Starting a Business | Listicle

4 Types Of Business Plans (Plus Software & Writing Services)

Published April 20, 2020

Published Apr 20, 2020

WRITTEN BY: Blake Stockton

This article is part of a larger series on Starting a Business .

A business plan is a written document that explains how a business will succeed. All businesses should have some type of plan. If you’re making a more in-depth business plan, consider using a software to keep your thoughts and financial projections well organized.

In this article, we talk about four types of business plans:

- One-page Business Plan

- Traditional Business Plan

- Business Model Canvas

- Business Pitch

Over time, you may make several of these business plans. For example, if your business starts as a weekend side-hustle, you may start with a one-page plan and a pitch—which verbally communicates your business.

Once your business grows, you may need financing from a bank. To be eligible for financing, you will need a traditional plan. If your business continues to grow and you have an executive team, you may choose to do a Business Model Canvas, which works well for input from a large group.

1. One-page Business Plan

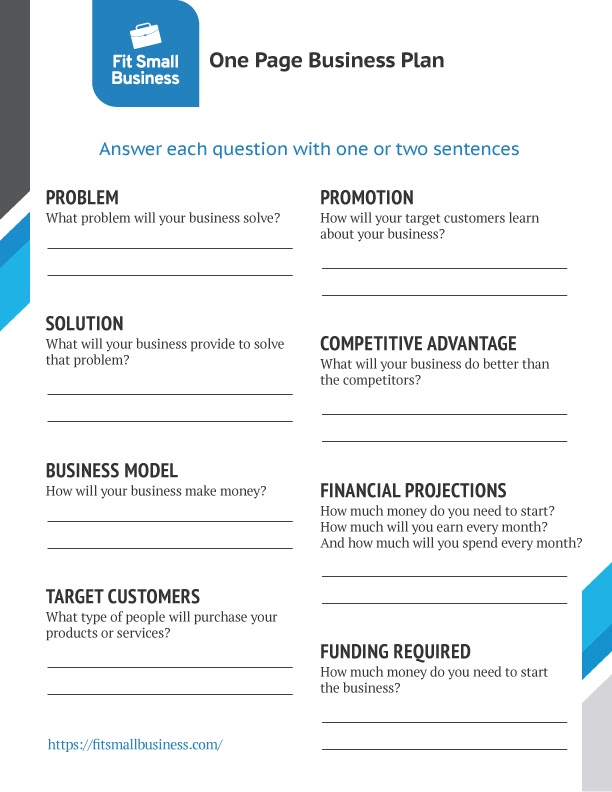

The one-page business plan is for a very small business such as a side-business. It’s a great way to get your ideas on paper and to work out the fundamentals of the business. With this plan, you’ll write a couple of sentences for important business concepts. It should include items such as the business model (how will it make money?) and competitive advantage (what will it do better than competitors?).

You should plan on spending around an hour to write out a one-page business plan. The simplified financial projections will be the most challenging and time-consuming. You most likely will need to do research online to get accurate income and expense estimates.

Click here to download our one-page business plan template to start your business planning today

Sections For The One Page Business Plan

Write one to two sentences to answer the following questions:

- Problem: What problem will your business solve?

- Solution: What will your business provide to solve that problem?

- Business model: How will your business make money?

- Target customers: What type of people will buy your product or service?

- Promotion: How will your target customers learn about your business?

- Competitive advantage: What will your business do better than the competitors?

- Financial projections: How much money do you need to start? How much will you earn every month? And how much will you spend every month?

- Funding required: How much money do you need to start the business?

What To Do After Creating Your One-page Plan

Once you create your plan, don’t just shove it in a desk drawer. Share it with supportive friends, family, and mentors for feedback. Consider updating the mini-plan based on their thoughts.

You may also want to do a few of the one-page biz plans to work out several business ideas you have. If you can’t decide which business to start, here’s a strategy to decide on one business. While writing the plans, pay attention to which business plan gets you most excited. Let your excitement point you in the direction of which biz to choose.

2. Traditional Business Plan

The traditional business plan is more in-depth and thorough than the one-page business plan. A traditional plan may contain over 40 pages of info about your business. Typically, you’ll use this plan to get funding from a bank such as a larger loan. You may also use a traditional business plan to attract investors to your business.

You should plan on spending at least 30 hours creating a well-researched business plan. In addition to writing the plan, you will also spend time doing market research and creating financial projections.

As a small business consultant, I’ve reviewed dozens of traditional business plans. Most business owners can easily do the research and write the plan. Where most have difficulty are the financial projections, which require creating several financial documents. If you don’t have a financial analysis background or interest, it’s a wise strategy to purchase a business plan software that walks you step-by-step through the financial projection process.

