- Search Menu

- Browse content in A - General Economics and Teaching

- Browse content in A1 - General Economics

- A10 - General

- A12 - Relation of Economics to Other Disciplines

- A13 - Relation of Economics to Social Values

- A14 - Sociology of Economics

- Browse content in A2 - Economic Education and Teaching of Economics

- A29 - Other

- Browse content in B - History of Economic Thought, Methodology, and Heterodox Approaches

- B0 - General

- Browse content in B1 - History of Economic Thought through 1925

- B11 - Preclassical (Ancient, Medieval, Mercantilist, Physiocratic)

- B12 - Classical (includes Adam Smith)

- Browse content in B2 - History of Economic Thought since 1925

- B20 - General

- B21 - Microeconomics

- B22 - Macroeconomics

- B25 - Historical; Institutional; Evolutionary; Austrian

- B26 - Financial Economics

- Browse content in B3 - History of Economic Thought: Individuals

- B31 - Individuals

- Browse content in B4 - Economic Methodology

- B41 - Economic Methodology

- Browse content in B5 - Current Heterodox Approaches

- B55 - Social Economics

- Browse content in C - Mathematical and Quantitative Methods

- Browse content in C0 - General

- C00 - General

- C02 - Mathematical Methods

- Browse content in C1 - Econometric and Statistical Methods and Methodology: General

- C10 - General

- C11 - Bayesian Analysis: General

- C12 - Hypothesis Testing: General

- C13 - Estimation: General

- C14 - Semiparametric and Nonparametric Methods: General

- C15 - Statistical Simulation Methods: General

- C19 - Other

- Browse content in C2 - Single Equation Models; Single Variables

- C21 - Cross-Sectional Models; Spatial Models; Treatment Effect Models; Quantile Regressions

- C22 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes

- C23 - Panel Data Models; Spatio-temporal Models

- C24 - Truncated and Censored Models; Switching Regression Models; Threshold Regression Models

- C25 - Discrete Regression and Qualitative Choice Models; Discrete Regressors; Proportions; Probabilities

- C26 - Instrumental Variables (IV) Estimation

- Browse content in C3 - Multiple or Simultaneous Equation Models; Multiple Variables

- C31 - Cross-Sectional Models; Spatial Models; Treatment Effect Models; Quantile Regressions; Social Interaction Models

- C32 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes; State Space Models

- C33 - Panel Data Models; Spatio-temporal Models

- C34 - Truncated and Censored Models; Switching Regression Models

- C35 - Discrete Regression and Qualitative Choice Models; Discrete Regressors; Proportions

- C36 - Instrumental Variables (IV) Estimation

- Browse content in C4 - Econometric and Statistical Methods: Special Topics

- C41 - Duration Analysis; Optimal Timing Strategies

- C43 - Index Numbers and Aggregation

- Browse content in C5 - Econometric Modeling

- C51 - Model Construction and Estimation

- C52 - Model Evaluation, Validation, and Selection

- C53 - Forecasting and Prediction Methods; Simulation Methods

- C54 - Quantitative Policy Modeling

- Browse content in C6 - Mathematical Methods; Programming Models; Mathematical and Simulation Modeling

- C60 - General

- C61 - Optimization Techniques; Programming Models; Dynamic Analysis

- C62 - Existence and Stability Conditions of Equilibrium

- C63 - Computational Techniques; Simulation Modeling

- Browse content in C7 - Game Theory and Bargaining Theory

- C71 - Cooperative Games

- C72 - Noncooperative Games

- C73 - Stochastic and Dynamic Games; Evolutionary Games; Repeated Games

- C78 - Bargaining Theory; Matching Theory

- Browse content in C8 - Data Collection and Data Estimation Methodology; Computer Programs

- C81 - Methodology for Collecting, Estimating, and Organizing Microeconomic Data; Data Access

- C82 - Methodology for Collecting, Estimating, and Organizing Macroeconomic Data; Data Access

- C83 - Survey Methods; Sampling Methods

- Browse content in C9 - Design of Experiments

- C90 - General

- C91 - Laboratory, Individual Behavior

- C92 - Laboratory, Group Behavior

- C93 - Field Experiments

- Browse content in D - Microeconomics

- Browse content in D0 - General

- D00 - General

- D01 - Microeconomic Behavior: Underlying Principles

- D02 - Institutions: Design, Formation, Operations, and Impact

- D03 - Behavioral Microeconomics: Underlying Principles

- D04 - Microeconomic Policy: Formulation; Implementation, and Evaluation

- Browse content in D1 - Household Behavior and Family Economics

- D10 - General

- D11 - Consumer Economics: Theory

- D12 - Consumer Economics: Empirical Analysis

- D13 - Household Production and Intrahousehold Allocation

- D14 - Household Saving; Personal Finance

- D15 - Intertemporal Household Choice: Life Cycle Models and Saving

- D16 - Collaborative Consumption

- D18 - Consumer Protection

- D19 - Other

- Browse content in D2 - Production and Organizations

- D21 - Firm Behavior: Theory

- D22 - Firm Behavior: Empirical Analysis

- D23 - Organizational Behavior; Transaction Costs; Property Rights

- D24 - Production; Cost; Capital; Capital, Total Factor, and Multifactor Productivity; Capacity

- D29 - Other

- Browse content in D3 - Distribution

- D30 - General

- D31 - Personal Income, Wealth, and Their Distributions

- D33 - Factor Income Distribution

- D39 - Other

- Browse content in D4 - Market Structure, Pricing, and Design

- D40 - General

- D41 - Perfect Competition

- D43 - Oligopoly and Other Forms of Market Imperfection

- D44 - Auctions

- Browse content in D5 - General Equilibrium and Disequilibrium

- D50 - General

- D53 - Financial Markets

- D58 - Computable and Other Applied General Equilibrium Models

- Browse content in D6 - Welfare Economics

- D60 - General

- D61 - Allocative Efficiency; Cost-Benefit Analysis

- D62 - Externalities

- D63 - Equity, Justice, Inequality, and Other Normative Criteria and Measurement

- D64 - Altruism; Philanthropy

- D69 - Other

- Browse content in D7 - Analysis of Collective Decision-Making

- D70 - General

- D71 - Social Choice; Clubs; Committees; Associations

- D72 - Political Processes: Rent-seeking, Lobbying, Elections, Legislatures, and Voting Behavior

- D73 - Bureaucracy; Administrative Processes in Public Organizations; Corruption

- D74 - Conflict; Conflict Resolution; Alliances; Revolutions

- D78 - Positive Analysis of Policy Formulation and Implementation

- Browse content in D8 - Information, Knowledge, and Uncertainty

- D80 - General

- D81 - Criteria for Decision-Making under Risk and Uncertainty

- D82 - Asymmetric and Private Information; Mechanism Design

- D83 - Search; Learning; Information and Knowledge; Communication; Belief; Unawareness

- D84 - Expectations; Speculations

- D85 - Network Formation and Analysis: Theory

- D86 - Economics of Contract: Theory

- Browse content in D9 - Micro-Based Behavioral Economics

- D90 - General

- D91 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on Decision Making

- D92 - Intertemporal Firm Choice, Investment, Capacity, and Financing

- Browse content in E - Macroeconomics and Monetary Economics

- Browse content in E0 - General

- E00 - General

- E01 - Measurement and Data on National Income and Product Accounts and Wealth; Environmental Accounts

- E02 - Institutions and the Macroeconomy

- Browse content in E1 - General Aggregative Models

- E10 - General

- E11 - Marxian; Sraffian; Kaleckian

- E12 - Keynes; Keynesian; Post-Keynesian

- E13 - Neoclassical

- E19 - Other

- Browse content in E2 - Consumption, Saving, Production, Investment, Labor Markets, and Informal Economy

- E20 - General

- E21 - Consumption; Saving; Wealth

- E22 - Investment; Capital; Intangible Capital; Capacity

- E23 - Production

- E24 - Employment; Unemployment; Wages; Intergenerational Income Distribution; Aggregate Human Capital; Aggregate Labor Productivity

- E25 - Aggregate Factor Income Distribution

- E26 - Informal Economy; Underground Economy

- E27 - Forecasting and Simulation: Models and Applications

- Browse content in E3 - Prices, Business Fluctuations, and Cycles

- E30 - General

- E31 - Price Level; Inflation; Deflation

- E32 - Business Fluctuations; Cycles

- E37 - Forecasting and Simulation: Models and Applications

- Browse content in E4 - Money and Interest Rates

- E40 - General

- E41 - Demand for Money

- E42 - Monetary Systems; Standards; Regimes; Government and the Monetary System; Payment Systems

