

This section is crucial for entrepreneurs and potential investors, offering a transparent understanding of the financial foundation required to initiate and sustain the business successfully.

This roadmap ensures a realistic evaluation of the business idea, identifying potential challenges and offering solutions.To write an effective plan, focus on what sets your venture apart from competitors, maintain conciseness, and embrace flexibility as a living document.

Answer fundamental questions about your business, create actionable checklists, execute the plan, and continually revise and update based on experiences and feedback.This iterative process fosters continuous improvement, helping entrepreneurs stay adaptable and enhance their business strategies over time.

- Clearly state the startup’s name and provide a concise description of its activities.

- Include a succinct mission statement capturing the startup’s purpose and goals, reflecting its core values.

- Specify the founding date and offer brief bios of key founders, highlighting relevant experience.

- Summarize the startup’s concept, explaining offered products or services and key distinguishing features.

- Clearly articulate the problem or need in the market that the startup addresses, defining the target audience.

- State what makes the startup unique, whether it’s a special feature, market gap, or competitive advantage.

- Provide a brief description of the market opportunity, covering target market size, trends, and growth prospects.

- Outline how the startup plans to generate revenue, detailing streams, pricing strategy, and potential partnerships.

- Offer a snapshot of the startup’s current status, highlighting key achievements such as product development or partnerships.

- If seeking funding, clearly state the amount sought and its allocation, covering areas like product development and marketing.

- Include a high-level financial summary with key projections for revenue, expenses, and profitability.

- Briefly outline future aspirations and plans, encompassing areas like expansion, product development, or strategic partnerships.

The projected industry growth is a pivotal aspect that forecasts the expansion of a specific sector over a defined timeframe.

For instance, it could provide an estimate of where that particular business will be standing in the next 10 years, and what will be the average annual growth rate of that industry.

This information provides prospective investors and stakeholders with a clear understanding of the industry’s potential and positions the startup within a dynamic and flourishing market.

- Emphasize the importance of industry trends and growth to your business.

- Provide a concise overview, including market size, major players, and recent trends.

- Briefly explain how you gathered data on industry growth projections (e.g., market research reports, expert interviews).

- Identify and discuss prevailing trends, such as technological advancements, changes in consumer behavior, and regulatory shifts.

- Summarize the industry’s historical growth, highlighting growth rates, market expansion, and notable milestones.

- Highlight key factors expected to drive industry growth, such as emerging markets, technological innovations, and demographic shifts.

- Discuss specific opportunities within the industry, including gaps in the market, underserved segments, or areas of competitive advantage.

- Acknowledge potential challenges or risks that could impact industry growth, demonstrating a realistic understanding.

- Present projections for future growth rates based on historical data, expert opinions, and your analysis. Include short-term and long-term projections.

- Discuss how key competitors are positioned to leverage industry growth, emphasizing your business’s differentiation strategies.

- Consider the regulatory landscape impacting growth, discussing anticipated changes and their potential effects on the industry.

- Explore international trends and their implications for industry growth, including factors like global economic conditions and geopolitical influences.

Here is example of market analysis section of a bank.

The break-even analysis serves as a vital financial tool, offering a detailed estimation of key metrics such as Sales Revenue, Cost of Sales, Gross Profit, Fixed Expenses, and Income Before Tax.

These critical components are visually presented through a bar graph, providing a clear and concise overview of the financial dynamics.

Additionally, the break-even analysis delves into a 12-month forecast, outlining the projected amount of revenue generated and the corresponding fixed costs.

This section is instrumental in helping stakeholders understand the financial threshold at which the business covers its costs and begins to generate profit.

- Define break-even analysis as a financial calculation where total revenue equals total costs.

- Identify constant costs regardless of production or sales levels.

- Enumerate and explain costs changing with production or sales.

- Present the break-even analysis formula, indicating the units needed to cover costs.

- Perform a practical break-even calculation using business-specific fixed costs, selling price, and variable cost per unit.

- Include a break-even chart or graph for a visual understanding of cost-revenue dynamics.

- Conduct a proactive sensitivity analysis to explore how changes in variables impact the break-even point.

- Specify the anticipated timeframe to reach the break-even point in terms of months or units sold.

- Clearly outline assumptions made in the analysis and provide justifications for transparency and credibility.

- Acknowledge potential risks or challenges that may affect the accuracy of the break-even analysis.

- Briefly mention contingency plans for difficulties in reaching the break-even point within the projected timeframe.

The management summary within the business plan provides a concise overview of the organizational structure and key personnel.

This includes a count of individuals, specifying the number of founders and operational team members integral to the organization.