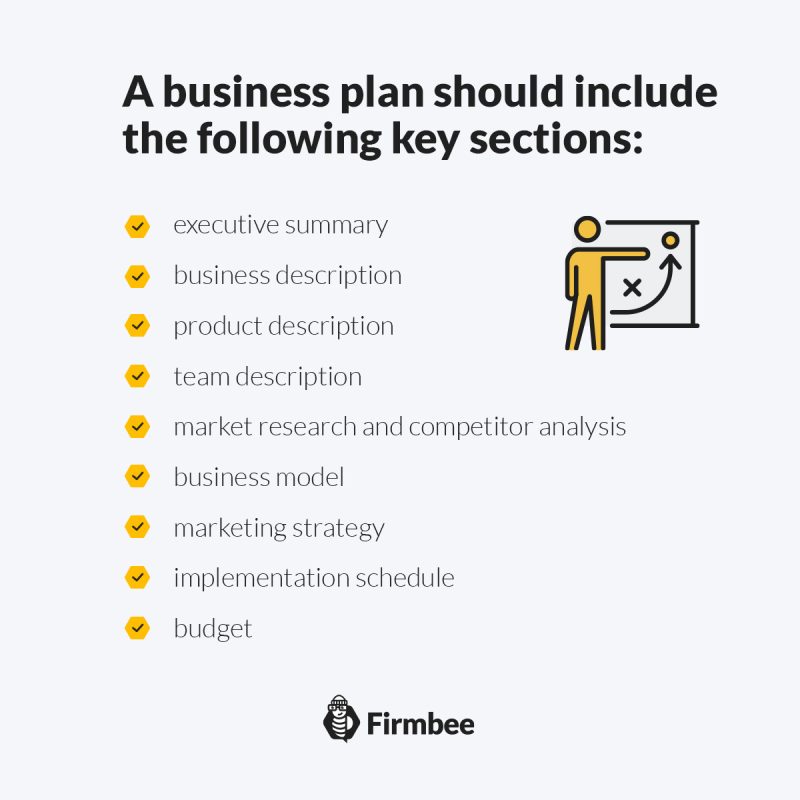

Traditional Business Plan Sections

- Opening Organizational & Legal Pages: The opening pages of your business plan need to be a cover page, nondisclosure agreement, and a table of contents.

- Executive Summary: You will complete this section last. It is a summary of the entire plan in less than two pages.

- Company Summary: Discuss the basics of the company such as its history, location, facilities, company ownership, and competitive advantage.

- Products & Services: Talk about how your business makes money (business model), the products or services it provides, and future products or services.

- Market & Industry Analysis: This section analyzes your potential customers and industry. Include any data here about your current (or ideal) customers, business industry, and competitors.

- Marketing Strategy & Implementation Summary: How will you reach your customers? Discuss your marketing, sales, and pricing strategy.

- Management & Organization Summary: Who will own and operate the business? If your business isn’t open yet, give a compelling reason why your background will make it a success. Include information on any managers in the business as well.

- Financial Data & Analysis: Here you want to show in charts and graphs how your business will be a success. You will include financial projections such as a profit & loss statement, projected cash flow, and business ratios.

- Appendix: Any documents or information that doesn’t fit in the above categories goes in the appendix. You may want to include documents such as a floor plan, trademark, or marketing materials.

Financial Projections

For a new business owner to complete a business plan, the financial projections will be the most challenging part. It’s difficult because you are mostly guessing how much money the business will make and spend every month for the next three years. Additionally, financial terminology and how it all flows together can make your head hurt.

Bankers and investors require financial projections in a business plan because they want to learn how you believe they will make their money back. It’s also a great idea to track your projections and update it with actual data as the business progresses.

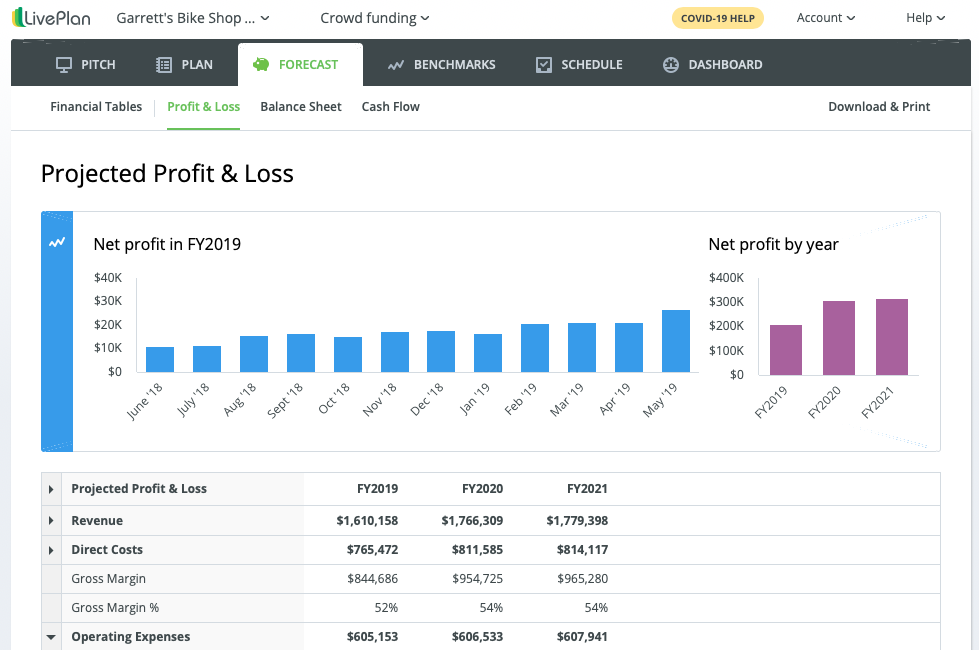

A no-cost way to create financial projections is to use SCORE’s free template . If you are overwhelmed by the free Excel document, I’d recommend using a business plan software . The LivePlan software walks you step-by-step through the financial projection process and turns your financial data into easy to read charts and graphs.

3. Modern Business Plan: Business Model Canvas

The Business Model Canvas (BMC) is an alternative to the traditional business plan. Released in 2008 , it updates sections such as Customer Relationships and Key Partnerships.

Many business owners prefer to use the BMC because it can be done as a visual exercise with the leadership team. Together, the team can go through each section and provide high-level input. Once you create the basics of the BMC, it’s easy to share with others. The contents can be summed up on one page, whereas the traditional plan above will likely be at least 40 pages.

Business Model Canvas Sections

- Customer Segments: Who are the most important type of customers or businesses that will be buying your products or services?

- Value Propositions: What value will you be delivering to customers? What customer problems are you trying to solve?

- Channels: What channels will you use to reach customers and maintain relationships?

- Customer Relationships: How will you maintain relationships with your customers?