- E43 - Interest Rates: Determination, Term Structure, and Effects

- E44 - Financial Markets and the Macroeconomy

- E47 - Forecasting and Simulation: Models and Applications

- Browse content in E5 - Monetary Policy, Central Banking, and the Supply of Money and Credit

- E50 - General

- E51 - Money Supply; Credit; Money Multipliers

- E52 - Monetary Policy

- E58 - Central Banks and Their Policies

- Browse content in E6 - Macroeconomic Policy, Macroeconomic Aspects of Public Finance, and General Outlook

- E60 - General

- E61 - Policy Objectives; Policy Designs and Consistency; Policy Coordination

- E62 - Fiscal Policy

- E63 - Comparative or Joint Analysis of Fiscal and Monetary Policy; Stabilization; Treasury Policy

- E65 - Studies of Particular Policy Episodes

- E69 - Other

- Browse content in E7 - Macro-Based Behavioral Economics

- E70 - General

- E71 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on the Macro Economy

- Browse content in F - International Economics

- Browse content in F0 - General

- F02 - International Economic Order and Integration

- Browse content in F1 - Trade

- F10 - General

- F11 - Neoclassical Models of Trade

- F12 - Models of Trade with Imperfect Competition and Scale Economies; Fragmentation

- F13 - Trade Policy; International Trade Organizations

- F14 - Empirical Studies of Trade

- F15 - Economic Integration

- F16 - Trade and Labor Market Interactions

- F17 - Trade Forecasting and Simulation

- F18 - Trade and Environment

- Browse content in F2 - International Factor Movements and International Business

- F21 - International Investment; Long-Term Capital Movements

- F22 - International Migration

- F23 - Multinational Firms; International Business

- F24 - Remittances

- Browse content in F3 - International Finance

- F30 - General

- F31 - Foreign Exchange

- F32 - Current Account Adjustment; Short-Term Capital Movements

- F33 - International Monetary Arrangements and Institutions

- F34 - International Lending and Debt Problems

- F35 - Foreign Aid

- F36 - Financial Aspects of Economic Integration

- F37 - International Finance Forecasting and Simulation: Models and Applications

- Browse content in F4 - Macroeconomic Aspects of International Trade and Finance

- F40 - General

- F41 - Open Economy Macroeconomics

- F42 - International Policy Coordination and Transmission

- F43 - Economic Growth of Open Economies

- F44 - International Business Cycles

- F45 - Macroeconomic Issues of Monetary Unions

- Browse content in F5 - International Relations, National Security, and International Political Economy

- F50 - General

- F51 - International Conflicts; Negotiations; Sanctions

- F52 - National Security; Economic Nationalism

- F53 - International Agreements and Observance; International Organizations

- F55 - International Institutional Arrangements

- F59 - Other

- Browse content in F6 - Economic Impacts of Globalization

- F62 - Macroeconomic Impacts

- F63 - Economic Development

- F64 - Environment

- Browse content in G - Financial Economics

- Browse content in G0 - General

- G01 - Financial Crises

- G02 - Behavioral Finance: Underlying Principles

- Browse content in G1 - General Financial Markets

- G10 - General

- G11 - Portfolio Choice; Investment Decisions

- G12 - Asset Pricing; Trading volume; Bond Interest Rates

- G14 - Information and Market Efficiency; Event Studies; Insider Trading

- G15 - International Financial Markets

- G18 - Government Policy and Regulation

- Browse content in G2 - Financial Institutions and Services

- G20 - General

- G21 - Banks; Depository Institutions; Micro Finance Institutions; Mortgages

- G22 - Insurance; Insurance Companies; Actuarial Studies

- G24 - Investment Banking; Venture Capital; Brokerage; Ratings and Ratings Agencies

- G28 - Government Policy and Regulation

- Browse content in G3 - Corporate Finance and Governance

- G32 - Financing Policy; Financial Risk and Risk Management; Capital and Ownership Structure; Value of Firms; Goodwill

- G33 - Bankruptcy; Liquidation

- G34 - Mergers; Acquisitions; Restructuring; Corporate Governance

- G35 - Payout Policy

- G38 - Government Policy and Regulation

- Browse content in H - Public Economics

- Browse content in H0 - General

- H00 - General

- Browse content in H1 - Structure and Scope of Government

- H10 - General

- H11 - Structure, Scope, and Performance of Government

- H12 - Crisis Management

- Browse content in H2 - Taxation, Subsidies, and Revenue

- H20 - General

- H21 - Efficiency; Optimal Taxation

- H22 - Incidence

- H23 - Externalities; Redistributive Effects; Environmental Taxes and Subsidies

- H24 - Personal Income and Other Nonbusiness Taxes and Subsidies; includes inheritance and gift taxes

- H25 - Business Taxes and Subsidies

- H26 - Tax Evasion and Avoidance

- Browse content in H3 - Fiscal Policies and Behavior of Economic Agents

- H30 - General

- H31 - Household

- Browse content in H4 - Publicly Provided Goods

- H40 - General

- H41 - Public Goods

- H42 - Publicly Provided Private Goods

- Browse content in H5 - National Government Expenditures and Related Policies

- H50 - General

- H51 - Government Expenditures and Health

- H52 - Government Expenditures and Education

- H53 - Government Expenditures and Welfare Programs

- H54 - Infrastructures; Other Public Investment and Capital Stock

- H55 - Social Security and Public Pensions

- H56 - National Security and War

- Browse content in H6 - National Budget, Deficit, and Debt

- H60 - General

- H61 - Budget; Budget Systems

- H62 - Deficit; Surplus

- H63 - Debt; Debt Management; Sovereign Debt

- Browse content in H7 - State and Local Government; Intergovernmental Relations

- H70 - General

- H71 - State and Local Taxation, Subsidies, and Revenue

- H72 - State and Local Budget and Expenditures

- H75 - State and Local Government: Health; Education; Welfare; Public Pensions

- H76 - State and Local Government: Other Expenditure Categories

- H77 - Intergovernmental Relations; Federalism; Secession

- Browse content in H8 - Miscellaneous Issues

- H83 - Public Administration; Public Sector Accounting and Audits

- H84 - Disaster Aid

- H87 - International Fiscal Issues; International Public Goods

- Browse content in I - Health, Education, and Welfare

- Browse content in I0 - General

- I00 - General

- Browse content in I1 - Health

- I10 - General

- I12 - Health Behavior

- I14 - Health and Inequality

- I15 - Health and Economic Development

- I18 - Government Policy; Regulation; Public Health

- I19 - Other

- Browse content in I2 - Education and Research Institutions

- I20 - General

- I21 - Analysis of Education

- I22 - Educational Finance; Financial Aid

- I23 - Higher Education; Research Institutions

- I24 - Education and Inequality

- I25 - Education and Economic Development

- I26 - Returns to Education

- I28 - Government Policy

- I29 - Other

- Browse content in I3 - Welfare, Well-Being, and Poverty

- I30 - General

- I31 - General Welfare

- I32 - Measurement and Analysis of Poverty

- I38 - Government Policy; Provision and Effects of Welfare Programs

- Browse content in J - Labor and Demographic Economics

- Browse content in J0 - General

- J00 - General

- J01 - Labor Economics: General

- J08 - Labor Economics Policies

- Browse content in J1 - Demographic Economics

- J10 - General

- J11 - Demographic Trends, Macroeconomic Effects, and Forecasts

- J12 - Marriage; Marital Dissolution; Family Structure; Domestic Abuse

- J13 - Fertility; Family Planning; Child Care; Children; Youth

- J14 - Economics of the Elderly; Economics of the Handicapped; Non-Labor Market Discrimination

- J15 - Economics of Minorities, Races, Indigenous Peoples, and Immigrants; Non-labor Discrimination

- J16 - Economics of Gender; Non-labor Discrimination

- J17 - Value of Life; Forgone Income

- J18 - Public Policy

- Browse content in J2 - Demand and Supply of Labor

- J20 - General

- J21 - Labor Force and Employment, Size, and Structure

- J22 - Time Allocation and Labor Supply

- J23 - Labor Demand

- J24 - Human Capital; Skills; Occupational Choice; Labor Productivity

- J26 - Retirement; Retirement Policies

- J28 - Safety; Job Satisfaction; Related Public Policy

- Browse content in J3 - Wages, Compensation, and Labor Costs

- J30 - General

- J31 - Wage Level and Structure; Wage Differentials

- J32 - Nonwage Labor Costs and Benefits; Retirement Plans; Private Pensions

- J33 - Compensation Packages; Payment Methods

- J38 - Public Policy

- Browse content in J4 - Particular Labor Markets

- J41 - Labor Contracts

- J42 - Monopsony; Segmented Labor Markets

- J45 - Public Sector Labor Markets

- J46 - Informal Labor Markets

- J48 - Public Policy

- Browse content in J5 - Labor-Management Relations, Trade Unions, and Collective Bargaining