The summary delves into the roles and responsibilities of each key figure, offering insights into the leadership dynamics driving the business.

Furthermore, the management summary sheds light on the financial aspect by presenting details about personal wages and payroll allocations for both founders and operational staff.

This comprehensive section ensures a clear understanding of the human resource framework and the financial commitments associated with the management team, crucial for stakeholders evaluating the business’s operational strength and leadership capability.

- Highlighting the critical role the management team plays in the business’s success, the introduction emphasizes their significance.

- Listing each key member with names, positions, and brief role summaries introduces the core of the management team.

- Providing brief biographies for each team member underscores their relevant experience, skills, achievements, and industry-specific expertise.

- Clearly outlining roles and responsibilities emphasizes how each team member’s skills contribute to the overall success of the business.

- Sharing the team’s vision and strategy involves discussing key strategic goals and outlining the plans to achieve them.

- Highlighting notable achievements or milestones showcases the team members’ successful ventures, industry recognition, or career accomplishments.

- Discussing team dynamics emphasizes collaboration and the complementary nature of their skills in driving the business forward.

- Introducing advisory board members, if applicable, underscores the additional guidance and expertise they bring to the business.

- Discussing how the team plans to contribute to future growth and development includes strategies for talent acquisition, leadership development, and succession planning.

- Touching on the team’s culture and values emphasizes their role in shaping the overall ethos of the business.

- If seeking investment, briefly mentioning how the management team plans to use funding for business growth and development provides insight into their financial strategy.

Here is example of marketing and sales plan section of a bank.

The financial indicators section within the business plan helps in evaluating the fiscal health and performance of the organization.

Year-after-year profitability estimates take center stage, encompassing key metrics such as gross margin, net profit margin, and EBITDA to revenue.

These indicators provide a comprehensive understanding of the business’s ability to generate profit relative to its revenue.

Furthermore, the financial indicators extend to leverage ratios, including the critical Debt to Equity ratio, Debt to Assets ratio, and Interest Coverage ratio.

These metrics illuminate the organization’s capital structure, debt management, and its capacity to meet interest obligations.

Liquidity ratios includes the Current Ratio and Current Debt to Total Asset Ratio.

These ratios provide insights into the company’s short-term financial health and its ability to meet immediate obligations.

The financial indicator toolbox is enriched with additional metrics, notably the Revenue to Equity ratio, which sheds light on the efficiency of generating revenue from equity investments.

- Detailed revenue forecasts for the next 3-5 years. Breakdown by product/service and geographical regions.

- Detailed breakdown of anticipated expenses. Include fixed and variable costs, operational expenses, and other relevant expenditures.

- Historical P&L statements if available. Projected future profits and losses based on revenue and expense projections.

- Outline of expected cash inflows and outflows. Emphasis on the ability to meet short-term obligations.

- Snapshot of the company’s financial position. Includes assets, liabilities, and equity.

- Calculation and presentation of key financial ratios (liquidity, solvency, profitability). Discussion on the significance of these ratios.

- Identification and explanation of relevant KPIs. Highlighting alignment with the overall business strategy.

- Discussion of potential financial risks. Mitigation strategies and addressing uncertainties.

- Clear statement of the amount and purpose of funds required.

- Outline of key assumptions underlying financial projections. Rationale for these assumptions.

- Summary of industry financial trends and business positioning. Outlook on future financial prospects considering market dynamics.

Looking For The Right Business Plan Format?

These sample business plans will provide you with a complete structure and format for your business plan, which will give you a head start on developing your document, so you won’t be stuck seeing an empty page and wondering what to write.

Simply going through the process of writing a business plan is one of its key benefits. If you sit down to write, you’ll naturally think about your startup costs, your target market , and any market analysis or research you’ll need to conduct. In addition to defining your position among your competitors, you will establish your goals and milestones.

You can see what should be included in a sample financial plan, but It is wrong to assume that a sample company’s financial projections will fit your own. If you need more resources to get you started, we recommend this guide on how to write a business plan .

In addition, you can download our 40+ free business plan templates covering a range of industries.

One-page business plans are short, compact, and to the point and are designed to make the plan easy to read at a glance. Make sure to include all of the sections, but truncate and summarize them

Start-up business plans are for businesses that are just getting started. They are usually developed to secure outside funding. In this regard, financials are of increased importance, as well as other sections that determine whether your business idea is viable, such as market research.

A strategic business plan lays out a company’s goals and how it will achieve them at a high level. It is a foundational document for the company as a whole. A strategic business plan allows all levels of the business to see the big picture, inspiring employees to work together to reach the company’s goals.

