- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Writing a Business Growth Plan

Table of Contents

When you run a business, it’s easy to get caught in the moment and focus only on the day in front of you. However, to be truly successful, you must look ahead and plan for growth. Many business owners create a business growth plan to map out the next one or two years and pinpoint how and when revenues will increase.

We’ll explain more about business growth plans and share strategies for writing a business growth plan that can set you on a path to success.

What is a business growth plan?

A business growth plan outlines where a company sees itself in the next one to two years. Business owners and leaders apply a growth mindset to create plans for expansion and increased revenues.

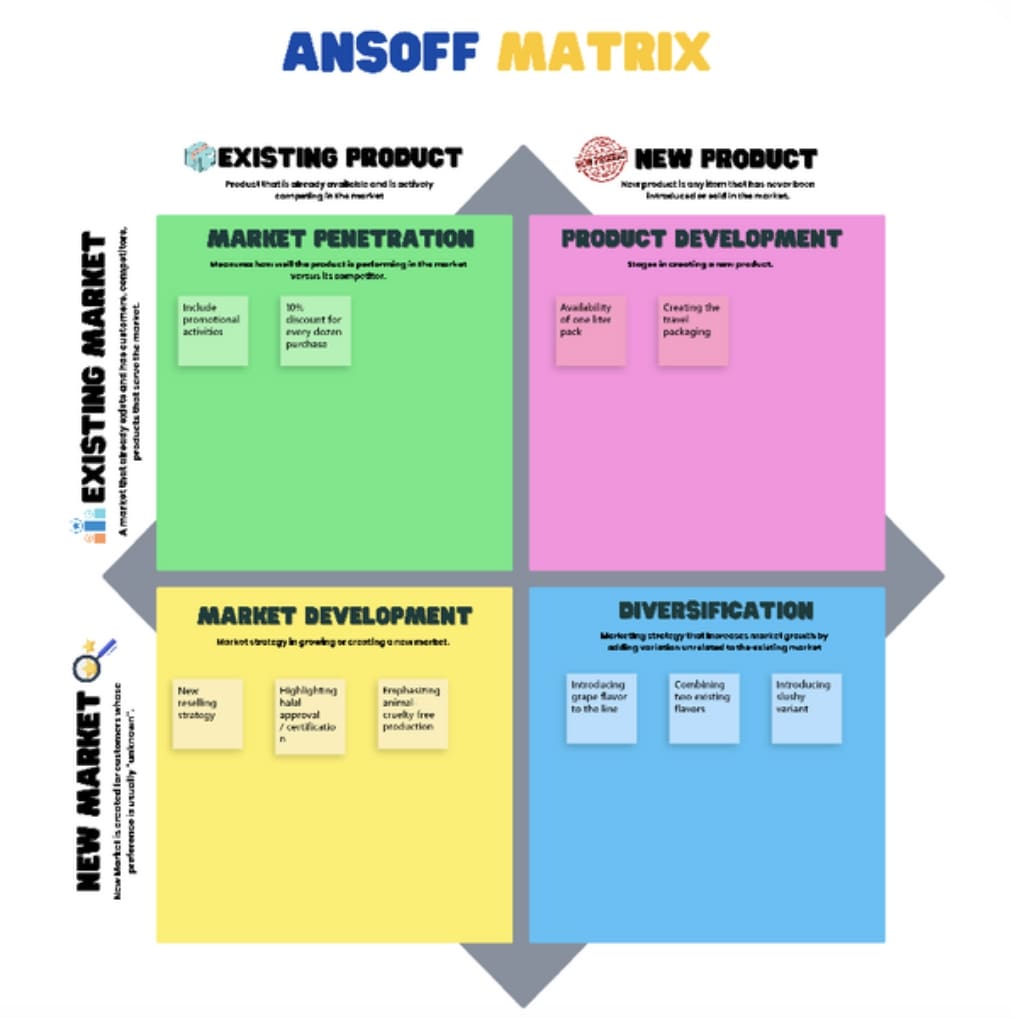

Business growth plans should be formatted quarterly. At the end of each quarter, the company can review the business goals it achieved and missed during that period. At this point, management can revise the business growth plan to reflect the current market standing.

What to include in a business growth plan

A business growth plan focuses specifically on expansion and how you’ll achieve it. Creating a useful plan takes time, but keeping your growth efforts on track can pay off substantially.

You should include the following elements in your growth plan:

- A description of expansion opportunities

- Financial goals broken down by quarter and year

- A marketing plan that details how you’ll achieve growth

- A financial plan to determine what capital is accessible during growth

- A breakdown of your company’s staffing needs and responsibilities

Your growth plan should also include an assessment of your operating systems and computer networks to determine if they can accommodate profitable growth .

How to write a business growth plan

To successfully write a business growth plan, you must do some forward-thinking and research. Here are some key steps to follow when writing your business growth plan.

1. Think ahead.

The future is always unpredictable. However, if you study your target market, your competition and your company’s past growth, you can plan for future expansion. The Small Business Administration (SBA) features a comprehensive guide to writing a business plan for growth.

2. Study other growth plans.

Before you start writing, review models from successful companies.

3. Discover opportunities for growth.

With some homework, you can determine if your expansion opportunities lie in creating new products , adding more services, targeting a new market, opening new business locations or going global, to name a few examples. Once you’ve identified your best options for growth, include them in your plan.

4. Evaluate your team.

Your plan should include an assessment of your employees and a look at staffing requirements to meet your growth objectives. By assessing your own skills and those of your employees, you can determine how much growth can be accomplished with your present team. You’ll also know when to ramp up the hiring process and what skill sets to look for in those new hires.

5. Find the capital.

Include detailed information on how you will fund expansion. Business.gov offers a guide on how to prepare funding requests and how to connect with SBA lenders.

6. Get the word out.

Growing your business requires a targeted marketing effort. Be sure to outline how you will effectively market your business to encourage growth and how your marketing efforts will evolve as you grow.

7. Ask for help.

Advice from other business owners who have enjoyed successful growth can be the ultimate tool in writing your growth plan.

8. Start writing.

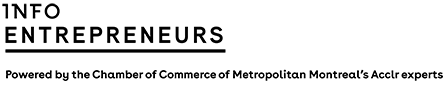

Business plan software has streamlined the process of writing growth plans by providing templates you can fill in with information specific to your company and industry. Most software programs are geared toward general business plans; however, you can easily modify them to create a plan that focuses on growth.

If you don’t have business plan software, don’t worry. You can create a business growth plan using Microsoft Word, Google Docs or a similar tool. For each growth opportunity, create the following sections:

- What is the opportunity? Is your growth opportunity a new geographic expansion, a new product or a new customer segment? How do you know there’s an opportunity? Include your market research to demonstrate the idea’s viability.

- What factors make this opportunity valuable at this time? For example, your growth opportunity could utilize new technology, take advantage of a strategic partnership or capitalize on a consumer trend.

- What are the risk factors for this opportunity? Identify factors that may make this growth opportunity challenging to execute. For example, challenges may include the state of the overall economy, intense competition or supply chain distribution issues. What is your plan for dealing with these challenges?

- What is your marketing and sales plan? Identify the marketing efforts and sales processes that can help you seize this growth opportunity. Detail the marketing channel you’ll use ( social media marketing , print marketing), your message and promising sales ideas. For example, you could hire sales reps for a new geographic area or set up distribution deals with relevant brick-and-mortar or online retailers .

- What are the costs involved in this growth area? For example, if you add a new product, you may need to buy new manufacturing equipment and raw materials. While marketing costs are a given, remember to include incremental sales costs like commissions. Outline any economies of scale or places where your existing operations make the new growth area less expensive than a stand-alone initiative.