- Key Resources : Who are the key people (inside the business), and what are the patents, places, and machines that the business couldn’t operate without?

- Key Activities: What crucial activities need to be done in the business so that you can serve your customers?

- Key Partnerships: What people or organizations (outside of the business) help your business operate such as suppliers or referral sources?

- Cost Structure: What are the largest expenses in your business? List at least seven.

- Revenue Streams: In what ways will your business earn money? If possible, list specific numbers such as the average earned per product or service performed.

Getting A Loan Or Investor with A BMC

Both banks and investors are becoming more open to accepting a Business Model Canvas instead of a traditional business plan. If you’re choosing to do a BMC to receive funding, always check with the bank or investor to determine if they will find it as an acceptable business plan.

Even though we didn’t discuss as a section for the BMC, when seeking funding, you must include thorough financial projections (similar to the traditional plan). Bankers and investors mostly care about how much money you believe the business will earn over the next three years, and how they will make their investment back.

Learn More About The BMC

You can learn about the specifics of the Business Model Canvas for free through blog posts and articles online. However, if you’re serious about applying it to your business, I recommend purchasing the official book by the creators of the BMC, called Business Model Generation. The book will walk you step-by-step through each section and provide several examples.

4. Business Pitch

A business pitch is a short explanation of your business in about 60 seconds. Many people also call this the elevator pitch. If you’re involved in the tech world, a business pitch is typically a 10 to 20-minute presentation given to angel investors and venture capitalists.

However, the typical business owner won’t be traveling to Silicon Valley, asking for a large sum of money.

When starting their business , the typical business owner will be explaining their business hundreds, if not thousands, of times. So in our perspective, the short verbal explanation is the business pitch. Use it to get customers, vendors, business peers, or potential partners excited about your business.

Business Pitch Structure

Depending on who you are telling your pitch to, the structure of your business pitch will change. For example, you probably won’t be including the business model info with a potential vendor; however, you would use it with a prospective business partner.

- Problem: In the first few seconds of the pitch, describe the problem your customer is having. If possible, try to connect it with the listener because it will make your message more personal.

- Solution: Immediately after the problem, discuss how you will solve it with your product or service.

- Business Model: If it isn’t apparent how your solution will make money, discuss it next. This clarification is especially important if you’re speaking to someone like an investor.

- Opportunity: Use statistics about your target customer and industry to explain how much potential your business has.

- Team: Mention your background and the team’s background. Consider mentioning facts like the total number of years’ experience in the industry, or prior successes.

- Ask: At the end of your pitch, your listener should be excited. Don’t let that excitement go to waste. Always ask for support in some way, which could be as small as visiting your website, or as large as asking for a million-dollar investment—just like Shark Tank!

How To Get Good At Delivering The Pitch

It’s a simple formula to get good at delivering the pitch: practice. Resolve to say your 60-second pitch 10 times per day. Say it in front of the mirror, in the car, and while walking the dog. The ultimate goal is to not stumble through your pitch, or stop to think what to say next.

Once you are somewhat confident in delivering the pitch, start saying it in front of people. Notice their body language. Do they make a face when you say a particular word or sentence? Maybe they are confused about what you’re saying. Do they look bored after 15 seconds? Perhaps your beginning hook isn’t strong enough.

Business Plan Software

A business plan software holds your hand step-by-step through the business plan creation process. Typically, software helps you create a traditional business plan that is ready to present to a banker or investor.

If you’re creating financial projections, I highly recommend purchasing business plan software. This purchase will keep you from working within a complicated Excel spreadsheet and makes your financial data look well organized in charts and graphs.

What To Look For In A Business Plan Software

Price: The cost of a business plan software is fairly similar. Expect to pay around $15 per month to access the software.

Ease of use: If possible, try a demo of the software to ensure it’s easy to use. Some biz plan software may not have been updated in several years and could be difficult to navigate.

Business plan design: When you print out your business plan, you want it to look professional. Also, certain software allows you to add graphics and visuals throughout your plan.

Diversity of products: In addition to the biz plan software, many companies provide resources such as marketing tools or connections with investors.

Educational materials: It’s important for a software to have quality educational materials so that you can learn as you create the plan. Some software includes video teachings.

Customer support: If you need help navigating the software or have questions about your biz plan, you’ll want to be able to reach a customer rep for guidance.

The Most Popular Biz Plan Software

The most popular business plan software available is from LivePlan They provide a 60-day free trial of their software so you can test it and make sure it’s the right fit for you.

One of LivePlan’s strongest features is its detailed and easy-to-use financial projections. The software asks you questions about your business, and it automatically calculates financial data like the gross margins and business ratios.

Software For A Tech Startup

If your business is a tech startup, your goals are different from the average business. You may need a large amount of capital to fuel your high-growth business.

Appealing to venture capital firms require different business plan elements such as working capital, gross margins, and available cash. Bizplanprovides those features for startups and helps them connect with potential investors.

Business Plan Writing Services

If you need a business plan, but don’t want to write it yourself and don’t want to use a software, you can pay a professional to create it for you. Several companies provide business plan writing services with experts who do market research and create custom-designed plans. Many of these companies also offer other writing services such as a pitch deck, feasibility study, or franchise-specific plan.

How To Choose A Biz Plan Writing Service

When choosing a business plan writing service, you first want to review the background of the writers. Some companies provide writers with MBAs (Master of Business Administration).

You also want to review samples of the business plans created. Remember, the company likely provided the best-designed business plans they have, so make sure to ask how much a particular well-designed business plan will cost, which may be out of your budget.

Cost Of A Business Plan Writing Service

A basic business plan writing service usually costs a minimum of $2,000. However, if your plan requires extensive research, custom graphics, and enhanced overall design, that cost can go up to over $10,000.