Developing a feasibility plan answers two primary questions about a business venture: who would purchase the service or product the company wants to sell, and if the venture is profitable.

Internal Business plans are geared to a specific audience within a company to keep your team on the same page and focused on the same goals.

In conclusion, whether you’re venturing into a traditional business or creating an innovative startup, the significance of a well-crafted business plan cannot be overstated. Different types of business plans cater to specific needs, from internal alignment to strategic expansion. Employing a template in MS Word ensures a polished presentation. The process of writing an executive summary, creating a plan, and defining the components of your business plan is essential.

Recognizing the need for a comprehensive and standard business plan can help guide your endeavors. Whether you choose to write a full business plan or opt for a one-page business overview, leveraging templates in MS Word can simplify the process. In essence, understanding the types of business plans and utilizing an executive summary template provides a structured approach to showcase your business overview.

Take inspiration from example business plans to tailor your strategy, ensuring a roadmap for success in the dynamic world of entrepreneurship. Always remember, a meticulously crafted business plan not only communicates your vision effectively but also serves as a valuable resource that can help secure investments and guide your business’s growth trajectory.

Begin with an executive summary, delve into market analysis, outline your strategies, create financial projections, and use available business plan examples as templates to guide your writing.

A comprehensive business plan template should encompass key sections such as an executive summary, business description, market analysis, marketing strategy, organizational structure, and financial projections. Seek templates online that cover these elements.

Tailor your business plan to the scale of your small business. Define your objectives clearly, outline cost-effective strategies, and emphasize agility in adapting to market changes.

Explore well-crafted business plan examples you can visit our website wisebusinessplan.

The fundamental components include an executive summary, business description, market analysis, marketing and sales strategy, organizational structure, product/service description, and financial projections.

Investors focus on growth potential, detailed financial projections, market analysis, competition analysis, and the qualifications and experience of your management team when reviewing a business plan.

To find a business plan example for a tech startup,you can visit our visit wisebusinessplan .

A business plan provides a comprehensive overview of your entire business, including strategies, operations, and financials. In contrast, a business proposal typically focuses on a specific project or offer, outlining the details and benefits to a potential client.

Craft an engaging executive summary by summarizing your business’s mission, highlighting the market opportunity, showcasing your product or service, and providing a concise overview of your financial projections.

Seek tailored business plan examples for nonprofit organizations you can visit wisebusinessplan .

These business plans are written by MBA writers. Real-world use cases were used in these plans.

Get our business plan writing and consultation service.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

Download 14 Professional Business Plan Samples

Your Full Name

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

400+ Business Plan Examples

Select your Business Category

IT, Staffing & Customer Service (16)

Construction, Architecture & Engineering (17)

Food, Beverage & Restaurant (57)

Real Estate & Rentals (16)

Mobile Apps & Software (6)

Education & Training (14)

Beauty Salon & Fitness (19)

Medical & Health Care (39)

Retail, Consumers & E-commerce (80)

Entertainment & Media (43)

Transportation, Logistics & Travel (26)

Agriculture, Farm & Food Production (18)

Nonprofit & Community (9)

Manufacturing & Wholesale (33)

Services (213)

Clothing & Fashion (12)

Children & Pets (16)

Fine Art & Crafts (5)

Cleaning, Maintenance & Repair (22)

Hotel & Lodging (9)

Finance & Investing (13)

Consulting, Advertising & Marketing (22)

Accounting, Insurance & Compliance (5)

Didn't find what you are looking for.

The answer is simple.

It’s an informal business plan that can convince you that your idea makes sense to the outside world because you are investing your time, money, and everything into that idea.

To write a business plan, maybe you think you don’t need a step-by-step guide or a sample business plan . After all, some entrepreneurs achieved success without writing a business plan. With great timing, past business experiences, entrepreneurial ambitions, and a little luck, some entrepreneurs build successful businesses without even writing an informal business plan.

But the odds are greater than those entrepreneurs fail.

And that’s why writing a business plan will help you succeed .

The easiest way to simplify the work of writing a business plan is to start with sample business plans.

What is business plan sample?

Why you should refer a business plan example, who should use business plan examples, how to use sample business plans.

What is Business Plan Sample?

That’s why we created business plan examples to help you get started.

Use our 400+ business plan examples written for all industries and write your business plan in half of the time with twice the impact.

- Guidance on what to include in each section. If you’ve never attended business school, you might never have created a SWOT analysis or a balance sheet before. Business templates that give guidance — in plain language — about what to include and how to fill in each section and create a complete and effective plan.