- How will your income, expenses and cash flow look? Project your income and expenses, and prepare a cash flow statement for the new growth area for the next three to five years. Include a break-even analysis, a sales forecast and all projected expenses to see how much the new initiative will add to the bottom line. Include how the new growth area will positively (or negatively) impact existing sales. For example, if you sell bathing suits and you decide to grow by adding cover-ups and sunglasses, you will likely sell more bathing suits.

A cash flow statement will indicate if you must secure additional financing, and a break-even analysis will let you know when the growth opportunity will stop being a drain on the company’s financial resources and start turning a profit.

After completing this exercise for each growth opportunity:

- Create a summary that accounts for all growth areas for the period.

- Include summarized financial statements to see the entire picture and its impact on the company.

- Evaluate the financing you’ll need to implement the plan, and include various options and rates.

Why are business growth plans important?

These are some of the many reasons why business growth plans are essential:

- Market share and penetration: If your market share remains constant in a world where costs consistently increase, you’ll inevitably start recording losses instead of profits. Business growth plans help you avoid this scenario.

- Recouping early losses: Most companies lose far more than they earn in their early years. To recoup these losses, you’ll need to grow your company to a point where it can make enough revenue to pay off your debts.

- Future risk minimization: Growth plans also matter for established businesses. These companies can always stand to make their sales more efficient and become more liquid. Liquidity can come in handy if you need money to cover unexpected problems.

- Appealing to investors: For most businesses, a business growth plan’s primary purpose is to find investors . Investors want to outline your company’s plans to build sales in the coming months.

- Concrete revenue plans: Growth plans are customizable to each business and don’t have to follow a set template. However, all business growth plans must focus heavily on revenue. The plan should answer a simple question: How does your company plan to make money each quarter?

Motivate your employees by sharing your growth plan. When employees see an opportunity for increased responsibility and compensation, they’re more likely to stay with your business.

What factors impact business growth?

Consider the following crucial factors that can impact business growth:

- Leadership: To achieve your goals, you must know the ins and outs of your business processes and how external forces impact them. Without this knowledge, you can’t direct and train your team to drive your revenue, and you will experience stagnation instead of growth.

- Management: As a small business owner, you’re innately involved in management – obtaining funding, resources, and physical and digital infrastructure. Ineffective management will impact your ability to perform these duties and could hamstring your growth.

- Customer loyalty: Acquiring new customers can be five times as expensive as retaining current ones, and a 5 percent boost in customer retention can increase profits by 25 percent to 95 percent. These statistics demonstrate that customer loyalty is fundamental to business growth.

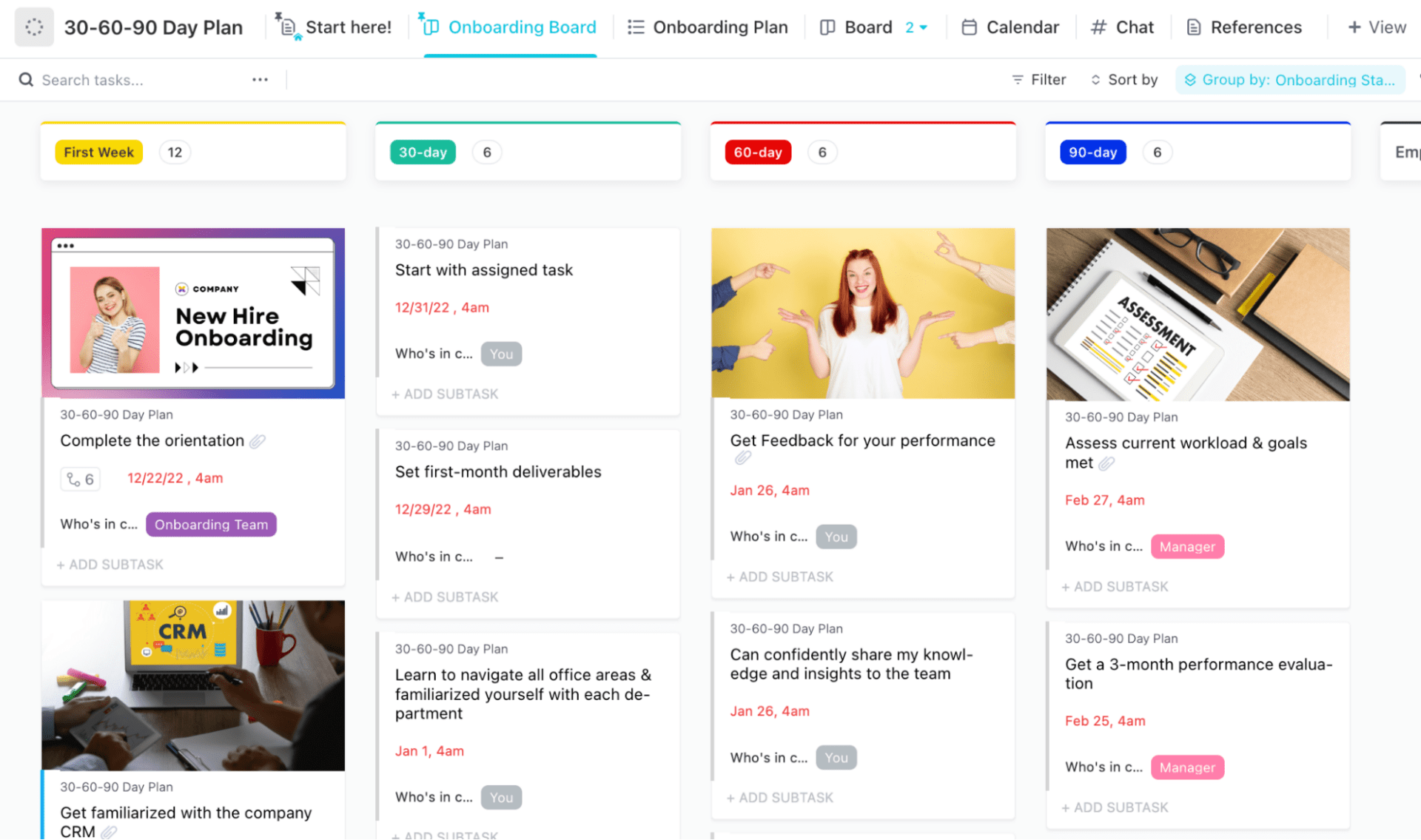

What are the four major growth strategies?

There are countless growth strategies for businesses, but only four primary types. With these growth strategies, you can determine how to build on your brand.

- Market strategy: A market strategy refers to how you plan to penetrate your target audience . This strategy isn’t intended for entering a new market or creating new products and services to boost your market share; it’s about leveraging your current offerings. For instance, can you adjust your pricing? Should you launch a new marketing campaign?

- Development strategy: This strategy means looking into ways to break your products and services into a new market. If you can’t find the growth you want in the current market, a goal could be to expand to a new market.

- Product strategy: Also known as “product development,” this strategy focuses on what new products and services you can target to your current market. How can you grow your business without entering new markets? What are your customers asking for?

- Diversification strategy: Diversification means expanding both your products and target markets. This strategy is usually best for smaller companies that have the means to be versatile with the products or services they offer and what new markets they attempt to penetrate.

Max Freedman contributed to this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

Company Growth Strategy: 7 Key Steps for Business Growth & Expansion

Published: April 17, 2023

A concrete growth strategy is more than a marketing strategy, it's a crucial cog in your business machine. Without one, you're at the mercy of a fickle consumer base and market fluctuations.

So, how do you plan to grow?

If you're unsure about the steps needed to craft an effective growth strategy, we've got you covered.

