- 33 Online Shopping Questionnaire + [Template Examples]

Online shopping is increasingly becoming the most preferred shopping option across the globe. In 2019 alone, an estimated 1.92 billion people purchased goods or services online. This has created a need to offer good customer service to online shoppers, which is why you need an online shopping questionnaire.

An online shopping questionnaire helps you to study users’ behaviors, experiences, and preferences as they shop items from your e-commerce store. In this article, we will discuss 33 questions you should include in your online shopping questionnaire to help you understand your customers’ needs.

Online Shopping Survey Questions

The types of questions listed in your online shopping survey must reflect the aims and objectives of the data collection process. Also, be sure to ask good survey questions that allow respondents to freely communicate their thoughts and perceptions without boxing them into a corner.

Close-ended questions, open-ended questions , and dichotomous questions are examples of good survey questions that you can add to your online shopping survey.

Close-Ended Questions

A close-ended question is a type of survey question that restricts respondents to a set of answer-options to choose from. In other words, the researcher provides options for you to choose from in response to the question. Close-ended questions help you to gather quantitative data .

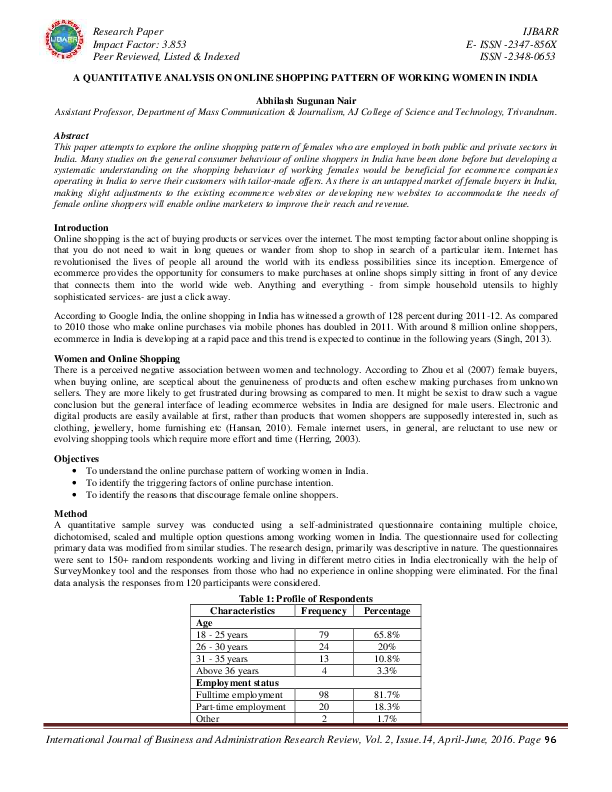

11 Close-ended Questions for an Online Shopping Questionnaire

How often do you shop on this site, choose 2 products you buy frequently on this site..

- Accessories

- Perfumes and Oils

- Skincare products

What is the biggest challenge you face with shopping online?

- Slow checkout time

- Lack of products I want

- Slow webpage response time

How likely are you to recommend this site to other online shoppers?

- Very likely

- Somewhat likely

- Very unlikely

What is your biggest concern about online shopping?

- Breach of personal information

- Breach of payment details

- Poor internet connection

How much do you spend on online shopping every month?

- Less than 100 USD

- $100 – $500

- $500 – $1000

- More than 1000 USD

How many times do you shop online in a month?

- More than thrice

Which payment method do you prefer for online shopping?

- Payment Gateways

- Bank transfer

How would you rate your overall online shopping experience?

How likely are you to return to this webpage for your online shopping.

- Highly unlikely

What is your gender?

- Others. Please state

- Prefer not to say

Open-Ended Questions

This is a type of survey question that does not limit respondents to predetermined answers. Open-ended questions allow you to fully communicate your ideas and perceptions in response to a question. You can describe them as free-form survey questions.

Examples of Open-Ended Questions in an Online Shopping Questionnaire

- Describe your online shopping experience with us . This question allows your customer to provide a holistic view of their overall customer experience with your organization.

- Describe a negative experience you had while shopping online . This question allows customers to highlight any areas needing improvement in your online store.

- Describe a positive experience you had while shopping . Let customers identify strong points when it comes to online shopping with your brand.

- Why do you shop online with us? With this question, you would be able to identify the unique selling points of your brand across different customer segments.

- How old are you ? This question helps you to understand who your customers are; that is, the different age groups that your brand appeals to.

- Which products do you buy regularly? The responses to this question will help you to identify fast-moving products and to categorize your stock accordingly.

- Have you experienced any difficulty with adding products to your online cart? This question allows respondents to provide specific feedback on definite aspects of your online shopping operations.

- What do you think about the pricing of our products ? Use this question to collect feedback on product pricing to avoid overcharging or under-charging your customers.

- What do you think about the quality of our products? This question allows you to collect first-hand feedback from customers in terms of the quality of your product(s).

- What other online store do you shop on? The answers to this question make it easy for you to identify your competition. You can leverage this data to create a better customer experience for your clients.

- What major challenges have you encountered while shopping on our site ? This question allows you to identify and address customer dissatisfaction easily. After identifying the challenges faced, you should work on providing sustainable solutions to them.

Dichotomous Question

A dichotomous question is a type of close-ended survey question that provides respondents with 2 opposite answer options for them to choose from. Common answer options in dichotomous questions include true/false, yes/no, fair/unfair, to mention a few.

Dichotomous Question Samples for an Online Shopping Questionnaire

Did you enjoy the online shopping experience on our website.

This question allows customers to provide feedback on the overall shopping experience.

Do you always shop on our website?

This simple question allows you to track consumer retention for your organization.

Would you recommend our website to others?

Positive responses to this question serve as an indicator of a good customer experience.

Our website provided the best online shopping experience.

Just like the first question in this section, this question helps you to gather feedback on your overall online shopping experience.

Do you have any challenges with our checkout method?

Get direct feedback from customers about your e-commerce checkout process on your website.

Our product prices are affordable.

This question allows you to gather feedback from customers about product pricing.

Have you ever had a bad experience while shopping with us?

This question allows you to track and address customer dissatisfaction.

Do you have any concerns about your data privacy while shopping online?

I always use the credit card option for my online shopping transactions..

This question prompts customers to indicate preferred payment options.

I always use the bank transfer method for online shopping transactions.

Just like the question above, customers can provide responses here that allow you to identify preferred payment methods for your e-commerce store.

Do you always shop online?

Responses to this question provide insight into customers’ behaviors and preferences.

Can’t find your preferred Online Shopping survey template? ithCreate yours for free with the easy-to-use Formplus builder

How to Create an Online Shopping Questionnaire with Formplus

With Formplus, you can create a smart online shopping questionnaire and either add the form to your website or share it with your customers using our multiple form sharing options. Formplus makes it easy for you to collect and process data from your customers, and this helps to improve customer experience and consumer satisfaction for your organization.

Follow these steps to create your online shopping questionnaire from scratch using Formplus.

- If you do not have a Formplus account, visit www.formpl.us to sign up for your Formplus account. If you have a Formplus account, visit the aforementioned website and click on the “Access Dashboard” button to gain access to your personalized Formplus dashboard.

- Once you have access to your Formplus dashboard, click on the “create new form” button to start building your online shopping survey. You’d find this button at the top left corner of your dashboard.

- Alternatively, you can modify any of the existing Formplus templates to suit your data collection needs. All you need to do is click on the “template” option on the dashboard navigation bar and then, follow the prompt.

- Now, you should be in the form builder. This is where you create your online shopping form. Start by adding the form title to the builder’s title bar.

- Next, go to the form fields section located on the left side of the form builder. There, you’d find more than 30 form field options including digital signature fields, payment fields, date-time validation, and so on. You can add any of these fields to your form by simply clicking on them or drag and drop the field from the builder’s inputs section.

- After adding the fields, click on the pencil icon just beside each field to access the form fields editing section. Here, you should add your question(s) and/or options.

- When you’ve added and modified all preferred fields accordingly, click on the save icon just at the top right corner of the builder. This automatically saves the form and takes you to the builder’s section.