- A business plan is vital to get an investment. If you’re seeking investment for your business, you’ll need to convince banks and investors why they should invest in your business . Lenders and investors will only risk their time and money if they’re certain that your business will be successful and profitable and they will get a great return on their investment.

- A business plan can help you prioritize. A complete, well-balanced business plan is one of the most valuable tools in assisting you to reach your long-term goals. It gives your business direction, defines your goals, outlines out strategies to reach your goals, and helps you to manage possible bumps in the way.

Who should use Business Plan Examples?

Well Everyone, who wants to write a business plan should use these sample business plans. These plans apply to almost all industries.

We have created a library of professional sample business plans from a wide variety of industries to help you start writing your business plan with minimum effort.

Use our Upmetrics — business plan software that offers step by step guide to start writing your business plan , especially if you’re writing an informal business plan to get a bank loan or outside investment.

Our extensive sample business plans library includes business plan templates and business plan examples for almost all business industries.

Make your plan in half the time & twice the impact with Upmetrics.

How to use Business Plan Examples to write your own?

Having real-life and industry-specific business plan examples by your side can be incredibly resourceful to help you write a business plan from scratch.

A well-planned structure helps you outline your plan, while content inspiration helps you set the tone for your business document.

Let’s dive deep and understand how to use these examples effectively to write your business plan.

1. Use examples as a guide

2. understanding the structure.

Traditional business plans generally follow a similar structure.

It starts with an executive summary followed by a company description, market analysis, product and services, sales and marketing strategies, operational plan, management team, financial plan, and appendix.

Using an example business plan is the best way to understand the structure and outline your plan.

3. Gaining Inspiration

Reading industry-specific business plan examples can help you gain inspiration for your plan. You can gain insights on presenting your business idea, vision, mission, and values and persuade investors to invest in your idea.

4. Learning Industry-Specific Language

There’s no universal template for business planning that fits all. An industry-specific template can help you learn and understand the business language for your industry and the best way to communicate your message to your investors.

5. Identifying Key Elements

Reading business plan examples of similar businesses can help you identify the key elements and information to include in your plan. You can keep note of these and ensure everything necessary for investors to consider is present in your final draft.

6. Crafting Financial Projections

A financial plan is a critical component of your business plan, and a good business plan example can help you better understand how they project their financials which can be incredibly helpful while forecasting yours.

7. Refining Your Executive Summary

As mentioned earlier, your executive summary is a key factor influencing potential investors and lenders to invest or lend you money. Analyzing free business plan templates can help you optimize your executive summary to make it more brief, persuasive, and attention-grabbing.

8. Realizing What Works and What Doesn’t

Analyzing industry-specific and real-life examples can help you determine what works best and what doesn’t within your industry. Understanding these factors can help you avoid many significant pitfalls.

While business plan examples can be incredibly helpful in writing a plan from scratch, ensure your plan is customized for your business and sends out a unique message. Your business plan must reflect its unique idea, vision, and target market.

Using your Business Plan as a Management Tool

It’s essential to have a business plan, but it’s also crucial to keep it up to date as your business progresses. A business plan is not merely a document that you write once and forget after you get started. It’s a business road map and vision that you should develop as your business progresses and evolves. It’s also important to update your business plan regularly as your business situation and position change.

How Business Plan Software can help you?

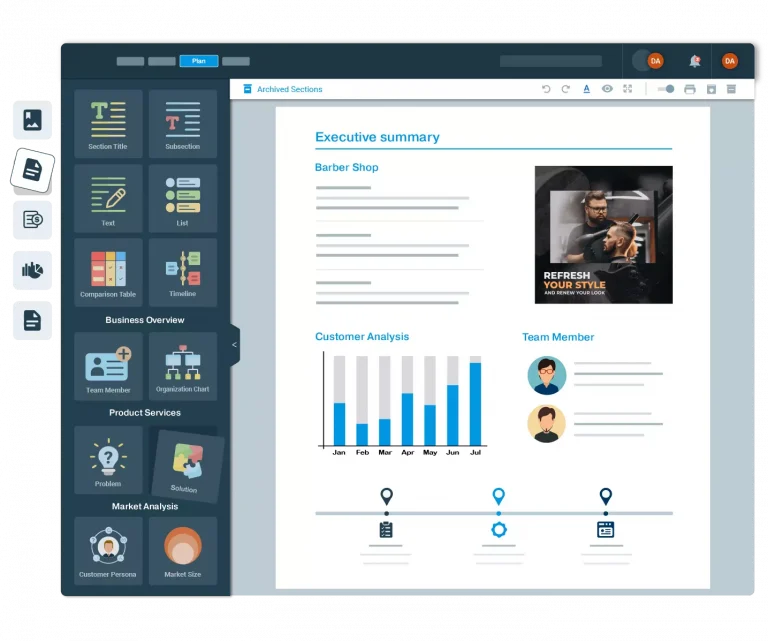

We have created Upmetrics — business plan software to simplify the process of business planning.