- J50 - General

- J51 - Trade Unions: Objectives, Structure, and Effects

- J52 - Dispute Resolution: Strikes, Arbitration, and Mediation; Collective Bargaining

- J53 - Labor-Management Relations; Industrial Jurisprudence

- J54 - Producer Cooperatives; Labor Managed Firms; Employee Ownership

- J58 - Public Policy

- Browse content in J6 - Mobility, Unemployment, Vacancies, and Immigrant Workers

- J60 - General

- J61 - Geographic Labor Mobility; Immigrant Workers

- J62 - Job, Occupational, and Intergenerational Mobility

- J63 - Turnover; Vacancies; Layoffs

- J64 - Unemployment: Models, Duration, Incidence, and Job Search

- J65 - Unemployment Insurance; Severance Pay; Plant Closings

- J68 - Public Policy

- Browse content in J7 - Labor Discrimination

- J71 - Discrimination

- Browse content in J8 - Labor Standards: National and International

- J81 - Working Conditions

- J88 - Public Policy

- Browse content in K - Law and Economics

- Browse content in K0 - General

- K00 - General

- Browse content in K1 - Basic Areas of Law

- K11 - Property Law

- K12 - Contract Law

- K13 - Tort Law and Product Liability; Forensic Economics

- K14 - Criminal Law

- K16 - Election Law

- Browse content in K3 - Other Substantive Areas of Law

- K31 - Labor Law

- K32 - Environmental, Health, and Safety Law

- K34 - Tax Law

- K37 - Immigration Law

- Browse content in K4 - Legal Procedure, the Legal System, and Illegal Behavior

- K41 - Litigation Process

- K42 - Illegal Behavior and the Enforcement of Law

- K49 - Other

- Browse content in L - Industrial Organization

- Browse content in L0 - General

- L00 - General

- Browse content in L1 - Market Structure, Firm Strategy, and Market Performance

- L10 - General

- L11 - Production, Pricing, and Market Structure; Size Distribution of Firms

- L12 - Monopoly; Monopolization Strategies

- L13 - Oligopoly and Other Imperfect Markets

- L14 - Transactional Relationships; Contracts and Reputation; Networks

- L16 - Industrial Organization and Macroeconomics: Industrial Structure and Structural Change; Industrial Price Indices

- Browse content in L2 - Firm Objectives, Organization, and Behavior

- L20 - General

- L21 - Business Objectives of the Firm

- L22 - Firm Organization and Market Structure

- L23 - Organization of Production

- L24 - Contracting Out; Joint Ventures; Technology Licensing

- L25 - Firm Performance: Size, Diversification, and Scope

- L26 - Entrepreneurship

- L29 - Other

- Browse content in L3 - Nonprofit Organizations and Public Enterprise

- L30 - General

- L31 - Nonprofit Institutions; NGOs; Social Entrepreneurship

- L32 - Public Enterprises; Public-Private Enterprises

- L33 - Comparison of Public and Private Enterprises and Nonprofit Institutions; Privatization; Contracting Out

- Browse content in L4 - Antitrust Issues and Policies

- L40 - General

- L41 - Monopolization; Horizontal Anticompetitive Practices

- L43 - Legal Monopolies and Regulation or Deregulation

- Browse content in L5 - Regulation and Industrial Policy

- L50 - General

- L51 - Economics of Regulation

- L52 - Industrial Policy; Sectoral Planning Methods

- L53 - Enterprise Policy

- Browse content in L6 - Industry Studies: Manufacturing

- L60 - General

- L66 - Food; Beverages; Cosmetics; Tobacco; Wine and Spirits

- Browse content in L7 - Industry Studies: Primary Products and Construction

- L71 - Mining, Extraction, and Refining: Hydrocarbon Fuels

- L78 - Government Policy

- Browse content in L8 - Industry Studies: Services

- L81 - Retail and Wholesale Trade; e-Commerce

- L83 - Sports; Gambling; Recreation; Tourism

- L86 - Information and Internet Services; Computer Software

- Browse content in L9 - Industry Studies: Transportation and Utilities

- L94 - Electric Utilities

- L98 - Government Policy

- Browse content in M - Business Administration and Business Economics; Marketing; Accounting; Personnel Economics

- Browse content in M1 - Business Administration

- M12 - Personnel Management; Executives; Executive Compensation

- M14 - Corporate Culture; Social Responsibility

- M16 - International Business Administration

- Browse content in M3 - Marketing and Advertising

- M31 - Marketing

- Browse content in M5 - Personnel Economics

- M50 - General

- M51 - Firm Employment Decisions; Promotions

- M52 - Compensation and Compensation Methods and Their Effects

- M53 - Training

- M54 - Labor Management

- M55 - Labor Contracting Devices

- Browse content in N - Economic History

- Browse content in N1 - Macroeconomics and Monetary Economics; Industrial Structure; Growth; Fluctuations

- N10 - General, International, or Comparative

- N11 - U.S.; Canada: Pre-1913

- N12 - U.S.; Canada: 1913-

- N13 - Europe: Pre-1913

- N15 - Asia including Middle East

- Browse content in N2 - Financial Markets and Institutions

- N20 - General, International, or Comparative

- N24 - Europe: 1913-

- N25 - Asia including Middle East

- Browse content in N3 - Labor and Consumers, Demography, Education, Health, Welfare, Income, Wealth, Religion, and Philanthropy

- N31 - U.S.; Canada: Pre-1913

- N33 - Europe: Pre-1913

- N34 - Europe: 1913-

- Browse content in N4 - Government, War, Law, International Relations, and Regulation

- N40 - General, International, or Comparative

- N45 - Asia including Middle East

- N47 - Africa; Oceania

- Browse content in N5 - Agriculture, Natural Resources, Environment, and Extractive Industries

- N50 - General, International, or Comparative

- N53 - Europe: Pre-1913

- N57 - Africa; Oceania

- Browse content in N7 - Transport, Trade, Energy, Technology, and Other Services

- N70 - General, International, or Comparative

- N72 - U.S.; Canada: 1913-

- Browse content in N9 - Regional and Urban History

- N97 - Africa; Oceania

- Browse content in O - Economic Development, Innovation, Technological Change, and Growth

- Browse content in O1 - Economic Development

- O10 - General

- O11 - Macroeconomic Analyses of Economic Development

- O12 - Microeconomic Analyses of Economic Development

- O13 - Agriculture; Natural Resources; Energy; Environment; Other Primary Products

- O14 - Industrialization; Manufacturing and Service Industries; Choice of Technology

- O15 - Human Resources; Human Development; Income Distribution; Migration

- O16 - Financial Markets; Saving and Capital Investment; Corporate Finance and Governance

- O17 - Formal and Informal Sectors; Shadow Economy; Institutional Arrangements

- O18 - Urban, Rural, Regional, and Transportation Analysis; Housing; Infrastructure

- O19 - International Linkages to Development; Role of International Organizations

- Browse content in O2 - Development Planning and Policy

- O22 - Project Analysis

- O23 - Fiscal and Monetary Policy in Development

- O24 - Trade Policy; Factor Movement Policy; Foreign Exchange Policy

- O25 - Industrial Policy

- Browse content in O3 - Innovation; Research and Development; Technological Change; Intellectual Property Rights

- O30 - General

- O31 - Innovation and Invention: Processes and Incentives

- O32 - Management of Technological Innovation and R&D

- O33 - Technological Change: Choices and Consequences; Diffusion Processes

- O34 - Intellectual Property and Intellectual Capital

- O38 - Government Policy

- O39 - Other

- Browse content in O4 - Economic Growth and Aggregate Productivity

- O40 - General

- O41 - One, Two, and Multisector Growth Models

- O42 - Monetary Growth Models

- O43 - Institutions and Growth

- O47 - Empirical Studies of Economic Growth; Aggregate Productivity; Cross-Country Output Convergence

- O49 - Other

- Browse content in O5 - Economywide Country Studies

- O50 - General

- O52 - Europe

- O53 - Asia including Middle East

- O55 - Africa

- O57 - Comparative Studies of Countries

- Browse content in P - Economic Systems

- Browse content in P1 - Capitalist Systems

- P10 - General

- P13 - Cooperative Enterprises

- P16 - Political Economy

- P17 - Performance and Prospects

- Browse content in P2 - Socialist Systems and Transitional Economies

- P20 - General

- P26 - Political Economy; Property Rights

- Browse content in P3 - Socialist Institutions and Their Transitions

- P31 - Socialist Enterprises and Their Transitions

- Browse content in P4 - Other Economic Systems

- P48 - Political Economy; Legal Institutions; Property Rights; Natural Resources; Energy; Environment; Regional Studies