Contact Your Local SBDC For A Review

If you have your business plan and are looking for someone to review it for feedback, your local SBDC (Small Business Development Center) may be able to help. The SBDC provides no-cost consulting and is funded in part by the SBA (Small Business Administration). There are over 1,000 SBDC locations across the US.

One of the SBDC’s core services is to provide detailed reviews of business plans. Depending on the expertise of your local SBDC Consultants, you may get lucky and have a business plan expert at your local center. Inquire if he or she can review your biz plan and provide feedback.

Obtain Capital

After creating your business plan, the next step in your journey to start a business is to obtain adequate capital . When potential business owners hear the word “capital,” they often think about big loans from banks. However, capital could also be a much smaller amount, such as $2,000 from a credit card or $5,000 from a crowdfunding campaign.

Bottom Line

Remember to revisit your business plan often. Even after one month, you may learn new insights about your product and market that requires a business plan revision. If you’re creating financial projections, it’s a business best practice to update your projections monthly with actual sales and expense data to determine if your assumptions you made are accurate.

About the Author

Find Blake On LinkedIn Twitter

Blake Stockton

Blake Stockton is a staff writer at Fit Small Business focusing on how to start brick-and-mortar and online businesses. He is a frequent guest lecturer at several undergraduate business and MBA classes at University of North Florida . Prior to joining Fit Small Business, Blake consulted with over 700 small biz owners and assisted with starting and growing their businesses.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

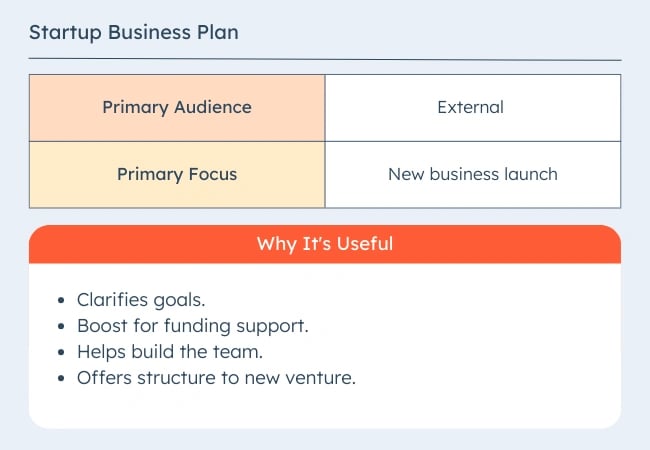

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

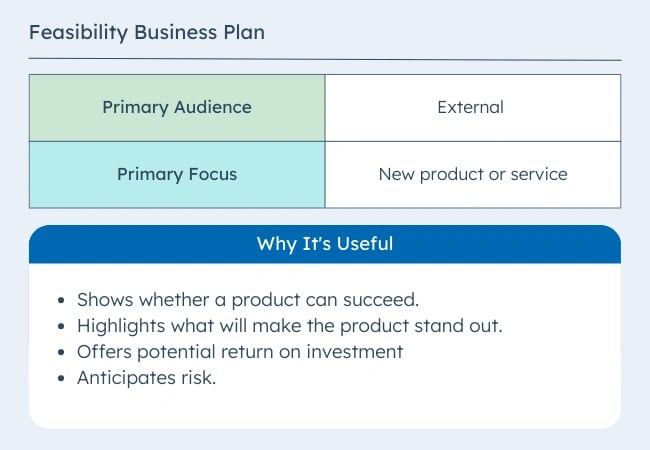

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

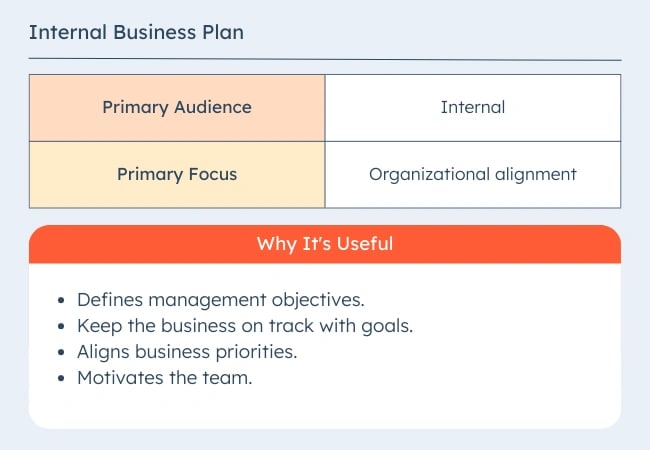

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

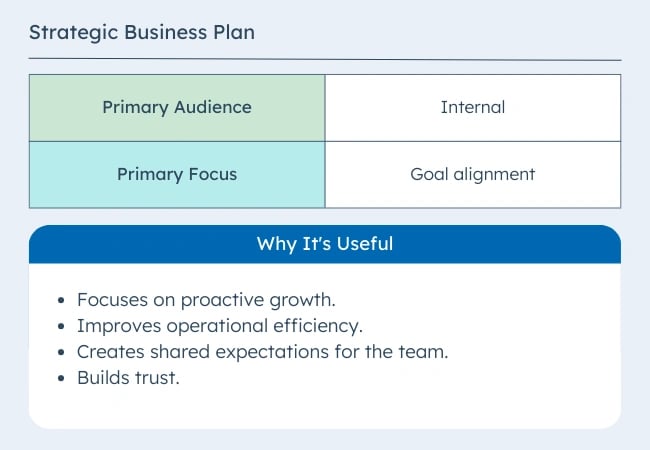

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

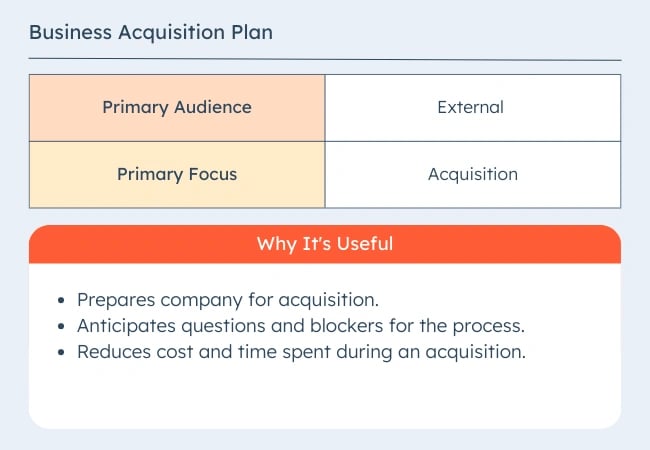

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![four types of business plan How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