Business Growth

Business growth is a stage where an organization experiences unprecedented and sustained increases in market reach and profit avenues. This can happen when a company increases revenue, produces more products or services, or expands its customer base.

For the majority of businesses, growth is the main objective. With that in mind, business decisions are often made based on what would contribute to the company’s continued growth and overall success. There are several methods that can facilitate growth which we'll explain more about below.

.png)

Free Strategic Planning Template

Access a business strategic planning template to grow your business.

- Sales and Revenue Growth

- Growth of Customer Base

- Expansion into New Regions

You're all set!

Click this link to access this resource at any time.

Types of Business Growth

As a business owner, you have several avenues for growth. Business growth can be broken down into the following categories:

With organic growth, a company expands through its own operations utilzing its own internal resources. This is in contrast to having to seek out external resources to facilitate growth.

An example of organic growth is making production more efficient so you can produce more within a shorter time frame, which leads to increased sales. A perk of utilizing organic growth is that it relies on self-sufficiency and avoids taking on debt. Additionally, the increased revenue created from organic growth can help fund more strategic growth methods later on. We’ll explain that below.

2. Strategic

Strategic growth involves developing initiatives that will help your business grow long term. An example of strategic growth could be coming up with a new product or developing a market strategy to target a new audience.

Unlike organic growth, these initiatives often require a significant amount of resources and funding. Businesses often take an organic approach first in hopes that their efforts will generate enough capital to invest in future strategic growth initiatives.

3. Internal

Internal growth strategy seeks to optimize internal business processes to increase revenue. Similar to organic growth, this strategy relies on companies using their own internal resources. Internal growth strategy is all about using existing resources in the most purposeful way possible.

An example of internal growth could be cutting wasteful spending and running a leaner operation by automating some of its functions instead of hiring more employees. Internal growth can be more challenging because it forces companies to look at how their processes can be improved and made more efficient rather than focusing on external factors like entering new markets to facilitate growth.

4. Mergers, Partnerships, Acquisitions

Although riskier than the other growth types, mergers, partnerships, and acquisitions can come with high rewards. There’s strength in numbers and a well-executed merger, partnership, or acquisition can help your business break into a new market, expand your customer base, or increase your products and services on offer.

Business Growth Strategy

A growth strategy is a plan that companies make to expand their business in a specific aspect, such as yearly revenue, number of customers, or number of products. Specific growth strategies can include adding new locations, investing in customer acquisition, or expanding a product line.

A company's industry and target market influence which growth strategies it will choose. Strategize, consider the available options, and build some into your business plan. Depending on the kind of company you're building, your growth strategy might include aspects like:

- Adding new locations

- Investing in customer acquisition

- Franchising opportunities

- Product line expansions

- Selling products online across multiple platforms

Your particular industry and target market will influence your decisions, but it's almost universally true that new customer acquisition will play a sizable role. That said, there are different types of overarching growth strategies you can adopt before making a specific choice, such as adding new locations. Let’s take a look.

Free Growth Strategy Template

Fill out this form to access your template, types of business growth strategies.

There are several general growth strategies that your organization can pursue. Some strategies may work in tandem. For instance, a customer growth and market growth strategy will usually go hand-in-hand.

Revenue Growth Strategy

A revenue growth strategy is an organization’s plan to increase revenue over a time period, such as year-over-year. Businesses pursuing a revenue growth strategy may monitor cash flow , leverage sales forecasting reports , analyze current market trends, diminish customer acquisition costs , and pursue strategic partnerships with other businesses to improve the bottom line.

Specific revenue growth tactics may include:

- Investing in sales training programs to boost close rates

- Leveraging technology to improve sales forecasting reports

- Using lower-cost marketing strategies to lower customer acquisition costs

- Continuing to train customer service reps

- Partnering with another company to promote your products and services

Customer Growth Strategy

A customer growth strategy is an organization’s plan to boost new customer acquisitions over a time period, such as month-over-month. Businesses pursuing a customer growth strategy may be more open to making large strategic investments, as long as the investments lead to greater customer acquisitions.

For this strategy, you may track customer churn rates , calculate customer lifetime value , and leverage pricing strategies to attract more customers. You might also spend more on marketing, sales, and CX , with new customer sign-ups as the north star metric.

Specific customer growth tactics may include:

- Investing in your marketing and sales organization’s headcount

- Increasing advertising and marketing spend

- Opening new locations in a promising market you’ve not yet reached

- Adding new product lines and services

- Adopting a discount or freemium pricing strategy

- Tracking metrics such as churn rates, customer lifetime value, and MRR

Marketing Growth Strategy

A marketing growth strategy — which is related, but not the same as, a market development strategy — is an organization’s plan to increase their total addressable market (TAM) and increase existing market share.

Businesses pursuing a marketing growth strategy will research different verticals, customer types, audiences, regions, and more to measure the viability of a market expansion.

Specific marketing growth tactics may include:

- Rebranding the business to appeal to a new audience

- Launching new products to appeal to buyers in a new market

- Opening new locations in other regions

- Adopting a different marketing strategy, e.g local marketing or event marketing , to appeal to new markets

- Becoming a franchisor so that individual business owners can buy franchises from you

Product Growth Strategy

A product growth strategy is an organization’s plan to increase product usage and sign-ups, or expand product lines. This type of growth strategy requires a significant investment into the organization’s product and engineering team (at SaaS organizations). In the retail industry, a product growth strategy may look like partnering with new manufacturers to expand your product catalog.

Specific tactics may include:

- Adding new features and benefits to existing products

- Adopting a freemium pricing strategy

- Adding new products to the existing product line

- Partnering with new manufacturers and providers

- Expanding into new markets and verticals to increase product adoption

Not sure what all of this can look like for your business? Here are some actionable tactics for achieving growth.

How to Grow a Company Successfully

- Use a growth strategy template.

- Choose your targeted area of growth.

- Conduct market and industry research.

- Set growth goals.

- Plan your course of action.

- Determine your growth tools and requirements.

- Execute your plan.

1. Use a growth strategy template [Free Tool] .

Image Source

Don’t hit the ground running without planning out and documenting the steps for your growth strategy. We recommend downloading this free Growth Strategy Template and working off the included section prompts to outline your intended process for growth in your organization.

2. Choose your targeted area of growth.

It’s great that you want to grow your business, but what exactly do you want to grow?

Your business growth plan should hone in on specific areas of growth. Common focuses of strategic growth initiatives might include:

- Growth in employee headcount

- Expansion of current office, retail, and/or warehouse space

- Addition of new locations or branches of your business

- Expansion into new regions, locations, cities, or countries

- Addition of new products and/or services

- Expanding purchase locations (i.e. selling in new stores or launching an online store)

- Growth in revenue and/or profit

- Growth of customer base and/or customer acquisition rate

It’s possible that your growth plan will encompass more than one of the initiatives outlined above, which makes sense — the best growth doesn't happen in a vacuum. For example, growing your unit sales will result in growth in revenue — and possibly additional locations and headcount to support the increased sales.

3. Conduct market and industry research.

After you’ve chosen what you want to grow, you’ll need to justify why you want to grow in this area (and if growth is even possible).

Researching the state of your industry is the best way to determine if your desired growth is both necessary and feasible. Examples could include running surveys and focus groups with existing and potential customers or digging into existing industry research.

The knowledge and facts you uncover in this step will shape the expectations and growth goals for this project to better determine a timeline, budget, and ultimate goal. This brings us to step four…

4. Set growth goals.

Once you’ve determined what you’re growing and why you’re growing, the next step is to determine how much you’ll be growing.

These goals should be based on your endgame aspirations of where you ideally want your organization to be, but they should also be achievable and realistic – which is why setting a goal based on industry research is so valuable.