- The Customize section is where you can change the look and feel of your online shopping survey. You can add preferred background images to your form, embed your organization’s logo, change the form font, or even customize the form layout using CSS.

- To add the online shopping survey to your website simply, go to the form builder’s “Share” page. You’d find it on the builder’s navigation panel right at the top corner.

- Click on the “embed” tab on the sidebar.

- You’d see 4 options here: Use as Pop-up, Use as iFrame embed, Embed in Facebook Page, and Embed in WordPress site.

- Click on “use as iFrame embed” and copy the displayed code.

- Paste the code at the appropriate place to add it to your site.

- If you have a WordPress website, you can embed the form by choosing the “Embed in WordPress site” option, copy the shortcode, and paste it inside your WordPress editor.

- Copy the form link and share it with respondents.

Importance of an Online Shopping Survey

E-commerce businesses, especially, should prioritize online shopping surveys because these data collection tools are key to business optimization, improved customer experience, brand loyalty, and increasing revenue. Here are 6 ways that online shopping surveys can make a difference in your business.

- Understand Consumer Behaviour: With an online shopping survey, you’d have a better understanding of your customers’ online shopping behaviors with specific insights into their preferences, challenges, and experiences. This allows you to place them into distinct customer segments as part of market research.

- Seamless Data Collection: An online shopping survey is a fast, easy, and convenient method of data collection . Unlike paper forms and other traditional survey methods, an online shopping survey can be filled on the go which allows you to gather real-time information from respondents, instantly.

- With a smart online survey, you’d find it easier to highlight current trends and patterns in consumers’ behaviors.

- Improved Customer Experience and Satisfaction: It helps you to immediately identify and address any challenges faced by your customers and to resolve these challenges accordingly. If you embed the survey into your e-commerce website, customers complete the questionnaire once they are done shopping on your webpage.

- Optimized Marketing Plans and Strategies: The data gathered via an online shopping survey can help you create a well-defined marketing plan and strategy for your organization. Having a clear knowledge of who your customers are and what different customer segments prefer typically empowers you to create specifically tailored adverts that appeal to each segment.

- It improves your organization’s response time to customers’ complaints.

Research shows that consumers spend an average of 5 hours shopping online every week and 92% of consumers shop online at least once a year . This, once again, emphasizes how much online shopping has become integral to our everyday lives.

If you want to create unforgettable online shopping experiences for your target audience, you must understand customers’ experiences and expectations. An online shopping questionnaire is a simple but effective data tool that helps you to gather objective data from consumers.

Connect to Formplus, Get Started Now - It's Free!

- compatibility questionnaires

- online questionnaire sample

- online shopping

- online store

- online surveys

- busayo.longe

You may also like:

Pilot Testing: Meaning, Importance + [Question Example]

This article will discuss what a pilot test is, best practices for implementing pilot tests and how Formplus can help create stellar...

Highest-Paying Survey Sites on the Web

In this post, we will highlight how the paid survey companies operate and we will also list out sites with legit paid surveys.

Survey or Questionnaire? 15 Differences & Similarities

Guide on differences between survey and questionnaires. + Survey Questionnaire tips, tools, advantages template and examples

4 Types of Questionnaire + Free Question Examples

For many years, questionnaires have been a popular data collection tool during research. Questionnaires are very diverse and

Formplus - For Seamless Data Collection

Collect data the right way with a versatile data collection tool. try formplus and transform your work productivity today..

Quantitative market research questions to ask for actionable insights

Types of quantitative market research questions, 36 quantitative research questions and examples, how to write your own quantitative market research questions, how to collect insightful data from your quantitative surveys, receive quantitative insights in weeks, not months.

There’s a big difference between asking “Why do you like our product?” and “On a scale of 1-10, how much do you like our product?” But both ways of asking are valuable in their own way.

Knowing your audience is not about guesswork or intuition, it is about concrete data. And while it’s valuable to learn the ‘why’ behind the ‘what’ with qualitative research, quantitative research is just as necessary — to spot trends, patterns and more.

Unlike qualitative research, which explores attitudes, opinions, and motivations through open-ended questions, quantitative research zeroes in on the numbers (see what we did there?). It’s the difference between gathering general opinions and collecting measurable, specific data.

But when is this approach the way to go? For starters, whenever you need to track factors over time, such as customer satisfaction. Or when assessing the popularity of a potential product feature, understanding demographic preferences, or analyzing consumer purchasing behavior in different locations.

Quantitative research reveals the impact and scale of sentiments for better decision-making. It’s also valuable when you’re looking to quantify the extent of a trend, measure the impact of a marketing campaign, or pin down the specifics of consumer behavior.

But how do you ask quantitative market research questions that don’t just scratch the surface? We’re here to give you some great examples of quantitative survey questions.

In the US? Check out these research platforms

Here are the top market research platforms in the US for reliable insights – check them out and start getting your insights today!

When thinking of quantitative market research questions, people often think ‘ ah, numbers ‘. But there’s more than meets the eye. Here’s how you can categorize the different types of quantitative research questions:

Descriptive quantitative research questions

These are your what , when , and how many types of questions. They help you sketch out the basic landscape of your market. For example, “How often do you shop online in a month?” or “What is your preferred method of payment while shopping online?” When you give answers people can select, it is quantifiable data. That’s different from asking: ”describe what a day out shopping looks like for you”, which is a qualitative question.

Comparative quantitative survey questions

These questions measure differences or changes over time or between groups. For instance, “How has your spending on online shopping changed since last year?” Comparative questions help you understand the dynamics and shifts in your market. Remember that you’re not just trying to find overlap: it’s just as important to know what differences there are.

Relationship-based quantitative survey questions

These questions aim to uncover correlations or relationships between two or more variables. They can reveal insights like, “Is there a link between age and the likelihood of using mobile payments?” These questions help you understand the deeper connections within your market, as well as test assumptions, as long as you dare to ask questions that challenge what you’re hoping to find.

Now, a quick note on reducing bias in quantitative survey questions . Here are some key points to remember:

- The key is in how you frame your questions.

- Always aim for neutrality.

- Avoid leading questions that suggest a particular answer.

- Be specific and clear to avoid confusion.

- Consider the order of your questions, as earlier questions can influence responses to later ones.

And finally, test your survey with a small group before a full rollout, to catch and correct any unintentional bias. This way, you ensure the data you collect is as accurate and reliable as possible, giving you the best insights to make those crucial business decisions.

If you want to make a quantitative survey that hits the spot, don’t just ask generic questions. We’re here with some examples that you can adapt to make your research a success.

Descriptive market research questions

With a descriptive quantitative research question, you can quickly get the most important info for your respondents on anything ranging from buying frequency to satisfaction levels.

- Insight : this question reveals the frequency of use, indicating customer dependency on your product or service.

- Benefit : understanding usage patterns can guide inventory management and marketing strategies.

- Insight : reveals the communication channels most favored by your audience.

- Benefit : tailor your customer service and marketing outreach to your customers’ preferred channels.

- Insight : provides an average spending figure for budget allocation in that category.

- Benefit : helps in pricing strategies and identifying the most lucrative customer segments.

- Insight : uncovers patterns in online shopping behavior.

- Benefit : optimizes the timing of online marketing campaigns and promotions.

- Insight : identifies the most effective channels for brand discovery.

- Benefit : informs where to allocate advertising spend for maximum impact.

- Insight : measures the likelihood (not effectiveness!) of word-of-mouth referrals.

- Benefit : assesses customer satisfaction and the potential for organic growth.

- Insight : highlights your unique selling points from the customer’s perspective.

- Benefit : guides messaging to emphasize what customers value most about your brand.

- Insight : offers a quantifiable measure of customer service satisfaction.

- Benefit : identifies areas for improvement in customer support.

- Insight : sheds light on the most popular aspects of your product.

- Benefit : informs product development and feature enhancement.

- Insight : uncovers the key motivators behind purchasing decisions.

- Benefit : helps create targeted marketing campaigns to focus on these driving factors.

Comparative market research questions

If you want to analyze and compare different variables, these questions can help.

- Insight : highlights changes in consumer spending habits over time.

- Benefit : useful for identifying trends and shifts in consumer behavior, aiding in long-term planning. Especially valuable if you add qualitative insights to this quantitative data.