Our financial forecasting module will create all the essential reports automatically. You just need to enter numbers and the application will do all the math to generate your financial reports. Later you can embed those reports into your business plan.

After completing your business plan, you can download your business plan in PDF or DOC file using Upmetrics. Also, you can share it online with investors or with other important people just by a quick link.

Ready to take the next step?

Now that you have a business idea and you know how to write a business plan, it’s time to go for it . Our business plan software will take you through each step outlined above in more detail so there are no surprises on your journey.

Simplifying Business Planning through AI-Powered Insights.

Founder, CEO & Lead Scientist at Nanolyse Technologies

After trying Upmetrics, I wish to highly recommend this app to anyone who needs to write a business plan flexibly and to a high standard.

Frequently Asked Questions

What is sample business plan, how do i write a business plan.

In business plan writing you will need to write the following sections into your business plan. These sections include an Executive Summary, Company Overview, Problem Analysis, The Solution, Market Analysis, Customer Analysis, Competitive Analysis, SWOT Analysis, Marketing Plan, Operations Plan, and Financial Plan.

Check out our article to learn how you can write these sections in detail for your business plan.

How long should my business plan be?

The length of your business plan depends on the type of plan you choose. There are one-page business plans that offer easy and practical planning. Then you have traditional business plans that usually vary from 20 to 50 pages. It’s worth noting that the quality of your business plan matters more than its length.

Should I hire someone to write my business plan for me?

Absolutely No, You as a business owner know all about your business idea, your business goals, target market and audience, and what you want to achieve by writing your plan. Don’t hire someone who doesn’t know what your readers will want, the reason is that, if you intend to raise funds, you are the best person that understands what investors will look out for in your business plan.

Consultants or business plan writers definitely can write a business plan but not better than you.

Looking for a faster way to finish your business plan?

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

- PDF Templates

- Fillable PDF Forms

- Sign Up for Free

- PDF Templates /

- Business Plan

Simple Business Plan Templates

Strategic Plan Template

Focus on the future and keep your company moving forward with Jotform’s Strategic Plan Template. Simply fill in the attached form with your company overview, delve deeper with a SWOT analysis, and finish off by determining your strategic goals, actions, and financial plans. Our fully-customizable template converts submitted information into polished PDFs, which you can download, print, or share instantly.

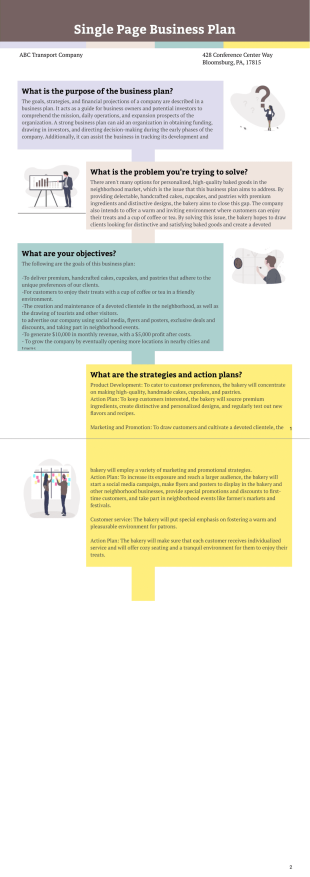

Single Page Business Plan

Get down to business with a customizable Single-Page Business Plan template from Jotform. Customize your plan in minutes. No coding. Drag and drop to build.

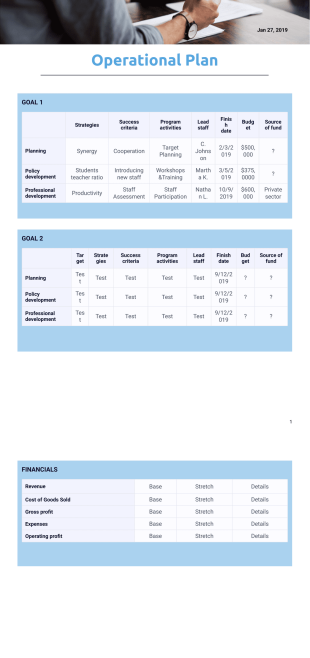

Operational Plan Template

This Operational Plan Sample is structured with important details for your organization. It comes ready to print, but you can simply edit the fields by putting your own organization information.