Lastly, take the steps to quantify your goals in terms of metrics and timeline. Aiming to "grow sales by 30% quarter-over-quarter for the next three years" is much clearer than "increasing sales."

5. Plan your course of action.

Next, outline how you’ll achieve your growth goals with a detailed growth strategy. Again – we suggest writing out a detailed growth strategy plan to gain the understanding and buy-in of your team.

Download this Template

This action plan should contain a list of action items, deadlines, teams or persons responsible, and resources for attaining your growth goal.

6. Determine your growth tools and requirements.

The last step before acting on your plan is determining any requirements your team will need through the process. These are specific resources that will help you meet your growth goals faster and with more accuracy. Examples might include:

- Funding: Organizations may need a capital investment or an internal budget allocation to see this project through.

- Tools & Software: Consider what technological resources may be needed to expedite and/or gain insights from the growth process.

- Services: Growth may be better achieved with the help of consultants, designers, or planners in a specific field.

7. Execute your plan.

With all of your planning, resourcing, and goal-setting complete, you’re now ready to execute your company growth plan and deliver results for the business.

Throughout this time, make sure you’re holding your stakeholders accountable, keeping the line of communication open, and comparing initial results to your forecasted growth goals to see if your projected results are still achievable or if anything needs to be adjusted.

Your growth plan and the tactics you leverage will ultimately be specific to your business, but there are some universal strategies you can implement when getting started.

To expand a business and its revenue, companies can implement different strategies for growth. Examples of growth strategy include:

Growth Strategy Examples

- Viral Loops

- Milestone Referrals

- Word-of-Mouth

- The 'When They Zig, We Zag' Approach

- In-Person Outreach

- Market Penetration

- Market Development

- Product Development

- Growth Alliances

- Acquisitions

- Organic Growth

- Social Media

- Excellent Customer Service

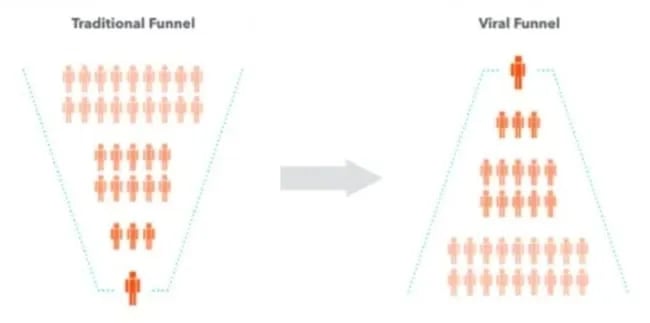

1. Viral Loops

Some growth strategies are tailored to be completely self-sustainable. They require an initial push, but ultimately, they rely primarily (if not solely) on users' enthusiasm to keep them going. One strategy that fits that bill is the viral loop.

The basic premise of a viral loop is straightforward:

- Someone tries your product.

- They're offered a valuable incentive to share it with others.

- They accept and share with their network.

- New users sign up, see the incentive for themselves, and share with their networks.

For instance, a cloud storage company trying to get off the ground might offer users an additional 500 MB for each referral.

Ideally, your incentive will be compelling enough for users to actively and enthusiastically encourage their friends and family to get on board. At its best, a viral loop is a self-perpetuating acquisition machine that operates 24/7/365.

That said, viral loops are not guaranteed to go viral, and they’ve become less effective as they’ve become more commonplace. But the potential is still there.

Part of the appeal is that the viral loop flips the traditional funnel upside-down:

Instead of needing as many leads as possible at the top, a viral loop funnel requires just one satisfied user to share with others. As long as every referral results in at least 1.1 new users, the system continues growing.

2. Milestone Referrals

The milestone referral model is similar to the viral loop in that it relies on incentives to kickstart and sustain it. But milestone referrals add a more intricate, progressive element to the process.

Companies that leverage viral loops generally offer a flat, consistent offer for individual referrals — businesses that use milestone referrals offer rewards for hitting specific benchmarks. In many cases, "milestones" are metrics like the number of referred friends.

For example, a business might include different or increasingly enticing incentives that come with one, five, and 10 referrals as opposed to a fixed incentive for each referral. A company will often leverage this strategy to encourage users to bring on a volume of friends and family that suits its specific business goals.

The strategy also adds an engaging element to the referral process. When done right, milestone referrals are simple to share with relatively straightforward objectives and enticing, tangible products as rewards.

3. Word-of-Mouth

Word-of-mouth is organic and effective. Recommendations from friends and family are some of the most powerful incentives for consumers to purchase or try a product or service.

The secret of word-of-mouth’s effectiveness lies in a deeply rooted psychological bias all people have — we subconsciously believe the majority knows better.

Social proof is central to most successful sales copywriting and broader content marketing efforts. That's why businesses draw so much attention to their online reputations.

They know in today's customer-driven world — one where communication methods change and information is available to all — a single negative blog post or tweet can compromise an entire marketing effort.

Pete Blackshaw , the father of digital word-of-mouth growth, says, "satisfied customers tell three friends; angry customers tell 3,000."

The key with word-of-mouth is to focus on a positive user experience. You need to grow a base of satisfied customers and sustain the wave of loyal feedback that comes with it.

With this method, you have to focus on delivering a spectacular user experience, and users will spread the word for you.

4. The "When They Zig, We Zag" Approach

Sometimes the best growth strategy a company can employ is standing out — offering a unique experience that sets it apart from other businesses in its space. When monotony defines an industry, the company that breaks it often finds an edge.

Say your company developed an app for transitioning playlists between music streaming apps. Assume you have a few competitors who all generate revenue through ads and paid subscriptions — both of which frustrate users.

In that case, you might be best off trying to shed some of the baggage that customers run into trouble with when using your competitors' programs. If your service is paid, you could consider offering a free trial of an ad-free experience — right off the bat.

The point here is that there's often a lot of value and opportunity in differentiating yourself. If you can "zig when they zag", you can capture consumers' attention and capitalize on their shifting interests.

5. In-Person Outreach

It might be a while before this particular approach can be employed again, but it's effective enough to warrant a mention. Sometimes, adding a human element to your growth strategy can help set things in motion for your business.

Prospects are often receptive to a personal approach — and there's nothing more personal than immediate, face-to-face interactions. Putting boots on the ground and personally interfacing with potential customers can be a great way to get your business the traction it needs to get going.

This could mean hosting or sponsoring events, attending conferences relevant to your space, hiring brand ambassadors, or any other way to directly and strategically reach out to your target demographic in person.

6. Market Penetration

Competition is a necessary part of business. Imagine that two companies in the same industry are targeting the same consumers. Typically, whatever customers Business A has, Business B does not. Market penetration is a strategy that builds off of this tug-of-war.

Market penetration increases the market share — the percentage of total sales in an industry generated by a company — of a product within a given industry. Coca-Cola, the most popular carbonated beverage in the United States, has a 42.8% market share. If competitors like Pepsi and Sprite were looking to increase market penetration, they would need to increase market share. This increase would imply that they are acquiring customers that were previously buying Coca-Cola or other carbonated beverage brands.

While lowering prices and advertising are two costly yet effective tactics to increase market share, they are part of a series of methods businesses can use for overall sales and customer retention.

7. Development

If a company feels as if they have plateaued and its current market no longer has room for growth, it might switch strategies from market penetration to market development. While market penetration focuses on a company and its current market, market development strategies lead businesses to tap into a new one.

Companies can decide to manufacture new products or find an innovative use for their project. Take Uber. Although few would say that the rideshare company has plateaued, six years after its launch in 2009, Uber launched UberEats, its online food ordering, and delivery platform. The company already had drivers set to take passengers to their destinations. Uber expanded their idea and has become one of the biggest names in the food delivery industry.