- Insight : compares consumer preferences between different shopping channels.

- Benefit : guides omnichannel marketing strategies and resource allocation.

- Insight : tracks changing consumer values and preferences over time.

- Benefit : useful for aligning product development and marketing with evolving consumer values.

- Insight : compares the weight of price versus brand in purchasing decisions.

- Benefit : informs pricing strategies and brand positioning efforts.

- Insight : evaluates customer perception of marketing efforts in product packaging.

- Benefit : assesses the impact of packaging on brand image and customer approval.

What are the top research platforms in the UK?

Here’s our list of the pros and cons of key market research platforms for UK brands

Relationship-based questions for quantitative research

In quantitative research, especially when exploring relationship-based aspects, the key is not to cram multiple inquiries into one question but to ask them sequentially.

This approach allows for a clearer and more focused response to each individual question. Later, during the analysis phase, you can then correlate the responses to uncover relationships between different variables.

For instance, instead of asking, “How often do you use our product and how satisfied are you with it?”, split this into two separate questions:

- “How often do you use our product (daily, weekly, monthly)?”

- “On a scale of 1-10, how satisfied are you with our product?”

By asking these questions separately, you ensure that respondents clearly focus on each aspect without being overwhelmed or confused by a dual-focused question. This approach yields more accurate and reliable data.

After the survey, you can analyze the results to see if there’s a correlation between usage frequency and satisfaction levels.

Here are some examples of combinations that can work well:

- What is your age group?

- Insight : correlates age with shopping preferences.

- Benefit : you can tailor marketing and sales strategies to different age demographics based on their preferred shopping channels.

- How long have you been using our products/services?

- Insight : links customer tenure with brand loyalty.

- Benefit : assesses the impact of long-term use on loyalty, informing customer retention initiatives.

- What is your approximate annual income?

- Insight : examines the relationship between income levels and purchasing behavior for premium products.

- Benefit : guides product and pricing strategies targeting different income segments.

- How often do you use social media for product discovery?

- Insight : assesses if frequent social media use for product discovery actually influences online shopping behavior.

- Benefit : informs the effectiveness of social media marketing in driving online sales in your target market.

- How would you rate your satisfaction with our post-purchase customer service (scale of 0-10)?

- Insight : links the level of service post-purchase with the likelihood of repeat purchases.

- Benefit : identifies if customer service is negatively or positively affecting repeat custom rates.

Brand tracking questions for quantitative insights

One thing you should definitely gather numerical data on, is your brand’s health. Just like your own health, stats, and numbers matter and can show you where to further investigate to ask qualitative research questions about. Learn if your brand stands strong through market trends and gain insights on whether your brand is growing in terms of awareness — and in which segments.

- Insight : measures brand awareness among the target audience.

- Benefit : helps assess the effectiveness of your marketing and branding efforts.

- Insight : evaluates brand loyalty and the potential for organic growth through word-of-mouth.

- Benefit : indicates customer satisfaction and the potential for brand advocacy.

- Insight: Identifies the most effective channels for brand discovery.

- Benefit: Informs where to focus marketing efforts for increased brand exposure.

- Insight: Measures brand visibility and frequency of encounters with the brand.

- Benefit: Helps evaluate the reach and frequency of marketing campaigns.

- Insight: Determines which brand values resonate most with the audience.

- Benefit: Aids in refining brand messaging and aligning it with customer values.

Quantitative consumer segmentation questions

Quantitative questions about customer segments can go beyond age group and gender. King Charles III is the same age as Ozzy Osbourne – would you say they’re very similar?

It is vital that you look at more variables so you can really tell the difference between your respondents, and make informed decisions based on the whole truth. Putting these consumer profiling questions and answers in specific ranges helps you create segments to tailor your marketing and customer experience for, rather than just aiming at the entire population.

- Insight : helps understand the economic demographics of your customers.

- Benefit : assists in pricing strategies and identifying which income groups are most engaged with your brand.

- Insight : reveals geographical spread and regional preferences.

- Benefit : guides regional marketing efforts and product distribution strategies.

- Insight : helps categorize customers by education level.

- Benefit : useful for tailoring communication and content complexity to different education backgrounds.

- Insight : provides insights into the professional background of your customers.

- Benefit : helps in creating industry-specific marketing campaigns and products.

- Insight : gives an idea of household size and composition.

- Benefit : useful for targeting products and services aimed at families or individuals.

- Insight : identifies customers who are parents of minors (which is different from parents of young adults, or even grown adults).

- Benefit : informs product and marketing strategies aimed at families with children.

Okay, so now you got the gist of it and have seen what quantitative questions can look like — as they come in all shapes and sizes. But they might feel too generic for your research, or you’re looking for something specific.

Here’s how you can whip up your own quantitative questions that deliver the insights you need for data-driven decisions.

Identify the key variables you need to measure

Start by pinpointing exactly what you want to know. Is it customer satisfaction, buying behavior, or brand awareness? Determining the specific variables you need to measure sets the foundation for your entire survey.

Choose the right survey distribution method

Think about how your questions will reach your audience. Will it be online through email or social media, over the phone, or in person? Your method should align with where your target audience is most active and responsive.

Make sure your questions are crystal-clear and unequivocally unbiased

We’ve mentioned it earlier, and we’ll do it again if we have to. The way you phrase your questions can make or break your survey. Aim for clarity and simplicity – questions should be easy to understand and answer. Avoid leading or loaded questions that might sway a respondent’s answer. Remember: it’s a survey, not a sales pitch.

Know where to ask for more detailed information and qualitative data

Quantitative market research questions only tell part of the story. If you see interesting trends in say purchase behavior or price sensitivity, or a particular product gets a bad rating, dig a little deeper. Follow up important questions with qualitative research questions to analyze what’s going on behind the numbers.

If you don’t want to end up with a pile of quantitative data that doesn’t do much for you or breaks the bank unnecessarily, it’s vital you choose a form of distributing the survey that makes sense. You can work with UK market research companies to outsource it all, or do it yourself. Here’s a brief look at the pros and cons of popular methods:

Telephone surveys:

- Pros : good for less tech-savvy demographics.

- Cons : time-consuming, potentially costly, and declining response rates. They might be better for qualitative research.

In-person surveys:

- Pros : also avoids any confusion with tech.

- Cons : logistically demanding and expensive, not suited for quick data collection.

Online survey software:

- Pros : cost-effective, broad reach, real-time data analysis, and versatile formats.

- Cons : it’s extra important to pay close attention to survey design, so people don’t get the urge to give false answers just to get to the end.

The choice is yours, but generally, quantitative research thrives when done with online surveys and it’s the go-to method for most international market research . And here at Attest, we help you get even more out of it by giving you a chock-full toolkit. From various types of questions to robust analytical tools (and a dedicated research expert for when you need a little extra help) — we set you up for measurable success.

Speed and accuracy in market research matter — but we don’t want you to sacrifice quality. With Attest, you get fast, actionable and high-quality insights.

Which market analysis tool is right for you?

Check our rundown of the top platforms for market analysis – and start making better decisions with reliable insights in no time!

VP Customer Success

Sam joined Attest in 2019 and leads the Customer Research Team. Sam and her team support brands through their market research journey, helping them carry out effective research and uncover insights to unlock new areas for growth.

Related articles

A guide to brand tracking: what it is & how to boost your brand roi, brand tracking, how to gather consumer insights (and use them to improve your business), 12 brand management software, platforms and tools to understand customer perception in 2024, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

Determinants of consumer's online shopping intention during COVID-19

Journal of Electronic Business & Digital Economics

ISSN : 2754-4214

Article publication date: 13 June 2023

Issue publication date: 26 July 2023

This paper aims to determine the factors that influence the consumer’s online shopping intention in the current pandemic context (COVID-19). For this purpose, a conceptual model has been developed by introducing the constructs “attitude,” “perceived utility,” “intention” as well as the variable “perceived risk of contagion.”

Design/methodology/approach

After collecting data from the questionnaire diffused in Moroccan e-commerce websites, this study used various statistical analyses with the multiple regression model on the SPSS statistical software to confirm or refute the research hypotheses.