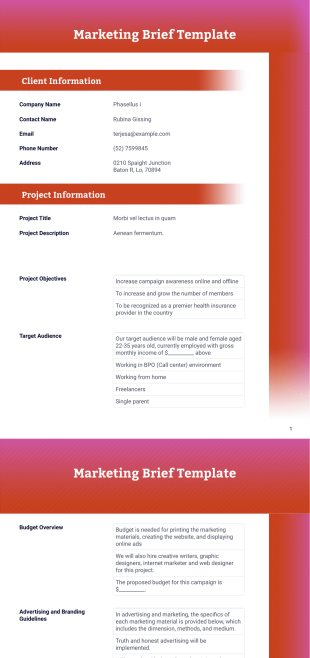

Marketing Brief Template

Managing a marketing campaign or promotion is a challenging task. You need to have a marketing plan in order to execute the campaign smoothly with the time and budget provided. Creating a Marketing Brief is very beneficial because it summarizes the marketing strategy for a specific campaign.If you are in the advertising agency or part of the marketing department, then this Marketing Creative Brief Template is for you. This well-designed template contains the client information, project information, and the marketing materials that will be used. The project details explain the project title, description, objectives, target audience, budget overview, advertising guidelines, and competitors.

Glamping Business Plan Template

Grab the attention of the investors by using this Glamping Business Plan Template. This business plan is simple yet effective because it contains all the necessary details when building a successful business.

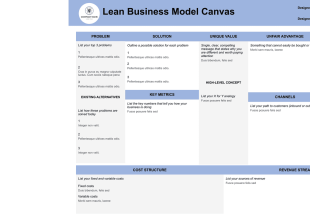

Lean Business Model Canvas Template

See your business from a new perspective with Jotform’s Lean Business Model Canvas Template. Simply fill in a short form with problems your business could solve, how they are currently being solved in the market, and how your company can uniquely work to solve these problems. Our template instantly converts the information into polished PDFs you can download or print for your next big meeting.Our Lean Business Model Canvas Template already looks professional, but you can personalize it further to match your business. Jotform PDF Editor lets you rearrange form fields or add your company logo at the touch of a button! By instantly converting your business model into an accessible PDF format, our Lean Business Model Canvas Template can help you see the bigger picture and determine how to take your business to the next level.

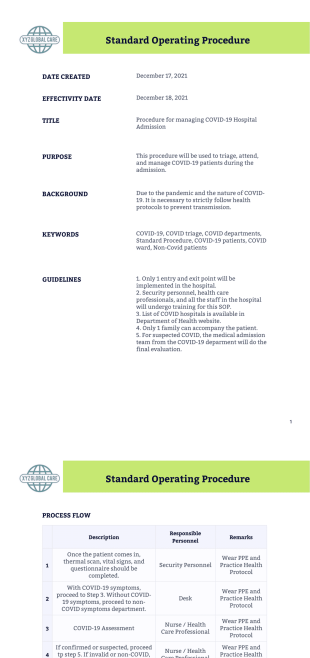

SOP Template

Create a process to organize your employees in managing specific cases or scenarios by using this SOP Template. This template is commonly used in any organization whether it is a small, medium, or large group.

Creative Brief Template

A Creative Brief is used in advertising, branding, and marketing industries. In order to have a strong and outstanding creative campaign, you need to have a game plan to follow. This serves as a guideline that will help in making decisions related to the campaign.This Creative Brief Template PDF discusses the project details like the project name, due date, and project description. The marketing materials that will be used are listed in the document which includes its specifications like the dimension size, the medium that will be used, and the quantity. This is the best Creative Brief Template you can use for your next creative marketing campaign.

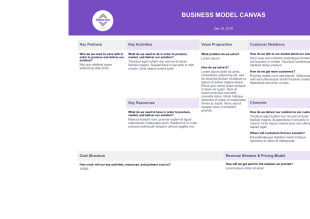

Business Model Canvas Template

Our Business Model Canvas Template includes nine segments which are key partners, key activities, value proposition, customer relations, customer segments, key resources, channels, cost structure, and pricing model.

Blog Post Outline Template

Use this Blog Post Outline Template for your blog content in order to get more visitors, followers, shares, and impressions. This template will definitely help your ranking in search engines.