8. Product Development

For growth, many businesses need to introduce something new. Product development — the creation of a new product or the enhancement of an existing one — allows companies to attract new customers and retain existing ones.

Online fast-fashion retailers are an example of this. A company like ASOS built its brand off of clothing. To appeal to a bigger customer base, it has since added face and body products, a collection made up of ASOS products and other popular brands. If an interested customer prefers to shop for their clothes, makeup, and skincare products at once, the brand now serves as a big draw.

9. Growth Alliances

Growth alliances are strategic collaborations between companies. They further the growth goals of the involved parties. Take JCPenney and Sephora. For Sephora, it can’t hurt for the makeup retailer to have more stores across the country. JCPenney, however, needed to keep up with powerhouses like Macy’s and its fully-fledged makeup section.

In 2006, Sephora began opening stores inside JCPenney. As of 2022, Sephora Inside JCPenney is now in over 574 stores. Simultaneously, JCPenney now carries a selection of makeup to rival competitors.

10. Acquisitions

Companies can use an acquisition strategy to promote growth. By acquiring other businesses, companies expand their operations through creating new products or expanding into a new industry. One of the more obvious ideas for growth, this strategy offers significant benefits to companies. They allow for faster growth, access to more customers, lower business risk, and more.

Founded in 1837, Procter & Gamble is a consumer goods company known for its acquisitions. It initially started in soaps and candles but currently has 65 acquired companies that have allowed it to expand into different markets. The list includes Pampers, Tide, Bounty, Tampax, Old Spice, and more. Although its sales dipped between 2016-2019, Procter & Gamble’s net sales for 2021 were $76 billion, its best year within the last decade.

11. Organic Growth

As mentioned previously, organic growth is the most ideal business growth strategy. It could look like focusing on SEO, developing engaging content, or prioritizing advertisements. Instead of focusing on external growth, organic growth is a sustainable strategy that promotes long-term success.

12. Leverage Social Media

Having a strong social media presence can be invaluable to marketing and business growth. Be sure to establish brand pages on all social media platforms like Instagram, Facebook, Pinterest, TikTok, Twitter, etc. Social media can help you increase engagement with your target audience and make it easier for potential customers to find your brand. It’s also great for word-of-mouth promotion as existing customers will likely share your content with their network.

13. Provide Excellent Customer Service

It can be tempting to focus on acquiring new customers, but maintaining loyalty with your existing customers is just as important. Providing an excellent customer service experience ensures that you’ll continue to keep the customers you have, and there’s a good chance you’ll reap some referrals too.

The Key to Growing Your Business

Controlled, sustainable growth is the key to successful businesses. Industries are constantly changing, and it is the responsibility of companies to adapt to these changes.

Successful companies plan for growth. They work for it. They earn it. So what's your plan?

Editor's note: This post was originally published in March 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

9 Bad Sales Habits (& How to Break Them In 2024), According to Sales Leaders

![market growth in a business plan 22 Best Sales Strategies, Plans, & Initiatives for Success [Templates]](https://blog.hubspot.com/hubfs/Best-Sales-Strategies-1.png)

22 Best Sales Strategies, Plans, & Initiatives for Success [Templates]

9 Key Social Selling Tips, According to Experts

![market growth in a business plan 7 Social Selling Trends to Leverage This Year [New Data]](https://blog.hubspot.com/hubfs/social%20selling%20trends.png)

7 Social Selling Trends to Leverage This Year [New Data]

![market growth in a business plan How Do Buyers Prefer to Interact With Sales Reps? [New Data]](https://blog.hubspot.com/hubfs/person%20phone%20or%20online%20sales%20FI.png)

How Do Buyers Prefer to Interact With Sales Reps? [New Data]

![market growth in a business plan 7 Sales Tips You Need to Know For 2024 [Expert Insights]](https://blog.hubspot.com/hubfs/Sales%20Tips%202024%20FI.png)

7 Sales Tips You Need to Know For 2024 [Expert Insights]

What is Sales Planning? How to Create a Sales Plan

Sales Tech: What Is It + What Does Your Team Really Need?

![market growth in a business plan 10 Key Sales Challenges for 2024 [+How You Can Overcome Them]](https://blog.hubspot.com/hubfs/sales%20challenges%20FI.png)

10 Key Sales Challenges for 2024 [+How You Can Overcome Them]

![market growth in a business plan The Top Sales Trends of 2024 & How To Leverage Them [New Data + Expert Tips]](https://blog.hubspot.com/hubfs/sales-trends-2023.png)

The Top Sales Trends of 2024 & How To Leverage Them [New Data + Expert Tips]

Plan your business's growth strategy with this free template.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Market Analysis for a Business Plan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A lot of preparation goes into starting a business before you can open your doors to the public or launch your online store. One of your first steps should be to write a business plan . A business plan will serve as your roadmap when building your business.

Within your business plan, there’s an important section you should pay careful attention to: your market analysis. Your market analysis helps you understand your target market and how you can thrive within it.

Simply put, your market analysis shows that you’ve done your research. It also contributes to your marketing strategy by defining your target customer and researching their buying habits. Overall, a market analysis will yield invaluable data if you have limited knowledge about your market, the market has fierce competition, and if you require a business loan. In this guide, we'll explore how to conduct your own market analysis.

How to conduct a market analysis: A step-by-step guide

In your market analysis, you can expect to cover the following:

Industry outlook

Target market

Market value

Competition

Barriers to entry

Let’s dive into an in-depth look into each section:

Step 1: Define your objective

Before you begin your market analysis, it’s important to define your objective for writing a market analysis. Are you writing it for internal purposes or for external purposes?

If you were doing a market analysis for internal purposes, you might be brainstorming new products to launch or adjusting your marketing tactics. An example of an external purpose might be that you need a market analysis to get approved for a business loan .

The comprehensiveness of your market analysis will depend on your objective. If you’re preparing for a new product launch, you might focus more heavily on researching the competition. A market analysis for a loan approval would require heavy data and research into market size and growth, share potential, and pricing.

Step 2: Provide an industry outlook

An industry outlook is a general direction of where your industry is heading. Lenders want to know whether you’re targeting a growing industry or declining industry. For example, if you’re looking to sell VCRs in 2020, it’s unlikely that your business will succeed.

Starting your market analysis with an industry outlook offers a preliminary view of the market and what to expect in your market analysis. When writing this section, you'll want to include:

Market size

Are you chasing big markets or are you targeting very niche markets? If you’re targeting a niche market, are there enough customers to support your business and buy your product?

Product life cycle

If you develop a product, what will its life cycle look like? Lenders want an overview of how your product will come into fruition after it’s developed and launched. In this section, you can discuss your product’s:

Research and development

Projected growth

How do you see your company performing over time? Calculating your year-over-year growth will help you and lenders see how your business has grown thus far. Calculating your projected growth shows how your business will fare in future projected market conditions.

Step 3: Determine your target market

This section of your market analysis is dedicated to your potential customer. Who is your ideal target customer? How can you cater your product to serve them specifically?

Don’t make the mistake of wanting to sell your product to everybody. Your target customer should be specific. For example, if you’re selling mittens, you wouldn’t want to market to warmer climates like Hawaii. You should target customers who live in colder regions. The more nuanced your target market is, the more information you’ll have to inform your business and marketing strategy.

With that in mind, your target market section should include the following points:

Demographics

This is where you leave nothing to mystery about your ideal customer. You want to know every aspect of your customer so you can best serve them. Dedicate time to researching the following demographics:

Income level

Create a customer persona

Creating a customer persona can help you better understand your customer. It can be easier to market to a person than data on paper. You can give this persona a name, background, and job. Mold this persona into your target customer.