The results indicate that attitude and perceived utility positively affect online shopping intention. However, the variable “perceived risk of contagion” has a weak effect on such intention, which can be explained by the period in which the survey was started (a few months after the confinement).

Originality/value

The scientific contribution of this study lies in the insertion of a new factor that will be called “perceived risk of contagion” in the research model. This factor has been inspired by the perceived risk theory of Bauer (1960). Furthermore, all studies dealing with this topic have been carried out in developed countries, such as France, Great Britain, Germany and the USA. For this reason, the researcher believe that it is more appropriate to study the intention to buy online during the COVID-19 pandemic in one of the developing countries, such as Morocco. This is based on the fact that to develop theories, it is necessary to examine a given problem in several countries. The context plays a determining role in such situations.

- Online shopping

- Behavioral intention

El Moussaoui, A.E. and Benbba, B. (2023), "Determinants of consumer's online shopping intention during COVID-19", Journal of Electronic Business & Digital Economics , Vol. 2 No. 1, pp. 69-88. https://doi.org/10.1108/JEBDE-01-2023-0002

Emerald Publishing Limited

Copyright © 2023, Alaa Eddine El Moussaoui and Brahim Benbba

Published in Journal of Electronic Business & Digital Economics . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at http://creativecommons.org/licences/by/4.0/legalcode

1. Introduction

COVID-19 is a contagious disease caused by a virus called coronavirus, which has affected many countries around the world. This pandemic has infected people in 185 countries. As more and more cities are locked down, many businesses are forced to close. Furthermore, the COVID-19 pandemic has led consumers to avoid meeting others and, consequently, there was an increase in the rate of non-contact consumption among both young and old people, who rarely use laptops. They are avoiding crowds and leaving their homes less often due to this crisis. Reducing the purchases needed is becoming a new norm. With the closure of many physical stores, the e-commerce strategy has gained importance during this period ( Sahli, 2020 ).

The COVID-19 pandemic has dramatically changed consumer habits. Although pandemic crises are not common, a single pandemic wave can cause disastrous and unexpected consequences. The majority of studies dealing with diseases and epidemics are medical in nature. Thus, there is little research conducted from a social science perspective. These studies have in turn been carried out in developed countries, such as France, Great Britain, Germany and the USA ( Moon, Choe, & Song, 2021 ). For this reason, we believe that it is more appropriate to study the intention to buy online in the context of the pandemic in one of the developing countries, such as Morocco, so as to complete the theoretical inventory related to this topic, and consequently to give the possibility to other researchers to compare these studies while taking into account the culture, economy and technology. In fact, Ajzen (1991) and Triandis (1979) have conducted some studies on the same phenomenon (adoption of technology). These researchers, who have focused on behavioral intentions, stated that by understanding the determinants of online purchasing, we will be able to develop some decision elements for marketers. The development of our model, which was conducted during the epidemic period (COVID-19), will help businesses willing to enter the online business sector to better understand the behavior of potential customers.

In this article, we intend to answer the following question: what are the factors that have favored the adoption of online shopping by consumers since the announcement of the health alert? To this end, we have proposed a model showing the determinants of the intention to buy online during the period of the health crisis (COVID-19), focusing on the various theoretical models of technology acceptance, which are related to the marketing field and specifically to the consumer behavior area. Thus, our scientific contribution lies in the insertion of a new factor that we will call “perceived risk of contagion” in our research model. This factor has been inspired by the perceived risk theory of Bauer (1960) . Furthermore, all studies dealing with this topic have been carried out in developed countries, such as France, Great Britain, Germany and the USA. For this reason, we believe that it is more appropriate to study the intention to buy online during the COVID-19 pandemic in one of the developing countries, such as Morocco. This is based on the fact that to develop theories, it is necessary to examine a given problem in several countries. The context plays a determining role in such situations.

Our article is structured as follows: first, in Section 2 , we present a related work section that describes previous research. Then, in Section 3 , we present the research methodology used in our study. Next, in Sections 4 and 5 , we discuss the results obtained. In Section 6 , we summarize our study and suggest future research directions.

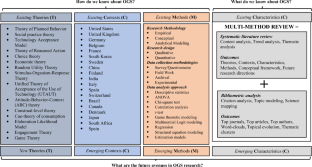

2. Literature review and hypotheses development

2.1 theories explaining the consumer’s online shopping behavior.

TRA: The precursors of the theory of reasoned action, Ajzen and Fishbein (1975) , have proposed a model that aims to explain and understand the behavior of individuals in various situations. This theory considers that each behavior is directly determined by the individual's intention to emit this behavior. In turn, behavioral intention is affected by two variables: the attitude toward the behavior and the subjective norm. As justified in Ajzen and Fishbein's (1975) work, attitude is determined by behavioral beliefs (beliefs about the probability of consequences) and evaluations of the quality or severity of those consequences. The second determinant of behavioral intention, which is the subjective norm, depends on beliefs about what people think they should do. Indeed, Sutton's (1998) meta-analysis confirms that the TRA has good validity, with the exception of being under-controlled only by intentional behavior, and lacking situational factors. This has led several researchers to test other ways of improving this theory. For these reasons, Ajzen (1991) was motivated to revise the theory of reasoned action while proposing the theory derived from the TRA which is the TPB.

TPB: To improve the TRA, Ajzen (1991) has developed a new theory derived from the TRA, which is the TPB. In this context, an additional determinant has been added: perceived behavioral control ( Ajzen, 1991 ; Emin, 2004 ). According to Ajzen's (1991) theory of planned behavior, any behavior that requires some reflection and/or planning, such as the realization of an online purchase, is affected directly by intention; the latter is determined by three variables: the attitude toward the behavior; the subjective norm; and the perceived behavioral control. The two first variables are previously defined. The third corresponds to the factors that facilitate or inhibit the execution of a given behavior ( Ajzen, 1991 ). In the context of our study, Moon et al. (2021 ) showed that when the consumer adopts a negative attitude toward COVID-19 and strongly perceives the subjective norm, he will choose online shopping channels over traditional ones. In addition, they indicated that the consumer would opt for online shopping channels when perceived behavioral control is significantly high; and vice versa.

TAM: In 1985, Fred Davis suggested a conceptual framework under the name of the TAM. He stated that the actual use of the system constitutes a response likely to be explained or predicted by the user's motivation. Davis, Bagozzi, and Warshaw (1989) showed that the latter can be explained by three factors: perceived ease of use, perceived usefulness and attitude. Davis suggested that the user's attitude constitutes a key factor in determining the user's use or rejection of the system. This attitude, in turn, is influenced by two major beliefs, namely, perceived usefulness and ease of use. Davis et al . (1989) defined the first belief as the level on which the person believes that the use of a particular system would improve their professional performance. Regarding the second belief, as the name suggests, it implies that the person uses a system without any effort ( Sharp, 2006 ). According to Marangunić and Granić (2015) , both beliefs are positively influenced by the design features of the system. Over time, Davis et al . (1989) found that attitude does not directly influence perceived usefulness and perceived ease of use. Based on these complementary results, a parsimonious TAM was suggested. The new model has incorporated behavioral intention as a new variable, which directly influences the perceived usefulness of the system ( Davis et al. , 1989 ). The other change introduced to the original TAM was the inclusion of certain factors called external variables.

IDT: Innovation diffusion theory was introduced in 1962 by Rogers. Its principal aim is to understand why, how and at what rate technologies spread through a social system ( Rogers, 1995 ). According to Al-Rahmi et al. (2019 ), an innovation that brings benefits, low complexity, perceived compatibility with existing beliefs and potential trialability, is likely to be diffused quickly and widely. Innovation diffusion theory adopts an opposite logic to that of behavioral change studies. It sees change primarily as a question of evolving or “reinventing” products and behaviors so that they better meet the individual's and group's requirements ( Wani & Ali, 2015 ). In this approach, it is not the people who change, but the innovations themselves ( Robinson, 2009 ). The innovation diffusion theory can be divided into four main elements, namely: innovation, time, communication system and social system.