19 Best Sample Business Plans & Examples to Help You Write Your Own

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![four types of business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![four types of business plan The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

What Type of Business Plan Do You Need?

8 min. read

Updated October 27, 2023

We get this question a lot, mainly because there are so many different things labelled as business plans: strategic plans, annual plans, operational plans, feasibility plans, and, of course, what most people think of, business plans for startups seeking investment. And also, what real business owners want—lean business plans for better management.

In this article, we’re going to help you figure out which plan is the one for you.

- Start with this: Form follows function

Put all business plans into this basic principle: form follows function . What do you want your business plan to do for you? That business objective should determine what kind of a plan you need.

All businesses start with a lean plan

These are things that every business owner needs to do in order to run the business effectively. They apply to all businesses, large or small, startup or not:

- Develop and execute strategy

- Set priorities

- Allocate efforts and resources according to priorities

- Establish tasks, responsibilities, and performance expectations

- Track results and compare them to expectations

- Manage cash flow

- Budget sales and spending

So, every business is better off with a lean plan.

It’s a short, effective collection of bullet points, lists, and forecasts, covering all of the functions above:

- It starts with bullet points for strategy. This isn’t text for outsiders. It’s not explanations; it’s reminders, for the entrepreneur and her team, of the major strategy points. Strategy is focus, so it’s a reminder of the target market, the product (or service), and the business identity. Sometimes it also includes a definition of success. It’s important, but just the bullet point reminders.

- Then come tactics. Strategy is useless without tactics. These are also bullet points. They are the important decisions made regarding key points of a marketing plan, product plan, financial plan, recruitment plan … not explanations or details for outsiders, but just the main points for you and your team. Think about pricing, channels, social media, launch dates, products, services, features, and so forth.

- Third part is concrete specifics. That includes a list of assumptions, important milestones, tasks, deadlines, responsibilities, and measurable performance expectations.

- The fourth and final part is budgets. That’s sales forecast, spending budget, and cash flow.

Make this the lean plan and add a regular process of review and revision to keep it fresh. You can download a free template for a lean business plan here . Can you imagine any business that isn’t better off for having at least this kind of planning in place, even if they don’t need an elaborate business plan? I can’t.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Lean plan for startups:

All startups can benefit from the lean plan above plus one extra ingredient: starting costs, and starting plans.

Starting costs

Starting costs are a matter of two lists: one for starting expenses, the other for starting assets.

The first list includes expenses like legal costs, logo, initial website, fixing up a location, and similar expenses that a startup business incurs once; and in some cases the expense of running expenses, such as rent and payroll, that have to start before launch for practical reasons.

The second includes assets required at start. These are items like starting inventory, equipment, and starting cash.

Startup plan

Keep it simple like the tactics in the normal lean plan, but add some bullets and concrete specifics for tasks and timing to get a startup going. These are items like choosing the location, setting up initial branding and website, accounts for social media, and launch events.

- A plan for the SBA, banks, investors, buyers, and partners

If you need to present a business plan to your bank or prospective investors, start with your latest revised lean business plan as the first draft. The lean plan is just for management. Dress that up to include the additional content that outsiders will want and need.

Add summaries and explanations

Add a very strong executive summary because some of your outsider target readers will read only that. Keep it short and make it fit the need. Often there’s a selling-the-idea or selling-the-potential purpose to a written plan, and in that case you make the summary include the highlights you want those readers to see to pique their interest.

Your lean plan doesn’t include details about your strategy, your company, your market, or your product. It has just summary tactics for marketing plan, product plan, financial plan, and management plan. Think of your readers—outsiders looking in—and help them understand the business. Achieve the specific goal of this dressed-up business plan.

Add formal financial projections

While the lean plan might be fine with just sales forecast, expense budget, and cash management, a business plan for a business plan event normally has to include formal financial projections that respect finance and accounting standards and include Profit and Loss, Cash Flow, and Balance Sheet. Banks will want to see projections of key ratios as well, and investors will like a Use of Funds table and sometimes a Break-even Analysis.

Stay mindful of the business purpose

We call it the business plan event—that’s the specific business need for a dressed-up plan. Form follows function here too.

A plan for investors will emphasize different elements than a plan for a bank loan. The investors want to see product-market fit; potential growth; something proprietary and protectable like technology, patents, trade secrets, or so-called secret sauce; and potential investor exit in a few years. The bank wants to see stability, credit history, collateral, and guarantees. A business broker or business buyer wants to see what can be most useful under new ownership.

Plan, pitch, and summary memo go together

Some business plan events require some special variations of your plan output. These days investors expect to see a short summary memo first. That’s a two to five page summary of your plan, a lot like your executive summary, but it stands alone. Then, if they like what they see from the summary, investors will want a pitch presentation. That’s a 20-40 minute slide presentation that backs up a verbal presentation, you with investors.