What are your customer’s pain points? How do these pain points influence how they buy products? What matters most to them? Why do they choose one brand over another?

Research and supporting material

Information without data are just claims. To add credibility to your market analysis, you need to include data. Some methods for collecting data include:

Target group surveys

Focus groups

Reading reviews

Feedback surveys

You can also consult resources online. For example, the U.S. Census Bureau can help you find demographics in calculating your market share. The U.S. Department of Commerce and the U.S. Small Business Administration also offer general data that can help you research your target industry.

Step 4: Calculate market value

You can use either top-down analysis or bottom-up analysis to calculate an estimate of your market value.

A top-down analysis tends to be the easier option of the two. It requires for you to calculate the entire market and then estimate how much of a share you expect your business to get. For example, let’s assume your target market consists of 100,000 people. If you’re optimistic and manage to get 1% of that market, you can expect to make 1,000 sales.

A bottom-up analysis is more data-driven and requires more research. You calculate the individual factors of your business and then estimate how high you can scale them to arrive at a projected market share. Some factors to consider when doing a bottom-up analysis include:

Where products are sold

Who your competition is

The price per unit

How many consumers you expect to reach

The average amount a customer would buy over time

While a bottom-up analysis requires more data than a top-down analysis, you can usually arrive at a more accurate calculation.

Step 5: Get to know your competition

Before you start a business, you need to research the level of competition within your market. Are there certain companies getting the lion’s share of the market? How can you position yourself to stand out from the competition?

There are two types of competitors that you should be aware of: direct competitors and indirect competitors.

Direct competitors are other businesses who sell the same product as you. If you and the company across town both sell apples, you are direct competitors.

An indirect competitor sells a different but similar product to yours. If that company across town sells oranges instead, they are an indirect competitor. Apples and oranges are different but they still target a similar market: people who eat fruits.

Also, here are some questions you want to answer when writing this section of your market analysis:

What are your competitor’s strengths?

What are your competitor’s weaknesses?

How can you cover your competitor’s weaknesses in your own business?

How can you solve the same problems better or differently than your competitors?

How can you leverage technology to better serve your customers?

How big of a threat are your competitors if you open your business?

Step 6: Identify your barriers

Writing a market analysis can help you identify some glaring barriers to starting your business. Researching these barriers will help you avoid any costly legal or business mistakes down the line. Some entry barriers to address in your marketing analysis include:

Technology: How rapid is technology advancing and can it render your product obsolete within the next five years?

Branding: You need to establish your brand identity to stand out in a saturated market.

Cost of entry: Startup costs, like renting a space and hiring employees, are expensive. Also, specialty equipment often comes with hefty price tags. (Consider researching equipment financing to help finance these purchases.)

Location: You need to secure a prime location if you’re opening a physical store.

Competition: A market with fierce competition can be a steep uphill battle (like attempting to go toe-to-toe with Apple or Amazon).

Step 7: Know the regulations

When starting a business, it’s your responsibility to research governmental and state business regulations within your market. Some regulations to keep in mind include (but aren’t limited to):

Employment and labor laws

Advertising

Environmental regulations

If you’re a newer entrepreneur and this is your first business, this part can be daunting so you might want to consult with a business attorney. A legal professional will help you identify the legal requirements specific to your business. You can also check online legal help sites like LegalZoom or Rocket Lawyer.

Tips when writing your market analysis

We wouldn’t be surprised if you feel overwhelmed by the sheer volume of information needed in a market analysis. Keep in mind, though, this research is key to launching a successful business. You don’t want to cut corners, but here are a few tips to help you out when writing your market analysis:

Use visual aids

Nobody likes 30 pages of nothing but text. Using visual aids can break up those text blocks, making your market analysis more visually appealing. When discussing statistics and metrics, charts and graphs will help you better communicate your data.

Include a summary

If you’ve ever read an article from an academic journal, you’ll notice that writers include an abstract that offers the reader a preview.

Use this same tactic when writing your market analysis. It will prime the reader of your market highlights before they dive into the hard data.

Get to the point

It’s better to keep your market analysis concise than to stuff it with fluff and repetition. You’ll want to present your data, analyze it, and then tie it back into how your business can thrive within your target market.

Revisit your market analysis regularly

Markets are always changing and it's important that your business changes with your target market. Revisiting your market analysis ensures that your business operations align with changing market conditions. The best businesses are the ones that can adapt.

Why should you write a market analysis?

Your market analysis helps you look at factors within your market to determine if it’s a good fit for your business model. A market analysis will help you:

1. Learn how to analyze the market need

Markets are always shifting and it’s a good idea to identify current and projected market conditions. These trends will help you understand the size of your market and whether there are paying customers waiting for you. Doing a market analysis helps you confirm that your target market is a lucrative market.

2. Learn about your customers

The best way to serve your customer is to understand them. A market analysis will examine your customer’s buying habits, pain points, and desires. This information will aid you in developing a business that addresses those points.

3. Get approved for a business loan

Starting a business, especially if it’s your first one, requires startup funding. A good first step is to apply for a business loan with your bank or other financial institution.

A thorough market analysis shows that you’re professional, prepared, and worth the investment from lenders. This preparation inspires confidence within the lender that you can build a business and repay the loan.

4. Beat the competition

Your research will offer valuable insight and certain advantages that the competition might not have. For example, thoroughly understanding your customer’s pain points and desires will help you develop a superior product or service than your competitors. If your business is already up and running, an updated market analysis can upgrade your marketing strategy or help you launch a new product.

Final thoughts

There is a saying that the first step to cutting down a tree is to sharpen an axe. In other words, preparation is the key to success. In business, preparation increases the chances that your business will succeed, even in a competitive market.

The market analysis section of your business plan separates the entrepreneurs who have done their homework from those who haven’t. Now that you’ve learned how to write a market analysis, it’s time for you to sharpen your axe and grow a successful business. And keep in mind, if you need help crafting your business plan, you can always turn to business plan software or a free template to help you stay organized.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

How to Write the Market Analysis Section of a Business Plan

Written by Dave Lavinsky

What is the Market Analysis in a Business Plan?

The market analysis section of your business plan is where you discuss the size of the market in which you’re competing and market trends that might affect your future potential such as economic, political, social and/or technological shifts.

This helps you and readers understand if your market is big enough to support your business’ growth, and whether future conditions will help or hurt your business. For example, stating that your market size is $56 billion, has been growing by 10% for the last 10 years, and that trends are expected to further increase the market size bodes well for your company’s success.

Download our Ultimate Business Plan Template here

What Should a Market Analysis Include?

You’ll want to address these issues in your market analysis:

- Size of Industry – How big is the overall industry?

- Projected Growth Rate of Industry – Is the industry growing or shrinking? How fast?

- Target Market – Who are you targeting with this product or service?

- Competition – How many businesses are currently in the same industry?

Learn how to write the full market analysis below.

How to Write a Market Analysis

Here’s how to write the market analysis section of a business plan.

- Describe each industry that you are competing in or will be targeting.

- Identify direct competition, but don’t forget about indirect competition – this may include companies selling different products to the same potential customer segments.

- Highlight strengths and weaknesses for both direct and indirect competitors, along with how your company stacks up against them based on what makes your company uniquely positioned to succeed.

- Include specific data, statistics, graphs, or charts if possible to make the market analysis more convincing to investors or lenders.

Finish Your Business Plan Today!

Industry overview.

In your industry overview, you will define the market in which you are competing (e.g., restaurant, medical devices, etc.).

You will then detail the sub-segment or niche of that market if applicable (e.g., within restaurants there are fast food restaurants, fine dining, etc.).