CVM: Daily consumption is highly dependent on price-quality ratio, convenience, health concerns, habit and the individual's responses to institutional and social norms ( Biswas, 2017 ). According to Thye Goh, Mohd Suki, and Fam (2014 ), the model of consumption values is based on three major principles: (1) The benefits of each consumption value vary significantly from one situation to another; (2) consumption behavior depends on several consumption values; and (3) all consumption values are fully independent of each other. In fact, CVM takes into account various components of consumption values, such as attractiveness, price, emotions, quality and environmental impact ( Hur, Yoo, & Chung, 2012 ; Phau, Quintal, & Shanka, 2014 ). Some researchers have combined these components into just three factors, such as functional value, psychological value and environmental value ( Biswas & Roy, 2015 ; Biswas, 2017 ).

2.2 Online shopping intention

Today, online shopping has significantly increased the level of competition in the online market ( Akroush & Al-Debei, 2015 ) and changed consumer habits ( Kühn & Petzer, 2018 ; El Moussaoui, Benbba, & El Andaloussi, 2022 ; El Moussaoui, Benbba, & El Andaloussi, 2022 , El Moussaoui, El Moussaoui, Benbba, Jaegler, & El Andaloussi, 2022 ). Indeed, several research studies have concentrated on consumers' online shopping intentions in different contexts. Table 1 summarizes these studies (conducted over the last 5 years), by identifying the main factors influencing online purchase intention, the methodology used including sample size and the theory or model used to explain such intention.

Attitude: a major component of the individual's voluntary behavior was introduced for the first time in the TRA. It is a key variable in understanding decision-making ( Akar & Dalgic, 2018 ). It corresponds mainly to the feelings of pleasure, joy, satisfaction or dissatisfaction that the consumer relates to a given behavior. The literature has shown that there is a positive link between attitude and customers' online purchase intentions ( Singh & Srivastava, 2018 ; Yang, Li, & Zhang, 2018 ; Ha & Nguyen, 2019 ; Rehman, Bhatti, Mohamed, & Ayoup, 2019 ). Indeed, when consumers favor online shopping, they tend to adopt this behavior. According to Karahanna, Straub, & Chervany ( 1999 ), attitude determines the intention to use information technology. Thus, a favorable attitude to Internet usage tends to generate a positive intention to purchase online. Simultaneously, the literature ( Sabik, 2014 ; Ezzahi & Jazi, 2018 ; Bourchich & Nejjar, 2021 ) confirmed that the attitude toward Internet usage positively affects the intention to buy products online. In terms of the context of this study, consumers around the world have all experienced a shift in their shopping behaviors due to health concerns, anxiety and confinement ( Ozturk, 2020 ). Consumers' attitudes toward online shopping had an impact on their intentions to purchase products and services during the pandemic. According to a study conducted in Morocco on the basis of 114 respondents, Hajraoui and Chalabi (2021 ) found that only 4% of consumers surveyed adopted online shopping during the COVID-19 health crisis, against 96% who still prefer to make their purchases in physical stores (supermarkets, souk municipal, retail stores…), this explains that the Moroccan consumers have a low orientation toward the electronic commerce. This is what we seek to confirm through our study while supporting the idea that attitude affects behavioral intention during a health crisis. Hypothesis H1 is developed as follows:

There is a positive and significant relationship between the attitude (favorable, unfavorable) toward online shopping and the intention to buy online during the health crisis.

Perceived risk of contagion: Since the 1960s, perceived risk by consumers has been discussed extensively in the literature. It is demonstrated to affect all purchase decisions, as well as the intention ( Cox, 1967 ). Perceived risk guides consumer behavior significantly since people are interested in avoiding mistakes ( Mitchell, 1999 ). A situation is considered risky if the decision involves discomfort ( Taylor, 1974 ) or uncertainty ( Engel, Blackwell, & Miniard, 1990 ). According to Liao, Palvia, & Lin (2010) , consumers are generally worried when they cannot be sure that purchases will achieve their desired goals. Some research has shown that online shopping presents a risk for consumers ( Bourlakis, Papagiannidis, & Fox, 2008 ; Bianchi & Andrews, 2012 ). In the current epidemiological situation, we can say that the perceived risk variable will allow us to better explain the obstacles that consumers may have before committing to an act of purchase. Bauer (1960) has divided this risk into five types: financial, performance, physical, psychological and finally social. These last two risks are often combined into a single variable, which is the psychosocial risk ( Kaplan, Szybillo, & Jacoby, 1974 ). Similarly, Gabarino and Strahilevitz (2004 ) decomposed perceived risk into two components: uncertainty about the decision's effectiveness, and the probable losses incurred during the purchase or consumption. With the appearance of the Coronavirus, the world has changed completely. COVID-19 has caused instabilities in many sectors of society ( Good, 2020 ). Customers preoccupied with the pandemic had to prevent, cope with or respond to these changes ( Ozturk, 2020 ). In this context, another dimension of risk that has been identified is the risk of contagion. This is the risk of being contaminated through gatherings, for example, in public spaces such as stores, buses, schools... This observation is based on a study conducted by the Criteo6 cabinet in March 2020. The investigation shows that 52% of consumers in the US and UK prefer the Web as a purchasing channel and that more than 70% of consumers in South Korea prefer to buy online. As for the countries that present a moderate rate, we can observe Spain with a percentage of 42% and France with 36.7%. Therefore, we can state that the fear of catching the virus has pushed consumers to adopt online shopping as a channel to make their purchases. Consequently, we would like to study this dimension of risk on the basis of the idea: the perceived risk (risk of contagion) has an impact on the intentions to purchase on the internet. The H2 hypothesis is proposed as follows:

There is a positive and significant relationship between the perceived risk of contagion and behavioral intention to purchase online during the health crisis.

There is a positive and significant relationship between the perceived utility of online shopping in the COVID-19 period and the behavioral purchase intention.

The research model and relationships proposed in this study are illustrated in Figure 1 .

3. Research methodology

3.1 research design and sampling.

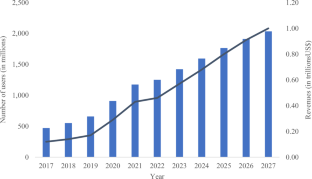

In this study, we adopted the quantitative methods approach using the questionnaire as a technique of collecting data. We have chosen this approach for two reasons. First, is to prevent crowds and, therefore, to avoid the risk of being contaminated by the coronavirus. Second, we opted for this method to collect a high number of data and in a minimal time, which is not the case for the qualitative study. The questionnaire is written in French since this language is the second language of the kingdom after Arabic. It is composed of three parts, and each part gives us specific information on the intention to buy online during Covid-19. Firstly, the questionnaire was submitted to a sample of 30 respondents to check its clarity and consistency. Then, we shared it on Linkedin and in the Facebook groups of e-commerce in Morocco (Maroc E-Commerce Communaute and J'ai testé en E-Commerce et je vous le recommande). We specifically selected these two social networks as they are the most popular and most used by consumers in the world ( El Moussaoui et al. , 2023 ). We waited seven weeks to collect the maximum possible number of responses ( Figure 2 ). In total, we received 220 completed questionnaires (Linkedin: 93; Facebook: 127) from 21 October to 8 December 2022.

3.2 Measurement instrument

To develop our measurement instrument, we have focused on the literature review. The existing documentation allowed us to develop our own items, from a set of items used by researchers. Table 2 shows the items chosen with the reference authors. All constructs in the study were operationalized as reflective constructs and adapted from past studies. The construct “Attitude towards online shopping” was measured by adapting six items from Limayem and Rowe (2006) , Sabik (2014) and Bourchich and Nejjar (2021) . The “Perceived utility” was measured by adapting six items from Zaoui (2009) and Ezzahi and Jazi (2018) . The two measurement items for “Perceived risk of contagion” were proposed by us. As for the dependent variable “Online shopping intention during Covid-19,” the four items were adapted from studies conducted by Ajzen (1991) and Moon et al. (2021) . It should be noted that the choice of variables was made on the basis of the acceptance model, incorporating the epidemiological factor “perceived risk of contagion.”