Neither summary memo nor pitch deck stand alone. They have to be summaries of your underlying plan. A pitch presentation is only really successful if it summarizes a real plan with a lot of concrete details on financials, milestones, traction, and next steps. Don’t get caught without a plan you can dig into when investors start asking more questions.

- Business plans have lots of different names

Shakespeare wrote, “a rose by any other name would smell as sweet.” I say a plan by any other name is still a plan. Here are some common varieties and business plan vocabulary.

Most lean plans are also internal plans

An operations plan—also called an annual plan—is a type of internal plan. An operations plan includes specific implementation milestones, project deadlines, and responsibilities of team members and managers. This is the plan used for staying on track to meet your goals as a business. Planning for your goals as a business allows your company to assign priorities, focus on results, and track your progress. Your operations plan covers the inner workings of your business. It outlines the specifics of who should be doing what, and when they should be doing it.

Of course, cash flow figures prominently here as well. For example, your milestones will need to have sufficient funding for their implementation, and you’ll need to track your progress so you know how much you’re spending.

A growth or expansion plan focuses on a specific area of a business, or a subset of the business. For example, a plan for the creation of a new product is a growth plan. These plans could be internal plans or not, depending on whether they are being linked to loan applications or new investment. An expansion plan requiring new outside investment would include full company descriptions and background on the management team, just the same as a standard plan for investors would. Loan applications would require this much detail as well.

However, an internal plan used to set up the steps for growth or expansion that is funded internally could skip these descriptions. It might not be necessary to include detailed financial projections for the company overall, but it should at least include detailed forecasts of sales and expenses for the new venture or product.

What’s a strategic plan?

A strategic plan is another kind of internal plan. A strategic plan incorporates the financial information and milestones of an operations plan, but focuses more on setting company-wide priorities. As you build the strategy for your company and decide how to implement it, you will want to examine your strengths and weaknesses as a business. What does your company do well? As your company grows, you want to play to your strengths. Strategy is often a matter of selecting the right opportunities. Resources should be funneled strategically to the areas where they will provide the biggest overall benefits.

Once you have an idea of your strategy, you must have a plan for implementing it. This is where the milestones portion of the plan becomes key. To effectively execute your strategies, it’s critical to assign responsibilities and have a schedule for following through. The implementation tactics you use will actively move you in the right direction toward achieving your goals.

Resources for moving forward

Reading about the different types of business plans is a good jumping-off point in the process of creating a business plan. If you’re looking for more information about business plans and how to write them, you’ll find our business planning tutorials and sample business plan library to be helpful resources.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

Related Articles

13 Min. Read

How to Write a Nonprofit Business Plan

5 Min. Read

How to Write a Growth-Oriented Business Plan

7 Min. Read

8 Steps to Write a Useful Internal Business Plan

11 Min. Read

Fundamentals of Lean Planning Explained

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

BUSINESS STRATEGIES

7 types of business plans every entrepreneur should know

- Amanda Bellucco Chatham

- Aug 3, 2023

What’s the difference between a small business that achieves breakthrough growth and one that fizzles quickly after launch? Oftentimes, it’s having a solid business plan.

Business plans provide you with a roadmap that will take you from wantrepreneur to entrepreneur. It will guide nearly every decision you make, from the people you hire and the products or services you offer, to the look and feel of the business website you create.

But did you know that there are many different types of business plans? Some types are best for new businesses looking to attract funding. Others help to define the way your company will operate day-to-day. You can even create a plan that prepares your business for the unexpected.

Read on to learn the seven most common types of business plans and determine which one fits your immediate needs.

What is a business plan?

A business plan is a written document that defines your company’s goals and explains how you will achieve them. Putting this information down on paper brings valuable benefits. It gives you insight into your competitors, helps you develop a unique value proposition and lets you set metrics that will guide you to profitability. It’s also a necessity to obtain funding through banks or investors.

Keep in mind that a business plan isn’t a one-and-done exercise. It’s a living document that you should update regularly as your company evolves. But which type of plan is right for your business?

7 common types of business plans

Startup business plan

Feasibility business plan

One-page business plan

What-if business plan

Growth business plan

Operations business plan

Strategic business plan

01. Startup business plan

The startup business plan is a comprehensive document that will set the foundation for your company’s success. It covers all aspects of a business, including a situation analysis, detailed financial information and a strategic marketing plan.

Startup plans serve two purposes: internally, they provide a step-by-step guide that you and your team can use to start a business and generate results on day one. Externally, they prove the validity of your business concept to banks and investors, whose capital you’ll likely need to make your entrepreneurial dreams a reality.

Elements of a startup business plan should include the following steps:

Executive summary : Write a brief synopsis of your company’s concept, potential audience, product or services, and the amount of funding required.

Company overview: Go into detail about your company’s location and its business goals. Be sure to include your company’s mission statement , which explains the “why” behind your business idea.

Products or services: Explain exactly what your business will offer to its customers. Include detailed descriptions and pricing.

Situation analysis: Use market research to explain the competitive landscape, key demographics and the current status of your industry.

Marketing plan: Discuss the strategies you’ll use to build awareness for your business and attract new customers or clients.

Management bios: Introduce the people who will lead your company. Include bios that detail their industry-specific background.

Financial projections: Be transparent about startup costs, cash flow projections and profit expectations.

Don’t be afraid to go into too much detail—a startup business plan can often run multiple pages long. Investors will expect and appreciate your thoroughness. However, if you have a hot new product idea and need to move fast, you can consider a lean business plan. It’s a popular type of business plan in the tech industry that focuses on creating a minimum viable product first, then scaling the business from there.

02. Feasibility business plan

Let’s say you started a boat rental company five years ago. You’ve steadily grown your business. Now, you want to explore expanding your inventory by renting out jet skis, kayaks and other water sports equipment. Will it be profitable? A feasibility business plan will let you know.