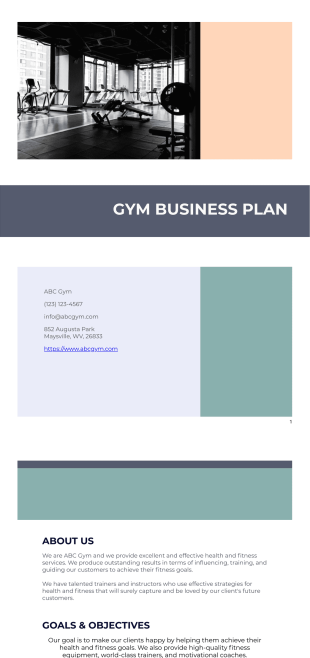

Gym Business Plan Template

Be successful in the gym business that you're building by securing funding or a loan with the help of this Gym Business Plan Template. This PDF can be printed and given to investors or loan applications.

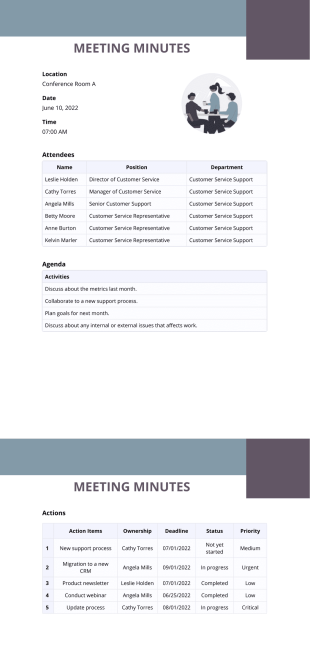

Meeting Minutes Template

Set goals, plan your actions, and update your team members by tracking the team meetings by using this Meeting Minutes Template. This PDF template will surely help the team in terms of planning and productivity.

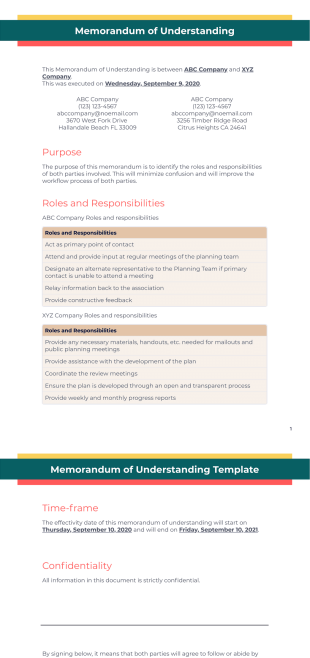

Memorandum of Understanding Template

Build a harmonious relationship between two or more parties by using this Memorandum of Understanding Template. This template is easy to use and can be customized via the PDF Editor.

Pressure Washing Estimate Template

Create estimates for pressure washing services with the use of web tools. Use this Pressure Washing Estimate PDF template and create instant estimates in PDF format without the trouble of hiring programmers.

Business Hours Template

Announce and let the customers know if your business is open and not by using this Business Hours Template. This PDF template can be customized and personalized by using the PDF Editor.

Scope of Work Template

Establish the responsibilities of the service provider by using this Scope of Work Template. This document will show the list of work and tasks that should be performed by the service provider.

Custom Sales Funnel Plan

Curriculum Vitae

Curriculum Vitae Template will provide you with all the necessary information that you need for your recruitment procedure and automate the job application process of your business.

Preliminary Notice Template

Notify the parties involved like the property owner, hiring party, notifying party, and contractor about the construction project by using this Preliminary Notice Template. This PDF template can be customized if needed via the PDF Editor.

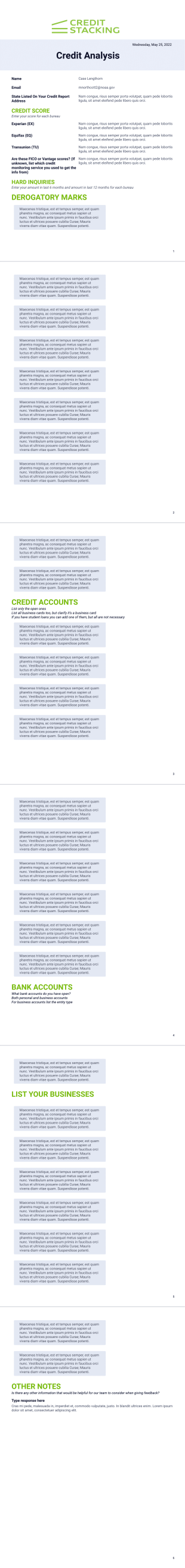

Credit Analysis

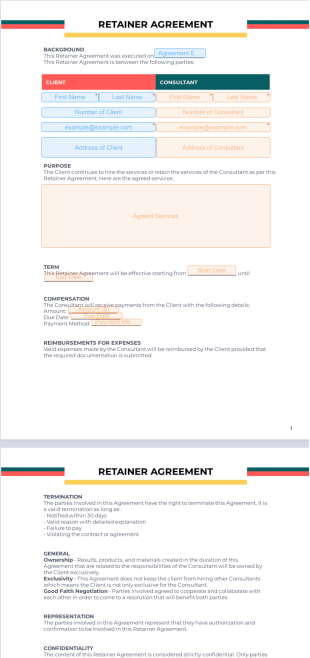

Retainer Agreement

Create retainer agreements online. Free, easy-to-customize template. Fill out on any device. Collect e-signatures. Save time with automation tools.