3.3 Data processing method

Following an initial verification of received questionnaires, some weaknesses were found in the dataset, allowing us to eliminate 8 incorrectly completed questionnaires. The total number of correctly filled questionnaires obtained was 220. The data processing was carried out with SPSS statistical software. There were two stages of analysis. The first one concerns the test of the reliability of measurement scales. It was realized through Principal Component Analysis (PCA), which is a factorial analysis technique. The second phase was devoted to testing the research hypotheses on the basis of the data collected ( El Moussaoui, Benbba, & El Andaloussi, 2022 ; El Moussaoui, Benbba, & El Andaloussi, 2022 , El Moussaoui, El Moussaoui, Benbba, Jaegler, & El Andaloussi, 2022 ). There are various statistical tools for testing relational research hypotheses. In this article, we have opted for multiple linear regression, an analytical model designed to explain the variance of a specific factor through a combination of explanatory variables ( El Moussaoui, Benbba, & El Andaloussi, 2022 ; El Moussaoui, Benbba, & El Andaloussi, 2022 , El Moussaoui , El Moussaoui, Benbba, Jaegler, & El Andaloussi, 2022 ).

4. Data analysis and results

4.1 description of consumer profile.

The survey was conducted with a sample of 220 Moroccan consumers of various profiles. As we see in Table 3 , the sample is composed of 101 men and 119 women, mostly aged between 18 and 45 years, with an education level of bac, bachelor, master or PhD.

4.2 Reliability of measurement scales

Before proceeding to the statistical analyses, we checked the internal reliability of the measurement scales by calculating Cronbach's alpha, which is an index that estimates the internal consistency of the items in our constructs. According to Nunnally (1978) , Cronbach's alpha value must be between 0.70 and 0.79 for the scale to be acceptable, between 0.80 and 0.90 to be “perfectly coherent” and above 0.95 to indicate that there are probably “redundant item.” On the other hand, a value between 0.60 and 0.69 is considered “minimally acceptable”; between 0.50 and 0.59, it is qualified as poor; and when the Cronbach's alpha value is lower than 0.50, the scale is “unacceptable.”

As presented in Table 4 , we obtained for the variable “Attitude” a Cronbach's alpha of 0.518, which represents a very low value. Therefore, we removed only one item (Attitude 5) to improve the quality of the model and reached a value of 0.732 ( Table 5 ). Doing the same thing for the variable “Perceived utility,” we obtained a value of 0.698, but with the removal of the item (Utility 4), the Cronbach's alpha value became 0.729. In the end, for the two variables “Perceived risk of contagion” and “Intention,” we kept all the attributed items since we obtained for the perceived risk of contagion a Cronbach's alpha of 0.875 and for the intention 0.870. So, both values are above 0.7, which means that they have a good reliability index. In the following, we will move to test the research hypotheses.

4.3 Hypothesis testing

H1 : There is a positive and significant relationship between the attitude (favorable, unfavorable) toward online shopping and the intention to buy online during the period of the health crisis (C OVID -19). From Table 6 , we can observe that there is a significant relationship between attitude and purchase intention (Sig = 0.000; P = 0.463). Therefore, both variables are positively correlated with a medium intensity. This means that the H1 hypothesis is validated.

H2 : There is a positive and significant relationship between perceived risk of contagion and intention to purchase online during the health crisis period. The examination of the results presented in Table 6 shows that there is a highly significant relationship between the perceived risk of contagion and the intention (Sig = 0.000; P = 0.452). Thus, the two variables are positively correlated with moderate intensity. It can be concluded that the H2 hypothesis is validated.

H3 : There is a positive and significant relationship between the perceived utility of online shopping in the C OVID -19 period and the behavioral purchase intention. The results presented in Table 6 indicate that there is a highly significant relationship between the perceived utility variable and the intention to purchase (Sig = 0.000; P = 0.581). Therefore, the two variables are positively correlated with high intensity. We can conclude that hypothesis H3 is validated.

In addition to the correlation analysis, we will ensure that there is no multi-collinearity effect between the variables. For this purpose, we need to examine the indicator of multi-collinearity which is the VIF (Variance Inflation Factor) (see Table 7 ). Following these results, we observe that all the values of the VIF are lower than 10, meaning that there isn't an inflation of high variance. Therefore, we can conclude that no variable is redundant, as well as no effect of multi-collinearity exists between the variables studied. Therefore, we can continue the analysis.

4.4 Model testing (multiple linear regression)

In the previous section, we tested the relationship of each of the explanatory variables with the variable that we want to explain (Intention). In this part, we will test the entire research model through multiple linear regression, using the “stepwise” method. This method allows us to analyze the influence of a selection of explanatory variables (independent) on the variable that we want to explain (dependent), as well as to keep the most economical model while maintaining only the significant variables in our research model. Table 8 shows a summary of the multiple regression analysis using the “stepwise” method.

In the model quality analysis, we opted for the stepwise method to keep only the significant variables and eliminate the redundant and unimportant variables. Then, we selected the third model with a coefficient of determination R 2 = 0.454, which signifies that the chosen model explains 45.40% of the total variance of the dependent variable “intention.” In terms of Fisher's significance, we have obtained a better level of significance (SIG.F = 0.000). In other words, the regression equation performs very significantly and allows us to conclude that the three explanatory variables (attitude, perceived risk of contagion and perceived utility) contribute significantly to the dependent variable (intention) scores. We did not retain models 1 and 2 for the reason that blocks a and b included only two variables Advantage and Attitude. Whereas, we are looking for a significant model that contains all of the study variables, including the risk of contagion, the latter variable significantly improved model 2 with an R -squared of 0.40 to 0.45 at the level of block c. In Table 8 , we present the importance of each explanatory variable in our research model.

The standardized coefficient “Beta” is interpreted in the same way as the Pearson regression coefficient. If Beta in absolute value is less than 0.29, the effect is low; if Beta is between 0.30 and 0.49, the effect is medium. Finally, if Beta in absolute value is higher than 0.50, the effect is high. It is important to remember that the objective of this step is to extract the variables that contribute significantly to the explanation of the phenomenon studied. Following the analysis of Table 9 , we note that the standardized coefficient of 0.371 of the variable “perceived utility” is the highest coefficient, then comes the variable “attitude” with a standardized coefficient Beta of 0.264 and finally the variable “perceived risk of contagion” comes last with a standardized coefficient Beta 0.252. The results obtained in Table 9 allow us to conclude that the variable “perceived utility” is the most important factor influencing consumers' intentions toward online purchases during the health crisis (COVID-19). This conclusion is perfectly in line with the analysis of Pearson's correlation coefficient since the variable “perceived utility” obtained the highest Pearson's coefficient (P = 0.581).

5. Discussion

5.1 effect of attitude toward online shopping in covid-19 period on behavioral intention.

The hypothesis that assumes a link between attitude and online shopping intention was validated in our sample. This finding is consistent with the TRA ( Ajzen and Fishbein, 1975 ), planned behavior ( Ajzen, 1991 ) and with TAM ( Davis et al ., 1989 ). Our result remains in agreement with previous works. It was found that even with this climate of the pandemic, attitude remains one of the determinants that can predict consumer behavior in the adoption of online shopping. This is exactly the case with the studies conducted by Sabik (2014 ), Ezzahi and Jazi (2018) , and Bourchich and Nejjar (2021 ) which confirmed that the attitude toward internet usage positively affects the intention to buy products online.

5.2 Effect of perceived utility on behavioral intention in the COVID-19 period

The hypothesis that assumes a positive and significant relationship between perceived utility and online purchase intention in the COVID-19 period is supported. The regression analysis shows that perceived utility has the greatest effect on behavioral intentions to purchase products on the Internet during the COVID-19 period. This finding follows the TAM of Davis et al . (1989) , which shows that intention is impacted by the perceived utility through attitude (mediating variable). This means that the consumer develops an intention to shop online during this epidemiological period only when he sees a benefit toward online shopping, such as avoiding crowds, home delivery and time-saving, etc.