Often called a decision-making plan, a feasibility business plan will help you understand the viability of offering a new product or launching into a new market. These business plans are typically internal and focus on answering two questions: Does the market exist, and will you make a profit from it? You might use a feasibility plan externally, too, if you need funding to support your new product or service.

Because you don’t need to include high-level, strategic information about your company, your feasibility business plan will be much shorter and more focused than a startup business plan. Feasibility plans typically include:

A description of the new product or service you wish to launch

A market analysis using third-party data

The target market , or your ideal customer profile

Any additional technology or personnel needs required

Required capital or funding sources

Predicted return on investment

Standards to objectively measure feasibility

A conclusion that includes recommendations on whether or not to move forward

03. One-page business plan

Imagine you’re a software developer looking to launch a tech startup around an app that you created from scratch. You’ve already written a detailed business plan, but you’re not sure if your strategy is 100% right. How can you get feedback from potential partners, customers or friends without making them slog through all 32 pages of the complete plan?

That’s where a one-page business plan comes in handy. It compresses your full business plan into a brief summary. Think of it as a cross between a business plan and an elevator pitch—an ideal format if you’re still fine-tuning your business plan. It’s also a great way to test whether investors will embrace your company, its mission or its goals.

Ideally, a one-page business plan should give someone a snapshot of your company in just a few minutes. But while brevity is important, your plan should still hit all the high points from your startup business plan. To accomplish this, structure a one-page plan similar to an outline. Consider including:

A short situation analysis that shows the need for your product or service

Your unique value proposition

Your mission statement and vision statement

Your target market

Your management team

The funding you’ll need

Financial projections

Expected results

Because a one-page plan is primarily used to gather feedback, make sure the format you choose is easy to update. That way, you can keep it fresh for new audiences.

04. What-if business plan

Pretend that you’re an accountant who started their own financial consulting business. You’re rapidly signing clients and growing your business when, 18 months into your new venture, you’re given the opportunity to buy another established firm in a nearby town. Is it a risk worth taking?

The what-if business plan will help you find an answer. It’s perfect for entrepreneurs who are looking to take big risks, such as acquiring or merging with another company, testing a new pricing model or adding an influx of new staff.

A what-if plan is additionally a great way to test out a worst-case scenario. For example, if you’re in the restaurant business, you can create a plan that explores the potential business repercussions of a public health emergency (like the COVID-19 pandemic), and then develop strategies to mitigate its effects.

You can share your what-if plan internally to prepare your leadership team and staff. You can also share it externally with bankers and partners so that they know your business is built to withstand any hard times. Include in your plan:

A detailed description of the business risk or other scenario

The impact it will have on your business

Specific actions you’ll take in a worst-case scenario

Risk management strategies you’ll employ

05. Growth business plan

Let’s say you’re operating a hair salon (see how to create a hair salon business plan ). You see an opportunity to expand your business and make it a full-fledged beauty bar by adding skin care, massage and other sought-after services. By creating a growth business plan, you’ll have a blueprint that will take you from your current state to your future state.

Sometimes called an expansion plan, a growth business plan is something like a crystal ball. It will help you see one to two years into the future. Creating a growth plan lets you see how far—and how fast—you can scale your business. It lets you know what you’ll need to get there, whether it’s funding, materials, people or property.

The audience for your growth plan will depend on your expected sources of capital. If you’re funding your expansion from within, then the audience is internal. If you need to attract the attention of outside investors, then the audience is external.

Much like a startup plan, your growth business plan should be rather comprehensive, especially if the people reviewing it aren’t familiar with your company. Include items specific to your potential new venture, including:

A brief assessment of your business’s current state

Information about your management team

A thorough analysis of the growth opportunity you’re seeking

The target audience for your new venture

The current competitive landscape

Resources you’ll need to achieve growth

Detailed financial forecasts

A funding request

Specific action steps your company will take

A timeline for completing those action steps

Another helpful thing to include in a growth business plan is a SWOT analysis . SWOT stands for strengths, weaknesses, opportunities and threats. A SWOT analysis will help you evaluate your performance, and that of your competitors. Including this type of in-depth review will show your investors that you’re making an objective, data-driven decision to expand your business, helping to build confidence and trust.

06. Operations business plan

You’ve always had a knack for accessories and have chosen to start your own online jewelry store. Even better, you already have your eCommerce business plan written. Now, it’s time to create a plan for how your company will implement its business model on a day-to-day basis.

An operations business plan will help you do just that. This internal-focused document will explain how your leadership team and your employees will propel your company forward. It should include specific responsibilities for each department, such as human resources, finance and marketing.

When you sit down to write an operations plan, you should use your company’s overall goals as your guide. Then, consider how each area of your business will contribute to those goals. Be sure to include:

A high-level overview of your business and its goals

A clear layout of key employees, departments and reporting lines

Processes you’ll use (i.e., how you’ll source products and fulfill orders)

Facilities and equipment you’ll need to conduct business effectively

Departmental budgets required

Risk management strategies that will ensure business continuity

Compliance and legal considerations

Clear metrics for each department to achieve

Timelines to help you reach those metrics

A measurement process to keep your teams on track

07. Strategic business plan

Say you open a coffee shop, but you know that one store is just the start. Eventually, you want to open multiple locations throughout your region. A strategic business plan will serve as your guide, helping define your company’s direction and decision-making over the next three to five years.

You should use a strategic business plan to align all of your internal stakeholders and employees around your company’s mission, vision and future goals. Your strategic plan should be high-level enough to create a clear vision of future success, yet also detailed enough to ensure you reach your eventual destination.