Next, you will describe the key characteristics of your industry. For example, discuss how big the market is in terms of units and revenues. Let the reader know if the market is growing or declining (and at what rate), and what key industry trends are facing your market.

Use third-party market research as much as possible to validate the discussion of your industry.

Here is a list of additional items you may analyze for a complete industry overview:

- An overview of the current state of the industry . How big is it, how much does it produce or sell? What are its key differentiators from competitors? What is its target customer base like – demographic information and psychographics? How has the industry performed over time (global, domestic)?

- Analyze the macro-economic factors impacting your industry . This includes items such as economic growth opportunities, inflation, exchange rates, interest rates, labor market trends, and technological improvements. You want to make sure that all of these are trending in a positive direction for you while also being realistic about them. For example, if the economy is in shambles you might want to wait before entering the particular market.

- Analyze the political factors impacting your industry . This is an often-overlooked section of any business plan, but it can be important depending on what type of company you are starting. If you’re in a highly regulated industry (such as medical devices), this is something that you’ll want to include.

- Analyze the social factors impacting your industry . This includes analyzing society’s interest in your product or service, historical trends in buying patterns in your industry, and any effects on the industry due to changes in culture. For example, if there is a growing counter-culture trend against big oil companies you might want to position yourself differently than a company in this industry.

- Analyze the technological factors impacting your industry . This includes analyzing new technologies being developed in software, hardware, or applications that can be used to improve your product or service. It also includes emerging consumer trends and will be highly dependent on your business type. In a technology-related venture, you would analyze how these changes are impacting consumers. For an educational-related venture, you would analyze how these changes are impacting students, teachers, and/or administrators.

For each of these items, you want to provide some detail about them including their current state as well as what external factors have played a role in the recent past. You can also include many other important factors if they apply to your business including demographic trends, legal issues, environmental concerns, and sustainability issues.

When you are done analyzing all of these factors, wrap it up by summing them up in a statement that includes your view on the future of the industry. This should be positive to attract investors, potential customers, and partners.

If you’re having trouble thinking about all of these factors then it might be helpful to first develop a SWOT analysis for your business.

Once you have an understanding of the market, you’ll need to think about how you will position yourself within that potential market.

Picking Your Niche

You want to think about how large your market is for this venture. You also want to consider whether you’d like to pick a niche within the overall industry or launch yourself into the mainstream.

If you have an innovative product it can be easier to enter the mainstream market – but at the same time, you might face some additional competition if there are similar products available.

You can choose to specialize in a niche market where you’ll face less competition – but might be able to sell your services at a higher price point (this could make it easier for you to get potential customers).

Of course, if your product or service is unique then there should be no competition. But, what happens if it isn’t unique? Will you be able to differentiate yourself enough to create a competitive advantage or edge?

If you are planning on entering the mainstream market, think about whether there are different sub-niches within your specific market. For example, within the technology industry, you can choose to specialize in laptops or smartphones or tablets, or other categories. While it will be more difficult to be unique in a mainstream market, you will still be able to focus on one type or category of products.

How Will You Stand Out?

Many companies are able to stand out – whether by offering a product that is unique or by marketing their products in a way that consumers notice. For example, Steve Jobs was able to take a business idea like the iPhone and make it into something that people talked about (while competitors struggled to play catch up).

You want your venture to stand out – whether with an innovative product or service or through marketing strategies. This might include a unique brand, name, or logo. It might also include packaging that stands out from competitors.

Write down how you will achieve this goal of standing out in the marketplace. If it’s a product, then what features do you have that other products don’t? If it’s a service, then what is it about this service that will make people want to use your company rather than your competition?

You also need to think about marketing. How are you going to promote yourself or sell your product or service? You’ll need a marketing plan for this – which might include writing copy, creating an advertisement, setting up a website, and several other activities. This should include a description of each of these strategies.

If you’re struggling with the details of any of these sections, it might be helpful to research what other companies in your market are doing and how they’ve been successful. You can use this business information to inform your own strategies and plans.

Relevant Market Size & Competition

In the second stage of your analysis, you must determine the size and competition in your specific market.

Target Market Section

Your company’s relevant market size is the amount of money it could make each year if it owned a complete market share.

It’s simple.

To begin, estimate how many consumers you expect to be interested in purchasing your products or services each year.

To generate a more precise estimate, enter the monetary amount these potential customers may be ready to spend on your goods or services each year.

The size of your market is the product of these two figures. Calculate this market value here so that your readers can see how big your market opportunity is (particularly if you are seeking debt or equity funding).

You’ll also want to include an analysis of your market conditions. Is this a growing or declining market? How fast is it growing (or declining)? What are the general trends in the market? How has your market shifted over time?

Include all of this information in your own business plan to give your readers a clear understanding of the market landscape you’re competing in.

The Competition

Next, you’ll need to create a comprehensive list of the competitors in your market. This competitive analysis includes:

- Direct Competitors – Companies that offer a similar product or service

- Indirect Competitors – Companies that sell products or services that are complementary to yours but not directly related

To show how large each competitor is, you can use metrics such as revenue, employees, number of locations, etc. If you have limited information about the company on hand then you may want to do some additional research or contact them directly for more information. You should also include their website so readers can learn more if they desire (along with social media profiles).

Once you complete this list, take a step back and try to determine how much market share each competitor has. You can use different methods to do this such as market research, surveys, or conduct focus groups or interviews with target customers.

You should also take into account the barriers to entry that exist in your market. What would it take for a new company to enter the market and start competing with you? This could be anything from capital requirements to licensing and permits.

When you have all of this information, you’ll want to create a table like the one below:

Once you have this data, you can start developing strategies to compete with the other companies which will be used again later to help you develop your marketing strategy and plan.

Writing a Market Analysis Tips

- Include an explanation of how you determined the size of the market and how much share competitors have.

- Include tables like the one above that show competitor size, barriers to entry, etc.

- Decide where you’re going to place this section in your business plan – before or after your SWOT analysis. You can use other sections as well such as your company summary or product/service description. Make sure you consider which information should come first for the reader to make the most sense.

- Brainstorm how you’re going to stand out in this competitive market.

Formatting the Market Analysis Section of Your Business Plan

Now that you understand the different components of the market analysis, let’s take a look at how you should structure this section in your business plan.

Your market analysis should be divided into two sections: the industry overview and market size & competition.

Each section should include detailed information about the topic and supporting evidence to back up your claims.

You’ll also want to make sure that all of your data is up-to-date. Be sure to include the date of the analysis in your business plan so readers know when it was conducted and if there have been any major changes since then.

In addition, you should also provide a short summary of what this section covers at the beginning of each paragraph or page. You can do this by using a title such as “Industry Overview” or another descriptive phrase that is easy to follow.

As with all sections in a business plan, make sure your market analysis is concise and includes only the most relevant information to keep your audience engaged until they reach your conclusion.

A strong market analysis can give your company a competitive edge over other businesses in its industry, which is why it’s essential to include this section in your business plan. By providing detailed information about the market you’re competing in, you can show your readers that you understand the industry and know how to capitalize on current and future trends.

Business Plan Market Analysis Examples

The following are examples of how to write the market analysis section of a business plan:

Business Plan Market Analysis Example #1 – Hosmer Sunglasses, a sunglasses manufacturer based in California

According to the Sunglass Association of America, the retail sales volume of Plano (non-prescription) sunglasses, clip-on sunglasses, and children’s sunglasses (hereinafter collectively referred to as “Sunwear”) totaled $2.9 billion last year. Premium-priced sunglasses are driving the Plano Sunwear market. Plano sunglasses priced at $100 or more accounted for more than 49% of all Sunwear sales among independent retail locations last year.

The Sunglass Association of America has projected that the dollar volume for retail sales of Plano Sunwear will grow 1.7% next year. Plano sunglass vendors are also bullish about sales in this year and beyond as a result of the growth of technology, particularly the growth of laser surgery and e-commerce.

Business Plan Market Analysis Example #2 – Nailed It!, a family-owned restaurant in Omaha, NE

According to the Nebraska Restaurant Association, last year total restaurant sales in Nebraska grew by 4.3%, reaching a record high of $2.8 billion. Sales at full-service restaurants were particularly strong, growing 7% over 2012 figures. This steady increase is being driven by population growth throughout the state. The Average Annual Growth Rate (AGR) since 2009 is 2.89%.

This fast growth has also encouraged the opening of new restaurants, with 3,035 operating statewide as of this year. The restaurant industry employs more than 41,000 workers in Nebraska and contributes nearly $3 billion to the state economy every year.

Nebraska’s population continues to increase – reaching 1.9 million in 2012, a 1.5% growth rate. In addition to population, the state has experienced record low unemployment every year since 2009 – with an average of 4.7% in 2013 and 2014.

Business Plan Market Analysis Example #3 – American Insurance Company (AIC), a chain of insurance agencies in Maine

American Insurance Company (AIC) offers high-quality insurance at low prices through its chain of retail outlets in the state of Maine. Since its inception, AIC has created an extensive network of agents and brokers across the country with expanding online, call center and retail business operations.

AIC is entering a market that will more than double in size over the next 50 years according to some industry forecasts. The insurance industry is enjoying low inflation rates, steady income growth, and improving standards of living for most Americans during what has been a difficult period for much of American business. This makes this a good time to enter the insurance industry as it enjoys higher margins because customers are purchasing more coverage due to increased costs from medical care and higher liability claims.

American Insurance Company provides affordable homeowners, auto, and business insurance through high-quality fulfillment centers across America that have earned a reputation for top-notch customer service.

AIC will face significant competition from both direct and indirect competitors. The indirect competition will come from a variety of businesses, including banks, other insurance companies, and online retailers. The direct competition will come from other well-funded start-ups as well as incumbents in the industry. AIC’s competitive advantages include its low prices, high quality, and excellent customer service.

AIC plans to grow at a rate that is above average for the industry as a whole. The company has identified a market that is expected to grow by more than 100% in the next decade. This growth is due to several factors: the increase in the number of two-income households, the aging population, and the impending retirement of many baby boomers will lead to an increase in the number of people who are purchasing insurance.

AIC projects revenues of $20M in year one, which is equivalent to 100% growth over the previous year. AIC forecasts revenue growth of 40%-60% each year on average for 10 years. After that, revenue growth is expected to slow down significantly due to market saturation.

The following table illustrates these projections:

Competitive Landscape

Direct Competition: P&C Insurance Market Leaders

Indirect Competition: Banks, Other Insurance Companies, Retailers

Market Analysis Conclusion

When writing the market analysis section, it is important to provide specific data and forecasts about the industry that your company operates in. This information can help make your business plan more convincing to potential investors.

If it’s helpful, you should also discuss how your company stacks up against its competitors based on what makes it unique. In addition, you can identify any strengths or weaknesses that your company has compared to its competitors.

Based on this data, provide projections for how much revenue your company expects to generate over the next few years. Providing this information early on in the business plan will help convince investors that you know what you are talking about and your company is well-positioned to succeed.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Other Resources for Writing Your Business Plan

How to Write a Great Business Plan Executive Summary How to Expertly Write the Company Description in Your Business Plan The Customer Analysis Section of Your Business Plan Completing the Competitive Analysis Section of Your Business Plan The Management Team Section of Your Business Plan Financial Assumptions and Your Business Plan How to Create Financial Projections for Your Business Plan Everything You Need to Know about the Business Plan Appendix Best Business Plan Software Business Plan Conclusion: Summary & Recap

Other Helpful Business Planning Articles & Templates

Growth Tactics

Creating an Effective Business Growth Plan

Last Updated on November 23, 2023 by Milton Campbell

As a business leader, you understand the importance of continually striving for growth and development in your enterprise. A carefully crafted growth plan can help you achieve your goals by outlining specific strategies and action plans to ensure that your company continues to thrive. In this article, we’ll explore the key components of an effective growth plan for your business and offer practical advice to help you create a roadmap to success.

What is a Growth Plan and Why Do You Need One?

A growth plan is a document that outlines the strategies and tactics that a business will use to achieve and sustain growth over a specified period. This plan should include a clear vision statement, measurable goals , and a detailed description of the strategies, action plans, and key performance indicators (KPIs) that will drive business growth. A growth plan can help you set goals and targets, identify potential challenges and opportunities, and ensure that all stakeholders are aligned with your vision. Furthermore, having a growth plan can help ensure the longevity of your business by providing a roadmap for success.

Factors Impacting Business Growth

Several factors can have a significant impact on the growth of a business. It is essential for business leaders and managers to identify and understand these factors in order to navigate the path to success. Let’s explore some key factors that influence business growth:

1. Economic Conditions

The overall health of the economy can greatly affect business growth. During periods of economic prosperity, with increased consumer spending and confidence, businesses tend to experience growth opportunities. Conversely, during economic downturns or recessions , consumer spending may decline, leading to challenges for businesses.

2. Market Demand and Competitiveness

The demand for a product or service has a direct impact on business growth. Assessing the market demand for your offerings, understanding consumer preferences, and identifying any gaps that your business can fill are crucial steps. Additionally, businesses need to evaluate the competitive landscape, including the presence of established competitors, barriers to entry, and emerging trends, in order to position themselves for growth.

3. Innovation and Technology

Keeping up with technological advancements and embracing innovation is essential for sustaining growth. Businesses that invest in research and development, adopt new technologies, and stay ahead of industry trends are often better positioned for growth. Innovation can lead to improved efficiency, enhanced product offerings, and increased customer satisfaction, all of which can drive business growth.

4. Financial Resources

Access to financial resources, such as capital for investment and working capital, is vital for business growth. Adequate funding allows businesses to expand operations, invest in marketing and advertising, develop new products or services, and hire additional staff. Businesses need to assess their financial capabilities and explore funding options to support their growth strategies.

5. Human Capital

The skills, knowledge, and expertise of the workforce are critical for driving business growth. Hiring and retaining talented employees who are aligned with the organization’s goals and values is essential. Businesses that invest in training and development programs, foster a positive work culture , and empower their employees are more likely to experience sustainable growth.

6. Regulatory Environment

The regulatory environment in which a business operates can impact growth opportunities. Compliance with industry-specific regulations, government policies, and legal requirements is crucial to avoid penalties and maintain credibility. Understanding and navigating the regulatory landscape allows businesses to identify potential obstacles and take necessary measures for growth.

7. Customer Satisfaction and Retention

Customer satisfaction and retention play a significant role in business growth. Satisfied customers are more likely to become repeat customers, refer others to the business, and contribute to its growth. Businesses need to focus on providing exceptional customer experiences, delivering quality products or services, and maintaining strong customer relationships to foster loyalty and drive growth.

These factors are just some of the many elements that influence business growth. By actively assessing and addressing these factors, businesses can create strategies and make informed decisions that contribute to their long-term success and expansion.

How to Develop a Growth Plan for Your Business

Developing a growth plan for your business is a crucial aspect of achieving long-term success. To create an effective growth plan, follow these steps:

Step 1: Define Your Growth Goals and Objectives

The first step in creating an effective growth plan is to define your goals and objectives. Think about where you want your business to be in three, five, or ten years and develop specific and measurable goals that will help you achieve your vision.

Step 2: Understand Your Business Needs