5.3 Influence of perceived risk (perceived risk of contagion) on behavioral intention

The hypothesis that assumes a positive and significant relationship between the perceived risk of contagion and the intention to buy online during the COVID-19 period is verified. The regression analysis gives the first variable the last rank in terms of effect. The fact that the variable “perceived risk of contagion” has a weak effect can be explained by the period in which we started our survey (a few months after the confinement), meaning that the panic and fear of the COVID-19 pandemic has visibly diminished among consumers. This result was unexpected, as it was predicted that this variable would have the highest effect, following the worsening epidemiological situation day after day. Indeed, this finding is in line with previous research results, especially the results of the Criteo study in 2020 conducted in five countries, namely, France, Spain, the UK, South Korea and the USA, which confirms that most consumers are oriented toward online shopping for epidemiological reasons. This approves that the perceived risks influence the behavioral intention to buy online ( Vijayasarathy & Jones, 2000 ).

6. Conclusion/implications/limitations

6.1 conclusion.

This paper aims to determine the factors that influence online shopping in the current pandemic context. For this purpose, we developed our conceptual model by referring to Davis et al. ' (1989) TAM. We introduced the constructs “Attitude,” “perceived utility,” “intention” as well as the variable “perceived risk of contagion.” The results indicate that attitude and perceived utility positively affect online shopping intention. However, the variable “perceived risk of contagion” has a weak effect on such intention, which can be explained by the period in which we started our survey (a few months after the confinement).

6.2 Implications

The results of this study provided additional empirical support for the constructs of the technology acceptance model. The inclusion of the variable “perceived risk of contagion” reinforces the original model and provides a contribution to their influence on online shopping intention during the COVID-19 pandemic. This, in turn, will allow us to better understand consumer behavior. This study is one of the first studies that incorporate the variable “perceived risk of contagion” into the TAM. This highlights the necessity of adapting models to different contexts for a better understanding of behavioral intention. Academics have frequently worried about the role of national factors in the adoption of technology by the consumer. Furthermore, they have discouraged researchers from modeling technology acceptance patterns, as they still believe that such a pattern differs completely from one country to another. In the context of the COVID-19 crisis, this study was conducted to fill this gap by providing insights into the factors that determine consumers' online purchase intention. In this way, the study increases the generality potential of the research instrument. This fact once again underlines the central role of context in the design of theories. Indeed, it is crucial to understand the contexts in which theories begin to break down, as these form a basis for future research and knowledge creation.

The results of this paper can be applied and exerted in the context of the new crown pneumonia epidemic. For example, it can guide e-commerce website policymakers to make decisions that are beneficial to consumers. It is recommended that e-commerce actors focus on the experience of the Internet users, by proposing fluidity in the whole process of the orders and making the navigation on the website and the purchase pleasant. We should also note that even though epidemics are no longer epiphenomena, they pose real managerial challenges. In this context, the marketing department of companies must devote its efforts essentially to media and non-media communication, to create a favorable attitude among website visitors. We also suggest that practitioners of the field focus more on the advantages mentioned above (avoiding crowds, home delivery and time-saving) through the different communication tools in order to develop the willingness of consumers to purchase on the Internet, and ultimately to have a good level of conversion in their e-commerce websites. In addition, the managers of online websites are required to clearly communicate the protective actions and measures they take in the preparation and delivery processes to support the consumer's sense of security.

6.3 Limitations/future research

The multiple linear regression model used in the article is mainly designed to explore the correlation between the variables. More rigorous research models and methods are needed to prove the causal relationship between the variables.

The consideration of the variables is not rich enough. Based on the TAM technology acceptance model, this paper investigates the impact of attitude, perceived utility and perceived risk of infection on online shopping intention during COVID-19. Many factors can affect consumers' online purchasing intention, such as perceived benefits, perceived costs, perceived value and other factors. Future research can take these limitations into consideration by including all these variables.

The data collected through the questionnaire is not always accountable for the user's purchasing behavior. During this process, we observed that some questionnaires were not 100% completed, which allowed us to leave them out of the statistical study. Also noting that our research model has been statistically validated, but we cannot generalize it because our sample size is relatively small. Therefore, future research can adopt the same conceptual model we proposed with a large sample size. In addition, all the measurement scales were selected from the literature, except for the scale measuring the variable “perceived risk of contagion” which we proposed ourselves and which has never been used in other works. It should be noted that this variable had the lowest score in the correlation analysis, which calls into question the internal reliability of the scale used, even though we obtained a high Cronbach's alpha. This limitation could be the subject of future research.

The questionnaire is not written in Morocco's first language. Thus, it can be alluded that this study is particularly addressed to people with a high level of education. For better clarity, future research in Morocco should take a significant sample by writing a questionnaire in Arabic, so that all Moroccan citizens will be able to answer it.

Research model

Data collection process

Main research dealing with online shopping intention

Source(s): Table by authors

Addo , P .C. , Jiaming , F. , Kulbo , N. B. , & Liangqiang , L. ( 2020 ). COVID-19: Fear appeal favoring purchase behavior towards personal protective equipment . The Service Industries Journal , 40 ( 7-8 ), 471 – 490 .

Akar , E. , & Dalgic , T. ( 2018 ). Understanding online consumers’ purchase intentions: A contribution from social network theory . Behaviour & Information Technology , 37 ( 5 ), 473 – 487 .

Ait Youssef , A. , Jaafari , M. , & Belhcen , L. ( 2020 ). Factors affecting the online purchase intention during COVID-19 crisis: The case of Morocco . Available at SSRN 3734389 .

Ajzen , I. ( 1991 ). The theory of planned behavior . Organizational Behavior and Human Decision Processes , 50 ( 2 ), 179 – 211 .

Ajzen , I. , & Fishbein , M. ( 1975 ). A Bayesian analysis of attribution processes . Psychological Bulletin , 82 ( 2 ), 261 .

Akroush , M. N. , & Al-Debei , M. M. ( 2015 ). An integrated model of factors affecting consumer attitudes towards online shopping . Business Process Management Journal , 21 ( 6 ), 1353 – 1376 .

Al-Rahmi , W. M. , Yahaya , N. , Aldraiweesh , A. A. , Alamri , M. M. , Aljarboa , N. A. , Alturki , U. , & Aljeraiwi , A. A. ( 2019 ). Integrating technology acceptance model with innovation diffusion theory: An empirical investigation on students’ intention to use E-learning systems . Ieee Access , 7 , 26797 – 26809 .

Audrey , Y. A. , Wiguna , A. S. , Ramadhani , S. A. , & Gui , A. ( 2022 ). Factors influencing online shopping intention in Indonesia . In 2022 International Conference on Information Management and Technology (ICIMTech) (pp. 357 – 362 ). IEEE .

Barkhi , R. , Belanger , F. , & Hicks , J. ( 2008 ). A model of the determinants of purchasing from virtual stores . Journal of Organizational Computing and Electronic Commerce , 18 ( 3 ), 177 – 196 .

Bauer , R. ( 1960 ), “ Consumer behavior as risk taking ”, Dynamic Marketing for a Changing World , American Marketing Association , Chicago , pp. 389 - 298 .

Bianchi , C. , & Andrews , L. ( 2012 ). Risk, trust, and consumer online purchasing behaviour: A Chilean perspective . International Marketing Review , 9 ( 3 ), 253 – 276 .

Biswas , A. ( 2017 ). A consumption value-gap analysis for sustainable consumption . Environmental Science and Pollution Research , 24 ( 8 ), 7714 – 7725 .

Biswas , A. , & Roy , M. ( 2015 ). Leveraging factors for sustained green consumption behavior based on consumption value perceptions: Testing the structural model . Journal of Cleaner Production , 95 , 332 – 340 .

Bourchich , A. , & Nejjar , B. ( 2021 ). Les déterminants de l’achat en ligne en période de la Covid -19 : Approche quantitative « Une étude Post confinement » [The Determinants of Online Shopping during Covid-19: A Quantitative Approach ‘A Post-Containment Study’] . International Journal of Accounting, Finance, Auditing, Management and Economics , 2 ( 5 ), 60 – 77 .

Bourlakis , M. , Papagiannidis , S. , & Fox , H. ( 2008 ). Econsumer behaviour: Past, present and future trajectories of an evolving retail revolution . International Journal of E-Business Research , 4 ( 3 ), 64 – 76 .