- Browse content in P5 - Comparative Economic Systems

- P50 - General

- Browse content in Q - Agricultural and Natural Resource Economics; Environmental and Ecological Economics

- Browse content in Q0 - General

- Q02 - Commodity Markets

- Browse content in Q1 - Agriculture

- Q11 - Aggregate Supply and Demand Analysis; Prices

- Q13 - Agricultural Markets and Marketing; Cooperatives; Agribusiness

- Q15 - Land Ownership and Tenure; Land Reform; Land Use; Irrigation; Agriculture and Environment

- Q16 - R&D; Agricultural Technology; Biofuels; Agricultural Extension Services

- Q17 - Agriculture in International Trade

- Q18 - Agricultural Policy; Food Policy

- Browse content in Q2 - Renewable Resources and Conservation

- Q20 - General

- Q22 - Fishery; Aquaculture

- Q23 - Forestry

- Q25 - Water

- Q26 - Recreational Aspects of Natural Resources

- Q29 - Other

- Browse content in Q3 - Nonrenewable Resources and Conservation

- Q30 - General

- Q32 - Exhaustible Resources and Economic Development

- Q33 - Resource Booms

- Q34 - Natural Resources and Domestic and International Conflicts

- Q38 - Government Policy

- Browse content in Q4 - Energy

- Q40 - General

- Q41 - Demand and Supply; Prices

- Q42 - Alternative Energy Sources

- Q43 - Energy and the Macroeconomy

- Q48 - Government Policy

- Browse content in Q5 - Environmental Economics

- Q50 - General

- Q51 - Valuation of Environmental Effects

- Q52 - Pollution Control Adoption Costs; Distributional Effects; Employment Effects

- Q53 - Air Pollution; Water Pollution; Noise; Hazardous Waste; Solid Waste; Recycling

- Q54 - Climate; Natural Disasters; Global Warming

- Q56 - Environment and Development; Environment and Trade; Sustainability; Environmental Accounts and Accounting; Environmental Equity; Population Growth

- Q58 - Government Policy

- Browse content in R - Urban, Rural, Regional, Real Estate, and Transportation Economics

- Browse content in R1 - General Regional Economics

- R10 - General

- R11 - Regional Economic Activity: Growth, Development, Environmental Issues, and Changes

- R15 - Econometric and Input-Output Models; Other Models

- Browse content in R2 - Household Analysis

- R23 - Regional Migration; Regional Labor Markets; Population; Neighborhood Characteristics

- R29 - Other

- Browse content in R4 - Transportation Economics

- R40 - General

- R41 - Transportation: Demand, Supply, and Congestion; Travel Time; Safety and Accidents; Transportation Noise

- Browse content in R5 - Regional Government Analysis

- R58 - Regional Development Planning and Policy

- Browse content in Z - Other Special Topics

- Browse content in Z1 - Cultural Economics; Economic Sociology; Economic Anthropology

- Z10 - General

- Z11 - Economics of the Arts and Literature

- Z12 - Religion

- Z13 - Economic Sociology; Economic Anthropology; Social and Economic Stratification

- Z19 - Other

- Browse content in Z2 - Sports Economics

- Z21 - Industry Studies

- Z22 - Labor Issues

- Z29 - Other

- Browse content in Z3 - Tourism Economics

- Z30 - General

- Advance articles

- Author Guidelines

- Submission Site

- Open Access

- About Oxford Economic Papers

- Editorial Board

- Advertising and Corporate Services

- Journals Career Network

- Self-Archiving Policy

- Dispatch Dates

- Terms and Conditions

- Journals on Oxford Academic

- Books on Oxford Academic

Managing Editors

James Forder

Francis J. Teal

About the journal

Oxford Economic Papers is a general economics journal, publishing refereed papers in economic theory, applied economics, econometrics, economic development, economic history, and the history of economic thought.

Symposium on Inequality

Browse research from the latest Oxford Economic Papers Symposium on Inequality. Articles discuss selective schooling systems, increased income inequality in advanced economies since the 1980s, and the impact of wealth on children’s exposure to environmental pollutants.

Browse papers

Special Issue: Sovereign Debt Restructuring

Read the latest Special Issue from Oxford Economic Papers , which investigates the mechanisms that help ensure the orderly functioning of sovereign debt markets, as well as conditions under which these same mechanisms lead to default, crisis, and costly debt restructuring.

Explore the issue

Hicks Lectures

Since 1984, Oxford Economic Papers has annually sponsored the Hicks lectures, a crucial element in fostering economic education. These lectures feature renowned researchers, including Nobel laureates, who impart valuable insights to both Oxford economic students and faculty.

Explore now

In the News

Developed countries benefit economically from counterterrorism efforts

A new study in Oxford Economic Papers suggests that developed counties may see significant economic gains from their efforts to combat terrorist threats. Developing counties, in contrast, appear to suffer economically from counterterrorism threats.

Read the press release | Read the article

Latest articles

Who are the super-rich and why they are paid so much?

One of the most common arguments against contemporary capitalism is that it generates extreme inequalities. Few individuals – it is often said – earn huge earnings, while the rest of society has to struggle to make ends meet...

Read the blog post | Read the article

Prostitution: The world's oldest public policy issue

Ever since the first arrangements were made for the exchange of some form of money for some form of sex, buying (or selling) sex has raised thorny issues for society's rulers and governments...

What are the hidden effects of tax credits?

UK tax credits are benefits first introduced in 1999 to help low-paid families through topping up their wages with the aims of 'making work pay' and reducing poverty, although they also cover non-working families with children...

The economics behind detecting terror plots

How many good guys are needed to catch the bad guys? This is the staffing question faced by counterterrorism agencies the world over...

Recommend to your library

Fill out our simple online form to recommend Oxford Economic Papers to your library.

Recommend now

JEL Codes Explained

Articles from Oxford Journals economics titles are classified according to the system used by the Journal of Economic Literature (commonly known as 'JEL codes').

Committee on Publication Ethics (COPE)

This journal is a member of and subscribes to the principles of the Committee on Publication Ethics (COPE)

publicationethics.org

Related Titles

- Recommend to your Library

Affiliations

- Online ISSN 1464-3812

- Print ISSN 0030-7653

- Copyright © 2024 Oxford University Press

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Institutional account management

- Rights and permissions

- Get help with access

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

How you can use RePEc:

Repec information for participants, recent activity.

RePEc Team summit , May 2002

LogEc list of the top 25 RePEc series last month (in terms of the number of file downloads)

Major participants

Find Economics institutions

- Coordinates

- Publications

- Corrections

More services and features

Ideas: economics research.

All the economics literature on one site

NEP: New Economics papers

Subscribe to new additions to RePEc

Author registration

Public profiles for Economics researchers

Economics Rankings

Various rankings of research in Economics & related fields

RePEc Genealogy

Who was a student of whom, using RePEc

RePEc Biblio

Curated articles & papers on various economics topics

EconAcademics

Blog aggregator for economics research

About RePEc

How to help.

- Additions, corrections

- Get papers listed

- Open a RePEc archive

- Get RePEc data

Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

Research items

Series and journals, institutions, historical rankings, documentation, top items by citations, top items by downloads, top items by abstract views, top series by citations, all series simple impact factors: all years , last 10 years recursive impact factors: all years , last 10 years discounted impact factors: all years , last 10 years recursive discounted impact factors: all years , last 10 years h-index: all years , last 10 years euclidian citation score: all years , last 10 years aggregate ranking: all years , last 10 years journals, working paper series, top series by downloads, top series by abstract views, aggregate ranking for authors worldwide, all author rankings for each individual criterion except for the first and the last, all are considered for the aggregate rankings. descriptions are in each link. nbworks , dnbworks , scworks , wscworks , anbworks , ascworks , awscworks , nbcites , dcites , sccites , dsccites , wsccites , wdsccites , anbcites , adcites , asccites , adsccites , awsccites , awdsccites , hindex , ncauthors , rcauthors , nbpages , scpages , wscpages , anbpages , ascpages , awscpages , absviews , downloads , aabsviews , adownloads , students , closeness , betweenness , nepcites , wu-index , euclidian . worldwide rankings for various sub-groups top women economists: publication in all years or last 10 years top young economists top economists by cohorts top deceased economists top authors by region, top authors by country, top authors by us state, top authors by us region, top authors by field, aggregate ranking for institutions worlwide, all institution rankings for each individual criterion, special rankings, top institutions by region, top institutions by country, top institutions by us state, top institutions by us region, top institutions by type, top institutions by field, aggregate ranking for regions, all region rankings for each infividual criterion.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Corrections.