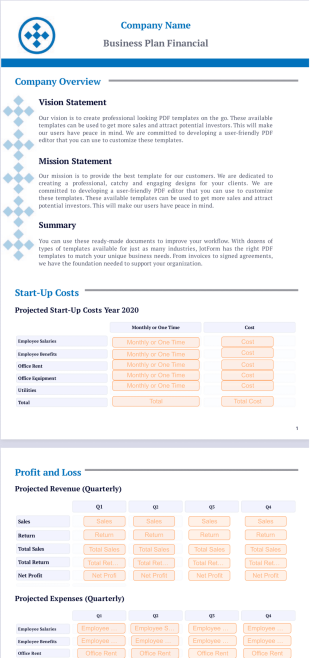

Business Plan Financial Template

Create a business plan financial template with Jotform Sign. Drag and drop to customize. Fill out and e-sign from any smartphone, tablet, or desktop.

Transaction Summary

Code of Conduct Template

Create a professional code of conduct to send to your employees. Can be signed from any smartphone, tablet, or computer. Easy to customize and share. No coding.

About Simple Business Plan Templates

Plans, strategies, roadmaps – Businesses rely on these things to gain perspective on what’s about to happen. Milestones laid down in strategic and careful planning for growth and expansion, visions of where the company’s headed 10 years from now, goals that should meet timelines, all these require a smart, prudent and calculated planning.

Whether you’re a startup, an SMB, or close to a Fortune 500, a solid business plan is crucial. And of course, writing business plans is a huge task. But, what if you needed something that requires input from others though? Say, an online form or a PDF template where responses from your colleagues and managers matter? Well, here’s a collection of PDF templates for business planning.

These are beautifully designed templates, specifically tailored for businesses and companies who don’t know where to start. The hard part was already done and that’s designing the template. These will serve as boilerplates for whatever milestone your business needs. You won’t need to worry on building something from scratch, you just need to focus on the content. Some of these templates will contain or collect executive summaries, opportunities, expectations, execution, financial plans, forecasts, the whole nine yards.

Business plan templates help give a clear vision of what lies ahead. They help you get things organized, planned out, and help you check off items from your to-do list more efficiently.

Frequently Asked Questions

1) what are the seven parts of a business plan.

- Executive summary. This is an overview of your business plan. The executive summary should include your company’s offerings, mission, goals, and projections. Think of it as the elevator pitch for your business plan. If you can’t get investors interested here, it’s unlikely they’ll want to keep reading.

- Company description and history. Describe your business’s legal structure and history in addition to what you do. If you just started this business, you may replace company history with your leadership team’s experience. The purpose of this section is to explain the company structure and build confidence in the people running the company.

- Products and services. Talk about what your company offers, whether that’s products, services, or a combination of the two. Describe your products and services in detail. Explain what makes your offering unique, what your profit margins are, what kind of demand you’re seeing for it, etc.

- Market and competitor research. Investors want to know if there’s demand for your offering. Describe the target market and how your product or service benefits potential customers. Include projections of where the industry is headed over the next few years. Additionally, detail your competitors and how saturated the market is.

- Sales and marketing strategy. This part of the business plan explains how you’ll promote your product. Outline elements such as your ideal customer profile (ICP) as well as your marketing channels, budget, and methods.

- Operations and logistics. Explain how you’ll source materials if you sell products as well as the technology you need to deliver such products and services. Also, provide details about your team, like how many people you’ll need and how you’ll manage employees.

- Financial plan and projections. It’s crucial to prove that your business will be financially viable. For this, you’ll need revenue and expense projections. Many investors want to see sample account statements, balance sheets, and cash flow projections.

2) How do you write a business plan?

Your business plan should be a realistic roadmap that helps you build a successful company. When writing it, take a balanced approach so that you’re not blind to the potential pitfalls and risks. You’ll draft each of the seven sections previously discussed.

Tackling these sections can be overwhelming, so some people like to start with a one-page business plan that includes short paragraphs for each element. Another way to give yourself a head start is by working from a business plan template. Once you have a good start, you can expand each section to make a compelling case for your business.