Chiu , W. , Kim , T. , & Won , D. ( 2018 ). Predicting consumers’ intention to purchase sporting goods online: An application of the model of goal-directed behavior . Asia Pacific Journal of Marketing and Logistics , 30 ( 2 ), 333 – 351 .

Cox , D. F. ( 1967 ). Risk taking and information handling in consumer behaviour . Boston : Harvard University Press .

Dang , V. T. , & Pham , T. L. ( 2018 ). An empirical investigation of consumer perceptions of online shopping in an emerging economy: Adoption theory perspective . Asia Pacific Journal of Marketing and Logistics , 30 ( 4 ), 952 – 971 .

Davis , F. D. , Bagozzi , R. P. , & Warshaw , P. R. ( 1989 ). User acceptance of computer technology: A comparison of two theoretical models . Management Science , 35 ( 8 ), 982 – 1003 .

El Moussaoui , A. E. , Benbba , B. and El Andaloussi , Z. ( 2022 ). Impact of logistics performance on the store image, consumer satisfaction and loyalty: A quantitative case study . Arab Gulf Journal of Scientific Research, (ahead-of-print ).

El Moussaoui , A. E. , Benbba , B. , & El Andaloussi , Z. ( 2022 ). Perception d’e-consommateur sur les consignes automatiques: Note de recherche [E-consumer perception of automated lockers: Research note] . Revue de Recherches en Economie et en Management Africain , 10 ( 10 ).

El Moussaoui , A. E. , El Moussaoui , T. , Benbba , B. , Jaegler , A. , & El Andaloussi , Z. ( 2022 ). Understanding the choice of collection & delivery point by the E-consumer via a machine learning model: Moroccan case study . Procedia Computer Science , 210 , 204 – 211 .

El Moussaoui , A. E. , Benbba , B. , Jaegler , A. , El Moussaoui , T. , El Andaloussi , Z. , & Chakir , L. ( 2023 ). Consumer perceptions of online shopping and willingness to use pick-up points: A case study of Morocco . Sustainability , 15 ( 9 ), 7405 .

Emin , S. ( 2004 ). Les facteurs déterminant la création d'entreprise par les chercheurs public: Application des modèles d'entention [The factors determining the creation of businesses by public researchers: Application of the training models] . Revue de l'entrepreneuriat , 3 ( 1 ), 1 - 20 .

Engel , J. , Blackwell , R. , & Miniard , P. ( 1990 ). Consumer behavior (pp. 789 ). Chicago : Bryden Press .

Eti , I. A. , Horaira , M. A. , & Bari , M. M. ( 2021 ). Power and stimulus of social media marketing on consumer purchase intention in Bangladesh during the COVID-19 . International Journal of Research in Business and Social Science (2147-4478) , 10 ( 1 ), 28 – 37 .

Ezzahi and Jazi ( 2018 ), “ Influence du bouche à oreille électronique sur l’intention d’achat: Une exploration netnographique ”.

Gabarino , E. , & Strahilevitz , M. ( 2004 ). Gender differences in the perceived risk of buying online and the effects of receiving a site recommendation . Journal of Business Research , 57 .

Good , K. W. ( 2020 ). The COVID-19 Apocalypse – rules for survival . Available from: https://www.jurist.org/commentary/2020/04/the-covid-19-apocalypse-rules-for-survival/ ( accessed 7 May 2023 ).

Ha , N. , & Nguyen , T. ( 2019 ). The effect of trust on consumers’ online purchase intention: An integration of TAM and TPB . Management Science Letters , 9 ( 9 ), 1451 – 1460 .

Hajraoui , K. , & Chalabi , H. ( 2021 ). Impact du confinement dû à la pandémie du SARS-CoV-2 sur le comportement d’achat et la fréquentation des points de vente des produits alimentaires au Maroc [Impact of confinement caused by the SARS-CoV-2 pandemic on purchasing behavior and food store frequency in Morocco] . Revue d’Etudes en Management et Finance d’Organisation , 5 ( 1 ).

Hur , W. M. , Yoo , J. J. , & Chung , T. L. ( 2012 ). The consumption values and consumer innovativeness on convergence products . Industrial Management & Data Systems .

Jain , S. ( 2022 ). Factors influencing online luxury purchase intentions: The moderating role of bandwagon luxury consumption behavior . South Asian Journal of Business Studies , (ahead-of-print) .

Jordan , G. , Leskovar , R. , & Marič , M. ( 2018 ). Impact of fear of identity theft and perceived risk on online purchase intention . Organizacija , 51 ( 2 ), 146 – 155 .

Kaplan , L. B. , Szybillo , G. J. , & Jacoby , J. ( 1974 ). Components of perceived risk in product purchase: A cross-validation . Journal of Applied Psychology , 59 ( 3 ), 287 .

Karahanna , E. , Straub , D. W. , & Chervany , N. L. ( 1999 ). Information technology adoption across time: A cross-sectional comparison of pre-adoption and post-adoption beliefs . MIS Quarterly , 183 – 213 .

Kühn , S. W. , & Petzer , D. J. ( 2018 ). Fostering purchase intentions toward online retailer websites in an emerging market: An SOR perspective . Journal of Internet Commerce , 17 ( 3 ), 255 – 282 .

Li , L. , Wang , Z. , Li , Y. , & Liao , A. ( 2021 ). Impacts of consumer innovativeness on the intention to purchase sustainable products . Sustainable Production and Consumption , 27 , 774 – 786 .

Li , Y. , Xu , Z. , & Xu , F. ( 2018 ). Perceived control and purchase intention in online shopping: The mediating role of self-efficacy . Social Behavior and Personality: An International Journal , 46 ( 1 ), 99 – 105 .

Liao , Palvia and Lin ( 2010 ), “ Stage antecedents of consumer online buying behavior ”, Electronic Markets , Vol. 20 , pp. 53 - 65 .

Limayem , M. , & Rowe , F. ( 2006 ). Comparaison des facteurs influençant les intentions d'achat à partir du Web à Hong Kong et en France: influence sociale , risques et aversion pour la perte du contact [Comparison of factors influencing web-based purchase intentions in Hong Kong and France: social influence, risk and contact loss aversion] . Revue française du marketing .

Ling , H. C. , Chen , H. R. , Ho , K. K. , & Hsiao , K. L. ( 2021 ). Exploring the factors affecting customers’ intention to purchase a smart speaker . Journal of Retailing and Consumer Services , 59 , 102331 .

Liu , H. , Feng , S. , & Hu , X.S. ( 2022 ). Process vs. outcome: Effects of food photo types in online restaurant reviews on consumers’ purchase intention . International Journal of Hospitality Management , 102 , 103179 .

Marangunić , N. , & Granić , A. ( 2015 ). Technology acceptance model: A literature review from 1986 to 2013 . Universal Access in the Information Society , 14 , 81 – 95 .

Mitchell , V. W. ( 1999 ). Consumer perceived risk: Conceptualisations and models . European Journal of Marketing , 33 ( 12 ), 163195 .

Moon , J. , Choe , Y. , & Song , H. ( 2021 ). Determinants of consumers’ online/offline shopping behaviours during the COVID-19 pandemic . International Journal of Environmental Research and Public Health , 18 ( 4 ), 1593 .

Nunnally ( 1978 ), “ An overview of psychological measurement ”, Clinical Diagnosis of Mental Disorders: A Handbook , pp. 97 - 146 .

Ozturk , R. ( 2020 ). Health or death? The online purchase intentions of consumers during the COVID-19 pandemic . Transnational Marketing Journal (TMJ) , 8 ( 2 ), 219 – 241 .

Phau , I. , Quintal , V. , & Shanka , T. ( 2014 ). Examining a consumption values theory approach of young tourists toward destination choice intentions . International Journal of Culture, Tourism and Hospitality Research .

Ramayah , T. , Rahman , S. A. , & Ling , N. C. ( 2018 ). How do consumption values influence online purchase intention among school leavers in Malaysia? . Revista Brasileira de Gestão de Negócios , 20 , 638 – 654 .

Redda , E. H. ( 2019 ). Attitudes towards online shopping: Application of the theory of planned behaviour . Acta Universitatis Danubius. Œconomica , 15 ( 2 ), 148 – 159 .