Be sure to include:

An executive summary

A company overview

Your mission and vision statements

Market research

A SWOT analysis

Specific, measurable goals you wish to achieve

Strategies to meet those goals

Financial projections based on those goals

Timelines for goal attainment

Related Posts

What is a target market and how to define yours

21 powerful mission statement examples that stand out

Free business plan template for small businesses

Was this article helpful?

- Getting Started

- Growing a Business

- Success Stories

The Top 4 Types of Business Plans

When it comes to writing a business plan, one style does not fit all.

Different industries require different plans. A retailer isn’t much like a manufacturer, and a professional services firm isn’t much like a fast-food restaurant. Each requires certain critical components for success—components that may be irrelevant or even completely absent in the operations of another type of firm.

For example, inventory is a key concern for both retailers and manufacturers. Look at Walmart, one of the great all-time success stories in retail. Expert, innovative management of inventory is an integral part of its success. Any business plan that purported to describe the important elements of these businesses would have had to devote considerable space to telling how the managers planned to manage inventory.

Contrast that with a professional services firm, such as a management consultant. A consultant has no inventory whatsoever. Their offerings consist entirely of the management analysis and advice they can provide. They don’t have to pay now for goods to be sold later or lay out cash to store products for eventual sale. The management consultant’s business plan, therefore, wouldn’t have a section on inventory or its management, control, and reduction.

This is one obvious example of the differences among plans for different industries. Sometimes, even companies in more closely related industries have significantly different business plans. For instance, the business plan for a fine French restaurant might need a section detailing how the management intends to attract and retain a distinguished chef. At a restaurant catering to the downtown lunchtime crowd, you might devote much plan space to the critical concern of location and quick turnaround of diners with very little about the chef.

You want your plan to present yourself and your business in the best, most accurate light. That’s true no matter what you intend to use your plan for, whether it’s destined for presentation at a venture capital conference or will never leave your office or be seen outside internal strategy sessions.

When you select clothing for a momentous occasion, odds are you try to pick items that will play up your best features. Think about your plan the same way. You want to reveal any positives your business may have and ensure they receive due consideration.

Business plans can be divided roughly into four distinct types: Mini-plans, presentation plans or decks, working plans, and what-if plans. Each plan requires different amounts of labor, not always with proportionately different results. A more elaborate plan is not guaranteed to be superior to an abbreviated one. Success depends on various factors and whether the right plan is used in the right setting. For example, a new hire may not want to read the same elaborate version that might be important to a potential investor.

The Mini-Plan

The mini-plan is preferred by many recipients because they can read it or download it quickly to read later on their iPhone or tablet. You include most of the same ingredients that you would in a longer plan, but you cut to the highlights while telling the same story. For a small business venture, it’s typically all that you need. For a more complex business, you may need a longer version.

The Presentation Plan

PowerPoint presentations changed how many, if not most, plans are presented. And while the plan is shorter than its predecessors, it’s not necessarily easier to present. Many people lose sleep over an upcoming presentation, especially one that can play a vital role in the future of your business. However, presenting your plan as a deck can be very powerful. Readers of a plan can’t always capture your passion for the business, nor can they ask questions when you finish. In 20 minutes, you can cover all the key points and tell your story from concept and mission statement through financial forecasts.

Remember to keep your graphics uncluttered and to make comments to accentuate your ideas rather than simply reading what is in front of your audience. While a presentation plan is concise, don’t be fooled. It takes plenty of planning. The pertinent questions—Who? What? Where? Why? When? and How?—need to be answered.

The Working Plan

A working plan is a tool to be used to operate your business. It is long on detail but cshort on presentation. As with a mini-plan, you probably can afford a somewhat higher degree of candor and informality when preparing a working plan.

In a presentation plan, you might describe a rival as “competing primarily on a price basis.” But in a working plan, your comment about the same competitor might be, “When is Jones ever going to stop this insane price-cutting?”

A plan intended strictly for internal use may also omit some elements that you need not explain to yourself. Likewise, you probably don’t need to include an appendix with resumes of key executives. Product photos are also unnecessary. Internal policy considerations may guide the decision about including or excluding certain information in a working plan. Many entrepreneurs are sensitive about employees knowing the precise salary the owner takes home from the business.

To the extent such information can be left out of a working plan without compromising its utility, you can feel free to protect your privacy. This document is like an old pair of khakis you wear to the office on Saturdays or that one ancient delivery truck that never seems to break down. It’s there to be used, not admired.

The What-If Plan

When you face unusual circumstances, you need a variant on the working plan. For example, prepare a contingency plan when you are seeking bank financing. A contingency plan is a plan based on the worst-case scenario that you can imagine your business surviving—loss of market share, heavy price competition, defection of a key member of your management team. A contingency plan can soothe the fears of a banker or investor by demonstrating that you have indeed considered more than a rosy scenario.

Your business may be considering an acquisition, in which case a pro forma business plan (some call this a what-if plan) can help you understand what the acquisition is worth and how it might affect your core business. What if you raise prices, invest in staff training, and reduce duplicative efforts? Such what-if planning doesn’t have to be as formal as a presentation plan. Perhaps you want to mull over the chances of a major expansion. A what-if plan can help you spot the increased needs for space, equipment, personnel, and other variables so you can make good decisions.

What sets these kinds of plans apart from the working and presentation plans is that they don’t necessarily describe how you will run the business. They are essentially more like an addendum to your actual business plan. If you decide to acquire that competitor or grow dramatically, you will want to incorporate some of the thinking already invested in these special purpose plans into your primary business plan.

If you are looking for extra guidance with an industry-specific business plan, you can visit Bplans.com to access over 500 free real-world business plan examples from a wide variety of industries to guide you through writing your own plan. If you’re looking for an intuitive tool that walks you through the plan writing process, you can try LivePlan. It includes many of these SBA-approved business plan examples and is especially useful when applying for a bank loan or outside investment.

Read the full article here

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *