Accounting for discounts under IFRS

Last update: July 2023

Discounts are probably the most popular selling tool in business. Without a doubt, many companies discount the price for their products or services in various forms, for example:

- Buy 1, get 1 free (and modifications),

- Get 10% off for purchases over CU 100 (and modifications),

- Gift vouchers,

- Settlement discounts (bonus for early payment or for cash payment),

and many others.

What do discounts really mean for us, accountants?

In most cases, troubles.

The reason is that discounts directly affect measurement of various items in the financial statements and potentially the accounting treatment (timing and journal entries).

In this article, I explain how you should treat the discounts from the point of view of both seller and buyer.

My good friend, Prof. Robin Joyce added a bonus to this article.

We try to explain why discounting is not always that great and how you should decide on the amount of your discount based on your own margins and sales.

Maybe you’ll be surprised to find out that not every single business can afford discounting. Yes, it’s an expensive selling tool!

Sellers provide discounts

When a seller provides a discount, it directly affect the amount of his revenue .

This standard specifies that you should present the revenue net of discounts . Just refer to IFRS 15.47 and following.

In other words, discounts reduce the amount of your revenue and do not represent cost of sales (or cost of promotion etc.).

For example, when you sell a machine for CU 100 and you decide to provide a discount of 3%, then you present a revenue of CU 97, and NOT the revenue of CU 100 and cost (of sales, marketing, whatever) of 3.

This rule seems very basic and very simple, yet its practical application can be challenging at some circumstances.

Let me give you 2 examples.

Example 1: Discount coupons

Imagine you run an e-shop with books. To support your sales, you send a discount coupon for CU 5 that your customers can use with every purchase over CU 100.

How should you account for the discount coupon?

In this particular example, you don’t recognize a provision in your financial statements for a discount at the time of distributing a coupon.

Because there’s no past event.

Remember, a customer would have to make a purchase over 100 and only then you have a liability to provide a discount of CU 5.

Instead, you simply recognize revenue net of CU 5 discount when a coupon is redeemed.

Example 2: Buy 1, get 1 free (or any free items)

You normally sell Thai cuisine for CU 10, its cost in your inventory is CU 6 and the cost of Thailand travel guide is CU 35.

What do to now?

Under IFRS 15 , the accounting treatment is the same if both books are delivered at the same time.

However, if you deliver Thailand travel guide in September and Thai cuisine in October due to low stock, then you would need to split the transaction price of CU 50 based on the relative stand-alone selling prices and recognize revenue accordingly.

More specifically:

- Total stand-alone selling prices: CU 50+CU 10 = CU 60

- Revenue allocated to Thailand travel guide: CU 50/CU 60*CU 50= CU 42 to be recognized in September.

- Revenue allocated to Thai cuisine: CU 10/CU 60*CU 50 = CU 8 to be recognized in October.

Costs of sales are recognized accordingly.

Buyers get discounts

When buyers get discounts, it’s a totally different story.

We need to look at IAS 2 Inventories , IAS 16 Property, plant and equipment or other similar standards for guidance.

Both IAS 2 and IAS 16 prescribe that we should initially measure an item of PPE or inventories at its cost including purchase price . And, it’s net of discounts .

However, let me stop here.

You should examine the reason for getting a discount.

If you receive a discount as a reduction in the purchase price of inventories, then you should deduct it from their costs.

When discounts refund some selling expenses , then these discounts are not deducted from the costs of inventories, but treated as income.

Another consideration might relate to settlement discounts , i.e. discounts received from quick payment. They should not be treated as finance income, but again, they reduce the cost of inventories.

Example 3 Rebates on inventories

- Sales price per unit: CU 5

- Volume discount per 1000 units: 10%

- Settlement discount: 2% when paid within 30 days

- Contribution for leaflet printing costs: 1%

If the supermarket intends to pay within 30 days, then it should reduce costs of inventories by settlement discount, too.

Contribution for leaflet printing costs is clearly refunding some selling expenses and therefore it should be treated as income, not as cost of inventories.

The costs of inventories is: CU 5*1 000 – CU 5*1 000*(10%+2%) = CU 4 400.

What about inventories received for free?

Well, it depends.

If a government (including governmental agencies) donated you some inventories, then you should apply the standard IAS 20 Accounting for Government grants and Disclosure of government assistance .

For example, you purchased 1 000 units at CU 2/unit and received 50 units for free, then you record 1 050 units at CU 2 000, i.e. CU 1,90/unit.

I have also seen that some companies record free items at their fair value while a credit entry goes in profit or loss (as an income). However, this approach is not supported by IFRS.

In any case, you should always seek the substance of a transaction and then make appropriate decision. You can read more about accounting for free assets here .

When you should NOT discount your goods or services

Let’s take a different angle of looking at discounts. My friend, Prof. Robin Joyce helped me with that.

Discounts represent a very powerful selling tool, but at the same time, they are like marketing’s nuclear weapon.

The reason is that discounts can lower price perception permanently or make your product a commodity.

It means that clients will see no difference between your product and other products – they will just buy the cheapest (not necessarily the best).

What do discounts do to your profit? Do you really need to discount your products or services in order to increase your profits?

If you sell some tangible products, then you need to know the exact financial impact of your planned discounts on sales and the net profit.

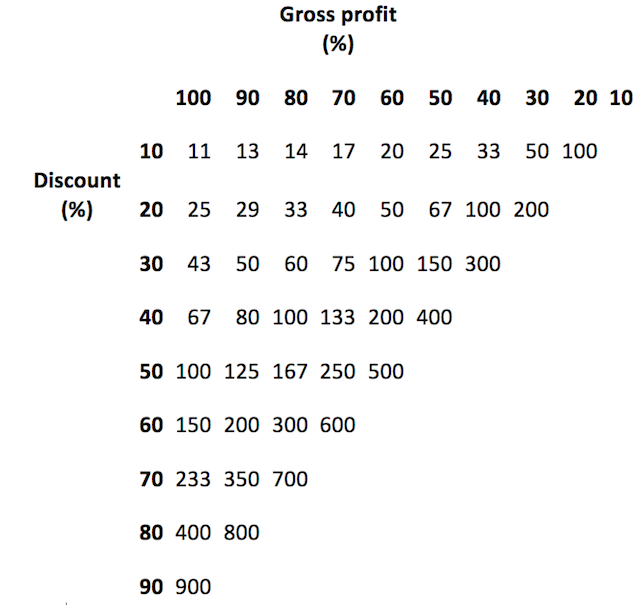

The following table sums it up (read the explanation below the table):

This table shows you how many additional items you should sell at your present profit margins, if you want to keep the same profit.

For example, if you are making 80% margin (top row), and you provide a discount of 20% (side column), you need to sell 33% more units to get the same financial result as without giving a discount.

Putting some numbers to it:

Let’s say you sell a product for CU 100 with 80% margin, therefore its cost of sale is CU 20. You sell normally 100 units, therefore your gross profit is CU 80*100 units = 8 000.

You’d like to give a discount of 20%. Looking at a table above, you need to sell 33% more units than before to have the same effect.

For verification, your new discounted sales price is CU 80, therefore your gross profit with 33% more units sold is CU 60 (80-20) * 133 units = 7 980 (Cu 20 is a rounding difference).

This table assumes that you provide discounts for all your units sold, not just some of them (in this case, you would need to adjust the calculation).

What are the conclusions?

- You need to know your gross margin before considering a discount.

- You need to know how many additional units you need to sell after discount to keep the profit. And, are you able to do so? Will your customers really buy 33% more with 20% discount?

- If you operate with low margins, you cannot afford any discount. For example, if you operate at 10% margin, you cannot give away any discount without hurting your gross profit. You simply cannot sell enough items to pay for it.

It’s your turn now! If you have any questions or concerns with regards to discounts and their accounting, please let me know in the comments below this article. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

105 Comments

Thank you Silvia Just want to ask weather sales discounts can be recorded directly in the sales account instead of recorded in a contra revenue account?

You can account for a discount as you please, but then, in the statement of financial position, you need to present revenues net of discounts. Using different accounts is a matter of convenience and it is OK as soon as you report it correctly in your balance sheet.

Hi Silvia, I have a similar scenario, except that the supplier is refunding for expenses incurred on their behalf in form of free goods; which we want to sell. The supplier has quoted a lower price than usual since this is a refund in form of free goods ( for clearance purposes) What should I base my cost price on( note that i want to add a few other landed costs to arrive to the full cost of the free goods)

Hi Silvia if purchased non current asset using installments (4 year & 4 installment) and recognized it according to IAS 16 then after the second installment the company get discount for settlement his balance by negotiate . how recognized this discount

Dear Silvia Superb article!! really i like the way you simplified and give such a insight knowledge about IFRS 15, i really appreciate your blog. .keep it up..!! i also enjoyed Q&A also..

How would we account for the below situation? ABC Ltd have issued coupons worth 1 mil to its customers on 31.03.2020. ABC Ltd predict that only 60% of the coupons will be redeemed in next month by end customers. How much shall we accrue in books in Mar’20 books.

Am working as accounting manager in auto leasing company. On a quarterly basis we are getting discount 3% on total purchases from the vendor. In the same time we are financing these cars through contracts to our customers for different financing periods 2, 3, 4, 5 Years. How to recognize these discounts?

Hi M. Mustafa, difficult to say without seeing that contract with the vendor and assessing the probability of getting the discount – is this 100%? Is this volume discount? Or settlement discount? I have no idea. However, if it is a volume discount and the probability is 100%, you should recognize your discount immediately. E.g. you buy a car for 100 000, and you will receive a discount of 3% about 3 months later with 100% probability. Thus the entry would be something like Debit PPE – Car: 97 000; Debit Receivable to vendor: 3 000; Credit Cash/bank/Trade payables/whatever applies: 100 000.

Hie Silvia can you please help with the following NM Ltd is a company listed on the ZSE Limited. NM is an online store that sells a large variety of gifts including books, movies, games and electronics. NM has a February year-end. During the 2011 christmas season NM sold gift vouchers to the value of $25 600 for cash. The holders of these gift vouchers may redeem the vouchers for merchandise in the future. Normally the vouchers expires within 12 months from date of issue. Of these gift vouchers, $10 200 were sold as part of a promotion where the purchaser will receive a $120 voucher for $100 paid. These promotional gift vouchers had a 31 January 2019 expiry date and at the expiry date, 23 vouchers were not redeemed. At 29 February 2019 vouchers to the value of $5 200 vouchers remained outstanding (not yet exchanged for merchandise). REQUIRED Discuss how the sale of gift vouchers of NM Ltd should be measured and recognised in terms of International Financial Reporting Standards (IFRS) for the year ended 29 February 2019.

Hello Silvia,

I have 3 Questions: 1. Assume a car-dealership sells a car for 45.000€ (list price:50.000€) . Can we regard the 5000€ discount as a variable component of consideration? (Assume that nowadays a customer has a valid expectation to get a discount) 2. price of car: 50.000€ -5000€ (discount) ,costs of vehicle(for dealer): 30.000€. Now the dealer recognized 45.000 Revenue and 30.000Cost of Sales on the income statement right? (nothing more in the following years) (The 5.000 discount don’t become apparent on the Inc.Statement right? 3. Which “article” in IFRS 15 states that I am not allowed to recognize variable components? (which “article” prooves my question 2?(that it doesn’t become apparent on the Inc.Statement?))

Silvia, I need your advice. We buy 100 unit and get free 3 unit . 3 unit is warranty goods. Instead of having reponsibility of warranty, seller give us 3 unit when diliver 100 unit (total is 103 unit). How should I record the free 3 unit in my book? Thank you

As 103 units and the unit price of (price for 100 units) divided by 103.

Hi I am currently auditing expenses of a grain handling terminal.

Hi Silvia, Under IFRS 15, can we recognise the full selling price of the service as revenue if it is offered for free e.g. Sign in now and get 2 months worth of subscriptions for free. e.g. Cr Revenue – $150 (Selling price of Sub) and Dr discount/cost of Service – $150 or should no revenue be recognised as it nets off to 0. Appreciate your assistance. Thanks Harshila

Thank you Silvia

Leave a Reply Cancel reply

Recent Comments

- Nyika on Tax Reconciliation under IAS 12 + Example

- Mushumbusi Kappia on How to Account for Compound Financial Instruments (IAS 32)

- Silvia on How to Account for Provisions – Practical Questions

- Mali on Example: Construction contracts under IFRS 15

- Tandin Tshewang on How to Account for Provisions – Practical Questions

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (64)

- Insurance (2)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

JOIN OUR FREE NEWSLETTER

report “Top 7 IFRS Mistakes” + free IFRS mini-course

1514305265169 -->

We use cookies to offer useful features and measure performance to improve your experience. By clicking "Accept" you agree to the categories of cookies you have selected. You can find further information here .

- Transaction portal

- Financier portal

- Vendor Finance

- Dealer Finance

- Sales Invoice Finance

- Dynamic Discounting

- Purchase Invoice Discounting

Bill Discounting

Just like we all need a regular supply of oxygen to survive, businesses require a steady supply of funds to survive and grow. Once a business is in running mode, it incurs certain production and distribution expenses. Forced by market considerations and to boost sales and build brand loyalty, most sellers offer their products and services to buyers on credit.

Until the seller receives payment against this product, the funds are blocked. While the payment is awaited, the business has to continue operating. It needs money to pay employees’ salaries, procure raw materials, and other day-to-day expenses. So, there is a requirement for funds to meet such operating expenses.

What is Bill Discounting?

Bill Discounting, also called Invoice Discounting, is a trading activity where a seller sells some goods or services to a buyer. The buyer has to make the payment as per the agreed credit period. Now, if the buyer needs money before that, he can approach a bank or some NBFC and ‘sell’ that invoice to them. The financial institution gets the invoice verified by the buyer and then makes payment to the seller on their behalf. However, they make some deductions, called ‘discount’, as their commission.

So, in a way, the seller gets a discounted payment for their bill. This way, they can run their business operations, and buyers get an extended credit period. On the due date, the seller makes the payment to the financial institution, which completes the cycle for that particular invoice. Since the seller gets payment on a ‘discount’, this transaction is called Bill Discounting.

Example of Bill Discounting:

Let’s take an example to understand this. You are in the business of office stationery and have supplied some office stationery to ABC Corporation. The invoice amount is, say, Rs. 1,00,000. Now, AMC Corporation (The buyer) agrees to make the full payment after 30 days.

But if you need the money before 30 days, the buyer will issue you a letter of credit from the bank for 30 days. You can approach the bank and collect payment against that invoice much quickly. For making this ‘advance payment’, the bank will charge some interest from you. So, you will get a discounted amount from the bank. Assuming the discount rate is 5%, the bank will charge you Rs. 5,000 and deposit Rs. 95,000 in your account. At the end of 30 days, the bank will collect Rs. 1,00,000 from the buyer.

This way, that particular invoice would get settled. This financial transaction involving the seller, buyer, and financial institution is called bill discounting or invoice discounting.

Bill Discounting Process:

The step-by-step process of bill discounting is given below:

- A seller supplies goods or services to a buyer and raises an invoice.

- The buyer accepts the invoice. This approval means the buyer acknowledges the invoice and promises to make the payment on the due date.

- The seller approaches the financial institution to get the bill discounted.

- The financial institute verifies the creditworthiness of the buyer and the legitimacy of the bill.

- Once approved, the bank disburses the funds to the seller after deducting the pre-defined fee, discount, or appropriate margin.

- Thus, the seller gets a quicker payment for the invoice, which can be used for other business purposes.

- At the end of the original credit period, the buyer makes the payment to the financial institution.

Features of Bill Discounting:

- Evaluating the seller and buyer: Before approving the bill discounting, the bank or NBFC first checks the seller’s reputation and the buyer’s creditworthiness. This is done to ensure that the buyer does not default on making the payment to the bank.

- Making instant cash available for the buyer: It is the most salient feature of bill discounting. The bank or NBFC purchases the invoice and immediately pays after discounting the bill. This makes life easy for the seller. They get an immediate payment and do not need to wait for the buyer to pay the bill.

- Discount Charge: The difference margin between the face value of the invoice and the amount approved and disbursed by the bank is called the discount. This discount is calculated on the maturity value at a certain percentage per annum.

- Maturity: The maturity date of a bill means the date on which payment of the invoice is due. The average maturity period is 30, 60, 90, or 120 days.

Bill Discounting Rate of Interest:

Most banks and NBFCs do not have a fixed interest rate for discounting bills. Any financial institution considers several factors before deciding on the discount, which may vary from customer to customer.

The various factors that go into consideration for deciding the discounting rate are:

- Financial history and credit score of the seller

- Years of being in the business

- Business volume

- Credit-worthiness of the buyer

- Stability of the business and industry

Eligibility Criteria:

The eligibility criteria for bill discounting varies from lender to lender and is generally decided by the management of the respective financial institution offering the service. However, the most common criteria for bill discounting are listed below:

- The company should have been in business for a reasonable period of time. Most financial institutions ask for a minimum of 3 years of being in the business.

- The seller should have dealt with at least 2 investment-grade companies.

- The credit score must be a minimum of 650 or above.

- The business must have a minimum turnover of 1 Crore.

Factors that affect the eligibility:

In addition to the criteria mentioned above, some general guidelines that affect the eligibility for bill discounting are listed below:

- Number of years in the business

- Nature or type of business

- Business Volume and Annual Turnover

- Financial Stability of the seller

- Repayment history and capability of the buyer

- Business Positive Net worth or Profitability

- Credit rating of a business

- Previous loan defaults, if any

Documents Required for Bill Discounting:

Some of the most common documents required for approving a bill discounting are:

- Duly filled application form with passport-sized photographs

- Business PAN card and address proof

- Applicant’s Aadhar card.

- GST Returns

- Income tax return & Financial statement with an audit report.

- Business Establishment Proof

- Last 12 months’ bank statement

- Bill of Exchange

- Letter of Credit

- Commercial Invoice

- Packing list with all the details

- Logistics details with a copy of the delivery note, if any

- Proof of certificates, registrations, licenses, and permits, if any

- Any other document required

Benefits of Bill Discounting

Bill discounting, as a financial transaction, is beneficial to all the parties involved – the seller, the buyer, and the financial institution. The buyer and the seller can stabilize their fund flow, while the financial institution can use the funds lying with them and make some profit on it.

The specific benefits of bill discounting are as follows:

- Improves cash flow position: All businesses, big or small, depend on cash flow to survive and grow. Bill discounting facility helps inject a quick cash flow into the business and help the businesses survive and flourish. The money received quickly may be used to pay salaries, procure raw materials for the next order, or invest in some new asset.

- Provides instant access to cash: For a seller, a bill discounting facility is a quick and hassle-free way of getting payment against their invoices. It helps them manage their working capital better and keep the working capital cycle short. Most financial institutions like MYND offer funds within 24 to 72 hours.

- No collateral involved: Bill discounting, as a process, is very simple. It does not involve much documentation. Secondly, the seller is not required to provide any collateral security to get the funds. The invoice itself is strong enough collateral to get the funds.

- No debt incurred: Getting funds using a bill discounting facility does not put the buyer under any kind of debt. Here, the buyers get money against the invoices, which is anyways due to them. It just helps them get the money. So, it does not create any debt liability for them. Compared to traditional financing models, a bill discounting facility is safe from any kind of loss or damage.

- No impact on business sheet: Bill discounting facility does not create any tax liability. It is more of an off-the-book process. So, it has no impact on the balance sheet of the business.

Bill Discounting Versus Business Loan

Conclusion:.

All businesses need money to run their operations. Compared to business loans, bill discounting is a better option to get funds, as the process is quite simple and does not create any kind of liability.

Working with a reputed financial partner like MYND helps the business get the funds at a reasonable discount. With declining interest rates, more and more MSMEs are opting for business discounting as a preferred method of financing their short-term funds’ requirements.

Q.1: What is bill discounting?

Ans: Business Discounting is a trading activity that allows sellers to get quick payment for their work. It helps them meet their operating expenses without depending on any external agency to provide the funds.

Q.2: Is bill discounting a loan?

Ans: Bill discounting allows the buyer to borrow funds for a short term against the discounted invoice from the lender. So, it can be treated as a loan.

Q.3: Can NBFCs offer bill discounting facilities?

Ans: Yes, NBFCs can offer bill discounting facilities. In fact, they provide better facilities as compared to banks.

Q.4: What is the repayment period in case of bill discounting?

Ans: The repayment period is equal to the credit period allowed by the buyer to the seller.

Q.5: How is the interest calculated on discounted bills?

Ans: The interest is calculated as per the guidelines of the lender for the credit period or the tenure of the bill which maybe 30 days, 60 days, 90 days, etc. as the case may be.

Q.6: Who collects the payment due for the bills discounted?

Ans: The payment may be collected by either of the two parties. This is discussed and agreed upon between the seller and their bank.

Q.7: Are GST, TDS, and VAT applicable on bill discounting?

Ans: No. GST, TDS, and VAT are not applicable on Bill discounting.

Share this post

- Search Search Please fill out this field.

What Is Discounting?

- How It Works

- Time Value of Money

Discounting and Risk

The bottom line.

- Investing Basics

Discounting: What It Means in Finance, With Example

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

Gordon Scott has been an active investor and technical analyst or 20+ years. He is a Chartered Market Technician (CMT).

:max_bytes(150000):strip_icc():format(webp)/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)

Discounting is the process of determining the present value of a payment or a stream of payments that is to be received in the future. Given the time value of money , a dollar is worth more today than it would be worth tomorrow. Discounting is the primary factor used in pricing a stream of tomorrow's cash flows.

Key Takeaways

- Discounting is the process of determining the present value of a future payment or stream of payments.

- A dollar is always worth more today than it would be worth tomorrow according to the concept of the time value of money.

- A higher discount indicates a greater level of risk associated with an investment and its future cash flows.

- An asset has no real value unless it can produce future cash flows.

How Discounting Works

The coupon payments found in a regular bond are discounted by a certain interest rate. They're then added together with the discounted par value to determine the bond's current value.

From a business perspective, an asset has no value unless it can produce cash flows in the future. Stocks pay dividends. Bonds pay interest and projects provide investors with incremental future cash flows. The value of those future cash flows in today's terms is calculated by applying a discount factor to future cash flows.

Time Value of Money and Discounting

It represents a discount on the price of a car when the car is on sale for 10% off. The same concept of discounting is used to value and price financial assets. The discounted or present value is the value of the bond today. The future value is the value of the bond at some future time. The difference in value between the future and the present is created by discounting the future back to the present using a discount factor, which is a function of time and interest rates.

A bond can have a par value of $1,000 and be priced at a 20% discount, which would be $800. The investor can purchase the bond today for a discount and receive the full face value of the bond at maturity. The difference is the investor's return.

A larger discount results in a greater return, which is a function of risk.

A higher discount generally means that there's a greater level of risk associated with an investment and its future cash flows. Discounting is the primary factor used in pricing a stream of tomorrow's cash flows. The cash flows of company earnings are discounted back at the cost of capital in the discounted cash flows model. Future cash flows are discounted back at a rate equal to the cost of obtaining the funds required to finance the cash flows.

A higher interest rate paid on debt also equates with a higher level of risk, which generates a higher discount and lowers the present value of the bond. Junk bonds are sold at a deep discount.

Likewise, a higher level of risk associated with a particular stock is represented as beta in the capital asset pricing model. It means a higher discount, which lowers the present value of the stock.

What Is a Breakpoint Discount?

Breakpoint discounts apply to Class A mutual funds. Investors must qualify for them through purchasing these mutual fund shares and meeting a few other requirements. They're volume discounts on the front-end sales load that are charged to the investor. They increase with the amount invested.

What Does It Mean When a Bond Is Callable?

A callable bond is a municipal bond that's subject to redemption by a state or local government before its maturity date. A government might do this because the bond is paying an interest rate that's higher than the market rate at the time. You can determine whether a bond is callable before you commit by looking it up on the Electronic Municipal Market Access website provided by the Municipal Securities Rulemaking Board.

What Is a Junk Bond?

"Junk bond" is another name for a high-yield bond. These bonds pay a higher interest rate or yield because they're rated poorly by Moody's and S&P due to a high risk of default. They are considered to be risky for investors.

Discounting is the process of selling an asset for something less than its value. A $35,000 car that's on sale with a 10% discount can be bought for $31,500. It's discounted by $3,500. A $1,000 bond that comes with a 20% discount can be purchased for $800.

Bonds are typically discounted because they carry a higher degree of risk to the purchaser or investor. The discount is based on the value of an asset's income at the present moment.

Don't be lured in by the prospect of purchasing a discounted investment without first checking into why a discount is being offered in the first place.

Study.com. " Bond Valuation Definition, Formula & Examples ."

Office of the New York State Attorney General. " Bond Investments ."

Harvard Business Review. " Does the Capital Asset Pricing Model Work? "

FINRA. " Breakpoints ."

Municipal Securities Rulemaking Board. " Seven Questions to Ask When Investing in Municipal Bonds ," Page 3.

Investor.gov. " High-Yield Bond (or Junk Bond) ."

:max_bytes(150000):strip_icc():format(webp)/investment-concept--growth-plant-on-coins-three-step-in-clear-glass-bottle-on-wooden-table-with-green-blurred-background-and-light--conceptual-saving-money-for-growing-business-and-future-909645158-227be9818e2f48a8bdac2c21b57cde1a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Blockchain Accounting & Tax Services

- Business Valuation

- Business Acquisitions by Aprio

- Business Applications Advisory Services

- Data Management and Insights

- Digital Transformation & Cybersecurity

- Sustainability Advisory Services

- Forensic Services

- Government Contracting Consulting

- Governance, Risk & Compliance Service

- Internal Audit Services

- Retirement Plan Services

- Risk Management Advisory

- Succession Planning

- Technical Accounting Consulting (TAC) Services

- Transaction Advisory

- Treasury Optimization Services

- Financial Assurance

- Non-Financial Assurance

- Information Assurance

- Employee Benefit Plan Audits

- Business Tax

- Employment Tax

- Individual & Family Tax

- International Tax

- State & Local Tax (SALT)

- Sales Tax Consulting and Compliance

- Business Tax Credits & Incentives

- R&D Tax Credits

- Tax Controversy and Dispute Resolution

- Wealth Management

- Outsourced Accounting

- CFO Advisory Services

- Payroll & HR

- Managed Compliance Services (CaaS)

- Financial & Accounting Staffing

- IT Staffing

- Dental Staffing

- Employee Retention Credit Audit and Controversy Services

- ERC Services

- Provider Relief Fund

- Construction

- Government Contracting

- Affordable & Public Housing

- Manufacturing & Distribution

- Financial Services

- Nonprofit & Education

- Private Equity

- Professional Services

- Real Estate Services

- Restaurant, Franchise & Hospitality

- Technology & Blockchain

- Aprio Firm Alliance

- Black Business Forum

- Diversity, Equity, Inclusion, and Belonging

- Pay Invoices

Insights | Assurance

How to Account for Debt Securities

August 17, 2018

US Treasury bills are short-term obligations sold at a price less than their face value. Treasury notes and bonds are long-term obligations that make semi-annual coupon interest payments. What is the proper way to record activity on these investments?

On a non-interest-bearing note, such as a Treasury bill, the difference between the face value and the purchase price is interest income. A discount is recorded when the amount paid is less than the face value and a premium when the amount paid is more than the face value (FASB Codification 835-30-25-5). At the time of purchase, a note with no periodic interest payments is valued at the present value of the future principal payments (face value). The present value calculation for notes paying periodic interest includes adding the present value of the future interest payments and the present value of the future principal payments. Since they are purchased at a discount, Treasury bills are effectively sold at their present value.

To recognize interest income consecutively over the life of a Treasury obligation, the interest method should be used. The interest method is used to amortize the discount or premium and recognize interest income (FASB Codification 835-30-35-1). The prevailing market rate for similar securities, also called the effective interest rate, at the time of purchase should be used when performing the interest method. Interest income is calculated by multiplying the purchase price by the effective interest rate. The interest income is added to the principle and carried to the next period’s beginning balance. This process is continued for every period until maturity. At maturity, the discount or premium will be fully amortized and the book value of the Treasury obligation will equal the face value of the Treasury obligation. Illustration provided at (FASB Codification 835-30-55-5).

Nonprofits must record investments at a fair market value on the statement of financial position (FASB Codification 958-320-35-1). Discounts and premiums are presented as either a deduction or addition of the Treasury obligation face value on the financial statements (FASB Codification 835-30-45-1A). Unrealized gains and losses from changes in fair market value are included in earnings (FASB Codification 320-10-35-1). Investment gains and losses are reported on the statement of activities as an increase or decrease to net assets (FASB Codification 958-320-45-1).

For example, consider the purchase of a two-year Treasury bill for $907, which has a face value of $1,000. The prevailing market rate at the time of issuance is 5% (compounded annually).

Journal entry to record the initial purchase:

Dr. Investment in T-bill 907

Cr. Cash 907

The interest rate method calculation is:

Journal entry to record the accrued interest at the end of year 1:

Dr. Investment in T-bill 45

Cr. Interest Income 45

At the end of the first year, assume interest rates have increased and the market value for a 1-year Treasury bill is now $934. After the first year, the book value of the Treasury bill purchased is $952 (purchase price of $907 plus year 1 accrued interest of $45), producing an unrealized loss of $18.

Journal entry to record the unrealized loss on the Treasury bill:

Dr. Unrealized loss 18

Cr. Investment in T-bill 18

Journal entry to record the accrued interest at the end of year 2:

Dr. Investment in T-bill 48

Cr. Interest Income 48

Journal entry to record receipt of face value at maturity:

Dr. Cash 1,000

Cr. Investment in T-bill 982*

Cr. Realized gain 18

*Ending book value is $1,000 face value less the $18 unrealized loss recorded after year 1.

For more information about accounting practices for debt securities, contact Aprio’s experienced advisors .

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Stay informed with Aprio. Subscribe now.

Recent articles.

NIST CSF 2.0 – Critical Updates and Need to Know Information

Unlocking Opportunities: Joint Ventures and the GSA Multiple Award Schedule

Important Considerations for the US Chile Tax Treaty

Investment Advisers: Prepare for New Anti-Money Laundering Rules

Income Tax Filing

File Income tax returns for free in 7 minutes

Expert Assisted Services

Get expert help for tax filing or starting your business

Tax Saving New

Curated Mutual Funds & plans for tax savings

Mutual fund Investments New

Invest in best Growth mutual funds

- e-Invoicing Software

Complete solution for all your e-invoicing needs

GST Software

Complete GST filing & billing solution

TaxCloud (Direct Tax Software)

I-T, e-TDS & Audit Software for CAs & Tax Professionals

- e-Invoicing

- Mutual Funds

- My Tax Returns

- My investments

- This page is best viewed in Chrome, Firefox or IE 11

- My Investments

- Download Black App

Recent Articles

- Invoice Factoring vs Supply Chain Financing

- Working capital challenges faced by Indian vendor ecosystems

- What can go wrong if vendor e-invoices aren’t validated?

- How Does Trade Discount or Early Payment Discount Benefit Buyer?

- Dynamic Discounting vs Traditional Trade Discounting

- InvoiceDiscounting

Bill discounting for business growth

Updated on : Feb 09, 2022 - 06:51:46 PM

08 min read.

Bill discounting is a simple process of selling the bill of exchange to the bank or a financial institution before its maturity at a price less than its actual price. The discount charges will depend on how much time remains for its maturity and the risk factor involved.

Meaning of bill discounting

Bill discounting is a type of invoice financing in which funds are issued against unpaid sale invoices. The financial institutions issue an advance to the seller at discounted rates. The business is not required to pledge any asset as collateral. The loan is advanced based on unpaid sale invoices. At the time of maturity of the invoice, the business will collect the payment from its customer and make the repayment to the financial institution. It is an easy way to improve cash flow in the organisation.

Advantages of bill discounting

- Fast and easy- The documentation required is very minimal. The financial institution grants loans within hours in case of emergencies.

- Collateral free- No asset is required to be kept as collateral. The loan is granted against unpaid sale invoices.

- Cost-effective lending facility- Bill discounting has two costs, i.e. service cost and discounting charge. The service fee is usually charged as a percentage of the annual turnover, and discounting charge is the cost of lending money. Despite these two charges, it is considered the most cost-effective lending facility by ensuring quick access to cash.

- Maintains confidentiality- The business has complete control over its sales ledger, and the customer is nowhere in the loop in this type of financing.

Ways in which bill discounting help business grow

- Helps in improved cash flows- Instant cash availability helps strengthen the business’s momentum. By opting for bill discounting, a business has enough funds to run its operations smoothly and even carry out expansion activities.

- Improved customer trust- When the customers know that they have time to make payments and the business is not solely dependent on that cash for its daily operations; they will trust you more. This will bring you more customers.

- Helps to shorten the cash cycle- The time involved to complete the cycle of selling goods and releasing its money is an extended period. In this period, one can undertake new projects to expand the business. One can trim this cash cycle by opting for invoice discounting.

- Helps to address emergencies- Businesses usually face emergencies to change in market demand of their goods or services. One can promptly face these emergencies if cash access is easy. Increased demand can be met by increasing production as cash is readily available.

- Easy credit availability- Nowadays, availing credit has become hassle-free with digital financial solutions. One can just upload the unpaid bills and avail funds by following a few simple steps. Easy credit availability helps to grow business.

Thus, we can conclude that by availing bill discounting facilities, one can make utmost use of its resources and grow its business.

Thank you for your feedback

- Media & Press

- User reviews

- Engineering blog

- Clear Library

- FinTech glossary

- ClearTax Chronicles

- GST Product Guides

- Trust & Safety

- Income Tax e Filing

- ClearInvestment

- ClearServices

- Mutual Funds & ITR e-filing App

- e-filing app Download

- CA partner program

- ClearTaxCloud

- Clear app Download

- Billing Software

- Invoicing Software

- ClearE-Waybill

- eWay Bill Registration

- Income Tax efiling

- Income Tax App android

- Efiling Income Tax

- Secion 80 Deductions

- Income tax for NRI

- Capital Gains Income

- House Property

- Income Tax Verification

- How to e-file ITR

- Income Tax Refund status

- File TDS Returns

- Income Tax Slab

- What is Form 16

- Salary Income

- How to File TDS Returns

- New Income Tax Portal

- Incometax.gov.in

- Mutual funds

- Best Tax Savings Mutual Funds

- SIP Mutual Funds

- Guide to tax savings

- SBI Mutual Fund

- Nippon Reliance mutual fund

- HDFC Mutual Fund

- UTI mutual fund

- ICICI Prudential Mutual Fund

- Aditya Birla Mutual Fund

- Axis mutual fund

- Motilal Oswal Mutual Fund

- Canara Robeco Mutual Fund

- Kotak Mutual Fund

- DSP Blackrocks Mutual Fund

- L&T Mutual Fund

- Edelweiss Mutual Fund

- Mirae Mutual Fund

- Income tax calculator

- GST calculator

- HRA calculator

- Find HSN code

- Generate rent receipts

- SIP calculator

- Mutual fund calculator

- GST number search

- FD Calculator

- Get IT refund status

- EMI Calculator

- PPF Calculator

- RD Calculator

- Tax Saving Calculator

- NPS Calculator

- Home Loan EMI Calculator

- HSN Code Finder

- IFSC Code Search

- Gold Rates Today

- GST Number Search by Name

- GST software

- New GST returns

- e-invoicing

- Input tax credit

- GST returns

- GST invoice

- GST services

- GST calendar

- Invoicing & Billing

- Tax filing for professionals

- Tax filing for traders

- Launch your business

- Services for businesses

- Trademark Registration

- Company Registration

- TDS returns

- Clear Launchpad

- Clear Max ITC

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Finance Articles

Discounting

Finding the present value of a sum of money or a series of cash flows received in the future.

Osman started his career as an investment banking analyst at Thomas Weisel Partners where he spent just over two years before moving into a growth equity investing role at Scale Venture Partners , focused on technology. He's currently a VP at KCK Group, the private equity arm of a middle eastern family office. Osman has a generalist industry focus on lower middle market growth equity and buyout transactions.

Osman holds a Bachelor of Science in Computer Science from the University of Southern California and a Master of Business Administration with concentrations in Finance, Entrepreneurship, and Economics from the University of Chicago Booth School of Business.

Elliot currently works as a Private Equity Associate at Greenridge Investment Partners, a middle market fund based in Austin, TX. He was previously an Analyst in Piper Jaffray 's Leveraged Finance group, working across all industry verticals on LBOs , acquisition financings, refinancings, and recapitalizations. Prior to Piper Jaffray, he spent 2 years at Citi in the Leveraged Finance Credit Portfolio group focused on origination and ongoing credit monitoring of outstanding loans and was also a member of the Columbia recruiting committee for the Investment Banking Division for incoming summer and full-time analysts.

Elliot has a Bachelor of Arts in Business Management from Columbia University.

What Is Discounting?

Understanding discounting.

- Formulas For Discounting

- Understanding The Discount Rate

- Practical Examples Of Discounting

Discounting is a crucial idea in finance which includes finding the present value of a sum of money or a series of cash flows received in the future. It revolves around a recurring financial motif called the time value of money .

This notion in finance means that a dollar in your pocket today is worth more than a dollar in your hands in the future. That is because if you can earn interest on that dollar that you have today while you wait for it to grow.

One dollar we have today invested in the right place will grow to become more than a dollar in the future. That is why it is always preferable to have a dollar right now than to have a dollar in the future. Therefore, consumers and investors should always consider their decisions regarding spending or investing their money.

It is also coherent with the idea of the present value of an asset, a sum of money, or a stream of future cash flows. When we discount any of these, we are essentially finding the present value of these assets at an earlier date, particularly the current date.

Present value is a crucial concept to understand for every investor and manager. For example, someone may want to know how much money they should invest now to have a certain amount of money in 10 years.

That question is answered by discounting the amount of money the person has in mind by 10 years. Naturally, the present value of that sum of money will be much less than the amount of money needed at the end.

That is because a dollar today is more valuable than a dollar after 10 years. Of course, the investor must have a specific interest rate in mind - the discount rate - which will be used to discount the sum of money to its present value.

This means transforming the future value of a sum of money or a series of cash flows into its present value: how much it would be worth today. Discounting is the opposite of compounding, which means transforming the present value into its future value.

It is essential in determining the price of different assets. The price of an asset that provides cash flows in the future is the discount of those cash flows. Discounting deals with price problems depending on a company's potential future financial success.

Take stocks, for example. Because the value or price of an asset is the present value of its future cash flows, we can theoretically find the price of a stock. The future cash flows a stock can have are called dividend payments.

So what is the current value of the stock? To find the price of a share, all we have to do is discount its future cash flows - that is, the dividends - to the current date. This can provide insights into how to value a stock based on the announced dividends that it will pay.

Stocks can pay different amounts of dividends or have equal dividend payments yearly. When a share pays equal dividends across several years, it is called an annuity payment. Alternatively, it can have a growing dividend at a certain percentage each year.

In addition, equal dividends can be paid throughout the corporation's life forever. This is called payments in perpetuity (coming from the word perpetual). Finally, there is a method to discount each payment using different formulas, all of which will be discussed later.

Another vital asset whose price or current value can be determined by discounting is bonds. Bonds have a face value, also called par or maturity value which describes the bond’s value when the bond is first issued.

It is also called maturity value because it totals the principal amount paid back to the holder at the end of maturity. Bonds also have interest payments , known as coupon payments.

To find the price at which the bonds are traded, we should discount the future coupon payments to find their present value. In addition, we should also discount the face value of $1,000 to the current date and add it to the present value of the stream of coupon payments.

Formulas for Discounting

There are multiple formulas to be able to discount future cash flows to the current date. All of these formulas almost have the same variables arranged differently:

Present value (which can also be referred to as principal or balance),

Future value (which can also be referred to as face value),

Periodic payments, as in the case of annuities and perpetuities (which can also be referred to as coupons),

Interest rate (which can also be referred to as discount rates),

The number of periods.

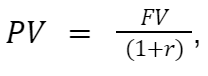

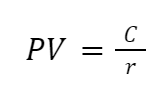

The most fundamental formula when it comes to discounting is the present value of a lump of money to be received in one period into the future:

PV: present value, the current value of an amount of money or a series of cash flows, is discounted using a predetermined discount rate.

FV: future value, which is the value of an asset or a sum of money at a future date, given that asset’s present value.

r: the discount rate, the rate at which future values are discounted to the current period.

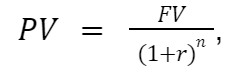

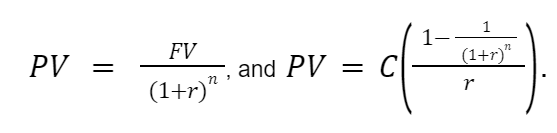

If the sum of the money were to be received after more than one period, then the formula would undergo a minor addition:

“n” is the number of periods after which a lump sum of money will be received. This formula is the one that most accurately represents the time value of money. This formula can also find the total present value of multiple future cash flows in different periods.

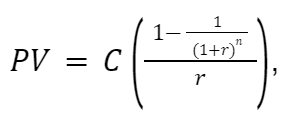

The following formula is important in discounting an annuity payment. An annuity is characterized by same-sized payments equally spaced between two points in time. It is a stream of equal and periodic payments. The formula for the present value of an annuity is:

Multiple variables need to be labeled in this formula:

C represents the periodic cash inflows in which annuities are characterized.

The variable “n” represents the number of periods, the same as the number of payments occurring throughout the annuity.

r represents the discount rate

Knowing the three variables “C,” “n,” and “r” will suffice to calculate the present value of an annuity. Nevertheless, we can also find the values of any of those variables as long as we know the present value of the annuity.

One thing to keep in mind when calculating annuities is the timing of the periodic payments. In the formula, it is assumed that payments are being made or received at the end of each period. This usual case is known as an ordinary annuity.

If payments are made at the beginning of each period, this is known as an annuity due , and the calculations slightly differ to discount an annuity due. We just have to multiply the PV of an ordinary annuity by (1+r), and we will have the present value of an annuity due.

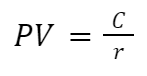

The final formula important in discounting is being able to discount a perpetuity payment.

Perpetuity is similar to an annuity because the cash inflows are equal and periodically spaced. The difference is that perpetuities go on forever (coming from the word perpetual).

This formula can be used in stock valuation . For example, some corporations promise their shareholders dividends in perpetuity, so this formula is suitable to estimate the current value of that stock. This is also known as the Dividend Discount Model or the Gordon Growth Model .

1. All the equations above can be rearranged to solve for variables other than the present value.

2. The discount rate r is denominated for the relevant period. That is to say. When payments are made yearly, the interest is denominated as an annual interest rate. If payments were made monthly, the interest rate should be divided by 12, and the number of periods should be multiplied by 12.

3. Usually, it is impossible to determine the discount rate r by rearranging the formulas; it requires a financial calculator or spreadsheet software like Excel

Understanding the Discount Rate

In short, the discount rate is the interest rate used to find the present value of future cash flows. It is a percentage applied in discounted cash flow analysis ( DCF ). It can also have other meanings, such as the rate the Fed charges to banks for short-term loans.

However, the first meaning of the discount rate is the one of interest in our topic. It is the interest rate used to find the present value of the expected future cash flows. For example, discounting $1,100 in one year to the current date using a discount rate of 10% yields a PV of $1,000.

Every investor and financial manager has to decide upon a reasonable and accurate discount rate to find the present value of investments. Once the discount rate is decided upon, estimating future cash flows will enable them to calculate the PV of such projects.

An appropriate discount rate is crucial in DCF since an investor can make erroneous decisions after calculating the present value of an investment. After all, the PV of a project indicates how much value it creates and how profitable it can be.

For assets that don’t carry risks above normal levels, the most appropriate rate that can be used is the risk-free rate. This rate represents the return of an investment or asset with zero risk. It is typically equal to the interest rate on 3-month US treasury bills.

On the corporate level, the most commonly used discount rate is the weighted average cost of capital (WACC). This is because companies usually invest in assets and projects with more risk than safer ones, like treasury bills.

WACC is inherently a percentage that shows us the company's cost to acquire new sources of finance, mainly debt and equity. That is why it is a weighted average between using debt and giving out equity to finance projects.

Practical examples of discounting

The two main real-life examples that will be discussed are finding the value of a stock and finding the value of a bond. For the stock, we will use the perpetuity formula, and for the bond, we will use the annuity formula.

1. Suppose a preferred stock pays $1 every quarter to its shareholders. At a discount rate of 10%, at what price should the stock sell today? This situation represents perpetuity since equal payments are being made indefinitely. Recall the formula of the PV of perpetuity.

C is the number of periodic payments, and r represents the discount rate. Since the payments are made quarterly, we must change the denomination of the interest rate from a yearly to a quarterly rate. This is done by dividing the 10% by 4 to get 2.5%.

Therefore, the stock should sell for PV = $1 / 0.025 = $40.

2. What is the value of a bond with a face value of $1,000 that pays a semiannual coupon with a coupon rate of 14%? The bond matures in 7 years, and the market's yield to maturity (the discount rate) is 16%.

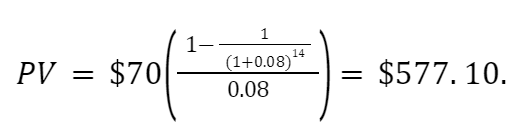

Most bonds have two types of payments. The first is the stream of coupon payments (annuity). With a coupon rate of 14% on the $1,000 face value, the bond pays $140 coupons per year. Since the payments are semiannual, the bond pays $70 every six months.

The second type of payment is future repayment. It represents a lump-sum return of capital of $1,000 after seven years when the bond matures. Therefore, finding the value of the bond requires combining the annuity and the lump-sum present value formulas. Recall the formulas:

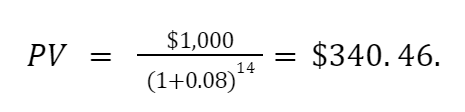

Remember that we should transform the 16% discount rate into a semiannual rate by dividing it by two and multiplying the number of periods (7) by 2. First, we calculate the present value of the $1,000 on the current date, which is equal to:

Then, we calculate the present value of the stream of coupon payments in the form of an annuity:

Therefore, the bond's current price is the sum of the two calculated present values. Therefore, the bond should currently sell for: $340.46 + $577.10 = $917.56.

Everything You Need To Master DCF Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Researched and Authored by Vatche Tchelderian | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Agency Costs

- Earnings Call

- Thai Baht (THB)

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

IMAGES

VIDEO

COMMENTS

The preparation and presentation of financial statements require the preparer to exercise judgement - e.g. in terms of the choice of accounting policies, the ordering of notes to the financial statements, how the disclosures should be tailored to reflect the reporting entity's specific circumstances, and the

S-X 4-01(a)(1) requires financial statements filed with the SEC to be presented in accordance with US GAAP, unless the SEC has indicated otherwise (e.g., foreign private issuers are permitted to use IFRS as issued by the IASB). Regulation S-K Item 10(e) prohibits the inclusion of non-GAAP information in financial statements filed with the SEC.

Publication date: 10 Mar 2024. us Financial statement presentation guide. A PDF version of this publication is attached here: Financial statement presentation guide (PDF 14.4mb) PwC is pleased to offer our Financial statement presentation guide. This guide serves as a compendium of many of today's presentation and disclosure requirements ...

11.3.1.4 Drafts payable. A draft is an order to pay a certain sum of money. It is signed by the drawer (e.g., an insurance company for a claim payment) and payable to order or bearer (e.g., an insurance policyholder). When the draft is presented to the drawee (i.e., the bank), it is paid only upon the approval of the drawer.

Approval by the Board of Classification of Liabilities as Current or Non-current—Deferral of Effective Date issued in July 2020. Classification of Liabilities as Current or Non-current—Deferral of Effective Date, which amended IAS 1, was approved for issue by all 14 members of the International Accounting Standards Board. Hans Hoogervorst.

In this Essentials, we highlight two of the principles in IAS 1: 1. Financial statements should fairly present the company's performance; and. 2. Disclosure of immaterial items can obscure material information. We explain how investors can use their knowledge of these fundamental principles of IFRS to have an efective dialogue with management ...

Once the debits and credits have been settled, presentation and disclosure is how that information is conveyed to financial statement users in a transparent, understandable and consistent manner. Disclosure goes 'behind the numbers' and is necessary to fully understand the financial statements. ASC 205 to 280 in the FASB's Accounting ...

This standard specifies that you should present the revenue net of discounts. Just refer to IFRS 15.47 and following. In other words, discounts reduce the amount of your revenue and do not represent cost of sales (or cost of promotion etc.). For example, when you sell a machine for CU 100 and you decide to provide a discount of 3%, then you ...

in financial statements and regulation that dictates corporate behaviour e.g., in the UK the pensions regime is governed by The Pensions Regulator. • The sensitivity of reported values to small changes in the discount rate were acknowledged by a range of interviewees and across standards.

Possible future standard setting by the IASB 4. Key financial reporting considerations for supplier financing arrangements 5. Derecognition of the trade payable 6. Presentation in the statement of financial position 8. Presentation in the statement of cash flows 10. Disclosures 12.

when necessary, is presumed to result in financial statements that present a true and fair view. 10 1p27 An entity prepares its financial statements, except for cash flow information, using the accrual basis of accounting. 11 1p10 (a),(b),(c), (d),(e),(ea), (f) Include the following components in the financial statements:

KPMG

The step-by-step process of bill discounting is given below: A seller supplies goods or services to a buyer and raises an invoice. The buyer accepts the invoice. This approval means the buyer acknowledges the invoice and promises to make the payment on the due date. The seller approaches the financial institution to get the bill discounted.

Let us take the example of DFG Inc., which sold merchandise to SWE Inc. on March 31, 2019, for a sales price of $100,000 with the terms - 10%, 5/10, n/30. Prepare the journal entries for recording the transaction if: SWE Inc. makes the payment on April 15, 2019, i.e., after a 5% discount expiry. SWE Inc. makes the payment on April 07, 2019 ...

Bill discounting is a financing option that allows businesses to get cash advances against their outstanding invoices. In other words, bill discounting is a process of selling unpaid bills to a third-party financier (known as a discounting agency) at a discount, in exchange for immediate cash. How it works: The process of bill discounting is ...

There are certain instances outside of ASC 450 (e.g., in the accounting for asset retirement obligations) where discounting is required. IFRS requires that the amount of a provision be the present value of the expenditure expected to be required to settle the obligation. The anticipated cash flows are discounted using a pre-tax discount rate ...

Discounting is the process of determining the present value of a payment or a stream of payments that is to be received in the future. Given the time value of money , a dollar is worth more today ...

Change presentation and calculation Add implementation note 3-8 1B. Share-based payment expense Change labels Add new common practice and calculation 9-16 1C. Unwinding of a discount Change labels 17-23 2. Other Comprehensive Income Type of change proposed Slide 2A. Currency translation gains or losses Add new line items with disclosure ...

Cash 907. The interest rate method calculation is: Journal entry to record the accrued interest at the end of year 1: Dr. Investment in T-bill 45. Cr. Interest Income 45. At the end of the first year, assume interest rates have increased and the market value for a 1-year Treasury bill is now $934.

The financial institution grants loans within hours in case of emergencies. Collateral free-No asset is required to be kept as collateral. The loan is granted against unpaid sale invoices. Cost-effective lending facility- Bill discounting has two costs, i.e. service cost and discounting charge. The service fee is usually charged as a percentage ...

It is the interest rate used to find the present value of the expected future cash flows. For example, discounting $1,100 in one year to the current date using a discount rate of 10% yields a PV of $1,000. Every investor and financial manager has to decide upon a reasonable and accurate discount rate to find the present value of investments.

This process of selling and getting short-term financial assistance is bill discounting. It is now the financier that further pursues the payment of the unpaid bill, not the company. Factoring and reverse factoring are the other two methods for bill discounting designed to increase the cash in-flow in the company efficiently.

2. Trade and Cash Discount 2.1 Trade Discount Generally, trade discount is provided by manufacturer on the retail price of a product when it sells its product to a reseller. It is deducted from the price at the time of sale and reseller pays the net amount. Trade discount reflects the profit margins of the reseller because it sells the product ...