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

Citations in Economics

Search our database of references , 65k experts.

Citation profiles for more than 65,000 researchers in Economics

2M processed papers

Search and download the latest research results in Economics published in journals and working papers

30M citations

Our database contains more than 30 million citations. They are the source of the documents, series and experts citation profiles

80M references

You may search our database of more that 80 million references extracted from articles and working papers

Submission of references and -- --MyCitEc is not working at the moment. We are working to improve -- --the service and apologize by the inconveniences -- --caused. --> CitEc is a RePEc service , providing citation data for Economics since 2001. Sponsored by INOMICS . Last updated March, 3 2024. Contact: CitEc Team .

Economics Journals

We publish a wide variety of open access journals in Economics . We invite you to learn more about the journals, view their metrics, explore our research articles, get to know our excellent author's services, and submit your research.

Read top open access articles from our collection

- The relationship between energy consumption, economic growth, and carbon dioxide emissions in Pakistan published in Financial Innovation

- The Coming Coronavirus Crisis: What Can We Learn? from Intereconomics

- Consumer stated preferences for dairy products with carbon footprint labels in Italy published in Agricultural and Food Economics

- Economic Implications of the Corona Crisis and Economic Policy Measures from Wirtschaftsdienst

- The moderating role of entrepreneurship education in shaping entrepreneurial intentions from Journal of Economic Structures

- Timing matters: the impact of response measures on COVID-19-related hospitalization and death rates in Germany and Switzerland published in Swiss Journal of Economics and Statistics

Journals in Economics

Explore our collection of journals. Read all of the articles freely and learn how to submit your research. Just click below:

Explore our entire collection of economics journals from SpringerNature

Publishing with SpringerOpen makes your work freely available online immediately upon publication. Our high-level peer-review and production processes guarantee the quality and reliability of the work. Make your research a part of our journal with rapid publication and high visibility.

Learn how to Submit Your Manuscript

Your browser needs to have JavaScript enabled to view this video

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 17 April 2024

The economic commitment of climate change

- Maximilian Kotz ORCID: orcid.org/0000-0003-2564-5043 1 , 2 ,

- Anders Levermann ORCID: orcid.org/0000-0003-4432-4704 1 , 2 &

- Leonie Wenz ORCID: orcid.org/0000-0002-8500-1568 1 , 3

Nature volume 628 , pages 551–557 ( 2024 ) Cite this article

70k Accesses

3527 Altmetric

Metrics details

- Environmental economics

- Environmental health

- Interdisciplinary studies

- Projection and prediction

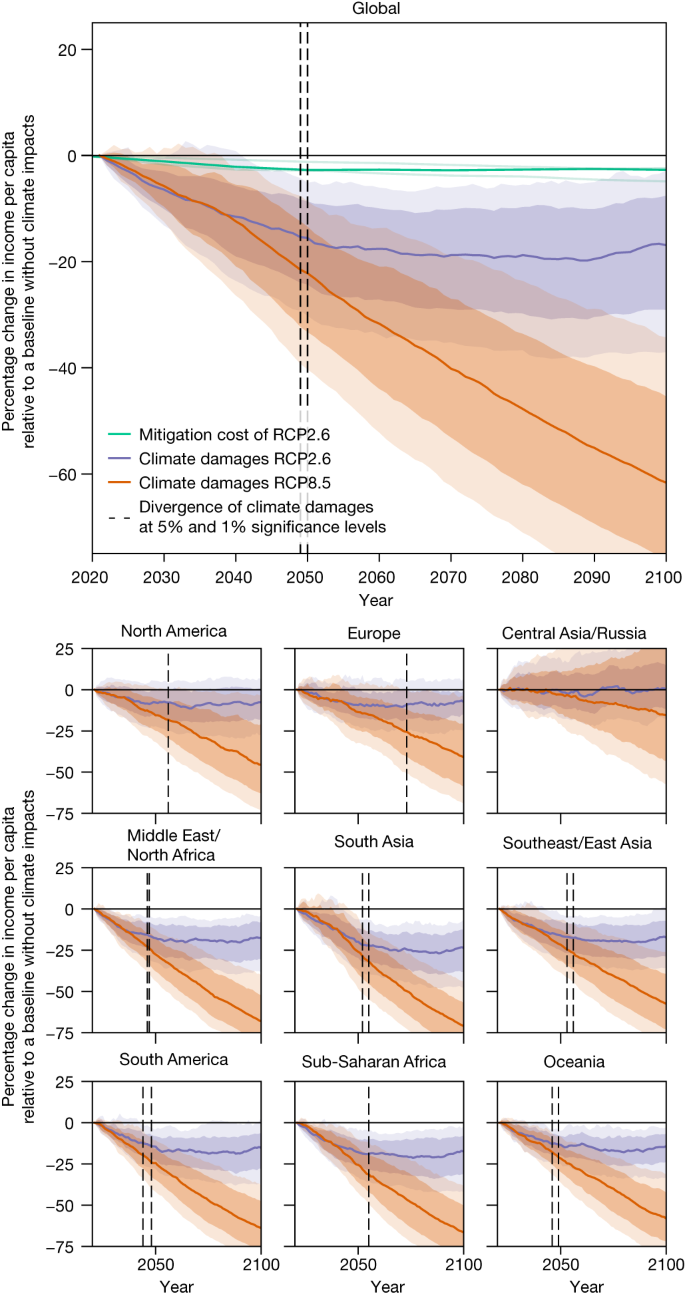

Global projections of macroeconomic climate-change damages typically consider impacts from average annual and national temperatures over long time horizons 1 , 2 , 3 , 4 , 5 , 6 . Here we use recent empirical findings from more than 1,600 regions worldwide over the past 40 years to project sub-national damages from temperature and precipitation, including daily variability and extremes 7 , 8 . Using an empirical approach that provides a robust lower bound on the persistence of impacts on economic growth, we find that the world economy is committed to an income reduction of 19% within the next 26 years independent of future emission choices (relative to a baseline without climate impacts, likely range of 11–29% accounting for physical climate and empirical uncertainty). These damages already outweigh the mitigation costs required to limit global warming to 2 °C by sixfold over this near-term time frame and thereafter diverge strongly dependent on emission choices. Committed damages arise predominantly through changes in average temperature, but accounting for further climatic components raises estimates by approximately 50% and leads to stronger regional heterogeneity. Committed losses are projected for all regions except those at very high latitudes, at which reductions in temperature variability bring benefits. The largest losses are committed at lower latitudes in regions with lower cumulative historical emissions and lower present-day income.

Similar content being viewed by others

Climate damage projections beyond annual temperature

Investment incentive reduced by climate damages can be restored by optimal policy

Climate economics support for the UN climate targets

Projections of the macroeconomic damage caused by future climate change are crucial to informing public and policy debates about adaptation, mitigation and climate justice. On the one hand, adaptation against climate impacts must be justified and planned on the basis of an understanding of their future magnitude and spatial distribution 9 . This is also of importance in the context of climate justice 10 , as well as to key societal actors, including governments, central banks and private businesses, which increasingly require the inclusion of climate risks in their macroeconomic forecasts to aid adaptive decision-making 11 , 12 . On the other hand, climate mitigation policy such as the Paris Climate Agreement is often evaluated by balancing the costs of its implementation against the benefits of avoiding projected physical damages. This evaluation occurs both formally through cost–benefit analyses 1 , 4 , 5 , 6 , as well as informally through public perception of mitigation and damage costs 13 .

Projections of future damages meet challenges when informing these debates, in particular the human biases relating to uncertainty and remoteness that are raised by long-term perspectives 14 . Here we aim to overcome such challenges by assessing the extent of economic damages from climate change to which the world is already committed by historical emissions and socio-economic inertia (the range of future emission scenarios that are considered socio-economically plausible 15 ). Such a focus on the near term limits the large uncertainties about diverging future emission trajectories, the resulting long-term climate response and the validity of applying historically observed climate–economic relations over long timescales during which socio-technical conditions may change considerably. As such, this focus aims to simplify the communication and maximize the credibility of projected economic damages from future climate change.

In projecting the future economic damages from climate change, we make use of recent advances in climate econometrics that provide evidence for impacts on sub-national economic growth from numerous components of the distribution of daily temperature and precipitation 3 , 7 , 8 . Using fixed-effects panel regression models to control for potential confounders, these studies exploit within-region variation in local temperature and precipitation in a panel of more than 1,600 regions worldwide, comprising climate and income data over the past 40 years, to identify the plausibly causal effects of changes in several climate variables on economic productivity 16 , 17 . Specifically, macroeconomic impacts have been identified from changing daily temperature variability, total annual precipitation, the annual number of wet days and extreme daily rainfall that occur in addition to those already identified from changing average temperature 2 , 3 , 18 . Moreover, regional heterogeneity in these effects based on the prevailing local climatic conditions has been found using interactions terms. The selection of these climate variables follows micro-level evidence for mechanisms related to the impacts of average temperatures on labour and agricultural productivity 2 , of temperature variability on agricultural productivity and health 7 , as well as of precipitation on agricultural productivity, labour outcomes and flood damages 8 (see Extended Data Table 1 for an overview, including more detailed references). References 7 , 8 contain a more detailed motivation for the use of these particular climate variables and provide extensive empirical tests about the robustness and nature of their effects on economic output, which are summarized in Methods . By accounting for these extra climatic variables at the sub-national level, we aim for a more comprehensive description of climate impacts with greater detail across both time and space.

Constraining the persistence of impacts

A key determinant and source of discrepancy in estimates of the magnitude of future climate damages is the extent to which the impact of a climate variable on economic growth rates persists. The two extreme cases in which these impacts persist indefinitely or only instantaneously are commonly referred to as growth or level effects 19 , 20 (see Methods section ‘Empirical model specification: fixed-effects distributed lag models’ for mathematical definitions). Recent work shows that future damages from climate change depend strongly on whether growth or level effects are assumed 20 . Following refs. 2 , 18 , we provide constraints on this persistence by using distributed lag models to test the significance of delayed effects separately for each climate variable. Notably, and in contrast to refs. 2 , 18 , we use climate variables in their first-differenced form following ref. 3 , implying a dependence of the growth rate on a change in climate variables. This choice means that a baseline specification without any lags constitutes a model prior of purely level effects, in which a permanent change in the climate has only an instantaneous effect on the growth rate 3 , 19 , 21 . By including lags, one can then test whether any effects may persist further. This is in contrast to the specification used by refs. 2 , 18 , in which climate variables are used without taking the first difference, implying a dependence of the growth rate on the level of climate variables. In this alternative case, the baseline specification without any lags constitutes a model prior of pure growth effects, in which a change in climate has an infinitely persistent effect on the growth rate. Consequently, including further lags in this alternative case tests whether the initial growth impact is recovered 18 , 19 , 21 . Both of these specifications suffer from the limiting possibility that, if too few lags are included, one might falsely accept the model prior. The limitations of including a very large number of lags, including loss of data and increasing statistical uncertainty with an increasing number of parameters, mean that such a possibility is likely. By choosing a specification in which the model prior is one of level effects, our approach is therefore conservative by design, avoiding assumptions of infinite persistence of climate impacts on growth and instead providing a lower bound on this persistence based on what is observable empirically (see Methods section ‘Empirical model specification: fixed-effects distributed lag models’ for further exposition of this framework). The conservative nature of such a choice is probably the reason that ref. 19 finds much greater consistency between the impacts projected by models that use the first difference of climate variables, as opposed to their levels.

We begin our empirical analysis of the persistence of climate impacts on growth using ten lags of the first-differenced climate variables in fixed-effects distributed lag models. We detect substantial effects on economic growth at time lags of up to approximately 8–10 years for the temperature terms and up to approximately 4 years for the precipitation terms (Extended Data Fig. 1 and Extended Data Table 2 ). Furthermore, evaluation by means of information criteria indicates that the inclusion of all five climate variables and the use of these numbers of lags provide a preferable trade-off between best-fitting the data and including further terms that could cause overfitting, in comparison with model specifications excluding climate variables or including more or fewer lags (Extended Data Fig. 3 , Supplementary Methods Section 1 and Supplementary Table 1 ). We therefore remove statistically insignificant terms at later lags (Supplementary Figs. 1 – 3 and Supplementary Tables 2 – 4 ). Further tests using Monte Carlo simulations demonstrate that the empirical models are robust to autocorrelation in the lagged climate variables (Supplementary Methods Section 2 and Supplementary Figs. 4 and 5 ), that information criteria provide an effective indicator for lag selection (Supplementary Methods Section 2 and Supplementary Fig. 6 ), that the results are robust to concerns of imperfect multicollinearity between climate variables and that including several climate variables is actually necessary to isolate their separate effects (Supplementary Methods Section 3 and Supplementary Fig. 7 ). We provide a further robustness check using a restricted distributed lag model to limit oscillations in the lagged parameter estimates that may result from autocorrelation, finding that it provides similar estimates of cumulative marginal effects to the unrestricted model (Supplementary Methods Section 4 and Supplementary Figs. 8 and 9 ). Finally, to explicitly account for any outstanding uncertainty arising from the precise choice of the number of lags, we include empirical models with marginally different numbers of lags in the error-sampling procedure of our projection of future damages. On the basis of the lag-selection procedure (the significance of lagged terms in Extended Data Fig. 1 and Extended Data Table 2 , as well as information criteria in Extended Data Fig. 3 ), we sample from models with eight to ten lags for temperature and four for precipitation (models shown in Supplementary Figs. 1 – 3 and Supplementary Tables 2 – 4 ). In summary, this empirical approach to constrain the persistence of climate impacts on economic growth rates is conservative by design in avoiding assumptions of infinite persistence, but nevertheless provides a lower bound on the extent of impact persistence that is robust to the numerous tests outlined above.

Committed damages until mid-century

We combine these empirical economic response functions (Supplementary Figs. 1 – 3 and Supplementary Tables 2 – 4 ) with an ensemble of 21 climate models (see Supplementary Table 5 ) from the Coupled Model Intercomparison Project Phase 6 (CMIP-6) 22 to project the macroeconomic damages from these components of physical climate change (see Methods for further details). Bias-adjusted climate models that provide a highly accurate reproduction of observed climatological patterns with limited uncertainty (Supplementary Table 6 ) are used to avoid introducing biases in the projections. Following a well-developed literature 2 , 3 , 19 , these projections do not aim to provide a prediction of future economic growth. Instead, they are a projection of the exogenous impact of future climate conditions on the economy relative to the baselines specified by socio-economic projections, based on the plausibly causal relationships inferred by the empirical models and assuming ceteris paribus. Other exogenous factors relevant for the prediction of economic output are purposefully assumed constant.

A Monte Carlo procedure that samples from climate model projections, empirical models with different numbers of lags and model parameter estimates (obtained by 1,000 block-bootstrap resamples of each of the regressions in Supplementary Figs. 1 – 3 and Supplementary Tables 2 – 4 ) is used to estimate the combined uncertainty from these sources. Given these uncertainty distributions, we find that projected global damages are statistically indistinguishable across the two most extreme emission scenarios until 2049 (at the 5% significance level; Fig. 1 ). As such, the climate damages occurring before this time constitute those to which the world is already committed owing to the combination of past emissions and the range of future emission scenarios that are considered socio-economically plausible 15 . These committed damages comprise a permanent income reduction of 19% on average globally (population-weighted average) in comparison with a baseline without climate-change impacts (with a likely range of 11–29%, following the likelihood classification adopted by the Intergovernmental Panel on Climate Change (IPCC); see caption of Fig. 1 ). Even though levels of income per capita generally still increase relative to those of today, this constitutes a permanent income reduction for most regions, including North America and Europe (each with median income reductions of approximately 11%) and with South Asia and Africa being the most strongly affected (each with median income reductions of approximately 22%; Fig. 1 ). Under a middle-of-the road scenario of future income development (SSP2, in which SSP stands for Shared Socio-economic Pathway), this corresponds to global annual damages in 2049 of 38 trillion in 2005 international dollars (likely range of 19–59 trillion 2005 international dollars). Compared with empirical specifications that assume pure growth or pure level effects, our preferred specification that provides a robust lower bound on the extent of climate impact persistence produces damages between these two extreme assumptions (Extended Data Fig. 3 ).

Estimates of the projected reduction in income per capita from changes in all climate variables based on empirical models of climate impacts on economic output with a robust lower bound on their persistence (Extended Data Fig. 1 ) under a low-emission scenario compatible with the 2 °C warming target and a high-emission scenario (SSP2-RCP2.6 and SSP5-RCP8.5, respectively) are shown in purple and orange, respectively. Shading represents the 34% and 10% confidence intervals reflecting the likely and very likely ranges, respectively (following the likelihood classification adopted by the IPCC), having estimated uncertainty from a Monte Carlo procedure, which samples the uncertainty from the choice of physical climate models, empirical models with different numbers of lags and bootstrapped estimates of the regression parameters shown in Supplementary Figs. 1 – 3 . Vertical dashed lines show the time at which the climate damages of the two emission scenarios diverge at the 5% and 1% significance levels based on the distribution of differences between emission scenarios arising from the uncertainty sampling discussed above. Note that uncertainty in the difference of the two scenarios is smaller than the combined uncertainty of the two respective scenarios because samples of the uncertainty (climate model and empirical model choice, as well as model parameter bootstrap) are consistent across the two emission scenarios, hence the divergence of damages occurs while the uncertainty bounds of the two separate damage scenarios still overlap. Estimates of global mitigation costs from the three IAMs that provide results for the SSP2 baseline and SSP2-RCP2.6 scenario are shown in light green in the top panel, with the median of these estimates shown in bold.

Damages already outweigh mitigation costs

We compare the damages to which the world is committed over the next 25 years to estimates of the mitigation costs required to achieve the Paris Climate Agreement. Taking estimates of mitigation costs from the three integrated assessment models (IAMs) in the IPCC AR6 database 23 that provide results under comparable scenarios (SSP2 baseline and SSP2-RCP2.6, in which RCP stands for Representative Concentration Pathway), we find that the median committed climate damages are larger than the median mitigation costs in 2050 (six trillion in 2005 international dollars) by a factor of approximately six (note that estimates of mitigation costs are only provided every 10 years by the IAMs and so a comparison in 2049 is not possible). This comparison simply aims to compare the magnitude of future damages against mitigation costs, rather than to conduct a formal cost–benefit analysis of transitioning from one emission path to another. Formal cost–benefit analyses typically find that the net benefits of mitigation only emerge after 2050 (ref. 5 ), which may lead some to conclude that physical damages from climate change are simply not large enough to outweigh mitigation costs until the second half of the century. Our simple comparison of their magnitudes makes clear that damages are actually already considerably larger than mitigation costs and the delayed emergence of net mitigation benefits results primarily from the fact that damages across different emission paths are indistinguishable until mid-century (Fig. 1 ).

Although these near-term damages constitute those to which the world is already committed, we note that damage estimates diverge strongly across emission scenarios after 2049, conveying the clear benefits of mitigation from a purely economic point of view that have been emphasized in previous studies 4 , 24 . As well as the uncertainties assessed in Fig. 1 , these conclusions are robust to structural choices, such as the timescale with which changes in the moderating variables of the empirical models are estimated (Supplementary Figs. 10 and 11 ), as well as the order in which one accounts for the intertemporal and international components of currency comparison (Supplementary Fig. 12 ; see Methods for further details).

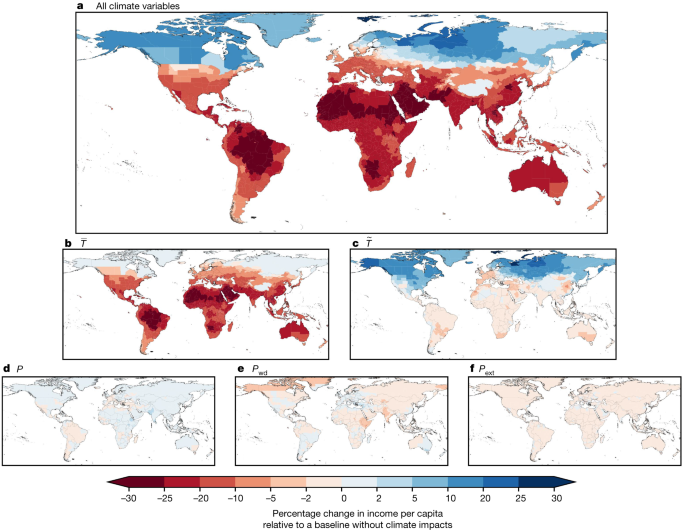

Damages from variability and extremes

Committed damages primarily arise through changes in average temperature (Fig. 2 ). This reflects the fact that projected changes in average temperature are larger than those in other climate variables when expressed as a function of their historical interannual variability (Extended Data Fig. 4 ). Because the historical variability is that on which the empirical models are estimated, larger projected changes in comparison with this variability probably lead to larger future impacts in a purely statistical sense. From a mechanistic perspective, one may plausibly interpret this result as implying that future changes in average temperature are the most unprecedented from the perspective of the historical fluctuations to which the economy is accustomed and therefore will cause the most damage. This insight may prove useful in terms of guiding adaptation measures to the sources of greatest damage.

Estimates of the median projected reduction in sub-national income per capita across emission scenarios (SSP2-RCP2.6 and SSP2-RCP8.5) as well as climate model, empirical model and model parameter uncertainty in the year in which climate damages diverge at the 5% level (2049, as identified in Fig. 1 ). a , Impacts arising from all climate variables. b – f , Impacts arising separately from changes in annual mean temperature ( b ), daily temperature variability ( c ), total annual precipitation ( d ), the annual number of wet days (>1 mm) ( e ) and extreme daily rainfall ( f ) (see Methods for further definitions). Data on national administrative boundaries are obtained from the GADM database version 3.6 and are freely available for academic use ( https://gadm.org/ ).

Nevertheless, future damages based on empirical models that consider changes in annual average temperature only and exclude the other climate variables constitute income reductions of only 13% in 2049 (Extended Data Fig. 5a , likely range 5–21%). This suggests that accounting for the other components of the distribution of temperature and precipitation raises net damages by nearly 50%. This increase arises through the further damages that these climatic components cause, but also because their inclusion reveals a stronger negative economic response to average temperatures (Extended Data Fig. 5b ). The latter finding is consistent with our Monte Carlo simulations, which suggest that the magnitude of the effect of average temperature on economic growth is underestimated unless accounting for the impacts of other correlated climate variables (Supplementary Fig. 7 ).

In terms of the relative contributions of the different climatic components to overall damages, we find that accounting for daily temperature variability causes the largest increase in overall damages relative to empirical frameworks that only consider changes in annual average temperature (4.9 percentage points, likely range 2.4–8.7 percentage points, equivalent to approximately 10 trillion international dollars). Accounting for precipitation causes smaller increases in overall damages, which are—nevertheless—equivalent to approximately 1.2 trillion international dollars: 0.01 percentage points (−0.37–0.33 percentage points), 0.34 percentage points (0.07–0.90 percentage points) and 0.36 percentage points (0.13–0.65 percentage points) from total annual precipitation, the number of wet days and extreme daily precipitation, respectively. Moreover, climate models seem to underestimate future changes in temperature variability 25 and extreme precipitation 26 , 27 in response to anthropogenic forcing as compared with that observed historically, suggesting that the true impacts from these variables may be larger.

The distribution of committed damages

The spatial distribution of committed damages (Fig. 2a ) reflects a complex interplay between the patterns of future change in several climatic components and those of historical economic vulnerability to changes in those variables. Damages resulting from increasing annual mean temperature (Fig. 2b ) are negative almost everywhere globally, and larger at lower latitudes in regions in which temperatures are already higher and economic vulnerability to temperature increases is greatest (see the response heterogeneity to mean temperature embodied in Extended Data Fig. 1a ). This occurs despite the amplified warming projected at higher latitudes 28 , suggesting that regional heterogeneity in economic vulnerability to temperature changes outweighs heterogeneity in the magnitude of future warming (Supplementary Fig. 13a ). Economic damages owing to daily temperature variability (Fig. 2c ) exhibit a strong latitudinal polarisation, primarily reflecting the physical response of daily variability to greenhouse forcing in which increases in variability across lower latitudes (and Europe) contrast decreases at high latitudes 25 (Supplementary Fig. 13b ). These two temperature terms are the dominant determinants of the pattern of overall damages (Fig. 2a ), which exhibits a strong polarity with damages across most of the globe except at the highest northern latitudes. Future changes in total annual precipitation mainly bring economic benefits except in regions of drying, such as the Mediterranean and central South America (Fig. 2d and Supplementary Fig. 13c ), but these benefits are opposed by changes in the number of wet days, which produce damages with a similar pattern of opposite sign (Fig. 2e and Supplementary Fig. 13d ). By contrast, changes in extreme daily rainfall produce damages in all regions, reflecting the intensification of daily rainfall extremes over global land areas 29 , 30 (Fig. 2f and Supplementary Fig. 13e ).

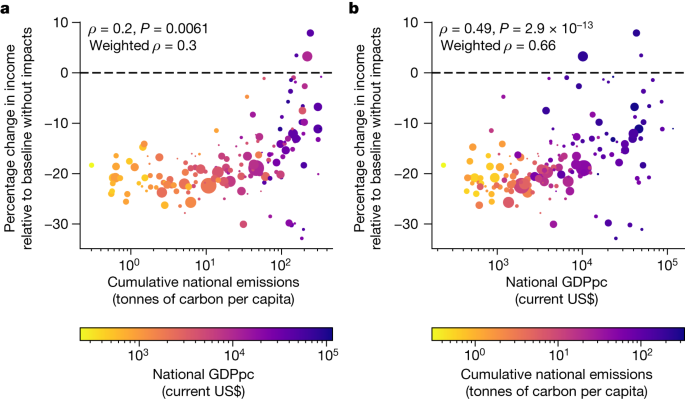

The spatial distribution of committed damages implies considerable injustice along two dimensions: culpability for the historical emissions that have caused climate change and pre-existing levels of socio-economic welfare. Spearman’s rank correlations indicate that committed damages are significantly larger in countries with smaller historical cumulative emissions, as well as in regions with lower current income per capita (Fig. 3 ). This implies that those countries that will suffer the most from the damages already committed are those that are least responsible for climate change and which also have the least resources to adapt to it.

Estimates of the median projected change in national income per capita across emission scenarios (RCP2.6 and RCP8.5) as well as climate model, empirical model and model parameter uncertainty in the year in which climate damages diverge at the 5% level (2049, as identified in Fig. 1 ) are plotted against cumulative national emissions per capita in 2020 (from the Global Carbon Project) and coloured by national income per capita in 2020 (from the World Bank) in a and vice versa in b . In each panel, the size of each scatter point is weighted by the national population in 2020 (from the World Bank). Inset numbers indicate the Spearman’s rank correlation ρ and P -values for a hypothesis test whose null hypothesis is of no correlation, as well as the Spearman’s rank correlation weighted by national population.

To further quantify this heterogeneity, we assess the difference in committed damages between the upper and lower quartiles of regions when ranked by present income levels and historical cumulative emissions (using a population weighting to both define the quartiles and estimate the group averages). On average, the quartile of countries with lower income are committed to an income loss that is 8.9 percentage points (or 61%) greater than the upper quartile (Extended Data Fig. 6 ), with a likely range of 3.8–14.7 percentage points across the uncertainty sampling of our damage projections (following the likelihood classification adopted by the IPCC). Similarly, the quartile of countries with lower historical cumulative emissions are committed to an income loss that is 6.9 percentage points (or 40%) greater than the upper quartile, with a likely range of 0.27–12 percentage points. These patterns reemphasize the prevalence of injustice in climate impacts 31 , 32 , 33 in the context of the damages to which the world is already committed by historical emissions and socio-economic inertia.

Contextualizing the magnitude of damages

The magnitude of projected economic damages exceeds previous literature estimates 2 , 3 , arising from several developments made on previous approaches. Our estimates are larger than those of ref. 2 (see first row of Extended Data Table 3 ), primarily because of the facts that sub-national estimates typically show a steeper temperature response (see also refs. 3 , 34 ) and that accounting for other climatic components raises damage estimates (Extended Data Fig. 5 ). However, we note that our empirical approach using first-differenced climate variables is conservative compared with that of ref. 2 in regard to the persistence of climate impacts on growth (see introduction and Methods section ‘Empirical model specification: fixed-effects distributed lag models’), an important determinant of the magnitude of long-term damages 19 , 21 . Using a similar empirical specification to ref. 2 , which assumes infinite persistence while maintaining the rest of our approach (sub-national data and further climate variables), produces considerably larger damages (purple curve of Extended Data Fig. 3 ). Compared with studies that do take the first difference of climate variables 3 , 35 , our estimates are also larger (see second and third rows of Extended Data Table 3 ). The inclusion of further climate variables (Extended Data Fig. 5 ) and a sufficient number of lags to more adequately capture the extent of impact persistence (Extended Data Figs. 1 and 2 ) are the main sources of this difference, as is the use of specifications that capture nonlinearities in the temperature response when compared with ref. 35 . In summary, our estimates develop on previous studies by incorporating the latest data and empirical insights 7 , 8 , as well as in providing a robust empirical lower bound on the persistence of impacts on economic growth, which constitutes a middle ground between the extremes of the growth-versus-levels debate 19 , 21 (Extended Data Fig. 3 ).

Compared with the fraction of variance explained by the empirical models historically (<5%), the projection of reductions in income of 19% may seem large. This arises owing to the fact that projected changes in climatic conditions are much larger than those that were experienced historically, particularly for changes in average temperature (Extended Data Fig. 4 ). As such, any assessment of future climate-change impacts necessarily requires an extrapolation outside the range of the historical data on which the empirical impact models were evaluated. Nevertheless, these models constitute the most state-of-the-art methods for inference of plausibly causal climate impacts based on observed data. Moreover, we take explicit steps to limit out-of-sample extrapolation by capping the moderating variables of the interaction terms at the 95th percentile of the historical distribution (see Methods ). This avoids extrapolating the marginal effects outside what was observed historically. Given the nonlinear response of economic output to annual mean temperature (Extended Data Fig. 1 and Extended Data Table 2 ), this is a conservative choice that limits the magnitude of damages that we project. Furthermore, back-of-the-envelope calculations indicate that the projected damages are consistent with the magnitude and patterns of historical economic development (see Supplementary Discussion Section 5 ).

Missing impacts and spatial spillovers

Despite assessing several climatic components from which economic impacts have recently been identified 3 , 7 , 8 , this assessment of aggregate climate damages should not be considered comprehensive. Important channels such as impacts from heatwaves 31 , sea-level rise 36 , tropical cyclones 37 and tipping points 38 , 39 , as well as non-market damages such as those to ecosystems 40 and human health 41 , are not considered in these estimates. Sea-level rise is unlikely to be feasibly incorporated into empirical assessments such as this because historical sea-level variability is mostly small. Non-market damages are inherently intractable within our estimates of impacts on aggregate monetary output and estimates of these impacts could arguably be considered as extra to those identified here. Recent empirical work suggests that accounting for these channels would probably raise estimates of these committed damages, with larger damages continuing to arise in the global south 31 , 36 , 37 , 38 , 39 , 40 , 41 , 42 .

Moreover, our main empirical analysis does not explicitly evaluate the potential for impacts in local regions to produce effects that ‘spill over’ into other regions. Such effects may further mitigate or amplify the impacts we estimate, for example, if companies relocate production from one affected region to another or if impacts propagate along supply chains. The current literature indicates that trade plays a substantial role in propagating spillover effects 43 , 44 , making their assessment at the sub-national level challenging without available data on sub-national trade dependencies. Studies accounting for only spatially adjacent neighbours indicate that negative impacts in one region induce further negative impacts in neighbouring regions 45 , 46 , 47 , 48 , suggesting that our projected damages are probably conservative by excluding these effects. In Supplementary Fig. 14 , we assess spillovers from neighbouring regions using a spatial-lag model. For simplicity, this analysis excludes temporal lags, focusing only on contemporaneous effects. The results show that accounting for spatial spillovers can amplify the overall magnitude, and also the heterogeneity, of impacts. Consistent with previous literature, this indicates that the overall magnitude (Fig. 1 ) and heterogeneity (Fig. 3 ) of damages that we project in our main specification may be conservative without explicitly accounting for spillovers. We note that further analysis that addresses both spatially and trade-connected spillovers, while also accounting for delayed impacts using temporal lags, would be necessary to adequately address this question fully. These approaches offer fruitful avenues for further research but are beyond the scope of this manuscript, which primarily aims to explore the impacts of different climate conditions and their persistence.

Policy implications

We find that the economic damages resulting from climate change until 2049 are those to which the world economy is already committed and that these greatly outweigh the costs required to mitigate emissions in line with the 2 °C target of the Paris Climate Agreement (Fig. 1 ). This assessment is complementary to formal analyses of the net costs and benefits associated with moving from one emission path to another, which typically find that net benefits of mitigation only emerge in the second half of the century 5 . Our simple comparison of the magnitude of damages and mitigation costs makes clear that this is primarily because damages are indistinguishable across emissions scenarios—that is, committed—until mid-century (Fig. 1 ) and that they are actually already much larger than mitigation costs. For simplicity, and owing to the availability of data, we compare damages to mitigation costs at the global level. Regional estimates of mitigation costs may shed further light on the national incentives for mitigation to which our results already hint, of relevance for international climate policy. Although these damages are committed from a mitigation perspective, adaptation may provide an opportunity to reduce them. Moreover, the strong divergence of damages after mid-century reemphasizes the clear benefits of mitigation from a purely economic perspective, as highlighted in previous studies 1 , 4 , 6 , 24 .

Historical climate data